- 1School of Computer Science and Technology, Shandong Technology and Business University, Yantai, China

- 2Shandong Intelligent Financial Engineering Laboratory, Yantai, China

- 3Shandong Key Laboratory of Computer Networks, Jinan, China

- 4School of Science, University of New South Wales, Sydney, NSW, Australia

- 5Chinese Academy of Science and Technology for Development, Beijing, China

Given the representativeness and availability of data, this paper selects personal posts from the Oriental Wealth Internet Cafe and Sina Internet Cafe Forum to analyze the mechanism of insurance company participation, investor sentiment, and stock price synchronicity in China. Using a panel of data of listed companies from 2007 to 2018, evidence shows that investor sentiment in the stock market forum will increase the synchronicity of stock prices in the short term, while an insurance company’s shareholding effectively reduces the impact of investor sentiment on share price synchronicity which plays a mediator effect; the higher the proportion of the insurance company’s shareholdings, the more evident the effect. By conducting counterfactual research, the study found that insurance company participation can reduce the synchronicity of stock price by 0.10435 in a group with high investor sentiment than a group with low investor sentiment. For each investor sentiment group, the higher the proportion of the insurance company’s shareholdings, the greater the reduction in the synchronicity of stock prices. The results of this study can be used by national regulatory authorities to formulate policies in the field of e-finance in order to reduce stock price synchronization, stabilize financial markets, and minimize systemic financial risks.

1 Introduction

Since China is a new capital market, its stock market development is late, market maturity is low, rules and regulations are not perfect, and irrational investment behavior such as “chasing up and down,” “blindly following the trend,” and “over-investment,” among other kinds, is frequent, resulting in the stock price’s normal value deviating from the predicted benchmark. The “same rise and fall” phenomenon is quite pronounced (Li and Myers, 2006), which has a negative impact on the sustainable development and prosperity of the entire capital market. Issues need to be traced back to their source, and edgy market regulations have to be strengthened.

Most of the information in the financial market is obtained from exogenous sources such as social media changes, whose sentiment change is closely related to asset prices; in particular, when sentiment enters the market, investors will have different rational and irrational behaviors because investor decision-making depends on its self-rational assessment of information, and the process of integrating emotional factors into stocks will affect stock prices in the next few days (Sul et al., 2017). Also, personal emotions can influence individual behaviors and decisions, and emotions can be infectious (Nofer and Hinz, 2015; Ruan et al., 2018); with information flowing increasingly faster, the stock price will be more likely to reverse (Andrei and Cujean, 2017), so the interaction between different users in the social network model on different stock forums will affect stock price fluctuations. Thus, these network forums are being increasingly used by investors. International research in this area is extensive, and the stock market forum research has involved a number of forum posts and post content (Antweiler and Frank, 2004; Das and Chen, 2007). At present, Chinese research on the appearance of investor sentiment in stock forum posts is relatively one-sided, and this paper makes an attempt to analyze investor sentiment in the stock market from a different perspective.

In view of various risks present in financial markets, insurance companies, as an important force in the capital market (Talonen et al., 2022), have attracted the attention of all parties. In October 2018, the Chinese Banking Regulatory Commission stated that it will increase the volume of investment provided by insurance funds to listed companies, going by a high-level financial and strategic perspective. This decision increased the power of institutional investors and solidified the foundation for long-term investments. On the one hand, the participation of insurance companies contributes to the company’s reducing operating costs (Zhao et al., 2021), the improvement of the corporate governance environment, and the stability of the market, and has a positive effect on the value of the company (Cornell et al., 2017; Olarewaju and Msomi, 2021). It can also effectively increase the company-specific information content in the stock price and improve market efficiency and stabilize the market. As a gray institutional investor, insurance companies prefer to invest in experience and pay more attention to the mechanism of corporate governance, which is more helpful in transferring risks and improving the overall operational efficiency (Ettlin et al., 2020; Guan and Hu, 2022). However, investors are irrational, and institutional investors are no exception (Zamri et al., 2017). Insurers may have a short-term vision, which in turn will influence managers to make short-term decisions that only increase short-term profits (Consuelo and Blanca, 2018). The media effects caused by information technology have an important impact on the development of the insurance industry (Kaigorodova et al., 2018). The question of how insurance funds boost market confidence, reduce share price risk, and stabilize financial markets when entering the market is very important. After the risk capital is increased, will it improve the efficiency of capital pricing through the company’s governance supervision, stabilize investor sentiment, let them hold shares, and make correct investment judgments and reduce the same rise and fall effect in the market? Or will the information asymmetry effect prevail, so that investors’ mood is quickly infected (Polonchek and Miller, 2005); and what if optimism or pessimism is amplified, resulting in an increase in the synchronicity of share prices? Given the important market position and influence of insurance companies, what role does insurance company participation play in regulating investor sentiment and share price synchronicity? The relationship has to be studied in greater depth.

The main contributions of this paper are as follows: first, from the point of view, there are still few studies on insurance company participation and stock price synchronicity, and the overall volume of research in the field is still relatively small. This paper offers a new perspective, examining insurance company participation, investor sentiment, and stock price synchronicity in a specific context. It is beneficial to thoroughly understand the relationship between investor sentiment and stock price synchronicity after the intervention of insurance companies, and provide suggestions on the investment behavior of institutional investors from insurance companies. Second, this paper enriches the impact of investor sentiment on share price synchronicity in the stock market forum under the background of internet finance and hopes to make marginal academic contributions. At the same time, the paper gives some practical advice for network risk management for emerging markets such as China, which helps to improve the efficiency of capital market pricing and promote the sustainable development of the market.

2 Literature review and hypothesis development

Share price synchronicity mainly refers to the relationship between a change in a company’s share price and the overall change of the market. Compared with a mature capital market, the “share price synchronicity” of an emerging capital market is more worthy of attention because, in the second case, the phenomenon of the “same rise and fall” is more pronounced. After examining data from a sample of more than 40 countries, Morck et al. (1999) found that Chinese capital markets have the second highest share price synchronicity in the world. In turn, Li and Myers (2006) found that Chinese share price synchronicity is very high in the world. Therefore, the issue of Chinese capital market share price synchronicity is very serious and it still demands the attention of researchers.

Factors determining stock price are complicated, and although there are many asset pricing models, none of them can provide a comprehensive explanation of the capital market stock price. This prompts researchers to study stock price synchronicity. Most researchers believe that stock price synchronicity is closely related to the efficiency of capital market information, which has a significant impact on a company’s financial behavior, decision-making, and resource allocation. Stock price synchronicity has become an increasingly important focus of theoretical and practical research papers. Scholars explain synchronicity of stock prices from a perspective of “information efficiency” and “irrationality.” One explanation of “information efficiency” is based on the view that the higher the company’s characteristic information reflected in the stock price, the lower the synchronicity of the share price. Using data samples from more than 40 countries, Morck et al. (1999) found that a better property rights protection system has a positive effect on information trading behavior, and it improves the quality of stock price information and reduces share price synchronicity. Durnev et al. (2003) found that share price synchronicity was negatively correlated with share price information content. This view is further supported by the study of emerging market countries, which found that the level of the development of capital markets is negatively correlated with share price synchronicity (Li et al., 2004). The security analysis increased the synchronicity of stock prices because security analysts provide more market information (Chan and Hameed, 2006), and the quality of accounting information is positively correlated with share price synchronicity (Jin, Z., 2010). The more timely the company’s accounting disclosure policy, the more transparent the information (Song, L., 2015), the more readable the annual report (Xuelian et al., 2018), the better the information environment for the company to improve governance, and the lower the share price synchronicity. The other method is to explain the synchronicity of stock prices from a perspective of “irrational factors.” West (1988) argued that share price synchronicity measures market noise and the size of investor sentiment. Greenwood and Nathan (2007) confirmed that both investor sentiment and market friction affect synchronicity of stock prices. Kelly (2014) found that companies with lower share price synchronicity, less institutional investor holdings, and analyst analysis have less liquidity in stocks and higher transaction costs. It can be seen that the influence of irrational factors on stock price synchronicity is very significant, and this paper attempts to explain the synchronicity of stock price from this perspective.

In the capital market, attention of investors is a scarce resource (Kahneman, 1973), which leads the investors to analyze and judge the information they are concerned about due to insufficient time and energy, resulting in a deviation in value judgment and finally, stock price volatility. According to the theory of behavioral finance, investor sentiment is an important factor affecting stock price volatility (De Long et al., 1990). It is mainly reflected in the investors’ beliefs and preferences, namely, rational expectations and rational preferences. “Belief” mainly refers to a deviation of investors’ expectations about the future, while “preference” refers to different psychological expectations or personal preferences of the investors, namely, their preferences for individual stocks and risks. The “heterogeneous belief hypothesis” (Hong and Stein, 2003) argues that heterogeneous beliefs and pessimism of investors are also released into the market through intermediary channels.

