- 1College of Information and Electrical Engineering, China Agricultural University, Beijing, China

- 2China Electric Power Research Institute, Nanjing, China

1 Introduction

In 2021, China proposed to promote the construction of the medium and long-term (M-L) electricity market and accelerate the construction of the national unified electricity market (Huang and Li, 2022). Each province had also issued M-L electricity market trading rules. M-L electricity market refers to the multi-year, annual, quarterly, monthly, weekly and multi-day electricity wholesale transactions carried out by power generation companies, power consumers, electric power companies, and other market entities through the negotiated transaction, centralized auction transactions, and other market-oriented methods. At present, the M-L electricity market in various provinces in China mainly carries out electrical energy transactions. The organization forms of the transaction include auction transactions and negotiated transactions. However, various organization forms are generally not considering network constraints during market clearing (Guo et al., 2020). This can lead to a series of problems, such as the power dispatching institution having to take a long time to do the security assessment, and the time of transaction organizations being longer. Moreover, the adjustment rate of the first market clearing result is relatively high because network constraints are not considered and the security assessment time is long (Xia et al., 2020). Due to the uncertainty of new energy, the market needs to provide sufficient adjustment opportunities, so the M-L market must have the ability to start the market periodically. But a high adjustment can make it difficult for the M-L market to carry out full-cycle and high-frequency transactions. The demand for normalized transactions in the M-L market cannot be met. Therefore, to take high-frequency transactions and security assessment into account in the market, it is necessary to consider the network’s available transfer capability (ATC) constraints in M-L electricity transactions.

The total transfer capability subtracts the transmission reliability margin and capacity benefit margin, and the remaining part is the available transmission capacity. It represents the amount of transmission capacity left in the network that could be used commercially. Domestic and foreign scholars have already conducted a wide range of studies on the M-L electricity market and ATC methods. The calculation methods of ATC include the method based on power flow and intelligent algorithms. Mohamed et al. provided a comprehensive review of the calculation methods of available transmission capacity (Mohammed et al., 2019). In the inter-provincial M-L electricity market research, Zeng et al. simplified the AC/DC hybrid network by using the sensitivity analysis method. Then, they considered the ATC constraints of the equivalent network and established a market optimization clearing model of centralized auction transactions (Zeng et al., 2020a). In addition, Zeng et al. aimed at the problem of market coupling in the national unified electricity market. They proposed three bi-level clearing models which were suitable for different market stages. They considered the ATC constraints of AC/DC networks and established the market clearing model for the inter-provincial market (Zeng et al., 2020b). Fu et al. also took into account the security constraints of the network in the M-L electricity market. On the strength of power transfer distribution factors, they calculated the available transfer capability of the grid through the DC power flow calculation method. Then they established the M-L electricity market transaction clearing model, which could ensure the transactions pass the security assessment (Fu et al., 2022). Europe is the forerunner in electricity market reform. In the process of coupling various European regions, European Union developed a Pan-European Hybrid Electricity Market Integration Algorithm (EUPHEMIA) (Lam et al., 2018). At the initial stage, EUPHEMIA adopted the ATC method to calculate the allocation of cross-regional capacity. This method is still used in most market areas today (The European Network of Transmission System Operators for Electricity, 2021). Chatzigiannis et al. established an elaborate model. The model considered a large number of network constraints and market constraints in European Power Exchanges (PXs). These constraints included ATC and flow-based (FB) network constraints (Chatzigiannis et al., 2016). Le et al. pointed out that Europe had completed day-ahead market coupling, and the next task was establishing continuous trading in the intraday market. They proposed an advanced algorithm that could coordinate continuous trading and discrete auction. The algorithm could realize the market clearing at any level of coordination between the two trading mechanisms (Le et al., 2019). Gunkel et al. made a comparative analysis of various models of the power transmission system. They argued that the net transmission capacity (NTC) method was conservative in calculating line capacity (Gunkel et al., 2020). Makrygiorgou et al. pointed out that the ATC method still occupied a dominant role in European cross-border transactions. Their study compared these two methods. They argued that the two methods had the same objective function in the problem of European market coupling and blocking management, and the main difference was the constraint conditions (Makrygiorgou et al., 2020). The ATC method could provide an easier way for transactions, but the utilization rate of power transmission capacity was not as good as the FB method.

