95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 25 October 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.1031827

This article is part of the Research Topic Corporate Environmental Management, Climate Change and Sustainable Development View all 21 articles

The energy sector is transforming as new regulations are set in place to take into account the environmental and social factors as well as corporate governance initiatives which can be integrated within organisations. Companies are pushing towards having better environmental, social and governance (ESG) scores as it impacts shareholders, investors, employees, customers amongst many others. The methodology used in this paper is quantitative and includes an analysis of the financial performance of publicly listed companies using return on equity, return on assets, return on sales, return on investment and also used the SARIMA (seasonal autoregressive integrated moving average) model to forecast revenues for the companies included in the research. The aim of this study is to investigate the impact of ESG activities within companies and how it affects investor returns. Considering regional and sectoral effects an observation of a positive relationship between ESG and investor returns is identified.

ESG (environmental, social and governance) has now become a global topic of conversation, with organisations all over the world adopting it. ESG is significant because it examines how businesses may meet the requirements of today’s generation without endangering the needs of future generations. It also ensures that investors are investing in companies that do not hurt the environment and that pay attention to social issues as well as corporate governance.

Oil and gas firms, like many others in other industries, are increasingly faced with the necessity to meet Environmental, Social, and Governance (““ESG”) imperatives in their operations. Traditionally seen as ‘licence to operate’ issues, these considerations have become increasingly important as corporations face both a rapid energy transition and increased shareholder activism and government oversight. However, while many businesses want to establish their environmental, social, and governance (ESG) credentials, they are impeded by the lack of globally standardised ESG criteria.

Implementing a good ESG strategy is one of the most difficult tasks facing energy firms. Leaders are more likely to achieve outcomes when organisations take a strategic approach to ESG that is tied to the company’s goals and values. Because ESG encompasses social and governance activities as well as the environment, oil and gas businesses must analyse their own and their employees’ demands. In order to satisfy a variety of stakeholders, an oil and gas company must develop an ESG strategy. ESG programs are also important for promoting energy industry innovation and lowering risks.

With the publication of the UN (ted Nations) Global Compact Initiative’s report “Who Cares Wins” in 2004, the term ESG was officially coined (UN, 2004). It set the lofty objective of bringing together three of the most important pillars of ethical finance: environmental, social, and governance. They all deal with different challenges and have a distinct assessment goal. (Billio et al., 2021).

Businesses can develop action plans and measure performance metrics, such as energy diversification, carbon footprint reduction, and natural resource sustainability, using a robust ESG framework. In the energy sector, there is a larger demand for ESG programs than ever before. Embracing ESG demonstrates to oil and gas firms that they care about their employees’ well-being. Focusing on ESG is a method for energy companies to demonstrate social responsibility and build confidence, as well as future-proof their operations for the new world of work.

Most firms that have been concentrated on profit maximisation have ignored environmental, social, and governance (ESG) responsibilities for decades. ESG duties were not only seen to have little impact on financial success, but they were also seen as a potential burden on the latter, as they were linked to cost rises. (Billio et al., 2021).

This research paper will discuss the various reasons as to why ESG and financial performance can lead to different conclusions, considering that financial performance can be measured using different methods and different indicators can be used to determine companies’ financial performance.

It will also focus on showing the importance of investing in the Social and Governance aspect of ESG as most companies have previously focused mainly on the environmental aspect due to understanding long-term environmental impacts.

It will contribute to society by addressing controversies surrounding the positive or negative correlation between ESG and financial performance that are yet to be resolved. It will also discuss the correlation between operational efficiencies, stock performance and lower cost of capital. It will also show why it is important for businesses to consider how the world is changing and how they can change with it based on what they can do to save the planet and ensure that their companies are run with integrity and are corruption free.

The acronyms CSR and ESG have been used interchangeably in the literature since Carroll (1979) classified corporate social responsibility (CSR) investments into environmental, social, and governance components. The pioneering proposal on ESG and corporate financial performance (CFP), known as trade-off theory, is thought to have originated with neoclassical scholars (Friedman, 1970; Vance, 1975; Wright and Ferris, 1997). They claim that a company’s main social obligation is to maximise economic rewards for its shareholders, whereas funds spent on ESG operations increase operating costs unnecessarily, resulting in a drop in profitability (Qureshi et al., 2021).

According to Qureshi et al. (2021), as a result, strong performance on multiple aspects of ESG might have a far broader connotation (Waddock and Graves, 1997) than a cost, a limitation, or a gift from the perspective of strategic management. Furthermore, it has the potential to be a significant source of innovation and competitive advantage (Porter and Kramer, 2006), resulting in enhanced CFP in the future (McGuire et al., 1990). Corporate sustainability is critical for long-term profitability and ensuring that markets give value to all members of society (United Nations Global Compact, 2014).

The benefits of a company’s involvement in sustainability are numerous. Employee involvement in the firm and improved motivation (Becchetti et al., 2008), image and brand benefits (Orlitzky and Swanson, 2012), and increased firm competitiveness (Frooman, 1999) are some of them. Kurucz et al. (2008) also mention reduction of costs and legitimacy as other benefits (Ching et al., 2017).

The early research on the advantages of ESG investing was conflicting. Existing research suggests, but does not prove, whether SRI (Socially Responsible Investing) investors are ready to accept substandard financial performance in order to achieve social or ethical goals, according to Renneboog et al. (2008). Investors actively responded to a “shock to the salience of sustainability,” according to Hartzmark and Sussman (2019), moving money away from funds featuring low portfolio sustainability ratings and toward those with high ratings. Surprisingly, they found no supporting evidence that high-sustainability funds outperformed low-sustainability funds, bolstering the argument that socially responsible investment has intrinsic (non-monetary) value for investors (Broadstock et al., 2021).

According to a 2006 study by Michael Barnett and Robert Salomon, suggested that the relationship between social and financial performance of specific ESG strategies is arcuate, which implies that as firms increase the concentration of their sustainability efforts, financial performance initially begins to decline before levelling off and improving.

The early 1970’s saw researchers looking for a link between environmental, social, and governance (ESG) principles and corporate financial performance (CFP) (Friede et al., 2015). The environmental, social, and corporate governance performance that is considered in business decision-making is referred to as ESG (Zhao et al., 2018). There have been more indisputable conclusions regarding this association in recent years, although research on this area suffers from nomenclature and terminological discrepancies. According to Meure et al. (2019), there are now thirty three definitions of corporate sustainability in use.

Global warming, deforestation, water and air pollution, land exploitation, and biodiversity loss are all addressed under the environmental pillar. As a result, it assesses a company’s energy efficiency, greenhouse gas emissions, waste, water, and resource management activities. As a result, a vast body of research has attempted to define the link between environmental and financial success. According to Derwall et al. (2004), more environmentally responsible companies have higher stock returns than their less environmentally friendly counterparts. Even after multiple methodological checks, these findings are still significant. On the basis of a sample of 2,982 major enterprises from both developed and developing nations, Manrique and Marti-Ballester (2017) reach similar conclusions. (Billio et al., 2021).

The social pillar encompasses issues such as gender policies, human rights protection, labour standards, workplace and product safety, public health, and income distribution, all of which have an impact on employee satisfaction. According to Edmans (2011), there is a strong link between employee satisfaction and long-term stock performance. In the period 1984–2009, American enterprises regarded to offer the greatest working conditions earned a 4-factor alpha of 3.5 percent each year (2.1 percent over the industry standard) (Billio et al., 2021).

Finally, the governance pillar addresses issues such as board of administration independence, shareholder rights, management remuneration, control methods, and anti-competitive practices, as well as legal compliance. Several research, such as Gompers et al. (2003), Tarmuji et al. (2016), and Velte (2017), have emphasised the large favourable influence of these activities (2017). Tarmuji et al. (2016) look at Malaysian and Singaporean firms, Velte (2017) looks at German firms, while Gompers et al. (2003) look at American firms. These three studies show that better governance standards have a favourable impact on a company’s profitability. (Billio et al., 2021).

Environmental, Social, and Governance (ESG) reporting is gaining traction among businesses and socially conscious societies. Firms with strong ESG disclosures are thought to have superior operating performance, higher returns, and lower firm-specific risk, according to stakeholders and fund managers. (Shaikh, 2022).

