95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 10 November 2022

Sec. Environmental Informatics and Remote Sensing

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.1059842

This article is part of the Research Topic ICT Diffusion and Environmental Sustainability View all 13 articles

Environmental issues are getting greater attention now that experts and authorities are paying attention to global warming. The industrial segment is mostly to blame for these environmental hitches, according to past research. The industrial sector is actively addressing the issues brought on by climate change. This study’s primary focus is on business environmental strategies in green innovation, which takes into account the company’s goals for sustainable development. This study also takes into account the importance of corporate management (CEO, ownership concentration, and gender diversity) for green innovation. This study evaluated fact by natural resource theory, resource dependency theory, agency theory and Porter hypothesis. Results from practical generalized least squares and generalized moments approaches provide various conclusions. The findings of this study demonstrated that companies with business environmental strategies as, environmental regulation, proactive environmental plans, corporate social responsibility, and board sustainable committees were more likely to implement green innovation practices. Additionally, corporate management (CEO, ownership concentration, and gender diversity) supports businesses’ efforts to innovate in the green sector. Importantly, our research showed that the importance of corporate management (CEO, ownership concentration, and gender diversity) in business environmental policies cannot be overstated (environmental regulations, proactive environmental strategies, corporate social responsibility, board sustainable committee, and green innovation). green innovation, as well. These findings significantly expand the scant amount of knowledge on corporate environmental initiatives and green innovation. In order to encourage green innovation for higher profitability while minimizing negative industrial consequences, this study also provides a number of suggestions and recommendations for stakeholders, including regulators, owners, and governments.

The enormous increase in the use of industrial manufacturing, greenhouse gas emissions, and resource exploitation pose a constant threat to environmental preservation. Business environmental strategies and its potential impact on corporate performance are topics that interest a growing number of stakeholders, including environmentalists, lawmakers, civil society organizations, markets, shareholders, and regulators (Wang et al., 2022). The importance of sustainable development (SD) is also frequently emphasized at the highest levels of the United Nations, most recently with the approval of the UN’s agenda for sustainable development (2015–2030), which monitors improvements in both environmental and social spheres (Boluk et al., 2019). Sustainable development goals have motive to control the environmental bad effects as well. The United Nation has more concern for industrial sector (Huan et al., 2021). The United Nations has developed 17 Sustainable Development Goals to combat the problems facing humanity on a global scale. Future policymakers and other socially significant individuals must value these objectives for them to be attained (Hák et al., 2016).

Since environmental concerns are particularly critical for businesses in developing nations, this research is pertinent to the context of rising economies (Rafique et al., 2022). According to past studies, the industrial sector has a detrimental effect on the environment because it helps a nation’s economy flourish (Javeed et al., 2021). China’s economic liberalization and progress are now significantly hampered by environmental degradation. The prestige and economic health of the nation suffer greatly as a result. Even if China’s economy is expanding, there are significant environmental problems because of significant investment, excessive pollution, and high consumption (Javeed et al., 2021). The environmental performance of Chinese businesses will undoubtedly improve in the face of criticism and scrutiny from around the globe. In this way, green creation is given special attention in the Chinese business sector.

Thankfully, the Chinese government has made a number of steps to handle the terrible condition, predominantly in the business and industrial sectors, both of which have a significant impact on pollution and output (Liu et al., 2022a). To encourage corporate social responsibility, green policies and other environmental programs have been developed (Huang et al., 2021). As a result, in this situation, it is being pushed for firm strategies to include ecological expansion targets in order to achieve sustainable goals (Javeed et al., 2021). “Green innovations” are brand-new production, management, or service models that lessen environmental problems. Green innovation is therefore more crucial as a tactical instrument for achieving environmental goals (Liu et al., 2022a).

The benefits of green innovation have been extensively researched (Cai et al., 2020), but the reasons why certain businesses invest in it more than others have not yet been adequately analyzed (Liu et al., 2022a). The corporate governance elements that affect green innovation are particularly understudied. The literature also emphasizes the differences in green innovation research among nations. These nations have particularly requested green innovation research due to the tremendous environmental harm they are currently facing (Javeed et al., 2021). Thus, business environmental approaches are imperative for green invention and conservational controlling (Mio et al., 2022). This study combines various business environmental strategies together to inspect the effect on green innovation. For example, Javeed et al. (2021) stated that environmental regulation as business environmental strategy is beneficial for improving green innovation.

Moreover, Zhou et al. (2019) underlined the significance of using pro-active environmental strategies in business to promote corporate social policies and green practices. In addition, Madueno et al. (2016) explained that corporate social practice is serve as business environmental strategy that have significant effects on firm level green practices. Orazalin and Environment (2020) presented the role of board sustainable committee as a business environmental strategies for improving firm long-run profit via green innovation. Therefore, this study proposes business environmental strategies for promotion of green innovation and combine all business environmental strategies together for presenting as framework of business environmental strategies. As a result, the composition and business environmental initiatives may determine the quality of green innovation (Kraus et al., 2020).

The importance to SGDs also falling for industrial sector. For the Sustainable Development Goals to be met, the business sector is a crucial partner. Businesses might contribute as a byproduct of their primary activities. As a result, we urge businesses all across the world to set ambitious goals, measure the effects of their efforts, and honestly communicate their progress (Boluk et al., 2019). Moreover, Chinese government also focusing on SGDs for improving environmental effects. In this context, the following query is posed: What are the key determinants that underpin this beneficial link, if corporate environmental initiatives can strengthen the company’s green innovation practices? The report recommends leveraging corporate management to advance business environmental objectives and encourage green innovation as a result.

Corporate top executive as the perception of the CEO is positively correlated with workplace environmental policies that support green innovation (Li, 2016). If the CEO is knowledgeable about environmental and sustainability measures, green innovation may be promoted (Huang et al., 2021). Furthermore, corporate management as ownership concentration also valuable for promoting business environmental strategies and green innovation. According to Chen et al. (2021), a company’s market orientation and green innovation are positively impacted by the concentration of its ownership. In addition, Younas et al. (2017) also demonstrated that ownership concentration as large shareholders have more concern for corporate environmental strategies. Because they want to make long-run profit through reputation. Besides, gender diversity as corporate management is also beneficial tool for corporate environmental and green practices (Harjoto et al., 2015). The relevance of female directors in promoting environmentally friendly operations for green innovation is also highlighted by (Boukattaya and Omri, 2021). They believed that females are more supporting to business environmental strategies for green practices.

As a result, this study advises using corporate management ideas to improve green innovation and to balance the rapport amid business ecological policies and sustainable actions. According to what we understand, no prior studies have specifically looked at the controlling upshot of corporate management (CEO, ownership concentration, and gender diversity) in the context of a connection concerning business environmental strategies (environmental regulations, proactive environmental strategies, corporate social responsibility, and board sustainable committee) and green innovation. In addition, the corporate governance also concerning for achieving SDGs (Chien, 2022). Unaware of it, many business owners and organizations already support sustainable development. They accomplish this, for instance, by doing the following: ensuring the health and welfare of their staff (Goal 3), being aware of the circumstances in which their supply chains operate (Goals 8, 12), by being informed of ways to lower their business’s carbon footprint (Goal 13), paying workers equally and impartially based on gender (Goals 5, 8), and the SDG Business Hub’s CEO Guide on Sustainable Development Goals provides information on the different steps CEOs of firms may take to better align their organizations with the SDGs (Chien, 2022). Besides, gender diversity is also vital part of SGDs (Singh et al., 2021).

