94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Energy Res. , 02 November 2023

Sec. Sustainable Energy Systems

Volume 11 - 2023 | https://doi.org/10.3389/fenrg.2023.1256317

This article is part of the Research Topic Supply Chain Transformation for Pursuing Carbon-neutrality View all 10 articles

In the current international trade characterized by global value chains (GVCs), to improve the trade interests of China’s manufacturing industry and change the unfavorable situation of “big but not strong,” industrial upgrading is an important issue that needs to be solved urgently. Based on the analysis of the impact of embedding in GVCs on the acquisition of trade benefits, the paper empirically tests the impact of embedding GVCs on manufacture upgrading by using industry segmentation data of China’s manufacturing industry from the year 2000 to 2014 in the world input–output database. The research shows that 1) from 2000 to 2014, forward and backward participation increased from 11.2% and 15.2% to 14.6% and 15.9%, respectively; China’s manufacturing industry mainly participates in the GVC in a backward way, which significantly improves trade interests; 2) both forward participation and backward participation in the GVC are conducive to the increase of trade benefits and are positive at the 5% level, which has a significant driving effect on the upgrading of the manufacturing industry; and 3) heterogeneity testing shows that capital-intensive, technology-intensive, and high-tech industries gain significant trade benefits, and embedding GVCs is more conducive to upgrading. Therefore, integrating into the GVC at a higher level is the direction to promote the upgrading of China’s manufacturing industry.

At present, the international economy is characterized by factor cooperation, trade of increased intermediate goods, and rapid development of outsourcing. A final product is jointly produced by countries according to advantageous factors, forming a vertical specialization mode (Cheng, 2022). Its manifestation is that multinational corporations distribute different production processes in different countries, and the final product has more than two production stages, more than two countries participate in production, forming “international intraproduct specialization” or “factor division” that is commonly known as the global value chain (GVC), which is particularly obvious in the manufacturing industry (Xiang, 2021). Affected by this, the pattern of international division of labor has expanded from interproduct division to intraproduct division, and international trade has developed from product trade to task trade (Chen et al., 2021). For developing countries, this means that export products that originally need to master a full set of production technologies can be integrated into the international division of labor under the background of GVC and only need to master the technology for specific production tasks or links. Therefore, the GVC provides developing countries with a fast track to accelerate the process of industrialization. China is a major manufacturing country and the “world factory.” Integrating into the GVC provides a fast channel for the rapid development of the manufacturing industry. Since entering into WTO, China has long relied on the advantage of low labor cost to engage in processing trade, embedded into the GVC dominated by developed countries, engaged in production and assembly with very low added value (Xiang, 2019). For example, when exporting a $200 iPhone, China only earns $3.36 in manual fees, and most of the profits are seized by developed countries (Wen, 2018). Many key parts and core technologies still depend on imports from abroad, the rise of trade protectionism has a great impact on China’s industry, considering its large scale, China’s manufacturing is still not powerful, and enhancing the added value of exporting products and obtaining more trade benefits is an important direction for the transformation and upgrading of the manufacturing industry.

In recent years, restricted by resources and environment, China’s factor cost advantage has gradually weakened, and it has fallen into the dilemma of “race to the bottom” with low-wage countries such as India and Vietnam, and a large number of labor-intensive industries have been transferred to Southeast Asian countries (Gao et al., 2020a). The high-end manufacturing return policy launched by the United States weakens the technology spillover effect of China’s export products, intensifies the competition in the manufacturing field, and brings “crowding risk.” The double squeeze of “high-end return” in developed countries and “low-end diversion” in developing countries forced China’s manufacturing industry to upgrade (Gao et al., 2020b). COVID-19 has brought a great impact, and the global economy has pressed the pause button. In the face of an uncertain economic situation at home and abroad, China has put forward a strategy of “accelerating the formation of a new development pattern with the domestic cycle as the main body and the domestic and international dual cycles promoting each other.” While emphasizing the domestic cycle, we should expand the opening at a higher level and integrate into global innovation chain. How to achieve upgrading of the manufacturing industry on the basis of domestic and foreign integrated development is an important issue that needs to be solved urgently (Fu, 2022; Li, 2022). In this context, clarifying the impact mechanisms of the integration of the GVC on manufacturing, upgrading, and testing the role of different impact mechanisms in China’s participation in the GVC will provide theoretical support and practical basis for solving the aforementioned problems. The article intends to start with analyzing the impact mechanism of embedded global value chain on the manufacturing industry, use a value-added trade decomposition method to calculate the degree of embedded global value chain, empirically test the relationship between GVC embedding and export domestic added value, and put forward a theoretical and practical basis for the upgrading of the manufacturing industry under the “double cycle” pattern.

Compared with existing research, possible marginal contributions of this paper are as follows: first, from a research perspective, exploring the relationship between integrating into the global production system and industrial upgrading from the perspective of GVC is beneficial for clarifying the mechanism of integrating the GVC on industrial upgrading and providing useful decision-making references for “seizing high position of GVC.” Second, from the perspective of research methods, the latest GVC forward and backward participation index constructed by Wang et al. (2017a) is used, and the characteristics of the GVC and the degree of embedding manufacturing GVC are comprehensively characterized. The latest data from the World Input Output Database (WIOD) are used, based on theoretical hypotheses, and econometric tests are conducted on overall and sub-samples. Third, in terms of research content, heterogeneity effects of integrating the GVC are analyzed from the perspectives of factor intensity and technology intensity, providing empirical evidence for preventing “capture by the low-end” and climbing toward high end of the GVC, enriching and expanding policy connotation of theoretical research.

