- 1College of Management Ocean University of China, Qingdao, China

- 2Antai College of Economics and Management, Shanghai Jiao Tong University, Shanghai, China

- 3School of Economics and Management, Southeast University, Nanjing, China

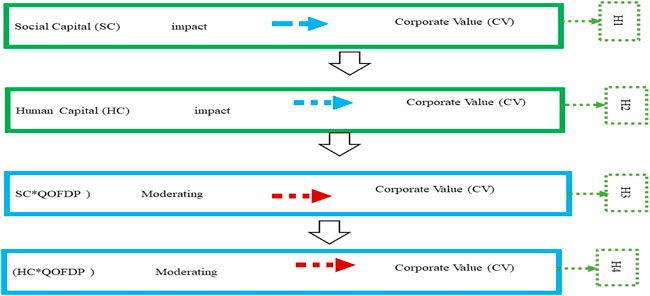

The study analyzes the impact of social and human capital on the corporate value of Pakistani enterprises listed on the stock exchange. The research specifically focused on Pakistan firms operating in the manufacturing sector. It assesses the moderating effect of QOFDP between social capital (SC) and human capital (HC) on corporate value. A quantitative analysis approach is applied to the primary data collected through a close-ended survey questionnaire from 600 supply chain employees of Pakistan manufacturing industry. Results were used to construct a quantitative inquiry approach for the primary data. The association and impact of Social capital (SC) on the corporate value of manufacturing enterprises were found to be statistically significant, and it was also shown that Quality of financial decision and policy making (QOFDP) acted as a moderator between HC and corporate value. The moderating of QOFDP was exclusive to SC and HC, although all factors indicating SC (i.e., internal, and external network of social capital) and human capital (HC) affected company value positively and considerably. In light of the above findings, it has been advised that Pakistani manufacturing companies participate in rational financial decision-making to increase business sustainability and corporate value. However, this study is limited to the manufacturing industry in Pakistan and cannot be applied to other industries or nations.

Introduction

Social capital is the network of connections between the members of a community and is essential for a country’s effective functioning, while the human capital represents the skills, knowledge, and experience exhibited by an individual or population having a value or cost to an organization or nation (Caiani et al., 2012; Ullah, Wang, Bashir, et al., 2021a). Businesses and entrepreneurs must purchase the materials needed for production. In contrast to social and human capital, financial capital helps to complete business operations in economic setting. All three are crucial and have different roles in the effective operations of a business. It is therefore essential to establish certain distinctions between human, financial, and social capital (Ullah et al., 2021c). The knowledge and skill sets necessary for people to launch successful businesses make up human capital (Caiani et al., 2012; Rehman et al., 2021). Financial capital is needed to ensure that a business can continue its operations, maintain its growth rate, and expand. Finally, social capital illustrates all the interpersonal and intra-organizational connections that provide entrepreneurs access to the tools they need to find, exploit, and thrive in business opportunities (Ahmad et al., 2021; Cubas et al., 2021; Y. Wang et al., 2019). Given that knowledge is essential and inventive, an organization’s social, human, and financial capital is viewed as a strategic asset, increasing its competitiveness and profitability. In order for enterprises to achieve more ambitious strategic goals by boosting competitiveness, human resource with focused competencies, knowledge, and skills are encouraged to obtain necessary knowledge and data and share it via social networks (Felix et al., 2018; Pucheta-Martínez and Gallego-Álvarez, 2020). Social capital has the potential to improve collaboration, lower transaction costs, encourage entrepreneurship, aid in the establishment of start-up businesses, and strengthen supplier ties, local production networks, and inter-firm learning. As a result, numerous studies have found that social capital has a favourable impact on a firm’s performance, albeit not always equally (Buera et al., 2011; Jabłónski and Jabłónski, 2016).

Companies prioritize their funding sources (internal to external) and reserve capital funding as a last resort, according to the pecking order theory. First, domestic resources are employed; if they are depleted, a loan is then granted. When offering further borrowing is not the best course of action, capital is offered (Kedar-levy, 2014; Jabłónski and Jabłónski, 2016). Businesses choose domestic funding first when it is available and loans over capital when they require outside funding. Because the quantity of data discrepancy and financial necessity varies depending on the stage of expansion, the size and development of the business decide the structure (Murshed, 2020).

Employees with a deeper awareness of social, financial, and labor issues will hold the position within the organization’s network and benefit from social and financial issues. Additionally, individuals that have “human capital” will increase their value by promoting information sharing throughout the company, which is why they provide superior outcomes. Amazing achievements can be achieved when stakeholders’ inputs are paired with empowered workers. The skills and talents that exist within employees can be identified and used to benefit the company encouraging more satisfied clients and higher profit margins. This is accomplished by providing participants and employees (with a greater commitment to the goals of the organization).

Since the many categories of businesses registered with the Pakistani stock exchange are the focus of this research, one of the challenges these institutions face is realizing the value of social capital in this region of rapid development. In light of growing shortages, these businesses face a significant financial difficulty. Investment in human resources, appropriate hiring, fundraising education, and social growth, however, frequently lag behind other organizations. The reading mentioned above is crucial when considering Pakistan’s vision because there are significant gaps in our society’s ability to access inclusive corporate governance and because Pakistan has spent more than 60 years trying to develop its various capitals and join a rapidly expanding economy. Various attempts have been made by succeeding governments to solve the country’s problems in different ways. Pakistan’s educational system still needs to be improved. The kids should receive education that equips them to be constructive members of society. During the academic years of high school, college, or university, practical skills should be taught. Farmers, employees in factories, laborer’s, housewives, mothers of young children, students, the jobless, and other groups face real problems that require further improvement. A large number of them have overcome poverty. Like the majority of other developing nations, Pakistan has effectively utilized foreign aid at the macro level. Instead of help, Pakistan could press for more fair trade (Pham et al., 2022).

It is well documented that an organization’s social, human, and financial capital becomes a commodity where such information is significant and inventive, making it very valuable and competitive. Employees with specialized expertise, abilities, and skills are urged to gather the information or data needed and share it via social networks set up by corporations to realize more ambitious objectives of perpetual competition. Social capital lowers transaction costs, boosts teamwork, makes startups and business operations simpler, and promotes supplier ties, local production networks, and robust learning. As a result, although some research have demonstrated the beneficial benefits of social accumulation on economic outcomes (capital), others have produced conflicting findings.

Numerous research have examined the moderating effects of numerous variables, but the results have been inconsistent, suggesting that the moderating effects of many variables may not have a significant impact on the relationship between social capital and company performance.

This research establishes and then examines the role of social capital indicators, human capital and Quality of financial decision making policy in the relation to corporate value. Its impact on the industries will be in terms of its implementation and adaptability within the industry as a yardstick or benchmark.

The present study contributes expertise and understanding of potential obstacles to implementing human and social capital based on shared values. The research proposes to achieve the following aims and objectives: First, to investigate the impact of social capital on corporate value. Second, to explore the impact of human capital on corporate value. Finally, to determine the impact of quality of financial decision policy making on corporate value in Pakistan. This study address the answers to the following questions:

RQ1: Does social capital positively and significantly lead on corporate value?

RQ2: Does human capita positively and significantly lead on corporate value?

RQ3: Does quality of financial decision policy positively and significantly lead on corporate value?

Theoretical foundation and hypothesis development

A business has a good chance to surpass its competitors if it has large resources. According to the resource-based hypothesis, companies have resources, some of which give them an advantage and some of which lead to unmatched long-term success (Pattillo et al., 2002). Resources that are valuable and uncommon can give you an advantage. If the company can be protected from imitation, transfer, or exchange of resources, this advantage can be maintained for a longer period of time. The status of managers and the resource-related technology are influenced by the resource-based theory in terms of verification. Resources are significant if they enable the business to create innovative technologies that take advantage of the opportunity and lessen the threat. If there is a tough road to obtaining the benefits a resource offers, then it cannot be replaced. An exclusive resource gives the company that owns it a competitive edge. A resource that is difficult to mirror is difficult for rivals to copy (Shahbaz et al., 2010; Ullah et al., 2015).

A variety of technologies and resources are used to develop important resources, which are then packaged to prevent duplication (Ni et al., 2021). Recognizing relevant resources among many resources is crucial. A valuable resource is money. Other crucial resources include things like houses and automobiles that are necessities. The resource-based perspective, however, has other enduring beliefs and worries. The theory aims to direct the crucial management resources linked to funds after the executive and the money. An important concept in resource-based theory is the substantial quality of corporate resources. The resources that may be available will be distinctive ones. Similar to money, a company’s tangible assets are important resources. Interestingly, such illusive resources do not exist. Intangible resources include the knowledge and abilities of the workforce, the company’s reputation, and the company’s way of life. Another crucial idea is competence. An organization has resources, and capabilities are what it can do (Restuccia & Rogerson, 2008; Haddad & Lotfaliei, 2019). When businesses increase their fundamental resources over longer periods, their capabilities develop through time. Some businesses have a specific ability to develop new capabilities that help the corporation stay up with changing conditions and develop a potent competence (Liao & Wei, 2016; Zhang Q. et al., 2021). It may be argued that resource-based theory is related to one parameter, namely capital misallocation, given the variables and study questions that concentrate on three factors: financial risk analysis, corporate capital efficiency, and capital misallocation. Based on the above theoretical foundation remark’s multidimensional perspective, it was concluded that capital misallocation is the practice of directing substantial resources to companies that have low capital returns (Warner, 2013; Venkateswaran, 2019).

The company should be seen as a collection of resources, especially vital intellectual property that can be exploited to achieve a competitive advantage and boost profitability (Zhu et al., 2018). In this instance, the business is aware of the capital it employs to allocate resources across various operational processes and locate them, preventing capital misallocation. This illustrates how a resource-based strategy shields companies from misallocating funds to projects that don’t boost their ability to compete. As a result, it is clear from the aforementioned reasoning that capital misallocation and resource-based theory are related.

