- Department of Biological Science and Technology, Jinzhong University, Jinzhong, China

Introduction: Trade networks of crude oil are susceptible to cascade of initial shocks that increase systemic trade risks and threaten energy security. This study introduces a novel method of modelling systemic trade risk of crude oil which is combined with a sentiment proxy from a network perspective.

Method: We construct sentiment instability to evaluate the uncertainty of crude oil trade in a country and use the PageRank algorithm to measure supplier diversity from a network perspective instead of direct trade partners.

Result: At the global level, we show that the distribution of systemic oil trade risk has an obvious heterogeneity and a significant negative correlation between systemic trade risk of crude oil and trade volume volatility. At the regional level, we compare the systemic trade risk of crude oil between China and America and systemic trade risks show strongly significant correlations with the price volatility in both China and America. Furthermore, the structure of trade network can effectively reduce the systemic risk in America while it increases the systemic trade risk in China.

Discussion: Our results can give a reason for an irrational practice of Chinese crude oil imports which are “buying when the price is rising and not buying when the price is declining”.

1 Introduction

With the development of the world economy, the continuous consumption of major fossil fuels and uncertain events on a global scale have impacted international trade. As an important part of international trade, crude oil trade also faces significant challenges. For example, due to the impact of COVID-19 on the crude oil industry, CAPEX, R&D investment, and exploitation projects in the crude oil market have been continuously reduced, and crude oil prices have been constantly fluctuating, posing a risk for the crude oil industry to lose its substantial energy market share (Norouzi, 2021). However, the volatility of crude oil prices has been identified as an obstacle to guaranteeing sustainable economic development as well as a catalyst of geopolitical crises (Sun et al., 2011; Haddadian and Shahidehpour, 2015; Lee et al., 2017). As oil supply shocks could propagate among trade channels (Maravalle, 2012), initial shocks may cause secondary effects, which eventually propagate through the entire interconnected trade network. Naturally, an external shock to any single country in the global oil trade network can spread through the entire network and potentially threaten the stability of the trade system, an effect termed the systemic trade risk of crude oil. With the increasingly interconnected trade system and the intense concern regarding oil supply security, there is an urgent need to assess the systemic risk level of oil trade networks, which would allow policymakers to understand potential threats to oil supply and manage the risk induced by the price volatility of crude oil.

Systemic risk measurement is an attempt to quantify the occurrence of contagion or a widespread shock resulting in a failure in a large fraction of a system (Neveu, 2018). For an interconnected system, an initial shock may propagate to cause cascades of subsequent failure (Haldane and May, 2011). The vulnerability of a system to such cascading effects can be modeled by complex network theory and assessed by its centrality measures (Grubesic et al., 2008; Simonsen et al., 2008; Battiston et al., 2012; Thurner and Poledna, 2013). Previous studies on the measurement of systemic risk mainly focused on the field of finance as a result of the impactful global financial crisis that began in 2007 (May and Arinaminpathy, 2010). Recently, trade protectionism is gradually growing and threatens economic globalization such as trade frictions between China and America. As it is increasingly clear that the security of resource supplies can only be understood in a framework that considers the global interconnections among systems of trading (Erdmann and Graedel, 2011), recent studies are gradually paying increased attention to the systemic trade risk of resources (Peter et al., 2015; Sun et al., 2017; Chen et al., 2018).

As an important derivative and strategic resource, the risk of crude oil is closely related to investor sentiment because of the impacts of geopolitics and macroeconomics (Qadan and Nama, 2018). However, previous studies on systemic trade risk have hardly considered investor sentiment. In this paper, we used simultaneously network-based analysis and investor sentiment to assess the systemic trade risk level of crude oil. At the global level, we observed a high-level heterogeneity of the distribution for both systemic and local trade risks. Furthermore, we used country-level panel data covering 103 countries for the period 2008–2015 and employed a random-effects model to investigate the relationship between trade risk and trade volume volatility, the results of which showed that most countries tend to adopt conservative trade strategies and guarantee the stability of oil trade volume to deal with high trade risks. At the regional level, we compared the trade risks of the largest developing country—China—and the largest developed country—America—which are also the two largest crude oil consumers. We showed that the volatility of crude oil prices in China and America were closely related to specific network centrality measures that we proposed to quantify systemic trade risk. This close relationship largely depended on the structural properties of the entire trade network rather than the local trade risks. Furthermore, we found that the network effects were conducive to a reduction of the American systemic trade risk and an increase in Chinese systemic trade risk.

This paper contributes to the literature in two ways. First, this study constructed sentiment instability to quantify the trading uncertainty in a particular market. Second, this study investigated the vulnerability to supply shocks in crude oil from a network perspective instead of directly importing channels. The corresponding results strongly emphasized the effects of entire trade networks on reducing systemic trade risks. Such findings are important for policymakers designing and implementing policies to manage the trade risks of crude oil.

The structure of this paper is as follows. The next section presents a literature review on measuring systemic trade risk and the theoretical basis for constructing our sentiment proxy. Section 3 describes the data, our network model, and the network centrality measurements. Section 4 presents and explains the empirical results. Finally, Section 5 provides the conclusion and policy implications.

