- 1Business School, Shandong University of Technology, Zibo, China

- 2Department of Ophthalmology, Zibo Central Hospital, Zibo, China

In recent years, the resource shortage and environmental degradation have made enterprises and governments increasingly aware of the importance of sustainable development. Meanwhile, the COVID-19 pandemic has also increased the shortage of medical materials. Based on this, we investigate the tradeoff of the critical medical devices refurbishing strategies when blockchain is used in three different structures: manufacturer refurbishing, retailer refurbishing, and third-party refurbishing in the two-period refurbishing strategies. We find that the manufacturer always benefits from the adoption of blockchain technology strategy in the manufacturer refurbishing scenario. However, for the retailer in the second period, the retailer references the adoption of blockchain only if the willingness to pay is extremely high. Additionally, when the medical supply chain channel member chooses retailer refurbishing or third-party strategy, the manufacturer always likes to use blockchain technology. That’s because it will help the information value spillover from the retailer to the manufacturer, which leads the manufacturer to get more profits and a lower profit for the retailer. However, in the retailer refurbishing or third-part strategy, the whole channel profits are higher than not adopting blockchain technology. Therefore, business managers can be based on our research to achieve profits Pareto-improving.

1 Introduction

Major public health emergencies such as the COVID-19 pandemic spread to almost all countries worldwide and have caused a shortage of medical materials (Liu Z et al., 2021; Fabris, 2022). According to data from Polaris Market Research, the impact of COVID-19 will increase the remanufactured medical imaging device market swell to $21.14 billion by 2027. In order to expand the supply and maximize the utilization efficiency of the extremely limited medical, the government encouraged automakers such as General Motors, BMW, SGM, and Toyota to join the medical devices refurbishing strategy to confront COVID-19 (Niu et al., 2022a). This effectively expands supply and achieves environmental, economic, and social performance goals.

Meanwhile, although the quality of the refurbished critical medical devices is increasing sharply, consumers, such as hospitals and medical institutions, are always sensitive to the refurbished devices they purchase. In order to solve these problems, plenty of manufacturers are trying to adopt blockchain technology because blockchain technology has the advantage of production information transparency, quality control, inspection, and logistics information transparency. This can be used to track anyone’s new/refurbished critical medical device’s authenticity from start to finish, in which all the channel members can get accurate information. It will help hospitals and medical institutions make informed purchase decisions and help manufacturers and retailers get accurate demand information (Niu et al., 2021a; Cao and Shen, 2022). It is clear to see that adopting blockchain technology will improve and solve purchasers’ demand uncertainty problems. Meanwhile, adopting blockchain technology also improves the brand image and extends the manufacturer’s selling market, lower inventories, and higher profit margins, ultimately achieving profitability and social responsibility goals.

However, in practice, retailers have more accurate demand information than manufacturers when they do not adopt blockchain technology. Therefore, if the retailer has the incentive to adopt a blockchain strategy? In which conditions will all channel members benefit from adopting blockchain technology? Which will be one of our research purposes. In addition, our research issue becomes our research issue of which channel member will effectively refurbish the used critical medical devices and then get more profits. Based on this, this study compares three different refurbishing structures with and without adopting blockchain technology in the two-period refurbishing strategies: manufacturer refurbishing, retailer refurbishing, and third-party refurbishing. Therefore, our research investigates the following questions: 1) Is blockchain technology always beneficial to the manufacturer and retailer? 2) Under which conditions and refurbishing structure, all channel members will be using blockchain strategy. 3) How would the customers’ belief

Motivated by the real-world application of blockchain for medical devices refurbishing and different refurbishing structures in the early days of major public health emergencies, we build the critical medical device refurbishing strategies with and without blockchain adoption in three different structures: manufacturer refurbishing, retailer refurbishing, and third-party refurbishing in the two-period refurbishing strategies. Following Niu et al. (2021a), we assume the retailer is more familiar with the market and has accurate demand information even without using blockchain technology. We focus on whether blockchain technology can benefit all the channel members and on which refurbishing structure all the channels can achieve Pareto-improving. Our research contributes to the extant literature can be summarized as follows.

1. To the best of our knowledge, our work first fills the research gap in examining the use of blockchain in the two-period medical devices refurbishing strategy, which is motivated by the shortage of medical materials during the impact of COVID-19. For the retailer in the first selling period, she references using blockchain technology that’s because it can help the retailer to get more demands and ultimately leads to a higher profit. For the retailer in the second period, the retailer’s reference depends on the consumer’s willingness to pay. Meanwhile, when the consumer’s willingness to pay is extremely high, the retailer can benefit more in the manufacturer refurbishing scenario.

