- School of Management, Guangzhou University, Guangzhou, China

Introduction: In reality, due to the low credit rating of small and medium-sized enterprises (SMEs), it is difficult for them to obtain sufficient financing from a single financier. This paper considers a dual-channel supply chain consisting of a capital-constrained manufacturer, an e-commerce platform (ECP), a third-party logistics company (3PL) and consumers. There are two innovations in this paper: the manufacturer obtains sufficient production funds through hybrid financing of the ECP and 3PL, and consumers want to know product information and compare prices. The contributions of this paper are to investigate new applications of blockchain in both hybrid financing and meeting consumer information search needs.

Methodology: We discuss the operation and pricing decisions of supply chain in two scenarios. These two scenarios are without adopting blockchain (N) and with adopting blockchain (B). Then, we compare the equilibrium decisions in two scenarios.

Results: The results show that the supply chain will adopt blockchain when certain conditions are met. The initial adoption of blockchain is bad for the ECP and 3PL. Further, we find that with the increase of financing ratio, the optimal financing interest rate of the ECP decreases, while the optimal financing interest rate of the 3PL increases.

Discussion: The numerical analysis shows that the adoption of blockchain can be more profitable when the cost of information search is high.

Management insights: In order to achieve supply chain coordination, the manufacturer should give subsidies the ECP and 3PL.

1 Introduction

The rapid development of Internet technology and logistics industry has enriched the channels of commodity sales. For example, well-known brands Apple and Lenovo not only sell their products through their official websites, but also sell their products on e-commerce platforms such as JD.com and Tmall.com.1 The innovation of these famous brands in sales mode has caused many enterprises to follow suit. However, due to the low credit rating, it is difficult for small and medium-sized enterprises (SMEs) to obtain financing from external banks or institutions (Zhao et al., 2018; Deng et al., 2019; Zhou and Li, 2020).

With the rapid development of e-commerce platforms (ECPs) and third-party logistics companies (3PLs), the traditional contract financing has been transformed into the loan financing of supply chain cooperative members (Huang et al., 2018; Yan et al., 2020), which relieves the pressure of enterprise financing. For examples, JD.com in 2013 for the first time offered financing services to capital-constrained suppliers who wholesale products to its platform (Yang et al., 2019; Sun et al., 2022). Taobao, Tmall and Amazon have also launched loan programs to help sellers (Dong et al., 2018). In addition, some 3PLs also include financial services, such as Exel, TNT Logistics, Schneider and NYK Logistics (Chen and Cai, 2011). Moreover, different from the traditional intra-supply chain financing, the ECP and 3 PL not only provide financing services, but also use advanced information technology to save a large amount of information (e.g., purchase records, logistics information, customer feedback) (Dong et al., 2018; Yan et al., 2020), which attracts a large number of enterprises and consumers (Zhang et al., 2018; Gong et al., 2019). However, the ECP and 3 PL not only bear the risk of default of SMEs, but also fail to address consumers’ demands for transparency and authenticity of information.

For listed companies, they are required to publish Environmental, Social and Governance (ESG) information disclosure system (Ren et al., 2023), but SMEs are not required. The emergence of blockchain technology can not only eliminate consumers’ concerns about product information (Choi et al., 2020b; Fan et al., 2020; Song et al., 2022), but also reduce the default risk of SMEs (Dolgui et al., 2019; Liu et al., 2021). The reason is that blockchain technology has the characteristics of immutable, irreversible, traceable and credible (Pournader et al., 2019). For example, the adoption of blockchain in supply chain can increase the transparency of information on the chain and reduce the risk of default by internal members (Chod et al., 2020; Zheng et al., 2022; Zhou et al., 2022).

Although both ECP and 3PL can provide financial services for enterprises, some enterprises can meet the demand of production only with the funds obtained from ECP or 3PL (Cai et al., 2014; Chen et al., 2018; Zhen et al., 2020). However, in real life, the funds obtained by an enterprise from a financing party are limited, and multi-party mixed financing is needed to meet the funding gap. For example, Airwallex, a financial technology company, solved its funding problems through a combination of external financing institutions and Alibaba financing.2 In addition, blockchain is widely used in external bank or institutional financing (Dong et al., 2021; Liu et al., 2021; Huo and Xue, 2023), but the application of blockchain to internal supply chain members financing is relatively rare. The above phenomenon triggers the research motivation.

Based on the above research motivation, this paper explores the optimal decisions of a capital-constrained supply chain without adopting and with adopting blockchain. In this paper, the capital-constrained manufacturer is funded by a mix of the ECP and the 3PL, and the manufacturer sells its products through direct sales channel and distribution channel on the ECP. Specifically, this paper focuses on the following questions:

1. How does blockchain affect equilibrium decisions of supply chain members?

2. In two scenarios without and with blockchain technology, what are the impact of the information search cost, the financing interest rate of the ECP and the 3PL, the logistics cost on the equilibrium decisions?

3. What are the optimal interest rates for the ECP and the 3PL?

4. When will the supply chain adopt blockchain? After the adoption of blockchain, how will the profits of the whole supply chain and its members change?

To address these questions, this study considers a dual-channel supply chain with capital constraints and constructs some related game models. Firstly, this study constructs profit functions to discuss the optimal sales price, wholesale price and demand under two scenarios. The two scenarios are without adopting blockchain (N) and with adopting blockchain (B). Then, we analyze that the effects of information search cost, the financing interest rate of the ECP and the 3PL, and the logistics cost on the equilibrium decision under two scenarios. Secondly, we calculate the respective optimal interest rate based on the profit maximization of supply chain financing members with and without blockchain, and analyze the factors that may affect the optimal decisions. Finally, the research discusses the conditions of blockchain adoption, and further analyzes the impact of blockchain adoption on profits.

The contributions of this paper are as follows. First, most of the previous studies considered either a single financier or a mixture of an external bank and an internal supplier. However, this study treats the EPC and the 3PL as internal members of the supply chain, and considers that both the EPC and the 3PL provide funds for the capital-constrained manufacturer, which provides a new way of financing. Second, compared with previous studies on blockchain, it is no longer limited to information traceability, transaction risk and authenticity. This paper considers that new applications of blockchain technology in reducing the information search costs and logistics costs. Third, through the analysis, we find that with the increase of financing ratio, the optimal financing interest rate of the ECP decreases, while the optimal financing interest rate of the 3PL increases. In addition, the supply chain will adopt blockchain when certain conditions are met. And the initial adoption of blockchain is unfavorable to the ECP and 3PL.

The remainder of the contribution is structured as follows. Section 2 reviews the relevant literature. In Section 3, the problem description and the game models under without and with blockchain are proposed. In Section 4, the equilibrium decisions of members in scenarios N and scenarios B are analyzed by using the Stackelberg Game method. In Section 5, the equilibrium decisions of scenarios N and scenarios B are discussed. In Section 6, the numerical analyze of equilibrium solutions in two scenarios are performed. In Section 7, conclusions and future research directions are presented.

2 Literature review

The relevant literature mainly involved in this paper includes two parts, namely, the operation of the capital-constrained supply chain and the application of blockchain in supply chain.

