- 1School of Economics, Peking University, Beijing, China

- 2Center for National Economics Studies, School of Economics, Peking University, Beijing, China

- 3Beijing Development Institute, Peking University, Beijing, China

Being affected by a variety of factors, power-generation structure plays an essential role in a high-quality and sustainable development. The focus of this paper is to evaluate the influence of electricity price on it. First, we provide a microeconomic framework to understand the impact mechanism. We discuss two effects through which price level can affect power generation, and then the power-generation structure. After that, an empirical test is conducted using provincial panel data, and the results of it are robust. We also test the above-mentioned mechanism empirically. There are two main conclusions. First, the electricity price has a positive effect on the share of thermal power in electricity generation. Second, the mechanism test shows that an increase of electricity price can not only improve efficiency of power plants but also propel firms to invest in more renewable energy plants.

Introduction

Over the past decades, the Chinese economy has been regarded as a miracle that has been growing rapidly. Along with the economic achievement goes higher energy demand. On the one hand, as non-renewable resources, fossil fuels could no longer be the main driver of development. On the other hand, electricity generated by traditional thermal power plants will generate more pollutants and carbon dioxide emissions to the atmosphere, which is inconsistent with what is expected in a sustainable society. Under the pressures of growing energy demand and the carbon emission reduction goal, promoting clean energy power generation, especially renewable energy power generation, proves to be a natural choice.

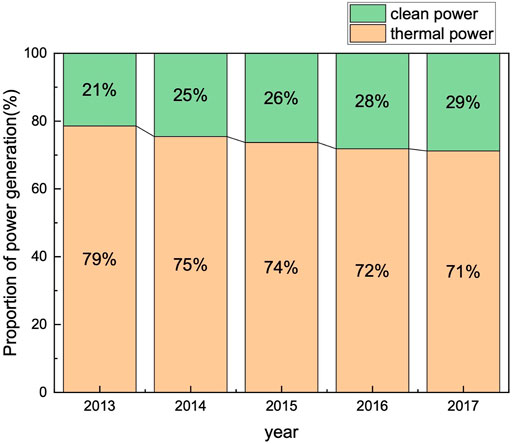

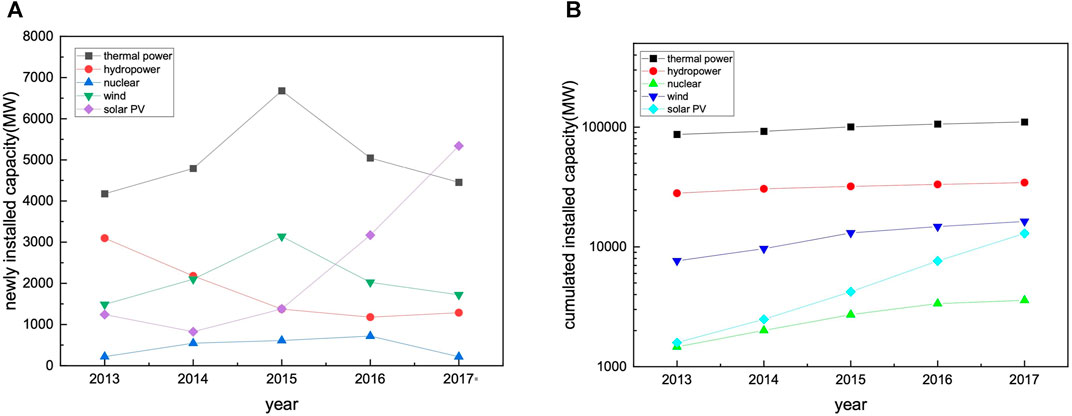

The clean energy power industry in China has experienced great changes thanks to the government’s support. In recent years, China has adopted laws, regulations, policies, and plans in renewable power sectors, such as Renewable Energy Law, Medium and Long-Term Development Plan for Renewable Energy, and Provisional Administrative Measures on the Renewable Energy Development Fund.1 Given subsidies and good market environment, there appears to be a dramatic rise in clean power capacity. In accordance with that, the share of clean energy in aggregate power generation has increased. Figure 1A shows the newly installed capacity and cumulated installed capacity in power sectors from 2013 to 2017 countrywide. In total, China’s clean power capacity newly installed has ascended from 6047 MW in 2013–8566 MW in 2017. The rise of solar PV appears to be the largest, which has increased from 1243 to 5341 MW. The newly installed capacity of hydropower has decreased. Figure 1B descripts the cumulated capacity, showing that the cumulated installed capacity of each type has also soared over this period. Figure 2 outlines trends of current shares of clean power electricity, increasing from 21 to 29% in 5 years. In total, clean energy made up 29% of gross electricity production in 2018. In comparison, Figure 2 also shows the changes of share for thermal power-generation. It suggests that power-generation structure defined as the proportion of electricity generated by thermal power-generation plant has dropped over the years.

FIGURE 1. (A) Newly installed capacity (MW) 2013–2017. (B) Cumulated installed capacity (MW) 2013–2017.

