Abstract

The heterogeneity of investor sentiment plays a key role in causing the asymmetry of information transmission patterns and transmission intensity between markets. This paper analyzes the asymmetric risk spillover between the international crude oil market and other markets, including commodity market and financial market, using monthly data from June 2006 to October 2020. The risk from the international crude oil market is separated into upside and downside risks. The empirical results suggest that, first, from the perspective of static spillover, the risk spillover between the international oil market and commodity market or financial market enhances significantly in response to rising return; second, from the perspective of dynamic spillover, the asymmetric risk spillover of international crude oil market manifests the key roles played by important events happening in the crude oil market and alternating attributes of crude oil. Some policy suggestions are proposed in light of these empirical results.

1 Introduction

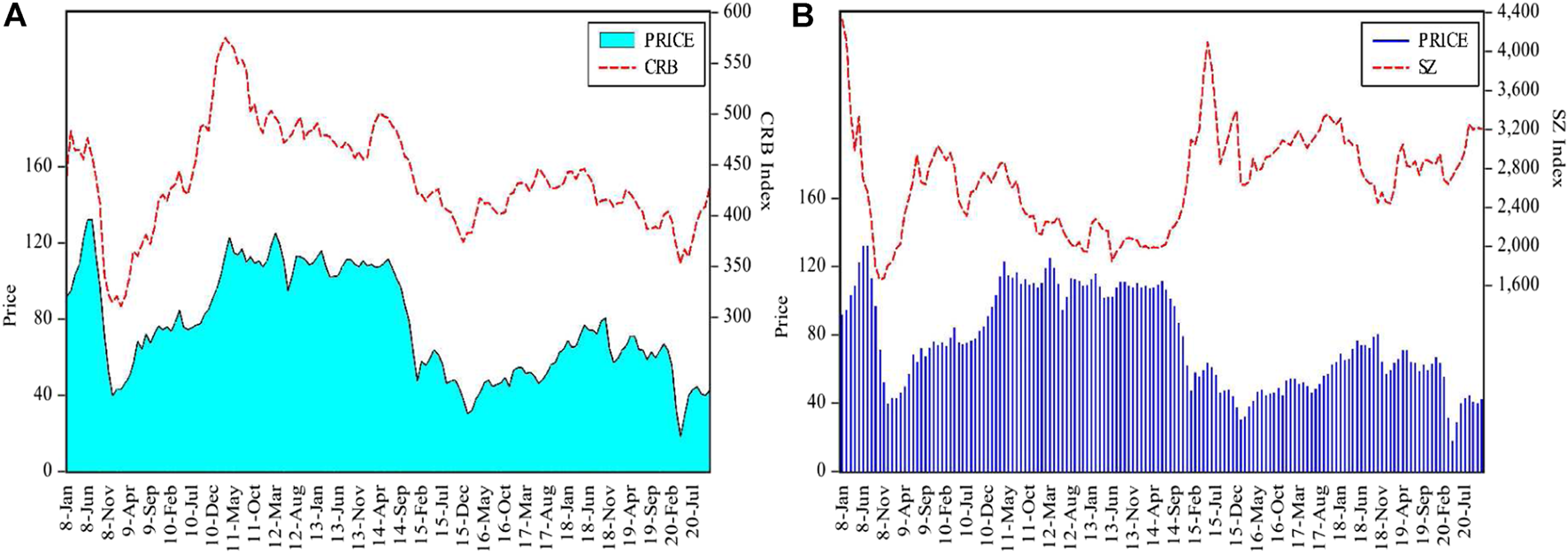

The dual attributes of crude oil show significant impacts on the risk spillover of the international crude oil market. As the most financialized energy product, crude oil has not only commodity attributes but also financial attributes. Factors such as global capital flow and investor speculation increase risk spillover between the international crude oil market and other markets like commodity market and financial market (Adekunle et al., 2020; Asai et al., 2020; Chkir et al., 2020; Li and Zhong, 2020; Huynh et al., 2020). Figure 1 shows the dynamics of international crude oil price and commodity index (CRB) and Shanghai Composite Index (SZ). As a major commodity, the price of crude oil shows the same trend as the CRB index, while it shows stage characteristics with the SZ index. The international crude oil price had a clear upward trend from January 2009 to May 2012. Meanwhile, the CRB index also rose rapidly. Capital gradually shifted from financial investment to real investment, driven by the global financial crisis. Demand for crude oil increased, which in turn led to a rise in its price. The negative correlation between the international crude oil market and the financial market continued at the beginning of 2015. The crude oil future market gradually improved since 2015, which suggests that the financial attribute of crude oil was formed. Global capital began to flow into financial markets, leading to a drop in demand for crude oil and ultimately lower international crude oil prices. The global economy gradually recovered after the financial crisis and the European debt crisis since 2015. Crude oil consumption has rebounded significantly. The demand for crude oil has increased in the market. Meanwhile, with the rapid development of the financial market, global capital was gradually finding a balance between real investment and financial investment. This challenges the demand for crude oil, leading to its price volatility (Dutta et al., 2021; 2020a). In conclusion, the risk spillover between the international crude oil market and the other two markets (commodity market and financial market) is dominated by the attributes of crude oil (Ballco and Gracia, 2020; Liang et al., 2020). The commodity attribute of crude oil determines it as a commodity. There is a strong spillover between the international crude oil market and the commodity market. The financial attribute of crude oil determines it as a hedging asset (Dutta et al., 2020b; Jalkh et al., 2020). There is also a strong spillover between the international crude oil market and financial market (Nasir et al., 2018). When the crude oil is dominated by dual attributes simultaneously, the risk connectedness between the international crude oil market and commodity market or financial market is uncertain. This uncertainty originates from the joint effect of the global flow of funds and investor expectation on the risk spillover (Hao et al., 2020).

FIGURE 1

Crude oil price and CRB index (A) and SZ index (B).

Risk spillover of the international crude oil market shows asymmetric in response to rising and falling returns. The gains and losses in the international crude oil market may be due to various investor decision behaviors caused by their heterogeneous expectations (Ji et al., 2019; Meng et al., 2020). The international crude oil market return is moving in the same direction as the commodity market. On the one hand, the price fluctuation of the international crude oil market will change the demand of crude oil-importing countries and then affect the supply of crude oil-exporting countries. The changing supply and demand relationship in the international crude oil market, in turn, causes the price volatility of the commodity market and further affects economic development. On the other hand, the decline in international crude oil prices provides opportunities for developing countries to reform energy prices and construct energy infrastructure. The declined price of international crude oil reduced the cost constraint on developing countries and provided conditions for energy reserve expansion and energy infrastructure construction (Meng et al., 2020). Influenced by the financial crisis and European debt crisis, the direction of international crude oil market return is roughly the same as that of the financial market from 2009 to 2015. The global economy rebounded after 2015. The investment environment in the financial market was improving. The international crude oil market return shows negative correlation with the financial market return. The negative correlation between prices of international crude oil and financial asset creates a large profit space for investors, especially fund investors (Choi and Hammoudeh, 2010; Zhang et al., 2017; Adekunle et al., 2020). Investors used crude oil as a hedging asset. They earned high profits by grasping the dropping trend of international crude oil prices. In addition, the risk spillover between the international crude oil market and the financial market is affected not only by the supply and demand of crude oil but also by external factors like unexpected events. These factors may change investor expectations and then their investment strategies (Degiannakis et al., 2014; Caporale et al., 2015).

This paper aims to analyze the asymmetric risk spillover of the international crude oil market in response to rising and falling returns. The risk from the international crude oil market can spread rapidly through market information, investor expectation, capital flow, and other channels. The high market correlation allows risk spilling over from the crude oil market to commodity market or financial market, leading to a “domino” effect. Therefore, how to reasonably measure the risk spillover of the crude oil market is of great significance to reduce the risk spillover effect between crude oil markets and commodity (financial) market. Furthermore, due to the heterogeneity of information access existing in investors and speculators, the ability of investors and speculators to respond to market price volatility is different in response to rising and falling returns. By analyzing and comparing risk spillovers of the crude oil market in response to different return trends, it provides a shred of empirical evidence for preventing risk contagion caused by speculators’ behaviors and protecting the legitimate rights and interests of investors. It is conducive to the overall arrangement of policies in different return trends of crude oil and the improvement of the cross-market information-sharing mechanism. It can fundamentally prevent the shock of price volatility of the international crude oil market on the commodity market, financial market, and economic development.

