95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Energy Res. , 10 August 2023

Sec. Smart Grids

Volume 11 - 2023 | https://doi.org/10.3389/fenrg.2023.1240542

This article is part of the Research Topic Planning, Operation and Control of Modern Power System with Large-scale Renewable Energy Generations, volume II View all 15 articles

Demand response technologies can achieve the objective of optimizing resource allocation and ensuring efficient operation of the smart grid by motivating the energy users to change their power usage behavior. However, the increasing uncertainty of smart grid environment brings great challenges to the development of demand response technique. In this study, we build a long short-term memory (LSTM) network as a load forecasting model to predict user load data in order to obtain accurate consumption behavior of energy users. Then, we utilize a Stackelberg game model based on the load forecasting model to dynamically optimize the electricity prices set by power suppliers at different times, enhancing the efficiency of demand response between users and suppliers. Extensive simulation experiments demonstrate that the LSTM-based load forecasting model achieves an accuracy of up to 96.37% in predicting user load demand. And the game model reduces the overall expenditure of users by 30% compared with the general pricing model.

The concept of the smart grid stems from the idea of Advanced Metering Infrastructure (AMI). Its goal is to enhance demand-side management and energy efficiency and to construct a self-healing, reliable grid protection system capable of withstanding severe human-induced disruptions and potential natural disasters (Mahela et al., 2022). However, the rapid advancement of information technology has led the power industry and research institutions to reconsider and expand the initial vision of the smart grid, enabling the full utilization of information technology within smart grids (Orlando et al., 2022). Recently, the smart grid has evolved into a typical cyber-physical system (CPS), integrating electric power, information transmission, network security communication, and intelligent computing. It has established a clean, secure, efficient, and sustainable advanced energy delivery network (Gao et al., 2023). For instance, to reduce peak demand and smooth load curves, power suppliers can use the high-speed communication network of a smart grid to encourage specific users to reduce their load during peak periods using real-time pricing signals. This not only incentivizes users to participate in the grid regulation but also smooths the load curve, thereby improving the overall energy utilization rate (Trujillo and García Torres, 2022).

The smart grid with distributed power supply model greatly enhances the reliability and self-healing capabilities of power system, reducing the scope of power outages through self-healing responses (Jasim et al., 2023). In terms of economic benefits, the cost-to-benefit ratio of a smart grid is approximately 4:1–5:1 (Gellings et al., 2004). In addition to bringing substantial direct economic benefits to power companies, this saves a significant amount of energy, contributing to environmental protection and sustainable development in society. To achieve the aforementioned benefits and generate greater economic gains, it is necessary to invest more research effort in areas such as demand response and load supervision (Khan et al., 2023).

Load monitoring (LM) technology allows power suppliers to make predictions about user’s load usage and to learn about load usage patterns, which can be divided into intrusive and non-intrusive types based on the monitoring approach. Intrusive load monitoring requires the installation of measuring devices on each load, which leads to higher overall costs and lower usage frequency (Wang et al., 2020). Non-intrusive load monitoring, on the other hand, does not require installing measuring devices in each user’s home. Instead, the devices are installed at the power entry points of various centralized units to collect aggregated data. Subsequently, the aggregated energy loads are decomposed into individual energy loads, enabling a simple and effective way to forecast load operations and energy consumption (Abubakar et al., 2017).

In order to effectively encourage the participation of users in the electricity trading process, power suppliers often utilize demand response techniques to motivate the power users changing their inherent power consumption behavior by adopting certain incentives. The research efforts of demand response techniques can be divided into price-based and incentive-based. Price-based demand response techniques help power suppliers to learn autonomous pricing strategies to arrange loads of energy users (Liu et al., 2017). Tang et al. (2019) and Cheng et al. (2022) modelled the interaction strategies between power grid and energy users as a Stackelberg game model, in which the grid optimizes the price to maximize its net profit and reduce demand fluctuation, and individual energy user optimizes the hourly power demand to minimize electricity bill and effects of demand alternation from the baseline. Sofana Reka and Ramesh (2016) utilized a generalized tit for tat dominant game-based energy scheduler to shift the peak average ratio of the smart grid. While, incentive-based demand response techniques enable power suppliers to learn an economic compensation mechanism to encourage energy users reducing their peak-periods loads (Zheng et al., 2022). For instance, Mansouri et al. (2023) proposes a three-layer risk-averse game theoretic-based strategy to coordinate smart buildings and EV fleets with microgrids scheduling. In the first layer of above strategy, a demand response program is designed for smart buildings where dynamic incentive tariffs are calculated based on the consumption pattern of subscribers.

Although demand response techniques have been widely deployed in addressing the resource allocation problem of smart grid (Sivasankarareddy et al., 2021; Panda et al., 2022). However, there remaining some obstacles that prevent above methods from implementing in realistic scenarios. 1) The increasing uncertainty of users loads brings great challenges to the establishment of accurate optimization model, resulting in the inefficiency of demand response strategies. 2) Existing game model-based demand response strategies lack the theoretical analysis of Nash equilibrium. Differently, this paper investigates a demand response model integrates load monitoring technology. In this demand response model, the interaction between power suppliers and users is modeled using game theory. Each power supplier dynamically adjusts its price signal based on the user’s demand, while users passively respond to the price signal by submitting their demand signals, ultimately maximizing the utility of user and profit of power supplier. The main contributions are as follows:

• This paper employs LSTM networks as the load forecasting model to predict user load data based on the load forecasting model and demand response theory. The LSTM network, with its memory units, can effectively capture historical load data and learn the periodic patterns in user load data.

• This paper designs a demand response model based on Stackelberg game theory, utilizing the load prediction results from the load forecasting model. This model accurately represents the complex demand response interaction between users and power suppliers in the smart grid. Mathematical derivations demonstrate that the entire interaction process can reach a Nash equilibrium, which can maximize the utility of both parties.