2.1 The operation of the capital-constrained supply chain

In supply chain finance, several scholars have conducted extensive research on the financing modes of external bank financing and internal trade credit financing. For examples, Kouvelis and Zhao (2011) explored the newsvendor problem in a supply chain with capital constraints and obtained the optimal price-only contract under bank financing in the presence of bankruptcy costs. Yan and Sun (2013) discussed that the commercial bank, as the leader, sets the appropriate loan amount according to the credit and collateral of the retailer. Feng et al. (2014) found that when a capital-constrained buyer obtains funds from a bank, the buyer’s profit and optimal purchase decision increase with bank financing. Huang et al. (2019) examined that a capital-constrained retailer obtains a short-term financing from a bank by supplier credit guarantee loan. In terms of internal trade credit financing, Xiao et al. (2016) discussed whether three kinds of trade credit contracts, namely revenue-sharing, buyback, and all-unit quantity discount, can realize the coordination of the capital-constrained supply chain. Gupta and Chen (2019) researched that small businesses with capital constraints can sell products to retailers through a consignment contract, and analyzed the condition that the retailer’s willingness to lend and the supplier’s willingness to accept. Yang et al. (2019) used a game model to consider the interactions among a retailer, an incumbent manufacturer and a capital-constrained new entrant manufacturer. Zhang et al. (2021) formulated the Stackelberg game models under centralized decision and decentralized decision to probe the pricing decision of a retailer-dominant dual-channel supply chain with manufacturer’s capital constraints. In addition, there are some studies on the hybrid financing of external bank financing and internal trade credit financing. For instances, Li et al. (2019) considered the optimal financing decisions for a capital-constrained manufacturer in a dual-channel supply chain. The manufacturer can choose three financing modes, namely, trade credit, bank loan, and hybrid financing of bank loan and equity. Jin and Zhang (2020) analyzed the conditions that the retailer adopts a hybrid financing mode of bank credit and trade credit and discussed how loss aversion and power imbalance impact the decisions of the supplier and retailer.

In addition to the traditional financing modes mentioned above, financing provided by ECPs and 3PLs is a new financing mode. For example, Chen and Zhang (2019) studied that a capital-constrained retailer can seek financing help from its upstream member or ECP to solve its inventory problem. Yan et al. (2020) researched the decisions of a dual-channel supply chain with capital constraints, where the capital-constrained supplier can obtain financing from the ECP. Furthermore, Yang et al. (2022) analyzed the optimal decisions of supply chain members under the hybrid financing scheme of bank credit and ECP. As for 3PLs financing, Chen and Cai (2011) proved that the 3PL financing can bring higher profits to the whole supply chain and its members. Huang et al. (2018) derived supply chain coordination conditions when the 3PL provide financing services for the capital-constrained retailer. Sun et al. (2022) explored operation and financing decisions in a dual-channel supply chain under ECP financing mode and 3PL financing mode. Although the above studies have discussed the finance modes of a single/dual channel supply chain with capital constraints, there are few studies on the hybrid financing mode of ECP and 3PL.

2.2 The application of blockchain in supply chain

In recent years, blockchain technology plays an important role in the operation of supply chain. Several scholars have studied the application of blockchain in supply chain according to its characteristics. 1) Traceability. For examples, Tian (2016) and Tian (2017) compared the traceability of blockchain, Internet of thing and RFID. Fan et al. (2020) considered whether the supply chain adopts blockchain technology is linked to the traceability awareness of consumers. Hastig and Sodhi (2020) found the need and importance of blockchain technology traceability. 2) Information disclosure and transparency. For examples, Choi et al. (2020b) explored the impacts of product information disclosure on the consumer surplus and seller benefits. Xu and He (2021) analyzed the effects of information disclosure strategies on the decisions of retail platform and consumers. Wu and Yu (2022) studied the impact of blockchain on platform supply chain from two aspects: information transparency and transaction cost. Zhou et al. (2022) explored that blockchain technology can improve the reliability of information disclosure. Iranmanesh et al. (2022) indicated the intention of SMEs to adopt blockchain is influenced by the contributions of blockchain to supply chain agility and transparency. 3) Sustainability. For examples, Xu et al. (2021) revealed that blockchain technology can not only improve the greenness of products, but also promote the coordination of supply chain to bring more profits to manufacturers and platforms. Xu and Choi (2021) proposed that blockchain technology can trace carbon emissions during production and realize coordination between manufacturers and online platforms. Tao et al. (2022) concluded that the involvement of blockchain technology in production affects product price and quality. Furthermore, the criteria and challenges of blockchain adoption are also studied. For examples, Dehshiri et al. (2022) and Almutairi et al. (2022) evaluated the application criteria and challenges of blockchain technology in the supply chains. Tiwari et al. (2023) identified challenges associated with 3PL and proposed a framework and decision roadmap for implementing BCT in 3PL.

The combination of blockchain and supply chain finance is a hot topic in current research. Choi (2020) proved that compared with traditional supply chain financing, blockchain technology financing can not only reduce operational risks, but also obtain more expected profits. Yu et al. (2020) compared the traditional supply chain financing model of platform undertakes guarantee and the new supply chain financing strategy of customer undertakes guarantee based on blockchain technology. The result indicated that the latter can bring a Pareto improvement. Dong et al. (2022) adopted advance payment (AP) as a financing instrument in a deep-tier supply chain to reduce the supply disruption risk in a traditional system and a blockchain-enabled system. Liu et al. (2021) analyzed the optimal decisions of supply chain members under blockchain platform finance (BPF) and small and medium-sized enterprises independent finance (SIF) compared the two financing models. Choi (2020) researched the product development project financing problem under the initial coin offering case and traditional bank case. Dong et al. (2021) discussed the impact of financial products (i.e., asset-backed securitization) and blockchain on the capital-constrained supply chain decisions. Wang et al. (2023) focused on the financing and operation strategies of the accounts receivable chain for capital-constrained downstream buyers driven by blockchain technology. Most of the above literature discusses the application of blockchain to external bank or institutional financing. However, the application of blockchain to supply chain internal financing literature is relatively rare.

Obviously, there is a lot of literature on supply chain financing modes. At present, the financing modes that they have studied are mainly bank credit, trade credit, mixed bank credit and ECP financing and a mixture of equity and bank credit. However, the literature on the hybrid financing mode of the ECP and 3PL is relatively rare. Although Sun et al. (2022) compared the operation and optimal decisions under the ECP financing mode and the 3PL financing mode, they did not discuss the hybrid financing mode of the ECP and 3PL. In addition, the previous literature mainly uses blockchain to ensure the authenticity and traceability of information and reduce the risk of transaction default. However, the literature considering the impact of blockchain on the information search costs of consumers and the logistics costs of the 3PL is relatively rare. Though Tao et al. (2022) studied that blockchain technology can reduce consumers’ information search costs, they did not study its impact on logistics costs. Different from the above researches, this paper studies how the ECP and 3PL hybrid financing mode and blockchain technology affect the optimal decisions of supply chain members.

