- School of Management, Harbin Institute of Technology, Harbin, China

Supported by government policies, the innovation of China’s solar photovoltaic industry has been triggered greatly. As an important part of public policy, various talent policies have been issued to increase support for innovation. Therefore, it is essential to study the relationship between talent policy and firm innovation of Chinese solar photovoltaic industry. However, there is less empirical research on this topic. In this context, this study examined whether talent policy influences firm innovation. To examine the underlying causal mechanism, this study explored the role of human capital quality structure and human capital function structure in the relationship between talent policy and firm innovation. Based on the buffering and bridging mechanism of resource dependence theory, an empirical model of talent policy, human capital structure and firm innovation were conceptualized. Using an unbalanced panel data of 101 listed firms of the solar photovoltaic industry in China from 2008 to 2021, the random effect GLS regression was employed to empirically test the impact of talent policy on firm innovation, the mediating effects of human capital quality structure and human capital function structure, and examined the heterogeneous impact of nature of property rights and R&D intensity on the above relationships. The results show that talent policy can significantly promote firm innovation. Human capital structure plays mediating effects on the relationship between talent policy and firm innovation. Moreover, the talent policy and human capital structure’s effects on firm innovation are more significant in non-state-owned firms and firms with low R&D intensity. This study provides an important reference for promoting firm innovation through human capital structure in the construction of the talent policy.

1 Introduction

As countries around the world vigorously promote renewable energy, the solar photovoltaic industry has developed rapidly (Sun et al., 2021; Liu et al., 2023). Photovoltaic industry is a typical representative of China’s strategic emerging industry. Since the formal start of development in 2000, the development speed and industry scale of China’s photovoltaic industry have been rapidly improved. According to the data released by the National Energy Administration, in the first half of 2022, the renewable energy power generation in China reached 1.25 trillion kWh, of which the solar power generation increased by 13.5%. The new installed capacity of China’s photovoltaic power generation was 30.88 GW, with a year-on-year growth of 137.4%, still showing a high-speed development trend. The total export volume of photovoltaic products, including silicon wafers, solar cells and photovoltaic modules, was about 25.9 billion US dollars, an increase of 113% year on year. The rapid development of solar photovoltaic industry benefits from the unremitting innovation efforts of firms. China’s solar photovoltaic firms set off round after round of scientific and technological innovation, and continuously increased investment in scientific and technological innovation. This results are consistent with the results of previous theoretical and empirical studies. According to the previous studies, among many factors influencing industrial development (Zhao et al., 2013; Zhang et al., 2021; Edziah et al., 2022), innovation has always played an important role in promoting the growth and gaining competitive advantages of solar photovoltaic industry (Zou et al., 2017; Zhao and Wang, 2020; Ge and Liu, 2022) due to its cost-saving advantages (Shubbak, 2019). Therefore, to better promote innovation, to reduce costs and increase efficiency, and to enhance the competitiveness of the photovoltaic industry are not only the top priorities of China’s photovoltaic industry development at present, but also in the future. Increasing the innovation capability and performance of the solar photovoltaic industry is still the main issue.

Talents have been proved to be one of the important factors to promote innovation. As an important part of public policy, talent policy has become an important measure for governments at all levels to cultivate, attract and develop talents. Since China implemented the strategy of strengthening the country by talents, governments at all levels have placed this strategy at an unprecedented height, and have gradually established a corresponding talent policy system that includes Thousand Talents Program, Cheung Kong Scholars Programme, etc (Wang et al., 2022). The report of the 19th National Congress of the Communist Party of China pointed out that talent is a strategic resource to achieve national rejuvenation and win the initiative of international competition. It emphasized that a more active, open and effective talent policy should be implemented to gather outstanding talents from all aspects. At the Central Talent Work Conference in 2021, Xi Jinping emphasized the in-depth implementation of the strategy of strengthening the country by talents in the new era, and speeding up the construction of an important talent center and innovation highland in the world, which showed the enduring priority of talent on the policy agenda (MacLachlan and Gong, 2022). Accordingly, to achieve the vision of an innovative country, Chinese governments at all levels have issued a large number of talent policies aimed at promoting innovation. In 2010, the Central Committee of the Communist Party of China and the State Council issued the Outline of the National Medium and Long term Talent Development Plan (2010–2020) in 2010, proposing the guidelines for national talent development. According to the policy issued by Fujian Province, if high-level talents introduced by firms create additional economic benefits, the government will give a certain proportion of rewards. In 2017, Shandong Province issued the Implementation Measures for Supporting Key Enterprises to Accelerate the Introduction of High-level Industrial Talents. In 2021, the Central Leading Group for Education reviewed and approved the Action Plan for Accelerating the Training of Urgent High level Talents (2021–2025). In 2021, the Ministry of Industry and Information Technology and five other departments jointly issued the Action Plan for Innovative Development of Smart PV Industry (2021–2025), and emphasized to promote the construction of talent echelon, strengthen talent training and guiding the rational flow of talents. In 2022, the Ministry of Education issued the Work Plan for Strengthening the Construction of Higher Education Talent Training System for Carbon Peak and Carbon Neutralization, which requires further strengthening the talent training of wind power, photovoltaic, hydropower and nuclear power. In 2022, the General Office of the Ministry of Education, the General Office of the National Development and Reform Commission and the General Department of the National Energy Administration jointly issued the Notice on the Implementation of the Special Project for Training High level Talents in Urgent Need of Countries with Energy Storage Technology, which requires accelerating the training of a number of high-level talents in need to support the core technology breakthrough and industrial development in the energy storage field, and making greater contributions to improving the national independent innovation ability and strategic core technology in the energy storage field. In order to promote innovation and development in solar photovoltaic industry, the central and local governments have issued relevant talent policies to increase support for innovation. The government expects to stimulate firm innovation through talent policy, but can talent policy promote firm innovation? How to promote firm innovation? The deep understanding of these issues not only has practical significance, but also has important theoretical value.

Positive governmental policy support has been proved to be an effective measures to boost the development of solar photovoltaic industry (Zhao et al., 2015; Yu et al., 2016). Currently, the most popular categorization of policy instruments in existing studies is demand-side and supply-side policies (Long et al., 2017; Wen et al., 2021), the former mainly involves government subsidy (Xiong and Yang, 2016; Luan and Lin. 2022), and the latter mainly involves FIT (Wang et al., 2016). In particular, many scholars have confirmed that in solar photovoltaic industry in China, the demand-side policy made a positive impact on the innovation activities (Gao and Rai, 2019), and the supply-side policies can also positively increase the innovation efficiency and performance of firms (Lin, B., and Luan, 2020; Jiang et al., 2021; Xu et al., 2022). Moreover, the study has shown that city-level demand-, supply-, and environment-side policies play an important role in the technology innovation of urban solar photovoltaic industry (Che et al., 2022). Furthermore, so far, only a few scholars have studied the China’s talent policy and its impact, including using content analysis to analyze the characteristics of talent policy (Zhang et al., 2019a), examining the effect of talent policy on the mobility of talents (Yue et al., 2020; Jiang, 2021), the firm investment (Dai et al., 2018) and the innovative work behavior (Zhang et al., 2021).

Although several scholars have analyzed the effectiveness of various policies, they mainly focused on the main types than specific sub-types, especially talent policy, and we are still unable to deeply understand the impact of talent policy on firm innovation in solar photovoltaic industry in China. According to the knowledge based theory, human capital reflects the quality level of workers, and is the comprehensive embodiment of workers’ knowledge, technology, health and ability. Human capital has obvious externalities, which promotes knowledge spillover through mutual communication and frequent interaction among workers, and improves the overall production efficiency of workers and the R&D efficiency of firms (Liu and Yang, 2021). Whether the government’s talent policy can change the human capital structure so as to affect firm innovation still needs to be demonstrated. Therefore, based on the buffering and bridging mechanism of resource dependence theory, this study believed that talent policy can directly affect firm innovation, and can also indirectly affect firm innovation by changing the human capital structure, and the above relationship can be affected by the nature of ownership and R&D intensity. Furthermore, based on panel data of 101 listed firms of solar photovoltaic industry in China from 2008 to 2021, this study put forward theoretical hypotheses and used regression model to empirically examine the impact mechanism of talent policy on firm innovation.

Compared with previous studies, the marginal contribution of this study mainly included the following three aspects. First, this study contributes to resource dependence theory by clarifying an internal mechanism by which government resource influence firms’ innovation activities. Based on the buffering and bridging mechanism, firms can effectively utilize government resources and other channel resources to better carry out innovation activities, which may also supplement the signal theory to better explain the impact mechanism of talent policy on firm innovation. Second, this study clarifies the mediating role of different types of human capital structure in the impact of talent policy on firm innovation, which is helpful to deeply understand the impact mechanism of talent policy on firm innovation. Meanwhile, previous studies have discussed the structure of human capital more from the perspective of academic background. This study has added the discussion of functional background, so the research on the structure of human capital has also been expanded. Third, this study enriched the research on the relationship between talent policy and firm innovation. This study verified that the impact of talent policy on human capital structure and firm innovation could vary depending on the nature of property rights and R&D intensity, which can provide theoretical support for firms with different nature of property rights and R&D intensity to adopt differentiated talent policies. The rest of this paper is organized as follows. The following section is a theoretical basis and research hypotheses. Section 3 gives a detailed description of the method, data sources, and construction of the key variables. Section 4 presents the empirical results and the results of robustness tests. Section 5 provides the main conclusions, clarifies the limitations and indicates the future of research.

2 Theoretical basis and research hypotheses

2.1 The background of solar photovoltaic industry and talent policy

Solar photovoltaic industry is a renewable energy industry generated by the combination of semiconductor technology and new energy demand, and is also an important development direction of China’s strategic emerging industries. In order to realize the sustainable development of the solar photovoltaic industry, the Chinese government has successively issued a package of policies aimed at improving the photovoltaic market and achieving industrial upgrading. According to the different ways of policy functions, the policy tools of the solar photovoltaic industry are usually divided into two categories: demand-driven policies and technology-driven policies. Compared with demand-based policies, supply-based policies have fewer types, mainly including government research and development subsidies, project low-interest loans, tax incentives, infrastructure construction subsidies, etc. Before 2013, the domestic market of solar photovoltaic industry was not well developed, and the government policy was mainly to realize the industrialization of solar photovoltaic power generation. After 2013, the domestic market has developed rapidly and the industrial chain has been gradually improved. The government policy is mainly aimed at encouraging the development of the application end and improving the overall innovation ability of the industry.