In recent years, with the development of network finance, scholars began to choose proxy variables for investor sentiment for their research from stock bar forums. Das and Chen (2007) established an emotional index by examining bullish and bearish views of the stock market forum’s users based on Morgan Stanley’s high-tech stock index, and showed that the sentiment index had a strong correlation with market behavior. Posts from the online financial forums reflect investors’ opinions because they contain information that affects stock returns and prices (Tumarkin, R., and Whitelaw, R. F., 2001). Antweiler, W. and Frank, M. Z. (2004) conducted a study of Yahoo e-mails and found that information contained in the stock messages helped to predict market volatility and that online stock message boards could drive the market, and the number of posts was positively correlated with the simultaneous fluctuations in stock prices. Especially since the beginning of the 21st century, the internet has become an important source of information for companies, and analysis of information from the internet is closely related to the extent to which investors understand a particular company (Amir and Eran, 2010). Social media websites have become a popular way for individuals to share their own results of financial security analysis. Message board sentiment is an important predictor of trading behavior (Sabherwal et al., 2011), as the views expressed in articles and comments predict future stock earnings and earnings surprises (Chen et al., 2014). Information posted on the investor’s internet stock message board reflects an investment bias (Huang et al., 2016), which creates investor sentiment. In turn, investors determine the operations of the entire market through an insight into the target company (Ackert et al., 2016). Given information asymmetry, it became increasingly popular to disseminate information online, and internet stock message boards have gradually become communicators of company-specific information, which can be incorporated into stock prices (Bowden et al., 2017; Li et al., 2018). Barberis et al. (1998) built a mood theory model for the rapid and convenient dissemination of information on the internet—the “anchoring” mentality of investors will lead to an insufficient response to stock price information, and widely available forum information may cause investors to overreact. Thus, investors’ attention and emotions are characteristics of different stages of their investment behavior. According to the theory of cognitive psychology, the process of making an investment choice is actually an information processing process, which includes the stages of feeding input, making a judgment, transformation, processing, storage, and making a decision on a particular investment. At every stage of this process, there are cognitive biases which lead to errors in judgment, resulting in abnormal fluctuations in stock prices. Moreover, investors’ attention to high-profile stocks does not necessarily mean that the bullish and bearish ideas of investors are the same. Therefore, it is necessary to study sentiments expressed in every particular post. The number of forum posts is used as a proxy variable for individual investors, and the content of the posts is used to extract personal information. As the number of posts increases, the stock is more likely to be noticed, leading to greater participation. Bullish and bearish views reflected in each post will form an emotional consistency index, which will lead to consistency of investor action. Subsequently, share price synchronicity will increase in the short term. On the other hand, if the number of posts on stocks decreases, stocks enter a state where nobody cares, investors’ sentiment consistency index reduces, the stock market’s same-up effect weakens, and synchronicity of stock prices decreases. Barber and Odean (2008) argued that most individual investors do not have enough energy to consider all of the available information and then make decisions, so they only consider information which attracts their attention. Therefore, the most popular stocks will have an upward price shock in the short term and then the effect will reverse. This reversal is consistent with over-focusing on weakness assumptions of limited attention (Seasholes and Wu, 2007); therefore, this paper considers the issue from a short-term perspective. Since most Chinese individual investors are not professionally trained, irrational behavior in the market is more pronounced—catching up with the kill is easier, investor sentiment is more consistent in the short term, and the same rise and fall phenomenon of stocks is more notable. Given the aforementioned factors, this paper puts forward the following hypothesis:

H1. Given that other conditions remain unchanged, the greater the number of stock market forum posts, the higher will be the sentiment consistency index and share price synchronicity in the short-term.

Development of the capital market cannot be separated from participation of institutional investors, including insurance companies. Specialized institutional investors have strong monitoring motivations due to large holdings of equity and long-term investment terms, which are beneficial for short-term institutional investors because they tend to trade rather than regulate. These findings suggest that institutional oversight limits managers’ withdrawals to the company’s cash flow. This reduces company-specific risks that managers absorb, resulting in a reduction in R2 (An and Zhang, 2011). Therefore, insurance company participation contributes to the improvement of the corporate governance environment and stabilization of the market, and enhances the value of businesses (Cornell al., 2007). It can also effectively enhance the company’s unique information content in the stock price and improve market efficiency. At the same time, as important institutional investors, insurance companies usually have professional analytical teams, access to more comprehensive information, and other advantages. They buy undervalued and premium stocks in order to achieve market balance, lower stock price volatility, and reduce stock price synchronicity. This is an important constraint on a surge and collapse of the “counterweight” (Statman, 1994). Contribution of insurance companies to economic growth is more evident in emerging markets (Han et al., 2010; Zhou et al., 2012). With regard to the extent to which insurance companies contribute to the overall risk impact of the market, corporate risk management affects investors’ risk needs (Hitchcox et al., 2011). If the market is in good health, investors will certainly take the risk situation into account to make prudent investments, and investor sentiment will usually be more stable. In this case, the stock market will be the same, the group effect of “the same rise and fall” will be reduced, the capital market pricing efficiency will improve, and the simultaneous operation effect of stock prices will also be reduced.

However, internationalization of capital markets has led to increased competition for scarce equity capital—the basic idea describing investor relations is increasing the demand for own shares in competition with shareholders and other participants of financial markets (Hausele, 1998). As gray institutional investors, insurers prefer to invest in experience and emphasize mechanisms consistent with corporate governance, but investors are irrational and institutional investors are no exception (Zamri et al., 2017). Insurers may have a shorter vision, which would prompt managers to make short-term decisions which only increase short-term profits (Consuelo and Blanca, 2018). The media effect of information technology has a significant impact on the development of the insurance industry (Kaigorodova et al., 2018). Polonchek and Miller (2005) further confirmed the impact caused by information asymmetry in insurance companies. In the course of the investment-making process, information on their investment behavior is bound to spread across the internet, be discussed in comments, and have an impact on investor sentiment. If it is good news, in times of high sentiment, the attitude of optimistic investors will influence the stock price, pushing up the real value of the stock and causing it to deviate from its normal value; the same up effect is serious: if it is bad news, the pessimistic investor’s low mood will inevitably cause the stock price to deviate further from the normal value, which in turn will contribute to the decline effect (Zou and Sun, 2012). The impact of investor sentiment is bound to form a value error (Duan and Shou, 2006).

According to the theory of cognitive dissonance, in order to eliminate tension, individuals will increase cognition and change cognition, so as to achieve a new state of equilibrium. Therefore, what is the relationship between insurance company participation and share price synchronicity? What role does it play in affecting investor sentiment and share price synchronicity? The following hypotheses are put forward:

H2a. Insurance company participation reduces share price synchronicity and plays an intermediary role between investor sentiment and share price synchronicity.

H2b. Insurance company participation increases the synchronicity of stock prices and plays an intermediary role between investor sentiment and stock price synchronicity.

Compared with mature foreign markets, the most crucial characteristic of the majority of the listed Chinese companies is the background of state-owned enterprises. Given the unique property rights of state-owned enterprises, the companies have different orientations. Decision-making and actions of most state-owned enterprises are not based solely on pursuing economic interests but on maximizing national interests, ensuring economic development and social stability. As the largest shareholders, state-owned enterprises can lead to certain conflicts of interest and even constitute a threat to other shareholders. In turn, this results in information asymmetry problems and proxy conflicts. Major shareholders occupy funds for fulfilling their own objectives of carrying out particular transactions, which inevitably harms the interests of small- and medium-sized shareholders, leads to agent conflicts, and results in suboptimal resource allocation. The problem of agencies in state-owned enterprises is more prominent than in private enterprises, and the opportunistic behavior of managers has a greater impact on investor sentiment. When investor sentiment is high, it is more likely to cause a company to over-invest, which will lead to a new round of expansion for speculative motives. The high mood in the market makes investors think that greater future share price earnings are offsetting the risks and the hot talk on the stock bar forums is bound to attract more over-the-counter investors and capital. Given the increase in the number of posts and consistent strengthening of the investor sentiment index, the stock’s co-rise-effect becomes more pronounced. In the process, company managers will deliberately conceal some of the negative news in order to cater to market sentiment, while a large number of posts on the hot theory and pessimism on the stock bar forum will lead to a decrease in the stock price (Tetlock, 2007; Ben-Rephael et al., 2012). In turn, the investor herd effect will result in a significant fall in share prices. Thus, the following hypothesis is put forward:

H3. Compared with the sample of private enterprises, the intermediary effect of risk-raising on investor sentiment and share price synchronicity is more evident in state-owned enterprises.

3 Data and methodology

3.1 Sample

This paper selects listed companies from the A-share market of Shanghai and Shenzhen in the period from 2007 to 2018 as research objects. The reason for the choice is due to the fact that new accounting standards have been implemented from 2007 onward, which deal with the following: 1) excluding financial listed companies, 2) excluding some companies marked with “ST” or “*ST,” and 3) excluding some companies with missing data. To eliminate the effects of extreme values, all successive variables were processed at 5% by winsorizing, for a total of 6,839 observations. The financial data used were downloaded from the CSMAR database and cross-paired.

