- 1Faculty of Electrical, and Computer Engineering, University of Tabriz, Tabriz, Iran

- 2Education Committee, Smart Cities Society, Institute of Electrical and Electronics Engineers, Piscataway, NJ, United States

- 3College of Engineering, Lawrence Technological University, Southfield, MI, United States

- 4Department of Energy, Aalborg University, Aalborg, Denmark

Intelligent predictive models are fundamental in peer-to-peer (P2P) energy trading as they properly estimate supply and demand variations and optimize energy distribution, and the other featured values, for participants in decentralized energy marketplaces. Consequently, DeepResTrade is a research work that presents an advanced model for predicting prices in a given traditional energy market. This model includes numerous fundamental components, including the concept of P2P trading systems, long-term and short-term memory (LSTM) networks, decision trees (DT), and Blockchain. DeepResTrade utilized a dataset with 70,084 data points, which included maximum/minimum capacities, as well as renewable generation, and price utilized of the communities. The developed model obtains a significant predictive performance of 0.000636% Mean Absolute Percentage Error (MAPE) and 0.000975% Root Mean Square Percentage Error (RMSPE). DeepResTrade’s performance is demonstrated by its RMSE of 0.016079 and MAE of 0.009125, indicating its capacity to reduce the difference between anticipated and actual prices. The model performs admirably in describing actual price variations in, as shown by a considerable R2 score of 0.999998. Furthermore, F1/recall scores of [1, 1, 1] with a precision of 1, all imply its accuracy.

Introduction

The driving motivation behind this work lies in the domain of P2P electrical energy trading a promising solution to the limitations of traditional centralized energy markets this approach facilitates direct transactions between energy producers and consumers enhancing flexibility efficiency and sustainability in the energy sector (Moniruzzaman et al., 2023), however, issues occur as a result of renewable energy volatility and the requirement for precise price estimates, focusing on the importance of fair and reliable trading platforms. This word, which introduces the new DeepResTrade idea, presents Blockchain-enabled LSTM-DT-based price forecasting by employing historical data-based calculators that leverage artificial intelligence and machine learning algorithms to properly estimate energy prices. Interaction with operators and the restructuring of decentralized renewable energy markets, P2P members are enabled to make informed decisions. Integration of Blockchain technology provides a transparent method for communication, and data integrity in P2P energy marketplaces.

The vision of DeepResTrade extends to renewable energy communities encompassing producers and consumers alike through seamless transactions The system fosters local energy generation and consumption promoting collaboration and resource optimization in its structure the paper introduces the motivation reviews recent advances and presents the smart sustainable grid concept in P2P energy trading it details the DeepResTrade framework simulations results in comparative analysis future directions and concludes the study.

Accordingly, the paper is structured as follows: Section 1 is the introduction covering the motivation of the study and recent advances, and a literature review of the field presenting the smart sustainable grid in the presence of P2P energy trading, Section 2 details the structure and operating framework, Section 3 focuses on simulations and results, Section 4 provides a comparative analysis, as well Section 8 discusses future works and concludes the paper.

Literature review

The effectiveness, capacity, and robustness of the system presented in (Moniruzzaman et al., 2023), which combines cooperative game theory and blockchain technology to encourage safe peer-to-peer energy trading, was demonstrated by comprehensive analysis and experiments, resulting in 6.5% improvement in terms of energy savings compared to the baseline model in the financial benefits of prosumers. Chien et al. (2023) proposed auto-executing blockchain-based peer-to-peer energy transaction market. The proposal to integrate blockchain into the business system is motivated by the decline in conventional energy generation and the growing popularity of renewable energy sources such as solar energy to consider energy consumption to ensure transparency, security, and integrity of transactions, and forecasting for effective energy demand planning (Boumaiza and Sanfilippoa, 2022) deploys an ABM simulation framework to demonstrate the efficiency of blockchain in facilitating electricity exchange and implementing transactional energy distributed energy resources, demonstrating the effectiveness of a proposed hybrid deep learning neural network in power consumption forecasting within a blockchain-based local energy market. Consumer energy costs are reduced by 17.8%, and utility grid loads are reduced by 76.4% by using the Federated Network, a Blockchain-based P2P energy trading and sharing platform that incorporates federated learning (Bouachir et al., 2022; Wang et al., 2022) introduces a blockchain-based cloud service platform for an integrated energy market, which enables secure and efficient energy trading and dispatch. A reliable smart grid implementation is proposed, and a novel machine learning-based approach using MLP-ELM and PCA is employed to predict smart grid stability, which surpasses traditional techniques in high accuracy, precision, recall, and F-measure (Qayyum et al., 2022) Co-workers in nanogrids. Presents a predictive optimization model for peer-to-peer energy trading, demonstrates its potential in increasing efficiency and reducing costs to reduce costs and optimize energy sharing among peers A novel algorithm is proposed for community energy management control, which enables customer engagement in energy trading and can achieve a significant reduction in energy demand and interaction with the electricity grid (Merrad et al., 2022) presents a blockchain-based P2P energy trading platform, including the use of smart contracts, deep learning inferences, and K-means clustering for transparent and secure energy routing. Blockchain technology enables the elimination of the producer-consumer gap in distributed energy production, with a versatile ABM simulation framework demonstrating its potential in forecasting household electricity usage within the ECCH microgrid (Boumaiza and Sanfilippob, 2023; Piao et al., 2023) proposed a P2P electricity trading framework for distributed photovoltaic power stations, using blockchain-based federated learning for decentralized model training and smart contracts for market matching and transaction recording, reliable and trustworthy transactions in the growing distributed energy landscape.

A self-tuned ANN-based adaptive predictor for accurate power consumption forecasting is proposed, with its design, training process, and results characterization, and its effects demonstrated through practical examples using K-means clustering and genetic algorithm (Baba, 2022). Gomes et al. (2022) proposed a practical solution that deploys end-user energy management systems, enables energy forecasting, and establishes a distributed discrimination-price auction peer-to-peer energy transaction market. This solution demonstrates its ability to reduce costs and validate forecasting models in real-world settings. A P2P Energy Management System (EMS) is presented, which uses energy forecasts 2 days in advance to minimize the net energy exchange with the utility and enables surplus energy sharing among users, resulting in improved energy independence and reduced operating costs (Al-Sorour et al., 2022; Choobineh et al., 2023) presents an overview of the development of blockchain, and its use in power systems, and explores barriers and emerging trends to widespread adoption in the power sector, emphasizing its potential for secure, decentralized energy trading platforms. The role of blockchain technology (BCT) in sustainable smart cities is examined, its applications in various fields are analyzed and trends, challenges, and future research directions are presented (Ullah et al., 2023; Lin et al., 2022) proposed a blockchain-based smart EV charging system to address congestion and demand imbalance, for privacy, fairness, and real-time control. A customized pricing scheme for a local electricity market (LEM) with distributed energy resources, including behind-the-meter photovoltaics (BTM PV) and energy storage (ES), is proposed, where the LEM agent, which is an ES system, works. Facilitates energy sharing within markets and communities, resulting in LEM agent profitability increasing from 4% to 130%, depending on weather conditions and load patterns (He and Zhang, 2023; Li et al., 2023) proposed a load forecasting method for energy cell-tissue systems that incorporates inter-cellular correlations using a BiLSTM network to enhance forecasting accuracy.

A hierarchical electricity trading scheme is presented to optimize power system functioning in smart grids using peer-to-peer electricity trading (Symiakakis and Kanellos, 2023; Niaei et al., 2022) presented an energy-sharing architecture based on peer-to-peer (P2P) that maximizes customer involvement, cost, revenue, and real-time programming to maximize profitability and revenue while managing unpredictability. Results for edge weight prediction in financial networks are obtained through the construction and training of deep learning models, with implications for portfolio diversification and systemic risk management (Bhattacharjee et al., 2022; Jin et al., 2023) presented a peer-to-peer (P2P) trading technique for power management in nanogrids using renewable energy sources (RES) and energy storage systems (ESSs). Electricity costs in smart homes are reduced by optimizing smart appliance scheduling and using a smart bidding technique for P2P trade, which minimizes grid reliance and leads to significant cost reductions (Kanakadhurga and Prabaharan, 2022; Timilsina and Silvestri, 2023) describes an automated framework for peer-to-peer energy trading that takes into consideration user perception and behavioral modeling to maximize utility for buyers while increasing profitability for sellers. In the absence of specialized models, an attempt is made to offer a price prediction approach based on machine learning and created statistical models (Mohamed et al., 2022; Hashemipour et al., 2022) provided a more accurate and economical way for simulating EV uncertainty in P2P trading, with less computing cost. To increase the accuracy of day-ahead forecasting, a unique dense dropout attention-based deep learning model is developed in (Li et al., 2022; Annamalai et al., 2022a) developed an adaptive machine learning-based SOC estimate (OML-SOCE) model for HEVs in TEM, ensuring dependable operation and effective battery balancing. A regulated peer-to-peer market structure is proposed allowing energy curves to be submitted by prosumers in transactive energy systems and achieving significant reductions in peak load and ramp rates while promoting local electricity generation (Lee and Zhang, 2023; Mehdin et al., 2022) proposed a decentralized energy market for small-scale prosumers, facilitating P2P trading and addressing uncertainty through robust optimization and the FADMM approach. Distributed TE management for P2P energy trading considers network constraints, utilizes the AC OPF model, and employs decentralized transaction clearing (Zhou et al., 2023; Nguyen, 2023) explores stochastic market clearing solutions in P2P energy markets, deriving explicit formulas for probability density functions and validating theoretical findings through simulations. A decentralized dual-loop scheme is proposed for network-aware peer-to-peer multi-energy scheduling and trading (P2P-MEST) in decentralized electric-heat systems, resulting in enhanced efficiency and cost reduction (Sun et al., 2023; Sedgh et al., 2023) A completely decentralized P2P electricity and gas market provides improved flexibility and economy, as well as the ability to engage in bilateral discussions with retailers and merchants to sell power upstream. Furthermore (Jamil et al., 2021), discusses the significance of AI in smart grids (Safari and Ghavifekra, 2021a). discusses quantum technologies in the context of smart grids, with a focus on predictive characteristics (Safari, 2022). uses precise AI-driven stock estimates (Safari and Ghavifekrb, 2021b). provides dependable AI-powered pricing projections (Abriz et al., 2023). looks into the frequency control of microgrids using a modified COA (Gharehbagh et al., 2023). investigates the impact of eclipses on Danish electrical stability, with a focus on dependability.

