95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 23 November 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.1062179

This article is part of the Research Topic Environmental Risk and Corporate Behaviour View all 30 articles

Wei Wang1,2*

Wei Wang1,2*In the context of increasing resource scarcity and environmental pollution, achieving sustainable development with environmental friendliness at its core is essential for maintaining long-term economic growth. However, the positive environmental externalities associated with sustainable development impose an additional cost burden on enterprises. Internalizing those positive environmental externalities in the form of corporate benefits through tax policies is the key to incentivizing sustainable development. Using the reform of China’s tax enforcement agency and tax enforcement system as a quasi-natural experimental context, this paper investigates the impact of tax equity on sustainable development. The empirical findings show that tax equity can promote the sustainable development of enterprises, and this promotion is achieved by enhancing corporate green innovation. Furthermore, tax equity has a stronger effect on the sustainable development of enterprises in a favorable market environment because it is more conducive to the protection of intellectual property and transformation of green innovation into tangible output. The tax equities brought about by different types of tax reforms have different effects on the sustainable development of enterprises in different life cycle stages because the types of tax inequities suffered by enterprises of different ages vary.

Since the industrial revolution, rapid economic growth has led to the overexploitation of resources and excessive discharge of industrial pollution, which have had a serious negative impact on the natural environment. This negative impact in turn affects economic development and limits the sustainability of economic growth. The international community has gradually become aware of this situation and thus adopted sustainable economic development as a core strategy. When faced with environmental problems, companies will improve their resource efficiency and seek to maintain a balance between economic output and environmental conservation to gain a sustainable competitive advantage (Hart, 1995a). The existing literature has proposed that two basic elements must be satisfied to achieve sustainable development: environmental sustainability, which mainly refers to minimizing the environmental hazards caused by operating activities (Antolin-Lopez et al., 2016) or minimizing resource consumption (Hart, 1995b; Chow & Chen, 2012), and economic growth sustainability, which refers to maintaining long-term growth in terms of profitability and operating performance (Bansal, 2005; Steurer et al., 2005; Erol et al., 2009). In other words, corporate sustainability is defined as the pursuit of sustained economic growth in the presence of ecological constraints (Shrivastava, 1995).

Although sustainable economic development is beneficial to the long-term growth of the economy as a whole, enterprises by nature maximize their individual interests and, in the absence of external constraints, are more likely to sacrifice the natural environment or waste public resources for their own benefit—that is, the so-called “tragedy of the commons” in economic theory. This contradiction between individual rationality and group irrationality is difficult to be address through market mechanisms. Polluting companies make a profit by transferring the costs of pollution control to the natural environment and lack the incentive to actively minimize negative environmental externalities (Jaffe et al., 2005); companies that are devoted to emissions reduction, resource recycling, and green innovation generate knowledge spillovers and positive environmental externalities but have to bear the associated costs of those efforts, which discourages them from further investing in environmentally friendly activities (Jaffe et al., 1995; Porter & Van, 1995; Rennings, 1998; Atanassov & Liu, 2014). Therefore, the environmental externalities of enterprise development must be addressed through public economic policy interventions, and taxation is one of the most effective means of regulating the externalities of enterprise behavior (Sun et al., 2008).

In recent years, governments around the world have promulgated a variety of tax policies to encourage sustainable development. Effective tax policies require not only sensible regulations, but also the guarantees provided by a transparent tax regime. Tax equity is one of the most important indicators of the fairness of a tax regime. Tax equity is related to the credibility of the tax regulations and their enforcement. When the tax regime lacks fairness, enterprises will ignore tax policies and invest resources into obtaining tax exceptions to support their profitability, which will in turn damage its credibility. To build an efficient and fair tax regime, the Chinese government has reformed the tax enforcement system and enforcement agencies, both of which have been used to reduce information asymmetries in tax enforcement. Such reforms have played an important role in creating a fair tax regime.1

Based on this, this paper constructs a difference-in-differences (DID) model using a sample of Chinese listed companies from 2000 to 2019 and constructs a quasi-natural experiment to test the impact of reduced tax inequity on sustainable development using the reforms of the tax enforcement system (i.e., the Golden Tax III project) and the tax enforcement agency (i.e., transferring social insurance collection from a third-party agency to the taxation department). We find that the reduction in tax inequity brought about by both reforms can significantly contribute to the sustainable development of enterprises, and the results are robust regardless of whether total factor productivity, labor intensity, or capital intensity is used as a measure of enterprise sustainability. Tax equity promotes sustainable development by increasing the number of green invention patent applications, utility patent applications, invention patent grants, and utility model grants. Furthermore, tax equity has a stronger effect on the sustainable development of enterprises in a favorable market environment, mainly because a such an environment is more conducive to green innovation. Reforming the tax enforcement system is more effective in promoting the sustainable development of young enterprises through green innovation because it is more effective in reducing information asymmetries on the collection side by breaking down tax agencies’ intradepartmental information barriers while inhibiting their rent-seeking behaviors. Moreover, young enterprises typically have fewer social connections and are more likely to suffer from tax inequities. Reforming tax enforcement agencies is more effective in promoting mature enterprises through green innovation because doing so relieves information asymmetries on the payment side by coordinating social insurance premiums and taxes while reducing the inequities caused by tax evasion. Since mature enterprises are generally more willing to pay social insurance premiums, they are more likely to benefit from the tax equity brought about by tax enforcement agency reform.

