- 1School of Economics, Wuhan University of Technology, Wuhan, China

- 2Center of Hubei Cooperative Innovation for Emissions Trading System, Hubei University of Economics, Wuhan, China

- 3School of Low Carbon Economics, Hubei University of Economics, Wuhan, China

Hydrogen fuel cell vehicle industry is in a rapid development stage. Studying the domestic spatial distribution of hydrogen fuel cell vehicle industry across a country, especially the spatio-temporal evolution of the innovation level and position of each region in innovation network, will help to understand the industry’s development trends and characteristics, and avoid repeated construction. This article uses social network analysis and patent citation information of 2,971 hydrogen fuel cell vehicle related invention patents, owned by 218 micro-innovators across 25 provinces of China from 2001 to 2020, to construct China’s hydrogen fuel cell vehicle innovation network. Based on the dimensions of knowledge production, knowledge consumption, and network broker, the network positions of sample provinces in three periods divided by four main national policies are classified. The main findings are as follows. 1) In China, the total sales of hydrogen fuel cell vehicle and the development of supporting infrastructure are balanced, and a series of national and local industrial development polices have been issued. 2) China’s hydrogen fuel cell vehicle innovation network density, the proportion of universities and research institutes among the innovators, and the active degree of the eastern provinces are all becoming higher. 3) The provinces in optimal network position are all from the eastern region. Shanghai and Liaoning are gradually replaced by Beijing and Jiangsu. 4) Sichuan in the western region is the only network broker based on knowledge consumption. 5) Although Zhejiang, Tianjin, Hebei, Guangdong, and Hubei are not yet in the optimal position, they are outstanding knowledge producers. Specifically, Guangdong is likely to climb to the optimal network position in the next period. The conclusions will help China’s provinces to formulate relevant development policies to optimize industry layout and enhance collaborative innovation in the hydrogen fuel cell vehicle industry.

1 Highlights

1) China’s hydrogen fuel cell vehicle innovation network density becomes higher.

2) Universities and research institutes are the main innovators in HFCV industry.

3) Provinces as knowledge producer are mainly from the east area.

4) Guangdong is climbing to optimal network position.

5) Hubei and Sichuan are outstanding in central and western areas respectively.

2 Introduction

Hydrogen fuel cell vehicle (HFCV) combines the advantages of short filling time, long continue voyage course, and truly achieving a zero-carbon emission goal during driving. Thus, HFCV is one of the important trends in the future of the vehicle industry. In the 1970s, the United States became the first country to use hydrogen energy as strategic energy. And then in the 1990s, Japan and South Korea started the R&D of HFCV. In recent years, more and more countries, including China, have involved in the HFCV industry. Nevertheless, due to the immaturity of commercialization in the HFCV industry, the countrie’s focuses are still the industrial guidance and layout. For instance, the United States plans to form a hydrogen energy network based on 55 hydrogen-filling stations across 35 states, and various countries have successively introduced large-scale subsidies to support the R&D and demonstration applications of HFCV. Hence, studying the spatial layout of HFCV industry across a country will help to optimize the resources allocation and then enhance industrial international competitiveness.

As a major vehicle producer and consumer, China emits CO2 in transportation sector with rapid growth. In 2018, the carbon emission in transportation sector accounts for 10.7% of the total emission in China (Yuan et al., 2021). Thus, the promotion of HFCV will be helpful for China to achieve the goal of carbon emissions peaking by 2030 and carbon neutrality by 2060 and will directly affect China’s position in the new round of international division in manufacturing. China has participated in the global competition of HFCV industry over 20 years since the first HFCV successfully designed at the beginning of the 2000s by local firms, Shanghai Automotive Industry Corporation and Dongfeng Motor Corporation. In recent years, China makes further efforts to accelerate its development pace by releasing a series of promotion policies through national and local governments. For instance, Energy Saving and New Energy Vehicle Technology Roadmap 2.0 released by the State Council of China in 2020 proposes that the number of HFCVs in China will reach 1 million in 2030, which will exceed Japan and become the second-largest country on the total number of HFCVs in the world, just behind South Korea.

Compared with the traditional oil-fueled vehicle industry, China’s HFCV industry has special characteristics. Firms in China’s HFCV industry are still highly dependent on firms in traditional oil-fueled vehicle industry for technology integration and components production. Therefore, the geographic distribution of these two types of firms has similarity. To promote local economic growth, many provinces in China have vigorously developed the oil-fueled vehicle industry since the 1990s. However, it causes a lot of problems such as repeated construction, low resource allocation efficiency, and environmental pollution. Thus, in the background that China’s national and local governments aim to formulate reasonable industrial development plan for HFCV industry, how to optimize the domestic layout of HFCV industry chain, for avoiding repeated construction, blind competition, and forming inter-region coordination, is one of the key issues needed to be considered in depth. Besides, HFCV industry is typically knowledge- and technology-intensive, which makes the innovation highly complex. In addition to the firms, universities and research institutes are the important knowledge producers and innovators as well in China. Therefore, how do these different organizations work together efficiently, and which provinces play the leading innovative role in China’s HFCV industry are the main questions needed to be focused on as well. Hence, to work out the solutions for the above-mentioned key issues, it is necessary to have insights on the spatio-temporal evolution of China’s HFCV industry in the past 20 years, specifically focusing on the regional innovation capability.

Previous related studies on the HFCV industry mainly focus on the qualitative description such as HFCV technology, HFCV industry development, and government policies, especially in Japan, South Korea, and ASEAN (Khan et al., 2021). In the case of China, the risk of blind competition among different provinces and industrial surplus due to the lack of national overall industrial plan are the main topics concerned by some researchers (Meng et al., 2020). However, the research on the spatio-temporal evolution of HFCV industry across provinces in China is nearly blank.

HFCV industry belongs to the strategic emerging industry, in which mastering core technologies independently is one of the effective ways of improving competitiveness. Owing to the “follower” role in the global traditional oil-fueled vehicles industry, Chinese local firms are in a passive position in international competition. So, it is necessary and valuable to identify the innovation capabilities and positions of the main players of HFCV industry in China. In related research on industrial innovation activities, patent is regarded as an important output indicator for innovation. The citing and cited situations of patents are often used to reflect knowledge flow among innovators and detect who plays the leading role in the innovation network. From the perspective of social network analysis in the strategic emerging industry, the previous related literature has analyzed the structure of innovation network and its relationship with innovation performance (Ritter et al., 2004; Ahmad Abuzaid, 2014; Semrau and Werner, 2014). There is no research on current status of China’s HFCV innovation activities by focusing on patent citation network, which characterizes technological innovation and knowledge flow, especially the spatial-temporal evolution of innovation activities across provinces.

Therefore, this article aims to fulfil the research gap on HFCV industry in China by answering the following questions.

First, what is the present situation of HFCV industry development in China? We want to understand in depth the HFCV’s industry spatial distribution across the provinces in China, and sort out the industrial development policies issued by Chinese national government.

Second, which provinces play the leading role of innovation in China’s HFCV industry during various periods of time? We construct innovation network based on patent citation information of micro-innovators locating in different provinces.

Third, what is the specific network position of each province in different periods? Specifically, we want to distinguish the provinces in optimal position or having the potential to be in optimal position in the next period. By analyzing the main reasons pushing forward the province’s evolution of the network position, we can verify the policy effect, and hope to provide implications for improving the competitiveness of China’s HFCV industry.

For answering the above-mentioned questions, in this article, first, we collect and screen out the patent data on China’s HFCV from 2001 to 2020, and sort out the relevant policies at the national and local levels. And then, we construct the innovation network of China’s HFCV industry based on 2,971 HFCV-related invention patents owned by 218 micro-innovators across 25 provinces from 2001 to 2020. Our focus is the knowledge flow direction based on patents, which can help to reveal the evolution of provinces’ innovation capabilities in HFCV. The possible contributions of this article are as follows.

First, by analyzing the authoritative statistical data, this article objectively evaluates the development process and current situation of China’s HFCV industry, as well as the industrial layout of each province. More importantly, our analysis can provide reference for optimizing the cooperation between provinces and forming the coordinated development of the whole industrial chain. In addition, by sorting out the important HFCV industrial policies at the national and local levels, this article identifies the time nodes of HFCV industrial development and builds the foundation for observing the innovation network’s evolution trend and evaluating the policy implication effect.

Second, according to patent citation information among micro-innovators locating in different provinces, this article innovatively constructs patent citation networks of HFCV in China. Compared to the number of patent applications, patent citation data can track the direction of knowledge flow and identify knowledge producers as well. Based on various statistical indicators and topological graphs of the patent citation network, we can intuitively understand the spatial layout characteristics of the innovation activities, the evolution trend of the innovation status, and the contributions made by multi-types of innovators in different time periods. In the process of HFCV patent identification, we decompose the core technical keywords of each link in the HFCV industry chain, screen these keywords in the authoritative patent database, and build a provincial innovation network by the SNA method through the patent citation relationship.

Third, based on the outdegree and indegree indictors in the HFCV patent citation network within different time periods, this article employs the cluster analysis method to identify three network statuses, namely, the knowledge producers, knowledge consumers, and network brokers. This article furtherly quantifies the status of the provinces and tracks their spatial evolution in the network. In particular, this article identifies which provinces are in the optimal network position and have great potential, that is, in the status both of knowledge producer and of network broker. Our findings can provide reference for in-depth understanding of the core competitiveness of HFCV industry.

This article obtains the main findings as follows. First, the total sales of HFCV and the development of supporting infrastructure are balanced in China, and a series of national and local industrial development polices have been issued. Second, the density of China’s HFCV innovation network is increasing, and the provinces playing the leading roles are mainly from the east area. In terms of the micro-innovators, the proportion of universities and research institutes has been gradually larger than firms. Third, the provinces in the optimal network position, namely, the network broker based on knowledge production, are changing. Specifically, Shanghai and Liaoning are gradually replaced by Beijing and Jiangsu, and Guangdong is climbing to the optimal position. Fourth, Sichuan is the only one network broker based on knowledge consumption at the current stage. Fifth, among the provinces temporarily located in non-broker position, Zhejiang, Hubei, Tianjin, and Hebei are prominent in the characteristics of knowledge production with strong development potential.