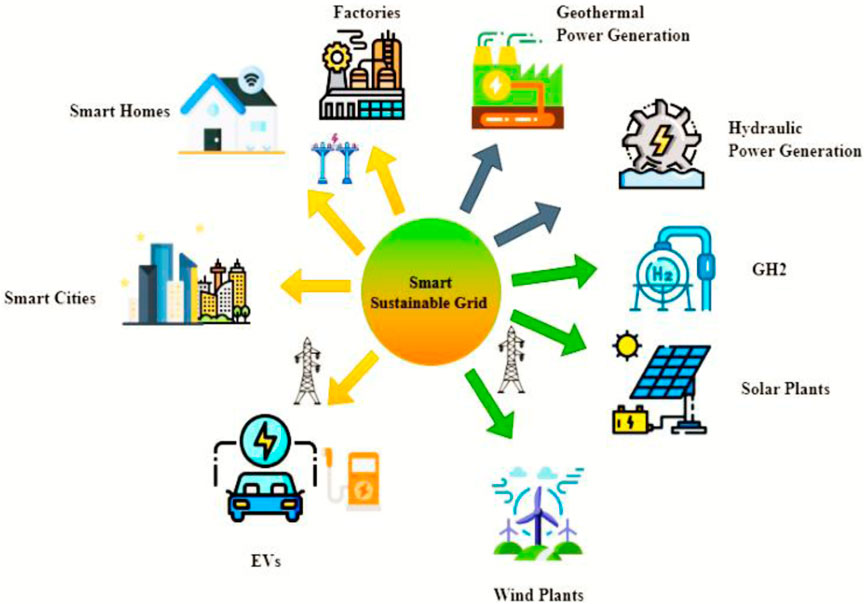

Smart sustainable grids are advanced power distribution systems that integrate various technologies to efficiently manage energy generation distribution and consumption while promoting sustainability and environmental responsibility, as conceptualized in Figure 1. These grids are designed to improve the reliability flexibility, and efficiency of the energy infrastructure while accommodating the integration of renewable energy sources and enabling P2P energy trading.

The fundamental components of Smart Sustainable Grids include:

Advanced Metering Infrastructure (AMI): Smart meters are deployed at consumer premises to measure real-time electricity consumption and communicate the data back to the utility company this enables consumers to monitor their energy usage and make informed decisions to optimize consumption patterns and reduce waste.

Renewable Energy Integration: Smart grids facilitate the seamless integration of renewable energy sources such as solar wind and hydroelectric power into the existing energy grid by managing these variable energy sources efficiently the smart grid can ensure a stable and consistent energy supply.

Energy Storage Systems: The inclusion of energy storage systems such as batteries allows excess energy generated during peak times to be stored and used when demand exceeds supply this feature helps to balance the grid and reduces the need for traditional fossil fuel-based backup power plants.

Demand Response: Smart grids enable demand response programs that incentivize consumers to adjust their energy consumption during peak periods through real-time pricing or other methods consumers can choose to reduce electricity usage when demand is high thereby reducing strain on the grid and enhancing its stability.

Distribution Automation: Automation and advanced control systems in smart grids enable rapid fault detection isolation and restoration this helps minimize downtime during power outages and reduces the overall operational costs of maintaining the grid.

P2P Energy Trading: One of the revolutionary features of smart sustainable grids is the implementation of P2P energy trading P2P trading allows individuals and businesses to buy and sell excess energy directly with each other through a decentralized platform this creates a new dynamic where prosumers consumers who also produce energy can become active participants in the energy market fostering a more community driven and decentralized approach to energy distribution.

The incorporation of P2P energy trading in smart grids offers several advantages:

Decentralization: P2P energy trading reduces the reliance on a central authority for energy distribution instead it empowers local communities and individuals to take charge of their energy needs promoting energy autonomy.

Enhanced Efficiency: P2P trading enables surplus energy generated from renewable sources to be efficiently distributed and utilized within the local community reducing transmission losses and promoting overall grid efficiency.

Flexibility and Resilience: With P2P trading communities can remain resilient during disasters or grid failures if the centralized grid goes down participants can still rely on localized energy transactions.

Cost Savings: By eliminating intermediaries and reducing transmission costs P2P trading can lead to cost savings for both energy producers and consumers.

Renewable Energy Encouragement: P2P trading provides a direct market for renewable energy producers encouraging more individuals and businesses to invest in clean energy generation.

Structure and operating framework

Overall structure

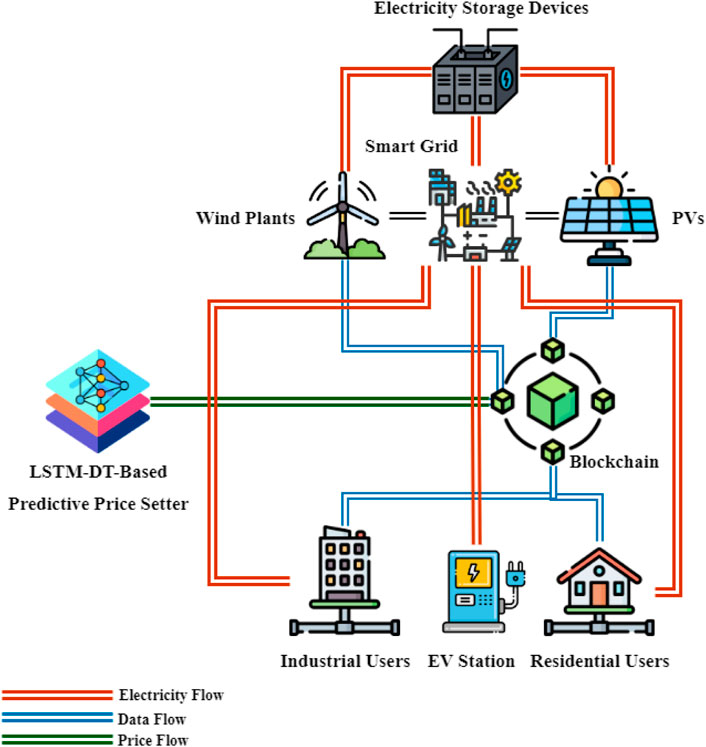

The architecture of DeepResTrade is designed to seamlessly integrate advanced predictive models and blockchain technology creating a robust and efficient system for P2P energy trading in decentralized renewable energy markets The framework consists of two main components the LSTM-DT-based price prediction model and the blockchain-enhanced trading system. The overall process of DeepResTrade is presented in Figure 2.

The overall process of DeepResTrade entails a seamless and efficient flow enabling accurate price prediction and secure P2P energy trading within decentralized renewable energy markets this comprehensive process initiates with the meticulous collection of historical data comprising crucial variables such as market prices maximum power minimum power and renewable energy production to ensure consistent and precise training of the LSTM-DT based price prediction model the collected data undergoes essential preprocessing steps including normalization and feature scaling subsequently the preprocessed data is utilized to train the long short term memory LSTM model which serves as the cornerstone of DeepResTrade’s price prediction capabilities the LSTM-DT network is expertly designed to capture temporal dependencies present in the historical data empowering it to generate accurate forecasts of future energy prices through a rigorous iterative training process the LSTM-DT model learns and optimizes its predictive capabilities becoming proficient in providing reliable and trustworthy energy price forecasts.

The next crucial phase of the process involves trading decision making leveraging the accurate price predictions derived from the LSTM-DT model active participants within the P2P energy market make informed and data driven trading decisions DeepResTrade adopts a straightforward yet effective trading strategy where a buy decision is executed when the predicted price exceeds the previous value indicating a potential price increase conversely a sell decision is implemented if the predicted price is lower hinting at a potential price decrease these informed trading actions facilitate a transparent and efficient trading environment for all participants to instill transparency in the trading process DeepResTrade integrates blockchain technology into its framework all trading decisions made by market participants are securely recorded as individual blocks within the blockchain each block comprehensively encapsulates vital information including the timestamp of the trade the predicted price at the time of the trade and the corresponding trading action undertaken by operating as a decentralized and tamper proof ledger the blockchain ensures that all participants possess access to identical transparent information this fosters an environment where trust and fairness prevail reinforcing the credibility of the P2P energy trading ecosystem following the successful execution of trading decisions DeepResTrade offers the opportunity for post trade analysis market participants can thoroughly assess the accuracy of the LSTM-DT predictions and the overall performance of their trading strategies such valuable insights enable participants to fine tune their trading approaches optimize their strategies and capitalize on emerging market trends accordingly DeepResTrade empowers market participants within decentralized renewable energy markets to make well informed and data driven decisions optimize their trading strategies and actively contribute to the development of a sustainable energy ecosystem the seamless integration of advanced predictive models specifically the LSTM-DT based price prediction model with the enhanced security of blockchain technology establishes DeepResTrade as a pioneering solution for the future of P2P energy trading promoting a cleaner greener and more efficient energy landscape.