3.2 Model building and variable measurement

3.2.1 Variables measurement

1) Stock price synchronicity

Based on the research findings of Morck et al. (1999), Piotroski and Roulstone (2004), Gul et al. (2010), and Xu et al. (2013), this article will calculate stock price synchronicity as follows. First, the weekly return yield on the stock i:

where R (i,w,t) represents the return on the stock i’s consideration of cash dividend reinvestment of the t-week in the t-year; R (M, w, t) represents the weighted average return on market capitalization of the t-week in the t-year for all A-share companies; and R (I, w, t) on behalf of the weighted average return on the market value of other stocks in the same industry excluding stock i of the t-week in the t-year, where the industry classification is based on the SFC’s 2012 industry classification criteria, and returns R2, which represents the part where the share price can be explained by market fluctuations, 1-R2 represents the characteristic risk of the company’s price fluctuations. However, since the R2 value range is within 0–1, which brings risk to the actual estimate, R2 is evaluated for the plurality, and we obtain the stock price synchronicity index of stock i in the t-year:

The higher the SYNCH, the higher the stock price synchronicity and the less accurate the company’s individual stock information.

2) Derivation of investor sentiment indicators

The Oriental Fortune Internet Cafe and Sina Internet Cafe Forum are the most popular forums in China. Given the representativeness and availability of the data, referring to Antweiler and Frank (2004), Das and Chen (2007), and Tetlock et al. (2008), this paper chooses posts from the Oriental Wealth Internet Cafe and the Sina Internet Cafe Forum as the object of study. According to the tone of a post’s content, it is considered either bullish or bearish. Tn stands for the total number of comments posted under a profile of a listed company within a year, and the variable represents investment concern. In order to facilitate calculation, natural arithmetic processing was carried out: TOPST = log (Tn).

SNCFMI stands for the indicator of the emotional consistency index, Ln represents the number of bullish posts, and Dn represents the number of bearish posts; the formula is:

3) Indicators of insurance company participation

The IP variable indicates whether there is insurance company participation in the stock, then the IP value equals 1, otherwise it equals 0; the SP variable indicates the percentage of insurance companies participating in shares.

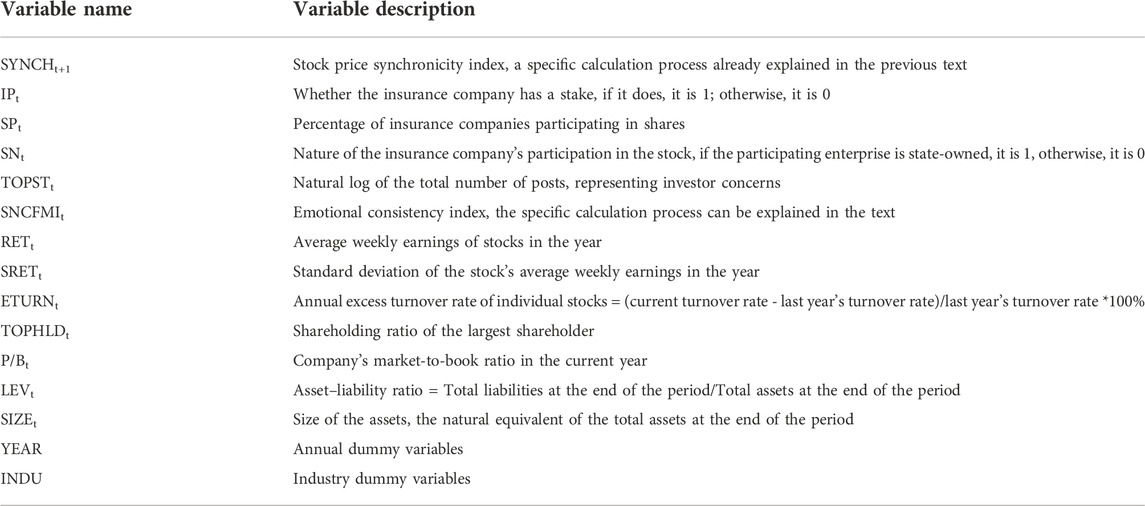

4) Control variables

Following the literature (Chen et al., 2000; Zou & Sun, 2012), the following control variables are added: the average return of the stock in the current year (RET), the weekly yield standard deviation (SRET), the annual excess turnover rate (ETURN), the largest shareholding ratio (TOPHLD), the nature of the company’s property rights (SN, if state-owned, defined as 1, otherwise defined as 0), the company’s current year’s market price-to-book ratio (P/B), asset–liability ratio (LEV), and the size of the company’s assets (SIZE). At the same time, this paper also controls industry and annual variables; for detailed variable definitions, see Appendix A.

3.2.2 Research model

With reference to Gul et al. (2010), we intend to build the following models for testing, with the dependent variable being SYNCHt+1 (stock price synchronicity) and the explanatory variables being TOPSTt, SNCFMIt, IPt, and SPt:

4 Results and discussion

4.1 Descriptive statistics

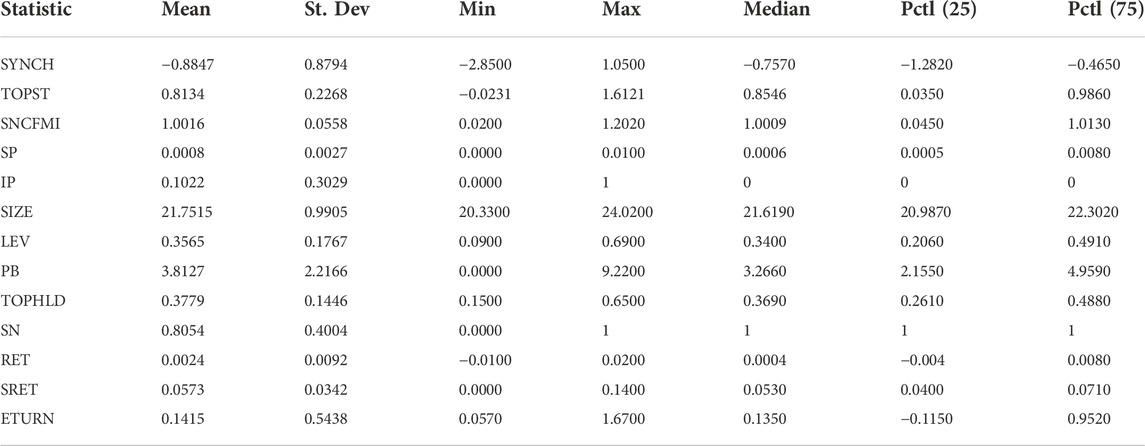

Table 1 is a descriptive statistic of the variables. The mean and standard deviation of share price synchronicity (SYNCH) is −0.8847 and 0.8794, respectively; the mean of the number index (TOPST) and sentiment consistency index (SNCFMI) is 0.8134 and 1.0016, respectively; and their standard deviations are 0.2268 and 0.0558, respectively, which is not very large, indicating that the investor sentiment indicators measured from different dimensions are relatively consistent. The standard deviation of whether insurance companies participate (IP) is 0.3029, and the maximum value of insurance companies’ participation in equity (SP) is 1%, which indicates that the participation of insurance companies in shares is relatively uniform, but the proportion of participation is still relatively small. In addition, we perform median and interquartile tests on the main variables, which are generally consistent with the results of the main studies. The descriptive statistics of other variables are basically within a reasonable range.