• This paper presents extensive simulation experiments to demonstrate the effectiveness of both the load forecasting model and demand response model. Simulation results prove that the LSTM-based load forecasting model can achieve up to 96.37% accuracy in load demand prediction for users. And the proposed game model can significantly reduce users’ electricity expenses.

The main notations utilized in this paper are summarized in Table 1.

Load supervision is a key technology that predicts future energy demand based on historical load data, temperature data, and weather data. The prediction of future demand from load supervision is a critical parameter for the operation and planning of a power system. Errors between the predictive model and the actual parameters can lead to increased operational costs and later increased costs for power suppliers. Hence, many load supervision models have been proposed to achieve more precise load demand prediction. Current research on load supervision models by scholars worldwide can be classified into two categories: models based on probability and statistics and models based on artificial intelligence.

Regarding probabilistic-statistical models (Huang and Shih, 2003), presents a variety of statistical models. These include the autoregressive model (AR), moving average model (MA), autoregressive moving average model (ARMA), and autoregressive integrated moving average model (ARIMA), with detailed explanations of each model’s mathematical expression and prediction methods. Hermias et al. (2017) uses an ARIMA model to predict future air-conditioning load based on seasonal component compensation. Alhmoud and Nawafleh (2021) used ARMA method and two neural network-based methods to predict the load data. Through simulation, it was demonstrated that the neural network approach could effectively improve the prediction accuracy. Among artificial intelligence-based load supervision models, Walther et al. (2019) proposed a very short-term load data predictor based on machine learning. It simply used a single-step delay, taking only the current value and time load data of the single-step delay as input to predict future load data. Mocanu et al. (2016) aimed to improve the design of power infrastructure and the effective deployment of distributed and renewable energy sources by predicting the electricity consumption patterns in power systems through a deep learning network, thereby enhancing the electricity efficiency of the entire power system. The authors creatively proposed the conditional restricted Boltzmann machine (CRBM) and factor conditional restricted Boltzmann machine (FCRBM) models to predict data and validated their accuracy through simulation experiments. Afrasiabi et al. (2020) mainly proposed a hybrid predictive model based on convolution neural networks to predict residential power load curves. By predicting the loads of individual users, the power supply system can better monitor electricity usage habits, thus achieving better load scheduling.

Compared with traditional power grids, the advantage of smart grids is that they can significantly improve the reliability of the entire power system and the responsiveness of users and can encourage users to participate more actively in energy trading decisions. Therefore, all scheduling and incentives on the demand side, including overall demand response management, are integral parts of the smart grid. Current demand response mechanisms can be divided into two categories: one is based on user incentive mechanisms, and the other is based on power pricing mechanisms.

Gyamfi et al. (2013) studied different demand response mechanisms, such as time-of-use (TOU) pricing, peak pricing, and real-time pricing, and applied them to users in different countries and regions to measure their response rates to these mechanisms. This laid a solid foundation for later research on demand response theories. The results showed that a large portion of households did not respond to price changes, possibly because they did not understand the pricing system and therefore did not react immediately to price changes. Zhang et al. (2023) proposed a demand response algorithm based on bidding incentives. This algorithm used Vickrey-Clarke-Groves mechanism to optimize the choice of energy policies to find the strategy that maximizes the total profit of the energy service provider while satisfying the user’s minimum load power requirements. Trujillo and García Torres (2022) proposed a multi-stage control system to manage the electric vehicle users’ demand, automatically adjust the load, and optimize the entire system using a stochastic optimization algorithm. This study provided the best demand response solutions for users by comparing various strategies based on pricing mechanism and incentive mechanism. Bokkisam et al. (2022) proposed a peer-to-peer demand transactive system. In this algorithm, the smart grid was divided into three agents: users, auctioneer, and utility. To consider the balance of user benefits, load demand, and energy supply, the third-party agent demonstrated method and blockchain-based method were tested. The optimal real-time demand allocation results was obtained through simulation experiments.

In summary, based on the current research status worldwide, the problem of demand response models based on load supervision in smart grids is a frontier issue that crosses multiple fields. Although many theories and results have been obtained in various fields, better integrating load supervision methods with demand response models to ensure the stability of overall system operation while achieving satisfactory returns between users and power suppliers is a subject that urgently needs to be studied.

The model of the game demand response strategy based on load demand forecasting studied in this paper includes two main entities: the power supplier and the users. Within the energy management unit, there are multiple power suppliers, each with varying capacities due to their different scales. However, each power supplier can independently supply electric power to users. Compared to the centralized power supply of traditional grids, this distributed power supply from multiple suppliers greatly enhances the stability and robustness of the entire power system. Each power supplier, constrained by its capacity and costs, sets real-time prices at each moment, resulting in different prices among suppliers. Users can choose to purchase electric power from the supplier that maximizes their own utility based on their load usage habits.

In the demand response strategy, the power suppliers first use the trained load demand prediction model to forecast the future load demand of each user. They then issue an initial electricity price signal to the users based on the predicted load demand. During this process, the prices set by each supplier differ based on the users’ load demand and the suppliers’ capacities and costs. Upon receiving the price signal, users calculate the optimal energy demand from different suppliers based on their maximum energy cost expenditure and a utility optimization function. They then send the demand signals to the respective suppliers. Each supplier receives the energy demand purchased by users, and being rational and self-interested, adjusts its electricity price information to maximize its own revenue. This forms a non-cooperative game model among the power suppliers. This entire demand response process continues until the system reaches a Nash equilibrium. At equilibrium, no power supplier can increase its revenue by unilaterally changing its price information.