Three influential authors—Pierre Bourdieu, James Coleman, and Robert Putnam—discuss social capital. Bourdieu discussed three different subject areas, however this study only focuses on “Social Capital.” “Social capital is a combination of a real or potential source linked to a strong network of less educated contacts of mutual understanding or recognition,” writes Bourdieu in a quick definition of the concept. Some people receive different types of income through social expenditures. In terms of athletic contexts, Bourdieu gives the example of golf clubs where people connect with one another to conduct business, a process that is not open to the general public due to the exclusivity of many golf clubs (Ikram et al., 2019; Asghar et al., 2020; Yang et al., 2021).

From Coleman’s perspective, there is no one entity that represents social capital. This is the framework that makes it feasible for actions to continue to have a beneficial impact; otherwise, it would not be possible. In her research, Coleman discovered that parental involvement and family income were responsible for the decline in school dropout rates. In this context, Coleman defines social capital as a group of resources obtained from familial connections that are crucial for the social development of the kid. These resources come in all shapes and sizes and help kids develop their personalities (Tinsley & Brown, 2000; Bems, 2008; Shabbir et al., 2020).

Tura and Harmaakorpi proposed that network inventive capability could be understood; social capital could be considered as a “license” to apply and expand such capability if the capability to maintain and implement network resources to ensure innovation creating activities. Tura and Harmaakorpi emphasized that while every participant may have a higher inventive capability on a personnel basis, without any “licensed” to attach to and utilize the other participants’ individual resources, everyone could not explain about the inventive capability of the network. They argued that the varied effects of social capital that bridges and bonds. Importantly, there is no alternative way of bonding social capital that may have a favorable impact on one’s innovation system. When regional innovation systems are formed on innovation networks with larger levels of personal bonding capital, this could result in less-than-ideal conditions. Every innovative network that is disrupted is harmful to both the network and the local system. Additionally, bridging social capital has good effects by assisting individual innovation networks in connecting with their surroundings. Huggins contends that networks are made up of network or social capital because of which enterprises may be helped in their operations of knowledge development and acquisition. The importance of information to network participants is inherent to social capital (Jabłónski and Jabłónski, 2016; Jabeen & Munir, 2018; Espinoza & Presbitero, 2021).

Corporate value

Researcher argue that corporate values are defined as the internal and external values of the firms. These values serve as the basis for the decision-making process, orient the actions ad behaviours of employees and contribute to corporate management as well. Corporate value possesses great importance for investors as investor perception of investing in the stock market is to gain profit in terms of capital gain and ownership of the firm. Before the investment, investors deeply look into the corporate values and stock prices (Abbas et al., 2021; J. Zhao et al., 2020). Companies take several steps to maximize their corporate values because they play a major role in the success of the company. Dong et al. (2022) documented that corporate values can be maximized by effective implementation of company strengths and minimizing the weakness that the company has. Corporate value creates transparency and loyalty among investors and employees of the company and escalates the employee turnover ratio. The stable and strong corporate values reflect the positive image of the company and support the company to gain national and international recognition.

Global trends suggest that in the upcoming decades, demand for new structures will rise quickly. Growing populations and rising levels of income around the world (particularly in locations in Asia and Africa, as well as the need for housing improvements in densely populated areas. The result is that a lot of resources are required including human and social capital (Pucheta-Martínez and Gallego-Álvarez, 2020; Dong et al., 2022). Corporate value has a major role in transforming building technology significantly in recent decades. Buildings, for instance, can be constructed using lesser environmental effects (such as using less metal or wood for a longer lifespan, or a product with the same structural properties greater rate of post-consumer recycling (Zhang eta l., 2022a). Nevertheless, despite these technical advancements, inefficient construction techniques are still being used commonly employed, especially in areas where this will be the most prevalent demand. Future effects will rely on resource use and supply tactics, as well as the degree and degree of socioeconomic development (Zhang et al., 2022b).

Impact of social capital on corporate value

Statistics support the effects of social capital on a firm’s corporate value. The effectiveness of decisions that affect the relationship between social capital and a firm’s.

Growth in terms of performance has an impact on how social capital affects corporate value. A few researchers have noted that the social capital provides a new dimension for firm theory in the context of the new economy and that corporate core competencies go beyond organizational capital to include social capital (Jiang et al., 2021). The organizational capital shows the capacity for internal coordination, while the social capital shows the resources present in the external environment. These two factors work in tandem to support corporate competency, increasing a company’s financial performance and market dominance, and data shows that the latter metric reflects the operational effectiveness of that specific company. In the spectrum of competition, social capital might be the kind of barrier that prevents rivals from snatching up market share. Shi (2003) emphasizes that social capital is a crucial component of corporate intellectual capital and that it can do much more to explain corporate competitive advantage than Iorember et al. (2021) classic study suggests. Shi also notes that social capital is an important component of organizational intellectual capital. From a socioeconomic perspective, it is widely believed that we are still in the early stages and are likely in a black space where theoretical and empirical frameworks have not yet been properly articulated (Yu & Qayyum, 2022).

An organization’s internal and external networks affect its social capital. The social network fiber is strengthened by stronger internal and external networks. Resources accessed via social networks also aid in the development of social capital (C. Liu et al., 2021). According to Hoi et al. (2018), Sanchez-Ruiz et al. (2019), community social capital limits harmful CSR actions that (Jin-fang et al., 2020) could harm non-shareholders and stakeholders while facilitating positive CSR actions that would benefit non-shareholders and stakeholders. The density of social capital in a community is also linked to how CSR initiatives will affect a company’s financial performance in the future. According to Gao et al. (2021), social networks prevent unethical corporate behavior and encourage more effective use of corporate resources in areas with strong social norms and higher levels of social capital (Mehmood, 2022).

Putman contends that social capital serves the greater good as well as the general welfare. According to Putnam, the social cohesiveness of money occurs when members of the same community and with similar values band together to further common objectives. They are members of the homo native group and frequently support restricted ownership. Putman contends that this kind of contact has drawbacks because it is thought to exclude outsiders. Due to the deportation of foreigners, the football team will primarily consist of fans and players with similar backgrounds. They will make an effort to exclude people from backgrounds different from their own. Social capital also has a tremendous deal of potential for social bridging. Interaction with various types of people emerges as a result of social interaction heterogeneity.

Zhang C. et al. (2021) demonstrated how social capital and economic growth are transmitted; in their study, regressions were tested on a set of developed and developing nations between 1980 and 2000. The literature suggests the following as the primary economic influences of social capital inside networks: 1) Social capital influences network productivity by reducing overall uncertainty in specialization and the division of labor. 2) Which lowers the network’s transaction costs. 3) The network’s impacted association costs. 4) That influences the innovation process by limiting the quantity and variety of knowledge the actor can produce. Since social capital is a term with a broad definition, new work frequently measures it with a CSR emphasis (Corporate Social Responsibility) (B. Zhao et al., 2018). Financial reporting quality and financial limitations are two networks through which social capital may affect cash holdings, according to Habib and Hasan’s explanation of the connection between social capital and corporate cash holdings from 2017. Most of the recent academic literature supports the idea that social capital is positively correlated with company value. According to Lins et al. (2017), social capital, as measured by CSR initiatives created through investments, benefits from the financial crisis. Enterprises with high social capital typically experience higher stock returns than firms with low social capital during the 2008–2009 financial crisis. High-CSR businesses also saw increases in profitability.

H1: There is a significant and positive association between Social Capital (SC) indicators and corporate value.

Impact of human capital on corporate value

In a recent study, reported that human capital is the intangible asset of the company and has a great impact on the company’s performance. The knowledge and experience of human capital added value by corporate resources. As employee recruiting involves the utilization of human capital in business operations, employers are responsible for providing fair compensation that reflects the value of human capital and the return on investment used.

Human capital is the most valuable and prized asset of the company. The global economy is becoming more knowledge-intensive which in turn increases the value of the human capital asset as well. This calls for a closer examination of human data, and in recent years, research has focused heavily on its impact on the generation of business value. In several studies, corporate value creations were quantified using both financial and non-financial performance data and examined the effect of human capital resources in annual reports of corporations (Lin et al., 2012).

