94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 07 November 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.1032586

This article is part of the Research Topic Resources and Environmental Management for Green Development View all 26 articles

Chenggang Li1,2

Chenggang Li1,2 Ziling Chen1,3

Ziling Chen1,3 Yiping Wu4*

Yiping Wu4* Xintong Zuo1

Xintong Zuo1 Han Jin1

Han Jin1 Yunbao Xu5

Yunbao Xu5 Bingying Zeng6

Bingying Zeng6 Gang Zhao1

Gang Zhao1 Yikang Wan1

Yikang Wan1Green finance is an important practice of China’s high-quality economic development in the new era, which is closely related to economic development, environment, and energy conditions. However, few studies systematically analyze the impact of green finance on economic development, environmental pollution, and energy consumption, especially on China which is turning to high-quality economic development. In order to fill the gap, based on the annual data on 30 provinces (autonomous regions and municipalities) in China from 2008 to 2018, we construct a comparatively comprehensive green finance index system and use a panel regression model to explore the impacts of green finance on high-quality economic development, environmental pollution, and energy consumption. We find that green finance can significantly promote high-quality economic development, mitigate environmental pollution, and reduce energy consumption. There is spatial and temporal heterogeneity in the impact of green finance on China’s economic quality, environmental pollution, and energy consumption. In the eastern region, green finance has a remarkable positive impact on high-quality economic development and a significant negative impact on energy consumption, but the impact on environmental pollution is inconspicuous. In the central region, green finance has a prominent effect on reducing environmental pollution, but the impact on high-quality economic development and energy consumption is not significant. In the western region, green finance has not been able to significantly promote high-quality economic development, mitigate environmental pollution, and reduce energy consumption. After the clear proposal of green finance, the role of green finance in promoting a high-quality economy has enhanced, and the role of green finance in reducing environmental pollution and energy consumption has decreased. This study can provide a useful decision-making reference for promoting high-quality economic development, reducing environmental pollution and energy consumption, and spurring sustainable development.

In the Integrated Reform Plan for Promoting Ecological Progress which was issued in September 2015, Article 45 clearly stated for the first time that “we should establish a green financial system in China.” In the proposal of the 13th Five-Year Plan, the Central Committee of the Communist Party of China once again explicitly proposed to develop green finance. Green finance has been upgraded to a national strategic goal and development plan, which shows that China attaches great importance to green finance. In 2017, the report of the 19th National Congress of the Communist Party of China (NCCPC) pointed out that China’s economy has shifted from a stage of high-speed growth to a stage of high-quality development. At this stage, the high-quality development strategy should be firmly implemented. The report also emphasizes the coordination and progress of the five dimensions, namely, economy, society, politics, ecology, and culture, and it focuses on solving key problems such as the optimization of industrial structure, the growth of productivity, and the development of power transformation. However, the current comprehensive development of China’s economy, environment, and energy is not coordinated enough, and new requirements are put forward for energy consumption, environmental pollution, and other resource and environmental problems in this report. At the same time, realizing the transformation of economic growth momentum and the expected emission reduction targets is also an important task for China to achieve high-quality and coordinated development. Therefore, it is a question worth exploring whether the development of green finance can promote high-quality economic development, mitigate environmental pollution, and reduce energy consumption in China.

The existing literature provides evidence for this study. Many scholars have expounded and explained the connotation of green finance. The concept of green finance originates from various economies’ growing concern for environmental protection and adaptation to climate change, which is a financial innovation that supports the transformation of a green economy (Bhatnagar and Sharma, 2022). Since green finance connects the financial industry, environmental improvement, and economic growth (Soundarrajan and Vivek, 2016), it is not only conducive to environmental protection but can also build a better world for our future (Jayasubramanian and Shanthi, 2014). However, some scholars believe that green finance inhibits green innovation capacity (Yu et al., 2021). The outbreak of COVID-19 has had a great impact on countries around the world. Therefore, some scholars believe that the green financial system needs to consider the impact of COVID-19 on investment in green projects (Farhad et al., 2021). Green finance, closely related to economic development, is important to countries at different levels of sustainable development (Djukic and Ilic, 2021). In order to achieve sustainable economic growth, it is necessary to evaluate green finance more rationally and quantitatively (Alieva and Altunina, 2021). Ecological environment protection and economic development can be effectively linked by further analyzing the coordination quantitatively between green finance and economic growth (Yin and Xu, 2022). Now, green finance has become a tool for coping with climate change, which can help solve the problems of financial products and services which are related to the environment (Gagan et al., 2022). In light of the development of financial technology, the positive impact of green finance on environmental protection has greatly increased (Sreenu, 2022). Considering the impact of monetary policy from a macro perspective, a global perspective will be adopted to solve the problem between green finance and the environment (EWA and Johannes, 2021). The development of a digital economy plays an important role in the process that green finance helps reduce carbon emissions of the environment (Zhang et al., 2022). By incorporating spatial geographical factors into the analysis, green finance has a significant spatial spillover effect on environmental improvement and is beneficial to the ecological environment of surrounding areas (Li and Gan, 2020; Li et al., 2022). Green finance is closely related to the sustainable development of energy. Whether from the perspective of a horizontal comparison or vertical trend, green finance can promote energy development (Zhang and Wang, 2019). There is risk transmission between green financial products and energy commodity markets (Hela et al., 2022), and reducing green financial risks will help increase the revenue of green energy projects (Farhad and Naoyuki, 2019). Green finance can help realize energy transformation and promote the demand for clean energy (Mara et al., 2022). At the same time, the development of green finance has promoted the realization of China’s sustainable development goals and has greatly improved the environmental emergencies caused by the crude model of past economic development and earlier improper sustainability management (Bryan et al., 2018; Sun et al., 2018).