P2P structure: a case study of IEEE 14-bus system

The world is undergoing a remarkable transformation in the energy sector driven by the increasing integration of renewable energy sources the proliferation of smart grid technologies and the rise of innovative solutions among these groundbreaking developments P2P energy trading has emerged as a promising concept that has the potential to revolutionize the way we produce distribute and consume energy P2P energy trading is an innovative system that enables consumers and prosumers to directly exchange surplus energy with each other fostering a decentralized and sustainable energy exchange ecosystem P2P energy trading is an advancement in the energy sector that leverages blockchain technology and smart grid capabilities to enable direct energy exchange between individual consumers and prosumers in a traditional energy model consumers rely on centralized utilities for their energy needs which are usually generated from non-renewable sources however with P2P energy trading consumers who generate their own energy through renewable sources such as solar panels or wind turbines can sell their surplus energy to nearby consumers creating a more localized and sustainable energy economy.

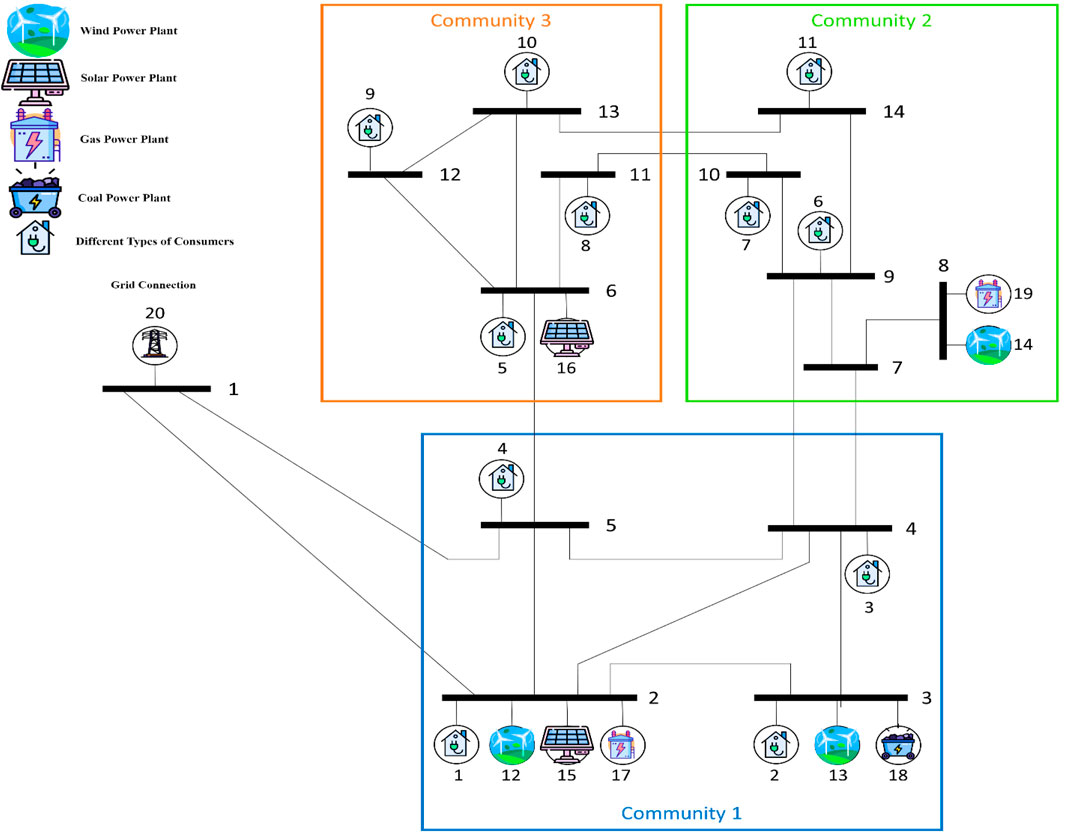

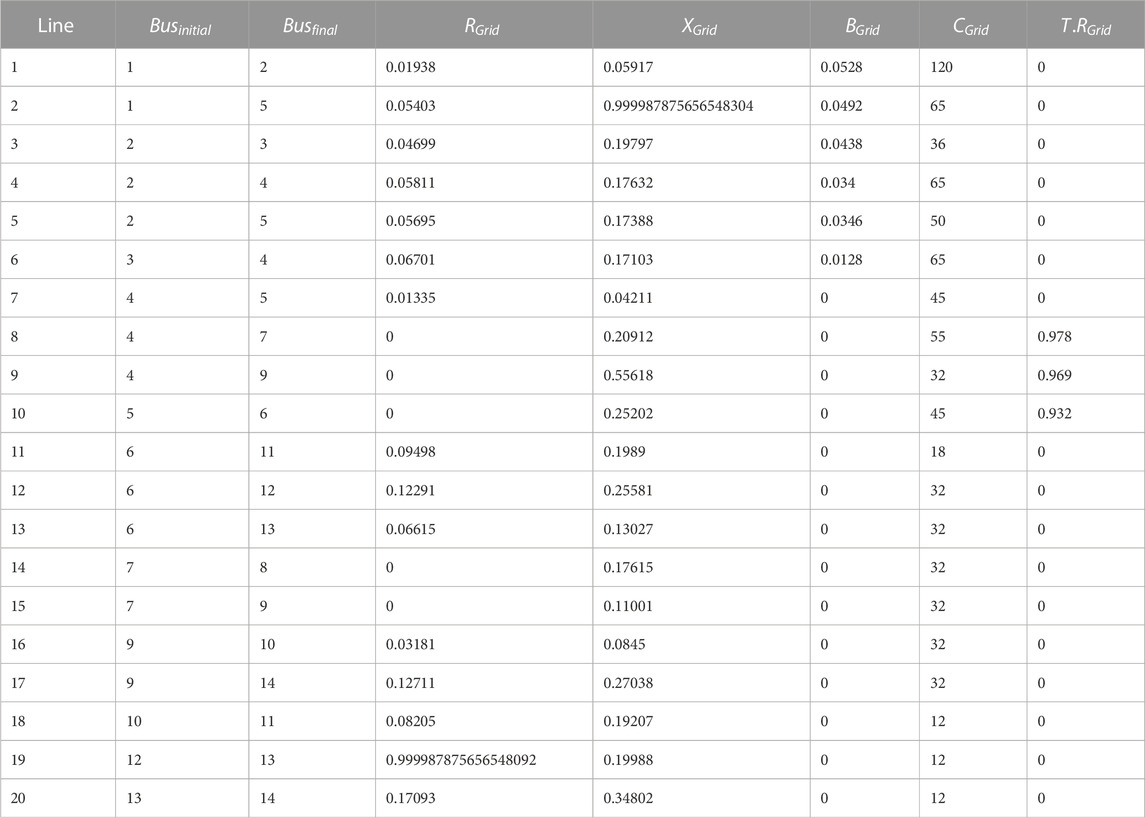

P2P energy trading in the IEEE 14-Bus system demonstrates how this innovative concept can be implemented in a small-scale power grid to enable decentralized energy exchange among consumers and prosumers. The IEEE 14-Bus system is a widely used standard test system in power system research and serves as an excellent platform for exploring P2P energy trading s feasibility and benefits the structure of the IEEE 14-Bus system is presented in Figure 3 and Table 1 as shown in this figure the IEEE 14-Bus system represents a simplified but realistic model of a power distribution network with 14 buses 20 transmission lines and 5 generators it is commonly used for power system analysis and control studies due to its moderate complexity and diverse system components to integrate P2P energy trading into the IEEE 14-Bus system several components and strategies can be employed:

Smart Meters: The first step is to install smart meters at consumer and prosumer locations these smart meters enable real-time monitoring of energy generation and consumption data which is crucial for facilitating energy trading and ensuring accurate billing.

Communication Infrastructure: Robust communication infrastructure is required to enable data exchange between smart meters and the trading platform communication protocols, such as WiFi or cellular networks can be used to establish secure and reliable connections.

Trading Platform: A decentralized trading platform using blockchain technology can be implemented the blockchain acts as a ledger recording all energy transactions and ensuring transparency and immutability.