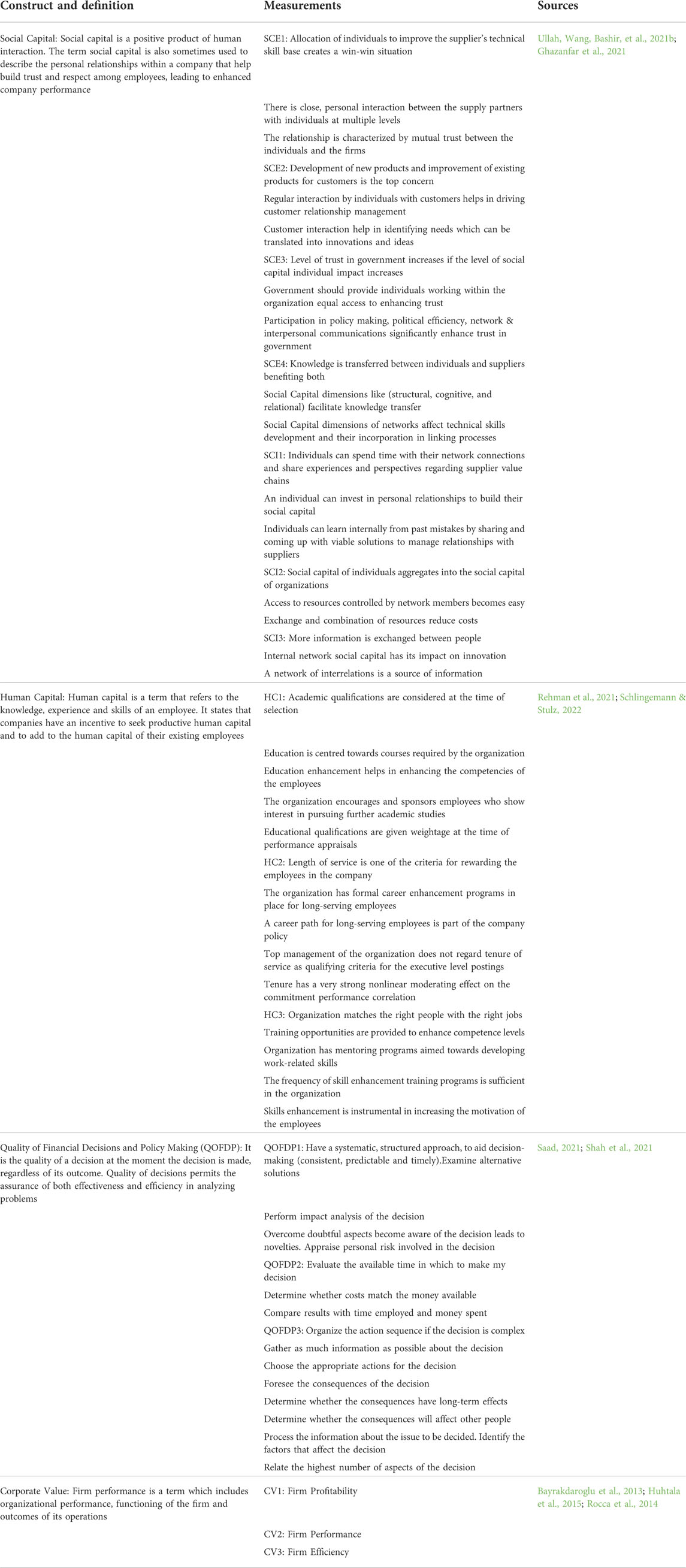

Other research examined the effect of human capital disclosures by businesses on the market and stakeholders’ value (Amorelli & Sanchez-Ruiz, 2019). Most previous research uses the Global Reporting Initiative (GRI) index to measure human capital reporting. Although, the GRI index was observed to lack in some issues that are of great importance from stakeholder perceptions in developing countries like Pakistan. It is because the economics and views of stakeholders in developed countries were used to establish the GRI index. Thus, the GRI index might not draw attention to several challenges particular in developing nations like Malaysia, Pakistan, India and Bangladesh. The legislation and proceeding literature both show that the current human capital metrics may not meet stakeholder expectations. Furthermore, based on their understanding and experience, stakeholders may feel the need to provide additional indicators (see Figure 1).

H2: There is a significant and positive association between Human Capital (HC) and corporate value.

Quality of financial decisions policy making on corporate value

In this study, the combined effects of social capital on firm performance were examined. As a result of the research project’s focus on the value of social capital, organizations will be better able to develop strategies for enhancing the abilities and talents of their staff members by creating solid, long-lasting connections with both internal and external networks that will be helpful in making wise choices. Organizational managers are expected to make strategic choices that have a big impact on how well their company performs. Decision-making styles and accuracy have been found to be closely related to organizational performance (Goll and Rasheed, 1997; Robert Baum and Wally, 2003). The contingency method ensures that organizations that carefully select their strategies while paying enough attention to decision-making formations outperform their competitors. It presents those decision-making structures as being chosen based on the competitive strategy implemented by organizations (Chung and Luo, 2008; Chung et al., 2012). Clarifying the strategic development process and the strategic intent, which undoubtedly explains the end goal, are some of the major issues in the field of strategic management. As a result, it is necessary to develop a plan for decision-making that will result in the effective formulation of strategy (Afiouni, 2007; Al-Tal and Emeagwali, 2019). However, it may not be enough for businesses to plan the existing industry market niche and associated constraints. An organization’s competitive strategy and its structural relationship are vital in increasing organizational performance and in enhancing its competitive advantage. Organizational executives must therefore look for new business prospects that can help their companies expand and become more competitive (Chen et al., 2022; Law et al., 2018; Y. Wang et al., 2019).

Becker’s approach to allocating resources for the economy and the environment is so widely accepted today that it is challenging to understand how ground-breaking his models and procedures were at the time (Gabriel et al., 1980; H. Liu & Baker, 2016). He asserted that a lot of academics and scientists were openly antagonistic to Becker’s use of microeconomic and practical techniques to analyses intra-household decision-making. This idea contends that humans are rational, they make decisions largely for their own benefit, and they are capable of changing their minds in reaction to new information (Risk, 2006).

H3: Multidimensional effect of social capital indicators moderated by quality of financial decisions making policy has a positive impact on a corporate value.

H4: Multidimensional effect of human capital moderated by the quality of financial decisions making policy has a positive impact on corporate value.

Conceptual framework

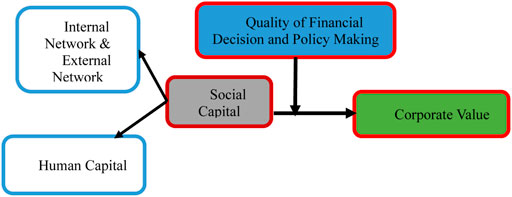

The study of institutional theory has grown in significance. However, the majority of this has taken place in wealthy nations. Institutional theory is linked to a number of viewpoints that alter how internal corporate activities are explained and carried out (Press, 1991; Moshirian, 2008). It is vital to remember that institutional theory is seen in this context as a particular paradigm for researching social capital, intellectual capital, and human capital. The institutional theory makes it possible to describe recent changes and to research advancements in accounting frameworks (public and global), about the observation of pertinent data by accounting data clients, the implementation of which depends on the legal system and determines the advancement of accounting in the company (Altayar, 2018). The emphasis on thorough financial transparency, which focuses on submitting integrated reports and monitoring the efficient operation of associations that keep data on the appropriateness of the use of materials and labor, is one area in which accounting development is anticipated. Additionally, resource data guarantees that the elements and financial data are progressing as necessary until alignment (Davis, 1987; Dhaene, 2012). The expense of replacement, the businessmen’s vulnerability, and the hazard are all reduced when the factory facility is operating properly. The legal structure also affects the entitlement to compensation and how easily one can access the market. On the other hand, weak or insufficient legal frameworks might compel admission. Institutional weaknesses may promote corruption and demonize entrepreneurs if they allow for self-aggrandizement. Institutional restrictions may also give rise to sporadic ties, such neighborhood groups. As a result, businesses can start up without being officially sanctioned (Society, 1953; Steuerle, 1996; H. Wang et al., 2018). We examine both the collective and individual effects as the conceptual model is developed because social capital, which includes internal and external networks and resources accessed through social networks, affects decision-making quality (Iram et al., 2020; Ghazanfar et al., 2021). The only way to study the influence is to look at it both individually and collectively. As they fall under the category of social capital and serve to define it, control variables including age, size, leverage, and human and financial capitals must be considered in the development of this model. Additionally, the effectiveness of decisions will define the firm’s performance. Each component of the created model is affected by the individual and collective effects of all the selected variables. The developed model is all-inclusive in that it incorporates every functional area falling under social capital (N. U. Khan et al., 2021; Danish et al., 2020).

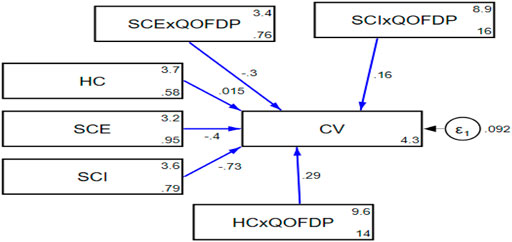

What impact does social capital have on business performance? Using social structure and traditional culture, Bian and Qiu (2000) provide clarity on this issue, and their core thesis is tenable in the context of transition. Therefore, to ignore a firm’s organizational traits and simply evaluate its social capital using the entrepreneurial index. The following model has been suggested in the context of manufacturing businesses operating in Pakistan based on the hypothesis formulation. According to the diagram indicates Figure 2 and Table 1, social capital is made up of three networks: an internal network, an external network of social capital, and a network of human capital. In this study, social capital components have been considered as independent variables. On the other hand, the dependent variable in this study on which the influence of social capital has been investigated is corporate performance or value. Additionally, the study’s moderating variable—which moderates the relationship between social capital and corporate performance—has been seen as the decision-quality of the companies (Ullah, Wang, Bashir, et al., 2021b; Lucas, 2021).

Result and discussion

Research method

The previous section provides a thorough review of previous literature, on the basis of which the researcher has also developed a conceptual framework of the study. However, this section is dedicated to highlighting the key methods and techniques that researcher has followed to achieve the primary goal of this study, which was to investigate the moderating impact of QOFDP on the association between SC, HC and Corporate value.

The research instrument that has been used in this study is a self-administered survey questionnaire, which was distributed among the study participants to collect their responses. The research instrument of the survey questionnaire includes several closed-ended questions on five key variables of this study, which was measured through the 5 points Likert scale that provides the option from strongly disagree to strongly agree. This has allowed the researcher to collect the most reliable quantitative data.

The prior study’s key areas of focus were the independent and dependent variables at the multidimensional level of the investigation. At the national or regional level, social capital is measured, occasionally by averaging individual survey responses, whereas economic outcomes (Jabłónski & Jabłónski, 2016; Dragomir, 2018). The World Values Survey is a global network of social scientists investigating how values are changing and how it affects social and political life (Sun et al., 2019; Yang et al., 2021). However, a study was done for Pakistani companies listed on the stock exchange. For organizational information and the primary characteristics of the study variables, descriptive statistics were produced. Data analysis from research surveys was used to show the data. The results showed that social capital has a statistically significant impact on business value. The quality of decisions that impact company value and social capital had a moderately positive association. The study’s findings also showed that the effectiveness of decisions has an impact on social capital’s ability to influence business performance. This study advances knowledge of the relationship between social capital and a firm’s performance (Asadi et al., 2020; Asif et al., 2020; F. N. Khan et al., 2020). The relationship between social capital and a firm’s growth in terms of corporate value is affected by the quality of financial decisions. This study has added to the body of knowledge by empirically demonstrating that increasing social capital can improve an organization’s performance (Afiouni, 2007; Rehman et al., 2021).

Sampling technique

Another crucial part of the tools and techniques researchers often use for data collection is the sampling approach that we devised. The idea of a sampling methodology can be thought of as a particular method for choosing the various sample entities (Ramawickrama and Opatha, 2017). Accessibility sampling was used in this study to select a representative sample from the entire study population. One of the most popular non-probability sampling techniques is known as the convenience sampling approach, in which the researcher chooses only those participants in a sample who are readily available (Ministry of Finance, 2019).

