- 1School of Economics and Trade, Changzhou Vocational Institute of Textile and Garment, Changzhou, China

- 2School of Engineering, The University of Manchester, Manchester, United Kingdom

Digitization has become a core engine for China’s energy companies to achieve green transition in a competitive marketplace. Using the panel data of China’s A-share listed energy companies, this study explores the impact of digitalization on energy companies’ green transition. The finding demonstrates that digitalization can significantly drive energy companies’ green transition. This finding remains valid following a series of robustness tests. Moreover, digitalization can indirectly enhance energy companies’ green transition by enhancing technological innovation and optimizing operational capacity. Further research demonstrates that the promoting effect of digitalization on green transition in the state-owned companies, growing and mature energy companies and companies in the east are more fully released. This research could assist policymakers and professionals in energy companies with decision-making references to promote green transition.

1 Introduction

The scale of the digital economy is growing, with new technologies, industries and business models emerging, injecting strong incentives and energy for global economic development (Li et al., 2020; Xu and Li, 2020; Sidorov and Senchenko, 2020; Sabli et al., 2023). China considers it a crucial element of healthy economic growth and has set out specific plans in the 14th Five-Year Plan to promote the digital economy. As the core engine of the deepening development of the digital economy, data is becoming a significant driver of new economic growth after land, capital, and labor (Cong et al., 2021), which has resulted in the emergence of novel economic structures and the implementation of significant changes to production and governance models. In terms of growth, Norway’s digital economy scale rose 34.4% in 2021, ranking first globally (China Academy of Information and Communications Technology, 2022). In addition, as a developing country, China continues to promote the overall arrangement for the digital economy based on its industrial base. In 2021, the scale of China’s digital economy surpassed 7.1 trillion USD, with an annual growth of 15.9% over the last decade (Accenture, 2021).

Nowadays, digitalization represents a new industrial revolution based on advanced digital technologies to provide an innovative endogenous impetus for growth (Lederman and Zouaidi 2020; Lang et al., 2020). Moreover, the digital economy can significantly bolster traditional industries and optimize resource utilization. As a micro-component of the macro-economy, enterprises are the mainstay of digital economy development. Enterprise digitalization is not only a micro-transformation that reflects the profound integration of digital technology and industrial advancement, but also an innovative symbol of the shift from traditional production systems to digital systems. In the era of the digital economy, when confronted with significant changes in technology and the commercial environment, a growing number of firms employ digital technologies to drive organizational transformation and expedite the creation of goods and services, thereby achieving digitalization. Overall, the combination of digitalization and traditional manufacturing enterprises can enhance the innovation capability of enterprises, the transformation of the management and operation mode, and the improvement of production efficiency. Meanwhile, it can make the production and operation process more automated and precise, reduce the waste and consumption for production and manufacturing, significantly lowering the cost of the green transition, thus gradually becoming a new kinetic force for the green transition of enterprises (Kemp-Benedict, 2018; Renfors, 2024).

Enterprise digitalization is fundamentally a systematic process to increase the efficacy of data flow using cutting-edge digital technology, thus enhancing its core market competitiveness (Mubarak and Petraite, 2020; Guenzi and Habel, 2020; Merdin et al., 2023). It can be predicted that enterprise digitalization is a long-term process. China’s local governments have been modifying and strengthening their policies to bolster support for corporate digitalization, thereby transforming and upgrading traditional industries. However, these micro-level transformations are superficial, and digitalization has not yet penetrated the system and business levels deeply enough. A relevant survey revealed that just 16% of firms achieved substantial benefits in digitalization adoption (Accenture, 2021).

As the leading end of many industrial chains, the energy industry is the basis for all scientific and technological activities, which plays a crucial role in developing a stable industrial economy (Wang et al., 2019; Guo et al., 2021; Lee et al., 2021). China’s energy industry, the world’s largest producer, has made tremendous progress. Moreover, it has constructed an integrated energy supply system that includes coal, electricity, oil, gas, and new energy sources, providing the nation with the capacity to reduce poverty, raise the quality of life for its people and maintain long-term, steady and fast economic development. However, it still suffers from severe environmental pollution, weak independent innovation ability, low production management efficiency, and poor product supply quality (Wang et al., 2020; Wang et al., 2022). Therefore, in the face of the energy shortage becoming the new normal, the pressure of industrial transformation and upgrading, and the urgent need to build new industrial competitiveness, promoting the energy industry’s green transition through digitalization is crucial to reducing costs and improving efficiency in the short term, changing business models and creating new business formats in the long term. However, digitalization adoption in more than half of energy companies was still at the stage of single-point trials and partial rollouts, with an evident lack of efforts to penetrate the depth of transformation at the institutional and operational levels. Nowadays, there is a significant deviation between the micro entity and the macro trend, also known as the deviation between the theoretical optimal solution and the transformation effectiveness. Moreover, this deviation makes the impact mechanisms of digitalization on energy companies’ green transition increasingly become a hot issue of social concern. Theoretical research has hypothesized that enterprise innovation and enterprise performance may be influenced by digitalization (Moretti and Biancardi, 2020; Andriushchenko et al., 2020; Buttice et al., 2020; Mubarak et al., 2021). Some research has also examined the paths in which digitalization can affect enterprise performance (Yoo et al., 2012; 23; Galindo-Martín et al., 2019; Peng and Tao, 2022). Nevertheless, prior studies have failed to provide a comprehensive framework for answering the question of whether energy companies’ digitalization can drive their green transition. This paper examines three specific questions. First, does digitalization improve energy companies’ green transition? Second, assuming the promoting role is verified, what are the underlying mechanisms? Finally, what are the differences in the influence of digitalization on green transition in terms of enterprise characteristics and geographical locations? The research on these issues will help to accurately evaluate and deeply understand the driving role of energy companies’ digitalization, which is crucial for boosting the rapid and healthy growth of energy companies.

The critical marginal contributions of this article are as follows. First, this study improves the academic understanding of the influence of digitalization on energy companies’ green transition in China. Second, from the perspective of technological innovation and operational capacity, we endeavor to evaluate the transmission mechanisms of digitalization affecting energy companies’ green transition, which contributes to opening the black box of the transmission mechanisms between digitalization and energy companies’ green transition. Third, the text recognition method is used to search, compare, and aggregate the keywords related to energy companies’ digitalization, thus providing a vital reference for analyzing the extent of digitalization. Finally, considering the possible asymmetrical effects of firm-level digitalization, this study fully interprets the structural differences of digitalization affecting green transition from the perspectives of ownership, life cycle and location, thereby providing empirical support for differentiated policy formulation.

2 Literature review and hypotheses development

2.1 Literature review

Digitalization is an inevitable choice for companies to survive and thrive when facing the digital economy. Most existing research focuses on its definitions and lacks a unified viewpoint (Vial, 2019; Abiodun et al., 2022). Some scholars assert that digitalization can improve the whole business process, thus enhancing dominant business performance and competitiveness (Frank et al., 2019; Li, 2020). Ribeiro-Navarrete et al. (2021) account that digitalization, a strategic change, can support the application modes of digital technology and enterprise operation after successful transformation. Verhoef et al. (2021) believe that digitalization can efficiently use digital technologies to examine and compile the acquired data into helpful information for precise evaluation, thereby improving enterprise performance. Therefore, digitalization can be summarized as “the combination of enterprise, technology, and data”, characterized by value creation and model innovation. Furthermore, this definition is consistent with current research on digitalization and refers to the use of cutting-edge digital technology in operational oversight and future development strategy to enhance corporate performance. Although the definition of digitalization is discussed in depth, how to drive enterprise digitalization is a crucial issue. Companies’ management teams and dynamic capabilities are recognized as the internal driving power for enterprise digitalization (Kohlir and Melville, 2019; Majchrzak et al., 2016; Hadjielias et al., 2021).