3 Model description, notations and assumptions

3.1 Problem description

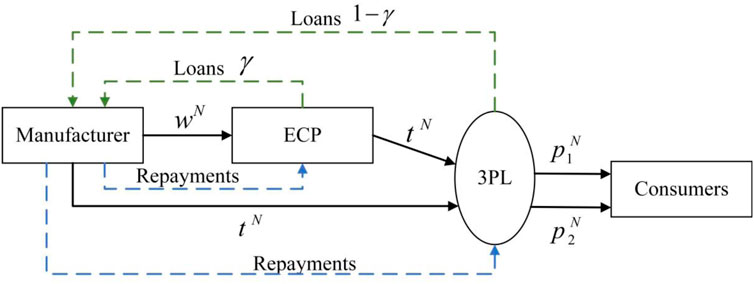

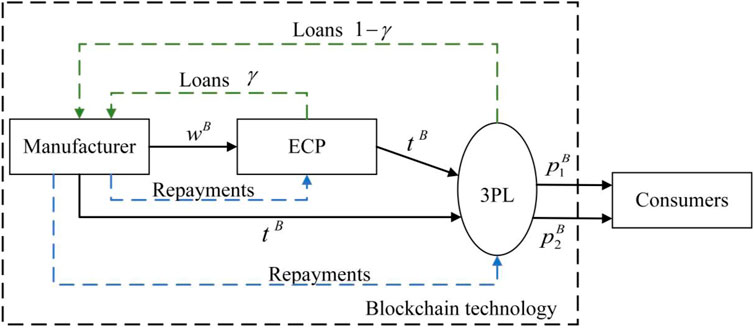

This study considers the supply chain composed of a capital-constrained manufacturer, an ECP, a 3PL company, and consumers who want to know product information and compare prices. The manufacture can sell products through the direct channel and the distribution channel. The direct channel is that products produced by the manufacturer are delivered directly to consumers by the 3PL, while the distribution channel is that products produced by the manufacturer are first wholesaled to the ECP, and then the ECP according to the order demand transports products via the 3PL. Due to a lack of capital, the manufacturer needs financing to maintain operations. This paper considers that the funds needed by the manufacturer are provided by the ECP and the 3PL in a certain proportion. Moreover, the two financing parties have different interest rates. Lastly, based on the cost of searching for product information for consumers, we compare the change of the optimal decisions with or without blockchain.

In this paper, the subscript

3.2 Assumptions and notations

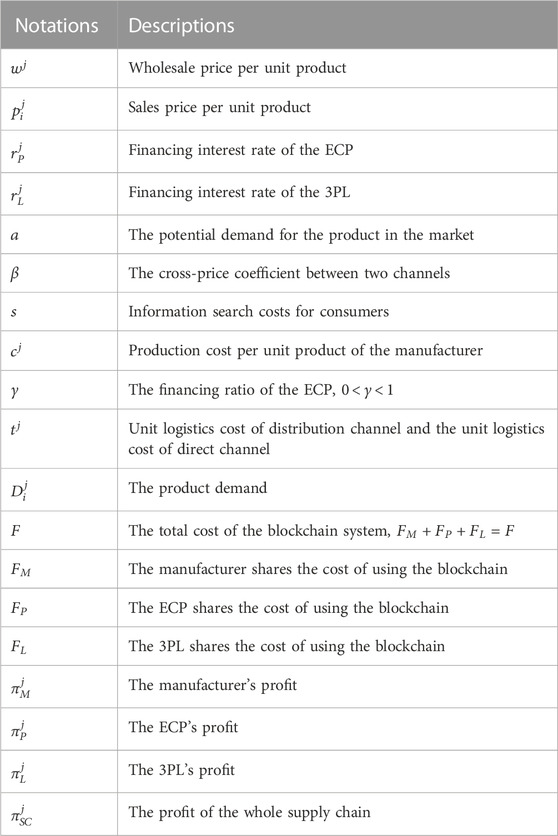

To analyze and simplify the proposed models, the assumptions and notations made by this paper are as follow.

(1) Based on the previous research (Ghosh and Shah, 2012; Li et al., 2015; Chen et al., 2019; Sun et al., 2022), in scenario N, the demand functions in the ECP distribution channel and the direct sales channel are as follows:

where

In scenario B, the demand functions in the ECP distribution channel and the direct sales channel are as follows:

In all of these functions,

(2) According to Jing and Seidmann (2013) and Sun et al. (2022), the initial capital of the manufacturer in this paper is

(3) As the assumption of Tao et al. (2022), we assume that blockchain technology can reduce production costs, i.e.,

(4) Like the existing literature (Cai et al., 2014; Liu et al., 2021), we also have

(5) Referring to the study of Huang et al. (2018) and Sun et al. (2022), this study assumes that the logistics costs per unit product of the two channels are the same. Therefore, in scenario N (or scenario B), the logistics costs of the two channels are

(6) According to the literature of Fan et al. (2020), the cost of a blockchain system is shared by supply chain members. In this paper, the manufacturer and the 3PL sell products through two channels, while the ECP sells through a single channel, so we assume that

(7) In this paper, we assume that supply chain members are risk neutral and the information among them is symmetrical (Sun et al., 2022).

4 Materials and methods

In this section, we first establish the profit functions of the manufacturer and the ECP in scenario N and scenario B, respectively. We use the Stackelberg Game method to solve the functions and analyze the results.

4.1 Scenario N

In scenario N, the decision sequence of the supply chain members is as follows. In terms of interest rates, the ECP first determines the interest rate, and then the 3PL determines the interest rate. In terms of prices, the ECP determines its sales price of the distribution channel, and then the manufacturer decides the wholesale price and the sales price of the direct channel. The profit functions of the manufacturer and the ECP can be expressed, namely,

Based on the principle of profit maximization and the inverse solution method, we can obtain the following lemma and corollary.

Lemma 1 In scenario N, (i) the optimal wholesale price, distribution price of the ECP and sales price of the manufacturer are as follows:

(ii) The optimal demand of the distribution sales channel and the direct sales channel are as follows:

Corollary 1 The optimal wholesale price, distribution price, direct sales price, distribution demand and direct sales demand have the following properties:

The following findings can be concluded from Corollary 1. First, all prices are negatively correlated with the cost of information search for consumers. This means that both the sales prices of two channels and the wholesale price will decrease as the information search costs increase. In addition, information search costs have a greater impact on the sales price of distribution channel than that of direct sales channel.

Second, the sales price of the two channels increases with the increase of logistics costs, while the wholesale price decreases as logistics costs increase. Simultaneously, the logistics cost has a greater impact on sales price than demand in two channels. This means that when logistics costs increase, the manufacturer and the ECP will raise their sales price to gain more profits.

Third, all prices are positively correlated with the interest rate of financing for both the ECP and the 3PL. As a result, the manufacturer and the ECP will raise prices regardless of who raises the interest rate. Moreover, the interest rates of the ECP and 3PL have a greater impact on wholesale price and direct sales price because their increase directly affects the manufacturer’s decisions.

Lastly, consumer information search costs, logistics costs and the interest rate of the 3PL have a negative impact on the demand of two channels. Besides, the increase of interest rate of the ECP will reduce the demand of the direct channel, but it will not affect the demand of the distribution channel.

