- 1School of Business, Nanjing Normal University, Nanjing, China

- 2School of Economics and Trade, Guangxi University of Finance and Economics, Nanning, China

- 3School of Business Administration, Guangxi University, Nanning, China

In the pivotal era of global industrial transformation, digital finance has emerged as a key driver in enhancing the modernization of China’s industrial chain. This study, utilizing data from 30 Chinese provinces from 2012 to 2020, investigates the influence of digital finance on industrial chain modernization through fixed effects and spatial econometric models. Our findings indicate a significant, positive impact of digital finance on industrial chain modernization. Heterogeneity analysis reveals that the eastern region benefits more from digital finance than central and western regions, and its influence has been more pronounced after 2016. Mechanistically, digital finance positively affects industrial agglomeration, industrial structure optimization, and facilitates Innovation Achievements Transformation, albeit with varying effectiveness across subindicators. Further, we observe positive spatial spillovers for both digital finance and industrial chain modernization. While digital finance significantly enhances industrial chain modernization, its impact on adjacent regions is negligible. Importantly, digital finance exerts a positive influence on industrial chain modernization in both short-term and long-term scenarios. This research elucidates the interplay between digital finance and the modernization of China’s industrial chain.

1 Introduction

The global climate change and environmental pollution issues are becoming increasingly serious (Ren et al., 2023a; Zheng et al., 2022). In the process of China’s industrial development, the trade opening and energy use consume a large amount of fossil fuels, and the consumption of fossil fuels increases carbon emissions (Abbas et al., 2022; Ali et al., 2022; Wen et al., 2022). Improving the modernization of industrial chain can improve the level of innovation, open up its trade and improve resource utilization efficiency, reduce energy consumption and environmental pollution, and help achieve a balance between economic development and environmental protection (Fan et al., 2020; Hu X et al., 2021; Ali et al., 2023). With the background of complex global industrial and supply chain changes, the modernization of the industrial chain has become an important goal for China as China is pursuing a high-quality development of industry in the new era.

Capital investment is the fore-end of industrial modernization development and occupies an unquestionable key position in the entire modern industrial chain construction. Compared to traditional finance, digital finance has many advantages in enhancing the modernization of China’s industrial chain. Firstly, as an emerging financial tool, digital finance has provided new sources of investment and financing for enterprises through its own financial essence (Awai et al., 2023). Secondly, digital finance is not limited by geography or time, and can cover vast rural areas and small and medium-sized enterprises that are difficult to reach by traditional financial services. It is a major policy that benefits all people, especially small and medium-sized enterprises. Finally, digital finance’s essence is relying on big data and artificial intelligence technology, which can monitor the dynamics of the financial market and enterprises’ credit status in real-time. This helps to reduce the transmission of financial risks in the industrial chain and ensure the stable operation of the industrial chain.

At present, scholars have conducted relevant research on the relationship between digital finance and industrial chain development, but there are some shortcomings in the research process of these studies. Firstly, the different impacts of different dimensions of digital finance on the modernization of the industrial chain were ignored. Secondly, the study did not consider the spatial spillover impact of digital finance on the development of the industrial chain, nor did it further consider whether digital finance has a long-term impact on the modernization of the industrial chain. Therefore, this article attempts to make up for the shortcomings of previous research by using provincial-level panel data from China to construct indicators for the modernization of China’s industrial chain and applying relevant empirical models to analyze the relationship between digital finance and modernization of the industrial chain from both theoretical and empirical perspectives, thereupon expanding the research scope of digital finance and adding specific paths to enhance the modernization of the industrial chain. The innovation of this article lies in: Firstly, industrial agglomeration, industrial structure upgrading, and innovation achievements transform as mechanism variables, fully reflect the internal mechanism of digital finance’s impact on industrial chain modernization, and enrich the theoretical connotation of existing research; Secondly, measure the indicators of various dimensions of digital finance, and study how these dimensions affect industrial agglomeration, industrial structure upgrading, and innovation achievement transformation; Thirdly, delve into the spatial and temporal effects of digital finance on the modernization of the industrial chain by considering spatial and temporal factors.

2 Theoretical analysis and research hypotheses

As an innovative product generated from the integration of finance and digital technology (Ren et al., 2023b; Yu et al., 2023), the impact of digital finance on the modernization of industrial chains is not only limited to the financial sector but also manifests in the positive externality of digital technology (Xiao et al., 2023a). These two facets play a crucial role in how digital finance influences the development of industrial chains. Digital technology alters the geographical limitations of financial services, breaks the industry barriers for capital utilization, fully demonstrates the efficiency of capital allocation (Lei et al., 2023), and paves new pathways and models for the financing needs of modernizing industrial chains. With the support of digital technology, digital finance can mitigate the financing pressures of businesses in a timely manner (Qiu et al., 2023), increase capital sources, thereby directly affecting the development, spatial layout, and technological advancement of businesses. Simultaneously, digital finance can leverage its digital technology to enhance efficiency of resource allocation and communication efficiency, and reduce transaction costs, profoundly influencing the development of businesses and even entire industries. However, the development of digital finance has generated a digital divide, which has led to digital inequality between regions, reduced regional financial efficiency and is not conducive to the modernization and balanced development of the industrial chain (Heeks, 2022; Wang et al., 2020). In conclusion, the article proposes Hypothesis 1a and Hypothesis 1b.

H1a. The development of digital finance can contribute to the improvement of the modernization of the industry chain.

H1b. The development of digital finance cannot contribute to the improvement of the modernization of the industry chain.

2.1 Digital finance, industrial agglomeration, and modernization of industrial chain

Industrial agglomeration, crucial to industrial chain modernization, boosts production factors’ circulation, fosters good inter-industrial relationships, constructs complementary models and reduces costs via joint economies of scale (Gamidullaeva Leyla, 2023). Digital finance, leveraging digitization, influences industrial agglomeration and bolsters modernization of the industrial chain. It expedites factor flow and knowledge spillover via technologies like mobile internet, big data, and cloud computing and reshapes resource allocation and aggregation methods through data acquisition, processing, and utilization (Wang et al., 2023). As China’s industrial development aligns with the second stage of Weber’s theory (An et al., 2015), digital finance strengthens interenterprise connectivity, influences aggregation and creates new geographical spatial structures (Forman and Van Zeebroeck, 2019; Hu W et al., 2021). Furthermore, digital finance utilizes its resource allocation prowess to impact industrial agglomeration. Digital inclusive finance directs high concentration of capital and talent and forms industrial clusters while mitigating enterprise financing constraints (Yang and Zhou, 2021). Financially intensive regions often create entrepreneur clusters and embody a talent agglomeration-driven development model. In conclusion, the article proposes Hypothesis 2.

H2. Digital finance promotes industry chain modernization through industrial agglomeration.

