- 1School of International Business, Guangxi University, Nanning, China

- 2College of Business, Shanghai University of Finance and Economics, Shanghai, China

Using a sample of Chinese listed firms during 2010–2018, this paper examines the relationship between digital financial inclusion and firms’ ESG disclosure. The results show that 1) digital financial inclusion can significantly promote firms’ ESG disclosure; 2) the promotion effect of digital financial inclusion on firms’ ESG disclosure occurs mainly through channels including the coverage breadth and usage depth; and 3) for firms with higher financing constraints and state-owned enterprises, the promotion effect of digital financial inclusion on firms’ ESG disclosure is more prominent. This paper provides relevant conclusions and insights for promoting firms’ ESG information disclosure, integrating the digital economy, and encouraging innovation development.

1 Introduction

Environmental, social, and governance (ESG) has been gaining considerable importance in recent years, especially in developing sustainable strategies. With numerous financial, social, and environmental crises, investors’ social awareness has increased significantly. At the G20 summits, China’s “High Principles of Digital Financial Inclusion” have been considered one of the guiding documents for the international community in the field of digital financial inclusion. This shows the international community’s recognition of China’s achievements in the field of digital finance. Digital financial inclusion can promote economic inclusion and growth using current internet technology and through computer information processing, data integration, and other related technologies for long-term modern financial exclusion. Moreover, it is an excellent way to enjoy formal financial services and all forms of sustainable development governance and to achieve ESG performance growth.

The ESG disclosure of firms has been a worldwide concern (Minutolo et al., 2019; Huang et al., 2022), especially in developing countries like China (Broadstock et al., 2021; Zhang et al., 2022). Most studies have discussed firms’ ESG disclosure from the perspectives of two main trends. On the one hand, the mainstream literature has relied on the economic consequences of firms’ ESG disclosure, including market information asymmetry (Siew et al., 2016), firm value (Yu et al., 2018; Wong et al., 2021), equity market liquidity (Egginton & McBrayer, 2019), financial performance (Minutolo et al., 2019), and earnings management practices (Kolsi et al., 2022). On the other hand, a growing strand of literature has started to take influence factors of firms’ ESG disclosure into consideration, such as board gender (Manita et al., 2018), CEO tenure (McBrayer, 2018), CEO power (Velte, 2019), and board structure (Husted & de Sousa-Filho, 2019), which is beneficial to empowering firms’ ESG disclosure and alleviating ESG information asymmetry of the capital market. The aforementioned trends mainly focus on the perspective of firms’ characteristics. However, they ignore the potential effects of digital financial inclusion on firms’ ESG disclosure. Therefore, the current paper aims to fill this gap by analyzing the relationship between digital financial inclusion and ESG disclosure of firms.

In China, firms’ ESG disclosure has been vigorously promoted and developed. In 2018, the Asset Management Association of China issued “the Green Investment Guidelines (for trial implementation),” which proposed the ESG disclosure framework for listed firms and required listed firms to disclose ESG information. The ESG disclosure system has accelerated the green transformation and development speed of Chinese listed firms, improved the transparency of the capital market, and been conducive to reducing information asymmetry between firms and investors. Therefore, facilitating firms’ ESG disclosure is conducive to stakeholders forming a better understanding of firms, reducing the uncertainty risk brought by information asymmetry, and improving the stability of the stock market. Therefore, we examine the relationship between digital financial inclusion and firms’ ESG disclosure in the Chinese institution background. This will help clarify the driving force of firms’ ESG disclosure. To some extent, the current paper not only has certain practical significance in China but also provides insights into the development of ESG disclosure in emerging market countries.

Additionally, a growing strand of literature has discussed how digital financial inclusion alleviates corporate financing constraints and information asymmetry, potentially affecting firms’ ESG disclosure (Fuster et al., 2019; Murinde et al., 2022). Hence, with the boosting of digital financial inclusion, it is puzzling that few studies have focused on ESG disclosure consequences caused by digital financial inclusion at the firm level (Siew et al., 2016; Zhang et al., 2022). So far, there is no clear conclusion about the impact of digital financial inclusion on firms’ ESG disclosure. The relationship between digital financial inclusion and firms’ ESG disclosure as a critical aspect of strategic decision-making remains unexplored (Broadstock et al., 2021; Luo et al., 2022). It is necessary to further explore whether and how digital financial inclusion affects firms’ ESG disclosure.

This paper explores the relationship between digital financial inclusion and firms’ disclosure of ESG. First, the paper merges panel data of Chinese A-share nonfinancial listed firms, including disclosure of ESG collected from the Bloomberg database and the digital inclusive finance index of Chinese prefecture-level cities during 2011–2018. Then, the paper examines the effect of digital financial inclusion on firms’ disclosure of ESG information based on the fixed-effect OLS model. The empirical results show that 1) digital financial inclusion can significantly promote firms’ ESG information disclosure; 2) the promotion effect of digital financial inclusion on firms’ ESG information disclosure occurs mainly through channels including the coverage breadth and usage depth; and 3) for firms with higher financing constraints and state-owned enterprises, the promotion effect of digital financial inclusion on firms’ disclosure of ESG information is more prominent.