Although clean energy (except for nuclear energy) is renewable and environmentally friendly in most cases, shortcomings exist. First, the introduction of a large-scale clean power plant has a higher cost than thermal ones. What’s more, the cost of power generation from clean energy cannot be reduced significantly in the short term. Financial support from the government is necessary for the penetration of renewable energy.2 The improvement of renewable energy power requires large amounts of money in research and development, with the characteristics of high-risk, high-investment, and uncertain-return, calling for the government’s support. Second, due to the features of clean energy, electricity generated by this mean is intermittent. Energy storage is another important technology barrier to break through. To contrast, technology innovation in thermal power generation provides the possibility of using fossil fuels in a more efficient and cleaner way. The cumulated installed capacity of thermal energy accounts for 71% of all in 2017 as shown in Figure 1B, which is still high, showing a big market share. Above-mentioned features hindered the progress of the clean energy industry, and they also play important roles in how electricity price can influence the power-generation structure.

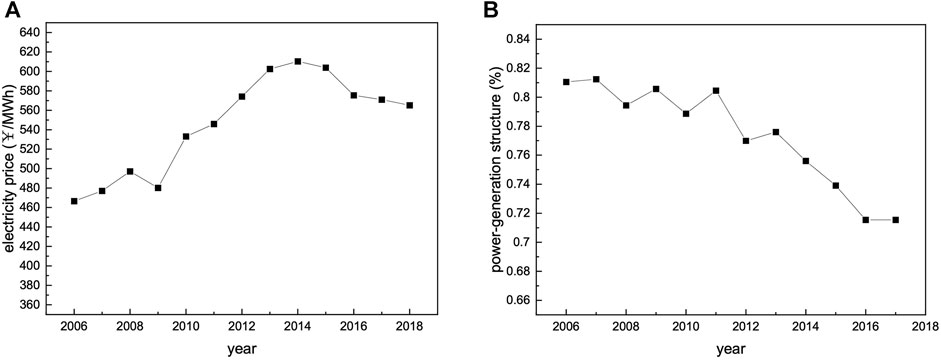

In this paper, we use provincial data from China to measure the effect of electricity price on the adjustment of power-generation structure. Figures 3A,B provide an overview of trends in average electricity price from 2006 to 2018 and average power-generation structure from 2006 to 2017, respectively.3 As shown in Figure 3, the electricity price shows an upward trend. Comparing Figures 3A,B, it appears that electricity price and power-generation structure on average varied with time in opposite directions. Is there any relationship between electricity price and power-generation structure? To what extent can the rise of electricity price have an effect on power-generation structure? If this relationship holds, how does it work? To investigate these problems, we first provide a microeconomic framework to explore two possible effects of the price level. We may assume a negative relationship between electricity price and power-generation structure from time trends shown in figures, though we could not simply come to this conclusion without tests. Therefore, we then examine this relationship empirically by conducting a fixed effect panel estimation.

The rest of this paper is organized as follows. Literature Review reviews the literature pertinent to electricity price, the cause and consequences of renewable energy policies, and the relationship between the electricity price and power-generation structure. Theoretical Analysis presents a theoretical analysis, after which Empirical Tests shows the empirical tests. Conclusion and Discussion concludes.

Literature Review

This paper primarily belongs to the literature on the effect of electricity price and the influencing factors of the development of energy and power industry. Specifically, we review research of the relationship between electricity price and power-generation structure, which is closely related to our research.

The topic of the influence of electricity price has spurred hot discussion among scholars. Generally speaking, related studies focus on the effect of electricity price in two aspects, the production and consumption side, respectively. For the production side, He et al. (2010) showed that an increase in electricity price will decrease the total output, Gross Domestic Product (GDP), and the Consumer Price Index (CPI), using a Computable Generalized Equilibrium (CGE) model. They argue that the government is supposed to deliberate over the electricity price policy, taking all possible factors into account. Looking into the impact of electricity price policies, researchers find similar negative effects. In an attempt to relieve the pressure of power shortages, which results from the rapid growth of electricity demand, price controls are regarded as a useful short-term approach by a variety of countries. However, empirical analyses show that the electricity price has an adverse relationship with electricity demand and the performance of economic sectors (Mirza et al., 2014; Kwon et al., 2016). The cross subsidy policy has also received lots of critiques (Moerenhout et al., 2019; Pu et al., 2020). However, Jia and Lin (2021) show that, under simulated counterfactual scenarios of cross subsidy elimination, CO2 emissions, industrial structure, as well as social welfare get worse, in spite of the improvement of economic performance. Considering the attributes of an export-oriented country like China, removing cross subsidies may not prove to be good. In addition, the conclusions of recent studies have provided evidence for the rationality of differential electricity pricing (DEP), under which policy firms are compelled to accelerate equipment upgrades, and energy-intensive industries are stimulated to make technological improvement (Yang et al., 2021; Zheng et al., 2021). This is consistent with the findings of positive relationship between a raise of electricity price and a boost in industrial competitiveness or total factor productivity (TFP) (Mordue, 2017; Elliott et al., 2019; Ai et al., 2020). Moreover, the electricity price is found to have a long influence on renewable energy (RE) innovation (Lin and Chen, 2019). For the consumption side, BuShehri and Wohlgenant (2012) estimated the welfare effects of a subsidy on electricity and showed that a small increase in the price of electricity can reduce annual consumption and consumers’ welfare, meanwhile providing financial and environmental benefits to the society. Study indicates that increasing-block power tariff is effective in mitigating rebound effect. Price increment results in less subsidy and deadweight loss, but it causes a loss in welfare (Lin and Liu, 2013; Wang and Lin, 2021). Above all, there is still room for improvement for electricity price policies.