2. We focus on different refurbishing structures: manufacturer refurbishing, retailer refurbishing, and third-party refurbishing in the two-period refurbishing strategies, which extended the refurbishing structures literature. We find that adopting blockchain technology will enhance the manufacturer and retailer’s price power. With the consumer’s willingness to pay increases, the manufacturer always benefits more in the manufacturer refurbishing scenario. Meanwhile, when the consumer’s willingness to pay is low, the retailer always benefits in the retailer refurbishing scenario. With the parameter

3. We show the impacts of consumers’ willingness to pay and customers’ belief in channel members’ preferences in the first and second selling periods when adopting blockchain. We find that when the consumer’s willingness to pay

The rest of this paper is organized as follows. Section 2 reviews the related literature. Section 3 developed a new model with and without adopting blockchain technology in the two-period refurbishing strategy. Section 4 extends the basic model by considering retailer and third-part refurbishing scenarios and comparing equilibrium outcomes under different refurbishing structures with and without blockchain technology. Section 5 uses numerical analysis to illustrate optimal environmental, economic, and social performance. Section 6 concludes the paper and discusses future research directions.

2 Literature review

Our research is closely related to the literature on critical medical device refurbishing, blockchain technology in quality guarantee, and the two-period refurbishing market structure.

2.1 Critical medical devices refurbishing

Heese et al. (2005) discussed that refurbished hospital equipment would significantly save costs. Hasani et al. (2015) propose a model for medical devices CLSC to save medical materials. Leung et al. (2018) show us that refurbished medical devices have good mechanical performance, and they would not put patient safety at risk. Budak and Ustundag (2016) presented a mathematical model to minimize the cost of medical waste in hospitals or health institutions. Eze et al. (2019) discussed a new definition for medical equipment remanufacture. Kargar et al. (2020) investigate a Reverse logistics model for medical waste management. Based on the emergency demands for medical devices, Oturu et al. (2021) investigate the applicability of remanufacturing medical equipment. Shafiee Roudbari et al. (2021) investigate a two-stage stochastic model in a medical equipment supply chain, considering uncertainty on the quality and quantity of returned products. As the increasing waste in the hospital and medical institutions and affected by major public health emergencies, governments began to drive the growth of sustainable practices in the medical devices industry actively (Akano et al., 2021). In order to reduce the environmental pollution caused by medical devices, Liu J et al. (2021) investigate how government intervention affects remanufacturing medical equipment supply chain in a game model. The key difference between this study and the above research is that we consider blockchain technology to improve the image of refurbished critical medical devices. Meanwhile, we consider three different refurbishing structures which are widely used in the real world.

2.2 Blockchain technology in quality guarantee

Choi (2019) built three different models to explore the values of blockchain technology in luxury supply chains. They find that the blockchain technology-supported platform can improve the brand image and ultimately achieve optimal performance among all three scenarios. Liu J et al. (2021) proposed a supply chain structure in the fusion application environment of blockchain to improve the trust relationships among chain members and product trustworthiness. Niu et al. (2021a) investigate the Incentive alignment for blockchain adoption in medicine supply chains. They find that adopting blockchain can improve the brand image and always benefits customers and society. Niu et al. (2021b) study the impact of blockchain on a retailer and her suppliers in the agricultural supply chain. They find that low-quality products seller will be better off in blockchain when the retailer’s brand image improvement is sufficiently significant. Tan (2022) introduced blockchain technology in the pre-owned virtual item market. They show that introducing blockchain can enhance consumer trust, guarantee product quality, and ultimately benefit both the developer and the consumer. Niu et al. (2022b) studied the quality verification model with blockchain to help e-tailers suffering from low-quality images. Cao and Shen (2022) show us that adopting blockchain technology would improve the quality of sustainable products. All the channel members will benefit. However, the research mentioned above is just focused on manufacturer refurbishing. They only considered one period of market structure and did not consider different channel members refurbishing structures.