Risk spillover between the international crude oil market and the stock market (or foreign exchange market) is another issue that scholars pay attention to. The existing literature analyzes the spillover effect between the crude oil market and the stock market from both static and dynamic perspectives (Bouri, 2015; Sim and Zhou, 2015; Tsai, 2015; You et al., 2017; Benkraiem et al., 2018). From a static perspective, Degiannakis et al. (2014) found from supply and demand that the financial market was impacted by the total demand for crude oil. Chen et al. (1986) tested whether the price shock of crude oil could be used as an impact factor in the asset pricing model. Other scholars used the same idea to analyze the price shock of international crude oil on the stock price. On the other hand, dynamic spillover has been a hot topic in recent years (Jimenezrodriguez, 2015; Kang et al., 2015; Narayan and Gupta, 2015). Gogineni (2010) proved that the crude oil price has a heterogeneous effect on stock indexes of various industries. Moya-Martinez et al. (2014) proved that crude oil price only has a significant impact on energy, construction, and other industries but has a small impact on other industries. Zhu et al. (2016) found that stock returns of different industries respond differently to the price shock of crude oil, using monthly data from March 1994 to June 2014. Liu et al. (2017) tested the dynamic spillover between WTI and financial markets in the United States and Russia, using the wavelet-based BEKK-GARCH method. Based on wavelet coherence analysis, Boubaker and Raza (2017) discussed the spillover of crude oil price shock on BRICS stock markets in different time periods and time frequencies. Mensi et al. (2017a) calculated VaR, CoVaR, and Delta CoVaR in different holding periods and different cycles of financial markets, based on the VMD method and Copula family functions. They further measured risk spillover of the crude oil market to the financial market.

Some scholars studied spillover between the international crude oil market and foreign exchange market or commodity market (Adams et al., 2020; Asai et al., 2020; Chkir et al., 2020; Huynh et al., 2020; Meng et al., 2020). Chen et al. (2016) studied the effect of crude oil market shock on the exchange rates of 16 OECD countries. The results suggest that the price shock of crude oil on the foreign exchange market is measured between 10 and 20%. Mensi et al. (2017b) studied the short-term, medium-term, and long-term impacts of crude oil prices on the foreign exchange markets of developed countries using methods like VMD decomposition. The results suggest that the price shock of crude oil on the foreign exchange market is asymmetric. Wen et al. (2018) analyzed the nonlinear shock of crude oil price on the US dollar by using HP filtering. The results suggest that the price shock of crude oil on the dollar is unidirectional and nonlinear. Inconsistent with the foreign exchange market, other scholars have shown that the causal relationship between crude oil and gold is time-varying. Besides, there is no nonlinear causal relationship between them. Huynh et al. (2020) analyzed the financialization of the crude oil market and its volatility spillover effect on the commodity market using commodity data from 1979 to 2019. Ji et al. (2019) analyzed the asymmetric risk dependence of the international crude oil market on the foreign exchange markets of China and the United States. The results show that risk dependence between the international crude oil market and China’s foreign exchange market is significantly asymmetric in different return trends of crude oil, while risk dependence between the international crude oil market and the United States foreign exchange market is not significant.

Building on the foundation of extant evidence, this paper provides contributions in several ways. First, this work complements in risk spillovers literature on crude oil markets. To our best knowledge, the prior studies provide empirical evidence on the static and dynamic risk spillover between the crude oil market and commodity (financial) markets. Additionally, prior research explores the heterogeneous spillover effect between crude oil markets and commodity (financial) markets from the perspective of sample heterogeneity, such as before and after the financial crisis, crude oil importing, and exporting countries. But they fail to link the oil attributes and the dynamic risk spillover. Our paper fills this gap by identifying the periods with oil attribute dominant and estimating the risk spillovers between crude oil market and commodity (financial) markets.

Secondly, we analyze the asymmetric risk spillover of the international crude oil market in response to its rising and falling returns. Due to the investor heterogeneity in the international crude oil market, investors’ capital holdings and market expectations are heterogeneous in response to rising and falling returns. In addition, the dual attributes of crude oil also have different effects on the dynamic characteristics of upside and downside risks in the international crude oil market. In the process of financial integration, preventing risk contagion caused by investor heterogeneity and improving market efficiency are the major issues to construct financial security system and develop the stable operation of the macroeconomy.

The rest of the paper is organized as follows. Hypotheses are presented in Section 2. In Section 3, we identify the dual attributes of crude oil and analyze its dynamic characteristics. In Section 4, we measure the upside and downside risks of the international crude oil market. In Section 5, we analyze the asymmetric risk spillover of the international crude oil market. In Section 6, we conclude the paper.

2 Hypotheses

The return trends of the crude oil market will affect the risk spillover between itself and the commodity market. Firstly, risk spillover is due to the convergence of price movements among markets caused by factors in macro fundamentals. Secondly, it is due to the fact that risks from factors like investors’ psychological expectations and cross-market capital flows are spilling over (Ballco and Gracia, 2020; Meng et al., 2020). The rising and falling returns of the crude oil market will cause price volatility of the international crude oil market to different degrees, which leads to its instability (Saculsan and Kanamura, 2020). Attention and sentiment of market participants may lead to different investor expectations in response to different return trends. As a result, investment strategies will change, which in turn affects the spillover direction between the international crude oil market and commodity market (Adams et al., 2020; Huynh et al., 2020). On the one hand, the rising return of crude oil attracts investors into the market, resulting in more attention. Large capitalization in the international crude oil market stabilizes investor sentiment. Investors formulate their investment strategies in light of their ability to capture market information. On the other hand, international crude oil price rises with the return rising, as well as the business operating cost. In order to obtain expected profits, business operators will reduce the demand for crude oil and increase the demand for its alternative commodities (Huang et al., 2019; Li et al., 2020a). In addition, with the price of international crude oil rising, the frequency of E&P and production activities related to crude oil extraction increase. The price of relevant production factors will increase with limited economic resources. As a result, the production cost and prices of these commodities increase (Chen et al., 2019; Liao et al., 2019; Liu et al., 2019). Therefore, the transmission direction of information is from the international crude oil market to the commodity market. For rational behavior of investors, the international crude oil market and other commodity markets are affected by the same macrofactors. Changes in public information like supply and demand in the market further affect the market price and investors’ risk expectations (Li et al., 2020b; Dong et al., 2020). In the practical investment process, market participants may not fully understand the information in the international crude oil market. In addition, the ability to acquire information is heterogeneous among participants. As a result, the information of investors is asymmetric. Because of the importance of crude oil in the commodity market, investors change their investment in the commodity market by referring to the international crude oil market. Therefore, the risk from the international crude oil market is transmitted to the commodity market in the rising return trend.

The international crude oil market is the risk recipient from the commodity market in the falling return trend. On the one hand, participants in the crude oil market worry that their investments are too in response to falling returns. Investors are pessimistic. They often avoid their investment risks and obtain expected profits by using an investment portfolio. The commodity market is one of the channels for investors to diversify their investments. As a part of an investment portfolio, the changing return of crude oil has a high correlation with its proportion in the investment portfolio. The proportion of assets in a portfolio is influenced by investors’ access to information and judgment. Investors pay more attention to information from the commodity market in the falling return of crude oil. Judging from information about the commodity market, investors change the proportion of assets in their portfolios, which in turn affects the flow of capital between the commodity market and the international crude oil market (Peng et al., 2020). On the other hand, the drop in crude oil return sends international oil prices lower. Companies will increase the demand for crude oil in order to reduce operating costs. This increase in demand expands the demand for currency in the market. Policymakers have softened the shock between the crude oil market and the commodity market by changing the supplying amount of currency. Different policies for investors release good or bad information. Investors adjust their investment strategies in response to changes in expectations. At this time, the commodity market plays a leading role in the international crude oil market. The information is transmitted from the commodity market to the international crude oil market.

Different attributes of crude oil have a significant effect on the risk of spillover (Adams et al., 2020; Huynh et al., 2020). If the commodity attribute of crude oil dominates, the international crude oil market is the risk recipient from the commodity market. As the most important commodity, the market information of crude oil will be affected by the information of the commodity market in both rising and falling returns of crude oil (Ballco and Gracia, 2020). This is largely due to crude oil’s relationship with other commodities. Specifically, crude oil is in an upstream and downstream relationship with commodities like food. Effects of policies on these commodities will lead to changes in commodity price, which in turn changes the demand for crude oil and ultimately affects the return volatility of the international crude oil market. In addition, commodities like crude oil and natural gas are substituting relationships. Rising demand for natural gas and other commodities will reduce global demand for crude oil and ultimately change the return volatility in the international crude oil market (Bauer et al., 2016; Li et al., 2020b). If the financial attribute of crude oil dominates, the upside risk of the international crude oil market will affect the commodity market risk, while the downside risk of the international crude oil market will be affected by the commodity market risk. This is mainly due to inconsistent investor expectations in different return trends. The financial attribute of crude oil plays a guiding role in the financialization of the commodity market. Investors are optimistic about the international crude oil market in response to rising returns and increase their exposure to crude oil. Investors adjust their investment strategies in the commodity market through the information from the international crude oil market. In the falling return of crude oil, investors’ pessimistic expectations make them pay more attention to the information from the commodity market and then change their investment strategies in the international crude oil market (Huynh et al., 2020).

