- 1Research Center for Economy of Upper Reaches of the Yangtse River, Chongqing Technology and Business University, Chongqing, China

- 2School of Finance, Chongqing Technology and Business University, Chongqing, China

- 3School of Economics, Shenzhen University, Shenzhen, China

High-quality development of energy finance (HQDEF) is not only a key component of high-quality economic development, but also an important solution to the current difficulties of China’s energy industry, such as environmental pollution and supply security. This study first clarifies the connotation and mechanism of high-quality energy finance, and then uses static super-efficiency DEA model as well as dynamic Malmquist index to evaluate the HQDEF from the perspective of input and output. We find that the overall effect of the HQDEF is at a low level. The scale efficiency and technical efficiency are deviating, where the former (latter) continues to expand (decline). The dynamic Malmquist index shows a slight decline in the efficiency of the HQDEF. Further studies on five dimensions of the HQDEF show that innovation has the highest correlation with each new energy industry. Lacking of innovation is the main bottleneck that restricts the development of the current new energy industry. The correlations among different industries have a tendency of “symmetry” and “convergence.” Our study provides countermeasures and suggestions for the high-quality and stable development of China’s energy finance from the perspectives of optimizing the financial support structure, building a technological innovation platform, optimizing the industrial structure, rationally making green investments and open development.

Introduction

Energy is a strategic material for national economic and social development. The Reforms and Open Door policy brought rapid growth and made China the second-largest economy in the world. With the cost of resource depletion and pollution, the sustainable development calls for green development for energy (Xu et al., 2019). Thus, it is important to transfer traditional energy into low-carbon or non-carbon green and clean energy. Moreover, finance can play an important role in this transition process. As a result, energy finance has emerged. In order to achieve high-quality development of economy and energy and practice ecological civilization, the evaluation of the high-quality efficiency of energy finance and the research of influencing factors have very important practical significance and theoretical value. Thus, it meaningful to evaluate the high-quality efficiency of energy finance and study the impact factors on energy finance.

As a new judgment on the mode of economic growth, the 19th National Congress of the Communist Party of China (CPC) adjusted its national development strategy and assigned the sustainable development the top priority. The transition from the stage of high-speed growth to high-quality development includes two dimensions: high-speed to sustainable and stable growth; and low-quality to high-quality development (Gao et al., 2019). Accordingly, “Quality first, efficiency first” becomes the central clue in evaluating the status of national economic growth. High-quality economy includes five development concepts: innovation, coordination, green, openness, and sharing.

Among these five concepts, green and one of its key components, namely green energy, play important roles in the national development (Suo and Tang, 2020). With the reinforcement of environmental awareness, China’s green and clean energy has experienced rapid growth and has entered a high-quality development stage. The core of high-quality energy development is to build a green, clean and sustainable energy supply system (Chen et al., 2020).

Finance is one of the important supporting conditions for the high-quality development of energy. The close integration of energy and finance creates the concept of energy finance. Under the five development concepts, the high-quality energy finance by reducing CO2 emissions (Chevallier et al., 2021) aim to promote the sustainable development of green and clean energy. The earliest energy financial trading market was the Coal Exchange in Cardiff, Wales in 1886. The application of finance to coal trading activities was the embryonic form of “energy finance” (Yu et al., 2015). Currently, the academic community still lacks a unified definition of energy finance. Researches on energy finance are mainly focus on the following aspects:

(a) There are several definitions of energy finance. The research on energy finance in the United States is mainly about financial support to energy industry, namely project financing. As required by capital demand, energy project financing is an important way to support energy industry (Dunkerley, 1995). Pollio (1998) has a similar view and points out that entities in project financing process diverse a lot. In China, energy finance has a broader definition, which includes the linkage mechanism between energy information and financial information, the integration of energy resources and financial resources through the linkage mechanism, and related risk management (He and Xue, 2010).

(b) The promotion of finance to the energy industry. Firstly, the initial manifestation of financial support for the development of the energy industry is financing (Schreft and Smith, 1998). Financing support requires a well-functioning financial system (King and Levine, 1993; Tadesse, 2005; Ma et al., 2021). China is expected to become the world’s largest development bank in terms of energy policy financing (Gallagher et al., 2018). Secondly, the development of the energy industry by finance can indirectly promote environmental protection (Grossman and Krueger, 1995; Halicioglu, 2009; Tamazian et al., 2009). Financial development contributes to a better environmental performance (Dasgupta et al., 2001; Liang, 2006; Wang and Jin, 2007; Tamazian et al., 2009). Therefore, Tamazian and Rao (2010) believe that financial development is a determinant of environmental performance. Thus, financial intermediaries can invest more financial resources in the energy industry for clean environment-related projects. Thirdly, the promotion of finance to the clean energy industry is manifested in the growth of equity and credit markets in related industries (Al Mamun et al., 2018). Some scholars also believe that banks and other financial institutions are the main driving forces of clean energy industry. Delina (2011) believes that the Asian Development Bank (ADB) has played a significant role in clean energy financing; Geddes et al. (2018) believe that state-owned investment banks play a key role in closing the funding gap for low-carbon energy technologies.

(c) Government funding support on new energy industry. Firstly, due to the market’s certain volatility (Ma et al., 2021), the investment of government funds can effectively promote new energy industry. Bhattacharyya (2012) believes most financial capital flow to large-scale energy projects in developed countries, and energy development in developing countries does not receive sufficient financial support. Corrocher and Cappa (2020) further finds that government policies can effectively stimulate private investment. Therefore, government financial investment in developing countries is also an important mean to promote the development of new energy. On the one hand, the government’s increase in fiscal public investment can fill the energy funding gap (Lewis, 2010; Jacobsson and Jacobsson, 2012); On the other hand, government increases financial investment and subsidies for the research and development of technologies and equipment in the field of new energy power generation, which can efficiently support energy industry (Graham and Brandon, 2003). Secondly, there are precedents for government investment in promoting the development of new energy industries. Uyterlinde et al. (2007) uses a market simulation method to investigate new energy technologies in the EU and finds that government funding supports contribute to rapid development of wind energy.

(d) More recent studies continue to discuss the efficiency of financial support on energy industry. Brunnschweiler (2008) finds that the expansion of financing scale has a significant role in promoting industrial growth, and concludes that various financing methods have different efficiency in promoting industrial growth. Beck et al. (2000), Berardi (2007) state that the efficiency of financial support is the core factor affecting the development of the energy industry. He et al. (2007) points out that the energy efficiency market is a new kind of energy finance, and it is needed to use the development of energy finance on promoting the development of the energy efficiency market in China.

Scholars have conducted numerous studies on the financial support for energy industry and related efficiency of the support. However, few have studies on the financial support for the green and low-carbon new energy and the HQDEF. Applying data of listed companies, this study mainly focus on three green and low-carbon energy industries, including wind energy, hydropower, and solar energy. In addition, the development of new energy vehicles can also alleviate environmental pollution. It is an important way to promote the application of renewable energy in the future, and it is also a part of the HQDEF. Our sample also includes the new energy automobile industry. Based on new energy listed companies, this study first defines the high quality of energy finance, and then uses the DEA model to evaluate the efficiency of financial resource input and economic efficiency output of the energy industry (in other words, evaluate the HQDEF). Our research is to fill the research gap of the high-quality energy finance by also dividing sample companies into four major new energy industries and studying on the determinants of the efficiency with the gray relational model.

Mechanism of High-Quality Energy Finance Activities

The High-Quality Energy Finance

Although Cardiff Coal Exchange of Wales initiated energy finance since 1886, the concept of energy finance was relatively vague. Any financial support to the energy industry can be called energy finance, that is, energy financing. According to literature, this study define energy finance as: (a) financial support on energy industry; (b) government guides banks, securities, insurance companies and other financial institutions to improve service models and services platform, and create the organic integration of the energy industry chain and financial capital chain; (c) a series of policies and institutional arrangements for providing financing support and financial services for all stages of the energy industry.

Like economic development, energy finance development evolves from rapid growth stage to high-quality development stage. The high-quality development of China’s energy finance commits to solve the structural imbalance between supply of fossil energy and demand of clean energy, and develops green and low-carbon new energy so as to ensure high quality economic development.

The HQDEF aims to improve the high-quality development of energy. Instead of pursuing rapid growth in the energy industry, it emphasizes the financial support for green, low-carbon, and clean energy industries. The specific content includes two aspects: (a) energy finance provides funding support to the new energy industry and ensures their continuous operation; (b) the operating efficiency of the new energy industry enables financial capital to obtain higher returns. Energy finance efficiency is equal to the quality of energy finance development.

As one of the contents of high-quality economic development, the factors affecting high-quality energy finance are five dimensions:-“innovation, coordination, green, openness, and sharing.” Since the high quality of energy finance is the judgment of the quality of energy finance development, the development of energy finance itself is also one of its determinants. Based on the five dimensions, factors affecting the HQDEF are divided into innovation dimensions, coordination dimensions, green dimensions, and open dimensions.

The Process of High-Quality Energy Finance Activities

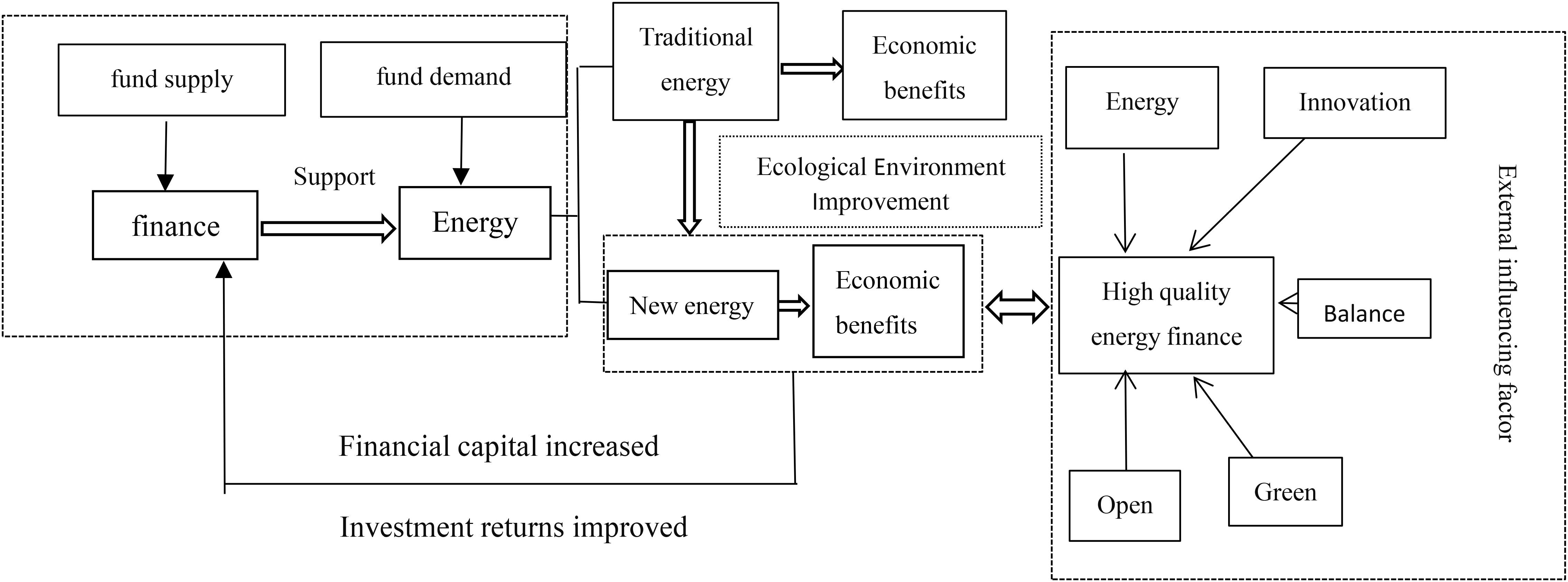

Based on the above theoretical analysis of high-quality energy finance, Figure 1 gives the mechanism of high-quality energy finance activities.

First of all, energy finance is a deep integration of finance and energy. On this basis, financial support on green and low-carbon new energy is a high-quality activity of energy finance. Strong support for such energy industry improves the transformation of energy into clean and low-carbon direction, which also contributes ecological environment. There are many factors can affect HQDEF. According to the characteristics, these factors can be divided into five dimensions: (a) the structural development of energy finance is the foundation; (b) innovation is the driving force; (c) balance is the structural balance; (d) green is the development direction; and (e) exploitation is the inevitable choice. Conversely, the economic benefits generated by the energy industry will enable the financial industry to obtain investment returns, and the financial capital invested will achieve value appreciation. The financial industry and the energy industry are a win-win situation. The whole process is the essence of high-quality energy finance.