This study contributes to digital financial inclusion and firms’ ESG disclosure literature in three ways. First, the study enriches the literature on the effect of digital financial inclusion on corporate strategic decision-making from the perspective of firms’ ESG disclosure. It can help us achieve a deeper understanding of how digital financial inclusion can influence corporate ESG behavior and information disclosure outcomes (Sedunov, 2017; Fuster et al., 2019; Goldstein et al., 2019; Thakor, 2020). Second, this study advances the investigation of the influence factors of firms’ ESG disclosure from the external financial environment perspective (i.e., digital financial inclusion). The study expands the understanding of the factors affecting firms’ ESG disclosure and goes beyond previous studies based on the single perspective of corporate characteristics (Manita et al., 2018; McBrayer, 2018; Husted & de Sousa-Filho, 2019; Velte, 2019). Third, the paper extends the understanding of the consequences of digital financial inclusion at the firm level and provides insights into the financial-development-driven force of firms’ ESG disclosure in emerging market countries (Husted & de Sousa-Filho, 2019; Jia & Lin, 2020; Li et al., 2021; Zhang et al., 2022).

The remainder of this paper is structured as follows: Section 2 consists of the literature review and hypothesis development. Section 3 describes the empirical strategy, including the empirical models, sample selection, and variables. Section 4 consists of the benchmark results, heterogeneous analysis, and robustness check. Section 5 provides the conclusions and insights.

2 Theoretical analysis and hypothesis development

The development of digital financial inclusion has improved the information environment of companies and thus facilitated their ESG disclosure behavior. On the one hand, it has helped reduce information asymmetry between investors and firms (Goldstein et al., 2019). According to the signaling theory (Arvidsson & Dumay, 2022), the development of digital financial inclusion reduces information asymmetry between firms and external investors (Lv & Xiong, 2022), allowing firms to release positive signals to external investors. This in turn reduces the stock market uncertainty risk and attracts more investment. Firms’ ESG disclosure releases signals to stakeholders that the firm is not entirely profit-seeking and selfish (Bhandari et al., 2022), which builds a good image of the firm. The firm continuously accumulates and forms reputational capital, actively engages in ESG activities, and releases positive ESG signals, which aids the firm’s disclosure of more ESG information. On the other hand, the development of digital financial inclusion helps alleviate information asymmetry between firms and financial institutions (Sedunov, 2017), and external financial institutions can assess the financial status and risk level of firms with diversified digital means (Gomber et al., 2017). To increase financial institutions’ willingness and enhance firms’ credit financing ability, firms will engage in and disclose more information related to ESG, aiming to send a signal to the market that the firms are practicing the concept of sustainable development. Firms desire to obtain a positive response from relevant investors by showing ESG green advantages. Therefore, with the development of digital financial inclusion, firms will engage in more ESG activities and carry out more ESG information disclosure.

The development of digital financial inclusion helps managers implement the concept of sustainable development, avoid short-sightedness, and enhance the ability of enterprises to cope with risks (Fuster et al., 2019; Yin et al., 2019). According to the upper echelon theory (Hambrick & Mason, 1984), with the development of digital financial inclusion, managers can identify and approve of the ESG concept (Yonker, 2017). The fulfillment of firms’ ESG social responsibility also lies in meeting the demands of stakeholders, creating a good external environment for corporate development, reducing potential risks of firms (Esposito De Falco et al., 2021), and thus promoting corporate ESG to engage in information disclosure. Furthermore, the development of digital inclusive finance has improved the corporate financing environment (Sedunov, 2017), reduced the cost of external financing, facilitated access to external financing (Fuster et al., 2019), helped enhance the market competitiveness of enterprises, and increased corporate value (Murinde et al., 2022). Thus, it has allowed firms to have more liquidity and cash flow and increased the level of shareholder wealth (Thakor, 2020), providing more support for enterprises to engage in ESG activities and promoting firms to engage in more ESG behaviors, including ESG information disclosure.

Hypothesis. Digital financial inclusion is positively associated with firms’ disclosure of ESG.

3 Empirical models, sample selection, and variables

3.1 Empirical models

To estimate the effects of digital financial inclusion on firms’ disclosure of ESG, we used a regression model. We defined the model as follows:

where i and t indicate the firm and year, respectively; the dependent variable ESG represents a firm’s disclosure of ESG; DFI refers to the digital financial inclusion index of the firm’s registered address; and CVs refer to control variables, which aim to control other heterogeneous characteristics at the firm level. This study controlled for state-owned enterprise (SOE), firm size (SIZE), leverage (LEV), return on asset (ROA), board size (BOARD), power concentration (BOTH), and shareholder ratio of the top management team (SR). Furthermore, industry-specific fixed effects μi were added to the regression to account for industry-specific characteristics. In contrast, time-specific fixed effects θt were used to capture all time-variant macro-level factors common to firms. c refers to the constant term. To account for potential serial correlation and heteroskedasticity, we clustered standard errors at the industry level.