The main contributions of this paper are in the following four aspects. First, the externalities of sustainable development require public policy interventions, and this paper takes tax reform as a proxy for pro-sustainable development public policy. Second, there has long been an academic debate about whether green innovation can promote sustainable development. This paper offers its perspective on this discussion by analyzing Chinese listed companies. Third, in the heterogeneity test, this paper finds that the market environment and life cycle characteristics of enterprises have heterogeneous effects on sustainable development-promoting tax equity, which provides a theoretical reference for the subsequent formulation of targeted public taxation policies. Last, two DID models that validate each other are constructed in the empirical study, which can serve as a basis for future research efforts.

Information asymmetry is an important cause of tax policy failure (Sen, 1988; Mirrlees & Vickey, 1996). Specifically, there are two main reasons for tax inequity. On the one hand, there is a certain degree of freedom in tax enforcement, and tax information asymmetries allow tax collectors to engage in rent seeking, which leads to tax inequities on the collection side; on the other hand, some enterprises may evade taxes by manipulating earnings, concealing actual income, bribing officials, etc., which create tax inequities on the payment side. To address these problems, the Chinese government has adopted reforms in both the tax enforcement system and the tax enforcement agencies. Both types of reforms are aimed at creating a standardized and fair tax regime by addressing the information asymmetries that exist in tax collection and administration.

The acquisition and supervision of tax-related information is an important means to ensuring the standardization of tax enforcement and provides an important guarantee against which the government implements tax policies and promotes tax equity (Gordon & Li, 2009). The Golden Tax Project, which was implemented in 1994, is a representative reform of the tax enforcement system. From 1994 to 1998, the Chinese government implemented “Golden Tax I,” which was designed to focus on the construction of a VAT cross-checking system, and promoted it in more than 50 cities. However, it did not achieve the desired effect due to the frequency of information errors caused by manual entry. To address this problem, China began to formally establish “Golden Tax II” in 1998 and rolled out the system to all provinces, prefecture-level cities and counties in 2001.

The “Golden Tax I” and “Golden Tax II” projects mainly focused on the joint verification of VAT, which could not meet the tax enforcement system’s increasingly complex needs in terms of expanding information processing and supervision, so China officially launched the “Golden Tax III” project in 2013. The “Golden Tax III” project is different from the previous two phases of the project in that it covers all tax types, generally uses big data, cloud computing and other advanced technical means, and is built following the principle of “one platform, two levels of processing, three coverage, and four systems2.” This project marked a leap forward in the supervision of tax-related information: the unified technical infrastructure platform enables the smooth flow of information between taxation departments and the data can be monitored and cross-checked, the exchange of information between the State Administration of Taxation and local taxation bureaus facilitates the multi-dimensional presentation of taxpayer profiles and prevents tax evasion, and the intradepartmental information exchange compresses the freedom in local tax collection and enforcement while combatting the irregularities in tax enforcement and unfair taxation caused by corruption and collusion.

“Golden Tax III” has made greater breakthroughs than “Golden Tax I” and “Golden Tax II” in terms of influencing reform and expanding the coverage of tax types. Therefore, this paper selects “Golden Tax III” as the research object for tax enforcement system reform and uses its promotion as a quasi-natural experiment to carry out empirical research. The specific rollout of “Golden Tax III” in each province and city is shown in Table 1.

Although social insurance premiums are fees, they have the characteristics of a quasi-taxation. Among more than 170 countries and regions with social insurance premiums, 132 have taxation departments acting as social insurance premium collection and administration agencies. There has long been an ample “free space” for the collection and administration of social insurance premiums in China, and the evasion of social insurance premiums was widespread. Although the “Interim Regulations on the Collection and Payment of Social Insurance Premiums” and the Social Insurance Law of the People’s Republic of China clearly stipulate the scope and norms of collection and payment, enterprises may find ways to evade social insurance premiums by changing their governance structure, compensation plans, and ownership structure as well as by looking for loopholes in the regulatory environment (Desai and Dharmapala, 2006; Chen et al., 2010; Armstrong et al., 2015; DeBacker et al., 2015).

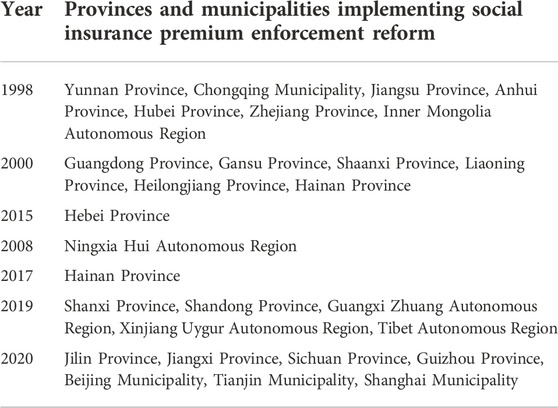

As the most critical factor at the enforcement level, the operation of collection agencies has a significant impact on the standardization of tax and social insurance premium collection as well as the prevention of tax evasion. In 1998, the Ministry of Finance, the Ministry of Labor, the People’s Bank of China, and the State Administration of Taxation jointly issued the “Notice on the Issuance of Interim Provisions on the Implementation of Two Lines of Management of the Basic Pension Insurance Fund for Enterprise Employees,” which clearly stipulates that both social insurance agencies and taxation departments are the legal agencies for collecting and managing social insurance premiums and that localities are free to choose between the two. In 1999, the 13th executive meeting of the State Council considered and adopted the “Provisional Regulations on Collection and Payment of Social Insurance Premiums,” which reconfirmed the collection and administration departments. Although both the social insurance and taxation departments are the legal collection agencies for social insurance premiums, the taxation departments are relatively more regulated and thus more aggressive in their collection efforts. On the one hand, there is a connection between social insurance premiums and income tax and thus the collection of social insurance premiums by the taxation department can allow for more efficient supervision of tax evasion by cross-checking information; on the other hand, the taxation department has stronger enforcement capabilities, a more complete collection and control system, and takes a firmer stance against tax evasion. To restrain tax evasion, more local governments are choosing to implement tax enforcement agency reform and replace third-party agencies with taxation departments as collectors of social insurance premiums. The specific rollout is shown in Table 2.