Tariff and Pricing Mechanism: Establishing a judicious and equitable tariff and pricing framework assumes paramount importance in catalyzing the active engagement of both consumers and prosumers within the dynamic tapestry of the P2P energy trading ecosystem this intricate orchestration necessitates the calibration of pricing mechanisms that harmoniously align the interests of prosumers who contribute their surplus energy to the grid with those of consumers seeking an economical energy supply striking this delicate balance entails meticulous consideration of factors spanning energy production distribution costs market dynamics and the prevailing regulatory landscape prosumers the linchpin of this paradigm shift stand poised to be adequately incentivized through a compensation structure that accurately reflects the value of their surplus energy contributions thus fostering a sense of recognition and fair reward for their pivotal role in the energy ecosystem concurrently consumers stand to reap the rewards of a competitive pricing environment where the allure of cost effective energy beckons thereby amplifying their motivation to actively participate and fortifying the foundations of a sustainable mutually beneficial P2P energy trading frontier.

The P2P system on the IEEE 14-Bus system is formulated as, conceptualized form (Jin et al., 2020):

In which,

Once the price is established, individuals make scheduling decisions aimed at maximizing their utility. These decisions take into account factors such as surplus power, load consumption, required demand, grid energy price, P2P trading price, and other relevant variables. The primary goal is to determine the optimal quantity to be traded within a 1-h time frame, ensuring the maximization of revenue. The objective function and constraints governing the determination of sales quantity for the prosumers can be outlined as follows:

Where,

In (3),

The constraints for the sales energy determination algorithm are outlined in (4) to (21). Equation 4 ensures energy balance, while Equation 5 determines the State of Charge (SOC) of the Energy Storage System (ESS) based on the SOC from the previous time step and the ESS output power in the current time step. Equation 6 allows the final and initial SOCs of the ESS to be set to the same value, which can be adjusted as desired. Additionally, Equation 7 and (8) impose limitations on the ESS output power to stay below the rated capacity.

Equation 9 and (10) introduce constraints related to the quantity of trading with the main grid, ensuring that it remains within defined limits. Equation 11 through (21) establish upper and lower bounds for the decision variables.

Operating framework

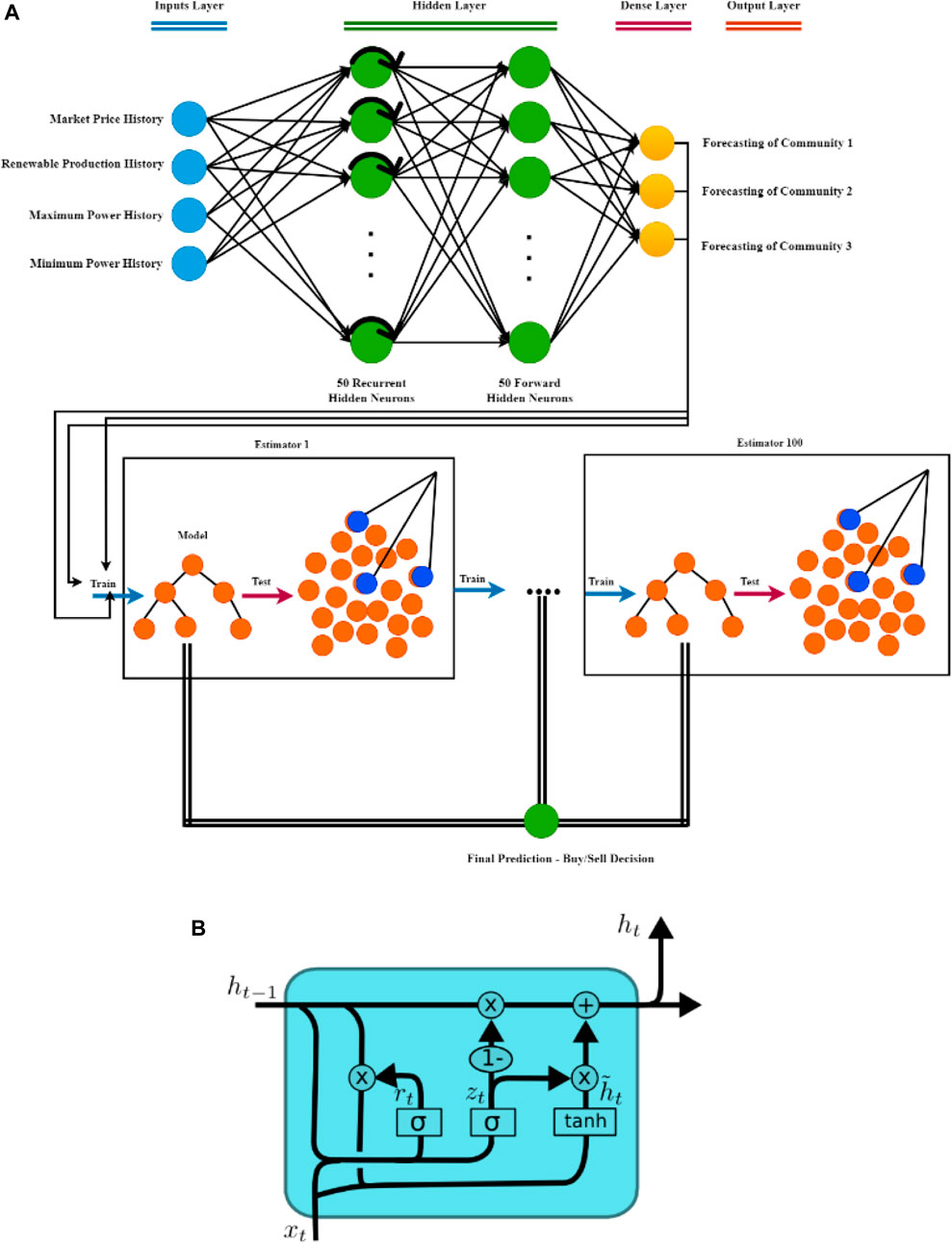

The LSTM-GBR structure of DeepResTrade forms the core of its advanced price prediction capabilities for P2P energy trading in decentralized renewable energy markets The LSTM model is a specialized type of recurrent neural network rnn that excels at capturing long-term dependencies and temporal patterns in sequential data making it well suited for time series forecasting tasks. The LSTM structure of the system is depicted in Figure 4.

According to Figure 4, the input to the LSTM-DT structure consists of historical data including market prices maximum power minimum power, and renewable energy production preprocessed and scaled to ensure consistency and optimal training the LSTM-DT architecture is designed to process sequential data efficiently allowing it to learn from past observations and generate accurate predictions of future energy prices.

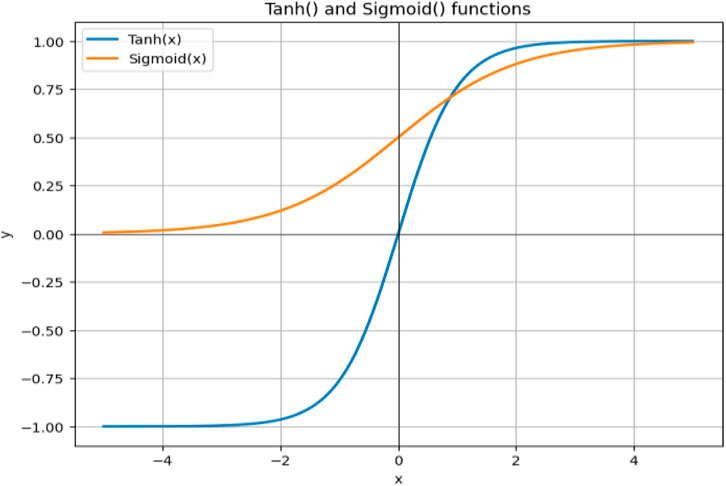

DeepResTrade’s LSTM-DT model comprises multiple LSTM cells, and Decisioning trees each responsible for capturing and storing relevant information from the input sequence these LSTM-DT cells maintain a memory state that enables them to retain information from earlier time steps and selectively forget or update this information based on the relevance to the current prediction this characteristic of LSTM-DT networks/trees makes them particularly adept at addressing the vanishing gradient problem which commonly occurs in traditional RNNs and empowers them to handle long term dependencies effectively the LSTM-DT model of DeepResTrade is arranged in layers with the first layer accepting the input data and subsequent layers facilitating the learning of increasingly complex patterns the return sequence parameter is set to true for the first LSTM layer to ensure that the output of each time step is passed to the subsequent LSTM layer furthermore the LSTM structure is augmented with dense layers to consolidate and refine the extracted features before generating the final prediction the final dense layer ensures that the output has the same number of features as the input making it suitable for price forecasting across multiple dimensions including market price renewable production and power limits. The LSTM formulation is performed as:

Where,

Also,

For the last step, the final prediction should be derived by Decision Tree:

In which,

DeepResTrade’s LSTM-DT structure undergoes a supervised learning process where historical data is fed into the model the model is trained to minimize my loss function between its predictions and the true labels through extensive training iterations the LSTM structure effectively learns from historical data to identify temporal patterns and adapts to dynamic changes in the energy market enabling it to provide highly accurate and reliable price predictions the integration of the LSTM-DT based price prediction model with blockchain technology ensures that DeepResTrade excels in transparent P2P energy trading promoting a sustainable and efficient energy ecosystem for the future. Accordingly, the overall PSEUDOCODE of DeepResTrade is defined in Algorithm 1.

Algorithm 1. Overall Algorithm of DeepResTrade.

Data Preparation:

Collect market price, min power, max power, and renewable generation data.

Organize the data into a matrix format where each row represents a data point with these attributes.

Train-Test Split:

Split the data into training and testing sets (e.g., 80% training, 20% testing).