Firms have limited financial resources that must be efficiently distributed across a variety of investment activities (Ahmed et al., 2021). The bidirectional effect of investments in ESG-related initiatives on the corporate financial performance has been well acknowledged in empirical investigations. Nonetheless, the outcomes of these studies (Margolis and Walsh, 2003; Krüger, 2015) that look into the “doing well by doing good” theory are conflicting and inconclusive. ESG performance and CFP have been linked in numerous research in both beneficial and harmful ways. Some researchers found a positive link between environmental performance and CFP (King and Lenox, 2002; Lee et al., 2016; Stanwick and Stanwick, 1998), while others discovered that CSR dimensions of society, environment, and employment practices have a negative impact on CFP (King and Lenox, 2002; Lee et al., 2016; Stanwick and Stanwick, 1998). (Brammer et al., 2006).

Yang et al. (2019) analysed the influence of CSR performance on the financial performance of Chinese pharmaceutical companies from a Chinese perspective. Their findings suggest that a company’s total CSR rating has a beneficial impact on financial performance. (Qureshi et al., 2021).

Researchers pointed out the importance of corporate social responsibility (CSR) when it started to be specifically analysed. Corporate social responsibility could be defined as the principles of business ethics to maintain the benefits of all company stakeholders. (Wang et al., 2011).

Regarding the favourable link between sustainability performance and CFP, Kapoor and Sandhu (2010) conducted a content study of Indian companies’ annual reports and websites to examine the impact of sustainability on CFP. The authors discovered that sustainability has a considerable impact on return on asset (ROA), return on sales (ROS) and return on equity (ROE), and seems to have a little impact on growth.

The relationship between financial performance and SR reviews was investigated by Akisik and Gal (2014). Sustainability report reviews significantly affect certain short- and long-term financial performance measures (growth associated with ROA, ROS, and ROE, as well as sales), in addition, sustainability reviews have a negative relation with firm value, and finally the effect of sales, leverage, and expansion is moderated by sustainability reviews, according to multivariate analysis.

According to Pan et al. (2014), even while sustainability seems to have no substantial impact on net asset growth or expansion, it may have a favourable impact on firm profits.

Overall, the authors discovered that sustainability had a considerable impact on ROA, ROE, and EPS (Earnings per share). (Ching et al., 2017).

Zhao et al. (2018) examine Chinese listed power generation companies and discover that high ESG performance can boost financial performance. Using MSCI (Morgan Stanley Capital International ESG KLD STATS data from 2000 to 2016, Brogi and Lagasio (2019) show that ESG has a beneficial influence on US company profitability as assessed by ROA, particularly in the banking industry. Ortas et al. (2015) get comparable results for the examples of Spain, France, and Japan, utilising the ASSET4 Database with MSCI data, highlighting the strong positive effect of ESG performance on financial performance for enterprises embracing the United Nations Global Compact (UNGC). The findings of Aureli et al. (2020) for 55 Dow Jones Sustainability World Index listed companies indicate the importance of ESG disclosure on firm market value.

Additionally, Giese et al. (2019), using MSCI ESG data, discovered that ESG information influences not just company valuation but also performance. Reduced capital costs, greater values, higher profitability, and lesser exposure to tail risk are all identified as avenues for such impacts by the authors. Using the Dow Jones Sustainability Asia Pacific Index (DJSIAP) and the FTSE4Good Global 100 Index (FTSE4Good), Lo and Kwan (2017) examine the case of Hong Kong corporations and find weak but encouraging evidence of market responsiveness to ESG information. Furthermore, as compared to SRI, ESG initiatives have a stronger observed effect (Billio et al., 2021).

A. Fatemi et al. (2018) used simulation research to show that CSR has a beneficial impact on corporate value. Similarly, studies showed favourable benefits of brand equity and CSR on company performance using quantile regression (Wang et al., 2015).

Furthermore, Wang and Sarkis (2017) evaluate the aggregate ESG scores of the top 500 green U.S. companies and find that greater CSR governance correlates to improved financial outcomes. However, Ching et al. (2017) discovered no link between a company’s sustainability reporting as well as the financial performance of listed companies on the corporate sustainability index.

Achim et al. (2016) looked into a group of companies that were featured on the Bucharest stock exchange. Their findings show a link between both the quality of corporate governance as well as the market value of the companies studied. As a result, a top score on corporate governance indicators can help to maximise the value of a company. Similarly, Wu and Shen (2013) find that CSR rules have a beneficial impact on accounting-based performance proxies.

A greater score on corporate governance and employee dimensions linked to a higher CFP in the banking industry, however product responsibility and society dimensions had no positive influence on CFP (Esteban-Sanchez et al., 2017).

Female corporate leaders are seen as good corporate citizens since they invest significantly more in the environment than their male colleagues (Jiang and Akbar, 2018). (Qureshi et al., 2021).

In order to investigate the neutral impact of sustainability performance on CFP, Inoue and Lee (2011) fragmented sustainability into five aspects and looked at how each of these dimensions influenced financial performance. Employee relations, product quality, community relations, environmental issues, and diversity issues were the five dimensions. ROA and Tobin’s Q were used to analyse a company’s short-term profitability and the market’s prediction of future profitability, with size serving as one of the control factors. The findings imply that the impact of each sustainability factor differs among industries, and that not all five characteristics have good short- and long-term economic implications. (Ching et al., 2017).

Jensen (2002) claimed that managers promoting sustainability will collide with the firm’s value maximisation, resulting in a negative correlation across sustainability performance and CFP (Ching et al., 2017).

The influence of ESG upon financial performance is explained by two primary opposing theories. The shareholder and stakeholder value maximisation theories are what they are termed. While the shareholder-focused theory claims that ESG participation is harmful to a company’s worth, the stakeholder-focused theory promotes the benefits of ESG practice as a way to increase company value.

The overinvestment hypothesis is based on the premise that there is a negative association between ESG practices and financial performance. According to Barnea and Rubin (2010), the agency problem (i.e., a conflict of interest amongst shareholders and managers) causes managers to invest heavily in ESG at the expense of shareholders in order to benefit themselves (Nguyen et al., 2022).

Such an expenditure goes beyond the threshold where the related expenses appear to outweigh the additional advantages (Krüger, 2015). Empirical support on the costs of ESG financialisation is provided by Liu et al. (2020). When a negative event occurs, such as a product recall, companies with exceptionally high ESG ratings, indicating over-investment in ESG, experience decreased shareholder value (Nguyen et al., 2022). Overall, according to the shareholder-focused view (Brammer et al., 2006; Crisóstomo et al., 2011), implementing ESG reduces corporate value.

The stakeholder-focused theory promotes the benefits of ESG practices, which can help companies perform better financially. The conflict-resolution hypothesis, based on that idea, suggests that implementing ESG could resolve the inherent dispute amongst managers as well as non-investing stakeholders (Freeman, 1984). Enterprises with stakeholder-friendly policies, according to Yarram and Fisher (2021), employ less short-term borrowing, potentially resolving a possible conflict between firms and major stakeholders. According to Cui et al. (2018), higher ESG performance may reduce information asymmetries across firms, resulting in cheaper equity and debt costs (Dhaliwal et al., 2011). (Bhuiyan and Nguyen, 2020).

Gupta and Jham (2021) argue that in the post-crisis phase, companies with superior ESG practices outperform the market. ESG engagement also improves a company’s reputation (Branco and Rodrigues, 2006), allowing for greater stakeholder commitment (Arouri et al., 2019), including consumer loyalty (Turker, 2009). This may reduce the volatility of company earnings (Amel-Zadeh and Serafeim, 2018). In essence, the stakeholder-focused thesis states that the higher the firm value, the greater the ESG performance (Lv et al., 2020).

It is worth noting that institutional investors as well as sovereign funds place a high value on ESG performers in order to create long-term financial returns while limiting risk in their investment portfolios (Kapoor, 2017). Conversely, Miralles- Quirós et al. (2019) discovered that Brazilian investors place a high priority on environmental, social, and governance performance. Similarly, Auer and Schuhmacher (2016) investigated the impact of investing in stocks of pro-ESG enterprises on portfolio returns mostly in Asia Pacific, United States and Europe. Similarly, Auer and Schuhmacher (2016) investigated the impact of investing in stocks of pro-ESG enterprises on portfolio returns mostly in Asia Pacific, United States, Europe, and their findings show that ESG-driven investments outperform the market in the United States and Asia Pacific area (Qureshi and Ahsan, 2022).