2.2 Digital finance, industrial structure upgrading, and industrial chain modernization

Industrial structure transformation is the root cause of the evolution and upgrading of the entire industrial chain (Chen et al., 2021). Through the effective combination of digital technology and financial innovation, digital finance can not only improve the industry’s production efficiency, but also promote the transformation and the industrial structure upgrading by driving emerging industries development (Li C et al., 2020). On the one hand, digital technology is an important feature of digital finance and an important way for information transmission between enterprises. The digitization degree has accelerated the flow of data and information between product and factor markets, shortened the dissemination cycle of innovative resources between projects, enterprises, and industries, accelerated professional division of labor (Li M.C et al., 2020), and accelerated the transformation and upgrading of enterprises and even the entire industry. When digital technology replaces enterprises’ basic work, the human capital allocation’s efficiency will also be significantly improved, thereby increasing the possibility of enterprise upgrading (World Bank, 2016). In short, the intelligent products application can improve enterprises’ business efficiency, and the newly emerged formats and models have played a crucial role in upgrading the industrial structure (Guo, 2019). On the other hand, financial innovation can improve the efficiency of capital allocation from the supply and demand level and realize the industrial structure upgrading (Zhou et al., 2022). Digital finance enables finance to better serve the real economy development by reducing enterprises’ financing costs, expanding their financing scale, and improving capital allocation efficiency (Feng et al., 2022). At the same time, financial activity is directly related to the utilization efficiency of financial resources. And by leveraging the advantages and disadvantages of finance itself, it accelerates its agglomeration towards emerging industries, leading to gradual elimination or even replacement of backward industries (Zhao and Wei, 2016). In conclusion, the article proposes Hypothesis 3.

H3. Digital finance promotes industry chain modernization through industrial structure upgrading.

2.3 Digital finance, innovation achievements transformation, and industrial chain’s modernization

Innovation Achievements Transformation, the cornerstone of enhancing the industrial chain’s modernization, necessitate efficient transformation for modernization (Zhang, 2021). Traditional financial institutions often manifest risk aversion when supporting innovation-centric firms. However, digital finance’s technology can more accurately assess risks, mitigating uneven financial resource distribution among enterprises (Rudenko et al., 2016). In the digital finance milieu, market entities enjoy more precise innovative financing services. Potential firms are readily identifiable, gaining financial support for early-stage research and development, which facilitates better implementation of innovative achievements (Teece, 2010). The introduction of digital elements invigorates the market’s innovation environment and enhances resource allocation and innovation efficiency (Xu and Li, 2022) and creates favourable external conditions for successful Innovation Achievements Transformation, Reduced external risk and improved firms ESG performance (Chen et al., 2023). Digital technology can also effectively discern consumer needs, drive product research and development innovation based on demand, hence foster successful Innovation Achievements Transformation (Charnley et al., 2022). Digital finance provides ample funding for enterprises’ innovative research and development, as well as implementation of innovative achievements. Concurrently, as an advanced financial technology, digital finance lures talent. With substantial corporate funds and talent reserves, enterprises’ innovation capabilities are inevitably enhanced, creating the conditions necessary for successful Innovation Achievements Transformation (Zhuang et al., 2021). In conclusion, the article proposes Hypothesis 4.

H4. Digital finance promotes industry chain modernization through Innovation Achievements Transformation.

3 Indicator description and model construction

3.1 Model settings

To verify the direct impact of digital finance on the industrial chain modernization, this article constructs the following benchmark model:

In model (1),

In order to further characterize the inherent correlation between digital finance and the industrial chain modernization, this article will examine its core impact mechanisms - industrial agglomeration, industrial structure upgrading, and the Innovation Achievements Transformation. Drawing on the research methods of Xu Hongwei, Zhong Yuejun (2022), we respectively observe the impact of digital finance

In Eq. 2, if digital finance can affect the industrial chain modernization through industrial agglomeration, industrial structure upgrading, and Innovation Achievements Transformation, it is expected to be significantly positive. Compared to existing research, the biggest highlight of this study is to divide digital finance into three dimensions and examine the impact of different dimensions of digital finance on the modernization of the industrial chain. At the same time, we will deeply explore the differences in the impact mechanisms of different dimensions of digital finance on the modernization of the industrial chain. This is conducive to better analyzing the path of digital finance and promoting the development of digital finance in depth, breadth, and digitization.

3.2 Indicator selection and calculation

3.2.1 The dependent variable

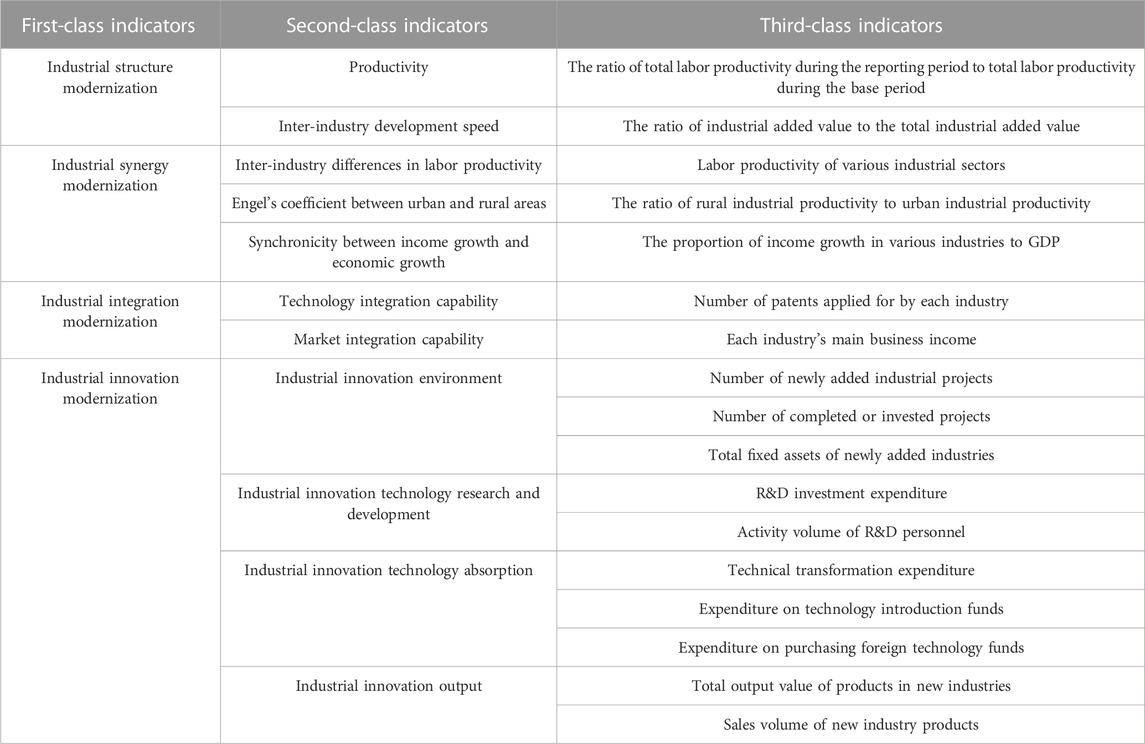

The dependent variable is industrial chain modernization (ICM). Referring to Mao, (2022) research, based on the principles of scientificity, comprehensiveness, and practicality, this study uses the spatiotemporal range entropy weight method to measure the modernization of China’s industrial chain. The indicator system is shown in Table 1.