Trade theory attempts to explain what benefits trade brings to countries, enterprises, or individuals, to make judgments about whether and how to participate in the international division of labor and provide a basis for trade policy (Tang, , 2020). At present, the global industrial chain is accelerating its restructuring, and the impact of integrating into the GVC on developing countries has become a hot research topic (Tian et al., 2022; Wiryawan et al., 2022). Most studies about the upgrading process show that by participating in the GVC, enterprises can achieve industrial upgrading through channels such as participating in the professional division of labor and obtaining technological spillovers (Pahl and Timmer, 2020; VeeramaniDhir, 2022). In recent years, with the development of research methods of value-added trade, studies have increasingly taken export domestic value added (DVA) as a measure of trade interest to examine the impact of participating in the GVC on DVA. The accounting for the degree of GVC embeddedness is based on the decomposition of value-added trade (Koopman et al., 2014). In the process of quantitative analysis of the GVC, the input–output analysis method is mainly used from a macro perspective. Hummels et al. (2001) used the vertical specialization (VS) index to measure the degree of a country’s participation in the international division of labor for the first time under the assumption that imports are entirely from abroad (Hummels et al., 2001). Johnson and Noguera (2012) used the Global Trade Analysis Project (GTAP) database to measure the participation of 94 countries in GVC production sharing by value-added export rate (VAX) (Johnson and Noguera, 2012); Wang et al. (2013) and Wang et al. (2017b) further improved and decomposed a country’s total trade into DVA and foreign value added and then expanded to the national, bilateral, and sectoral levels. The total export was divided into nine parts and 16 parts, respectively. Based on the complete decomposition of total exports, the GVC participation index (GVC_participation) is constructed to measure the degree of a country’s participation in the GVC division of labor (Wang et al., 2013). The former HIY decomposition method may lead to a serious underestimate of the share of foreign value added. The latest input–output decomposition method establishes a complete set of accounting rules from official trade gross value statistics to trade value-added statistics by distinguishing the content of domestic and foreign factors in various production activities and distinguishing content of factors in various domestic and foreign production activities (Wang et al., 2017a; Wang et al., 2017b). The participation of China’s manufacturing industry in the GVC showed a dynamic trend from 2000 to 2018. By 2018, the forward and backward participation in China’s manufacturing industry had reached 0.148 and 0.162, respectively (Huang and Yang, 2022; Zhang and Li, 2022). Regarding the measurement of manufacture upgrading, one kind of literature is measured by alternative indicators such as export domestic value-added rate (DVAR), export technology complexity (EXPY), revealed comparative advantage (RCA), which is considered as DVAR (domestic value creation part included in export products), EXPY (technical level contained in export products), and RCA (proportion of industrial export share), which can measure a country’s position in the GVC and take increasing income, improving technical level or market share as the direction of industrial upgrading (Kee and Tang, 2016; Johnson and Noguera, 2012). The other kind of literature is measured by the upstream degree (UI) index constructed by Antràs and Chor (2018). Judging by measuring distance from the beginning of production to the final product, the lower the upstream index, the more the benefits. The direction of industrial upgrading is defined with the size of the UI index.

To analyze the factors affecting industrial upgrading, the domestic and foreign literature discusses the impact of human capital quality, capital deepening, foreign direct investment (FDI), system quality, infrastructure construction, trade facilitation, and other factors on industrial upgrading (Kummritz et al., 2017; Zhang and Li, 2022). Human capital is indispensable to economic development. The deepening of senior talent and capital is an important factor to promote scientific and technological progress. The technological spillovers and competitive effects brought by FDI are important forces driving the technological progress of enterprises and the renewal of product quality. System quality and business environment are the key areas for the optimization and improvement of China’s opening to the outside world. They are crucial to attracting foreign capital and talent and creating a good development environment for enterprises. Domestic and foreign scholars empirically tested the influencing factors of manufacture upgrading through macro- and micro-level data. Xiang (2020) used the panel data of China’s manufacturing industry to find that domestic service factor input is conducive to the upgrading of the manufacturing value chain, while the impact of foreign service factor input on manufacture upgrading is negative (long and Wang, 2017). Yu Donghua et al. (2019) selected panel data of China’s manufacturing industry from 2001 to 2014 and found that although there are “low-end locking” and “absorption threshold” effects, embedding the GVC is conducive to the transformation and upgrading of China’s manufacturing industry (Gao et al., 2019). Kee and Tang (2016) integrated macro and micro data and found that by using domestic raw materials to replace imported raw materials, the domestic added value of export products can be increased and China’s industrial upgrading can be achieved (Koopman et al., 2014).

Through literature review, it can be found that different scholars have analyzed the impact of GVC embedding on manufacture upgrading from different angles. The research conclusions of most literature are positive, and some scholars have studied the “capture effect” and “low-end locking” of GVC embedding (Xiao et al., 2019; Xiang, 2020). At present, few studies focus on China to investigate the impact of different participation paths of the GVC on the upgrading of China’s manufacturing industry. Therefore, this paper will take export DVA as the measurement index of manufacture upgrading, on the basis of describing the path of China’s manufacturing industry, integrated into the GVC, investigate the differential impact of GVC forward participation and backward participation on China’s manufacture upgrading, and identify the impact mechanisms of the aforementioned two paths. The structure of the article will be arranged as follows, the second part is theoretical analysis, the third part is the empirical test and explanation, the fourth part is further heterogeneity analysis, and the last part is conclusion and recommendations.