The talent policy is one of the powerful tools for various countries to promote social and economic development and enhance comprehensive national strength. To cultivate, introduce, and maximize talent holistically while incorporating it into a vital talent center and global innovation hub, China has implemented a strategy of reinforcing the country’s talent in line with Xi Jinping’s New Era of Socialism with Chinese Characteristics (Jacob and Subba, 2022). In recent years, local governments in China have issued a number of talent policies to attract, educate and manage talents, and the news of “war for talent” and “war for talent” is not uncommon. At present, the talent policies issued by local governments mainly involve two parts, namely, service support and environment development. The former mainly focuses on the construction of talent team, reflecting the preferential policies of support, reward, service and so on directly aimed at all kinds of talents. The latter mainly focuses on optimizing the allocation of innovative resources and increasing policy support for important talent carrier platforms. Both have their own emphasis and complement each other. The implementation of talent policy support at the firm level is a reward and subsidy for the construction of firms’ talent teams.

Despite the rapid development of the solar photovoltaic industry, there are still many problems in terms of talents, such as the irrational talent supply structure, the irrational talent regional structure, the insufficient number of high-end talents, the imperfect talent training system, the disconnection of industry and education, the chaos of talent recruitment market, the serious loss of talent teams, and the obvious influence of the talents’ siphon effect (Wang et al., 2022). At present, the solar photovoltaic industry is speeding up its development in the direction of “specialization, refinement, specialty and innovation”. It is in urgent need of innovative talents, management talents and a large number of high-quality technical and skilled talents with high education background and high level. Thus, solar photovoltaic firms should attract talents through a good scientific research atmosphere and excellent material and spiritual conditions, improve scientific and reasonable talent incentive and assessment mechanism, and let talents enter and stay.

2.2 The impact of talent policy on firm innovation

Innovation has been widely regarded as an important driving force for firms’ success and development. However, innovation activities may be under-invested owing to the asymmetric information and limited external finance. According to the resource dependence theory, firms will seek to obtain resources from different channels to reduce dependence on each resource (Wei and Clegg, 2017). The value of the government’s talent policy is to reduce the effect of information asymmetry, alleviate the impact of resource scarcity, and to build beneficial external relationships. Thus, we argue that two mechanisms can be used to explain how talent policy can influence firm innovation: buffering and bridging. The former allows the firms to develop internal resources, minimizing resourcedependencies. The latter helps firms to acquire social capital and legitimacy from financial institutions, obtaining competitive advantage (Zhang and Guan, 2022).

According to the buffering mechanism of resource dependence theory, talent policy can directly promote firm innovation by generating compensation effects that help firms to increase innovation investments. The government’s talent policy can undoubtedly bring financial resources support via talent subsidies, which can effectively buffer the resource depletion by creating resource-munificent environments (Amezcua et al., 2013), and ease the financial pressure and increase the innovation initiatives. Thus, talent policy could help firms to increase investment, reduce the investment risk and cost in innovation activities (Cin et al., 2017), enabling firms greater flexibility in leveraging financial resources to grasp opportunities and carry out innovation activities (Gao et al., 2021). Thus, talent policy can alleviates the uncertainty of innovation, which will increase firms’ ex-ante tolerance for innovation risks (Stiglitz, 2015), and is sufficient to offset or even exceed the cost generated by innovation investments.

Furthermore, as the institutional guarantee of talent development, talent policy can include the training, selection, use, evaluation, incentive and other links of talents in firms to be standardized. For each link of talent development, the government has issued corresponding talent policies. On the one hand, these policies can provide services for firms and help them manage talents more instructively. On the other hand, these policies can be implemented to all aspects of talent management to improve the firms’ human resource management system. Under the government supervision and system guarantee, a good human resource management system can convey information, mobilize the innovation enthusiasm of talents, and thus promote firm innovation (Piening et al., 2013). To summarize, our analysis of literature leads to the hypothesis.

H1. Talent policy can significantly promote firm innovation.

2.3 Talent policy and human capital structure

According to the bridging mechanism of resource dependence theory, in addition to directly increasing investment to produce compensation effect in innovation activities, talent policy also promotes innovation through allocation effect, which will affect the allocation of human capital among firms. Generally, talent policy can be regarded as signal of legitimacy and quality, which can help firms to attract resources (Soderblom et al., 2015). Specifically, the government decides to subsidize a firm after evaluating its talent management practices, which could send a positive signal to the market that the firm has excellent management abilities and talents. Therefore, talent policy can create signaling effects (Wu, 2017), reducing the information asymmetry problem, helping the firm to gain access to external resources that are vital for the innovation activities (Wang et al., 2020), and to attract collaborations from external stakeholders (Bianchi et al., 2019; Ahn et al., 2020).

Regarded as the important resources to significantly influence the firms’ operation processes, researchers have began incorporating the management of human capital and its impact on innovation (Afcha and Lucena, 2022; Salimi and Della Torre, 2022). However, the previous studies on firm innovation mainly discussed the importance of the stock of human capital, and less discussed how the structure of human capital affects firm innovation (Guo et al., 2022). Generally, human capital structure refers the difference level (Jabbour et al., 2017). The existing research on human capital structure is more measured according to employees’ educational background, while other alternatives are less considered (Mohammadi et al., 2017; Bogers et al., 2018). Thus, in this study, we examined human capital structure from two perspectives: one is the quality and the other is the function. The quality structure of human capital, as indicated by employees’ educational background and level, is supposed to be positively associated with cognitive skills and information processing abilities. The function structure of human capital represents the position in the value chain and the degree of embedding in the firms (Menéndez Blanco and Montes-Botella. 2017). According to the previous study (Fryges, 2009), firms can be classified into production-oriented and technology-oriented firms. The former is a firm which focused on reducing cost through mass production, and the latter is a firm which focused on development led by advanced technologies. Thus, the human capital function structure can be represented by the ratio of production staff and the ratio of technology staff. Overall, the improvement of the human capital structure is the common requirement to achieve a high degree of fit between the government’s talent policy and the firm’s talent demand. From the perspective of government talent policy, the agglomeration of human capital can be regarded as an important driving force for economic growth (Saether, 2019), and the policy of talent introduction has higher requirements for its subsidized subjects in education background, technical level, and research achievements, which increase human capital stock and optimize human capital structure (Wang et al., 2020). To achieve better results in the talent war, governments’ talent policy removes the institutional barriers that restrict the rational flow and optimal allocation of talents, provides institutional guarantees and public services to encourage the flow of high-level talents among firms by issuing relevant talent policies (Blom et al., 2021). According to information about the talents’ preference for public services, the discretionary power can be used to improve the efficiency of public service allocation, which further promotes the accumulation and optimization of human capital (Wen and Lee, 2020).

In the content of the allocation mechanism, governments’ talent policy can help the firms rewarded by talent policy gain more awareness from job seekers and enhance the legitimacy, which are believed to be conducive to improving the structure of human capital. At the same time, from the perspective of firms’ talent demand, firms also have their own demand for talent introduction to promote better development. The firms’ quality requirements for human capital is mainly reflected in the following aspects. On the one hand, high-quality human capital has stronger learning ability and higher labor productivity, and can understand relevant professional knowledge, which could play a prominent role in firms’ growth and development (Bayo-Moriones and Lera-Lopez, 2007). On the other hand, employees with low comprehensive quality are often engaged in simple and repetitive work in firms. In the process of development and transformation, some repetitive jobs will be gradually replaced by automated machines and equipment, which will reduce the demand of firms for low skilled employees and is reflected in the improvement of employee quality structure (Che and Zhang, 2018). Therefore, high-quality human capital will significantly promote the firms’ development, which is reflected in the improvement of quality structure of human capital. Moreover, firms also have some requirements for the functional areas of human capital structure. The progress of technology will replace the production and more repetitive work with low technology content, will require more professional technicians and R&D personnel (Haini, 2019). Furthermore, according to the smile curve theory, high added value can be generated in the field of technology and sales, while the lowest added value can be generated in the field of production and manufacturing (Park and Park, 2021). Therefore, the concentration of firms’ employees with high added value is the performance of the advanced human capital, which is reflected in the improvement of the function structure of human capital. To summarize, our analysis of literature leads to the hypothesis.

H2a. Talent policy can significantly improve human capital quality structure.

H2b. Talent policy can significantly improve human capital function structure.

2.4 The mediating role of human capital structure

Previous research has largely pointed out that a unique set of knowledge, skills and experience is very important for firm innovation (Ren and Song, 2021). Therefore, human capital, in terms of knowledge embodied in an firm’s employees, is regarded as being a crucial driver for innovation (Sun et al., 2020).

The impact of different levels of human capital on firm innovation is heterogeneous, and high-level human capital can enhance the technological content and novelty of products, and the contribution of high-level human capital to the improvement of total factor productivity is unmatched by low-level human capital (Chang and Lin, 2017). The upgrading of the human capital structure affects innovation including the saving of the innovation input and the growth of the innovation output (Zhang et al., 2019). It is reasonable that higher-level human capital may have a higher ability to innovate (Crespo Cuaresma et al., 2014), because human capital can improve labor productivity and enhance absorptive capacity (Teixeira and Queirós, 2016).

Meanwhile, formal education is highly instrumental and necessary to increase the productivity and efficiency of workers by increasing the cognitive level of workers’ production capacity (Liu et al., 2017). The skills and knowledge of individual employees can also be leveraged to improve the ability to efficiently and effectively enhance productivity and performance (Kim and Lee, 2022). Moreover, highly educated and skilled employees are more inclined to innovate and reported to be significantly more likely to develop new and innovative ideas (McGuirk et al., 2015), and can adapt rapidly and efficiently to new tasks and environments, and have the necessary knowledge and skills to identify problems and develop innovative solutions (De Spiegelaere et al., 2018), which directly promote firm innovation. Furthermore, talent agglomeration can also impact firm innovation by producing knowledge spillover effect and developing the innovation environment. The generation of new knowledge is a process of long-term accumulation and qualitative change, and new knowledge could be learned, imitated and surpassed by other workers, resulting in a knowledge spillover effect (Burcharth et al., 2014). The agglomeration of heterogeneous talents with multidisciplinary knowledge in a gathering workplace also supply the opportunities for communication and creates a good learning atmosphere, which further inspires the innovative consciousness (Shi et al., 2022).

However, due to the lack of elasticity in the supply of high-level human capital such as scientists and engineers, there will not be a large supply in a short time (Afcha and García-Quevedo, 2016). In addition, the innovative performance of talents is largely influenced by their environment, and talents are more willing to actively explore external knowledge in a favorable environment (Ilinitch et al., 1996). Only when highly motivated can employees transform their knowledge and skills into creativity, and providing an effective reward system is a necessary condition to positively promote highly valuable workers to create innovative behaviors (Sanders et al., 2018). Meanwhile, the government’s talent policies are different for talents at different levels. There are incentive policies for high-level talents such as academicians, professors and doctors, as well as settlement policies for undergraduate and postgraduate talents. Local governments can improve workers’ flexibility through talent policies such as cultivating talents, introducing talents, and encouraging innovative work of talents, which could improve firm innovation level. The talent policy also reduces the cost of human capital flow, attracts talents to quickly gather within the domain, and promotes innovation effects. Furthermore, highly educated and skilled employees are also expected to better interpret the talent policy (Rauch et al., 2005). Highly educated and skilled employees have more confidence in their work and are more likely to react positively talent policy, which could promote them to engage in risking-taking innovation activities (De Winne and Sels, 2010; Bornay-Barrachina et al., 2012).