TABLE 2. Implementation of social insurance premium collection and management reform in Chinese provinces and municipalities.

Tax enforcement reform contributes to tax equity by reducing information asymmetries, and the impact of corporate tax equity on sustainable development can be analyzed from both the corporate and market perspectives. From the corporate side, reducing tax inequities promotes green innovation and sustainable development through three main pathways. First, reducing tax inequities means that enterprises face a less unfair tax burden, which enables them to retain more profits such that they have more resources to invest in green innovation. Second, reducing tax inequities makes enterprises more optimistic about their future prospects, boosts their confidence, and encourages them to respond more positively to environmental protection and innovation policy guidance, which in turn motivates them to invest in green innovation resources (Liu et al., 2022). Third, enterprises facing fewer tax inequities are more inclined to send positive signals to the market, which reduces their cost of financing and relieves their financing constraints (Sialm, 2006; Baum et al., 2009; Croce et al., 2012; Francis et al., 2014). From the market side, tax equity reduces the distortions in resource allocation caused by the government’s “special care,” thus alleviating the problem of mismatched production resources and facilitating the flow of production materials to more efficient enterprises. In light of the above analysis, the first hypothesis of this paper can be proposed:

Hypothesis 1:. Tax equity promotes sustainable development.The reduction in tax inequities brought about by tax enforcement reform will promote the sustainable development of enterprises. According to the theoretical analysis in the previous section, it can be seen that tax equity promotes green innovation. Therefore, this paper analyzes the influencing mechanism of tax equity on the sustainable development of enterprises from the perspective of green innovation.Innovation is the core driver of enterprise development, and green innovation can improve enterprises’ production processes, convert waste into goods, reduce compliance costs, and enhance enterprises’ environmental reputation and competitive advantages, all of which promote sustainable development (Hart, 1995a; Porter and Van, 1995; Sharma and Vredenburg, 1998; Eiadat, 2008). First, green innovation can help firms build a competitive advantage by reducing their costs while contributing to the development of differentiated products (Porter and Van, 1995). Second, firms that engage in green innovation can benefit from a reduced cost of compliance with government environmental regulations (Hart, 1995b). Third, green innovation can help firms improve their market position (Mirata and Emtairah, 2005; Bernauer et al., 2007; Tian et al., 2021). Fourth, green innovation can enhance firms’ environmental reputation (Eiadat et al., 2008). Studies have shown that consumers are more inclined to buy products that support green innovation concepts (Heun et al., 2014; Tully & Winer, 2014), and some consumers are inclined to pay higher prices for environmentally friendly products and services (Bhat, 1993). Fifth, the adoption of green innovation strategies optimizes operational processes and thus improves economic performance (Banerjee, 2001). Furthermore, environmental performance makes not only a direct but also an indirect contribution to economic performance (Shrivastava, 1995). Most scholars believe that corporate green innovation helps firms build sustainable competitive advantages (e.g., Porter and Van, 1995; Brunnermeier & Cohen, 2003; Johnstone, 2007). Therefore, this paper proposes its second hypothesis:

Hypothesis 2:. Green innovation is a mediating mechanism through which tax equity promotes sustainable development.

This paper selects Chinese listed companies from 2000 to 2019 as the sample. Financial companies, companies with owner’s equity of less than zero, companies under special treatment, and companies with less than 3 years of innovation data are removed from the sample, leaving a final sample of 8,935 observations. Patent data are manually collected from the website of the State Intellectual Property Office, and all financial data are obtained from the CSMAR database. Data on tax enforcement reforms at both the prefectural and provincial levels are obtained from the State Council website and local government websites, and data on the market environment are obtained from the Marketization Index published by Fan Gang and Wang Xiaolu (Fan et al., 2001). To eliminate the effect of extreme values, all continuous variables are winsorized at the 1% and 99% percentiles.

In this paper, total factor productivity calculated using the LP method (Levinsohn and Petrin, 2003) is chosen as a measure of enterprise sustainability and total factor productivity calculated using the OP method (Olley and Pakes, 1996), capital intensity and labor intensity (Solow, 1956; Forbes, 2002; Carayannis, 2004) are used as alternative indicators.

In terms of explanatory variables, this paper uses two dummy variables to indicate whether the firm has experienced tax enforcement reform (ROS/ROI). A value of one is assigned if the firm is in an area-year where tax enforcement reform has been implemented and zero otherwise. UNF_ROS/UNF_ROI is used to indicate whether the firm suffered from tax inequity before the reform was implemented. A value of one is assigned if the tax burden of the firm is higher than the regional average before the reform and zero otherwise. The product of ROS/ROI and UNF_ROS/UNF_ROI (ROS*UNF_ROS/ROI*UNF_ROI) therefore represents the reduction in tax inequity, as the reforms reduce information asymmetries and thus reduce tax inequity from both the government and corporate sides (Allingham and Sandmo, 1972; Slemrod et al., 2001; Desai and Dharmapala, 2006; Kleven et al., 2011; Armstrong et al., 2015; DeBacker et al., 2015; Pomeranz, 2015; Carrillo et al., 2017; Chen, 2017).

To capture the green innovation of the sample firms, this paper uses the number of green invention patent applications, utility model patent applications, invention patent grants, and utility model patent grants. The detailed definitions of the variables are presented in Table 3.