Methodology and Data

DEA-Malmquist Model

The efficiency of financial support to the energy industry is the degree of proper allocation of financial resources to the energy industry. The economic benefits of financial support to energy industry are measured in multiple dimensions, that is, the energy financial efficiency has multiple inputs and multiple outputs. DEA model is a quantitative analysis method that uses linear programming to evaluate relative effectiveness (Charnes et al., 1978). With the values of multiple inputs and multiple outputs, the DEA method can evaluate the efficiency of Decision Making Unit (DMU). Since the input of financial resources is relatively easy to be controlled while the output of economic benefits is not, input-oriented DEA is employed.

The traditional DEA-CCR model and DEA-BCC model are able to identify whether DMU is efficient, but cannot sort out the order upon the effectiveness of DMUs that are both on the frontier of production. In order to solve this problem, Andersen and Petersen (1993) proposed Super Efficiency DEA (SE-DEA) in 1993. Eq. (1) gives the basic mechanism SE-DEA apples, that is to reconstruct the efficient frontier employing the production frontier DMUs, and to sort the effectiveness upon DMUs, while the efficiency value of the non-effective DMUs remains unchanged.

Where, ε is a non-Archimedean infinitesimal; n is the number of DMUs, where each DMU includes m input variables and s output variables, is the slack variable of the input variable, and is the slack variable of the output; λj is the weight coefficient of the index; θj_0 is the measured super-efficiency value of the j0-the DMU.

DEA model works out the comprehensive efficiency value of financial support on the new energy industry. If the assumption of constant returns to scale of enterprises is released, the technical efficiency measured by the super-efficiency DEA can be decomposed into pure technical efficiency (PTE) and scale efficiency (SE). PTE refers to whether the financial element input is efficient, when the return to scale changes. SE refers to the ratio of minimum input when scale return is constant to the minimum input when scale return changes; or under a given input level, the ratio of the maximum output when the return to scale changes on the maximum output when the return to scale is constant.

The super-efficiency DEA model measures static technical efficiency, which can be decomposed into pure technical efficiency and scale efficiency. Based on DEA, The Mamlquist index is able to investigate the intertemporal changes of the total factor production efficiency index during the sample period. Malmquist’s ideas are used to analyze TFP (Caves et al., 1982). Subsequently, the Malmquist index model as a non-parametric method for measuring dynamic production efficiency has received extensive attention from the academic community. The following shows that Malmquist Index (TFP) measures the dynamic change of total factor productivity index. Total factor productivity index can be divided into technical efficiency index (Effch) and technological progress index (Tech). Effch can be further divided into pure technical efficiency index (Pech) and scale efficiency index (Sech).

If both the Malmquist index and the decomposition of its index are greater than 1, the efficiency has risen and its dynamic change shows an upward trend; if they are less than 1, the dynamic change is a downward trend. By comparing the Malmquist index and its decomposition, the efficiency results and the reasons for the dynamic changes can be shown more concretely.

Generalized Gray Correlation Model

The gray relational degree is employed to investigate the correlation among energy financial efficiency and its impact factors. According to the gray system theory, gray relational order (GRO) can be used to describe the strength, size, and order of the relationship between factors. The gray correlation analysis includes Deng’s correlation degree and generalized gray correlation degree. Among them, the generalized gray correlation degree can be divided into absolute, relative and comprehensive correlation degree, respectively. The absolute correlation degree measures the similarity degree of each sequence curve in geometric shape; the relative correlation degree targets on the relation between the change rate of each sequence curve relative to the starting point; and the comprehensive correlation degree is a combination between absolute and relative correlation degree, which can not only reflect the similarity of each sequence curve, but also reflect the closeness of the change rate of each sequence relative to the starting point. It is a quantitative index to comprehensively represent the correlation between sequences.

There are 5 steps to achieve The general gray relational degree. The system behavior sequence is set up as follows:

Step 1: the initial value image (or mean image) of each sequence;

Step 2: the difference sequence;

Step 3: the maximum and minimum differences of the poles;

Step 4: the correlation coefficient;

Step 5: the correlation degree.

Derived from the above, given the same sequence length of the system behavior, the calculation steps of the improved absolute correlation degree are:

The zeroing images at the beginning of the sequence are:

Down the line(xi(1)−xi(1),xi(2)−xi(1),⋯,xi(n)−xi(1))

Let , then the gray absolute correlation degree is:

If and are the initial value images of Xi and Xj, the gray absolute correlation degree of and is called the gray relative correlation degree rij of Xi and Xj. Finally, the calculation formula of gray comprehensive correlation degree is

Variable Selection and Description

According to the mechanism of HQDEF, The input of financial resources and the output of green and low-carbon energy industry are the key indicators to evaluate the HQDEF, as well as the key contents to measure the efficiency of financial support on the development of new energy industry. Therefore, it is very important to construct a reasonable index system of financial input and energy enterprise output for DEA efficiency evaluation.

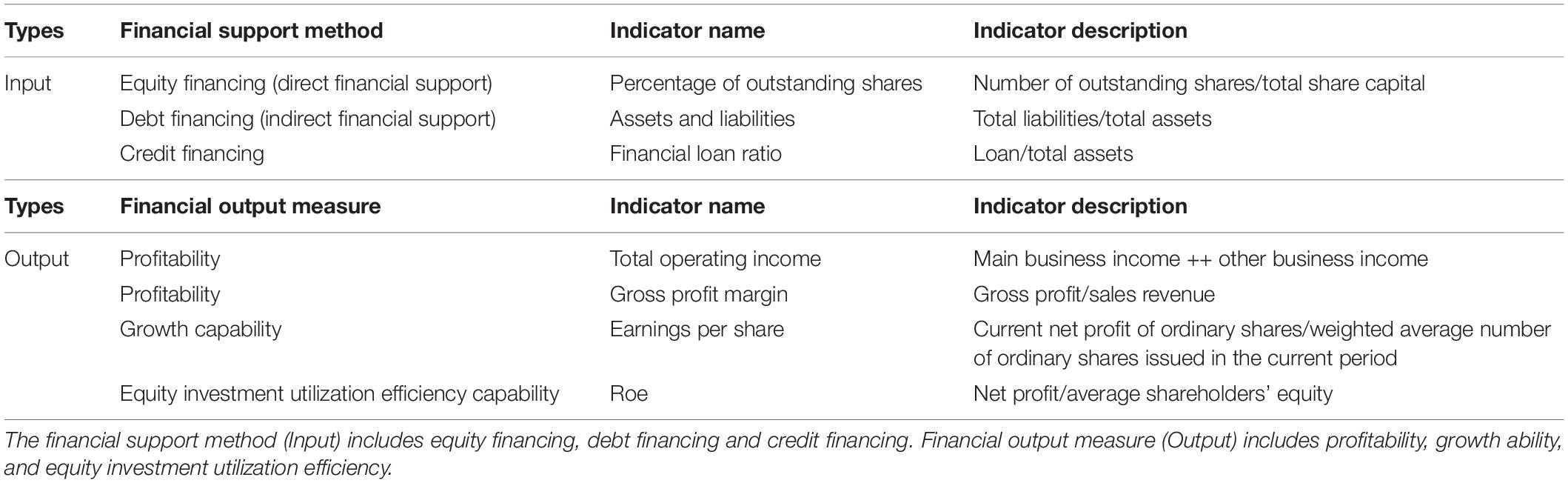

Financing for new energy industry mainly includes equity, debt, credit and other methods (Vanacker and Manigart, 2010). The asset-liability ratio, proportion of outstanding shares, and the ratio of loans on total assets are selected to measure financial resources input (Li and Xu, 2011). For the economic benefits of financial support to industries or companies, we use company’s operating income, sales profit, return on net assets, earnings per share, asset turnover, etc. (Li and Xu, 2011). Operating income can measure the sales scale; sales profit can measure the output of the profitability; earnings per share can measure the growth ability; return on net assets can measure the efficiency of company’s equity investment utilization. The selection of input-output indicators of energy finance as shown in Table 1:

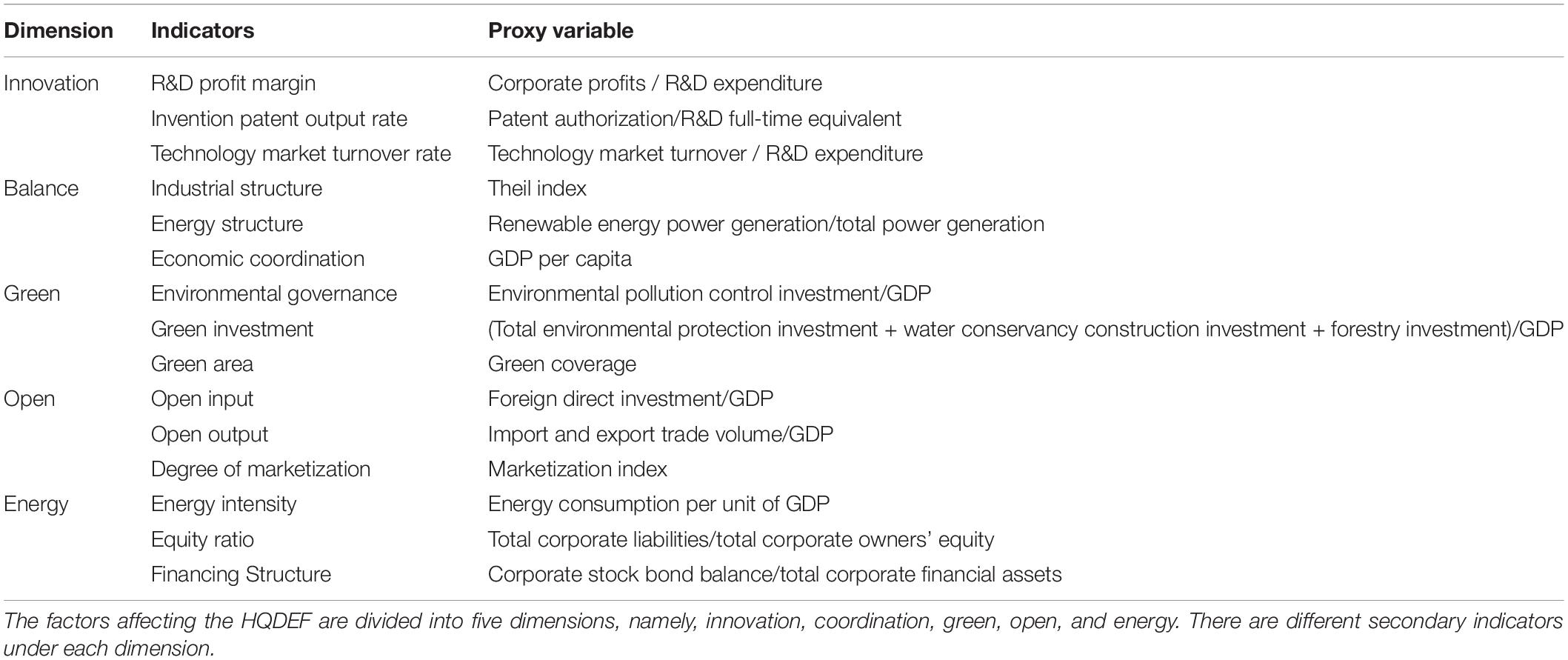

Determinants of the HQDEF can be sorted out after evaluation. As the high-quality energy finance is part of the high-quality economic development, the high-quality economy includes the five development concepts of “innovation, balance, green, open, and sharing” (Gao, 2019). The HQDEF should also include similar development concepts. Therefore, this study explores determinants of the efficiency of high quality energy finance from the five dimensions, including innovation, balance, green, openness, and the structural of energy finance, as shown in Table 2.

Innovation is the primary driving force of development. The innovation dimension includes factors affecting high quality energy in terms of R&D, patent output, and transformation of scientific and technological achievements. The R&D profit is the benefit obtained from unit investment. The higher the ratio, the stronger the ability of R&D creates value. The output rate of invention patents is the ratio of number of patents granted to the full-time equivalent of R&D. The higher the ratio, the stronger the innovation ability is. The technology market transaction rate is the ratio of technology market transaction amount on R&D expenditure, which can reflect the transformation ability of scientific and technological achievements. The greater the ratio, the stronger the transformation ability of achievements is.

Coordinated development can promote national economic stability and long-term development. The balance dimension investigates determinants of high-quality energy with industrial structure, energy structure and economic balance. The coordination of the industrial structure is characterized by the Theil index. The smaller the Theil index, the more efficient the industrial structure is (Gan et al., 2011). The coordination of the energy structure is characterized by the proportion of renewable energy power generation on the total power generation. The larger the value, the more in line with the HQDEF is. The coordination of the economic can reflect the affluence of the region and also have an impact on the HQDEF. The variable of economic balance is characterized by per capita GDP.

Green is the ultimate goal of energy finance development. The green dimension includes environmental governance, green investment and green space area. Environmental governance is an investment in environmental pollution control and is conducive to the development of energy finance. This study selects the proportion of environmental pollution control investment on GDP as an environmental governance indicator. Most literature use environmental investment as the indicator of green investment. The sum of the three types of investment in environmental protection investment, water conservancy construction investment and forestry investment is used as investment in green development (Liao and Shi, 2018), and the ratio to GDP is used as green investment. The green space area is the output of green development. The larger the green space coverage area, the more it meets the requirements of HQDEF is. The green space coverage rate is selected as the proxy variable.

