- 1School of Humanities and Social Sciences, Beijing Institute of Technology, Beijing, China

- 2School of Social and Political Sciences, University of Glasgow, Glasgow, United Kingdom

Our study explores how CEOs’ educational attainment affects green innovation at the enterprise level and whether CEO educational attainment and green innovation can improve enterprise performance. To date, few studies have used environmental patents of listed companies to measure green innovation at the micro-level. Furthermore, existing studies have rarely considered the heterogeneity of the enterprise type or social responsibility and institutional intervention. Thus, by using a fixed-effects model, we argue that there is a positive relationship between CEO educational attainment and green innovation. Additionally, CEO education level significantly improves enterprise performance which leads to more sustainable green patent output by influencing green innovation based on data from listed companies in heavily polluting industries in Shanghai and Shenzhen from 2010 to 2018. Moreover, the result is still held after controlling for companies’ fixed effects and using the propensity score matching method (PSM) to eliminate endogenous and sample selection bias. Specifically, we demonstrate the following findings: 1) the positive influence of CEOs’ educational attainment on green innovation behavior is more significant in private enterprises and enterprises with higher social responsibility. 2) Strict environmental legislation can make a positive impact in regions with heavy environmental pollution. 3) Enterprises’ performance and sustainable environmental innovation are promoted by the positive mechanism. Our results not only enrich the literature on the relationship between education and innovation in terms of heterogeneity but also have significance in determining how to reduce pollution from the perspective of environmental governance and enterprise management.

1 Introduction

Economists have long emphasized the impact of CEO education on enterprise performance (Hsu et al., 2013; Zhou et al., 2021), and CEO education has been regarded as a powerful governance tool to deal with sustainable growth (Lacy et al., 2012; Ghardallou, 2022). These studies suggest that CEO education may contribute to enterprises’ sustainable performance. Meanwhile, environmental protection has become a global policy issue in recent years. In particular, close attention has been paid to the impact of climate change on society, with countries actively promoting carbon emission reduction, and the role of enterprises has been underlined in ecological, social, and economic development. In order to achieve sustainable goals and economic transition, enterprises tend to link “green development” and “innovation-driven development” (Filipović et al., 2022). Therefore, green innovation has gradually evolved into an important strategy for enterprise development. Instead of directly participating in environmental governance and investment, green innovation not only reduces environmental pollution and promotes companies’ environmental performance but also enables companies to carry out green research and development (R&D) at a technological level. Based on the aforementioned factors, we ask whether a high level of CEO education can promote green innovation and, thus, affect enterprise performance.

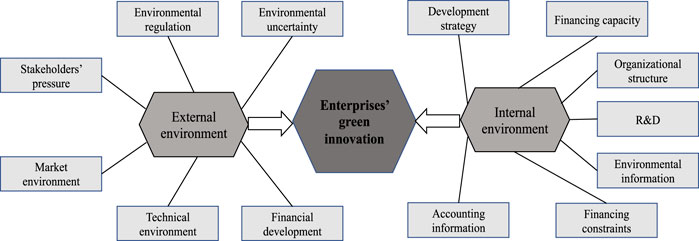

The general “green innovation” in academia is also called “ecological innovation,” “environmental innovation,” or “sustainable innovation,” which includes innovation in green technologies and products. Following previous studies that measure green innovation using green patents (Hall and Helmers, 2013; Escobar and Arellano, 2019; Soewarno et al., 2019), this study argues that green innovation involves the development of green technologies, including environment-friendly technologies, energy-saving technologies, renewable energy technologies, and eco-innovation technologies. According to the World Intellectual Property Organization, green innovation enjoys not only the economic returns of innovation but also the environmental efficiency of green technologies, and thus, it unifies economic benefits and ecological benefits. However, green innovation within enterprises is troubled by high risks and uncertainties, reflected in the long R&D period, the large number of investments, short-term returns, and lower profits. Existing studies have revealed that green innovation within enterprises is influenced by both the external and internal environment. The external environment includes 1) national laws, regulations, and systems on environmental protection, which set the conditions for them to enter the market and how to participate in the market, as well as the costs they will bear after violating these conditions (Huang et al., 2021), 2) industry competition, which mainly shows the attraction of enterprises to production factors and production efficiency events (Guo et al., 2022), and 3) energy prices and policies, which will directly affect the market positioning and strategic planning of green innovation (Bloom et al., 2010; Melander, 2018). The internal environment is related to 1) the organizational structure and management practices, which impact green innovation through information flow, experience accumulation, flexibility, organizational efficiency, and logistics (Wang P. et al., 2022; Amore et al., 2019; Amore and Bennedsen, 2016), 2) corporate governance, which motivates green innovation of enterprises through equity structure, board governance, and operator incentives (Xue et al., 2022; Liu et al., 2021), and 3) the company’s strategy and accounting behavior, which focus on the internal systems of enterprises and industrial alliances (Rui and Lu, 2021).

However, the existing studies suffer from the following shortcomings: 1) few studies discuss the impact of managers on green innovation from the perspective of educational attainment. As the main human capital within enterprises, CEOs’ decisions and ideas have a profound impact on enterprise performance. 2) The existing studies are carried out using a relatively general framework, and few studies distinguish between enterprise type, social responsibility, and institutional intervention. Environmental regulation was strengthened after the introduction of the Environmental Protection Law in the People’s Republic of China in 2015, which raises the question of whether CEOs’ educational attainment is more significant in promoting green innovation. 3) The joint impact of CEOs’ educational attainment and green innovation on enterprise performance is also rarely explored in previous studies. Therefore, to address the abovementioned deficiencies, this study aims to explore the influence of CEO educational attainment on the green innovation of enterprises and whether CEO educational attainment and green innovation improve enterprise performance.

Our study contributes to the previous literature in the following ways: 1) regarding data, we first use the number of green patents at the enterprise level to investigate the relationship between CEOs’ educational attainment, green innovation, and enterprise performance. This kind of micro-level data can improve the efficiency of enterprise resource allocation and better serve macro decision-making. 2) We focus on heterogeneity at the enterprise level, social level, and institutional level, which strengthens our conclusions. 3) The joint effect of CEOs’ educational attainment and green innovation on enterprise performance is examined. This could make a great difference to industry–university–institutional cooperation and the market value of green innovation.

The rest of the study is organized as follows. Section 2 presents a literature review on the determinants of enterprises’ green innovation and how CEOs’ education impacts enterprises’ green innovation. Section 3 describes the data, variables, and strategy for analysis. Section 4 presents the modeling results. The findings are discussed in Section 5. Finally, Section 6 outlines the conclusions and policy implications.

2 Literature review

In this section, we explore two main issues. The first is the determinants of enterprises’ green innovation to understand why it is important for enterprises to carry out green innovation and which factors affect enterprise performance. Second, we assess the relationship between CEO education and green innovation in the existing literature. The review provides a solid foundation for variable selection and the discussion of results in this article.

2.1 Determinants of enterprises’ green innovation

Enterprises’ green innovation depends on both the external and internal environment. Figure 1 shows the determinants of enterprises’ green innovation in previous studies. In terms of the external environment, these impacts mainly come from environmental regulation (Gong et al., 2020), environmental uncertainty, the pressure exerted by stakeholders (Wu and Hu, 2020), the market environment (Xie et al., 2019), the technical environment (Peters and Romi, 2014), and financial development (Hu et al., 2022). The impacts are examined based on the paradigm of environmental economics. As an influence mechanism, environmental regulation generally exerts pressure on enterprises through policies that aim to change their behavior. When enterprises face the pressure of environmental regulation, they will weigh the cost of environmental penalties against the benefits of green innovation (He et al., 2022). Environmental regulation determinants can include a series of environmental punishments (Karydas and Zhang, 2019), a low-carbon city policy (Zhang W. et al., 2020), green tax (Li et al., 2021), emission rights, and carbon emission zone trading market policy (Huang et al., 2022). Innovation in cost-effective emission reduction has significant potential for enterprises’ development. For example, in commercial building operations, a stepwise approach to decarbonization and carbon neutrality is advocated (Zhang S. F. et al., 2022). Thus, developing new carbon emission measurement technologies has become an important direction of green innovation for enterprises (Yan and Xu, 2022). In addition, existing literature shows that the uncertainty of environmental policies, especially economic-related policies, leads to the reduction of green invention patent applications by enterprises (Baker et al., 2016; Zhu et al., 2021). Moreover, this uncertainty has a negative role in regulating the relationship between voluntary environmental regulation and innovation output (Gulen and Ion, 2016). This is because the uncertainty has a negative impact on the macroeconomy, as it intensifies the changes in key macroeconomic variables, that is, financial assets, stock prices, economic output, and employment (Pan et al., 2021). Moreover, uncertainty inhibits the investment of enterprises, increases financing costs for enterprises, and affects the psychological expectation of enterprises on the market (Chen et al., 2022). Therefore, policy uncertainty hinders enterprise innovation.