At present, there are different definitions of manufacturing upgrading. Gereffi et al. (2001) defined industrial upgrading under the background of global value chain as four types: product upgrading, process upgrading, function upgrading, and chain upgrading (Yu and Tian, 2019). In recent years, with the development of the decomposition method of value-added trade, research studies have increasingly taken export DVA as the index to measure trade interest. Therefore, this paper defines the upgrading of the manufacturing industry as the process of transformation from a low-value-added industry to a high-value-added industry, that is, the process of continuous increase of value added in export and the rise of trade interests. The division of labor in the global value chain makes specialization within the scope of globalization more refined. The added value in the GVC is distributed in various links such as design and R&D, production and manufacturing, marketing, and distribution. With the advantages of resource endowment and human capital, China’s manufacturing industry is embedded in the GVC and is changing from low-end processing and assembly to R&D and design and brand marketing, and it is climbing from low value-added links to high value-added links (Yue et al., 2018). China has become the world’s largest manufacturing country since 2010, and the total domestic added value of the manufacturing industry has been increasing. Embedding the GVC has a significant impact on China’s acquisition of technology, enhancement of innovation, and realization of value chain climbing. The manufacturing industry achieves industrial upgrading through three ways: specialization effect, learning by doing effect, and technological spillover effect.

China’s manufacturing industry can gain economies of scale by participating in global specialization. The production efficiency of enterprises has been continuously improved due to the fine division of labor, and the production cost has been greatly reduced. The industrial products made in China have occupied the global market with an irresistible price advantage, obtaining a continuous expansion of the total DAV. Direct integration of the GVC reduces the cost of industrial strategy selection of China’s manufacturing industry. In the process of undertaking industrial transfer in developed countries, China can learn from the original development mode and path of developed countries, make full use of global resources and markets, and drive the common development of domestic related industries through the introduction of foreign advanced technology, capital, and talents; trade and investment drive the optimization of the industrial structure, solve the problems of insufficient domestic capital goods and poor technology, and quickly achieve industrial development and upgrading on a high basis (Hu et al., 2020).

Participating in GVC can acquire technical knowledge, accumulate production experience in understanding and solving problems, continuously strengthen production, and improve labor productivity. It has not only trained a large number of skilled workers but also trained a large number of engineers learning foreign advanced technology, and human capital can be optimized. The import of intermediate products has optimized the allocation of resources and laid a foundation for improving the technical content of domestic export intermediate products. Enterprises have upgraded their products through technology follow-up or imitation innovation to enhance the DAV of their products. The learning by doing effect not only optimizes the allocation of resources and human capital but also promotes the upgrading of the industrial structure (Gereffi et al., 2001).

After embedding the GVC, Chinese enterprises can directly introduce or learn from the advanced technology of foreign enterprises, undertake outsourcing businesses such as communication and electronics industries, import intermediate products containing a large amount of knowledge and technology for processing and production, and have the opportunity to divide labor and cooperate with developed countries to obtain “technology spillover” (Wang, 2019). At the same time, to meet the strict requirements of multinational corporations on product safety, environmental protection, and other product quality and occupy a place in the fierce international market, Chinese manufacturing enterprises need to constantly improve their processes and realize product upgrading through digestion, absorption, reintegration, and innovation. The high standard requirements of multinational corporations force OEM enterprises to improve their technical standards, promote continuous improvement of export product quality standards, and upgrade in the GVC (Yu and Cheng, 2021).

At the same time, we also notice that to maintain their own interests, developed countries will set up barriers and implement blockades in key core technology fields. As a result, developing countries are “locked and captured at the low-end chain,” and there is even a risk of “chain breaking,” and the long-term introduction of foreign technology will lead to substitution and lack of independent innovation ability of enterprises, forming path dependence for long-term engagement in low-end low profit links. There is a threshold effect in absorbing advanced technology of multinational corporations. Technology spillover will have a positive impact only when the level of economic development and human capital reach a certain threshold (Wang et al., 2021). In short, whether the effect of embedded GVC is good or bad needs to be judged according to different economic environments and development stages and other factors. The following will be tested in the empirical part, and a conclusion will be drawn. Based on the aforementioned analysis, the following assumptions are put forward:

Hypothesis 1. Positive effect of embedding into the GVC is greater than the negative effect, which is conducive to China’s manufacturing industry to obtain trade benefits, achieve product upgrading and process upgrading through learning advanced technology and experience, and promote the upgrading of the industrial structure.

Hypothesis 2. Different manufacturing industries have different trade interests embedded in the GVC. China’s manufacturing industry, which mainly involves labor-intensive industries in the international division of labor, can improve the technical content of products, increase the DAV of exports, and facilitate industrial upgrading.

Assuming that there are G countries and N industrial sectors in the world, the inter-country input–output table (ICIO) is shown in Table 1.

Among them, Zsr is the intermediate input matrix (produced in country S and used in country R), Ysr is the final product vector, Vas is the added value vector, and Xs is the total output vector. Wang Zhi (2013) decomposed the total value of a country’s export trade into 16 parts, including added value and double counting, according to different sources and the final destination of added value of trade, realizing the complete decomposition of export trade. The specific decomposition formula of the total export trade value of country s (or region) to country r (or region)

According to the aforementioned decomposition process, the 16 parts of the total export trade are summarized and combined, as shown in Table 2.