In light of this, this paper puts forward the theory of risk spillover between the international crude oil market and commodity market in rising and falling return trends.

Hypothesis 1. There is a significant difference in risk spillover between the international crude oil market and commodity market in rising and falling return trends of crude oil. In addition, this difference is relevant to the attribute of crude oil.

The risk spillover between the international crude oil market and financial market in different return trends is mainly due to the transmission of information and investor behaviors in these two markets, determined by differences in investor risk preference (Chen et al., 2020; Chkir et al., 2020; Wong, 2020). On the one hand, the essence of risk spillover between the international crude oil market and the financial market is the process of information transmission between the markets. On the other hand, the risk spillover between the international crude oil market and the financial market is ultimately realized through the trading behaviors of investors (Kang et al., 2015; Adams et al., 2020). Market participants change their assessment of the return and risk from the international crude oil market and financial market by judging the information they own, so that price risk can reflect the information understanding of market participants (Jimenezrodriguez, 2015; Sim and Zhou, 2015). Investors’ trading behaviors move currency between markets. The movement of funds between markets by market participants affects asset prices in the markets. With the price of crude oil fluctuates, investors in pursuit of profit maximization will quickly adjust their capital allocation ratio in the international crude oil market and financial market, which will lead to the cross-market transfer of funds and consequent volatility of asset prices in the financial market; namely, risk spills over between markets (Kang et al., 2015). Investors were optimistic about the crude oil market in response to the rising return of crude oil. Investors pay more attention to information from the international crude oil market. As a safe-haven asset for investors, the rising return of crude oil increases investors’ appetite for crude oil assets. Higher returns reduce the asymmetry in market participants’ access to information about the crude oil market. They optimize their portfolio strategies by using their judgment of market information. Furthermore, the change in strategies diverts money from the financial market to the international crude oil market. Therefore, upside risk from the international crude oil market is transmitted to the financial market (Ji et al., 2019). It is a different story for downside risk. Investors are risk-averse in response to falling returns. The decline of return increases the panic in the international crude oil market. The return volatility of crude oil increases the risk of the international crude oil market, shaking the role of crude oil as a safe-haven asset. Investors began to increase financial asset investment to avoid the investment risk in the crude oil market, causing capital to flow from the international crude oil market to the financial market (Hao et al., 2020). At this time, information in the financial market plays the role in guiding the information in the international crude oil market. Due to the long development of the financial market and high market efficiency, investors adjust their investment strategies and change their investment in crude oil assets through their ability to obtain information and making judgments. Therefore, the international crude oil market is the risk recipient of risk from the financial market in the fall return of crude oil.

The financial attribute of crude oil has a significant effect on the risk spillover. The financial attribute of crude oil is the key attribute as a safe-haven asset. The international crude oil market behaves as the risk recipient from the financial market in both the rising and falling returns of crude oil (Hao et al., 2020). This is mainly due to the positioning of crude oil assets by investors. If the financial attribute of crude oil dominates, it is more difficult to supervise the market (Zhang et al., 2017). The market stability declines. The main purpose of investors is to hedge financial investment risk through crude oil assets. Therefore, the return volatility of crude oil is mainly related to investors’ access to information and judgment on the financial market. The different trends in return reflect different investor expectations on the market. With optimistic expectations on the market, other assets strongly correlative with crude oil can be bought to realize additional profits in response to rising asset prices. With pessimistic expectations on the market, market participants realize asset hedging by purchasing another asset that is negatively uncorrelated with the declining asset. In this way, when the financial attribute of crude oil is dominant, the risk from the financial market is transmitted to the international crude oil market (Wen et al., 2018). In light of this, this paper puts forward the hypothesis on risk spillover between the international crude oil market and the financial market. The risk from the international crude oil market includes upside risk and downside risk.

Hypothesis 2. The role played by the international crude oil market in influencing the financial market risk is different in response to the upside and downside risks of the crude oil market. In addition, the financial attribute of crude oil has a significant effect on the risk spillover.

3 Study Design

The asymmetric risk spillover in the international crude oil market in response to rising and falling returns of crude oil is relevant to crude oil attributes. In this section, first, we introduce the measure model for risk spillover. Then we expound on the measurement methods for variables. In order to analyze the relationship between risk spillover and crude oil attributes, the method of identifying the crude oil attributes is described at the end of this section.

3.1 Measure Model for Risk Spillover in International Crude Oil Market

The measuring method of risk spillover can accurately evaluate the propagation pattern between different markets. In the existing literature, it involves static spillover and dynamic spillover, where measures for static spillover are such as Nonlinear Granger Causality Test, spatial autocorrelation, and other econometric models, while measures for dynamic spillover are VAR models, GARCH models, Copula models, and DY spillover indexes. On the one hand, influenced by different attributes of crude oil, the risk of the international crude oil market has stage characteristics. In order to analyze the risk spillover of the international crude oil market, it is necessary to study the dynamic version (Liu et al., 2019; Li et al., 2021a, Li et al., 2021b). Both causality test and econometric models measure the static spillover between markets but cannot describe the time variability of spillover. On the other hand, GARCH models, VAR models, Copula models, and CoVaR measure dynamic spillover (Dong et al., 2019; Li et al., 2020). These models can describe the dynamic characteristics of the relationship between markets. However, it lacks a description of risk spillover directions in the international crude oil market, commodity market, and financial market. The network analysis method can not only describe the time variability of spillover but also quantify the risk spillover direction. However, the requirement on the amount of data may fail to achieve the expected results (Li et al., 2020b; Chen and Dong, 2020).

In this paper, we measure the risk spillover of the international crude oil market by using the DY spillover index, proposed by Diebold and Yilmaz (2012). This method quantifies the risk spillover of the international crude oil market by combining generalized variance decomposition and the VAR model. The generalized variance decomposition method overcomes the differences in the variance decomposition of the variables in the VAR model. It can not only systematically describe the risk spillover between markets but also measure the time variation of spillover intensity and spillover direction between the international crude oil market and commodity market (financial market) (Li et al., 2020b; Chen and Dong, 2020; Dong et al., 2020).

The construction of the DY spillover index is mainly divided into three steps. First, we construct VAR models of risk in the international crude oil market, commodity market, and financial market. Second, we use generalized variance decomposition to measure the intensity to which different markets are exposed to external shocks. Third, we use variance contribution rate to construct static and dynamic spillover indexes.

Thus, the VAR (p) models for risk in the international crude oil market, commodity market, and financial market are given as follows:where Riskt is a 3 × 3 risk matrix, including risks of the international crude oil market, commodity market, and financial market. p is the lag order, determined by AIC and SC criteria. ɛt is a three-dimension error vector of independent normal distribution, with mean zero and covariance Σ. The VMA form of Eq. 1 can be written aswhere Ai is a 3 × 3 matrix, satisfying the following condition Eq. 3

As i = 0, Ai is three order unit matrix; as i < 0, Ai is the zero matrix. Eq. 2 and Eq. 3 are applied to the following generalized variance decomposition. Second, we take the variance decomposition to measure the intensity to which the international crude oil market, commodity market, and financial market are affected by themselves or by other markets. It can be formulated as follows:where θij (H) means the variance of market i’s prediction of market j at step H forward, quantifying the impact of risk across markets. As i = j, it describes the risk shock intensity of the market itself. σii is the i’th diagonal element in the matrix Σ. ej is the selecting column vector; i.e., the j’th element is one, while others are zeros.

Using generalized variance decomposition Eq. 4 does not result in the sum of every row in the variance decomposition table being one. Therefore, for calculating the spillover indexes, we take normalization processing for θij (H). The formula of normalization processing can be written as follows:By taking the normalization processing, there holds that and . Finally, we construct the static and dynamic spillover indexes. The dynamic spillover index is built by setting the corresponding window period and then estimating (1)–(4) in order to return the spillover index. With the objective, based on the normalized variance decomposition, this paper constructs the total spillover index to systematically describe the correlation between international crude oil market, commodity market, and financial market. The total spillover index can be defined as follows:Furthermore, we construct the net risk spillover indexes of the international crude oil market. The net risk spillover index can be written as follows:where Toi (H) and Fromi (H) represent different directions of risk spillover in the international crude oil market. The former refers to the risk spillover from the international crude oil market to commodity market and financial market, while the latter refers to the risk spillover from commodity market and financial market to the international crude oil market. The calculating formulas are as follows:In addition, this paper constructs a net pairwise risk spillover index between markets, by the following formula:where is the risk spillover from market j to market i, while is the risk spillover from market i to market j, and i, j (i ≠ j) represent the three markets. The net pairwise spillover index describes the intensity and direction of risk spillover between the international oil market and other markets, i.e., the commodity market and financial market.