Through the literature review, we can find that although the literature on green finance is rich, most of them are about the connotation of green finance or related to economy and there are few literature reports related to the environment and energy. At the same time, there are fewer literature reports systematically and deeply studying the relationship between green finance, economy, environment, and energy. On one hand, systematically exploring the impact of green finance is conducive to promoting the high-quality, comprehensive, and coordinated development of China’s economy, environment, and energy; on the other hand, it deeply studies the spatial and temporal heterogeneity of the impact of green finance and provides Chinese experience for the coordinated development of world green finance.

In order to make up for the shortcomings of the aforementioned research studies, we mainly study the following two questions about the impact of green finance. First, is the impact of green finance on the economy, environment, and energy beneficial? Second, is the impact of green finance heterogeneous spatially and temporally? Solving the aforementioned questions is very important for China’s green financial development and comprehensive and coordinated development. At the same time, it has practical reference significance for promoting the development of green finance and the coordinated development of economy, environment, and energy in various countries and fills the academic gaps in the study of the relationship between green finance, economy, environment, and energy in terms of system and spatial and temporal heterogeneity.

To answer the aforementioned questions and distinguish from other works of literature, taking the annual data on 30 provinces and municipalities directly under the central government and autonomous regions (excluding Tibet, Hong Kong, Macao, and Taiwan) in China from 2008 to 2018 as a research sample, this study constructs a relatively comprehensive green finance index system. A panel regression model is used to examine whether green finance can promote high-quality economic development, mitigate environmental pollution, and reduce energy consumption, and further investigate the spatial and temporal heterogeneity of the impact of green finance on the economy, environment, and energy.

The contribution of this study is mainly reflected in two aspects. First, we have built a relatively comprehensive evaluation index of green finance and high-quality economic development. We consider green finance from the five dimensions, namely, green credit, green securities, green investment, green insurance, and carbon finance. We also select 20 variables from the five dimensions, namely, innovation, coordination, green, openness, and sharing to consider the high-quality development of the economy. The description of green finance and a high-quality economy is relatively comprehensive. Second, we systematically and deeply examine the impact of green finance on economic quality, environmental pollution, and energy consumption, as well as the spatial and temporal heterogeneity.

The rest of the study is arranged as follows: the second section is the model and data, including model construction, variable selection, and data description. The third section is the results, including descriptive statistics of variables, spatial–temporal evolution analysis, benchmark regression results, heterogeneity analysis, and the robustness test. The fourth section is discussion, which combines relevant theories with the reality of China and discusses the results of the study. The fifth section is the conclusion and implications, which summarizes the research results of this study and puts forward corresponding research implications.

A panel data model is used to examine whether the development of green finance has a significant impact on the high-quality development of China’s economy, environmental pollution, and energy consumption. Therefore, this study uses the panel data on 30 provinces (autonomous regions and municipalities) in China from 2008 to 2018 to study the relationship between green finance, high-quality economy, environmental pollution, and energy consumption. The model is shown in Formula (1):

In this formula,

At present, the measurement standard of high-quality economic development in academic circles has not reached a unified level. Considering portraying the high-quality economic development concept as much as possible, the authors refer to the research studies of Wei and Li (2018), Zeng et al. (2019), Zhao et al. (2020), and Cheng and Xia (2021). Based on the five dimensions of the five development concepts, namely, innovation, coordination, green, openness, and sharing, the authors use the entropy method to construct high-quality economic development indicators. The specific indicators are shown in Supplementary Table S1.

The construction of high-quality economic indicators is, first, about innovation. “Innovative” development focuses on the issue of development power. Based on the three perspectives of innovation input, innovation output, and innovation contribution, the authors select variables to measure the connotation of “innovation.” Second, it is about coordination. “Coordinated” development focuses on imbalances in development. Based on the three perspectives of regional coordination, urban–rural coordination, and structural coordination, this study selects variables to measure the connotation of “coordination.” Third, it is about green. The “green” concept focuses on investigating the impact of production activities on the natural environment. Based on the three perspectives of environmental pollution, resource consumption, and greening, this study selects variables to measure the connotation of “green.” Fourth, it is about openness. “Open” development focuses on internal and external linkage. Based on the three perspectives of the open environment, open degree, and open performance, the authors select variables to measure the connotation of “openness.” Fifth, it is about sharing. The concept of “sharing” focuses on the distribution of social welfare and the quality of people’s life. Based on the three perspectives of public service, people’s livelihood quality, and people’s life, this study selects variables to measure the connotation of “sharing.”

As for the environmental pollution indicators, three secondary indicators, namely, carbon emission, PM2.5, and industrial dust are selected, and the entropy method is used to construct the total environmental pollution indicators. Among them, the carbon emission index refers to the practice of Shan et al. (2018), which calculates the carbon dioxide emission data generated by the combustion of fossil fuels (raw coal, crude oil, and natural gas) from top to bottom using the statistical data on energy supply, and it also follows the emission accounting method of the Intergovernmental Panel on Climate Change (IPCC). The measurement method is the apparent emission accounting method. For PM2.5 and industrial dust, the annual average concentration of fine particles and industrial dust emission is selected. As for energy consumption indicators, the authors refer to the practices of most scholars and select the logarithm of energy consumption in each region.