3.2.2 Explanatory variable

The explanatory variable is digital finance. This article mainly uses data compiled by the Digital Finance Research Center of Peking University, which measures the depth, breadth, and coverage of digital finance.

3.2.3 Mechanism variables

Industrial agglomeration (Miao et al., 2023): Using location entropy to calculate industrial agglomeration, which is the ratio of the proportion of industrial added value in each province to the total domestic industrial added value to the proportion of GDP in each province to the domestic GDP; Industrial structure upgrading (Ren et al., 2023c): the ratio of the output value of the tertiary industry to the output value of the secondary industry; Achievements of industrial innovation: adopt the natural logarithm of regional new product sales revenue.

3.2.4 Control variables

Economic development (Eco): natural logarithm of regional GDP. With the improvement of the economic development level, the modernization of industrial chain is getting better and better (Qunhui, 2020); Talent support (Ts): natural logarithm of the number of college students. Talents provide the necessary human capital for the modernization construction of the industrial chain (Tien et al., 2021); Education development (Edu): natural logarithm of the number of ordinary colleges and universities. The higher the education level of areas, the higher the quality of the population, the more conducive to the development of advanced industries (Berry and Glaeser, 2005); Infrastructure (St): natural logarithm of per capita road area. Infrastructure is a prerequisite for industrial development (Malah kuete and Asongu, 2022); Government support (Gs): ratio of general public budget expenditure to GDP. The role of the government in the development process of this industry cannot be underestimated (Li et al., 2023).

3.3 Data source

The research sample for this article is 30 provinces in China from 2011 to 2020 (based on data availability, excluding Hong Kong, Macao, Taiwan, and Tibet). The digital finance data comes from the “The Peking University Digital Financial Inclusion Index of China (PKU_DFIIC)” released by Institute of Digital Finance Peking University, and other related research data is obtained through China EPS database.

3.4 Descriptive statistics

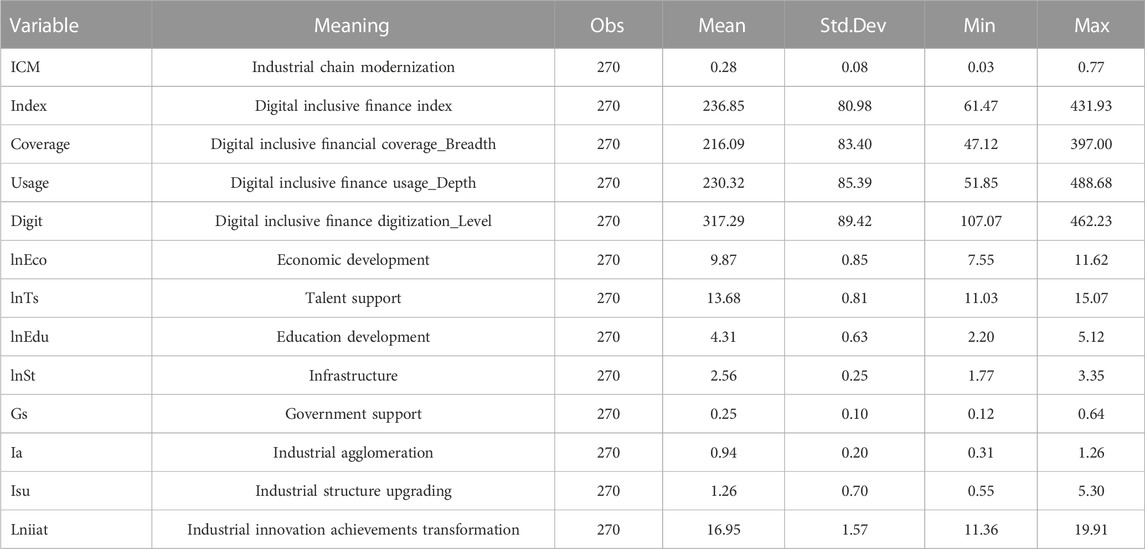

The descriptive statistics for the main variables are shown in Table 2.

4 Quantitative regression analysis

4.1 Benchmark regression

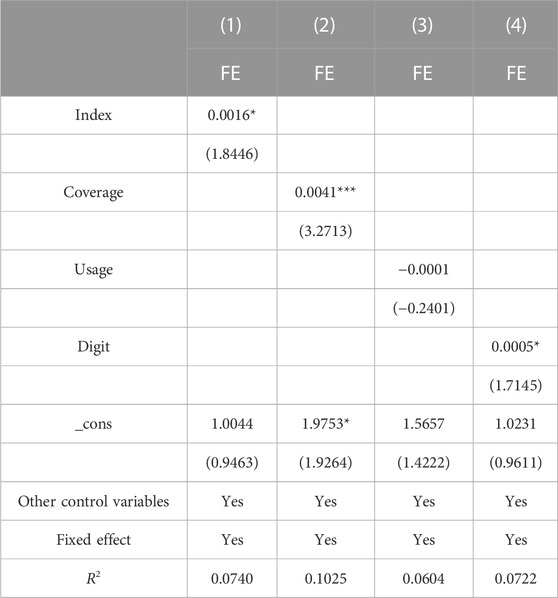

The fixed effects model is used in columns (1)–(4) of Table 3, and the results in column (1) indicate that digital finance has improved the industrial chain modernization at a significance level of 1%, which is in line with the H1a of this article. Columns (2)–(4) represent the impact of coverage breadth, depth of use, and degree of digitization on the industrial chain modernization. It can be found that digital finance’s coverage significantly affects the industrial chain modernization level at a level of 5%. The depth of use and digitization both improve the industrial chain modernization at a significance level of 1%, indicating that digital finance can mainly influence the development of the industrial chain modernization through its financial essence (coverage breadth, service depth) and digitization, which means that the coverage, depth of use, and digitalization degree of digital finance rely on the digital financial services provided by digital technology, which can increase industrial credit capital availability, stimulate the industrial entities’s vitality, and ensure investment’s completeness in industrial development funds by expanding financing channels, alleviating the opacity of information between credit parties, and improving financial services’ efficiency. This lays the foundation for promoting of the industrial chain modernization.

TABLE 3. Regression results of digital finance and various indicators on the industrial chain modernization.