Descriptive analysis

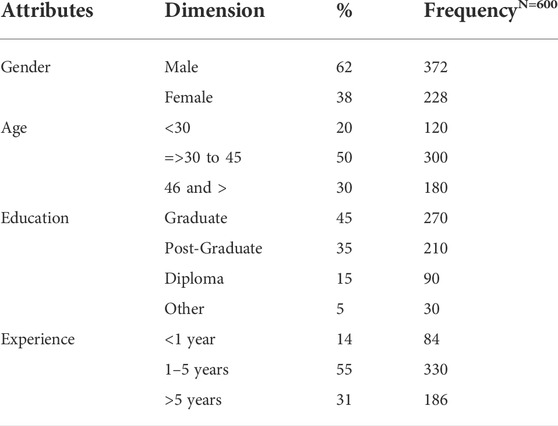

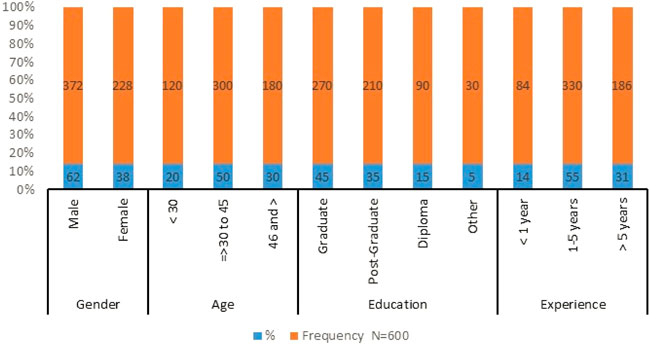

One of the primary factors in favour of choosing this procedure was the convenience sampling method’s lower risk of problems. In this regard, the researcher’s sample size, or the number of respondents from which the data were gathered, was 600. This has made it possible for the researcher to compile thorough data regarding the many study factors, which ultimately helps in achieving the main research goals. In this study, survey data analysis was used to give the results of demographic statistics. Table 2 and Figure 3 clearly shows that the sample for this study was made up of 62% men and 38% women. According to this poll, 20 percent of respondents were under the age of 30, 30 percent were between the ages of 46 and 45, and 50 percent were in the 30 to 45 age range. It reveals the respondents’ level of education. It shows that 45 percent of the population held a degree, 35 percent had a postgraduate degree, 15 percent had a diploma, and 5 percent belonged to other groups. It has been noted that in terms of industrial experience, 55 percent had between one and 5 years’ worth, 31 percent had more than 5 years’ worth, and 11 percent had less than 1 year.

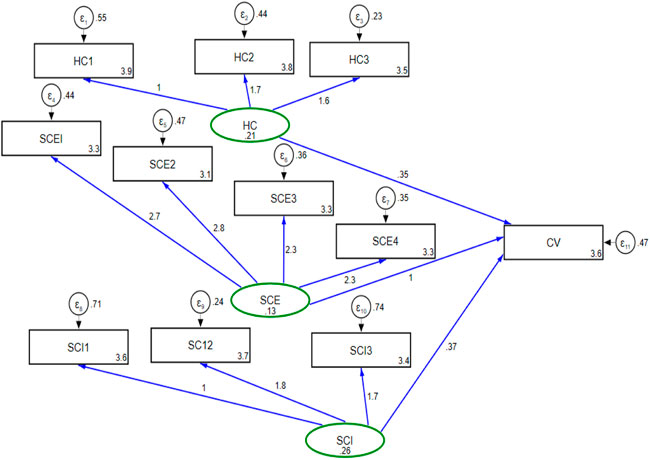

Confirmatory factor analysis

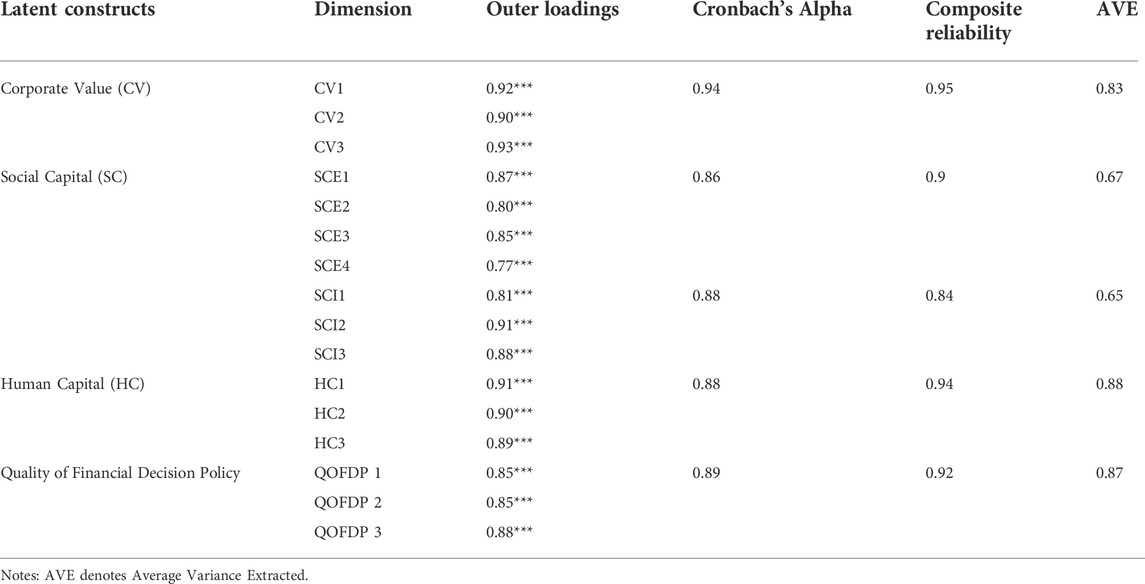

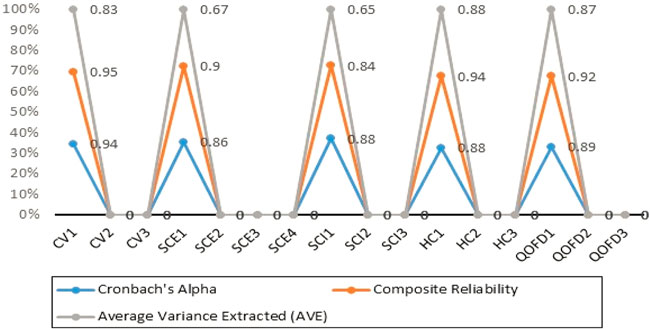

Checking the data for validity and reliability using CFA is the first step in applying the SEM model. The validity of the study’s indicators has been suggested utilising outer loadings. According to Ullah et al. (2021a) factor loading is another name for outer loading, which should be more than 0.6. Considering this, Table 3 shows that none of the indicators required to be eliminated since their factor loading was calculated to be higher than the 0.6 criterion. As a result, the final model comprised all indicators. First, Cronbach Alpha has been utilised in reliability testing, along with composite reliability. To be considered reliable, a latent construct’s composite reliability and Cronbach Alpha values must be higher than 0.7 (Ullah et al., 2021c). In this regard, all of the latent constructs employed in the study are reliable because the least Cronbach Alpha value obtained was 0.73, while Table 3’s minimum value for composite reliability is 0.84. As a result, the constructions employed in this work are trustworthy. Additionally, AVE has been applied to test the convergent validity of the latent constructs. The AVE’s threshold of 0.5 is used to determine relatedness Ahmad et al. (2021). Given this factor, Table 2’s results show that all the conclusions are sound because no value was discovered to be less than 0.5. Additionally, certain outcomes are shown in Figure 4. To recognise the multicollinearity issue between explanatory variables, we create correlation estimate (Murshed, 2020; Shahzad et al., 2020). Findings show that each variable has a correlation less than or equal to 0.80. Table 2 also includes a report of the outcomes. This study does not have a multicollinearity problem.

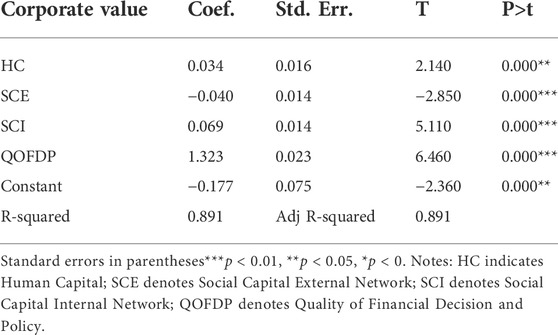

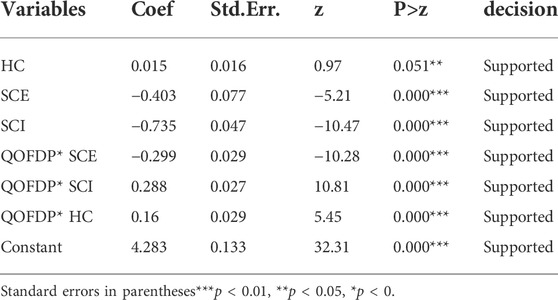

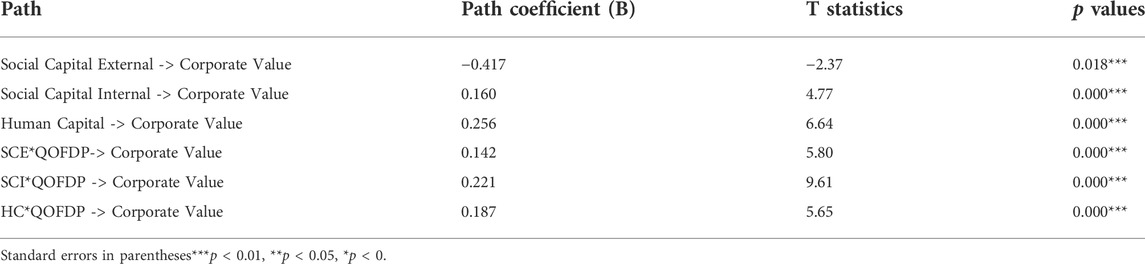

We created and advocated bootstrapping as a method to determine the significance levels. Abbas et al. (2021) classifies bootstrapping as a resampling method, which is presented in Table 4 for the current study. It is evident that the multifaceted impact of social capital indicators on company value is statistically significant and favourable [