The total output X can be divided into two parts: intermediate product AY and final product Y:

Therefore, the domestic added value and final product production can be decomposed into

By summing up the line vectors in Eq. 4, according to the flow direction, the domestic added value at the country/sector level is decomposed into (forward linkage)

By summing up the vectors in Eq. 4, according to the source, the added value of final product production is decomposed into (backward linkage)

Among them, V_ D、Y_ D does not involve trade; it is the DAV produced and absorbed by the country. V_ RT、Y_ RT is the DAV included in the final product export. V_ GVC_ S、Y_ GVC_ S refers to a simple GVC activity that only crosses the border once and is the DAV included in the export of intermediate products; V_ GVC_ C、Y_ GVC_ C refers to complex GVC activities that cross the border more than once, involving indirect trade with third countries.

On the basis of Eqs. 5 and (6), the forward participation index (PA_f) and the backward participation index (PA_b) are constructed to measure the degree of a country’s sector level participation in the GVC:

The forward participation index (PA_f) calculates the proportion of added value created by a country to the DAV contained in global exports of intermediate goods. It measures the degree of dependence of other countries on domestic intermediates, and it is the value added calculated from the perspective of production, which is similar to the VS1 index proposed by Hummels et al. (2001), but VS1 is the proportion of the total value in trade. The backward participation index (PA_b) calculates the proportion of intermediate products used by the country from the perspective of added value and measures the country’s dependence on other countries’ intermediates. The traditional VS and VS1 indicators cannot reflect whether a country participates in simple GVC or complex GVC. In terms of total value, the VS1 indicator may be very high for industries with few direct exports (such as mining), and the improved indicators can better reflect the degree of a country’s participation in the GVC.

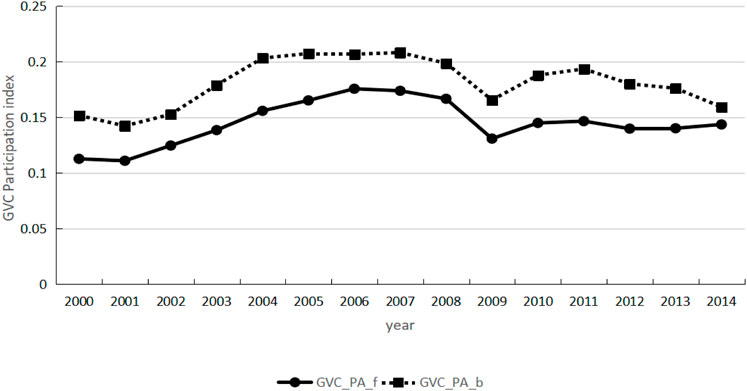

According to the calculation methods of the forward participation index (PA_f) and the backward participation index (PA_b) mentioned above and using the data of the WIOD 2016 database, Figure 1 measures the participation degree of China’s manufacturing industry in the GVC from 2000 to 2014.

FIGURE 1. Participation of China’s manufacturing industry in the GVC from 2000 to 2014. Source: WIOD

As can be seen from Figure 1, China’s manufacturing industry mainly participates in the GVC in the way of backward participation, which shows that China’s manufacturing industry mainly depends on the supply of imported intermediates in the process of integrating into global production, embeds the processing and assembly link of the GVC with the advantage of cheap labor, and mainly participates in global division of labor in the way of “processing trade.” This is also a realistic feature that “processing trade” accounts for half of China’s import and export since China’s entry into WTO. At the same time, China also exports intermediate products, such as aircraft, auto parts, and other products, and participates in the GVC in a forward-linking way. Data from the World Bank show that China has become the world’s most important product supplier and demander, and it is the central node of the GVC, becoming the core hub of the GVC (Zhang and Zhang, 2022).

With the time dynamic evolution track of participation, the forward and backward participation indexes were increasing from 12.5% and 15.6% in 2001 to 18.6% and 19.9% in 2008, respectively, indicating that after China’s accession to the WTO, China’s participation in the international division of labor continued to deepen, and the manufacturing industry was deeply integrated into the GVC. In 2008, due to the impact of the global financial crisis, there was a brief decline, and the participation index dropped to 13.7% and 16.3%, respectively, in 2009. After the impact of the crisis subsided, it gradually recovered. From 2010 to 2014, the trend of trade protection became increasingly serious, and the trend of anti-globalization spread. The forward and backward participation decreased from 15.1% and 18.2% to 12.5% and 15.1%, respectively. There was a trend of “decoupling” of the GVC and internalization of the global industrial chain demonstrated by Timmer et al. (2016) (Hu et al., 2021). It is worth noting that compared with the decline of backward participation since 2012, the forward participation is rising. China’s manufacturing industry is changing from a user of imported intermediate goods to a provider of exported intermediate goods. In the dynamic transformation from “value input” to “value output,” which replaces imported foreign added value with DAV, the transformation and upgrading of processing trade has achieved preliminary results.

The aforementioned research shows that different embedding methods, or different sectors of manufacturing industries, participate in the international division of labor and have different effects on the DAV of exports. To test the impact of GVC embedding on the upgrading of the manufacturing industry, the econometric model is set as follows:

where subscript i represents the manufacturing industry sector and t represents the year. The explained variable is export DVA, that is, the total DVA of China’s manufacturing export sector, which is an indicator to measure the upgrading of the manufacturing industry; according to the decomposition framework of trade added value by Wang et al. (2013), the larger its value is, the more trade benefits will be obtained from exports. The core explanatory variable PA represents GVC embeddedness, including GVC forward participation (PA_f) and GVC backward participation (PA_b), and the calculation method is derived from the previous section. Controls represent industry control variables, including GVC position (PO), labor productivity (PR), industry capital intensity (K/L), and foreign direct investment (FDI). γi, μt, and δit represent industry fixed effects, year fixed effects, and standard error, respectively. Taking into account the differences in the level values of different variables, logarithmic processing was performed during the estimation process.