Friede et al. (2015) did a thorough systematic assessment of the literature and discovered that the association between CPF and ESGP is well-grounded. Almost 90% of the studies observed a non-negative connection, and the vast majority of research showed a favourable CFP-ESG performance relationship. Furthermore, a recent study demonstrated a non-negative relationship between most ESG actions and CFP using a large worldwide data set (Xie et al., 2019).

Environmental, Social, and Governance (ESG) reporting is gaining traction among businesses and socially conscious societies. Firms with strong ESG disclosures are thought to have superior higher returns, operating performance, and reduced firm-specific risk, according to stakeholders and fund managers (Shaikh, 2022).

Bloomberg developed and propagated the ESG score, which is a quantitative assessment that covers around 120 environmental, social, and governance factors. In the last three decades, the literature and empirical studies investigating the topic between sustainability disclosure (SD) and financial performance (FP) have expanded at an accelerating rate (Shaikh, 2022).

Environmental, social, and corporate governance (ESG) ratings first appeared in the 1980’s as a mechanism for investors to screen companies based on their environmental, social, and corporate governance performance. Eiris (which merged with Vigeo in 2015) was the first ESG rating agency, founded in 1983 in France, while Kinder, Lydenberg & Domini (KLD) was founded seven years later in the United States. (Berg et al., 2022).

ESG ratings: Unlike values-based and positive impact screenings, which look at the products and services a company produces, ESG ratings look at how ESG opportunities and risks are integrated into the organisation’s business model. This analysis is usually based on a variety of E, S, and G-related variables, such as carbon footprint, data security, water usage, human capital development, executive pay, and board structure. There are two main approaches to ESG ratings methodologies: one that is based on the rater’s subjective standards for what makes “excellent” ESG, and the other that is based on financial relevance. (Giese and Lee, 2018).

ESG rating methodologies:

1. Preference-based ESG ratings: The various ESG indicators are averaged using a scorecard, with the weights representing the preferences, depending on the rater’s norms or standards. As it is founded on a weighted aggregate of several various indicators, such as gender diversity and carbon emissions, the concluding ESG score has no clear economic relevance. The scorecard, on the other hand, creates a metric that enables the rater to judge organisations based on this normative scale of “excellent” and “poor” ESG (Giese and Lee, 2018).

2. Financial-model-based ESG ratings: A model that picks and weights ESG variables based on an economic reason and is required to develop ESG ratings that may be used as a financial risk indicator in portfolio construction. MSCI ESG Ratings, for example, convert ESG related risks for a certain industry into a standardised scale. MSCI ESG Research evaluates the extent to which each ESG risk indicator may affect potential income or the company’s assets for each ESG risk indicator. Certain scholars have only looked at one facet of ESG (Giese and Lee, 2018).

Considering ESG ratings are a necessary component of most types of sustainable investing, the market for ESG ratings has grown in lockstep with the market for sustainable investing. Several early ESG rating services were bought by prominent financial data suppliers as sustainable investment moved from specialised to mainstream. MSCI purchased KLD in 2010, Morningstar purchased 40% of Sustainalytics in 2017, Moody’s acquired Vigeo-Eiris in 2019, and S&P Global purchased RobecoSAM in 2019. (Berg et al., 2022).

It is important to note that it is challenging for investors and consumers to determine which companies are truly committed to sustainability, companies may invest in high - cost sustainability initiatives to reduce ambiguity (Connelly et al., 2011), which is gives reason as to why sustainability reporting frameworks are crucial (Ching et al., 2017).

Investors can use ESG rating agencies to evaluate firms for ESG performance in the same way they can use credit ratings to assess companies for creditworthiness. However, there are a minimum of three key distinctions between ESG and credit ratings. ESG reporting is still in its infancy, while financial reporting standards have evolved and consolidated over the last century. (Berg et al., 2022).

Companies will aim to portray their sustainability attempts and shortcomings in the most favourable light possible, and reporting standards will assist in determining the genuine nature of such initiatives. A consistent framework eliminates the possibility of uncertainty in measuring various types of data (Coalition for Environmentally Responsible Economy, 2010). The implementation of a uniform model for reporting is crucial for investors since it allows them to assess the reports and analyse companies (Ching et al., 2017).

Investors and stakeholders in the energy industry, as well as the public at large, are increasingly aware that ESG ratings are essential drivers. ESG investing was long considered a specialty, but it has now become a critical area for businesses of all sizes, especially after the outbreak of Covid-19.

Different theories have emerged regarding the idea of whether a company is willing to focus on social welfare as an investment. Social welfare can be regarded as environmental and social issues as well as stakeholder value maximisation. Linked to the stakeholder’s theory mentioned before by Freeman, an argument has been noted on how in a competitive market, a firm lowering its profits in order to pursue social and environmental goals may not survive the competition and disciplining actions from the market for corporate control (Renneboog et al., 2008).

Conventional financial reporting is regulated, mandated, and must meet the following qualitative criteria: reliability, relevance, materiality, comparability and ability to grasp. ESG reporting, on the other hand, is troublesome due to poor reporting quality that does not match the aforementioned standards. Apart from that, in most parts of the world, ESG reporting is unregulated. As ESG is progressively regarded to be an essential component of effective and sustainable business performance, a global framework is required to provide greater comparability, transparency, avoid fragmentation and reduce the complexity of ESG disclosure, potentially reducing the risk of greenwashing (De Silva Lokuwaduge et al., 2020).

Being a responsible corporate citizen has a cost, as it necessitates corporations actively developing and maintaining their social image, which may yield intangible benefits, whereas ESG initiatives have a measurable cost. Consequently, stakeholders may find evaluating this long-term value offer challenging (Broadstock et al., 2021).

Each provider examines different aspects, employs a different technique, and weights each factor differently (Park and Jang, 2021). Significant disparities in ESG ratings among providers may make ESG management more difficult and limit the influence of ESG scores on investment portfolios (Boffo & Patalano, 2020).

When discussing the wide variance in external assessments, data quality is often brought up. According to Eccles et al. (2019), the market contains about 500 ESG rankings, 120 voluntary ESG disclosure standards and over 100 ESG awards.

One of the difficulties that has surfaced as the need for ESG data develops in tandem with the frequency of responsible investing is the disparity in ESG scores among various organisations. This is hardly surprising, considering the intangible nature of sustainability in general and the inclusion of a variety of subjective scoring criteria (Zumente and Bistrova, 2021).

The challenge of ESG data quality was emphasised by Eccles et al. (2019), who suggested that there is a trade-off regarding reliability and validity of ESG data. Dorfleitner et al. (2015) also found a paucity of ESG rating convergence.

Berg et al. (2022) compared the ESG ratings of five market-leading ESG rating agencies (KLD, Vigeo-Eiris, Sustainanalytics, RobecoSAM and Asset4) and found an average correlation coefficient of 0.61, which is significantly lower than the 0.99 correlation coefficient found among commonly compared credit ratings such as S&P and Moody’s. The discrepancies were mostly explained by three main factors: firstly, scope divergence, which refers to the different sets of attributes used by each agency, Secondly, weight divergence, which refers to attribute weighting in the calculation of scores, and lastly, measurement divergence, which refers to cases where agencies use different proxies to measure the same attributes (Zumente and Bistrova, 2021).

The source of ESG data may have a substantial impact on the ESG evaluation results (OECD, 2020). Along with the implementation of green strategies, there is also the emergence of greenwashing, which Siano et al. (2017) described as the divergence among two types of behaviour: the first being, minimal eco-efficiency, while the other is, advocacy of the green ideals of sustainable development (Baran et al., 2022).

Greenwashing primarily seeks to promote ecological advantages rather than actual investments in green initiatives, and the majority is used by corporations in the chemical, energy and automobile sectors to promote their own products as ecologically benign (Pimonenko et al., 2020).