In Model (1), the coefficient of interest is β1, which indicates the effect of digital financial inclusion on firms’ disclosure of ESG. β1 should be significantly positive because digital financial inclusion can promote firms’ disclosure of ESG.

3.2 Sample coverage and data sources

We combined three data sources to examine the effect of digital financial inclusion on firms’ disclosure of ESG. The first data source was the China Stock Market & Accounting Research database, which contains detailed information about all Chinese listed firms’ annual reports and firms’ financial information. The second data source was the digital financial inclusion index database, named “The Peking University Digital Financial Inclusion Index of China.” It is the most comprehensive online digital financial inclusion database and provides detailed Chinese prefecture-level data on the digital financial inclusion index, which comprises the digital financial inclusion index and other essential dimensions (such as coverage breadth, digitization level, and usage depth). The third database was the Bloomberg ESG disclosure score. Bloomberg provides ESG data to more than 9,000 companies in more than 83 countries from public documents, such as social corporate responsibility reports, corporate annual reports, and corporate websites.

We chose all Chinese nonfinancial listed companies (excluding enterprises in the financial and real estate industries) listed on the Shanghai and Shenzhen exchanges from 2011 to 2018. We obtained our regression sample for the empirical analysis by merging the aforementioned three databases through manual matching of firms’ registered addresses and names by year.

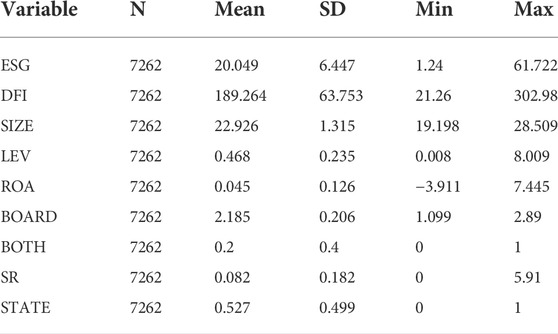

We obtained our regression sample for the analysis by manually matching the firms’ registered addresses through a merger of the two databases. Following the previous research (Ding et al., 2018), we imposed the following restrictions: 1) we deleted firms from the financial industry and 2) we deleted firms that were specially treated. We winsorized the continuous variables at the 1% and 99% levels to minimize outlier effects. Table 1 lists the definitions of all the variables, while Table 2 reports the summary of statistics.

3.3 Disclosure of environmental, social, and governance

ESG scores comprised three fundamental dimensions: environmental, social, and governance. Within all dimensions, the scores range from 0 to 100, and the maximum value represents the enterprise’s highest level of sustainable activity. ESG evaluates enterprises based on industry attributes, which is a relative value. We defined each company’s ESG score by the Bloomberg ESG disclosure score. Bloomberg provides ESG data to more than 9,000 companies in more than 83 countries from public documents, such as social corporate responsibility reports, corporate annual reports, and corporate websites. Bloomberg established the ESG database in early 2008. The ESG Yuan Shu score algorithm is based on the global reporting initiative for enterprise sustainable development report standards. These data points are mainly disclosed related to social environment corporate social responsibility performance. In 2010, the ESG team increased the data points to 101 points through additional “Bloomberg indicators.” These additional indicators mainly disclosed the activities of relevant companies in communication, learning, and strengthening awareness of corporate responsibility, including governance related to the social environment. The Bloomberg’s ESG database provides enough information to disclose CSR activities and explore the relationship between digital financial inclusion and CSR activities.

3.4 The digital financial inclusion index

Thanks to the efforts of the Chinese central and local governments and the Peking University Digital Financial Research Center, “The Peking University Digital Financial Inclusion Index of China” has adopted the aforementioned database to measure digital financial inclusion (Bollaert et al., 2021; Lv & Xiong, 2022).

The general index of financial inclusion indicates the development status of digital inclusive finance in China. The three second-level indicators, respectively, represent the breadth of coverage, usage depth, and digitalization degree of digital inclusive finance. The main data source was the Alipay ecosystem, which mainly describes the development level of digital inclusive finance in different regions. It covers 31 mainland provinces, 377 cities above the prefecture level, and nearly 2,800 counties. The explanatory variable data selected in this paper were from “The Peking University Digital Financial Inclusion Index of China (2011–2020),” released by Peking University.

3.5 Other variables

Following the previous literature (Gulen & Ion, 2016; Ding et al., 2018), we defined the measurement of the other variables as follows: state-owned enterprise (SOE), measured by a dummy variable equal to 1 if the firm’s ownership is state owned and 0 otherwise; firm size (SIZE), measured by the natural logarithm of total assets; leverage (LEV), the ratio of total liabilities divided by total assets; return on asset (ROA), measured by the ratio of net profits relative to total assets; board size (BOARD), measured by the natural logarithm of the number of board members; and power concentration (BOTH), measured by a dummy variable equal to 1 if the CEO is also the chairman of the board and 0 otherwise. The shareholder ratio of the top management team (SR) is measured by the proportion of shares held by the top management team to the total share capital.