Game theory is a formal analytical framework that studies complex interactions among independent rational players using specific mathematical representations and derives the optimal strategies of the players based on individual rational behavior. Over the decades, game theory has been widely applied in various disciplines, ranging from economics and political science to psychology, achieving significant progress across different fields. In today’s large-scale smart grid systems and various cyber-physical systems (CPSs), complex interactions often exist among multiple intelligent nodes. To achieve better interactions between power suppliers and users, the framework of game theory has become an important theoretical analysis tool and has been widely applied in practical optimization scenarios (Cheng and Yu, 2019). Game models typically consist of three elements: players

The aforementioned game model can be applied to demand response management in smart grids. A smart grid system has

In recent years, the rapid development of information technology has led to the widespread application of smart grids. In a smart grid, the integration of various renewable energy supply nodes, electric vehicle nodes, and user access nodes significantly increases the complexity and instability of the entire system. Undoubtedly, compared to the centralized energy supply in traditional grids, the access of various distributed nodes in smart grids poses unprecedented challenges to system stability. To address this issue, load supervision technology has been widely applied in practical projects. Through load supervision technology, it is possible to assist in demand response and achieve the transfer of peak demand, thereby improving the overall stability of the system. In the field of load supervision, deep learning techniques have begun to be widely used. Deep learning utilizes multilayer neural connections to extract features from input data. Compared to traditional machine learning algorithms, deep learning greatly improves the accuracy of models and enhances prediction accuracy through stacking layers and increasing the number of neurons.

Although classical feedforward fully connected neural networks work well for traditional data classification and regression problems, they face challenges when dealing with continuous sequential data such as time series load data and speech data. This is because sequential data have inherent order dependencies, and it is not straightforward to split these time series data into independent training samples to train a traditional feedforward neural network. Therefore, to consider the sequential nature of the data during training, adjustments need to be made to the structure of the traditional feedforward neural network by introducing memory units, giving rise to RNNs. Long short-term memory (LSTM) networks are a type of neural network architecture proposed to address the issue of vanishing gradients in RNNs (Cai et al., 2022). Compared to traditional RNN architectures, LSTM incorporates dedicated memory modules to retain previous information. In terms of the update mechanism, LSTM does not directly overwrite the information in the memory unit with the sequence information obtained at the previous time step. Instead, it accumulates information over time, ensuring the retention of information from much earlier sequences. Figure 1 represents a basic LSTM unit, which includes three crucial gate structures: the input gate, the output gate, and the forget gate. The input gate determines whether the current information xt should be stored in memory cell st. The output gate determines whether the current information in memory cell st should be output as the current output ht. The forget gate controls how much information from the previous memory cell st−1 should be stored in the current memory cell st.

After obtaining the load consumption data, the first step is to perform data cleaning, which includes handling outliers and missing values in the data. Then, the correlation between different features needs to be examined. Since the dataset in this study has many features, using all of them as training data would result in an excessively high dimensionality of the training dataset. Moreover, for time series data, when constructing the supervised model data, a certain time step delay is applied, which further increases the number of features, leading to a significant computational burden and prolonged training time. Therefore, to address this issue, it is necessary to eliminate some highly correlated feature attributes through correlation analysis, aiming to improve training speed without compromising model accuracy.

Through correlation analysis, it is found that there is a strong correlation between various features. In this study, temperature and humidity are selected as the training data features (Chen et al., 2021). Additionally, since user load consumption is often related to user behavior patterns, with lower consumption during weekdays and higher consumption during weekends, this study uses an additional feature to represent whether the current date is a weekend in training the model.

The load supervision model is primarily built using LSTM networks and trained with the historical load data obtained in the previous section.

The construction steps of the entire model are as follows:

1) Encode the vector data W indicating whether it is a working day, where 1 represents a working day and 0 represents a weekend.

2) Normalize the load data L, temperature data T, and humidity data H, and then concatenate these vectors to form the input matrix X = {T, H, W, L}.

3) Transform the preprocessed time series data X into data suitable for supervised learning based on the designated time step K. By using a sliding window approach, the input matrix X is shifted with a step size.

4) Input the matrix X into the LSTM network for model training.

The framework of the entire model is shown in Figure 2.

In traditional demand response models, due to the complex interaction between users and the power supply side, the optimization process often only considers one side of the demand response. For instance, when considering the maximization of user welfare, the maximization of the power supply side’s benefits is not included. To model the complex interaction process between multiple users and multiple power suppliers in the demand response, this section studies a model based on a Stackelberg game as shown in Figure 3. First, each power supplier predicts the future load demand of users using the load demand prediction model proposed in the previous section and determines the initial electricity price based on the current load demand and its own power supply. Then, each user compares the price signals provided by all power suppliers to maximize their own benefits, purchases electricity from different power suppliers according to their own electricity usage habits, and synchronizes the demand information in real time to the designated power supplier. Finally, the power supplier updates its price signal based on the user’s purchased demand and the price signals of the other power suppliers.

In the entire demand response model,

The entire interaction process of the demand response model constitutes a Stackelberg game. In this game process, the power supplier, as a leader, sends the real-time price signal to the followers first, while the user, as a follower, optimizes their load demand allocation according to the price signal issued by the leader. Therefore, the entire game process can be seen as a game of electricity prices among various power suppliers. The power suppliers set their own electricity prices according to the amount of user loads and the price levels of other power suppliers, while the users passively respond, maximizing their own utility functions through the real-time price signals issued by the power suppliers.

The entire system architecture involves multiple users and multiple power suppliers, where each user

where γn > 0 and βn ≥ 1 are both constant coefficients. These coefficients ensure that when the user does not purchase electricity from any power supplier, that is, when dn = 0, the value of the formula

The user’s goal is to maximize their utility function while first satisfying their own budget by determining their electricity demand purchases based on their own electricity consumption habits and the prices of different power suppliers. The optimization function can be expressed as:

where pk represents the real-time unit power price provided by power supplier k and Bn represents the maximum electricity expenditure that user n can afford. The optimization process on the user side does not involve a game between users; they only passively accept the price signals provided by the power supplier to maximize their utility functions. Each user’s decision can be considered as being made independently.