The following control variables are selected in this paper:

(1) GVC position index (PO): the position of the manufacturing industry embedded in the GVC. “Upstream index” constructed by Antras et al. (2012) is referred to measure the position of China’s manufacturing industry embedded in the GVC. The data come from the RIGVC UIBE database. (2) Labor productivity (PR): measured by per capita domestic added value. (3) Industry capital intensity (K/L): measured by the ratio of fixed capital to the number of employees in the manufacturing sector. The data of the aforementioned two variables are from socio-economic accounts of WIOD. (4) Foreign direct investment (FDI): it is measured by the accumulative value of the amount of foreign direct investment actually utilized in the year. The data are from the annual database of the National Bureau of Statistics of China (NBSC), and the descriptive statistical results of each variable are shown in Table 3.

According to the data of the latest version of WIOD (2016), this paper analyzes the impact of GVC embedding on manufacture upgrading by using panel data of 18 sub-industries of China’s manufacturing industry from 2000 to 2014. Before the regression test, the panel fixed-effects model (FE) and random-effects model (RE) are used to regress Eq. 8. The results of the Hausman test reject the original hypothesis at the level of 1%, so the econometric model adopts the fixed-effects model for regression. At the same time, to control the possible endogenous problems, by controlling the time fixed effect and sector fixed effect, the endogenous problem caused by missing variables is partially solved. The test results are shown in Table 4.

The regression of column (1) shows that when GVC forward participation is taken as the explanatory variable, its coefficient is 1.655, and the estimated value has passed the significance statistical test at the level of 5%. When other control variables are added to column (2), the result is 0.425, which is still significant at the same level, indicating that GVC forward participation of the manufacturing industry is conducive to the increase of DAV of export and plays a positive role in promoting the upgrading of the manufacturing industry, and the results of columns (3) and (4) also show that GVC backward participation plays a significant positive role in promoting DVA of exports; comparing the values of column (2) and column (4), it can be found that the coefficient of forward participation of 0.425 is greater than that of backward participation of 0.341, and the significant level is higher, indicating that forward participation is more conducive to obtaining trade benefits. The aforementioned two dimensions show that the division of labor embedded in the GVC is conducive to the improvement of DAV of China’s manufacturing exports, and the manufacturing industry can obtain the increase of trade benefits by participating in the GVC.

On one hand, China imports intermediate products for assembly and processing. On the other hand, China also exports intermediate products for production by other countries. China’s manufacturing industry is already in the hub of double circulation of the GVC. One circulation is the value chain between China and developed countries. China imports intermediate products for assembly and processing from developed countries, and the final products are exported to foreign markets. Another circulation is between China and developing countries. China exports intermediate products and imports final products; that is, China participates in the international division of labor in the way of forward and backward participation. The way of forward participation is that China exports intermediate products for use by other countries. There is more DAV contained in export intermediate products. Chinese products continue to be upgraded, technical content is higher and higher, and industrial products rise to the middle and high end of the value chain. Backward participation means that China participates in the division of labor characterized by processing trade. Although the added value at the enterprise level is not high, labor-intensive industries not only solve a large number of employment problems but also obtain large trade benefits in the process of “learning by doing,” which is conducive to industrial upgrading. Compared with the two, forward participation is more conducive to upgrading, which is in line with the expectations of economic intuition and verifies theoretical hypothesis 1.

In the regression results of control variables, there is a positive relationship between DVA and the position of global value chain (PO) and labor productivity (PR). The significance test shows that enterprises in the upstream of the GVC and those with higher labor productivity gain higher trade benefits, while their export products contain more DAV. For example, enterprises engaged in design and R&D illustrate this. From the perspective of industry capital intensity (K/L), its coefficient is negative and significant, indicating that the industry capital intensity is high and it obtains less trade benefits. The possible reason is that too much fixed asset investment reduces the acquisition of trade benefits when exporting products. It is worth noting that the regression results of the impact of FDI on export DVA have passed the significance test at the level of 1%, indicating that FDI is an important factor to improve trade interests. It is an important force to promote the integration of China’s manufacturing industry into GVC at the beginning of opening up. For example, foreign-funded enterprises represented by Foxconn make full use of China’s cheap labor, invest in labor-intensive industries such as electronics and computers, place assembly and processing links in China, export finished products abroad, and integrate GVC in the way of backward participation. The processing trade once occupied half of China’s trade, which promoted the rapid growth of China’s manufacturing scale and the increase of trade interests. At the same time, relevant studies show that FDI is a “double-edged sword” with positive and negative effects, while stimulating economic growth, it also “captures” Chinese enterprises and lowers the position of GVC division of labor, which is not conducive to industry upgrade.