ESG is not a checkbox exercise anymore, but rather a necessity for retaining and recruiting stakeholder support. The implementation of ESG as a workforce strategy is now more critical than ever. Energy firms that understand the importance of ESG will be equipped to attract and retain the best staff while also satisfying market expectations (Petroplan, 2021).

The oil and gas industry is well-known for posing an environmental danger. Many businesses within this industry have taken initiatives to comply with ESG and reduce their environmental effect. According to sources, the British oil firm BP aims to invest $220 million in solar projects to aid the transition to a low-carbon future. Over the last five years, nearly $60 billion has been invested in renewables, hydrogen, and digital technologies. Environmental conditions are clearly becoming a focus for oil and gas firms in terms of optimising operations and boosting value throughout their enterprises. While most oil and gas corporations will likely continue to invest in traditional production, industry leaders are taking sustainable energy more seriously (Petroplan, 2021).

According to Enverus (2022), the ‘Environmental’ measure is perhaps the most important for energy companies wanting to present themselves favourably with investors. The elements listed below all have a part in limiting their influence and ensuring that they stay competitive and investable within the market:

1. Greenhouse gas reduction

2. Alleviate greenhouse gases

3. Manage flaring

4. Adhere to new regulations

The table below shows some of the factors that need to be considered within the Energy sector to generate better ESG reports as this shows a level of transparency within the business. This can give confidence to potential investors, customers and stakeholders.

The accounting and finance literature has investigated investor decisions centred around information flow to the stock market. Financial reporting’s foundations have long been intertwined with financial capital providers’ decision-making processes (IASB, 2018). Investors are increasingly interested in non-financial data including Intellectual capital (IC), corporate social responsibility (CSR) and environmental, social, and governance (ESG) (Murray et al., 2006; Zhang et al., 2018).

Prior accounting and finance research has looked at the impact of corporate and government information updates on the stock market (e.g. Bamber, 1986; Graham et al., 2003; Mitchell and Mulherin, 1994). The degree of abnormal returns or trading quantities, which is reflective of the usefulness in the relevant information of the releases, has been used to gauge investor reactions. The degree of activity on the stock market may reveal information about an investor’s behaviour (Djajadikerta et al., 2022).

Notwithstanding some mainstream criticism, more than four decades of scholarly and analytical data suggests that incorporating ESG into the investment strategy can result in higher risk-adjusted returns and long-term value creation (Eccles, et al., 2017). Nevertheless, certain managers’ and asset owners’ long-standing concerns regarding the feasibility of responsible investment methods are not entirely unwarranted. Responsible investing, if not fully applied, can result in inferior financial results. Managers must leverage both ESG opportunities and risks to achieve the full potential of ESG integration. The greatest ESG strategy for this is the full inclusion of ESG considerations into the investment process (Cappucci, 2017).

When making investing decisions, investors employ a variety of ways to get reliable data. Investors used to make judgments only on the basis of financial performance, whereas they now have more objectives than just profit (Park and Oh, 2022). Furthermore, they are making investing decisions based on factors other than just financial data (including ESG data) (Sultana et al., 2018). Corporate CSR actions and management might be influenced by investors (Park and Ghauri, 2015).

Due to the perceived importance of such information to investors’ purchase or sell decisions (Holland, 2003), and especially with ethical investors expanding, firms have been interested in the publication of such non-financial information (Tschopp and Huefner, 2015). Regardless, public information like earnings releases, company acquisitions, government laws, and economic policies have been found to have a significant impact on investor decisions, culminating in the degree of activity on financial markets (Djajadikerta et al., 2022).

Asset managers and banks, on the other hand, can encourage businesses to enhance their sustainability standards by requiring a particular level of ESG performance before lending or investing (Zumente and Bistrova, 2021). In this sense, corporations are put under indirect pressure to strengthen their sustainability efforts and, as a result, their financial resilience (OECD, 2020).

Asset owners have a considerable influence since they can require that a particular level of ESG criteria and disclosures be met throughout their portfolio (Eurosif, 2016). According to an S&P poll of 194 credit risk experts working in banks and other financial institutions, 86 percent of respondents believe that rising investor demand is driving the integration of ESG factors into credit risk assessments. 83 percent of those polled agree that environmental, social, and governance (ESG) factors play an important role in credit risk assessment (S&P Global Market Intelligence, 2020; Zumente and Bistrova, 2021).

Socially responsible investors value not only the financial return on their investments, but also the societal impact. These preferences for return, risk, and social responsibility can be implemented in a variety of ways, and numerous multi-criteria portfolio optimization models have been developed to fill this gap over time (Amon et al., 2021).

Park and Oh (2022), state that individual investors are becoming more interested in ESG investing for two reasons. ESG investing, for starters, aggressively advocates ethical investment practices; secondly, ESG investments are seen as a way to improve the performance of managed portfolios, as well as a way to boost returns and lower portfolio risk (Broadstock et al., 2021). A business announcement is important public information that assists individual investors in making informed investment decisions quickly and effectively (Pradhan and Kasilingam, 2015).

According to Zumente and Bistrova (2021), due to the long-term and active interaction that exists between financial investors and enterprises, private equity and venture capital firms are uniquely qualified to integrate and develop ESG standards in their portfolio firms (Invest Europe, 2021).

Due to the modern portfolio concept, any approach that restricts a portfolio’s investment tends to force the manager to select from a smaller range of prospective investments, reducing the portfolio’s potential to diversify firm-specific risk and, ultimately, the portfolio’s long-term potential return (Asness et al., 2018; Cappucci, 2017).

Scholars have been interested about price and stock market changes that are not explained by basic study. Changes in investor views are thought to produce price swings and large fluctuations in trading volume on the stock market. Changes in investor beliefs, on the other hand, may be influenced by emerging information, which, when perceived by investors, might have an impact on their actions (Djajadikerta et al., 2022).

Several worldwide and regional research allow financial investors to determine their present level of ESG compliance. According to an EY global institutional investor survey, 98 percent of institutional investors use ESG variables to evaluate company performance, with 72 percent utilising a methodical approach, up from 32 percent the previous year. Furthermore, 43 percent of respondents stated that the company’s non-financial performance has played a significant impact in investment decision-making in 2019 (EY, 2020).

Bilbao-Terol and colleagues (2019), introduce a goal-programming approach for an SRI portfolio, for example, that allows investors to align their ethical and financial inclinations. They show that investors’ risk attitudes influence the loss of return as a result of picking SRIs using UK mutual funds (Amon et al., 2021).

Clark et al. (2015), presented an upgraded meta-study, which drew on more than 200 sources, found a striking link between rigorous sustainable corporate practices and economic performance. In fact, 45 of the 51 academic works analysed (88 percent) reveal a link between sustainability and operational effectiveness. Eccles et al., 2014) found that the portfolio of strong sustainable companies beats the portfolio of low-sustainability companies in terms of stock market and financial performance from 1993 to 2010. These findings support theoretical predictions of a null to mildly positive relationship between ESG and CFP (Baran et al., 2022).

In this study, the author adds ongoing debate on whether a company’s ESG performance affects its CFP by posing the following research question: Do investors investing in the European energy sector, using an ESG strategy, have expected higher returns?

To answer that question, The paper investigates at whether there is a link between ESG performance and CFP, by relying on a quantitative method conducting the following accounting-based profitability measurements as a proxy: return on equity (ROE), return on investment (ROI), return on assets (ROA), as well as return on sales (ROS). The fact that most of those ratios have appeared in earlier research projects on the relationship between ESG performance and CFP, as analysed in the meta-analysis by Margolis et al. (2009), justifies such a choice.

Return on equity (ROE) is a ratio that measures a company’s ability to generate net income dependent on individual equity; it is an indicator of profitability from the standpoint of the shareholders. The higher the company’s ROE, the greater its ability to earn more profits, and consequently higher stock prices (Nursiam and Rahayu, 2019).

A high ROE indicates that the company has done a good job investing its capital to generate returns for its shareholders. As a result, the relationship among ROE and stock price can be considered positive. Hutami (2012), Rosmiati (2016), and Sutapa (2018) all believe that ROE has a favourable and considerable impact on stock prices (Nursiam and Rahayu, 2019).