Opening up is leading to the development of energy finance. The opening up dimension can be divided into three aspects: open input, open output and marketization degree. Input factor under this section is the proportion of foreign direct investment in regional GDP. The higher the value is, the higher the degree of openness. Output factor is the economic growth of foreign trade obtained under the premise of opening the international door, expressed as the proportion of import and export trade on regional GDP. The degree of marketization is changing along with the development of the market economy, so that the efficiency of resource allocation will also change. As a result, it will further affect the allocation of financial resources to the new energy industry. Therefore, this article uses marketization index to measure the marketization degree.

The structural of energy finance is a determinant from the perspective of energy and finance. For energy, differences in economic structure and resource composition will lead to significant differences in hidden energy intensity (Lenzen, 1998; Miller and Blair, 2009). Therefore, this study incorporates the equity ratio into the structural development dimension of energy finance. External financing has become an important source of funds for enterprises (Hall, 2002; Hu et al., 2020). This study takes the ratio of corporate stock and bond balance to the total financial assets as the financing structure variable.

Data

Research data is collected from Flush and Wind databases. The DEA model requires that the input-output index is positive. given the economic outputs of energy finance have zero or negative values, the input-output index should be dimensionless to ensure non-negative data. The original data should be adjusted as below :

The factors of the high-quality energy finance development come from corporate data and Chinese provinces data. The structural dimension data of energy finance are from China Energy Statistical Yearbook, Oriental Fortune Net, Flush Shun APP, sina Finance and Economics. The innovation dimension data are from China Science and Technology Statistics Yearbook, EPS Science and Technology Statistics, Flush Shun APP databases. The balance dimension data are obtained from the National Bureau of Statistics and EPS energy Statistics databases. The green dimension data are derived from EPS macroeconomic database, China Environment Yearbook, China Water Conservancy Yearbook, and China Forestry Yearbook. The open dimension data are derived from EPS Regional Economic Database and China Provincial Marketization Index Report. Data of control variables are obtained from National Bureau of Statistics and China Statistical Yearbook.

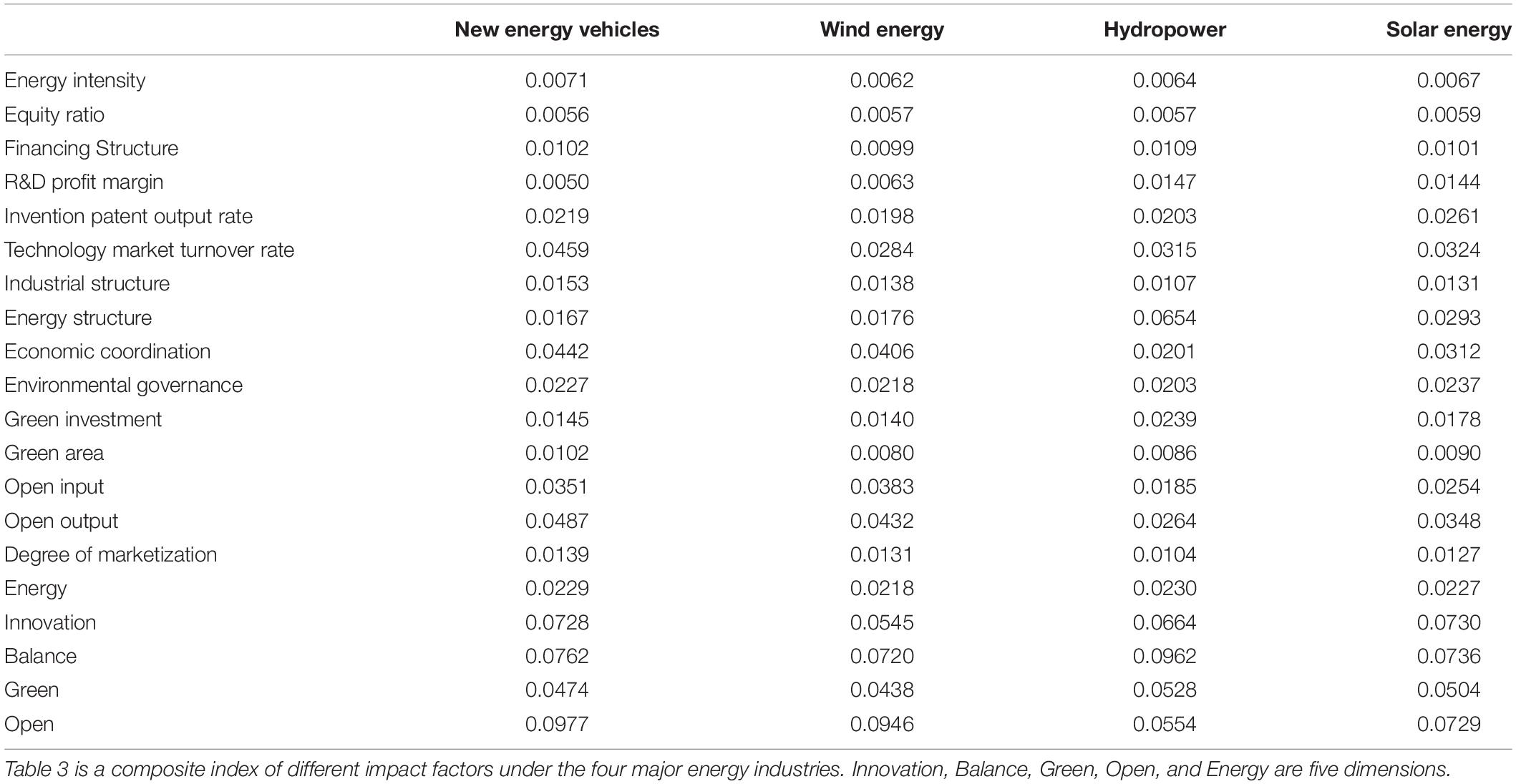

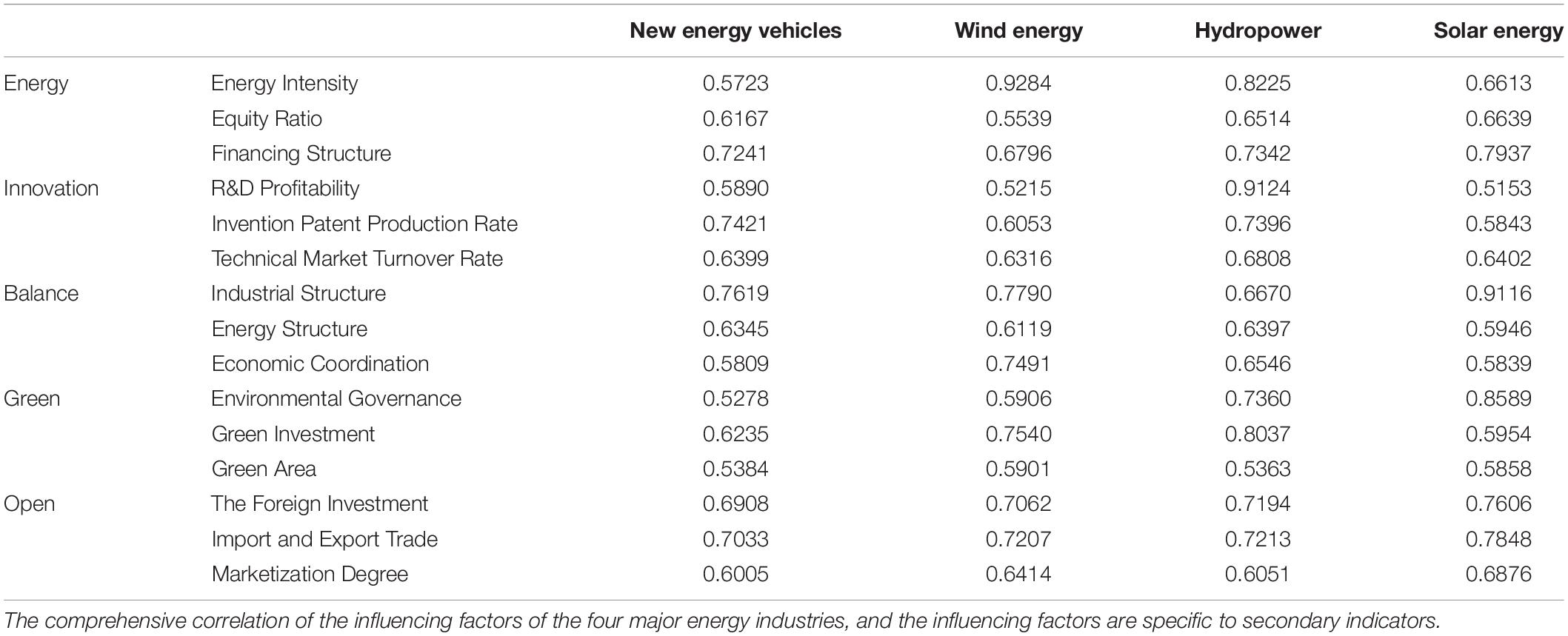

Considering the comprehensiveness of indicators, this study uses entropy method to assign weights to second-level indicators and calculated the composite index of second-level indicators and first-level indicators by means of weighted sum, as shown in Table 3 (see Supplementary AppendixTables 2–5 for the sector composite index). Table 3 lists the comprehensive index of energy vehicles, wind energy, hydropower and solar energy as well as the comprehensive index of five dimensions. In the new energy vehicle and wind energy industry, the open dimension composite index is the highest, while in the hydropower and solar energy industry, the balance dimension composite index is the highest. The entropy method can be used to integrate the second-level index into the influencing factors of the five dimensions. This study researches on the impact factors of the HQDEF mainly focuses on five influencing factors.

Results and Discussion

DEA Efficiency Evaluation

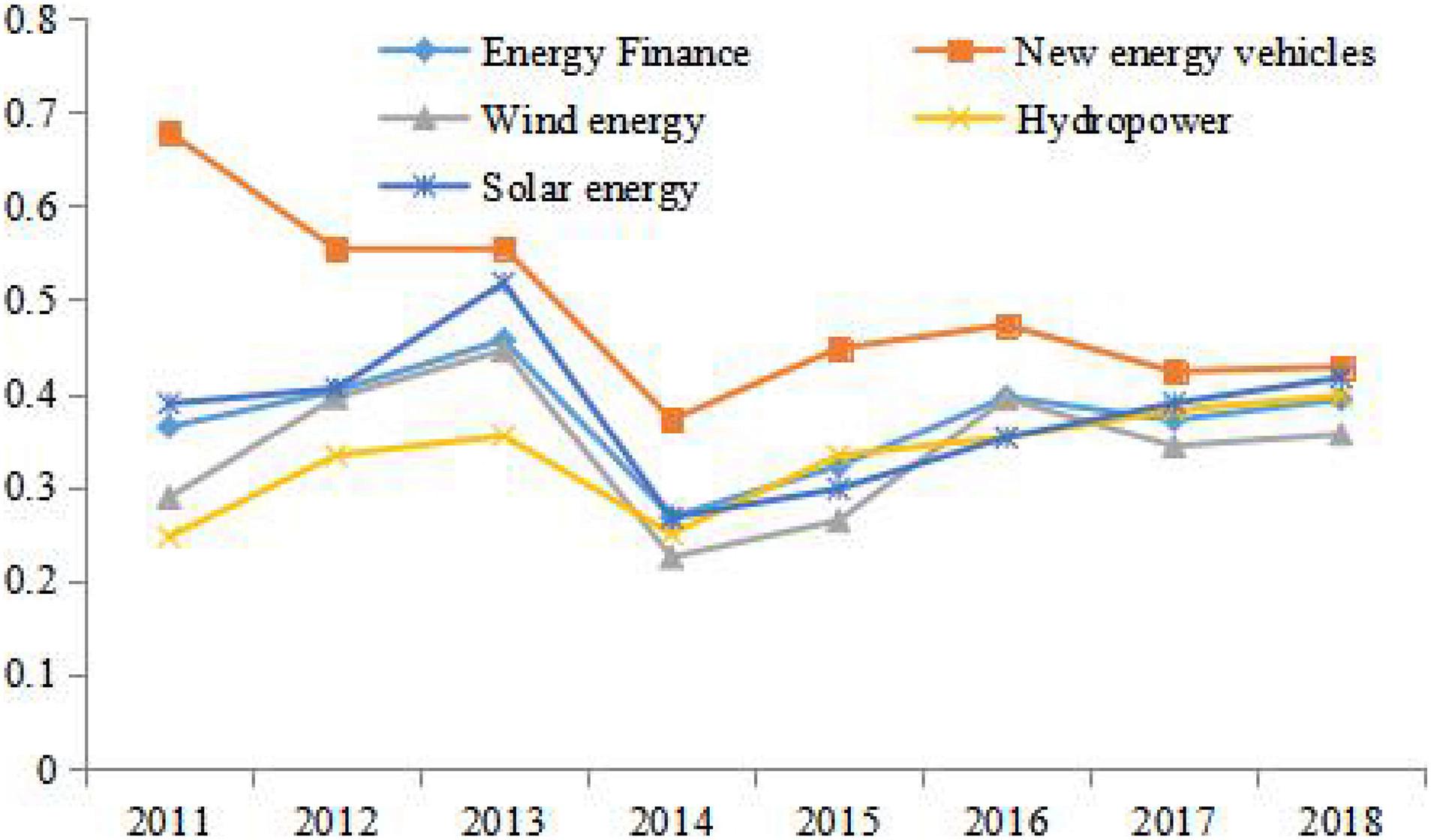

The super-efficiency DEA model finds that the high-quality development of China’s energy finance is at a relatively low level. The technical efficiency was around 0.4 in the past 2 years, indicating that there is still room to improve the HQDEF in China.