In summary, the current research on the ATC method has been relatively mature. Many studies have analyzed the application of the ATC method in China’s inter-provincial M-L electricity market. However, as for the intra-provincial M-L electricity market, there is still a lack of relevant research. The existing research has provided a sufficient experience for the research of the intra-provincial electricity market. Therefore, China must research intra-provincial M-L electricity market clearing models considering ATC constraints. This can lay the foundation for realizing the connection of electricity markets between different regions and building a unified national electricity market.

2 Intra-provincial M-L transaction mechanism considering ATC

Available transmission capacity represents the amount of transmission capacity left in the network that could be used commercially. On the one hand, power grid operation is complicated and uncertain due to various factors. On the other hand, the proportion of new energy with intermittent, random, and volatile characteristics in the power grid will gradually increase, and will gradually enter the power market for trading in the future. The peak load of the power system is often close to the transmission capacity limit of the grid, which will make the situation of the grid more complicated. Therefore, the transmission capacity of the power network must be calculated frequently to ensure the stability of high-frequency power transactions.

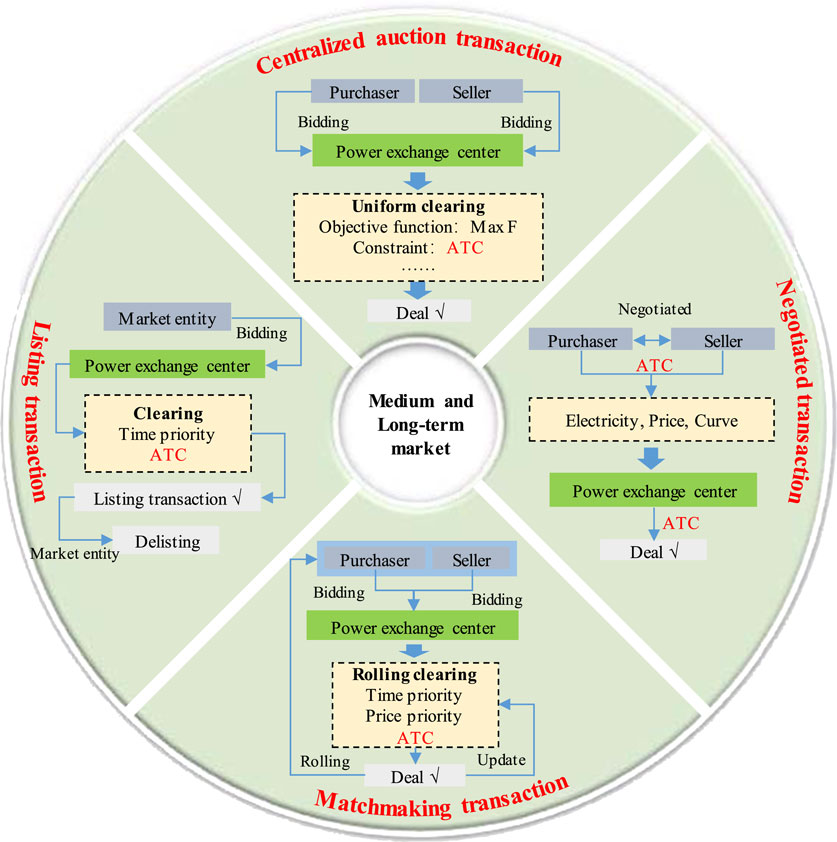

At present, the M-L electricity market in various provinces mainly conducts electrical energy transactions. The organization forms of the transaction include auction transactions and negotiated transactions. Auction transactions include centralized auction transactions, matchmaking transactions, and listing transactions. The process organization of various transactions is different. Therefore, to consider the application of ATC in the M-L market, we should analyze the four transaction modes separately. The intra-provincial M-L transaction mechanisms considering ATC constraints established in this paper are shown in Figure 1. The following is an analysis of these four trading methods.