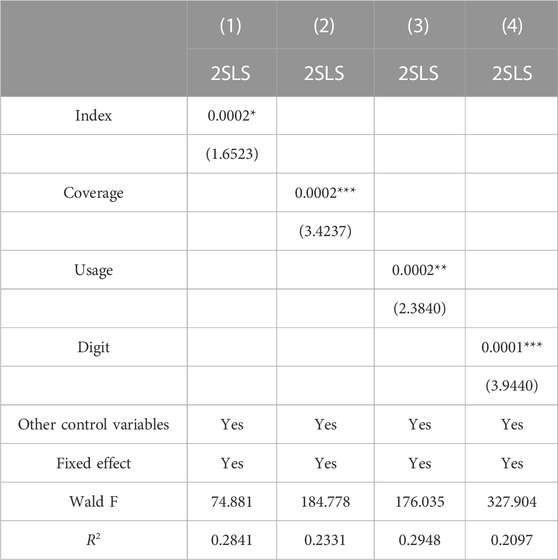

In columns (1)–(4) of Table 4, the 2SLS instrumental variable method was used to eliminate endogeneity and test the impact of the digital finance index and its subdimensions on the industrial chain modernization. Regarding the selection of instrumental variables, we draw on the research of Zhang et al. (2020) and use the spherical distance from the sample province to Hangzhou as instrumental variables. On the one hand, the distance objectively exists and is not necessarily related to the level of industrial chain development in the region, thus conforming to the exogenous characteristics of instrumental variables. On the other hand, Hangzhou is digital finance’s birthplace, and the distance from Hangzhou is related to digital finance’s development in the region to a certain extent. Therefore, it’s consistent with the correlation premise of instrumental variables. On this basis, considering that the single dimension of distance does not change over time, and drawing on the research of Li Muchen and Feng Sixian (2021), the interaction term between various indices of digital finance and spherical distance is added as instrumental variables to the regression equation. The results show that after eliminating endogeneity, digital finance still significantly affects the industrial chain modernization. The sub-dimension results show that the coverage, depth of use, and digitization degree of digital finance are significant, consistent with the regression results of the fixed effects model in columns (2)–(4) of Table 3.

4.2 Heterogeneity analysis

4.2.1 Regional heterogeneity

Due to geographical differences and differences in economic resource endowments, there will also be significant differences in the development of digital finance. Due to regional differences, there is a significant differentiation in financing psychology and financial infrastructure. The puzzle in theory and practice is that digital finance will fully leverage its inclusive nature, inject funds and technical support into the modernization of industrial chain in the central and western regions, or become another sharp tool for extracting funds. Therefore, digital finance has geographical heterogeneity in the modernization of industrial chains in different regions.

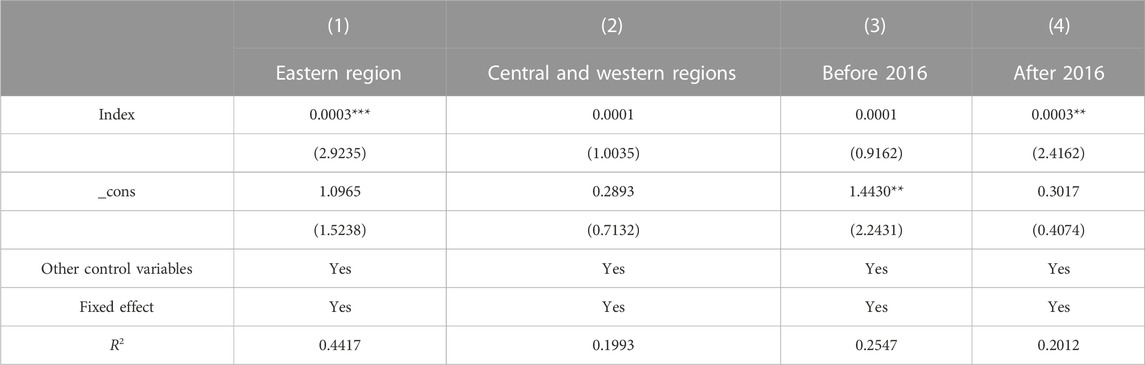

In view of this, the samples from each province were divided into eastern and central western regions for heterogeneity analysis by region. The regression results are shown in columns (1)–(2) of Table 5. The results indicate that digital finance has significantly improved the modernization of industrial chain in the eastern region, but its effect on the central and western regions is not significant. The reason may be that the eastern region has an inherent advantage in being the birthplace and is better able to seize the opportunities brought by digital finance. However, the “inclusive” effect of digital finance on the development of the industrial chain in the central and western regions has not yet been fully realized. Compared to the eastern region, the central and western regions are relatively lacking in new infrastructure, talent, and technology, and have not yet formed an external environment that is compatible with digital finance, which cannot fully play the role of digital finance.

4.2.2 Temporal heterogeneity

Digital finance was first proposed at the 2016 Hangzhou G20 Summit, which can be called the first year of digital finance, and may present a watershed effect here. That is, before 2016, digital finance had just started, and its effectiveness was significantly smaller than that after 2016. Based on this assumption, this article divides the samples into different time periods, and the regression results are shown in columns (3)–(4) of Table 5. Column (3) is based on the results of sample regression before 2016, and the promotion effect of digital finance on the modernization of industrial chain is not significant. Column (4) is based on regression results after 2016. Digital finance has significantly promoted the modernization of industrial chain. After 2016, digital finance has played a significant role in reducing investment and financing costs, enhancing financing efficiency, and providing capital support for small and micro industries. The regression results show that digital finance has a more significant promoting effect on the modernization of industrial chain.

4.3 Mechanism analysis

In this section, we will establish a model to verify the impact of digital finance and its subindicators (coverage breadth, depth of use, and degree of digitization) on industrial agglomeration, industrial structure upgrading, and successful transformation of industrial innovation.

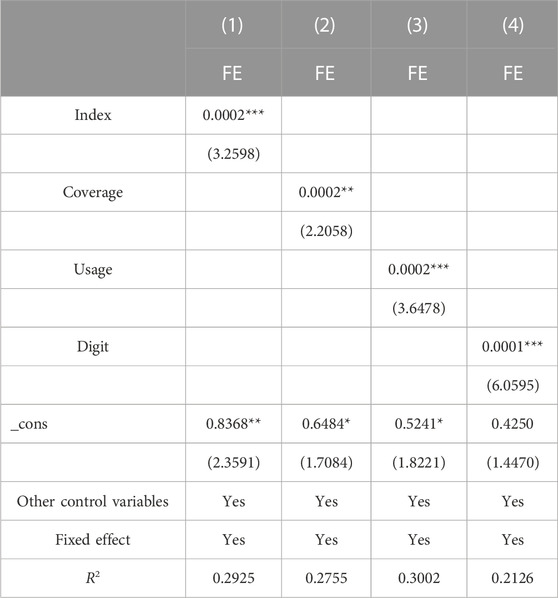

Table 6 shows the regression results of digital finance and its subindicators on industrial agglomeration. Column (1) indicates that digital finance significantly improves regional industrial agglomeration, the subdimensions of columns (2)–(3) indicate that the coverage of digital finance increases industrial agglomeration, while the use depth of digital finance has no significant effect on industrial agglomeration. This indicates that the concentration of industrial formation spatial scope is mainly related to digital finance’s coverage. Digital finance’s coverage determines beneficiary enterprises number, leading to agglomeration within a certain range of enterprises. Column (4) shows that the degree of digitalization has significantly increased the industrial agglomeration, which is the positive effect of the spatial externality of digital technology, consistent with the H2.