Consistent with these views, we argue that higher-level human capital may reinforce the positive relationship between talent policy and firm innovation. Specifically, talent policy creates a more concise and convenient environment for firms to attract high-quality talents for innovation, which provides technical support for the improvement of innovation activities. To summarize, our analysis of literature leads to the hypothesis.

H3a. Human capital quality structure plays a mediating role in the relationship between talent policy and firm innovation.

H3b. Human capital function structure plays a mediating role in the relationship between talent policy and firm innovation.

3 Methology

3.1 Sample selection and data sources

Following the previous study (Liu et al., 2021), the A-share listed firms from China’s Shanghai and Shenzhen Stock Exchanges were selected as the samples. To ensure that the selection of these firms truly reflects the PV sector, we searched the data using the keywords such as “photovoltaic” and “solar”. Moreover, we checked the annual reports to exclude the firms that have only the partially relevant business description. Furthermore, we also excluded ST or *ST firms. Finally, 101 listed solar PV firms were included in our study. Considering the fact that the R&D expenses data disclosure of Chinese listed firms has been relatively complete since 2008, we chose 2008–2021 as the research interval. As a result, we obtained an unbalanced panel data containing 788 effective observations. The financial data were manually sorted according to the firms’ annual report from CNINFO (http://www.cninfo.com.cn/new/index). Patent data obtained was from CNIPA (China National Intellectual Property Administration) (http://epub.cnipa.gov.cn/Index).

3.2 Variable descriptions

3.2.1 Dependent variable

The dependent variable of our study is firm innovation. Measuring firm innovation is complex and difficult. Recent studies have measured firm innovation on the basis of R&D expenditures (Audretsch and Belitski, 2022; Krammer, 2022) and patent counts (Ko et al., 2021; Peng et al., 2022). While R&D expenditures only capture observable innovation inputs, patenting activity reflects the successful outputs after it has invested all observable and unobservable innovation inputs. Additionally, patenting activity may be regarded as a measure of innovation efficiency (Atallah et al., 2021), and patents were closely related to development of new products that show a commercial value and were also externally validate innovation outcomes (Chen et al., 2016). Moreover, the application of patents can produce short-term profitability and can be expected to bring more persistent future benefits (Fitzgerald et al., 2021). Following previous studies (Sierra-Morán et al., 2022), we used the natural logarithm of total patent applications to measure firm innovation. In particular, the annual number of patents applied to the China National Intellectual Property Administration in three separate categories (invention patents, utility model patents and design patents) was used. We summed all patent applications for each firm. At the same time, we defined FIN as the substitution variable to conduct robustness test, describing the total patent applications in the current year.

3.2.2 Independent variable

In order to analyze the impact of talent policy on firm innovation, this study used the government talent project funding received by firms to measure the talent subsidy. In previous studies, many scholars have measured R&D subsidies using the subsidies for non-operating income (Chen et al., 2018; Wu et al., 2020; Xu et al., 2022). Similar to the data collection method used for the above R&D subsidies, the method of “keyword search” can be employed to collect talent subsidies from notes disclosed in the “Details of Government Subsidies” under the “Non-operating Income” account in the financial statement of the annual report. If the title or goal of a subsidy included any of the following keywords (talents, postdoctoral fellows, academicians, experts, leading talents, talents plan, thousand talents plan, and ten thousand talents plan), the subsidy was identified as the talent subsidy (Shao and Chen, 2022). For the results of keyword search, we also conducted a manual comparison to confirm that the selected information belonged to a talent project, and then aggregated the talent subsidy to the firm every year, finally generating two independent variables: STS and DTS. STS indicated the logarithm of one plus the amount of subsidies obtained by the talent policy. If the firms were not supported by the talent policy, this variable is 0. We defined DTS as the dummy variable, describing whether the government subsidies aim to promote talent management. If it does, DTS equals 1, otherwise 0.

3.2.3 Mediating variables

The mediating variable in this study is human capital structure. We examined the structure of human capital from two aspects: the quality structure and the function structure. The quality structure represented the education level of the employees, and the function structure represented the position type of the employees. In accordance with recent research (Chu and Fang, 2020; Yang et al., 2022), we used the proportion of employees with master’s degree or higher compared to the overall amount of employees to measure the human capital quality structure. At the same time, according to the previous studies (Zhang et al., 2018; Song et al., 2019), we selected the proportion of technical and R&D employees in total employees to measure the human capital function structure.

3.2.4 Control variables

To alleviate the possible confounding effects, some relevant control variables were used in this study. First, according to the previous study (Tang et al., 2021), we selected four variables to represent firms’ financial level, including leverage ratio, return on assets, sales growth ratio and operating cash flow. Second, we controlled for R&D intensity, which is often viewed as an important innovation capacity (Yang et al., 2010). Third, we included two essential firm characteristics that are pertinent to innovation outcomes (Klingebiel and Rammer, 2014): firm age and firm size. Finally, we also controlled for firms’ board size (Zona et al., 2013) and nature of property rights (Yi et al., 2021).

All variable definitions are shown in Table 1.

4 Results and discussion

4.1 Descriptive statistics and correlation analysis

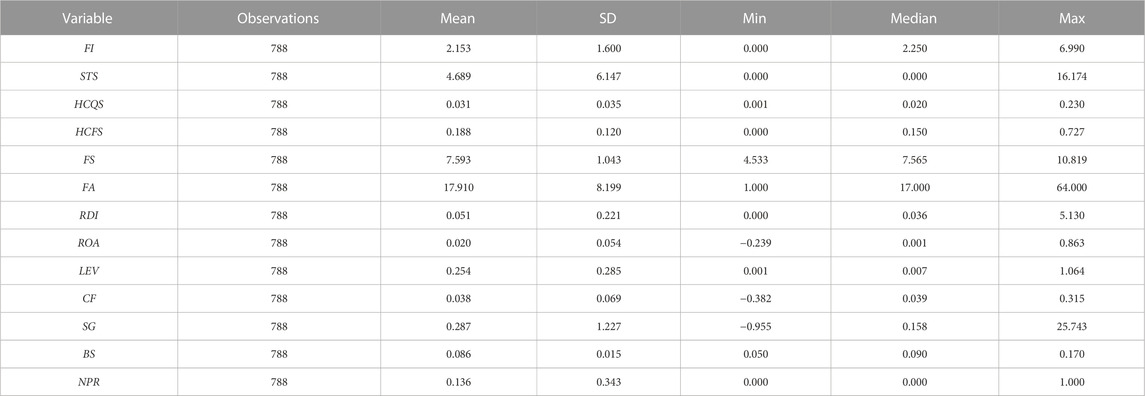

Table 2 shows the results of descriptive statistics for the variables used in the empirical study. According to the results of Table 2, the mean of FI is 2.153, demonstrating that the innovation output level of listed firms from solar energy industry is generally low. Meanwhile, the mean and SD of STS are 4.689 and 6.147, respectively. These results suggest that different listed firms have great differences in receiving talent subsidies. As for human capital, the mean of HCQS and HCFS are 0.031 and 0.188, respectively, indicating that the education level and the proportion of technicians of listed firms from solar energy industry are still at a relatively low level, and also shows that there is much room for improving the structure of employees.

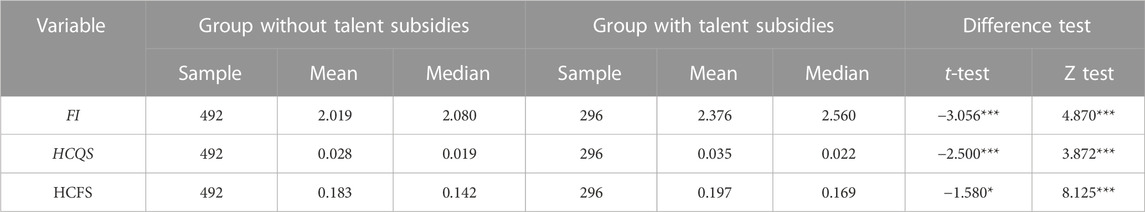

Moreover, Table 3 also shows the difference test results of main variables between firms with and without talent subsidies. In terms of sample size, there are 492 samples without talent subsidies, accounting for 62% of the total sample, while there are 296 samples with talent subsidies, accounting for 38% of the total sample. This shows that more than half of the firms are still not funded by the government’s talent policy, which also shows that many firms have not done enough in talent management. Firm innovation of firms not receiving talent subsidy is lower than of firms receiving talent subsidy, which are 2.019 and 2.376 respectively. Meanwhile, human capital quality structure of firms not receiving talent subsidy is lower than of firms receiving talent subsidy, which are 0.028 and 0.035 respectively. Moreover, human capital function structure of firms not receiving talent subsidy is also lower than of firms receiving talent subsidy, which are 0.183 and 0.197 respectively. Furthermore, we also conducted the mean and median difference test of the two groups of samples, and the two results were basically consistent.

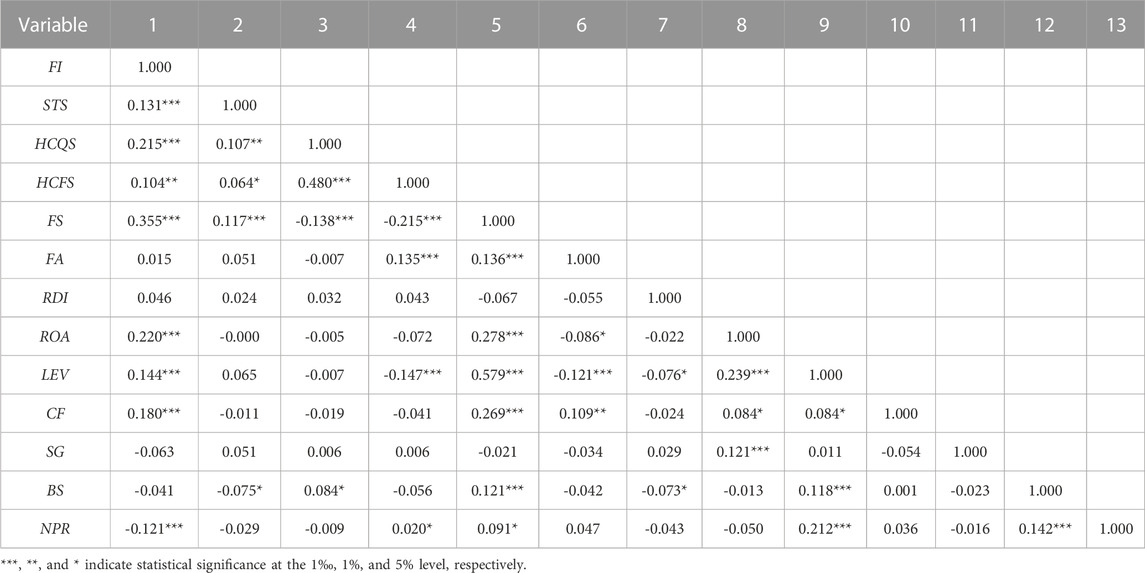

Table 4 shows the results of correlation analysis for main variables. According to the results of Table 4, the correlation coefficients between variables are small, except the correlation coefficients between FS and LEV, which is slightly greater than 0.5. Moreover, the research results of Table 2 show that STS has a significant positive correlation with HCQS and HCFS, which indicates that STS can optimize the human capital structure of firms. At the same time, there is also a significant positive correlation between STS and FI, as well as between HCQS/HCFS and FI, which suggests that STS and HCS can effectively promote firm innovation.