According to the results of Lemma 1, the optimal profit of each supply chain member is as follows:

According to Eqs 13–15, we can obtain the optimal profit of the whole supply chain:

Corollary 2 The profit functions of each supply chain member and the whole supply chain have the following characteristics, respectively:

Corollary 2 manifests that the increase in consumer information search costs has an adverse effect on the profits of each member of the supply chain and the whole supply chain. The reason is that the increasing of information search costs leads to a decrease in prices and demand, which makes profits reduction.

Next, we analyze the interest rates of the ECP and 3PL. Through the optimal solutions of Lemma 1, the following profit functions can be derived:

By solving Eqs 17, 18, we are able to obtain the following proposition.

Proposition 1 If the optimal interest rates exist (i.e.,

Considering that

Corollary 3 The optimal interest rates of the ECP and 3PL have the following characteristics, respectively:

Corollary 3 (i) indicates that the optimal financing interest rates of the ECP and the 3PL declines with the increase of information search cost. This is because the information search cost will directly affect the demand of consumers, and thus indirectly affect the production of the manufacturer. In other words, the increase in information search costs reduces the order volume and the financing needs of the manufacturer, so the ECP and the 3PL will lower the financing interest rates to attract the manufacturer. Similarly, (ii) when production costs increase, the optimal financing interest rates of the ECP and the 3PL will decrease. The reason is that the production costs affect the amount of financing, and then lead to the change of financing interest rates. As a result, the ECP and 3PL should lower interest rates to attract the manufacturer when production costs increase. Furthermore, (iii) the logistics costs are negatively relevant to the interest rate of the 3PL, while they do not change the interest rate of the ECP. This means that the 3PL can raise the financing interest rates by discounting the logistics cost per unit of product. Therefore, when the logistics costs increase, the 3PL should lower the interest rate to attract the manufacturer and the ECP can raise the interest rate appropriately to increase its own profits. Eventually, (iv) the financing interest rate of the ECP decreases as the ratio of financing increases. In contrast, the financing interest rate of the 3PL increases as the ratio of financing increases. Under the circumstances, the ECP and the 3PL will adjust the interest rates based on the amount borrowed by the manufacturer.

4.2 Scenario B

In scenario B, the decision order of supply chain members is similar to scenario N. The profit functions of the manufacturer and the ECP can be expressed, namely,

Based on the principle of profit maximization and the inverse solution method, we can obtain the following lemma and corollary.

Lemma 2 In scenario B, (i) the optimal wholesale price, distribution price of the ECP and sales price of the manufacturer are as follows:

(ii) The optimal demand of the distribution sales channel and the direct sales channel are as follows:

Corollary 4 The optimal wholesale price, distribution price, direct sales price, distribution demand and direct sales demand have the following properties:

Corollary 4 shows that the logistics costs positively affect the sales price of the two channels and negatively influence the wholesale price. When the logistics costs increase, the manufacturer will raise the sales price of the direct sales channel, which leads to the decrease of the order quantity of the direct channel. In order to maximize profits, the manufacturer need to reduce the wholesale price to increase the order quantity of the distribution channel. Meanwhile, the ECP will raise the distribution price to maintain profits when the logistics costs increase. Moreover, the interest rate of financing for both the ECP and the 3PL have a positive effect on all prices, which means that the manufacturer and the ECP will raise prices regardless of who raises the interest rate. And when the interest rate of the ECP increases, it has the greatest impact on the wholesale price, followed by the sales price of the direct sales channel, and it has the least impact on the sales price of the distribution channel. In addition, logistics costs and the interest rate of the 3PL are negatively correlated with the demand of two channels. Lastly, the increase of interest rate of the ECP can decrease the demand of the direct channel, but it cannot affect the demand of the distribution channel.

According to the results of Lemma 2, the optimal profit of each supply chain member is as follows:

According to Eqs 29–31, we can obtain the optimal profit of the whole supply chain:

Next, we analyze the interest rates of the ECP and 3PL. Through the optimal solutions of Lemma 2, the following profit functions can be derived:

By solving Eqs 33, 34, we are able to obtain the following proposition.

Proposition 2 If the optimal interest rates exist (i.e.,

Considering that

Corollary 5 The optimal interest rates of the ECP and 3PL have the following characteristics, respectively:

Corollary 5 (i) demonstrates that the production cost per unit is negatively correlated with the financing interest rates. The reason is that the increase of production cost leads to the increase of financing amount, and the ECP and 3PL will get more profits by reducing the interest rate. Thus, when the cost of production increases, ECP and 3PL need to adjust their own interest rates downward. Likewise, (ii) the interest rate of the ECP is not affected by the change of logistics costs, while the interest rate of the 3PL decreases with the increase of logistics costs. It means that the ECP can increase the interest rate within a reasonable range to gain more profit. Therefore, when logistics costs increase, the 3PL need to adjust its own interest rate downward but the ECP can adjust its own interest rate upward appropriately. Additionally, (iii) the increase of the financing ratio will reduce the interest rate of the ECP and increase the interest rate of 3PL. Hence financiers will make more profits through the adjustment of interest rates.

5 Discussion

This section discusses the equilibrium decisions in two scenarios from three aspects: price, demand and profit. The specific analysis is as follows:

5.1 Price and demand comparison

Corollary 6 In two scenarios, the optimal wholesale price, distribution price, direct sales price, demand of distribution channel and demand of direct sales channel have the following relationship:

(i) ① If

② If

(ii) If

(iii) If

(iv)

(v)

Corollary 6 (i) states that the wholesale price of the manufacturer in scenario B is higher than that in scenario N when the consumer’s information search costs are within a certain range. This is because the market demand decreases as the information search costs increases in scenario N, which leads to a decrease in the manufacturer’s wholesale price. Similarly, (ii) and (iii) show that the sales price of the two channels in scenario B is higher than that in scenario N when the information search costs are within a certain range. The reason is that the change of information search costs will affect the demand, and thus affect the sale prices of the manufacturer and the ECP. Specifically, the increase of information search cost will lead to the decrease of demand, and supply chain members need to reduce the sales price in order to obtain more profits. (iv) and (v) indicate that the demand of two channels in scenario B is higher than that in scenario N. The reason is that the increase in information search costs will directly lead to a decrease in demand.

5.2 Profits comparison

Corollary 7 In two scenarios, the optimal profit of whole supply chain, the manufacturer, the ECP and the 3PL have the following relationship:

(i) If

(ii) If

(iii) If

(iv) If

Corollary 7 presents that when certain conditions are met, the profit in scenario B is higher than that in scenario N. (i) shows that when the consumers’ information search costs meet certain condition, the profit of the whole supply chain in scenario B is higher than that in scenario N. This certain condition is related to the potential demand for the product in the market, the cross-price coefficient between two channels, production cost per unit, logistics cost per unit, the financing ratio of the ECP and interest rates. In other words, the supply chain will adopt blockchain technology under this condition. (ii) shows that when the consumers’ information search costs meet certain condition, the manufacture’s profit in scenario B is higher than that in scenario N. (iii) shows that when the consumers’ information search costs meet certain condition, the ECP’s profit in scenario B is higher than that in scenario N. (iv) shows that when the consumers’ information search costs meet certain condition, the 3PL’s profit in scenario B is higher than that in scenario N. These conditions are closely related to information search costs of consumers, production costs of the manufacturer, the intensity of competition between the two channels, the cost of blockchain adoption, transportation costs, interest rates and the potential market demand.