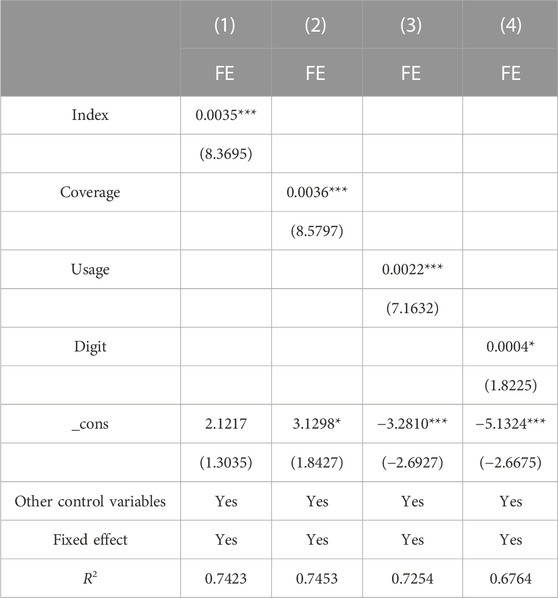

Table 7 shows the regression structure of digital finance and its subindicators on the industrial structure upgrading. Column (1) shows that digital finance has improved the industrial chain modernization at a significance level of 1%. Columns (2)–(3) represent the regression of financial coverage and usage depth to the industrial chain modernization. The results indicate that the digital finance’s coverage and depth can effectively promote the industrial structure upgrading. Column (4) indicates that digitization significantly enhances the industrial structure upgrading, accelerates the information flow in product and factor markets, and accelerates enterprise transformation and upgrading, consistent with the H3 of this article.

TABLE 7. Regression results of digital finance and various indicators on industrial structure optimization.

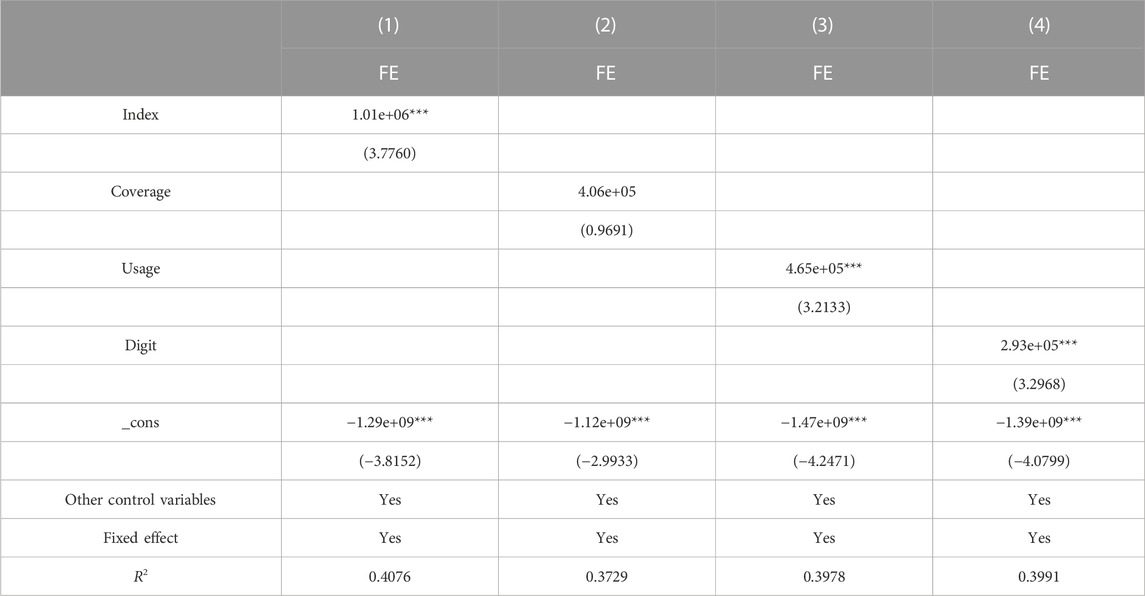

Table 8 shows the regression results of digital finance and its subindicators on the industrial Innovation Achievements Transformation. Column (1) indicates that digital finance promotes the Innovation Achievements Transformation and promotes it at a significance level of 1%. Columns (2)–(3) show the impact of financial coverage and usage depth on the industrial chain modernization. The results show that the coverage of digital finance has no significant impact on the Innovation Achievements Transformation, while the depth of use helps to promote the Innovation Achievements Transformation. The possible reason is that industrial innovation achievements require deep financial support, so compared to the breadth of coverage, the depth of use of digital finance can play a more effective role in promoting the Innovation Achievements Transformation. The digitization of column (4) promotes the Innovation Achievements Transformation at a level of 1%, while digital technology promotes innovation activity, accurately identifies user needs, and promotes the implementation of achievements, consistent with the H4.

TABLE 8. Regression results of digital finance and various indicators on the innovation achievements transformation.

5 Extended analysis

The issue of information asymmetry is a key issue that restricts the modernization of the industrial chain in obtaining credit funds. In the process of allocating credit funds, traditional financial markets mainly rely on mortgaged assets as the measurement criteria for issuing corporate credit funds. However, items that can be mortgaged cannot accurately identify the needs of the fund demand side. Digital finance avoids information asymmetry between credit parties and increases the availability of industrial financial services. It should be noted that the digital economy has real-time characteristics in solving information asymmetry, so the modernization of industrial chain has dynamic spatial spillover effects. Therefore, this section introduces a spatial econometric model that includes spatial lag term, time lag term, and spatiotemporal lag term to detect the dynamic spatial spillover effects of digital finance and industrial chain modernization, which can effectively avoid endogeneity issues in the model. The model is as follows:

In Formula 3,

The spatial weight matrix W adopts the geographical distance matrix based on the distance function, as follows:

In Formula 4,

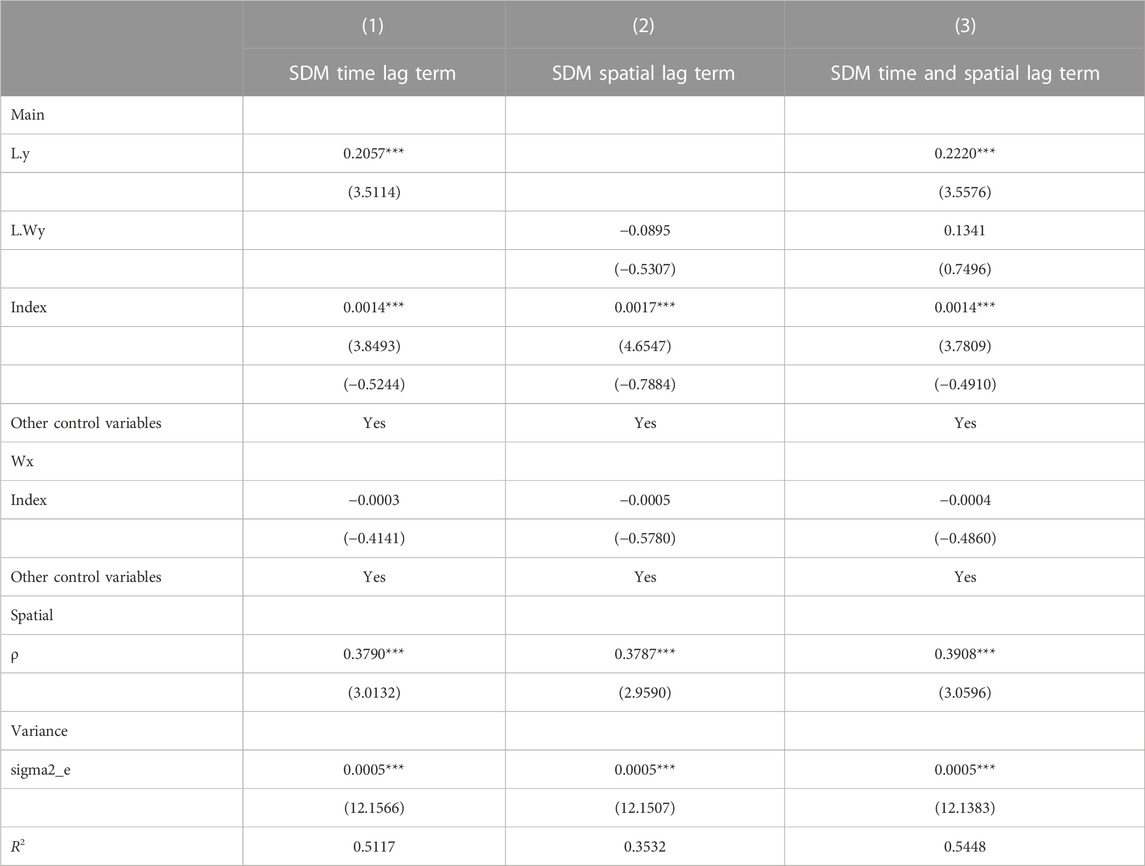

Columns (1)–(3) in Table 9 show the time lag term, spatial lag term, and time and spatial lag term of the spatial Durbin model (SDM). The results show that in the Spatial Durbin Model (SDM), the lag coefficient of the dependent variable ρ is significantly positive at 1%. This indicates that there is a spatial spillover effect in the modernization of industrial chain, and the coefficient of digital finance is significantly positive, indicating that digital finance can significantly improve the modernization of industrial chain. Under the real-time nature of digital technology, the modernization of industrial chain has significant spatial dynamic effects. The implementation of digital finance provides strength for a new round of financial supply in the entire financial market, increases the types of financial services, and increases the probability and scope of industrial entities obtaining credit capital. As a strong supplement to traditional financial services, digital finance also relies on a series of digital technology advantages to broaden financing channels, increase the scale of financial coverage in the industrial chain, and provide capital support to the main body of industrial development. With the support of digital finance, the modernization of the previous industrial chain can significantly have a positive effect on the modernization of the next industrial chain.

TABLE 9. The spatial measurement results of digital finance on the modernization of industrial chain.

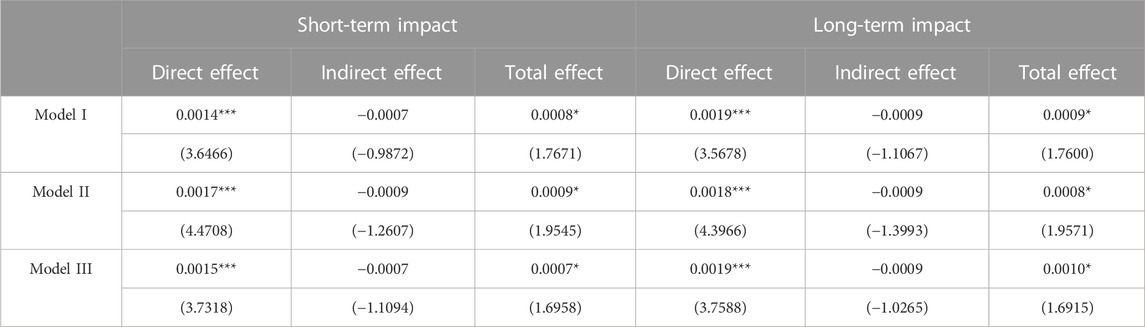

The model I, model II, and model III in Table 10 respectively correspond to the model decomposition effect of adding time lag term, space lag term, time lag term, and space lag term. The regression results of the three models are consistent and can be used as robustness tests for each other. In the short term, the direct impact of digital finance on the modernization of industrial chain is significantly positive, while the indirect impact is not significant. The overall effect is significantly positive. In the long run, the direct impact of digital finance on the modernization of industrial chain is also significantly positive, while the indirect impact is not significant. The overall effect is significantly positive. That is to say, digital finance has a significant positive impact on the modernization of local industrial chains in both the short-term and long-term, but has no significant impact on the modernization of adjacent regional industrial chains. The long-term direct effect is greater than the short-term direct effect, indicating that in the short term, digital finance may influence the modernization development of the industrial chain through its own role, while in the long term, it is through the joint action of itself and technological changes on the modernization of the industrial chain. In other words, digital finance can not only support the modernization of the industrial chain itself, but also make this boosting effect more apparent through technological changes in the long term.

TABLE 10. The direct, indirect, and total effects of digital finance on the modernization of industrial chain.

6 Discussion

The empirical results show that digital finance has a positive and positive impact on the modernization of the Chinese industrial chain, which is consistent with the research findings Lei et al., 2023; Xiao et al., 2023b). Our findings underscore the fact that digital finance has a significant and positive impact on this process, primarily by breaking down traditional time-space constraints between capital demand and supply.

Notably, the influence of digital finance is heterogeneous across different regions of China. The eastern region, which is typically more developed and has more mature digital infrastructure, benefits more significantly from digital finance compared to the central and western regions. This implies that digital finance might be more effective in regions with a certain level of economic and digital development, suggesting that digital infrastructure could be a prerequisite for maximizing the benefits of digital finance. Therefore, the existence of differences in financial endowments across regions may account for the differences with the findings of scholars (Heeks, 2022; Wang et al., 2020).

Our results also highlight that the impact of digital finance has been more pronounced after 2016. This might be attributed to the rapid advancements in digital technologies and financial innovations that have occurred in recent years. Furthermore, we found that digital finance contributes positively to industrial agglomeration, industrial structure optimization, and Innovation Achievements Transformation. The varying effectiveness across these subindicators suggests the multifaceted nature of digital finance’s influence on industrial modernization.

Finally, our research reveals positive spatial spillovers of digital finance and industrial chain modernization. However, the impact of digital finance on adjacent regions was found to be negligible. This could be due to the localized nature of digital finance, where its benefits are primarily reaped within the region where it is implemented.