3.2 Variable Measure

In this paper, the conditional autoregressive value at risk model (CAViaR) model is used to measure the risks of the international crude oil market, commodity market, and financial market. The existing risk measure methods mainly come into being in light of different returns of the international crude oil market. On the one hand, market risk is measured in response to asset returns. In light of this, existing literature uses static and dynamic VaR based on GARCH models to predict market risk including the stock market, international crude oil market, and virtual currency market (Bernardi and Catania, 2016; Ferraty and Quintela-Del-Rí o, 2016; Gkillas and Katsiampa, 2018; Li et al., 2018). On the other hand, the market risk is measured in response to different asset returns. Most of the existing literature uses extreme value theory (ES) to measure risk. ES is set up in response to extreme events, making up for the drawback of ordinary VAR. The above methods have two common features. One is based on a specific distribution of international oil market return, while the second is based on parameter estimation methods. In the former case, international crude oil market return is limited to certain distribution, like a normal distribution, t distribution, GED distribution, and the others. Based on historical experience, they use parametric models to measure risk from the international crude oil market. Besides, for parametric models, the accuracy of parameter estimation and the degree of model fitting are two aspects that need to be considered. It can be seen from the definition of risk that the measure of international crude oil market risk is predicting quantile. Considering the agglomeration effect of international crude oil market return and the application of quantile regression in risk measure, Engle and Manganelli (2004) proposed a CAViaR. The model needs not to presuppose the distribution of the international crude oil market return and uses the quantile regression to calculate the quantile. At the same time, considering the agglomeration of international crude oil market return, it adds the lag term of the risk. The existing literature predicts the dynamic upside and downside risks by using four forms of the CAViaR model (Meng and Taylor, 2018; Liu et al., 2019; Li et al., 2020b, Li et al., 2021a). Therefore, the CAViaR model is used in this paper to measure the risk of the international crude oil market. The CAViaR model can be written as follows:where Riskt is the international crude oil market risk in t month; l (Rt−j) is an exogenous variable, describing the impact of different forms of international crude oil market income on risk, mainly describing the impact of different forms of international crude oil market yield on risk. Lag term Riskt−i (β) describes the agglomeration of risk in the international oil market. Based on different forms of international crude oil market yields, Engle and Manganelli (2004) further proposed four models, absolutely symmetric model, asymmetric model, indirect GARCH model, and adaptive model, as follows:

Absolutely symmetric modelAsymmetric modelwhere and describe monthly positive and negative yields of the international crude oil market.

Indirect GARCH modelAdaptive modelwhere G is a bounded positive constant. We test model fitting by comparing the fitting results of different risk measurement methods for the international crude oil market. This paper uses the values of HIT and DQ statistics.

With the properties of VAR and dynamic quantile test, Engle and Manganelli (2004) proposed HIT and DQ test methods. HIT examines the difference between risk measures and the returns in the international crude oil market. The HIT statistics can be represented as follows:where I (⋅) is an indicative function, as Rt < Riskt (β) and Hitt (β) = 1−α; otherwise, it takes value −α. In addition, according to the definition of quantile function, Hitt (β) = 0 if given the data in period t−1. In other words, the value of Hitt (β) has nothing to do with risk and lag term. Therefore, the HIT test may not be sufficient to test the goodness of fitting the model. Furthermore, Engle and Manganelli (2004) proposed the DQ test, whose statistic is as follows:where DQIS and DQOS are statistics for fitting samples and testing samples, respectively. measures the international crude oil market return by fitting samples. . Similarly, suppose that TR is the size of fitting samples and NR is the size of testing samples. measures the international crude oil market return by testing samples. , and

3.3 Identifying Dual Attributed of Crude Oil

The financial attribute of crude oil determines that the crude oil price is positively affected by monetary policy. The financial attribute of crude oil means that the formation and volatility of international crude oil prices have the essential characteristics of financial assets, such that it will play an important role in the financial market. The crude oil derivative market has experienced significant development. As a result, the price of crude oil is gradually indexing. The price volatility cycle shortens and the volatility range increases (Zhang et al., 2017; Raheem et al., 2020). On the one hand, monetary policy is the key factor that the dollar exchange rate affects and manipulates the international crude oil price. On the other hand, the monetary policy creates opportunities for hedgers and speculators to profit in the international crude oil market. Monetary policy has an impact on the price of the international crude oil market mainly due to speculative demand (Chen et al., 2016; Wen et al., 2018; Mariam et al., 2020). Expansionary monetary policy will increase the demand for crude oil, reduce the uncertainty of the international crude oil market, and release good news for investors. Investors’ grasp of news increases their optimistic expectations, which in turn changes the allocation of investors’ money in real and financial investments. Speculative demand increases accordingly (Tang and Xiong, 2010; Oleg and Ekaterina, 2020). Therefore, good news leads to the rising price of crude oil derivatives, finally impacting the spot price of the international crude oil market. Conversely, the tight monetary policy increases the investment uncertainty in the international oil market. In turn, investor expectations change. Speculative demand falls, leading to lower price of crude oil derivative. Due to the important role of crude oil derivatives in price discovery, hedging, and risk aversion, the spot price of the international crude oil market also changes.

The commodity attribute of crude oil is relevant to the positive impact of crude oil demand on the price of the international crude oil market. As a key input in production activities, crude oil has the characteristics of general commodity as well as scarcity, strategy, and politics. The particularity of crude oil determines its commodity attribute. The commodity attribute of crude oil means that its price is affected by supply and demand in the market. The supply structure of the international crude oil market has evolved from the original OPEC countries as the main body to the present three main bodies including OPEC rich country group, OPEC poor country group, and non-OPEC countries (Ghassan and AlHajhoj, 2016; Liu et al., 2019). The scarcity of crude oil determines the high uncertainty of crude oil reserves in the future. Supply is inelastic in the short term. Meanwhile, OPEC’s regulation of crude oil supply has a lag effect. Therefore, the price of the international crude oil market is affected by short-term demand. The demand for crude oil is usually correlated with the total demand of the national economy. The demand for crude oil increases with the total social demand, as the economy is booming. In the short-term supply constant situation, this will inevitably lead to rising prices in the international crude oil market. On the contrary, if the economy is in a depression, the total social demand is weak, resulting in falling demand for crude oil falling price of crude oil. The long-term supply of crude oil is more elastic. However, because crude oil is a nonrenewable resource, its reserve, resource endowment, production cost, production capacity, and OPEC decision all limit its supply (Loutia et al., 2016; Liu et al., 2019).

Furthermore, there is an endogenous relationship between the price of crude oil and monetary policy as well as demand for crude oil. Both monetary policy and demand for crude oil have positive effects on the price of crude oil. Secondly, the price of international crude oil affects the production cost of enterprises and then their demands for crude oil. The price of international crude oil can also affect a country’s inflation level. As one of the goals of monetary policy, in order to maintain price stability, the country will formulate corresponding monetary policies to adjust the inflation level. So the price of crude oil also affects the monetary policies (Liao et al., 2019). In light of this, the relationship between the price of the international crude oil market and monetary policy as well as the demand for crude oil is endogenous. The traditional linear model cannot describe the endogenous relationship completely. Therefore, this paper constructs a VAR model. In addition, taking into account the immediate impact of international crude oil price, demand for crude oil, and monetary policy, as well as the structural shocks on the correlation, imitating the work of Kilian (2009), this paper attempts to construct an SVAR model to identify the dual attributes of crude oil.

The constructed SVAR (p) model is as follows:where is a 3 × 3 matrix, opit is international crude oil price at time t, demt is demand for crude oil at time t, and mpot represents the money policy. p is the lag order, tested by SC criterion. B0 describes immediate impact among the international crude oil price, demand for crude oil and money policy, while Bi describes the marginal impact of lag i order. As B0 is invertible, Eq. 19 can be simplified into Eq. 20:where is the structural vector of shock on crude oil, including price shock, demand shock, and money policy shock. According to the objective of this paper, referring to the existing literature, in the paper, we associate the matrix B0 with short-term zero constraints and construct the SVAR model as follows:where the corresponding positions in the matrix represent immediate impacts among variables. More specially, the international crude oil price will respond to the impact of demand for crude oil and monetary policy, so the first element in the first row of the constraint matrix is one, and the other elements are not zero. With the changing price of crude oil, it has a lag effect on the demand for crude oil, due to the business investment plans and crude oil reserves; namely, crude oil price shock will not affect current demand for crude oil, b21 = 0. In addition, the changing price of crude oil and demand does not make any difference to monetary policies, i.e., b31 = b32 = 0. However, money policies cause changes in the current demand for crude oil.