Table 4 presents the descriptive statistics of the variables. The minimum value of TFP_LP is 5.785, the maximum value is 10.720, and the standard deviation is 1.010, which indicates that enterprise sustainability varies widely. The mean of ROS is 0.426 and the mean of ROI is 0.604, which indicates that roughly half of the observations have experienced tax enforcement reform. The green innovation indicators (lnGIPA, lnGUPA, lnGIA, lnGIA) vary widely among enterprises.

To test the impact of reduced tax inequity on the sustainable development of enterprises, this paper selects tax enforcement reform (i.e., tax enforcement system reform represented by the Golden Tax III project and tax enforcement agency reform represented by switching social insurance premium collection to the tax departments) as quasi-natural experiments, respectively, and designs a DID model to observe the effect of the reduced tax inequity brought about by tax enforcement reform on the sustainable development of enterprises. Based on this, the paper constructs the following models:

1) Using the tax enforcement system reform represented by the Golden Tax III project as the quasi-natural experiment:

where TFP_LPit is the explanatory variable that indicates the sustainable development of firm i in year t, ROSit is the indicator for tax enforcement system reform, and UNF_ROSi indicates whether the firm suffered from tax inequity before the tax enforcement system reform. ROSit×UNF_ROSi is the core explanatory variable in this paper, which indicates the degree to which tax inequity is reduced by tax enforcement system reform. In addition, this paper controls for firm age (LnAge), firm size (LnSize), leverage ratio (LnLEV), board size (LnBSZ), board independence (RID), and firm profitability (ROA). Year and industry fixed effects are also controlled for to eliminate the possible influence of year- and industry-invariant factors.

2) Using the tax enforcement agency reform represented by switching social insurance premium collection to the tax departments as the quasi-natural experiment:

where ROIit is similarly used as the indicator for tax enforcement agency reform and UNF_ROIi indicates whether the firm suffered from tax inequity before the tax enforcement agency reform. ROIit×UNF_ROIi is the core explanatory variable in this paper, which indicates the degree to which tax inequity is reduced by tax enforcement agency reform.

Table 5 reports the results of the baseline regressions on the impact of reduced tax inequity from tax enforcement reform on firms’ sustainable development. Regression 1) demonstrates the impact of the reduction in tax inequity brought about by the tax enforcement system reform on the sustainable development of enterprises. The main explanatory variable UNF_ROS×ROS is significantly positive at the 1% level with a coefficient of 0.130, thus indicating that firms suffering from tax inequity experience a 13.0% more increase in enterprise sustainability after the reform compared to firms that did not suffer from tax inequity before it.

Regression 2) demonstrates the impact of the reduction in tax inequity brought about by tax enforcement agency reform on the sustainable development of enterprises. The main explanatory variable UNF_ROI×ROI is significantly positive at the 1% level with a coefficient of 0.279, thus indicating that firms that suffered from tax inequity experienced a 28.9% more increase in sustainability after the reform compared to firms that did not suffer from tax inequity before it.

The above results are consistent with the hypothesis that tax equity makes a significant contribution to the sustainable development of enterprises.

The key assumption for the above regressions to provide causal inference is that the control group (i.e., firms that did not suffer from tax inequity before the reform) provides an effective counterfactual for the sustainability of firms in the experimental group (i.e., firms that suffered from tax inequity before the reform). The basic premise for this assumption to hold is that the experimental and control groups satisfy the parallel trend condition. Moreover, considering that there may be a lag in the effect of tax enforcement reform and the possibility that the effect of reform may be affected by other related policies, this paper follows Beck et al. (2010) and Wang (2013) by constructing a more flexible DID model to allow the estimated coefficients to vary across years and thus examines the parallel trend before the reform as well as the dynamic effect after it.

Model (3)/(4) replaces ROSit/ROIit in Model (1)/(2) with the set of variables ROSitk/ROIitk, where k is the difference between the observation year and the year of reform implementation and takes the value of 0 if it is in the year of reform, n if it is the nth year of reform, and -m if it is the mth year before the reform. In the sample period of this paper (2000–2019), the value of k takes the ranges of [−16,7] in Model (3) and [−19,21] in Model (4). Due to space limitations, this paper only presents the 5-year results before and after the reform implementation.

Table 6 reports the dynamic effects of the tax enforcement reform. Regressions 1–3 show the effects of the reform in the tax enforcement system. Companies are grouped according to whether they suffered from income tax inequity before the reform, with Regression 1 including the experimental group, Regression 2 including the control group and Regression 3 including the full sample. The results show that before the implementation of the tax enforcement system reform, the estimated coefficients are nonsignificant in all three groups. In the years after the implementation of the reform, there is a significant increase in sustainable development in the experimental group, while there is no significant impact in the control group. In the full sample group, ROSitk has a significant effect on corporate sustainability, but the coefficients are smaller than those of the experimental group due to the inclusion of the control group sample. The above results indicate that the reform in the tax enforcement system has a dynamic long-term impact on the sustainable development of enterprises. Regressions 4–6 report the results of the dynamic regressions of the tax enforcement agency reform. The results are similar and indicate that the reform in tax enforcement agencies also has a dynamic long-term impact on the sustainable development of enterprises. Together, the above results verify the findings of the baseline regression.

