- 1Institute of Circular Economy, Beijing University of Technology, Beijing, China

- 2Chinese Academy for Environmental Planning, Beijing, China

The carbon market is a crucial market-oriented tool in achieving carbon neutrality and has been adopted by many countries and regions. China has established a policy system covering eight carbon trading pilots since 2013 and has implemented effective practices. Despite the evaluation of the carbon markets at the national level, few studies identified the carbon emission reduction effect for a specific region or assessed the differentiated characteristics that may significantly impact the development of the carbon market. This study took the Beijing-Tianjin-Hebei (BTH) region as the research sample and aimed to estimate the carbon emission reduction effect of the carbon market by using a difference-in-differences approach. Our findings suggested that the carbon market in the BTH region effectively reduced its carbon intensity by 14.04%. Our estimations were robust after using a winsorization panel or establishing a new control group. Furthermore, the results also indicated that the carbon market’s effect on reducing carbon intensity differs across cities and shows an increasing trend yearly. Relevant recommendations for promoting carbon trading policies were proposed.

1 Introduction

Carbon emission trading is an essential economic means of achieving carbon emission reduction targets (Dai et al., 2018). At present, many countries and regions have established carbon emission trading systems. The European Union officially launched a carbon market in 2005 and became the first region to use market mechanisms to implement the Paris Agreement’s carbon reduction targets (Redmond and Convery, 2015; Bayer and Aklin, 2020). California’s cap-and-trade system is one of the largest multi-sectoral emissions trading systems and aims to meet California’s ambitious goals to reduce greenhouse gas emissions (Hu and Chen, 2019; Xu and Hobbs, 2021). Additionally, carbon markets in New Zealand (Rontard and Hernández, 2022) and Swiss (Qi and Weng, 2016) are also developing rapidly and have become important policy instruments for carbon reduction.

In China, carbon trading has been ongoing for many years. China’s carbon trading policy was established under the framework of the carbon emission reduction policy. In December 2009, China made great efforts to promote the adoption of the Copenhagen Accord at the Climate Change Conference, which proposed that China will reduce its carbon intensity by 40–45% from the 2005 level by 2020. The Chinese government has adopted measures to achieve the carbon reduction target, including decomposition and assessment of carbon intensity targets, compilation of national greenhouse gas inventories, and a carbon trading policy. Among these policies, carbon trading is a market-oriented policy that allocates carbon quotas to enterprises and trades based on market demand and supply. China’s carbon trading policy starts with establishing carbon trading pilots. The earliest carbon trading pilots began in Shenzhen, Beijing, Shanghai, Tianjin, Guangdong, Hubei, and Chongqing. After several years of trading practices, Fujian became the eighth carbon trading pilot in 2016 (Liu et al., 2019). Overall, China’s carbon trading pilots have three distinguishing characteristics. First, the carbon trading pilots are fragmented rather than unified. Because each carbon trading pilot is distributed in different regions, it objectively causes spatial and operational separation between carbon markets. Second, the vitality of regional carbon trading pilots is different, which is usually related to the level of local economic development. It has been proved that carbon trading pilots in Shenzhen, Shanghai, Guangdong, and Beijing are more active due to the higher economic growth. Furthermore, the regional carbon trading pilots have accumulated rich experience establishing the national carbon market. In July 2021, China launched a nationwide carbon emission trading market in the power generation sector after the practices of regional carbon trading pilots (Zhu et al., 2022). Therefore, China has formed a carbon trading policy system consisting of a national carbon market in the power generation sector and eight carbon trading pilots.

Despite the accelerating development of the national carbon market, regional carbon trading pilots still play a crucial role in the carbon trading policy system. China’s regional carbon trading volume and turnover are on the rise. According to the Wind Database, the pilots’ total carbon trading volumes rose from 0.3 million tons in 2013 to 43.4 million tons in 2020. Accordingly, the carbon trading turnover increased from 20.47 million tons in 2013 to 1,266.84 million Chinese currency Yuan (hereafter, CNY) in 2020. Consequently, the carbon trading volume and turnover from 2013 to 2020 accumulated to 237.2 million tons and 5,744.66 million CNY, respectively. These figures indicate that regional carbon trading pilots have become an increasingly crucial market-oriented policy tool and will continue to promote carbon emission reduction.

Some fascinating studies have analyzed the reduction effect of carbon trading policies (Munnings et al., 2016; Zhou et al., 2019; Xuan et al., 2020; Wang et al., 2022). Most previous studies focused on investigating carbon markets’ impact on reducing carbon emissions in all pilots. These studies provide an overall assessment of the carbon trading policy in China but did not explore specific regions, leading to an unclear identification of carbon trading pilots’ characteristics. However, the carbon market characteristics differ across cities due to the significant differences in economic development, population size, and industrial structure among cities. Therefore, it is urgent to carry out relevant studies on specific regions to supplement the research deficiencies.