In order to investigate the aforementioned issues, this study makes use of a range of theoretical frameworks for suitable theoretical support. For example, natural resource theory, resource dependency theory, agency theory, and Porter hypothesis uses for supporting the function of business environmental strategies and green innovation with the interactive role of corporate management (Jensen and Meckling, 1976; Porter and Van der Linde, 1995; Liu et al., 2022b; Suriyapongprapai et al., 2022). All theories encourage corporate for social and environmental actions. For example, the idea behind resource dependency theory is that in order for an organization, such a commercial corporation, to acquire resources, it must transact with other individuals and organizations in its environment and support corporate social actions (Hillman et al., 2009). Similarly, natural resource theory also considering corporate social actions for improvement of global warming. Importantly, Porter supported the corporate all environmental strategies for innovation and better performance. Lastly, the agency theory backed the corporate management factors for the improvement of corporate social actions.

All non-financial A-listed firms in China that were registered with both stock exchanges, Shanghai and Shenzhen, were included in this analysis, which used data from 2010 to 2019. The results show that business environmental strategies, which comprises elements of environmental regulations, proactive environmental strategies, corporate social responsibility, board sustainable committee, and green innovation are substantially and positively associated to green innovation. Secondly, result reveals that corporate management, including the CEO, ownership concentration, and gender diversity, may compel businesses to engage in green innovation. Most importantly, this study suggests that Corporate management, including the CEO, ownership concentration, and gender diversity, can make positive association amid business environmental strategies environmental regulations, proactive environmental strategies, corporate social responsibility, board sustainable committee and green innovation.

Our results indicate that corporate environmental plans are advantageous for green innovation. Additionally, corporate management can help to strengthen the connection between green innovation and company environmental policies. Additionally, our discovery broadens our understanding for policymakers who want to advance corporate-level sustainable improvement intentions. Regulatory organizations can concentrate on these discoveries in a manner similar to this to eliminate undesirable industrial results. By contributing in the mitigation of negative industrial consequences, firm sustainable practices, such as green innovation and corporate environmental plans, can be profitable for businesses in emerging and developed countries. With the aid of this study, the sustainable development goals of the UN might be accomplished. The study’s remaining components are divided into various groups. The empirical analysis and theoretical assessment of evolving hypotheses are presented in Section 2. Section 3 discusses the methods for gathering data, measuring variables, and doing research. Section 4 of this study presents the findings. Section 5 contains a summary of the conclusions, implications, limitations, and suggested next measures. Figure 1 highlights the context of the study.

Business environmental strategies are crucial because they can give organizations a competitive edge while also enhancing their operations. As a result, the theory based on natural resources shed light on corporate actions when businesses are engaged in maintaining the natural environment in this context (Hart, 1995). The three main goals of this theory are long-term development, product stewardship, and pollution control strategies. Cost-saving, distinctiveness, and hybrid environmental initiatives are typically investigated (Walsh et al., 2017). For example, environmental regulations, proactive environmental strategies, CSR, and board sustainable committee are the part of corporate environmental strategies. Every corporation want to make long-run development (Nunkoo and Boateng, 2010), product differentiation (Porter and and Kramer., 2007) and trying for removing industrial negative effects (Javeed et al., 2022). Thus, the natural resource theory supported the corporate sustainable practices. Moreover, this theory shed the light on the protection of natural resources which are being damaged by global warming (Walsh et al., 2017). Therefore, this theory supported the function of business sustainable policies for green innovation.

The Porter put up ideas that supported the contribution of environmental laws to innovative business strategies for gaining competitive advantage (Porter, 1991). Porter essentially provided two viewpoints: the innovative compensation idea and the first mover advantage (Porter, 1991; Porter and Van der Linde, 1995; Ambec and Barla, 2002). These theories emphasized the significance of environmentally friendly business methods for innovation. Similarly, Porter and and Kramer. (2007), Porter and Kramer. (2011) learn that how corporate social strategy may increase the value of shareholders while also being a crucial instrument for innovation and competitive advantage. In light of this, this theory also emphasized the necessity of corporate sustainability plans for green innovation. Porter highlighting the importance of sustainable and social practices for firms for achieving competitive advantage. This study selected various factors as business environmental strategies for improvement of green innovation. These actions may create differentiation among firms. Furthermore, it will help to gain long-run survival of the firm. These actions encourage firms for making innovation practices and it can compel firms to be part of environmental cleaning. Our selected factors related to environmental and social aspect of the firms and it will surely increase the firm reputation in the market. Therefore, Porter hypothesis also supported the role of business environmental actions for innovation.

Resource dependency theory stated that top executives make significant contributions to corporate strategy development, providing expertise and guidance, improving corporate reputation and legitimacy, enabling access to resources, and improving relationships with all internal and external stakeholders (Hillman and Dalziel, 2003). Moreover, this theory also supported the role of gender diversity for business sustainable strategies. Women on boards serve a different societal purpose than men, and gender diversity leads to greater strategic decision-making (Bantel, 1993). In order to construct sustainable practices at firm level, the resource dependency theory also supported the role of top executives (Sun and Sun, 2021). This theory is imperative for the evaluation of our selected corporate governance variables for environmental and innovation practices. This theory entices the corporate governance top executives especially CEOs, large shareholders, and gender diversity for the improvement of corporate reputation. These business environmental strategies can be beneficial for firms for attaining long-term development and cleaning environment as well. Moreover, these practices can also protect the corporate resources for long-run.

Ross discovers the agency dilemma for the first time. Jensen and Meckling (1976) proposed the agency theory to cover up the agency cost. In this idea, the role of corporate environmental strategy for green innovation is emphasized. Because they believe that presence of sustainable practices may reduce agency conflict (Jensen and Meckling, 1976). Furthermore, the top governance also willing to reduce the agency cost in this scenario (Fama et al., 1983). The role of the CEO, ownership concentration, and gender diversity for green innovation and company environmental practices were thus backed by this theory. The agency issues harmful for corporate performance and reputation. Firms in social and environmental actions are supposed to be reputed and well-managed. Therefore, corporate executives try for removing agency issues by encouraging the business environmental strategies for green innovation. The development of green innovation is also beneficial for enhancing stakeholder confidence. So, this way firms can solve agency issue.

This study majorly focuses on business sustainable strategies for green innovation. Prior literature explained the position of different sustainable approaches for green innovation (Song et al., 2018). Therefore, this study tries to use appropriate business sustainable strategies for completing this probe. As sustainable business practices, environmental laws, proactive environmental measures, corporate social responsibility, and board sustainability committee have been chosen (Hart, 1997).

Porter (1991) gave the theoretical perspective on the connection concerning environmental rules and organizational innovation, stating that well-managed environmental restrictions force enterprises to move toward innovation. Porter also identified two theoretical perspectives: innovation compensation theory and first-mover advantage theory (Porter, 1991; Porter and Van der Linde, 1995). These theories highlight the critical role of environmental rules in helping businesses become more inventive and lucrative. Environmental rules encourage businesses to create unique items for the market, which leads to business innovation.

These restrictions may impose a cost burden on businesses, but they also encourage them to look for methods to innovate in order to offset the regulatory cost (Kneller et al., 2012). Environmental restrictions, according to Barbera et al. (1990), improve business productivity and market repute. Furthermore, Jaffe et al. (1995) pointed out that environmental rules are critical for firms to survive in a competitive market by driving green innovation. Manufacturing enterprises are more liable for pollution, thus they adhere to environmental regulations with a high rate and they have major focus on green innovation (Brunnermeier et al., 2003). Environmental restrictions, according to Porter (1991), offer a win-win situation for enterprises in a highly competitive market by pushing them to generate unique and original items for green innovation. Besides, a number of academics have demonstrated that environmental rules are critical for promoting environmental practices and reducing industrial negative impacts (Arimura et al., 2007). Thus, this study proposes that environmental regulations can be helpful for corporate green innovation. The question of whether sustainable development approaches can solve these concerns while boosting competitiveness and sustainability has been stoked by these pressures, which have increased the focus on green and sustainable value creation (Yousaf et al., 2021). As a result, we’ve come up with the following hypothesis:

H1: Environmental regulations influence green innovation in a major and favorable way.