2.3 Two-period refurbishing market structure

Ferrer and Swaminathan (2006) investigate the monopoly and duopoly cases in which firms produce new products in the first period and refurbished products in the second period. Chen and Hsu (2015) study the trade-in rebates offered by the manufacturer to the consumers in the two-period refurbishing market. Zhu et al. (2016) built a two-period duopoly competition model, indicating that adopting trade-in could bring a competitive advantage. Mondal and Giri (2020) investigate the impact of green innovation, marketing effort, and collection rate of refurbished products in a two-period reverse logistics closed-loop green supply chain model. In order to solve the problems of the original equipment manufacturer’s licensing strategy and the independent refurbishing distribution channel, Qiao and Su (2021) build two-period game models. Timoumi et al. (2021) compare manufacturer and retailer refurbishing in two closed-loop supply chain structures. They show that the manufacturers will benefit more if they forgo profits and let the retailer refurbish used products. Wang et al. (2021) build two-period game models in a closed-loop supply chain through contract coordination to address the carbon emission reduction strategies. Bai et al. (2022) introduce three contracts for the manufacturer and retailer refurbishing structures. They find that all channel members benefit from the reward point contract in the manufacturer refurbishing. The above research study on two periods of refurbishing market structure just focuses on how to refurbish, and they did not consider the information transparency. Consequently, in this research, we examine the efficiencies of blockchain technology under three different refurbishing contracts.

3 Model

We investigate a two-period medical supply chain consist one critical medical device manufacturer (M) and a medical device retailer (R). In the first period, the manufacturer produces the critical medical device and sells them to the retailer at wholesale price

The inverse demand functions in scenario BC can be written as:

Here, the parameter

Here,

3.1 Analysis

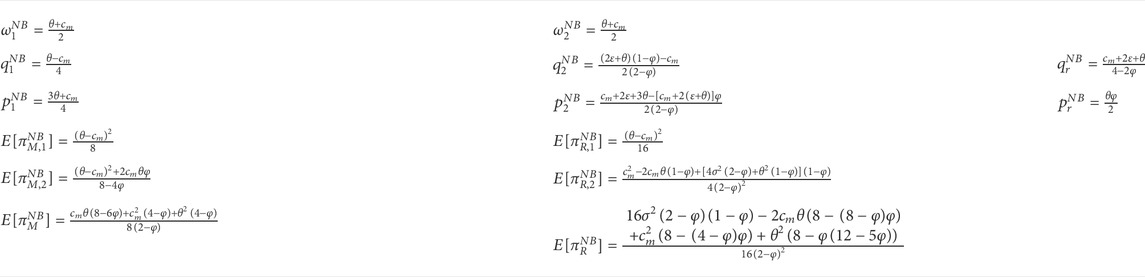

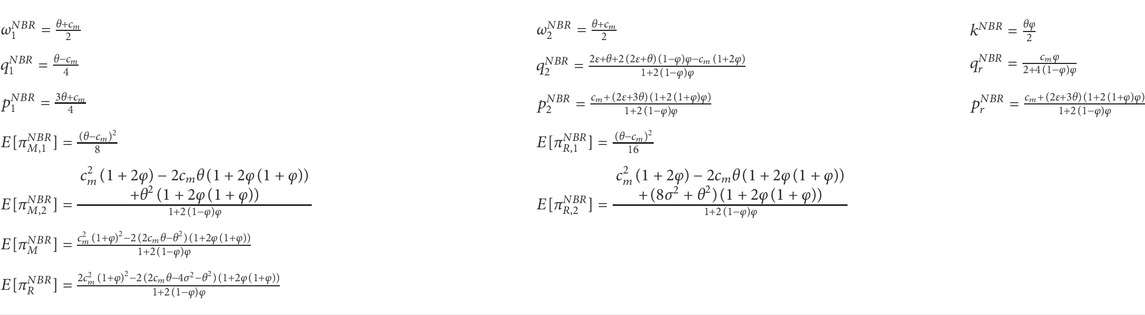

The equilibrium outcomes in the manufacturer refurbishing scenario are summarized in Tables 1, 2.

Lemma 1: When

Lemma 1shows that the expectation of customers’ beliefs

Lemma 2:

Lemma 2 indicates that in the first period, the retailer has the absolute power to control the newly produced critical medical devices. However, in the second period, as the manufacturer sent the refurbished critical medical devices to the market, some consumers transferred to the refurbishing market based on the low prices. In order to capture the lost consumers, the retailer had to reduce the selling prices. There are no effects whether using or not using blockchain technology.

Lemma 3: (1)

Lemma 3 shows us that the retailer always gets a higher profit margin in the first period by using blockchain technology. However, the improvement of market potential

Proposition 1: Comparison of different

(1)

(2)

(3)