Nevertheless, there is a significant dearth of previous research linking digitalization to energy companies’ green transition, and its probable transmission mechanisms can only be inferred from relevant research. As digitalization becomes more widespread and profound, studies on the link between digitalization and innovation performance have garnered much academic interest. Bloom et al. (2013) argue that digital technologies could contribute to a decrease in spending on acquiring valuable information and promote the movement of internal resource elements, thus driving enterprise innovation. Paunov and Rollo (2016) further investigate the knowledge spillover effect of the Internet and argued that it could significantly improve enterprises’ production efficiency and innovation performance. Gaglio et al. (2022) consider that digital communication technologies have a beneficial effect on innovation performance. Mubarak et al. (2021) assert that Industry 4.0 technologies and open innovation can promote the green innovation performance of firms. Conversely, Kohtamäki et al. (2020) assert that there may be a “digital paradox.” Specifically, although digitalization endows enterprises with greater innovation vitality, the correlation between low-level digitalization and high-level service has a notable negative effect on the innovation efficiency of companies.

Research on whether digitalization increases corporate performance can also provide reference for examining the influence of digitalization on green transition, but the results of the studies vary. Some scholars believe that there is a facilitating effect between the two according to extensive research (Andriushchenko et al., 2020; Moretti and Biancardi, 2020; Taques et al., 2021). However, Curran (2018) reveals that traditional digital technology cannot substantially impact corporate development. Existing research has revealed that enterprise digitalization can promote operation efficiency, reduce operating costs, and stimulate innovative motivation, thus improving the economic performance of enterprises. First, digital technologies include structured and unstructured data, which expands the potential of data mining to extract meaningful information from massive data sets (Yoo et al., 2012; Galindo-Martín et al., 2019). Therefore, digitalization can enhance firms’ operational capabilities by improving the ability to cope with market needs and collaborative operations. Second, digitalization contributes to reducing a firm’s operating costs. The advantages of digital technology include openness and sharing, which can reduce the adverse impact of information asymmetry and transaction costs between trading parties (Nambisan, 2017; Zhai et al., 2022). Third, a firm’s data elements are constantly being energized by digital technologies, resulting in continuous learning and motivated cooperation among companies. Meanwhile, different kinds of firms will be tightly integrated to optimize and reconstruct the innovation process and stimulate innovation power (Ode and Ayavoo, 2020; Kanabar et al., 2022).

Overall, the above three strands of literature give essential insights into how digitalization affects energy companies’ green transition. However, the following important space remains to be investigated. First, the existing studies mainly concentrate on the effects of digitalization on innovation performance or corporate performance, while there is a lack of focus on the transmission mechanisms of digitalization affecting energy companies’ green transition from a more systematic perspective. Second, using single indicators such as structure scale is inconsistent with the digitalization’s features, and there need more relevant statistical data on how to calculate the level of digitalization (Peng and Tao, 2022). Third, most studies concentrate on overall effects, ignoring heterogeneity among enterprises or regions, which can result in inaccurate research findings. Hence, the correlation between digitalization and energy companies’ green transition still has more room for exploration.

This paper seeks to make the following contributions to the research. First, this research uses text recognition to measure the digitalization of China’s A-share listed energy companies from 2008 to 2022. It creatively explores whether digitalization promotes energy companies’ green transition, expanding the horizons and depth of research on energy companies’ digitalization. Second, this research provides a deeper comprehension of the mechanisms of how digitalization impacts energy companies’ green transition by exploring the mediating roles of technological innovation and operational capacity. Finally, this study offers a critical and unique analysis, especially considering firms’ ownership type and life cycle, to identify the heterogeneous influence of digitalization on energy companies’ green transition. Furthermore, to deepen our research, we appraise the heterogeneous impact of energy companies’ digitalization in the eastern, central, and western areas.

2.2 Hypothesis development

The core of infrastructure construction of the digital economy is digital enterprise. The way traditional firms create and capture value must be transformed using digital technology to form the internal key factors of China’s economic development (Cong et al., 2021). Enterprise digitalization is a crucial stage that micro-enterprise entities must go through to follow the law of development in the new era, which is the deep integration of enterprises’ production and operation processes with digital technology and an unavoidable decision for companies’ survival and growth (Murthy et al., 2021). Early, firms’ digitalization began with the construction of hardware platforms and devices and gradually expanded into business models, user experience, and business conceptions (Miao, 2021). Moreover, digitalization is more continuous and comprehensive than the established concepts, such as IT adoption (Sousa and Rocha, 2019; Syukur and Muin, 2023). Thus, many energy companies have succeeded in using digital technologies to improve productivity and lower production and operating expenses, enhancing quality management capabilities and satisfying individual needs. Meanwhile, digitalization has given rise to many new commercial models and facilitated the emergence of the platform economy, which is also essential in driving energy companies’ green transition. Digitalization is proceeding towards eliminating the asymmetry of information between supply and demand and accumulating tremendous innovation potential, thereby forming a virtuous cycle for technological transformation and changes in organizational structure and improving the level of green transition. Correspondingly, this research proposes:

Hypothesis 1. Digitalization drives energy companies’ green transition.

Digitalization has brought about stronger technological innovation momentum at both input and output levels, providing a solid technology power for driving energy companies’ green transition. First, as a model for innovation in the new era, digitalization may be a significant source of inspiration for technical advancement (Tavoletti et al., 2021), creating a favorable ecological environment for energy companies to operate and innovate in a direction that is conducive to technological innovation. In particular, with the widespread use of cutting-edge information technologies, the upgrading and transformation of traditional energy companies to digital energy companies have been promoted vigorously. On the one hand, when energy companies put forward the primary goal of implementing intelligence and digitalization, they tend to increase R&D investment to achieve the above strategic goals. On the other hand, digitalization replaces the traditional business-oriented innovation model with an Internet business model. It is a critical driving force for energy companies to gain information on market trends and customer needs. Meanwhile, consumers can participate more extensively in product production and value creation (Ko et al., 2022). To proactively adapt to this market orientation, energy companies generally have a more significant motivation to engage more in R&D to meet consumers’ individual needs via technological innovation and increase the competitiveness of their core products. Second, Energy companies can use their innovation resources more efficiently by implementing a digitalization strategy. Energy companies employ new information technology to actively seek and access external knowledge, creating a shared innovation model that includes various innovation resources, enhancing their R&D efficiency and innovation output. Specifically, optimizing inputs and outputs at the innovation level can primarily affect the future development prospects of energy companies, which is a crucial factor influencing the green transition level of enterprises. Especially under the background of total factor productivity, the above changes will help energy companies gain an advantage in market competition. Finally, due to high production efficiency and innovation efficiency, production resources will tend to flow rapidly into energy companies undergoing significant digitalization.