To ensure reliability of the aforementioned test results, two methods are used for the robustness test. The first method is to overcome the potential endogeneity and prevent two-way causality between DVA and GVC participation; that is, DVA may also affect the degree of GVC embedded in the manufacturing industry. The lag period of GVC forward participation and GVC backward participation is introduced into the equation, the impact of the current period can be excluded to a certain extent, and the regression results are reported in columns (1) and (2) of Table 5; in the second method, VS and VS1 indicators proposed by Hummels are used as alternative indicators of GVC forward participation and GVC backward participation, and empirical results are reported in columns (3) and (4) of Table 5. It can be seen that the estimated coefficients of variables have passed the significance level test to different degrees, and the estimated symbols are consistent with the benchmark regression results, which further shows that the embedded GVC is conducive to the upgrading of the manufacturing industry. The result is robust.

To analyze the differences of trade benefits obtained by manufacturing industries with different factor intensities, (1) the C5∼C9, C16, and C22 sectors in the WIOD are classified as labor-intensive manufacturing industries by referring to the division method by Xiang (2016), (2) C10∼C15 sectors are classified as capital-intensive manufacturing, and (3) C17∼C21 sectors are classified as technology-intensive manufacturing (Zheng and He, 2021). The impact of GVC embedding on manufacture upgrading is tested in groups. The regression results are shown in Table 6.

It can be seen from Table 6 that manufacturing industries with different factor intensities in the forward participation mode have a significant impact at the level of 10% and 5%, respectively. However, for manufacturing industries with different factor intensities in the way of backward participation, only the technology-intensive manufacturing industry is significant at the level of 10%; capital-intensive and labor-intensive industries are not significant, which means that compared with the processing and production of imported intermediate products, intermediate products are exported to obtain more trade benefits. The results of forward participation regression show that with the development of China’s manufacturing industry and the continuous improvement of capital- and technology-intensive industries, the technical level of domestic complete machine products has reached an international advanced level and has a large production capacity. The empirical results show that by exporting to foreign countries, significant trade benefits can be obtained. The regression results with backward participation as the main explanatory variable show that China’s traditional manufacturing industries, such as footwear and other labor-intensive industries, which are embedded in the GVC by means of processing trade, give full play to the advantage of cheap labor and widely participate in the GVC driven by foreign investment, but the trade benefits obtained from exports are not significant. The main reason is that such industries are at the low end of the GVC and their profits are as thin as a blade. They can only win by relying on scale and quantity advantages, such as handbags, clothing, and footwear produced by Chinese OEM, and high-value-added links such as brand, design, and marketing are in the hands of developed countries. Only by increasing technical content, refining labor-intensive industries, and shifting to the direction of R&D, design, and brand marketing can more export added value be obtained.

The DVA of exports obtained by manufacturing sectors with different technical levels is also different. The following is a test of trade benefits obtained by manufacturing sectors with different technical levels. According to OECD technical classification standard, the manufacturing industry in WIOD is divided into four categories:(1) among them, the C17 sector is high-tech manufacturing;(2) C11, C12, and C18∼C21 sectors are medium- and high-tech manufacturing; (3) C10 and C13∼C15 sectors are medium- and low-tech manufacturing; and (4) C5∼C9 and C22 sectors are low-tech manufacturing (Hong and Shang, 2019). The grouping regression test results are shown in Table 7.

As can be seen from Table 7, forward participation and backward participation have passed the significance test at the level of 5% and 1%, respectively, in high-tech industries, backward participation is not significant in low-tech industries, and others have passed the significance test at the level of 10%. Whether participating in GVC forward or backward, the higher the technical level, the more significant the regression result, indicating that the higher the technical level of the industry is, the more significant the participation in the GVC to obtain trade benefits. In particular, the backward participation mode of the high-tech industry is significant at the level of 1%, indicating that the “technology spillover” effect of participating in the GVC has brought obvious trade benefits to China, and hypothesis 2 has passed the test. China carries out the processing and assembly of low-end links by importing foreign advanced equipment and high-end technology and acquires new knowledge and skills through technology spillover, which can quickly achieve the upgrading of process flow and products; however, in high-end manufacturing fields such as precision instruments, CNC machine tools and electronic equipment, many key parts and core technologies are still in the hands of developed countries. When China plans to enter the field of “core and commanding heights,” it will challenge the vested interests of developed countries and encounter the dilemma of blockade and capture, and only by strengthening R&D and independent innovation can China break through the dilemma of “low-end locking.”

By using the panel data of China’s manufacturing industry from 2000 to 2014 in WIOD, this paper calculates the degree of China’s manufacturing industry embedded in the GVC and empirically tests the impact of GVC embedding on the upgrading of the manufacturing industry. The results show that 1) China’s manufacturing industry mainly embeds the GVC in the way of backward participation, which is manifested in the processing trade of imported intermediate products. 2) Embedding GVC is conducive to obtaining trade benefits and upgrading the Chinese manufacturing industry. 3) Capital-intensive industries, technology-intensive industries, and high-tech industries gain significant trade benefits, and embedding the GVC is more conducive to upgrading.