7 Conclusion and policy recommendations

The research concludes that digital finance has a positive and significant impact on the modernization of industrial chain. Digital finance uses high-end and cutting-edge digital technology to break the objective time-space constraints between the demand side of financial capital and the supplier of financial resources, and can obtain credit capital more quickly, which provides a basis for promoting the industrial structure upgrading, industrial agglomeration and Innovation Achievements Transformation.

Therefore, this paper puts forward the following policies and suggestions: firstly, improve the quality of financial services, form a large-scale digital financial market system, further expand the depth and breadth of financial services, and transform digital finance from capital allocation function to capital allocation; Give full play to the leading role of the capital market, provide operational capital for the industrial chain development, increase the direct financing’s proportion by enterprises, inject new momentum into industrial development, and promote the high-end trend of the industrial chain. Secondly, promote a high degree of integration between digital finance business and the industrial chain, create and set up digital finance products that are in line with the industrial chain development, guide funds to flow into high-end industries, strengthen the role of digital finance in fund allocation in the industrial chain, actively promote the allocation of capital elements from low-end industries to high-end industries in the value chain, and assist in industrial agglomeration, industrial upgrading, and innovation transformation.

8 Limitations

Despite the significant findings, our research is not without limitations. First, our study focused on the provincial level, potentially overlooking variations at the city or district level. Digital finance development and its impacts could be more nuanced and vary significantly within provinces, which our study does not capture. Finally, our study did not examine the potential negative impacts or risks associated with digital finance, such as increased cybersecurity threats or financial instability. Future research could aim to provide a more balanced perspective by investigating both the advantages and potential risks of digital finance.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

QX: conceptualization, supervision, validation, project administration, funding support, and writing—review. YZ: formal analysis and writing—original draft, review, and editing. XF: providing original data. LS: language polishing. XC: writing—review. All authors contributed to the article and approved the submitted version.

Funding

This research is funded by the China Scholarship Council’s project “National Construction of High-level University Public Graduate Students” (project number: 202206860022); China Jiangsu Graduate Research and Innovation Program Project “Research on Rural Revitalization Strategy Driven by Inclusive Finance under the Background of Digital Economy” (project number: KYCX22_1387); China Social Science Foundation (project number: 20BJY001).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbas, S., Gui, P., Chen, A., and Ali, N. (2022). The effect of renewable energy development, market regulation, and environmental innovation on CO2 emissions in BRICS countries. Environ. Sci. Pollut. Res. 29 (39), 59483–59501. doi:10.1007/s11356-022-20013-7

Ali, N., Phoungthong, K., Khan, A., Abbas, S., Dilanchiev, A., Tariq, S., et al. (2023). Does FDI foster technological innovations? Empirical evidence from BRICS economies. Plos one 18 (3), e0282498. doi:10.1371/journal.pone.0282498

Ali, N., Phoungthong, K., Techato, K., Ali, W., Abbas, S., Dhanraj, J. A., et al. (2022). FDI, green innovation and environmental quality nexus: ew insights from BRICS economies. Sustainability 14 (4), 2181. doi:10.3390/su14042181

An, Q., Chen, H., Wu, J., and Liang, L. (2015). Measuring slacks-based efficiency for commercial banks in China by using a two-stage DEA model with undesirable output. Ann. Operations Res. 235, 13–35. doi:10.1007/s10479-015-1987-1

Awais, M., Afzal, A., Firdousi, S., and Hasnaoui, A. (2023). Is fintech the new path to sustainable resource utilisation and economic development? J. Resour. Policy 81, 103309. doi:10.1016/j.resourpol.2023.103309

Berry, C. R., and Glaeser, E. L. (2005). The divergence of human capital levels across cities. Pap. regional Sci. 84 (3), 407–444. doi:10.1111/j.1435-5957.2005.00047.x

Charnley, F., Knecht, F., Muenkel, H., Pletosu, D., Rickard, V., Sambonet, C., et al. (2022). Can digital technologies increase consumer acceptance of circular business models? The case of second hand fashion. J. Sustain. 14 (8), 4589. doi:10.3390/su14084589

Chen, X., Chen, X., Xu, L., and Wen, F. (2023). Attention to climate change and downside risk: evidence from China. Risk Anal. 43 (5), 1011–1031. doi:10.1111/risa.13975

Chen, X. Y., Chen, M. S., and Wang, X. L. (2021). The path selection of advanced manufacturing industry foundation and modernization of industrial chain in fujian province. J. Southwest Acad. Res. 02, 145–154. doi:10.13658/j.cnki.sar.2021.02.015

Fan, X. J., Wu, S. M., Lei, Y. L., Li, S. T., and Li, L. (2020). Have China's resource-based regions improved in the division of GVCs? — Taking shanxi province as an example. J. Resour. Policy 68, 101725. doi:10.1016/j.resourpol.2020.101725

Feng, S., Zhang, R., and Li, G. (2022). Environmental decentralization, digital finance and green technology innovation. Struct. Change Econ. Dyn. 61, 70–83. doi:10.1016/j.strueco.2022.02.008

Forman, C., and Van Zeebroeck, N. (2019). Digital technology adoption and knowledge flows within firms: Can the internet overcome geographic and technological distance? Res. Policy 48 (8), 103697–697. doi:10.1016/j.respol.2018.10.021

Gamidullaeva Leyla, A. (2023). Industrial cluster of the region as a localized ecosystem: the role of selforganization and collaboration factors. J. π-Economy 16 (99). doi:10.18721/JE.16105

Guo, K. M. (2019). Development of artificial intelligence, transformation and upgrading of industrial structure, and changes in labor income share. J. Manag. World 35 (07), 60–77. doi:10.19744/j.cnki.11-1235/f.2019.0092

Heeks, R. (2022). Digital inequality beyond the digital divide: conceptualizing adverse digital incorporation in the global South. Inf. Technol. Dev. 28 (4), 688–704. doi:10.1080/02681102.2022.2068492

Hu W, W., Chen, X. D., and Chen, Z. (2021). Theoretical model and interaction mechanism of informatization, industrialization and manufacturing agglomeration. Reg. Econ. Rev. 5, 54–72. doi:10.14017/j.cnki.2095-5766.2021.0086

Hu X, X., Ali, N., Malik, M., Hussain, J., Fengyi, J., and Nilofar, M. (2021). Impact of economic openness and innovations on the environment: a new look into ASEAN countries. Pol. J. Environ. Stud. 30 (4), 3601–3613. doi:10.15244/pjoes/130898

Lei, T., Luo, X., Jiang, J., and Zou, K. (2023). Emission reduction effect of digital finance: Evidence from China. Environ. Sci. Pollut. Res. 30 (22), 62032–62050. doi:10.1007/s11356-023-26424-4

Li, C., Li, D., and Zhou, C. (2020). The mechanism of digital economy driving the transformation and upgrading of manufacturing industry—analysis based on the perspective of industrial chain. Bus. Res. 2, 73–82. doi:10.13902/j.cnki.syyj.2020.02.008

Li, M., Cao, G., Li, H., Hao, Z., and Zhang, L. (2023). How government subsidies affect technology innovation in the context of industry 4.0: evidence from Chinese new-energy enterprises. Kybernetes. doi:10.1108/K-08-2022-1098

Li, M. C., Feng, S. X., and Xie, X. (2020). Research on the heterogeneity of the impact of digital inclusive finance on the urban-rural income gap. J.Journal Nanjing Agric. Univ. Sci. 20 (03), 132–145. doi:10.19714/j.cnki.1671-7465.2020.0046

Malah Kuete, Y. F., and Asongu, S. A. (2022). Infrastructure development as a prerequisite for structural change in Africa. J. Knowl. Econ. 14, 1386–1412. doi:10.1007/s13132-022-00989-w

Mao, B. (2022). Construction and comprehensive measurement of the index system for the modenization of China's industrial chain. J.Reform Econ. Syst. 02, 114–120.