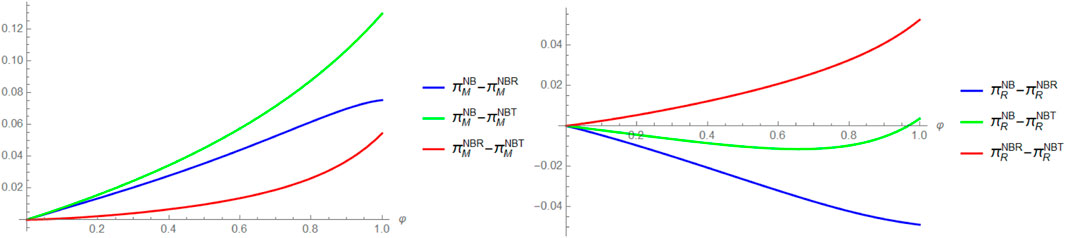

Proposition 1 shows that with the increase in

4 Extensions

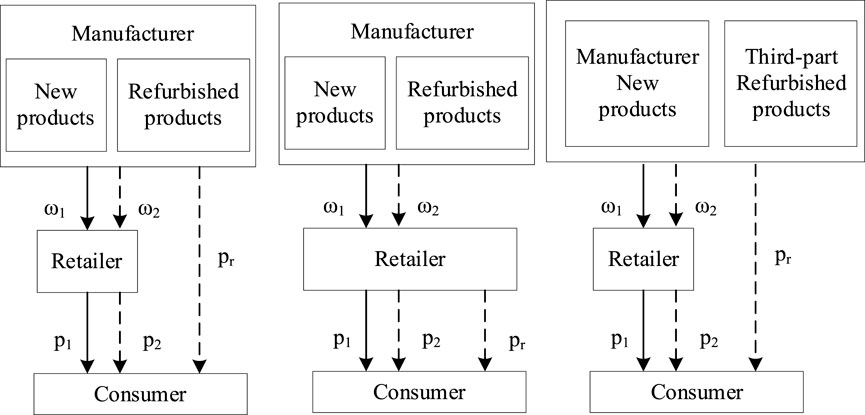

In this part, we investigate the two-period refurbishing strategies in two different structures: retailer refurbishing and third-party refurbishing. Figure 3 indicates the different channel structures in the two-period medical supply chain.

4.1 Retailer refurbishing

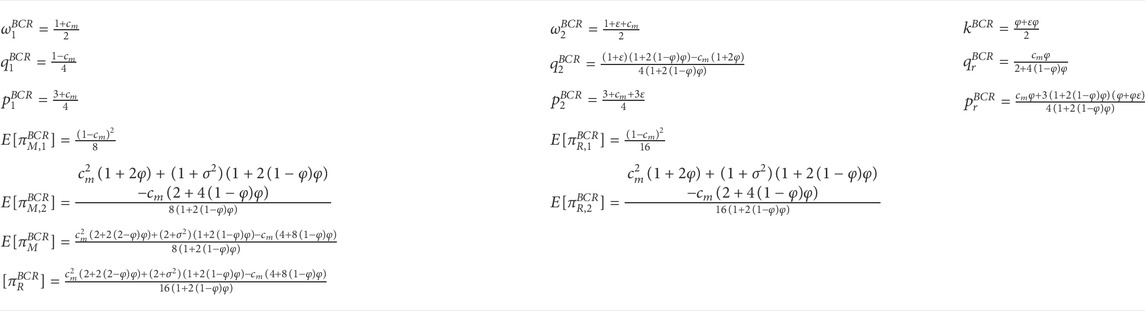

In this subsection, we assume retailers are reselling the new critical medical devices both in the first and second periods. Meanwhile, the retailer refurbished and sold the refurbished critical medical devices. We use the notations NBR and BCR to represent without and with utilizing blockchain technology, respectively. Meanwhile, to help the retailer refurbish products suffering from low-quality images, the retailer receives quality certification from the manufacturer and pays the certificate fee k for the unit refurbished medical device. In addition, the retailer’s refurbishing cost is

The equilibrium outcomes in the manufacturer refurbishing scenario are summarized in Tables 3, 4.

Lemma 4: Comparison of different

(1)

(2)

(3)

Lemma 4 has similar results as proposition 1 indicated. As

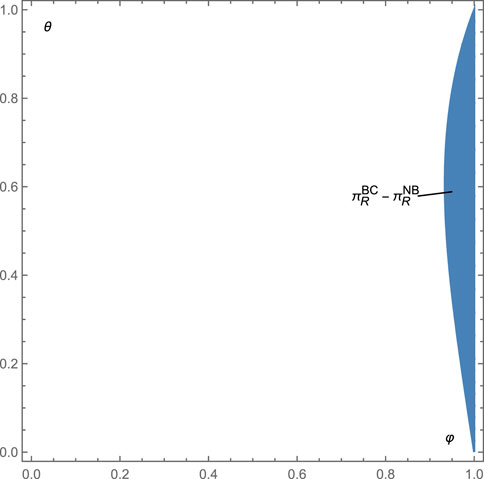

Proposition 2: In the retailer refurbishing scenario, the manufacturer always benefits from adopting blockchain technology (i.e.,

Proposition 2 indicates that when the medical supply chain channel member chooses a retailer refurbishing strategy, the manufacturer always likes to use blockchain technology that’s because, through blockchain technology, the information value will spillover from the retailer to the manufacturer, which leads the manufacturer to get more profits, and which lead to a lower profit for the retailer.