4.2 Analysis of main empirical results

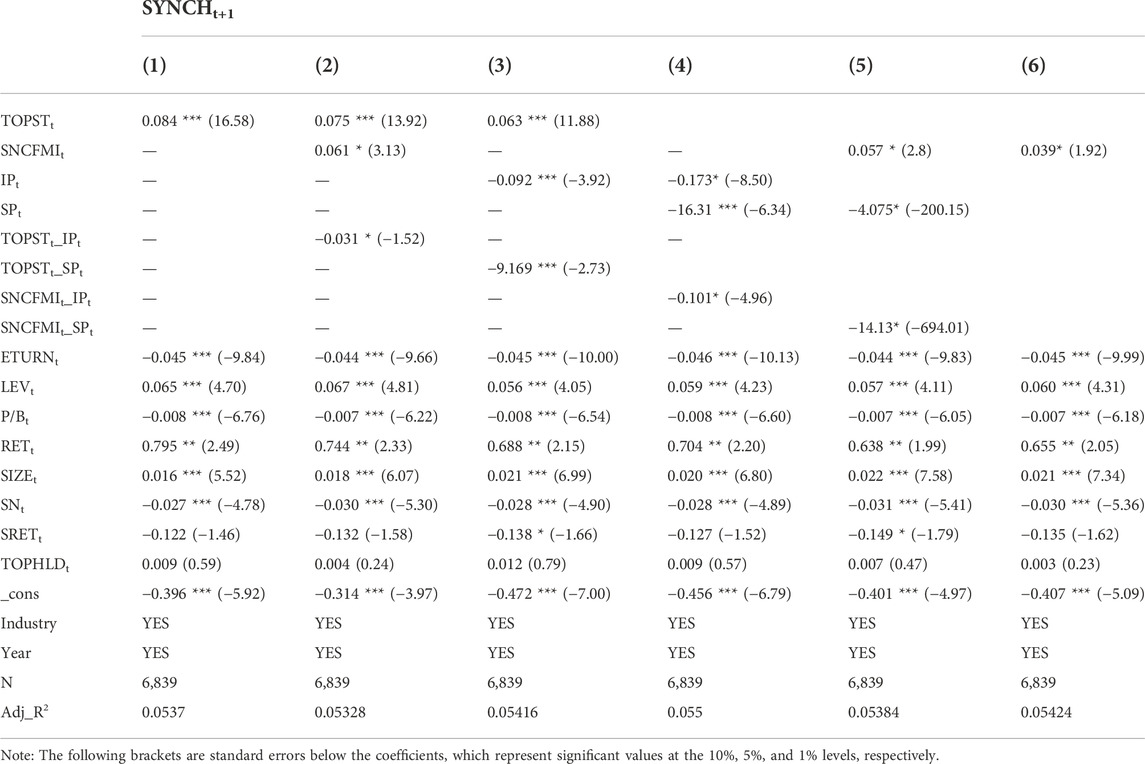

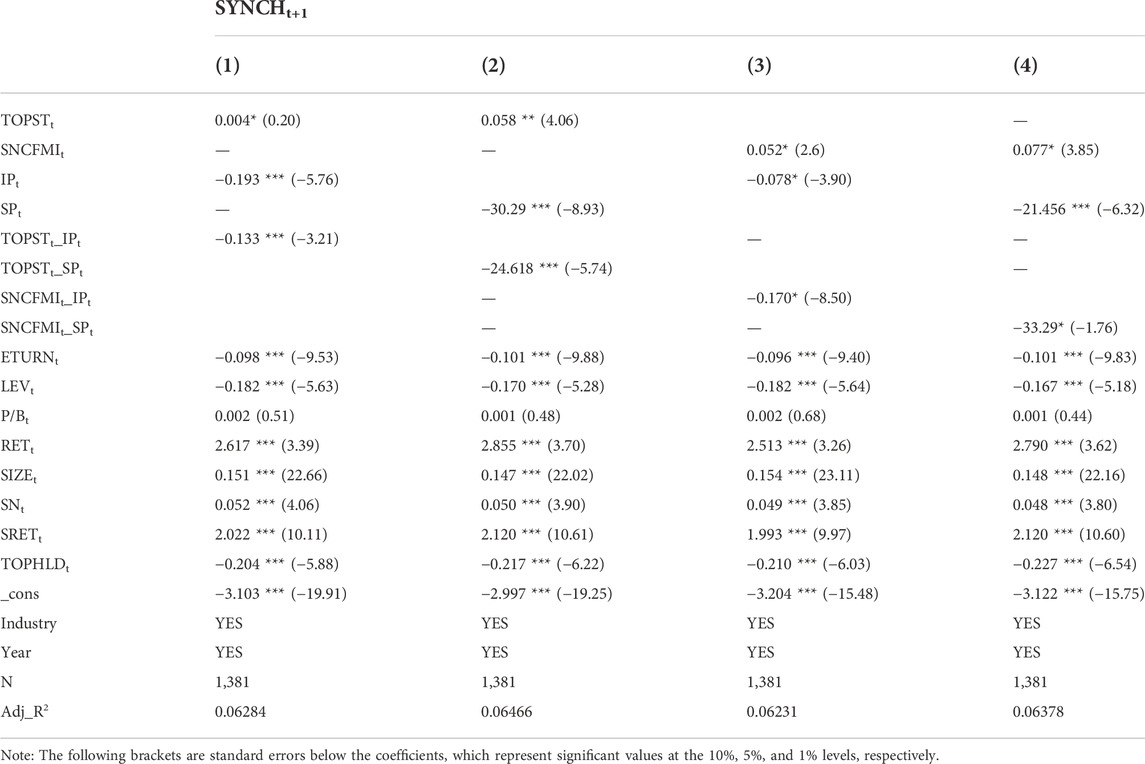

Table 2 shows the regression test results of hypotheses 1 and 2; the empirical results are all controlled for the annual and industry variables because the variables are the share price synchronization “SYNCHt+1.” Column (1) and column (2) examin the impact of investor sentiment indicators represented by the number of posts and sentiment consistency indices on the synchronicity of stock prices, in which the coefficients of TOPSTt and SNCFMIt were positive and significant at the level of 1% and 10%, respectively, indicating that investor sentiment and share price synchronicity were positive. The greater the volatility of investor sentiment, the greater the synchronicity of share prices. This is mainly because when good news appears in the market, the number of posts in the stock bar forum increases, and the higher the sentiment consistency index, the higher the investor sentiment. Thus, market sentiment helped increase the psychological expectations of investors, prompting its behavior on the “herd effect”; where it is proactive to buy stocks, the stock price is on the upward trend; at the same time, it sends a signal to other investors in the market that they think that the stock price continues to increase, thus entering the market to buy a large number of stocks; when the “same-up effect” of the stock is very serious, the stock price increases to a certain extent, the stock is overvalued, and it will create a bubble; then, the stock price starts to show a downward trend. In particular, when bad news starts flowing into the market, the market becomes relatively depressed, and investors rush to sell their stocks in order to avoid the continuous fall of stock price caused by the depreciation of funds. The more the stock price falls, the more investors follow each other, and market pessimism continues to increase until the point when the investors try to get rid of these stocks and sell them as fast as possible. The stock price will fall “severely.” So, the investor sentiment of the stock market forum increased the synchronicity of the share price, verifying hypothesis H1.

Columns (3)–(6) test the results of the relationship between insurance company participation, investor sentiment, and share price synchronicity. Among them, the coefficients of TOPSTt are positive and both are significant at the 1% significance level, the coefficients of SNCFMIt are positive and both are significant at the 10% significance level, the coefficients of IPt and SPt are negative and significant at the 1% and 10% significance levels, respectively, and the coefficients of TOPSTt_IPt (the interaction term of TOPSTt and IPt) and TOPSTt_SPt (the interaction of TOPSTt and SPt) are negative and significant at 10% and 1%, respectively. The coefficients of SNCFMIt_IPt (the interaction term of SNCFMIt and IPt) and SNCFMIt_SPt (the interaction term of SNCFMIt.and SPt) are negative and both are significant at the 10% significance level. This shows that although investor sentiment has increased the synchronicity of stock prices, the risk of insurance company participation effectively reduces the impact of investor sentiment to share price synchronicity, which played a certain intermediary effect. This may be because insurance company participation has played a role in reducing the synchronicity of stock prices through the adjustment of investor sentiment; because insurance companies’ participation in the market is a positive signal, investors have a higher degree of psychological security, the number of posts indicate that the market is a hot topic on the internet, and the stock has investment opportunities temporarily, and the market will have a large influx of funds, which is good news. Investors have good expectations of the stock price and a higher sentiment consistency index; they will firmly hold stocks and the market situation will be stable. The higher the proportion of insurance company shareholdings, the more stable the investor sentiment; they will feel that this is good news in the capital market and have a good value judgment, they will not be in a hurry to leave the market and investors’ herd effect is weaker, and the stock’s same rise and fall effect and the stock price synchronicity is lower, which verifies hypothesis H2a.