Energy companies’ digitalization can effectively raise enterprise value and improve financial stability, thereby increasing the level of green transition. Moreover, the core of energy companies’ digitalization is to achieve comprehensive empowerment of enterprise production and operation through data, which can significantly enhance efficiency in using production tools and lower operation and maintenance costs and inventory costs (Green, 2020). Specifically, it can significantly promote the information process of energy companies. The latest digital technologies are widely used for collecting and processing information on research, production, sales and management, which can effectively enhance communication efficiency in industrial supply chains, promoting the precise management of the product’s whole life cycle and realizing the optimal distribution of available resources throughout the entire industrial chains (Naimi-Sadigh et al., 2022). Moreover, digital information technology can rapidly deal with information asymmetry and reduce energy companies’ costs of information search and product development. In addition, the widespread use of digital technologies has given birth to a new commercial model of the sharing economy, thereby reducing the threshold of resource utilization and operating costs through sharing technology, equipment and services and enhancing the allocation efficiency of production materials. Moreover, energy companies’ digitalization corresponds with the direction of the digital economy in the new era, which is also a new engine for strengthening China’s current digital economy. In particular, the COVID-19 outbreak has ushered in a period of opportunity for digitalization. The capital market is more likely to favor energy companies that align with national policy guidelines and economic practices. Furthermore, the market value for energy companies will continue to increase, which will help absorb more external investment and boost the level of green transition. In addition, digitalization can improve data processing capabilities through digital technology, increasing the depth of analysis of decision-making principles and making business forecasts more accurate (Wielgos et al., 2021). Therefore, an accurate analysis of the macro market and competitive environment can be achieved using big data, which contributes to maximizing energy companies’ capital utilization with limited financial resources. In other words, enterprise digitalization can be beneficial for the suitable formulation of data-driven decision-making and the practical improvement of financial control. It is noteworthy that capital in the market will flow to these energy companies with good financial conditions to increase the production scale and management level, thus raising the level of green transition. Correspondingly, this research proposes:

Hypothesis 2. Digitalization drives energy companies’ green transition by enhancing technological innovation and operational capacity.

3 Research design

3.1 Empirical model

This study creates a benchmark model to determine the influence of digitalization on energy companies’ green transition, which is described in the following:

where

To further validate how digitalization can enhance energy companies’ green transition, we use the successive test (Baron and Kenny, 1986) based on Equation 1 and the following equations:

where

3.2 Variables

3.2.1 Green transition

Industrial green transition is oriented to the intensive use of resources and environmental friendliness, with green innovation as the core, to achieve green and sustainable development of the whole industrial production process and to obtain a win-win situation in terms of economic and environmental benefits (Liu et al., 2024). Based on relevant research (Yang and Chi, 2023; Feder, 2022), this study constructs an evaluation indicator system for energy companies’ green transition from four dimensions: green culture, green innovation, green production and green emissions based on textual analysis (Table 1), and uses the entropy weight method to measure the enterprise green transformation index.

3.2.2 Digitalization

Digitalization (Dig) in this research is the core explanatory variable. The existing research mainly stagnates in theoretical analysis, and there are few quantitative analyses on the digitalization of companies (Pan et al., 2022). In this research, we use Python for textual recognition of corporate annual reports, which can indicate the keywords about digitalization in a corporate annual report and derive the text intensity of digitalization, which is used as a proxy variable in this research (Ode and Ayavoo, 2020). Specifically, a dictionary of 47 and 58 keywords related to the underlying technology and practical application is used for textual analysis.

3.2.3 Mediation variables

In this paper, the mediating variables can be selected from two directions. First, the digitalization strategy enables energy companies to better integrate production resources, enhancing technological innovation and forming an excellent innovative ecological scene. Moreover, improving the innovation level can play an essential role in improving the level of green transition. Second, after a particular stage of digitalization, energy companies will have improved their production and management capabilities, increasing enterprise value to a certain extent and providing a solid technical guarantee for improving financial stability. This operational capacity will become a vital driving force for energy companies’ green transition. Therefore, we select innovation input (II) and innovation output (IO) as the proxy variables for technological innovation. Moreover, enterprise value (EV) and finance stability (FS) are selected as proxy variables for operational capacity to reflect energy companies’ economic achievement and risk level after digitalization adoption. Specifically, innovation input is calculated by the ratio of corporate R&D investment to operating revenue and the logarithm of the enterprise patent applications expresses innovation output. Furthermore, enterprise value is measured by Tobin’s q and the asset-liability ratio measures financial stability.

3.2.4 Control variables

In line with relevant literature, we regulate five variables believed to influence the green transition level of energy companies, including company scale (CS), company age (CA), return on assets (ROA), revenue growth rate (RGA) and total assets turnover (TAT). Specifically, company scale is measured as a firm’s total assets, return on net assets is measured as the ratio of net profit to average shareholders’ equity, and total assets turnover is measured as the ratio of net revenue to average total assets. In addition, both firm size and firm age are processed with logarithm.

3.3 Data

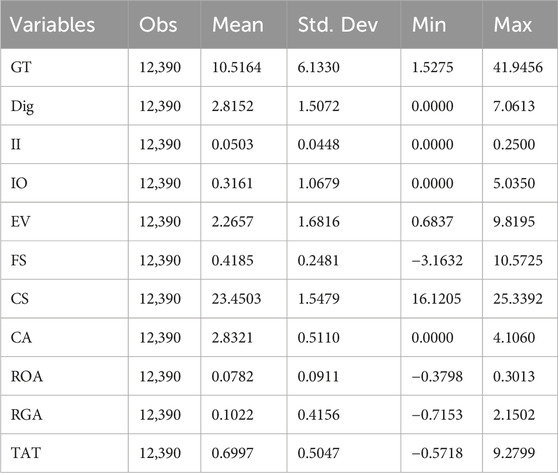

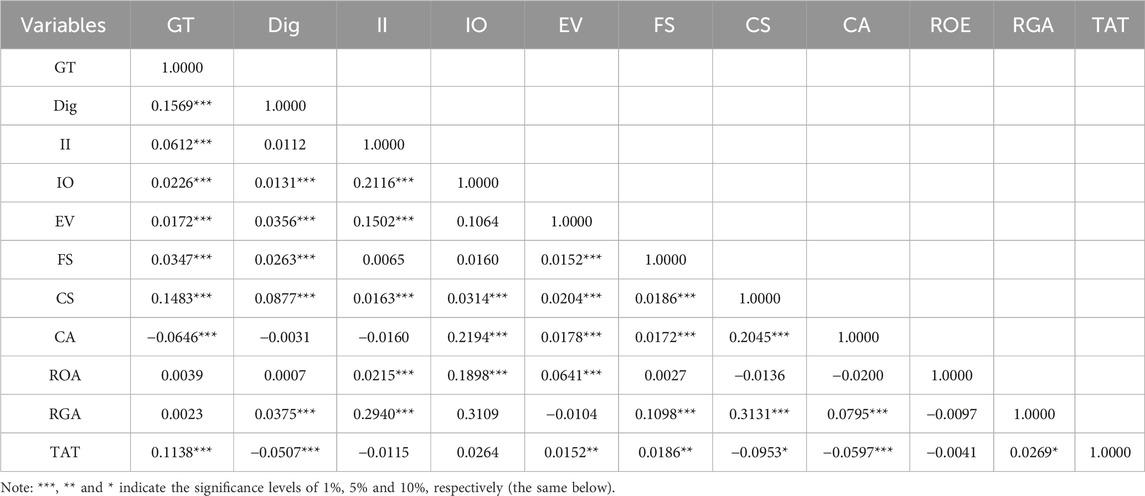

Based on the availability and integrity of the data, this paper selects 826 Chinese A-share listed energy firms as study samples. Considering that China’s new accounting standards were used in 2007, the study period is 2008–2022 to maintain consistency in the calibre of financial data. On this basis, the data in this paper are processed as follows. First, samples with specific financial data in the ST and *ST categories are excluded. Second, the IPO current period samples and the public offering samples are deleted, and the samples with missing data for more than five consecutive years are removed. Third, considering the interference of extreme outliers to the findings, this paper applies a 1% decrease in the upper and lower tails of all continuous variables. In addition, the raw data of this paper are derived from the WIND database. Table 2 shows the descriptive statistics for key indicators.