2 Theoretical background

Systemic risk is often defined as the risk that a large fraction of a system will collapse as a consequence of seemingly minor and local shocks that initially only affect a small part of the system. Because of the interconnectedness of the systems, these shocks may cause secondary effects that eventually propagate throughout the entire network. Awareness of systemic risk has greatly increased in the finance literature in the wake of the 2008 financial crisis (Billio et al., 2012; Huang et al., 2009). For financial systems, systemic risk is, to a large extent, a network effect in which external shocks to a single financial institution result in a sudden reduction of financial flows to other institutions, causing distress for them as well (Haldane and May, 2011). This chain of reduced financial flows can spread through the system, potentially leading to positive feedback dynamics and resulting in a strong reduction of the total net worth of financial institutions (Calvo et al., 2004). Relevant research has confirmed the cascade conduction effect of networks and the impact of network structure on network function (Jia et al., 2020; Jia et al., 2019; Li et al., 2022; Li et al., 2018).

It is becoming increasingly clear that resource production and trade systems have gradually formed a global interconnected network. Snyder and Kick (1979) were the first to study the international trade system, examining the flow relationship of trade by constructing an international trade network. Fagiolo et al. (2010) used measurement indicators such as the degree distribution and the cumulative intensity distribution of weighted networks to explore the evolutionary trends of trade risk networks among countries over time. Jia et al. (2023) studied the transmission of tungsten product price fluctuation in trade activities between the Chinese domestic market and international trade market from the industry chain perspective. The Chinese domestic market was embedded into the international trade market to construct a price fluctuation transmission network (network-in-network) in the tungsten industry chain. With the increasingly mature development of network theory, some scholars have also used network theory to examine the spatial correlation characteristics of international trade in crude oil. Ji et al. (2014) constructed a crude oil trade network and analyzed the overall characteristics, regional characteristics, and stability of the oil trade. Zhang et al. (2014) established a network of crude oil trade competition to analyze the evolution of crude oil trade competition patterns and communication methods and proposed a “5C” policy framework. Therefore, it is necessary to explore the system trade risks of crude oil from a network perspective.

Sun et al. (2017) summarized the measurement method of systemic trade risk of crude oil from previous studies and divided it into a diversification index to attempt to identify the risk factors. The former aimed at investigating supplier diversification, while the latter aimed to assess trade uncertainty in a country.

Basically, diversifying supply sources is helpful to reduce specific risk, which is often induced by some events uniquely related to individual supplier nations. Therefore, supplier diversification can reduce disruption vulnerability from a specific supplier source in theory and practice (Wu et al., 2007; Cohen et al., 2011; Yang et al., 2014). Usually, relying on a single supplier source exposes a company to risks such as political instability, natural disasters, or economic crises that may occur in that specific supplier’s country. By diversifying supplier sources, a company can spread its risk across multiple suppliers, reducing the impact of any disruptions that might occur in one supplier’s country on the company’s operations. Supplier diversification can also contribute to healthy competition between suppliers, which can lead to better pricing, quality, and innovation (Wu et al., 2007; Cohen et al., 2011; Yang et al., 2014). In summary, supplier diversification is a reliable and effective risk management strategy that can help companies to achieve long-term success and sustainability in their operations. Lesbirel (2004) found that supplier diversification can lead to improved energy supply security by reducing the impact of supply disruptions from specific sources. Japan’s policy of importing energy from a diverse range of sources has been effective in mitigating the risks associated with overreliance on particular suppliers and emphasizes the importance of supplier diversification in ensuring reliable and secure energy supplies.

Wu et al. (2008) evaluated the systemic risk of China’s petroleum product imports and emphasized the importance of supplier diversification as a means of mitigating these risks and improving energy supply security. Global diversification can reduce dependence on a single supply source; thus, reducing the risk of energy supply interruption and diversifying energy supply sources can also reduce the possibility of market monopolies, thereby increasing transparency and market stability (Bahgat, 2006; Yergin, 2006; Ladislaw, 2007; Cohen et al., 2011). Therefore, policymakers should consider promoting the global diversification of supply sources to enhance the security of energy supplies. Even though a country may receive imports from a large number of countries, the ultimate source of those imports may be just one country, making the importing country vulnerable to supply shocks if the source country experiences disruptions. In this case, a supplier diversification index that measures the number of direct suppliers will overestimate the degree of diversification and underestimate its vulnerability to supply shocks. Therefore, we used PageRank to measure the global diversification of oil supply. PageRank is a popular algorithm used by search engines to rank web pages based on their relevance and importance. This method offers some advantages over traditional diversification indexes that rely on direct trade flows with neighboring countries. Considering the entire global network of oil trade relations provides a more comprehensive measure of diversification that accounts for indirect relationships and dependencies between countries (Newman, 2010). In summary, this method considered both diversification and measured the network’s ability to withstand shocks from the perspective of the entire network, enabling a comprehensive analysis of the systemic trade risks of crude oil.