Considering the increasingly large population with dramatically increased demand and serious concerns about environmental pollution including carbon emissions, an increasing number of countries have realized the vital role RE plays in the generation of electricity ever since the 20th century. In order to boost the development of RE, a variety of supporting laws, regulations, and plans have been promulgated. Some researchers have provided thorough review of the main policies (Zhao et al., 2011; Hu et al., 2013; Zhao Z.-Y. et al., 2016; Jamil et al., 2016). Focusing on the carbon emissions trading (CET) system, Cong and Wei (2010) investigated its potential effect on China’s power sector. The results show that the introduction of CET will significantly raise the proportion of environmentally friendly technologies, especially for solar energy. Although it is proved that supporting policies are significantly related to the booming of installed capacity, the existing barriers for RE industry should not be ignored, for example, the discrepancy between the growth of RE plants and their contribution to electricity generation, which is partly due to the deficiency in power grid system. Based on detailed analysis on a wide range of policies, suggestions are presented such as conducting a renewable portfolio standard mechanism, updating technological progress of grid system, reforming electricity price mechanism, etc. (Wang, 2010; Wang et al., 2010; Zhao, 2011; Ouyang and Lin, 2014).

In addition to political factors, the development of energy and power industry is also influenced by other factors. According to systematic analysis, Alagappan et al. (2011) and Biresselioglu et al. (2016) showed the importance of political, economic, and environmental factors on RE capacity development. Schmid (2012) and Jenner et al. (2013) applied the fixed effect model to the influence of impact factors. They suggested that a well-performed policy should be designed together with market context and the interaction between them. The subject of the policy effect has attracted much attention, while the price effect has received less. When it comes to the influence of electricity price, recent studies often regard it as one of the economic factors controlled. Studies measure the energy and power industry performance by using either cumulated capacity or the proportion of capacity and power generation. The influence of electricity price is ambiguous if it is solely analyzed in theory. The empirical results differ as a result of different data source or model specification. Carley (2009) shows that the increase of electricity price significantly reduces the ratio of RE in power generation. The results of Shrimali and Kniefel (2011) indicated the opposite. Zhao X. et al. (2016) compared price policies and non-price policies and showed that the former has greater effect on wind power development. Furthermore, price policies have larger influence in areas with poor wind resources, and non-price policies the opposite. To sum up, effective policies and healthy market environment combine to encourage the advance of energy and power industry. The design of related policies is supposed to take incentive as priority and deliberately incorporate environmental considerations.

The energy and power industry around the globe has experienced great changes since the 20th century. Furthermore, the marketization of energy and power industry differs among countries and regions (Kagiannas et al., 2004). As a result of varying degree to which the electricity price is regulated, research methods and goals depend. In some countries, competition has been set in motion by fostering a competitive electricity spot market. By estimating the relationship between daily average electricity price and electricity generation from a variety of sources, some empirical studies have provided the evidence of the merit order effect. Furthermore, their findings indicate that the rise of RE power generation can result in the fall of electricity price, whilst the influence of RE power generation on the volatility is diverse among Germany, Italy, and Australia (Tveten et al., 2013; Cludius et al., 2014; Clò et al., 2015). Ketterer (2014) employs a GARCH model to evaluate how the level and volatility of the electricity price are affected by wind electricity generation, and they show that wind power can reduce the price levels, meanwhile amplifying the price volatility. With respect to China, the electricity price has been regulated for a long period of time, despite that the Chinese government has promulgated a series of laws, regulations, and plans to deregulate the electricity price progressively (Liu et al., 2019).

Although studies show that electricity price could be an instrument to trigger the development of renewable energy power generation, fewer studies consider the impact of electricity price on power-generation structure. In this paper, we will conduct both a theoretical and an empirical analysis to investigate this relationship.

Theoretical Analysis

In this section, we provide a microeconomic theoretical model to illustrate the mechanism how the electricity price affects the power-generation structure, which can be described as the ratio of electricity generated by thermal power plants.

The Model

There are two types of power-generation plants, namely thermal power-generation plant and clean power-generation plant. A set of plants is characterized by its fixed cost

The fixed cost of power plant is distributed in the market, whose density functions are denoted by

For each set of plant, the firm solves the optimization problem,

where

Comparative Statics

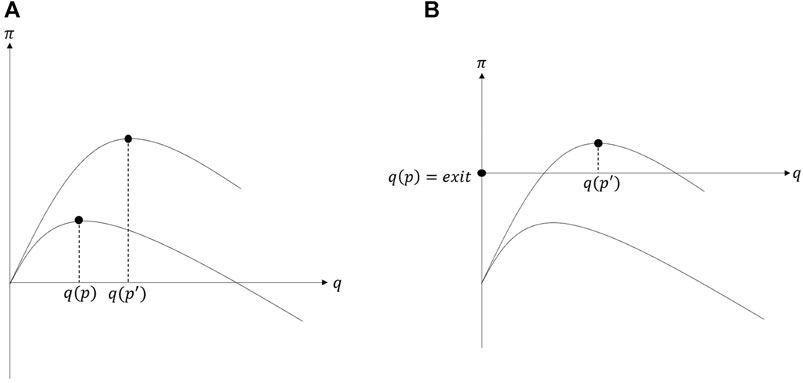

First, we consider the influence of an increase in the electricity price. It triggers two effects on the equilibrium quantity. The electricity price can affect the generation of both thermal power and clean power sector, thus influencing the generation mix. In our analysis, they are defined as the efficiency effect and the entrance effect.