Firms’ readiness to promote a sustainable environment has not yet been formalized (Haffar et al., 2018). As a result, there is still discussion regarding gaining a competitive edge by implementing proactive ecological policies. Green novelty is seen as a long-term corporate development approach (Rehman et al., 2021). According to Zhou et al. (2019), academics’ attention has switched to proactive environmental methods for improving long-term performance. In support of this claim, Solovida et al. (2017) pointed out that enterprises with environmental plans had better long-term performance than those without. Through the use of green practices, companies with proactive environmental policies are thought to have a sound business approach (Kong et al., 2020).

Proactive environmental tactics include the use of acceptable raw resources, the reduction of waste, and the creation of goods that adhere to environmentally beneficial standards (Singh et al., 2020). Green innovation can be boosted by the effectiveness of proactive environmental policies (Rehman et al., 2021). Environmental solutions that are proactive are critical for gaining a competitive advantage through innovation (Porter, 1991). Stakeholders are more interested in companies that are environmentally conscious (Liao and Environment, 2018). As a result, proactive environmental policies boost stakeholder trust. As a result, businesses who have proactive environmental initiatives ought to have an advantage in terms of green innovation. Furthermore, they came to the conclusion that the firms’ long-term success is linked to proactive environmental initiatives. Environmentally proactive tactics compel businesses to engage in environmentally friendly practices in order to avoid environmental problems (Zhang et al., 2019).

Numerous researchers have already found a link concerning proactive environmental policy and business gain, but green innovation has not received enough attention. (Ryszko, 2016). As a result, there is a pressing need to investigate manufacturing companies’ environmental procedures. Furthermore, Liu et al. (2015) argued for the importance of proactive environmental initiatives in improving ecological policies. Environmental legality contributes to the improvement of green novelty processes at the corporate stage (Zhang et al., 2022). According to Chen et al. (2016), aggressive actions enhancing green product innovation and creativity. As a result, based on the previously indicated justifications, we proposed the hypothesis.

H2Environmental strategies that are proactive are beneficial to the advancement of green innovation.

McWilliams and Siegel (2000) come to the conclusion that CSR and corporate innovation are favorably linked. Their findings backed with Porter’s assertions (Porter and Van der Linde, 1995). Porter and and Kramer. (2007) find that CSR is a critical instrument for green innovation and competitive advantage, as well as a way to increase shareholder value. The competitive advantage can help a company operate better, and CSR is tied to the competitive advantage (Saeidi et al., 2015). Hull and Rothenberg (2008) claims that enterprises’ participation in CSR activities leads to green innovation. They also argued that CSR activities boost corporate innovation capability, which might give businesses a competitive advantage (Russo and Fouts, 1997). Shahzad et al. (2020) demonstrates the favorable relationship between green innovation and corporate social accountability.

In addition, Hong et al. (2020) also believes that CSR activities can be work as booster for corporate green innovation. Various research, on the other hand, support the link between CSR and corporate green innovation (McWilliams and Siegel, 2000). According to Wagner (2010), CSR delivers multi-dimensional benefits for improving corporate performance, with innovation being a key component of those benefits. Martinez-Conesa et al. (2017) also believe that CSR can help firms innovate more effectively. They highlight how CSR may help a company innovate. CSR, they say, boosts investment chances in the research and development section which leading to green innovation. In light of the aforementioned literature, a hypothesis has been formulated for this investigation.

H3: Corporate Social Responsibility positively influences on Green Innovation.

The most important part of corporate governance is the board’s sustainability committee, which plays a key role in supporting sustainable practices (Hussain et al., 2018). The presence of a sustainable committee promotes corporate governance, which automatically increases firm performance (Liu et al., 2021). The board sustainable committee is supposed to be good business sustainable strategy (Chams and García-Blandón, 2019). Spitzeck (2009) stated in this context that sustainable committees urge corporations to participate in corporate social practices, resulting in enhanced long-term sustainability. Biswas et al. (2018) also provided evidence of the benefits of a sustainable board committee for enhancing Australian companies’ social and environmental performance. Dixon-Fowler et al. (2017) Employing information from S&P 500 corporations, researchers looked into how environmental board committees affected corporate environmental performance. Their findings also confirmed the hypothesis that environmental board committees are associated with superior environmental performance. In addition, the function of board sustainable committees in improving sustainable practices was endorsed by (Orazalin and Environment, 2020).

H4: The Board of Directors’ Sustainable Committee has a supportive view of green innovation.

The CEOs normally approve all key investment and finance choices (Cronqvist et al., 2012). The longevity of diverse businesses is usually linked to the important decisions made by the CEO in terms of business innovation (Aghion et al., 2013). A strong CEO is more focused on company innovation to make the company lucrative for the sake of his good reputation (Griffin et al., 2007). CEO has various skills to invest in social or environmental issues (Hirshleifer et al., 2012). Galasso and Simcoe (2011) discover that a self-assured CEO may drive innovation within a business by investing in risky and challenging projects. According to Hirshleifer et al. (2012), A CEO who exudes confidence is more willing and able to contribute to a company’s R&D project in order to foster green innovation. Similarly, Quan et al. (2021) show that a strong CEO promotes green innovation and is continuously seeking for ways to increase the company’s profit.

Green innovation is frequently viewed as a pro-social corporate behavior, making CEOs inclined to engage in its activities (Ren et al., 2021). The role of CEO is highly important for long-run survival of the firm. According to previous studies, corporate social actions are really helpful for making reputation in the market (Quan et al., 2021). Thus, CEO especially from developing economy firms trying to participate in environmental and social actions (Berger et al., 2008), which will help to achieve in long-term success in the form of reputation and innovation. CEOs can also accomplish this goal through green innovation, which not only helps the environment by reducing pollution but also benefits society at large by lowering environmental threats and enhancing environmental quality (Ren et al., 2021). Besides, better business innovation outcomes may result from CEOs’ pilot credentials, superior educational experience, and transformative leadership (Huang et al., 2021).

Additionally, a strong CEO benefits a company’s innovation for a number of reasons. First off, a strong CEO holds a position of authority within the business, therefore he controls the company’s reputation and course. A strong CEO employs cutting-edge strategies not only to raise profits but also to enhance brand perception and staff satisfaction (Lewellyn and Muller-Kahle, 2012). Boyd et al. (2011) also support the notion that strong CEO traits and green innovation are positively correlated. Quan et al. (2021) further points out that a powerful CEO has a detrimental impact on green innovation. Moreover, CEO wants to clear his position and they invest in social practices for the satisfaction of shareholders (Javeed et al., 2021). Green innovation is a good way for CEO’s to make company positive image in market. As a result, we propose the fifth hypothesis:

H5: Green Innovation is influenced by CEO power in a major and beneficial way.

A strong CEO is advantageous not just to the firm’s innovation (Griffin et al., 2007), but also to environmental regulations and corporate social activities (Li, 2016). Green innovation could be boosted if the CEO is well-versed in environmental and sustainability objectives (Huang et al., 2021). According to Kassinis et al. (2016), the perception of the CEO and workplace regulations are positively correlated. A strong CEO is constantly looking for methods to boost the company’s reputation, and sustainable business practices are a great weapon for him to use (Javeed et al., 2021). Environmental strategies, according to Porter (1991), are beneficial to enhancing corporate innovation and profitability as well. Environmental regulations and other long-term objectives are crucial instruments for promoting green innovation since an excellent CEO is always keen to invest in business innovation and profitability (Porter, 1991).