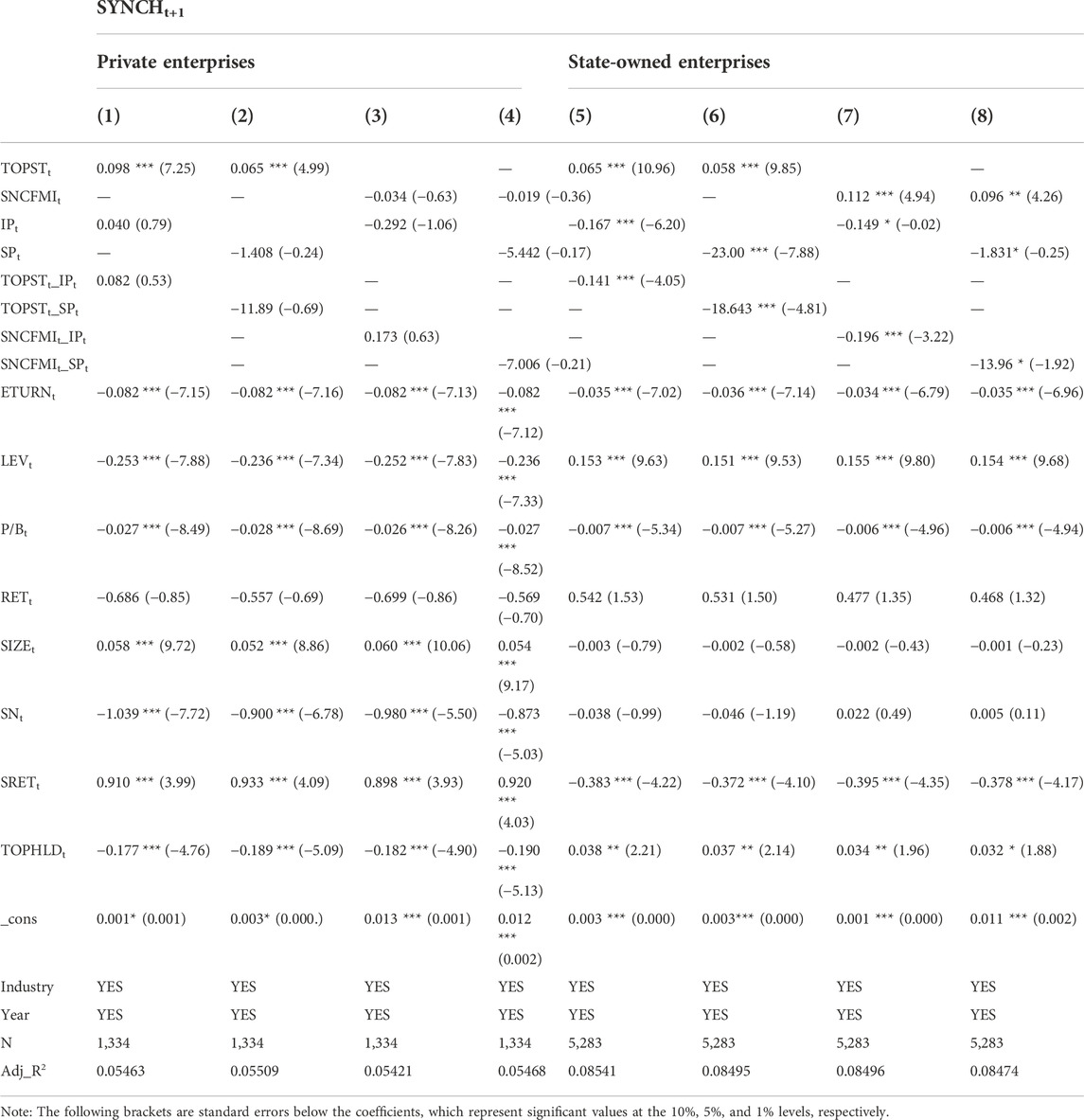

Table 3 shows the regression result of the sample of private enterprises and state-owned enterprises in testing insurance company participation, investor sentiment, and stock price synchronicity, and the empirical results all control the annual and industry variables, as the explained variables are share price synchronization “SYNCHt+1.” In columns (5)–(8), the coefficients of TOPSTt were positive and significant at the 1% significance level, the coefficients of SNCFMIt were positive and both were significant at the 1% and 5% levels, the coefficients of IPt and SPt were negative and significant at the significance levels of 1% and 10%, respectively, and the TOPSTt_IPt (the interaction of TOPSTt and IPt) and TOPSTt_SPt (TOPSTt and SPt interactions) are both negative and significant at the 1% significance level. The coefficients of SNCFMIt_IPt (the interaction of SNCFMIt and IPt) and SNCFMIt_SPt (the interaction of SNCFMIt and SPt) were negative and significant at the significance level of 1% and 10%, respectively. In general, the coefficients of the state-owned sample of columns (5)–(8) were more significant than the private sample of columns (1)–(4). This may be because the so-called enterprise sample is more serious than private enterprises because of the problem of proxy conflict; the management’s profit-scenting behavior will have a greater impact on the mood of investors through the network posts, especially on the mainstream views in the posts, where emotional resonance and consensus view are very easy to produce a “herd effect,” and the effect of the same rise and fall of share price is stronger. The insurance company participation can reduce the share price synchronicity through the intermediary effect on investor sentiment because insurance participation means the influx of funds in the market; first of all, it can enhance market confidence, and investors expect good future returns of the stock price and they will be at ease holding shares; however, when the market situation is relatively stable, investor sentiment will be more stable with higher proportion of insurance company shareholdings. This is good news for the capital market, as investors will not be in a hurry to leave the market and will insist on investment value. Therefore, the impact of insurance company participation on state-owned enterprises is more significant than that of private enterprises and hypothesis H3 is verified.

Through the aforementioned analysis, the basic assumptions have been verified, but there are still some points that need further explanation. With regard to whether the impact of investors’ positive and negative emotions on the synchronization of stock prices is symmetrical, from the efficient market hypothesis, the behavior of investors in the market is incorporated as information in the share price, but this hypothesis is valid if the market subject is rational and transmits valid private information. This hypothesis is based on the assumption that market participants are not fully rational and that investor sentiment represents different attitudes to investing in the market. However, from the theory of behavioral finance, every market player is a behavioral financier whose behavior is not fully qualified and does not follow a set paradigm, and is more influenced by the psychological and market environment. Therefore, in different market environments where investor sentiment is optimistic and pessimistic, the impact of positive insurance intervention on investors is not entirely symmetrical and does not have the same effect of reducing share price synchronization.

In addition, different types of insurance companies have different investment strategies; there is a big difference between life insurance companies and non-life insurance companies. In terms of product attributes, life insurance mainly covers people in old age and sickness, while non-life insurance mainly covers people for property losses. However, most consumers are accustomed to thinking of non-life insurance as consumption and life insurance products as investment with the function of preserving and increasing value. From the perspective of the public body of the market, people generally prefer to save money rather than spend it, and thus, people are more inclined in practice to buy life insurance products from banks rather than general insurance products. Therefore, in terms of relative strength, life insurance term business has a large cash flow and wholesale business has a stable cash flow, while non-life insurance has greater uncertainty. From the perspective of cooperative interests, life insurance companies are more complementary in terms of business, generally larger in scale, with strong going concern, good corporate credit, and sound corporate governance, while non-life insurance companies are relatively small, with brutal competition, high volatility, and unstable cash flows prone to default, and for this reason, financial institutions have relatively less trust in them. As a result, life insurance funding is relatively large, has low claim risk and is trusted by the financial markets, and its impact on the market is relatively high. Therefore, life insurance funds have a relatively stronger impact on the market.

4.3 Endogenous problems

Reverse causality (also known as co-factoring bias), missing variables, and measurement bias (Fazzari et al., 1988) are the main sources of endogenous problems. As far as reverse causality is concerned, since the first-order lag of the interpreted variable is used to regress in this paper, it weakens the possible endogenous problem to some extent. These variables may indirectly affect share price synchronicity. Measurement bias is always present in social survey data; considering that the survey data used in this paper have strict data quality control, this paper believes that the endogenous impact is limited.

At the same time, the robust analysis part of this paper also carried out PSM analysis to solve the problem of sample selection deviation, further weakening the endogenous problem.