In Table 3, the correlation coefficient between digitalization and energy companies’ green transition is 0.1569, and the correlation coefficients of the other variables almost do not exceed 0.4. Moreover, most correlation coefficients obtained have passed the significance test of 10%. Therefore, we can conclude that the multicollinearity problem is not considered in the subsequent study.

4 Results analysis and discussion

4.1 Baseline findings

This study uses model (1) to investigate the impact of digitalization on energy companies’ green transition. From column (1) in Table 4, we can find that when just individual and time-fixed effects are included, the regression coefficient of digitalization is considerably positive, revealing that improving energy companies’ digitalization level will contribute to enhancing their green transition. Moreover, the findings of column (2), including all control variables, show that a one percentage point increase in digitalization raises energy companies’ green transition by 0.0242 percentage points. Therefore, Hypothesis 1 is confirmed.

4.2 Robustness test

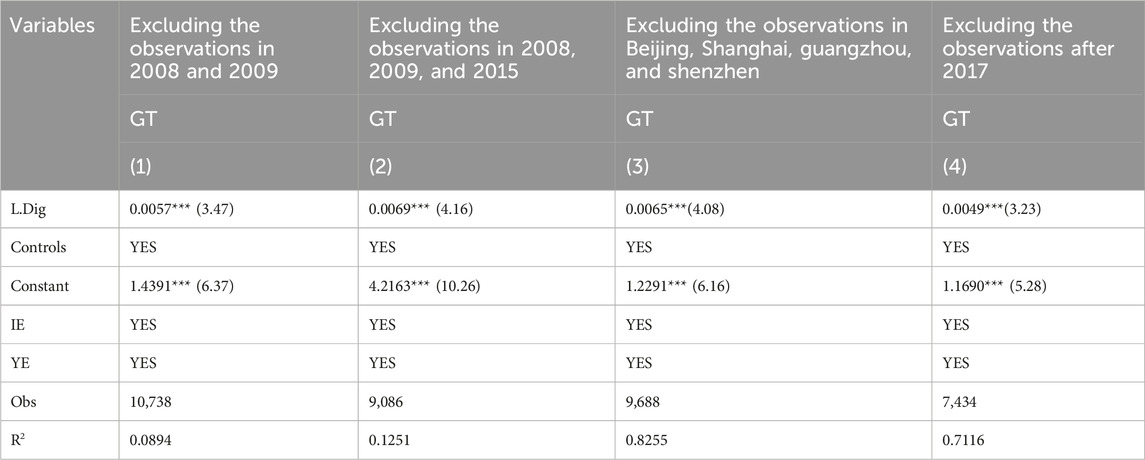

4.2.1 Removing specific samples

Digitalization and energy companies’ green transition are both linked in some way to major financial shocks on a global scale. Shocks from significant adverse financial events will block an energy enterprise’s adoption of digitalization. Meanwhile, its green transition level may face stagnation. In the last two decades, there have been two relatively severe financial shocks at home and abroad, including the worldwide financial crisis in 2008 and the China stock market crash in 2015. Because of the post-effective characteristics of the worldwide financial crisis, this paper removes the sample data of energy companies in 2008 and 2009. Considering the exclusion of the impact of the China stock market crash, the observations for 2010–2014 and 2016–2022 are retained in the regression. Furthermore, because of the unique political and economic characteristics of municipalities under the direct control of the central government, the sample data of energy companies in Beijing, Shanghai, Guangzhou and Shenzhen is selected and eliminated. In addition, Chinese Accounting Standards were significantly revised around 2017 in terms of financial instruments, income, and leasing, so the sample data of energy companies after 2017 is excluded from the study. The findings of Table 5 illustrate that removing specific samples cannot change the positive correlation between digitalization and energy companies’ green transition, which verifies the core conclusion’s robustness in this study.

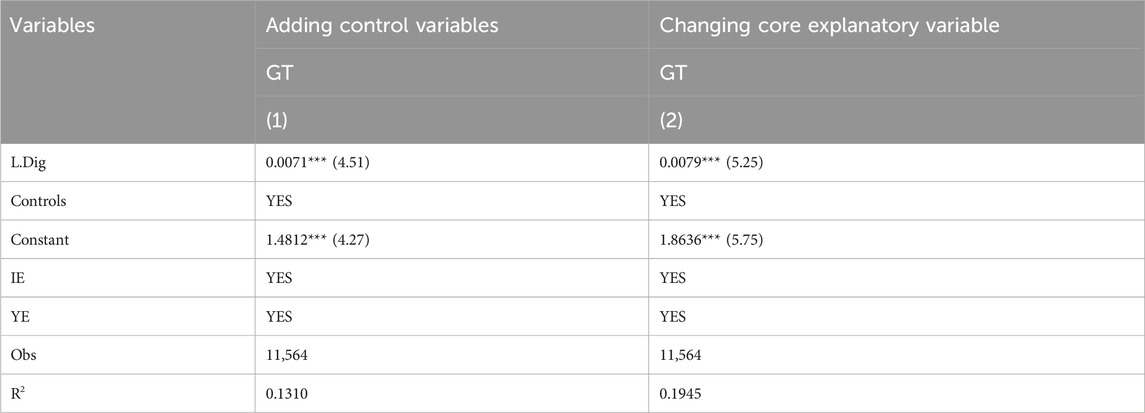

4.2.2 Adjustment of variables

Additional control variables [capital intensity (CI) and concentration of shareholding (CS)] are included in Equation 1 to mitigate endogeneity issues arising from missing variables. Specifically, capital intensity is calculated by the ratio of net fixed assets to the number of employees. The concentration of shareholding is measured by the sum of the top 5 shareholders’ shareholdings. In addition, digitalization is measured by the ratio of intangible assets related to digitalization in corporate annual reports to intangible assets. In Table 6, energy companies’ green transition is still driven by digitalization, consistent with the findings of the baseline model.