Furthermore, a CEO who is knowledgeable of environmental standards might reduce costs by involving businesses in green innovation (Huang et al., 2021). In general, if a powerful CEO is concerned about environmental policies and other sustainable practices, then he puts pressure on company management to implement business sustainable strategies, which leads to increased green innovation (Roxas and Coetzer, 2012). In this sense, Javeed and Lefen (2019) Considering the moderating effect of CEO authority, examine the correlation amid corporate social responsibility and company success in Pakistan. They found that a capable CEO positively moderates the relationship amid corporate social accountability and firm performance. Because the globe is currently beset by environmental challenges, environmental rules are expected to be a top priority for businesses (Luo et al., 2021). Business sustainable strategy is a critical instrument for improving corporate innovation, and CEOs can exert pressure on companies to implement CSR policies (Javeed and Lefen, 2019).

Due to the fact that climate change is becoming increasingly important to company operations, corporations must be instrumental in lowering GHG emissions (Luo et al., 2017) and CEO has more concern to participate in sustainable practices (Javeed et al., 2021). Recently, corporate governance techniques have been applied to track GHG emissions and the risks associated with climate change (Haque, 2017). One such mechanism is the characteristics of the CEO, as they are crucial in managing, monitoring, directing, and rewarding carbon-related behaviors in day-to-day business operations (Jaffe et al., 1995).

H6: A powerful CEO is beneficial to moderate the association amid business sustainable strategies and green innovation.

Because large shareholders can considerably influence corporate decisions, ownership concentration plays an important role in green innovation (Hu et al., 2021). The proportion of big shareholders who participate in corporate decision-making to improve the firm’s action is referred to as ownership concentration. Large shareholders support corporate innovation strategies because they are the most effective way to increase the value of the company (Li, 2016). Large shareholders are solely concerned with increasing the value of the company, and they keep a close eye on management (Wu and Hu, 2020). Large shareholders place pressure on executives to improve the company’s performance, which may encourage them to develop new goods (Deng et al., 2013).

Furthermore, voting rights come with ownership concentration, putting pressure on management and tiny shareholders to perform green practices (Al-Jaifi, 2017). Ownership concentration is beneficial in limiting over-investment and diversification by management (Bethel and Liebeskind, 1993). Companies with significant ownership concentrations effectively control management and other shareholders, enabling them to engage in social initiatives that support green innovation (Alchian and Demsetz, 1972). Furthermore, the significant stockholders are more concerned with the needs of the customers. As a result, they observe the actions of competitors and the market condition; this circumstance forces businesses to implement creative tactics in order to achieve potential growth (Baysinger et al., 1991). Song et al. (2018) argue that a firm’s ownership concentration has a favorable impact on its green innovation and market orientation. We establish the following hypothesis based on the foregoing discussion:

H7: The concentration of ownership has a favorable impact on Green innovation.

According to previous research, ownership concentration is beneficial to company innovation and social practices (Alchian and Demsetz, 1972). Environmental performance is connected to business decisions since ownership concentration has such a significant impact on them, and when major shareholders are willing to invest in environmental standards, the company’s reputation is immediately improved (Kagan et al., 2003). Furthermore, Javeed and Lefen (2019) argument that ownership concentration is a practical tool for enhancing corporate performance and social activities.

Ownership concentration not only encourages management to embrace environmental policies for a positive image in the market, but it also encourages them to innovate (Baysinger et al., 1991). Agency conflicts may be reduced by large owners’ participation in societal norms (Liu et al., 2021). Large shareholders, according to Maung et al. (2016), possess a great deal of decision-making authority and can decide whether to engage in social and environmental initiatives for business novelty. Major shareholders are constantly seeking for ways to grow their wealth, according to a number of specialists, and as a result, they are interested in exploring R&D practices in order to create innovation (Hill and Jones, 1992). To back up this claim, Liu et al. (2022b) discovered that ownership structure had a favorable impact on manufacturing enterprises’ environmental performance.

Furthermore, Calza et al. (2016) find that substantial shareholders benefit environmental proactivity since they focus on long-term earnings and environmental practices in order to improve the firm’s market image. Minority stockholders are just interested in making a quick profit and are unconcerned about the company’s long-term sustainability. Large shareholders, on the other hand, are supposed to be the owners of companies, thus they require the companies to survive in the long run (Iatridis, 2013). Businesses engage in social initiatives that enhance their market standing and spur the creation of novel products that will satisfy both shareholders and society (Howell and Allen, 2017).

The level of voluntary corporate transparency is influenced by the ownership structure. The level of monitoring and consequently the breadth of voluntary disclosures is determined by an organization’s ownership structure (Giannarakis et al., 2020). Tang et al. (2018) examined the connection between ownership structure and voluntary disclosures and found no connection between managerial or governmental ownership and voluntary disclosures, but a substantial inverse association between block holder ownership and voluntary disclosures. To meet their investment estimation needs, corporate investors may put pressure on companies to reveal more information (Sparkes and Cowton, 2004).

Ownership concentration is particularly essential in the corporate sector because it includes the majority or top shareholders (Javeed et al., 2021). Ownership concentration assists in enhancing social norms at the corporate level (Alchian and Demsetz, 1972). The willingness to participate in corporate social practices for long-term development is crucial because the ownership concentration has significant decision-making power in the organization (Delmas et al., 2010). Strong sustainable development targets can be accomplished with the willingness to concentrate ownership, according to Javeed and Lefen (2019).

H8: Ownership concentration is beneficial to moderate the association amid business sustainable strategies and green innovation.

The social behaviors of businesses are significantly impacted by gender diversity Multiple studies have linked female directors to effective, long-term practices (Hillman et al., 2002). Furthermore, Harjoto et al. (2015) found that compared to male directors, female directors are more concerned with the long-term viability of corporate social activity. According to a meta-analysis study, female directors are crucial for increasing a company’s social initiatives (Byron and Post, 2016). Furthermore, Harjoto and Rossi (2019) exposed that companies can engage in long-term, sustainable corporate social initiatives by having female directors.

Boukattaya and Omri (2021) highlighted the value of having female directors in order to improve environmentally friendly operations. Several academics have investigated the association among gender diversity and corporate social performance, including (Post et al., 2015). It was also determined that having female directors was essential for long-term progress, according to their findings. Furthermore, according to Landry et al. (2016), A company’s ethical behavior is reflected by the presence of female directors on its board of directors, which enhances its reputation in society. Besides, administrations with female executives, according to Qiu et al. (2016), possess effective corporate social programs.

Female directors strive to collect more profit for the delight of shareholders by attending social gatherings (Hussain et al., 2018). Droms Hatch et al. (2015) asked participants what they thought about the role of male and female directors in social activities in two separate areas of corporate social aspects. According to their findings, people have a considerably more favorable opinion of female directors than male directors when it comes to sustainable habits. Female directors, on the other hand, take corporate social responsibility more seriously than male directors, according to (Hyun et al., 2016). Corporate social practices, according to Romano et al. (2020), have a positive association with gender diversity.

H9: The growth of green innovation is aided by gender diversity.

According to the vast majority of studies on how female board directors affect social performance, they are more effective in numerous facets of green finance. For instance, it has been found that boards with higher gender diversity are more likely to accomplish the organization’s social goal (Al Fadli et al., 2019). Amorelli et al. (2021) women on boards were shown to be positively correlated with “institutional strength CSR,” but not with “technical strength CSR.” The majority of academics in this topic have focused on a single CSP component, such charity (McWilliams and Siegel, 2000), the quality of the working environment Landry et al. (2016), the natural environment Post et al. (2011), or ethics Ibrahim and Angelidis (1994).

Cabeza-García et al. (2018) looked examined the connection between board diversity and how much GHG information is disclosed in the United Kingdom and found a strong correlation. Additionally, they reported on the long-term effects of female directors on corporations. Al Fadli et al. (2019) investigate how the board’s qualities may be linked to CSR and find a favorable link. Cordeiro et al. (2020) stated that female executives more concern for business environmental policies. Ma et al. (2022) examine how female board directors respond to gender issues reporting and find a positive link. Orazalin and Environment (2020) A positive association was shown when the effects of board gender diversity and CSR strategy were examined in Europe. Tingbani et al. (2020) also supported the function of gender diversity for corporate environmental approaches.