Centralized auction transaction: Centralized auction transaction requires all the market entities to declare the information including the amount of electricity and price in different periods on the power trading platform. Then the power exchange center organizes the uniform clearing. Finally, the transaction results are formed after checking by the power dispatching institution. Generally, market transaction clearing uses the integrated method of two models. One model is security-constrained unit commitment, and the other model is security-constrained economic dispatch. Currently, the M-L centralized auction transaction generally only sets price and electricity constraints. Therefore, under the new transaction mechanism. To form the trading result with the curve at different time segments, the ATC constraints of the network should be taken into account in the market transaction clearing model.

Matchmaking transaction: During the opening period of the matchmaking transaction, each market entity can submit the bidding information at any time, and the power exchange center carries out the rolling matchmaking transaction according to the principle of time first and price first. Unlike the unified clearing of centralized auction transactions, the matchmaking transaction will be cleared all the time. Whenever a piece of bidding information meets the requirements, a deal is struck. Therefore, under the new transaction mechanism, the matchmaking transaction should consider the ATC constraints of the transmission network in each matching clearing. After completing a transaction, the ATC constraints of the transmission network are updated on a rolling basis to provide constraints for the next transaction.

Listing transaction: In the listing transaction, a market entity (power buyer or the power seller) puts forward the bidding information, including power purchase information, power sale information, or the power energy and price at different periods of the contract. After the power exchange center conducts the market clearing of the application information, the listing transaction result will be formed. During the listing transaction period, after the listing entity completes the listing operation, the delisting entity shall proceed to delist operation. Therefore, under the new transaction mechanism, there are two aspects needed to think about the ATC constraints of the transmission network in the listing transaction. On the one hand, the generating capacity of the unit and load demand level need to be considered when the power exchange center is clearing to form the listing transaction results. On the other hand, when the delisting entity proceeds with the delisting operation, it should not only ensure that the delisting power or the maximum power shall not exceed the upper limit of the listing transaction but also ensure that the trading results after delisting shall not exceed the transmission capacity limit of the power grid. Therefore, the ATC constraints of the network should be considered before and after the listing transaction.

Negotiated transaction: In the negotiation transaction, market entities independently negotiate the electricity and price of the transaction. The negotiated transaction shall be declared and confirmed by one party in the power exchange center. After that, the power trading center clears the negotiation result and submits it to the power dispatching institution for security assessment, thereby forming the final trading result. Therefore, under the new transaction mechanism, the power exchange center shall publish the ATC of the transmission network in advance before the opening of the bilateral negotiation transaction, to guide the trading quantity and the method of the curve decomposition of the two parties. When clearing the negotiated electricity, the power exchange center should also consider the ATC constraints, to ensure that the electricity transaction curve reached meets the operation demand of the grid.

3 Discussion

The application of technical methods requires a complete market mechanism to cooperate with each other. At present, the reformation of the electricity market in China is in the initial stage. In order to realize the application of the ATC method in the intra-provincial M-L electricity market. The electricity market mechanism requires to be further refined. In-depth research is still needed on the following aspects. First of all, it is necessary to realize the connection of trading between different regions. This requires close coordination between the power exchange center and the power dispatching institution in various regions. Second, the transaction of the M-L electricity market includes different time-scale, such as annual transactions, quarterly transactions, monthly transactions, and multi-day transactions. Therefore, a full-cycle transaction mechanism of the M-L electricity market needs to be established. Gradually realize the connection between the M-L market with the spot market. Finally, the power exchange center submits the market clearing result to the power dispatching institution. The power dispatching institution returns the data to the power exchange center, such as the available transmission capacity. Through the collaboration between the two, real-time updates of the grid’s available transmission capacity can be realized. The M-L electricity market transactions will have two characters, full-time and high-frequency. Therefore, there are many benefits to considering the available transmission capacity constraints in M-L electricity transactions. On the one hand, it can shorten the overall transaction time and increase the frequency of the transaction. On the other hand, it also can provide crucial technical support for new energy participation in the M-L electricity market.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

The research is supported by the State Grid Corporation of China: Research on Key Technologies of Intra-provincial Medium and Long Term Transaction Considering Available Transfer Capacity (No. 5108-202218280A-2-290-XG).