ROE is a ratio used to determine a company’s ability to generate net income based on a specific capital share; it is one of the profitability assessments from the shareholders’ perspective. The formula for the ROE variable is as follows, according to Mardiyanto (2009):

An advantage of using ROE is that it compares companies across different industries by concentrating on their capacity to yield money to shareholders. Revenue and profit margins differ substantially between industries, making comparison challenging. However, ROE transforms profits data into a highly meaningful metric that can be evaluated across industries.

In hindsight a significant issue with return on equity is that it does not account for a firm‘s debt. It simply takes into account net income and shareholder equity. As a result, a firm can have large amounts of unsustainable debt and still appear to be doing well based on the return on equity metric.

Return on assets is a measure that shows how profitable a company is in comparison to its total assets. A higher return on investment (ROI) implies that a corporation is more effective and productive in maintaining its balance sheet to create profit, whilst a lower ROA suggests that there is space for development. ROA can be used by investors to measure how well a company utilises its assets to make a profit. ROA can be calculate using the following formula:

A possible benefit of using ROA is that because it is based on operational income, the indicator accurately reflects the impact of both equity as well as loan financing on asset expenditures and their potential to create profit. As a result, organisations with various financing arrangements can be evaluated without any modifications.

It can be mentioned that one of the major issues with return on assets is that it does not account for intangible assets. Numerous businesses in the current economy depend significantly on intangible assets to deliver significant value. Therefore if it is considered, it may not be awarded the right value while recorded for in assets suggesting that one could wind up undervaluing a business and thus making a terrible investment decision.

Return on sales (ROS) is a metric that measures how effectively a company converts sales into profits. An increasing ROS suggests that a company’s efficiency is improving, whereas a declining ROS may indicate imminent financial difficulties.

This efficiency ratio is used by creditors, investors and other debt holders because it effectively communicates the proportion of operational cash a firm produces on its sales and provides insight into future dividends, the company’s capability to repay debt as well as reinvestment potential. ROS can be calculated using the formula below:

Data from ROS can be contrasted to statistics from a trend analysis to indicate the company’s progress over time. If a company’s return on sales has gone up, then they have improved financially, and if it has declined, it might assist them to realise where they need to improve. One can also conduct a comparative examination of other firms to see if they are ahead of their competitors, however the review is more successful if it involves a firm within the same sector.

However, it is not an appropriate representation of returns because it is suggested that a corporation should assess the worth of its returns using capital rather than sales. In addition companies that are just starting out would not have sufficient data to calculate ROS as they also have high operational expenses.

Return on Investment (ROI) is a prominent profit indicator that is used to assess how well an investment has done. When considering whether or not to or not to invest in the purchase of a firm, it can be used to calculate the profitability of a stock investment. ROI is a defined, generic measure of profitability since it is reasonably simple to compute and understand (Bodie,Z, & Kane,A, 2020). ROI can be calculated using many formulas, however the following formula is the one used in this paper:

ROI assists managers in assessing the rate of return that may be expected from numerous investments in several areas. This enables them to make an investment that will boost departmental as well as organisational performance. Also, while making the best use of existing investments.

Furthermore, a downside of ROI is it does not take into account the period in which an investment is actually held. Thus, a profitability metric that takes into account the holding duration may be more beneficial for an investor comparing potential investments.

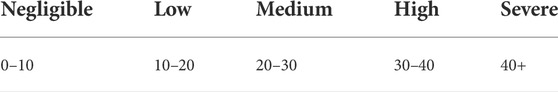

This scale is a digest of sustainalytics ESG risk ratings. Sustainalytics’ ESG Risk Ratings assess a company’s susceptibility to industry-specific material ESG risks and how well those risks are managed. This multidimensional approach to quantifying ESG risk combines management and exposure ideas to result in an unbiased assessment of ESG risk. It establishes five levels of ESG risk complexity that may have an influence on a company’s enterprise value (Sustainalytics, 2022).

Lower ratings imply reduced unmanaged ESG risk, whereas higher scores represent more unmanaged risk. Unmanaged Risk is calculated on an open-ended scale with a zero (no risk) beginning point and, in 95 percent of instances, a maximum score of less than 50. Companies are classified into one of five risk categories mentioned in the table above, based on their quantitative scores. (Sustainalytics, 2019).

Since these risk classifications are absolute, a ‘high risk’ evaluation indicates a comparable level of mismanaged ESG risk throughout all sub industries covered. This means that a company in one sector can successfully be compared to another in a completely different sector. With the success of ESG Risk Rating Scores it has developed a unified currency for ESG risk (Sustainalytics, 2019).

Within the ESG Risk Ratings, an issue is considered relevant if its existence or omission in financial reporting is anticipated to affect the judgments of a reasonable investor. To be deemed essential in the ESG Risk Ratings, a concern must have a relatively significant implication on a company’s economic value and, as a result, its financial risk- and return profile from an investment standpoint (Sustainalytics, 2019).

It is important to note that an underlying concept of the ESG Risk Ratings is that the globe is shifting to a much more sustainable economy and that, as a result, proper management of ESG risks should be correlated with superior long-term organisational value. Several concerns are substantial from an ESG standpoint even though the financial effects are not completely quantifiable currently (Sustainalytics, 2019).

There are 3 building blocks considered when it comes to a company’s overall rating score.

The first is Corporate governance which accounts for approximately 20% of a company‘s total unmanaged risk score. It relates to the policies and procedures that govern and control business operations which can include business ethics and risk management, among others. (Standard Chartered, 2021). This is an important building block as it helps mitigate risks such as money laundering, fraud scandals, corruption and many others.

The second building block is material issues. Material ESG concerns are those that have an influence on a company’s financial risk-return profile. Within this building block, issues surrounding the environment, human capital management and health and safety are incorporated. It can be mentioned that in fact not all ESG issues are correlated with financial performance and this may be different from one industry to the other, however recognizing major ESG concerns is critical for investors as companies are subject to various ESG challenges with varying degrees. (Standard Chartered, 2021).

The third and final building block is Idiosyncratic ESG Issues. These issues are unforeseeable and therefore they might happen to any company in any sector and hence fall beyond the logic that captures sub industry-specific material ESG problems. If the corresponding incident assessment by Sustainalytics is deemed high and severe, idiosyncratic issues become major ESG issues. This encompasses important anti-competitive activities as well as social supply chain mishaps (Standard Chartered, 2021).

SARIMA stands for Seasonal AutoRegressive Integrated Moving Average. The SARIMA model augments an ARIMA model by accounting for seasonality. It is a major statistical model proposed by Box and Jenkins around the 1970’s (Shumway and Stoffer, 2017).

SARIMA’s multiplicative process will be represented as (p,d,q) (P,D,Q)s with p denoting non-seasonal AR order, d denoting non-seasonal differencing, q representing non-seasonal MA order, P denoting seasonal AR order, D signalling seasonal differencing, Q representing seasonal MA order, and s denoting time span of recurring seasonal pattern (Arzo Ahmed and Moloy, 2018).

ARIMA is a popular method for identifying patterns in non-stationary time series (Shumway and Stoffer, 2017). Some periodical time series are primarily employed with the ARIMA model, namely the non-seasonal ARIMA (p, d, q) model. The duration of the seasonal period is shown by the subscripted letters’. For example, s = 7 in an hourly data time series, 4 in a quarterly data series, and 12 in a monthly data series (Permanasari et al., 2013).

The ARIMA model is illustrated as:

When zt is the level of differencing, the constant is denoted by δ, and φ is an autoregressive operator, a stochastic shock corresponding to time period t, and θ is a moving average operator.

The model could be described more explicitly without differencing procedures as:

The non-seasonal components are:

It is worth noting that the seasonal and non-seasonal AR components multiply each other on the left side of the formula, while the seasonal and non-seasonal MA elements multiply each other on the right side of the formula.

As seen in an example given by Murat and Adanacioglu and Yercan (2012): Assume we specify ARIMA (0, 0, 1) (0, 0, 1)12 for the analysed series.

The model incorporates a non-seasonal MA (1) component, a seasonal MA (1) component, with no differencing, and no AR components, with S = 12 as the seasonal period.

The non-seasonal MA (1) polynomial can be given by: (B) = 1 + θ1B.

The seasonal MA (1) polynomial is expressed as: Θ(B12) = 1 + Θ1B12.