Ferrero-Ferrero et al. (2015) highlighted that gender diversity could be helpful for sustainable reporting at firm level. Lu et al. (2019) also encouraged the role of gender diversity for business sustainable strategies. Pucheta-Martinez et al. (2018) demonstrated that board diversity enhances corporate reputation via environmental policies. Haque (2017) state a positive correlation between carbon reduction operations and greenhouse gas (GHG) emissions of a corporation in the United Kingdom was found when the effects of board characteristics and sustainable pay policies were examined.

H10: Gender diversity is beneficial to moderate the association amid business sustainable strategies and green innovation.

The manufacturing industry in China is part of the study’s sample. We selected this sample for the following reasons: First, manufacturing, one of China’s core industries, is essential to the economy of the country and to the livelihoods of many people. Second, the manufacturing sector is currently faced with enormous societal challenges such as tax fraud, corruption, and high risks for health and safety (Kong et al., 2020). We use two stock exchanges to conduct our investigation; Shanghai and Shenzhen are two Chinese stock exchanges that fall under the “A” category. We examined manufacturing companies that were listed on both stock exchanges. The manufacturing businesses that we chose for this study were also chosen for a variety of reasons. As an illustration, manufacturing firms actively participate in environmental preservation and have positive relationships with philanthropic causes (Zhang et al., 2021).

Additionally, it is believed that Chinese manufacturing companies pollute more (Cai and Li, 2018). Chinese manufacturers benefit from a wealth of resources, strong production rates, and higher rates of investment in environmental restoration. The waste, air, water, and manufacturing industries all contribute significantly to pollution (Rehman et al., 2021). As a result, manufacturing corporations are under more pressure than companies in other industries to disclose accurate information about corporate social issues (Haniffa et al., 2005). For a sample of all A-share listed firms in China from 2010 to 2019, we use the following selection criteria. First, financial organizations are not included due to concerns with accounting statement comparability and a few environmental issues. Second, data anomalies do not include companies with negative net assets. Finally, we exclude companies whose data cannot be accessed. The sample distribution is based on the most recent revision of the Industry Classification Guidance for Listed Companies published by the China Securities Regulatory Commission (CSRC). In addition to other significant data from the China Stock Market and Accounting Research Database, we gather patent information from the corporation’s annual reports (CSMAR). Finally, 297 companies are chosen to complete this inquiry.

A previous researcher asserted that precise variable measurement yields successful results in empirical tests (Javeed et al., 2021). Investors in exclusive rights are frequently seen working on green innovation projects. Therefore, environmental patent applications filed by businesses constitute green innovation (Cai et al., 2021). Typically, businesses file patents to increase sales, get technological advantages, and safeguard their name in society. Therefore, it is believed that patent filings are the best tool for assessing a company’s intellectual property operations (Cai and Li, 2018). In light of these findings, this study maintains the course of green invention policies based on quantity, such as patent applications made by businesses over time. This study using green innovation as a dependent variable.

Due to environmental problems, environmental regulations are becoming more and more popular worldwide. In this analysis, we use a proxy that is consistent with earlier research to estimate environmental regulations: annually cost for environmental and ecological programs divided by business output value (Javeed et al., 2020).

This study defines the proactive environmental strategy proxy as the firm’s overall investment in R&D (Ge et al., 2018). This proxy for estimating PES had also been supported by earlier academics (Darnall et al., 2010).

Corporate social responsibility refers to a company’s operations that are concerned not just with profit but also with societal issues. CSR is calculated by dividing total equity by the sum of EPS, total taxes, staff wages, interests, and public spending minus social costs (Feng et al., 2018).

In this analysis, CEO power, which is measured using the CEO compensation ratio, is used as an independent and moderating variable (Javeed and Lefen, 2019). Determined as, the total compensation of CEO divided by other executives. Cash payment is the finest tool for controlling CEO authority in firms.

The percentage of an organization’s ownership held by larger shareholders is referred to as ownership concentration. A shareholder is regarded as a major shareholder if they own 10% or more of the company’s equity (La Porta et al., 1997).

In this study, gender diversity is a moderating and independent variable. The proportion of female board members used to determine the board’s gender diversity. This important gender diversity measure has been used in earlier investigations (Yasser et al., 2017). Even though this study evaluates gender diversity in accordance with these academics.

To acquire the best results, this study used a variety of control variables. Control variables at the corporate governance level include the size of the company, the ratio of equipment to other assets, the turnover of assets, and environmental consciousness. The standard log of the business’s full assets is used to determine size (Chodorow-Reich et al., 2022). The cost of plant, property, and equipment is divided by the company’s overall sales to get at the plant, property, and equipment ratio (Li, 2016). The ratio of total sales to total assets is used to calculate asset turnover (Javeed et al., 2021). The final step in evaluating environmental awareness involves dividing the total workforce by the amount of money spent by the company on redesigning and greenery-related expenses (Javeed et al., 2021).

In statistics and econometrics, multi-dimensional data that entail measurements across time are known as longitudinal data and panel data, respectively. Panel data are a subset of longitudinal data that include observations made for the same participants across time. Panel data is commonly associated to endogeneity issues, according to prior research (Li, 2016). The overall correlation cannot be construed as a causal influence whenever additional factors exist that contribute to a connection between a treatment and an outcome. The term “endogeneity dilemma” is frequently used to describe this situation. Endogeneity bias, which can result in confusing data and faulty theoretical elucidation, can be caused by uncertain conclusions (Li, 2016). Despite this, the endogeneity issue has not been addressed by the bulk of researchers that work with panel data. For instance, 90% of published panel data research does not address endogeneity issues (Feng et al., 2018).

Therefore, for controlling endogeneity problem, this study focusing on GMM model. Prior author reported that most crucial suggestion for dealing with endogeneity is the generalized method of moments (GMM). The GMM approach to resolving this issue has received support from more academics as well (Wintoki et al., 2012). The dynamic panel model, often known as the generalized mixed model (GMM) approach, was created in 1991 by Arellano and Bond (1991). With time, the factors’ relationship changes. A smart strategy for addressing these challenges is to use the GMM model. This approach is also highly helpful for developing accurate equation assessments (Feng et al., 2018). The GMM technique frequently allows for the exploitation of the lags of predicted variables. These variables delays are thus a very helpful technique to avoid endogeneity in panel data [81]. The GMM model uses “internal modifying data” to handle endogeneity (Li, 2016). The GMM model is also the most effective method for removing endogeneity from panel data since it has specific effects for changing coefficients (Li, 2016). In order to overcome the limits of panel data and achieve the best findings, the GMM model is utilized in this study.

Feasible generalized least square (FGLS) is a technique for assessing the unidentified contour in a linear regression model when data show a high level of residual correlation (Wooldridge et al., 2016). In the first instance, FGLS is discovered by Aitken (1936) in 1934. The best method for dealing with heteroskedasticity is FGLS. The Ordinary Least Square (OLS) approach may become ineffective when the variance of the independent variables is not equal because the estimators may draw the incorrect conclusions as a result of unclear results. It is possible that the incorrect terms in the equation will be connected in a particular pattern (Wintoki et al., 2012). The chance of a subsequent link could therefore bias the outcomes. In this work, the FGLS model is utilized as a robustness test to make sure that the results are accurate.

This study has been divided into three aspects.