6 Numerical analysis

In this section, we perform a numerical analysis of the equilibrium solutions in two scenarios. Parameters are set referring to Sun et al. (2022) and Yang et al. (2022),

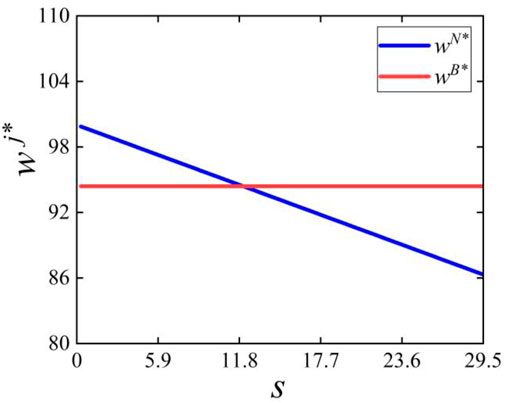

Figure 3 shows that the relationship between information search costs of consumers and the manufacturer’s wholesale prices in two scenarios. In scenario N, the manufacturer’s wholesale price decreases with the increase of consumers’ information search costs, which is consistent with Corollary 1 (i). Moreover, when consumers’ information search costs are high, the optimal wholesale price of the manufacturer in scenario B is higher than that in scenario N. when consumers’ information search costs are low, the optimal wholesale price of the manufacturer in scenario N is higher than that in scenario B. This result is consistent with Corollary 6 (i).

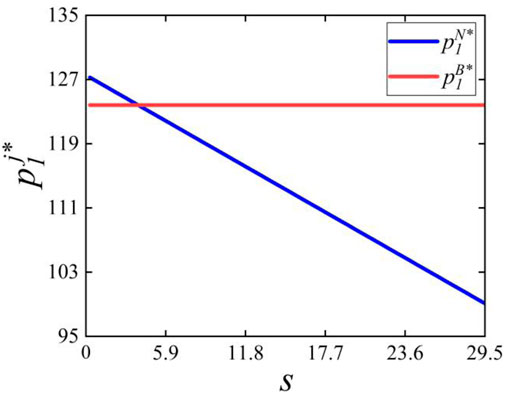

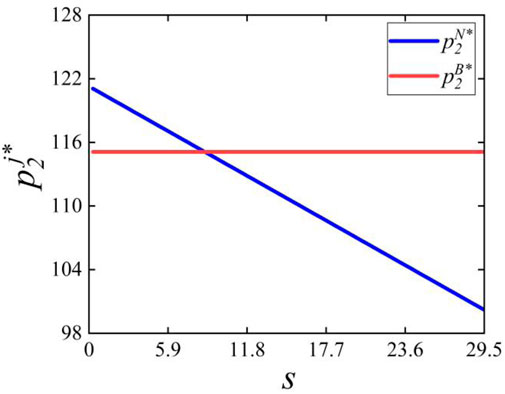

Figure 4 shows that the relationship between information search costs of consumers and the distribution prices of the ECP in two scenarios. In scenario N, the distribution price of the ECP decreases with the increase of consumers’ information search costs, which is consistent with Corollary 1 (i). Moreover, when consumers’ information search costs are high, the optimal distribution price of the ECP in scenario B is higher than that in scenario N. when consumers’ information search costs are low, the optimal distribution price of the ECP in scenario N is higher than that in scenario B. This result is consistent with Corollary 6 (ii).

Figure 5 shows that the relationship between information search costs of consumers and the direct sales prices of the manufacturer in two scenarios. In scenario N, the direct sales price of the manufacturer decreases with the increase of consumers’ information search costs, which is consistent with Corollary 1 (i). Moreover, when consumers’ information search costs are high, the optimal direct sales price of the manufacturer in scenario B is higher than that in scenario N. when consumers’ information search costs are low, the optimal direct sales price of the manufacturer in scenario N is higher than that in scenario B. This result is consistent with Corollary 6 (iii).

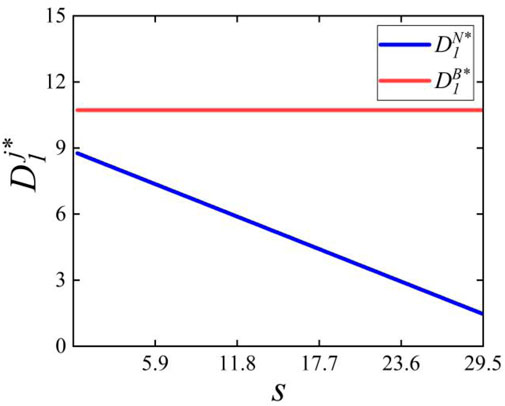

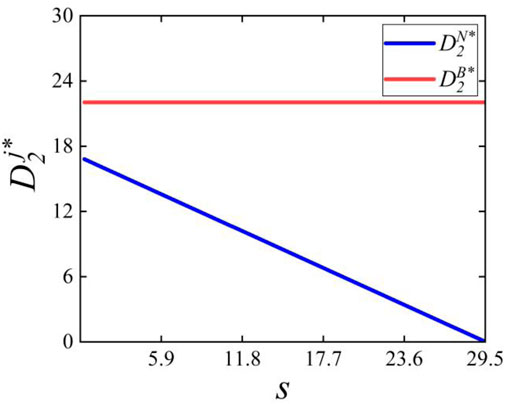

Figure 6 shows that the relationship between information search costs of consumers and the demand for distribution channel in two scenarios. In scenario N, the demand for distribution channel decreases with the increase of consumers’ information search costs, which is consistent with Corollary 1 (ii). Moreover, the demand for distribution channel in scenario B is always higher than in scenario N. This result is consistent with Corollary 6 (iv).

Figure 7 shows that the relationship between information search costs of consumers and the demand for direct sales channel in two scenarios. In scenario N, the demand for direct sales channel decreases with the increase of consumers’ information search costs, which is consistent with Corollary 1 (ii). Moreover, the demand of distribution channel in scenario B is always higher than in scenario N. This result is consistent with Corollary 6 (v).