The subsequent sections of this article are organized as follows. Section 3 reviews the related literature. Section 4 presents the panorama of HFCV industry development in China in the period of 2001–2020. Section 5 describes the data, methodology, and the main characteristics of innovation network based on patent citation information among the provinces in China. Section 6 analyzes the temporal evolution of China’s HFCV innovation network by using topological graph. Section 7 explores the spatial evolution of network, by analyzing the network position of the provinces. Finally, Section 8 concludes and proposes policy implications.

3 Literature Review

Understanding the spatio-temporal evolution of China’s HFCV innovation network is helpful for identifying each province’s position and attributes, guiding the optimization of industrial layout, and forming future industrial development plan at both national and local levels. Therefore, we review the related literature from four aspects, including the development and innovation of HFCV industry, patent citation in innovation network, measurement for network position, and spatio-temporal evolution of network.

3.1 Development and Innovation of HFCV Industry

Nowadays, most nations are predominately preoccupied with the need to increase economic growth amidst pressure for increased energy consumption (Udemba et al., 2020). However, higher energy consumption from fossil fuel aggravates climatic deterioration, and global sustainable development is facing serious obstacles such as global warming caused by greenhouse gas emissions. Therefore, energy portfolio diversification is more urgently necessary than ever (Udemba et al., 2020). The most widely recognized clean energy source is hydrogen (Liu et al., 2018; Nowotny et al., 2018), which makes developing HFCV one of the most effective solutions for countries to reduce emissions of greenhouse gases and improve energy security (Moliner et al., 2016; Moriarty and Honnery, 2019). Some advanced countries have already started to develop HFCV. As one of the global leaders in hydrogen energy and fuel cell technology, Japan reduces the cost of fuel cell production and closes the price gap with oil-fueled vehicles by increasing R&D expenditure (Khan et al., 2021). South Korea aims to expand the supply of HFCV through government policy such as subsidies to cover production cost and lower selling price (Kim et al., 2019). When HFCV becomes widely used in ASEAN, hydrogen will be the sticking point to the coupling of renewable and the transport sector (Li and Kimura, 2021). For China, since the reduction of polluting emissions is linked to the principle of sustainable development (Mele and Magazzino, 2020), the development of hydrogen energy and HFCV industry is highly related to China’s energy development strategy and ecological civilization construction. Nevertheless, China is facing the risk of blind competition and industrial surplus due to the lack of national overall plan for industry development and continuity of related policies (Meng et al., 2020). In addition, due to the imbalance of regional development, the contribution to the growth of transport investments is different from region to region in China (Magazzino and Mele, 2020). From the technology side, although HFCV is still in the initial technology development phase over a period of time (Hardman et al., 2013; Hacking et al., 2019), it is radical innovation with the potential to significantly disrupt conventional combustion engine technology (Zapata and Nieuwenhuis, 2010). Among the core technologies of HFCV, fuel cell is a typical representative. In response to increasing pressure from stakeholders, many automakers would have struggled to develop inter-organizational fuel cell innovations without the involvement of suppliers with specialist capabilities in fuel cell technologies (Borgstedt et al., 2017). Besides, the lack of infrastructure maintenance eliminates the positive effects of transport investments over time in the medium term in China (Magazzino and Mele, 2020), hence, the well development of hydrogen infrastructure is a guarantee of HFCV industry.

3.2 Patent Citation in Innovation Network

Owing to the standardized information related to the development of new ideas and technologies, patent is considered the most valuable output index of innovation activities (Frietsch and Grupp, 2006). The patent citation analysis method reveals the internal information and structure of patent by identifying the citing-cited relationship among patents, and this method has been applied in the network-related research (Abraham and Moitra, 2001; Breitzman and Mogee, 2002; Zhou et al., 2014). In addition, it has been used in the research on knowledge flow (Ho et al., 2014), constructing knowledge network (Jaffe et al., 1993), technology diffusion (Xiang et al., 2013), and the structure among innovators participating in knowledge creation (Belderbos, 2001; lo Storto, 2006; Ma et al., 2009). Moreover, the citation relationship between patents or applicants is the focus of patent citation analysis as well (Narin, 1994). Citations to prior patents indicate that knowledge in the cited patent is beneficial to innovate new knowledge described in the citing patent (Verspagen, 2007), which provides good evidence of the links between technological antecedents and descendants.

However, patent citation information cannot reveal the whole characteristics of knowledge flow (Li et al., 2007). Social network analysis (SNA) is widely used to understand the interaction and connection among innovators. It is a quantitative technology developed by sociologists based on mathematical methods and graph theory. Therefore, a methodology combining social network theory with patent citation information has emerged. For example, through patent citation analysis, Verspagen (2007) maps the technological trajectories of fuel cell industry. Ji et al. (2019) construct global networks of genetically modified crops technology by patent citation relations. Watanabe and Takagi (2021) examine how technology has evolved within the technological field of computer graphic processing systems based on patent citation network.

3.3 Measurement for Network Position

Node’s position in network determines its quantity and quality of resource (Koene, 1984). The center position in the innovation network means the control of competitive advantage (Foerster, 2016; Chai et al., 2017). Hence, many scholars have identified the position of node in the network according to some indicators and classified nodes into different groups. By the patent-cited intensity, Bekkers and Martinelli (2012) divide the position of node in innovation network into knowledge producer and knowledge consumer. Kim and Song (2013) construct a patent lawsuit network, and use three dimensions, namely eigenvector, indegree, and outdegree centrality, to divide firms into four groups, including key players, patent troll, victim, and bystander. Based on outdegree and indegree centrality, Choe et al. (2016) design Outdegree-Indegree (OI) index and betweenness centrality to describe a node’s ability of producing knowledge, and then divide innovators into 4 categories, namely, broker based on producing knowledge, broker based on absorbing knowledge, knowledge producer, and knowledge absorber.

3.4 Spatio-Temporal Evolution of Network

Many scholars have focused on the spatial and temporal development of a sector based on the SNA method. Jiang et al. (2017) collect the low-cost carrier’s data from 2005 to 2013 to study the development trends of air transport network in China. They divide the temporal evolution into three periods, namely, funding period, developing period, and stable period, while from the spatial evolution aspect, the connectivity of network is increasingly close. Similarly, Liu et al. (2021) find that the green innovation network evolves from forming, boom to stable period, and the network based on provincial level are increasingly related closely by constructing the green innovation network in China from 2007 to 2017. Some researches combine the spatial and temporal evolution of network with knowledge spillover. For instance, Li et al. (2015) analyze the development of scientific knowledge networks and technological knowledge networks in biotechnology field by using published papers and applied patents from 2001 to 2012, and they find that knowledge spillovers in spatio-temporal evolution of the networks have features of both hierarchical and contagious diffusion. They also find that knowledge spillovers are shifting from inter-cities to inter-regions. More recently, some researches focus on the key nodes in the network. Liu and Yu (2020) analyze the spatio-temporal evolution of key nodes in the network, intra-regional, and cross-regional cooperative innovation relationships in China’s new energy vehicle industry. The eastern regions including Beijing, Shanghai, Guangdong, Jiangsu, and Zhejiang are key innovators and they are active in intra and inter-regional cooperative innovation. Li et al. (2021) study the evolution of the patent collaboration network of China’s intelligent manufacturing equipment industry. They find that Jiangsu mainly innovates through intra-provincial collaboration while Beijing, Guangdong, and Shandong tend to inter-provincial collaboration.

3.5 Comments

Previous researches on HFCV industry mainly focus on the qualitative description such as HFCV technology, industry development, and policies. There is no study on the construction of HFCV innovation network, the quantitative identification of innovator’s position in the network, and the spatio-temporal evolution of the network. The detailed limits are as follows.

First, the studies, which decompose HFCV core technologies according to the industry chain and construct HFCV innovation network based on patents of specific technologies, are still very limited. Focusing on China, the decomposition of the core technologies based on industry chain is conducive to accurately locate the competitiveness of different provinces in HFCV industry, and helpful to formulate effective regional and inter-firm cooperative development strategies, for avoiding repeated construction and waste of resources.

Second, the SNA method has not been used to measure innovator’s position in the HFCV innovation network. From the perspective of data visualization, we can more clearly and intuitively describe the development process of innovation in China’s HFCV industry, knowledge flow among provinces, and the evolution of the roles played by provinces in the innovation network.

Third, there is still no study focusing on China’s HFCV innovation network. Although China, as a late comer in global HFCV industry, has a short history for HFCV development, it has the characteristics of rapid development, large market potential, and active innovation. In 2020, China is the world’s third biggest producers of HFCV, even overpassing Japan1. In terms of industry development potential, China and the U.S. will tie for the first place of HFCV producing in 2030. Therefore, it is important and significant to investigate the characteristics of spatio-temporal evolution of China’s HFCV innovation network.