In 2007, the State Environmental Protection Administration, the People’s Bank of China, and the China Bank Regulatory Commission jointly issued opinions on implementing environmental protection policies and regulations to prevent credit risks and formally issued the green credit policy. In 2008, the Industrial Bank officially announced the adoption of the “Equator Principle,” which became the first Equator Bank in China. Therefore, it can be considered that China’s green finance practice began in 2008. By referring to the existing literature and the availability of data, we set the research scope as 2008–2018. In addition, since the measurement variables of green finance have not been unified yet, the entropy method was used to synthesize the green finance indicator in this study. The specific indicator selection and definition are shown in Supplementary Table S2.

Regarding the construction of green finance, referring to Gao and Zhang (2021)and Zhou et al. (2021), we build indicators from five aspects. First, it is about green credit. It is considered to measure green credit with the variable of interest payment proportions of high energy-consuming enterprises, among which, the high energy-consuming industries include the petroleum processing and coking industry, nuclear fuel processing industry, chemical raw materials and chemical product manufacturing industry, non-metallic mineral product industry, ferrous metal smelting and rolling processing industry, non-ferrous metal smelting and rolling processing industry, and electricity and heat production and supply industry. Since the latest data on enterprise interest payments are in 2018, data collection ended in 2018. Second, it is about green securities. Due to the availability of data, the variable of the market value of high energy-consuming industries is selected to measure green securities. Third, it is about green investment. The authors plan to measure green investment with the variable of the proportion of energy conservation and environmental protection expenditure. Fourth, it is about green insurance. Environmental liability insurance is an important part of green insurance. However, since environmental liability insurance was implemented in China in 2013, considering the time range of the study, the authors select two variables, namely, the proportion of the agricultural insurance scale and the compensation ratio of agricultural insurance, to measure green insurance. Fifth, it is about carbon finance. Referring to most practices of existing research, carbon finance is measured by carbon intensity variables.

As for the selection of control variables in formula (1), this study refers to the common practice of domestic scholars and selects six variables: the urbanization level, government intervention, technological progress, foreign direct investment, industrial structure, and resident income level. Among them, the urbanization level indicator is characterized by the proportion of the number of urban people in the total number of people, government intervention is characterized by the proportion of fiscal expenditure in the GDP, technological progress is characterized by the logarithm of the number of patents applied for authorization, foreign direct investment is characterized by the logarithm of foreign direct investment in each province, the industrial structure is characterized by the ratio of the second industry to the total output value, and the resident income level is described by the logarithm of the per capita disposable income of regional residents. The specific control variables are shown in Table 1.

For the variables involved in this study, the descriptive statistical results are shown in Figure 1. According to Figure 1, it can be seen that there is a big difference between the minimum and maximum values of high-quality economy, environmental pollution, energy consumption, and green finance. It can be inferred that the high-quality economic development level, environmental pollution, energy consumption, and the development level of green finance show an increasing trend over time, and there are significant differences between different provinces (autonomous regions and municipalities) (see Supplementary Table S3 for detailed results).

Figure 2 shows the evolution of green finance in various regions of China over time. Before green finance was clearly put forward (2008 and 2012), the development level of green finance in various regions of China was generally low, showing an increasing trend from the central and eastern regions to the southwest. Among them, Sichuan and Zhejiang provinces had the fastest growth rate. After the clear proposal of green finance (2015 and 2018), the development level of green finance in most regions of China has significantly improved and the regions with high development levels are still concentrated in the southwest. In terms of regional difference, the development level of the eastern region is the lowest and the most stable, while the development level of the western region is high but unstable. In terms of time difference, before green finance was clearly proposed, the overall development level of green finance in China was low; after the proposal, the development level of green finance in China has significantly improved.

Figure 3 shows the evolution of high-quality economic development in various regions of China over time. At the early stage of studying the sample (2008), China’s high-quality economic development level was at a low level. In the middle period of studying the sample (2015), the high-quality economic development level of each region was still low, and only Anhui and Hubei provinces were at a relatively high level of development. At the end of studying the sample (2018), the level of high-quality economic development across China enhanced rapidly, showing the characteristics of being high in the south and low in the north. Observing the time–space evolution of a high-quality economy, it is found that there is an obvious time difference which shows a trend of rapid development after 2015.

Figure 4 shows the evolution of environmental pollution in various regions of China over time. At the early stage of studying the sample (2008), the environmental pollution level in China was not high on the whole, but it showed obvious regional differences. The pollution level in Southeast China was relatively higher. In the middle period of studying the sample (2015), the environmental pollution level of various regions in China improved, and the regions with relatively high environmental pollution levels were concentrated in Beijing, Tianjin, and Hebei provinces. At the end of studying the sample (2018), the environmental pollution level in some areas decreased significantly, especially in Beijing, Tianjin, and Hebei provinces and their surrounding areas. On the whole, China’s environmental pollution shows a development trend of increasing first and then decreasing with time. Regionally, there is a downward trend of diffusion from Beijing, Tianjin, and Hebei provinces to their surrounding areas.