4 Asymmetric Risk Spillover of International Crude Oil Market in Response to Different Returns

4.1 Data Selection and Feature Analysis

With the crude oil attribute identification and risk measure of different markets, this paper uses monthly data from June 2006 to October 2020 to analyze the asymmetric risk spillover of the international crude oil market. First, risk measure is the key variable of risk spillover. The main markets include the international crude oil market, the commodity market, and the financial market. We use the spot price of Brent crude oil as the proxy variable of international crude oil market price. Spot prices of Brent and WTI crude oil represent the dynamic price characteristics of the international crude oil market. Since 2011, the international crude oil industry has gradually shifted to Western Europe, driven by the crude oil extraction cost, idle capacity, and other factors. Brent has also overtaken WTI and become the benchmark of the international crude oil market. We use China Commodity Price Index (CCPI) to measure the commodity market price, while the financial market price is measured by Shanghai composite index. In this paper, we construct logarithmic return sequences of different markets and apply the measure methods given in Section 3.2 to quantify the market risk.

Then, we identify the crude oil attributes. We can analyze the risk dynamics and heterogeneity characteristics of the international crude oil market in periods dominated by different crude oil attributes. According to Section 3.3, the variables identifying crude oil attributes include international crude oil market price, demand for crude oil, and monetary policy. We use Brent crude oil spot price as the proxy variable of international crude oil market price, while the growth rate of the Baltic Dry Bulk Index (BDI) is selected to measure the crude oil demand. Two problems should be considered when choosing measures for crude oil demand. First, heterogeneity of industrial structures in countries leads to different dependence of economic development on crude oil. Second, due to the contribution of emerging countries like BRICS to global economic development, crude oil demand becomes the key factor affecting the price of the international crude oil market. Referring to Kilian (2009), who considered the close relationship between Baltic Freight Index and crude oil demand, in this paper, we use BDI as the proxy variable of crude oil demand. In addition, we choose the global money supply to measure the monetary policy. After obtaining the amount of money supply in the United States, Japan, and the European Union, we use the historical bilateral exchange rate data to convert the money supply into dollars and then sum it up, finally obtaining the proxy variable of monetary policy. In this paper, the seasonal effect of variables is considered, where we take seasonal adjustment for the international crude oil price, BDI, and GM2 by using X12. In order to eliminate heteroscedasticity, this paper further takes logarithms for data. All the data originate from the WIND database1.

Finally, we analyze the risk spillover of the international crude oil market. In light of the identification of crude oil attributes and measures of market risk, in this paper, we use the DY spillover index to analyze the asymmetric risk spillover of the international crude oil market in response to rising and falling returns. The risk spillover model was fitted by RStudio. The risk measures were calculated by using Matlab. We use EVIEWS to identify crude oil attributes. In this subsection, we analyze the characteristics of the international crude oil market, commodity market, and financial market in periods dominated by different attributes of crude oil and in response to both return trends of crude oil. Figure 2 shows the risk dynamics in response to different returns, while Table 1 reports the relationship among the three markets.

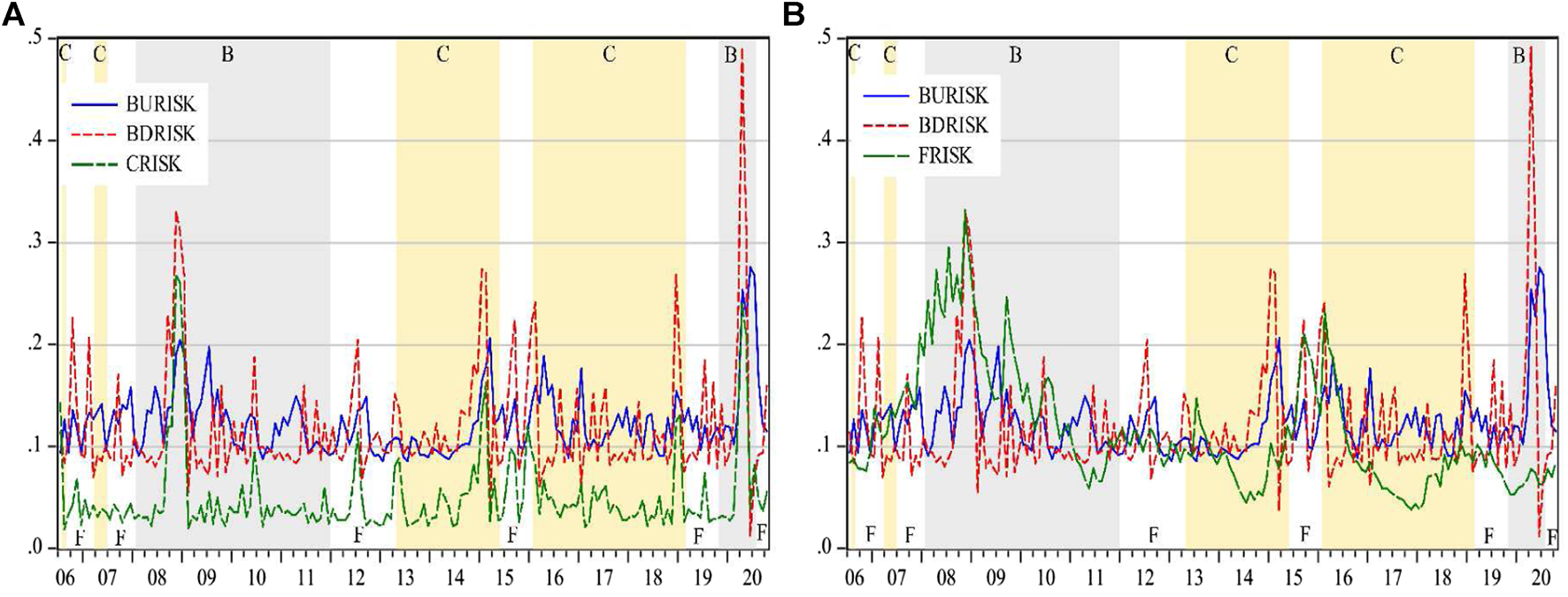

FIGURE 2

Risk dynamics of the international crude oil market, commodity market, and financial market. (A) Risk evolutions of the international crude oil market and commodity market. (B) Risk evolutions of the international crude oil market and financial market. BURISK and BDRISK represent the upside risk and downside risk, respectively. CRISK is the commodity market risk. FRISK is the financial market risk. B means that the dual attributes of crude oil are dominant. C means that the commodity attribute of crude oil is dominant. F means that the financial attribute is dominant.

TABLE 1

| (a) Full sample | (b) Dominated by commodity attribute | |||||

|---|---|---|---|---|---|---|

| — | BRISK | CRISK | FRISK | BRISK | CRISK | FRISK |

| BRISK | 1 | — | — | 1 | 0.8165 (0.9107) | 0.8905 (0.7966) |

| CRISK | 0.5082 (0.8225) | 1 | — | — | 1 | 0.7240 (0.7240) |

| FRISK | 0.2162 (0.1518) | 0.2542 (0.2542) | 1 | — | — | 1 |

| (c) Dominated by financial attribute | (d) Dominated by dual attributes | |||||

| BRISK | 1 | — | — | 1 | 0.7525 (0.9258) | 0.8254 (0.7278) |

| CRISK | 0.8572 (0.8932) | 1 | — | — | 1 | 0.6490 (0.6490) |

| FRISK | 0.9020 (0.8717) | 0.8299 (0.8299) | 1 | — | — | 1 |

Risk connectedness in different return trends of crude oil.

The risk evolution of the international crude oil market and commodity market shows stage characteristics. Figure 2A shows the risk evolution of the international crude oil market and commodity market. In the period dominated by financial attributes of crude oil, the upside risk evolution of the international crude oil market is highly similar to the risk evolution of the commodity market. In the period dominated by commodity attributes of crude oil, the downside risk evolution of the international crude oil market is almost consistent with the risk evolution of commodity markets. In the period dominated by dual attributes of crude oil, the downside risk evolution of the international crude oil market behaves similarly to the risk evolution of commodity markets. These are due to heterogeneous investor attention in the periods dominated by different attributes of crude oil (Asai et al., 2020; Huynh et al., 2020). Investors take their expected profits from the international crude oil market in the period dominated by the financial attribute of crude oil. Investors have less uncertainty about their profits in the rising return of crude oil than that in the falling return. Thus, the upside risk evolution of the international crude oil market is highly similar to the risk evolution of the commodity market. The commodity attribute is the essential attribute of crude oil. It shows lower return volatility of the international crude oil market in its rising trend. In the falling return of crude oil, as higher market panic, the market shows stronger volatility, resulting in higher uncertainty on expected profits of investors. At this time, market participants avoid investment risks by diversifying investments. Meanwhile, as a crucial commodity, the instability of the international crude oil market may lower the stability of the commodity market. In light of this, if the commodity attribute is dominant, the downside risk evolution of the international crude oil market and the risk evolution of the commodity market keep almost consistent. There is a strong relationship between the dual attributes of crude oil and major events. The event shocks on the international crude oil market aggravate the panic market. Investment expectations of market participants do not vary much. Investors adjust their investment strategies through the sharing of information in the market, which increases the downside risk of the international crude oil market and then changes the commodity market risk (Liu et al., 2019). Therefore, if the dual attributes of crude oil are dominant, the downside risk evolution of the international crude oil market and the risk of the commodity market keep almost consistent.