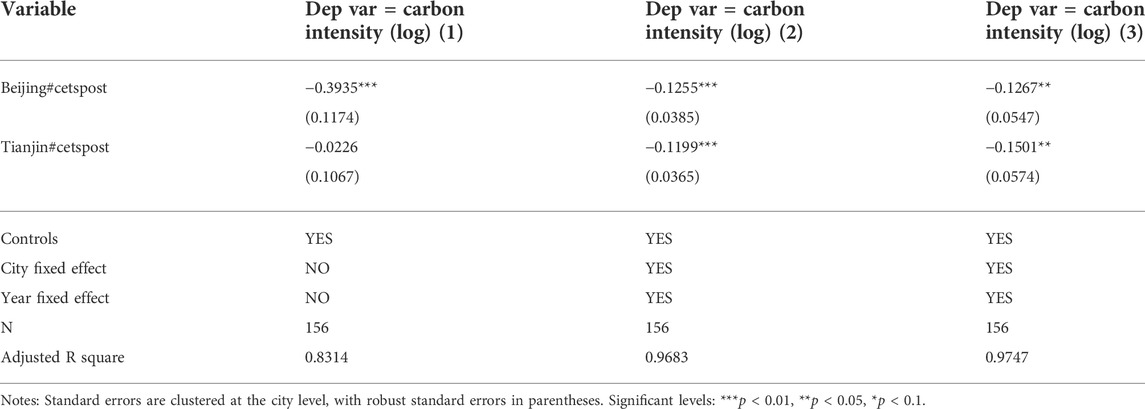

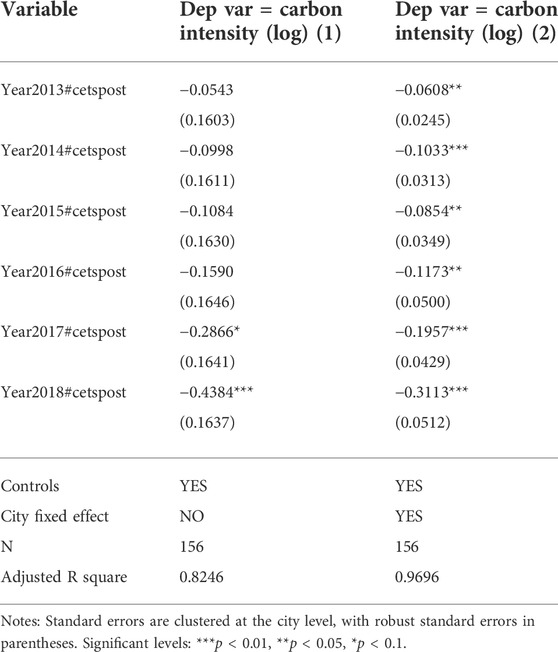

This study mainly aims at identifying the carbon emission reduction effect in the Beijing-Tianjin-Hebei (BTH) region, focusing on solving the following research problems: Does the carbon trading policy effectively reduce carbon intensity in the BTH region? Are there any differences between different cities and years if the reduction effect exists? The analysis focusing on the BTH region is valuable in research. The BTH region consists of two municipalities (Beijing and Tianjin) and one province (Hebei) and has become a major national strategic development area (As shown in Figure 1). As a significant economic growth pole in northern China, the BTH region assumes an important economic role. The political, economic, and social characteristics in the BTH region are different among cities, which complicates the implementation of the carbon trading policy. For example, Beijing’s GDP and population are the highest among these cities, with a GDP of 3,610.26 billion CNY and a population of 21.89 million (Figure 2A). Furthermore, the proportion of the BTH region’s GDP to total GDP at 8.59% (Figure 2B), and the population proportion at 7.82% (Figure 2C).

FIGURE 1. The geographical distribution of the treatment and control groups. Data sources: National administrative division information inquiry platform.

FIGURE 2. The GDP and population description of the Beijing-Tianjin-Hebei region. Note: (A) shows the GDP and population of cities in the BTH region; (B) indicates the proportion of the BTH region’s GDP in the nation; (C) provides the proportion of the BTH region’s population in the nation. Data sources: Wind database.

To comprehensively solve the research problems, we constructed a quasi-natural experiment by comparing the adoption of the policy between a treatment and a control group. Using a difference-in-differences model (DID), we explored whether the carbon trading policy in the BTH region affects carbon intensity. We employed a series of robustness tests to verify the reliability of the results. Furthermore, we examined the potential heterogeneous effects across cities over the years and provided policy implications to promote the regional carbon trading policy.

The remainder of this study is organized as follows: Section 2 provides a literature review, Section 3 describes the methodology and data, Section 4 provides the main results, Section 5 discusses the findings, and Section 6 concludes and provides policy implications.

2 Literature review

The carbon trading policy has been widely investigated. Scholars conducted multi-dimensional discussions about carbon markets. The carbon market is a market-oriented policy tool in some countries and regions. Some studies have summarized the main characteristics of marketization mechanisms, including the contents of carbon quota allocation, carbon price, and carbon finance. As the carbon market continues to grow, some studies evaluated the efficiency of the carbon market, providing some findings for showing the maturity of the carbon market. Since the essence of the carbon market is to promote carbon mitigation, a growing number of studies focused on estimating the reduction effectiveness of carbon trading policy. These studies used econometric approaches and compared the carbon trading intervention on carbon emissions between different policy groups. Overall, the relevant research concerning carbon trading policy can be summarized in three aspects as follows:

First, some studies focused on introducing the main characteristics of carbon trading policy. Since the European Union (EU) carbon market has been developing for many years and has formed a relatively mature market system, some studies reviewed the characteristics of the EU carbon market. Some studies observed the carbon trading behaviors of the emitting enterprises, assessing the interactions between carbon trading behaviors and carbon price in the EU market (Bayer and Aklin, 2020). For the market design, some studies revealed the initial allocation rules, permits price, spatial and temporal limits, and correlation between clean development mechanisms and the carbon market in the EU (Chevallier, 2011). To assess the maturity of the carbon market, some studies applied comprehensive criteria to identify the maturity degree and found the EU carbon market was currently the most mature carbon trading market (Zhang et al., 2019).

As China actively promotes developing carbon markets, some scholars reviewed the developing process of China’s carbon markets and analyzed the opportunities and challenges of promoting the carbon market (Liu et al., 2015; Weng and Xu, 2018). In terms of specific research on the carbon market, researchers have carried out studies from different dimensions. Some studies focused on the analysis of how to allocate carbon emission allowances. They compared the advantages and disadvantages of benchmark, grandfathering, and other methods (Zhang et al., 2014; Liao et al., 2015; Wang et al., 2019) and evaluated the regional and sectoral impacts (Yu et al., 2018; Zhang et al., 2018; Peng et al., 2021). Most studies on carbon pricing concluded that the carbon price is a crucial instrument in guiding enterprises’ behaviors (Narassimhan et al., 2018; Zhu et al., 2019; Lu et al., 2020), and the level of the carbon price is highly correlated with carbon emissions reduction (Fang et al., 2018; Tvinnereim and Mehling, 2018; Lin and Jia, 2019). These studies described China’s regional carbon markets and how they evolved into an integrated national carbon market. Based on the characteristics of carbon markets, previous studies have proved that developing carbon markets is theoretically and practically possible and has been an effective environmental policy to help realize the target of carbon emissions in China.

Second, some studies evaluated the efficiency of carbon markets. To estimate the developing level of carbon markets, researchers proposed an entropy-based TOPSIS model to measure the maturity of the carbon market. They concluded that the overall maturity of China’s pilot carbon markets is relatively low, and there are apparent differences in maturities among the seven pilot carbon markets (Liu et al., 2019). Most studies directly evaluated the efficiency of China’s carbon market. For example, some studies used the DEA method (Zhang W. et al., 2020) and the multifractal detrended fluctuation technique (Fan et al., 2019) to measure market efficiency. Based on the DEA model, their results suggest that the overall efficiency of China’s carbon trading pilots increases annually and shows regional differences. More specifically, in 2015 and 2016, the carbon markets in Guangdong and Shenzhen gradually matured, while the markets in Shanghai and Chongqing did not reach efficiency standards (Zhang W. et al., 2020). Furthermore, fewer researchers focused on a specific carbon market, such as the Hubei market, to detect market efficiency using a wild bootstrapping variance ratio test. Their findings indicate that the market efficiency for 2014–2020 in the Hubei pilot is around 0.3951, less than 1, suggesting a weak status of carbon market efficiency (Chen et al., 2021).