4 Results and discussion

4.1 Baseline regression

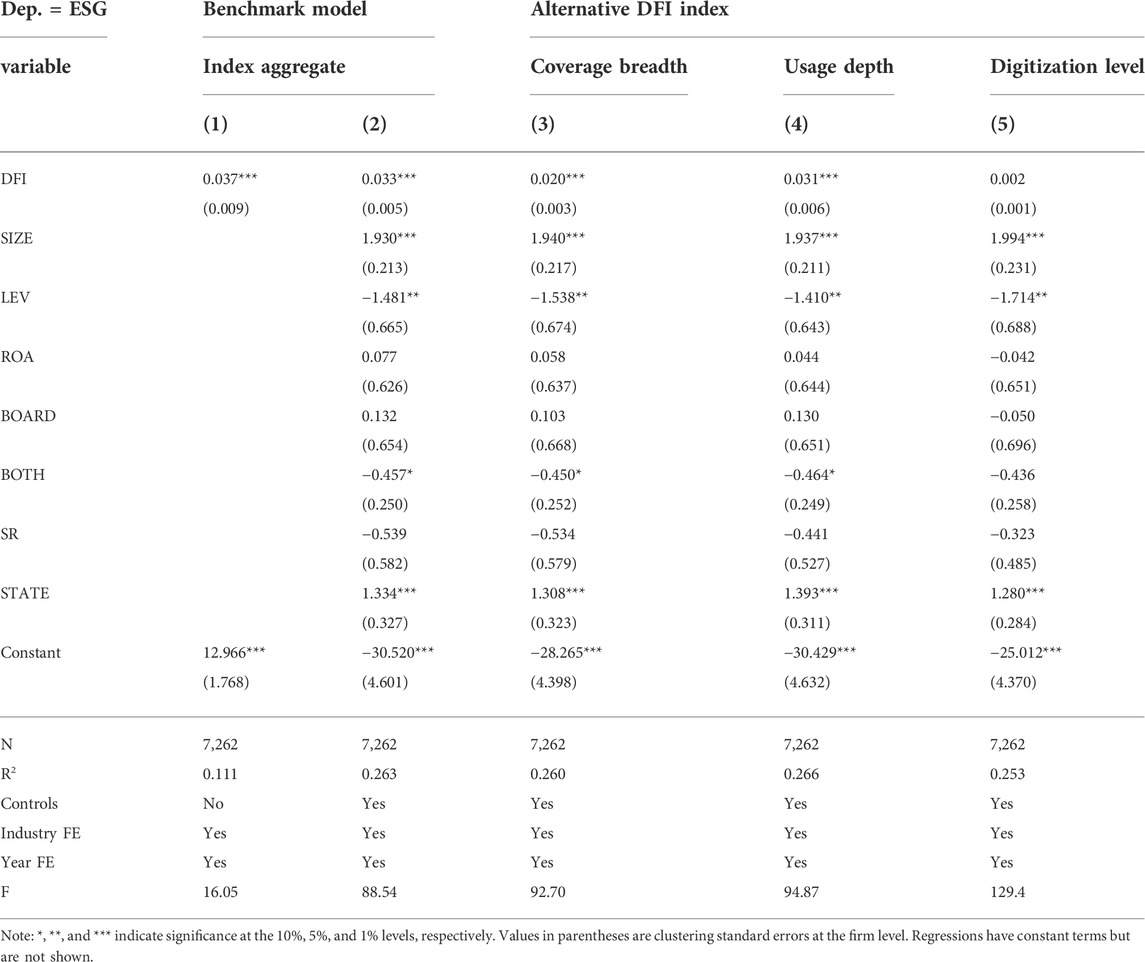

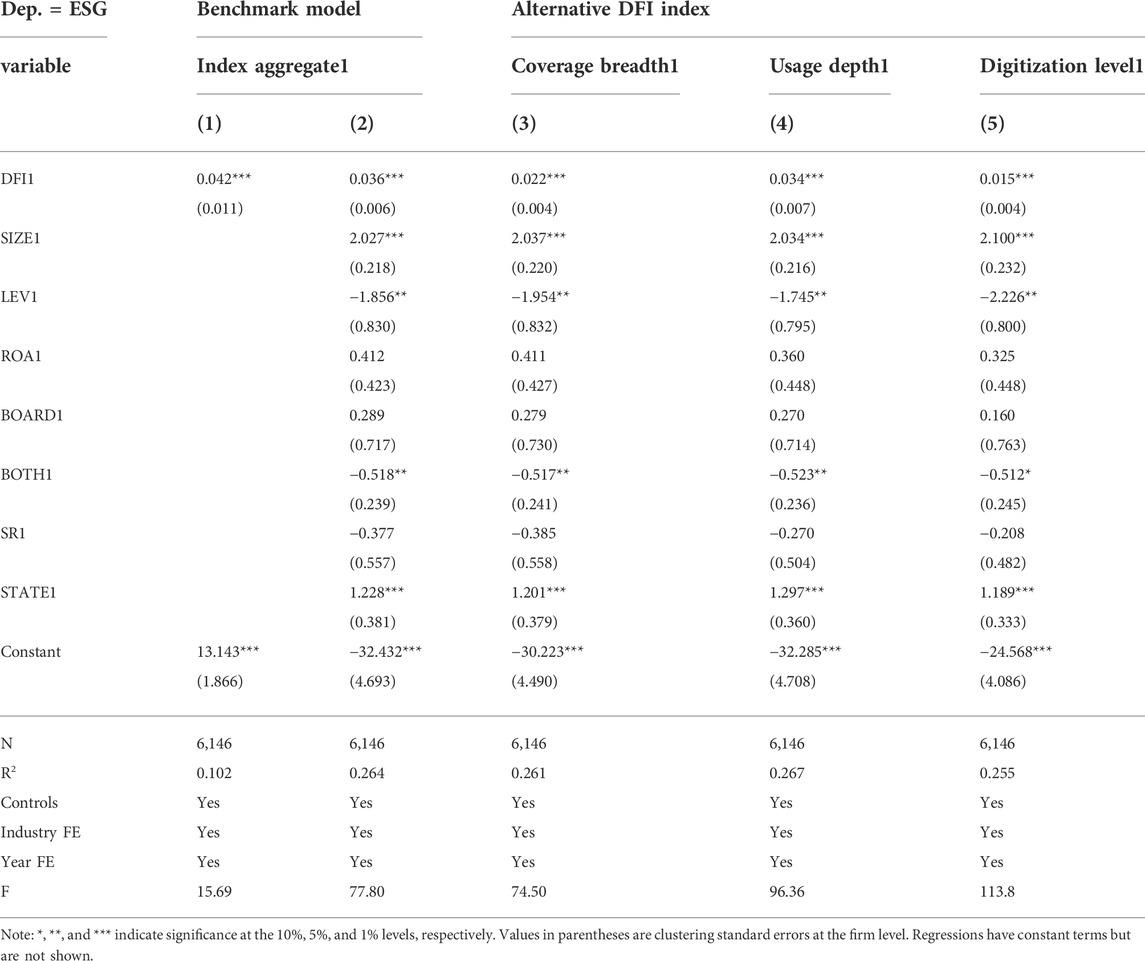

Table 3 shows the estimated results of the benchmark regression model. Three alternative indexes of digital financial inclusion (DFI), namely, breadth (coverage breadth), depth (usage depth), and digital level (digitization level), were employed to further test the effect of digital financial inclusion.

The regression results are as follows: under the benchmark regression, column 2) of Table 3 shows that the estimated coefficient of DFI is 0.033, which is significantly positive at 1%, thus indicating that the development of digital financial inclusion is significantly positively associated with firms’ ESG disclosure. This paper also employed three alternative indexes of digital financial inclusion, namely, breadth (coverage breadth), depth (usage depth), and digital level (digitization level) results, as columns (3), (4), and (5) show. The estimated coefficient of coverage breadth is 0.02 at the 1% significance level. The estimated coefficient of usage depth is 0.031 at the 1% significance level. The aforementioned results support our hypothesis that digital financial inclusion can effectively promote firms’ ESG disclosure.

Based on the estimation results in column 2) of Table 3, we find that a one-standard-deviation increase in digital financial inclusion raises a firm’s ESG disclosure score by 6.27 points, obtained by multiplying the standard deviation of the digital financial inclusion measure by the estimated coefficient. Considering that the mean of ESG disclosure is 20.049, this effect is also economically significant.