Risk factors also can be used to assess trade uncertainty levels in a particular country. Some of these risk factors include political risk, economic risk, legal and regulatory risk, environmental risk, and social risk. For instance, Peter et al. (2015) used political instability and trade barriers as risk factors to evaluate the risk level of a particular country, to help identify potential obstacles to doing business in a particular country, and to develop strategies to mitigate these risks. Gupta (2008) used eight selected indicators to assess the relative vulnerability of 26 net-importing countries, helping policymakers in these countries to better understand and develop strategies to mitigate the potential risks they face. Le Coq and Paltseva (2009) proposed an index to better evaluate the risks associated with the external energy supply of a country. Their index was based on four indicators: energy dependence, diversity of supply sources, level of import concentration, and the political stability of energy suppliers. Sun et al. (2017) developed a model for assessing the systemic risk associated with global crude oil trade. The model was based on four risk factors: availability, accessibility, acceptability, and affordability. Based on an analysis of previous literature, the fundamental factors that influence the long-term supply and demand of crude oil generally do not change significantly in the short term. However, it is important to note that short-term changes can also impact the demand and supply of crude oil, leading to short-term price volatility and potential systemic risk. As a result, it remains necessary to assess and manage these short-term risks to ensure stability in the global crude oil trade. For instance, the price of crude oil in 2008 was approximately 140 USD per barrel while the price of crude oil in 2009 dropped to approximately 40 USD per barrel. Thus, while fundamental factors impact the price of crude oil, market psychology also plays a role in price fluctuations. In general, market psychology reflects the behavior and sentiments of investors. Investor sentiment, speculation, and panic-buying or selling can have a significant impact on oil prices, especially in the short term. Geopolitical factors can be difficult to measure, and traditional risk factors may not fully capture the potential impact of political risks on oil prices. A sentiment proxy can provide a more nuanced view of the market and consider factors that may not be captured by traditional risk measures (Correlje and van der Linde, 2006). By including sentiment proxy, investors can gain a better understanding of the potential risks and uncertainties in the crude oil market.

The term “sentiment” can have different meanings depending on different research fields. In finance and investment, sentiment is often used to describe investor emotions and attitudes toward the market or specific assets. Brown and Cliff (2004) defined sentiment as the overall sense of optimism or pessimism in the market, which can affect investment decisions and market behavior. Long et al. (1990) linked sentiment to noise trading, which refers to buying or selling stocks based on rumors or emotions rather than fundamental analysis. Baker and Wurgler (2006) defined “investment sentiment” as the overall attitude of investors toward the market or specific assets. Economic psychology studies have found that individuals may change their online searching behavior in response to changes in market uncertainty. This occurs because, during times of uncertainty, investors may seek more information and use search engines to gather more knowledge about a specific market or investment (Lemieux and Peterson, 2011; Abbas et al., 2013). The Google search volume index (GSVI) can provide insights into how the general population is searching for information related to specific assets or topics, which can be indicative of overall sentiment toward those assets or topics, and provides a direct measure of market attention (Andrei and Hasler, 2015). Therefore, we used the GSVI as a sentiment proxy to quantify the trading uncertainty in a particular market.

In the field of economic psychology, the relationship between investor sentiment and risk continues to be a topic of debate. The affect infusion model suggests that positive sentiment reduces risk aversion, which would indicate a positive relationship between investor sentiment and market risk (Forgas, 1995). The mood maintenance hypothesis proposes that positive sentiment increases risk aversion, indicating a negative relationship between investor sentiment and market risk. To avoid getting involved in the debate of these two competing streams, we made the following hypothesis: the volatility of the Google search volume index (or sentiment instability) could reflect the risk level of a particular country; moreover, the hypothesis suggests that changes in the level of investor sentiment could be an indicator of increased or decreased risk in the market. Our hypothesis suggested that investor sentiment can be used as a proxy for trade uncertainty and overall risk level in a country. By assuming that sentiment instability is directly related to the risk level of a country, the model can provide insights into the potential impacts of changing sentiment on investment decisions and market outcomes, including changes in capital flows, asset prices, and overall market volatility.

In summary, this study constructed a network of crude oil system trade risk from a network perspective using the PageRank method and combined sentiment proxy as risk factors to explore their role in this network.

3 Data and methodology

3.1 Data

The data used to describe the crude oil trade in this paper were downloaded from the UN Comtrade website on May 11, 2018. The website contains all export and import flows (both trade volume and trade value) among 103 countries from 2008 to 2015. The commodity name is Crude oil, and its HS code is 2709. We used the variance in trade volume (kg) to represent the volatility of trade volume. The data on price volatility in year t of country

The data for the Google searches were extracted from the Google Trends website (https://www.google.com/trends/correlate). Although professional platforms such as Bloomberg and Reuters provide more accurate information about the crude oil and capital markets, we used data from Google searches to construct a sentiment proxy to estimate uncertainty in a country for two reasons. First, based on the availability of data, Google searches can provide information on worldwide investors from the corresponding 103 countries. Second, a previous study revealed that the results of Google searches are broadly consistent with theories of investor sentiment (Da et al., 2015). We aggregated the monthly Google search volume index (GSVI) of a series of keywords related to “crude oil” from January 2008 to December 2015 for 103 countries. GSVI values range from 0 to 100 and refer to the total number of searches in a country for a term relative to the total number of searches performed on Google over time. The higher the GSVI of a country, the more the attention that corresponding investors pay to crude oil. We obtained the sentiment instability in country

3.2 Constructing trade risk networks

We first constructed the directed and weighted network of international crude oil trade flows

The network-based vulnerability of country

where

3.3 Network measures and corresponding connotation

Networks consist of a set of nodes (in this paper, countries that participate in the trade of international crude oil) that are connected by links (oil trade risk flows). The matrix

3.3.1 In-degree: oil supply diversity

The degree of a node in a network is defined as the number of links of a given node (Newman, 2010). The out-degree in our case was the number of export links a country had with others, while the in-degree was the number of import links.

The in-degree value of

A higher in-degree value indicated a wider range of a country’s directed imports and implied a higher local oil supplier diversity.