5. Robustness test

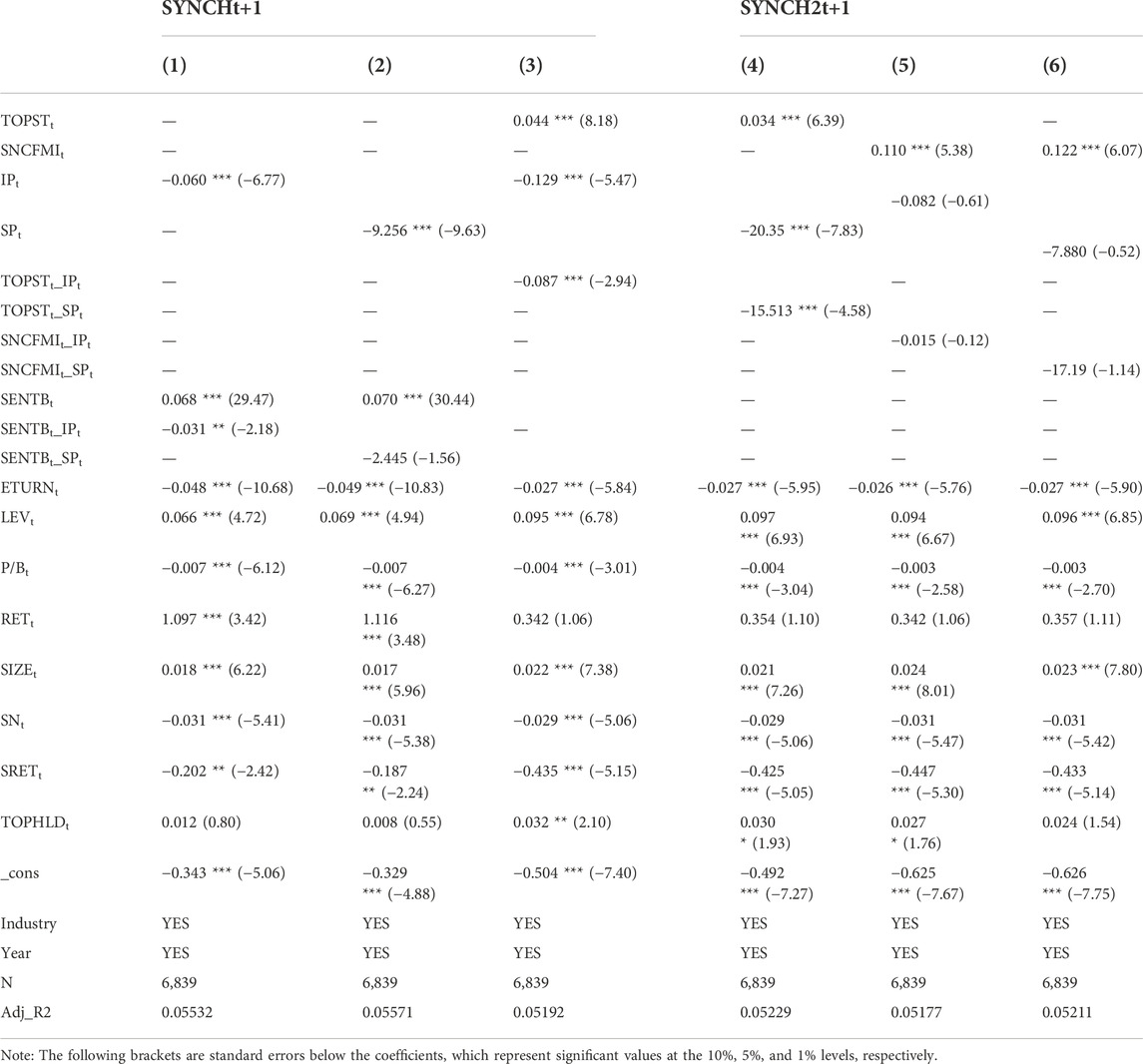

Table 4 shows the result of the robustness test. Columns (1) and (2) change the arguments SENTB, SENTB is bullish index B, which is calculated as ln ((1 + Ln)/(1 + Dn)); columns (3)– (6) replace “SYNCHt+1” with “SYNCH2t+1,” SYNCH2t+1 is recalculated on the basis of the SFC’s 2002 industry classification standard, and then the regression test is carried out separately; the regression results are consistent, and H1 and H2a are further verified.

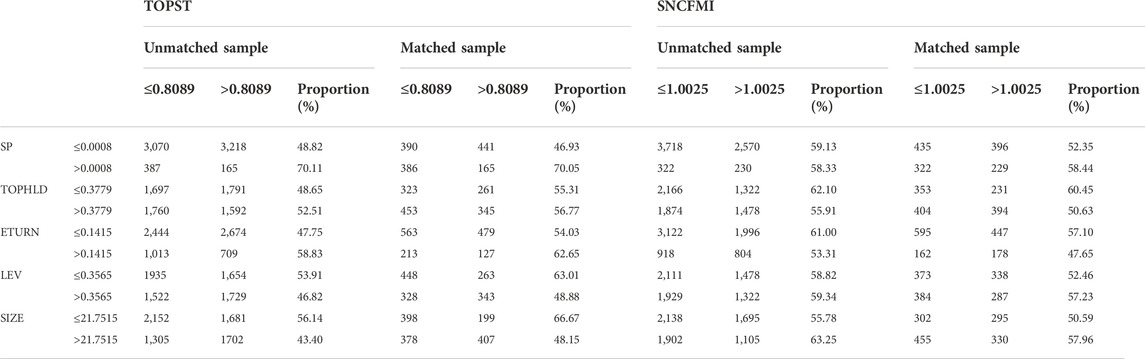

In order to prevent the endogenous problems caused by the systematic differentiation between investor sentiment index companies and non-investor sentiment index companies, this paper uses the PSM method to select a matching sample for companies with investor sentiment through the ratio tendency score (PS); the relationship between insurance company participation, investor sentiment, and stock price synchronization is tested, and the excess turnover rate of individual stock (ETURN), asset–liability rate (LEV), price-to-book ratio (P/B), weekly mean earnings of stock (RET), company size (SIZE), property nature (SN), standard deviation of RET (SRET), and the largest shareholder shareholding ratio (TOPHLD), the eight aforementioned company characteristic variables are used to establish a tendentious model of investor sentiment, and the logit model is used to estimate the tendency score value (PS value) of investor sentiment in each company. For each company with an indicator of investor sentiment, we select the company that had no investor sentiment in the same year and the closest PS value was used as a matching sample, and examined the difference in the factor variables between the two groups. Table 5 shows the PSM test result and provides further support for hypotheses 1 and 2a.

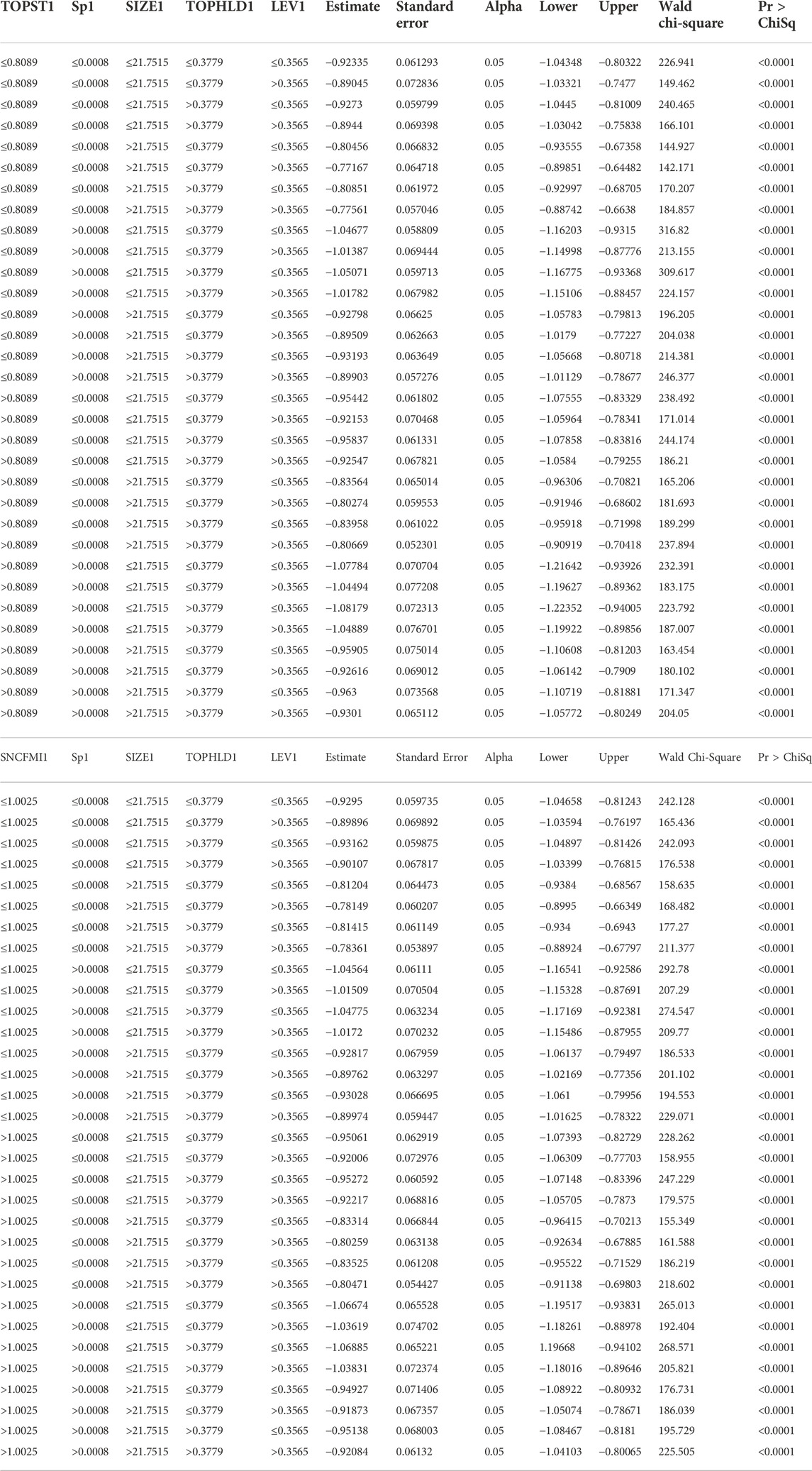

At the same time, this paper constructs counterfactual research and compares the stock price synchronization (high and low) comparison between investor sentiment and non-investor sentiment under other conditions unchanged. In order to compare the marginal effect of investor sentiment more intuitively, SP, TOPHLD, ETURN, LEV, and SIZE are recoded according to the initial sample mean in the calculation (greater than or equal to the mean part is a group, less than the mean part is a group), and the TOPST and SNCFMI are re-regressed to obtain the tendentious score (probability) and match the tendency score, and the pairing sample according to the nearest neighbor 1-1 match is obtained. Table 6 shows the basic group descriptive statistics before and after PSM pairing, and the selection of the grouping critical value (e.g., 0.0008 in the SP) is mainly taken from the mean level in the original data set at the same time; we re-establish the regression equation, calculate the marginal effects of each key variable (average marginal effect, AME), and compare the marginal effects at different levels, where the SYNCH is analyzed using a paired sample. We compare the variables’ (such as SIZE, TOPHLD, and LEV) marginal effects by factor, and the results are shown in Table 7.