Proposition 3: In the retailer refurbishing scenario, the whole channel always has a higher profit when adopting blockchain technology (i.e.,

Proposition 3 illustrates that although adopting blockchain technology will destroy some of the retailer’s profits, but the whole channel always benefits more, which means the blockchain technology always helps the whole medical channel archive Pareto-improving.

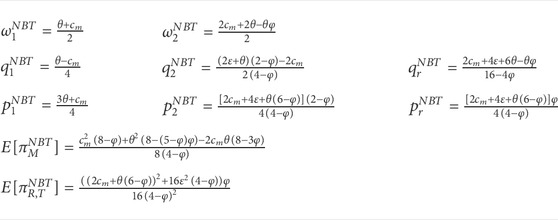

4.2 The third-party refurbishing

This subsection assumes third-party refurbishing and selling of critical medical devices in the second period. We use NBT and BCT’s notations to represent without and utilizing blockchain technology, respectively. Then, the expected profit functions of the manufacturer and retailer in two periods can be expressed as follows:

The equilibrium outcomes in the manufacturer refurbishing scenario are summarized in Tables 5, 6.

Lemma 5: Comparison of different

(1)

(2)

(3)

Lemma 5 also indicated similar results. As

Proposition 4: In a third-party refurbishing scenario, the manufacturer always benefits from adopting blockchain technology (i.e.,

Proposition 4 indicates that when adopting the third-part refurbishing strategy, the manufacturer always benefits from blockchain technology while the retailer always gets lower profits.

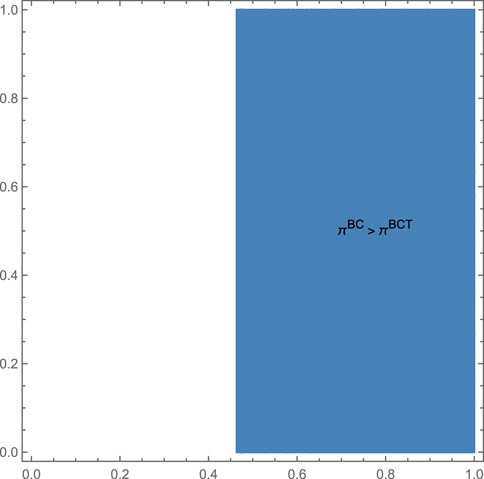

Proposition 5: In a third-party refurbishing scenario, the whole channel always has a higher profit when adopting blockchain technology (i.e.,

Proposition 5 illustrates that although the retailer loses some profits, the whole channel always benefits more.

5 Numerical analysis

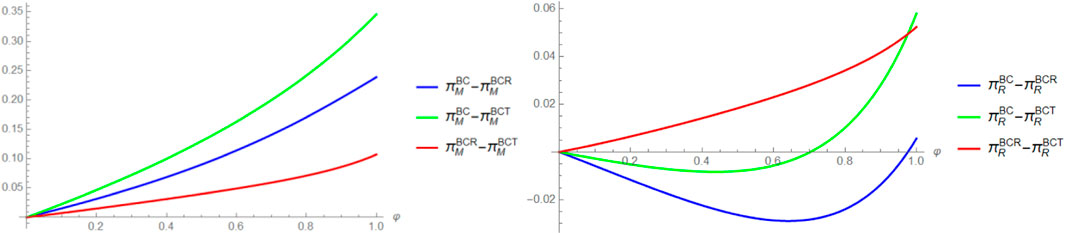

We use numerical analysis to illustrate the value of different refurbishing mechanisms. Figure 4 indicates that in the different scenarios without adopting blockchain technology, with the consumer’s willingness to pay

FIGURE 4. Comparison of the different manufacturer and retailer’ profits in the scenario without adopting blockchain technology.

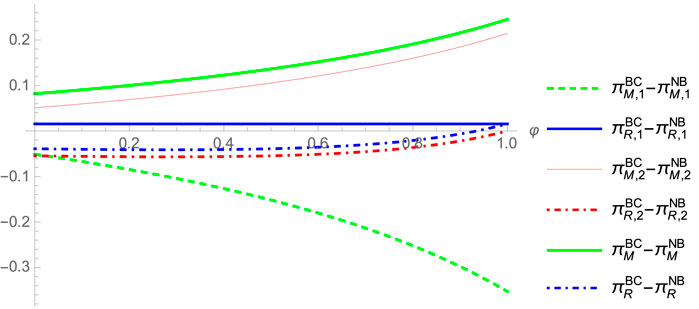

Figure 5 illustrates the impact of the consumer’s willingness to pay

FIGURE 5. The retailer’s preference in manufacturer refurbishing and third-party refurbishing scenarios without adopting blockchain technology.