4 Development of the HFCV Industry in China

4.1 Status of China’s HFCV Industry in the World

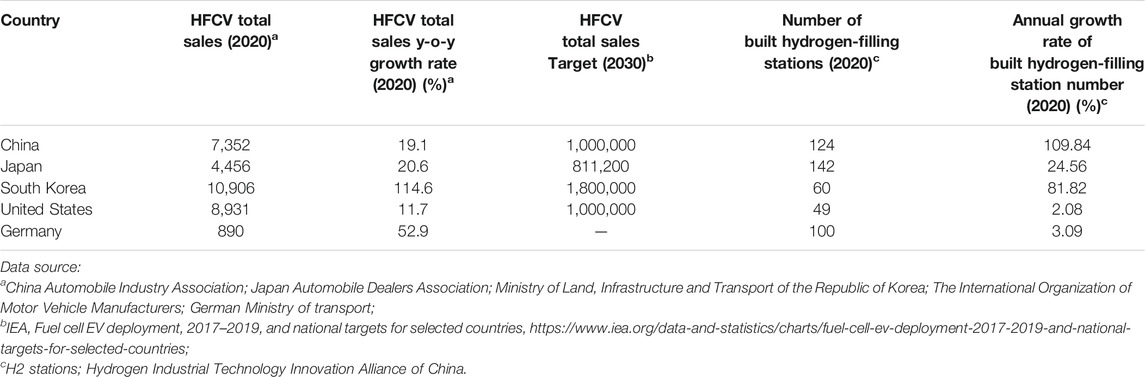

The global HFCV industry has entered a new phase since Toyota launched the world’s first HFCV in 2014. Table 1 compares the HFCV industry development of the world’s top five countries in HFCV total sales by 2020, including China, Japan, South Korea, the United States, and Germany, which together account for about 98% of HFCV world total sales. Driven by high subsidies from national government, South Korea sells 10,906 HFCVs in 2020 with 114.6% y-o-y growth rate, ranking first in the world, and it has set a target of 1.8 million HFCVs for 2030 according to the data from IEA. Japan is the world leader on the construction of hydrogen infrastructure with the greatest number of hydrogen filling stations at present. The United States also has a great number of HFCVs but lacks hydrogen-filling stations. In contrast with the United States, Germany has built 100 hydrogen-filling stations by 2020, but with low level of HFCVs total sales. China’s HFCV industry development is more balanced compared with the United States and Germany. China has the fastest growth among the five countries in the number of hydrogen-filling stations, with y-o-y growth rate of 109.84% in 2020. In addition, China sells 7,352 HFCVs in 2020 ranking third in the world.

4.2 Development Characteristics of HFCV Industry in China

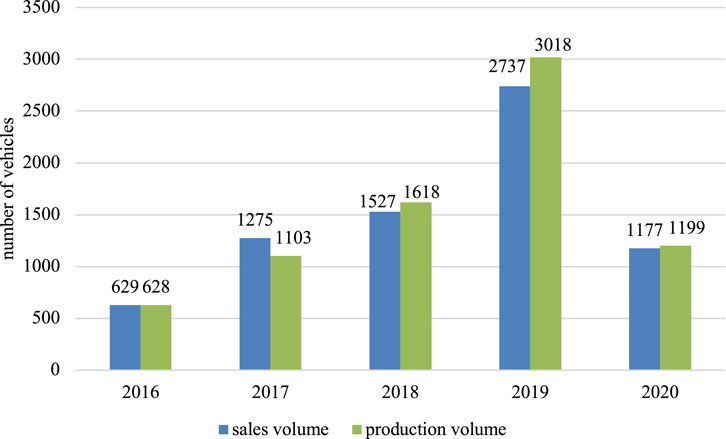

China has always attached great importance to the development of HFCVs. Figure 1 shows the number of HFCV’s production and sales volume in China from 2016 to 2020. Overall, China’s production and sales volume of HFCV increased first and then decreased, both peaked in 2019 at 3,018 units and 2,737 units respectively. As a result of COVID-19 outbreak and changes of national subsidy policies in 2020, China’s production and sales volume of HFCVs fell sharply in 2020, decreased to 1,199 units of production and 1,177 units of sales.

FIGURE 1. Comparison on production and sales of HFCV in China (2016–2020). Data source: China Auto Parts industry Association.

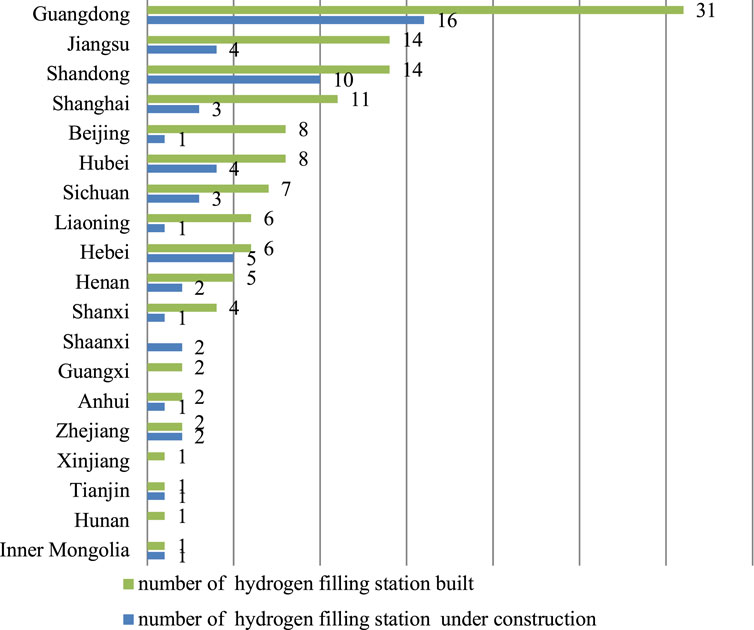

HFCV industry chain is long and complex. Specifically, the upstream of the industry chain mainly includes hydrogen and other raw materials, fuel cell, and related core parts for HFCV. The midstream mainly includes HFCV manufacturing and integration. In contrast, the downstream mainly includes hydrogen infrastructure such as hydrogen-filling station and its supporting facilities, which is a very important link in the HFCV industry chain. According to the data from H2 stations, China’s total number of built hydrogen-filling stations ranked second in the world by 2020, only behind Japan. Figure 2 further shows the specific total number of hydrogen-filling stations built and under construction in various provinces of China by 2020. Guangdong is in the leading position with 31 built stations. Jiangsu, Shandong, and Shanghai all have more than 10 built stations. In terms of the number of hydrogen-filling station under construction, there are 57 hydrogen-filling stations under construction in China by 2020. The top three provinces are Guangdong, Shandong, and Hebei respectively.

FIGURE 2. The number of hydrogen-filling stations built and under construction of China’s provinces by 2020. Data source: GGII. Note: For simplifying, “Province” in this article includes municipalities directly under the Central Government.

4.3 National and Local Supporting Policies for HFCV Industry Development in China

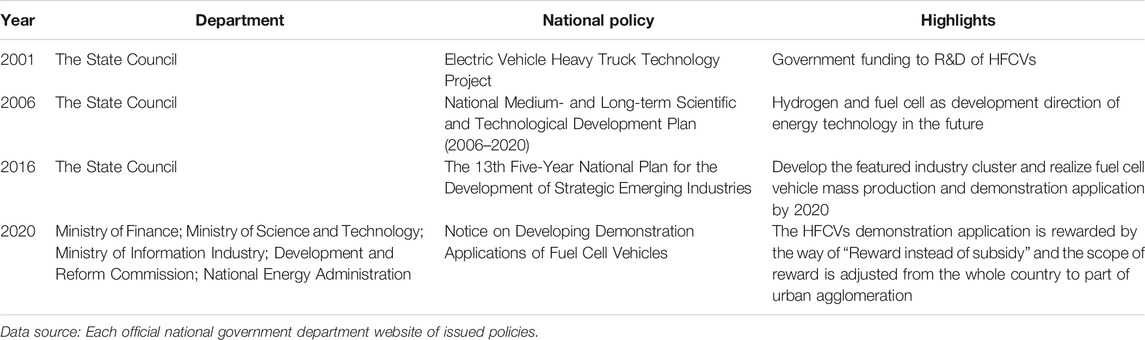

Although China’s HFCV industry has developed rapidly in recent years, it is still in the initial stage of development from the perspective of product life cycle. Therefore, it needs the support from national and local governments. Table 2 presents China’s main national supporting policies for the development of China’s HFCV industry from 2001 to 2020, of which 2001, 2006, 2016, and 2020 are four important time nodes. To better analyze the China’s HFCV innovation network on the temporal dimension, we use four time-nodes of 2001, 2006, 2016, and 2020 mentioned above as the basis of the evolution of China’s HFCV innovation network. Therefore, we ultimately construct three different multi-valued and directed networks to analyze the network evolution, each starting in 2001 and ending in 2006, 2016, and 2020 respectively.

TABLE 2. List of main national policies supporting the development of HFCV industry in China (2001–2020).

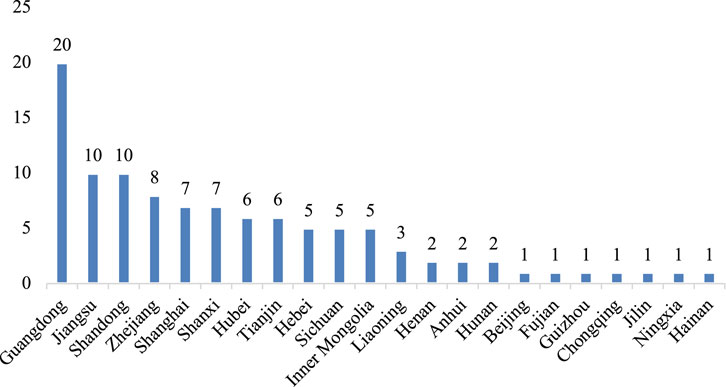

As the intersection of traditional industry and strategic emerging industry, the development of HFCV industry has also been listed as the key field by China’s local governments. Since Shanghai released the Shanghai Fuel Cell Vehicle Industry Development Plan in 2017, some major vehicle production provinces have also formulated relevant industry development plans for HFCVs. Figure 3 shows the number of local policies related to HFCVs issued by 22 provinces in China between 2017 and 2020. The total number of related local policies is 105. Among them, the largest number of policies is issued in Guangdong with 20 policies, accounting for 19.05% of the total. The followed provinces are Jiangsu and Shandong both with 10 policies. In terms of geographical distribution, the provinces of Yangtze River Delta and Pearl River Delta account for 44.76% of the total number of policies, indicating that the eastern coastal regions are currently the key places of the development of China’s HFCV industry.