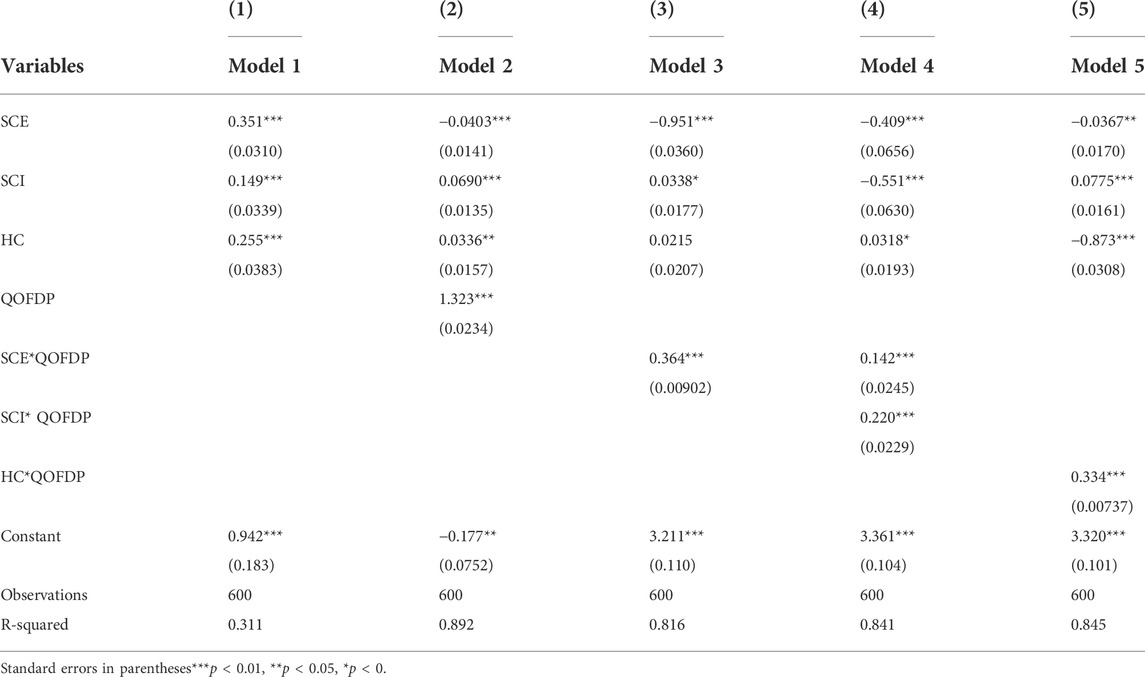

We examined the effects of SC and HC on CV and the mediating role of QOFDP in the link between SC and HC based on the results previously obtained and utilizing a SEM. In the first instance, the SEM reveals that simply the suggested fit indices are sufficient (Table 6), demonstrating that this variable is being measured correctly (Figure 5). Similarly, it can be shown that SCE(external network) and on CV have a negative impact that is both direct and negative, with an average rating, with the loading impact of CV having a higher impact with an impact factor of −0.403.

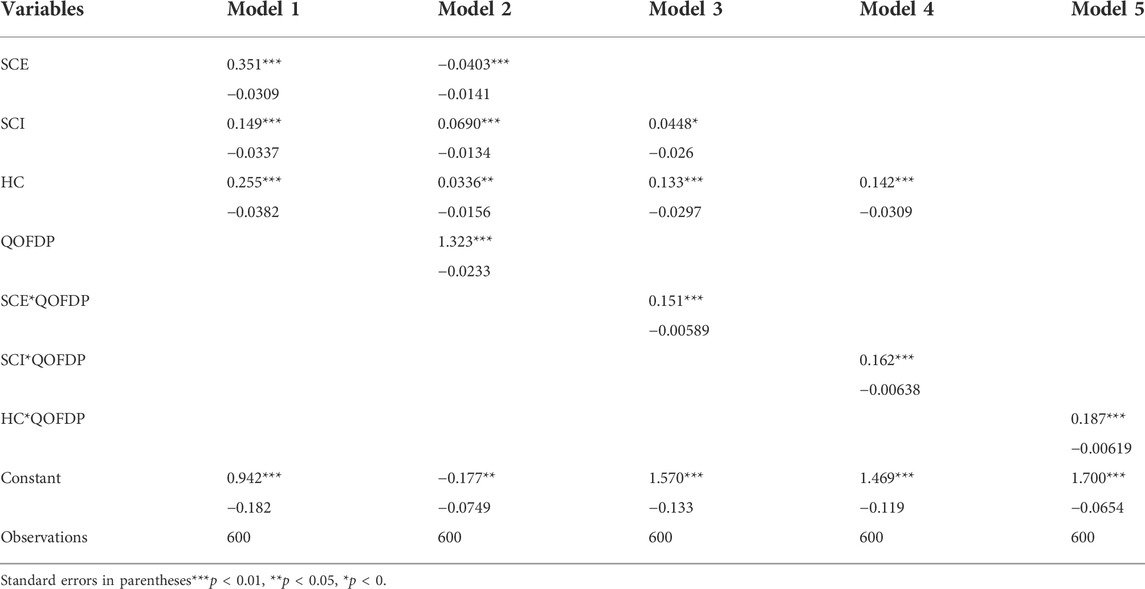

Regarding the second analysis, which looked at the mediating role of QOFDP in the link between SC and CV, all HC-acceptable indications were found from this adjusted model after three iterations in which one indicator from those evaluated by CV was eliminated (Table 7). The robustness of the association between SC and QOFDP mediated by CV (Figure 6) shows that the QOFDP has a strong and positive impact on the link between the two variables, as the impact is 0.364 for mediation while it is 0.351 for the direct relationship between SC and CV. As a result, it is demonstrable that QOFDP is an important mediating factor in the connection between the dimensions of SC and HC. The results show that the external social capital network (SCE) has a poor correlation with business value.

Sensitivity analysis

Based on one of the numerical models, the capital market theory aims to detect and forecast the long-term movements of capital and, in some situations, of financial markets. The term “capital market theory” is not exclusive when referring to the concept of protection. The capital market theory is a model that aims to value resources, typically stocks, but it compromises the advantages that financiers seek and the inherent risks (Holmes et al., 2008; By and Becker, 2022). Pressure from both internal and external stakeholders is seen as one of the key factors affecting a firm’s strategy. The internal stakeholders of the company could have a big influence on how companies are created. On the other hand, external stakeholders have a detrimental impact on business performance and capital efficiency (Xin et al., 2020). Multidimensional theories have, in the end, provided a thorough explanation of the significance and importance of this work. Overall, robustness tests show that although SCE (external network) has a negative influence on CV (−0.0403 respectively), QOFDP as compared to CV (1.323) does support the latter’s beneficial impact on CV. Pakistan should implement this study as a practical application. An earlier study explored and suggested the influence of social capital on the productivity of SMEs. This study provides proof that using a multifaceted approach to the social capital factor considerably and favorably increases the value of business sectors. On the other hand, empirical data show that external networks have a detrimental impact on the value and productivity of businesses. The Pakistani government should support and foster the value of the corporate sector.

Hypothesis summary

Results show that there is a positive and significant relationship between corporate value and social capital indices. Indicators of social capital in the framework of theoretical and empirical study offer greater intellectual capabilities to enhance company performance. This study offers proof that businesses implement sensible practices to raise corporate value. Similar to this, indices of human capital indicate a strong correlation between corporate values. The results of this investigation show both with and without a moderator. The effectiveness of financial decisions and policymaking play a beneficial influence in the relationship between social and human capital and their effects on business value (See Table 8). Researchers contend that various networks of external stakeholder groups put pressure on corporations to emphasize their commitment to corporate environmental practices that are integrated into SEMS performance and disclosed to increase both their efficiency and overall beneficial influence on society (Nazir et al., 2022).

Discussion

This study aims to inquire about the association between SC and HC on corporate value. Apart from that, another main objective has been to assess the moderating impact QOFDP on the association between SC and Corporate value. For achieving the main goal of this study, the researcher has followed a quantitative research design, in which the primary data was gathered through a survey questionnaire. Moreover, for the purpose of analysing the gathered data, the researcher has employed the SEM technique. In SEM, the researcher has conducted a CFA analysis to confirm the validity and reliability of the model and also conducts path assessment to test the model. In this regard, all the latent constructs are found be reliable as the value of Cronbach Alpha and composite reliability were computed above 0.7. Moreover, the outcomes of AVE also confirm the validity of all the latent constructs, as all the variables are found to be below 0.5. The extensive review of the existing literature has allowed the researcher to identify some of the key factors of SC that can influence corporate value. In this regard, some of the major factors of SC that were identified in this study include internal network and external network of social capital. All these factors were also highlighted in the conceptual framework, the impact of which has been examined on corporate value.

In accordance with the results of this study, all the variables including SC, HC and QOFDP are found to have a significant impact on corporate value, as p-value of all of these variables is computed as 0.000. On the other hand, the outcomes of this also confirm the significant moderating effect of QOFDP on the association between SC and corporate value. Similarly, with respect to the association between green HC and corporate value, the moderating impact of QOFDP is found to be significant. In contrast, as per the results, QOFD is found to have a significant moderating impact on the association between green human capital and corporate value. Conclusively, on the basis of the overall research outcomes of this study, the developed hypothesis including H1, H2, H3 and H4, and H6 are accepted.

The results of this study show that a multidimensional view of social capital is an important element in raising the standard of financial judgment and policy. In fact, the CFA for Corporate value results revealed that the following actions are crucial for businesses looking to improve the caliber of their financial decisions and policies. Offering new items or services, registering patents, and/or obtaining industrial property licenses are all examples of generating new policies or financial decisions, service delivery or logistics systems, or implementing major changes in these processes. However, because it will critically examine current policies and their efficacy in boosting social capital, financial capital, human capital, firm’s characteristics, and decision-quality, this research work will be of great assistance to policy makers in Pakistan’s various industrial sectors. This will then result in the adjustment of policy, where necessary.