3.3.2 In-strength: local trade risk

While the degree of a node merely depends on the number of links, the strength of a node also considers their weights (Newman, 2010). The in-strength

The in-strength

The lower the local supplier diversity and the higher the dependence, the higher the local trade risk. We defined

3.3.3 PageRank: systemic trade risk

The PageRank algorithm derives from ranking the importance of websites. The basic intuition is that the more important the websites are, the more likely these websites are to be linked from other websites, even when there is no direct link between these websites. In this paper, the PageRank indicates the likelihood of being affected by supply shocks in any other countries, even when there is no direct trade relationship between these countries.

The PageRank

The PageRank,

We used the schematic diagram shown in Figure 1 to elaborate on the difference between local and systemic trade risks. Country A imports crude oil from three countries with low sentiment instability, which are represented as three green nodes. Using Equation 4, the local trade risk of country A is low because all directed exporters of country A are stable. However, the systemic trade risk of country A is relatively high as its exporters are all influenced by the same country with an unstable sentiment.

4 Empirical results and discussion

4.1 Global results: systemic oil trade risk of 103 countries

4.1.1 Description of oil trade risk

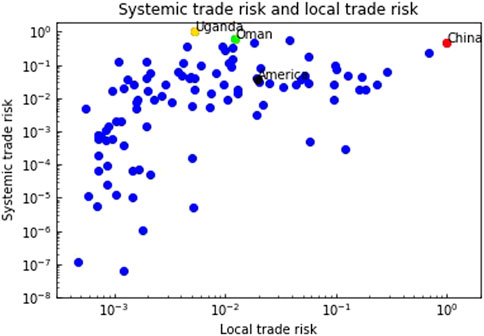

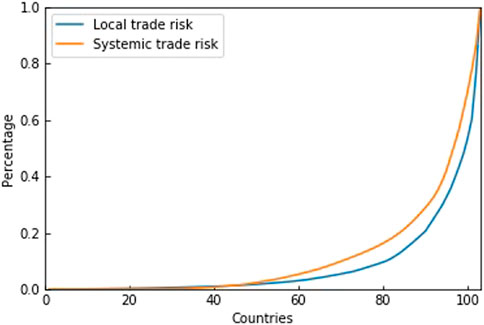

As shown in Figure 2, higher local trade risk generally corresponds to higher systemic trade risk. Uganda, the third-largest oil storage country in Africa, showed the largest systemic trade risk during 2008 and 2015. The government in Uganda aimed at promoting its economy through crude oil trade; however, Uganda showed no real progress on pipeline laying in East Africa. Therefore, poor infrastructure exacerbated the risk of its crude oil marginalization as well as its systemic trade risk and kept the crude oil in Uganda from the international crude oil market. Oman, a crude oil-exporting country in the Middle East, showed the second largest systemic trade risk. Oman is the only country in the Middle East that has not joined the seven crude oil exporting countries and independently provides monthly prices for its crude oil. China and America are the largest importing countries, but China has the largest local trade risk and large systemic trade risk. Furthermore, as shown in Figure 3, the distribution of trade risks among 103 countries showed obvious heterogeneity, implying that a minority of countries had high trade risks.

4.1.2 Trade risk and trade volume volatility

We used country-level panel data covering 103 countries for the period 2008–2015 and employed a random-effects model to investigate the relationship between trade risk and trade volume volatility as shown in Table 1. In all situations, the relations between trade risks and volume volatility of crude oil were negative and statistically significant, implying that most countries tend to take conservative trade strategies and guarantee the stability of oil trade volume to deal with high trade risks. When local trade risk was combined with sentiment proxy, the significance of the relationship between local trade risk and trade volume volatility changed from the 1 percent level to the 10 percent level. However, when systemic trade risk was combined with sentiment instability, it still showed a statistically significant relationship with trade volume volatility, implying an improving ability to predict trade volume volatility. This suggested that sentiment instability may be a more useful measure for predicting trade volume volatility because it factors in global events and sentiment, which can have a significant impact on international trade. On the other hand, local trade risk and systemic trade risk may provide important insights into specific challenges and risks faced by individual countries in their domestic and international trade. In summary, these findings highlighted the importance of considering multiple factors and measures when analyzing trade risks and predicting trade volume volatility. By taking a comprehensive approach, policymakers and businesses can better understand the complex and dynamic nature of international trade and develop effective strategies to manage risks and promote growth.

Overall, at the global level, we observed high-level heterogeneity in the distributions of both systemic trade risk and local trade risk. Moreover, the relationship between trade risk and trade volume volatility could not be influenced by sentiment. Specifically, whether or not combined with sentiment, systemic trade risks could better predict trade volume volatility.

4.2 Regional results: comparison of oil trade risks between China and America

To better understand the inner nature of systemic trade risk, we compared oil trade risks between China and America. These countries are not only the two biggest economies in the world but are also the two largest consumers of crude oil. Predictably, their dependence on crude oil importation makes them susceptible to crude oil supply. Any risk in the global crude oil trade network may cause volatility and even threaten their energy security. In this section, we compared their crude oil trade risks from direct neighbors and their systemic crude oil trade risks, which are affected by the whole trade network, to reveal the inner differences in oil trade risk between China and America.