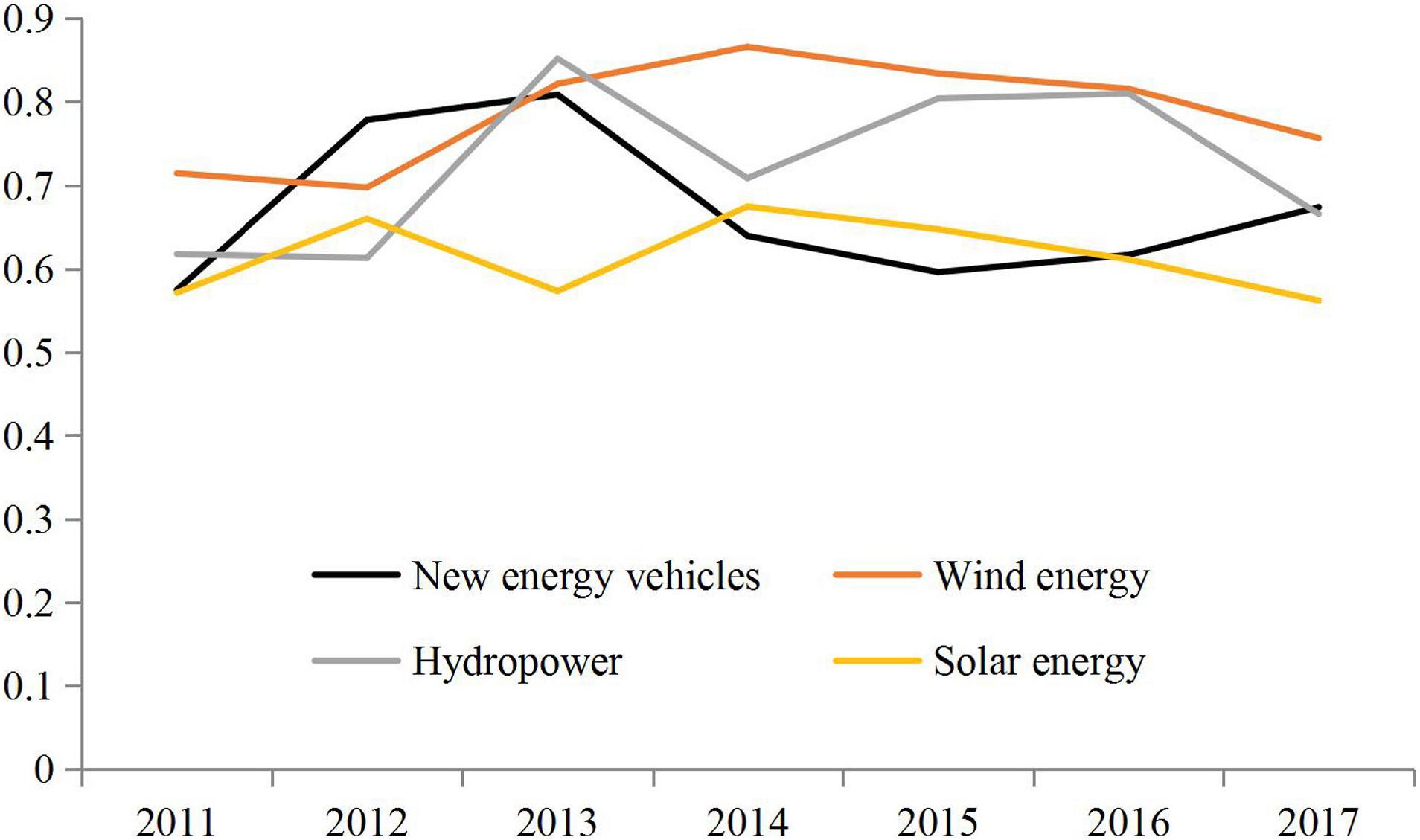

The efficiency of financial support in new energy industry is slightly different as shown in Figure 2. The comprehensive efficiency of financial support in new energy vehicle industry is higher than the other three industries, with the steepest variation range. Since 2011, the comprehensive efficiency of financial support for all energy industries has been rising continuously, except for new energy vehicle. Until 2014, the comprehensive efficiency values of all energy industries dropped to their lowest point, and then showed a small increase. In the past 2 years, the comprehensive efficiency values showed a steady trend. This reflects from the side that the efficiency of China’s energy financial development tends to be flat, and the overall efficiency of financial-supported energy has stabilized after the large fluctuations in the past few years, which is in line with the trend of high-quality development. The reason for the change may due to the recent supply side structural reforms. Government continuously encourages high-quality economic development, and required steady reforms. Therefore, in terms of financial support for energy, high-quality development is constantly practiced to avoid unreasonable and inappropriate allocation of financial resources.

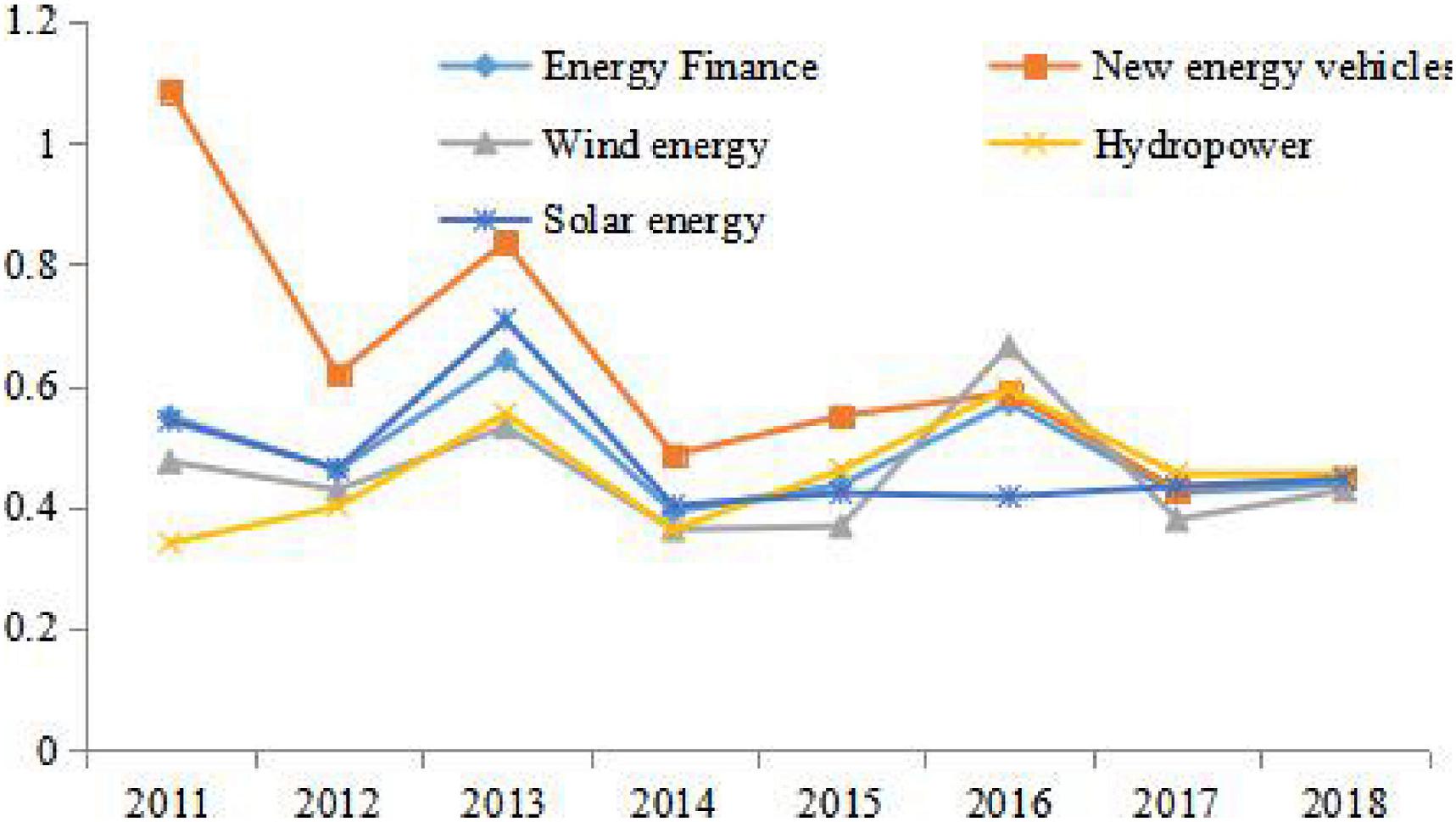

Similar to Figures 2, 3 shows that the pure technical efficiency value of financial support in energy vehicle industry is relatively high, with a large range of variation. The curves of the four industries and the energy finance curve remain stable. The efficiency values are around 0.5, which is also at a low level.

Figure 4 shows that the changes in the scale efficiency of financial support for new energy industries are similar, except for the hydropower industry. Most industries reached the lowest point in 2014, while the hydropower industry was at the lowest level of scale efficiency in 2013. Subsequently, various new energy industries rose in volatility, indicating that the scale effect of the high-quality development of China’s energy finance is constantly expanding.