It will further force businesses to rethink their current methods for achieving company performance. The value of social capital will come under close scrutiny. In order to create a culture of open communication and efficient procedures, the efficacy will be evaluated.

The study also looked at how decisions’ quality affected a firm’s success, which was later validated. Based on the research variables, which no other study was aware of by the researcher who attempted to do so, a full analysis of the registered Pakistan Stock Exchange firms is performed in this research. Second, because the majority of earlier research was conducted in wealthy nations, organizations in developing nations may not be able to implement the study’s conclusions due to the different set of conditions. Therefore, the results of this study will be more applicable in the setting of a developing globe. There is no such thing as the ideal investment, but for modern capitalists, finding a method that offers decent returns with little risk is a major priority.

There are certain implications of the research findings as well in the context of the organization management and the literature as well. It also has the implications for the policy makers as well (Nazir et al., 2022). The management of the organization can use this study for improving the corporate performance of their organization. It has set certain recommendations that are helpful for the organizations to improve their social capital performance and further can also be used by the organizations for developing the strong strategy for reducing the compliance risks and ensuring higher integrity of the organization (Twum et al., 2021). Furthermore, it has the implications for the present literature as well since it contributes in different ways. The limited literature on the role of compliance risk on the working capital has been added by elaborating in-depth different perspectives of the working capital performance and the wider factors of the compliance risks as well.

Evidence from earlier literature shows that professional workers who are essential to company value are under hired. According to the study’s findings, corporate sectors in Pakistan exacerbate managerial agency conflict, causing businesses to lose growth efficiency. The quality of financial decisions and policies applied in the context of moderation has a substantial impact on company value, which in turn has an impact on their financial performance. Corporate sectors with strong financial strategies for career development and training are typically less likely to take excessive business risks. Additional findings indicate that the QOFDP tends to influence SC and HC, which in turn affects corporate value. The QOFDP and business value link, however, needs more research and development.

Theoretical contribution

This study makes a considerable contribution to the literature and has resource-based theory and theoretical implications. The study helps understand the combined social capital and human capital effects through social exchange and institutional theories. Specifically, relationship exchange helps supply chain partners exchange resources, while social interactions help explain its corporate value (Ullah, Wang, Bashir, et al., 2021b). It also contributed to the theoretical understanding by discussing the mediating role of quality of decision between the social capital, human capital and corporate performance and hence it possess significant implication for the present literature and theory.

These outcomes support the findings of Ullah et al. (2021c) about the favorable effects of innovation on company performance and competitiveness. This is particularly true in emerging economies where innovation is scarce. The impact of social capital on a firm’s performance is also explored, including human and the quality of financial decisions and the results of policy decisions are depending on the decisions’ quality, which serves as a moderating variable. The quality of the policies and decisions that are made, as well as the combined impact of social capital, human capital, and decision-making quality on a firm’s corporate value, mitigate the impact of social capital on corporate performance. Finally, taking everything into account, these results show that, as shown by several studies on the research, social capital factors continue to be the primary criterion for business sustainability (Thiagaraj & Thangaswamy, 2017; Jun et al., 2020).

By offering a more inclusive distinction of the previously mentioned social capital link with corporate success, this study adds to the body of knowledge (Shabbir et al., 2020). We added to the body of literature already in existence by examining how corporate performance in the Pakistani corporate sector affects the quality of financial decisions and policies by concentrating on the quality of financial decisions and policies and building on earlier studies that showed how SC and HC performance had a significant impact on corporate value. Furthermore, we think that these findings will spur academia to improve SEMS efficiency by allowing for the mild impact of SC and HC perspective. The results should motivate organizations to promote intellectual skills in their corporate sectors.

Conclusion

This work examined the interaction between SC and HC in Pakistan’s medium- and large-scale businesses to identify necessary actions for businesses to enhance their corporate performance. It was discovered that SC and HC generally have a positive effect on corporate value, so businesses should concentrate on promoting corporate sustainability and performance that are moderated by QOFDP. Businesses that use quality of financial decision to create corporate value for their stakeholders have better competitive and sustainability capabilities. On the other hand, SCE has a negative relationship with CV. The suggested approach also demonstrated that corporate value (CV) has a higher direct relation on the quality of financial decisions and policy (QOFDP).

Findings prove that Pakistan is eager to moving forward with its reforms in all areas of social capital networks, human capital, and the establishment of sound financial policies. It should also be put into practice in Pakistan as a practical application. Action plans have been proposed to improve the nation’s financial analysis system to achieve this. Better systems should be made available by the Pakistani government to enhance business planning. The efficient mechanism ought to be considered in long-term and short-term financial decision-making as part of future planning and strategy. The study offers a superior method for enhancing business standards about the quality of financial decisions and policies. Therefore, to optimize corporate resource allocation, legislators, CEOs, and other stakeholders should put in place efficient research methods. Additionally, increase the efficiency with which policies are implemented to raise corporate sustainability and value.

Policy implications

It is vital for businesses to understand the importance of corporate performance to social capital and to take steps to improve business sustainability and quality of financial decision. Companies in Pakistan manufacturing industry are also pushed to be cognizant of environmental, economic, and business performance. It is also the government’s job to develop projects that provide green finance to employees. Businesses can increase environmental sustainability by increasing employee awareness of environmental issues. As a result, the Pakistan government should devise more enticing policies to encourage knowledge transfer and governance solutions outside of Pakistan.

Policymakers must create a financial plan for the next five to 10 years to increase business value in Pakistan. Results point to the direct effect of government involvement on the strategic diversity of corporate sectors. In this way, the current study examines the influence of SC and HC concerns for company value on the standard of financial judgments and corporate policy, as well as how this influence varies across nations with sophisticated financial sectors.

Furthermore, there are some of the policy implications of the research as well which implies to the regulatory bodies that are concerned with the compliances of the organization. It is viewed that the policy makers has the significance in the compliances of the organization and the way organization makes its decision and hence it implies them to develop the regulations that would help in developing better mechanism of the compliances in the organization.

Research limitation and future research

Despite widening the scope of this study, it has certain limitations as well. Firstly, the research is limited to the geographical bounds of Pakistan. Secondly, the analysis conducted in this study is limited to the manufacturing sector, therefore, it cannot be generalised to any other sector. Thirdly, limited factors of SC and HC and moderating variables have been considered in this study. Considering all the limitations, the research has sufficient room for improvement. For instance, more sample size can be considered in future to produce more robust results. In addition, in future, the researchers of this domain can conduct research on any specific manufacturing industry, for instance, pharmaceutical, retail, textile, etc. Moreover, the analysis can be conducted on any other country as well, for example, China and other Asian countries etc. or a comparative analysis between developing countries can be done as well. Lastly, more moderators or mediators can be tested between social capital and corporate value. It will make it possible to validate with greater precision that corporate sustainability-related actions do, in fact have a higher impact on business performance than sound financial and policy decisions.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Ethics statement

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. Written informed consent from the participants was not required to participate in this study in accordance with the national legislation and the institutional requirements.

Author contributions

JZ: Conceptualization, Methodology. HU: Review, editing writing—original draft. DX Supervision, Data Visualization. HA Editing and Proofreading.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2022.1015132/full#supplementary-material

References

Abbas, M. G., Wang, Z., Bashir, S., Iqbal, W., and Ullah, H. (2021). Nexus between energy policy and environmental performance in China: The moderating role of green finance adopted firms.

Afiouni, F. (2007). Human resource management and knowledge management: A road map toward improving organizational performance. J. Am. Acad. Bus., 11. 124–130.

Ahmad, N., Ullah, Z., Arshad, M. Z., Kamran, H., Scholz, M., and Han, H. (2021). Relationship between corporate social responsibility at the micro-level and environmental performance: The mediating role of employee pro-environmental behavior and the moderating role of gender. Sustain. Prod. Consum. 27, 1138–1148. doi:10.1016/j.spc.2021.02.034

Al-Tal, M. J. Y., and Emeagwali, O. L. (2019). Knowledge-based HR practices and innovation in SMEs. Organizacija 52 (1), 6–21. doi:10.2478/orga-2019-0002

Altayar, M. S. (2018). Motivations for open data adoption: An institutional theory perspective. Government Information Quarterly. doi:10.1016/j.giq.2018.09.006

Asadi, S., OmSalameh Pourhashemi, S., Nilashi, M., Abdullah, R., Samad, S., Yadegaridehkordi, E., et al. (2020). Investigating influence of green innovation on sustainability performance: A case on Malaysian hotel industry. J. Clean. Prod. 258, 120860. doi:10.1016/j.jclepro.2020.120860

Asghar, M. M., Wang, Z., Wang, B., and Zaidi, S. A. H. (2020). Nonrenewable energy—environmental and health effects on human capital: Empirical evidence from Pakistan. Environ. Sci. Pollut. Res. 27 (3), 2630–2646. doi:10.1007/s11356-019-06686-7

Asif, M., Khan, K. B., Anser, M. K., Nassani, A. A., Abro, M. M. Q., and Zaman, K. (2020). Dynamic interaction between financial development and natural resources: Evaluating the ‘Resource curse’ hypothesis. Resour. Policy 65, 101566. doi:10.1016/j.resourpol.2019.101566

Bayrakdaroglu, A., Ege, I., and Yazici, N. (2013). A panel data analysis of capital structure determinants: Empirical results from Turkish capital market. Int. J. Econ. Finance 5 (4), 131–140. doi:10.5539/ijef.v5n4p131

Bems, R. (2008). Aggregate investment expenditures on tradable and nontradable goods. Rev. Econ. Dyn. 11 (4), 852–883. doi:10.1016/j.red.2008.02.004

Bian, Y., and Qiu, H. (2000). The social capital of enterprises and its efficiency. Social Sciences in Chin 2 (2), 87–99.