The upside risk evolution of the international crude oil market is highly similar to the risk evolution of financial markets. Figure 2B shows the risk evolutions of the international crude oil market and the financial market. In the period dominated by the financial attribute of crude oil, the upside risk of the international crude oil market has almost the same evolution as the financial market risk. If the dual attributes of crude oil are dominant, the upside risk of international crude oil market risk has almost the same evolution as the financial market risk. If the commodity attribute of crude oil is dominant, the correlation between the risk evolutions of the international crude oil market and the financial market depends on the financial market risk level. These results suggest the relationship between the international crude oil market and the financial market (Kang et al., 2015; Adams et al., 2020; Hao et al., 2020). The financialization of crude oil has enabled a large number of speculative groups to enter the international crude oil market, investing in crude oil assets as a kind of safe-haven assets. The purpose of the speculative groups is to earn the expected or excess profits, so it is more in pursuit of rising returns. To hedge investment risk, financial speculative groups enter the international crude oil market in response to its rising return. They make use of their information advantages, timely adjusting their investment strategies. Therefore, if the financial attribute of crude oil is dominant, the upside risk of the international crude oil market is highly similar to the financial market risk. If the commodity attribute of crude oil is dominant, the risk level of the financial market decides its relationship to the international crude oil market. If the measured risk level of the financial market is less than 0.1, it is not significantly correlative to the international crude oil market. Otherwise, the upside risk of the international crude oil market has the same evolution as the financial market risk.

The risk evolutions of the international crude oil market and both the commodity market and financial market have stage characteristics. In this paper, we further explore the risk connectedness in periods dominated by different attributes of crude oil (see Table 1).

It is the correlation coefficients between international crude oil downside risk and commodity (financial) market risk in the brackets. BRISK, CRISK, and FRISK are, respectively, represent the international crude oil market risk, commodity market risk, and financial market risk.

The upside risk of the international crude oil market is highly correlated with commodity market risk. In the subsample, there is a higher correlation between the international crude oil market and commodity market. If the commodity attribute of crude oil is dominant, the correlation coefficient between the upside risk of the international crude oil market and commodity market risk is given as 0.8165, while it is given as 0.9107 between the downside risk of the international crude oil market and commodity market risk. If the dual attributes are dominant, the correlation between the upside risk of the international crude oil market and commodity market risk is measured as 0.7525, which is slightly different from that between downside risk and commodity market risk, measured by 0.9258. If the financial attribute of crude oil is dominant, the correlation between the upside risk of the international crude oil market and commodity market risk is 0.8572, while it is 0.8932 between downside risk and commodity market risk. As a major commodity, there is a stronger correlation between the downside risk of the international crude oil market and the commodity market. This suggests the stage characteristics of risk evolutions of the international crude oil market and commodity market.

The risk of the international crude oil market in the trend of upward yield is one of the origins leading to risk varying of the financial market. When dominated by the commodity attribute of crude oil, the correlations between the international crude oil market and financial market risk are given as 0.8905 in the trend of the upward yield of crude oil and 0.7966 in the trend of the downward yield of crude oil. When dominated by dual attributes, the correlations between the international crude oil market and financial market risk in the trends of upward and downward yields are given as 0.8254 and 0.7278, respectively. When dominated by the financial attribute, the correlation between international crude oil market risk and financial market risk is 0.9020 in the trend of the upward yield of crude oil, while it is 0.8717 in the trend of the downward yield of crude oil. The correlations between the international crude oil market risk and financial market risk in different yield trends of crude oil suggest their relationship.

4.2 Static Risk Spillover of International Crude Oil Market in Response to Different Returns

To analyze the static risk spillover of the international crude oil market, first, we need to test the stationarity of risk sequences in different markets; second, we determine the lag order of the VAR model; finally, we calculate the static risk spillover matrix. Table 2 and Table 3 report the results of the stationarity test and selection of lag order, while Table 4 describes the static risk spillover matrix of the international crude oil market in response to different returns.

TABLE 2

| ADF-1% level | ADF-5% level | ADF-10% level | ADF-statistics | Prob | |

|---|---|---|---|---|---|

| BURISK | −3.4687 | −2.8731 | −2.5757 | −5.9231 | 0.000 |

| BDRISK | −3.4687 | −2.8731 | −2.5757 | −8.8818 | 0.000 |

| CRISK | −3.4687 | −2.8731 | −2.5757 | −6.9720 | 0.000 |

| DFRISK | −2.5786 | −1.9427 | −1.6155 | −16.546 | 0.000 |

Stationary test for the international crude oil market in the upward yield.

TABLE 3

| Panel a: international crude oil market risk in the upward yield | ||||||

|---|---|---|---|---|---|---|

| Lag | LogL | LR | FPE | AIC | SC | HQ |

| 0 | 1055.26 | NA | 7.84e−10 | −12.453 | −12.397 | −12.430 |

| 1 | 1148.26 | 181.61a | 2.90e−10a | −13.447a | −13.225a | −13.357a |

| 2 | 1154.03 | 11.042 | 3.02e−10 | −13.409 | −13.019 | −13.251 |

| 3 | 1159.52 | 10.330 | 3.14e−10 | −13.367 | −12.811 | −13.141 |

| Panel b: international crude oil market risk in the downward yield | ||||||

| 0 | 1025.38 | NA | 1.12e−09 | −12.099 | −12.043 | −12.077 |

| 1 | 1076.97 | 100.72 | 6.75e−10a | −12.603a | −12.381a | −12.513a |

| 2 | 1083.01 | 11.582 | 6.99e−10 | −12.568 | −12.179 | −12.410 |

| 3 | 1093.79 | 20.288 | 6.84e−10 | −12.589 | −12.033 | −12.364 |

Selection of lag order in the VAR model.

Suggested lag orders through each criterion.

TABLE 4

| BRISK | CRISK | FRISK | FROM | |

|---|---|---|---|---|

| BRISK | 64.65 (57.22) | 5.34 (2.27) | 30.01 (40.52) | 11.78 (14.26) |

| CRISK | 13.08 (21.51) | 68.44 (44.21) | 18.48 (34.28) | 10.52 (18.60) |

| FRISK | 16.77 (11.21) | 0.49 (4.51) | 82.74 (84.28) | 5.75 (5.24) |

| TO | 9.95 (10.91) | 1.94 (2.26) | 16.16 (24.93) | 28.05 (38.10) |

| S i,net | −1.84 (-3.35) | −8.57 (−16.34) | 10.41 (19.69) | — |

Static risk spillover matrix between the international crude oil market and other markets.

It is the static risk spillover between international crude oil downside risk and commodity (financial) market risk in the brackets. BRISK, CRISK, and FRISK represent, respectively, the international crude oil market risk, commodity market risk, and financial market risk.

The VAR model requires stationarity of the considered sequences, i.e., the upside risk (BURISK) and downside risk [(BDRISK)] of the international crude oil market, commodity market risk (CRISK), and financial market risk (FRISK). In this paper, we use ADF to test the stationarity of BURISK, BDRISK, CRISK, and FRISK. ADF should determine whether the intercept term and trend term exist in the BURISK, BDRISK, CRISK, and FRISK. According to the sequence charts of undifferentiated BURISK, BDRISK, CRISK, and FRISK, we can find that they all have intercept terms. However, the differentiated sequences do not have intercept terms or trend terms.

We can know from Table 2 that the ADF for the upside risk of the international crude oil market is −5.9231, where the p-value is 0.000, less than confidence level 0.05. The ADF for the downside risk of the international crude oil market and commodity market risk are −8.8818 and −6.972, respectively. The ADF for the financial market risk with the first difference is −16.546, where the p-value is 0.000, less than the confidence level of 0.05. Therefore, the international crude oil market risk and commodity market risk are stationary sequences, while the financial market risk is the I (1) sequence.