4.2 Regression analysis

Unlike the fixed effect model, the random effect model can allow for the estimation of the relationship between variables when independent variables are both longitudinal and time invariant. Thus, based on the characteristics of our sample, we employed the random effect GLS regression to test the hypotheses.

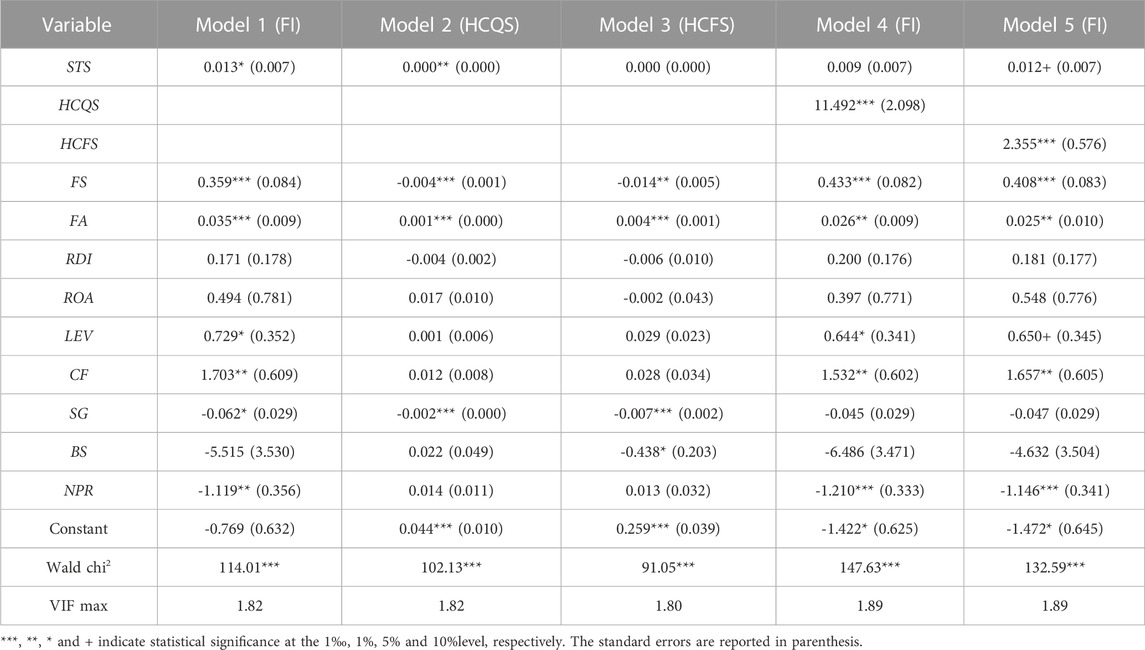

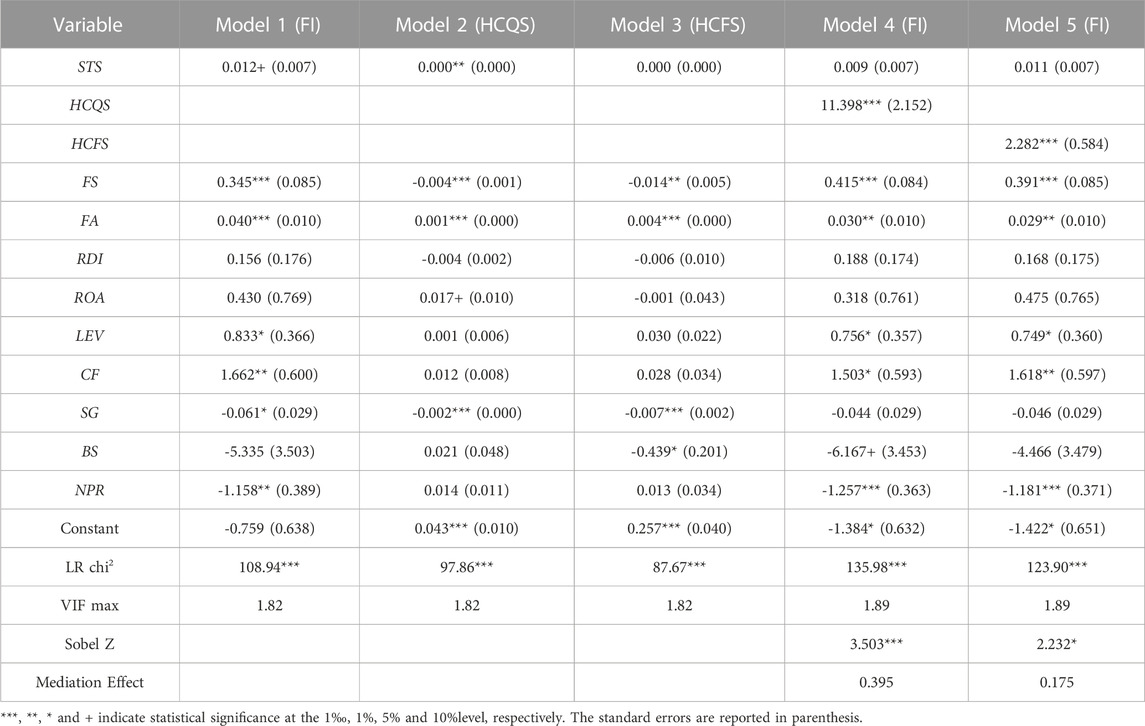

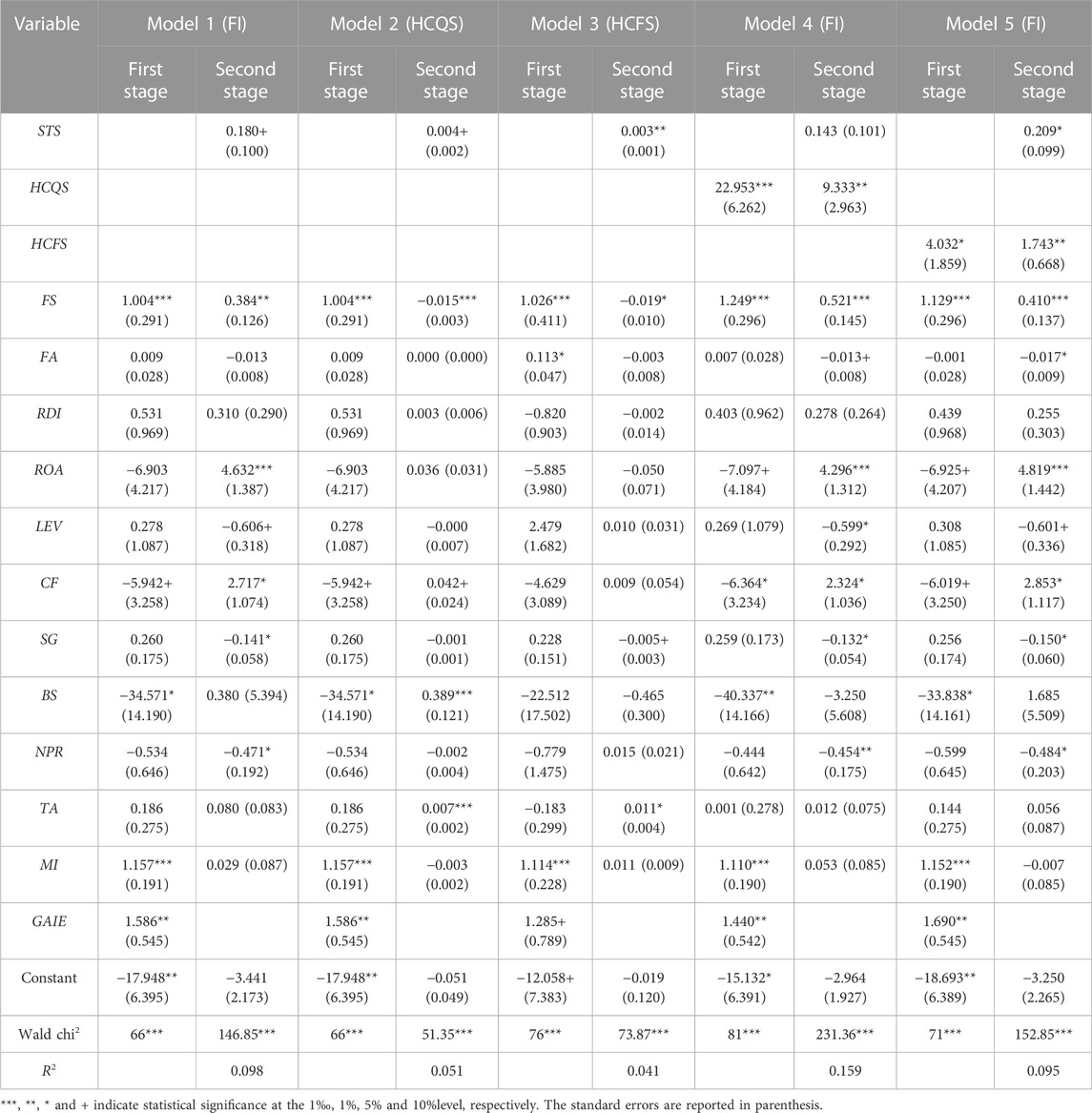

Table 5 and Table 6 show the result of regression analysis. Model 1 tested the effect of talent subsidy on firm innovation. Model 2-5 examined the mediator effect of human capital on the relationship between talent subsidy and firm innovation. We also used the stepwise regression test proposed by previous study (Agnoli and Outreville, 2021) and sobel test to test mediating effect, which are shown in Table 5 and Table 6, respectively.