Stakeholder pressure consists of government supervision of formal environmental legitimacy and media supervision of informal environmental legitimacy (Serohi, 2022). By increasing the dual pressure of local government regulation and public opinion, environmental media reports have played an external binding role in the industry and promoted regional innovation (Ocicka et al., 2022). Furthermore, environmental supervision can also affect governance through human capital. High human capital helps green innovation by reducing pollution emissions, but reducing pollution emissions through human capital cannot offset the direct positive impact of environmental regulation on pollution emissions (Dong et al., 2022). Thus, institutional regulation has always been regarded as an important influencing factor. In addition, some studies also consider upstream and downstream industries as stakeholders from the perspective of supply chains (Gong et al., 2020; Akhtar et al., 2021). Compared with collaboration only with customers (downstream external collaboration) or suppliers (upstream external collaboration), these studies argue that broad collaboration in the supply chain is very important for green innovation. Meanwhile, from the perspective of the market environment, the impact of rising labor costs on green technology innovation has a threshold effect. With the increase in market monopoly, green innovation demonstrates an “inverted U” trend (Wurlod and Noailly, 2018). In addition, market orientation has a positive and significant impact on green self-efficacy and green innovation, and green self-efficacy plays a significant intermediary role between market orientation and green innovation (Lv et al., 2021). On the other hand, resource allocation also regulates the relationship between market orientation and green innovation. Within technical environments, changes in technology cannot completely affect the stock of green patents (Soewarno et al., 2019). Li and Ouyang (2020) also supported these results based on evidence from China. The authors suggest that there is a nonlinear relationship between technological change and green productivity, which depends on the specific economic situation and the natural resources of a city. Notably, local technological changes have had a negative impact on China’s green innovation. This situation is more prominent in resource-dependent cities than in non-resource-dependent cities. As the economic situation changes, technology transfer from a foreign direct investment may improve or hinder the growth of green innovation. Although the impact of technological absorptive capacity is small, it is positive. Lastly, there are differences in the impact of financial development on green technology innovation. Specifically, financial structure is conducive to the development of green innovation, while the financial scale and efficiency have a negative impact on green innovation (Ghisetti et al., 2017).

Regarding enterprises’ internal environment, previous literature focuses on the impact of enterprise development strategies (Wang, 2019), enterprise financing capacity (Ardito et al., 2019), and enterprise organizational structure (Schaltegger et al., 2017) on green innovation. The basis of these factors is the enterprises’ own resources and their ability to obtain resources. In addition, when considering the impact of enterprise behavior on green innovation, the internal environment is often regarded as an important intermediary factor, such as corporate R&D (Ding et al., 2022), comparability of accounting information (Zhang Y. et al., 2020), environmental information disclosure (Tian and Yu, 2017), and financing constraints (Huang et al., 2020).

2.2 Effect of CEOs’ education on enterprises’ green innovation

In addition to the business environment of enterprises, the characteristics of enterprise managers are also important in green innovation. Compared with general technological breakthroughs, green innovation has higher technical requirements and a higher risk of research and development (R&D) failure, and thus, the behavior of executives has a significant impact. In general, these behaviors are often closely related to managers’ experience, personality, and motivation (Li and Gao, 2022). For example, executives’ awareness of environmental protection can positively regulate the relationship between mandatory environmental policies, market pressure, innovative resources, and green innovation (Arena et al., 2018). Due to stronger moral and altruistic preferences as well as lower risk aversion, senior executives’ military experience helps them lead enterprises to carry out green technology innovation in the face of environmental policy pressure (Nam et al., 2008). In addition, executives with radical personalities are more willing to take high risks, pursue high returns, and then carry out green innovations. On the contrary, CEOs with a preventive focus are more likely to avoid risks and pursue stability (Shin, 2012). When the tenure of CEOs is short, they will be more adventurous and pioneering and will focus on environmental protection and green innovation. Accordingly, with the growth of executives’ tenure, their decision-making style tends to be risk-averse. Considering the high risk and income uncertainty of green innovation, they will reduce green innovation measures (Stegeman et al., 2020).

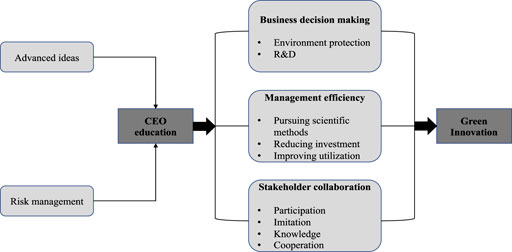

Furthermore, some studies pay particular attention to the relationship between CEO education and corporate environmental behavior and demonstrate a positive effect between them (Xue et al., 2022; Fearon et al., 2018). This mechanism indicates that education shapes the management style, thus improving the sustainability of enterprise behavior (Cucculelli, 2017). Figure 2 illustrates how CEOs’ education affects enterprises’ green innovation. The CEO’s personality and higher education experience play an important role. Moreover, compared with other characteristics, the variability of educational qualifications is relatively high, so exploring the effects of higher education has practical value for guiding enterprise behavior. Higher education plays a unique role in shaping personal values, notably three different values, namely, personal standards, knowledge standards, and social standards (Xia et al., 2022). As the leader of an enterprise’s senior management team, the CEO is ultimately responsible for identifying innovation opportunities, obtaining innovation resources, and selecting and implementing innovation strategies (Zhang Z. et al., 2022). The CEO’s education level comprehensively reflects their stock of knowledge, innovation awareness, cognitive ability, and social network and capital, which will inevitably have a far-reaching impact on the innovation behavior and performance of enterprises (Jiang et al., 2021). CEOs with high education levels have the following characteristics: first, their ideas are more advanced, and their strategic layout is more forward-looking. Green innovation has a longer-term investment value and may bring higher economic added value in the future (Van Rooij, 2010). Therefore, they tend to invest in green innovation. Second, they have a stronger awareness of risk management. For heavily polluting enterprises, pollution punishment is an important source of risk (Cronqvist et al., 2012). Highly educated CEOs will be very concerned about environmental issues and will reduce the punishment risk caused by enterprises’ pollution by carrying out more green innovation (Oh and Barker, 2018).

As a result, CEO education affects enterprises’ green innovation in the following three ways. First, CEOs have an important influence on corporate decision-making because they tend to follow their own personal values (Kong et al., 2021). Furthermore, CEOs with science-related degrees encourage enterprises to invest more in R&D (Su et al., 2020). Thus, CEOs with a high level of education tend to consider the environmental protection of enterprises and support R&D and the output of green patents. Second, from the perspective of management efficiency, high CEO education can reduce investment in green patents and improve their utilization because highly educated managers may be more able to identify and pursue energy-saving approaches. By reducing the energy density of enterprises, CEO management practices can improve productivity and promote green output (Wang P. et al., 2022). Third, CEOs may significantly affect the green innovation of other enterprises in the value chain through stakeholder participation, imitation, and knowledge transfer (Chen and Puttitanun, 2005). Environmental leadership and environmental knowledge learning not only have a positive impact on enterprise performance but also play an intermediary role in green innovation (Bottazzi and Peri, 2007).

3 Methodology

3.1 Data and variables

Based on the official classification standards issued by the China Securities Regulatory Commission, we have selected the heavily polluting enterprises listed in China from 2010 to 2018 as the sample. Among them, the judgment standard of heavy-polluting enterprises is based on the Guidelines for Environmental Information Disclosure of Listed Companies published by the Ministry of Environmental Protection in China in 2010. This study utilizes the following process for sample screening: first, excluding listed companies that have been removed from the list of financed funds and bonds due to the delisting risk or other risk warnings in the exchange. Second, excluding listed companies with a trading status of ST and PT in the current year. Third, eliminating samples with missing data. Finally, we obtain a total of 8,876 company annual observations. At the same time, in order to avoid the influence of outliers, all continuous variables are windorized at the upper and lower 1% quantiles.

One of our dependent variables is green innovation (GREENPAT), and we use the patent count as its proxy. The number of patents granted is the measure of innovation output (Mancusi, 2008). Previous research has used patent count data as a proxy for aggregate innovation (Diana and Usha, 2009; Gao et al., 2020). However, the effectiveness of patent count data to measure innovation is also questioned by some studies. First, though the patent count can demonstrate innovation output, it cannot exhibit all innovation processes (Alamsyah et al., 2020). For example, although strong IPR protection improves the patent count, it does not necessarily increase innovation propensity because it is only a static measure of innovation at particular time points in the innovation process (Eppinger, 2021). Fortunately, our study focuses on the effects of CEO education on green innovation output, and thus, this kind of measure is sufficient. The benefits of patent protection must be greater than the costs of patent applications and grants to happen. At the same time, patent protection cannot include all innovation output as some inventions can be protected by trade secrets and copyright. Therefore, there may be a downwardly biased measure of innovation (Eppinger, 2021). Similarly, Cohen et al. (2003) have indicated that considerable heterogeneity exists in patenting behavior in different industries. On the other hand, this cannot work at an aggregated level because patenting is closely linked to inventive activities overall and can reflect innovation ability at an aggregated level, such as regional or nationwide (Eppinger, 2021). Thus, in terms of our aim and questions, the patent count is a good proxy of green innovation output. In our study, the quantification of green innovation is the logarithm of the number of green patent applications in the current year plus 1. In exploring how CEOs’ educational attainment and green innovation affect enterprise performance, our dependent variable is enterprise performance. We use the return on equity (ROE) of an enterprise to measure enterprise performance. ROE provides a measurement of an enterprise’s ability to use its equity to obtain a return. It is a popular index in accounting to refer to enterprise performance.