To understand the energy demand optimization process on the user side more clearly, this article first assumes a general situation: there are only N users and three power suppliers in the demand response management system. After careful analysis of the general situation, the conclusion is extended to

Introducing the Lagrange multipliers λn,1, λn,2, λn,3, λn,4, the optimization problem with inequality constraints is represented by a Lagrange function as follows:

The KKT conditions are:

When the utility function is maximized, the first derivative of Eq. 4 needs to be zero; that is,

To determine the optimal amount of energy for each user to purchase from each power supplier at this time, the amount of electrical energy purchased by users from each power supplier needs to be considered in categories:

1) When dn,1 > 0, dn,2 > 0, dn,3 > 0:

Through Eqs 6–8, we can derive λn,2 = λn,3 = λn,4 = 0. Substituting λn,2, λn,3, and λn,4 into Eq. 12, we obtain:

Substituting Eq. 13 into Eq. 5, we can solve for:

Finally, by substituting Eq. 14 into Eq. 13, we can solve for the amount of electricity each user purchases from each power supplier:

2) When dn,1 > 0, dn,2 = 0, dn,3 = 0:

Through Eq. 6, we can obtain λn,2 = 0. Substituting λn,2 = 0 into Eq. 12, we obtain:

Substituting Eq. 16 into Eq. 5, we can obtain:

According to λn,1 > 0 in the KKT condition, (γn/λn,1) − βnp1 − Bn = 0 can be obtained. Therefore, the solved λn,1 can be brought into Eq. 16 to obtain:

From dn,2 = dn,3 = 0, we can obtain Bn = βn(2p3 − p1 − p2) = βn(2p2 − p1 − p3). Substituting this into Eq. 18, we can finally obtain:

3) When dn,1 = 0, dn,2 > 0, dn,3 = 0:

Similarly, we can solve to obtain:

4) When dn,1 = 0, dn,2 = 0, dn,3 > 0:

The solution for dn,3 is:

5) When dn,1 = 0, dn,2 = 0, dn,3 = 0:

In this scenario, users do not purchase electricity from any power provider. From Equation 5, we can deduce that Bn = 0, meaning that the user’s electricity expenditure budget is 0. This situation is not within the scope of this paper.

Therefore, using Eqs 15, 19–21, the user’s demand for each power provider can be generalized to scenarios where there are

From Eq. 22, we can see that the amount of electricity dn,k that user n purchases from a specific power provider k is to maximize their own utility function depends on the real-time electricity price pk currently offered by power provider k, as well as the electricity prices offered by other power providers

Substituting Eq. 22 into Eq. 23, we find that each user’s electricity expenditure needs to satisfy:

where Eq. 24 represents that the user’s electricity expenditure is related to the price set by each power provider and the user’s minimum energy demand. Above value can be used as a baseline to test whether the user’s expenditure will decrease after the demand response.

In the game-based model considered in this paper, the price setting of a power provider is related not only to the electricity expenditure set by each user but also to the prices set by other power providers. The utility function of a power provider is expressed as:

where p−k represents the electricity prices set by power providers other than k.

The goal of each power provider is to maximize its profit after selling electricity under the constraint of its own production capacity. Therefore, the optimization function for each power provider can be expressed as:

where Gk represents the maximum production capacity of each power provider. The energy demand provided for all users cannot exceed this value. In the process of selling electricity, the more electricity the power provider sells, the more profit it will obtain. Therefore, the constraint on energy sales can be converted to the equation

When the power provider obtains the optimal price setting,

where Eq. 29 is a simplified form of Eq. 28.

For each power provider, Eq. 29 provides a constraint equation. Combined with

From Eq. 30, we can deduce that the real-time price of each power supplier depends both on its own capacity Gk and the electricity prices set by other power suppliers. When there is only one power supplier in the entire demand response system, i.e., K = 1, there is no game between power suppliers, and the optimal price set by the power supplier is p1 = B/G1, which only depends on the users’ electricity expenditure budget and the supplier’s own capacity. Therefore, this article considers the case of K ≥ 2; that is, there is a price game between each power supplier, and every user sets real-time electricity prices to maximize their own profit. However, the main problem in the process of solving Eq. 30 is that the solution of pk is related to the prices of other power suppliers, and the calculation of the prices of other power suppliers depends on pk. The entire price calculation process falls into a vicious cycle. To solve this problem, we can substitute the price of each power supplier into Eq. 30, thus converting the calculation of the supplier’s price into a function of the capacities of each power supplier:

In the previous subsection, the optimal demand quantity for each user to purchase from each power supplier was obtained from Eq. 22. To satisfy the requirement that the electricity purchase quantity is dn,k ≥ 0 from any user

When the demand for each power supplier from the user meets dn,k ≥ 0, the price of the power supplier also needs to meet:

Therefore, when the power supplier sets its own real-time electricity price, to ensure that the demand of each user from each power supplier meets dn,k ≥ 0, each power supplier must first satisfy Eq. 33 when setting the real-time price. The solution obtained through the Lagrange function in the previous section, Eq. 30, can be proven to meet this condition.

The following will prove that each power supplier’s real-time electricity price, obtained through Eq. 30, can maximize each supplier’s utility function and is the best response to each user.

Proof. First, assume that pk is the power price set by supplier k obtained through Eq. 30. Then, if supplier k increases or decreases this price, it can obtain

Compared with the case when the price of supplier k is not adjusted, the difference in the amount of electricity each user buys from supplier k is:

According to Eq. 35, when the electricity price set by supplier k rises, that is,

According to Eq. 36, when the supplier’s price rises, that is, ϵk > 0, and Z − ZK < 0, we have

In the demand response model, the profits of each power supplier mainly come from the electricity expenditures of all users. The total budget for electricity consumption among all users is fixed; i.e.,

For the Stackelberg game model, the overall process is shown in Figure 4. First, the power suppliers compete to determine the price signals most advantageous to themselves. They then distribute these price signals to each user. The users, in turn, calculate their optimal demands for each power supplier based on these price signals and then publish these demand quantities to the designated power suppliers. Finally, the users update the prices based on these demand quantities until the price competition among power suppliers reaches a Nash equilibrium.