Figure 5 shows the evolution of energy consumption in various regions of China over time. At the early stage of studying the sample (2008), China’s energy consumption level was relatively high, with a decreasing trend from the eastern coastal areas to the inland. In the middle period of studying the sample (2015), the energy consumption level of various regions in China improved, especially in the southwest region. At the end of studying the sample (2018), the energy consumption level in most areas of China continued to increase, and the northeast and coastal areas reached the same energy consumption level. On the whole, China’s energy consumption is in a state of continuous rise, and the concentration areas with high energy consumption have spread from the eastern coastal areas to the inland.

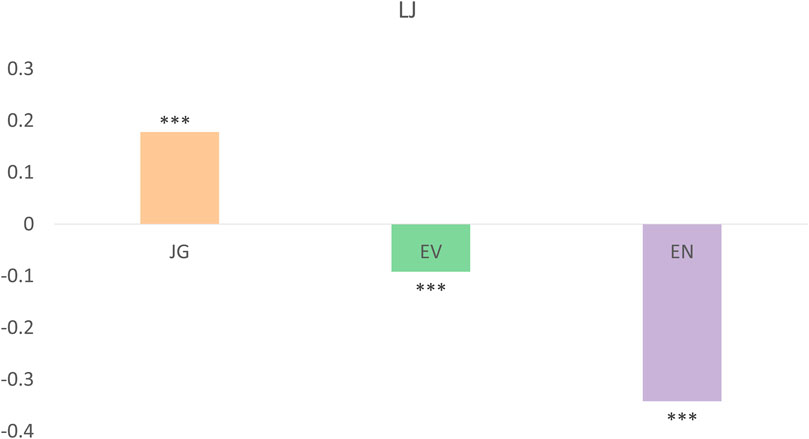

Green finance can promote high-quality economic development, mitigate environmental pollution, and reduce energy consumption (Figure 6). Among them, model (1) is the panel regression model between green finance and high-quality economic development. It is found that there is a positive correlation between green finance and high-quality economic development, that is, green finance can promote high-quality economic development. Model (2) is the panel regression model between green finance and environmental pollution. The results show that green finance and environmental pollution are significantly negatively correlated, which indicates that green finance can improve the ecological environment. The results of model (3) show that green finance has a significant negative impact on energy consumption, that is, green finance helps reduce energy consumption.

FIGURE 6. Benchmark regression results when control variables are not added (see Supplementary Table S4 for detailed results).

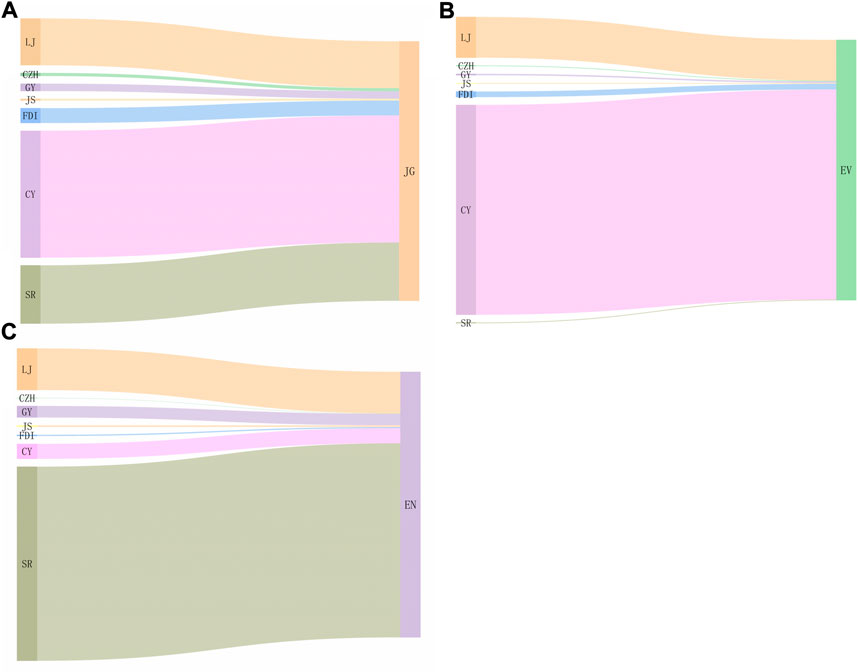

The positive impact of green finance on economic quality, environmental pollution, and energy consumption is significant (Figure 7). According to model (1) corresponding to graph (A) in Figure 7, it is found that after control variables are added, there is still a significant positive relationship between green finance and high-quality economic development. The results in graph (B) correspond to model (2). After controlling relevant variables, the relationship between green finance and environmental pollution is still negative, indicating that the improvement effect of green finance on environmental pollution is relatively significant. The results in graph (C) correspond to model (3), and it is also found that green finance has a significant negative impact on energy consumption. Among the control variables, the urbanization level and technological progress have a positive impact on high-quality economic development, and there is a significant negative correlation between government intervention and high-quality economic development. Economic growth can be promoted by the urbanization level through its impact on investment and consumption (Zhu and Huang, 2016). Meanwhile, the improvement in the urbanization level will promote coordinated development through investment and consumption so as to ultimately promote high-quality economic development. The improvement in the technological level will greatly promote the development of the innovation level and ultimately fuel the high-quality economic development level. The level of government intervention should be in an appropriate range. Excessive government intervention will affect the efficiency of resource allocation and be detrimental to high-quality economic development. The industrial structure has a significant negative impact on environmental pollution. If the industrial structure is adjusted and optimized, the energy utilization effect will be improved, thus reducing environmental pollution. In addition, technological progress, government intervention, and resident income have significant positive effects on energy consumption.