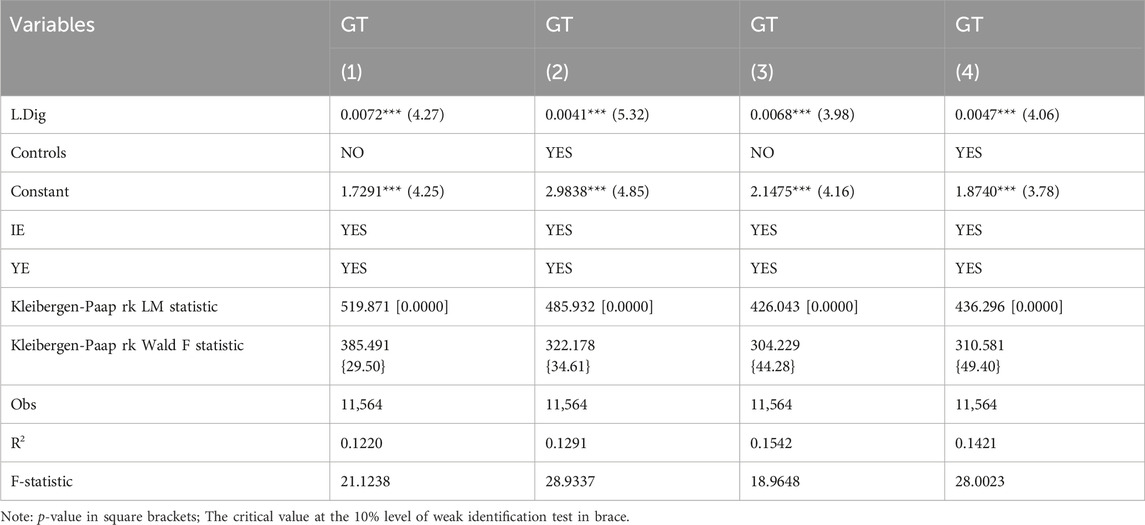

4.2.3 Instrumental variable

Lagging the core explanatory variable can alleviate the endogeneity of the model caused by mutual causality. However, the model may still be susceptible to endogeneity issues due to missing variables. Consequently, this research may address the endogeneity problem more successfully using proper instrumental variables. The digitization level of other firms in the same region influences this firm’s digitalization but does not directly influence its green transition. Thus, the generated instrumental variable meets the requirements for correlation and exogeneity. As a result, the mean value of digitalization of all firms in the same province except this firm is used as the instrumental variable, and the TSLS method is used for estimating. Columns (1) and (2) in Table 7 demonstrate that digitalization drives energy companies’ green transition after adopting the instrumental variable. In addition, according to relevant research (Nunn and Qian, 2014), we generate the interaction term (HDel) as an additional instrumental variable. Columns (3) and (4) verify this core conclusion. The above findings again prove the core findings of this paper.

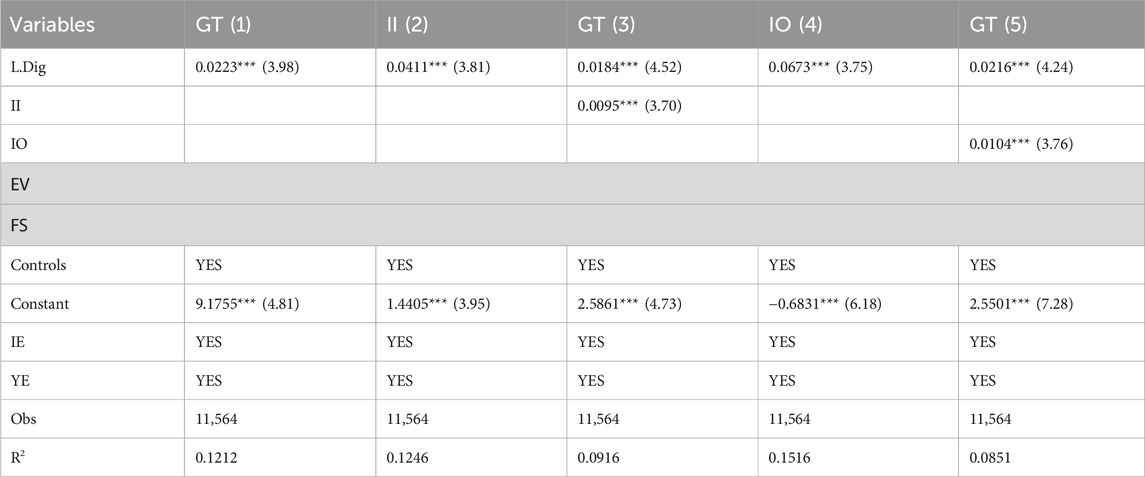

4.3 Transformation mechanisms

In this section, we use model (2) and (3) to examine the transmission mechanisms that digitalization affects energy companies’ green transition from two perspectives: technological innovation and operational capacity. In columns (2) and (4) of Table 8, the coefficients of digitalization on innovation input and innovation output are both significantly positive (0.0411 and 0.0673), revealing that digitalization can enhance energy companies’ innovation level. Similarly, it can be inferred from columns (3) and (5) that the impact coefficients for the relationship between innovation input and innovation output and green transition are also significantly positive (0.0095 and 0.0104). Therefore, the above findings indicate that digitalization can increase energy companies’ green transition by enhancing innovation. Digitalization is a systematic project that requires more dedicated investment in developing energy companies, thereby raising the demand for innovation investment. Furthermore, digitalization can provide powerful support for enterprises to allocate innovative resources to improve innovation output effectively. Therefore, digitalization can contribute to the energy companies’ innovation success. Supported by cutting-edge digital technologies, energy companies with a high level of technological innovation can better stimulate the integration of digital technologies with production and management to improve their market competitiveness.

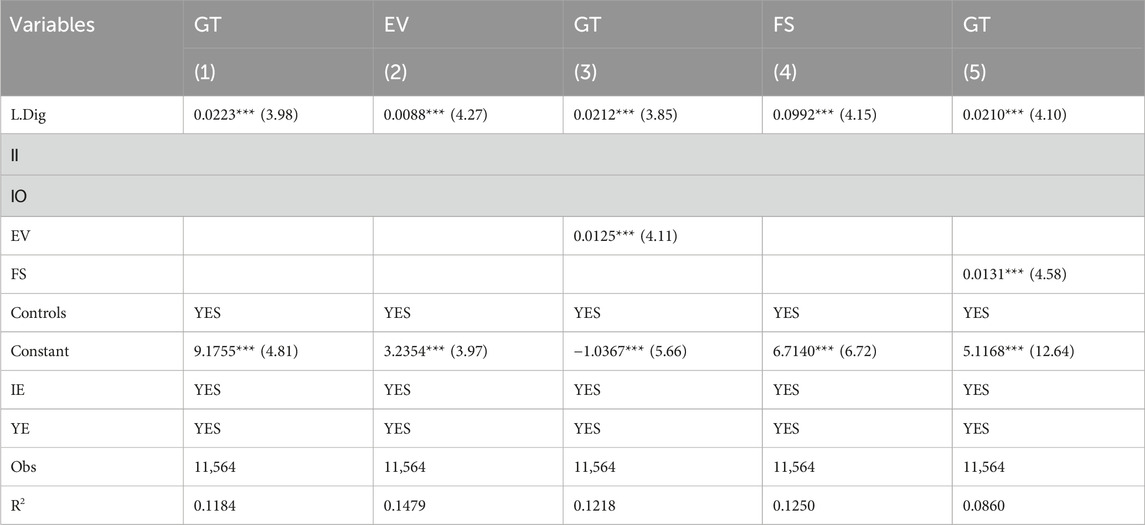

In columns (2) and (4) of Table 9, the coefficients of digitalization on enterprise value and finance stability are both significantly positive, demonstrating that energy companies’ digitalization can enhance enterprise value and financial stability. Enterprise value and financial stability are also shown to affect green transition positively in columns (3) and (5). These findings demonstrate that energy companies’ digitalization can enhance green transition through the mediating role of enterprise value and financial stability. Facilitating the digitalization process satisfies the demands of domestic policies for energy companies, thereby assuredly augmenting enterprise value. Furthermore, digitalization will enhance energy companies’ innovation and profitability and provide a stable foundation for improving their financial structure. As a result, energy companies with a high level of operational capacity can make full use of all types of resources, thereby improving their green transition. To sum up, Hypothesis 2 is verified.