The third category investigated the reduction effect of China’s carbon trading policy. Concerning the primary target of reducing carbon emissions, some researchers examined whether the carbon market promotes carbon mitigation. Some research focuses on estimating the reduction effect of carbon trading pilots in China. Their studies commonly used a DID model to compare the policy group (treatment) and the non-policy group (control). Most of the research concluded that the carbon market is an efficient carbon mitigation way (Jotzo et al., 2018; Dong et al., 2019; Zhou et al., 2019; Chai et al., 2022). In the background of achieving carbon neutrality, some scholars proposed that the carbon trading policy has a significant and sustainable impact on achieving carbon neutrality (Wang et al., 2022). As the development level of carbon trading is highly correlated with carbon reduction costs, some studies focused on assessing the economic costs of carbon trading policies (Newell et al., 2014; Fan et al., 2016; Qi and Weng, 2016). Some of these studies used a multi-regional Computable General Equilibrium (CGE) model to examine the impact of the national carbon market on regional economics. Their findings suggested that the national carbon market can effectively reduce economic costs by improving welfare and reducing regional economic disparity.

Furthermore, some studies assessed the effects of carbon emissions reduction from an enterprise perspective. Based on a quasi-natural experiment, some studies comprehensively assessed China’s regional carbon trading policy on firm carbon emissions. Their findings suggested that the regional carbon trading policy effectively reduced a 16.7% reduction in total carbon emissions and a 9.7% reduction in carbon intensity for firms (Cui et al., 2021). Compared with China’s carbon markets, the EU carbon market has been widely investigated by studies. Some scholars used firm-level trading datasets to observe the causal impact of EU carbon trading on carbon emissions and found that the carbon trading policy in the EU has a slight improvement in carbon intensity (Jaraite-Kažukauske and Di Maria, 2016). Most studies supported that the carbon trading policy positively impacts firms’ behaviors: management, transaction, and technology (Cao et al., 2021; Li et al., 2021).

In general, scholars have carried out a lot of research on carbon markets. These studies provided insightful evidence for policymakers to develop carbon markets and offer valuable references for academic research. However, the current research on China’s carbon market mainly analyzes the reduction impact from the perspective of the overall carbon markets. Furthermore, few studies focus on a specific region for targeted research. This may lead to insufficient identification of the differential characteristics of regional carbon markets.

3 Methodology and data

3.1 Methodology

We constructed a DID approach to estimate the carbon markets’ effect on reducing carbon intensity. The DID model is an efficient method for identifying causal effects in research. The DID model has been widely used in econometric analyses and is an efficient approach for assessing the impact of a specific policy. The basic specification of the DID model was to set the treatment and control groups in a quasi-natural experiment. Rather than other characteristics, the policy is the primary intervention that causes differences between the treatment and control groups (Arnold et al., 2010). The advantage of this approach is that it can estimate the effect of a specific intervention or treatment by comparing changes in outcomes over time. Many scholars used the DID method to investigate China’s clean winter heating policy (Weng et al., 2021; Weng et al., 2022) and air pollution control policy (He et al., 2020; Zhang et al., 2021).

Based on the characteristics of China’s carbon markets, we constructed a quasi-natural experiment for the Beijing-Tianjin-Hebei (BTH) region. In the DID model, we set cities that implemented the carbon trading policy as a treatment group while cities that have not implemented the policy as a control group. Therefore, the model specifications are set as follows:

Where

Furthermore, we controlled for a series of fixed-effects in the model. Usually, the fixed-effects models can be summarized into three types: individual fixed-effects, time fixed-effects, and two-way (both individual and time) fixed-effects model. In the individual fixed-effect model, only the unobservable time-invariant determinants are controlled. In the time fixed-effect models, only the city trends in different periods are controlled. The two-way fixed-effects model is the combined effects of the individual and time fixed-effects models. Therefore, we used a city-specific fixed effect

3.2 Data sources

We used carbon intensity as a dependent variable, calculated by coal, natural gas, oil, and electricity consumption for each city in the BTH region. These energy-related data are drawn from the City Statistical Yearbook and the official website of each city’s statistical bureau. Furthermore, we collected yearly data on population, the proportion of secondary industrial added values, number of industrial firms, foreign direct investment, energy consumption, and fiscal expenditure from the City Statistical Yearbook.

4 Results

4.1 Reduction effect of the carbon markets

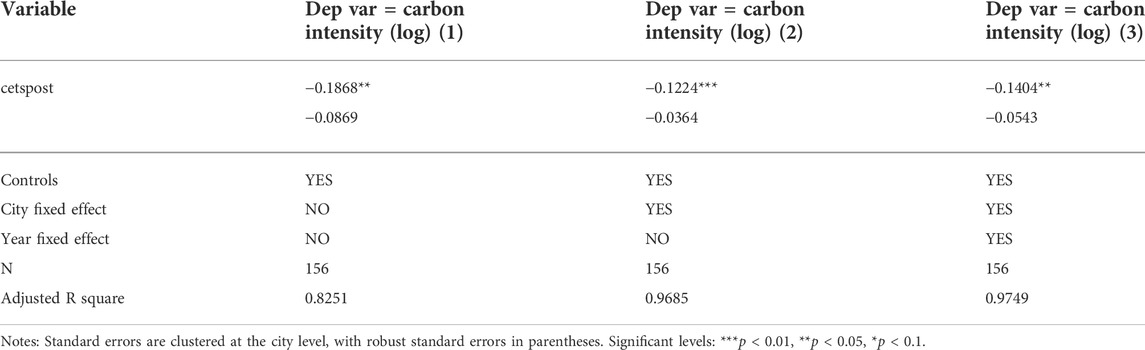

Table 1 reports the results that the carbon markets may impact carbon intensity. Column 1) shows the estimation without including any fixed effects. We found that the carbon trading policy would cause a reduction of 18.68% in carbon intensity in the BTH region. In column 2), we included a city fixed-effect to control unobservable time-invariant determinants of carbon intensity across cities and found that carbon intensity decreased by 12.24% after implementing a carbon trading policy. Furthermore, we included city and year fixed effects in column 3). The results indicate that the carbon trading policy would considerably reduce the effect with 14.04% in carbon intensity.