To further rule out the concern that the increase in enterprise sustainability is a result of the tax enforcement reforms and not random, we conduct a placebo test by setting a pseudo-event time as a placebo during the years of the implementation of the tax enforcement reform. With the placebo replacing the year in which the treatment effect actually occurred, the experimental and control groups are re-selected based on the placebo year. The results reported in Table 7 reveal that the effects of the key variables in both Regressions 1 and 2(UNF_ROS_pb×ROS_pb/UNF_ROI_pb×ROI_pb) on enterprise sustainability are no longer significant, thus indicating that the increase in enterprise sustainability is indeed caused by the tax enforcement reforms and their resulting reduction in tax inequity—that is, the results of the main regressions are robust3.

The basic theory of economic growth states that the production function is

In the main regression, the measure of enterprise sustainability is the total factor productivity (TFP) calculated using the LP method. To verify the robustness of the model and more comprehensively measure enterprise sustainability, the total factor productivity calculated using the OP method (TFP_OP), labor intensity (LAB), and capital intensity (CAP) are selected as alternative indicators of enterprise sustainability. Table 8 reports the regression results of the alternative indicators as explanatory variables, respectively, where Regressions 1, 3, and 5 test the effect of reduced tax inequity resulting from the reform of the tax enforcement system on the dependent variable, and Regressions 2, 4, and 6 test the effect of reduced tax inequity resulting from the reform of the tax enforcement agencies on the dependent variable. In all regressions, the main variables UNF_ROS×ROS/UNF_ROI×ROI reveal a significantly positive effect on the dependent variables, which indicates that the effect of tax equity on the sustainable development of enterprises is robust.

To further examine the impact of tax equity on corporate sustainability, in this section, this paper empirically investigates the pathways through which tax equity affects corporate sustainability using green innovation as a mediating variable (Stewart, 1979; Schoenecker and Swanson, 2002; Andonova, 2003; Cano and Cano, 2006). In this paper, four indicators (green invention patent applications, utility model applications, invention patent grants, and utility model grants) are selected as measures of corporate green innovation. This paper adopts the causal steps approach to test for the mediating mechanism effect (Judd & Kenny, 1981; Sobel, 1982; Baron and Kenny, 1986).

Green innovation applications represent the current green innovation output of enterprises, and green invention patent and utility model applications are selected as the metrics used in this paper. Among them, an invention patent refers to a new technical solution for a product, method or improvement, and a utility model refers to a new technical solution for a product shape, structure or combination thereof that is suitable for practical use. Table 9 reports the results of the empirical tests of the reduction in tax inequity brought about by the tax enforcement reform enacted through green invention patent applications.

Running Regressions 1 and 4 is the first step of the mediating mechanism effect test. The interaction terms are significant at the 1% level and the coefficients are positive, which indicates that the reduction in tax inequity brought about by tax enforcement reform significantly contributes to the sustainable development of enterprises. In Regressions 2 and 5, the interaction terms are significant at the 5% level and the coefficients are 0.094 and 0.119, respectively, thus indicating that the reduction in tax inequity brought about by tax enforcement reform increases green invention patent applications by approximately 10%. In Regressions 3 and 6, the coefficients on lnGIPA are significantly positive at the 1% level, which indicates that there is a significantly positive relationship between green invention patent applications and the sustainable development of enterprises. Meanwhile, the coefficients on the interaction term are significant at the 1% level, but less so than their counterparts in Regressions 1 and 3, thus indicating that green invention patent applications partially mediate the relationship between tax equity and the sustainable development of enterprises.

Table 10 reports the results of the empirical tests on how the reduction in tax inequity brought about by tax enforcement reform affects sustainable development through green utility model applications. Similarly, green utility model applications exhibit a partial mediating pattern in the relationship between tax equity and sustainable development.

A patent application indicates that a company has made an invention and applied for authorization from the intellectual property department. However, whether the final authorization is granted depends on whether the patent meets the corresponding requirements. In other words, patent grants are a better indicator of an enterprise’s ability to innovate than patent applications. Based on this, this paper also tests the mediating effects of the number of green invention patents and utility models that have been granted.

Table 11 reports the results of the empirical tests on the mediating effect of green invention model patent grants. In Regressions 1 and 4, the coefficients on the interaction terms UNF_ROS×ROS and UNF_ROI×ROI are both significant and positive at the 1% level, thus indicating that tax equity positively affects enterprise sustainability; in Regressions 2 and 5 the interaction terms remain significantly positive, which indicates that tax equity increases the number of green invention patent grants; in Regressions 3 and 6, lnGIA has a positive coefficient at the 1% level, which indicates that green invention patent grants promote sustainable development. The interaction terms, although significant at the 1% level, have smaller coefficients than their counterparts in Regressions 1 and 4, thus indicating that green invention patent grants partially mediate the effect of tax equity on sustainable development.

Table 12 reports the results of the empirical tests on how the reduction in tax inequity brought about by tax enforcement reform affects sustainable development through green utility model grants. Similarly, green utility model grants exhibit a partial mediating pattern in the relationship between tax equity and sustainable development.

The actions taken by firms differ depending on their maturity and the market environment in which they operate. Thus, theoretically, the effects of changes in tax equity on the sustainable development of enterprises may differ between firms in different life cycle stages and market environments. To identify the heterogeneous effects of tax equity on enterprise sustainability more precisely, this paper conducts empirical tests from the following two aspects.