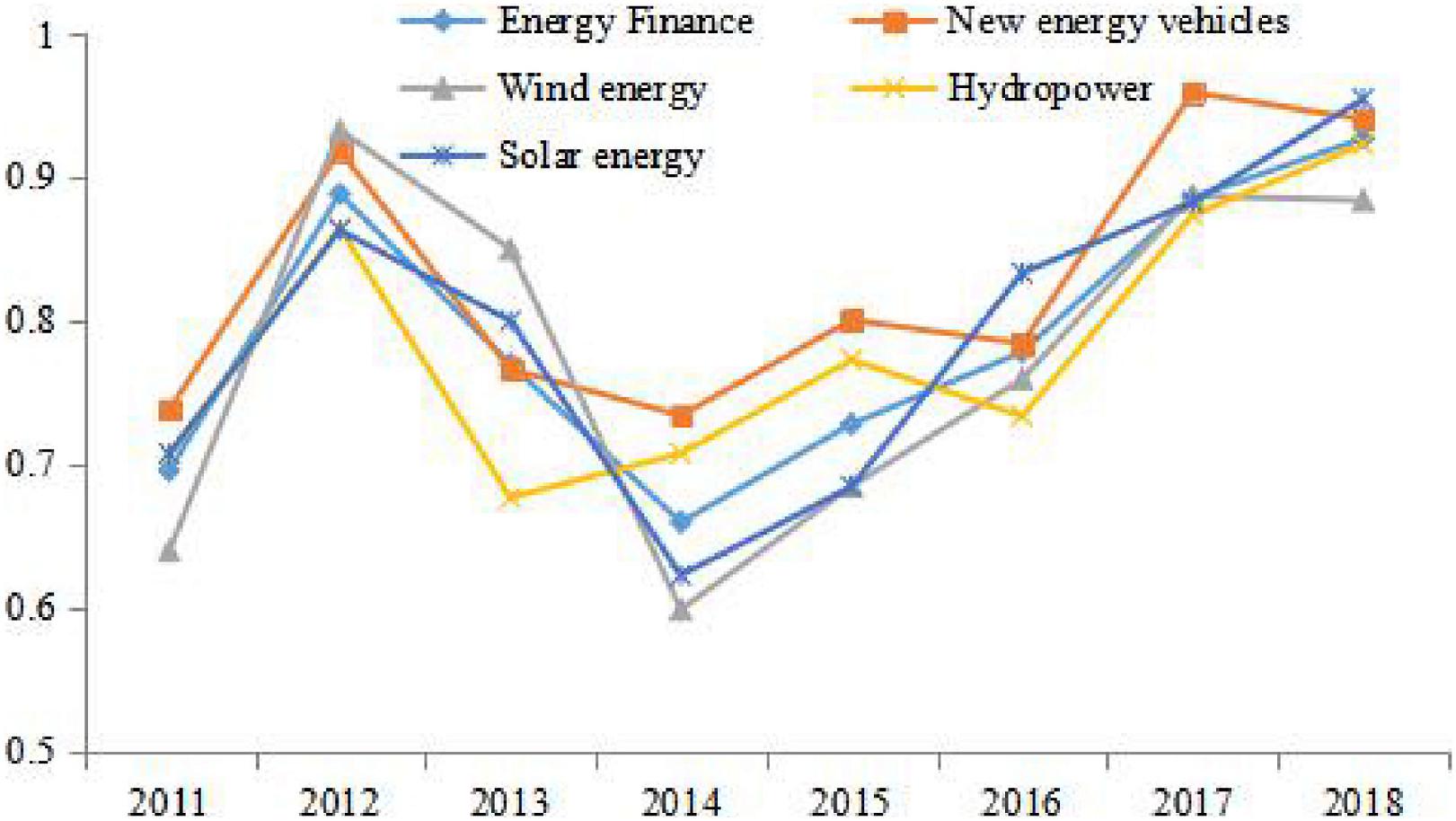

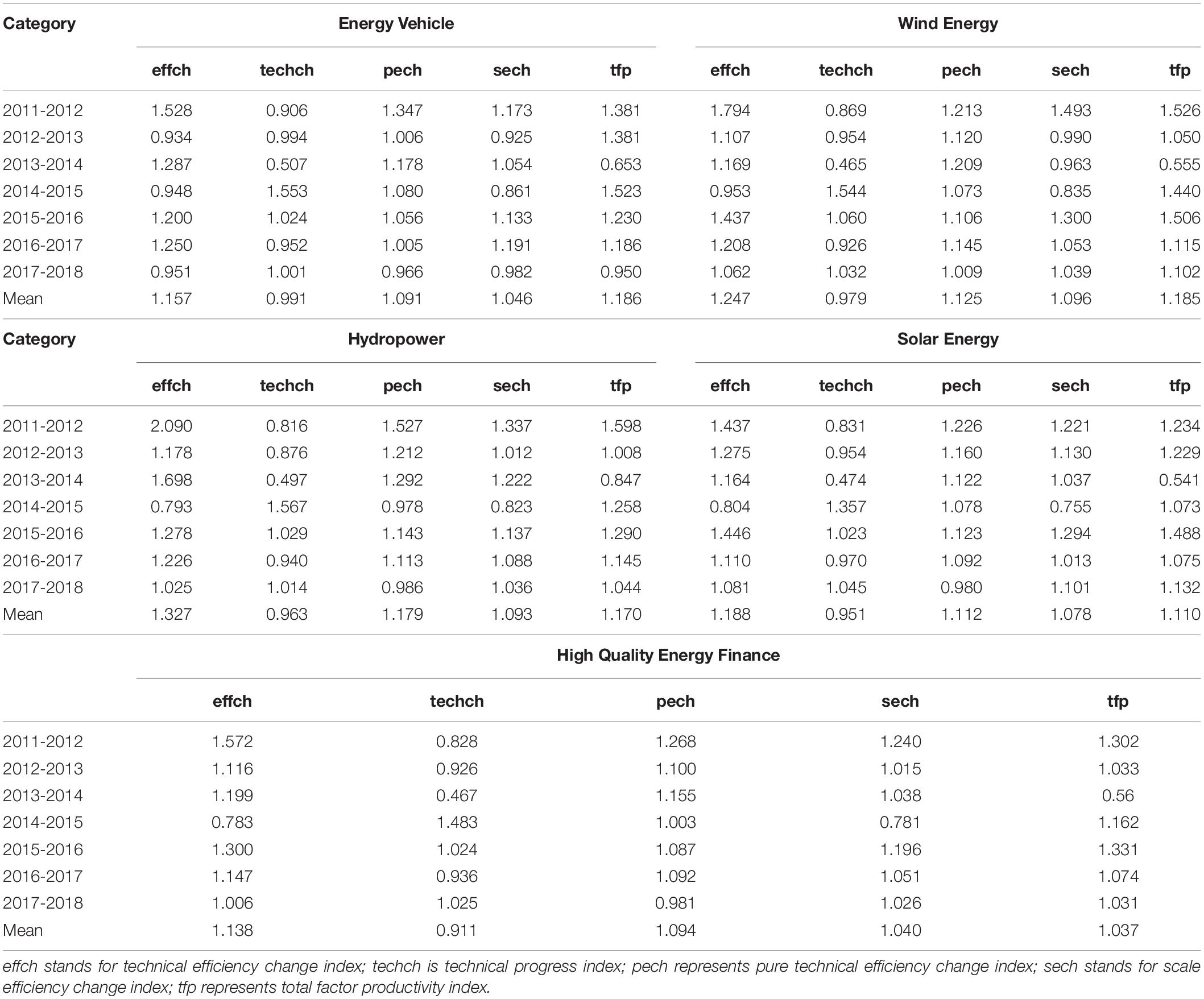

Malmquist Decomposition

Mamlquist index is employed to investigate the dynamic trend of efficiency. Table 4 indicates that the average efficiency change of the Malmquist Index is 1.037 during the sample study period, with an average increase of 3.7%. From the decomposed Malmquist, the technical efficiency index has increased by 13.8% on average, and the technical progress index has decreased by 8.9%. It is safe to conclude that the main reason for the increase in the overall financing efficiency index of energy finance is the improvement of technical efficiency, while the level of technological progress is declining. Moreover, the change of technological progress index has been gradually rising since 2014, and the average change shows a downward trend mainly due to the decrease of technological progress index before 2014. This reflects that the HQDEF in China has a well performance in technical efficiency, while technological progress still needs improvement.

Specifically, the four new energy industries have different Malmquist index changes. According to the Total Factor productivity Index (TFP), the financing efficiency of new energy vehicles, wind energy, and hydropower all increase by about 18% on average, while the increase in solar energy is slightly smaller (11%). From the perspective of the decomposed total factor productivity (TFP), the average change of the efficiency of the four new energy industries shows an upward trend in the technical efficiency change index. Among them, new energy vehicle industry has the smallest change, with a rise of 15.7%, indicating that the financial support for energy vehicle industry is the worst among the four new energy industries. This may due to global warming and the frequent occurrence of extreme weather, which leads to an urgent need for energy vehicles. Therefore, the mass production of energy vehicles emerges in recent years, and the profits of listed new energy companies in the past 2 years have been relatively considerable. Hydroelectric industry has the highest average technical efficiency change index, rose 32.7%. This may due to the early development of hydropower in China. Earlier investment has provided sufficient preliminary funds for hydropower development, resulting in a reduction in the current hydropower financing demand. Most areas of the country are already using hydropower, so the hydropower industry can achieve increased revenue and better financing effects.

Under the index of technological progress, the average change of efficiency of the four new energy industries shows a downward trend, indicating that China’s technological progress in the development and utilization of new energy is not enough, leading to a retrograde trend of technological progress in the new energy industry. Among them, the average change index of technological progress in solar energy industry was the largest, with a drop of 4.9%. This may be because China focuses its solar energy utilization on photovoltaic power generation, while solar cooling technology, heat pump technology and other technologies pay less attention than photovoltaic power generation, leading to a large decline in the technological progress index of solar energy utilization. The technological progress indexes of energy vehicles, wind energy and hydropower are also on a downward trend, but the decline is not as large as that of the solar energy industry, and it has slightly increased in 2017-2018. This shows that the technological progress of the new energy industry still needs to be improved, and improving technological progress is a way to further improve efficiency.

From the pure technical efficiency change index and scale efficiency change index, the average change of each new energy industry shows an upward trend, and the difference in the value of increase is not too large. It is worth noting that the change in the pure technical efficiency of the wind energy industry is greater than 1 every year, indicating that the change in the funds use efficiency of the financial support for the wind energy industry is on the rise and the funds use efficiency is relatively high. The pure technical efficiency of energy vehicles, hydropower and solar energy industries showed a downward trend in 2017-2018, but the average change index of pure technical efficiency was still all greater than 1, which may be attributed to the high use efficiency of finance support in the early years of the sample study. The changes of wind energy, hydropower and solar energy in recent 3 years are all greater than 1, which reflects the scale effect gradually formed in these three new energy industries in recent years.

Correlation Analysis of High-Quality Efficiency of Energy Finance in Different Dimension

Set the measured efficiency as dependent variable, the gray correlation between the efficiency and the different dimensions, and the correlation between the efficiency of the energy finance industry and the influencing factors is shown in Table 5.

In the dimension of energy structure, energy intensity is highly correlated with wind energy and hydropower industry. Financing structure is highly correlated with four industries, all above 0.65. In the innovation dimension, the efficiency of wind energy and hydropower industry has a high correlation with the innovation dimension, especially the research and development profit margin of the hydropower industry. The invention patent production rate has the highest correlation with the new energy vehicle industry. In the balance dimension, the correlation between industrial structure and various energy industries is high, especially the correlation with solar energy industry, which is as high as 0.9116. In the green dimension, the environmental governance solar industry has the highest correlation. The correlation between green investment and wind energy, hydropower is relatively high. In the dimension of openness, the correlation between each index and industry efficiency is all greater than 0.6, among which the correlation between foreign investment, import and export trade, degree of marketization and the four industries is all higher than 0.6, indicating that optimizing industrial structure and improving the quality of import and export trade are of great significance to the development of energy finance. On the whole, the comprehensive correlation degree is above 0.5, indicating that the variables in each dimension are highly correlated with the high quality efficiency of energy finance.

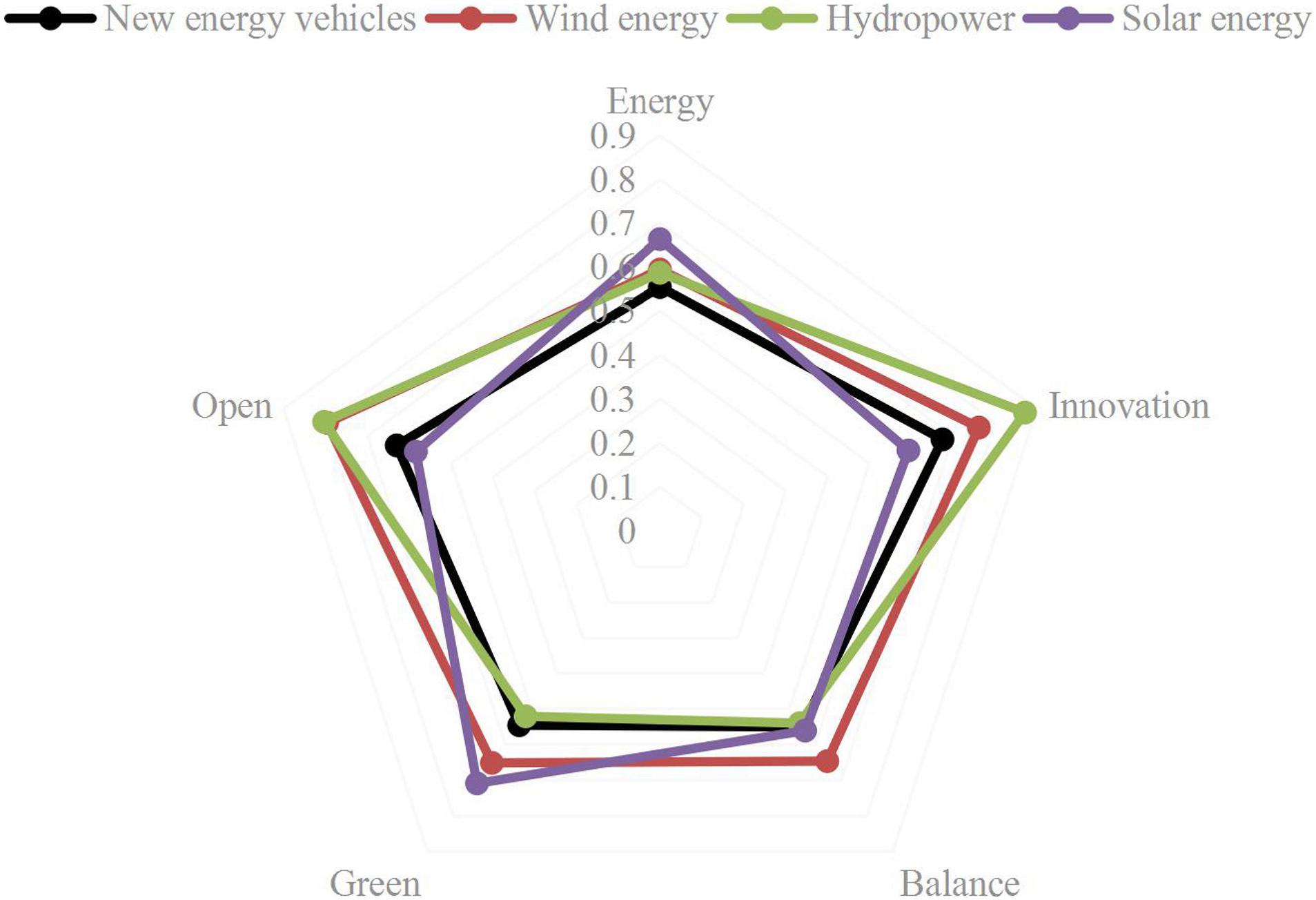

A comprehensive correlation analysis for the determinants of the five dimensions and the four new energy industry efficiency values, and the results are shown in Figure 5. The correlation between the efficiency value of the new energy vehicle industry and each dimension is below 0.7, presenting a “diamond shape.” The correlation with the innovation dimension is the highest (0.6745), which indicates that innovation has the most important influence on the development of the new energy vehicle industry. The efficiency value of wind energy and hydropower industry has the highest correlation with innovation dimension and open dimension, all above 0.75. This shows that technological innovation and open development are most important for the high-quality development of the wind and hydropower industry. The efficiency value of the solar energy industry is highly correlated with the green dimension (0.7091). Combined with Table 5, environmental governance contributes to the green dimension by 0.8589, indicating that green environmental protection and environmental investment are particularly important for the development of the solar energy industry. The correlation between the solar energy industry efficiency value and the technical market turnover rate is 0.6402, which belongs to the second ranking. In general, the innovation dimension has the highest correlation with the new energy vehicle, wind energy, hydropower and solar energy industries, which fully reflects the fact that science and technology is the primary productive force, and the development of innovative science and technology can develop China’s energy finance from the source.