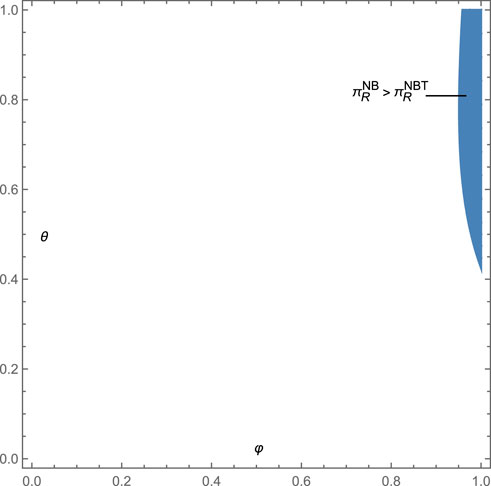

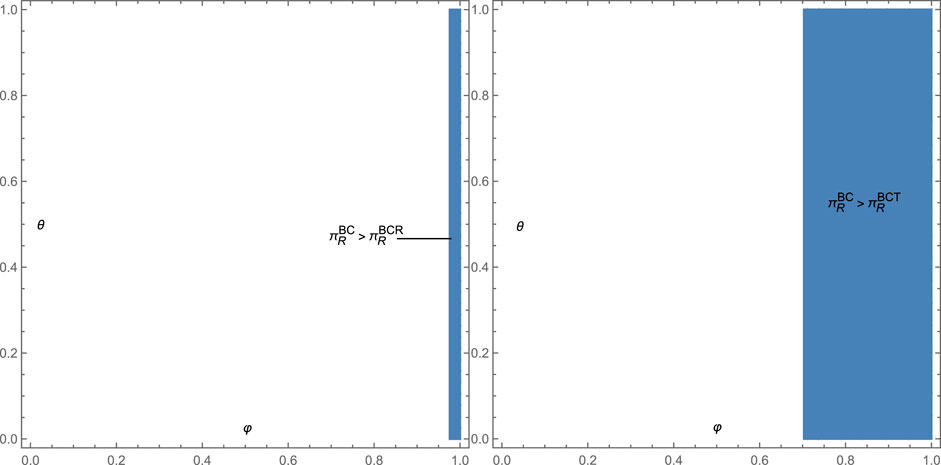

Figure 6 shows that in the different scenarios with adopting blockchain technology, with the consumer’s willingness to pay

FIGURE 6. Comparison of the different manufacturer and retailer’ profits in the scenario with adopting blockchain technology.

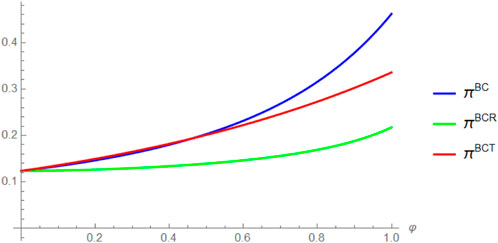

Figure 7 illustrates the impact of the consumer’s willingness to pay

FIGURE 7. The retailer’s preference in manufacturer refurbishing, retailer refurbishing, and third-party refurbishing scenarios with adopting blockchain technology.

In the different scenarios with blockchain technology, when the consumer’s willingness to pay

FIGURE 8. Comparison of the different whole channel profits in the scenario with adopting blockchain technology.

6 Conclusion

There was a shortage of medical materials in the early days of major public health emergencies. Based on this, a huge number of critical medical device manufacturers have moved to join refurbishing strategies to confront pandemics such as COVID-19, etc. This paper is motivated by the real-world application of blockchain for medical device refurbishing and different refurbishing structures in the early days of major public health emergencies. We investigate the tradeoff of the critical medical devices refurbishing strategies when blockchain is used in three different structures, manufacturer refurbishing, retailer refurbishing, and third-party refurbishing in the two-period refurbishing strategies.