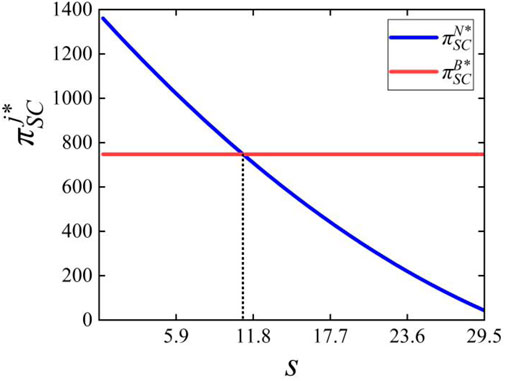

Figure 8 shows that the relationship between information search costs of consumers and the profits of the whole supply chain in two scenarios. In scenario N, the profit of the whole supply chain decreases with the increase of consumers’ information search costs, which is consistent with Corollary 2. In addition, when consumers’ information search costs are high, the optimal profit of the whole supply chain in scenario B is higher than that in scenario N. when consumers’ information search costs are low, the optimal profit of the whole supply chain in scenario N is higher than that in scenario B. This result is consistent with Corollary 7 (i). Finally, from Figure 8, we can find that the supply chain can obtain more profit by using blockchain than without using blockchain when consumers’ information search costs

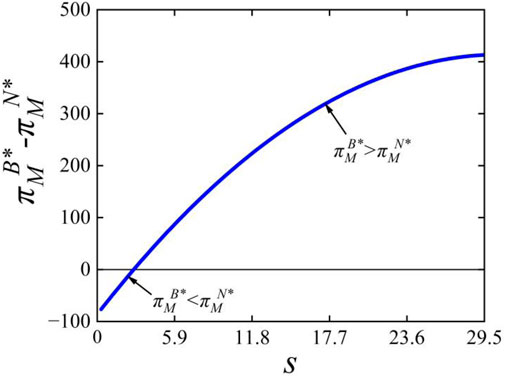

Figure 9 shows that the relationship between information search costs of consumers and the profits of the manufacture in two scenarios. In scenario N, as consumers’ information search cost increase, the manufacturer’s profit will decrease, which is consistent with Corollary 2. Moreover, when consumers’ information search cost is within a certain range, the manufacturer’s profit in scenario B is higher than that in scenario N. This result is consistent with Corollary 7 (ii).

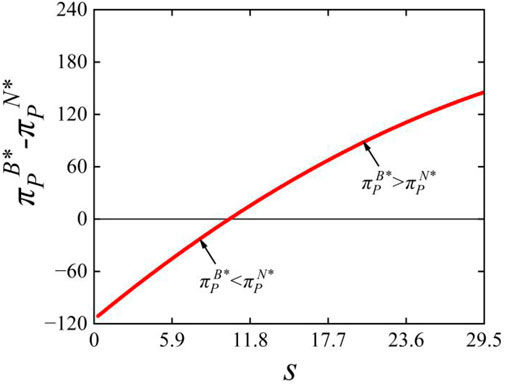

Figure 10 shows that the relationship between information search costs of consumers and the profits of the ECP in two scenarios. In scenario N, as consumers’ information search costs increase, the ECP’s profit will decrease, which is consistent with Corollary 2. Moreover, when consumers’ information search cost is within a certain range, the ECP’s profit in scenario B is higher than that in scenario N. This result is consistent with Corollary 7 (iii).

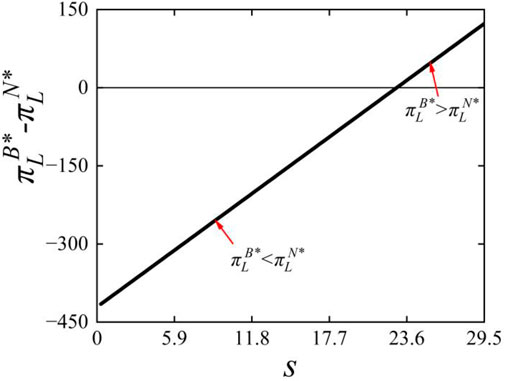

Figure 11 shows that the relationship between information search costs of consumers and the profits of the 3PL in two scenarios. In scenario N, as consumers’ information search costs increase, the 3PL’s profit will decrease, which is consistent with Corollary 2. Moreover, when consumers’ information search cost is within a certain range, the 3 PL’s profit in scenario B is higher than that in scenario N. This result is consistent with Corollary 7 (iv).

7 Conclusion

This paper explores pricing and financing of a dual-channel supply chain with and without blockchain. We analyze equilibrium decisions under two scenarios, and discuss the influence of information search costs, logistics costs, financing interest rates and other factors on the equilibrium decisions. Next, we compare the optimal price, demand and profit with and without blockchain.

Through the analysis of the model in this paper, we are able to obtain the following conclusion. First of all, when supply chain members do not adopt blockchain, the optimal prices and demand decrease as the cost of information search for consumer increases. Moreover, the information search costs have a greater impact on price than on demand. The increase of information search costs will also reduce the financing interest rate of the ECP and the 3PL. Meanwhile, their increase will cause the profit of members of the supply chain to decline. Second, in two scenarios, the increase of logistics cost per unit makes the sales price of two channels rise. However, as it increases, the optimal wholesale prices and demand will fall. In addition, the increase in logistics cost per unit will decrease the optimal interest rate of the 3PL, but will not affect the optimal interest rate of the ECP. Finally, unit production cost is negatively related to the optimal interest rate of the ECP and 3PL.

Further, by comparing the optimal solutions of the two scenarios, we can draw the following conclusions. First, when consumer information search costs meet different specific conditions, the optimal direct selling price, distribution price and wholesale price in scenario B are respectively higher than in scenario N. Second, the optimal order quantity of the two channels in scenario B is always greater than that in scenario N. Last, when the consumer’s information traceability cost meets certain conditions, the profit of scenario B will be greater than Scenario N. In other words, the supply chain will adopt blockchain technology at this time.

There are some management insights to be gained from the above conclusions. For the whole supply chain, when the consumer’s information search cost meets a certain range, the adoption of blockchain can obtain more profits. However, for each supply chain member, their respective profits from blockchain adoption are different. Therefore, the supply chain members should cooperate to achieve win-win-win. Specifically, for the manufacturer, the benefits of adopting blockchain are significant. But for the ECP and 3PL, the initial adoption of blockchain is a loss for them because of the cost of blockchain. Thus, in order to realize the coordination of the supply chain, the manufacturer need to give subsidies to the ECP and 3PL at the initial stage of blockchain adoption.

There are also some limitations in this paper. First, we only analyzed the logistics costs of the direct sales channel equal to the distribution channel. Second, this paper discusses that the demand of two channels is linear. Third, the cost of blockchain technology shared by supply chain members in this paper is based on sales channels. However, the limitations of this study provide valuable suggestions for future research. Firstly, future research can explore that the logistics cost of the direct sales channel is not equal to the logistics cost of the distribution channel. Next, the stochastic demand of dual channels is also an interesting direction that deserves to be explored in future research. In addition, the unit cost that supply chain members will pay when adopting blockchain technology can be further discussed.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

ZH: writing–original draft; writing–review and editing; supervision. ZW: writing–original draft; writing–review and editing; software. BC: writing–original draft; writing –review and editing; supervision. All authors contributed to the article and approved the submitted version.