Figure 5. Comprehensive correlation degree of the four new energy industries in different dimensions.

Trend Analysis of the Correlation Between Efficiency in Different Dimensions

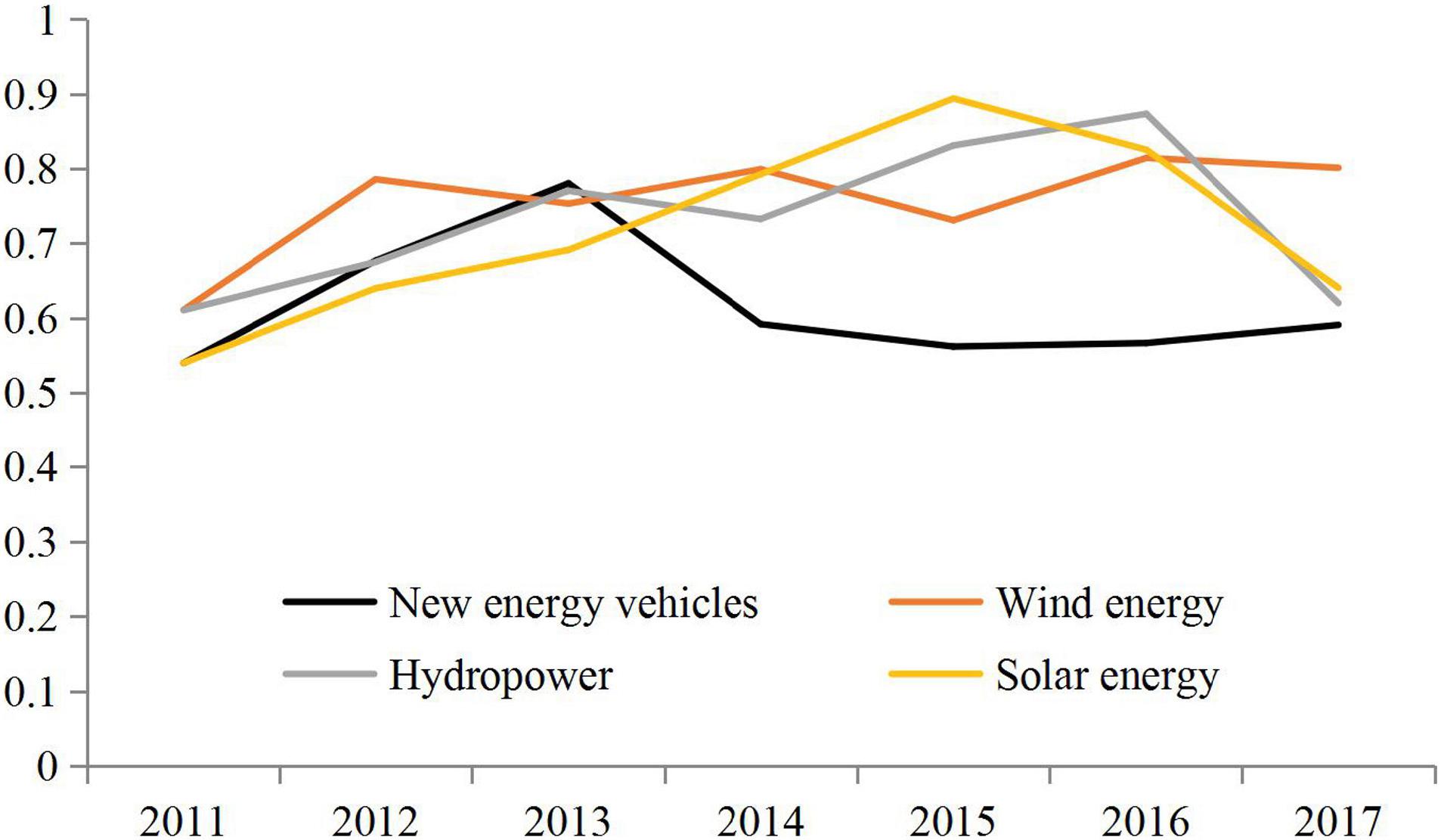

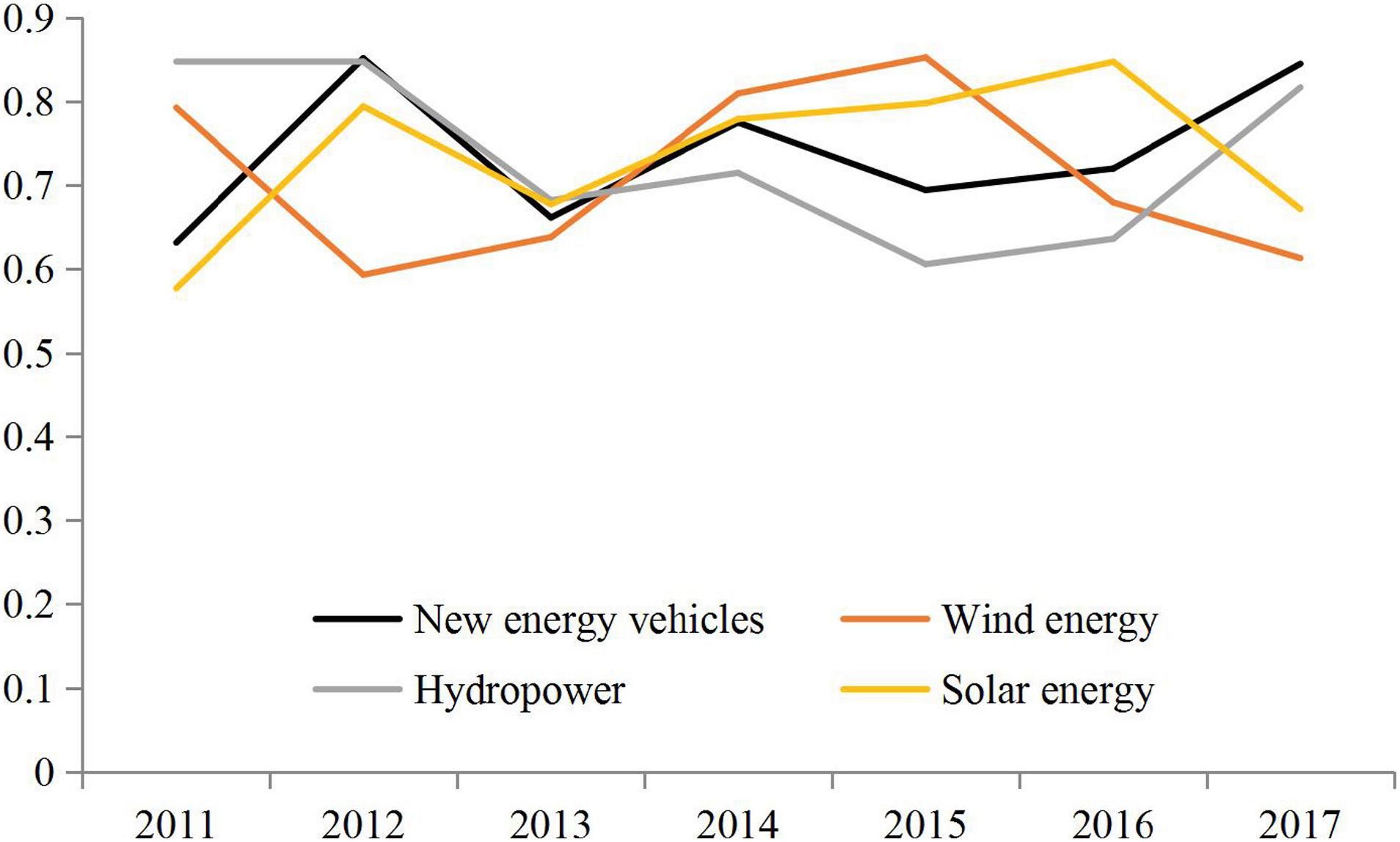

The correlation between different dimensions and the efficiency of four new energy industries are shown in the trend analysis chart (Figures 6–10), which gives the variation of different new energy industries’ efficiency on gray correlation degree in different years.

Figure 6. Comprehensive correlation between efficiency of four new energy industries and energy structure.

Figure 7. Comprehensive correlation between the efficiency of the four new energy industries and Innovation.

Figure 8. Comprehensive correlation between the efficiency of the four new energy industries and Balance.

Figure 9. The comprehensive correlation between the efficiency of four new energy industries and Green.

Figure 10. The comprehensive correlation between the efficiency of four new energy industries and Open.

Figure 6 shows the comprehensive correlation between the efficiency of four new energy industries and the structural dimension of energy finance. It can be found that the correlation of four new energy industries has a downward trend. Before 2013, the correlation among the efficiency of four new energy industries and the dimension of energy finance showed an increasing trend. 2013 was the cut-off point, and the correlation degree of four new energy industries showed a great difference. The correlation degree of new energy vehicle industry declined in 2013, and it has been in a stable state since then. However, new energy vehicle industry develops rapidly in recent years, indicating that structural dimension of energy finance is not the main factor impact on the development of new energy vehicles. The comprehensive correlation between the wind and hydropower sectors has fluctuated since 2013, suggesting that the influence of the structure of energy finance on wind energy and hydropower industry are uncertain. This is related to the maturity of wind energy and hydropower industries in recent years, and the correlation between their high-quality development and the structure of energy finance are not obvious. Only the correlation of solar industry shows a significant upward trend, reaching a high of 0.8938 in 2015. However, it decline sharply after that. This may be because China’s photovoltaic industry has already ranked first in the world due to the strong financial support for the photovoltaic industry in the past few years. It is not energy finance but technology that restricts the development of photovoltaic industry.