On the one hand, if the firm possesses the plant, it will never choose to exit since the fixed cost of the plant it already has is zero. Moreover, the equilibrium quantity satisfies the first-order condition,

The power sector can be divided into two groups. One is the thermal power sector, which generates electricity using fossil fuels, during which process considerable pollutants and emissions are exhausted. The other is the clean power sector, the generation process of which is thought to be environmentally friendly and is much cleaner. Broadly speaking, these two sectors constitute the entire power sector.

For the efficiency effect, there are two main concerns. On the one hand, the rise of price can stimulate power sectors to produce more electricity. Although the variable cost of clean energy is smaller or even close to 0, the production of electricity heavily depends on an appropriate climatic condition. Hence, it is hard to infer the changes of the power-generation mix. On the other, due to historical reasons, the market share of thermal power is greater than that of clean power. This situation that thermal-generation technology is maturer compared to clean power implies that the efficiency effect of thermal power dominates that of clean power, i.e., a rise in electricity price leads to larger change on the average utilization hours of the thermal power sector than clean power. The aggregate efficiency effect is unclear. Note that, for both the thermal power and the clean power sector, an increase in electricity price has a positive effect on the average utilization hours with the decline of marginal cost.

We then discuss the entrance effect, which provides incentives to buy a new plant. It is known that the fixed cost of a hydropower generation plant is much higher than a thermal power plant in the early stages of development. On the decision margin, the revenue of plant equals to

Combining these two effects, which differ in thermal and clean power sector, we propose that taking both the efficiency effect and the entrance effect into consideration, an increase in electricity price may have an influence on the power supply structure. In the next section, we will empirically explore the impact of electricity price on power-generation structure using provincial data from China.

Empirical Tests

In Model Specification, we specify the estimation framework and clarify the meaning of variables. In Data Sources and Descriptive Statistics, we show the data sources and descriptive statistics. In Basic Results and Robustness, basic results are presented, and we then discuss the results of robustness. In Mechanism Tests, two effects are estimated.

Model Specification

According to the theoretical analysis in Theoretical Analysis, we propose that there are two channels of electricity price may influence thermal power and clean power sector, which are viewed as efficiency effect and entrance effect. However, the aggregate effect of electricity price is ambiguous. In order to investigate the aggregate impact on power-generation structure empirically, we adopt the econometric framework illustrated below.

where

For the core independent variable, we use the annual average electricity sales price in each province as a proxy variable. To illustrate, as the annual average sales price incorporates the information of on-grid prices of various energy sources, it is more appropriate for us to adopt it as the proxy variable for the price analyzed in the theoretical model. Later in the mechanism test, we then adopt the on-grid price of wind power to further investigate the entrance effect. On account of the fact that the deregulation process of electricity prices in China is still in process, and most of the prices are still determined by the government based on various factors, not determined by supply and demand daily in a price market, we regard the electricity price as an exogenous variable in our analysis.

Except for electricity price, some other economic factors are also considered as potential variables to explain power-generation structure, based on the following assumptions. First, real GDP could be regarded as a measure of regional economic scale. The higher costs of renewable energy relative to fossil fuels can be overcome by regions with higher economic scales. Second, the proportion of secondary industry as in output value could reflect regional industrial structure. The type of downstream industry will also affect the generation mix. Third, we use urban population density to indicate degree of population agglomeration. It is expected that regions with higher population density tend to have less space for the promotion of renewable energy plants such as giant wind turbines and large hydroelectric power stations. Accordingly, we also include these variables in our estimation as control variables.

Data Sources and Descriptive Statistics

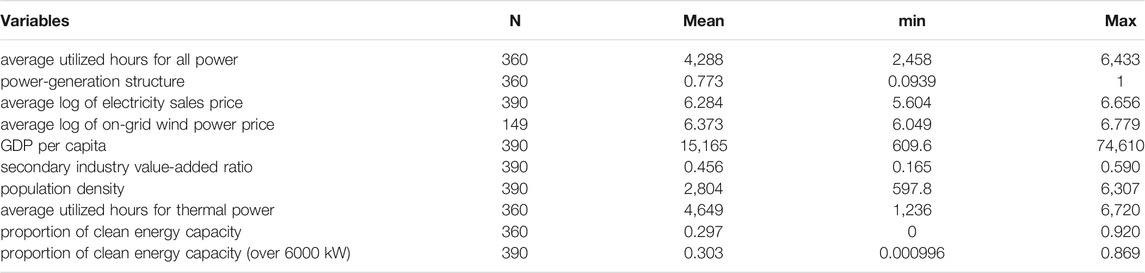

In our estimation, power-generation structure is defined as the proportion of electricity generated by thermal power-generation plant. For the core independent variable, we focus on the electricity sales price, which is set by the government. Price policies are unified in each province and determined according to the factors that can constitute the electricity price. In addition, we use the on-grid price of wind power for the mechanism test. Due to the lack of data in Tibet Province, we could not include it in our estimation. In addition, Hong Kong, Macao, and Taiwan are not included since price policies are different in these regions. Missing variables in prices are filled in by interpolation. In our mechanism test, we use average utilization hours as a measure of efficiency. For the control variables, real GDPs are calculated at constant prices in 2005.

We get the data of prices and average utilization hours from WIND Economic Database, electricity capacity, and generation data from the China Electric Power Yearbook, and the data of controls from Chinese Research Data Services (CNRDS) Platform. To construct our samples, we use variables from 2006 to 2018. In our basic estimation and mechanism test, data span from 2006 to 2017 and from 2007 to 2018, respectively. Table 1 shows some basic characteristics of our data.