FIGURE 7. Impact of green finance on high-quality economic development, environmental pollution, and energy consumption after adding control variables (see Supplementary Table S5 for detailed results).

In 2021, the People’s Bank of China issued the Report on the Development of Green Finance in China (2020), which pointed out that new progress has been made in the development of green finance, institutional arrangements have been continuously improved, and the basic practice has produced a marked effect. The vice president of the People’s Bank of China said that China initially formed a policy system and market environment to support the development of green finance. In the new era, guiding high-quality economic development and reducing environmental pollution and energy consumption are important tasks for China’s comprehensive and coordinated development. At the same time, we find that green finance has a significantly positive impact on high-quality economic development and reduces environmental pollution and energy consumption, indicating that we can promote China’s comprehensive and coordinated development by boosting green finance development.

In recent years, great importance has been attached to the development of the green economy both at home and abroad. China proposed to carry out the reform of the ecological civilization system and encouraged financial institutions to integrate green responsibility with the development of finance as much as possible in the process of operation. However, the development level of green finance in different regions of China is quite different. After green finance is explicitly proposed, the development of green finance in some regions is faster. Therefore, it is inferred that the impact of green finance in China on the economy, environment, and energy has spatial and temporal heterogeneity.

In the eastern region, green finance can significantly promote high-quality economic development and reduce energy consumption; in the central region, the improvement of environmental pollution is very significant; in the western region, its impact on high-quality economy, environmental pollution, and energy consumption is not significant (Figure 8). From this, it can be inferred that the industrial structure in the eastern region has been optimized and upgraded, the production cost of enterprises has been relatively reduced, and the efficiency of technology research and development has been improved. Therefore, capital, manpower, and technology investment have gradually produced a positive net effect, and the energy utilization efficiency has significantly improved; thus, the environmental pollution situation is effectively improved. Therefore, the development of green finance does not play a significant role in improving the environment in the eastern region. In the central region, green finance can significantly mitigate environmental pollution. But the impact of green finance on high-quality economic development and energy consumption is not significant. However, in the western region, green finance can neither significantly promote high-quality economic development and reduce energy consumption nor significantly mitigate environmental pollution. It can be inferred from this result that, on one hand, compared with the eastern and central regions, the western region has uneven resource distribution, a relatively backward technological level, a relatively deteriorated industrial structure, and a large demand for energy. Therefore, the development of green finance, on the contrary, presents a trend of inhibiting the coordinated development and opening level of the western region, and ultimately shows a negative correlation with the high quality of the economy. The negative impact of green finance on energy consumption is not significant. On the other hand, the base number of carbon emissions, PM2.5 concentration, and industrial dust emissions in the western region is lower than that in the eastern and central regions, that is, the environmental pollution situation in the western region is better than that in the other two regions. The impact of green finance on the environment cannot be fully demonstrated, so the impact of green finance on the environment is not significant.

FIGURE 8. Impact of green finance on the spatial and temporal heterogeneity of high-quality economic development, environmental pollution, and energy consumption, and the impact on different regions of China and the impact of green finance before and after its proposition. Considering the differences in the economic level and resource allocation among eastern, central, and western regions of China, as well as the differences between different provinces and cities in the descriptive statistical results, the sample size is divided into three groups: the eastern, central, and western regions for regression again. The regression results show that the impact of green finance on the economy, environment, and energy is heterogeneous in the eastern, central, and western regions (see Supplementary Table S6 for detailed results). Green finance was clearly proposed for the first time in 2015. Therefore, the sample size was divided into two stages, 2008–2014 and 2015–2018, for research (see Supplementary Table S7 for detailed results).

After the clear proposal of green finance, the role of green finance in promoting a high-quality economy has increased, and the role of green finance in improving environmental pollution and energy consumption has decreased (Figure 8). Before green finance was clearly proposed, the impact of green finance on economic quality and environmental pollution was not significant, and the impact on energy consumption was very significant. After green finance is put forward, its impact on the high-quality economy, environmental pollution, and energy consumption has become insignificant. The coefficient value of the high-quality economy has significantly increased, and the absolute value of the coefficient of environmental pollution and energy consumption has decreased.