4.2 Additional analyses

4.2.1 Impact of financial constraints

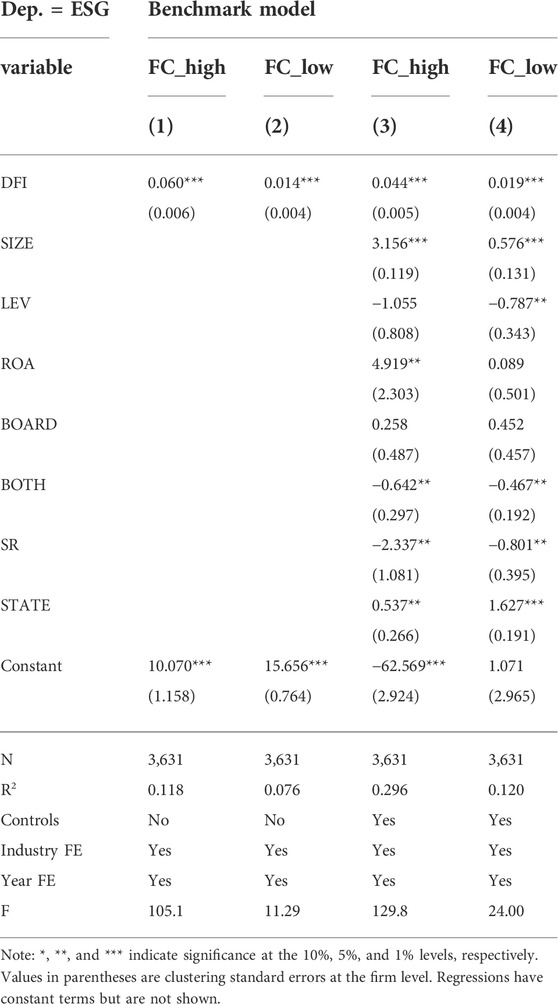

Following the literature (Hadlock & Pierce, 2010), we calculated the absolute value of the SA index to measure firms’ financing constraints. The greater the absolute value of the SA index, the greater the corresponding financing constraint would be. We then adopted the sorting method to classify all firms into two groups using the median value of the absolute value of the SA index. Firms whose SA was above the median were defined to exhibit higher financing constraints, named FC_high. Firms whose SA was lower than the median were defined to exhibit lower financing constraints, named FC_low. We estimated our benchmark model on the subsample of firms with higher financing constraints and lower financing constraints. The results are shown in Table 4.

As shown in Table 4, compared with columns 3) and 4), the estimated coefficient of DFI in column 3) is 0.044 at the 1% significance level, which is larger than the estimated coefficient of DFI in column 4). Therefore, we conclude that for firms with higher financing constraints, the promotion effect of digital financial inclusion on firms’ disclosure of ESG is more prominent.

4.2.2 Impact of state-owned enterprise

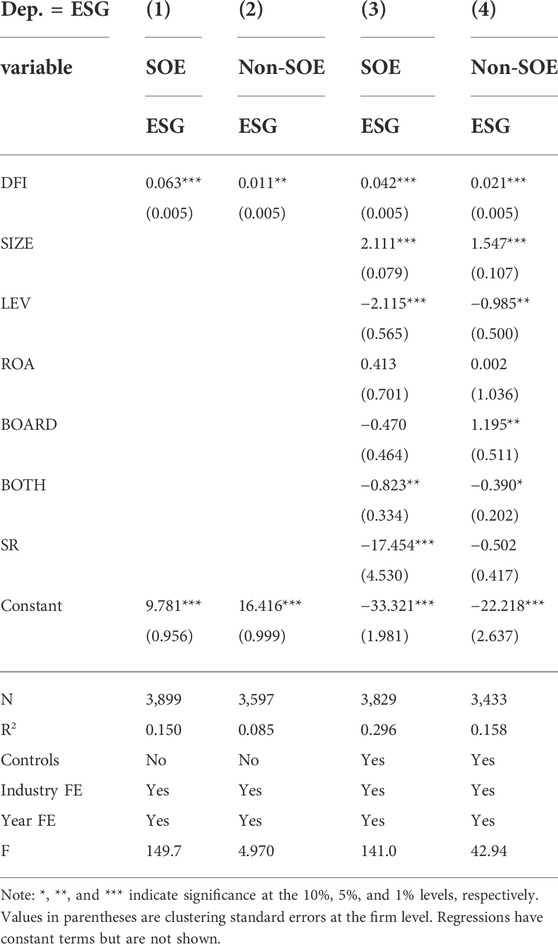

Compared to non-state-owned enterprises, state-owned enterprises will have more noneconomic goals in China (Ding et al., 2018). Therefore, the effect of digital financial inclusion on firms’ ESG disclosure potential will vary across ownership. We estimate our benchmark model on the subsample of state-owned enterprises (SOEs) and non-state-owned enterprises (non-SOEs). The related results are shown in Table 5.

Based on the results in Table 5, according to the comparison of columns 3) and 4), the estimated coefficient of DFI in SOEs is 0.042 at the 1% significance level, which is larger than the estimated coefficient of DFI in non-SOEs. This shows that digital financial inclusion exerts a more prominent effect on firms’ ESG disclosure in SOEs.

4.3 Robustness check

To mitigate the potential endogenous problems, we lagged the development level of regional digital financial inclusion with the control variables and conducted a regression analysis. The results are shown in Table 6.

According to Table 6, the estimated coefficient of DFI is still significantly positive at the 1% level. The lag breadth (coverage breadth 1), the lag depth (usage depth 1), and the lag digitization (digitization level 1) are all positively significant at the 1% level. Therefore, the results are still stable after considering the endogeneity problem.

5 Conclusion and discussion

Firms’ disclosure of ESG is important for their strategic decision-making. However, the topic of whether digital financial inclusion can promote firms’ disclosure of ESG needs to be further explored. We used the panel data for China’s nonfinancial listed firms from 2011 to 2018 to estimate the effects of digital financial inclusion on firms’ disclosure of ESG. The estimation results indicated that digital financial inclusion positively promotes firms’ disclosure of ESG. The positive effect was evident in SOEs. We also paid close attention to the role of the information environment and financial constraints. The positive effect was favorable in firms with a better information environment and high financial constraints. Additionally, we determined that the positive effect was robust after the lag difference.