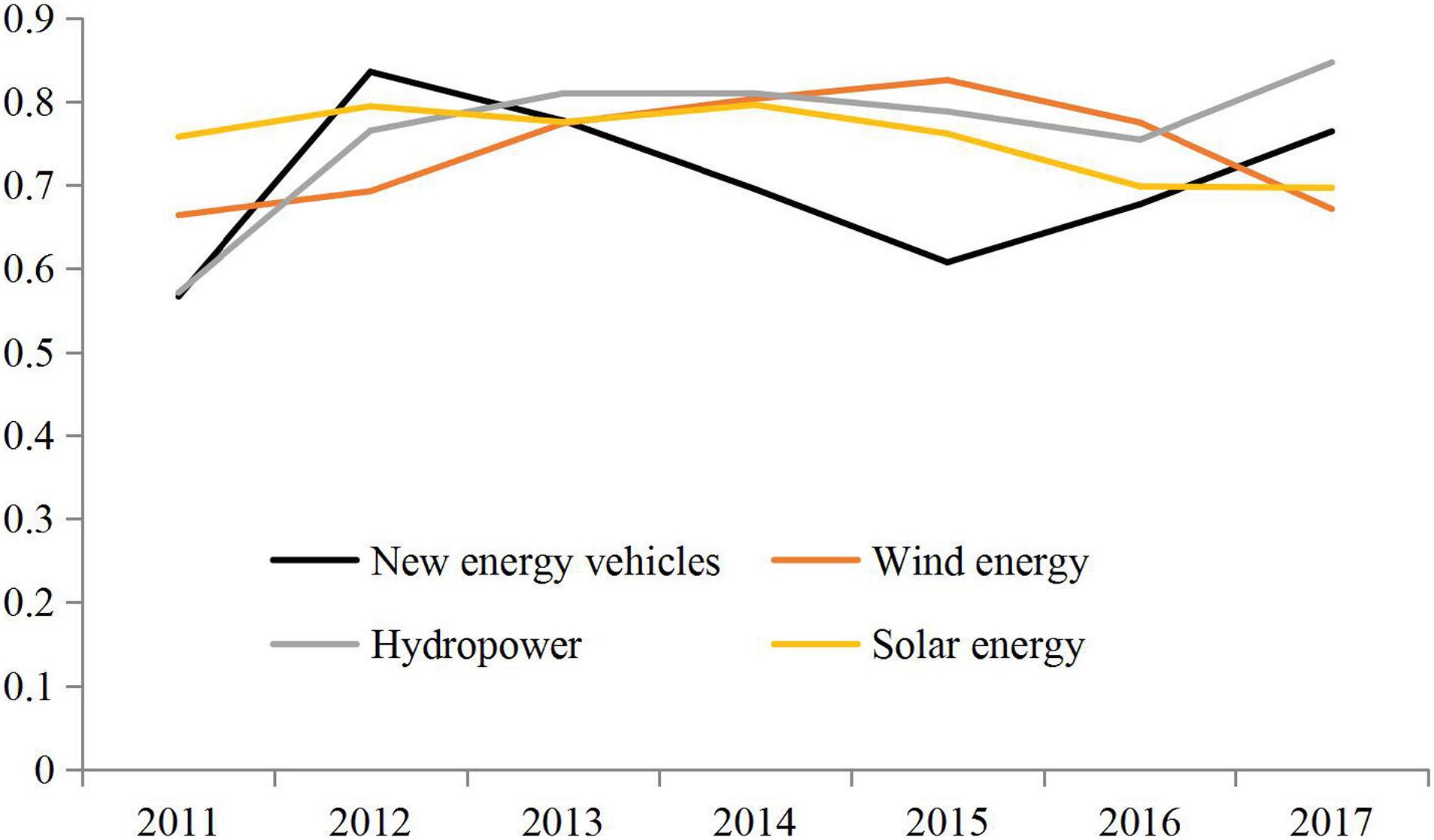

Figure 7 shows the comprehensive correlation between the efficiency of four new energy industries and innovation dimensions. The trend charts of four new energy industries’ correlation degree present roughly “symmetrical” shape. Also, 2013 is the cut-off point. Before 2013, the correlation degree of new energy vehicle, hydropower and solar energy industries was first increased and then decreased, presenting a “symmetric” feature with the wind energy industry which first decreased and then increased. After 2013, the correlation between new energy vehicles and hydropower industry was consistent, showing a “symmetric” feature with the trend of wind energy and solar energy industry. In addition, the correlation between new energy vehicles and hydropower industry will increase in the future, while that between wind energy and solar energy industries will decrease in the future, but the correlation value is above 0.6, which is at a relatively high level. This may be because of China’s vigorous promotion of scientific and technological innovation in recent years, as well as its vigorous promotion of technological innovation in the energy industry, so as to promote energy reform through technological transformation. Under the leadership of national policies, wind energy and solar energy industries are making continuous breakthroughs under the environment of innovation and reform. Intelligent blades that adapt to wind conditions and can significantly improve energy output, intelligent solar water heating auxiliary control devices and other innovative achievements are constantly emerging. The push for innovation has also increased the research of new energy vehicle industry on global challenges such as battery charging infrastructure for pure electric vehicles (PEV) and hybrid electric vehicles (HEV), so as to continuously overcome technical difficulties and achieve technological breakthroughs. This shows that although the correlation between different new energy industries and the innovation dimension has different trends, the correlation is still very high, which is consistent with the current era background of vigorously promoting the development of scientific and technological innovation. Innovative development is the most fundamental way to promote the HQDEF.

Figure 8 shows the comprehensive correlation among the efficiency of four new energy industries and balance dimension. The trend chart of the correlation degree of four new energy industries roughly presents the shape of pairwise “symmetry” and “consistency.” Taking 2013 as the cut-off point, the trend chart of the correlation degree of wind energy and solar energy industry presents a “symmetrical” feature before 2013: the correlation degree of wind energy industry first decreases and then increases. While solar energy industry is the other way around. After 2013, the trend chart of correlation degree shows a “consistent” shape with a downward trend, indicating that the influence of the overall balance dimension on the wind and solar energy industry has a downward trend. Taking 2013 as the cut-off point, the trend chart of the correlation degree between the energy of new energy vehicles and the hydropower industry shows a “symmetrical” feature before 2013. The overall correlation is on the rise, reaching the peak in 2013, and declining after 2014, indicating that the balance dimension significantly related to the development of new energy vehicles and hydropower industry before 2013. One possible reason is the development of these two industries was very compatible with social industrial structure and economic structure at that time, and their balance dimension played a significant role in promoting the development of the industry. After 2014, the trend chart of the correlation degree between new energy vehicles and the hydropower industry shows a “symmetrical” feature again, and the correlation degree of the hydropower industry is significantly higher than that of the new energy vehicle industry. This may be due to the relatively mature development of the hydropower industry in China, which has a high fitness degree with the development of social economic structure and industrial structure. Therefore, the balance dimension has a more important impact on the development of the hydropower industry.

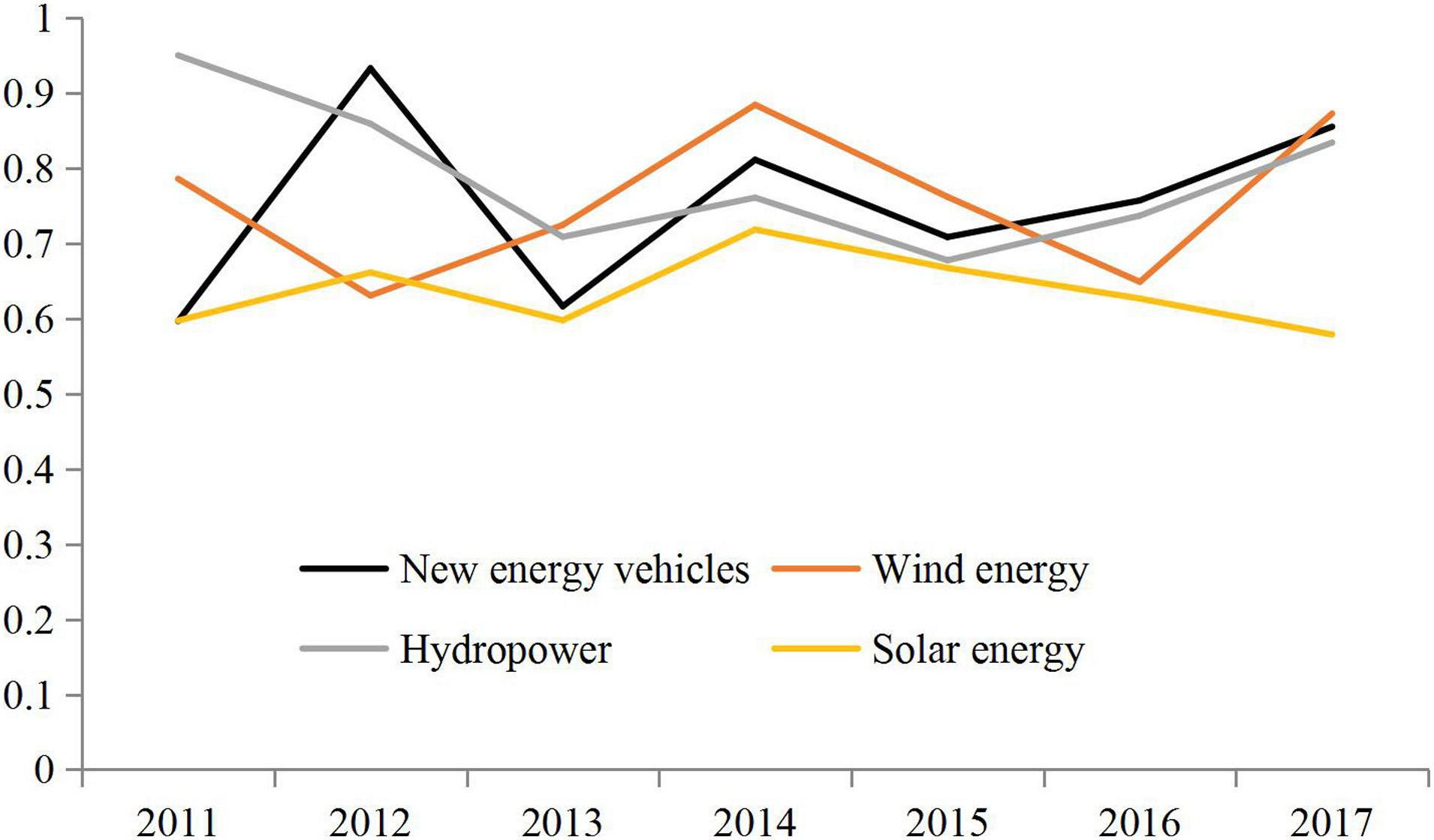

Figure 9 demonstrates the comprehensive correlation between the efficiency of four new energy industries and green dimension. The trend chart of the correlation degree of wind energy industry and solar energy industry shows a “symmetrical” feature. Both of them have a high correlation degree, above 0.65. The increasing trend in the correlation degree of hydropower industry reflects that the green dimension is closely related to the development of hydropower industry, which may be related to huge scale of the hydropower industry, especially dam generation. Ecological and environmental protection is keen to realize the coordinated development of environment, people and economy. The correlation degree trend chart of new energy vehicle industry has obvious volatility. The correlation increased in 2012, possibly due to guidance from some local governments. For example, Beijing has introduced a series of green guidance policies: in addition to new energy vehicle subsidies, individual consumers will also be able to buy new energy vehicles without shaking the number. In 2015, the correlation of new energy vehicle industry rose again, which was also due to the promulgation of the policy. The Ministry of Science and Technology announced the plan to establish a sound electric vehicle power system technology system and industrial chain by 2020. The Ministry of Transport is also encouraging the promotion of new energy vehicles, which can be purchased without restrictions.

Figure 10 shows the comprehensive correlation among the efficiency of four new energy industries and open dimension. We find that the correlation of new energy vehicle, wind energy and hydropower industry has an upward trend. The higher the degree of openness, the more foreign capital is involved; hence the higher the degree of marketization, the more efficient on resources allocation. Opening the international door for the export of domestic new energy products can inject capital into new energy industry. The declining correlation between solar energy industry and open dimension may be due to the insufficient aftereffect of domestic installed capacity caused by the rush to install, especially in 2016. Due to the large scale of rush to install, the impact of the benchmark electricity price adjustment in 2017 will slow down, and the space of the photovoltaic market will be greatly compressed. All these lead to the gradual decrease of the influence of open dimensions on solar industry. However, in general, open has an important impact on new energy industry. Open is the result of mutual benefit and can effectively promote the development of new energy industry.

Concluding Remarks

We apply Malmquist index to evaluate the HQDEF in China from the perspective of input and output, the super-efficiency DEA model and dynamic. Further, from the perspectives of energy structure, innovation, balance, green and open dimensions, we analyze the gray correlation determinants of high-quality development in different energy industries and draw the following conclusions:

First, the overall efficiency of high-quality energy finance in China is at a relatively low level, with the trend of scale efficiency deviating from technical efficiency. Technical (scale) efficiency continues to decline (expand). The overall efficiency of high-quality energy finance in China fluctuates around 0.4, indicating that there is great room for improvement in the HQDEF in China. However, the scale effect continues to expand, reaching as high as 0.9, reflecting that the scale effect of China’s energy finance has reached a high level, and the improvement of overall efficiency depends on the improvement of technical efficiency. Meanwhile, the dynamic Malmquist index shows that the level of technological progress for the high-quality development of China’s energy finance fluctuates greatly, and on average it is 0.911 (less than 1). There is a phenomenon of insufficient technical progress, reflecting that technical and its related efficiency improvements are the key to the high-quality development of China’s energy finance.

Second, the correlation between four different industries and five dimensions is significantly different. We find that the correlation among new energy vehicles, wind energy, hydropower industries and innovation dimension, is the highest. Solar energy industry has the highest correlation with green dimension. In addition, in terms of secondary index, energy intensity is highly correlated with wind energy and hydropower industry, meanwhile the invention patent production rate is highly correlated with new energy vehicle industry.

Third, four different industries and five dimensions show a trend of “symmetry” and “convergence,” the dimension of innovation is most obvious. Besides,” four new energy industries are highly correlated with innovation dimension, which reflects the importance of innovation to new energy industry. The correlations among four new energy industries and balance dimension are roughly in the shape of pairwise “symmetry” and “convergence.” In terms of green dimension, the trend chart of the correlation degree among wind and solar energy industries has the characteristics of “symmetry.”

According to the above research on the high-quality development of China’s energy finance and on the basis of influencing factors, this study proposes the following suggestions in order to improve the efficiency of China’s energy finance and promote the HQDEF:

(1) Optimizing the financial support structure and broaden financing channels. First, the government should enact policies to support energy industry, should encourage financial institutions to lend money to energy companies, and should promote the development of new energy industry by increasing the ratio of enterprise property rights. Second, the government should improve the listing system such as the GEM, and reduce the listing conditions of enterprises. Third, enterprises are suggested to develop special financing projects, such as wind energy project financing and photovoltaic project financing, improve the financing amount and optimize the financing structure.