These findings suggest that the carbon trading policy in the BTH region plays a significant role in reducing carbon intensity. The primary reason for its effectiveness is that it can decrease carbon abatement costs for enterprises through trading. Once the demanders with high carbon abatement costs need to purchase the carbon quota, they would trade with suppliers whose carbon reduction costs are relatively lower. As a result, demanders and suppliers would benefit from the trading process. The demanders can achieve their abatement targets at a low cost, while the suppliers can obtain additional economic benefits based on their low-carbon technological innovation. Therefore, the carbon trading policy can help reduce carbon reduction costs, yield enterprises’ financial revenues, and result in considerable carbon emission reduction.

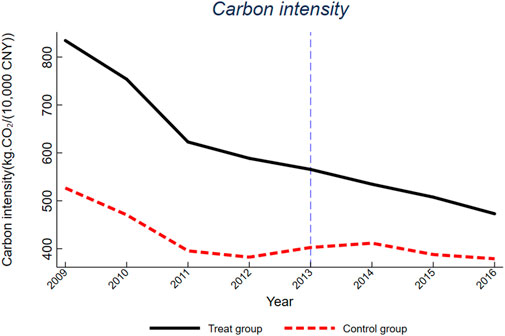

4.2 Parallel trend test

Figure 3 plots the parallel trend of carbon intensity between the treat and control groups before and after the carbon trading policy. The basic assumption of the parallel trend is that there were no systematic differences between treat and control groups before the policy. The dashed vertical line in Figure 3 is the year when the carbon trading policy started. In most years, we found that the carbon intensity in the treat group tended to be higher than in the control group. However, carbon intensity in the treat group showed a more evident decreasing trend after policy implementation, leading to increasingly narrow differences in carbon intensity between the treat and control groups. These findings indicate that the changing trend that the carbon trading policy plays a prominent role in reducing carbon intensity and the parallel trend between the treat and control groups is satisfied.

4.3 Robustness test

4.3.1 Winsorization panels

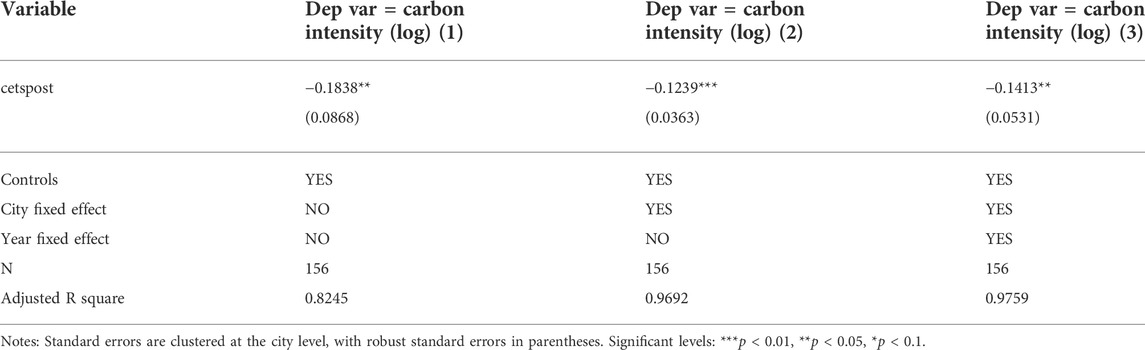

Because extreme values may interfere with the overall distribution trend of samples, we reported the results of a winsorization panel in Table 2. We winsorized all variables in the panel at 1st and 99th percentiles and overwrote the old variables. Results show that the reduction estimates are stable compared to the main regression in Table 1. Columns (1)–3) report the estimations with or without fixed effects. Without any fixed effects in column (1), the reduction coefficient is 18.38% showing that the carbon trading policy can significantly reduce carbon intensity in the BTH region. In columns 2) and (3), the city and year fixed effects are subsequently added, indicating that these fixed effects slightly decrease the reduction magnitude with a decrease of 12.39 and 14.13%, respectively. The results under the winsorization panels are close to the results in the main regression, suggesting that our panel data structure is relatively robust and no significant extreme values interfere with the results, further indicating the reliability of the main results.

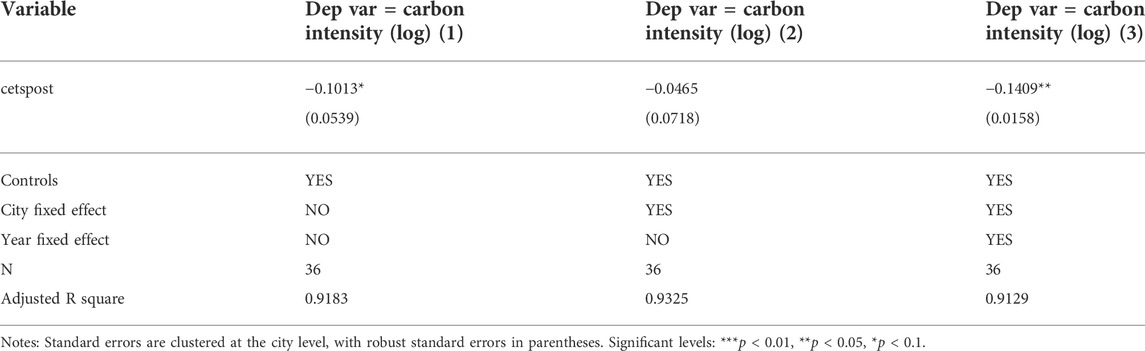

4.3.2 Effect of a new control group

Table 3 shows the robustness test if a new control group is included. In the baseline regression, we set cities in Hebei province that have not implemented carbon trading policies as the control group. Still, if the control group was significantly different from the treatment group, the results could also be biased. Therefore, we chose Shijiazhuang, the provincial capital city with the highest economic development and the largest concentration of population in Hebei province, as a new control group. Shijiazhuang has more common features regarding geography, economy, and politics with the treatment cities. Columns (1)–3) show the estimations under different controlled fixed effects. We found that the overall reduction effect is still maintained, but the fixed effects also impact the results. Specifically, the regression coefficient in column 2) is not significant when only the city fixed effect is controlled but excludes the year fixed effect. This is mainly because the yearly differences between cities may significantly affect the carbon intensity, leading to a biased estimation without controlling for the year fixed-effect. Therefore, we added the year fixed-effect in the model and found that the coefficient is statistically significant in column 3) with a reduction of 14.09% when both city and year fixed-effects are included in the regression. These results provide supporting evidence for demonstrating the robustness of the baseline regressions.