Maintain the order of data to preserve temporal relationships. LSTM Model:

Initialize an LSTM (Long Short-Term Memory) neural network.

Configure the LSTM layers, such as the number of units, activation functions, and input shape.

Compile the model with an appropriate optimizer and loss function.

Train LSTM:

Extract features (Market Price, Min Power, Max Power, Renewable Generation) and target (Buy/Sell decision) from the training data.

Fit the LSTM model using the training data, specifying the number of epochs and batch size.

Decision Tree Model:

Initialize a Decision Tree classifier.

Train Decision Tree:

Train the Decision Tree model using the same training data used for the LSTM model.

Analysis:

Extract features from the testing data.

Use the trained LSTM model to predict Buy/Sell decisions for the testing data.

Use the trained Decision Tree model to predict Buy/Sell decisions for the testing data.

Consensus:

Combine the predictions from the LSTM and Decision Tree models. A simple approach might be averaging the predictions.

Blockchain Integration:

Initialize a blockchain object.

For each data point’s consensus prediction:

Determine the final decision (Buy/Sell) based on the consensus prediction.

Create a transaction data containing a timestamp and the decision.

Add the transaction to the blockchain.

Display Blockchain or Perform Transactions:

Display the final blockchain with all the transactions, showing the decision and timestamp for each.

Simulations and results

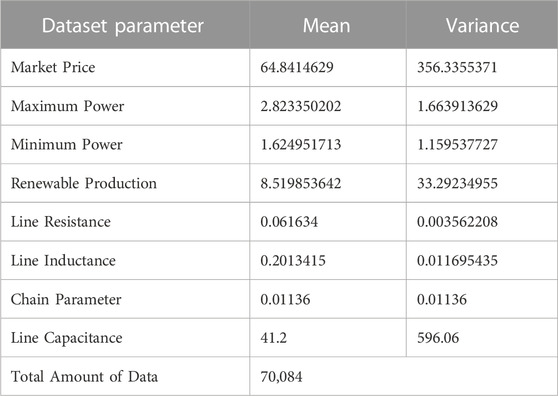

Using a data set of 70,084 data points, this study created a P2P trading system based on LSTM-based price forecasting. Market pricing, maximum power, minimum power, and renewable generation statistics were all included in the data collection (Sousa et al., 2018). The system was tested in three communities: producers and consumers, as well as renewable energy resources. The goal was to evaluate the LSTM model’s feasibility and performance in projecting prices for decentralized energy markets. The export price has a mean of 64.8414629, reflecting an average pricing level, with a variation of 356.3355371, indicating price swings and maximum power has a mean of 2.823350202, demonstrating an average maximum power capacity, with a variance of 1.663913629. The minimal power required to expose the range of variance within the data signifies the average and spread of the minimum power values. The dataset has a mean of 8.519853642 and a variation of 33.29234955 in terms of renewable generation, demonstrating typical renewable energy generation levels and the degree of variability within the dataset. Moving on to the electrical network’s characteristics, the line resistance has a mean of 0.061634 and a variance of 0.003562208, reflecting the network’s average resistance level and fluctuation. The line inductance has a mean of 0.2013415 and a variance of 0.011695435, reflecting the network’s average inductance and degree of fluctuation. The chain parameter also has a mean of 0.01136 and a variance of 0.01136, showing the average value and range of shifts. Finally, the average line capacitance is 41.2, with a variance of 596.06, providing insight into the average capacitance level and its variability. Also, the detailed information of the utilized data is available in Table 2.

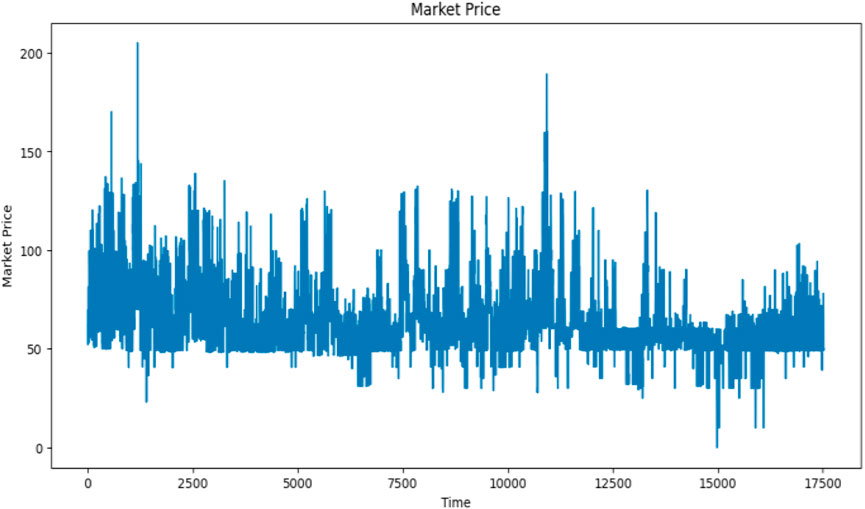

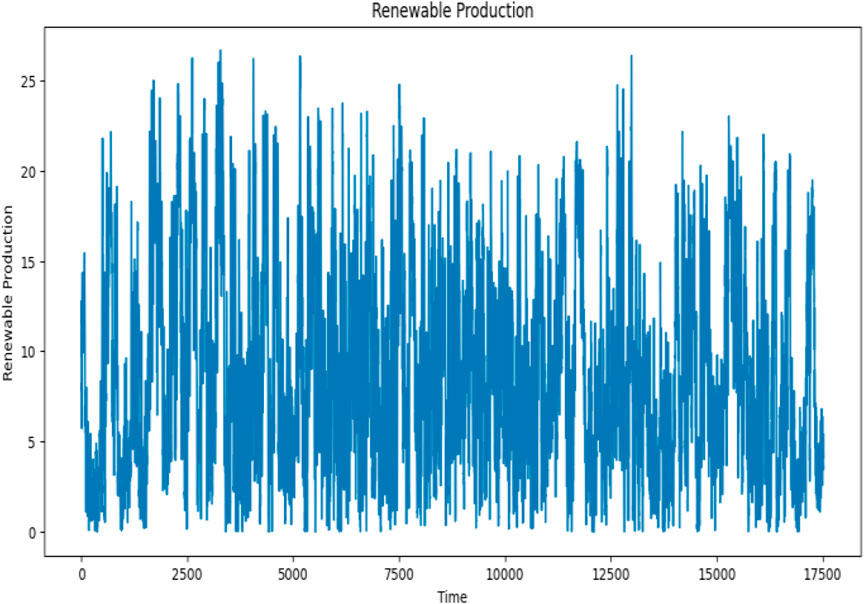

To test the performance and efficiency of the built P2P trading system, simulations were run using the DeepResTrade framework. The integrated LSTM-based price prediction model in the DeepResTrade framework employed a data set of 70,084 data points. This data collection contains information on market pricing, peak capacity, minimum capacity, and renewable generation. The system was put to the test in three communities: producers, consumers, and renewable energy. DeepResTrade simulation findings were quite encouraging. The LSTM model displayed amazing accuracy in capturing dynamic market pricing, peak efficiency, minimum efficiency, and renewable generation while working within the system. Parameters such as line resistance, line current, series parameter, and line capacitance might all be taken into account by the system. These simulations’ average and exchange values gave a greater comprehension of network activity and its implications on decentralized energy markets DeepResTrade simulations proved the efficiency and efficacy of the P2P trading system. In the process, the LSTM model enabled accurate price forecasting through efficient and consistent trade among local players. Research on power grid characteristics has improved our understanding of system performance and its implications for decentralized energy markets. Market price and renewable production are conceptualized in Figures 6, 7, respectively.

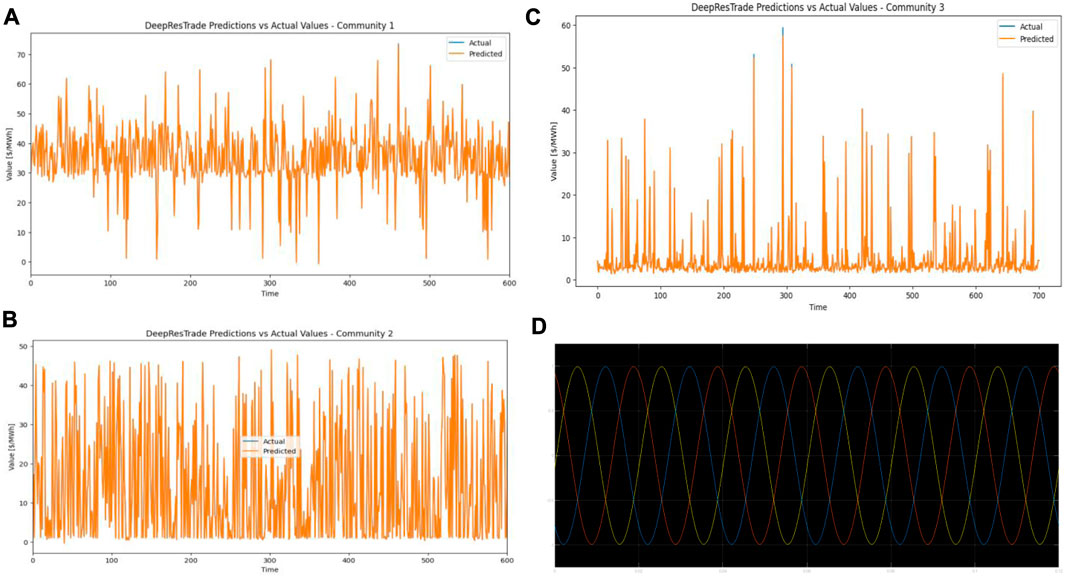

Figures 6, 7 show that both market pricing and renewable generation have a considerable impact on decision-making. The market price is an important aspect that influences trading decisions inside the system. Using historical market pricing data, DeepResTrade’s LSTM-DT-based model predictions future price trends. These projections influence the business decisions made by P2P market participants. If the LSTM-DT model predicts an increase in market price, for example, participants may place purchase orders in anticipation of a profitable transaction. If the model predicts a reduction in market price, sell orders may be supported in order to avoid further losses. The LSTM-DT model’s price prediction accuracy has a direct influence on the profitability and success of business decisions made inside the P2P system. In addition, DeepResTrade P2P trading outcomes in three communities are expected in Figure 8.