4.2.1 Price volatility and network effects

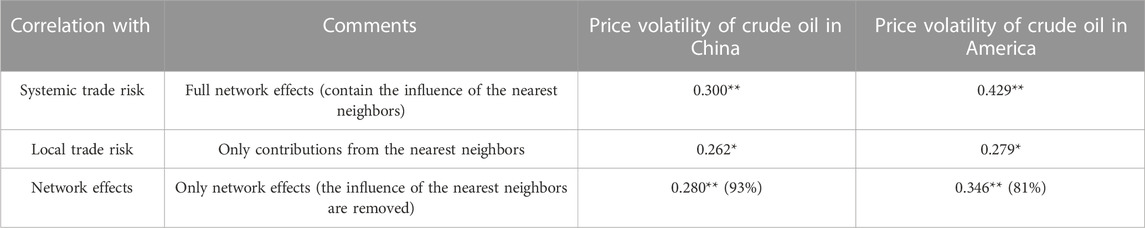

As price volatility is a general origin of crude oil trade risks (47;48), we calculated the correlations of systemic trade risk, local trade risk, and price volatility in China and America as shown in Table 2. We observed a significant correlation (

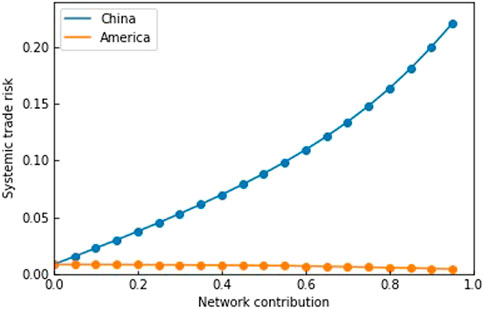

4.2.2 Systemic oil trade risk and network effects

To further uncover the impact of trade network effects, we studied the influence of the coefficient α, which is the fraction of the network contribution. When α = 0, the network contributions in Equation 5 were completely eliminated and the likelihood of being affected by supplier shocks for any country was equal. We increased the weight of the network contributions by increasing the value of parameter α from 0 to 1. As network contributions increase, countries inherit more systemic trade risk if they import from countries that are systemically risky. When α = 0, the indicator “systemic trade risk” is dominated by the recursive network effects. As shown in Figure 4, the systemic oil trade risk of China increased rapidly as α varied from 0 to 1, while the systemic oil trade risk of America decreased with increasing network contribution. This result suggested that the position of countries in global trade networks has an impact on their systemic trade risks. Specifically, America has a superior position in the international crude oil trade network, which may mitigate its systemic oil trade risks. Conversely, China has a relatively inferior position in the global trade system, which contributes to its high systemic oil trade risks. This indicates that a country’s position in global trade networks is an important factor in determining its level of systemic trade risk, and may have important implications for its economic stability and resilience.

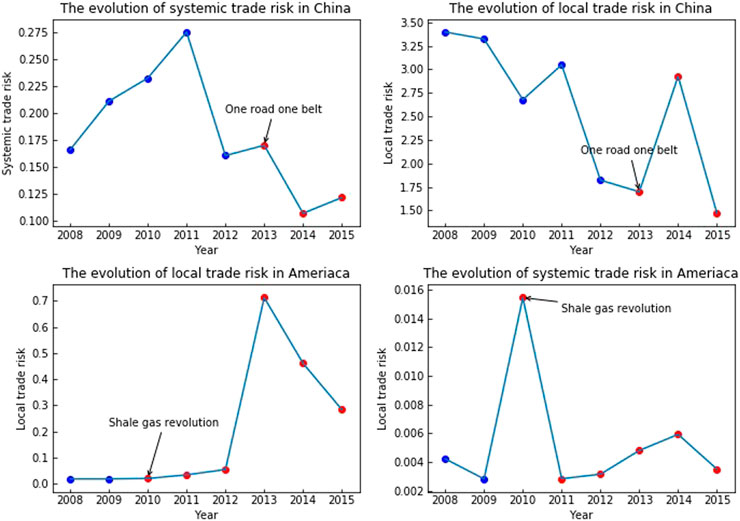

4.2.3 Evolution of trade risk

As big crude oil consumers, both China and America have urgent needs to monitor and manage their systemic oil trade risks. To shed light on the differences in their trade risk, we compared the evolution of their local and systemic oil trade risks, as shown in Figure 5. The local trade risks of China from 2008 to 2015 tended to decrease slowly, implying a continuous improvement in its local trade conditions. However, systemic oil trade risk increased from 2008 to 2011 and decreased from 2012 to 2015, which is far from the evolution of its local trade risk. In 2013, China launched the “One Belt One Road” initiative, which aimed at improving its trade situation. After that, the systemic trade risk of China dropped, although its local trade risk did not significantly decrease. In America, although its local trade risk obviously rose after 2012, its systemic trade risk stayed at a low level except in 2010. The explanation for this result is that its dependence on crude oil importation continuously decreased after the shale gas revolution. Thus, America’s reliance on imported crude oil has decreased since the shale gas revolution. This could be because the shale gas revolution has enabled America to produce more of its own energy resources domestically, reducing the need for imports, which has kept America in a superior position in the global trade network. The position of a country in global trade networks is an important factor in determining its trade risk level. Therefore, America’s superior position in the international crude oil trade network may result in lower systemic trade risk for the country in that specific sector.

Wu et al. (2009) reported an irrational practice of Chinese crude oil imports, described as “buying when the price is rising and not buying when the price is declining.” Our results can give a reason for this irrational practice. China faces significant systemic trade risks regarding crude oil due to its heavy reliance on imports. While China may be able to optimize its local trade situation to reduce its local trade risk, it is still subject to systemic risk in the larger trade network. Additionally, high crude oil prices lead to high trade risk for importing countries like China. As a result, even if China does not want to follow certain crude oil import practices, it may have to do so to ensure the security of its crude oil supply.