4.4 Heterogeneity test

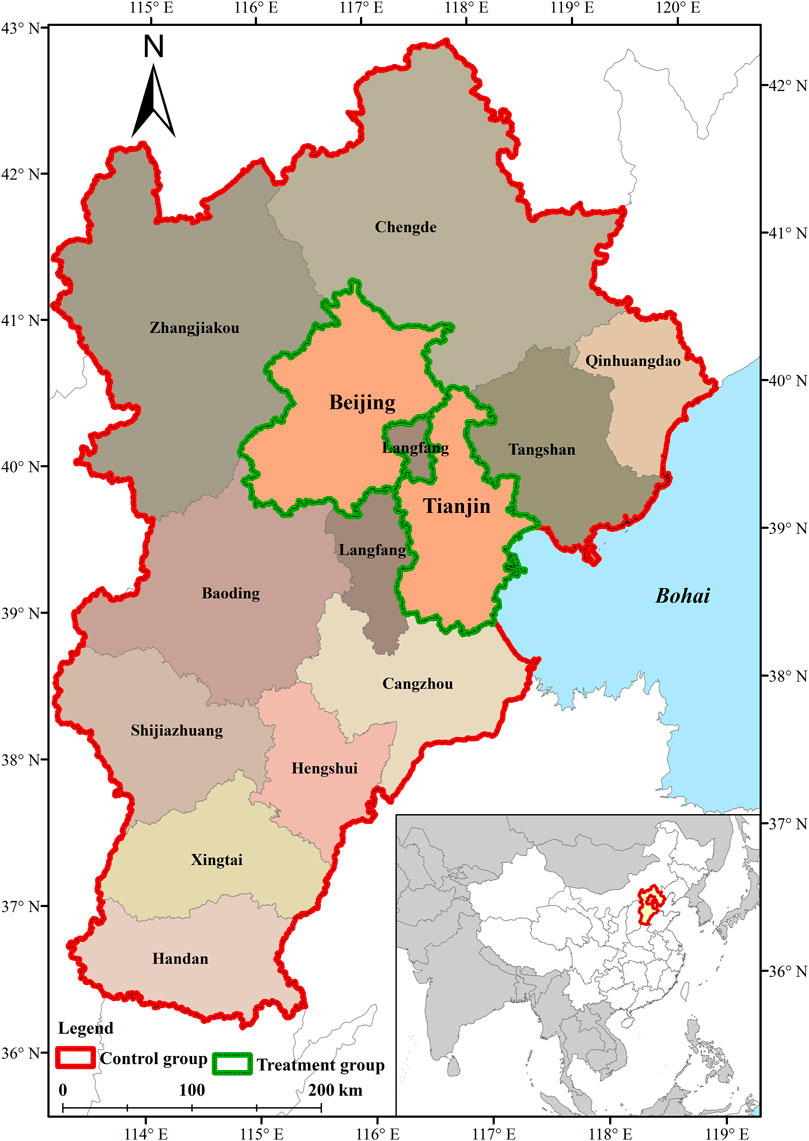

4.4.1 Heterogeneous effect of Beijing and Tianjin

Table 4 shows the heterogenous effect across cities. We used a dummy variable representing Beijing and Tianjin to conduct cross-regression with policy variables. Columns (1)–3) show the results after controlling for different fixed effects. In column (3), when controlling for city and year fixed effects, we found that the reduction effect in Tianjin is slightly higher than that in Beijing, indicating a reduction of 12.67 and 15.01% in Beijing and Tianjin, respectively. These results demonstrate that although carbon markets in different cities significantly reduce carbon intensity, the effects are different. This is because Beijing is the political center and has a large economic system, implying more diverse and flexible means to reduce carbon emissions. In the past years, Beijing has implemented the toughest-ever air pollution control policies (Zheng et al., 2017). These policies not only achieved the goal of air quality improvement but also played a synergistic effect on carbon emission reduction (Liu et al., 2020; Xu et al., 2021). With the intervention of other environmental policies, the role of the carbon market in reducing carbon intensity in Beijing will be lower than that in Tianjin.

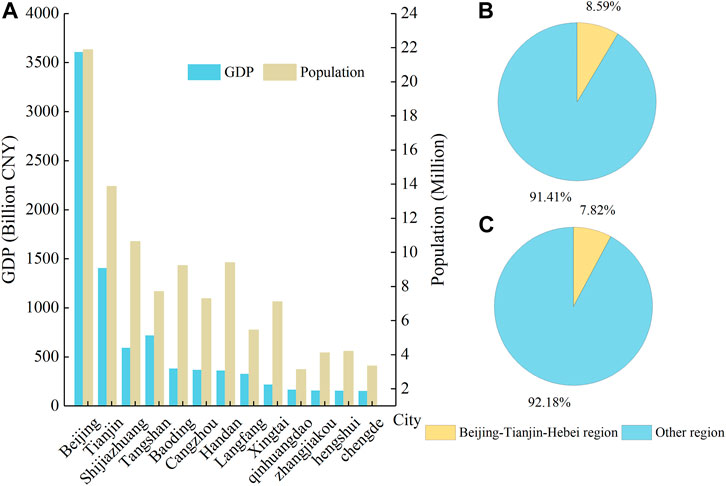

4.4.2 Heterogeneous effect over the years

Table 5 reports the regression results over the years. Column 3) shows city control and year-fixed effects estimates. When controlling for the city fixed effect, we found that the reduction effects of carbon intensity in the BTH region are statistically significant, showing an increasing trend yearly. For example, the reduction effects of carbon intensity are slightly less than that in the later years, showing a 6.08, 10.33, and 8.54% reduction in 2013, 2014, and 2015, respectively. In contrast, the reduction effects are more considerable in 2016, 2017, and 2018, indicating a reduction of 11.73, 19.57, and 31.13%, respectively. These intensified reduction effects over the years suggest that the carbon market in the BTH region is gradually maturing and playing an increasingly significant role in reducing carbon emissions. With the continuous practical development of the carbon market, the mechanism of the carbon market, such as the mechanism of carbon quota allocation, information disclosure, price guidance, and transaction supervision, has gradually been established and improved. As a result, the carbon intensity reduction effect of the carbon market has shown an increasing trend year by year.

5 Discussion

The carbon trading system is an essential market-based environmental policy widely used in many countries and regions. In China, eight carbon trading pilots have been established since 2013. Numerous studies have investigated the overall reduction effect of all carbon trading pilots. Still, few studies focused on a specific region to identify its characteristics and analyze the effectiveness of carbon emissions mitigation. Therefore, we constructed a quasi-natural experiment to examine the carbon emissions reduction effect in China’s BTH region, considered one of the most important economic and social development regions.