(2) Building a platform for technological innovation and cultivating the ability to promote the development of cutting-edge technologies. First, relying on energy enterprises, energy research institutes and universities to set up technological innovation platforms to provide research and development bases for overcoming technical difficulties. Second, strengthen investment in technology research and product innovation funds, and improve industrial technology and output levels. Third, for hydropower with more mature development technologies, in addition to cultivating more efficient development technologies, we should also promote the technologies, construction of demonstration projects, and realize the gradual scale and industrialization of innovative technologies.

(3) Optimize the industrial structure and improve the regional economy. First, for wind energy and hydropower industries, energy structure and economic coordination and industries with high relevance can be improved by increasing the overall renewable energy power generation in the region to optimize the use of green and low-carbon energy. The long-term mechanism for promoting regional economic development provides a solid economic foundation for wind energy and hydropower industries.

(4) Invest in green development in a rational way to achieve the coordinated development of human beings, the environment and the economy. First, green and environmental governance investment must be increased in areas with serious environmental pollution in the development of new energy for rational resource allocation. Second, set up an environmental governance and supervision mechanism in advance. Once it is found to cause major pollution to the local environment, it is necessary to stop development in time, find the source of the pollution and solve the pollution in time. Third, the development of hydropower, wind power and other new energy causes environmental damage and residents emigrated. Thus, the government should compensate for them.

(5) Expand the degree of openness and accelerate the process of marketization. First, it is necessary to increase the degree of “bringing in and going out” for industries where the open environment has a high correlation with efficiency. Second, while opening the door to internationalization, we must reduce our dependence on foreign advanced technology and gain core competitiveness with independent innovation capabilities. Third, improve the marketization process, reduce government intervention, and balance market supply and demand for resource allocation, which can further promote the development of new energy industry.

Theoretical and Practical Contributions

The main contributions of this study are as follows: First, we propose the concept of high-quality energy finance based on the analysis of the action mechanism of high quality in energy finance. Second, we find that the overall efficiency of high quality energy finance is at a relatively low level, and the trend of scale efficiency deviates from that of technology efficiency. The scale (technical) efficiency continues to expand (decline). Third, technical efficiency is the restriction of China’s HQDEF. Technological innovation and progress is an important way to break the current bottleneck of high-quality energy finance. Fourth, the Chinese government needs to provide reasonable green investment support and use institutional advantages to ensure the development and application of green and low-carbon energy technologies. By doing so, it will be possible to achieve one of the energy planning goals, to make clean and low-carbon energy the main body of energy supply increment.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author/s.

Author Contributions

ZS was responsible for the idea of the article. GY was responsible for the empirical evidence, wrote the full text, and completed the first draft. GY and ZM were responsible for the submission of the manuscript. ZM put forward opinions on the empirical part and analyzed the data and results. DX and WY were responsible for data collection. HY was responsible for the revision and proofreading of the full text. All authors contributed to the article and approved the submitted version.

Funding

This study received financial support from the Ministry of Science and Technology National Key R&D Program Intergovernmental International Science and Technology Innovation Cooperation Key Project “EIR Program – New Urban Energy Interconnect System Research and it is Pilot Application (Project No: SQ2018YFE96500),” research of national social science fund projects Study on Energy Structure Adjustment and Green Energy Development in China (Project No: 15BJL045), Chongqing Social Science Planning Project “Research on Chongqing Carbon Emissions Trading Pricing Strategy” (Project No: 2019WT52), and Chongqing Bank Co., Ltd. Joint Training Base for Master of Finance (Project No: yjd183002).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2021.662424/full#supplementary-material

References

Al Mamun, M., Sohag, K., Shahbaz, M., and Hammoudeh, S. (2018). Financial markets, innovations and cleaner energy production in OECD countries. Energy Econ. 72, 236–254. doi: 10.1016/j.eneco.2018.04.011

Andersen, P., and Petersen, N. C. (1993). A procedure for ranking efficient units in data envelopment analysis. Manag. Sci. 39, 1261–1264. doi: 10.1287/mnsc.39.10.1261

Beck, T., Levine, R., and Loayza, N. (2000). Finance and the sources of growth. J. Financ. Econ. 58, 261–300.

Berardi, M. (2007). Heterogeneity and misspecifications in learning. J. Econom. Dynam. Control 31, 3203–3227.

Bhattacharyya, S. C. (2012). Energy access programmes and sustainable development: a critical review and analysis. Energy Sustain. Dev. 16, 260–271. doi: 10.1016/j.esd.2012.05.002

Brunnschweiler, C. N. (2008). Cursing the blessings? Natural resource abundance, institutions, and economic growth. World Dev. 36, 399–419. doi: 10.1016/j.worlddev.2007.03.004

Caves, D. W., Christensen, L. R., and Diewert, W. E. (1982). The economic theory of index numbers and the measurement of input, output, and productivity. Econometr. J. Econ. Soc. 50, 1393–1414. doi: 10.2307/1913388

Chen, G., Yu, D., and Liang, Z. (2020). Analysis and reflection on high-quality development of new energy with chinese characteristics in energy transition. Proc. CSEE 40, 5493–5506, (In Chinese).

Charnes, A., Cooper, W. W., and Rhodes, E. (1978). Measuring the efficiency of decision making units. Eur. J. Operat. Res. 2, 429–444. doi: 10.1016/0377-2217(78)90138-8

Chevallier, J., Goutte, S., Guesmi, K., and Ji, Q. (2021). Green finance and the restructuring of the oil-gas-coal business model under carbon asset stranding constraints. Energy Policy 149:112055. doi: 10.1016/j.enpol.2020.112055

Corrocher, N., and Cappa, E. (2020). The role of public interventions in inducing private climate finance: an empirical analysis of the solar energy sector. Energy Policy 147:111787. doi: 10.1016/j.enpol.2020.111787

Dasgupta, S., Laplante, B., and Mamingi, N. (2001). Pollution and capital markets in developing countries. J. Environ. Econ. Manag. 42, 310–335. doi: 10.1006/jeem.2000.1161

Delina, L. L. (2011). Clean energy financing at Asian development bank. Energy Sustain. Dev. 15, 195–199. doi: 10.1016/j.esd.2011.04.005

Dunkerley, J. (1995). Financing the energy sector in developing countries: context and overview. Energy Policy 23, 929–939. doi: 10.1016/0301-4215(95)00101-8

Gallagher, K. P., Kamal, R., Jin, J., Chen, Y., and Ma, X. (2018). Energizing development finance? The benefits and risks of China’s development finance in the global energy sector. Energy Policy 122, 313–321. doi: 10.1016/j.enpol.2018.06.009

Gan, C. H., Zheng, R. G., and Yu, D. F. (2011). An empirical study on the effects of industrial structure on economic growth and fluctuations in China. Econ. Res. J. 5, 4–16.

Gao, P. (2019). Understanding, grasping and promoting high-quality economic development. Econ. Dyn. 08, 3–9.

Gao, P., Du, C., Liu, X., Yuan, F., and Tang, D. (2019). The construction of a modern economic system in the context of high-quality development: a new framework. Econom. Res. J. 54, 4–17, (In Chinese).

Geddes, A., Schmidt, T. S., and Steffen, B. (2018). The multiple roles of state investment banks in low-carbon energy finance: an analysis of Australia, the UK and Germany. Energy Policy 115, 158–170. doi: 10.1016/j.enpol.2018.01.009

Graham, A. D., and Brandon, O. (2003). Optimizing the level of renewable electric R&D expenditures using real options analysis. Energy Policy 31, 1589–1608. doi: 10.1016/s0301-4215(02)00225-2

Grossman, G. M., and Krueger, A. B. (1995). Economic growth and the environment. Q. J. Econ. 110, 353–377.

Halicioglu, F. (2009). An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 37, 1156–1164. doi: 10.1016/j.enpol.2008.11.012

He, L., and Xue, Y. (2010). The Connotation and architecture of energy finance from the perspective of industrial symbiosis. Productivity Res. 12, 232–233.

Hu, H., Fan, C., and Du, Q. (2020). Financing structure, financing constraints, and enterprise innovation investment. China Econom. Stud. 1, 27–41, (In Chinese).

Jacobsson, R., and Jacobsson, S. (2012). The emerging funding gap for the European energy sector—will the financial sector deliver? Environ. Innov. Soc. Trans. 5, 49–59. doi: 10.1016/j.eist.2012.10.002

King, R. G., and Levine, R. (1993). Finance and growth: schumpeter might be right. Q. J. Econ. 108, 717–737. doi: 10.2307/2118406

Lenzen, M. (1998). Primary energy and greenhouse gases embodied in Australian final consumption: an input–output analysis. Energy Policy 26, 495–506. doi: 10.1016/s0301-4215(98)00012-3

Lewis, J. I. (2010). The evolving role of carbon finance in promoting renewable energy development in China. Energy Policy 38, 2875–2886. doi: 10.1016/j.enpol.2010.01.020

Li, K., and Xu, L. (2011). Financing constraints, debt capacity and corporate performance. Econ. Stud. 5, 61–73.

Liang, G. (2006). International business and industry life cycle: theory, empirical evidence and policy implication. Paper Accepted for Presentation at the Annual Conference on Corporate Strategy, Berlin.

Liao, X., and Shi, X. (2018). Public appeal, environmental regulation and green investment: Evidence from China. Energy Policy 119, 554–562. doi: 10.1016/j.enpol.2018.05.020

Ma, Y.-R., Ji, Q., Wu, F., and Pan, J. (2021). Financialization, idiosyncratic information and commodity co-movements. Energy Econ. 94:105083. doi: 10.1016/j.eneco.2020.105083

Miller, R. E., and Blair, P. D. (2009). Input-Output Analysis: Foundations and Extensions. Cambridge: Cambridge university press.

Pollio, G. (1998). Project finance and international energy development. Energy Policy 26, 687–697. doi: 10.1016/s0301-4215(98)00028-7

Schreft, S. L., and Smith, B. D. (1998). The effects of open market operations in a model of intermediation and growth. Rev. Econ. Stud. 65, 519–550. doi: 10.1111/1467-937x.00056

Suo, J., and Tang, R. (2020). Research on the measurement of high quality development level of green energy in China. J. Technol. Econom. 39, 125–133, (In Chinese).

Tadesse, S. A. (2005). Financial Development and Technology. Ann Arbor, MI: William Davidson Institute. Working Paper, 2005, No. 749.

Tamazian, A., Chousa, J. P., and Vadlamannati, K. C. (2009). Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37, 246–253. doi: 10.1016/j.enpol.2008.08.025

Tamazian, A., and Rao, B. B. (2010). Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ. 32, 137–145. doi: 10.1016/j.eneco.2009.04.004

Uyterlinde, M. A., Junginger, M., de Vries, H. J., Faaij, A. P., and Turkenburg, W. C. (2007). Implications of technological learning on the prospects for renewable energy technologies in Europe. Energy Policy 35, 4072–4087. doi: 10.1016/j.enpol.2007.02.004

Vanacker, T. R., and Manigart, S. (2010). Pecking order and debt capacity considerations for high-growth companies seeking financing. Small Bus. Econ. 35, 53–69. doi: 10.1007/s11187-008-9150-x

Wang, H., and Jin, Y. (2007). Industrial ownership and environmental performance: evidence from China. Environ. Resource Econ. 36, 255–273. doi: 10.1007/s10640-006-9027-x

Xu, X., Wei, Z., Ji, Q., Wang, C., and Gao, G. (2019). Global renewable energy development: influencing factors, trend predictions and countermeasures. Resour. Policy 63:101470. doi: 10.1016/j.resourpol.2019.101470

Keywords: high-quality energy finance, technical efficiency, scale efficiency, influencing factors, innovation dimensions, correlation analysis

Citation: Sheng Z, Yuan G, Xiru D, Minglong Z, Yi W and Yu H (2021) Research on High Quality Evaluation and Influencing Factors of China Energy Finance: Evidence From A-Share New Energy Companies. Front. Environ. Sci. 9:662424. doi: 10.3389/fenvs.2021.662424

Received: 01 February 2021; Accepted: 17 March 2021;

Published: 04 May 2021.

Edited by:

Elie Bouri, Lebanese American University, LebanonReviewed by:

Yu Wei, Yunnan University of Finance and Economics, ChinaPeng Wang, Southwestern University of Finance and Economics, China

Copyright © 2021 Sheng, Yuan, Xiru, Minglong, Yi and Yu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Gao Yuan, Z2FveXVhbjE1OTIzMEAxNjMuY29t; Zhang Minglong, OTIzOTU0NzI0QHFxLmNvbQ==

Zeng Sheng1

Zeng Sheng1 Gao Yuan

Gao Yuan He Yu

He Yu