Basic Results

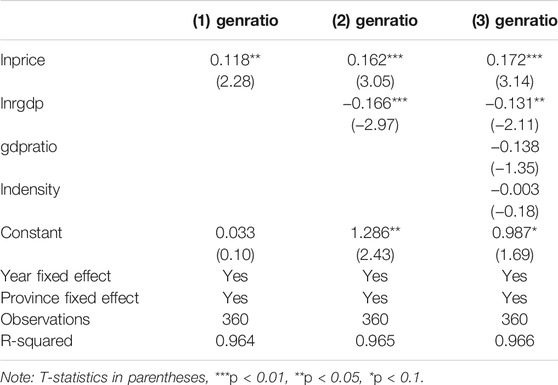

In order to figure out the influence of electricity price on power-generation structure, we estimate it by using Eq. 3. Table 2 reports the basic results of our regression. The first column shows the result without control variables. Column 2 includes economic scale, and Column 3 adds all three control variables. According to basic results, the coefficient on price level is significantly larger than zero. It shows that the increase of electricity price significantly lifts up the thermal power ratio. This conclusion holds when we add other potential influencing factors. As is shown in Column 3, a 1 percentage point increase in electricity price is associated with a 0.17 absolute increase in power structure. The empirical results indicate that the efficiency effect exceeds the entrance effect. In other words, the electricity generated from thermal power sector due to larger efficiency improvement surpasses the electricity from newly installed renewable energy plants attributed to the entrance effect. The influences of the efficiency effect and the entrance effect require further exploration, which we will discuss later in Mechanism Tests.

Furthermore, the economic scale is negatively related to power-generation structure. Column 3 illustrated that a 1 percentage increase in GDP per capita can reduce the proportion of thermal power generation as share of total generation by a 0.17 absolute value. This provides empirical evidence for our assumptions that the economic scale plays a role in the development of non-fossil fuel power industry. The industrial structure and population agglomeration appear to be insignificant.

Robustness

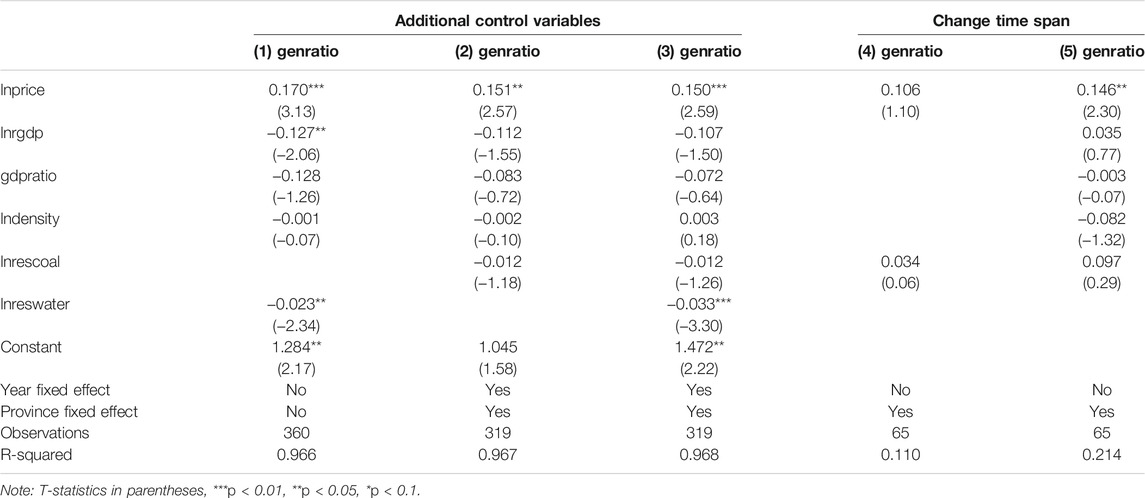

Additional Control Variables

Except for economic factors, the power-generation structure can be influenced by its resource reserves. The introduction of a power-generation plant is partly related to resource endowment, for example, provinces with large water resources reserves provide a good environment for the development of hydroelectric power stations. For instance, if a region is abundant in surface water reserves, it has greater potential to introduce hydroelectric power stations and to develop clean energy. Considering the influence of omitted variables on the regression result, water resources reserves and coal resources reserves are added in our regression. As in the first three columns in Table 3, the coefficient on electricity price is still significantly positive, and smaller than that in the basic result. The basic results are robust with the addition of other variables.

Change Time Span

The transmission and distributional price is the prominent difference between the electricity sales price and on-grid prices. In order to promote the reform of electricity power market, one of the key tasks is to separately approve the transmission and distribution price for electricity, according to Several Opinions on Further Deepening the Reform of the Electricity Power System No. 9 Document and Implementation Opinions on Promoting Transmission and Distribution Price Reform. As is stated in these policies, the total permitted revenue and transmission and distribution price of the power grid companies should be in accordance with the principle of “permitted costs plus reasonable benefits.” Under this circumstance, the electricity sales price will be in line with the on-grid prices, and the former can be a better proxy in our estimation.

Since 2015, the government has gradually expanded the scope of pilot regions. In 2006, most of the provinces in China have successively carried out this reform. We figured out the pilot regions each year and formulated a new data set, where all provinces have conducted the above-mentioned electricity price reform. The fourth and fifth columns in Table 3 show the results. During this short period, the time fixed effect is supposed to be insignificant. Thus, we only include the province fixed effect in this estimation.4 The effect of electricity price is still positive with a smaller coefficient as compared to the corresponding basic estimation, indicating the robustness of conclusion in our basic results.