FIGURE 3. The number of HFCV-related local supporting policies issued by China’s province (2017–2020). Data source: Each official local government department website of issued policies.

5 Data and Methodology

5.1 Data

5.1.1 Patent Database

Based on the core technologies and key products of HFCV industry, we search the patents in the Incopat patent database. Incopat is a leading provider of IP information worldwide, focusing on deep integration and value mining of IP data. There are more than 2,000 users worldwide, including well-known firms, universities, and research institutions, such as Tsinghua University. Incopat is a database that provides relevant information related to the prior art for each patent in State Intellectual Property Office (SIPO) in China (Howell, 2019). In addition to the China’s patent data, Incopat collects official and verified patent data from more than 130 countries, regions, and organizations in the world, and leads the world in the rate of updating patent information.

5.1.2 Data Collection Step

The steps of our data collection in Incopat and screening are as follows.

First, the key words for patent retrieval are determined, which is “Title or Abstract = Metal Bipolar Plate or Graphite Bipolar Plate or Composite Bipolar Plate or Proton Exchange Membrane or Platinum Catalyst or Carbon Paper or Gas Diffusion Layer or Membrane Electrode Assembly or Integration Stacks or DC/DC Transformation or Water and Heat Management or Air Compressor or Hydrogen Circulation Pump or Fuel cell System Integration or Hydrogen Production or Hydrogen Storage or Hydrogen Transportation or Hydrogen Station or Hydrogen Fueling Receptacle or Hydrogen Fueling Nozzle or Hydrogen Fuel cell or Hydrogen Fuel cell Vehicle.”

Second, the patents are further screened after preliminary searching. Since invention patent represents the higher innovation level and ability, we only keep invention patents, excluding the utility model patents and design patents. Besides, we restrict the country in China and delete the patents without patent citation relationships or unrelated with HFCV industry. We also set the time range from 2001 to 2020. Therefore, we preliminarily obtain 7,336 invention patents with patent citation relationships and related with HFCV industry. Furthermore, we obtain 4,845 invention patents of 1,252 innovators after duplicate removal.

Third, based on the Pareto’s rule, also known as the law of the vital few and the principle of factor sparsity, which states that for many phenomena 80% of consequences stem from 20% of the causes, we set the threshold as 4 for innovator’s number of invention patents. Specifically, we exclude the innovators whose invention patent number is less than 4, and then obtain 3,528 invention patents of 254 innovators.

Besides, data of Taiwan, Hong Kong, and Macao are excluded in our research due to the missing of data. We further sort out the innovators based on their provincial identity of China. Firms are classified based on their headquarters, while universities and research institutes are based on their geographical locations. Therefore, finally, we obtain 2,971 invention patents of 218 innovators across 25 provinces in China from 2001 to 2020.

5.2 Methodology

5.2.1 Methods for Network Construction

Patent citation represents the process of knowledge flow. Backward citations indicate the degree of knowledge inflow, and forward citations show the inventive quality from the technological and economic perspectives (Henderson et al., 1998). Based on the final sample after patent searching and screening, and the patent citation relationships among sample provinces, we construct China’s HFCV patent citation innovation network in spatial dimension. Since the patent citation relation strength is represented by the frequency of patent citation between innovators, our patent citation innovation network is multi-valued and directed.

5.2.2 Measures for Network Analysis and Network Position

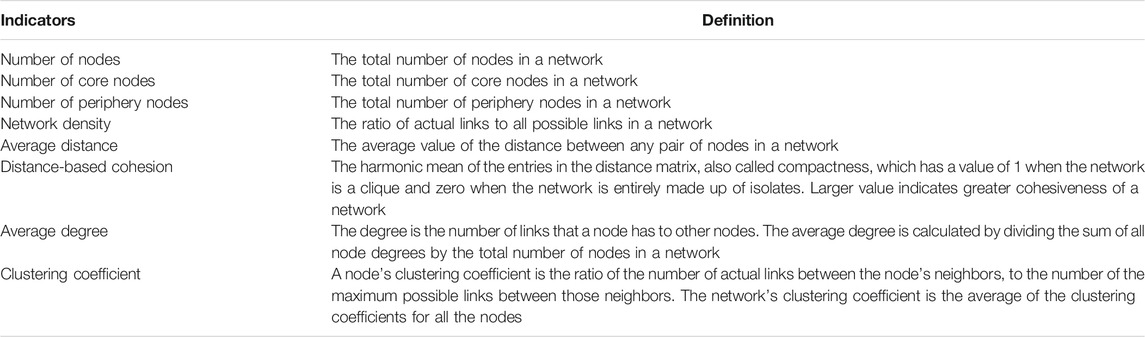

For analyzing the structure and characteristics of China’s HFCV innovation networks in different periods, we use various statistical indicators to conduct network topology analysis, including network density, average distance, distance-based cohesion, average degree, and clustering coefficient. These indicators have been widely used in network literature for analyzing the structure and properties of the network (Okamura and Vonortas, 2006). Table 3 concludes the indicators we use and their definitions for the network evolution topological analysis.

Based on the patent citation relationships between nodes, we visualize the network evolution through UCINET6 to present knowledge flow and node’s properties. And then we carry out the centrality analysis by using the indicators proposed by Freeman (1979). Degree centrality and betweenness centrality are used to estimate the value and significance of top 10 provinces in China’s HFCV innovation network in different periods. The detail calculation process of the key index is explained as follows.

Degree centrality is measured by using the sum of nodes directly connected to one node, so it has a meaning of local centrality. The degree centrality of Node

We also use betweenness centrality to measure the degree to which one node as the broker in a network. Betweenness centrality represents the function of a province in bridging information flow between nodes innovation network. The betweenness centrality of Node

Choe et al. (2016) calculate the network broker and knowledge production capability based on betweenness centrality and Outdegree-Indegree (OI) index. We refer this method in our analysis. Furthermore, we divide the sample provinces in China’s HFCV innovation network into four groups according to these two indicators by using k-means cluster analysis. The detailed method and formula are introduced in Section 6.

6 Evolution of Patent Citation Innovation Network

6.1 Features of Network Evolution

For discovering the features of the formation and evolution of China’s HFCV patent citation network, we analyze the network evolution from three perspectives. First, from the micro perspective, we analyze the composition of innovators and the proportion of their patent applications in each period. Second, from the provincial perspective, we compare the number of provinces’ patents in each period to find out the main patent application regions of the HFCV industry in China. Last, we analyze the performance of the provinces on indegree, outdegree, and betweenness centrality for each period to identify the most dynamic 10 provinces in China’s HFCV patent citation innovation network.

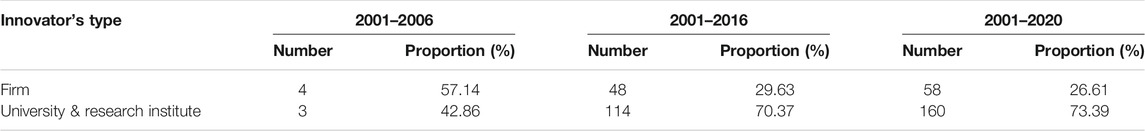

Table 4 shows the number and proportion of innovators of HFCV for the three periods2. The innovators are divided into two types, namely firm and university & research institute. We find that the universities and research institutes are the main innovators in China’s HFCV industry. Compared with the period from 2001 to 2006, the gap between the two types of innovators is continually widen from 2001 to 2020, namely, firm’s patent accounts for 26.61%, while that of university and research institute’s patent accounts for 73.39%.

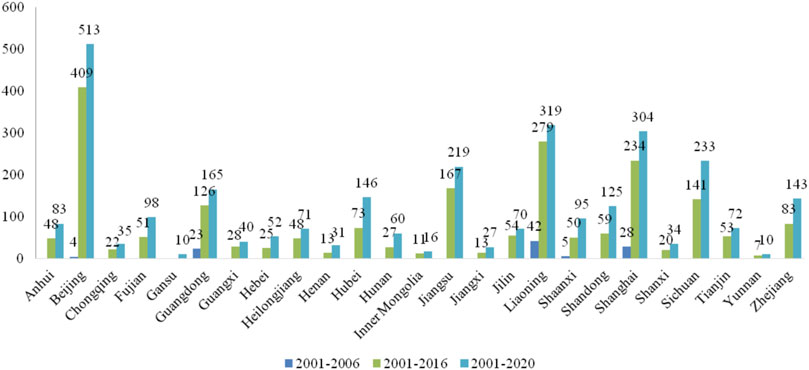

Figure 4 presents the sample province’s number of invention patents in HFCV industry in three distinct periods. From 2001 to 2006, the total number of patents at provincial level is 102. In this period, Liaoning has the largest number of invention patents, followed by Shanghai and Guangdong. The number of patents in Liaoning is 42, which accounts for 41.18% of the total. From 2001 to 2016, the total number of patents is 2,041. It is worth noting that Beijing shows a strong innovation ability, whose number of patents comes to the first-place and accounts for 20.4% of the total. From 2001 to 2020, the total number of province’s patents is 2,971. Beijing still has the biggest number of patents among all the provinces with 513 patents, and followed by Liaoning and Shanghai. Therefore, we find that the eastern provinces are more dynamic for patent application in China’s HFCV industry. What is noteworthy is that Sichuan, the only province from the west, has overpassed Jiangsu with 233 patents.