In this paper, we use the SC criterion to determine the p-value in the VAR model. We can see from Table 3 that SC attains the minimum with lag order one, given as −13.225. Therefore, we set the lag order as one in the VAR model. Similarly, Table 3 suggests lag order one in the VAR model. In light of this, we use the first-order difference sequences of the international crude oil market risk and the commodity market risk and the financial market risk to fit the VAR (1) model.

According to the results testing the stationary and lag order, in this paper, we fit the VAR (1) model by using the international crude oil market risk, commodity market risk, and the financial market risk with the first difference. Furthermore, we use generalized variance decomposition to get the static risk spillover matrixes. Table 4 reports the static risk spillover matrixes between the international crude oil market and other markets.

The international crude oil market receives risk from commodity market and financial market more easily in its falling return. In the rising return of crude oil, the risk receipt of the international crude oil market from commodity market and financial market is measured as 11.78%, where the proportion of transmitting risk is 9.95%. On the contrary, the receiving proportion of the international crude oil market is 14.26% in its falling return, while the risk spilling over to commodity market and financial market is 10.91%. In light of this, the net risk spillover index of the international crude oil market in its rising return is −1.84%, and it is −3.35% on the contrary. In summary, the international crude oil market is the risk receiver. The receiving degree is relevant to the return trend. The changing returns of the commodity market and financial market will lead to an adjustment of investors’ investment strategies and then affect the international crude oil market risk (Asai et al., 2020; Huynh et al., 2020). The investor attention and market sentiment in different return trends result in inconsistent impacts (Li et al., 2018; Dong et al., 2020). Specifically, investors in other markets are bullish on international crude oil markets in their rising return. They are optimistic and less likely to face investment losses. With the ability to acquire the information of the commodity market and the financial market and making judgments, it is easier for investors to formulate investment strategies. It has low uncertainty for investors to obtain the expected benefits. At this time, the international crude oil market risk is impacted weakly by the other market risks. Investors are pessimistic about the falling return of crude oil. It has higher uncertainty of their expected benefits. With the low market sentiment, it is difficult for investors to reformulate their investment strategies. The market liquidity is blocked, which enhances the risk spillover between markets (You et al., 2017). Total spillover cannot reflect the difference of spillover intensities and spillover directions between markets. So in this subsection, we analyze the net spillover between the international crude oil market and the other two markets.

The return trend of crude oil makes difference to the risk spillover between the international crude oil market and other markets. The international crude oil market risk is transmitted into the commodity market, and meanwhile, it is the receiver of financial market risk. The net pairwise spillover between the upside risk of the international crude oil market and commodity market risk is measured as 7.74%, while the net pairwise spillover between the downside risk of the international crude oil market and financial market risk is −13.24%. The net spillover between the downside risk of the international crude oil market and commodity market risk is 19.24%, while the net spillover between the downside risk of the international crude oil market and financial market risk is −29.31%. Downside risk spillover from the international crude oil market to other markets is stronger than the upside risk spillover from the international crude oil market to other markets. On the other hand, we can see from the static spillover matrix that the spillover direction between the international crude oil market and commodity market is different from that between the international crude oil market and financial market. The international crude oil market plays the role of like intermediate; namely, it receives risk from the international crude oil market and then transmits risk to the commodity market.

4.3 Dynamic Risk Spillover of International Crude Oil Market in Different Return Trends

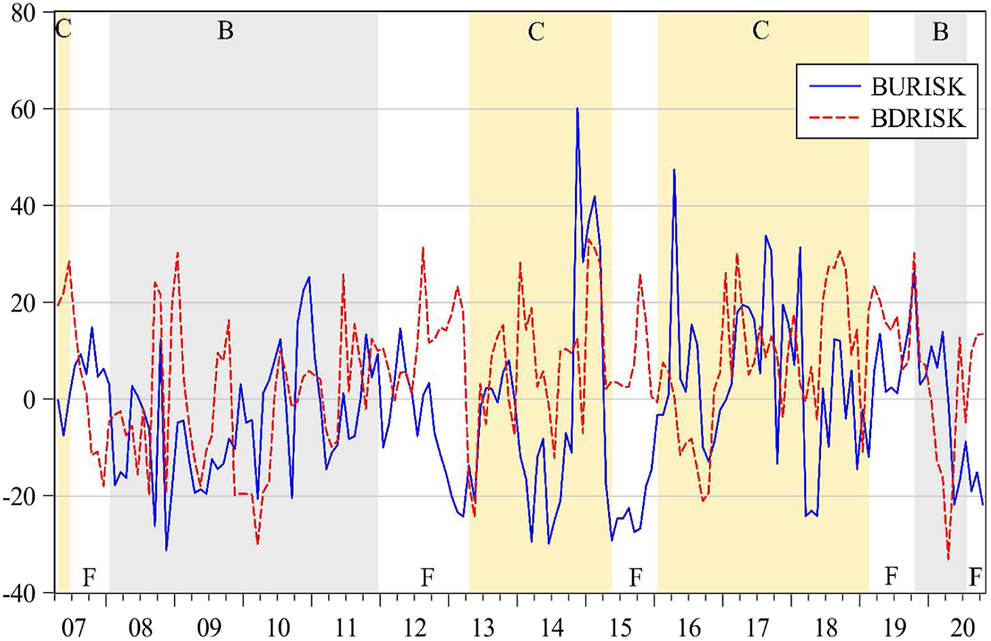

Different attributes of crude oil have a significant effect on the risk spillover of the international crude oil market. Static spillover cannot fully reflect the time-varying characteristics of risk spillover in the international crude oil market. Therefore, in this paper, we construct the net spillover index and net pairwise spillover index to analyze the dynamic characteristics of the international crude oil market by using rolling windows. Figure 3 shows the net spillover indexes of the international crude oil market in different return trends, while the net pairwise indexes are shown in Figure 4.

FIGURE 3

Dynamics of net risk spillover indexes of the international crude oil market in the upward and downward yields. BURISK and BDRISK represent the upside risk and downside risk, respectively. B means that the dual attributes of crude oil are dominant. C means that the commodity attribute of crude oil is dominant. F means that the financial attribute is dominant.

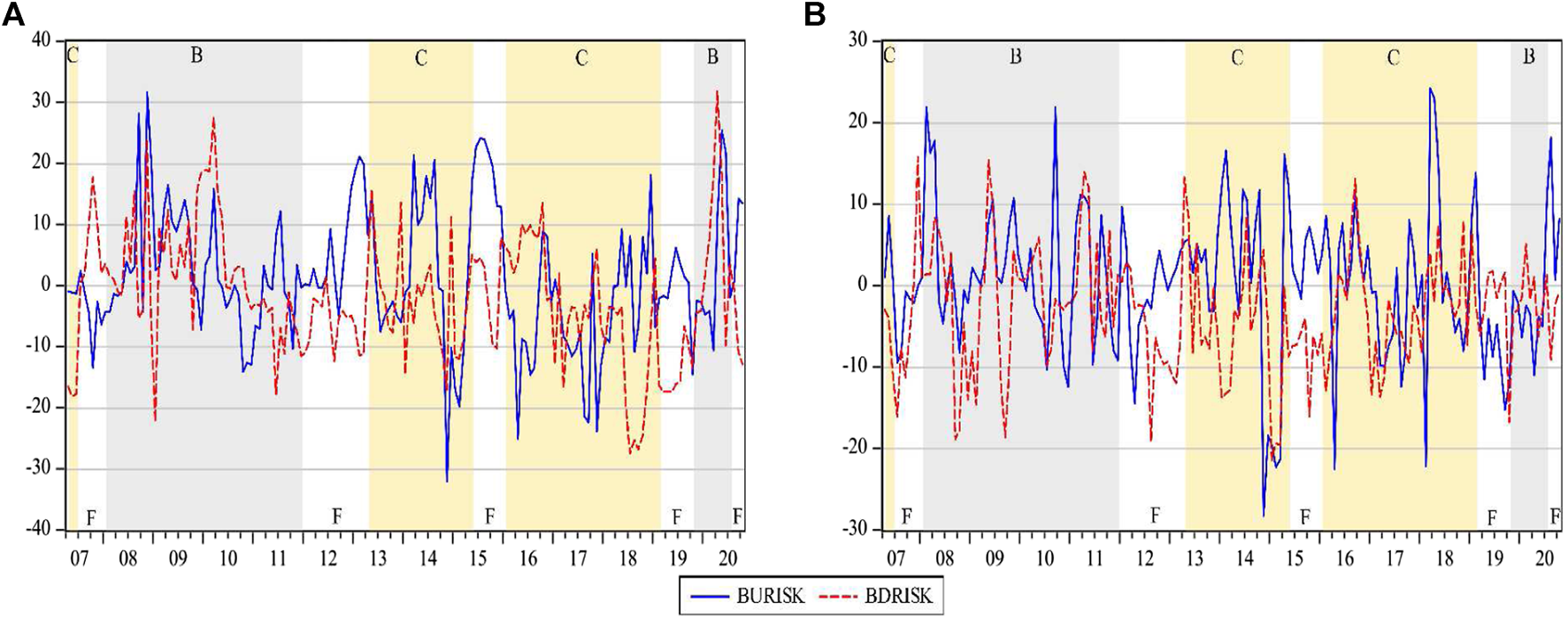

FIGURE 4

Risk spillover between the international crude oil market and commodity market or financial market. (A) Risk spillover index of the international crude oil market and commodity market. (B) Risk spillover index of the international crude oil market and financial market. BURISK and BDRISK represent the upside risk and downside risk respectively. CRISK is the commodity market risk. FRISK is the financial market risk. B means that the dual attributes of crude oil are dominant. C means that the commodity attribute of crude oil is dominant. F means that the financial attribute is dominant.