From this equation,

From this equation,

From this equation,

From this equation,

From this equation,

Control variables of firm i at year t;

Table 1 displays the descriptive statistics for corporate management, green innovation, company environmental strategies, and control variables. The mean and standard deviation values are shown in this table. Table 1 also includes the results of the Pearson correlation test. The outcomes of the examination of Pearson coefficient correlation are shown in Table 1. The majority of the variables show a strong and positive correlation. Similar to this, all of the control variables show a strong and positive relationship.

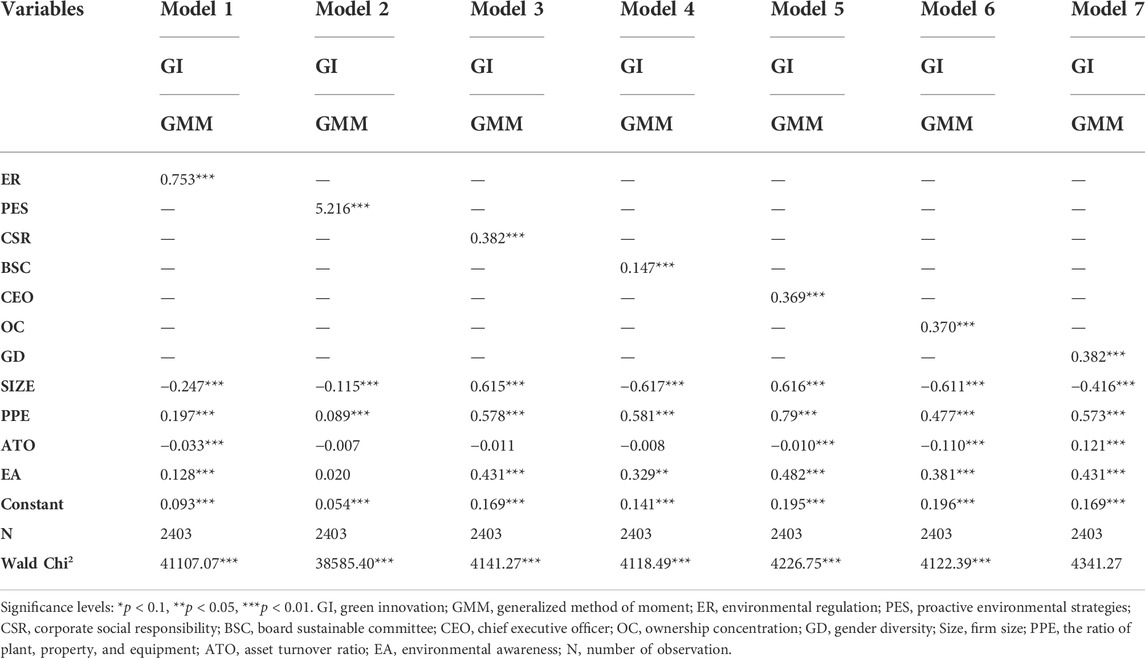

The outcomes of the GMM technique for the connection between business environmental strategies as (environmental regulations, proactive environmental strategies, corporate social responsibility, board sustainable committee) and green innovation are shown in Table 2. Model 1 shows that, when using the GMM technique, ER has a considerable and favorable influence on GI and values (

TABLE 2. Results of link between Business Environmental Strategies and Green Innovation, Corporate Management and Green Innovation.

Furthermore, the outcomes of the GMM technique for the connection between corporate management as (CEO power, ownership concentration, gender diversity) and green innovation are also revealed in Table 2. Model 5 shows that, when using the GMM technique, CEO has a considerable and favorable influence on GI and values (

Table 3 displays the findings of the GMM technique for the relationship between business environmental strategies such as (environmental regulations, proactive environmental strategies, corporate social responsibility, board sustainable committee) and green innovation with the interaction of powerful CEO. Model 1 shows that, when using the GMM technique, CEO*ER has a considerable and favorable influence on GI and values (

Aside from that, Table 4 presents the results of the GMM technique for the relationship between business environmental strategies like (environmental regulations, proactive environmental strategies, corporate social responsibility, board sustainable committee) and green innovation with the interaction of ownership concentration. Model 1 shows that, when using the GMM technique, OC*ER has a considerable and favorable influence on GI and values (

In addition, Table 5 presents the results of the GMM technique for the relationship between business environmental strategies like (environmental regulations, proactive environmental strategies, corporate social responsibility, board sustainable committee) and green innovation with the interaction of gender diversity. Model 1 shows that, when using the GMM technique, GD*ER has a considerable and favorable influence on GI and values (

This study uses an additional test to confirm the findings as a robustness test. This paper conducts further data analysis for the robustness test using feasible generalized least squares methodology (FGLS). Therefore, Table 6 presents the results of the FGLS technique for the relationship between business environmental strategies like (environmental regulations, proactive environmental strategies, corporate social responsibility, board sustainable committee) and green innovation. Model 1 shows that, when using the FGLS technique, ER has a considerable and favorable influence on GI and values (

Furthermore, the outcomes of the FGLS technique for the connection between corporate management as (CEO power, ownership concentration, gender diversity) and green innovation are also revealed in Table 6. Model 5 shows that, when using the FGLS technique, CEO has a considerable and favorable influence on GI and values (

Table 7 displays the findings of the FGLS technique for the relationship between business environmental strategies such as (environmental regulations, proactive environmental strategies, corporate social responsibility, board sustainable committee) and green innovation with the interaction of powerful CEO. Model 1 shows that, when using the FGLS technique, CEO*ER has a considerable and favorable influence on GI and values (

Moreover, Table 8 presents the results of the FGLS technique for the relationship between business environmental strategies like (environmental regulations, proactive environmental strategies, corporate social responsibility, board sustainable committee) and green innovation with the interaction of ownership concentration. Model 1 shows that, when using the FGLS technique, OC*ER has a considerable and favorable influence on GI and values (

Moreover, Table 9 presents the results of the FGLS technique for the relationship between business environmental strategies like (environmental regulations, proactive environmental strategies, corporate social responsibility, board sustainable committee) and green innovation with the interaction of gender diversity. Model 1 shows that, when using the FGLS technique, GD*ER has a considerable and favorable influence on GI and values (

Every country’s progress depends on the industrial sector, yet it is also responsible for social and environmental problems (Javeed et al., 2021). Environmental problems that affect both the natural environment and human life are currently being dealt with in many countries. As a result, numerous governments have put into practice various strategies for sustainable development, which tries to increase profitability by resolving environmental challenges (Fan et al., 2021). The purpose of this study is to examine the qualities that can aid a business in achieving long-term success in this situation. This study combined different environmental or social practices for firms under the head of “business environmental strategies”. For example, environmental regulations, proactive environmental strategies, corporate social responsibility, and board sustainable committee have been selected as business environmental strategies. The primary aim of this study is that business environmental strategies plays significant role for improving green innovation.

This study has inspected environmental strategies impact on green innovation separately. From hypothesis one to four, our outcomes concluded that business environmental strategies like environmental regulations, proactive environmental strategies, corporate social responsibility, and board sustainable committee are really valuable for improving green innovation at firm level. For supporting these outcomes, prior many authors findings are consistent with it. For example, Pan et al. (2021) supported environmental regulations, Mio et al. (2022) supported CSR, Solovida et al. (2017) supported proactive environmental strategies, Dixon-Fowler et al. (2017) supported board sustainable committee. Moreover, according to Palmer et al. (1995), environmental regulations are essential for businesses to thrive in a cutthroat market by spurring green innovation. Utilizing appropriate raw materials, cutting waste, and producing things that correspond to environmentally beneficial norms, or “green innovation,” are all proactive environmental measures (Singh et al., 2020).