The model can be written as follows: (xt - μ) = (1 + Θ1(B12)) (1 + θ1(B))wt.

After multiplying both polynomials on the right side, we get the following equation

Which can also be written as

Therefore we can conclude that the MA components in this model lags at 1, 12 and 13.

George Box and Gwilym Jenkins investigated a streamlined method for acquiring extensive information about the ARIMA model and employing the multivariate ARIMA model. The Box-Jenkins (BJ) approach comprises of four successive phases:

1. Identification: This stage is concerned with the selection of the order of regular differencing (d), seasonal differencing (D), non-seasonal order of Autoregressive (p), seasonal order of Autoregressive (P), non-seasonal order of Moving Average (q), and non-seasonal order of Autoregressive (P) (Q).

2. Estimation: The previous data is utilised to determine the variables of the preliminary model.

3. Diagnostic checking:The diagnostic test is done to ensure that the preliminary model is suitable.

4. Forecasting: Step 3’s final model is utilised to predict forecast values.

To investigate the SARIMA model this approach is commonly used because of its capacity to capture the relevant trend by evaluating historical patterns (Permanasari et al., 2013).

Seasonal Autoregressive Integrated Moving Average, SARIMA supports univariate time series data with a seasonal component which is the nature of the study here. To investigate the SARIMA model this approach is commonly used because of its capacity to capture the relevant trend by evaluating historical patterns (Permanasari et al., 2013).

The SARIMA method is one of the modelling approaches in forecasting in this industry. Several studies have applied this method (Malik and Yadav, 2020) to forecast ESG and performance based on transformation of data (Ding et al., 2010) By using Root-Mean-Square Error, the authors found that Seasonal Autoregressive Integrated Average (SARIMA) gave the most accurate results for the classical approach used in this paper in forecasting returns in the energy sector using the ESG scores (Gao et al., 2022).

This chapter will go through the data in greater detail, information about the firms included in this paper, as well as some summary statistics.

The data used in this study to calculate ROA, ROE, ROS, and ROI have been obtained from published financial statements from the companies included and use a time frame from 2018 up to 2022 (Figures 1–5). Whilst the data used in the SARIMA model to create forecasts used a time frame from quarter 1, 2017 to quarter 1, 2022.

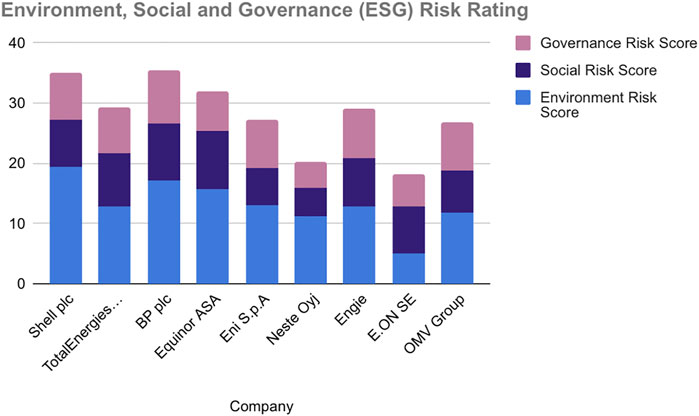

FIGURE 5. Stacked ESG column chart. Source: Sustainalytics, 2022.

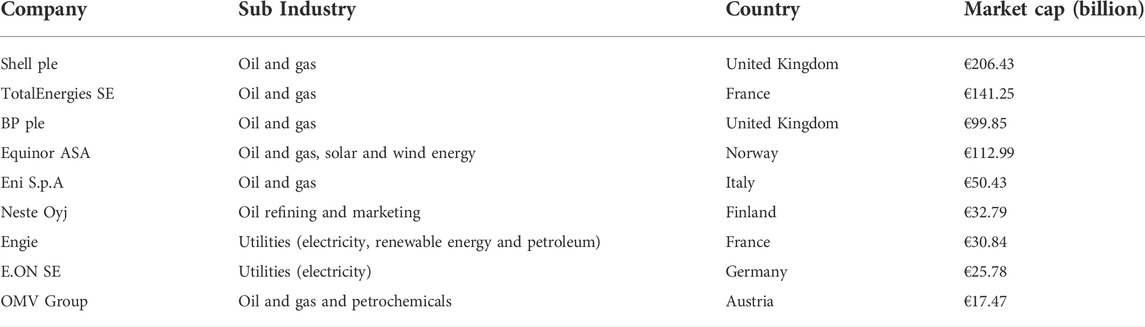

The sample used comprises some of the biggest companies in the energy sector within Europe. The reason as to why large cap companies were chosen is because they are more willing to publish their ESG activities and the actions taken in order to implement them.

A potential proposal is that investor returns are higher when it takes into account environmental, social and governance factors. ESG may be positively linked to a firm’s performance hence, increasing the return for investors. As the times are changing investors are more concerned about what firms are doing to be more environmentally friendly, their selling practices and product labelling as well as the governance factors such as board diversity and corruption free practices.

The slack resource theory posits that, rather than firms’ ESG impacting CFP, improved CFP leads to enhanced ESG outcomes (Waddock and Graves, 1997). An improved financial position allows enterprises to invest greater monetary resources in activities that are more socially responsible and can include employee relations, the environment and society (Preston and O'Bannon, 1997).

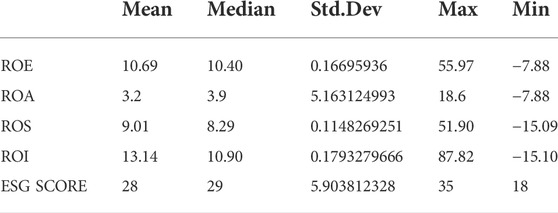

An overview of the key variables used in this paper are presented in the table below (Table 1).

Most of the financial data was obtained from published financial statements by the companies as well as yahoo finance which has compiled data of financial statements which were extremely helpful.

This section will focus on the results obtained from using financial models and different statistical calculations which have been revealed through analysing the data.

The table below is a summary of the sample used in this paper (Table 1). It consists of nine companies within the European Energy sector. In an attempt to diversify the sample, companies from 7 European countries were used. These companies are all considered large caps as they all have a market value of €10 billion and above.

In general, market capitalization correlates to a firm’s level of development. Large-cap stock investments are usually considered more cautious than small-cap or midcap stock investments, perhaps providing lower risk in return for far less aggressive potential growth. Midcap equities, in contrast, fall on the risk and reward continuum between large and small companies. Market capitalization is derived by multiplying the number of shares outstanding by the last closing price (Bloomberg, 2020) The value is expressed in billions of euros. The market capitalization is the value of the company’s outstanding shares minus treasury shares. If the corporation has numerous shares, the market capitalization of all common stocks at the conclusion of the time is representative. As a result, it becomes a type of risk gauge because it demonstrates the firm’s financial capability (Corporate Finance Institute, 2020).

In the case of the ROE indicator it can be seen that E. on SE has quite a high ROE in 2018 of nearly 60% which can easily be attributed to the fact that they are able to use investment funds efficiently in order to generate earnings growth. In addition Neste Oyj, also is seen to have a high ROE which suggests that they have generated great profits with minimal equity capital. It also means that they have been able to obtain steady earnings growth whilst giving the majority of its profits back to its shareholders. Evidently there has been a great drop in ROE for the other companies included in the sample during the period of 2020 where most companies were greatly affected by the COVID-19 pandemic, however an improvement in ROE can be seen within the next few years. Lastly BP plc had a poor ROE from 2021 to 2022 this is due to an attempt to cut debt below €33 billion where the company decided to sell parts of its shares in the Oman gas field. It is also worth mentioning that during this time BP’s renewables projects were resulting in losses.

Regarding the ROA indicator, the sample in this paper consists of companies within the same industry making it easier to analyse as they would have a similar asset base. The results from ROA as seen in the Figure 2, mimic similar results as the ones seen in the ROE graph. Neste Oyj can be seen to have a high ROA indicating that its operating cash is adequate enough to cover its debt. Similarly to ROE there was an occurrence of some negative readings especially around 2020 due to the pandemic. Furthermore, BP plc seems to also have a declining ROA from 2021 to 2022 as they are looking to sell most of their assets in order to reinvest the money into assets that are of renewable energy.