Funding

This work is supported by the National Natural Science Foundation of China (Grant No. 71871206).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenrg.2023.1226813/full#supplementary-material

Footnotes

1https://apple.tmall.com/, https://www.apple.com.cn/, https://www.lenovo.com.cn/?pmf_source=P0000003194M0007, https://mall.jd.com/index-1000000157.html

2https://www.airwallex.com/cn/newsroom

References

Almutairi, K., Dehshiri, S., Dehshiri, S., Hoa, A., Dhanraj, J., Mostafaeipour, A., et al. (2022). Blockchain technology application challenges in renewable Energy supply chain management. Environ. Sci. Pollut. Res. 30, 72041–72058. doi:10.1007/s11356-021-18311-7

Cai, G., Chen, X., and Xiao, Z. (2014). The roles of bank and trade credits: theoretical analysis and empirical evidence. Prod. Operations Manag. 23 (4), 583–598. doi:10.1111/poms.12035

Chen, X., and Cai, G. G. (2011). Joint logistics and financial services by a 3PL firm. Eur. J. Operational Res. 214 (3), 579–587. doi:10.1016/j.ejor.2011.05.010

Chen, X., Cai, G., and Song, J. S. (2018). The cash flow advantages of 3PLs as supply chain orchestrators. Manuf. Serv. Operations Manag. 21 (2), 435–451. doi:10.1287/msom.2017.0667

Chen, Z., Fang, L., and Wang, H. (2019). Internal incentives and operations strategies for the water-saving supply chain with cap-and-trade regulation. Front. Eng. Manag. 6 (1), 87–101. doi:10.1007/s42524-019-0006-7

Chen, Z., and Zhang, R. (2019). A cash-constrained dynamic lot-sizing problem with loss of goodwill and credit-based loan. Int. Trans. Operational Res. 28 (5), 2841–2866. doi:10.1111/itor.12675

Chod, J., Trichakis, N., Tsoukalas, G., Aspegren, H., and Weber, M. (2020). On the financing benefits of supply chain transparency and blockchain adoption. Manag. Sci. 66, 4378–4396. doi:10.1287/mnsc.2019.3434

Choi, T. M., Feng, L., and Li, R. (2020b). Information disclosure structure in supply chains with rental service platforms in the blockchain technology era. Int. J. Prod. Econ. 221, 107473. doi:10.1016/j.ijpe.2019.08.008

Choi, T. M. (2020). Financing product development projects in the blockchain era: initial coin offerings versus traditional bank loans. IEEE Trans. Eng. Manag. 69, 3184–3196. doi:10.1109/TEM.2020.3032426

Choi, T. M. (2020). Supply chain financing using blockchain: impacts on supply chains selling fashionable products. Ann. Operations Res., 1–23. doi:10.1007/s10479-020-03615-7

Dehshiri, S., Emamat, M., and Amiri, M. (2022). A novel group BWM approach to evaluate the implementation criteria of blockchain technology in the automotive industry supply chain. Expert Syst. Appl. 198, 116826. doi:10.1016/j.eswa.2022.116826

Deng, S., Fu, K., Xu, J., and Zhu, K. (2019). The supply chain effects of trade credit under uncertain demands. Omega 98, 102113. doi:10.1016/j.omega.2019.102113

Dolgui, A., Ivanov, D., Potryasaev, S., Sokolov, B., Ivanova, M., and Werner, F. (2019). Blockchain-oriented dynamic modelling of smart contract design and execution in the supply chain. Int. J. Prod. Res. 58 (7), 2184–2199. doi:10.1080/00207543.2019.1627439

Dong, C., Chen, C., Shi, X., and Ng, C. T. (2021). Operations strategy for supply chain finance with asset-backed securitization: centralization and blockchain adoption. Int. J. Prod. Econ. 241, 108261. doi:10.1016/j.ijpe.2021.108261

Dong, L., Qiu, Y., and Xu, F. (2022). Blockchain-enabled deep-tier supply chain finance. Manufacturing & Service Operations Management. Available at SSRN 3776953. doi:10.1287/msom.2022.1123

Dong, L., Ren, L., and Zhang, D. (2018). Financing small and medium-size enterprises via retail platforms. Available at SSRN 3257899. doi:10.2139/ssrn.3257899

Fan, Z. P., Wu, X. Y., and Cao, B. B. (2020). Considering the traceability awareness of consumers: should the supply chain adopt the blockchain technology? Ann. Operations Res. 309, 837–860. doi:10.1007/s10479-020-03729-y

Feng, Y., Mu, Y., Hu, B., and Kumar, A. (2014). Commodity options purchasing and credit financing under capital constraint. Int. J. Prod. Econ. 153, 230–237. doi:10.1016/j.ijpe.2014.03.003

Ghosh, D., and Shah, J. (2012). A comparative analysis of greening policies across supply chain structures. Int. J. Prod. Econ. 135 (2), 568–583. doi:10.1016/j.ijpe.2011.05.027

Gong, D., Liu, S., Liu, J., and Ren, L. (2019). Who benefits from online financing? A sharing economy E-tailing platform perspective. Int. J. Prod. Econ. 222, 107490. doi:10.1016/j.ijpe.2019.09.011

Gupta, D., and Chen, Y. (2019). Retailer-direct financing contracts under consignment. Manuf. Serv. Operations Manag. 22 (3), 528–544. doi:10.1287/msom.2018.0754

Hastig, G. M., and Sodhi, M. S. (2020). Blockchain for supply chain traceability: business requirements and critical success factors. Prod. Operations Manag. 29 (4), 935–954. doi:10.1111/poms.13147

Huang, J., Yang, W., and Tu, Y. (2019). Supplier credit guarantee loan in supply chain with financial constraint and bargaining. Int. J. Prod. Res. 57 (22), 7158–7173. doi:10.1080/00207543.2019.1581386

Huang, S., Fan, Z. P., and Wang, X. (2018). Optimal operational strategies of supply chain under financing service by a 3PL firm. Int. J. Prod. Res. 57 (11), 3405–3420. doi:10.1080/00207543.2018.1534017

Huo, H., and Xue, N. (2023). Financing the three-tier supply chain: advance payment vs. Blockchain-enabled financing mode. Discrete Dyn. Nat. Soc. 2023, 1–14. doi:10.1155/2023/6554524

Iranmanesh, M., Maroufkhani, P., Asadi, S., Ghobakhloo, M., Dwivedi, Y., and Tseng, M. (2022). Effects of supply chain transparency, alignment, adaptability, and agility on blockchain adoption in supply chain among SMEs. Comput. Industrial Eng. 176, 108931. doi:10.1016/j.cie.2022.108931

Jin, W., and Zhang, Q. (2020). Decision making in trade credit financing: impact of loss aversion and power imbalance. Int. Trans. Operational Res. 28 (5), 2607–2632. doi:10.1111/itor.12912

Jing, B., and Seidmann, A. (2013). Finance sourcing in a supply chain. Decis. support Syst. 58, 15–20. doi:10.2139/ssrn.2228897

Kouvelis, P., and Zhao, W. (2011). The newsvendor problem and price-only contract when bankruptcy costs exist. Prod. Operations Manag. 20 (6), 921–936. doi:10.1111/j.1937-5956.2010.01211.x

Li, B., Zhu, M., Jiang, Y., and Li, Z. (2015). Pricing policies of a competitive dual-channel green supply chain. J. Clean. Prod. 112, 2029–2042. doi:10.1016/j.jclepro.2015.05.017

Li, G., Wu, H., and Xiao, S. (2019). Financing strategies for a capital-constrained manufacturer in a dual-channel supply chain. Int. Trans. Operational Res. 27 (5), 2317–2339. doi:10.1111/itor.12653

Liu, L., Li, Y., and Jiang, T. (2021). Optimal strategies for financing a three-level supply chain through blockchain platform finance. Int. J. Prod. Res. 61, 3564–3581. doi:10.1080/00207543.2021.2001601