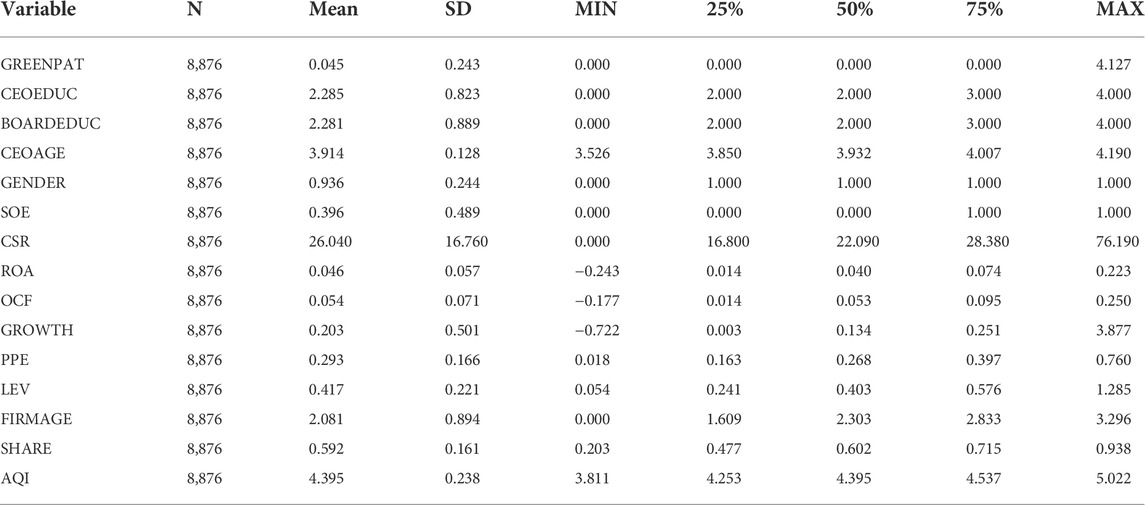

In this study, the explanatory variable is the education level of the CEO, including four points for a doctoral degree, three points for a master’s degree, two points for an undergraduate degree, one point for a junior college education, and zero points for a below junior college level. In addition, we selected a series of control variables, including return on assets (ROA), the ratio of total liabilities to total assets (LEV), company growth (GROWTH), company size (SIZE), the net book value of property, plant, and equipment (PPE), the nature of property rights (SOE), the firm listing age (FIRMAGE), the shareholding concentration (SHARE), the pollution of the enterprise location (AQI), corporate social responsibility (CSR), the CEO’s gender (GENDER), the CEO’s age (CEOAGE), board education level (BOARDEDUC), and operating cash flow (OCF). Table 1 shows the variables in our study.

3.2 Analysis strategy

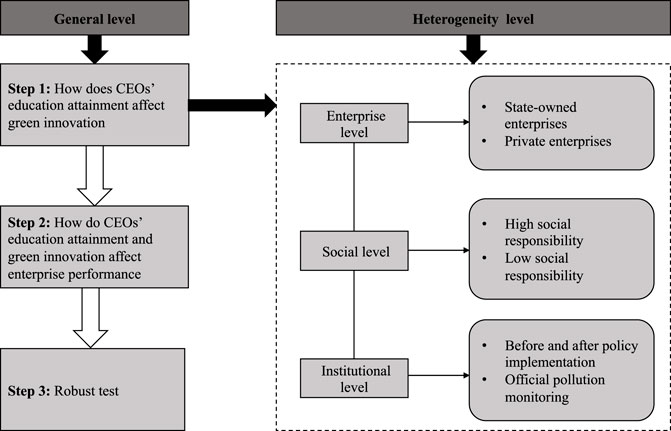

Figure 3 demonstrates the strategy for analysis in our study. At a general level, we first use the fixed-effects model to explore the effects of CEOs’ educational attainment on green innovation with respect to heavy-polluting enterprises. This provides us with a basic relationship between CEOs’ educational attainment and green innovation. Meanwhile, considering heterogeneity issues, the study conducts a further analysis of these mechanisms. We analyze heterogeneity in terms of enterprise type and social and institutional perspectives. In terms of enterprise type, state-owned enterprises and private enterprises are considered. Regarding the social perspective, we categorize organizations according to their social responsibility score, distinguishing between high responsibility and low responsibility. Finally, this study focuses on the institutional differences before and after the implementation of new regulations. We look at the implementation of the Environmental Protection Law in the People’s Republic of China in 2015. After the promulgation of the law, enterprises will face political costs and environmental pressures. Enterprises have to weigh the costs of pollution control with the benefits of green innovation and consider whether the potential benefits of green innovation will encourage managers to innovate. In addition, official environmental pollution monitoring is also included at the institutional level. Based on the mean of the air quality index of the city where the enterprises are located, we divide the organizations into high-pollution enterprises and low-pollution enterprises. Enterprises whose mean is higher than the mean of all companies belong to the high-pollution group. The rest belong to the low-pollution group. Second, after considering the mediating effects of green innovation, we discuss the joint impact of CEOs’ educational attainment and green innovation on enterprise performance. Third, in order to avoid endogeneity, the study conducts robust testing by replacing the dependent variable and methods.

We assess how CEOs’ educational attainment affects green innovation and how CEOs’ educational attainment and green innovation affect enterprise performance. The study constructs two basic regression models.

where

4 Results

Table 2 illustrates the descriptive statistics. The results indicate that green innovation output is significantly different among companies. In terms of CEOEDUC, the results show that the mean CEO educational attainment is a bachelor’s degree, but there are still differences in our sample.

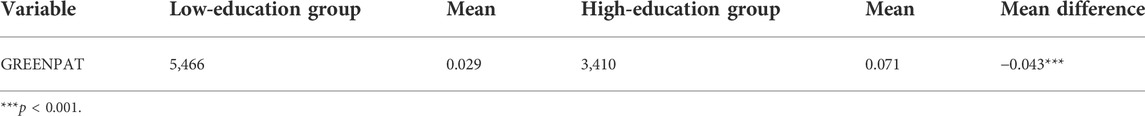

In order to describe our sample distribution in closer detail, the CEO sample is divided into two groups according to educational attainment. Those with master’s degrees or above are classified as the high-degree group, and others are classified as the low-degree group. A single-sample mean test is carried out on green innovation and CEO educational level. The results are indicated in Table 3. The mean of the green innovation of enterprises with higher CEO degrees is 0.071, while that of enterprises with lower CEO degrees is 0.029. In addition, the green innovation ability of the former is significantly higher than that of the latter. The difference between them is significant at 1%. These results indicate that educational attainment does have an important effect on green innovation.