FIGURE 8. P2P market price-based strategy prediction in (A) community 1, (B) community 2, (C) community 3, and (D) voltage of all 14 buses in normal status.

Based on Figure 8, DeepResTrade achieved significant success in implementing a peer-to-peer trading system in three different communities. This system effectively managed the sharing of energy resources, allowing producers to securely offer extra renewable energy to consumers. To improve the trading process, DeepResTrade used an advanced price prediction model called LSTM. This model accurately forecasted prices, helping participants make smarter trading choices based on expected price trends. These precise predictions decreased risks and led to more profitable transactions.

DeepResTrade has also incorporated blockchain technology. Blockchain’s immutable records provide a trusted system, reducing fraud risks and improving market integrity. In addition to economic benefits, DeepResTrade had significant environmental benefits. By promoting the exchange of renewable energy, the system contributes to a sustainable energy future. Participants were encouraged to adopt green energy options, thereby reducing their carbon footprint and supporting sustainable practices. DeepResTrade’s results highlight its potential to transform decentralized energy markets and shape the future of P2P energy trading.

The capacity of the framework to maximize resource utilization, give accurate price estimates, improve trade potential, provide transparency and security, and encourage sustainable energy practices highlights its significance in the renewable energy industry. Future studies should concentrate on assessing the framework’s scalability, real-world application, and performance in various market scenarios to fully realize its promise in the energy business. Blockchain technology improves the business process in the system illustration (Figure 8). Blockchain is made up of blocks that include information like timestamps, business decisions, and hash values. The following blocks are concatenated with decisions and previous hash values, beginning with a genesis block. The integrity of a blockchain is determined by whether the hash of each block matches the hash of the preceding block.

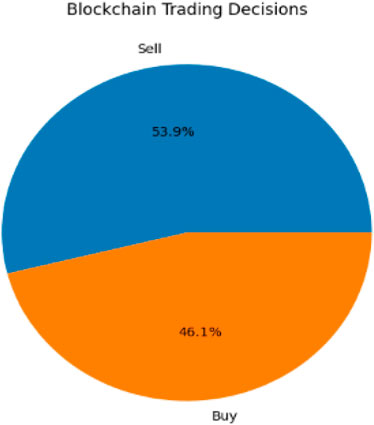

Trading choices in simulations are based on LSTM model predictions. Each purchase or sale decision is recorded as a new block on the blockchain. Blockchain records transaction history transparently and securely. The legitimacy of the blockchain is determined by confirming that all blocks’ hashes and preceding hash values match. Furthermore, as illustrated in Figure 9, trading choices saved in the blockchain may be evaluated by looking at the frequency of buying and selling decisions, providing trading patterns, and the efficacy of the LSTM model in generating lucrative decisions.

To evaluate the performance of DeepResTrade, multiple KPIs were considered and performance evaluation results were determined.

Mean absolute percentage error (MAPE)

The average percentage difference between expected and actual values is measured by MAPE. It is determined by taking the average of the absolute differences between the expected and actual values and multiplying it by 100.

Root mean square percentage error (RMSPE)

RMSPE is a measure of the root mean square percentage difference between anticipated and actual values, comparable to MAPE. It is determined by dividing the anticipated and actual values by the square root of the average of the squared discrepancies, multiplied by 100.

RMSE (root mean square error)

In regression settings, the root mean square error (RMSE) is a statistic that is frequently used to assess the average magnitude of the mistakes between the predicted and actual values. It is calculated using the square root of the average of the squared discrepancies between the expected and actual values. The root mean square error (RMSE) is a metric that assesses how well a regression model fits the data, with lower values indicating better performance. The RMSE value is expressed in the same units as the target variable. RMSE is formulated as:

Where n is the number of data, and

MAE (mean absolute error)

Another statistic used to assess the performance of regression models is MAE. The average absolute difference between anticipated and actual values is calculated. MAE, unlike RMSE, does not punish big mistakes excessively since it only examines absolute differences. MAE is calculated using the same units as the target variable, as follows:

Precision

Accuracy is a statistic used in binary classification to calculate the proportion of genuine positive predictions (properly predicted positive cases) vs. total predicted positive instances. Accuracy is concerned with the accuracy of optimistic forecasts. It is determined by dividing the total number of true positives by the total number of false positives, symbolized below:

That,

Recall

Recall, also known as sensitivity or true positive rate, is a binary classification statistic that measures the proportion of true positive predictions out of all true positive cases. The capacity of a model to locate all positive occurrences is the focus of recall. It is determined by dividing the total number of true positives by the total number of false negatives. Recall is calculated as:

F1 score

The F1 score is a single-value statistic that combines accuracy and recall. It is a balanced measure of a model’s performance since it is the harmonic mean of accuracy and recall. The F1 score is a number between 0 and 1, with 1 being the greatest possible performance. When the class distribution is imbalanced and a single measure is required to evaluate the model:

, mean, and variance of the community data are calculated as follows:

Where n is the number of data,

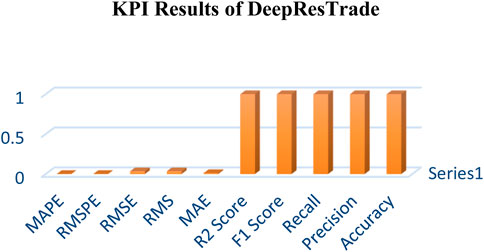

In terms of forecast values, the DeepResTrade model outperformed the other models, with a MAPE of 0.999987% and a MAPE of 0.000975%. These measures are highly accurate, with just minor discrepancies between anticipated and actual values and root mean square percentage differences. The model’s correctness was confirmed by its RMSE of 0.016079 and MAE of 0.009125, indicating that there were only minor variations between predicted and actual data. The model explained the variation in the original data, with an R2 score of 0.999998 indicating an excellent match. An F1 score of [1, 1, 1] indicates that the anticipated values are accurate and reliable. The model also has a high recall of [1, 1, 1], which detects positive conditions correctly. As well, this model obtained a high degree of accuracy in its predictions, with an amount of 1, as presented in Figure 10.

Overall, these impressive performance metrics highlight the effectiveness and accuracy of the DeepResTrade model in predicting the values.

Comparison

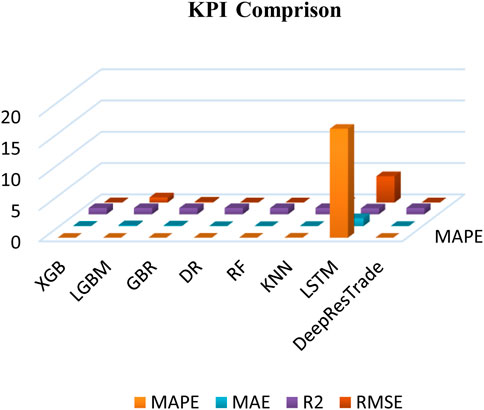

In this section, a comprehensive comparison is presented between DeepResTrade and other intelligent models in the scope of P2P electrical energy trading. The comparison is based on several KPIs including RMSE, MAE, MAPE, and R2. These metrics are utilized as critical benchmarks to evaluate the predictive accuracy and effectiveness of the different systems. The comparison is available in Table 3 and Figure 11.

DeepResTrade has shown impressive results, exceeding other efforts in the field of peer-to-peer energy trading. The system displayed high forecasting accuracy in anticipating energy costs, with a low RMSE of 0.01607904605926803 and an MAE of 0.009125763632771632. DeepResTrade, for instance, got an considerable low MAPE of 0.999987875656548%, suggesting great prediction accuracy. Furthermore, the system had a high R2 value of 0.9999988178724151, indicating a robust fit of the model to the data. Aside from predictive capabilities, DeepResTrade’s use of blockchain technology ensures transparency in trading transactions, resulting in a dependable and efficient energy trading environment. These accomplishments demonstrate DeepResTrade’s potential to reimagine renewable energy markets and promote sustainable energy behaviors.