The aforementioned research conclusions have important policy implications for further research on the upgrading of China’s manufacturing industry and achieving high-quality development. In recent years, trade frictions provoked by the United States and the impact of COVID-19 have intensified trade protectionism (Timmer et al., 2016). Under the domestic and foreign dual pressure, it becomes more urgent for China’s manufacturing industry to upgrade. In the context of building a new development pattern of domestic and international double circulation, the experience of integrating into the GVC shows that under the new development pattern, it is necessary to further expand opening up and integrate with the world at a higher level. For example, the signing of RCEP has laid a good foundation for high-level opening up of regional members, and it will promote export growth and the digital transformation and upgrading of China’s manufacturing industry (Xiang, 2016). In view of this, this paper puts forward the following suggestions: first, we should continue to integrate into the GVC, constantly optimize the trade structure, and cultivate new competitive advantages of enterprises in the international markets. The integration of the GVC is a successful experience in the upgrading of the Chinese manufacturing industry. In the future, China needs to continue to open up from a high starting point, siphon foreign advanced production factors into a high-quality business environment, actively undertake high-tech production links with multinational companies, and promote industrial upgrading with the help of technology spillover effects. Second, we should vigorously promote transformation of enterprises toward digitalization, cultivate advanced manufacturing industry clusters, build a new value chain dominated by domestic demand, and drive domestic to climb to the middle and high end of GVC. For example, China’s high-speed rail industry chain has driven supporting industries to expand to foreign markets under domestic market effect, and it promoted the dynamic transformation from a GVC to a global innovation chain. Third, we should formulate upgrading strategies according to the classification of manufacturing industries and encourage and guide foreign capital to invest more in high-tech industries. Traditional labor-intensive manufacturing products need to improve their technological content, strengthen brand building, and upgrade to labor-intensive links in high-tech industrial chains. We also need to cultivate internal motivation for independent innovation of high-tech enterprises, break through external dependence on core technologies and key components, reduce dependence on foreign high-tech products, and strive to become the main body of the global innovation chain.

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

QF: writing–original draft and writing–review and editing.

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Antràs, P., and Chor, D. (2018). On the measurement of upstreamness and downstreamness in global value chains. Cambridge, Massachusetts, United States: National Bureau of Economic Research.

Chaisse, J., and Chakraborty, D. (2021). The future of international trade governance in a protectionist world: theorizing WTO negotiating perspectives. Wash. Int. Law J. 31 (1), 1–57.

Chakraborty, D., and Chaisse, J. (2021). The mystery of reciprocal demand for regional trade partnership: indian experience in RCEP regional value chains. Law Dev. Rev. 14 (1), 163–214. doi:10.1515/ldr-2020-0078

Chen, Q., Pan, M., Wang, J., and Wang, L. (2021). Reconstruction of global value chain,task trade and total factor productivity. Nankai Econ. Res. 2021 (02), 3–23.

Cheng, D. (2022). The evolution of global value chain network and China's innovation growth. People's Forum·Academic Front. 2022 (07), 54–63.

Fu, Q. (2022). How does digital technology affect manufacturing upgrading? Theory and evidence from China. PLoS ONE 17 (5), e0267299. doi:10.1371/journal.pone.0267299

Gao, J., Wang, B., and Song, Y. (2020b). A study on impact of the return of American manufacturing on quality of China's domestic value chain. World Econ. Res. (10), 121–134+137.

Gao, X., Huang, J., and Yuan, K. (2019). Embedded position of value chain and domestic value added rate of export. Res. Quantitative Econ. And Tech. Econ. (6), 41–61.

Gao, X., Huang, J., and Yuan, K. (2020a). Is there an industrial "smile curve" in China's manufacturing industry? Stat. Res. 37 (07), 15–29.

Gereffi, G., Humphrey, J., Kaplinsky, R., and Sturgeon*, T. J. (2001). Introduction:globalisation,value chains and development. IDS Bull. 32 (3), 1–8. doi:10.1111/j.1759-5436.2001.mp32003001.x

Hong, J., and Shang, H. (2019). Conjugate circulation theory" of China's open economy: theory and evidence. Chin. Soc. Sci. (01), 42–64+205.

Hu, D., Yin, X., and Chen, F. (2021). Strategic isolation,capability loss and low-end lock-in of OEM enterprises. Manag. Rev. 33 (09), 249–259.

Hu, D., Yin, X., and Hu, J. (2020). Strategic capture, capability loss and low-end lock-in of OEM enterprises--regulatory role based on network relationship capability. Contemp. Finance And Econ. (1), 89–100.

Huang, G. F., and Yang, G. C. (2022). Comparison of participation and status in international division of labor in Chinese manufacturing industry based on global value chain adjustment. Statistics Decis. 38 (03), 108–113.

Hummels, D., Ishii, J., and Yi, K. M. (2001). The nature and growth of vertical specialization in world trade. Am. Econ. Rev. 54 (1), 75–96. doi:10.1016/s0022-1996(00)00093-3

Johnson, R. C., and Noguera, G. (2012). Accounting for Intermediates: production sharing and trade in value added. J. Int. Econ. 86 (2), 224–236. doi:10.1016/j.jinteco.2011.10.003

Kee, H. L., and Tang, H. (2016). Domestic value added in exports: theory and firm evidence from China. Am. Econ. Rev. 106 (6), 1402–1436. doi:10.1257/aer.20131687

Koopman, R., Wang, Z., and We, S. J. (2014). Tracing value-added and double counting in gross exports. Am. Econ. Rev. 104 (2), 459–494. doi:10.1257/aer.104.2.459

Kummritz, V., Taglioni, D., and Winkler, D. E. (2017). Economic upgrading through global value chain participation which policies increase the value added gains? Cheltenham, United Kingdom: Edward Elgar Publishing.

Li, F. (2022). The characteristics and general laws of great powers in dual-cycle linkage: an investigation from the perspective of trade. World Econ. Res. (05), 102–116+137.