Overall, at the regional level, we showed that the volatility of crude oil prices in China and America was closely related to specific network centrality measures that we proposed to quantify systemic trade risk. This close relationship largely depended on the structural properties of the entire trade network rather than the local trade risks. Furthermore, we found that the network effects were conducive to a reduction of systemic trade risk in America and an increase in systemic trade risk in China.

5 Conclusion

This study introduces a novel way to model the systemic trade risk of crude oil, which is combined with a sentiment proxy from a network perspective. We constructed sentiment instability using the standard deviation of the monthly Google search volume index in a certain country and used PageRank to calculate the systemic trade risk of crude oil, which indicated the likelihood of being affected by supply shocks in any other country. At the global level, the distribution of systemic oil trade risk showed an obvious heterogeneity among 103 countries. Furthermore, country-level panel data covering 103 countries for the period 2008–2015 and the use of a random-effects model revealed a significant relationship between systemic trade risk and trade volume volatility. At the regional level, as both China and America have an urgent need to manage their trade risks of crude oil, we compared their systemic trade risks of crude oil. First, we found that the systemic trade risk of crude oil was strongly and significantly correlated with price volatility in both China and America. Moreover, these correlations largely depended on the structure of the entire trade network other than local trade risks that are influenced by their direct trading partners. Second, as the contribution of network effects increased, the systemic trade risk of crude oil in America gradually decreased while that in China increased. Third, after China launched the “One Belt One Road” initiative in 2013, the local trade risk in China did not significantly decrease while systemic trade risk in China decreased, implying its improvement in oil trade circumstances. In contrast, after the success of the shale gas revolution in America, its dependence on crude oil importation declined but America still showed a low level of systemic trade risk of crude oil due to its superior position in the international crude oil trade network.

Several reasons may explain why specific countries are more prone to trade risks: 1 Political instability: Countries facing political instability or unrest may be at a higher risk of experiencing trade disruptions such as trade wars, embargoes, or sanctions. 2 Economic vulnerabilities: Countries with weak or underdeveloped economies may be more vulnerable to external shocks or fluctuations in global commodity prices, which can impact their trade volumes and increase risk. 3 Dependence on a limited range of exports: Countries heavily dependent on a limited range of exports may face significant risks if the demand for these goods decreases or if there is a disruption in the global supply chain. 4 Geopolitical locations: Countries located in regions of conflict or tension may be at a higher risk of experiencing disruptions to their trade due to geopolitical factors or security concerns. 5 Weak regulatory environments: Countries with weak regulatory frameworks or a lack of transparency in their trade practices may be at a higher risk of facing difficulties in conducting international trade. America, as the largest developed country, has strong economic stability, no geopolitical factors and national security issues, good regulatory environment, and reduced crude oil import demand after the shale gas revolution. These factors make America less prone to systemic trade risks than other countries. On the other hand, China is facing challenges such as regulatory compliance, intellectual property protection, and unfair competition from state-owned enterprises. The ongoing trade war has caused significant disruptions to global supply chains and trade flows. This has not only affected China’s exports to America but has also impacted its relations with other trading partners.

A number of policy implications emerge from our results regarding the systemic trade risk of crude oil. Although trade in crude oil inevitably involves some degree of imperfect information, better information transparency is needed to reduce uncertainty and stabilize the market psychology. Better transparency may encourage increased collaboration and communication among market participants, potentially leading to greater trust and more stable market conditions. Therefore, efforts to promote transparency in the crude oil market could play a key role in reducing systemic risk and improving the stability of global trade networks for crude oil. Furthermore, our results emphasize the contributions of network effects to systemic trade risk. Policymakers should consider the structure of the entire trading network to better understand the risks in the crude oil trade. In contrast to the elimination of systemic risk in financial networks by means of a systemic risk transaction tax (Poledna and Thurner, 2016), a systemic oil trade risk tax could also be applied to eliminate the systemic risk in the crude oil trade.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Materials, further inquiries can be directed to the corresponding author.

Author contributions

HC contributed to the study conception and design. HC and AL organized the database. HC, YZ, and RC performed the statistical analysis. HC wrote the first draft of the manuscript. HC and AL wrote sections of the manuscript. All authors contributed to the article and approved the submitted version.

Acknowledgments

The authors thank Shanxi Zhongzhi Bochuang Technology Service Corporation for the preprocessing of the artificial raw data.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbas, A. E., Bakir, N. O., Klutke, G. A., and Sun, Z. W. (2013). Effects of risk aversion on the value of information in two-action decision problems. Decis. Anal. 10, 257–275. doi:10.1287/deca.2013.0275

Andrei, D., and Hasler, M. (2015). Investor attention and stock market volatility. Rev. Financial Stud. 28, 33–72. doi:10.1093/rfs/hhu059

Bahgat, G. (2006). Europe's energy security: Challenges and opportunities. Int. Aff. 82, 961–975. doi:10.1111/j.1468-2346.2006.00580.x

Baker, M., and Wurgler, J. (2006). Investor sentiment and the cross-section of stock returns. J. Finance 61, 1645–1680. doi:10.1111/j.1540-6261.2006.00885.x

Balestra, P., and Nerlove, M. (1966). Pooling cross section and time-series data in the estimation of a dynamic model: The demand for natural gas. Econometrica 34, 585–612. doi:10.2307/1909771