Following the analytical observations derived from our model, we find that under the scenarios of manufacturer and third-part refurbishing, blockchain technology enhances the manufacturer and retailer’s price power in both the first and second periods. Therefore, it will help the manufacturer and retailer to aggressively set high wholesale prices and selling prices for the newly produced critical medical devices. Meanwhile, the manufacturer and retailer extend the market through blockchain technology, which ultimately leads to higher demand. However, under retailer refurbishing scenarios, for the refurbished critical medical devices in the second period, the retailer’s selling price reference depends on the consumer’s willingness to pay

Then, we investigate the impact of the consumer’s willingness to pay

Our research provides valuable managerial insights into manufacturer and retailer refurbishing strategies in the green supply chain, and these insights are summarized as follows:

1. Adopting blockchain will always enhance the manufacturer and retailer’s price power in both the first and second periods, which will help the whole medical channel achieve Pareto-improving. This strategy will enhance the cooperation between upstream and downstream enterprises. Therefore, we suggest an integrated supply chain using blockchain technology.

2. When the consumer’s willingness to pay is high, we suggest the retailer adopt blockchain because blockchain technology can help the retailer to get more demand and ultimately lead to a higher profit. These findings explained why the BOPS (Buy online and pick up in store) stores such as Walgreens and Walmart are involved in blockchain strategy.

3. Considering the different refurbishing strategies, when the consumer’s willingness to pay

Assuredly, our research has some limitations, and future studies can be extended in the following directions. First, the sales service significantly affects the brand image when the hospital or medical institutions buy critical medical devices. Therefore, our model in future research can consider how to make the service decisions in the critical medical devices refurbishing supply chain. Meanwhile, as we discussed, blockchain adoption could help manufacturers get accurate demand information. How to make the return policy also needs to be considered because of the difference between new and refurbished critical medical devices. Furthermore, research on knowledge sharing, inventory policy, and lead time decisions based on our models should be more attractive in practice.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

YB and WS: Conceptualization, formal analysis, visualization, writing—original draft. WS: supervision, writing—review, and editing. YB: writing—review, modeling analysis, project administration, and editing.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2022.1022209/full#supplementary-material

References

Akano, D. I., Ijomah, W., and Windmill, J. (2021). Hierarchical analysis of factors influencing acceptance of remanufactured medical devices. Clean. Responsible Consum. 2, 100017. doi:10.1016/J.CLRC.2021.100017

Bai, Y., Song, W., and Wang, X. (2022). Contracts Selection under quality uncertainty in refurbish decisions. IEEE Access 10, 6084–6098. doi:10.1109/ACCESS.2021.3135830

Budak, A., and Ustundag, A. (2016). Reverse logistics optimisation for waste collection and disposal in health institutions: The case of Turkey. Int. J. Logist. Res. Appl. 20, 322–341. doi:10.1080/13675567.2016.1234595

Cao, Y., and Shen, B. (2022). Adopting blockchain technology to block less sustainable products’ entry in global trade. Transp. Res. Part E Logist. Transp. Rev. 161, 102695. doi:10.1016/J.TRE.2022.102695

Chen, J.-M., and Hsu, Y.-T. (2015). Trade-in strategy for a durable goods firm with recovery cost. J. Industrial Prod. Eng. 32, 396–407. doi:10.1080/21681015.2015.1071288

Choi, T. M. (2019). Blockchain-technology-supported platforms for diamond authentication and certification in luxury supply chains. Transp. Res. Part E Logist. Transp. Rev. 128, 17–29. doi:10.1016/J.TRE.2019.05.011

Eze, S., Ijomah, W., and Wong, T. C. (2019). Accessing medical equipment in developing countries through remanufacturing. Jnl. Remanufactur. 93 (9), 207–233. doi:10.1007/S13243-018-0065-7

Fabris, N. (2022). Impact of Covid-19 pandemic on financial innovation, Cashless Society, and Cyber Risk. ECONOMICS 10, 73–86. doi:10.2478/EOIK-2022-0002

Ferrer, G., and Swaminathan, J. M. (2006). Managing new and remanufactured products. Manag. Sci. 52, 15–26. doi:10.1287/MNSC.1050.0465

Hasani, A., Zegordi, S. H., and Nikbakhsh, E. (2015). Robust closed-loop global supply chain network design under uncertainty: The case of the medical device industry. Int. J. Prod. Res. 53, 1596–1624. doi:10.1080/00207543.2014.965349

Heese, H. S., Cattani, K., Ferrer, G., Gilland, W., and Roth, A. V. (2005). Competitive advantage through take-back of used products. Eur. J. Oper. Res. 164, 143–157. doi:10.1016/J.EJOR.2003.11.008

Kargar, S., Pourmehdi, M., and Paydar, M. M. (2020). Reverse logistics network design for medical waste management in the epidemic outbreak of the novel coronavirus (COVID-19). Sci. Total Environ. 746, 141183. doi:10.1016/J.SCITOTENV.2020.141183