Our findings suggest that the carbon trading policy in the BTH region is effective in reducing carbon intensity. The results show that the carbon intensity in the BTH region would decrease by 14.04% when implementing the carbon trading policy. Our studies are consistent with the findings in other studies, and the reduction magnitude is considerable. For example, some studies found that China’s carbon trading pilots have significantly reduced carbon intensity, leading to an average annual decline of approximately 0.026 tons/10,000 yuan in the pilot provinces (Zhou et al., 2019). Similarly, other studies used a DID model to test China’s carbon trading pilots’ effect on reducing carbon intensity. Their findings are close to ours, showing that the carbon intensity in the carbon trading pilots decreased by 24.85% (Xuan et al., 2020) and 11% (Chai et al., 2022). Most studies focused on evaluating the effectiveness of the carbon trading policy at the national level. However, our research takes a specific region of China into a new perspective. Unlike other carbon trading pilots (e.g., Shanghai, Guangdong, Hubei, Chongqing, and Shenzhen), the carbon market in the BTH region has more policy implications for achieving carbon emission reduction targets. The BTH region is an essential economic but most polluted (Wu et al., 2015) and a substantial source of carbon emissions (Zhou et al., 2021) in China, but the existing studies have not fully identified the role of carbon trading policy in the BTH region in reducing carbon emissions. As a result, researchers and policymakers did not prove the effectiveness and appropriateness of the carbon market in the BTH region. In the background of achieving carbon neutrality, promoting regional carbon emission reduction becomes more urgent and meaningful. Therefore, our analysis provides evidence that the BTH region’s carbon trading policy has yielded considerable reduction benefits. These findings further prove the importance of developing a regional carbon trading system.

Our results can be compared with those studies focused on the industrial level. For example, some scholars investigated the effect of carbon trading policy on carbon reduction in industrial enterprises. They found that it can significantly reduce the emission (24.2%) of industrial CO2 (Zhang W. et al., 2020) and achieve 129.588 million tons of carbon emission reduction (Fan et al., 2016) in all carbon trading pilots. In contrast, some researchers revealed that China’s carbon markets decreased industrial carbon intensity by 19.8% during 2015–2020 (Zhang Y.-J. et al., 2020). Their findings indicated that regional carbon trading effectively reduces firm emissions, leading to a 16.7% reduction in total emissions and a 9.7% reduction in emission intensity (Cui et al., 2021). Due to the lack of relevant data, we did not directly investigate the reduction effect of carbon trading policy in the BTH region at the industrial- or firm-level. However, our findings demonstrated on the macro level that the carbon trading policy in the BTH region could help enterprises in different industrial sectors achieve carbon emission reduction.

Furthermore, we also found some differentiated market characteristics in the BTH region. On the one hand, our findings suggest that the carbon emission reduction effect in Tianjin is slightly more significant than that in Beijing, showing a reduction of 12.67 in Beijing and 15.01% in Tianjin. This is mainly due to the different levels of other environmental policies adopted in carbon emission reduction. As the capital city of Beijing, it has more rich resources and flexible mechanisms to promote enterprises’ carbon emission reduction. For example, Beijing has strictly restricted the development of highly polluting plants, vigorously supported the popularization of electric vehicles, and effectively promoted green and low-carbon technological innovation. These measures could replace some effects of the carbon market, leading to a lower reduction magnitude in Beijing. However, the reduction effect of the carbon market in Beijing is still considerable, indicating that the government should maintain supportive policies and enrich the policy instruments for the carbon market.

On the other hand, we found an increasing trend of reduction effects over the years. The estimations show that the impact of the carbon market on carbon intensity was 6.08% in 2013 but increased rapidly to 31.13% in 2018. This implies that the carbon market in the BTH region is playing a more significant role in reducing carbon intensity yearly and will become a more critical reduction policy measure in the future. With the continuous development of the carbon market, governments will continuously improve the carbon quota allocation, trading operations, carbon price, and other mechanisms of the carbon market will be constantly improved. In this context, more enterprises will join the carbon market and promote the carbon trading volumes and turnovers to increase. Accordingly, the carbon intensity will continue to decrease. These findings imply that the government must adopt more effective measures to support the development of the carbon market and continuously improve the trading system in terms of carbon quota allocation, carbon price, and environmental regulation.

6 Conclusion and policy implication

This study investigated the effect of the carbon market on reducing carbon intensity in the BTH region of China. We constructed a quasi-natural experiment to establish a treatment and control group. Based on the DID model, we found that the BTH region’s carbon market effectively reduced carbon intensity. We also show that the carbon trading policy would considerably reduce the effect of 14.04% in carbon intensity. Our estimations were robust when we used a winsorization panel or established a new control group. Furthermore, we test for heterogeneous effects. Our findings suggest that the carbon market’s impact on reducing carbon intensity differs across cities and shows an increasing trend yearly.

Our findings provided insightful policy implications for governments in China and other developing countries. We confirmed the importance of implementing a carbon trading system for carbon emission reduction, which requires the Chinese government to increase support for developing the carbon market. Local governments should formulate differentiated schemes for carbon emission quota allocation and trading to enhance the reliability and flexibility of carbon markets because regional carbon trading pilots have different characteristics. Second, we suggest supporting more firms from different sectors to participate in the carbon market because they are one of the major stakeholders. In particular, governments should break barriers to inter-provincial trading for the regional carbon trading market as soon as possible. Enterprises among carbon trading pilots should be encouraged to carry out transactions. Meanwhile, our study provides some empirical references for developing countries that have not yet implemented carbon trading policies. We recommend that they carry out carbon trading pilot policies in some regions, especially in the developed cities, and then gradually introduce different sectors into the carbon markets. Based on accumulated experience from the carbon trading pilots, it would be appropriate to establish a national carbon market and form a comprehensive carbon trading system.

Although we have provided a comprehensive evaluation of the BTH region’s carbon market, some limitations still exist. One is that the carbon market is a systematic environmental instrument that includes carbon quota allocation, carbon price, carbon trading mechanism, and environmental impact. However, our study only focuses on identifying the carbon reduction effect and examining the potential differences among cities over the years. The other is that due to the lack of micro enterprise-level data, we cannot investigate the enterprises’ behavioral changes and their decision-making results when they are involved in the carbon trading process. Therefore, our future study will focus on two aspects. First, we expect to observe more changes in firm behavior as data becomes available. The firm-level research can help us identify the micro mechanism through which carbon markets affect individual decision-making and behavior adjustment and then analyze how to achieve carbon emission reduction targets. Second, we hope to investigate the potential mechanism of carbon markets promoting green technology innovation, resulting in a significant reduction in carbon intensity.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

ZW: conceptualization, writing-review and editing; TL: supervision; CC: validation. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Beijing Social Science Foundation (21GLC062).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Arnold, B. F., Khush, R. S., Ramaswamy, P., London, A. G., Rajkumar, P., Ramaprabha, P., et al. (2010). Causal inference methods to study nonrandomized, preexisting development interventions. Proc. Natl. Acad. Sci. U. S. A. 107, 22605–22610. doi:10.1073/pnas.1008944107