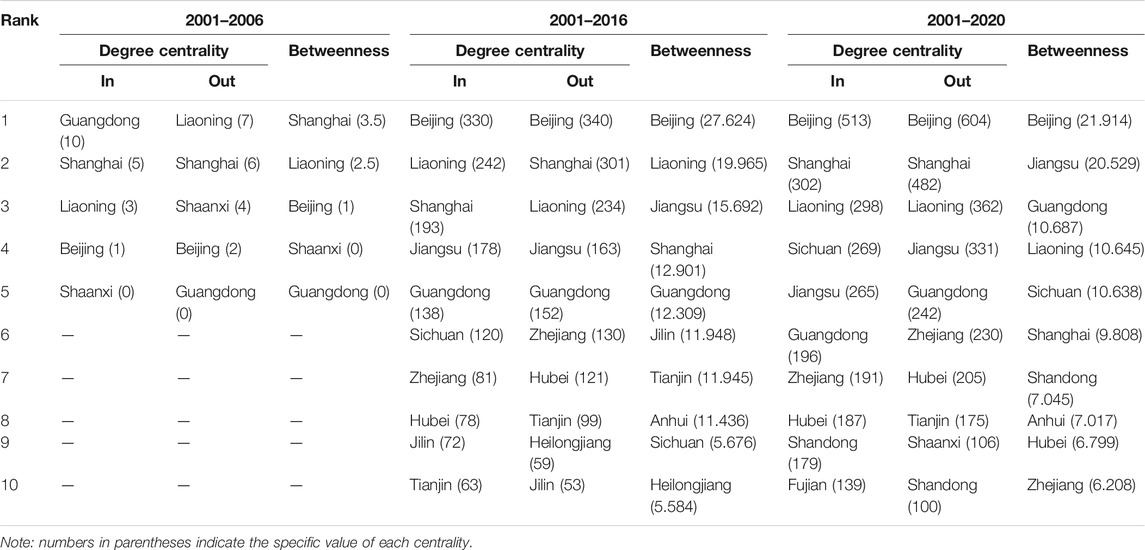

Table 5 furtherly shows the top 10 provinces ranked by centrality of indegree, outdegree, and betweenness in three periods. Owing to the limitation of data, the period from 2001 to 2006 only includes five provinces, with Guangdong, Liaoning, and Shanghai as the top 3. Guangdong has the highest indegree, while its outdegree and betweenness are the lowest among all the provinces, which indicates that Guangdong tends to cite patents from other provinces in this period. Liaoning and Shanghai are relatively stable, ranking in the top 3 among all the three centralities. From 2001 to 2016, Beijing shows the most active performance among all the sample provinces, with indegree, outdegree, and betweenness centrality ranking the first. It is also interesting to note that the top 5 provinces on the three centralities indicators all include Beijing, Liaoning, Shanghai, Jiangsu, and Guangdong, which indicates that these five provinces are the most active in this period. From 2001 to 2020, Beijing still occupies the first place in all three indicators. What’s the difference from the previous period is that Sichuan shows a good performance with ranking fourth place in indegree centrality and fifth place in betweenness centrality, which breaks the stable situation that the top 5 provinces are all from the east. We deduce the reasons why the eastern regions in leading position are caused by the high level of economic development and innovation ability, and better vehicle industry foundation. While for Sichuan province, the local industry development policy for HFCV industry plays the certain impetus function. Sichuan has issued 5 related policies on HFCVs and built 7 hydrogen-filling stations with 220 HFCVs in demonstration application, which makes it rank top in the western regions of China. Besides, it has carried out deep cooperation with Chongqing province. The southwest industrial cluster of the HFCV industry in China has been formed.

6.2 Evolution of Network Topology

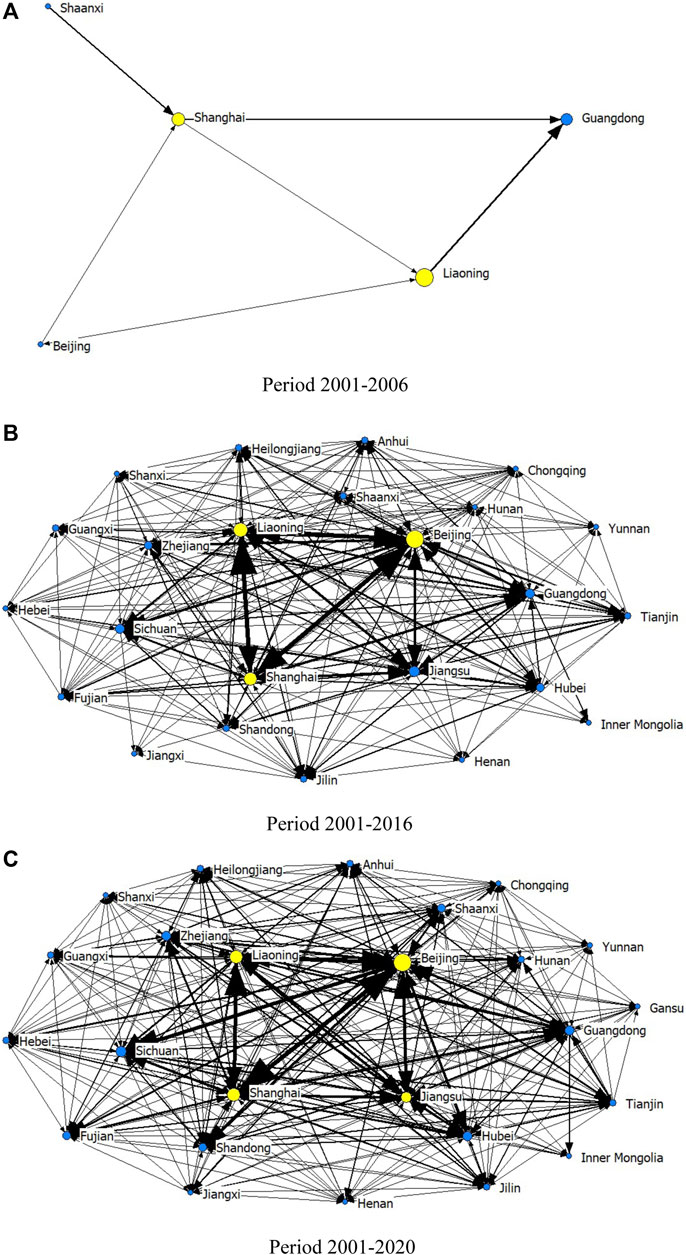

Based on 2,971 patents of 218 micro-innovators from 25 provinces from 2001 to 2020, we construct three multi-valued and directed patent citation innovation networks of China’s HFCV in three periods. In addition, we also conduct core-periphery analysis on these three networks and then find out the specific geographical features of core and periphery nodes. In Figures 5A–C, the node represents the province. Node’s color represents node’s activity level. Yellow node means core province. Blue node means periphery province. The arrowed line between nodes represents the patent citation relationship between provinces. The direction of the arrowed line represents the flow of the knowledge, namely, starting node of the arrowed line is the knowledge consumer and the ending node of the arrowed line is the knowledge producer.

FIGURE 5. Evolution of China’s HFCV patent citation network for the three periods. (A) (2001–2006), (B) (2001–2016), (C) (2001–2020). Note: Node represents the province. Node’s color represents node’s activity level. Yellow node means core province. Blue node means periphery province. The arrowed line between nodes represents the patent citation relationship between provinces. The direction of the arrowed line represents the flow of the knowledge.

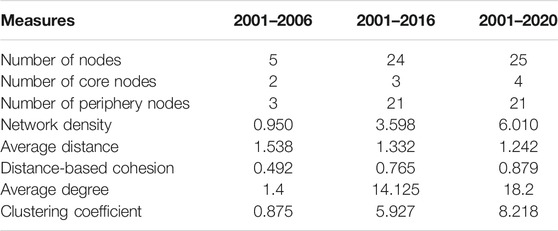

Table 6 shows the results of the network topology analysis for three periods. In detail, the density of network from 2001 to 2006 is 0.950, which is relatively sparse with only 5 provinces participating. The density of network from 2001 to 2016 reaches 3.598 with 24 provinces participating, and that from 2001 to 2020 nearly double to 6.010 with 25 provinces. This result reveals that China’s HFCV patent citation network has changed from sparse to denser and the number of participating provinces has increased over time. In addition, the clustering coefficient of the three networks is increasing, which indicates that China’s HFCV patent citation networks present high cluster feature. Besides, from the perspective of the connection between nodes, we find that the average distance between provinces decreases, the value of distance-based cohesion increases, and the average degree increases. Therefore, the patent citation relationship between provinces shows an increasingly close trend. Combined with network topological graphs in Figure 5, we conclude that Shanghai and Liaoning are the core provinces in the period of 2001–2006, while Beijing joins the core province family in the period of 2001–2016, and then followed by Jiangsu in the period of 2001–2020. We deduce that Beijing is the center of science and technology innovation of China with the largest number of high-quality universities and research institutions, which provides strong foundation for R&D of HFCVs. In contrast Jiangsu province is one of the most competitive provinces in the development of China’s HFCV industry. Not only does the local government attach great importance to the development of HFCV industry, with the number of related policies issued for HFCVs ranking second among all the provinces of China, but also has formed a complete HFCV industry chain layout inside the Jiangsu province. The industry chain includes the upstream of fuel cell core parts R&D, the midstream of the whole vehicle manufacturing, as well as the downstream of hydrogen-filling stations and its supporting facilities construction.

7 Analysis of Province Position in Patent Citation Network

7.1 The Method for Identifying Province Position

To understand the position of each province in China’s HFCV patent citation network, and according to Choe et al. (2016), we use OI index and betweenness centrality as two indicators for identifying province position in the China’s HFCV innovation network.

The OI index compares the degree centrality to which a province cites other provinces (indegree) with the degree to which a province is cited by other provinces (outdegree). The calculation method is shown in Eq. 3:

If the OI index is greater than 0, the number of cited patents in a province is greater than the number of citing patents, indicating that the province is a knowledge producer. If the index is less than 0, the number of cited patents in the province is less than the number of citing patents, indicating that the province belongs to knowledge consumer.