Future works

Several topics require additional investigation to better enhance and expand the DeepResTrade system’s capabilities. First, precise prediction models must be developed. While LSTM-DT forecasters have shown efficacy, more sophisticated techniques, such as deep learning architectures or ensemble algorithms, may produce even more accurate and robust price projections. Incorporating external elements like as weather patterns, market demand-supply dynamics, and regulatory changes can also give a more complete knowledge of the renewable energy industry and increase prediction accuracy. Second, optimizing trading methods inside the DeepResTrade framework opens up new opportunities. Integrating advanced optimization algorithms can enable the discovery of optimal business decisions that take into account aspects such as energy prices, grid restrictions, and renewable energy availability. These approaches, by optimizing economic rewards and operational efficiency, can contribute to the overall success and acceptance of P2P energy trading. Furthermore, investigating the integration of smart grid technology and demand response mechanisms might improve the flexibility and adaptability of corporate strategies, resulting in more efficient energy resource allocation.

Third, scalability and interoperability are critical considerations. As the DeepResTrade system grows to support bigger renewable energy communities, scalability and interoperability become increasingly important. Future studies may concentrate on building protocols and processes that allow for the smooth integration of various communities, allowing for inter-community energy trade. Interoperability with current energy market infrastructure and regulatory frameworks will be key for P2P energy trading system adoption. Incorporation of developing technology and concepts should also be explored. Quantum technology has sparked interest due to its potential to transform industries such as optimization and data processing. Integrating quantum technologies, quantum neural networks, and quantum LSTM models into the DeepResTrade system might give considerable benefits.

Conclusion

DeepResTrade, presented in this paper, has demonstrated considerable performance for the decentralized renewable energy market. DeepResTrade employs developed predictive models and blockchain technology to be tested in the challenges of price volatility, uncertainty, and trust in P2P energy trading. In this work, which employed a dataset of 70,084 data points, significant KPIs amounts resulted. The system’s MAPE was 0.999987%, while its RMSPE was with a value of 0.000975%, repsectively. These metrics represent the system’s capacity to estimate energy prices properly, allowing market participants to make informed decisions and enhance their trading tactics. DeepResTrade similarly got an RMSE of 0.016079 and an MAE of 0.009125, indicating that the predicted and actual values deviated barely, and the difference is so low. The R2 score of 0.999998 indicates that the model can explain 99.99% of the variation in true data, with a considerable fit. As well, an F1 score of [1, 1, 1], a recall value of [1, 1, 1], and an overall accuracy of 1 illustrate the system’s capacity to forecast proper trading decisions in the P2P energy market. Excellent KPI results demonstrate DeepResTrade’s effectiveness and accuracy in forecasting energy prices and facilitating transparent and secure energy trading. By giving precise pricing projections, the technology enables market participants to optimize their energy business strategies, maximize economic benefits, and promote the usage of renewable energy sources. DeepResTrade highlights the system’s precision, effectiveness, and ability to enhance the renewable energy business, encourage sustainable energy habits, and contribute to a cleaner, more efficient energy environment. DeepResTrade lays the framework for P2P energy trading, empowering communities, encouraging renewable energy adoption, and hastening the transition to a greener future.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: Tiago Sousa, Tiago Soares, Pierre Pinson, FabioMoret, Thomas Baroche, and Etienne Sorin. (2018). The P2P-IEEE 14 bus system data set (Data set). Zenodo. https://doi.org/10.5281/zenodo.1220935.

Author contributions

AS: Conceptualization, Data curation, Investigation, Methodology, Software, Visualization, Writing–original draft, Writing–review and editing. HK: Resources, Writing–original draft, Writing–review and editing. MN-H: Supervision, Writing–review and editing. AO: Supervision, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abriz, A. F., Ghavifekr, A. A., Soltaninejad, M., Tavana, A., Safari, A., and Ziamanesh, S. “2023, Modified cuckoo optimization algorithm for frequency regulation of microgrids,” in Proceedings of the 2023 8th International Conference on Technology and Energy Management (ICTEM), Mazandaran, Babol, Iran, Islamic Republic, February 2023, 1–5.

Abu-Salih, B., Wongthongtham, P., Morrison, G., Coutinho, K., Al-Okaily, M., and Huneiti, A. (2022). Short-term renewable energy consumption and generation forecasting: A case study of western Australia. Heliyon 8 (3), e09152. doi:10.1016/j.heliyon.2022.e09152

Al-Sorour, A., Fazeli, M., Monfared, M., Fahmy, A., Searle, J. R., and Lewis, R. P. (2022). Enhancing PV self-consumption within an energy community using MILP-based P2P trading. IEEE Access 10, 93760–93772. doi:10.1109/access.2022.3202649

Alsirhani, A., Alshahrani, M. M., Abukwaik, A., Taloba, A. I., Abd El-Aziz, R. M., and Salem, M. (2023). A novel approach to predicting the stability of the smart grid utilizing MLP-ELM technique. Alexandria Eng. J. 74, 495–508. doi:10.1016/j.aej.2023.05.063

Annamalai, S., Mangaiyarkarasi, S. P., Rani, M. S., Ashokkumar, V., Gupta, D., and Rodrigues, J. J. (2022b). Design of peer-to-peer energy trading in transactive energy management for charge estimation of lithium-ion battery on hybrid electric vehicles. Electr. Power Syst. Res. 207, 107845. doi:10.1016/j.epsr.2022.107845

Annamalai, S., Mangaiyarkarasi, S., Rani, M. S., Ashokkumar, V., Gupta, D., and Rodrigues, J. J. (2022a). Design of peer-to-peer energy trading in transactive energy management for charge estimation of lithium-ion battery on hybrid electric vehicles. Electr. Power Syst. Res. 207, 107845. doi:10.1016/j.epsr.2022.107845

Baba, A. (2022). Electricity-consuming forecasting by using a self-tuned ANN-based adaptable predictor. Electr. Power Syst. Res. 210, 108134. doi:10.1016/j.epsr.2022.108134

Bhattacharjee, B., Kumar, R., and Senthilkumar, A. (2022). Unidirectional and bidirectional LSTM models for edge weight predictions in dynamic cross-market equity networks. Int. Rev. Financial Analysis 84, 102384. doi:10.1016/j.irfa.2022.102384

Bouachir, O., Aloqaily, M., Özkasap, Ö., and Ali, F. (2022). Federatedgrids: federated learning and blockchain-assisted p2p energy sharing. IEEE Trans. Green Commun. Netw. 6, 424–436. doi:10.1109/tgcn.2022.3140978

Boumaiza, A., and Sanfilippo, A. “,2022 Data forecasting with application to blockchain-based local energy markets,” in Proceedings of the 2022 13th International Renewable Energy Congress (IREC), Hammamet, Tunisia, December 2022, 1–5.

Boumaiza, A., and Sanfilippo, A. ,2023 “Local energy marketplace agents-based analysis,” in Proceedings of the 2023 IEEE International Systems Conference (SysCon), Vancouver, BC, Canada, April 2023, 1–5.

Chien, I., Karthikeyan, P., and Hsiung, P.-A. ,2023 “P2P energy transaction market prediction in smart grids using blockchain and LSTM,” in Proceedings of the 2023 IEEE International Conference on Consumer Electronics (ICCE), Las Vegas, NV, USA, January 2023, 1–2.

Choobineh, M., Arabnya, A., Sohrabi, B., Khodaei, A., and Paaso, A. (2023). Blockchain technology in energy systems: A state-of-the-art review. IET Blockchain 3, 35–59. doi:10.1049/blc2.12020

Gharehbagh, H. K., Jalalat, S. M., Bayati, N., and Ebel, T. “2023, Evaluation of solar and lunar eclipse impacts on Danish power system as a case study,” in Proceedings of the 2023 IEEE International Conference on Environment and Electrical Engineering and 2023 IEEE Industrial and Commercial Power Systems Europe (EEEIC/I&CPS Europe), Madrid, Spain, June 2023, 1–5.

Gomes, L., Morais, H., Gonçalves, C., Gomes, E., Pereira, L., and Vale, Z. (2022). Impact of forecasting models errors in a peer-to-peer energy sharing market. Energies 15, 3543. doi:10.3390/en15103543

Hashemipour, N., Aghaei, J., Del Granado, P. C., Kavousi-Fard, A., Niknam, T., Shafie-khah, M., et al. (2022). Uncertainty modeling for participation of electric vehicles in collaborative energy consumption. IEEE Trans. Veh. Technol. 71, 10293–10302. doi:10.1109/tvt.2022.3184514

He, L., and Zhang, J. (2023). Energy trading in local electricity markets with behind-the-meter solar and energy storage. IEEE Trans. Energy Mark. Policy Regul. 1, 107–117. doi:10.1109/tempr.2023.3250948

Jamil, F., Iqbal, N., Ahmad, S., and Kim, D. (2021). Peer-to-peer energy trading mechanism based on blockchain and machine learning for sustainable electrical power supply in smart grid. Ieee Access 9, 39193–39217. doi:10.1109/access.2021.3060457

Jin, H., Lee, S., Nengroo, S. H., Ahn, G., Chang, Y.-J., and Har, D. (2023). P2P power trading of nanogrids for power management in consideration of battery lifetime of ESS. Energy Build. 297, 113290. doi:10.1016/j.enbuild.2023.113290

Jin, Y., Choi, J., and Won, D. (2020). Pricing and operation strategy for peer-to-peer energy trading using distribution system usage charge and game theoretic model. IEEE Access 8, 137720–137730. doi:10.1109/access.2020.3011400

Kanakadhurga, D., and Prabaharan, N. (2022). Peer-to-Peer trading with Demand Response using proposed smart bidding strategy. Appl. Energy 327, 120061. doi:10.1016/j.apenergy.2022.120061

Lee, Z. E., and Zhang, K. M. (2023). Regulated peer-to-peer energy markets for harnessing decentralized demand flexibility. Appl. Energy 336, 120672. doi:10.1016/j.apenergy.2023.120672

Li, L., and Zhang, S. (2021). Peer-to-peer multi-energy sharing for home microgrids: an integration of data-driven and model-driven approaches. Int. J. Electr. Power and Energy Syst. 133, 107243. doi:10.1016/j.ijepes.2021.107243

Li, Y., Ding, Y., Liu, Y., Yang, T., Wang, P., Wang, J., et al. (2022). Dense skip attention based deep learning for day-ahead electricity price forecasting. IEEE Trans. Power Syst. 38, 4308–4327. doi:10.1109/tpwrs.2022.3217579

Li, Z., Yu, F., and Guan, Q. 2023“BiLSTM network-based approach for electric load forecasting in energy cell-tissue systems,” in Proceedings of the2022 First International Conference on Cyber-Energy Systems and Intelligent Energy (ICCSIE), Shenyang, China, January 2023, 1–5.