From the perspective of corporate ESG disclosure behaviors, this paper first provides micro-empirical evidence for evaluating the effects of digital financial inclusion. The study argues that digital financial inclusion is an essential factor that promotes firms’ disclosure of ESG. Thus, on the one hand, a central government needs to develop digital financial inclusion and foster firms’ ESG disclosure positively. The government’s support for the development of digital financial inclusion can help firms engage in ESG and disclose it more actively, helping to achieve the goal of reducing peak carbon dioxide emissions and achieving carbon neutrality. Therefore, the government can advocate the development of digital financial inclusion and set multiple goals, including boosting digital financial inclusion and fostering firms’ ability to engage in ESG activities. On the other hand, firms are induced to disclose high-quality ESG information and then make full use of the benefits of the growth of digital financial inclusion to improve their competitiveness and attract more investor attention and investment.

Finally, this paper did not assess the impact of digital financial inclusion on firms’ ESG disclosure in different regions. Future studies can take various regional heterogeneities into consideration and re-examine the influence of digital financial inclusion on firms’ ESG disclosure.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding authors.

Author contributions

All authors contributed to the conception and design of study. Data collection and empirical study were conducted by YL. Supervision and writing of the first draft were performed by LW. YZ contributed to the critical revision of the manuscript and final approval of the version to be published. All authors contributed to the article and approved the submitted version.

Funding

This work was supported by the “2021 Postgraduate Innovation Funds for the Shanghai University of Finance and Economics” [grant numbers CXJJ-202-404].

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Arvidsson, S., and Dumay, J. (2022). Corporate ESG reporting quantity, quality and performance: Where to now for environmental policy and practice? Bus. Strategy Environ. 31 (3), 1091–1110. doi:10.1002/bse.2937

Bhandari, K. R., Ranta, M., and Salo, J. (2022). The resource-based view, stakeholder capitalism, ESG, and sustainable competitive advantage: The firm’s embeddedness into ecology, society, and governance. Bus. Strategy Environ. 31 (4), 1525–1537. doi:10.1002/bse.2967

Bollaert, H., Lopez-de-Silanes, F., and Schwienbacher, A. (2021). Fintech and access to finance. J. Corp. Finance 68, 101941. doi:10.1016/j.jcorpfin.2021.101941

Broadstock, D. C., Chan, K., Cheng, L. T., and Wang, X. (2021). The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Finance Res. Lett. 38, 101716. doi:10.1016/j.frl.2020.101716

Ding, H., Fan, H., and Lin, S. (2018). Connect to trade. J. Int. Econ. 110, 50–62. doi:10.1016/j.jinteco.2017.10.004

Egginton, J. F., and McBrayer, G. A. (2019). Does it pay to be forthcoming? Evidence from CSR disclosure and equity market liquidity. Corp. Soc. Responsib. Environ. Manag. 26 (2), 396–407. doi:10.1002/csr.1691

Esposito De Falco, S., Scandurra, G., and Thomas, A. (2021). How stakeholders affect the pursuit of the Environmental, Social, and Governance. Evidence from innovative small and medium enterprises. Corp. Soc. Responsib. Environ. Manag. 28 (5), 1528–1539. doi:10.1002/csr.2183

Fuster, A., Plosser, M., Schnabl, P., and Vickery, J. (2019). The Role of technology in mortgage lending. Rev. Financ. Stud. 32 (5), 1854–1899. doi:10.1093/rfs/hhz018

Goldstein, I., Jiang, W., and Karolyi, G. A. (2019). To FinTech and beyond. Rev. Financ. Stud. 32 (5), 1647–1661. doi:10.1093/rfs/hhz025

Gomber, P., Koch, J.-A., and Siering, M. (2017). Digital Finance and FinTech: Current research and future research directions. J. Bus. Econ. 87 (5), 537–580. doi:10.1007/s11573-017-0852-x

Gulen, H., and Ion, M. (2016). Policy uncertainty and corporate investment. Rev. Financial Stud. 29 (3), 523–564.