Bayer, P., and Aklin, M. (2020). The European Union emissions trading system reduced CO2 emissions despite low prices. Proc. Natl. Acad. Sci. U. S. A. 117, 8804–8812. doi:10.1073/pnas.1918128117

Cao, J., Ho, M. S., Ma, R., and Teng, F. (2021). When carbon emission trading meets a regulated industry: Evidence from the electricity sector of China. J. Public Econ. 200, 104470. doi:10.1016/j.jpubeco.2021.104470

Chai, S., Sun, R., Zhang, K., Ding, Y., and Wei, W. (2022). Is emissions trading scheme (ETS) an effective market-incentivized environmental regulation policy? evidence from china’s eight ETS pilots. Int. J. Environ. Res. Public Health 19, 3177. doi:10.3390/ijerph19063177

Chen, Y., Ba, S., Yang, Q., Yuan, T., Zhao, H., Zhou, M., et al. (2021). Efficiency of China’s carbon market: A case study of hubei pilot market. Energy 222, 119946. doi:10.1016/j.energy.2021.119946

Chevallier, J. (2011). Econometric analysis of carbon markets: The European union emissions trading scheme and the clean development mechanism. Berlin, Germany: Springer Science & Business Media

Cui, J., Wang, C., Zhang, J., and Zheng, Y. (2021). The effectiveness of China’s regional carbon market pilots in reducing firm emissions. Proc. Natl. Acad. Sci. U. S. A. 118, e2109912118. doi:10.1073/pnas.2109912118

Dai, H., Xie, Y., Liu, J., and Masui, T. (2018). Aligning renewable energy targets with carbon emissions trading to achieve China's INDCs: A general equilibrium assessment. Renew. Sustain. Energy Rev. 82, 4121–4131. doi:10.1016/j.rser.2017.10.061

Dong, F., Dai, Y., Zhang, S., Zhang, X., and Long, R. (2019). Can a carbon emission trading scheme generate the porter effect? Evidence from pilot areas in China. Sci. Total Environ. 653, 565–577. doi:10.1016/j.scitotenv.2018.10.395

Fan, X., Lv, X., Yin, J., Tian, L., and Liang, J. (2019). Multifractality and market efficiency of carbon emission trading market: Analysis using the multifractal detrended fluctuation technique. Appl. Energy 251, 113333. doi:10.1016/j.apenergy.2019.113333

Fan, Y., Wu, J., Xia, Y., and Liu, J.-Y. (2016). How will a nationwide carbon market affect regional economies and efficiency of CO2 emission reduction in China? China Econ. Rev. 38, 151–166. doi:10.1016/j.chieco.2015.12.011

Fang, G., Tian, L., Liu, M., Fu, M., and Sun, M. (2018). How to optimize the development of carbon trading in China—enlightenment from evolution rules of the EU carbon price. Appl. energy 211, 1039–1049. doi:10.1016/j.apenergy.2017.12.001

He, G., Pan, Y., and Tanaka, T. (2020). The short-term impacts of COVID-19 lockdown on urban air pollution in China. Nat. Sustain. 3, 1005–1011. doi:10.1038/s41893-020-0581-y

Hu, K., and Chen, Y. (2019). Equilibrium fuel supply and carbon credit pricing under market competition and environmental regulations: A California case study. Appl. Energy 236, 815–824. doi:10.1016/j.apenergy.2018.12.041

Jaraite-Kažukauske, J., and Di Maria, C. (2016). Did the EU ETS make a difference? An empirical assessment using Lithuanian firm-level data. Energy J. 37. doi:10.5547/01956574.37.2.jjar

Jotzo, F., Karplus, V., Grubb, M., Löschel, A., Neuhoff, K., Wu, L., et al. (2018). China’s emissions trading takes steps towards big ambitions. Nat. Clim. Chang. 8, 265–267. doi:10.1038/s41558-018-0130-0

Li, Y., Liu, T., Song, Y., Li, Z., and Guo, X. (2021). Could carbon emission control firms achieve an effective financing in the carbon market? A case study of China's emission trading scheme. J. Clean. Prod. 314, 128004. doi:10.1016/j.jclepro.2021.128004

Liao, Z., Zhu, X., and Shi, J. (2015). Case study on initial allocation of Shanghai carbon emission trading based on shapley value. J. Clean. Prod. 103, 338–344. doi:10.1016/j.jclepro.2014.06.045

Lin, B., and Jia, Z. (2019). Impacts of carbon price level in carbon emission trading market. Appl. Energy 239, 157–170. doi:10.1016/j.apenergy.2019.01.194

Liu, L., Chen, C., Zhao, Y., and Zhao, E. (2015). China׳ s carbon-emissions trading: Overview, challenges and future. Renew. Sustain. Energy Rev. 49, 254–266. doi:10.1016/j.rser.2015.04.076

Liu, X., Zhou, X., Zhu, B., He, K., and Wang, P. (2019). Measuring the maturity of carbon market in China: An entropy-based TOPSIS approach. J. Clean. Prod. 229, 94–103. doi:10.1016/j.jclepro.2019.04.380

Liu, Z., Wang, F., Tang, Z., and Tang, J. (2020). Predictions and driving factors of production-based CO2 emissions in Beijing, China. Sustain. Cities Soc. 53, 101909. doi:10.1016/j.scs.2019.101909

Lu, H., Ma, X., Huang, K., and Azimi, M. (2020). Carbon trading volume and price forecasting in China using multiple machine learning models. J. Clean. Prod. 249, 119386. doi:10.1016/j.jclepro.2019.119386

Munnings, C., Morgenstern, R. D., Wang, Z., and Liu, X. (2016). Assessing the design of three carbon trading pilot programs in China. Energy Policy 96, 688–699. doi:10.1016/j.enpol.2016.06.015

Narassimhan, E., Gallagher, K. S., Koester, S., and Alejo, J. R. (2018). Carbon pricing in practice: A review of existing emissions trading systems. Clim. Policy 18, 967–991. doi:10.1080/14693062.2018.1467827

Newell, R. G., Pizer, W. A., and Raimi, D. (2014). Carbon market lessons and global policy outlook. Science 343, 1316–1317. doi:10.1126/science.1246907

Peng, H., Qi, S., and Cui, J. (2021). The environmental and economic effects of the carbon emissions trading scheme in China: The role of alternative allowance allocation. Sustain. Prod. Consum. 28, 105–115. doi:10.1016/j.spc.2021.03.031

Qi, T., and Weng, Y. (2016). Economic impacts of an international carbon market in achieving the INDC targets. Energy 109, 886–893. doi:10.1016/j.energy.2016.05.081

Redmond, L., and Convery, F. (2015). The global carbon market-mechanism landscape: Pre and post 2020 perspectives. Clim. Policy 15, 647–669. doi:10.1080/14693062.2014.965126

Rontard, B., and Hernández, H. R. (2022). Political construction of carbon pricing: Experience from New Zealand emissions trading scheme. Environ. Dev.