4.1 The effect of CEOs’ educational attainment on green innovation

4.1.1 The results at a general level

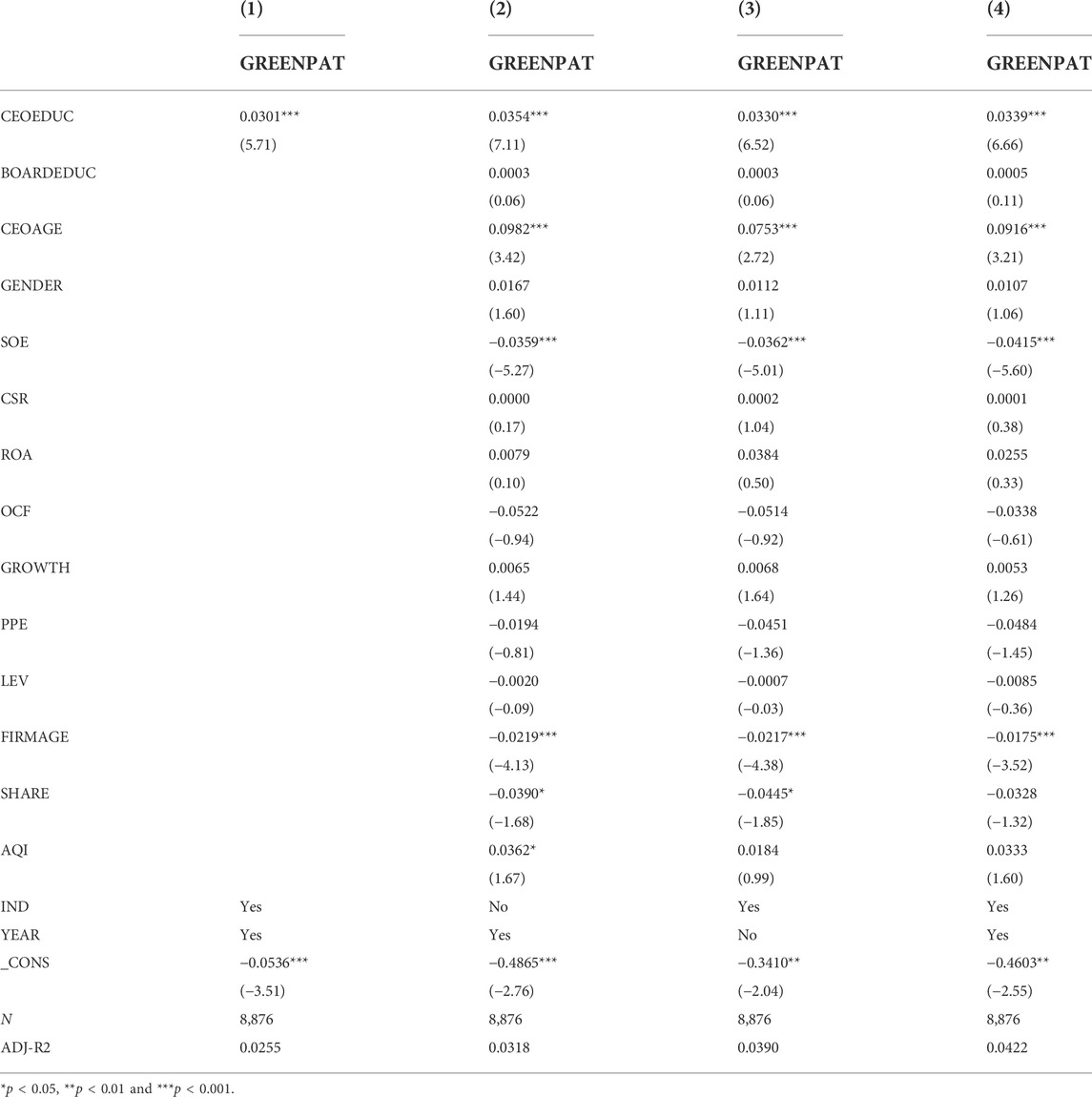

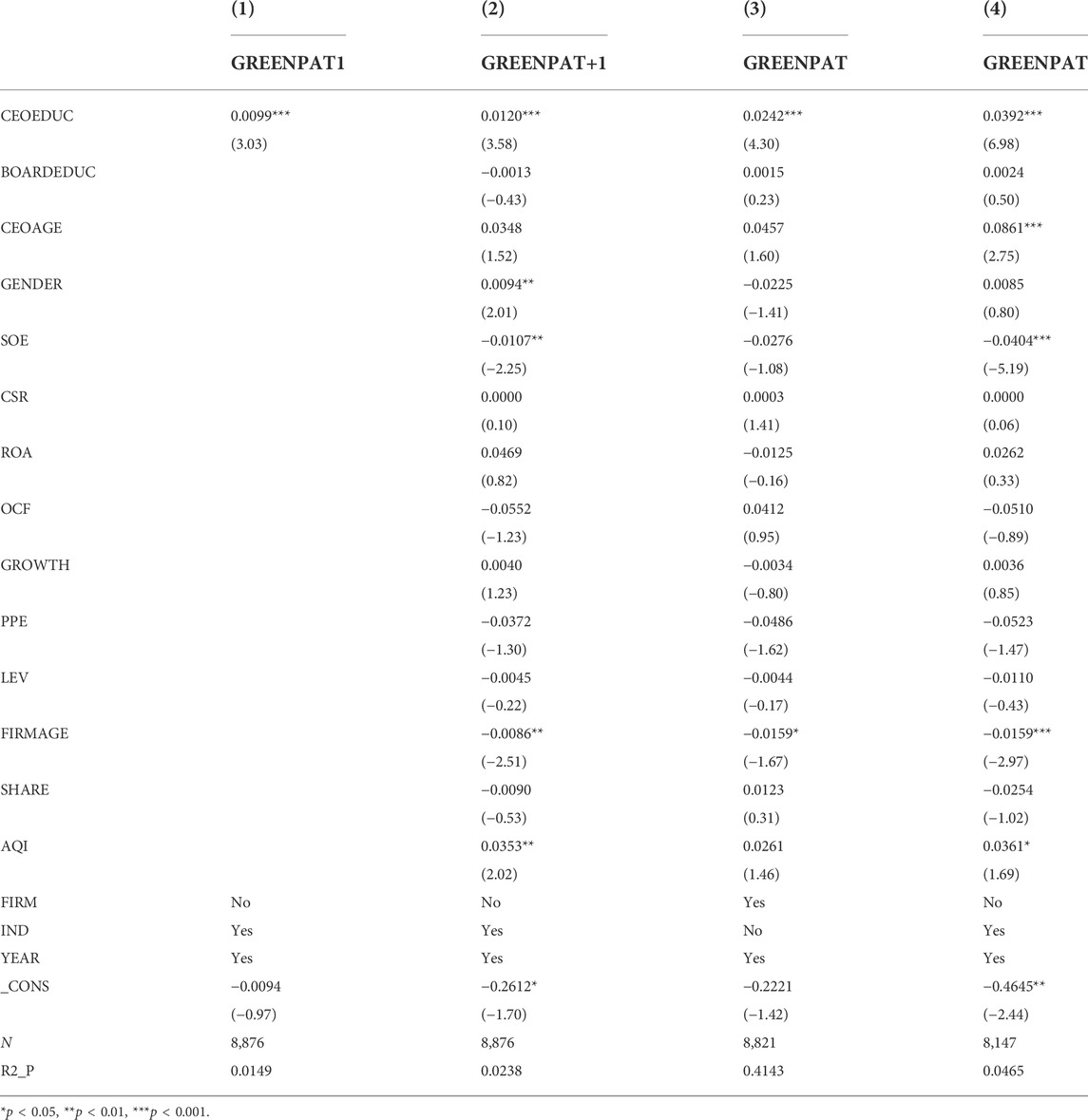

The results of the OLS regression in this study are shown in Table 4. Column (1) contains the OLS results for single variables. Columns (2), (3), and (4) show the regression results for annual fixed effects, industry fixed effects, and the combined effect, respectively. As shown in Table 4, the regression coefficients of CEO educational attainment are above 0.03 and are positive at 1% in all models, indicating that CEO educational attainment has significant positive effects on the green innovation performance of enterprises. Regarding control variables, the coefficient of board educational attainment is insignificant. A possible explanation is that CEOs’ participation and influence on the enterprises’ innovation and related decisions are more direct. There is a positive relationship between CEO age and green innovation, revealing that experienced CEOs can help green innovation. The empirical results also show that green innovation is negatively correlated with the nature of property rights, which means that private enterprises are more competitive in the field of green innovation. There is a significant negative correlation between company age and green innovation, which indicates that with the increase in company age, the company may lack green innovation motivation.

4.1.2 The results with respect to enterprise and social heterogeneity

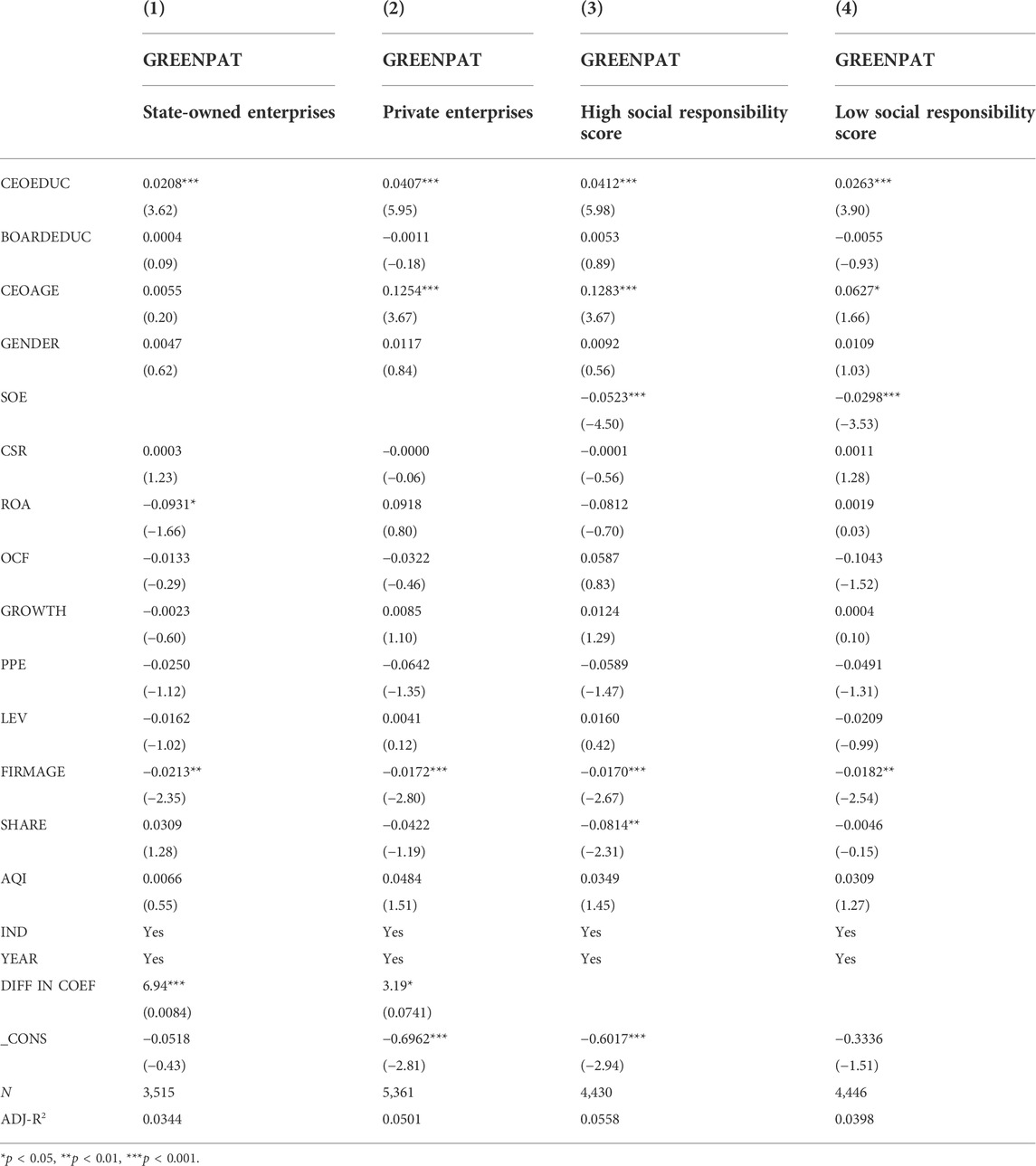

In order to consider the role of an enterprise and social heterogeneity, the study performs a cross-section test to analyze the influence of CEOs’ educational attainment on the green innovation of enterprises. The empirical results regarding enterprise heterogeneity are illustrated in Table 5, in which columns (1) and (2) are the regression results for state-owned and private enterprises, respectively. As shown in Table 5, although the regression coefficients of CEOs’ educational attainment are significantly positive in sub-samples, the coefficient difference test indicates that CEOs’ educational attainment promotes green innovation more significantly in private enterprises. Thus, compared with state-owned enterprises, private enterprises are more motivated to carry out green innovation in order to build a better corporate image and gain more social recognition. This may be due to financing or other constraints.