Conflict of interest

YG was employed by China Electric Power Research Institute.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Chatzigiannis, D. I., Dourbois, G. A., Biskas, P. N., and Bakirtzis, A. G. (2016). European day-ahead electricity market clearing model. Electr. Power Syst. Res. 140, 140225–140239. doi:10.1016/j.epsr.2016.06.019

The European Network of Transmission System Operators for Electricity (2021). ENTSO-E report on capacity calculation and allocation 2021. Available at: ENTSO_E_Capacity_calculation_and_allocation_report_2021_c7eac81cfd.pdf (azureedge.net).

Fu, X., Yang, K., Li, G., and Zeng, D. (2022). Research on the trading arrangement and clearing model of medium- and long-term inter-provincial markets considering security constraints. Front. Energy Res. 9, 839108. doi:10.3389/fenrg.2021.839108

Gunkel, P. A., Koduvere, H., Kirkerud, J. G., Fausto, F. J., and Ravn, H. (2020). Modelling transmission systems in energy system analysis: A comparative study. J. Environ. Manage 262, 110289. doi:10.1016/j.jenvman.2020.110289

Guo, H., Davidson, M. R., Chen, Q., Zhang, D., Jiang, N., Xia, Q., et al. (2020). Power market reform in China: Motivations, progress, and recommendations. Energy Policy 145, 111717. doi:10.1016/j.enpol.2020.111717

Huang, W., and Li, H. (2022). Game theory applications in the electricity market and renewable energy trading: A critical survey. Front. Energy Res. 10, 1009217. doi:10.3389/fenrg.2022.1009217

Lam, L. H., Ilea, V., and Bovo, C. (2018). European day-ahead electricity market coupling: Discussion, modeling, and case study. Electr. Power Syst. Res. 155, 15580–15592. doi:10.1016/j.epsr.2017.10.003

Le, H. L., Ilea, V., and Bovo, C. (2019). Integrated European intra-day electricity market: Rules, modeling and analysis. Appl. Energy 238, 238258–238273. doi:10.1016/j.apenergy.2018.12.073

Makrygiorgou, D. I., Andriopoulos, N., Georgantas, I., Dikaiakos, C., and Papaioannou, G. P. (2020). Cross-border electricity trading in southeast Europe towards an internal European market. Energies (Basel) 13, 136653. doi:10.3390/en13246653

Mohammed, O. O., Mustafa, M. W., Mohammed, D. S. S., and Otuoze, A. O. (2019). Available transfer capability calculation methods: A comprehensive review. Int. Trans. Electr. Energy Syst. 29. doi:10.1002/2050-7038.2846

Xia, Q., Chen, Q., Xie, K., Pang, B., Li, Z., and Guo, H. (2020). Key issues of national unified electricity market with Chinese characteristics (2): The development path, trading varieties and policy recommendations of inter-regional and inter-provincial electricity markets. Power Syst. Technol. 44, 2801–2808. doi:10.13335/j.1000-3673.pst.2020.0392

Zeng, D., Xie, K., Pang, B., Li, Z., and Yang, Z. (2020). Key issues of national unified electricity market with Chinese characteristics (3): Research on transaction clearing models and algorithms adapting to the coordinated operation of provincial electricity markets. Power Syst. Technol. 44, 2809–2819. doi:10.13335/j.1000-3673.pst.2020.0435

Keywords: medium and long-term electricity market, available transfer capability, centralized auction transaction, matchmaking transaction, listing transaction, negotiated transaction

Citation: Yang K, Guo Y and Fu X (2023) Opinion on intra-provincial medium and long-term electricity market considering available transmission capacity. Front. Energy Res. 11:1132224. doi: 10.3389/fenrg.2023.1132224

Received: 27 December 2022; Accepted: 20 January 2023;

Published: 01 February 2023.

Edited by:

Bin Zhou, Hunan University, ChinaReviewed by:

Saddam Aziz, Hong Kong Polytechnic University, Hong Kong SAR, ChinaWolong Yang, China Power Engineering Consulting Group, China

Copyright © 2023 Yang, Guo and Fu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xueqian Fu, ZnV4dWVxaWFuQGNhdS5lZHUuY24=

Kaitao Yang

Kaitao Yang Yanmin Guo2

Yanmin Guo2 Xueqian Fu

Xueqian Fu