4.4 Heterogeneity effects

The above results have already provided empirical evidence for the promoting role of digitalization in energy companies’ green transition. However, this generalizability test may omit useful heterogeneous information, blunting the policy recommendations derived from the study’s findings. To improve the precision and depth of this study, we consider the structural differences in firm attributes to accurately portray the differential impact on energy companies’ green transition in the face of equivalent digitalization shocks. In addition, energy companies in different geographical locations have significant differences in policy implementation and economic level, resulting in different effects on digitalization. Accordingly, this research investigates the correlation between digitalization and energy companies’ green transition based on regional heterogeneity.

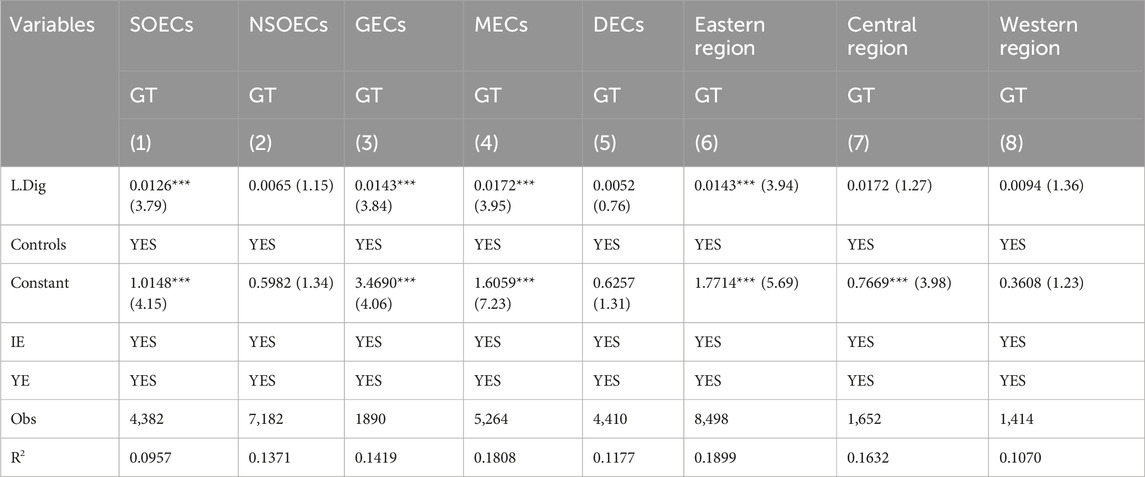

First, we divide the samples into state-owned energy companies (SOECs) and non-owned energy companies (NSOECs) to analyze the differential effects of digitalization based on ownership type. In columns (1) and (2) of Table 10, the coefficient of digitalization in SOECs is significantly positive, while the same coefficient in NSOECs is not significant. It can be concluded that only digitalization in SOECs can significantly increase the green transition level. A possible explanation for this finding is that most NSOECs have more severe resource constraints. Specifically, more resources invested in digitalization projects will reduce the resources available in normal corporate operations and weaken their ability to cope with fierce market competition. Moreover, NSOECs are often at a relative disadvantage in the industrial chain, and their main business base is weaker than that of SOECs, and thus it may take a longer time for the influence of digitalization on energy companies’ green transition to be demonstrated. Overall, compared with NSOECs, SOECs have more advantages in playing the promoting role of digitalization.

Second, we divide the samples into three categories according to the life cycle of enterprise development: growing energy companies (GECs), mature energy companies (MECs) and declining energy companies (DECs). From the regression findings of columns (3) to (5), it can be inferred that digitalization’s contribution to green transition is significant for GECs and MECs. In contrast, the same coefficient for DECs is not significant. One possible reason is that GECs have a solid intrinsic need to use innovative technologies to improve the green transition level when facing tough and fierce market competition. Although the economic conditions of energy companies in the growth stage are poor, investing some resources in digital technology projects is a meaningful way to secure market share and achieve leapfrogging. Furthermore, MECs have innovative technological conditions that can meet the needs of digitalization adoption as well as obvious advantages in terms of access to financing, profitability and technology development, which can continuously integrate digitalization into their organizational structure and production management to make full use of the effectiveness of a digitalization strategy. Conversely, DECs are facing operational difficulties and severe losses. Thus, the development and decision-making orientation of DECs are no longer geared towards digitalization, and the objective technological infrastructure to increase the degree of digitalization has long been lost. In summary, the digitalization level of DECs is generally low and does not contribute to green transition.

Finally, columns (6)–(8) show the classification regression results based on regional heterogeneity. The coefficient of digitalization is significantly positive in the subsample of the eastern area but not significant in the subsamples of the central and eastern areas. The main reason is that energy companies in the eastern region have natural advantages in terms of market share, resource access and decision-making systems. Moreover, compared with other regions, energy companies in the eastern region have a higher chance of obtaining digital benefits. Moreover, they can be more invested in driving the digitalization of their companies and thus proactively take on the crucial task of being a digitalization leader. Because of the lack of supporting conditions for digitalization in terms of policy, funding, and infrastructure, it is difficult for energy companies in the central and western areas to generate a positive contribution to green transition.

5 Conclusions and policy suggestions

Can digitalization improve energy companies’ green transition? Do technological innovation and operational capacity play a mediating role between digitalization and energy companies’ green transition? In response, this study selects a sample of Chinese listed energy companies to profoundly investigate how energy companies’ digitalization affects their green transition. This study’s primary contribution is to create a comprehensive empirical framework to analyze the impact mechanisms of energy companies’ digitalization affecting their green transition, narrowing the gaps in existing research. We find that digitalization can effectively drive energy companies’ green transition. Meanwhile, a sequence of robustness tests confirms this conclusion again. Furthermore, energy companies’ digitalization can enhance technological innovation and operational capacity, leading to a high level of green transition. Specifically, energy companies’ digitalization has a positive indirect effect on green transition by enhancing innovation and internal management. In addition, the promoting effect of digitalization on energy companies’ green transition is more pronounced in a subsample of SOECs, GECs and MECs, and companies in the eastern region.

Digitalization is a vital driving force for improving firm-level green transition and thereby promotes the healthy development of enterprises [46,62]. Based on the above conclusions, this paper proposes the following policy recommendations.

(1) Energy companies should strengthen their environmental awareness, seize the opportunities of digitalization and use digitalization to promote green transition. Energy companies should analyze their development model, explore the focus and difficulties of green transition, and use digitalization to purposefully improve the conditions for green transition and break through the dilemma of green transition. Therefore, to upgrade from traditional companies to digital companies, energy companies should fully grasp the development opportunities of digitalization and further stimulate the in-depth integration of digital technologies with enterprise development at the technical and organizational levels. Moreover, the government should strategically improve the digitalization process of energy companies. Specifically, the primary strategies include strengthening the construction of big data platforms and promoting the intellectual property protection of digital technologies and data assets, thereby enhancing the green effects of digitalization.

(2) Technological innovation in energy companies should be adapted to digitalization needs to minimize enterprise risks in convergent innovation. Moreover, we should build a comprehensive patent property rights protection system to promote the digitalization projects of enterprises to be locked and protected through patents, promoting enterprises’ digitalization strategy by commercializing research results. Furthermore, we should further promote the integration of digital technology applications with the production management of energy companies to achieve optimal allocation of resources and avoid unquestioningly expanding independent R&D investments, thus providing sustainable momentum for improving energy companies’ green transition.

(3) Policy formulation and implementation for energy companies’ digitalization should focus on refinement and differentiation. For instance, NSOECs should constantly be supported to use cutting-edge digital technologies more extensively to improve their core competitiveness in the market. Furthermore, GECs and MECs should be strongly encouraged to concentrate on strengthening the market-based promotion of digital applications. In addition, policymakers should promote the digitalization of central and western energy companies and provide the necessary external conditions for their digitalization strategies.