It can be noted that when SIZE, TOPHLD, and LEV are taken in larger groups or all taken in smaller groups, and the core variables are taken in larger groups or all taken in smaller groups, insurance company participation in the high group with investor sentiment (TOPST>0.8089 and SNCFMI>1.0025) can reduce share price synchronization by 0.10435 (−1.07784 + 1.04677−1.06674 + 1.04564−0.95442 + 0.92335−0.95061 + 0.9295 = 0.10435) compared with the group of low investor sentiment (TOPST ≤ 0.8089 and SNCFMI ≤ 1.0025); for the high-level investor sentiment group (TOPST>0.8089 and SNCFMI>1.0025), the group with a high proportion of insurance company participation reduced the share price synchronization by 0.16955 (−1.00784−0.95442−1.06674 0.95061 = −0.16955) compared with the group of low proportion of insurance company participation. For the group with low investor sentiment (TOPST ≤ 0.8089 and SNCFMI ≤ 1.0025), the group with a high insurance company participation shareholding is more helpful in reducing the synchronization of share prices by 0.23956 (−1.04677 + 0.92335−1.04564 + 0.9295 = −0.23956) than the group with low-insurance company participation shareholding. It can be seen that for investors with high and low emotional groups, the higher the proportion of insurance capital shares, the more it helps to reduce stock price synchronicity.

In addition, compared to other institutional investors, the sources of funds, investment strategies, and operating methods of insurance companies show different characteristics. First, longevity and stability are important features of insurance funds. A total of 70% of insurance products have a duration of over 7 years, and life insurance and annuity insurance are mostly long-term insurance products with a duration of more than 10 years to several decades, and the average usable life of insurance funds is over 10 years, so insurance companies’ funds are more targeted at long-term investments. Second, the flow of funds for insurance companies is relatively stable. Life insurance payouts are related to the life table of the insured and, apart from force majeure, the life table is relatively stable and insurance companies are able to accurately estimate the outflow of funds. Third, based on the risk constraints on solvency imposed by liability-side repayment pressures and prudential policies, insurers are risk-averse, emphasize capital safety, and place a high emphasis on the level of risk management in the use of capital. Fourth, policies and regulations promote long-term sound investment by insurance companies, continuously expanding the scope and proportion of investment by insurance companies and significantly increasing the cap on the proportion of companies held by insurance companies, while counter-cyclical asset recognition standards and equity method bookkeeping reduce the impact of short-term market fluctuations on the investment returns of insurance institutions and encourage them to strategically increase their holdings in listed companies. In summary, unlike short-sighted institutional investors, insurance institutions prefer to hold listed companies based on a stable, long-term, and concentrated investment strategy, and are more often strategic institutional investors. After holding shares in listed companies, insurance institutions bring their sound business ideas and management experience to listed companies and actively play an external monitoring role. Fifth, insurance institutional investors have a cautious and risk-averse governance style and are involved in supervising the business decisions of enterprises, which is more characteristic of strategic investors. So, the mitigation effect comes from insurance companies.

6 Conclusion

The influence of e-finance on financial markets has attracted more attention from enterprises and academia. As an important factor affecting stock price, investor sentiment has an important influence on the synchronicity of stock price and is prone to produce a “domino effect.” Based on the investor sentiment from the perspective of public opinion in the stock market, this paper systematically studies the effect of insurance company participation on the synchronicity of stock prices. The results show that the investor sentiment of the stock market forum will increase the synchronicity of stock prices in the short term and both are positively correlated, while insurance company participation effectively reduces the impact of investor sentiment to share price synchronicity, which played a certain intermediary effect, and the higher the proportion of insurance company shareholdings, the more evident the effect. Because when insurance companies participate in the stock market, they will play a good role in the capital market through corporate governance, and there is a great effect on network forum information to help stabilize investor sentiment, thus reducing the herd effect and the same rise and fall effect of stock price. Through the construction of counterfactual research, we found that insurance company participation in the group of high investor sentiment can reduce the synchronicity of stock price by 0.10435 than the group of low investor sentiment group; for the investor sentiment group, the group with high proportion of insurance companies’ shareholdings is more help to reduce the synchronicity of stock prices. The conclusion of this paper has profound implications for investors’ investment strategy and the supervision of the capital market by the state.

The conclusion shows that 1) it is important to educate investors and pay more attention to the changes in investor sentiment at the same time in order to prevent their excessive investment behavior affecting market stability; 2) an insurance company is an important institutional investor which plays an important role in the capital market’s sustainable development, and the national policy should correctly guide insurance company to participate in the market and avoid disadvantages and create profits for the market, and different types of insurance companies should also make decisions based on their own characteristics; 3) in the case of the rise and fall effect, the government should formulate corresponding policies and regulations to manage institutional investors to prevent risk and the regulatory authorities should strengthen supervision and prevent speculative capital investment behavior; and 4) in the high-speed information-developed society, the relevant information departments of the state should clean up the security market-related information channels and prevent illegal elements from deliberately disturbing the audio-visual behavior, so as to establish the correct investment sentiment orientation and improve the efficiency of capital market pricing.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

FH: conceptualization, methodology, and writing—original draft and editing. BL: formal analysis, investigation, and validation. JY: conceptualization and writing—-review and editing. All authors contributed to the manuscript and approved the submitted version.

Funding

This work was supported by the second batch of general projects of wealth management characteristics research of Shandong Technology and Business University (2022YB09), the Shandong Computer Society Provincial Key Laboratory Joint Open Fund (SDKLCN-2020-06), Shandong Technology and Business University Doctoral Research Startup Fund (BS202022), and the Natural Science Foundation of Shandong Province (ZR2021MF015).

Acknowledgments

The authors thank the handling editor and anonymous referees of this journal for insightful comments.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ackert, L. F., Jiang, L., Lee, H. S., and Liu, J. (2016). Influential investors in online stock forums. Int. Rev. Financial Analysis 45, 39–46. doi:10.1016/j.irfa.2016.02.001

Amir, R., and Eran, R. (2010). Informed investors and the internet. J. Bus. Finance Account. 37 (7-8), 841–865. doi:10.1111/j.1468-5957.2010.02187.x

An, H., and Zhang, T. (2011). Stock price synchronicity, crash risk, and institutional investors. J. Corp. Finance 21 (1), 1–15. doi:10.1016/j.jcorpfin.2013.01.001

Andrei, D., and Cujean, J. (2017). Information percolation, momentum and reversal. J. Financial Econ. 123 (3), 617–645. doi:10.1016/j.jfineco.2016.05.012

Antweiler, W., and Frank, M. Z. (2004). Is all that talk just noise? The information content of internet stock message boards. J. Finance 59 (3), 1259–1294. doi:10.1111/j.1540-6261.2004.00662.x

Barber, B. M., and Odean, T. (2008). All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors. Rev. Financ. Stud. 21 (2), 785–818. doi:10.1093/rfs/hhm079

Barberis, N., Shleifer, A., and Vishny, R. W. (1998). A model of investor sentiment1We are grateful to the NSF for financial support, and to oliver blanchard, alon brav, john campbell (a referee), john cochrane, edward glaeser, J.B. Heaton, danny kahneman, david laibson, owen lamont, drazen prelec, jay ritter (a referee), ken singleton, dick thaler, an anonymous referee, and the editor, bill schwert, for comments.1. J. Financial Econ. 49 (3), 307–343. doi:10.1016/s0304-405x(98)00027-0

Ben-Rephael, A., Kandel, S., and Wohl, A. (2012). Measuring investor sentiment with mutual fund flows. J. Financial Econ. 104 (2), 363–382. doi:10.1016/j.jfineco.2010.08.018

Bowden, J., Burton, B., and Power, D. (2017). Rumours built on quicksand: Evidence on the nature and impact of message board postings in modern equity markets. Eur. J. Finance 24, 544–564. doi:10.1080/1351847x.2017.1288647

Chan, K., and Hameed, A. (2006). Stock price synchronicity and analyst coverage in emerging markets. J. Financial Econ. 80 (1), 115–147. doi:10.1016/j.jfineco.2005.03.010

Chen, H., De, P., Hu, Y., and Hwang, B. H. (2014). Wisdom of crowds: The value of stock opinions transmitted through social media. Rev. Financ. Stud. 27 (5), 1367–1403. doi:10.1093/rfs/hhu001

Chen, J., Hong, H., and Stein, J. C. (2000). Forecasting crashes: Trading volume, past returns and conditional skewness in stock prices. J. Financ. Econ. 61 (3), 345–381. doi:10.1016/s0304-405x(01)00066-6

Consuelo, P. M. M., and Blanca, López-Zamora (2018). Engagement of directors representing institutional investors on environmental disclosure. Corp. Soc. Responsib. Environ. Manag. 25 (6), 1108–1120. doi:10.1002/csr.1525

Cornell, B., Landsman, W. R., and Stubben, S. R. (2017). Accounting information, investor sentiment, and market pricing. J. Law, Finance, Account. 2 (5), 325–345. doi:10.1561/108.00000017

Das, S. R., and Chen, M. Y. (2007). Yahoo! For amazon: Sentiment extraction from small talk on the web. Manag. Sci. 53 (9), 1375–1388. doi:10.1287/mnsc.1070.0704

De Long, J. B., Shleifer, A., Summers, L. H., and Waldmann, R. J. (1990). Positive feedback investment strategies and destabilizing rational speculation. J. Finance 45 (2), 379–395. doi:10.2307/2328662

Duan, L., and Shou, C. (2006). Management short-horizon, investor sentiment and corporate investment distortion in China stock market. Chin. J. Manag. Sci. 14 (2), 16–23.