The risk spillover between the international crude oil market and commodity market and financial market shows stage characteristics. Figure 3 shows the dynamics of net spillover indexes of the international crude oil market. If the financial attribute of crude oil is dominant, the risk spillover from the international crude oil market in its falling return to the commodity market and financial market is stronger, except the second half of 2007. If the commodity attribute of crude oil is dominant, the net spillover of the international crude oil market in its rising return shows cyclic characteristics, while that in its falling return shows positive spillover and strong volatility. If the dual attributes are dominant, the return trend of crude oil has slightly different impacts on the risk spillover between the international crude oil market and commodity market and financial market. This is relevant to the attributes of crude oil and investors’ expectations (Asai et al., 2020; Huynh et al., 2020). If the financial attribute of crude oil is dominant, the rising return of crude oil weakens the uncertainty of investors’ expected benefits. In the falling return, the market sentiment is low. Investors become more uncertain about their investments. As crude oil is considered as one of the safe-haven assets, its market risk may impact others. In the second half of 2007, the financial environment improved. Investors’ expected benefits were less uncertain. This was due to the external environment. As more investors entered the financial market, it increased the market uncertainty. The asymmetry of information was gradually prominent in the market. Thus, the upside risk of the international crude oil market showed a more significant spillover effect (Liu et al., 2019). If the commodity attribute is dominant, pessimism dominates the international crude oil market in response to falling returns. The information in the market may transmit to others. The impact direction of major events on the international crude oil market is relevant to the complexity and information asymmetry of market participants (Saeed and Ridoy, 2020). Due to the high complexity of market participants, it enhances the information asymmetry in the international crude oil market. Investors have a heterogeneous judgment in response to return trends of the international crude oil market. Therefore, if the dual attributes of crude oil are dominant, risk spillovers from the international crude oil market to other markets in different return trends of crude oil both show stronger volatility. In addition, positive and negative directions are alternate.

The total spillover index reflects the dynamic characteristics of international crude oil market risk. However, it cannot fully reflect the stage characteristics of risk spillover between the international crude oil market and commodity market or financial market. In light of this, we further construct the net pairwise spillover indexes to analyze the dynamic characteristics of risk spillover between the international crude oil market and the others, including the commodity market and financial market (see Figure 4).

The risk spillover between the international crude oil market and commodity market is significantly relevant to the attribute of crude oil. Figure 4A reflects the net spillover indexes between the international crude oil market and commodity market. If the financial attribute of crude oil is dominant, the spillover directions between these two markets are different in response to rising and falling returns of crude oil. The upside risk of the international crude oil market is transmitted to the commodity market, except the second half of 2007. If the dual attributes of crude oil are dominant, there are the same spillover directions from the international crude oil market to the commodity market in its rising and falling returns. If the commodity attribute of crude oil is dominant, the volatility range of risk spillover between the international crude oil market and commodity market is significantly different in terms of the rising and falling returns of crude oil. In summary, the upside risk of the international crude oil market is transmitted to the commodity market, while in the falling return, it is the risk receiver from the commodity market. On the one hand, the rising return attracts more investors into the international crude oil market, resulting in more attention to the market. The increasing capital in the international crude oil market has stabilized investor sentiment. On the other hand, the rising return of crude oil increases its price, leading to higher business costs for enterprises. The enterprises have to reduce the crude oil demand and increase demand for substitutes, such that they can earn their expected profits (Li et al., 2020a). In addition, the frequency of exploration and production activities relative to crude oil extraction may increase with the price of international crude oil. The associative price of the production factors will rise when economic resources are limited, resulting in increased production cost and price of the commodity. On the contrary, market participants worry about their investment risk in response to the falling return. They usually avoid their investment risk and earn their expected profits by portfolio (Huynh et al., 2020). Meanwhile, the falling return of crude oil sends its price lower. Enterprises increase their demand for crude oil to reduce operation costs, which in turn increase the demand for currency in the market. Policymakers soften the shock between the crude oil market and the commodity market by changing the money supply. However, the change of risk spillover directions has an early warning effect on crude oil attribute alternation. For instance, in the second half of 2007, the investment environment for financial assets was improving. The return of the international crude oil market showed a rising trend. At that time, the downside risk of the international crude oil market was transmitted to the commodity market. Similar cases happened in the periods when the attributes of crude oil were alternant.

The dynamic risk spillover between the international crude oil market and the financial market is almost consistent. Figure 4B reflects the net spillover indexes between the international crude oil market and the financial market. The directions of risk spillover between the international crude oil market and the financial market are different in terms of return trends. The volatility range of risk spillover between the international crude oil market and the financial market in the rising return is stronger compared with that in the falling return.

The upside risk of the international crude oil market is transmitted to the financial market, while it is the risk receiver from the financial market in the falling return. Investors pay more attention to information of the international crude oil market in its rising return. As a safe-haven asset for investors, the rising return of crude oil drives investors to increase their investment in crude oil (Hao et al., 2020). The rising return weakens the asymmetry in market participants’ access to information about the crude oil market. They optimize their portfolio according to their judgment on the market information (Benkraiem et al., 2018). Furthermore, the changing strategies cause the flow of funds from the financial market to the international crude oil market (Mariam et al., 2020). In the falling return, international oil market panic strengthens, causing stronger volatility of the crude oil return and larger market risk. The role of crude oil as a safe-haven asset declines. Investors turn to financial investment, causing the flow of funds from the international crude oil market to the financial market. At this time, information spreads from the financial market to the international crude oil market. Investors adjust their investment strategies through their access to and judgment of financial market information, changing their investment in crude oil. Similarly, the changing spillover direction has an early warning effect on crude oil attribute alternation.

The dynamics of net risk spillover between the international crude oil market and commodity market or financial market suggest their difference in terms of the crude oil attributes. However, it cannot quantify the difference. In light of this, in this paper, we analyze the quantitative characteristics of net pairwise spillover indexes through descriptive statistics. Table 5 reports the quantitative characteristics of net pairwise spillover indexes of the international crude oil market.

TABLE 5

| (a) Net risk spillover between the international crude oil market and commodity market | ||||

|---|---|---|---|---|

| Mean value | Range | Maximum value | Minimum value | Standard deviation |

| 1.3864 (−1.7712) | 63.671 (59.378) | 31.732 (31.917) | −31.939 (−27.461) | 11.139 (10.629) |

| -2.9513 (−4.0862) | 53.414 (43.318) | 21.475 (15.857) | −31.939 (−27.461) | 11.132 (10.205) |

| 6.2953 (−4.7005) | 37.574 (35.126) | 24.196 (17.724) | −13.378 (−17.402) | 9.770 (8.5145) |

| 2.7397 (3.1128) | 46.248 (54.137) | 31.732 (31.917) | −14.516 (−22.220) | 10.372 (10.971) |

| (b) Net risk spillover between the international crude oil market and financial market | ||||

| 0.4698 (-3.0979) | 52.476 (37.185) | 24.272 (15.820) | −28.204 (−21.365) | 9.0263 (7.3347) |

| 0.4799 (-3.4834) | 52.476 (34.651) | 24.272 (13.286) | −28.204 (−21.365) | 10.772 (7.3542) |

| −0.2320 (−4.6413) | 33.381 (34.782) | 18.216 (15.820) | −15.165 (−18.962) | 7.4487 (6.2375) |

| 0.9845 (−1.4928) | 34.369 (34.291) | 21.984 (15.472) | −12.385 (−18.819) | 7.9337 (7.8679) |

Net pairwise risk spillover indexes between the international crude oil market and other markets.

It is the net pairwise spillover between international crude oil downside risk and commodity (financial) market risk in the brackets.