Columns (3) and (4) show the empirical results of groups with higher and lower social responsibility scores, which focus on social heterogeneity. As indicated in Table 5, although the regression coefficients of CEOs’ educational attainment are significantly positive in various sub-samples, the coefficient difference test shows that the positive impact of CEOs’ educational attainment on green innovation is more significant in enterprises with higher social responsibility scores. When fulfilling its social responsibility, an enterprise takes the interests of stakeholders into account and tries to balance its relationships with the environment, society, and economy. It will be more motivated if stakeholders, such as consumers, have a strong demand for green products and companies with environment-friendly images or if the government limits enterprises with environmental regulations (Li and Patiño-Echeverri, 2017).

4.1.3 The results with respect to institutional heterogeneity

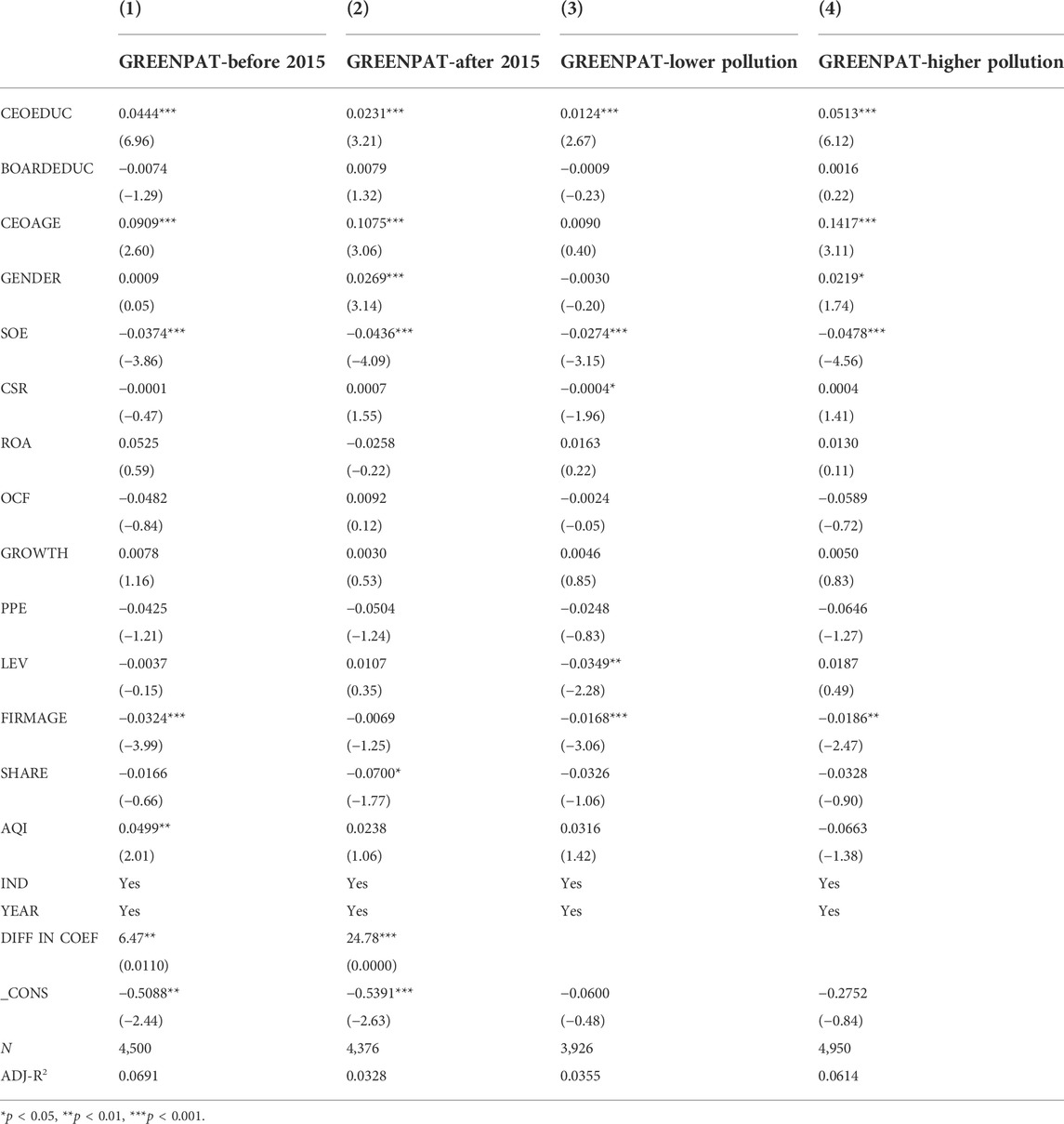

Based on the environmental regulatory policies and the pollution of enterprises, the difference test of the sub-samples is carried out. The empirical results are displayed in Table 6, in which columns (1) and (2) show the results of the sub-sample test before and after 2015, respectively. It is found that the relationship between CEO educational attainment and the green innovation of enterprises is more significant in the sample before 2015. Since the promulgation of the Environmental Protection Law in the People’s Republic of China in 2015, enterprises have been confronted with more political costs and environmental pressures. Through the compensation and economic returns brought by green innovation, enterprises can make up for the pollution control costs and the investment costs of green product development. After weighing up the costs and benefits, the potential benefits of green innovation will motivate companies to innovate.

In terms of official pollution monitoring, columns (3) and (4) show the results of samples with lower pollution levels and higher pollution levels, respectively. Based on the results, the positive impact of CEO educational attainment on green innovation is more significant in areas with higher pollution levels. In these regions, the stricter environmental regulations of local governments will force companies to meet the environmental protection requirements through green innovation.

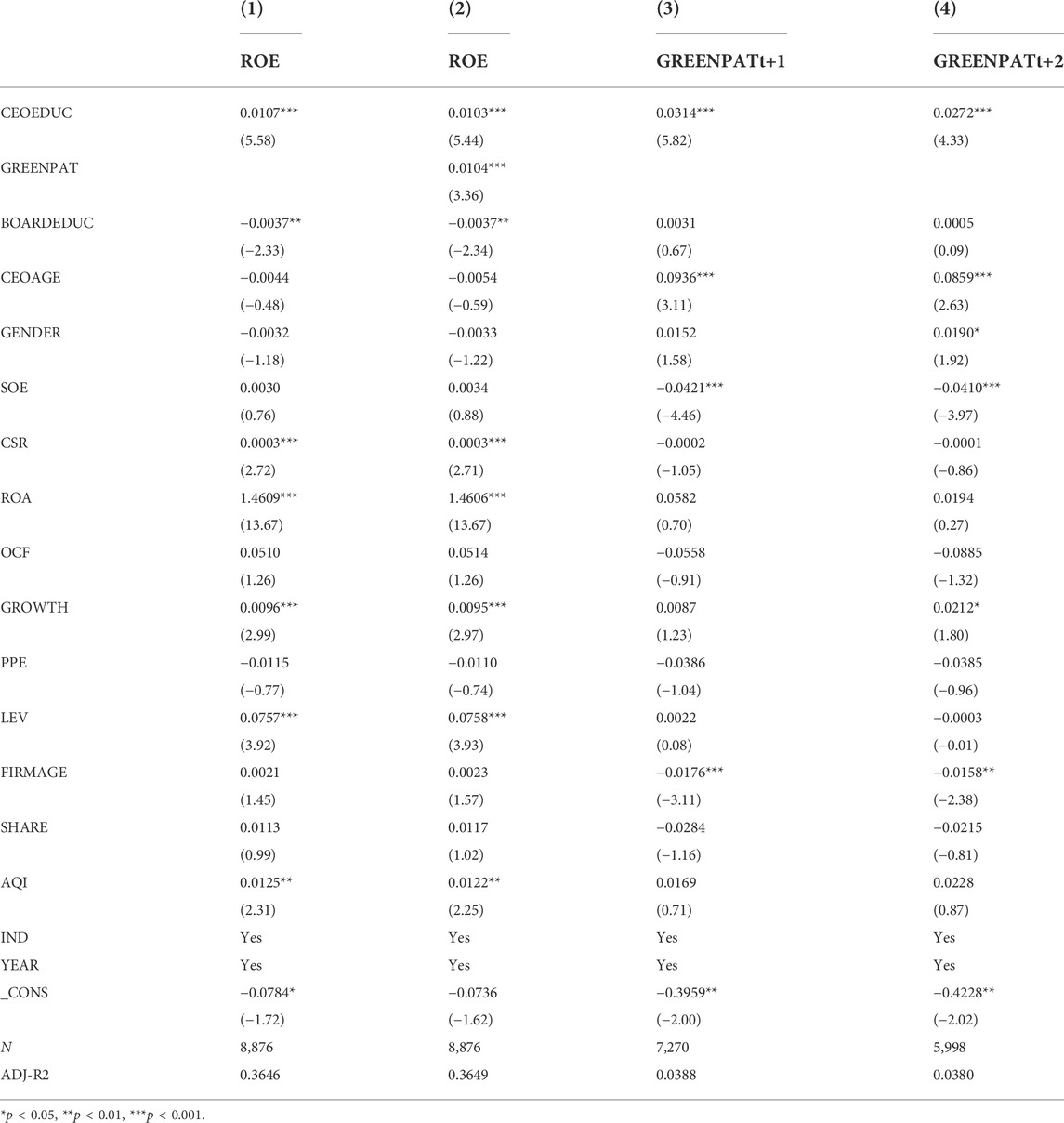

4.2 The effects of CEOs’ educational attainment and green innovation on enterprise performance

This study examines how CEOs’ educational attainment and green innovation jointly influence enterprise performance. The empirical results are shown in Table 7. Column (1) excludes green innovation, and CEO educational attainment is positively correlated with the company’s ROE, and the regression coefficient is significantly positive at 1%. Column (2) includes green innovation, and the variables of green innovation are further engaged. It is found that both CEO educational attainment and green innovation of enterprises are positively correlated with ROE. For consideration, we also test the lag period of the innovation effect. The study explores the influence of CEO educational attainment on the long-term green innovation of enterprises, as shown in columns (3) and (4) in Table 7. There is a positive relationship between CEO education level and green patents of enterprises over one and two years, which indicates that CEO educational attainment has a long-term influence on enterprise innovation.