This study has its potential limitations. First, this research uses a strategy of integrating theoretical hypothesis and empirical testing, which may be explored from various perspectives. Future studies could construct a theoretical model to analyze how energy companies’ digitalization drives their green transition. In particular, a dynamic panel model can be considered to explore the impact of digitalization on the green transformation of energy companies. Second, although this research explores many listed energy companies, we could not conduct a study using the data of all Chinese energy companies because of data unavailability. Meanwhile, the implications of digitalization may change with time. Hence future studies should broaden the metrics and measurements of digitalization in future research. Third, we only examine technological innovation and operational capacity in the driving mechanisms of digitalization affecting energy companies’ green transition. Future research may consider other mechanisms, such as digital governance and human capital structure.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding authors.

Author contributions

YR: Supervision, Visualization, Writing–review and editing, Conceptualization, Methodology, Project administration. YX: Conceptualization, Methodology, Visualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Writing–original draft.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. Blue Project of Jiangsu Province (2023).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abiodun, T., Rampersad, G., and Brinkworth, R. (2022). Driving industrial digital transformation. J. Comput. Inf. Syst. 63 (6), 1345–1361. doi:10.1080/08874417.2022.2151526

Andriushchenko, K., Buriachenko, A., Rozhko, O., Lavruk, O., Skok, P., Hlushchenko, Y., et al. (2020). Peculiarities of sustainable development of enterprises in the context of digital transformation. Entrep. Sustain. Iss. 7 (3), 2255–2270. doi:10.9770/jesi.2020.7.3(53)

Baron, R. M., and Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

Bloom, N., Garicano, L., Sadun, R., and Van Reenen, J. (2013). The distinct effects of information technology and communication technology on firm organization. Manage. Sci. 60 (12), 2859–2885. doi:10.1287/mnsc.2014.2013

Buttice, V., Caviggioli, F., Franzoni, C., Scellato, G., Stryszowski, P., and Thumm, N. (2020). Counterfeiting in digital technologies: an empirical analysis of the economic performance and innovative activities of affected companies. Res. Policy 49 (5), 103959. doi:10.1016/j.respol.2020.103959

China Academy of Information and Communications Technology (2022). Global digital economy white paper.

Cong, L. W., Xie, D., and Zhang, L. (2021). Knowledge accumulation, privacy, and growth in a data economy. Manage. Sci. 67 (10), 6480–6492. doi:10.1287/mnsc.2021.3986

Curran, D. (2018). Risk, innovation, and democracy in the digital economy. Eur. J. Soc. Theory 21 (2), 207–226. doi:10.1177/1368431017710907

Feder, T. (2022). Germany’s green transition regains momentum. Phys. Today 75 (5), 23–25. doi:10.1063/pt.3.4998

Frank, A. G., Dalenogare, L. S., and Ayala, N. F. (2019). Industry 4.0 technologies: implementation patterns in manufacturing companies. Int. J. Prod. Econ. 210 (1), 15–26. doi:10.1016/j.ijpe.2019.01.004

Gaglio, C., Kraemer-Mbula, E., and Lorenz, E. (2022). The effects of digital transformation on innovation and productivity: firm-level evidence of South African manufacturing micro and small enterprises. Technol. Forecast Soc. 182, 121785. doi:10.1016/j.techfore.2022.121785

Galindo-Martín, M. A., Casta no-Martínez, M. S., and Mendez-Picazo, M. T. (2019). Digital transformation, digital dividends and entrepreneurship: a quantitative analysis. J. Bus. Res. 101, 522–527. doi:10.1016/j.jbusres.2018.12.014

Green, S. (2020). A digital start-up project–CARM tool as an innovative approach to digital government transformation. Comput. Syst. Sci. Eng. 35 (4), 257–269. doi:10.32604/csse.2020.35.257

Guenzi, P., and Habel, J. (2020). Mastering the digital transformation of sales. Calif. Manage. Rev. 62 (4), 57–85. doi:10.1177/0008125620931857

Guo, J., Wang, Y. N., and Yang, W. (2021). China’s anti-corruption shock and resource reallocation in the energy industry. Energ. Econ. 96, 105182. doi:10.1016/j.eneco.2021.105182

Hadjielias, E., Dada, O., Cruz, A. D., Zekas, S., Christofi, M., and Sakka, G. (2021). How do digital innovation teams function? Understanding the team cognition-process nexus within the context of digital transformation. J. Bus. Res. 122, 373–386. doi:10.1016/j.jbusres.2020.08.045

Kanabar, M., McDonald, J., and Parikh, P. (2022). Grid innovations and digital transformation: grid innovations and digital transformation of power substations are accelerating the energy transition for global utilities. Ieee. Power Energy M. 20 (2), 83–95. doi:10.1109/mpe.2022.3153784

Kemp-Benedict, E. (2018). Investing in a green transition. Ecol. Econ. 153, 218–236. doi:10.1016/j.ecolecon.2018.07.012

Ko, A., Feher, P., Kovacs, T., Mitev, A., and Szabo, Z. (2022). Influencing factors of digital transformation: management or IT is the driving force? Int. J. Inov. Sci. 14 (1), 1–20. doi:10.1108/ijis-01-2021-0007

Kohlir, R., and Melville, N. P. (2019). Digital innovation: a review and Synthesis. Inf. Syst. J. 29 (1), 200–223. doi:10.1111/isj.12193

Kohtamäki, M., Parida, V., Patel, P. C., and Gebauer, H. (2020). The relationship between digitalization and sericitization: the role of sericitization in capturing the financial potential of digitalization. Technol. Forecast Soc. 151, 119804–119809. doi:10.1016/j.techfore.2019.119804

Lange, S., Santarius, T., and Pohl, J. (2020). Digitalization and energy consumption: does ICT reduce energy demand? Ecol. Econ1. 76, 50–73. doi:10.1016/j.ecolecon.2020.106760

Lederman, D., and Zouaidi, M. (2020). Incidence of the digital economy and frictional unemployment: international evidence. Appl. Econ. 54 (51), 5873–5888. doi:10.1080/00036846.2022.2054927

Lee, C. C., Wang, C. W., Ho, S. J., and Wu, T. P. (2021). The impact of natural disaster on energy consumption: international evidence. Energ. Econ. 97, 105021. doi:10.1016/j.eneco.2020.105021

Li, F. (2020). The digital transformation of business models in the creative industries: a holistic framework and emerging trends. Technovation 92-93 (3-4), 102012. doi:10.1016/j.elerap.2020.101004

Li, K., Dan, J. K., Lang, K. R., Kauffman, R. J., and Naldi, M. (2020). How should we understand the digital economy in Asia? Critical assessment and research agenda. Electron. Commer. R. A 44, 101004.