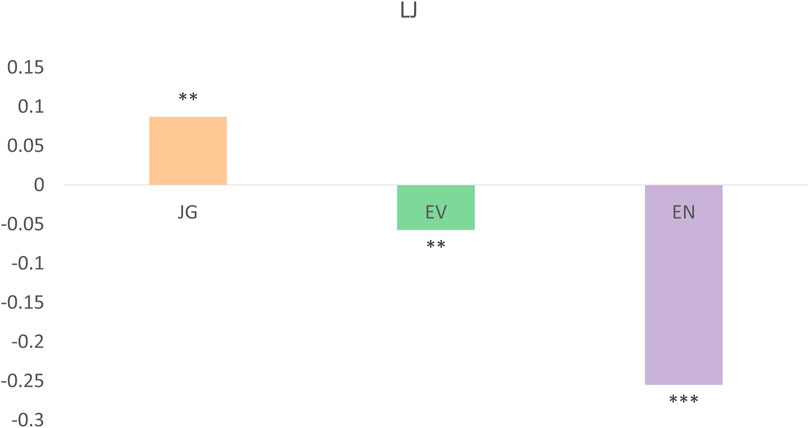

Green finance has a relatively robust impact on high-quality economic development, environmental pollution, and energy consumption, indicating that the research results of this study are relatively reliable (Figure 9). This study adopts the method of changing the model to test the robustness. The maximum likelihood estimation method is selected to test the impact relationship between green finance, high-quality economic development, environmental pollution, and energy consumption. By observing the results in Figure 9, it is found that green finance has a significant impact on the economy, environment, and energy, and all coefficient values have passed the significance level at 5%.

FIGURE 9. Stability test of green finance’s impacts on high-quality economic development, environmental pollution, and energy consumption (see Supplementary Table S8 for detailed results). *, **, and *** mean significance at the significance level of 10%, 5%, and 1%, respectively.

Understanding the impact of green finance on the economy, environment, and energy is crucial to sustainable development in the future and can help us cope with the financing challenges brought by climate change (Shunsuke et al., 2022). The authors have built high-quality economic development indicators from the five dimensions, namely, innovation, coordination, green, openness, and sharing, and have measured the development level of green finance based on the indicators of green credit, green securities, green investment, green insurance, and carbon finance. A relatively comprehensive evaluation method has been adopted to examine the impact of green finance on the economy, environment, and energy, which is conducive to promoting the development of green finance in many aspects and systematically promotes sustainable development, and we try to provide better practical solutions.

It is found that green finance has a significant positive effect on high-quality economic development, environmental pollution, and energy consumption (Figure 6 and Figure 7). Therefore, promoting the sustainable development of green finance, to a certain extent, is promoting high-quality economic development and reducing environmental pollution and energy consumption, which is fully consistent with the green low-carbon concept and the strategy of “carbon peak emissions and carbon neutrality” that we advocate. When the green growth strategy is applied in reality, it can not only reflect the economic achievements but can also affect the ecosystem (Onil et al., 2020). In particular, in the global context of vigorously developing digital technology, it can promote financial reform and the development of green fund project financing, and solve some technological problems in environmental resources (Karsten and Marian, 2021).

This study proposes that the positive effects of green finance on high-quality economic development, environmental pollution, and energy consumption have spatial and temporal heterogeneity, and the development strategy of green finance should be better formulated, according to the characteristics of space–time differences. In the eastern region, the positive effect on high-quality economic development and energy consumption is significant; in the central region, the positive effect on environmental pollution is significant; but in the western region, the effect on high-quality economic development, environmental pollution, and energy consumption is insignificant and even shows a negative effect on high-quality economic development. The huge regional differences explain the complexity of the development of green finance in different regions, which cannot be explained simply based on the law that the development of the financial industry decreases from east to west. From the perspective of promoting high-quality economic development, green finance is currently more suitable to be developed in the eastern region to give full play to its positive role. However, the financial foundation and resource endowment of the central and western regions are not as good as those of the eastern region. In particular, the massive loss of human capital is not conducive to the development of green finance in the central and western regions, and it is also difficult to promote high-quality economic development. Based on the situation of environmental pollution, green finance has more development edges in the central region. On one hand, the eastern region has a large population and a high degree of urbanization, which has a large intensity of environmental pollution. On the other hand, industrial development in the western region is slow, and the environmental damage rate and the environmental pollution intensity are also low. In general, the environmental pollution intensity in the central region can play a positive role in green finance. In addition, improving energy consumption is similar to but different from promoting high-quality economic development. The similar thing is the restriction of resource endowment, which makes energy consumption in the central and western regions unable to be significantly improved through green finance. The difference is that the adjustment and transfer of the industrial structure enable the eastern region to significantly reduce energy consumption while developing green finance. Before green finance was clearly proposed, its positive impact on energy consumption was very significant; after the introduction of green finance, its boosting effect on the high-quality economy has increased, but its positive impact on environmental pollution and energy consumption has decreased. It can be seen that the positive impact of green finance on the high-quality economy is persistent.

This study uses the annual data on 30 provinces and cities in China from 2008 to 2018 to test the impact and heterogeneity of green finance on high-quality economic development, environmental pollution, and energy consumption through the panel regression model and have passed the robustness test. Through empirical analysis, the following conclusions are drawn: (1) green finance can significantly promote high-quality economic development, mitigate environmental pollution, and reduce energy consumption, and this conclusion is stable. (2) The impact of green finance on the economic high-quality level, environmental pollution, and energy consumption in different regions and at different times is heterogeneous. In the eastern region, green finance has a significant impact on high-quality economic development and energy consumption but not on environmental pollution; in the central region, green finance has a significant effect on improving environmental pollution; however, in the western region, green finance can neither significantly promote high-quality economic development nor significantly reduce environmental pollution and energy consumption. After the clear proposal of green finance, the role of green finance in promoting a high-quality economy has increased, and its positive impact on reducing environmental pollution and energy consumption has decreased. This study proposes that green finance has a systematic impact and spatial and temporal heterogeneity on high-quality economic development, environmental pollution, and energy consumption, which reflects the problems in the development of green finance in most countries and provides development ideas to solve the problems.