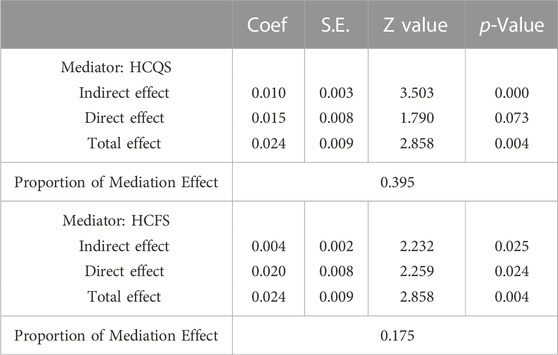

The results of Model 1 in Table 5 shows that the talent subsidy positively significantly impacts firm innovation at the 5% level (β = 0.013). This suggests that the implementation of the talent policy can promote firms’ innovation activity, thus Hypothesis 1 is supported. Model 2 and 4 were mainly used to test whether talent subsidy could pass through human capital quality structure to affect firm innovation. The results of Model 2 show that talent subsidy positively significantly impacts human capital quality structure at the 1% level (β = 0.000). Thus, Hypothesis 2a is supported. Meanwhile, although the influence of human capital quality structure on firm innovation was positive and significant at the 0.1% (β = 11.492) in Model 4, the influence of talent subsidy on firm innovation is not positive and significant at the 5% (β = 0.009) in Model 4. These results suggest that human capital quality structure is an essential mediation to link talent subsidy and firm innovation. Moreover, the results of sobel test of Table 6 show that the ratio of the mediation effect of total effect of human capital quality structure is 0.395, suggesting that human capital quality structure can explain 39.5% effect of talent subsidy on firm innovation. This also means that there is a significant mediation role of human capital quality structure. Thus, Hypothesis 3a is supported. Model 3 and 5 were mainly used to test whether talent subsidy could pass through human capital function structure to affect firm innovation. The results of Model 3 show that talent subsidy positively has not significant effect on human capital function structure at the 5% level (β = 0.000). Thus, Hypothesis 2b is not supported. Given the coefficient is not significant, the Sobel test must be further conducted to confirm whether human capital function structure can mediate the relationship between talent subsidy and firm innovation. Meanwhile, the influence of human capital function structure on firm innovation was positive and significant at the 0.1% (β = 2.355) in Model 5, and the influence of talent subsidy on firm innovation was also positive and significant at the 1% (β = 0.012) in Model 5. These results suggest that human capital function structure partially mediates the relationship between talent subsidy and firm innovation. Furthermore, the results of Sobel test of Table 6 show that the ration of the mediation effect of total effect of human capital function structure is 0.175, suggesting that human capital function structure can explain 17.5% effect of talent subsidy on firm innovation. This also means that there is a significant mediation role of human capital quality structure. Thus, Hypothesis 3b is supported.

4.3 Robustness test

4.3.1 Benchmark regression robustness test

We conducted the three robustness checks to assess how regression coefficients respond to changes in the regression specification.

First, we employed the ML regression method to replace the GLS regression method, and the results are shown in Table 7. According to the regression results in Table 7, STS has a positive and significant effect on FI. Meanwhile, the results of stepwise regression and Sobel test show that both HCQS and HCFS mediate the relationship between STS and FI. The results are basically consistent with those before replacement. Thus, the research results are stable.

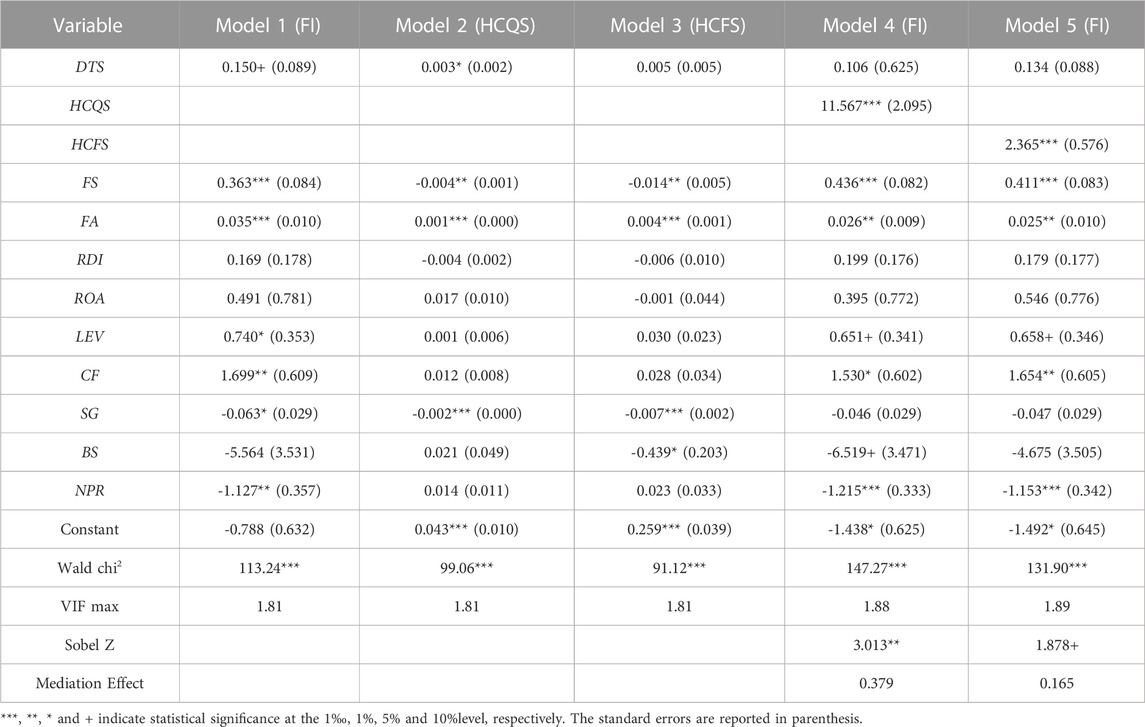

Second, we used DTS to replace the independent variable (STS), and the results are shown in Table 8. According to the regression results in Table 8, DTS has also a positive and significant effect on FI. Meanwhile, the results of stepwise regression and Sobel test show that both HCQS and HCFS also mediate the relationship between DTS and FI. The results are basically consistent with those before replacement. Thus, the research results are stable.

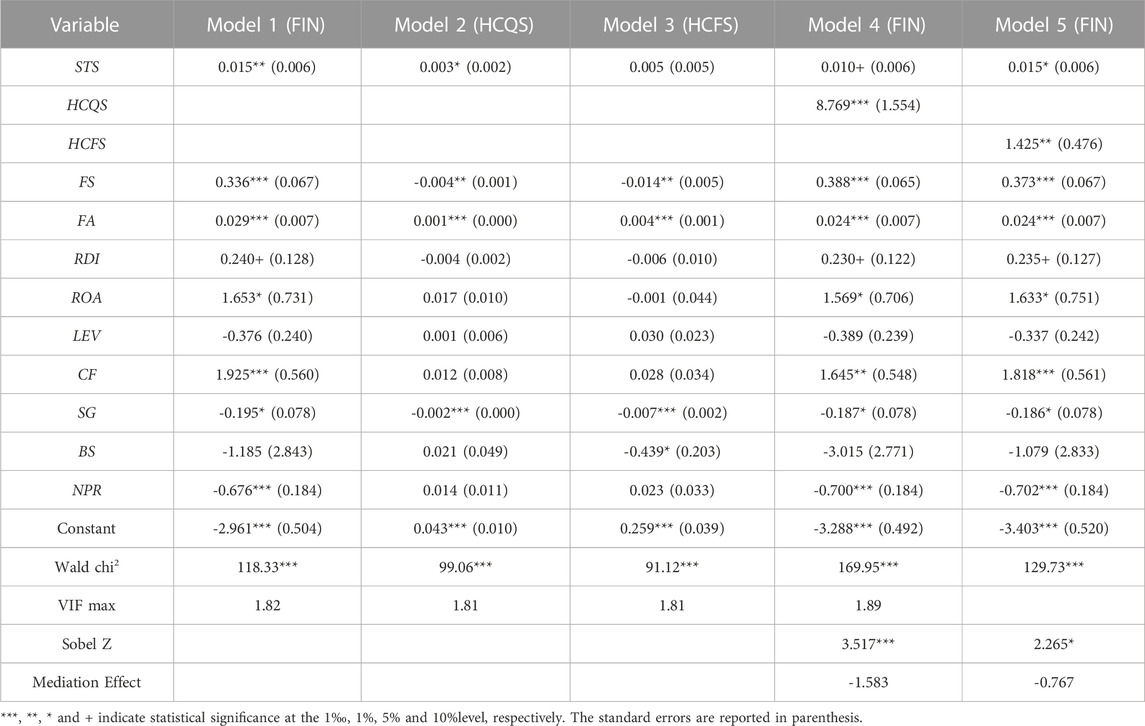

Third, FIN was used to replace the dependent variable (FI). At the same time, considering the distribution characteristics of the number of patents, the regression method was also changed to negative binomial regression. These results are shown in Table 9. According to the regression results in Table 9, STS has also a positive and significant effect on FI. Meanwhile, the results of stepwise regression and Sobel test show that both HCQS and HCFS also partially mediate the relationship between DTS and FI. The results are basically consistent with those before replacement. Thus, the research results are stable.

4.3.2 Robustness test of the mediation effect

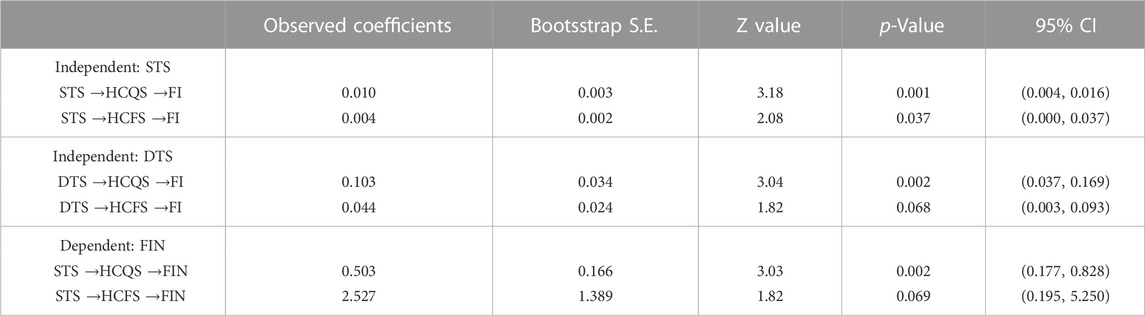

Next bootstrapping analysis was carried out proposed by previous study (Liu et al., 2022) to examine talent subsidy indirect influence on firm innovation caused through human capital structure. Table 10 shows the repeated sampling with replacement for 1,000 repetitions of the regression of the mediation effect. The Z values of the indirect effect of HCQS and HCFS are 3.18 and 2.18, which have passed the test at the significance level of 0.1% and 5%, respectively. Thus, there is a mediation effect.