Let

where d(p⋆) represents the users’ best response to the power suppliers’ prices. As users are only responding passively, there exists a unique best response to the price signals of power suppliers; i.e., the users’ optimal response signals are calculated through Eq. 22.

Thus, it only needs to be proven that a unique equilibrium point exists in the price competition among power suppliers. When power suppliers compete in price, they mainly consider their utility function Uk(pk), which is a continuous concave function for any power supplier. This utility function, within a specified range, necessarily satisfies

The data used for training the load supervision model come from a publicly available load dataset provided by MIT. This dataset captures the household load data of multiple users from 10 July 2014 to 31 December 2016. The data were collected through smart meter devices, with samples taken every 15 min, and include twelve features, such as temperature, humidity, pressure, wind speed, and perceived temperature of the environment, as well as the current load consumption data of multiple users. The load data of the users are shown in Figure 5.

In deep learning networks, it is challenging to determine the number of hidden layers and the number of neurons in each layer. There is no strict theoretical way of determining the optimal numbers of hidden layers and neurons in a network structure. Before determining the number of hidden layers, it should be understood that the role of the hidden layers is mainly to increase the non-linear fitting ability of the model. If the input data are linearly separable, then hidden layers are not necessary. However, for more complex sequential and speech data, it may be necessary to add more hidden layers to improve the model’s learning capability. Once the number of hidden layers has been determined, the most important issue is how to determine the number of neurons in each layer. If there are too few neurons in the hidden layer, it will cause underfitting. If there are too many neurons, it may lead to overfitting. Therefore, selecting an appropriate number of neurons is extremely important.

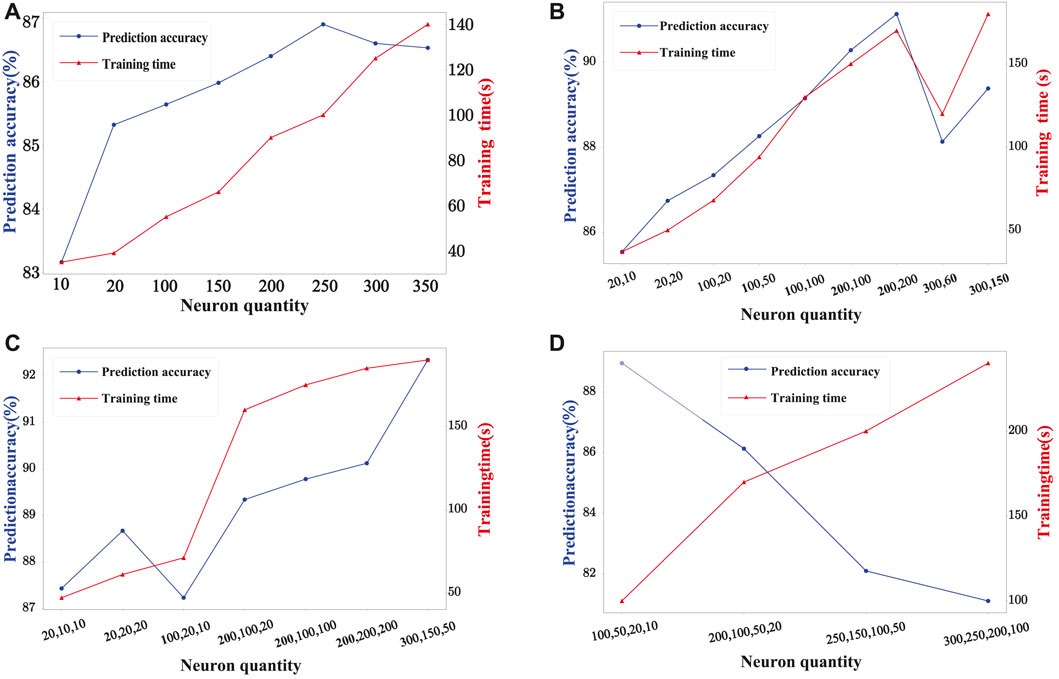

This paper determines the relationship between the prediction accuracy and training time of the model with different numbers of layers and neurons through experiments, as shown in Figure 6.

FIGURE 6. Impact of neuron quantity on prediction accuracy: (A) single-layer neural network; (B) two-layer neural network; (C) three-layer neural network; (D) four-layer neural network.

Figure 6 show that when using a three-layer neural network, the average prediction accuracy is the highest, and the average training time of the model is relatively low. When a four-layer neural network is used, the model enters a state of overfitting, results in the low overall prediction accuracy and the long training time. Besides, we can also observe from Figure 6 that the best prediction accuracy can be achieved when the numbers of neurons in each layer are (300, 150, 50).

To speed up the model’s training time, the dataset is sampled every 30 min, reducing the scale of the training data. The overall flow of the training algorithm is to first divide the dataset that has not yet been trained into training, validation, and testing sets. Then, we set the number of layers and the number of neurons in each layer in the LSTM network of the load supervision model based on the model parameters from the previous subsection. Meanwhile, a dropout layer is added between each pair of layers to prevent overfitting. Finally, we specify the loss function for model training. Time series data delay steps of 1, 3, 5, 7, 10, and 15 days were selected for the load data prediction of user 1 and user 2. The delay step length refers to how many days of data are used to predict future load data. The longer the delay step length of the time series data, the more features will be obtained in the training data, allowing the model to better learn user behavior patterns. The results of user load data prediction are shown in Table 2.

For user 1, the highest prediction accuracy was achieved with a 10-day time series step delay, reaching 91.54%, higher than the 91.11% accuracy obtained with a 15-day time series step delay. The analysis shows that when training the model with a 15-day time series step delay, the number of features is significantly higher than that with a 10-day time series step delay. The trained prediction model should have a higher accuracy, but possibly because there are too many features, overfitting occurs, thus reducing the prediction accuracy on the test set. This can be prevented by setting the coefficient of the dropout layer, thereby improving the prediction accuracy of the model. For user 2, the highest prediction accuracy was achieved with a 15-day time series step delay, reaching 96.37%, and a lower prediction accuracy of 94.56% was achieved with a 7-day time series step delay. This indicates a significant difference in the power usage habits of user 2 on weekdays and weekends, resulting in a surge in load demand on the weekend and many jump points, thereby reducing the overall prediction accuracy. Generally, the LSTM-based load supervision model can achieve good prediction accuracy for future load demand.