Liu, Y. X., Lei, P., and He, D. Y. (2024). Endogenous green technology progress, green transition and carbon emissions. Int. Rev. Econ. Financ. 91, 69–82. doi:10.1016/j.iref.2023.12.007

Majchrzak, A., Markus, M. L., and Wareham, J. (2016). Designing for digital transformation: lessons for information systems research from the study of ICT and societal challenges. MIS Q 40 (2), 267–277. doi:10.25300/misq/2016/40:2.03

Merdin, D., Ersoz, F., and Taskin, H. (2023). Digital transformation: digital maturity model for Turkish businesses. Gazi. U. J. Sci. 36 (1), 263–282. doi:10.35378/gujs.982772

Miao, Z. L. (2021). Digital economy value chain: concept, model structure, and mechanism. Appl. Econ. 53 (37), 4342–4357. doi:10.1080/00036846.2021.1899121

Moretti, F., and Biancardi, D. (2020). Inbound open innovation and firm performance. J. Innov. Knowl. 5 (1), 1–19. doi:10.1016/j.jik.2018.03.001

Mubarak, M. F., and Petraite, M. (2020). Industry 4.0 technologies, digital trust and technological orientation: what matters in open innovation? Technol. Forecast Soc. 161, 120332. doi:10.1016/j.techfore.2020.120332

Mubarak, M. F., Tiwari, S., Petraite, M., Mubarik, M., and Raja Mohd Rasi, R. Z. (2021). How Industry 4.0 technologies and open innovation can improve green innovation performance? Manag. Environ. Qual. 32 (5), 1007–1022. doi:10.1108/meq-11-2020-0266

Murthy, K. V., Kalsie, A., and Shankar, R. (2021). Digital economy in a global perspective: is there a digital divide? Transnatl. Corp. Rev. 13 (1), 1–15. doi:10.1080/19186444.2020.1871257

Naimi-Sadigh, A., Asgari, T., and Rabiei, M. (2022). Digital transformation in the value chain disruption of banking services. J. Knowl. Econ. 13 (2), 1212–1242. doi:10.1007/s13132-021-00759-0

Nambisan, S. (2017). Digital entrepreneurship: toward a digital technology perspective of entrepreneurship. Entrep. Theory Pract. 41 (6), 1029–1055. doi:10.1111/etap.12254

Nunn, N., and Qian, N. (2014). US food aid and civil conflict. Am. Econ. Rev. 104 (6), 1630–1666. doi:10.1257/aer.104.6.1630

Ode, E., and Ayavoo, R. (2020). The mediating role of knowledge application in the relationship between knowledge management practices and firm innovation. J. Innov. Knowl. 5 (3), 210–218. doi:10.1016/j.jik.2019.08.002

Pan, W. R., Xie, T., Wang, Z. W., and Ma, L. S. (2022). Digital economy: an innovation driver for total factor productivity. J. Bus. Res. 139, 303–311. doi:10.1016/j.jbusres.2021.09.061

Paunov, C., and Rollo, V. (2016). Has the internet fostered inclusive innovation in the developing world? World Dev. 78, 587–609. doi:10.1016/j.worlddev.2015.10.029

Peng, Y. Z., and Tao, C. Q. (2022). Can digital transformation promote enterprise performance? From the perspective of public policy and innovation. J. Innov. Knowl. 7, 100198. doi:10.1016/j.jik.2022.100198

Renfors, S. M. (2024). Supporting green transition in the Finnish tourism sector by identifying green skills. Eur. J. Tour. Res. 36, 3612. doi:10.54055/ejtr.v36i.3223

Ribeiro-Navarrete, S., Botella-Carrubi, D., Palacios-Marques, D., and Orero-Blat, M. (2021). The effect of digitalization on business performance: An applied study of KIBS. J. Bus. Res. 126, 319–326. doi:10.1016/j.jbusres.2020.12.065

Sabli, N., Jaafar, N. I., and Azmi, A. C. (2023). Discovering the global landscape of digital economy: a two-decade bibliometric review. Technol. Anal. Strateg., 1–16. doi:10.1080/09537325.2023.2290153

Sidorov, A., and Senchenko, P. (2020). Regional digital economy: assessment of development levels. Mathematics 8 (12), 2143. doi:10.3390/math8122143

Sousa, M. J., and Rocha, A. (2019). Digital learning: developing skills for digital transformation of organizations. Future Gener. Comp. sy. 91, 327–334. doi:10.1016/j.future.2018.08.048

Syukur, A., and Muin, P. N. (2023). Public innovation and digital transformation by HanneleVäyrynen, NinaHelander, HarriJalonen, eds., 2022, London: routledge, 210 pages, £104.00 ($170.00) (hardback). ISBN 9781032137414. J. Policy Anal. Manag. 42 (4), 1143–1147. doi:10.1002/pam.22503

Taques, F. H., Lopez, M. G., Basso, L. F., and Areal, N. (2021). Indicators used to measure service innovation and manufacturing innovation. J. Innov. Knowl. 6 (1), 11–26. doi:10.1016/j.jik.2019.12.001

Tavoletti, E., Kazemargi, N., Cerruti, C., Grieco, C., and Appolloni, A. (2021). Business model innovation and digital transformation in global management consulting firms. Eur. J. Innov. Manag. 25 (6), 612–636. doi:10.1108/EJIM-11-2020-0443

Verhoef, P. C., Broekhuizen, T., Bart, Y., Bhattacharya, A., Dong, J. Q., Fabian, N., et al. (2021). Digital transformation: a multidisciplinary reflection and research agenda. J. Bus. Res. 122, 889–901. doi:10.1016/j.jbusres.2019.09.022

Vial, G. (2019). Understanding digital transformation: a review and a research agenda. J. Strateg. Inf. Syst. 28 (2), 118–144. doi:10.1016/j.jsis.2019.01.003

Wang, F., Sun, X. Y., Reiner, D. M., and Wu, M. (2020). Changing trends of the elasticity of China’s carbon emission intensity to industry structure and energy efficiency. Energ. Econ. 86, 104679. doi:10.1016/j.eneco.2020.104679

Wang, K. H., Su, C. W., Lobon, O. R., and Moldovan, N. C. (2019). Chinese renewable energy industries’ boom and recession: evidence from bubble detection procedure. Energ. Policy 138, 111200. doi:10.1016/j.enpol.2019.111200

Wang, X. Y., Yu, B. Y., An, R. Y., Sun, F. H., and Xu, S. (2022). An integrated analysis of China? s iron and steel industry towards carbon neutrality. Appl. Energ. 322, 119453. doi:10.1016/j.apenergy.2022.119453

Wielgos, D. M., Homburg, C., and Kuehnl, C. (2021). Digital business capability: its impact on firm and customer performance. J. Acad. Mark. Sci. 49 (4), 762–789. doi:10.1007/s11747-021-00771-5

Xu, Y. T., and Li, T. H. (2020). Measuring digital economy in China. Natl. Account. Rev. 4 (3), 251–272. doi:10.3934/nar.2022015

Yang, Y., and Chi, Y. (2023). Path selection for enterprises’ green transition: green innovation and green mergers and acquisitions. J. Clean. Prod. 412, 137397. doi:10.1016/j.jclepro.2023.137397

Yoo, Y., Boland, R. J., Lyytinen, K., and Majchrzak, A. (2012). Organizing for innovation in the digitized world. Organ. Sci. 23 (5), 1398–1408. doi:10.1287/orsc.1120.0771

Keywords: digitalization, green transition, energy companies, technological innovation, operational capacity

Citation: Ren Y and Xia Y (2024) Research on the impact of digitalization on energy companies’ green transition: new insights from China. Front. Energy Res. 12:1421832. doi: 10.3389/fenrg.2024.1421832

Received: 23 April 2024; Accepted: 09 September 2024;

Published: 18 September 2024.

Edited by:

Guoxiang Li, Nanjing Normal University, ChinaCopyright © 2024 Ren and Xia. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yangjun Ren, eWpyZW5AY3p0Z2kuZWR1LmNu

Yangjun Ren

Yangjun Ren Yuening Xia

Yuening Xia