Lin, Y.-J., Chen, Y.-C., Zheng, J.-Y., Shao, D.-W., Chu, D., and Yang, H.-T. (2022). Blockchain-based intelligent charging station management system platform. IEEE Access 10, 101936–101956. doi:10.1109/access.2022.3208894

Liu, J., Zhou, Y., Yang, H., and Wu, H. (2022). Uncertainty energy planning of net-zero energy communities with peer-to-peer energy trading and green vehicle storage considering climate changes by 2050 with machine learning methods. Appl. Energy 321, 119394. doi:10.1016/j.apenergy.2022.119394

Mehdinejad, M., Shayanfar, H. A., Mohammadi-Ivatloo, B., and Nafisi, H. (2022). Designing a robust decentralized energy transactions framework for active prosumers in peer-to-peer local electricity markets. IEEE Access 10, 26743–26755. doi:10.1109/access.2022.3151922

Merrad, Y., Habaebi, M. H., Islam, M. R., Gunawan, T. S., Elsheikh, E. A., Suliman, F., et al. (2022). Machine learning-blockchain based autonomic peer-to-peer energy trading system. Appl. Sci. 12, 3507. doi:10.3390/app12073507

Mohamed, M. A., El-Henawy, I. M., and Salah, A. (2022). Price prediction of seasonal items using machine learning and statistical methods. Comput. Mater. Continua 70, 3473–3489. doi:10.32604/cmc.2022.020782

Moniruzzaman, M., Yassine, A., and Benlamri, R. (2023). Blockchain and cooperative game theory for peer-to-peer energy trading in smart grids. Int. J. Electr. Power and Energy Syst. 151, 109111. doi:10.1016/j.ijepes.2023.109111

Nguyen, D. H. (2023). Probability distribution of market clearing solution in peer-to-peer energy market. Int. J. Electr. Power and Energy Syst. 148, 109014. doi:10.1016/j.ijepes.2023.109014

Niaei, H., Masoumi, A., Jafari, A. R., Marzband, M., Hosseini, S. H., and Mahmoudi, A. (2022). Smart peer-to-peer and transactive energy sharing architecture considering incentive-based demand response programming under joint uncertainty and line outage contingency. J. Clean. Prod. 363, 132403. doi:10.1016/j.jclepro.2022.132403

Peng, D., Xiao, H., Pei, W., Sun, H., and Ye, S. (2022). A novel deep learning based peer-to-peer transaction method for prosumers under two-stage market environment. IET Smart Grid 5 (6), 430–439. doi:10.1049/stg2.12078

Petrucci, A., Barone, G., Buonomano, A., and Athienitis, A. (2022). Modelling of a multi-stage energy management control routine for energy demand forecasting, flexibility, and optimization of smart communities using a Recurrent Neural Network. Energy Convers. Manag. 268, 115995. doi:10.1016/j.enconman.2022.115995

Piao, X., Ding, H., Song, H., Xu, Q., Wang, S., and Song, X. ,2023 A decentralized framework of electricity trading for distributed photovoltaic power stations. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4422412.

Qayyum, F., Jamil, H., Jamil, F., and Kim, D. (2022). Predictive optimization based energy cost minimization and energy sharing mechanism for peer-to-peer nanogrid network. IEEE Access 10, 23593–23604. doi:10.1109/access.2022.3153837

Safari, A. ,2022 “Data driven artificial neural network LSTM hybrid predictive model applied for international stock index prediction,” in Proceedings of the 2022 8th International Conference on Web Research (ICWR), Tehran, Iran, Islamic Republic, May 2022, 115–120.

Safari, A., and Ghavifekr, A. A. ,2021a “International stock index prediction using artificial neural network (ANN) and Python programming,” in Proceedings of the 2021 7th International Conference on Control, Instrumentation and Automation (ICCIA), Tabriz, Iran, February 2021, 1–7.

Safari, A., and Ghavifekr, A. A. ,2021b “Quantum neural networks (QNN) application in weather prediction of smart grids,” in Proceedings of the 2021 11th Smart Grid Conference (SGC), Tabriz, Iran, Islamic Republic, December 2021, 1–6.

Safari, A., and Ghavifekr, A. A. ,2022 “Quantum technology and quantum neural networks in smart grids control: premier perspectives,” in Proceedings of the 2022 8th International Conference on Control, Instrumentation and Automation (ICCIA), Tehran, Iran, Islamic Republic, March 2022, 1–6.

Sanayha, M., and Vateekul, P. (2022). Model-based approach on multi-agent deep reinforcement learning with multiple clusters for peer-to-peer energy trading. IEEE Access 10, 127882–127893. doi:10.1109/access.2022.3224460

Sedgh, S. A., Aghamohammadloo, H., Khazaei, H., Mehdinejad, M., and Asadi, S. (2023). A new design for the peer-to-peer electricity and gas markets based on robust probabilistic programming. Energies 16, 3464. doi:10.3390/en16083464

Sousa, Tiago, Soares, Tiago, Pierre, Pinson, Moret, Fabio, Baroche, Thomas, and Sorin, Etienne (2018). The P2P-IEEE 14-Bus system data set. Zenodo. doi:10.5281/zenodo.1220935

Sun, C., Liu, Y., Li, Y., Lin, S., Gooi, H. B., and Zhu, J. (2023). Network-aware P2P multi-energy trading in decentralized electric-heat systems. Appl. Energy 345, 121298. doi:10.1016/j.apenergy.2023.121298

Symiakakis, M. S., and Kanellos, F. D. (2023). Towards the detailed modeling of deregulated electricity markets comprising Smart prosumers and peer to peer energy trading. Electr. Power Syst. Res. 217, 109158. doi:10.1016/j.epsr.2023.109158

Timilsina, A., and Silvestri, S. (2023). P2P energy trading through prospect theory, differential evolution, and reinforcement learning. New York, NY, United States: ACM Transactions on Evolutionary Learning.

Ullah, Z., Naeem, M., Coronato, A., Ribino, P., and De Pietro, G. (2023). Blockchain applications in sustainable smart cities. Sustain. Cities Soc. 97, 104697. doi:10.1016/j.scs.2023.104697

Wang, L., Ma, Y., Zhu, L., Wang, X., Cong, H., and Shi, T. (2022). Design of integrated energy market cloud service platform based on blockchain smart contract. Int. J. Electr. Power and Energy Syst. 135, 107515. doi:10.1016/j.ijepes.2021.107515

Wang, X., Liu, Y., Zhao, J., Liu, C., Liu, J., and Yan, J. (2021). Surrogate model enabled deep reinforcement learning for hybrid energy community operation. Appl. Energy 289, 116722. doi:10.1016/j.apenergy.2021.116722

Zhou, Y., Wang, J., Zhang, Y., Wei, J., Sun, W., and Wang, J. (2023). A fully-decentralized transactive energy management under distribution network constraints via peer-to-peer energy trading. IEEE Trans. Energy Mark. Policy Regul., 1–12. doi:10.1109/tempr.2023.3263685

Nomenclature

Keywords: peer-to-peer energy trading, artificial intelligence, neural networks, market price prediction, renewable production, blockchain, decentralized market

Citation: Safari A, Gharehbagh HK, Nazari-Heris M and Oshnoei A (2023) DeepResTrade: a peer-to-peer LSTM-decision tree-based price prediction and blockchain-enhanced trading system for renewable energy decentralized markets. Front. Energy Res. 11:1275686. doi: 10.3389/fenrg.2023.1275686

Received: 10 August 2023; Accepted: 11 September 2023;

Published: 28 September 2023.

Edited by:

Zhengmao Li, Aalto University, FinlandReviewed by:

Changsen Feng, Zhejiang University of Technology, ChinaLuhao Wang, University of Jinan, China

Copyright © 2023 Safari, Gharehbagh, Nazari-Heris and Oshnoei. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Ashkan Safari, YXNoa2Fuc2FmYXJpQGllZWUub3Jn

Ashkan Safari

Ashkan Safari Hamed Kheirandish Gharehbagh

Hamed Kheirandish Gharehbagh Morteza Nazari-Heris

Morteza Nazari-Heris Arman Oshnoei

Arman Oshnoei