Buera, F. J., Kaboski, J. P., and Shin, Y. (2011). Finance and development: A tale of two sectors. Am. Econ. Rev. 101 (5), 1964–2002. doi:10.1257/aer.101.5.1964

By, T., and Becker, G. (2022). Introduction to a theory of the allocation of time by gary becker James J . Heckman Source. Econ. J. 125 (583), 403–409. doi:10.1111/ecoj

Caiani, A., Godin, A., and Lucarelli, S. (2012). Innovation and finance: An SFC analysis of great surges of development. SSRN J. 733. doi:10.2139/ssrn.2169384

Chen, D., Ma, Y., Martin, X., and Michaely, R. (2022). On the fast track: Information acquisition costs and information production ✩. J. Financial Econ., 143 (2), 794–823. doi:10.1016/j.jfineco.2021.06.025

Chung, C. N., and Luo, X. (2008). Institutional logics or agency costs: The influence of corporate governance models on business group restructuring in emerging economies. Organization Science, 19 (5), 766–784.

Chung, H. F., Wang, C. L., and Huang, P. H. (2012). A contingency approach to international marketing strategy and decision-making structure among exporting firms. International Marketing Review, 29 (1), 54–87.

Danish, R. Q., Hafeez, S., Ali, H. F., Mehta, A. M., Ahmad, M. B., and Ali, M. (2020). Impact of ethical leadership on organizational commitment and organizational citizenship behavior with mediating role of intrinsic motivation. Int. Rev. Manag. Mark. 10 (4), 25–30. doi:10.32479/irmm.9840

Davis, B. S. J. (1987). “Allocative disturbances and specific capital in real business cycle theories author (s): Steven J. Davis source: The American economic review,” in Papers and Proceedings of the Ninety-Ninth Annual Meeting of the American, May, 1987, 326–332.

Dhaene, J. (2012). Optimal capital allocation principles author (s): Jan Dhaene, andreas tsanakas , emiliano A. Valdez and steven vanduffel. Available at: https://www.jstor.org/stable/41350677.

Dong, K., Zhao, J., Ren, X., and Shi, Y. (2022). Environmental regulation, human capital, and pollutant emissions: The case of SO 2 emissions for China. J. Chin. Econ. Bus. Stud. 00 (00), 1–25. doi:10.1080/14765284.2022.2106539

Dragomir, V. D. (2018). How do we measure corporate environmental performance? A critical review. J. Clean. Prod. 196, 1124–1157. doi:10.1016/j.jclepro.2018.06.014

Espinoza, R., and Presbitero, A. F. (2021). Delays in public investment projects. Int. Econ. doi:10.1016/j.inteco.2021.10.002

Felix, D., Oluwabusola, O., Okere, W., Ozordi, E., Osagie, G., Osiregbemhe, S., et al. (2018). Datasets for board meeting frequency and financial performance of Nigerian deposit money banks. Data Brief 19, 1852–1855. doi:10.1016/j.dib.2018.06.044

Gabriel, S. C., Baker, C. B., Gabriel, S. C., and Baker, C. B. (1980). Concepts of business and financial risk. Am. J. Agric. Econ. 62 (3), 560–564. doi:10.2307/1240215

Gao, Z., Xu, Y., Sun, C., Wang, X., Guo, Y., Qiu, S., et al. (2021). A systematic review of asymptomatic infections with COVID-19. Journal of Microbiology, Immunology and Infection 54 (1), 12–16.

Ghazanfar, M., Zhuquan, A., Hafeez, W., Muhammad, U., and Hasnain, M. (2021). Do entrepreneurial orientation and intellectual capital influence SMEs’ growth? Evidence from Pakistan.

Goll, I., and Rasheed, A. M. (1997). Rational decision-making and firm performance: The moderating role of the environment. Strategic Management Journal 18 (7), 583–591. doi:10.1016/j.frl.2019.04.011

Haddad, K., and Lotfaliei, B. (2019). Trade-off theory and zero leverage. Finance Res. Lett. 31, 165–170. doi:10.1016/j.frl.2019.04.011

Hoi, C. K., Wu, Q., and Zhang, H. (2018). Community social capital and corporate social responsibility. Journal of Business Ethics 152 (3), 647–665.

Holmes, T. J., Mitchell, M. F., Holmes, T. J., and Mitchell, M. F. (2008). A theory of factor allocation and plant size, 329–351.

Huhtala, M., Tolvanen, A., Mauno, S., and Feldt, T. (2015). The associations between ethical organizational culture, burnout, and engagement: A multilevel study. J. Bus. Psychol. 30 (2), 399–414. doi:10.1007/s10869-014-9369-2

Ikram, M., Mahmoudi, A., Zulfiqar, S., Shah, A., and Mohsin, M. (2019). Forecasting number of ISO 14001 certifications of selected countries: Application of even GM (1, 1), DGM, and NDGM models.

Iorember, P. T., Jelilov, G., Usman, O., Işık, A., and Celik, B. (2021). Correction to: The influence of renewable energy use, human capital, and trade on environmental quality in south Africa: Multiple structural breaks cointegration approach. Environ. Sci. Pollut. Res. 28 (11), 13175. doi:10.1007/s11356-020-11860-3

Iram, R., Anser, M. K., Awan, R. U., Ali, A., Abbas, Q., and Chaudhry, I. S. (2020). Prioritization of renewable solar energy to prevent energy insecurity: An integrated role. Singap. Econ. Rev. 66, 391–412. doi:10.1142/S021759082043002X

Jabeen, R., and Munir, S. (2018). The mediating effects of job satisfaction on the relationship between ethical leadership and organizational citizenship behavior. Korea Int. Trade Res. Inst. 5 (2), 753–765. doi:10.16980/jitc.16.5.202010.753

Jabłónski, A., and Jabłónski, M. (2016). Research on business models in their life cycle. Sustain. Switz. 8 (5), 430. doi:10.3390/su8050430

Jiang, Y., Guo, C., and Wu, Y. (2021). Can environmental information disclosure promote the high-quality development of enterprises? The mediating effect of intellectual capital. Environ. Sci. Pollut. Res. Int. 28 (24), 30743–30757. doi:10.1007/s11356-021-12921-x

Jin-fang, T., Chao, P. A. N., Rui, X. U. E., Xiao-tong, Y., Chen, W., Xu-zhao, J. I., et al. (2020). Corporate innovation and environmental investment: The moderating role of institutional environment. Adv. Clim. Change Res. 11 (2), 85–91. doi:10.1016/j.accre.2020.05.003

Jun, W., Waheed, J., Hussain, H., Jamil, I., Borbášová, D., and Anser, M. K. (2020). Working women and per capita household consumption expenditures; an untouched reality. Zb. Rad. Ekon. Fak. Au Rijeci. doi:10.18045/zbefri.2020.1.35

Kedar-levy, H. (2014). Predicting defaults of highly-levered firms with an adapted altman model predicting defaults of highly-levered firms.

Khan, F. N., Sana, A., and Arif, U. (2020). Information and communication technology (ICT) and environmental sustainability: A panel data analysis, 36718–36731.

Khan, N. U., Anwar, M., Li, S., and Khattak, M. S. (2021). Intellectual capital, financial resources, and green supply chain management as predictors of financial and environmental performance. Environ. Sci. Pollut. Res. 28, 19755–19767. doi:10.1007/s11356-020-12243-4

Law, S. H., Lee, W. C., and Singh, N. (2018). Revisiting the finance-innovation nexus: Evidence from a non-linear approach. J. Innovation Knowl. 3 (3), 143–153. doi:10.1016/j.jik.2017.02.001

Lin, L. S., Huang, C., Du, P. L., and Lin, T. F. (2012). Human capital disclosure and organizational performance: The moderating effects of knowledge intensity and organizational size. Management Decision.

Liu, C., Fang, J., and Xie, R. (2021). Energy policy and corporate financial performance: Evidence from China’s 11th five-year plan. Energy Econ. 93, 105030. doi:10.1016/j.eneco.2020.105030

Liu, H., and Baker, C. (2016). Ordinary aristocrats: The discursive construction of philanthropists as ethical leaders. J. Bus. Ethics 133 (2), 261–277. doi:10.1007/S10551-014-2394-2

Lucas, A. (2021). Investigating networks of corporate influence on government decision-making: The case of Australia’s climate change and energy policies. Energy Res. Soc. Sci. 81, 102271. doi:10.1016/j.erss.2021.102271

Mehmood, U. (2022). Environmental degradation and financial development: Do institutional quality and human capital make a difference in G11 nations? Environ. Sci. Pollut. Res. 29 (25), 38017–38025. doi:10.1007/s11356-022-18825-8

Ministry of Finance (2019). Capital markets and corporate sector. http://www.finance.gov.pk/survey/chapters_19/6-Captial Markets.pdf.

Moshirian, F. (2008). Globalisation, growth and institutions. J. Bank. Finance 32 (4), 472–479. doi:10.1016/j.jbankfin.2007.10.002

Murshed, M. (2020). An empirical analysis of the non-linear impacts of ICT-trade openness on renewable energy transition , energy efficiency , clean cooking fuel access and environmental sustainability in South Asia, 36254–36281.

Nazir, M., Akbar, M., Akbar, A., Poulova, P., Hussain, A., and Azeem Qureshi, M. (2022). The nexus between corporate environment, social, and governance performance and cost of capital: Evidence from top global tech leaders. Environ. Sci. Pollut. Res. 29 (15), 22623–22636. doi:10.1007/s11356-021-17362-0

Ni, X., Wang, Y., and Yin, D. (2021). Does modern information technology attenuate managerial information hoarding ? evidence from the EDGAR implementation. J. Corp. Finance 71, 102100. doi:10.1016/j.jcorpfin.2021.102100

Pattillo, C., Poirson, H., and Ricci, L. (2002). External debt and growth. Finance Dev. 39 (2), 1–35. doi:10.5089/9781451849073.001

Pham, T., Talavera, O., Wood, G., and Yin, S. (2022). Quality of working environment and corporate financial distress. Finance Res. Lett. 46, 102449. doi:10.1016/j.frl.2021.102449

Press, C. (1991). The theory of allocation and its implications for marketing and industrial structure:Why Rationing Is Efficient Author (s): Dennis W . Carlton (The University of Chicago Press for The Booth School of Business, University of Chicago), 231–262.