4.3 Robust test

The study uses two methods to deal with the endogenous issues caused by variable measurement errors, missing data, and self-selection bias in regression. First, columns (1) and (2) use another core variable. The number of green invention patents is used as an alternative index of the explained variables. Second, the enterprise fixed-effects model in column (3) and the propensity score matching method (PSM) in column (4) are carried out to avoid potential missing variables and self-selection bias. As shown in Table 8, there remains a positive relationship between CEO educational attainment and the green innovation of enterprises, and the regression coefficients are significantly positive at 1%.

5 Discussion

In terms of enterprise heterogeneity, our results show that CEO education is more capable of promoting green innovation in private enterprises than in state-owned enterprises because the coefficient of state-owned enterprises (0.0208) is less than that of private enterprises (0.0407). First, from the perspective of innovation motivation, the existing studies argue that due to the government’s public financial support and the fact that they have less competitive pressures (Zhan and Zhu, 2021), state-owned enterprises lack the internal incentive and motivation for innovation and have low innovation efficiency (TÕNURIST and Karo, 2016). In order to achieve rapid economic growth, local governments support the investment and financing platforms of state-owned enterprises in their jurisdictions to attract fixed-asset investment projects with high labor absorption and quick performance (Goodell et al., 2021), which can avoid the uncertainty and long period of technology asset investment. Meanwhile, because local governments have the power to appoint and remove managers of state-owned enterprises, they cater to short-term economic growth for political promotion, but they ignore R&D investment related to green innovation. Furthermore, state-owned enterprises have an intrinsic connection with politics (Zhang, 2017). They can use political resources to interfere, obstruct, or delay the enforcement process of environmental protection regulators. As a result, state-owned enterprises have less pressure in terms of environmental regulation, which leads to their lack of motivation for green innovation. Even if there are environmental accidents, they also have a strong ability to bear fines.

Second, although private enterprises are more innovative, their ability to bear fines is weaker than that of state-owned enterprises. Moreover, compared with the identity advantages of state-owned enterprises, private enterprises are faced with stricter environmental supervision and competitive pressure (Yan and Xu, 2022). Therefore, they expect to reduce environmental pressure and gain a competitive advantage through green innovation, which means they have greater enthusiasm for green innovation.

Regarding social heterogeneity, enterprises with high social responsibility (0.0412) have greater enthusiasm for green innovation. According to stakeholder theory, responsible enterprises tend to disclose their environmental protection measures and social performance to society to establish an image as a green enterprise (Heikkurinen and Ketola, 2012). The social responsibility report can also strengthen the communication between enterprises and investors, thus promoting green innovation output. In addition, a positive enterprise image can lead to more high-quality investment and trust, which will enable enterprises to have more funds for green technology innovation.

Institutional heterogeneity has significantly positive effects on green innovation, which is in line with the previous literature (Lubacha and Wendler, 2021; Wang F. et al., 2022). When enterprises face the pressure of environmental regulation, they will weigh up the cost of environmental punishment and the benefits of green innovation. Appropriate environmental regulation can eliminate some less-efficient technologies and ensure the market value of green innovation (Bai et al., 2021). Most of the previous studies focus on how environmental regulation affects the innovation behavior of enterprises but do not include the education level of the CEO as a decision maker in the situation. In our study, the coefficient of CEOEDUC (0.0444) in Table 6 is greater than that of Model 2 (0.0231), indicating that CEOs with high educational attainment can better understand and take advantage of environmental regulation, thus promoting green innovation in enterprises. Furthermore, with the strengthening of environmental regulations, severe punishment makes enterprises require CEOs with higher educational attainment. Therefore, CEOs with higher education will have more knowledge about social values and political systems with respect to environmental issues, which will lead them to be more forward-looking when making green innovation decisions.

In addition, due to the varying degrees of environmental pollution in different regions, the impact of CEO education on green innovation also differs. In Table 6, the coefficient (0.0513) in Model 4 is greater than that in Model 3 (0.0124). Specifically, in regions with high environmental pollution, environmental issues are of greater concern to the government, the public, and the media. Therefore, being under pressure, these regions are more inclined to introduce green innovations. Also, green innovation plays an important role in reducing the intensity of environmental pollution. Green innovation is a key element in China’s regional environmental pollution governance because it can accelerate the upgrading of industrial structures and eliminate backward industries (Du et al., 2021). In Table 7, Models 3 and 4 use the lagged phase I and phase II variables of patent applications to test the lagged impact of CEO education on green innovation. Our results show that the impact of CEO education on green innovation growth is relatively stable, and the lag is not long. All in all, CEOs with high educational attainment tend to promote green innovation continuously and steadily, and green innovation will be further transformed into actual economic output.

6 Conclusion

Green innovation is a crucial way for enterprises to improve environmental resource utilization rates and reduce energy consumption. It uses innovative technologies to realize economic and environmental goals. Our study not only explores the effects of CEO educational attainment on green innovation but also examines how CEO educational attainment jointly influences green innovation and enterprises. Generally, CEOs with a high level of education will rationally consider the sustainable development of enterprises by focusing on green innovation. However, we also consider the heterogeneity of the enterprise type, social responsibility, and institutional intervention. In addition, we explore green innovation as an explanatory variable to assess the role of CEO education in enterprise performance. Therefore, based on micro-level patent data, we contribute to the existing literature by discussing heterogeneity at the enterprise, social, and institutional levels, as well as indicating the impact on enterprise performance.

Overall, our study argues that CEO educational attainment is positively correlated with green innovation, though various heterogeneities exist. Specifically, we draw the following conclusions: 1) The green innovation ability of an enterprise increases with the improvement of its CEO’s education level, and CEO educational attainment is usually higher in enterprises with stronger social responsibility, which are more likely to carry out green innovation. Managers with higher degrees have received more positive education on social values. Public welfare concepts of environmental protection have already been rooted in their management practice, which will encourage them to make green innovation decisions. 2) Compared with state-owned enterprises, the positive impact of CEO educational attainment on green innovation is more significant in private enterprises. 3) We find that the positive influence of CEO educational attainment on green innovation is more prevalent after the introduction of the strict Environmental Protection Law in 2015. 4) In regions with severe pollution, a CEO’s educational attainment promotes green innovation more effectively.

In exploring whether CEO educational attainment and green innovation can improve enterprise performance, the study concludes that the CEO education level significantly improves enterprise performance and more sustainable green patent output by influencing green innovation. Patented technology formed by technological innovation can enhance the competitive advantages of enterprises and lay a foundation for their rapid development. Furthermore, with growing public awareness of environmental protection, enterprises contribute to environmental protection through green technology innovation, which improves the social image of enterprises and gives a positive signal to the market, thereby reducing financing costs for enterprises.

Our study also offers some policy implications. As decision makers and executors, CEOs are fundamental to enterprises’ behavior. With broader society advocating environmental issues, enterprises play a crucial role in building a low-carbon society and achieving carbon neutrality. Cao et al. (2019) Green innovation has both economic and social benefits for enterprises. This study suggests that improving the human resource plan and education levels of CEOs can effectively promote green innovation behavior in enterprises. In conclusion, the study not only enriches research on the influencing factors behind green innovation in enterprises at the theoretical level but also guides the human resource plan for CEOs at the practical level (Cao et al., 2019).

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

CZ: methodology and writing; HL: writing; XG: revision; JF: revision; and XG: supervision and writing.