Firms at different life cycle stages have different tax sensitivities and therefore respond differently to changes to the tax regime. Based on this, the paper groups the sample according to firm age. Those above the average age are defined as mature firms and those below the average age are defined as young firms. Table 13 reports the regression results of the heterogeneity tests. The coefficients on UNF_ROS×ROS/UNF_ROI×ROI are significantly positive at the 1% level in all regressions, thus indicating that reducing tax inequities significantly contributes to enterprise sustainability irrespective of age. Furthermore, the coefficient on UNF_ROS×ROS is significantly larger in the group of young firms than it is in the group of mature firms, which indicates that the reduction in tax inequity brought about by tax enforcement reform promotes sustainable development to a greater degree in young firms; the coefficient on UNF_ROI×ROI is larger for mature firms than it is for young firms, which indicates that the reduction in tax inequity brought about by tax enforcement agency reform promotes sustainable development to a greater degree in mature firms. This may be due to the fact that reforming the tax enforcement system breaks down intradepartmental information barriers and is therefore more effective in reducing information asymmetries on the enforcement side and preventing rent-seeking behaviors among enforcement agencies. While young enterprises have fewer social connections and are more likely to suffer from tax inequities resulting from tax enforcement, they benefit more from tax enforcement system reform. Reforming tax enforcement agencies reduces information asymmetries on the payment side by coordinating social security contributions and tax payments and thus discourages tax evasion. Since mature enterprises are generally more disciplined in paying social security contributions, they are more likely to benefit from the tax equity brought about by tax enforcement agency reform.

A favorable market environment is more protective of inventions and more conducive to the transformation of patented technologies into tangible output, so the market environment has an important impact on the sustainable development of enterprises. Therefore, this paper incorporates the marketization index to observe the heterogeneous impact of reduced tax inequities on the sustainable development of enterprises under different marketization conditions.

Table 14 reports regression results. In both the unfavorable and the favorable market environment subgroups, the coefficients on Reformit×Inequityi are all significantly positive. This indicates that the reduction in tax inequity brought about by tax enforcement reform significantly contributes to the sustainable development of enterprises regardless of the market environment. Furthermore, this paper finds that the coefficients on UNF_ROS×ROS/UNF_ROI×ROI are larger in the regressions on the favorable market environment subgroup. This indicates that tax equity can better promote the sustainable development of enterprises in areas with a favorable market environment.

Sustainable development, which represents a form of economic growth with environmental friendliness as its main feature, is becoming an urgent priority as environmental pollution and resource scarcity are becoming increasingly serious problems. However, the positive environmental externalities associated with sustainable development impose an additional cost burden on enterprises, which makes sustainable development difficult to enforce through market regulation. The key to stimulating sustainable development is to convert its positive environmental externalities into corporate income through taxation policies. Establishing a fair tax regime enhances the credibility of tax law and its enforcement, which are essential prerequisites for tax policies to have the desired effect.

This paper takes a sample of Chinese listed companies between 2000 and 2019 and constructs DID models using two types of tax reform as quasi-natural experiments—namely, tax enforcement system reform and tax enforcement agency reform—as they are both important pathways for promoting tax equity. The paper finds through empirical research that tax equity has a facilitating effect on the sustainable development of enterprises and that promoting green innovation has a mediating effect.

Furthermore, tax equity promotes sustainable development to a greater degree in favorable market environments, mainly because they are more conducive to the protection and transformation of green innovation. Tax enforcement system reform has a more pronounced effect on young firms, while tax enforcement agency reform has a more pronounced effect on mature firms, mainly because young firms are more vulnerable to tax inequities that originate from the enforcement side. However, mature firms can benefit more from increased tax equity on the payment side.

Based on the above findings, this paper draws the following conclusions. 1) Corporate sustainable development has “double environmental externalities,” and the mismatch between benefits and costs is the main obstacle to enterprises adoption of sustainable development strategies. 2) Tax enforcement reform begins with relieving information asymmetries and achieving a balance between the “fairness” of taxation and the “efficiency” of sustainable economic development; doing so enables the government to encourage green innovation and promote sustainable economic development through taxation policy. 3) A favorable market environment is an important prerequisite for tax equity to be able to promote sustainable development, mainly because it offers better protection for the intellectual property rights associated with green innovation and is also conducive to the transformation of green innovation into tangible output. 4) Different types of tax enforcement reforms have different impacts on the sustainable development of enterprises at different life cycle stages, mainly because they suffer from different types of tax inequity. Therefore, different tax policies should be adopted for enterprises at different life cycle stages to internalize the positive externalities of green innovation. 5) In the parallel trend test, we find that the positive effect of tax enforcement reform on the sustainable development of enterprises first increases and then gradually decreases, which indicates that policy reform cannot immediately achieve its objectives and thus needs to be continuously and consistently promoted (Fan et al. 2001).

Publicly available datasets were analyzed in this study. This data can be found here: https://cn.gtadata.com/https://www.cnipa.gov.cn/.

WW designed the study, performed the statistical analysis, and wrote the draft of the manuscript.

Author WW was employed by the company Hundsun Technologies Inc.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

1The details of the implementation of the reforms and their impact on tax equity are described in the institutional background section of this paper.

2“One platform” refers to the unified technical platform, including network hardware and basic software; “two levels of processing” refers to relying on the unified technical platform to gradually realize centralized processing of data and information in the State Administration of Taxation and provincial bureaus; “three coverage” refers to covering all tax types, covering all processes, covering state and local taxation institutions at all levels and networking with relevant departments; and “four types of systems” refers to four major applications used for tax enforcement, administrative management, managing external information and decision support.

3The detailed method of assigning virtual years for the tax enforcement system reform is as follows. First, the regions are ranked in the order of provinces and municipalities in Table 1 (i.e., Chongqing, Shaanxi, ......, Guangdong, ......, Shanghai, etc). As reform was carried out from 2013 to 2017, the virtual years between 2013 and 2017 are then assigned to the regions in the order of their rank, (e.g., Chongqing 2013; Shaanxi 2014; ......, Henan Province 2017; Inner Mongolia Autonomous Region 2013, .....). The method used to assign the virtual years of tax enforcement agency reform is similar.