Betweenness centrality represents the function of a province in bridging information flow between nodes in innovation network. The greater the value of betweenness centrality, the stronger the function of the province as a broker in the network, and the greater the possibility of the province as a network center.

According to the values of OI index and betweenness centrality, we divide the position of the provinces into four groups, as shown in Table 7.

In Table 7, we define that the provinces in Group 1 are both network brokers and knowledge producers, which are in the optimal network position. The provinces in Group 2 are network brokers based on knowledge consumption. The provinces in Group 3 are not network brokers, but they are knowledge producers. The provinces in Group 4 are non-brokers with low knowledge production capacity and in an unfavorable network position.

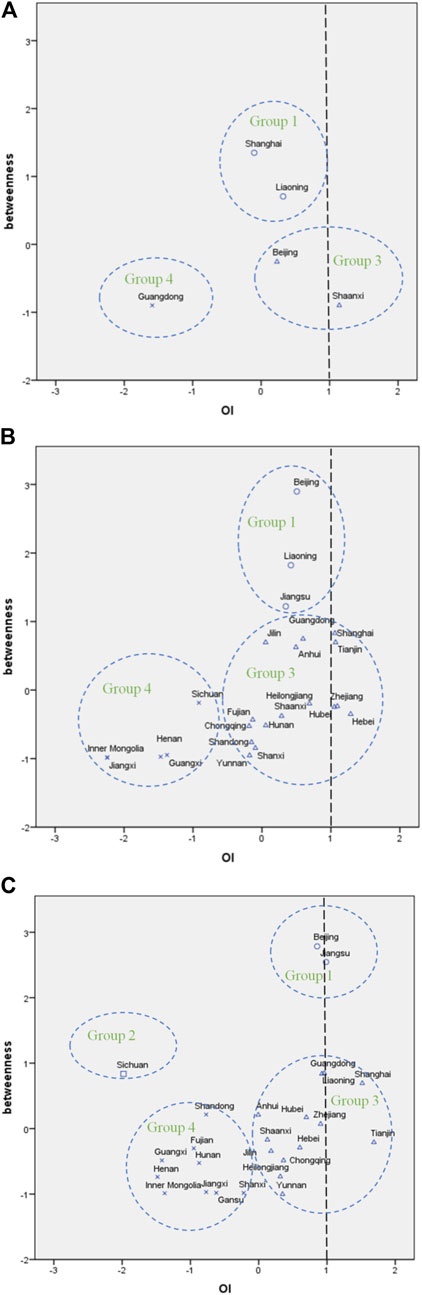

To unify the scale of the OI index and betweenness centrality, we standardize the two indicators. Then, we use the k-mean cluster analysis method to classify the province position in three periods, as shown in Figure 6. In the first and second periods, due to the lack of provinces in Group 2, we set the k value to 3, which means that the provinces are divided into three groups. In the third period, we successfully and completely identify the provinces in Group 2; therefore, the k value is 4. In addition, we use dotted circles in Figure 6 to distinguish and classify the province position, and insert a straight broken line where the value of OI index is 1 according to the Pareto’s rule, treating provinces with an OI index greater than or equal to 1 as provinces with high knowledge production capacity.

FIGURE 6. Position of Chinese provinces in China’s HFCV innovation network. Note: circle: Group 1, square: Group 2, triangle: Group 3, cross: Group 4. (A) (2001–2006), (B) (2001–2016), (C) (2001–2020).

7.2 Identification of the Optimal Network Position

According to the division of province position in Table 7, the provinces in Group 1 play the role of the knowledge bridge in the innovation network and are also the knowledge producers with the optimal network position. Figure 6 shows the position changes of each province in China’s HFCV innovation network. In the first period, Shanghai and Liaoning are in Group 1, but Beijing and Jiangsu replace them climbing to the optimal network position in the second and third periods. The results of the core-periphery analysis also show the characteristics of Beijing and Jiangsu from late comers to first movers. Shanghai and Liaoning are the first batch of provinces in China to develop HFCV industry, promoting them to become the brokers in the HFCV innovation network in the first period. For instance, in 2001, Shanghai Automotive Industry Corporate (SAIC) with General Motor and the Pan Asia Technical Automotive Center jointly successfully developed China’s first hybrid fuel cell vehicle powered by hydrogen, namely, the Phoenix Fuel Cell Vehicle. Dalian Institute of Chemical Physics (DICP) in Liaoning made great progress in the field of proton exchange membrane fuel cell technology in the 1990s and jointly developed the first 30-kilowatt fuel cell bus with Dongfeng Motor in 2001. However, as China attaches more importance to the HFCV industry, many provinces have been involved in the HFCV industry. From 2017 to 2020, China’s 22 local governments have issued 105 policies for the HFCV industry. The vehicle firms in many provinces start to develop HFCVs. For instance, Chinese old brands, such as Beiqi Foton Auto, Chery Auto, and China First Automotive Works (FAW) Corporate, have gradually started the R&D and production of HFCVs. Meanwhile, new competitors, such as Grove, have emerged in recent years. In this context, Beijing and Jiangsu stand out from many provinces and gradually replace Shanghai and Liaoning at the optimal position in the network. We deduce that this phenomenon may be also related to the number of universities and research institutes participating in the HFCV innovation network as well. As the HFCV industry is in its infancy in the world and China, its core technologies are still in the transition stage from innovation to commerce from the perspective of product life cycle. Therefore, universities and research institutes are undertaking the task of innovation and generating technology. The number of universities and research institutes participating in the HFCV innovation network in Beijing and Jiangsu are the top 2 in the second and third periods. Specifically, in the second period, based on our data, Beijing had 21 universities and research institutes, and Jiangsu had 14 universities and research institutes conducing HFCV-related innovation activities. In the third period, Beijing’s number of university and research institute has increased to 25, and Jiangsu has increased to 17, which has facilitated these two provinces to become the innovation network centers with the optimal position in China’s HFCV industry.

7.3 Identification of Provinces With Strong Knowledge Production Capacity

In Table 7, except for the provinces in Group 1, the provinces in Group 3 play the role of knowledge producers in the network as well. We regard provinces with OI index greater than or equal to 1 as provinces with high knowledge production capacity. Figure 6 shows that Beijing and Shaanxi have high knowledge production capacity in the first period. While in the second period, the OI indexes of Tianjin, Zhejiang, Hubei, and Hebei are all greater than 1, showing strong knowledge productivity. In the third period, the OI indexes of Hubei, Hebei, and Zhejiang decrease, but they are still close to 1. In addition, Guangdong’s OI index rises to 1 in the third period, becoming an outstanding knowledge producer. In the meanwhile, its betweenness centrality is the highest among all the knowledge producers in Group 3. Therefore, we conclude that Zhejiang, Hubei, Hebei, Tianjin, and Guangdong are outstanding knowledge producers in China’s HFCV industry, and Guangdong is expected to climb to Group 1, the optimal network position, in the next period. According to the arrangement of relevant industrial policies in Section 4, the number of HFCV industry policies in these five knowledge-producing provinces are all among the top 10 in China as shown in Figure 3, confirming that local industrial policy is an important factor for promoting the technological production in China’s HFCV industry.

It is worth noting that Zhejiang, Hebei, Tianjin, and Guangdong are all from the east of China. Specifically, Zhejiang has issued 8 policies related to the HFCV industry from 2017 to 2020, the most representative is the Development of Hydrogen Fuel Cell Vehicle Industry in Zhejiang in 2020. The plan details how to build a demonstration zone for the HFCV industry in Zhejiang, which is inseparable from the transportation industry foundation of Zhejiang. Besides, in 2019, the Ministry of Transport of China released the Opinions on Zhejiang Province’s Development of Constructing a Modern Comprehensive Three-dimensional Transportation Network and Other Pilot Works for Country with Strong Transportation, facilitating Zhejiang to design the demonstration scene of HFCV.

Tianjin is also a key place for China’s HFCV industry. Tianjin has issued 6 related policies in 2017–2020. Tianjin Hydrogen Energy Industry Development Action Plan (2019–2022) proposes the necessity to introduce international advanced HFCV model and encourage the mass production of domestic HFCV. In terms of vehicle firm, Toyota, the international pioneer firm in HFCV, plans to cooperate with China FAW Corporation to invest 1.22 billion dollars to build a new energy vehicle plant in Tianjin, providing chance to cooperate in the field of HFCV.

Affected by the radiation effect of the Beijing-Tianjin-Hebei cluster, Hebei has issued 5 relevant policies from the period of 2017 to 2020, contributing to building the whole HFCV industry chain. Besides, Hebei has been included in the first batch of national HFCV demonstration cities in 2021, which will further strengthen Hebei’s capacity in HFCVs technology. The most typical example of demonstration is that Zhangjiakou city in Hebei province as the main place for 2022 Winter Olympics will provide 2,000 HFCVs for spectators, tourists, and athletes.

Since 2013, Guangdong has formed the whole HFCV industrial chain. Guangdong also creates Yunfu Hydrogen Energy Town in 2018, which is a HFCV cluster of R&D, production, hydrogen energy infrastructure supporting services, and demonstration zone. By the end of 2020, Guangdong has owned 2,415 HFCVs and 31 hydrogen-filling stations, both ranking first among all the China’s provinces since its HFCV industrial policies covering the development of fuel cell core components, hydrogen infrastructure, HFCV demonstration application, and industry standard setting.

Industrial foundation may be another reason for Guangdong becoming a knowledge producer. Guangdong has been the province with the largest vehicle production in China, reaching 3.132 million vehicles in 2020. The experience and technology of traditional vehicles, especially vehicle integration technology, have become an industrial foundation for HFCV.