Li, F., Cao, Y., and Kunze, Li (2022). Research on regional differences and convergence of China's manufacturing export technology complexity. Quantitative Tech. Econ. Res. 39 (04), 107–126.

long, W., and Wang, L. (2017). Analysis on transformation and upgrading of China's manufacturing industry under the global value chain system. Res. Quantitative Econ. And Tech. Econ. (6), 71–86.

Pahl, S., and Timmer, M. P. (2020). Do global value chains enhance economic upgrading? A long view. J. Dev. Stud. 56 (9), 1683–1705. doi:10.1080/00220388.2019.1702159

Ren, T. (2020). Qi Junyan Productive service input and international competitiveness of manufacturing industr-data test of multinational industry based on WIOD. Discuss. Mod. Econ. (5), 52–61.

Tang, E. (2020). Analysis of Chinese enterprises' export behavior choice along development direction of international trade theory. Res. Institutional Econ. (03), 177–205.

Tian, K., Dietzenbacher, E., and Jong-A-Pin, R. (2022). Global value chain participation and its impact on industrial upgrading. World Econ. 45 (5), 1362–1385. doi:10.1111/twec.13209

Timmer, M., Los, B., and Stehrer, R. (2016). “An anatomy of the global trade slowdown based on the WIOD 2016 release,” in GGDC research memorandum GD-162 (Groningen, Netherlands: Groningen Growth and Development Centre, University of Groningen).

VeeramaniDhir, C. G. (2022). Do developing countries gain by participating in global value chains? Evidence from India. Rev. World Econ. 158 (4), 1011–1042. doi:10.1007/s10290-021-00452-z

Wang, L. (2019). Embeddedness of global value chains and trade benefits:an empirical analysis based on China. Finance Econ. Res. 45 (07), 71–83.

Wang, M., Duan, W., and Long, D. (2021). Policy cognition divergence,learning by doing and hierarchical government governance. World Econ. 44 (10), 130–156.

Wang, Z., Wei, S. J., and Yu, X. D. (2017a). Characterizing global value chains: production length and upstreamness. Cambridge, Massachusetts, United States: National Bureau of Economic Research.

Wang, Z., Wei, S. J., and Yu, X. D. (2017b). Measures of participation in global value chains and global business cycles. Cambridge, Massachusetts, United States: National Bureau of Economic Research.

Wang, Z., Wei, S. J., and Zhu, K. F. (2013). Quantifying international production sharing at the bilateral and sector levels. Cambridge, Massachusetts, United States: National Bureau of Economic Research.

Wen, D. (2018). Global value chain division of labor and China's trade imbalance-a study based on value added trade. Quantitative Econ. And Tech. Econ. Res. 35 (11), 39–57.

Wiryawan, B. A., Aginta, H., and Fazaalloh, A. M. (2022). Does GVC participation help industrial upgrading in developing countries? New evidence from panel data analysis. J. Int. Trade & Econ. Dev. 32, 1112–1129. doi:10.1080/09638199.2022.2149840

Wu, H., Zhang, S., and Liu, M. (2019). Research on trade competitiveness of China and ASEAN from perspective of "one belt one road"—analysis based on improved revealed comparative advantage index. Int. Econ. Coop. (06), 53–61.

Xiang, D. (2016). Evolution and determinants of connotative service value of China's manufacturing export. Econ. Res. (9), 44–57.

Xiang, D. (2021). Factor division, institutional opening and high-quality development of export trade. Tianjin Soc. Sci. (03), 93–98.

Xiang, D. (2020). Service orientation of manufacturing industry and the rise of value chain:empirical evidence from China. J. Xi'an Jiaot. Univ. Soc. Sci. Ed. (5), 37–52.

Xiang, D. (2019). The new development of factor division and China's new round of high-level opening-up strategy adjustment. Economist (05), 85–93.

Xiao, Yu, Xia, J., and Ni, H. (2019). Climbing path of global value chain of China's manufacturing industry. Res. Quantitative Econ. And Tech. Econ. (11), 40–59.

Yu, D., and Tian, S. (2019). The impact mechanism of embedded global value chain on transformation and upgrading of China's manufacturing industry. Reform (03), 50–60.

Yu, R., and Cheng, X. (2021). A study on influence of depth of trade agreements on level of specialization in China. Asia-Pacific Econ. 2021 (02), 114–125.

Yue, L. V., Chen, S., and Sheng, bin (2018). Will embedding in the global value chain lead to "low-end locking" made in China? Manag. World (8), 11–29.

Zhang, L. P., and Li, C. L. (2022). Global value chain participation and status of Chinese industries: based on a literature review perspective. Sci. Technol. Manag. Res. 42 (08), 111–118.

Zhang, R., and Zhang, C. (2022). Does energy efficiency benefit from foreign direct investment technology spillovers?evidence from manufacturing sector in Guangdong, China. Sustainability 14 (3), 1421. doi:10.3390/su14031421

Keywords: global value chain, China’s manufacturing industry, forward participation, backward participation, upgrading

Citation: Fu Q (2023) The impact of global value chain embedding on the upgrading of China’s manufacturing industry. Front. Energy Res. 11:1256317. doi: 10.3389/fenrg.2023.1256317

Received: 10 July 2023; Accepted: 10 October 2023;

Published: 02 November 2023.

Edited by:

Michael Carbajales-Dale, Clemson University, United StatesReviewed by:

Vidya C. T, Centre for Economic and Social Studies (CESS), IndiaCopyright © 2023 Fu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Qingwei Fu, MzYyMDI1MTM2QHFxLmNvbQ==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.