Durnev, A., Morck, R., Yeung, B., and Paul, Z. (2003). Does greater firm-specific return variation mean more or less informed stock pricing? J. Account. Res. 41 (5), 797–836. doi:10.1046/j.1475-679x.2003.00124.x

Ettlin, N., Farkas, W., and Smirnow, A. (2020). Optimal risk-sharing across a network of insurance companies. Insur. Math. Econ. 95, 39–47.

Fazzari, S. M., Hubbard, R. G., Petersen, B. C., Blinder, A. S., and Poterba, J. M. (1988). Financing constraints and corporate investment. Brookings Pap. Econ. Activity 1988 (1), 141–206. doi:10.2307/2534426

Greenwood, R. M., and Nathan, S. (2007). Trading patterns and excess comovement of stock returns. Financial Analysts J. 63 (5), 69–81. doi:10.2469/faj.v63.n5.4841

Guan, G., and Hu, X. (2022). Equilibrium mean–variance reinsurance and investment strategies for a general insurance company under smooth ambiguity. North Am. J. Econ. Finance 63, 101793. doi:10.1016/j.najef.2022.101793

Gul, F. A., Kim, J. B., and Qiu, A. A. (2010). Ownership concentration, foreign shareholding, audit quality, and stock price synchronicity: Evidence from China. J. Financial Econ. 95 (3), 425–442. doi:10.1016/j.jfineco.2009.11.005

Han, L., Li, D., Moshirian, F., and Tian, Y. (2010). Insurance development and economic growth. Geneva Pap. Risk insur. Issues Pract. 35 (2), 183–199. doi:10.1057/gpp.2010.4

Hausele, S. (1998). Investor relations: Basic principles and importance in the insurance industry. Insur. Math. Econ. 22 (2), 192–193. doi:10.1016/s0167-6687(98)80054-1

Hitchcox, A. N., Klumpes, P. J. M., Mcgaughey, K. W., Smith, A. D., and Taverner, N. H. (2011). ERM for insurance companies – adding the investor's point of view- Abstract of the London Discussion. Br. Actuar. J. 16 (2), 385–404. doi:10.1017/s1357321711000134

Hong, H., and Stein, J. C. (2003). Differences of opinion, short-sales constraints, and market crashes. Rev. Financ. Stud. 16 (2), 487–525. doi:10.1093/rfs/hhg006

Huang, Y., Qiu, H., and Wu, Z. (2016). Local bias in investor attention: Evidence from China”s internet stock message boards. J. Empir. Finance 38, 338–354. doi:10.1016/j.jempfin.2016.07.007

Jin, Z. (2010). New accounting standard, accounting information quality and stock price synchronicity. Account. Res. 22 (7), 19–26.

Kaigorodova, G. N., Mustafina, A. A., and Alyakina, D. P. (2018). Directions of improving information system of insurance company. J. Phys. Conf. Ser. 1015, 042016. doi:10.1088/1742-6596/1015/4/042016

Kelly, P. J. (2014). Information efficiency and firm-specific return variation. Q. J. Finance 4 (4), 1450018–1450044. doi:10.1142/s2010139214500189

Li, J., and Myers, Stewart C. (2006). R2 around the world: New theory and new tests. J. Financial Econ. 79 (2), 257–292. doi:10.1016/j.jfineco.2004.11.003

Li, K., Morck, R., Yeung, Y. B., and Yeung, B. (2004). Firm-specific variation and openness in emerging markets. Rev. Econ. Stat. 86 (3), 658–669. doi:10.1162/0034653041811789

Li, X., Shen, D., and Zhang, W. (2018). Do Chinese internet stock message boards convey firm-specific information? Pacific-Basin Finance J. 49, 1–14. doi:10.1016/j.pacfin.2018.03.003

Morck, R., Yeung, B., and Yu, W. (1999). The information content of stock markets: Why do emerging markets have synchronous stock price movements? J. Financ. Econ. 58 (1), 215–260. doi:10.1016/s0304-405x(00)00071-4

Nofer, M., and Hinz, O. (2015). Using twitter to predict the stock market. Bus. Inf. Syst. Eng. 57 (4), 229–242. doi:10.1007/s12599-015-0390-4

Olarewaju, O. M., and Msomi, T. S. (2021). Intellectual capital and financial performance of South African development community’s general insurance companies. Heliyon 7 (4), e06712. doi:10.1016/j.heliyon.2021.e06712

Piotroski, J. D., and Roulstone, D. T. (2004). The influence of analysts, institutional investors, and insiders on the incorporation of market, industry, and firm-specific information into stock prices. Account. Rev. 79 (4), 1119–1151. doi:10.2308/accr.2004.79.4.1119

Polonchek, J., and Miller, R. K. (2005). The impact of management communications on insurance company share repurchases. J. Insur. Issues 28 (2), 183–210.

Ruan, Y., Durresi, A., and Alfantoukh, L. (2018). Using twitter trust network for stock market analysis. Knowledge-Based Syst. 145 (APR.1), 207–218. doi:10.1016/j.knosys.2018.01.016

Sabherwal, S., Sarkar, S. K., and Zhang, Y. (2011). Do internet stock message boards influence trading? Evidence from heavily discussed stocks with no fundamental news. J. Bus. Finance Account. 38 (9-10), 1209–1237. doi:10.1111/j.1468-5957.2011.02258.x

Seasholes, M. S., and Wu, G. (2007). Predictable behavior, profits, and attention. J. Empir. Finance 14 (5), 590–610. doi:10.1016/j.jempfin.2007.03.002

Song, L. (2015). Accounting disclosure, stock price synchronicity and stock crash risk: An emerging-market perspective. Int. J. Account. Inf. Manag. 23 (4), 349–363. doi:10.1108/ijaim-02-2015-0007

Statman, S. M., and Statman, M. (1994). Behavioral capital asset pricing theory. J. Financial Quantitative Analysis 29 (3), 323–349. doi:10.2307/2331334

Sul, H. K., Dennis, A. R., and Yuan, L. I. (2017). Trading on twitter: Using social media sentiment to predict stock returns. Decis. Sci. 48 (3), 454–488. doi:10.1111/deci.12229

Talonen, A., Mähönen, J., and Kwon, W. J. (2022). Examining the investment operations as a derived core function of mutual insurance companies: Research agenda and guide. J. Co-op. Organ. Manag. 10, 100168–100169. doi:10.1016/j.jcom.2022.100168

Tetlock, P. C. (2007). Giving content to investor sentiment: The role of media in the stock market. J. Finance 62 (3), 1139–1168. doi:10.1111/j.1540-6261.2007.01232.x

Tumarkin, R., and Whitelaw, R. F. (2001). News or noise? Internet postings and stock prices. Financial Analysts J. 57 (3), 41–51. doi:10.2469/faj.v57.n3.2449

West, K. D. (1988). Dividend innovations and stock price volatility. Econometrica 56 (1), 37–61. doi:10.2307/1911841

Xu, N., Chan, K. C., Jiang, X., and Yi, Z. (2013). Do star analysts know more firm-specific information? Evidence from China. J. Bank. Finance 37 (1), 89–102. doi:10.1016/j.jbankfin.2012.08.014

Xuelian, B., Yi, D., and Nan, H. (2018). Financial report readability and stock return synchronicity. Appl. Econ., 1–18.

Zamri, A., Haslindar, I., and Jasman, T. (2017). Institutional investor behavioral biases: Syntheses of theory and evidence. Manag. Res. Rev. 40 (5), 578–603. doi:10.1108/mrr-04-2016-0091

Zhao, T., Pei, R., and Pan, J. (2021). The evolution and determinants of Chinese property insurance companies’ profitability: A DEA-based perspective. J. Manag. Sci. Eng. 6 (4), 449–466. doi:10.1016/j.jmse.2021.09.005

Zhou, C., Wu, C., Li, D., and Chen, Z. (2012). Insurance stock returns and economic growth. Geneva Pap. Risk insur. Issues Pract. 37 (3), 405–428. doi:10.1057/gpp.2012.22

Zou, H., and Sun, L. (2012). “The influence of investor sentiment on stock return and its volatility under different market states,” in Fifth International Conference on Business Intelligence & Financial Engineering.

Appendix A: Variable definitions.

Keywords: investor sentiment, insurance company participation, stock price synchronicity, sustainable development, capital market

Citation: Hao F, Li B and Yang J (2022) The impact of insurance company participation on the capital market’s sustainable development—empirical evidence based on investor sentiment and stock price synchronicity. Front. Environ. Sci. 10:1072094. doi: 10.3389/fenvs.2022.1072094

Received: 17 October 2022; Accepted: 07 November 2022;

Published: 25 November 2022.

Edited by:

Yuantao Xie, University of International Business and Economics, ChinaReviewed by:

Yu Mao, Tsinghua University, ChinaXiaoke Sun, Guangdong University of Foreign Studies, China

Copyright © 2022 Hao, Li and Yang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Juan Yang, eWFuZ2pAY2FzdGVkLm9yZy5jbg==

Fangjing Hao

Fangjing Hao Boyang Li

Boyang Li Juan Yang5*

Juan Yang5*