Furthermore, Table 7 also shows the results of the robustness analysis of the mediation effect of substituting the independent variable as DTS, and substituting the dependent variable as FIN. The Z values of the indirect effect were all significant and passed the test, suggesting that there was a mediation effect, which also proved the robustness of the results of the mediation effect.

4.4 Heterogeneity analysis

The above results have shown that talent policy can significantly promote firm innovation, but it is not yet clear whether this role is affected by the firms’ conditions. To explore the impact of talent policy on firm innovation, two variables were selected for further analysis: the R&D intensity and the nature of property rights.

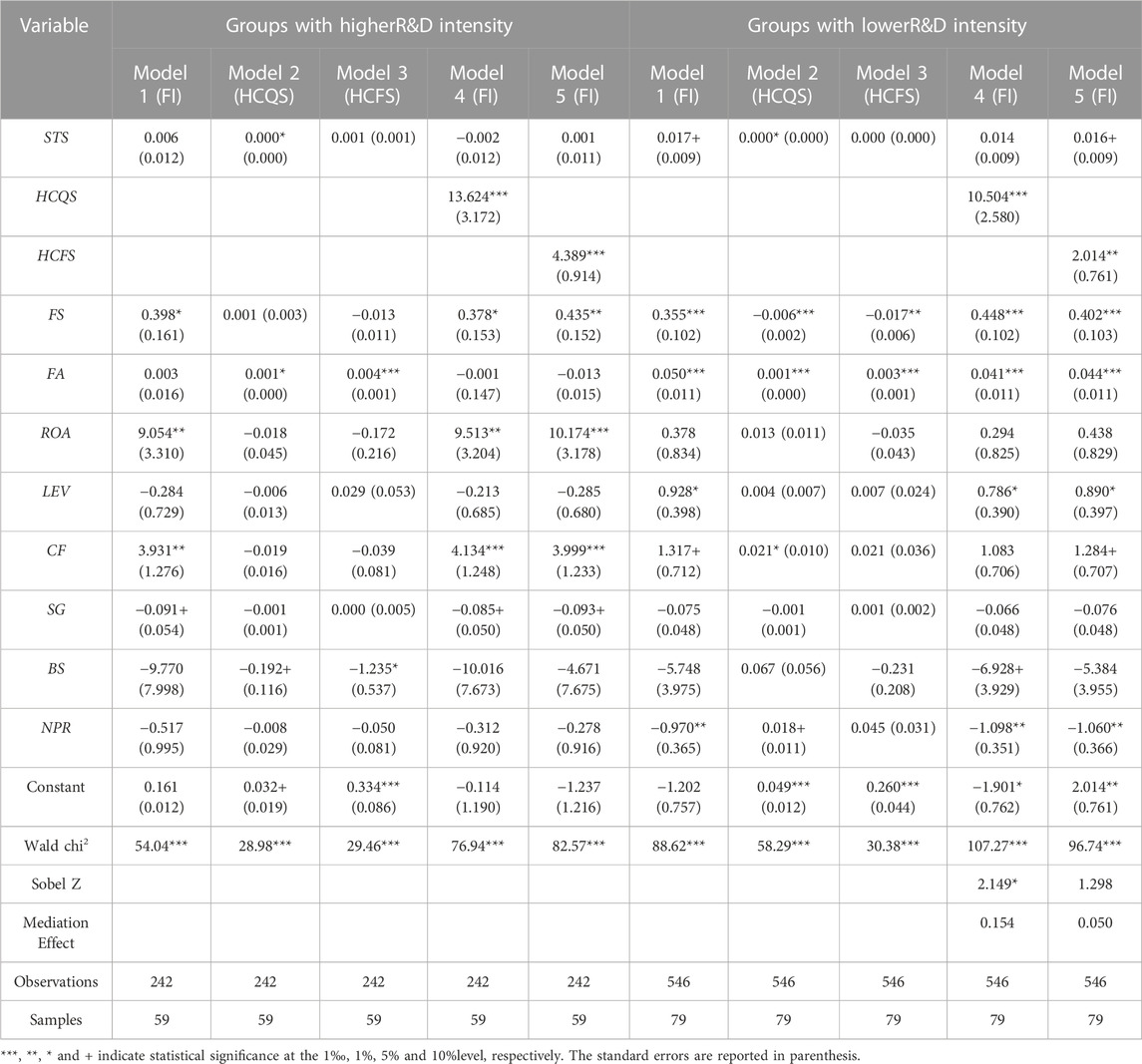

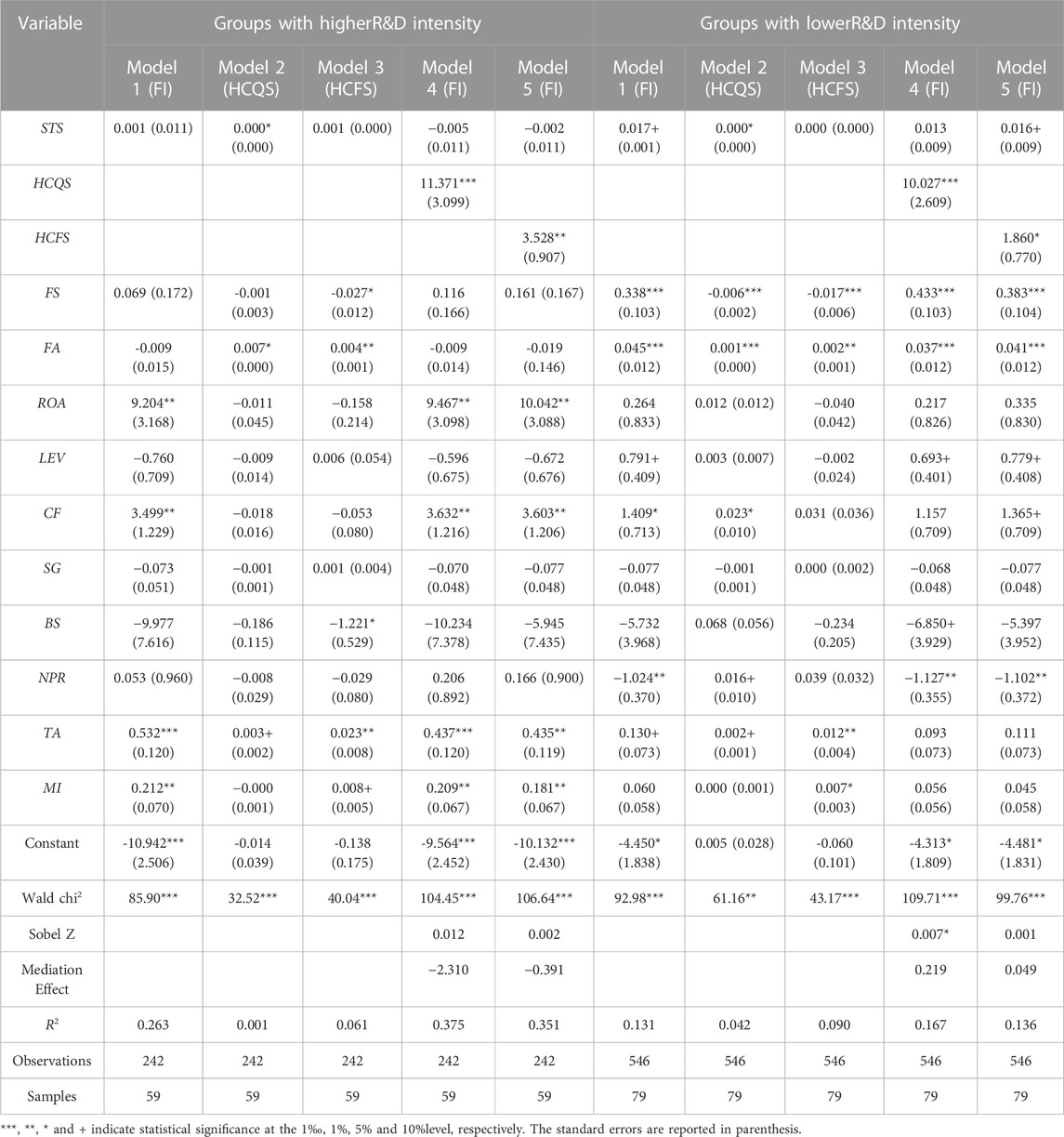

Table 11 reports the R&D intensity heterogeneity analysis of the benchmark regression. In our study, firms whose R&D intensity is lower than the mean level were classified as low groups, and those whose intensity is not lower than the mean level are classified as high groups. According to the regression results in Table 11, STS has a positive and significant effect only on FI in low groups. Meanwhile, the results of stepwise regression and Sobel test also show that both HCQS and HCFS only mediate the relationship between STS and FI in low groups. These results suggest that talent policy can significantly promote the innovation of firms with low R&D intensity, while it does not significantly promote the innovation of firms with high R&D intensity.