Leung, L. W., Evranos, B., Grimster, A., Li, A., Norman, M., Bajpai, A., et al. (2018). Remanufactured circular mapping catheters: Safety, effectiveness and cost. J. Interv. Card. Electrophysiol. 562 (56), 205–211. doi:10.1007/S10840-018-0497-X

Liu, J., Bai, J., and Wu, D. (2021). Medical supplies scheduling in major public health emergencies. Transp. Res. Part E Logist. Transp. Rev. 154, 102464. doi:10.1016/J.TRE.2021.102464

Liu Z, Zheng, Lang, Lingling, Li, Lingling, Zhao, Yuanjun, and Shi, Lihua (2021). Evolutionary game analysis on the recycling strategy of household medical device enterprises under government dynamic rewards and punishments. Math. Biosci. Eng. 18, 6434–6451. doi:10.3934/MBE.2021320

Mondal, C., and Giri, B. C. (2020). Pricing and used product collection strategies in a two-period closed-loop supply chain under greening level and effort dependent demand. J. Clean. Prod. 265, 121335. doi:10.1016/J.JCLEPRO.2020.121335

Niu, B., Dai, Z., and Li, Q. (2022a). Sharing knowledge to an Entrant for production Investment confronting COVID-19: Incentive alignment and Lose–Lose Dilemma. Risk Anal. 42, 177–205. doi:10.1111/RISA.13839

Niu, B., Dong, J., Dai, Z., and Jin, J. Y. (2022b). Market expansion vs. intensified competition: Overseas supplier’s adoption of blockchain in a cross-border agricultural supply chain. Electron. Commer. Res. Appl. 51, 101113. doi:10.1016/J.ELERAP.2021.101113

Niu, B., Dong, J., and Liu, Y. (2021a). Incentive alignment for blockchain adoption in medicine supply chains. Transp. Res. Part E Logist. Transp. Rev. 152, 102276. doi:10.1016/J.TRE.2021.102276

Niu, B., Shen, Z., and Xie, F. (2021b). The value of blockchain and agricultural supply chain parties’ participation confronting random bacteria pollution. J. Clean. Prod. 319, 128579. doi:10.1016/J.JCLEPRO.2021.128579

Oturu, K., Ijomah, W., Broeksmit, A., Reig, D. H., Millar, M., Peacock, C., et al. (2021). Investigation of remanufacturing technologies for medical equipment in the UK and context in which technology can be exported in the developing world. Jnl. Remanufactur. 113 11, 227–242. doi:10.1007/S13243-021-00102-5

Qiao, H., and Su, Q. (2021). Distribution channel and licensing strategy choice considering consumer online reviews in a closed-loop supply chain. Transp. Res. Part E Logist. Transp. Rev. 151, 102338. doi:10.1016/J.TRE.2021.102338

Shafiee Roudbari, E., Fatemi Ghomi, S. M. T., and Sajadieh, M. S. (2021). Reverse logistics network design for product reuse, remanufacturing, recycling and refurbishing under uncertainty. J. Manuf. Syst. 60, 473–486. doi:10.1016/J.JMSY.2021.06.012

Tan, Y. (2022). Implications of blockchain-powered marketplace of preowned virtual goods. Prod. Oper. Manag. doi:10.1111/POMS.13657

Timoumi, A., Singh, N., and Kumar, S. (2021). Is your retailer a friend or foe: When should the manufacturer allow its retailer to refurbish? Prod. Oper. Manag. 30, 2814–2839. doi:10.1111/POMS.13548

Wang, N., Zhang, Y., and Li, J. (2021). Carbon emission reduction and coordination in a closed-loop supply chain with outsourcing remanufacturing. Kybernetes. ahead-of-print. doi:10.1108/K-11-2020-0800

Keywords: blockchain technology, refurbished products, supply chain coordination, channel structure, environmental collaboration

Citation: Bai Y and Song W (2022) Environmental collaboration and blockchain technology adoption in green medical supply chain management during the COVID-19 pandemic. Front. Environ. Sci. 10:1022209. doi: 10.3389/fenvs.2022.1022209

Received: 18 August 2022; Accepted: 26 September 2022;

Published: 10 October 2022.

Edited by:

Željko Stević, University of East Sarajevo, Bosnia and HerzegovinaReviewed by:

Zoran Mastilo, University of East Sarajevo, Bosnia and HerzegovinaNaeem Jan, Korea National University of Transportation, South Korea

Copyright © 2022 Bai and Song. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wenqi Song, czkzMDAzMjE1MUAxNjMuY29t

Yang Bai

Yang Bai Wenqi Song2*

Wenqi Song2*