According to Hull and Rothenberg (2008), businesses who participate in CSR initiatives promote green innovation. Additionally, they contended that CSR initiatives improve corporate innovation capacity, which may provide organizations a competitive edge. A sustainable board committee has been shown to improve Australian companies’ social and environmental performance, which is helpful for green innovation, according to Biswas et al. (2018). Theoretically, the natural resources theory and Porter hypothesis supported these outcomes (Porter, 1991; Hart and Dowell, 2011). Moreover, firms in developing economies have motive to compete in the international market. Therefore, to fulfill the international quality, environmental, and social standards also compel them to participate in business environmental strategies. The pressure of global warming and sustainable development goals also encouraging firms to make environmental friendly strategies. Importantly, firms with green innovation can also enhance profit ratio. Moreover, they can entice more shareholders by participating in business environmental strategies. China is fast growing economy in the world and have a lot of pressure for environmental issues as well. Therefore, the Chinese authorities have proper rules, regulations, and laws for industrial sector to participate in environment cleaning projects.

In addition to this, our study hypothesis five, seven, and nine concluded that corporate management as CEO power, ownership concentration and gender diversity is also valuable for improving green innovation. Prior studies such as, Hirshleifer et al. (2012) supported the role of CEO power, Song et al. (2018) supported the role of ownership concentration, Harjoto and Rossi (2019) supported the role of gender diversity for corporate green innovation. Corporate top management is very important for social practices as green innovation. A strong CEO has the skills to invest in green or social aspects and is more concerned with business innovation to make the company profitable for the sake of his good reputation (Griffin et al., 2007).

Moreover, companies with significant ownership concentrations effectively control management and other shareholders, enabling them to engage in social initiatives that support green innovation (Alchian and Demsetz, 1972). The social behaviors of businesses are significantly impacted by gender diversity. In numerous studies, female directors have been associated with reliable, enduring practices (Hillman et al., 2002). Furthermore, compared to male directors, female directors are more concerned with the long-term viability of corporate social initiatives. Theoretically, the resource dependency theory and agency theory supported these results. Corporate top executives have major responsibility to increase the profit and reputation of the firms (Javeed et al., 2021). The green innovation is a valuable tool for firms to gain the innovative image in the market (Abbas and Sağsan, 2019). Therefore, corporate management as CEO, ownership concentration, and gender diversity support the firm actions for green innovation. Moreover, female on top position is more concerned for environmental and social actions as compare to men.

Importantly, our study hypothesis six, eight, and 10th reported that corporate environmental strategies as, environmental regulations, proactive environmental strategies, corporate social responsibility, and board sustainable committee are really valuable for improving green innovation with the moderating role of corporate management (CEO power, ownership concentration, and gender diversity). There are various studies which supported the role of CEO power, ownership concentration, and gender diversity for improvement of business environmental strategies and green innovation (Boyd et al., 2011; Harjoto et al., 2015; Orazalin and Environment, 2020). According to Griffin et al. (2007), a great CEO benefits the company’s innovation as well as environmental strategies and corporate social responsibility initiatives. One such mechanism is the characteristics of the CEO, as they are crucial to managing, monitoring, guiding, and rewarding green practices in day-to-day company activities and development efforts (Jaffe et al., 1995). Additionally, ownership concentration is a beneficial tool for enhancing business social practices and performance, according to Javeed and Lefen (2019).

Ownership concentration have a lot of decision-making authority, and they might decide to engage in social and environmental practices for business innovation (Maung et al., 2016). The social activities of a firm can be improved by having more female directors (Byron and Post, 2016). In addition, Harjoto and Rossi (2019) found that the presence of female directors encourages businesses to adopt long-term, sustainable corporate social practices. The significance of having female directors is another point made by Boukattaya and Omri (2021) in order to improve ecologically sustainable operations. These findings also supported by resource dependency theory and agency theory. Corporate top executives are responsible for making all kind of strategies. Therefore, in the context of Chinese market they have a lot pressure from government and other authorities to participate in business environmental strategies (Teets, 2018). In addition, the role of gender diversity is highly important in Chinese market. They are interested in environmental and social actions for reputation and long-term profit. Consequently, they support corporate environmental strategies for green innovation.

With time, environmental problems have increased in frequency, and most academics think that the industrial sector is mostly to blame. The government and institutions are becoming more concerned about mitigating the detrimental effects of industry on the environment as the strain on the environment and sustainable development increases. Additionally, strong environmental practices are attracting the attention of legislators. Therefore, this study focusing on business environmental strategies as, environmental regulations, proactive environmental strategies, corporate social responsibility, and board sustainable for improving green innovation. Moreover, this study uses corporate management important factors as, CEO power, ownership concentration, and gender diversity for green innovation and as moderators on the association amid business environmental strategies and green innovation.

Panel data of 297 manufacturing companies in China were collected for this study from 2010 to 2019. This study uses two important statistical techniques, firstly, GMM model which also covers endogeneity issues and the FGLS model as a robustness analysis. This study comes to the conclusion that business environmental strategies like environmental regulations, proactive environmental strategies, corporate social responsibility, asnd board sustainable committee playing important role for enhancing green innovation at firm level. Besides, this study concluded that corporate management like CEO power, ownership concentration, and gender diversity is also imperative tool for increasing corporate green innovation. Importantly, this study stated that corporate management like CEO power, ownership concentration, and gender diversity positively moderates the link amid business environmental strategies like environmental regulations, proactive environmental strategies, corporate social responsibility, board sustainable committee and green innovation.

The findings of this study provide a number of recommendations and implications for policymakers, owners, institutions, governments, and managers. It could be advantageous to have corporate environmental strategy at the enterprise level. Businesses are advised to develop long-term plans to counteract adverse effects of industry. Additionally, this study emphasizes the value of corporate management in advancing sustainable practices. To improve long-term development, every government and policymaker should encourage CEOs and women to work in enterprises. Females must be represented on the board of directors and the sustainability committee since they are more motivated to engage in social behaviors.

The results of this study further highlight the value of ownership concentration for long-term sustainability and growth. Concentrated ownership makes up a substantial portion of corporate ownership, and their decisions are weighted more heavily within the business. This study provides guidance to governments and policy makers to develop these business environmental strategies like environmental regulations, proactive environmental strategies, corporate social responsibility, and board sustainable committee for promoting corporate social practices and improving reputation. This is the first study which investigated all these environmental strategies together for inspecting on green innovation. Importantly, this study highlighting the importance of green innovation at firm which also helps to reduce industrial negative effects.

So, this study entices shareholders and other governance to be a part of business environmental strategies. The environmental and social practices at firm level enhancing reputation in the market. Moreover, firms of developing economies could gain more benefits that having aim to compete in international market. Additionally, this study’s recommendations make social practices for top executives in businesses. Environmentally conscious businesses are viewed as being more socially conscious than others. Corporate social strategies methods enable businesses to boost earnings right away. Every regulatory body should make sure that every business has environmental strategy and corporate management involvement, especially those in developing economies. As a form of moral support and encouragement, institutions and governments can give prizes to businesses that have improved their sustainability policies. Additionally, because business social activities provide organizations with long-term benefits, this research implies that the cost of such activities is lower than the benefits. Additionally, by employing sustainable methods, businesses from developing nations may build a solid reputation and favorable perceptions in the global marketplace. This study also motivates companies to stop acting unethically and take part in civic activities. The study’s findings suggest that the industrial sector might be a key player in cleaning up the environment. International social and quality standards can also be useful for putting pressure on companies to follow social norms.

It is crucial to take into account how the study may affect the Chinese context. Chinese listed companies are state- or government-controlled, and in the majority of corporations, the government makes the majority of the decisions. Our findings may aid companies in luring owners, partners, and financiers from both developed and developing countries to join them in business environmental strategies. Policy makers from China could also get benefits by using this study finding for improving environmental glitches. The world economy and community are grappling with a conundrum in this area as a result of the excessive use of resources and rising use of hazardous substances, which have led to environmental issues. The function of business environmental initiatives and green innovation would be of utmost relevance for companies wanting to boost their profit.