Allingham, M. G., and Sandmo, A. (1972). Income tax evasion: A theoretical analysis. J. Public Econ. 1 (3-4), 323–338. doi:10.1016/0047-2727(72)90010-2

Andonova, L. B. (2003). Openness and the environment in Central and Eastern Europe: Can trade and foreign investment stimulate better environmental management in enterprises? J. Environ. Dev. 12 (2), 177–204. doi:10.1177/1070496503012002003

Antolín-López, R., Delgado-Ceballos, J., and Montiel, I. (2016). Deconstructing corporate sustainability: A comparison of different stakeholder metrics. J. Clean. Prod. 136, 5–17. doi:10.1016/j.jclepro.2016.01.111

Armstrong, C. S., Blouin, J. L., Jagolinzer, A. D., and Larcker, D. F. (2015). Corporate governance, incentives, and tax avoidance. J. Account. Econ. 60 (1), 1–17. doi:10.1016/j.jacceco.2015.02.003

Atanassov, J., and Liu, X. (2014). “Corporate income taxes, financial constraints and innovation,” in Unpublished working paper (Lincoln and Eugene: University of Nebraska and University of Oregon).

Banerjee, S. B. (2001). Managerial perceptions of corporate environmentalism: Interpretations from industry and strategic implications for organizations. J. Manag. Studs 38 (4), 489–513. doi:10.1111/1467-6486.00246

Bansal, P. (2005). Evolving sustainably: A longitudinal study of corporate sustainable development. Strateg. Manag. J. 26 (3), 197–218. doi:10.1002/smj.441

Baron, R. M., and Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personality Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

Baum, C. F., Caglayan, M., and Ozkan, N. (2009). The second moments matter: The impact of macroeconomic uncertainty on the allocation of loanable funds. Econ. Lett. 102 (2), 87–89. doi:10.1016/j.econlet.2008.11.019

Beck, T., Levine, R., and Levkov, A. (2010). Big bad banks? The winners and losers from bank deregulation in the United States. J. Finance 65 (5), 1637–1667. doi:10.1111/j.1540-6261.2010.01589.x

Bhat, V. N. (1993). Green marketing begins with green design. J. Bus. Industrial Mark. 8 (4), 26–31. doi:10.1108/08858629310047243

Brunnermeier, S. B., and Cohen, M. A. (2003). Determinants of environmental innovation in US manufacturing industries. J. Environ. Econ. Manag. 45 (2), 278–293. doi:10.1016/s0095-0696(02)00058-x

Cano, C. P., and Cano, P. Q. (2006). Human resources management and its impact on innovation performance in companies. Int. J. Technol. Manag. 35 (1-4), 11–28. doi:10.1504/ijtm.2006.009227

Carayannis, E. G. (2004). Measuring intangibles: Managing intangibles for tangible outcomes in research and innovation. Int. J. Nucl. Knowl. Manag. 1 (1-2), 49–67. doi:10.1504/ijnkm.2004.005102

Carrillo, P., Pomeranz, D., and Singhal, M. (2017). Dodging the taxman: Firm misreporting and limits to tax enforcement. Am. Econ. J. Appl. Econ. 9 (2), 144–164. doi:10.1257/app.20140495

Chen, S., Chen, X., Cheng, Q., and Shevlin, T. (2010). Are family firms more tax aggressive than non-family firms? J. financial Econ. 95 (1), 41–61. doi:10.1016/j.jfineco.2009.02.003

Chen, S. X. (2017). The effect of a fiscal squeeze on tax enforcement: Evidence from a natural experiment in China. J. Public Econ. 147, 62–76. doi:10.1016/j.jpubeco.2017.01.001

Chow, W. S., and Chen, Y. (2012). Corporate sustainable development: Testing a new scale based on the mainland Chinese context. J. Bus. Ethics 105 (4), 519–533. doi:10.1007/s10551-011-0983-x

Croce, M. M., Kung, H., Nguyen, T. T., and Schmid, L. (2012). Fiscal policies and asset prices. Rev. Financ. Stud. 25 (9), 2635–2672. doi:10.1093/rfs/hhs060

DeBacker, J., Heim, B. T., and Tran, A. (2015). Importing corruption culture from overseas: Evidence from corporate tax evasion in the United States. J. Financial Econ. 117 (1), 122–138. doi:10.1016/j.jfineco.2012.11.009

Desai, M. A., and Dharmapala, D. (2006). Corporate tax avoidance and high-powered incentives. J. Financial Econ. 79 (1), 145–179. doi:10.1016/j.jfineco.2005.02.002

Eiadat, Y., Kelly, A., Roche, F., and Eyadat, H. (2008). Green and competitive? An empirical test of the mediating role of environmental innovation strategy. J. World Bus. 43 (2), 131–145. doi:10.1016/j.jwb.2007.11.012

Erol, I., Cakar, N., Erel, D., and Sari, R. (2009). Sustainability in the Turkish retailing industry. Sust. Dev. 17 (1), 49–67. doi:10.1002/sd.369

Fan, G., Wang, X., and Zhang, L. (2001). Annual report 2000: Marketization index for China’s provinces. Beijing: China & World Economy.5

Forbes, N., and Wield, D. (2002). From followers to leaders: Managing technology and innovation. London: Routledge.