Hadlock, C. J., and Pierce, J. R. (2010). New evidence on measuring financial constraints: Moving beyond the KZ index. Rev. Financ. Stud. 23 (5), 1909–1940. doi:10.1093/rfs/hhq009

Hambrick, D. C., and Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. Acad. Manage. Rev. 9 (2), 193–206. doi:10.5465/amr.1984.4277628

Huang, Q., Li, Y., Lin, M., and McBrayer, G. A. (2022). Natural disasters, risk salience, and corporate ESG disclosure. J. Corp. Finance 72, 102152. doi:10.1016/j.jcorpfin.2021.102152

Husted, B. W., and de Sousa-Filho, J. M. (2019). Board structure and environmental, social, and governance disclosure in Latin America. J. Bus. Res. 102, 220–227. doi:10.1016/j.jbusres.2018.01.017

Jia, Z., and Lin, B. (2020). Rethinking the choice of carbon tax and carbon trading in China. Technol. Forecast. Soc. Change 159, 120187. doi:10.1016/j.techfore.2020.120187

Kolsi, M. C., Al-Hiyari, A., and Hussainey, K. (2022). Does environmental, social and governance performance score mitigate earnings management practices? Evid. U. S. Commer. Banks 18, 1–16. doi:10.21203/rs.3.rs-1585001/v1

Li, K., Yan, Y., and Zhang, X. (2021). Carbon-abatement policies, investment preferences, and directed technological change: Evidence from China. Technol. Forecast. Soc. Change 172, 121015. doi:10.1016/j.techfore.2021.121015

Luo, S., Yimamu, N., Li, Y., Wu, H., Irfan, M., and Hao, Y. (2022). Digitalization and sustainable development: How could digital economy development improve green innovation in China? Bus. Strategy Environ. doi:10.1002/bse.3223

Lv, P., and Xiong, H. (2022). Can FinTech improve corporate investment efficiency? Evidence from China. Res. Int. Bus. Finance 60, 101571. doi:10.1016/j.ribaf.2021.101571

Manita, R., Bruna, M. G., Dang, R., and Houanti, L. (2018). Board gender diversity and ESG disclosure: Evidence from the USA. J. Appl. Account. Res. 19, 206–224. doi:10.1108/JAAR-01-2017-0024

McBrayer, G. A. (2018). Does persistence explain ESG disclosure decisions? Corp. Soc. Responsib. Environ. Manag. 25 (6), 1074–1086. doi:10.1002/csr.1521

Minutolo, M. C., Kristjanpoller, W. D., and Stakeley, J. (2019). Exploring environmental, social, and governance disclosure effects on the S&P 500 financial performance. Bus. Strategy Environ. 28 (6), 1083–1095. doi:10.1002/bse.2303

Murinde, V., Rizopoulos, E., and Zachariadis, M. (2022). The impact of the FinTech revolution on the future of banking: Opportunities and risks. Int. Rev. Financial Analysis 81, 102103. doi:10.1016/j.irfa.2022.102103

Sedunov, J. (2017). Does bank technology affect small business lending decisions? J. Financial Res. 40 (1), 5–32. doi:10.1111/jfir.12116

Siew, R. Y., Balatbat, M. C., and Carmichael, D. G. (2016). The impact of ESG disclosures and institutional ownership on market information asymmetry. Asia-Pacific J. Account. Econ. 23 (4), 432–448. doi:10.1080/16081625.2016.1170100

Thakor, A. V. (2020). Fintech and banking: What do we know? J. Financial Intermediation 41, 100833. doi:10.1016/j.jfi.2019.100833

Velte, P. (2019). Does CEO power moderate the link between ESG performance and financial performance? A focus on the German two-tier system. Manag. Res. Rev. 43, 497–520. doi:10.1108/MRR-04-2019-0182

Wong, W. C., Batten, J. A., Mohamed-Arshad, S. B., Nordin, S., and Adzis, A. A. (2021). Does ESG certification add firm value? Finance Res. Lett. 39, 101593. doi:10.1016/j.frl.2020.101593

Yin, Z., Gong, X., Guo, P., and Wu, T. (2019). What drives entrepreneurship in digital economy? Evidence from China. Econ. Model. 82, 66–73. doi:10.1016/j.econmod.2019.09.026

Yonker, S. E. (2017). Do managers give hometown labor an edge? Rev. Financ. Stud. 30 (10), 3581–3604. doi:10.1093/rfs/hhx030

Yu, E. P., Guo, C. Q., and Luu, B. V. (2018). Environmental, social and governance transparency and firm value. Bus. Strategy Environ. 27 (7), 987–1004. doi:10.1002/bse.2047

Keywords: digital financial inclusion, ESG disclosure, financing constraints, listed firms, China, ownership structure

Citation: Lu Y, Wang L and Zhang Y (2022) Does digital financial inclusion matter for firms’ ESG disclosure? Evidence from China. Front. Environ. Sci. 10:1029975. doi: 10.3389/fenvs.2022.1029975

Received: 28 August 2022; Accepted: 25 October 2022;

Published: 10 November 2022.

Edited by:

Mohamed Chakib Kolsi, Emirates College of Technology, United Arab EmiratesReviewed by:

Valeria Naciti, University of Messina, ItalyMário Nuno Mata, Instituto Politécnico de Lisboa, Portugal

Copyright © 2022 Lu, Wang and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Liang Wang, bHVtaW5vdXNfd2FuZ0AxNjMuc3VmZS5lZHUuY24=; Yu Zhang, eXVfemhhbmdAMTYzLnN1ZmUuZWR1LmNu

Yichun Lu

Yichun Lu Liang Wang

Liang Wang Yu Zhang

Yu Zhang