Acknowledgments

Our study is funded by National Natural Science Foundation of China “A Research on Governance Mechanism and Performance of University Spin-off Companies in China (Grant No. 71302027)”.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Akhtar, S., Martins, J. M., Mata, P. N., Tian, H., Naz, S., Dâmaso, M., et al. (2021). Assessing the relationship between market orientation and green product innovation: The intervening role of green self-efficacy and moderating role of resource bricolage. Sustainability 13 (20), 11494. doi:10.3390/su132011494

Alamsyah, D. P., Othman, N. A., and Mohammed, H. A. A. (2020). The awareness of environmentally friendly products: The im-pact of green advertising and green brand image. Manag. Sci. Lett. 10 (9), 1961–1968. doi:10.5267/j.msl.2020.2.017

Amore, M. D., and Bennedsen, M. (2016). Corporate governance and green innovation. J. Environ. Econ. Manag. 75, 54–72. doi:10.1016/j.jeem.2015.11.003

Amore, M. D., Bennedsen, M., Larsen, B., and Rosenbaum, P. (2019). CEO education and corporate environmental footprint. J. Environ. Econ. Manag. 94, 254–273. doi:10.1016/j.jeem.2019.02.001

Ardito, L., Messeni Petruzzelli, A., Pascucci, F., and Peruffo, E. (2019). Inter‐firm R&D collaborations and green innovation value: The role of family firms' involvement and the moderating effects of proximity dimensions. Bus. Strategy Environ. 28 (1), 185–197. doi:10.1002/bse.2248

Arena, C., Michelon, G., and Trojanowski, G. (2018). Big egos can be green: A study of CEO hubris and environmental innovation. Brit. J. Manage. 29 (2), 316–336. doi:10.1111/1467-8551.12250

Bai, Y., Wang, J. Y., and Jiao, J. L. (2021). A framework for determining the impacts of a multiple relationship network on green innovation. Sustain. Prod. Consum. 27, 471–484. doi:10.1016/j.spc.2021.01.014

Baker, S. R., Bloom, N., and Davis, S. J. (2016). Measuring economic policy uncertainty. Q. J. Econ. 131 (4), 1593–1636. doi:10.1093/qje/qjw024

Bloom, N., Genakos, C., Martin, R., and Sadun, R. (2010). Modern management: Good for the environment or just hot air? Econ. J. 120 (544), 551–572. doi:10.1111/j.1468-0297.2010.02351.x

Bottazzi, L., and Peri, G. (2007). The international dynamics of R&D and innovation in the long run and in the short run. Econ. J. 117 (518), 486–511. doi:10.1111/j.1468-0297.2007.02027.x

Cao, W., Zhang, Y., and Qian, P. (2019). The effect of innovation-driven strategy on green economic development in China-An empirical study of smart cities. Int. J. Environ. Res. Public Health 16 (9), 1520. doi:10.3390/ijerph16091520

Chen, Y., and Puttitanun, T. (2005). Intellectual property rights and innovation in developing countries. J. Dev. Econ. 78 (2), 474–493. doi:10.1016/j.jdeveco.2004.11.005

Chen, Z., Jin, J., and Li, M. (2022). Does media coverage influence firm green innovation? The moderating role of regional environment. Technol. Soc. 70, 102006. doi:10.1016/j.techsoc.2022.102006

Cohen, W. M., Arora, A., and Ceccagnoli, M. (2003). R&D and the patent premium. NBER Working Paper Series, 9431. doi:10.3386/w9431

Cronqvist, H., Makhija, A. K., and Yonker, S. E. (2012). Behavioral consistency in corporate finance: CEO personal and corporate leverage. J. Financial Econ. 103 (1), 20–40. doi:10.1016/j.jfineco.2011.08.005

Cucculelli, M. (2017). Firm age and the probability of product innovation. Do CEO tenure and product tenure matter? J. Evol. Econ. 28 (1), 153–179. doi:10.1007/s00191-017-0542-4

Diana, We., and Usha, N. (2009). Innovation, inequality and intellectual property rights. World Dev. 37 (5), 889–901. doi:10.1016/j.worlddev.2008.09.013

Ding, J., Lu, Z., and Yu, C. (2022). Environmental information disclosure and firms’ green innovation: Evidence from China. Int. Rev. Econ. Finance 81, 147–159. doi:10.1016/j.iref.2022.05.007

Dong, K. L., Zhao, J., Ren, X. H., and Shi, Y. K. (2022). Environmental regulation, human capital, and pollutant emissions: The case of SO2 emissions for China. J. Chin. Econ. Bus. Stud., 1–25. ahead-of-print (ahead-of-print). doi:10.1080/14765284.2022.2106539

Du, K., Cheng, Y. Y., and Yao, X. (2021). Environmental regulation, green technology innovation, and industrial structure upgrading: The road to the green transformation of Chinese cities. Energy Econ. 98, 105247. doi:10.1016/j.eneco.2021.105247

Eppinger, E. (2021). How open innovation practices deliver societal benefits. Sustainability 13 (3), 1431. doi:10.3390/su13031431

Escobar, A. B., and Arellano, E. N. (2019). Green innovation from the global south: Renewable energy patents in Chile, 1877–1910. Bus. Hist. Rev. 93 (2), 379–395. doi:10.1017/s000768051900062x

Fearon, C., Nachmias, S., McLaughlin, H., and Jackson, S. (2018). Personal values, social capital, and higher education student career decidedness: A new 'protean'-informed model. Stud. High. Educ. 43 (2), 269–291. doi:10.1080/03075079.2016.1162781

Filipović, S., Lior, N., and Radovanović, M. (2022). The green deal – just transition and sustainable development goals Nexus. Renew. Sustain. Energy Rev. 168, 112759. doi:10.1016/j.rser.2022.112759

Gao, X., Cao, M., Yang, T., and Basiri, A. (2020). Transport development, intellectual property rights protection and innovation: The case of the Yangtze River Delta Region, China. Res. Transp. Bus. Manag. 37, 100563. doi:10.1016/j.rtbm.2020.100563

Ghardallou, W. (2022). Corporate sustainability and firm performance: The moderating role of CEO education and tenure. Sustainability 14 (6), 3513. doi:10.3390/su14063513

Ghisetti, C., Mancinelli, S., Mazzanti, M., and Zoli, M. (2017). Financial barriers and environmental innovations: Evidence from EU manufacturing firms. Clim. Policy 17 (1), S131–S147. doi:10.1080/14693062.2016.1242057

Gong, R., Wu, Y., Chen, F., and Yan, T. (2020). Labor costs, market environment and green technological innovation: Evidence from high-pollution firms. Int. J. Environ. Res. Public Health 17 (2), 522. doi:10.3390/ijerph17020522

Goodell, J. W., Li, M. S., and Liu, D. S. (2021). Price informativeness and state-owned enterprises: Considering their heterogeneity. Int. Rev. financial analysis 76, 101783. doi:10.1016/j.irfa.2021.101783

Gulen, H., and Ion, M. (2016). Policy uncertainty and corporate investment. Rev. Financial Stud. 29 (3), 523–564.

Guo, Y., Fan, L., and Yuan, X. (2022). Market competition, Financialization, and green innovation: Evidence from China’s manufacturing industries. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.836019

Hall, B. H., and Helmers, C. (2013). Innovation and diffusion of clean/green technology: Can patent commons help? J. Environ. Econ. Manag. 66 (1), 33–51. doi:10.1016/j.jeem.2012.12.008

He, C., Wang, Y., and Tang, K. (2022). Impact of low-carbon city construction policy on green innovation performance in China. Emerg. Mark. Finance Trade, 1–12. ahead-of-print. doi:10.1080/1540496X.2022.2089019

Heikkurinen, P., and Ketola, T. (2012). Corporate responsibility and identity: From a stakeholder to an awareness approach. Bus. Strategy Environ. 21 (5), 326–337. doi:10.1002/bse.744

Hsu, W. T., Chen, H. L., and Cheng, C. Y. (2013). Internationalization and firm performance of SMEs: The moderating effects of CEO attributes. J. World Bus. 48 (1), 1–12. doi:10.1016/j.jwb.2012.06.001

Hu, J., Wang, K., Su, C., and Umar, M. (2022). Oil price, green innovation and institutional pressure: A China's perspective. Resour. Policy 78, 102788. doi:10.1016/j.resourpol.2022.102788

Huang, S., Chau, K. Y., Chien, F., and Shen, H. (2020). The impact of startups’ dual learning on their green innovation capability: The effects of business executives’ environmental awareness and environmental regulations. Sustainability 12 (16), 6526. doi:10.3390/su12166526

Huang, M., Li, M., and Liao, Z. (2021). Do politically connected CEOs promote Chinese listed industrial firms’ green innovation? The mediating role of external governance environments. J. Clean. Prod. 278, 123634. doi:10.1016/j.jclepro.2020.123634

Huang, J., Wang, Z., Jiang, Z., and Zhong, Q. (2022). Environmental policy uncertainty and corporate green innovation: Evidence from China. Eur. J. Innov. Manag. doi:10.1108/EJIM-12-2021-0591

Jiang, M., Chen, D., and Yu, H. (2021). Research on reward and punishment contract model and coordination of green supply chain based on fairness preference. Sustainability 13 (16), 8749. doi:10.3390/su13168749

Karydas, C., and Zhang, L. (2019). Green tax reform, endogenous innovation and the growth dividend. J. Environ. Econ. Manag. 97, 158–181. doi:10.1016/j.jeem.2017.09.005

Kong, T., Feng, T., and Huo, B. (2021). Green supply chain integration and financial performance: A social contagion and information sharing perspective. Bus. Strategy Environ. 30 (5), 2255–2270. doi:10.1002/bse.2745

Lacy, P., Haines, A., and Hayard, R. H. T. (2012). Developing strategies and leaders to succeed in a new era of sustainability: Findings and insights from the United Nations Global Compact-Accenture CEO Study. J. Mgmt. Dev. 31 (4), 346–357. doi:10.1108/02621711211218997

Li, M., and Patiño-Echeverri, D. (2017). Estimating benefits and costs of policies proposed in the 13th FYP to improve energy efficiency and reduce air emissions of China's electric power sector. Energy Policy 111, 222–234. doi:10.1016/j.enpol.2017.09.011

Li, W., and Ouyang, X. (2020). Investigating the development efficiency of the green economy in China's equipment manufacturing industry. Environ. Sci. Pollut. Res. Int. 27 (19), 24070–24080. doi:10.1007/s11356-020-08811-3