The ROS indicator shows that most of the companies have steady ROS despite a decline in the year 2020 due to the pandemic mentioned previously. However there is an unusual increase in ROS for Equinor ASA which was due to increased liquid and gas prices as well as powerful productions and an increase in gas production.

The graph in Figure 4 shows the ROI for the companies within the sample and shows a stable ROI until 2019 to 2020 where the pandemic really affected these businesses. Equinor ASA has an unusually high ROI which exemplifies its potential to outperform other companies within the same industry due to it accelerating growth. In addition, it can be seen that E. on SE has a declining ROI from the year 2020 onwards. This can be due to a great decrease in demand from industrial and commercial power usage.

Using the sample of companies in the energy industry a graph was developed to show each company’s ESG risk rating and how each ESG factor contributes to the overall ESG risk (Table 2). As seen in Figure 5 the ESG risk ratings for the following companies fall within a total score of 35 and a minimum total score of 18. Shell plc and BP plc share a similar total score of 35 suggesting that they fall within the “high” category. This means that they have increased unmanaged risks. E. on SE can be seen to have a lower total score of 18 thus placed in the “low” category according to Sustainalytics ESG risk rating scale (Tables 3, 4 and 5). This means that it has reduced unmanaged risk.

TABLE 2. ESG risk rating scale. Source: Sustainalytics, 2019.

TABLE 4. Summary of the most important figures regarding financial and social concerns. Source: Own elaboration.

TABLE 5. Summary of the sample used in this research. Source: Bloomberg, 2022.

In this paper, a (0,1,1), (0,1,1)4 SARIMA model was applied in order to forecast revenues for the next 4 quarters using the nine companies previously mentioned. Data from quarter 1, 2017 to quarter 1, 2022 was used to test for seasonality while incorporating an autoregressive integrated moving average model. After calculations to find the constant, theta (θ) and phi (φ) were completed, they were used to generate revenue forecasts for quarter 2, 2020 until quarter 1 2023.

Figure 6 shows the revenues for the chosen nine companies and their potential forecasts for the next four-quarters. As seen, some of the market leaders include Shell plc, BP plc and TotalEnergies with declines in revenues during Q1 2020 and Q2 2020 due to the pandemic and then a pattern in revenues begin to form in quarter 3, 2021 as the estimates obtained using the SARIMA model are plotted on the graph until quarter 1 2023. With these results it is possible for potential investors to analyse how a company’s performance can impact their returns, whilst still focusing on ESG activities.

The aim of this paper is to investigate the correlation between investor returns and ESG activities within the energy industry. This section will present the key arguments and main takeaways, illustrate and critique them in relation to the research objectives. It will also highlight how it corresponds to earlier studies. This section will also include limitations of the energy sector in relation to ESG as well as limitations of the study and will conclude with recommendations.

Environmental, social, and governance (ESG) investing has sparked a widespread curiosity by many asset managers. The value of ESG-focused portfolios across major markets surpassed US$30 trillion in 2019. ESG investing is important to investors for a minimum of two reasons. For starters, by emphasising ESG investing, ethically responsible investment activities are strongly encouraged. Secondly, ESG investing is rapidly being thought of as a way to improve performance of a managed portfolio, thus improving returns while decreasing portfolio risk (Broadstock et al., 2021).

Investors are mostly drawn to organisations that have a high number of assets to invest in and it causes the stock market to rise in value. This idea is reinforced by Rahmandia (2013) and Zaki, et al. (2017), who claim that a company’s scale has a favourable impact on stock prices.

Oil and gas corporations’ social and governance activity is frequently disregarded in favour of environmental exhortations. However, In the past, the energy sector has been a pioneer in creating excellent health, safety, and governance rules. During the last two to three years, the emergence of ESG has resulted in significant adjustments toward focusing on “E” factor and “S” factor and organisational cultures are rapidly evolving to tackle these issues.

Following the Paris Climate Agreement (United Nations, 2015), ESG has advanced dramatically, and numerous worldwide efforts are working to advance ESG standards. Previously, environmental reviews were best suited, with little attention for emissions or impacts farther along the value chain. ESG has become its own entity, propelled by huge institutional investors and foreign financiers. Finance and investment must be the driving forces behind transformation. As a result, as a worldwide corporation, they will select financiers who prioritise ESG in their strategy, as it is what potential investors expect.

The energy sector must recognise the role that governments all over the globe have undertaken in conditioning the people to the usage of fossil fuels. Investors are aware of the shifting market trends and are monitoring the actions done in accordance. Technology applications in the decarbonization of the energy sector should be a primary priority for enterprises in the energy and gas industry in order to adapt to shifting market demands and restore investor confidence.

As most oil and gas firms will likely continue to invest in traditional production, industry leaders are prioritising sustainable energy projects as compared to other firms within the industry (Petroplan, 2021). The urge for resilient and secure practices is at the heart of the energy sector’s change. A global appeal has been issued to investigate sustainable energy practices and to embrace safe processes.

Almost all energy companies considering investment and finance are building solid ESG frameworks with net-zero decarbonisation proposals. Investors are not exclusively focusing their financial choices upon how leaders incorporated ESG principles into their firms, but they are also advocating for quantitative and qualitative ESG criteria to thoroughly analyse whether firms can compete in the shift towards carbon-free energy.

As the energy industry is evolving it can be noted that there is a positive correlation between ESG activities within a company and investor returns considering that companies investing in ESG activities have higher or better financial performance. This in turn guarantees the chances of an investor receiving their returns. According to Cappucci (2017), full inclusion of ESG within the investment process is the ultimate ESG strategy. Therefore, allowing companies to attract financial capital by investing in ESG initiatives.

Furthermore, results from this research may have managerial implications. The thesis outcomes help Managers continue making strategic decisions relating to the ESG pillars that will keep investors satisfied and attract future investors willing to invest in future projects. Regarding the energy industry, some of the future projects may be linked towards renewable energy and low carbon energy. Managers may also have to understand investor behaviour and possibly find solutions to convince investors that they made the ‘right’ choice. This is because investor behaviour is solemnly based on cognitive, social and emotional factors that influence their decisions.

Lastly, it is crucial for managers to stay connected with market trends and this can apply to portfolio managers and business managers. For businesses it is key to know which areas may need improvement and which areas are performing well. This will allow for long term strategies to be created and thus being able to safe-proof investor funds. Eccles et al. (2017) suggested that incorporating ESG into an investment strategy can lead to higher risk-adjusted returns and long term value creation.

ESG is a theoretical model for driving improved corporate operations and ensuring the survival of one’s organisation from imminent environmental and social constraints. Reservations about the absence of standardisation and comparability of environmental disclosure, as well as modern viewpoints on ESG in the developing world, persist.

The documenting, consistency, and comparability of the ESG criteria remains the most significant impediment to pervasive transformation. As things currently stand, businesses can select the structure that best suits their needs and allows them to offer a flattering account of activities. Businesses are now disclosing ESG accomplishments, which helps finance and investment comprehend exposure of assets and select the best suited customers.

As Renneboog et al. (2008) stated, in a competitive market, a company reducing its profits in order to pursue social and environmental goals may not endure the competition and disciplining actions from the market for corporate control.

In addition, there seems to be a challenge to strike a balance given the need for cleaner fuels and the societal ramifications of limiting additional gas production on the continent. This leads back to the necessity for better disclosure of objectives and behaviours, as well as relevant perspectives. As seen in the findings mentioned earlier, BP pc has been shifting towards renewables and low carbon energy projects, however they have experienced low revenues on these projects as it currently seems to be less profitable than their previous projects. According to the OECD (2020), due to indirect pressure, firms are attempting to strengthen their sustainability efforts which can be costly whilst showing their financial resilience.

With regards to this paper some limitations include the sample as companies within this sample are only European, making it difficult to generalise the results to other continents. Furthermore, the sample only consists of companies within the energy industry with a similar asset base, therefore making it complicated to generalise to smaller companies within the same industry or even larger companies outside the energy sector. It also affects the validity of the results as only a small sample of nine companies were incorporated in this study. A larger sample would have yielded more accurate results making it easier to identify a significant relationship within the data.