Tvinnereim, E., and Mehling, M. (2018). Carbon pricing and deep decarbonisation. Energy policy 121, 185–189. doi:10.1016/j.enpol.2018.06.020

Wang, B., Zhao, J., and Wei, Y. (2019). Carbon emission quota allocating on coal and electric power enterprises under carbon trading pilot in China: Mathematical formulation and solution technique. J. Clean. Prod. 239, 118104. doi:10.1016/j.jclepro.2019.118104

Wang, X., Huang, J., and Liu, H. (2022). Can China's carbon trading policy help achieve carbon neutrality?—a study of policy effects from the five-sphere integrated plan perspective. J. Environ. Manag. 305, 114357. doi:10.1016/j.jenvman.2021.114357

Weng, Q., and Xu, H. (2018). A review of China’s carbon trading market. Renew. Sustain. Energy Rev. 91, 613–619. doi:10.1016/j.rser.2018.04.026

Weng, Z., Han, E., Wu, Y., Shi, L., Ma, Z., and Liu, T. (2021). Environmental and economic impacts of transitioning to cleaner heating in Northern China. Resour. Conservation Recycl. 172, 105673. doi:10.1016/j.resconrec.2021.105673

Weng, Z., Wang, Y., Yang, X., Cheng, C., Tan, X., and Shi, L. (2022). Effect of cleaner residential heating policy on air pollution: A case study in shandong province, China. J. Environ. Manag. 311, 114847. doi:10.1016/j.jenvman.2022.114847

Wu, D., Xu, Y., and Zhang, S. (2015). Will joint regional air pollution control be more cost-effective? an empirical study of China's beijing–tianjin–hebei region. J. Environ. Manag. 149, 27–36. doi:10.1016/j.jenvman.2014.09.032

Xu, M., Qin, Z., and Zhang, S. (2021). Carbon dioxide mitigation co-effect analysis of clean air policies: Lessons and perspectives in China’s beijing–tianjin–hebei region. Environ. Res. Lett. 16, 015006. doi:10.1088/1748-9326/abd215

Xu, Q., and Hobbs, B. F. (2021). Economic efficiency of alternative border carbon adjustment schemes: A case study of California carbon pricing and the western north American power market. Energy Policy 156, 112463. doi:10.1016/j.enpol.2021.112463

Xuan, D., Ma, X., and Shang, Y. (2020). Can China’s policy of carbon emission trading promote carbon emission reduction? J. Clean. Prod. 270, 122383. doi:10.1016/j.jclepro.2020.122383

Yu, Z., Geng, Y., Dai, H., Wu, R., Liu, Z., Tian, X., et al. (2018). A general equilibrium analysis on the impacts of regional and sectoral emission allowance allocation at carbon trading market. J. Clean. Prod. 192, 421–432. doi:10.1016/j.jclepro.2018.05.006

Zhang, F., Fang, H., and Song, W. (2019). Carbon market maturity analysis with an integrated multi-criteria decision making method: a case study of EU and China. J. Clean. Prod. 241, 118296. doi:10.1016/j.jclepro.2019.118296

Zhang, L., Li, Y., and Jia, Z. (2018). Impact of carbon allowance allocation on power industry in china’s carbon trading market: computable general equilibrium based analysis. Appl. energy 229, 814–827. doi:10.1016/j.apenergy.2018.08.055

Zhang, W., Li, J., Li, G., and Guo, S. (2020a). Emission reduction effect and carbon market efficiency of carbon emissions trading policy in China. Energy 196, 117117. doi:10.1016/j.energy.2020.117117

Zhang, Y.-J., Liang, T., Jin, Y.-L., and Shen, B. (2020b). The impact of carbon trading on economic output and carbon emissions reduction in China’s industrial sectors. Appl. Energy 260, 114290. doi:10.1016/j.apenergy.2019.114290

Zhang, Y.-J., Wang, A.-D., and Da, Y.-B. (2014). Regional allocation of carbon emission quotas in china: Evidence from the Shapley value method. Energy Policy 74, 454–464. doi:10.1016/j.enpol.2014.08.006

Zhang, Z., Zhang, J., and Feng, Y. (2021). Assessment of the carbon emission reduction effect of the air pollution prevention and control action plan in China. Int. J. Environ. Res. Public Health 18, 13307. doi:10.3390/ijerph182413307

Zheng, Y., Xue, T., Zhang, Q., Geng, G., Tong, D., Li, X., et al. (2017). Air quality improvements and health benefits from China’s clean air action since 2013. Environ. Res. Lett. 12, 114020. doi:10.1088/1748-9326/aa8a32

Zhou, B., Zhang, C., Song, H., and Wang, Q. (2019). How does emission trading reduce china's carbon intensity? An exploration using a decomposition and difference-in-differences approach. Sci. total Environ. 676, 514–523. doi:10.1016/j.scitotenv.2019.04.303

Zhou, Y., Chen, M., Tang, Z., and Mei, Z. (2021). Urbanization, land use change, and carbon emissions: Quantitative assessments for city-level carbon emissions in Beijing-Tianjin-Hebei region. Sustain. Cities Soc. 66, 102701. doi:10.1016/j.scs.2020.102701

Zhu, B., Ye, S., Han, D., Wang, P., He, K., Wei, Y.-M., et al. (2019). A multiscale analysis for carbon price drivers. Energy Econ. 78, 202–216. doi:10.1016/j.eneco.2018.11.007

Keywords: carbon neutrality, carbon market, carbon reduction, carbon intensity, beijing-tianjin-hebei region

Citation: Weng Z, Liu T and Cheng C (2022) Reduction effect of carbon markets: A case study of the Beijing-Tianjin-Hebei region of China. Front. Environ. Sci. 10:1013708. doi: 10.3389/fenvs.2022.1013708

Received: 07 August 2022; Accepted: 01 September 2022;

Published: 15 September 2022.

Edited by:

Dan Tong, Tsinghua University, ChinaCopyright © 2022 Weng, Liu and Cheng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Tingting Liu, dGluZ3RpbmcubGl1QGJqdXQuZWR1LmNu

Zhixiong Weng

Zhixiong Weng Tingting Liu

Tingting Liu Cuiyun Cheng

Cuiyun Cheng