Mechanism Tests

As is discussed in Theoretical Analysis, the direction of impact on the power-generation is ambiguous. Electricity price may affect power-generation structure via two channels. For the efficiency effect, either thermal or clean power-generation plant tends to improve its working hours as price level rises. Due to historical reasons, thermal plant occupies a huge market share and has more mature technology than clean ones.5 Although the variable cost of clean energy is lower than that of thermal power, the power generation generated by clean energy (except for nuclear power energy) is highly dependent on weather conditions. Thus, the specific direction of the efficiency effect requires testing. In terms of the entrance effect, we propose that any type of plant has incentives to enter the market as a result of the price increase. However, the aggregate entrance effect considering the thermal power and clean power sector is ambiguous. Above all, the aggregate effect is uncertain. In this section, we estimate two effects in turn.

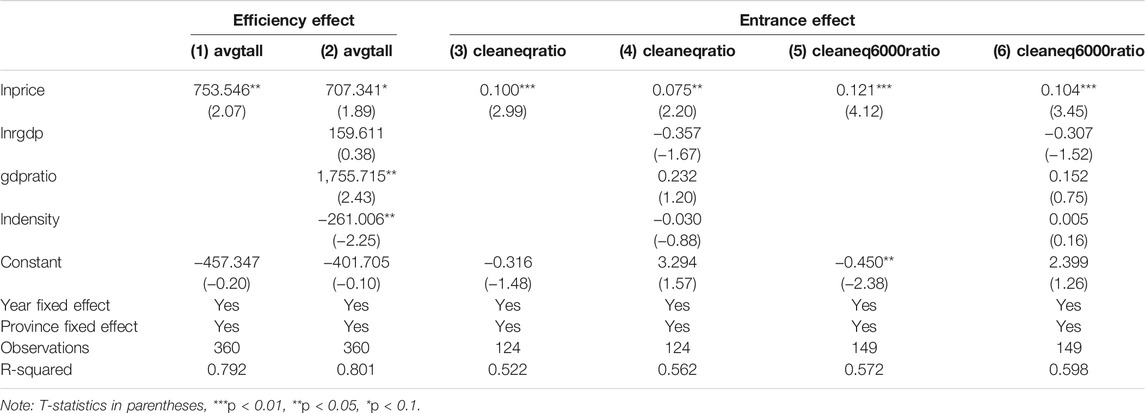

Efficiency Effect

The baseline results show that the price level and power-generation structure move in the same direction. Based on Eq. 3, we re-estimate by replacing the dependent variable by average utilization hours in thermal power-generation plant and in all power-generation plant. Results are shown in the first two columns of Table 4. Column 1 indicates that the rise of electricity price has a positive effect on average utilization hours. This result stands not only for thermal plant but also for all power-generation plant. The coefficient in Column 1 is larger than in Column 2, showing a large impact of electricity price on thermal power-generation plant. These results point out that a rise in price level can lift up the average utilization hours of thermal power plants. Meanwhile, the impact on total average utilization hours is also positive. There are two implications here. One is the great advance of power generation technology for fossil fuels. The other is that the potentials in clean energy are still large, including the innovation of generation technology, for example, with which renewable energy power generation could overcome the barrier of climatic conditions. Overall, according to the efficiency effect, electricity price will increase the power-generation structure.

Entrance Effect

With respect to the entrance effect, we focus on whether electricity companies will be propelled by the raise of electricity price. The dependent variables are replaced by the ratio of clean energy cumulated capacity in total capacity or in total capacity whose power is over 6000 kW. The independent variable is replaced by wind power on-grid price. Columns 3 to 6 of Table 4 display the results. The coefficients of price are significantly positive in each regression, which indicate the positive relationship between price and the introduction of new plants. This outcome provides evidence for the entrance effect analysed in Theoretical Analysis.

Conclusion and Discussion

Based on microeconomic theories, a price incentive can have an influence on the decision of market participants. This paper assumes that electricity price may affect the power-generation structure and plays its role through two channels, namely the efficiency effect and the entrance effect. The specific direction of influence cannot be acquired solely in qualitative analysis. Although our model cannot predict the direction of influence, the empirical results show that, with the rise of electricity price, the power-generation structure tends to grow, which seems to be inconsistent with the concept of sustainable development. The robustness of this result is also examined. Some other issues are illustrated in the mechanism test, that an increase in price level can significantly improve the average utilization hours of power-generation plant, especially for thermal power-generation ones, which partly reflect the technology improvement in power sectors. The price is proved to be an incentive to clean power plant investors, which is described as the entrance effect.

The carbon peak and carbon neutral goals were put forward for the first time in December 2020 in the annual Central Economic Work Conference. Boosting the enormous development in new energy, accelerating the dynamic adjustment of the energy structure, and promoting the peak of fossil fuel consumption combine to formulate an essential way to obtain these goals. The large amounts of emissions from thermal power generation cannot be ignored. Therefore, it is worthwhile to investigate the causes and consequences of the power-generation structure in China. This paper aims to study the role of electricity price concerning power-generation structure. The results show that an increase of price causes the proportion of thermal power generation to rise significantly. In addition, the electricity price can not only stimulate existing power plants to increase their utilization but also encourage firms to invest in renewable energy plants.