Miao, X., Han, J., Wang, S., and Li, X. (2023). Spatial effects of market integration on the industrial agglomeration of agricultural products: evidence from China. Environ. Sci. Pollut. Res. 30, 84949–84971. doi:10.1007/s11356-023-28303-4

Qiu, Y., Wang, Z., and Zheng, M. (2023). Can digital finance improve corporate environmental performance? Evidence from heavy polluting listed companies in China. Emerg. Mark. Finance Trade, 1–21. doi:10.1080/1540496X.2023.2167489

Qunhui, H. (2020). Facilitating modernization of China’s industrial and supply chains and advancing optimization and upgrade of its economic system.

Ren, X., Li, J., He, F., and Lucey, B. (2023a). Impact of climate policy uncertainty on traditional energy and green markets: evidence from time-varying granger tests. Renew. Sustain. Energy Rev. 173, 113058. doi:10.1016/j.rser.2022.113058

Ren, X., Zeng, G., and Gozgor, G. (2023b). How does digital finance affect industrial structure upgrading? Evidence from Chinese prefecture-level cities. J. Environ. Manag. 330, 117125. doi:10.1016/j.jenvman.2022.117125

Ren, X., Zeng, G., and Zhao, Y. (2023c). Digital finance and corporate ESG performance: empirical evidence from listed companies in China. Pacific-Basin Finance J. 79, 102019. doi:10.1016/j.pacfin.2023.102019

Rudenko, M. N., Goloshchapova, L. V., Savvina, O. V., Zamkovoy, A. A., Chernikova, N. V., and Andryushchenko, O. G. (2016). Innovative activity of financial and industrial groups. Int. J. Econ. Financial Issues 6 (8), 108–114. Available at: https://dergipark.org.tr/en/pub/ijefi/issue/32018/354077.

Teece, D. J. (2010). Business Models,Business Strategy and innovation. Long. Range Plan. 43 (2), 172–194. doi:10.1016/j.lrp.2009.07.003

Tien, N. H., Ngoc, N. M., and Anh, D. B. H. (2021). Current situation of high-quality human resources in FDI enterprises in Vietnam-solutions to attract and maintain. Int. J. Multidiscip. Res. Growth Eval. 2 (1), 31–38.

Wang, M. J., Zhang, M. Z., Chen, H. Q., and Yu, D. H. (2023). How does digital economy promote the geographical agglomeration of manufacturing industry? J. Sustain. 15 (2), 1727. doi:10.3390/su15021727

Wang, Q., Yang, J., Chiu, Y. H., and Lin, T. Y. (2020). The impact of digital finance on financial efficiency. Manag. Decis. Econ. 41 (7), 1225–1236. doi:10.1002/mde.3168

Wen, J., Ali, W., Hussain, J., Khan, N. A., Hussain, H., Ali, N., et al. (2022). Dynamics between green innovation and environmental quality: new insights into South asian economies. Econ. Politica J. Anal. Institutional Econ. 39 (2), 543–565. doi:10.1007/s40888-021-00248-2

Xiao, Q., Fang, X. B., and Li, K. (2023a). The road to green innovation: how financial technology affects enterprise green innovation. J. Finance Econ. 03, 45–58.

Xiao, Q., Wang, Y., Liao, H. J., Han, G., and Liu, Y. J. (2023b). The impact of digital inclusive finance on agricultural green total factor productivity: a study based on China’s provinces. J. Sustain. 15 (2), 1192. doi:10.3390/su15021192

Xu, J., and Li, W. (2022). The impact of the digital economy on innovation: new evidence from panel threshold model. Sustainability 14 (22), 15028. doi:10.3390/su142215028

Yang, J., and Zhou, C. L. (2021). Does industrial clustering mitigate the sensitivity of firm relocation to tax differentials? The role of financing. J. Finance Res. Lett. 40, 101681. doi:10.1016/j.frl.2020.101681

Yu, Y., Zhang, Q., and Song, F. (2023). Non-linear impacts and spatial spillover of digital finance on green total factor productivity: an empirical study of smart cities in China. Sustainability 15 (12), 9260. doi:10.3390/su15129260

Zhang, Q. Z. (2021). Improving the modenization of the industrial chain and supply chain requires precise implementation of policies. J. China Econ. Rev. 02, 25–26.

Zhang, X., Yang, T., Wang, C., and Wan, G. H. (2020). The development of digital finance and the growth of resident consumption: theory and practice in China. J. Manag. World 36 (11), 48–63. doi:10.19744/j.cnki.11-1235/f.2020.0168

Zhao, G., and Wei, W. (2016). The impact of financial liberalization on the optimization and upgrading of industrial structure: an empirical study based on inter provincial dynamic panel data. J. J. Humanit. 07, 35–41. doi:10.15895/j.cnki.rwzz.2016.07.005

Zheng, Y., Wen, F., Deng, H., and Zeng, A. (2022). The relationship between carbon market attention and the EU CET market: evidence from different market conditions. Finance Res. Lett. 50, 103140. doi:10.1016/j.frl.2022.103140

Keywords: digital finance, modernization of industrial chain, industrial agglomeration, industrial structure optimization, innovation achievements transformation

Citation: Xiao Q, Fang X, Su L, Chen X and Zhu Y (2023) The impact of digital finance on the modernization of China’s industrial chain. Front. Energy Res. 11:1244230. doi: 10.3389/fenrg.2023.1244230

Received: 22 June 2023; Accepted: 17 August 2023;

Published: 29 August 2023.

Edited by:

Xiaohang Ren, Central South University, ChinaReviewed by:

Najabat Ali, Hamdard University Islamabad, PakistanYan Zheng, Central South University, China

Copyright © 2023 Xiao, Fang, Su, Chen and Zhu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yaxi Zhu, MjEwNTAxMDA1QG5qbnUuZWR1LmNu

†ORCID:Quan Xiao, orcid.org/0000-0002-6963-607X; Xubing Fang, orcid.org/0000-0003-3116-8968; Yaxi Zhu, orcid.org/0009-0002-2366-6860

Quan Xiao

Quan Xiao Xubing Fang

Xubing Fang Lin Su2

Lin Su2 Xinhe Chen

Xinhe Chen Yaxi Zhu

Yaxi Zhu