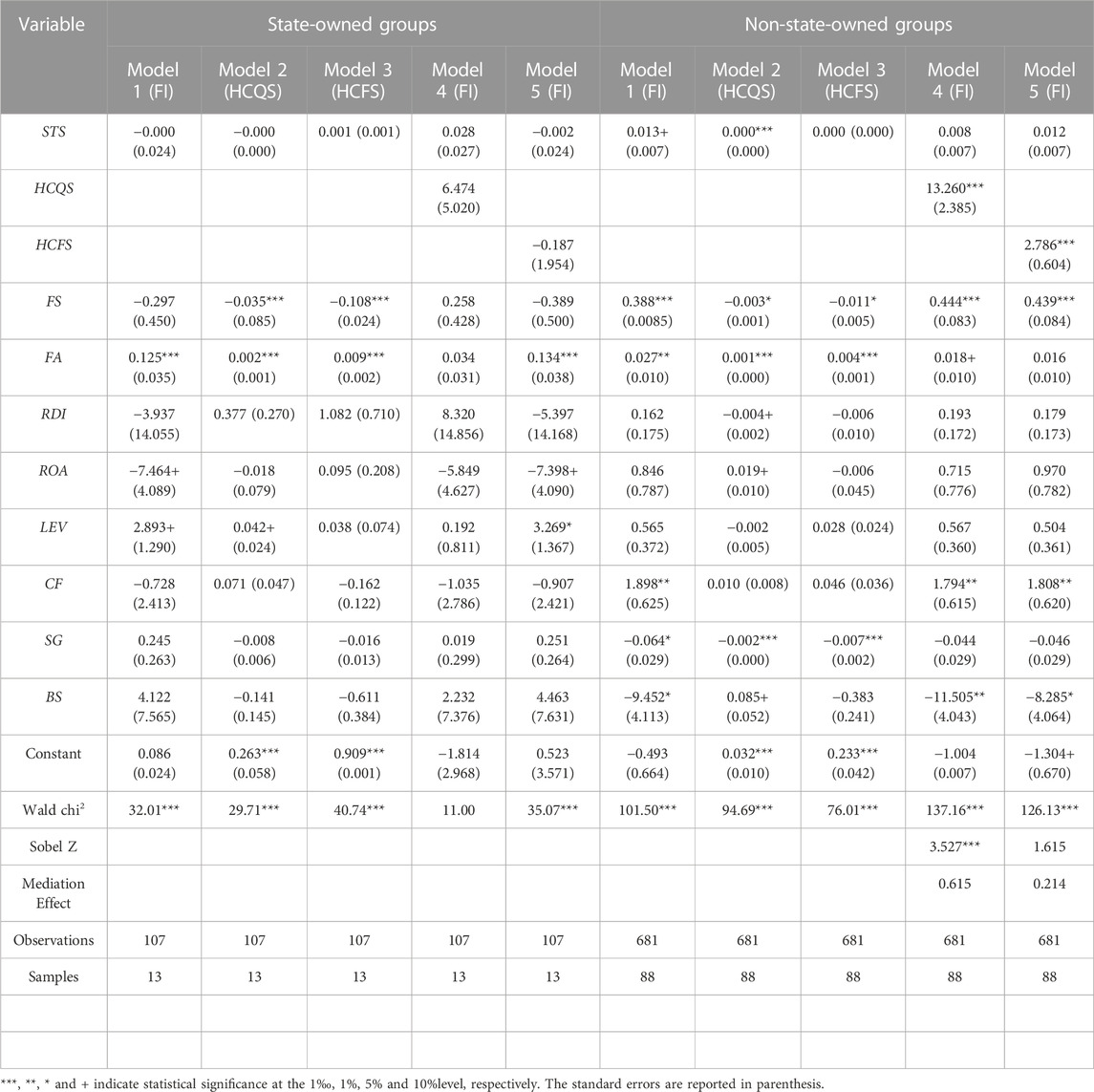

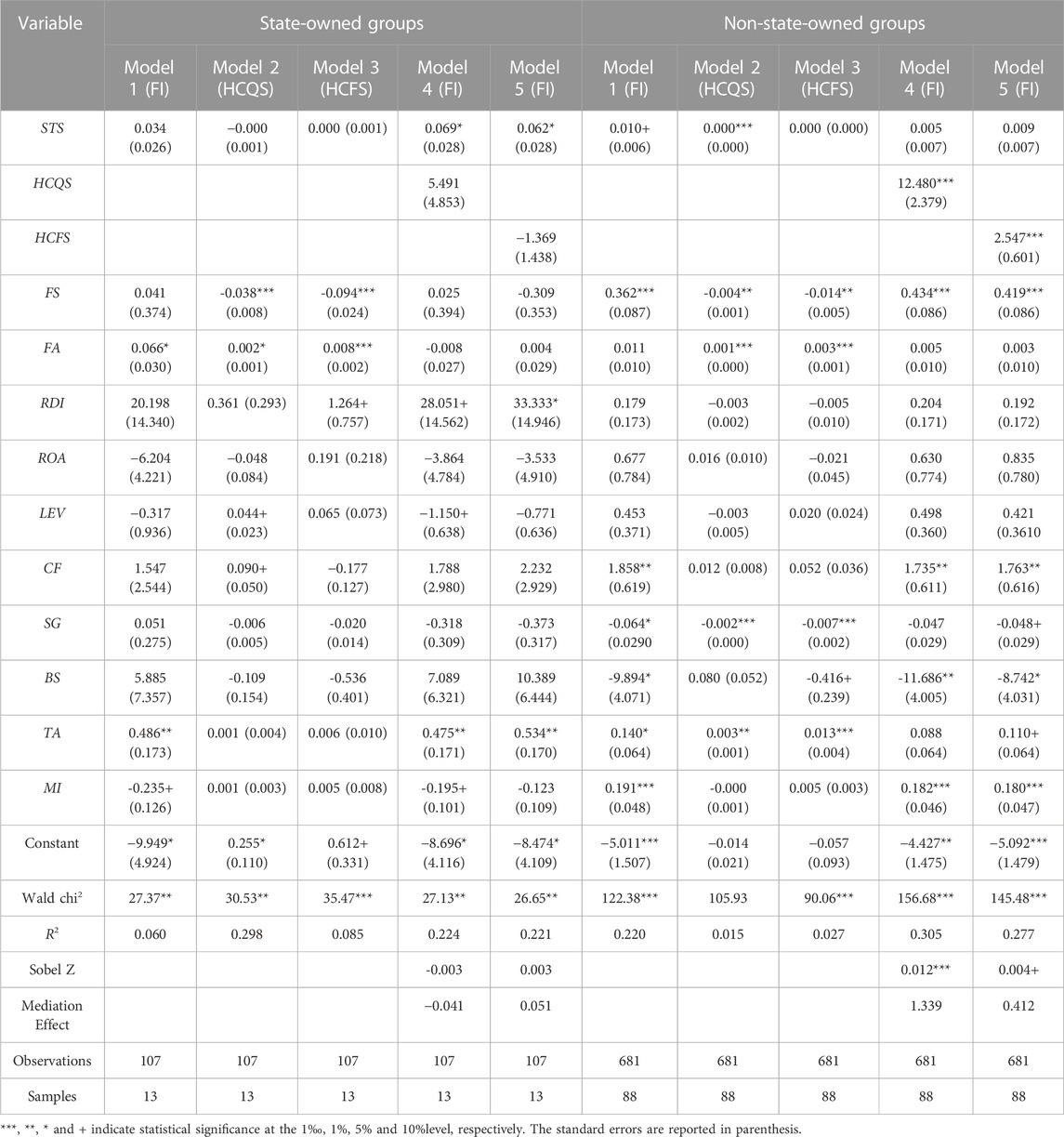

Table 12 reports the nature of property rights heterogeneity analysis of the benchmark regression. In our study, listed firms were classified as state-owned and non-state-owned groups. According to the regression results in Table 12, STS has a positive and significant effect only on FI in non-state-owned groups. Meanwhile, the results of stepwise regression and Sobel test also show that both HCQS and HCFS only mediate the relationship between STS and FI in non-state-owned groups. These results suggest that talent policy can significantly promote the innovation of non-state-owned firms, while it does not significantly promote the innovation of state-owned firms.

4.5 Endogeneity test

To accurately estimate the effect of talent policy on firm innovation, this study further discuss the endogenous problems that may exist in the above analysis model. The endogenous problem mainly comes from omitted variables and reverse causality. First, although this study has already controlled for important variables that affect firm innovation, there may be some variables missing, which can lead to biased results. Second, before subsidizing firms’ talents, the government looks into their outstanding innovation performance, indicating that innovative firms are more likely to obtain subsidies. Given the above sources of the endogenous problems, we dealt with the endogenous problems by adopting two techniques as follows.

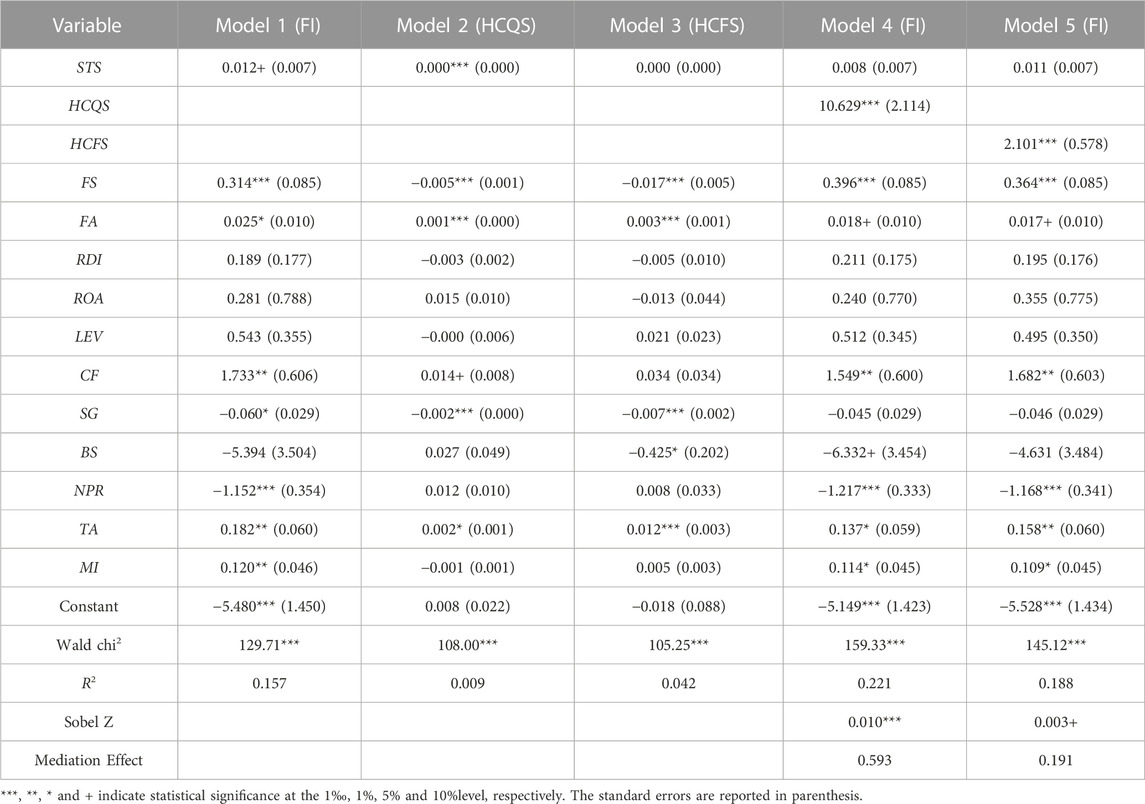

Firstly, to solve the endogenous problems caused by omitted variables, the total assets (TA) and marketization index (MI) were introduced into the basic regression model as control variables, which are often viewed as important factors affecting the innovation. The former was represented by the natural logarithm of total assets (Ain et al., 2022), and the latter was represented by Fangang’s regional marketization index (Wang et al., 2021). The results of regression analysis are presented in Table 13.

Secondly, to solve the endogenous problems caused by reverse causality, we employed the instrumental variable method. Following Zhang (2020), we used the government’s ability to intervene in the economy (GAIE) as instrumental variables, which is represented by the proportion of fiscal expenditure and fiscal revenue of each province in the current year and may satisfy correlation and exogeneity. First of all, the financial expenditure in the same region is limited. With the increase of the total amount of government subsidies, the amount of talent subsidies in all industries will be affected, so this variable meets the relevant requirements. Secondly, the government subsidy expenditure is more a reflection of the macro policy, and it is difficult to directly affect the innovation behavior of a single enterprise, so it conforms to the exogenous regulations. The two-stage least square method was applied to estimate the above models, and the estimated results are shown in Table 14.