Based on the whole study, there are two recommendations we would like to suggest. First, it is the power-generation structure, not the power-capacity structure, that deserves more attention. Although the ratio of installed capacity for renewable energy has soared these years, the growth of the ratio of electricity from renewable energy is relatively slow. However, power generation mix directly influences the emissions of pollutants and GHG. Thus, the government is supposed to upgrade the power grid system, enhance the productivity and utilization of power machines, and strengthen the supervision on the introduction of idle power plants. Second, innovation plays a significant part in achieving sustainable goals. Technology breakthrough may not only improve the efficiency of plants and reduce the line loss rate, but it also has the potential to contribute to a sharp decrease of carbon emissions.

Data Availability Statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Zhao et al. (2016a) has identified and summarized incentive approaches in China for renewable energy following chronological order

2Ouyang and Lin (2014) suggests that financial subsidy is an essential method in dealing with the high-cost problem

3Due to the availability of reliable data, the time interval of the average power-generation structure data is from 2006 to 2017, which is the latest data we could access until now

4The small amount of the data we could get is another important consideration

5Note that the clean energy technology has been advancing dramatically recently

References

Ai, H., Xiong, S., Li, K., and Jia, P. (2020). Electricity price and Industrial green Productivity: Does the "Low-Electricity price Trap" Exist? Energy 207, 118239. doi:10.1016/j.energy.2020.118239

Alagappan, L., Orans, R., and Woo, C. K. (2011). What Drives Renewable Energy Development? Energy policy 39, 5099–5104. doi:10.1016/j.enpol.2011.06.003

Biresselioglu, M. E., Kilinc, D., Onater-Isberk, E., and Yelkenci, T. (2016). Estimating the Political, Economic and Environmental Factors' Impact on the Installed Wind Capacity Development: A System GMM Approach. Renew. Energ. 96, 636–644. doi:10.1016/j.renene.2016.05.034

BuShehri, M. A. M., and Wohlgenant, M. K. (2012). Measuring the Welfare Effects of Reducing a Subsidy on a Commodity Using Micro-models: An Application to Kuwait's Residential Demand for Electricity. Energ. Econ. 34, 419–425. doi:10.1016/j.eneco.2011.08.001

Carley, S. (2009). State Renewable Energy Electricity Policies: An Empirical Evaluation of Effectiveness. Energy policy 37, 3071–3081. doi:10.1016/j.enpol.2009.03.062

Clò, S., Cataldi, A., and Zoppoli, P. (2015). The merit-order Effect in the Italian Power Market: The Impact of Solar and Wind Generation on National Wholesale Electricity Prices. Energy Policy 77, 79–88. doi:10.1016/j.enpol.2014.11.038

Cludius, J., Forrest, S., and MacGill, I. (2014). Distributional Effects of the Australian Renewable Energy Target (RET) through Wholesale and Retail Electricity price Impacts. Energy Policy 71, 40–51. doi:10.1016/j.enpol.2014.04.008

Cong, R.-G., and Wei, Y.-M. (2010). Potential Impact of (CET) Carbon Emissions Trading on China's Power Sector: A Perspective from Different Allowance Allocation Options. Energy 35, 3921–3931. doi:10.1016/j.energy.2010.06.013

Elliott, R., Sun, P., and Zhu, T. (2019). Electricity Prices and Industry Switching: Evidence from Chinese Manufacturing Firms. Energ. Econ. 78, 567. doi:10.1016/j.eneco.2018.11.029

He, Y. X., Zhang, S. L., Yang, L. Y., Wang, Y. J., and Wang, J. (2010). Economic Analysis of Coal price-electricity price Adjustment in China Based on the CGE Model. Energy Policy 38, 6629–6637. doi:10.1016/j.enpol.2010.06.033

Hu, Z., Wang, J., Byrne, J., and Kurdgelashvili, L. (2013). Review of Wind Power Tariff Policies in China. Energy Policy 53, 41–50. doi:10.1016/j.enpol.2012.09.057

Jamil, M., Ahmad, F., and Jeon, Y. J. (2016). Renewable Energy Technologies Adopted by the UAE: Prospects and Challenges - A Comprehensive Overview. Renew. Sustain. Energ. Rev. 55, 1181–1194. doi:10.1016/j.rser.2015.05.087

Jenner, S., Groba, F., and Indvik, J. (2013). Assessing the Strength and Effectiveness of Renewable Electricity Feed-In Tariffs in European Union Countries. Energy policy 52, 385–401. doi:10.1016/j.enpol.2012.09.046

Jia, Z., and Lin, B. (2021). The Impact of Removing Cross Subsidies in Electric Power Industry in China: Welfare, Economy, and CO2 Emission. Energy Policy 148, 111994. doi:10.1016/j.enpol.2020.111994

Kagiannas, A. G., Askounis, D. T., and Psarras, J. (2004). Power Generation Planning: a Survey from Monopoly to Competition. Int. J. Electr. Power Energ. Syst. 26, 413–421. doi:10.1016/j.ijepes.2003.11.003

Ketterer, J. C. (2014). The Impact of Wind Power Generation on the Electricity price in Germany. Energ. Econ. 44, 270–280. doi:10.1016/j.eneco.2014.04.003

Kwon, S., Cho, S.-H., Roberts, R. K., Kim, H. J., Park, K., and Edward Yu, T. (2016). Effects of Electricity-price Policy on Electricity Demand and Manufacturing Output. Energy 102, 324–334. doi:10.1016/j.energy.2016.02.027