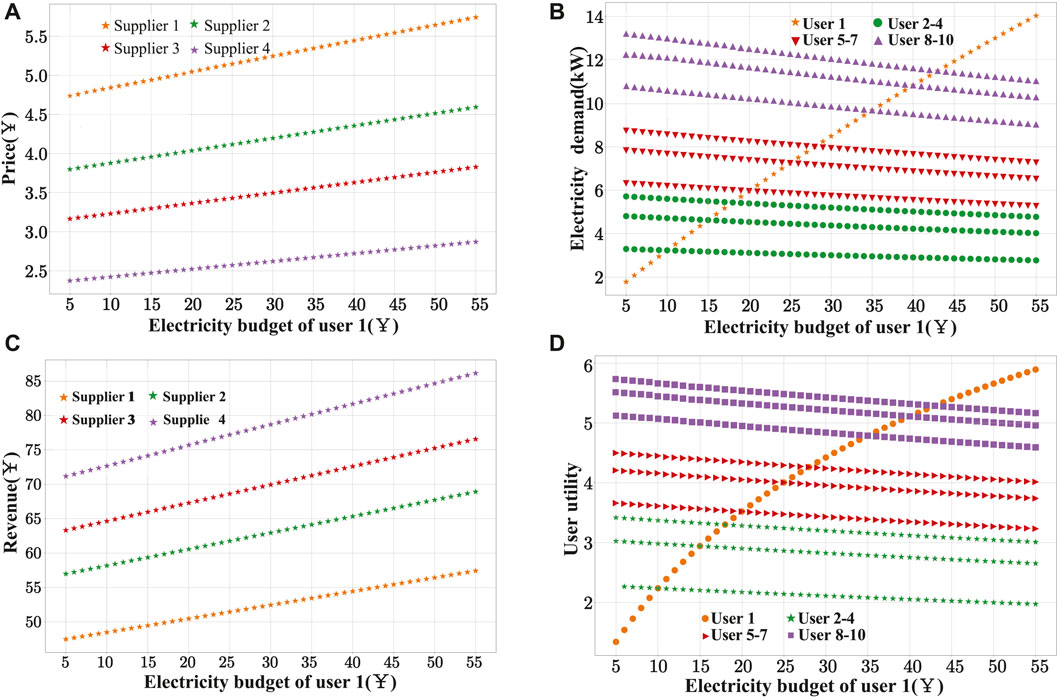

The optimization effect of the entire game model is studied by changing the user’s own electricity budget. In the experiment, the constant coefficients in the utility functions of all users are initially set to γn = 5, βn = 5. Then, 10 users and 4 suppliers are considered in the demand response model, with the electricity budgets for the users are set as B1 = 10, B2 = 15, B3 = 18, B4 = 20, B5 = 25, B6 = 28, B7 = 35, B8 = 40, B9 = 45, B10 = 50. The capacities of the suppliers at each moment are set as G1 = 10, G2 = 15, G3 = 20, G4 = 30. After predicting the future load demand of each user based on the load supervision model, the initial electricity prices of the suppliers are set as p1 = 1.5, p2 = 2.2, p3 = 2.5, p4 = 2.0.

Figure 7A represents the optimal electricity prices set by each power supplier after the game as user 1’s electricity budget continues to increase. As the user’s budget increases, the electricity prices set by each power supplier also increase. Because Power Supplier 1 has the least capacity, the real-time electricity price it sets is the highest. Figure 7B represents the demand curves for electricity for each user. As user 1’s electricity budget continues to increase, the purchased electricity also increases. Since the production capacity of all suppliers is fixed at any moment, this leads to a decrease in the energy demand of other users, manifested as a declining trend in their demand curves. Figure 7C shows the profit curve of each power supplier. From this figure, it can be seen that the income of the power suppliers does not show a positive correlation with the real-time set electricity price. In the electricity price curve, the price set by Power Supplier 1 is the highest, but its profit is the lowest among all suppliers. In contrast, Power Supplier 4, which sets the lowest price, obtains the highest profit due to its larger capacity. Figure 7D represents the utility function curves of users. Since user 1 purchased a large amount of electricity, their utility curve gradually increases, causing the utility curves of other users to decrease, which conforms to real-life scenarios.

FIGURE 7. Optimization results of the game model: (A) power supplier price; (B) user demand; (C) power supplier revenue; (D) user utility.

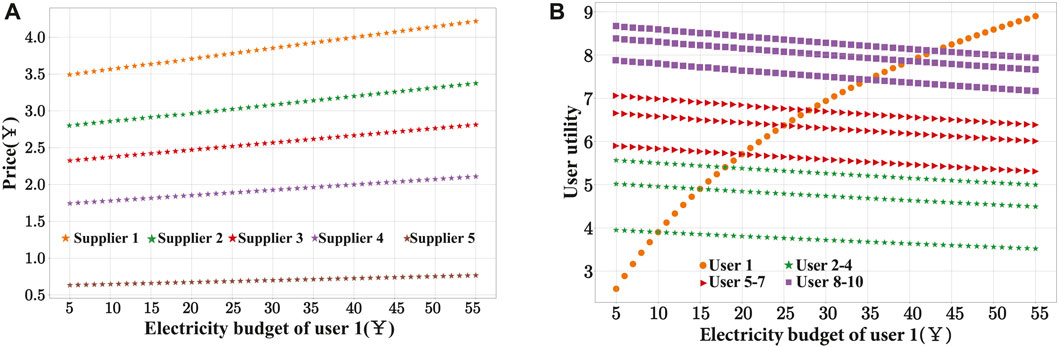

To verify whether the introduction of a large-capacity power supplier will affect the utility of users, Power Supplier 5 was added to the original experiment, and its power supply capacity was set as G5 = 100. Comparing Figure 8B and Figure 7D, it can be seen that when Power Supplier 5 is added, the utility of the users increases, indicating that the addition of Power Supplier 5 does not reduce the utility of the users. As shown in Figure 8A, it is almost impossible for a power supplier in the proposed game model to control prices by significantly increasing capacity; this will only lead to an overall excess capacity in the system, causing a decrease in the prices set by all power suppliers. Therefore, in the entire system model, the more capacity a power supplier has, the more the users’ utility will increase.