Pournader, M., Shi, Y., Seuring, S., and Koh, S. L. (2019). Blockchain applications in supply chains, transport and logistics: A systematic review of the literature. Int. J. Prod. Res. 58 (7), 2063–2081. doi:10.1080/00207543.2019.1650976

Ren, X., Zeng, G., and Zhao, Y. (2023). Digital finance and corporate ESG performance: empirical evidence from listed companies in China. Pacific-Basin Finance J. 79, 102019. doi:10.1016/j.pacfin.2023.102019

Song, Y., Liu, J., Zhang, W., and Li, J. (2022). Blockchain’s role in e-commerce sellers’ decision-making on information disclosure under competition. Ann. Operations Res., 1–40. doi:10.1007/s10479-021-04276-w

Sun, J., Yuan, P., and Hua, L. (2022). Pricing and financing strategies of a dual-channel supply chain with a capital-constrained manufacturer. Ann. Operations Res., 1–21. doi:10.1007/s10479-022-04602-w

Tao, F., Wang, Y. Y., and Zhu, S. H. (2022). Impact of blockchain technology on the optimal pricing and quality decisions of platform supply chains. Int. J. Prod. Res. 61, 3670–3684. doi:10.1080/00207543.2022.2050828

Tian, F. (2017). “A supply chain traceability system for food safety based on HACCP, blockchain & Internet of things,” in 2017 International conference on service systems and service management (IEEE), 1–6. doi:10.1109/icsssm.2017.7996119

Tian, F. (2016). “An agri-food supply chain traceability system for China based on RFID & blockchain technology,” in 2016 13th international conference on service systems and service management (ICSSSM) (IEEE), 1–6. doi:10.1109/ICSSSM.2016.7538424

Tiwari, S., Sharma, P., Choi, T., and Lim, A. (2023). Blockchain and third-party logistics for global supply chain operations: stakeholders’ perspectives and decision roadmap. Transp. Res. Part E-Logistics Transp. Rev. 170, 103012. doi:10.1016/j.tre.2022.103012

Wang, C., Chen, X., Xu, X., and Jin, W. (2023). Financing and operating strategies for blockchain technology-driven accounts receivable chains. Eur. J. operational Res. 304 (3), 1279–1295. doi:10.1016/j.ejor.2022.05.013

Wu, J., and Yu, J. (2022). Blockchain’s impact on platform supply chains: transaction cost and information transparency perspectives. Int. J. Prod. Res. 61, 3703–3716. doi:10.1080/00207543.2022.2027037

Xiao, S., Sethi, S. P., Liu, M., and Ma, S. (2016). Coordinating contracts for a financially constrained supply chain. Omega 72, 71–86. doi:10.1016/j.omega.2016.11.005

Xu, Q., and He, Y. (2021). Optimal information disclosure strategies for a retail platform in the blockchain technology era. Int. J. Prod. Res. 61, 3781–3792. doi:10.1080/00207543.2021.1976434

Xu, X., and Choi, T. M. (2021). Supply chain operations with online platforms under the cap-and-trade regulation: impacts of using blockchain technology. Transp. Res. Part E Logist. Transp. Rev. 155, 102491. doi:10.1016/j.tre.2021.102491

Xu, X., Zhang, M., Dou, G., and Yu, Y. (2021). Coordination of a supply chain with an online platform considering green technology in the blockchain era. Int. J. Prod. Res. 61, 3793–3810. doi:10.1080/00207543.2021.1894367

Yan, N., and Sun, B. (2013). Coordinating loan strategies for supply chain financing with limited credit. Or Spectr. 35 (4), 1039–1058. doi:10.1007/s00291-013-0329-4

Yan, N., Zhang, Y., Xu, X., and Gao, Y. (2020). Online finance with dual channels and bidirectional free-riding effect. Int. J. Prod. Econ. 231, 107834. doi:10.1016/j.ijpe.2020.107834

Yang, H., Sun, F., Chen, J., and Chen, B. (2019). Financing decisions in a supply chain with a capital-constrained manufacturer as new entrant. Int. J. Prod. Econ. 216, 321–332. doi:10.1016/j.ijpe.2019.06.014

Yang, H., Zhen, Z., Yan, Q., and Wan, H. (2022). Mixed financing scheme in a capital-constrained supply chain: bank credit and e-commerce platform financing. Int. Trans. Operational Res. 29 (4), 2423–2447. doi:10.1111/itor.13090

Yu, Y., Huang, G., and Guo, X. (2020). Financing strategy analysis for a multi-sided platform with blockchain technology. Int. J. Prod. Res. 59 (15), 4513–4532. doi:10.1080/00207543.2020.1766718

Zhang, C., Wang, Y., Liu, Y., and Wang, H. (2021). Coordination contracts for a dual-channel supply chain under capital constraints. J. Industrial Manag. Optim. 17 (3), 1485–1504. doi:10.3934/jimo.2020031

Zhang, T., Li, G., Lai, K. K., and Leung, J. W. (2018). Information disclosure strategies for the intermediary and competitive sellers. Eur. J. Operational Res. 271 (3), 1156–1173. doi:10.1016/j.ejor.2018.06.037

Zhao, M., Dong, C., and Cheng, T. C. E. (2018). Quality disclosure strategies for small business enterprises in a competitive marketplace. Eur. J. Operational Res. 270 (1), 218–229. doi:10.1016/j.ejor.2018.03.030

Zhen, X., Shi, D., Li, Y., and Zhang, C. (2020). Manufacturer's financing strategy in a dual-channel supply chain: third-party platform, bank, and retailer credit financing. Transp. Res. Part E Logist. Transp. Rev. 133, 101820. doi:10.1016/j.tre.2019.101820

Zheng, K., Zheng, L., Guathier, J., Zhou, L., Behl, A., Zhang, J., et al. (2022). Blockchain technology for enterprise credit information sharing in supply chain finance. J. Innovation Knowl. 7 (4), 100256. doi:10.1016/j.jik.2022.100256

Zhou, H., and Li, L. (2020). The impact of supply chain practices and quality management on firm performance: evidence from China's small and medium manufacturing enterprises. Int. J. Prod. Econ. 230, 107816. doi:10.1016/j.ijpe.2020.107816

Keywords: capital constraint, hybrid financing, blockchain, supply chain pricing, information search costs of consumers

Citation: Huang Z, Wu Z and Cao B (2023) Operation strategies of capital-constrained small and medium-sized enterprises based on blockchain technology. Front. Energy Res. 11:1226813. doi: 10.3389/fenrg.2023.1226813

Received: 22 May 2023; Accepted: 01 August 2023;

Published: 05 September 2023.

Edited by:

Francesco Liberato Cappiello, University of Naples Federico II, ItalyReviewed by:

Seyyed Jalaladdin Hosseini Dehshiri, Allameh Tabataba’i University, IranYan Zheng, Central South University, China

Copyright © 2023 Huang, Wu and Cao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zhen Wu, MTQ2NjM2Mjk3NEBxcS5jb20=

Zuqing Huang

Zuqing Huang Zhen Wu

Zhen Wu Bingbing Cao

Bingbing Cao