Francis, B. B., Hasan, I., and Zhu, Y. (2014). Political uncertainty and bank loan contracting. J. Empir. Finance 29, 281–286. doi:10.1016/j.jempfin.2014.08.004

Hart, S. L. (1995). A natural-resource-based view of the firm. Acad. Manage. Rev. 20 (4), 986–1014. doi:10.5465/amr.1995.9512280033

Heun, P., Laroche, T., Raghuraman, M. K., and Gasser, S. M. (2001). The positioning and dynamics of origins of replication in the budding yeast nucleus. J. Cell Biol. 152 (2), 385–400. doi:10.1083/jcb.152.2.385

Jaffe, A. B., Peterson, S. R., Portney, P. R., and Stavins, R. N. (1995). Environmental regulation and the competitiveness of US manufacturing: What does the evidence tell us? J. Econ. Literature 33 (1), 132–163.

Johnstone, N. (2007). Environmental policy and corporate behaviour. Cheltenham: Edward Elgar Publishing.

Judd, C. M., and Kenny, D. A. (1981). Process analysis: Estimating mediation in treatment evaluations. Eval. Rev. 5 (5), 602–619. doi:10.1177/0193841x8100500502

Kleven, H. J., Knudsen, M. B., Kreiner, C. T., Pedersen, S., and Saez, E. (2011). Unwilling or unable to cheat? Evidence from a tax audit experiment in Denmark. Econometrica 79 (3), 651–692.

Levinsohn, J., and Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 70 (2), 317–341. doi:10.1111/1467-937x.00246

Liu, H., Jiang, J., Xue, R., Meng, X., and Hu, S. (2022). Corporate environmental governance scheme and investment efficiency over the course of COVID-19. Finance Res. Lett. 47, 102726. doi:10.1016/j.frl.2022.102726

Mirata, M., and Emtairah, T. (2005). Industrial symbiosis networks and the contribution to environmental innovation: The case of the Landskrona industrial symbiosis programme. J. Clean. Prod. 13 (10-11), 993–1002. doi:10.1016/j.jclepro.2004.12.010

Mirrlees, J. A., and Vickrey, W. (1996). Economic sciences prize in economic sciences 1996 explore advanced information.

Olley, G. S., and Pakes, A. (1996). The dynamics of productivity in the telecommunications equipment industry. Econometrica 64 (6), 1263–1297. doi:10.2307/2171831

Pomeranz, D. (2015). No taxation without information: Deterrence and self-enforcement in the value added tax. Am. Econ. Rev. 105 (8), 2539–2569. doi:10.1257/aer.20130393

Porter, M. E., and Van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Rennings, K. (1998). Towards a theory and policy of eco-innovation-Neoclassical and (Co-) Evolutionary Perspectives (No. 98-24. Mannheim: ZEW Discussion Papers.

Schoenecker, T., and Swanson, L. (2002). Indicators of firm technological capability: Validity and performance implications. IEEE Trans. Eng. Manag. 49 (1), 36–44. doi:10.1109/17.985746

Sharma, S., and Vredenburg, H. (1998). Proactive corporate environmental strategy and the development of competitively valuable organizational capabilities. Strateg. Manag. J. 19 (8), 729–753. doi:10.1002/(sici)1097-0266(199808)19:8<729:aid-smj967>3.0.co;2-4

Shrivastava, P. (1995). The role of corporations in achieving ecological sustainability. Acad. Manage. Rev. 20 (4), 936–960. doi:10.5465/amr.1995.9512280026

Sialm, C. (2006). Stochastic taxation and asset pricing in dynamic general equilibrium. J. Econ. Dyn. Control 30 (3), 511–540. doi:10.1016/j.jedc.2005.02.004

Slemrod, J., Blumenthal, M., and Christian, C. (2001). Taxpayer response to an increased probability of audit: Evidence from a controlled experiment in Minnesota. J. Public Econ. 79 (3), 455–483. doi:10.1016/s0047-2727(99)00107-3

Sobel, M. E. (1982). Asymptotic confidence intervals for indirect effects in structural equation models. Sociol. Methodol. 13, 290–312. doi:10.2307/270723

Solow, R., Walras, L., and Jaffe, W. (1956). Elements of pure economics. Econometrica 24, 87–89. doi:10.2307/1905263

Steurer, R., Langer, M. E., Konrad, A., and Martinuzzi, A. (2005). Corporations, stakeholders and sustainable development I: A theoretical exploration of business–society relations. J. Bus. Ethics 61 (3), 263–281. doi:10.1007/s10551-005-7054-0

Stewart, F. (1979). International technology transfer: Issues and policy options. Washington, DC: World Bank.

Sun, Y., Lu, Y., Wang, T., Ma, H., and He, G. (2008). Pattern of patent-based environmental technology innovation in China. Technol. Forecast. Soc. Change 75 (7), 1032–1042. doi:10.1016/j.techfore.2007.09.004

Tian, J., Cao, W., Cheng, Q., Huang, Y., and Hu, S. (2021). Corporate competing culture and environmental investment. Front. Psychol. 12, 774173. doi:10.3389/fpsyg.2021.774173

Tully, S. M., and Winer, R. S. (2014). The role of the beneficiary in willingness to pay for socially responsible products: A meta-analysis. J. Retail. 90 (2), 255–274. doi:10.1016/j.jretai.2014.03.004

Keywords: tax equity, sustainable development, green innovation, tax enforcement system reform, tax enforcement agency reform

Citation: Wang W (2022) Tax equity, green innovation and corporate sustainable development. Front. Environ. Sci. 10:1062179. doi: 10.3389/fenvs.2022.1062179

Received: 05 October 2022; Accepted: 09 November 2022;

Published: 23 November 2022.

Edited by:

Shiyang Hu, Chongqing University, ChinaReviewed by:

Jiu Lili, Hong Kong Baptist University, Hong Kong, SAR ChinaCopyright © 2022 Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wei Wang, dmljd2FuZzYxOUAxNjMuY29t

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.