Businesses in developing economies focus on green innovation to enhance environmental management and meet international requirements. Environmentally conscious companies are absorbing expenses, reducing resource use, and implementing technology that improve their capacity to compete on both home and international markets. The government should also impose a significant fee on polluting companies that do not use greener production techniques. Government should create a detailed framework that outlines how businesses should transform into organizations that foresee pollution. This would lower the cost of doing business with the government. The results of this study may be useful to organizations, policymakers, and society as a whole. Companies can boost their output and competitiveness in their primary markets with the aid of green innovation. Since green innovation reduces carbon footprints, improves air and water quality, emits fewer toxins into the environment, and employs more sustainable energy sources, it will be advantageous to future generations and have a lasting effect on society.

There are some empirical issues with the study that can suggest new directions for research. In order to analyze the nuanced relationship between corporate environmental objectives and green innovation, the study’s initial focus is on China. Future studies could look at various growing nations or contrast them with developed nations. Second, several contextual factors could weaken the main links discovered by the study. Additional industries could be examined in a subsequent study to assess the impact of corporate governance, enterprise pattern, and other factors on the relationship between business environmental strategies and green innovation. Additionally, as business environmental strategy is a broad concept, the current study did not account for the effects of other elements of environmental strategy. Future research on this topic might include additional components like carbon accounting, comprehensive environmental policies, etc.

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding authors.

Conceptualization, Writing-Original Draft Preparation, Formal Analysis, Methodology, SJ; Writing-Review and Editing, RL; Data Collection, NZ; Supervised, XC. All authors have read and agreed to the published version of the manuscript.

The authors would like to acknowledge the support provided by Management School, Hunan City University, Yiyang, China.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abbas, J., and Sağsan, M. J. J. O. C. P. (2019). Impact of knowledge management practices on green innovation and corporate sustainable development: A structural analysis. J. Clean. Prod. 229, 611–620. doi:10.1016/j.jclepro.2019.05.024

Aghion, P., van Reenen, J., and Zingales, L. J. A. E. R. (2013). Innovation and institutional ownership. Am. Econ. Rev. 103, 277–304. doi:10.1257/aer.103.1.277

Aitken, A. C. (1936). IV.—on least squares and linear combination of observations. Proc. R. Soc. Edinb. 55, 42–48. doi:10.1017/s0370164600014346

al Fadli, A., Sands, J., Jones, G., Beattie, C., Pensiero, D. J. A. A., and Business & Journal, F. 2019. Board gender diversity and CSR reporting: Evidence from Jordan. 13, 29. doi:10.14453/aabfj.v13i3.3

Al-Jaifi, H. A. (2017). “Ownership concentration, earnings management and stock market liquidity: Evidence from Malaysia,” in Corporate Governance: The international journal of business in society. Sintok: Emerald.

Alchian, A. A., and Demsetz, H. J. T. A. E. R. (1972). “Production, information costs, and economic organization,” in The American economic review. JSTOR, 62 (5), 777–795.

Ambec, S., and Barla, P. (2002). A theoretical foundation of the Porter hypothesis. Econ. Lett. 75, 355–360. doi:10.1016/s0165-1765(02)00005-8

Amorelli, M. F., and García‐Sánchez, I. M. (2021). “Trends in the dynamic evolution of board gender diversity and corporate social responsibility,” in Corporate Social Responsibility and Environmental Management. Salamanca: Wiley Online Library, 28 (2), 537–389.

Arellano, M., and Bond, S. J. T. R. O. E. S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 58, 277–297. doi:10.2307/2297968

Arimura, T., Hibiki, A., Johnstone, N. J. E. P., and Behaviour, C. (2007). An empirical study of environmental R&D: What encourages facilities to be environmentally innovative, 142

Bantel, K. A. J. P. R. (1993). Strategic clarity in banking: Role of top management-team demography. Psychol. Rep. 73, 1187–1201. doi:10.2466/pr0.1993.73.3f.1187

Barbera, A. J., Mcconnell, V. D. J. J. O. E. E., and Management, (1990). The impact of environmental regulations on industry productivity: Direct and indirect effects. J. Environ. Econ. Manage. 18, 50–65. doi:10.1016/0095-0696(90)90051-y

Baysinger, B. D., Kosnik, R. D., and Turk, T. A. J. A. O. M. J. (1991). Effects of board and ownership structure on corporate R&D strategy. Acad. Manage. J. 34, 205–214. doi:10.5465/256308

Berger, R., Dutta, S., Raffel, T., and Samuels, G. (2008). Innovating at the top: How global CEOs drive innovation for growth and profit. Springer.

Bethel, J. E., and Liebeskind, J. J. S. M. J. (1993). The effects of ownership structure on corporate restructuring. Strateg. Manag. J. 14, 15–31. doi:10.1002/smj.4250140904

Biswas, P. K., Mansi, M., and Pandey, R. J. P. A. R. (2018). Board composition, sustainability committee and corporate social and environmental performance in Australia.

Boluk, K. A., Cavaliere, C. T., and Higgins-Desbiolles, F. J. J. O. S. T. (2019). A critical framework for interrogating the united nations sustainable development goals 2030 agenda in tourism. Taylor & Francis.

Boukattaya, S., and Omri, A. J. S. (2021). Impact of board gender diversity on corporate social responsibility and irresponsibility: Empirical evidence from France, 13, 4712.

Boyd, B. K., Haynes, K. T., and Zona, F. J. J. O. M. S. (2011). Dimensions of CEO–board relations, 48, 1892

Brunnermeier, S. B., Cohen, M. A. J. J. O. E. E., and Management, (2003). Determinants of environmental innovation in US manufacturing industries, 45, 278.

Byron, K., and Post, C. J. C. G. A. I. R. (2016). Women on boards of directors and corporate social performance: A meta-analysis. Corp. Gov. An Int. Rev. 24, 428–442. doi:10.1111/corg.12165

Cabeza‐García, L., Fernández‐Gago, R., and Nieto, M. J. E. M. R. (2018). Do board gender diversity and director typology. CSR reporting? 15, 559

Cai, W., Lai, K.-H. J. R., and Reviews, S. E. (2021). “Sustainability assessment of mechanical manufacturing systems in the industrial sector,” in Renewable and Sustainable Energy Reviews. Chongqing: Elsevier, 135, 110169.

Cai, W., and Li, G. J. J. O. C. P. (2018). The drivers of eco-innovation and its impact on performance: Evidence from China. J. Clean. Prod. 176, 110–118. doi:10.1016/j.jclepro.2017.12.109

Cai, X., Zhu, B., Zhang, H., Li, L., and Xie, M. J. S. O. T. T. E. (2020). Can direct environmental regulation promote green technology innovation in heavily polluting industries? Sci. Total Environ. 746, 140810. doi:10.1016/j.scitotenv.2020.140810

Calza, F., Profumo, G., and Tutore, I. (2016). “Corporate ownership and environmental proactivity,” in Business Strategy and the Environment. Naples: Wiley Online Library, 25 (6), 369–389.

Chams, N., and García-Blandón, J. J. J. O. C. P. (2019). Sustainable or not sustainable? role board Dir. 226, 1067

Chen, H., Li, X., Zeng, S., Ma, H., and Lin, H. J. M. D. (2016). Does state capitalism matter in firm internationalization? Pace, rhythm, location choice, and product diversity.

Chen, S., Wang, Y., Albitar, K., and Huang, Z. J. B. I. R. (2021). Does ownership concentration affect corporate environmental responsibility engagement? Mediat. role Corp. leverage 21, S13–S24.

Chien, F. J. E. R.-E. I. (2022). The role of corporate governance and environmental and social responsibilities on the achievement of sustainable development goals in Malaysian logistic companies, 1–21.