Based on the research conclusions, we make the following policy implications:

1) Under the policy background of promoting high-quality economic development and energy conservation and emission reduction, the local government can appropriately develop green finance on the basis of considering the allocation of resources of all parties and continue to improve the market system and legal system of green finance.

2) On one hand, we should continue to encourage the innovation of green financial products including the innovation of green products by enterprises and the innovation of financial products and financial services by financial institutions so as to promote the improvement of economic quality. On the other hand, we should build and improve the green governance system, focus on solving the pain points and difficulties in environmental development, improve the ecological environment, and promote sustainable development. In addition, we should enhance the synergy among the participants of green finance, pay attention to the inclusive effect of green achievements, publicize the green life concept to the masses, guide the change of a green way of life, and reduce energy consumption.

3) The long-term boosting effect of green finance on economic quality should be maximized. The western region should pay attention to the optimization and adjustment of the industrial structure and strive to solve the problems of uncoordinated development in all aspects. As most of the western regions are provinces rich in energy, they are highly dependent on energy. Therefore, we should devote ourselves to technological innovation and the implementation of green environmental protection projects in order to change the current energy consumption structure and improve the energy utilization efficiency. The central region should continue to learn from the eastern regions’ advanced green governance methods, promote high-quality economic development through green governance, and promote the coordinated development of the economy, environment, and energy. The eastern region should make the best use of its own talent and resource advantages, strive to highlight its optimal value through green innovation, and promote high-quality economic achievements to be shared by more people.

Publicly available datasets were analyzed in this study. These data can be found at: the Yearbook of Science and Technology of China, the China Statistics Yearbook, the Yearbook of Environmental Statistics of China, the Yearbook of Chinese Industry Statistics, the Fourth National Economic Census, the China Carbon Accounting Databases (CEADs), Guotai'an CSMAR Databases, the Ministry of Science and Technology of China, the Ministry of Environmental Protection of China, the National Bureau of Statistics of China, and the statistical yearbooks of various provinces.

CL: conceptualization, funding acquisition, writing—review and editing, and supervision. ZC: data curation, methodology, visualization, writing—original draft, and formal analysis. YW: writing—review and editing and supervision. XZ: data curation and writing—original draft. HJ: data curation. YX: writing—review and editing. BZ: writing—review and editing. GZ: writing—review and editing. YW: writing—review and editing.

This research was supported by the Hebei Social Science Foundation Project (No: HB18YJ011) and the 2020 University Level Scientific Research Fund Project of Guizhou University of Finance and Economics (No: 2020XZD01).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2022.1032586/full#supplementary-material

Alieva, I. A., and Altunina, V. V. (2021). Current trends in the development of a green finance system: Methodology and practice. Balt. Reg. 13 (2), 64–89. doi:10.5922/2079-8555-2021-2-4

Bhatnagar, S., and Sharma, D. (2022). Evolution of green finance and its enablers: A bibliometric analysis. Renew. Sustain. Energy Rev. 162, 112405. doi:10.1016/j.rser.2022.112405

Bryan, B., Gao, L., Ye, Y., Sun, X., Connor, J. D., Crossman, N. D., et al. (2018). China’s response to a national land-system sustainability emergency. Nature 559 (7713), 193–204. doi:10.1038/s41586-018-0280-2

Cheng, J. J., and Xia, Y. X. (2021). Measurement and comparison of China's provincial economy high quality development level based on new development concept. J. Industrial Technol. Econ. 40 (6), 153–160. doi:10.3969/j.issn.1004-910X.2021.06.019

Djukic, G., and Ilic, B. (2021). Importance of green investment and entrepreneurship for economic development. Serbia: World Scientific Publishing Co. Pte. Ltd.

Ewa, D., and Johannes, J. (2021). A classification of different approaches to green finance and green monetary policy. Sustainability 13 (21), 11902–11915. doi:10.3390/su132111902

Farhad, T. H., Naoyuki, Y., and Han, P. (2021). Analyzing the characteristics of green bond markets to facilitate green finance in the post-COVID-19 world. Sustainability 13 (10), 5719–5724. doi:10.3390/su13105719

Farhad, T. H., and Naoyuki, Y. (2019). The way to induce private participation in green finance and investment. Finance Res. Lett. 31, 98–103. doi:10.1016/j.frl.2019.04.016

Gagan, D. S., Mahesh, V., Muhammad, S., Gupta, M., and Chopra, R. (2022). Transitioning green finance from theory to practice for renewable energy development. Renew. Energy 195, 554–565. doi:10.1016/j.renene.2022.06.041

Gao, J. J., and Zhang, W. W. (2021). Research on the impact of green finance on the ecologicalization of China’s industrial structure. Econ. Rev. J. (2), 105–115. doi:10.16528/j.cnki.22-1054/f.202102105

Hela, M., Christian, U., and Khaled, G. (2022). Downside and upside risk spillovers between green finance and energy markets. Finance Res. Lett. 47, 102612. doi:10.1016/j.frl.2021.102612

Jayasubramanian, P., and Shanthi, M. (2014). Green finance. Indian J. Appl. Res. 4 (8), 610–612. doi:10.36106/ijar