With oil prices increasing and governments encouraging measures to solve the climate catastrophe, some experts and ESG investors predicted oil and gas corporations to reinvest their earnings in low-carbon technologies. With this being done successfully companies can fortify their businesses by repaying debts amassed during the Covid-19 pandemic, thus increasing its dividends and purchasing back their stock.

Companies within the energy industry especially within the oil and gas sector should begin their transformation to renewable energy as well as low carbon energy. They should opt to invest in projects that assist in energy transition and this could include hydrogen production, wind farms and electric charging networks considering the shift towards electric vehicles is currently taking place. Investing in energy transition now will make it easier for these firms to have a greater long term environmental impact, meet future demand and compete with other players within the industry as well as improve their access to financial services.

Firms within this industry should consider publishing full ESG reports that thoroughly expound on their ESG initiatives and how it will affect the company’s future as well its performance overall. This would boost a firm’s worth by demonstrating its social responsibility and might have an impact on good occurrences while eliminating unfavourable events.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2022.1031827/full#supplementary-material

Achim, M. V., Borlea, S. N., and Mare, C. (2016). Corporate governance and business performance: Evidence for the Romanian economy. J. Bus. Econ. Manag. 17 (3), 458–474. doi:10.3846/16111699.2013.834841

Adanacioglu, H., and Yercan, M. (2012). An analysis of tomato prices at wholesale level in Turkey: An application of SARIMA model. Custos e@ gronegócio line 8 (4), 52–75.

Ahmed, B., Akbar, M., Sabahat, T., Ali, S., Hussain, A., Akbar, A., et al. (2021). Does firm life cycle impact corporate investment efficiency? Sustainability 13 (1), 197. doi:10.3390/su13010197

Akisik, O., and Gal, G. (2014). Financial performance and reviews of corporate social responsibility reports. J. Manag. Control 25, 259–288. doi:10.1007/s00187-014-0198-2

Amel-Zadeh, A., and Serafeim, G. (2018). Why and how investors use ESG information: Evidence from a global survey. Financial Analysts J. 74 (3), 87–103. doi:10.2469/faj.v74.n3.2

Amon, J., Rammerstorfer, M., and Weinmayer, K. (2021). Passive ESG portfolio management—the benchmark strategy for socially responsible investors. Sustainability 13 (16), 9388. doi:10.3390/su13169388

Arouri, M., Gomes, M., and Pukthuanthong, K. (2019). Corporate social responsibility and M&A uncertainty. J. Corp. Finance 56, 176–198. doi:10.1016/j.jcorpfin.2019.02.002

Arzo Ahmed, S. N., and Moloy, M. D. J. (2021). Modeling and forecasting of time series data using different techniques. Multicult. Educ. 7 (11).

Auer, B. R., and Schuhmacher, F. (2016). Do socially (ir)responsible invest-ments pay? New evidence from international ESG data. Q. Rev. Econ. Finance 59, 51–62. doi:10.1016/j.qref.2015.07.002

Asness, C., Frazzini, A., Israel, R., Moskowitz, T. J., and Pedersen, L. H. (2018). Size matters, if you control your junk. J. Financial Econ. 129 (3), 479–509. doi:10.1016/j.jfineco.2018.05.006

Aureli, S., Gigli, S., Medei, R., and Supino, E. (2020). The value relevance of environmental, social, and governance disclosure: Evidence from DowJones Sustainability World Index listed companies. Corp. Soc. Responsib. Environ. Manag. 27, 43–52. doi:10.1002/csr.1772

Bamber, L. S. (1986). The information content of annual earnings releases: A trading volume approach. J. Account. Res. 24 (1), 40–56. doi:10.2307/2490803

Baran, M., Kuźniarska, A., Makieła, Z., Sławik, A., and Stuss, M. (2022). Does ESG reporting relate to corporate financial performance in the context of the energy sector transformation? Evidence from Poland. Energies 15 (2), 477. doi:10.3390/en15020477

Barnea, A., and Rubin, A. (2010). Corporate social responsibility as a conflict between shareholders. J. Bus. Ethics 97, 71–86. doi:10.1007/s10551-010-0496-z

Becchetti, L., Di Giacomo, S., and Pinnacchio, D. (2008). Corporate social responsibility and corporate performance: Evidence from a panel of US listed companies. Appl. Econ. 40, 541–567. doi:10.1080/00036840500428112

Berg, F., Kölbel, J., and Rigobon, R. (2022). Aggregate confusion: The divergence of ESG ratings, 6–10. [ebook].

Bhuiyan, M. B. U., and Nguyen, T. H. N. (2020). Impact of CSR on cost of debt and cost of capital: Australian evidence. Soc. Responsib. J. 3, 419–430. doi:10.1108/SRJ-08-2018-0208

Billio, M., Costola, M., Hristova, I., Latino, C., and Pelizzon, L. (2021). Inside the ESG ratings: (Dis)agreement and performance. Corp. Soc. Responsib. Environ. Manag. 28 (5), 1426–1445. doi:10.1002/csr.2177

Bloomberg, (2020). Forget amazon: In europe, small caps are pandemic’s big winners. Retrieved 28 April 2022, from https://www.bloomberg.com/news/articles/2020-10-03/forget-amazon-in-europe-small-caps-are-pandemic-s-big-winners?leadSource=uverify%20wall.

Bloomberg, L. P. (2022). Company information. [accessed at: https://www.bloomberg.com/europe (Retrieved 10 May, 2022).

Brammer, S., Brooks, C., and Pavelin, S. (2006). Corporate social performance and stock returns: UK evidence from disaggre- gate measures. Financ. Manag. 35 (3), 97–116. doi:10.1111/j.1755-053x.2006.tb00149.x

Branco, M. C., and Rodrigues, L. c. L. (2006). Corporate social responsibility and resource-based perspectives. J. Bus. Ethics 69, 111–132. doi:10.1007/s10551-006-9071-z

Broadstock, D. C., Chan, K., Cheng, L. T. W., and Wang, X. (2021). The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Finance Res. Lett. 38, 101716. doi:10.1016/j.frl.2020.101716

Brogi, M., and Lagasio, V. (2019). Environmental, Social, and Governance and company profitability: Are financial intermediaries different? Corp. Soc. Responsib. Environ. Manag. 26, 576–587. doi:10.1002/csr.1704

Cappucci, M. (2017). The ESG integration paradox. Available at SSRN: https://ssrn.com/abstract=2983227.

Carroll, A. B. (1979). A three-dimensional conceptual model of corporate performance. Acad. Manage. Rev. 4, 497–505. doi:10.5465/amr.1979.4498296

Ching, H. Y., Gerab, F., and Toste, T. H. (2017). The quality of sustainability reports and corporate financial performance: Evidence from Brazilian listed companies. SAGE Open 7 (2), 215824401771202. Article 712027. doi:10.1177/2158244017712027

Clark, G. L., Feiner, A., and Viehs, M. (2015). From the stockholder to the stakeholder. How sustainability can drive financial outperformance. SSRN Electron. J. doi:10.2139/ssrn.2508281

Coalition for Environmentally Responsible Economies (CERES) (2010).In Biodiversity and traditional knowledge, 318.

Connelly, B. L., Ketchen, D. J., and Slater, S. F. (2011). Toward a “theoretical toolbox” for sustainability research in marketing. J. Acad. Mark. Sci. 39 (1), 86–100. doi:10.1007/s11747-010-0199-0

Corporate Finance Institute (2022). Market capitalization. Retrieved 27 January 2022, from https://corporatefinanceinstitute.com/resources/knowledge/finance/what-is-market-capitalization/.

Crisóstomo, V., de Souza Freire, F., and Cortes de Vasconcellos, F. (2011). Corporate social responsibility, firm value and financial performance in Brazil. Soc. Responsib. J. 7 (2), 295–309. doi:10.1108/17471111111141549

Cui, J., Jo, H., and Na, H. (2018). Does corporate social responsibility affect information asymmetry? J. Bus. Ethics 148 (3), 549–572. doi:10.1007/s10551-015-3003-8

De Silva Lokuwaduge, , Chitra, S., and de Silva, K. (2020). Emerging corporate disclosure of environmental social and governance (ESG) risks: An Australian study. Australas. Account. Bus. Finance J. 14 (2), 35–50. doi:10.14453/aabfj.v14i2.4