Battiston, S., Puliga, M., Kaushik, R., Tasca, P., and Caldarelli, G. (2012). Debtrank: Too central to fail? Financial networks, the fed and systemic risk. Sci. Rep. 2, 541–546. doi:10.1038/srep00541

Billio, M., Getmansky, M., Lo, A. W., and Pelizzon, L. (2012). Econometric measures of connectedness and systemic risk in the finance and insurance sectors. J. financial Econ. 104, 535–559. doi:10.1016/j.jfineco.2011.12.010

Brown, G. W., and Cliff, M. T. (2004). Investor sentiment and the near-term stock market. J. Empir. Finance 11, 1–27. doi:10.1016/j.jempfin.2002.12.001

Calvo, G., Izquierdo, A., and Mejia, L. F. (2004) On the empirics of sudden stops: The relevance of balance sheet effects. NBER Working Paper 10520.

Chen, Z. H., An, H. Z., An, F., Guan, Q., and Hao, X. Q. (2018). Structural risk evaluation of global gas trade by a network-based dynamics simulation model. Energy 159, 457–471. doi:10.1016/j.energy.2018.06.166

Cohen, G., Joutz, F., and Loungani, P. (2011). Measuring energy security: Trends in the diversification of oil and natural gas supplies. Energy Policy 39, 4860–4869. doi:10.1016/j.enpol.2011.06.034

Correlje, A., and Van der Linde, C. (2006). Energy supply security and geopolitics: A European perspective. Energy Policy 34, 532–543. doi:10.1016/j.enpol.2005.11.008

Da, Z., Engelberg, J., and Gao, P. J. (2015). The sum of all FEARS investor sentiment and asset prices. Rev. Financial Stud. 28, 1–32. doi:10.1093/rfs/hhu072

Erdmann, L., and Graedel, T. E. (2011). Criticality of non-fuel minerals: A review of major approaches and analyses. Environ. Sci. Technol. 45, 7620–7630. doi:10.1021/es200563g

Fagiolo, G., Reyes, J., and Schiavo, S. (2010). The evolution of the world trade web: A weighted-network analysis. J. Evol. Econ. 20, 479–514. doi:10.1007/s00191-009-0160-x

Forgas, J. P. (1995). Mood and judgment: The affect infusion model (AIM). Psychol. Bull. 117, 39–66. doi:10.1037/0033-2909.117.1.39

Grubesic, T. H., Matisziw, T. C., Murray, A. T., and Snediker, D. (2008). Comparative approaches for assessing network vulnerability. Int. regional Sci. Rev. 31, 88–112. doi:10.1177/0160017607308679

Gupta, E. (2008). Oil vulnerability index of oil-importing countries. Energy Policy 36, 1195–1211. doi:10.1016/j.enpol.2007.11.011

Haddadian, G., and Shahidehpour, M. (2015). Ripple effects of the shale gas boom in the US: Shift in the balance of energy resources, technology deployment, climate policies, energy markets, geopolitics and policy development. Electr. J. 28, 17–38. doi:10.1016/j.tej.2015.02.004

Haldane, A. G., and May, R. M. (2011). Systemic risk in banking ecosystems. Nature 469, 351–355. doi:10.1038/nature09659

Huang, X., Zhou, H., and Zhu, H. (2009). A framework for assessing the systemic risk of major financial institutions. J. Bank. Finance 33, 1–43. doi:10.17016/feds.2009.37

Isen, A. M., Nygren, T. E., and Ashby, F. G. (1988). Influence of positive affect on the subjective utility of gains and losses: It is just not worth the risk. J. personality Soc. Psychol. 55, 710–717. doi:10.1037/0022-3514.55.5.710

Ji, Q., Zhang, H. Y., and Fan, Y. (2014). Identification of global oil trade patterns: An empirical research based on complex network theory. Energy Convers. Manag. 85, 856–865. doi:10.1016/j.enconman.2013.12.072

Jia, N., An, H., Gao, X., Liu, D., and Chang, H. (2023). The main transmission paths of price fluctuations for tungsten products along the industry chain. Resour. Policy 80, 103230. doi:10.1016/j.resourpol.2022.103230

Jia, N., Gao, X., An, H., Sun, X., Jiang, M., Liu, X., et al. (2020). Identifying key sectors based on cascading effect along paths in the embodied CO 2 emission flow network in Beijing-Tianjin-Hebei region, China. Environ. Sci. Pollut. Res. 27, 17138–17151. doi:10.1007/s11356-020-08217-1

Jia, N., Gao, X., Liu, D., Shi, J., and Jiang, M. (2019). Identification and evolution of critical betweenness sectors and transactions from the view of CO2 reduction in supply chain network. J. Clean. Prod. 232, 163–173. doi:10.1016/j.jclepro.2019.05.346

Ladislaw, S. (2007). Providing energy security in an interdependent world. Wash. Q. 30, 95–104. doi:10.1162/wash.2007.30.4.95

Le Coq, C., and Paltseva, E. (2009). Measuring the security of external energy supply in the European Union. Energy Policy 37, 4474–4481. doi:10.1016/j.enpol.2009.05.069

Lee, C. C., Lee, C. C., and Ning, S. L. (2017). Dynamic relationship of oil price shocks and country risks. Energy Econ. 66, 571–581. doi:10.1016/j.eneco.2017.01.028