Lin, B., and Chen, Y. (2019). Does Electricity price Matter for Innovation in Renewable Energy Technologies in China? Energ. Econ. 78, 259–266. doi:10.1016/j.eneco.2018.11.014

Lin, B., and Liu, X. (2013). Electricity Tariff Reform and Rebound Effect of Residential Electricity Consumption in China. Energy 59, 240–247. doi:10.1016/j.energy.2013.07.021

Liu, H., Zhang, Z., Chen, Z.-M., and Dou, D. (2019). The Impact of China's Electricity price Deregulation on Coal and Power Industries: Two-Stage Game Modeling. Energy Policy 134, 110957. doi:10.1016/j.enpol.2019.110957

Mehmood Mirza, F., Bergland, O., and Afzal, N. (2014). Electricity Conservation Policies and Sectorial Output in Pakistan: An Empirical Analysis. Energy Policy 73, 757–766. doi:10.1016/j.enpol.2014.06.016

Moerenhout, T. S. H., Sharma, S., and Urpelainen, J. (2019). Commercial and Industrial Consumers' Perspectives on Electricity Pricing Reform: Evidence from India. Energy Policy 130, 162–171. doi:10.1016/j.enpol.2019.03.046

Mordue, G. (2017). Electricity Prices and Industrial Competitiveness: A Case Study of Final Assembly Automobile Manufacturing in the United States and Canada. Energy Policy 111, 32–40. doi:10.1016/j.enpol.2017.09.008

Ouyang, X., and Lin, B. (2014). Levelized Cost of Electricity (LCOE) of Renewable Energies and Required Subsidies in China. Energy policy 70, 64–73. doi:10.1016/j.enpol.2014.03.030

Pu, L., Wang, X., Tan, Z., Wang, H., Yang, J., and Wu, J. (2020). Is China's Electricity price Cross-Subsidy Policy Reasonable? Comparative Analysis of Eastern, central, and Western Regions. Energy Policy 138, 111250. doi:10.1016/j.enpol.2020.111250

Schmid, G. (2012). The Development of Renewable Energy Power in India: Which Policies Have Been Effective? Energy Policy 45, 317–326. doi:10.1016/j.enpol.2012.02.039

Shrimali, G., and Kniefel, J. (2011). Are Government Policies Effective in Promoting Deployment of Renewable Electricity Resources? Energy Policy 39, 4726–4741. doi:10.1016/j.enpol.2011.06.055

Tveten, Å. G., Bolkesjø, T. F., Martinsen, T., and Hvarnes, H. (2013). Solar Feed-In Tariffs and the merit Order Effect: A Study of the German Electricity Market. Energy Policy 61, 761–770. doi:10.1016/j.enpol.2013.05.060

Wang, F., Yin, H., and Li, S. (2010). China's Renewable Energy Policy: Commitments and Challenges. Energy Policy 38, 1872–1878. doi:10.1016/j.enpol.2009.11.065

Wang, Q. (2010). Effective Policies for Renewable Energy—The Example of China’s Wind Power—Lessons for China’s Photovoltaic Power. Renew. Sustain. Energ. Rev. 14, 702. doi:10.1016/j.rser.2009.08.013

Wang, Y., and Lin, B. (2021). Performance of Alternative Electricity Prices on Residential Welfare in China. Energy Policy 153, 112233. doi:10.1016/j.enpol.2021.112233

Yang, M., Yuan, Y., and Sun, C. (2021). The Economic Impacts of China's Differential Electricity Pricing Policy: Evidence from Energy-Intensive Firms in Hunan Province. Energ. Econ. 94, 105088. doi:10.1016/j.eneco.2020.105088

Zhao, X., Li, S., Zhang, S., Yang, R., and Liu, S. (2016a). The Effectiveness of China's Wind Power Policy: An Empirical Analysis. Energy Policy 95, 269–279. doi:10.1016/j.enpol.2016.04.050

Zhao, X., Liu, X., Liu, P., and Feng, T. (2011). The Mechanism and Policy on the Electricity price of Renewable Energy in China. Renew. Sustain. Energ. Rev. 15, 4302–4309. doi:10.1016/j.rser.2011.07.120

Zhao, Z.-Y., Chen, Y.-L., and Chang, R.-D. (2016b). How to Stimulate Renewable Energy Power Generation Effectively? - China's Incentive Approaches and Lessons. Renew. Energ. 92, 147–156. doi:10.1016/j.renene.2016.02.001

Zhao, Z.-Y. (2011). Impacts of Renewable Energy Regulations on the Structure of Power Generation in China - A Critical Analysis. Renew. Energ. 36, 24. doi:10.1016/j.renene.2010.05.015

Keywords: electricity price, power-generation structure, fixed effect, efficiency effect, entrance effect

Citation: Wang J and Li H (2021) The Impact of Electricity Price on Power-Generation Structure: Evidence From China. Front. Environ. Sci. 9:733809. doi: 10.3389/fenvs.2021.733809

Received: 30 June 2021; Accepted: 09 August 2021;

Published: 20 September 2021.

Edited by:

Qiang Ji, Institutes of Science and Development (CAS), ChinaReviewed by:

Xingping Zhang, North China Electric Power University, ChinaLianyong Feng, China University of Petroleum, China

Copyright © 2021 Wang and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hong Li, bGlob25ncGt1cGFwZXJAMTI2LmNvbQ==

Jing Wang

Jing Wang Hong Li1,2,3*

Hong Li1,2,3*