Pucheta-Martínez, M. C., and Gallego-Álvarez, I. (2020). Do board characteristics drive firm performance? An international perspective review of managerial science. Springer Berl. Heidelb. 14. doi:10.1007/s11846-019-00330-x

Ramawickrama, J., and Opatha, H. H. D. N. P. (2017). Quality of work life, job satisfaction, and the facets of the relationship between the two constructs. Int. Bus. Res. 10 (4), 167. doi:10.5539/ibr.v10n4p167

Rehman, S. U., Kraus, S., Shah, S. A., Khanin, D., and Mahto, R. V. (2021). Analyzing the relationship between green innovation and environmental performance in large manufacturing firms. Technol. Forecast. Soc. Change 163, 120481. doi:10.1016/j.techfore.2020.120481

Restuccia, D., and Rogerson, R. (2008). Policy distortions and aggregate productivity with heterogeneous establishments. Rev. Econ. Dyn. 11 (4), 707–720. doi:10.1016/j.red.2008.05.002

Risk, A. (2006). Solvency, capital allocation, and fair rate of return in insurance author (s): Michael sherris published by: American risk and insurance association stable. Available at: https://www.jstor.org/stable/3519970,

Robert Baum, J., and Wally, S. (2003). Strategic decision speed and firm performance. Strategic Management Journal 24 (11), 1107–1129.

Rocca, M. La, Stagliano, R., and Rocca, T. La. (2014). Unrelated diversification, 145–174. doi:10.1007/s11846-013-0098-0

Saad, A. F. (2021). Institutional change in the global economy: How trade reform can be detrimental to welfare. Econ. Model. 95, 97–110. doi:10.1016/j.econmod.2020.12.006

Sanchez-Ruiz, P., Daspit, J. J., Holt, D. T., and Rutherford, M. W. (2019). Family social capital in the family firm: A taxonomic classification, relationships with outcomes, and directions for advancement. Family Business Review 32 (2), 131–153.

Schlingemann, F. P., and Stulz, R. M. (2022). Have exchange-liste d firms b ecome less important for the economy. J. Financial Econ. 143 (2), 927–958. doi:10.1016/j.jfineco.2021.08.009

Shabbir, M. S., Aslam, E., Irshad, A., Bilal, K., Aziz, S., Abbasi, B. A., et al. (2020). Nexus between corporate social responsibility and financial and non-financial sectors’ performance: A non-linear and disaggregated approach. Environ. Sci. Pollut. Res. 27 (31), 39164–39179. doi:10.1007/s11356-020-09972-x

Shah, S. M. H., Nawaz, M., and Batool, A. (2021). Effect of manpower and resource factors on labor productivity at house building projects in DHA lahore. Manag. Sci. Bus. Decis. 1 (1), 12–20. doi:10.52812/msbd.14

Shahbaz, M., Ahmad, N., and Wahid, A. N. M. (2010). Savings-investment correlation and capital outflow: The case of Pakistan. Transit. Stud. Rev. 17 (1), 80–97. doi:10.1007/s11300-010-0137-3

Shahzad, M., Qu, Y., Javed, S. A., Zafar, A. U., and Rehman, S. U. (2020). Relation of environment sustainability to CSR and green innovation: A case of Pakistani manufacturing industry. J. Clean. Prod. 253, 119938. doi:10.1016/j.jclepro.2019.119938

Shi, C. (2003). On the trade-off between the future benefits and riskiness of R&D: A bondholders’ perspective. Journal of Accounting and Economics 35 (2), 227–254.

Society, T. E. (1953). Capital accumulation and efficient allocation of resources author (s): Edmond malinvaud published by: The econometric society stable. Available at: https://www.jstor.org/stable/1905538.

Steuerle, B. C. E. (1996). “How should government allocate subsidies for human capital? author (s): C. Eugene Steuerle source: The American economic review,” in Papers and Proceedings of the Hundredth and Eighth Annual Meeting of the American Econo, May, 1996, 353–357.

Sun, H. P., Tariq, G., Haris, M., and Mohsin, M. (2019). Evaluating the environmental effects of economic openness: Evidence from SAARC countries. Environ. Sci. Pollut. Res. 26, 24542–24551. doi:10.1007/s11356-019-05750-6

Thiagaraj, D., and Thangaswamy, A. (2017). Theoretical concept of job satisfaction - a study. Int. J. Res. Granthaalayah. 5 (6), 464–470. doi:10.29121/granthaalayah.v5.i6.2017.2057

Tinsley, H. E. A., and Brown, S. D. (2000). “Multivariate statistics and mathematical modeling,” in Handbook of applied multivariate statistics and mathematical modeling (Academic Press), 3–36. doi:10.1016/b978-012691360-6/50002-1

Twum, F. A., Long, X., Salman, M., Mensah, C. N., Kankam, W. A., and Tachie, A. K. (2021). The influence of technological innovation and human capital on environmental efficiency among different regions in Asia-Pacific. Environ. Sci. Pollut. Res. 28 (14), 17119–17131. doi:10.1007/s11356-020-12130-y

Ullah, H., Abbas, A., and Iqbal, N. (2015). Impact of capital structure on profitability in the manufacturing and non-manufacturing industries of Pakistan. Int. Lett. Soc. Humanist. Sci. 59, 28–39. doi:10.18052/www.scipress.com/ilshs.59.28

Ullah, H., Wang, Z., Abbas, M. G., Zhang, F., and Shahzad, U. (2021a). Association of financial distress and predicted bankruptcy: The case of Pakistani banking sector, 573–585. doi:10.13106/jafeb.2021.vol8.no1.573

Ullah, H., Wang, Z., Bashir, S., Khan, A. R., Riaz, M., and Syed, N. (2021b). Nexus between IT capability and green intellectual capital on sustainable businesses: Evidence from emerging economies. Environ. Sci. Pollut. Res. Int. 28, 27825–27843. doi:10.1007/s11356-020-12245-2

Ullah, H., Wang, Z., Mohsin, M., Jiang, W., and Abbas, H. (2021c). Multidimensional perspective of green financial innovation between green intellectual capital on sustainable business: The case of Pakistan. Environ. Sci. Pollut. Res. 29, 5552–5568. doi:10.1007/s11356-021-15919-7

Venkateswaran, V. (2019). Comments on ‘Loss-offset provisions in the corporate tax code and misallocation of capital. J. Monetary Econ. 105, 21–23. doi:10.1016/j.jmoneco.2019.04.008

Wang, H., Ye, K., and Zhong, K. (2018). Accounting research in China: Commemorating the 40th anniversary of reform and opening up. Front. Bus. Res. China 6, 25. doi:10.1186/s11782-018-0046-6

Wang, Y., Tsai, C. H., Lin, D. D., Enkhbuyant, O., and Cai, J. (2019). Effects of human, relational, and psychological capitals on new venture performance. Front. Psychol. 10, 1071–1110. doi:10.3389/fpsyg.2019.01071

Warner, R. M. (2013). From bivariate through multivariate techniques. Appl. Statistics Bivariate Through Multivar. Tech., 645–687.

Xin, Z., Tahajuddin, S., Lajuni, N., Bosi, M. K., Lee, A., Xin, Z., et al. (2020). Internal stakeholders. Press. Environ. Account. Report. SMEs Shanxi Prov. China 1 (3), 438–450. doi:10.6007/IJARAFMS

Yang, Z., Abbas, Q., Hanif, I., Alharthi, M., Taghizadeh-Hesary, F., Aziz, B., et al. (2021). Short- and long-run influence of energy utilization and economic growth on carbon discharge in emerging SREB economies. Renew. Energy 165, 43–51. doi:10.1016/j.renene.2020.10.141

Yu, Y., and Qayyum, M. (2022). Dynamics between carbon emission, imported cultural goods, human capital, income, and energy consumption: Renewed evidence from panel VAR approach. Environ. Sci. Pollut. Res. 29, 58360–58377. doi:10.1007/s11356-022-19862-z

Zhang, C., Liu, Q., Ge, G., Hao, Y., and Hao, H. (2021). The impact of government intervention on corporate environmental performance: Evidence from China’s national civilized city award. Finance Res. Lett. 39, 101624–101712. doi:10.1016/j.frl.2020.101624

Zhang, Q., Yang, L., and Liu, C. (2021). Vertical structure, capital misallocation and capital allocation efficiency of the real economy. Econ. Change Restruct. 54 (2), 557–584. doi:10.1007/s10644-020-09289-2

Zhang, S., Ma, M., Li, K., Ma, Z., Feng, W., and Cai, W. (2022a). Historical carbon abatement in the commercial building operation: China versus the US. Energy Econ. 105, 105712. doi:10.1016/j.eneco.2021.105712

Zhang, S., Ma, M., Xiang, X., Cai, W., Feng, W., and Ma, Z. (2022b). Potential to decarbonize the commercial building operation of the top two emitters by 2060. Resour. Conservation Recycl. 185, 106481. doi:10.1016/j.resconrec.2022.106481

Zhao, B., Yao, P., Bianchi, T. S., Arellano, A. R., Wang, X., Yang, J., et al. (2018). The remineralization of sedimentary organic carbon in different sedimentary regimes of the Yellow and East China Seas. Chem. Geol. 495, 104–117. doi:10.1016/j.chemgeo.2018.08.012

Zhao, J., Jiang, Q., Dong, X., and Dong, K. (2020). Would environmental regulation improve the greenhouse gas benefits of natural gas use? A Chinese case study. Energy Econ. 87, 104712. doi:10.1016/j.eneco.2020.104712

Keywords: social capital (culture), human capital (HC), quality of financial information, policy, SMEs, small and medium sized enterprises

Citation: Zhang J, Ulllah H, Diao X and Abbas H (2022) Multidimensional perspective of social capital and quality of financial decision on corporate value: The case of Pakistan. Front. Environ. Sci. 10:1015132. doi: 10.3389/fenvs.2022.1015132

Received: 09 August 2022; Accepted: 12 September 2022;

Published: 10 October 2022.

Edited by:

Kangyin Dong, University of International Business and Economics, ChinaCopyright © 2022 Zhang, Ulllah, Diao and Abbas. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hafeez Ulllah, aGFmZXouMjAxN0Bob3RtYWlsLmNvbQ==

Jiewei Zhang1

Jiewei Zhang1 Hafeez Ulllah

Hafeez Ulllah