Karsten, S., and Marian, F. (2021). Leveraging blockchain technology for innovative climate finance under the Green Climate Fund. Earth Syst. Gov. 7, 100084. doi:10.1016/j.esg.2020.100084

Li, C. G., Fan, X. B., Hu, Y. X., Yan, Y., Shang, G., and Chen, Y. (2022). Spatial spillover effect of green finance on economic development, environmental pollution, and clean energy production across China. Environ. Sci. Pollut. Res. Int. 10, 1–16. doi:10.1007/s11356-022-21782-x

Li, C. G., and Gan, Y. (2020). The spatial spillover effects of green finance on ecological environment-empirical research based on spatial econometric model. Environ. Sci. Pollut. Res. 28 (5), 5651–5665. doi:10.1007/s11356-020-10961-3

Mara, M., Eyup, D., and Dilvin, T. (2022). A step forward on sustainability: The nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ. 109, 105945. doi:10.1016/j.eneco.2022.105945

Onil, B., Kenneth, J., Martin, C., Dudek, S., Horridge, M., Alavalapati, J. R., et al. (2020). Economic, land use, and ecosystem services impacts of Rwanda's Green Growth Strategy: An application of the IEEM+ESM platform. Sci. Total Environ. 729, 138779. doi:10.1016/j.scitotenv.2020.138779

Shan, Y., Guan, D., Zheng, H., Ou, J., Li, Y., Meng, J., et al. (2018). China CO2 emission accounts 1997–2015. Sci. Data 5 (1), 170201. doi:10.1038/sdata.2017.201

Shunsuke, M., David, B., and Jeffrey, W. (2022). Green and climate finance: Challenges and opportunities. Int. Rev. Financial Analysis 79, 101962. doi:10.1016/j.irfa.2021.101962

Soundarrajan, P., and Vivek, N. (2016). Green finance for sustainable green economic growth in India. Agric. Econ. 62 (1), 35–44. doi:10.17221/174/2014-AGRICECON

Sreenu, N. (2022). Impact of fintech and green finance on environmental quality protection in India: By applying the semi-parametric difference-in-differences (SDID). Renew. Energy 193, 913–919. doi:10.1016/j.renene.2022.05.020

Sun, X. F., Gao, L., Ren, H., Ye, Y., Li, A., Stafford-Smith, M., et al. (2018). China’s progress towards sustainable land development and ecological civilization. Landsc. Ecol. 33, 1647–1653. doi:10.1007/s10980-018-0706-0

Wei, M., and Li, S. H. (2018). Study on the measurement of economic high-quality development level in China in the new era. J. Quantitative Tech. Econ. 35 (11), 3–20. doi:10.13653/j.cnki.jqte.2018.11.001

Yin, X. L., and Xu, Z. R. (2022). An empirical analysis of the coupling and coordinative development of China's green finance and economic growth. Resour. Policy 75, 102476. doi:10.1016/j.resourpol.2021.102476

Yu, C. H., Wu, X., Zhang, D., Chen, S., and Zhao, J. (2021). Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 153, 112255. doi:10.1016/j.enpol.2021.112255

Zeng, Y., Han, F., and Liu, J. F. (2019). Does the agglomeration of producer services promote the quality of urban economic growth? J. Quantitative Tech. Econ. 36 (5), 83–100. doi:10.13653/j.cnki.jqte.2019.05.005

Zhang, B. F., and Wang, Y. F. (2019). The effect of green finance on energy sus tainable development: A case study in China. Emerg. Mark. Finance Trade 57 (12), 3435–3454. doi:10.1080/1540496x.2019.1695595

Zhang, D. Y., Muhammad, M., and Farhad, T. H. (2022). Does green finance counteract the climate change mitigation: Asymmetric effect of renewable energy investment and R&D. Energy Econ. 113, 106183. doi:10.1016/j.eneco.2022.106183

Zhao, T., Zhang, Z., and Liang, S. H. (2020). Digital economy, entrepreneurship, and high-quality economic development: Empirical evidence from urban China. J. Manag. World 36 (10), 65–76. doi:10.19744/j.cnki.11-1235/f.2020.0154

Zhou, C. Y., Tian, F., and Zhou, T. (2021). Green finance and high-quality development: Mechanism and effects. J. Chongqing Univ. (Soc. Sci. Ed.) 5, 001. doi:10.11835/j.issn.1008-5831.jg.2021

Keywords: green finance, high-quality economic development, environmental pollution, energy consumption, heterogeneity

Citation: Li C, Chen Z, Wu Y, Zuo X, Jin H, Xu Y, Zeng B, Zhao G and Wan Y (2022) Impact of green finance on China’s high-quality economic development, environmental pollution, and energy consumption. Front. Environ. Sci. 10:1032586. doi: 10.3389/fenvs.2022.1032586

Received: 31 August 2022; Accepted: 21 October 2022;

Published: 07 November 2022.

Edited by:

Lei Gao, Commonwealth Scientific and Industrial Research Organisation (CSIRO), AustraliaReviewed by:

Yantuan Yu, Guangdong University of Foreign Studies, ChinaCopyright © 2022 Li, Chen, Wu, Zuo, Jin, Xu, Zeng, Zhao and Wan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yiping Wu, eWlwaW5nMkBzdHVkZW50LnVuaW1lbGIuZWR1LmF1

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.