FIGURE 8. Optimization results of the game model after adding power supplier 5: (A) power supplier price; (B) user utility.

Finally, to further verify the application of the model in actual production, an analysis of user load data revealed that the load demand curves of all users exhibit a distinct regularity, reaching a peak at noon, followed by reduced consumption and an increase again in the evening. Therefore, we extracted a day’s energy consumption data and real-time electricity price information from the U.S. National Energy website. The dataset includes 2,000 users and 5 power suppliers. The energy consumption data of these users are used to verify whether the model can improve the utility of users. Figure 9 represents the energy consumption data of users at different times of the day. Figure 10 represents the prices set by the power suppliers after the game and the normal electricity prices set daily. Figure 11 shows that after adopting the real-time electricity prices calculated based on the game model, the overall expenditure of users decreases by 30% compared with traditional pricing model, indicating that when all power suppliers adopt real-time electricity prices calculated based on the game model, every user in the demand response model will gain substantial benefits.

In this paper, we employ a long short-term memory (LSTM) network as a load forecasting model to predict user load data in a smart grid and utilize a Stackelberg game model based on the load forecasting model to reduce the overall expenditure of energy users. The main contribution of this paper can be summarized as follows:

1) This paper employs an LSTM network as a load supervision model to forecast users’ load data. The LSTM network integrates gate structures and memory units internally, enabling it to memorize historical data effectively and predict users’ cyclical demand behaviors.

2) Based on the load supervision model, this paper built a Stackelberg game model to optimize the optimal power prices set by the power supplier in real time at each moment, making the demand response between users and the power supplier more efficient. Specifically, the power supplier first sets the initial power prices according to the forecasted user demand and then adjusts its power prices in real time in response to user reactions and price competition with other power suppliers, achieving its maximum profit.

3) This paper compares the prediction accuracy of forecasting models with different layers and numbers of neurons through simulation experiments and obtains optimal model parameters. Results of comparing actual user data and the prediction output demonstrate that LSTM-based load forecasting model achieves an accuracy of up to 96.37%. Additionally, the game model reduces the overall expenditure of users by 30% compared with the general pricing model.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

FC contributed to the conception, performed the experiment and wrote the manuscript. DA contributed to the manuscript correction and foundation support. GZ helped perform the analysis with constructive discussions. All authors contributed to the article and approved the submitted version.

This work was supported in part by the National Natural Science Foundation of China under Grant Nos. 62173268, 61803295, 61973247, and 61673315; in part by the Major Research Plan of the National Natural Science Foundation of China under Grant 61833015; in part by the National Postdoctoral Innovative Talents Support Program of China under Grant BX20200272; in part the National Key Research and Development Program of China under Grant 2019YFB1704103; and in part by the China Postdoctoral Science Foundation under Grant 2018M643659.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abubakar, I., Khalid, S., Mustafa, M., Shareef, H., and Mustapha, M. (2017). Application of load monitoring in appliances’ energy management–a review. Renew. Sustain. Energy Rev. 67, 235–245. doi:10.1016/j.rser.2016.09.064

Afrasiabi, M., Mohammadi, M., Rastegar, M., Stankovic, L., Afrasiabi, S., and Khazaei, M. (2020). Deep-based conditional probability density function forecasting of residential loads. IEEE Trans. Smart Grid 11, 3646–3657. doi:10.1109/tsg.2020.2972513

Alhmoud, L., and Nawafleh, Q. (2021). Short-term load forecasting for Jordan power system based on narx-elman neural network and arma model. IEEE Can. J. Electr. Comput. Eng. 44, 356–363. doi:10.1109/icjece.2021.3076124

Bokkisam, H. R., Singh, S., Acharya, R. M., and Selvan, M. P. (2022). Blockchain-based peer-to-peer transactive energy system for community microgrid with demand response management. CSEE J. Power Energy Syst. 8, 198–211. doi:10.17775/CSEEJPES.2020.06660

Cai, T., Wu, C., and Zhang, J. (2022). “A bagging long short-term memory network for financial transmission rights forecasting,” in 2022 7th IEEE workshop on the electronic grid (eGRID) (IEEE), 1–5.

Chen, C., Lu, N., Jiang, B., Xing, Y., and Zhu, Z. H. (2021). Prediction interval estimation of aeroengine remaining useful life based on bidirectional long short-term memory network. IEEE Trans. Instrum. Meas. 70, 1–13. doi:10.1109/tim.2021.3126006

Cheng, L., Chen, Y., and Liu, G. (2022). 2pns-eg: a general two-population n-strategy evolutionary game for strategic long-term bidding in a deregulated market under different market clearing mechanisms. Int. J. Electr. Power Energy Syst. 142, 108182. doi:10.1016/j.ijepes.2022.108182

Cheng, L., and Yu, T. (2019). Game-theoretic approaches applied to transactions in the open and ever-growing electricity markets from the perspective of power demand response: an overview. IEEE Access 7, 25727–25762. doi:10.1109/access.2019.2900356

Gao, Y., Ma, J., Wang, J., and Wu, Y. (2023). Event-triggered adaptive fixed-time secure control for nonlinear cyber-physical system with false data-injection attacks. IEEE Trans. Circuits Syst. II Express Briefs 70, 316–320. doi:10.1109/tcsii.2022.3217823

Gellings, C. W., Samotyj, M., and Howe, B. (2004). The future’s smart delivery system [electric power supply]. IEEE Power Energy Mag. 2, 40–48. doi:10.1109/mpae.2004.1338121

Gyamfi, S., Krumdieck, S., and Urmee, T. (2013). Residential peak electricity demand response—Highlights of some behavioural issues. Renew. Sustain. Energy Rev. 25, 71–77. doi:10.1016/j.rser.2013.04.006

Hermias, J. P., Teknomo, K., and Monje, J. C. N. (2017). “Short-term stochastic load forecasting using autoregressive integrated moving average models and hidden markov model,” in 2017 international conference on information and communication technologies (ICICT) (IEEE), 131–137.)