In contrast, the number of university and research institutes in Guangdong participating in China’s HFCV innovation network is only 4 and 7 in 2016 and 2020 respectively, which may be one of the main reasons for Guangdong’s lack of betweenness to climb to optimal position. To improve the R&D strength and capability from local universities and research institutes, Guangdong is actively introducing universities and research institutes from other provinces. Therefore, we take the view that Guangdong has the potential to be in the optimal position of China’s HFCV innovation network in the near future.

It is a remarkable fact that Hubei is the only province located in the central region with strong knowledge production capacity. Hubei has issued a total number of 6 related policies between 2017 and 2020, ranking fifth in China. At the same time, Hubei masters core technologies in the field of fuel cells. For instance, relying on local university, namely Wuhan University of Technology, WUT HyPower Technology Corporation in Hubei has become the largest membrane electrode supplier in domestic market and the fifth in international market. With the independent R&D and production technology of membrane electrode, this firm exports products to the United States, Germany, South Korea, and other advanced countries in large quantities, and becomes the main membrane electrode supplier of SinoHytech, leading to revenue exceeding 100 million yuan in 2019. In terms of industry foundation, Hubei, as a large vehicle province, has vehicle integration technology and brand advantages. For instance, Dongfeng Motor in Hubei has also been committed to the production of HFCVs since 2001. Besides, Hubei is a large hydropower province with abundant water resources, which will promote the development of hydrogen energy and HFCV industry.

7.4 Identification of Broker Based on Knowledge Consumption

According to Table 7, the provinces in Group 2 and Group 4 both are knowledge consumers in the network. The provinces in Group 4 are in an unfavorable network position, and the provinces in Group 2 are brokers based on knowledge consumption. It is worth noting that in the third period of China’s HFCV innovation networks, Sichuan has become the first and only broker based on knowledge consumption among sample provinces. Specifically, Sichuan has issued five policies in 2017–2020 to support the development of the local HFCV industry. In 2019, Sichuan issued the Implementation Plan for Dealing the Pollution Control of Diesel Trucks in Sichuan to encourage the demonstration applications of fuel cell trucks and the construction of hydrogen-filling stations. Besides, this plan supports technological breakthroughs in the field of alternative fuels, hybrid power, blade electric, and fuel cell, strengthening the focus on the HFCV industry. At the same time, a few related firms have emerged in Sichuan. In 2018, Dongfang Electric and Chengdu Bus jointly developed hydrogen fuel cell bus. In the same year, Sichuan Natural Gas Investment Corporation and Sichuan Jinxing Corporation jointly constructed a skid-mounted hydrogen station with 400 kg per day. In terms of industry foundation, according to the Research Report on the Comprehensive Development Index of China’s Electronic Information Manufacturing Industry (2018) issued by the Ministry of Industry and Information Technology of China, Sichuan’s electronic information manufacturing industry development index ranks seventh in China, and ranks first in the central and western regions, providing industry foundation for the breakthrough in fuel cell technology. Besides, Sichuan has abundant water resources, which can provide resource support for the development of the hydrogen energy industry. In short, the support of government policies, the emergence of related firms, the foundation of industry, and the abundance of hydrogen resources have jointly helped Sichuan gradually moving toward the center of the innovation network. However, from the perspective of patent citation, Sichuan has been in the role of a knowledge consumer, indicating that Sichuan becomes a network broker by technological importing.

8 Conclusion and Policy Implications

The development of the HFCV industry is one of the important paths to achieve the upgrade of China’s vehicle industry and the goal of carbon neutrality in 2060. To avoid repeated construction and blind competition existing in the China’s traditional oil-fueled vehicle industry, it is important to optimize the layout of the China’s HFCV industry among provinces and to form the coordinated development of different regions based on the advantages and positions of provinces in the industry. Therefore, we use patent citation information of 2,971 HFCV patents, applied by 218 innovators across 25 provinces of China from 2001 to 2020, to construct China’s HFCV innovation network through social network analysis. And then the temporal evolution of network has been in-depth analyzed. Furthermore, to study the spatial evolution of the innovation network, the provinces position in innovation network is divided into four groups based on the knowledge production, knowledge consumption, and network broker by the cluster analysis method.

The main findings are as follows. First, the total sales of hydrogen fuel cell vehicle and the development of supporting infrastructure are balanced in China, and a series of national and local industrial development polices have been issued. Second, the proportion of universities and research institutes in China’s HFCV innovation network is increasing. Third, from the first period (2001–2006) to the third period (2001–2020), more and more provinces have participated in the construction of China’s HFCV innovation network, and the eastern provinces have become increasingly active. At the same time, the density of innovation network is increasing. Fourth, in the three periods, the provinces in the optimal network position in China’s HFCV innovation network are all from the eastern regions. Beijing and Jiangsu gradually replaced Shanghai and Liaoning, which may be related to the number of universities and research institutes participating in the innovation network. Guangdong is likely to climb to the optimal network position in the next period with great potential. Fifth, the network broker based on knowledge consumption in the innovation network only appeared in the third period, that is Sichuan from the western region. Besides, in the third period, the non-broker provinces with strong knowledge production capabilities are Zhejiang, Tianjin, Hebei, Guangdong, and Hubei. Based on the main findings, we propose the following policy implications for the reasonable spatial layout and competitiveness promotion of China’s HFCV industry.

First, in terms of industry layout, China should prioritize provinces in the leading position of HFCV industry or with industry foundation and resource abundance. Specifically, Beijing can make full use of the hydrogen energy resource from Fangshan district in Beijing, Tianjin, and Hebei, and hydrogen production ability from Sinopec to form Beijing-Tianjin-Hebei demonstration cluster in hydrogen industry. Shanghai, Jiangsu, and Zhejiang can construct HFCV demonstration cluster based on traditional vehicle industry, equipment manufacturing industry, and transportation industry. Liaoning and Hubei can focus on the advantages of core components in the fuel cell field to drive the development of the fuel cell industry in the northeast and central regions of China, respectively. Guangdong can contribute to designing the HFCV standard system based on its demonstration experience of HFCV and hydrogen-filling station.

Second, in terms of industry-university-research collaboration, China should encourage firms, universities, and research institutes to establish strategic alliances or jointly set up firms to accelerate the industrialization of research findings. For example, Guangdong can introduce some high-class universities from other provinces to collaborate with local HFCVs innovators, in order to climb to the network center in the next period. At the same time, Sichuan also needs to enhance the knowledge production capacity with the help of universities and research institutes to transfer from the network center based on knowledge consumption to the network center based on knowledge production.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author Contributions

PY: Conceptualization, Validation, Formal analysis, Writing—original draft. FJ: Writing-review & editing, Data curation ZC: Methodology, Data curation, Formal analysis. YS:Validation, Formal analysis, Writing—original draft.

Funding

This work was supported by National Natural Science Foundation of China (Grant No. 72074069), and National Social Science Foundation of China (Grant No. 19BJY107). All remaining errors are on our own.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Data source: China Automobile Industry Association; Japan Automobile Dealers Association.

2According to the important plans and policies for the development of China’s HFCV industry at the national level, this article selects four time-nodes of 2001, 2006, 2016, and 2020. The details of the policies are presented in Section 4.

References

Abraham, B. P., and Moitra, S. D. (2001). Innovation Assessment through Patent Analysis. Technovation 21, 245–252. doi:10.1016/S0166-4972(00)00040-7

Ahmad Abuzaid, A. N. (2014). The Impact of Strategic Alliance Partner Characteristics on Firm's Innovation: Evidence from Jordan. Int. J. Bus. Manag. Sci. 9, 77–87. doi:10.5539/ijbm.v9n3p77

Bekkers, R., and Martinelli, A. (2012). Knowledge Positions in High-Tech Markets: Trajectories, Standards, Strategies and True Innovators. Technol. Forecast. Soc. Change 79, 1192–1216. doi:10.1016/j.techfore.2012.01.009

Belderbos, R. (2001). Overseas Innovations by Japanese Firms: An Analysis of Patent and Subsidiary Data. Res. Pol. 30, 313–332. doi:10.1016/S0048-7333(99)00120-1

Borgstedt, P., Neyer, B., and Schewe, G. (2017). Paving the Road to Electric Vehicles - A Patent Analysis of the Automotive Supply Industry. J. Clean. Prod. 167, 75–87. doi:10.1016/j.jclepro.2017.08.161

Breitzman, A. F., and Mogee, M. E. (2002). The many Applications of Patent Analysis. J. Inf. Sci. 28, 187–205. doi:10.1177/016555150202800302

Chai, R., Chen, M., Chen, Q., and Gao, Y. (2017). An Optimal Joint User Association and Power Allocation Algorithm for Secrecy Information Transmission in Heterogeneous Networks. Wireless Commun. Mobile Comput. 2017, 1–13. doi:10.1155/2017/5120538

Choe, H., Lee, D. H., Kim, H. D., and Seo, I. W. (2016). Structural Properties and Inter-Organizational Knowledge Flows of Patent Citation Network: The Case of Organic Solar Cells. Renew. Sustain. Energ. Rev. 55, 361–370. doi:10.1016/j.rser.2015.10.150

Foerster, M. (2016). Dynamics of Strategic Information Transmission in Social Networks. SSRN J. doi:10.2139/ssrn.2888492

Freeman, L. C. (1979). Centrality in Social Networks. Soc. Networks 1, 215–239. doi:10.1016/0378-8733(78)90021-7

Frietsch, R., and Grupp, H. (2006). There's a New Man in Town: The Paradigm Shift in Optical Technology. Technovation 26, 13–29. doi:10.1016/j.technovation.2004.07.007

Hacking, N., Pearson, P., and Eames, M. (2019). Mapping Innovation and Diffusion of Hydrogen Fuel Cell Technologies: Evidence from the UK's Hydrogen Fuel Cell Technological Innovation System, 1954-2012. Int. J. Hydrogen Energ. 44, 29805–29848. doi:10.1016/j.ijhydene.2019.09.137