Lemieux, J., and Peterson, R. A. (2011). Purchase deadline as a moderator of the effects of price uncertainty on search duration. J. Econ. Psychol. 32, 33–44. doi:10.1016/j.joep.2010.10.005

Lesbirel, S. H. (2004). Diversification and energy security risks: The Japanese case. Jpn. J. Political Sci. 5, 1–22. doi:10.1017/s146810990400129x

Li, Y., Li, H., Guo, S., and Liu, Y. (2022). Evaluating the structural robustness of large-scale emerging industry with blurring boundaries. Entropy 24, 1773. doi:10.3390/e24121773

Li, Y., Li, H., Liu, N., and Liu, X. (2018). Important institutions of interinstitutional scientific collaboration networks in materials science. Scientometrics 117, 85–103. doi:10.1007/s11192-018-2837-0

Long, J. B. D., Shleifer, A., Summers, L. H., and Waldmann, R. J. (1990). Noise trader risk in financial markets. J. Political Econ. 98, 703–738. doi:10.1086/261703

Maravalle, A. (2012). The role of the trade channel in the propagation of oil supply shocks. Energy Econ. 34, 2135–2147. doi:10.1016/j.eneco.2012.03.002

May, R. M., and Arinaminpathy, N. (2010). Systemic risk: The dynamics of model banking systems. J. R. Soc. Interface 7, 823–838. doi:10.1098/rsif.2009.0359

Neveu, A. R. (2018). A survey of network-based analysis and systemic risk measurement. J. Econ. Interact. Coord. 13, 241–281. doi:10.1007/s11403-016-0182-z

Norouzi, N. (2021). Post-COVID-19 and globalization of oil and natural gas trade: Challenges, opportunities, lessons, regulations, and strategies. Int. J. energy Res. 45, 14338–14356. doi:10.1002/er.6762

Peter, K., Michael, O., and Stefan, T. (2015). Systemic trade risk of critical resources. Sci. Adv. 1, e1500522. doi:10.1126/sciadv.1500522

Poledna, S., and Thurner, S. (2016). Elimination of systemic risk in financial networks by means of a systemic risk transaction tax. Quant. finance 16, 1599–1613. doi:10.1080/14697688.2016.1156146

Qadan, M., and Nama, H. (2018). Investor sentiment and the price of oil. Energy Econ. 69, 42–58. doi:10.1016/j.eneco.2017.10.035

Simonsen, I., Buzna, L., Peters, K., Bornholdt, S., and Helbing, D. (2008). Transient dynamics increasing network vulnerability to cascading failures. Phys. Rev. Lett. 100, 218701. doi:10.1103/physrevlett.100.218701

Snyder, D., and Kick, E. L. (1979). Structural position in the world system and economic growth, 1955-1970: A multiple-network analysis of transnational interactions. Am. J. Sociol. 84, 1096–1126. doi:10.1086/226902

Sun, X., Li, J., Wu, D., and Yi, S. (2011). Energy geopolitics and Chinese strategic decision of the energy-supply security: A multiple-attribute analysis. J. Multi-Criteria Decis. Analysis 18, 151–160. doi:10.1002/mcda.479

Sun, X., Liu, C., Chen, X., and Li, J. (2017). Modeling systemic risk of crude oil imports: Case of China’s global oil supply chain. Energy 121, 449–465. doi:10.1016/j.energy.2017.01.018

Thurner, S., and Poledna, S. (2013). DebtRank-transparency: Controlling systemic risk in financial networks. Sci. Rep. 3, 1–7. doi:10.1038/srep01888

Wu, G., Liu, L. C., and Wei, Y. M. (2009). Comparison of China's oil import risk: Results based on portfolio theory and a diversification index approach. Energy Policy 37, 3557–3565. doi:10.1016/j.enpol.2009.04.031

Wu, G., Wei, Y. M., and Fan, Y. (2008). “An empirical analysis for the import risk of China's petroleum products based on the improved portfolio approach,” in 2008 IEEE International Conference on Sustainable Energy Technologies, Singapore, 24-27 November 2008, 57–62.

Wu, G., Wei, Y. M., Fan, Y., and Liu, L. C. (2007). An empirical analysis of the risk of crude oil imports in China using improved portfolio approach. Energy Policy 35, 4190–4199. doi:10.1016/j.enpol.2007.02.009

Yang, Y., Li, J., Sun, X., and Chen, J. (2014). Measuring external oil supply risk: A modified diversification index with country risk and potential oil exports. Energy 68, 930–938. doi:10.1016/j.energy.2014.02.091

Keywords: systemic trade risk, crude oil, network, sentiment instability, energy security

Citation: Chang H, Luo A, Zheng Y, Chang R and Liu Y (2023) Modeling the systemic trade risk of crude oil from a network perspective, combined with a sentiment proxy. Front. Energy Res. 11:1178763. doi: 10.3389/fenrg.2023.1178763

Received: 03 March 2023; Accepted: 23 May 2023;

Published: 09 June 2023.

Edited by:

Xiaohu Yang, Xi’an Jiaotong University, ChinaReviewed by:

Xiaolei Sun, Chinese Academy of Sciences (CAS), ChinaC. T. Vidya, Centre for Economic and Social Studies (CESS), India

Copyright © 2023 Chang, Luo, Zheng, Chang and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hao Chang, Y2hhbmdoYW9mejNAb3V0bG9vay5jb20=

Hao Chang

Hao Chang Aiguo Luo

Aiguo Luo