Li, X., Hu, Z., and Zhang, Q. (2021). Environmental regulation, economic policy uncertainty, and green technology innovation. Clean. Technol. Environ. Policy 23 (10), 2975–2988. doi:10.1007/s10098-021-02219-4

Li, M., and Gao, X. (2022). Implementation of enterprises' green technology innovation under market-based environmental regulation: An evolutionary game approach. J. Environ. Manage. 308, 114570. doi:10.1016/j.jenvman.2022.114570

Liu, Y., Wang, A., and Wu, Y. (2021). Environmental regulation and green innovation: Evidence from China’s new environmental protection law. J. Clean. Prod. 297, 126698. doi:10.1016/j.jclepro.2021.126698

Lubacha, J., and Wendler, T. (2021). Do European firms obey the rules? Environmental innovativeness in light of institutional frameworks. Industry innovation 28 (9), 1196–1223. doi:10.1080/13662716.2021.1929869

Lv, C., Shao, C., and Lee, C. (2021). Green technology innovation and financial development: Do environmental regulation and innovation output matter? Energy Econ. 98, 105237. doi:10.1016/j.eneco.2021.105237

Mancusi, M. L. (2008). International spillovers and absorptive capacity: A cross-country cross-sector analysis based on patents and citations. J. Int. Econ. 76 (2), 155–165. doi:10.1016/j.jinteco.2008.06.007

Melander, L. (2018). Customer and supplier collaboration in green product innovation: External and internal capabilities. Bus. Strategy Environ. 27 (6), 677–693. doi:10.1002/bse.2024

Nam, J., Wang, J., and Zhang, G. (2008). Managerial career concerns and risk management. J. Risk Insur. 75 (3), 785–809. doi:10.1111/j.1539-6975.2008.00284.x

Ocicka, B., Baraniecka, A., and Jefmański, B. (2022). Exploring supply chain collaboration for green innovations: Evidence from the high-tech industry in Poland. Energies 15 (5), 1750. doi:10.3390/en15051750

Oh, W., and Barker, V. L. (2018). Not all ties are equal: CEO outside directorships and strategic imitation in R&D investment. J. Manag. 44 (4), 1312–1337. doi:10.1177/0149206315614371

Pan, Z., Liu, L., Bai, S., and Ma, Q. (2021). Can the social trust promote corporate green innovation? Evidence from China. Environ. Sci. Pollut. Res. 28 (37), 52157–52173. doi:10.1007/s11356-021-14293-8

Peters, G. F., and Romi, A. M. (2014). Does the voluntary adoption of corporate governance mechanisms improve environmental risk disclosures? Evidence from greenhouse gas emission accounting. J. Bus. Ethics 125 (4), 637–666. doi:10.1007/s10551-013-1886-9

Rui, Z., and Lu, Y. (2021). Stakeholder pressure, corporate environmental ethics and green innovation. Asian J. Technol. Innovation 29 (1), 70–86. doi:10.1080/19761597.2020.1783563

Schaltegger, S., Etxeberria, I. Á., and Ortas, E. (2017). Innovating Corporate accounting and reporting for sustainability – attributes and challenges. Sust. Dev. 25 (2), 113–122. doi:10.1002/sd.1666

Serohi, A. (2022). E-mobility ecosystem innovation – impact on downstream supply chain management processes. Is India ready for inevitable change in auto sector? Supply Chain Manag. 27 (2), 232–249. doi:10.1108/scm-11-2020-0588

Shin, Y. (2012). CEO ethical leadership, ethical climate, climate strength, and collective organizational citizenship behavior. J. Bus. Ethics 108 (3), 299–312. doi:10.1007/s10551-011-1091-7

Soewarno, N., Tjahjadi, B., and Fithrianti, F. (2019). Green innovation strategy and green innovation: The roles of green organizational identity and environmental organizational legitimacy. Manag. Decis. 57 (11), 3061–3078. doi:10.1108/md-05-2018-0563

Stegeman, I., Godfrey, A., Romeo-Velilla, M., Bell, R., Staatsen, B., van der Vliet, N., et al. (2020). etcEncouraging and enabling lifestyles and behaviours to simultaneously promote environmental sustainability, health and equity: Key policy messages from INHERIT. Int. J. Environ. Res. Public Health 17 (19), 7166. doi:10.3390/ijerph17197166

Su, X., Xu, A., Lin, W., Chen, Y., Liu, S., and Xu, W. (2020). Environmental leadership, green innovation practices, environmental knowledge learning, and firm performance. SAGE Open 10 (2), 215824402092290. doi:10.1177/2158244020922909

Tian, D., and Yu, Q. (2017). The influence of top managers' background characteristics on enterprise green innovation. Res. Financial Econ. Issues 6, 108–113. (In Chinese).

Tõnurist, P., and Karo, E. (2016). State owned enterprises as instruments of innovation policy. Ann. public Coop. Econ. 87 (4), 623–648. doi:10.1111/apce.12126

Van Rooij, B. (2010). Greening industry without enforcement? An assessment of the world bank's pollution regulation model for developing countries. Law Policy 32 (1), 127–152.

Wang, C. (2019). How organizational green culture influences green performance and competitive advantage: The mediating role of green innovation. J. Manuf. Technol. Manag. 30 (4), 666–683. doi:10.1108/jmtm-09-2018-0314

Wang, F., Rani, T., and Razzaq, A. (2022a). Environmental impact of fiscal decentralization, green technology innovation and institution’s efficiency in developed countries using advance panel modelling. Energy & Environ., 0958305X2210747. doi:10.1177/0958305X221074727

Wang, P., Bu, H., and Liu, F. (2022b). Internal control and enterprise green innovation. Energies (Basel) 15 (6), 2193. doi:10.3390/en15062193

Wu, H., and Hu, S. (2020). The impact of synergy effect between government subsidies and slack resources on green technology innovation. J. Clean. Prod. 274, 122682. doi:10.1016/j.jclepro.2020.122682

Wurlod, J., and Noailly, J. (2018). The impact of green innovation on energy intensity: An empirical analysis for 14 industrial sectors in OECD countries. Energy Econ. 71, 47–61. doi:10.1016/j.eneco.2017.12.012

Xia, Q., Tan, M., Cao, Q., and Li, L. (2022). The microfoundations of open innovation: CEO overconfidence and innovation choices. R&D Manag. (Online first). doi:10.1111/radm.12544

Xie, X., Huo, J., and Zou, H. (2019). Green process innovation, green product innovation, and corporate financial performance: A content analysis method. J. Bus. Res. 101, 697–706. doi:10.1016/j.jbusres.2019.01.010

Xue, Y., Jiang, C., Guo, Y., Liu, J., Wu, H., and Hao, Y. (2022). Corporate social responsibility and high-quality development: Do green innovation, environmental investment and corporate governance matter? Emerg. Mark. Finance Trade 58 (11), 3191–3214. doi:10.1080/1540496x.2022.2034616

Yan, Y. L., and Xu, X. X. (2022). Does entrepreneur invest more in environmental protection when joining the communist party? Evidence from Chinese private firms. Emerg. Mark. Finance Trade 58 (3), 754–775. doi:10.1080/1540496x.2020.1848814

Zhan, J., and Zhu, J. (2021). The effects of state ownership on innovation: Evidence from the state-owned enterprises reform in China. Appl. Econ. n53 (1), 145–163. doi:10.1080/00036846.2020.1796918

Zhang, C. (2017). Political connections and corporate environmental responsibility: Adopting or escaping? Energy Econ. 68, 539–547. doi:10.1016/j.eneco.2017.10.036

Zhang, W., Li, J., Li, G., and Guo, S. (2020a). Emission reduction effect and carbon market efficiency of carbon emissions trading policy in China. Energy 196, 117117. doi:10.1016/j.energy.2020.117117

Zhang, Y., Xing, C., and Wang, Y. (2020b). Does green innovation mitigate financing constraints? Evidence from China’s private enterprises. J. Clean. Prod. 264, 121698.

Zhang, S. F., Ma, M. D., Xiang, X. W., Cai, W. G., Feng, W., and Ma, Z. L. (2022a). Potential to decarbonize the commercial building operation of the top two emitters by 2060. Resour. conservation Recycl. 185, 106481. doi:10.1016/j.resconrec.2022.106481

Zhang, Z., Zhang, B., and Jia, M. (2022c). The military imprint: The effect of executives’ military experience on firm pollution and environmental innovation. Leadersh. Q. 33 (2), 101562. doi:10.1016/j.leaqua.2021.101562

Zhou, M. L., Chen, F. L., and Chen, Z. F. (2021). Can CEO education promote environmental innovation: Evidence from Chinese enterprises. J. Clean. Prod. 297, 126725. doi:10.1016/j.jclepro.2021.126725

Keywords: educational attainment, CEO, green innovation, enterprises, pollution

Citation: Zhang C, Li H, Gou X, Feng J and Gao X (2022) CEO educational attainment, green innovation, and enterprise performance: Evidence from China’s heavy-polluting enterprises. Front. Environ. Sci. 10:1042400. doi: 10.3389/fenvs.2022.1042400

Received: 12 September 2022; Accepted: 19 October 2022;

Published: 09 November 2022.

Edited by:

Kangyin Dong, University of International Business and Economics, ChinaReviewed by:

Minda Ma, Lawrence Berkeley National Laboratory, United StatesShufan Zhang, Chongqing University, China

Copyright © 2022 Zhang, Li, Gou, Feng and Gao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xing Gao, xing.gao@bit.edu.cn

Chenyu Zhang1

Chenyu Zhang1 Xing Gao

Xing Gao