Huang, S.-J., and Shih, K.-R. (2003). Short-term load forecasting via arma model identification including non-Gaussian process considerations. IEEE Trans. power Syst. 18, 673–679. doi:10.1109/tpwrs.2003.811010

Jasim, A. M., Jasim, B. H., Flah, A., Bolshev, V., and Mihet-Popa, L. (2023). A new optimized demand management system for smart grid-based residential buildings adopting renewable and storage energies. Energy Rep. 9, 4018–4035. doi:10.1016/j.egyr.2023.03.038

Khan, M. A., Saleh, A. M., Waseem, M., and Sajjad, I. A. (2023). Artificial intelligence enabled demand response: prospects and challenges in smart grid environment. IEEE Access 11, 1477–1505. doi:10.1109/access.2022.3231444

Liu, N., Yu, X., Wang, C., Li, C., Ma, L., and Lei, J. (2017). Energy-sharing model with price-based demand response for microgrids of peer-to-peer prosumers. IEEE Trans. Power Syst. 32, 3569–3583. doi:10.1109/tpwrs.2017.2649558

Mahela, O. P., Khosravy, M., Gupta, N., Khan, B., Alhelou, H. H., Mahla, R., et al. (2022). Comprehensive overview of multi-agent systems for controlling smart grids. CSEE J. Power Energy Syst. 8, 115–131. doi:10.17775/CSEEJPES.2020.03390

Mansouri, S. A., Paredes, Ángel, González, J. M., and Aguado, J. A. (2023). A three-layer game theoretic-based strategy for optimal scheduling of microgrids by leveraging a dynamic demand response program designer to unlock the potential of smart buildings and electric vehicle fleets. Appl. Energy 347, 121440. doi:10.1016/j.apenergy.2023.121440

Mocanu, E., Nguyen, P. H., Gibescu, M., and Kling, W. L. (2016). Deep learning for estimating building energy consumption. Sustain. Energy, Grids Netw. 6, 91–99. doi:10.1016/j.segan.2016.02.005

Orlando, M., Estebsari, A., Pons, E., Pau, M., Quer, S., Poncino, M., et al. (2022). A smart meter infrastructure for smart grid iot applications. IEEE Internet Things J. 9, 12529–12541. doi:10.1109/jiot.2021.3137596

Panda, S., Mohanty, S., Rout, P. K., Sahu, B. K., Parida, S. M., Kotb, H., et al. (2022). An insight into the integration of distributed energy resources and energy storage systems with smart distribution networks using demand-side management. Appl. Sci. 12, 8914. doi:10.3390/app12178914

Sivasankarareddy, V., Sundari, G., Rami Reddy, C., Aymen, F., and Bortoni, E. C. (2021). Grid-based routing model for energy efficient and secure data transmission in wsn for smart building applications. Appl. Sci. 11, 10517. doi:10.3390/app112210517

Sofana Reka, S., and Ramesh, V. (2016). A demand response modeling for residential consumers in smart grid environment using game theory based energy scheduling algorithm. Ain Shams Eng. J. 7, 835–845. doi:10.1016/j.asej.2015.12.004

Tang, R., Wang, S., and Li, H. (2019). Game theory based interactive demand side management responding to dynamic pricing in price-based demand response of smart grids. Appl. Energy 250, 118–130. doi:10.1016/j.apenergy.2019.04.177

Trujillo, D., and García Torres, E. M. (2022). Demand response due to the penetration of electric vehicles in a microgrid through stochastic optimization. IEEE Lat. Am. Trans. 20, 651–658. doi:10.1109/tla.2022.9675471

Walther, J., Spanier, D., Panten, N., and Abele, E. (2019). Very short-term load forecasting on factory level–a machine learning approach. Procedia CIRP 80, 705–710. doi:10.1016/j.procir.2019.01.060

Wang, L., Hou, C., Ye, B., Wang, X., Yin, C., and Cong, H. (2021). Optimal operation analysis of integrated community energy system considering the uncertainty of demand response. IEEE Trans. Power Syst. 36, 3681–3691. doi:10.1109/tpwrs.2021.3051720

Wang, L., Jones, D., Chapman, G. J., Siddle, H. J., Russell, D. A., Alazmani, A., et al. (2020). A review of wearable sensor systems to monitor plantar loading in the assessment of diabetic foot ulcers. IEEE Trans. Biomed. Eng. 67, 1989–2004. doi:10.1109/tbme.2019.2953630

Zhang, Z., Huang, Y., Chen, Z., and Lee, W.-J. (2023). Integrated demand response for microgrids with incentive compatible bidding mechanism. IEEE Trans. Industry Appl. 59, 118–127. doi:10.1109/tia.2022.3204626

Keywords: demand response, game theory, load monitoring, smart grid, load forecasting

Citation: Cui F, An D and Zhang G (2023) A game strategy for demand response based on load monitoring in smart grid. Front. Energy Res. 11:1240542. doi: 10.3389/fenrg.2023.1240542

Received: 15 June 2023; Accepted: 01 August 2023;

Published: 10 August 2023.

Edited by:

Xia Lei, Xihua University, ChinaReviewed by:

Flah Aymen, École Nationale d’Ingénieurs de Gabès, TunisiaCopyright © 2023 Cui, An and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Dou An, ZG91YW4yMDE3QHhqdHUuZWR1LmNu

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.