Hardman, S., Steinberger-Wilckens, R., and Van Der Horst, D. (2013). Disruptive Innovations: The Case for Hydrogen Fuel Cells and Battery Electric Vehicles. Int. J. Hydrogen Energ. 38, 15438–15451. doi:10.1016/j.ijhydene.2013.09.088

Henderson, R., Jaffe, A. B., and Trajtenberg, M. (1998). Universities as a Source of Commercial Technology: A Detailed Analysis of university Patenting, 1965-1988. Rev. Econ. Stat. 80, 119–127. doi:10.1162/003465398557221

Ho, M. H.-C., Lin, V. H., and Liu, J. S. (2014). Exploring Knowledge Diffusion Among Nations: A Study of Core Technologies in Fuel Cells. Scientometrics 100, 149–171. doi:10.1007/s11192-014-1265-z

Howell, A. (2019). Heterogeneous Impacts of China's Economic and Development Zone Program. J. Reg. Sci 59, 797–818. doi:10.1111/jors.12465

Jaffe, A. B., Trajtenberg, M., and Henderson, R. (1993). Geographic Localization of Knowledge Spillovers as Evidenced by Patent Citations. Q. J. Econ. 108, 577–598. doi:10.2307/2118401

Ji, J., Barnett, G. A., and Chu, J. (2019). Global Networks of Genetically Modified Crops Technology: A Patent Citation Network Analysis. Scientometrics 118, 737–762. doi:10.1007/s11192-019-03006-1

Jiang, Y., Yao, B., Wang, L., Feng, T., and Kong, L. (2017). Evolution Trends of the Network Structure of Spring Airlines in China: A Temporal and Spatial Analysis. J. Air Transport Manage. 60, 18–30. doi:10.1016/j.jairtraman.2016.12.009

Khan, U., Yamamoto, T., and Sato, H. (2021). An Insight into Potential Early Adopters of Hydrogen Fuel-Cell Vehicles in Japan. Int. J. Hydrogen Energ. 46, 10589–10607. doi:10.1016/j.ijhydene.2020.12.173

Kim, H., and Song, J. (2013). Social Network Analysis of Patent Infringement Lawsuits. Technol. Forecast. Soc. Change 80, 944–955. doi:10.1016/j.techfore.2012.10.014

Kim, J.-H., Kim, H.-J., and Yoo, S.-H. (2019). Willingness to Pay for Fuel-Cell Electric Vehicles in South Korea. Energy 174, 497–502. doi:10.1016/j.energy.2019.02.185

Koene, J. (1984). Applied Network Analysis: A Methodological Introduction. Eur. J. Oper. Res. 17 (3), 422–423. doi:10.1016/0377-2217(84)90146-2

Li, C., Bai, L., Liu, W., Yao, L., and Travis Waller, S. (2021). Urban Mobility Analytics: A Deep Spatial-Temporal Product Neural Network for Traveler Attributes Inference. Transportation Res. C: Emerging Tech. 124, 102921. doi:10.1016/j.trc.2020.102921

Li, D., Wei, Y. D., and Wang, T. (2015). Spatial and Temporal Evolution of Urban Innovation Network in China. Habitat Int. 49, 484–496. doi:10.1016/j.habitatint.2015.05.031

Li, Y., and Kimura, S. (2021). Economic Competitiveness and Environmental Implications of Hydrogen Energy and Fuel Cell Electric Vehicles in ASEAN Countries: The Current and Future Scenarios. Energy Policy 148, 111980. doi:10.1016/j.enpol.2020.111980

Liu, F., Zhao, F., Liu, Z., and Hao, H. (2018). The Impact of Fuel Cell Vehicle Deployment on Road Transport Greenhouse Gas Emissions: The China Case. Int. J. Hydrogen Energ. 43, 22604–22621. doi:10.1016/j.ijhydene.2018.10.088

Liu, Y., Shao, X., Tang, M., and Lan, H. (2021). Spatio-Temporal Evolution of Green Innovation Network and its Multidimensional Proximity Analysis: Empirical Evidence from China. J. Clean. Prod. 283, 124649. doi:10.1016/j.jclepro.2020.124649

Liu, Y., and Yu, Q. (2020). Temporal-Spatial Evolution and Innovation Agglomeration of Technological Innovation Network in New Energy Vehicle Industry. J. Dalian Univ. Technol. Soc. Sci. 41, 40–48. doi:10.19525/j.issn1008-407x.2020.06.005

lo Storto, C. (2006). A Method Based on Patent Analysis for the Investigation of Technological Innovation Strategies: The European Medical Prostheses Industry. Technovation 26, 932–942. doi:10.1016/j.technovation.2005.10.005

Ma, Z., Lee, Y., and Chen, C.-F. P. (2009). Booming or Emerging? China's Technological Capability and International Collaboration in Patent Activities. Technol. Forecast. Soc. Change 76, 787–796. doi:10.1016/j.techfore.2008.11.003

Magazzino, C., and Mele, M. (2020). On the Relationship between Transportation Infrastructure and Economic Development in China. Res. Transportation Econ., 100947. doi:10.1016/j.retrec.2020.100947

Mele, M., and Magazzino, C. (2020). A Machine Learning Analysis of the Relationship Among Iron and Steel Industries, Air Pollution, and Economic Growth in China. J. Clean. Prod. 277, 123293. doi:10.1016/j.jclepro.2020.123293

Meng, X., Gu, A., Wu, X., Zhou, L., Zhou, J., Liu, B., et al. (2020). Status Quo of China Hydrogen Strategy in the Field of Transportation and International Comparisons. Int. J. Hydrogen Energ. 46, 28887–28899. doi:10.1016/j.ijhydene.2020.11.049

Moliner, R., Lázaro, M. J., and Suelves, I. (2016). Analysis of the Strategies for Bridging the Gap Towards the Hydrogen Economy. Int. J. Hydrogen Energ. 41, 19500–19508. doi:10.1016/j.ijhydene.2016.06.202

Moriarty, P., and Honnery, D. (2019). Prospects for Hydrogen as a Transport Fuel. Int. J. Hydrogen Energ. 44, 16029–16037. doi:10.1016/j.ijhydene.2019.04.278

Nowotny, J., Dodson, J., Fiechter, S., Gür, T. M., Kennedy, B., Macyk, W., et al. (2018). Towards Global Sustainability: Education on Environmentally Clean Energy Technologies. Renew. Sustain. Energ. Rev. 81, 2541–2551. doi:10.1016/j.rser.2017.06.060

Okamura, K., and Vonortas, N. S. (2006). European Alliance and Knowledge Networks1. Technol. Anal. Strateg. Manage. 18, 535–560. doi:10.1080/09537320601019677

Ritter, T., Wilkinson, I. F., and Johnston, W. J. (2004). Managing in Complex Business Networks. Ind. Marketing Manage. 33, 175–183. doi:10.1016/j.indmarman.2003.10.016

Semrau, T., and Werner, A. (2014). How Exactly Do Network Relationships Pay off? The Effects of Network Size and Relationship Quality on Access to Start-Up Resources. Entrepreneurship Theor. Pract. 38, 501–525. doi:10.1111/etap.12011

Udemba, E. N., Magazzino, C., and Bekun, F. V. (2020). Modeling the Nexus between Pollutant Emission, Energy Consumption, Foreign Direct Investment, and Economic Growth: New Insights from China. Environ. Sci. Pollut. Res. 27, 17831–17842. doi:10.1007/s11356-020-08180-x

Verspagen, B. (2007). Mapping Technological Trajectories as Patent Citation Networks: A Study on the History of Fuel Cell Research. Advs. Complex Syst. 10, 93–115. doi:10.1142/S0219525907000945

Watanabe, I., and Takagi, S. (2021). Technological Trajectory Analysis of Patent Citation Networks: Examining the Technological Evolution of Computer Graphic Processing Systems. Rev. Socionetwork Strat 15, 1–25. doi:10.1007/s12626-020-00066-1

Xiang, X.-Y., Cai, H., Lam, S., and Pei, Y.-L. (2013). International Knowledge Spillover through Co-Inventors: An Empirical Study Using Chinese Assignee's Patent Data. Technol. Forecast. Soc. Change 80, 161–174. doi:10.1016/j.techfore.2012.07.003

Yuan, Z., Li, Z., Kang, L., Tan, X., Zhou, X., Li, X., et al. (2021). A Review of Low-Carbon Measurements and Transition Pathway of Transport Sector in China. Clim. Chang. Res. 17, 27–35. doi:10.12006/j.issn.1673-1719.2020.202

Zapata, C., and Nieuwenhuis, P. (2010). Exploring Innovation in the Automotive Industry: New Technologies for Cleaner Cars. J. Clean. Prod. 18, 14–20. doi:10.1016/j.jclepro.2009.09.009

Keywords: hydrogen fuel cell vehicle, patent citation network, spatio-temporal evolution, network position, innovation network density

Citation: Yu P, Jiang F, Cai Z and Sun Y (2021) The Spatio-Temporal Evolution of China’s Hydrogen Fuel Cell Vehicle Innovation Network: Evidence From Patent Citation at Provincial Level. Front. Environ. Sci. 9:733488. doi: 10.3389/fenvs.2021.733488

Received: 30 June 2021; Accepted: 27 August 2021;

Published: 01 October 2021.

Edited by:

Cosimo Magazzino, Roma Tre University, ItalyReviewed by:

Felix Haifeng Liao, University of Idaho, United StatesFei Ma, Chang’an University, China

Copyright © 2021 Yu, Jiang, Cai and Sun. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yongping Sun, c3VueXBAaGJ1ZS5lZHUuY24=

Pei Yu

Pei Yu Feng Jiang

Feng Jiang Zhengfang Cai

Zhengfang Cai Yongping Sun

Yongping Sun