According to the results of Table 13, the results of regression analysis show that the roles of the additional control variables are significant, which are basically consistent with the results of benchmark models. It indicates that empirical results are robust. The results of regression analysis in Table 14 show that the coefficients of GAIE are positive and significant at 10% and 1% level respectively in first stage regression analysis, indicating the validity of the instrument variable. As can be also seen from Table 14, the coefficients of STS, HCQS and HCFS are significantly positive at 10% and 1% level respectively in second stage regression analysis. These results suggest that talent policy can indirectly facilitate firm innovation through human capital structure.

Furthermore, this study regrouped all samples according to the R&D intensity and property nature, and then performed regression analysis including additional control variables. These results are shown in Table 15 and Table 16. The results in Table 15 and Table 16 show that the coefficients of STS, HCQS and HCFS are significantly positive in non-state-owned groups and in low R&D intensity groups, which are basically consistent with the results of benchmark models and suggest that talent policy can indirectly facilitate firm innovation through human capital structure.

TABLE 15. Regression analysis of higher and lower R&D intensity groups based on the additional control variables.

TABLE 16. Regression analysis of state-owned and non-state-owned groups based on the additional control variables.

5 Conclusion and implicatoins

5.1 Main Conclusion

Based on the unbalanced panel data of 101 listed firms of solar photovoltaic industry in China from 2008 to 2021, this study employed the random effect GLS regression to empirically explore the impact mechanism of talent policy on firm innovation. The main conclusions are as follows. Firstly, talent policy exerts a significant and positive influence on firm innovation. Innovation has a strong negative externality. Simply relying on market regulation could inevitably lead to insufficient input of factors, loss of efficiency, etc. According to the buffering mechanism of resource dependence theory, on the one hand, talent policy can directly promote firm innovation by generating compensation effects that help firms to increase innovation investments, and on the other hand, talent policy can mobilize the innovation enthusiasm of talents and thus promote firm innovation. This conclusion confirms the effectiveness of talent policy, which is of great significance to the promotion of innovation in solar photovoltaic industry. Secondly, talent policy promoted firm innovation by the structure of human capital, including two intermediary paths: quality and function. According to the bridging mechanism of resource dependence theory, talent policy can be regarded as a signal of legitimacy and quality, which can help firms attract talents to change the structure of human capital though allocation effect, and thus help firms promote innovation activities. Thus, the government’s talent policy has played a huge role in changing the stock and structure of human capital. Finally, the talent policy and human capital structure’s effects on firm innovation can vary depending on the nature of property rights and R&D intensity, and these relationships are more significant in non-state-owned firms and firms with low R&D intensity. This suggests that the government should consider the nature of property rights and R&D and allocate resources reasonably when talent subsidies to solar photovoltaic firms.

5.2 Practical implications

Based on the above conclusions, this study draws the following practical implications for managers as well as policymakers.

For governments at all levels, they should play an important role in guiding policies to promote the development of the solar photovoltaic industry. First, the government should put the talent policy in a more important position when promoting the development of solar photovoltaic industry. At present, the government’s support in solar photovoltaic firms’ talent management is far less than the support for R&D subsidies. However, the talent policy can effectively supply resources and significantly promote solar photovoltaic firms’ innovation. Therefore, the talent policy has relatively lower implementation cost and more effective innovation promotion effect, which should be fully valued in solar photovoltaic industry. Second, the government should further play the role of talent policy in creating signaling effects and reducing the information asymmetry problem in solar photovoltaic industry. The government can not only help solar photovoltaic firms attract more talents to engage in innovation activities through the release of talent policies, but also, more importantly, optimize the talent structure of solar photovoltaic firms, so as to play a greater role in promoting innovation. On the whole, human capital quality structure plays a more important role in promoting solar photovoltaic firms’ innovation than human capital function structure. In the short term, the governments will focus on increasing quality structure of human capital in solar photovoltaic industry. However, in the long run, the governments’ talent policy should give consideration to both the improvement of quality and function structure of human capital in solar photovoltaic industry. Third, the government’s talent policy should consider the difference of nature of solar photovoltaic firms’ own conditions. Specially, the government should continue to optimize the talent policy evaluation mechanism, comprehensively consider the nature of property rights and R&D, and implement differentiated subsidy policies. Compared to non-state-owned firms in solar photovoltaic industry, state-owned firms can undertake innovation risks with stable internally generated funds and average the innovation investments through a large volume of sales. Therefore, state-owned firms are less enthusiastic about spending talent subsidies to accelerate innovation in solar photovoltaic industry. Similarly, solar photovoltaic firms with higher R&D intensity also have sufficient funds to engage in innovation activities, so they are less enthusiastic about obtaining talent subsidy.

For solar photovoltaic firms, they should actively respond to the requirements of talent policies and optimize their management activities. First, the implementation of the talent policy can not only help solar photovoltaic firms reduce the operational burden and improve the risk aversion ability, but also help solar photovoltaic firms greatly improve the human capital structure to promote innovation. Therefore, solar photovoltaic firms should break the constraints of their own conditions and make full use of the positive effects of different talent policies. Second, solar photovoltaic firms should avoid heavy reliance on government resources to promote innovation activities. Maintaining diverse access to resources and optimizing the allocation of internal resources will help solar photovoltaic firms pay attention to the innovation activities themselves, so as to obtain sustainable output.

5.3 Limitations and future research

This study had some limitations. First, due to the lack of relevant data, non-listed firms were not included in the scope of analysis, resulting in insufficient sample size. Therefore, in the future research, the research object can be extended and the universality of the conclusion can be further verified. Second, this study only analyzes the mediating role of human capital structure. In the future, we should further explore the mechanisms by which talent policy influence firm innovation, and the signal effect of talent policy on attracting other external stakeholders.

Data availability statement

The original contribution presented in the study are included in the article/supplementary materials, further inquiries can be directed to the corresponding author.

Author contributions

YZ: conceptualization and writing—original draft. SQ: conceptualization and writing—review and editing. PG: methodology, formal analysis, supervision.

Funding

This study was supported by the National Natural Science Foundation of China (grant number 72172041) and Humanities and Social Sciences Project of the Ministry of Education in China (grant number 20YJC630022).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Afcha, S., and García-Quevedo, J. (2016). The impact of R&D subsidies on R&D employment composition. Ind. Corp. Change. 25 (6), 955–975. doi:10.1093/icc/dtw008

Afcha, S., and Lucena, A. (2022). R&D subsidies and firm innovation: Does human capital matter? Ind. Innov. 29 (10), 1171–1201. doi:10.1080/13662716.2022.2088334

Agnoli, L., and Outreville, J. F. (2021). Wine consumption and culture: A cross-country analysis. Appl. Econ. Perspect. Pol. 43 (3), 1101–1124. doi:10.1002/aepp.13097

Ahn, J. M., Lee, W., and Mortara, L. (2020). Do government R&D subsidies stimulate collaboration initiatives in private firms?. Technol. Forecast. Soc. Chang. 151, 119840. doi:10.1016/j.techfore.2019.119840

Ain, Q. U., Yuan, X., and Javaid, H. M. (2022). The impact of board gender diversity and foreign institutional investors on firm innovation: Evidence from China. Eu. J. Innov. manage. 25 (3), 813–837. doi:10.1108/ejim-10-2020-0439

Amezcua, A. S., Grimes, M. G., Bradley, S. W., and Wiklund, J. (2013). Organizational sponsorship and founding environments: A contingency view on the survival of business-incubated firms, 1994–2007. Acad. Manage. J. 56 (6), 1628–1654. doi:10.5465/amj.2011.0652

Atallah, G., de Fuentes, C., and Panasian, C. A. (2021). Ownership, compensation and board diversity as innovation drivers: A comparison of U.S. And Canadian firms. Int. J. Innov. Manage. 25 (3), 2150025. doi:10.1142/S1363919621500250

Audretsch, D. B., and Belitski, M. (2022). Evaluating internal and external knowledge sources in firm innovation and productivity: An industry perspective. R&D Manage 53, 168–192. (Avaliable online: 12 September 2022). doi:10.1111/radm.12556

Bayo-Moriones, J. A., and Lera-Lopez, F. (2007). A firm level analysis of determinants of ICT adoption in Spain. Technovation 27 (6-7), 352–366. doi:10.1016/j.technovation.2007.01.003

Bianchi, M., Murtinu, S., and Scalera, V. G. (2019). R&D subsidies as dual signals in technological collaborations. Res. Policy. 48 (9), 103821. doi:10.1016/j.respol.2019.103821

Blom, R., Kruyen, P. M., Van Thiel, S., and Van der Heijden, B. I. (2021). HRM philosophies and policies in semi-autonomous agencies: Identification of important contextual factors. Int. J. Hum. Resour. Manag. 32 (18), 3862–3887. doi:10.1080/09585192.2019.1640768

Bogers, M., Foss, N. J., and Lyngsie, J. (2018). The ‘human side’ of open innovation: The role of employee diversity in firm-level openness. Res. Policy. 47 (1), 218–231. doi:10.1016/j.respol.2017.10.012

Bornay-Barrachina, M., De la Rosa-Navarro, D., López-Cabrales, A., and Valle-Cabrera, R. (2012). Employment relationships and firm innovation: The double role of human capital. Brit. J. Manage. 23 (2), 223–240. doi:10.1111/j.1467-8551.2010.00735.x

Burcharth, A. L. D. A., Knudsen, M. P., and Søndergaard, H. A. (2014). Neither invented nor shared here: The impact and management of attitudes for the adoption of open innovation practices. Technovation 34, 149–161. doi:10.1016/j.technovation.2013.11.007

Chang, C. F., and Lin, C. S. (2017). The role of human capital in manufacturing plant growth: Evidence from Taiwan. Pac. Econ. Rev. 22 (4), 554–584. doi:10.1111/1468-0106.12227

Che, X. J., Zhou, P., and Chai, K. H. (2022). Regional policy effect on photovoltaic (PV) technology innovation: Findings from 260 cities in China. Energy Policy 162, 112807. doi:10.1016/j.enpol.2022.112807

Che, Y., and Zhang, L. (2018). Human capital, technology adoption and firm performance: Impacts of China's higher education expansion in the late 1990s. Econ. J. 128 (614), 2282–2320. doi:10.1111/ecoj.12524

Chen, C. J., Lin, B. W., Lin, Y. H., and Hsiao, Y. C. (2016). Ownership structure, independent board members and innovation performance: A contingency perspective. J. Bus. Res. 69 (9), 3371–3379. doi:10.1016/j.jbusres.2016.02.007

Chen, J., Heng, C. S., Tan, B. C., and Lin, Z. (2018). The distinct signaling effects of R&D subsidy and non-R&D subsidy on IPO performance of IT entrepreneurial firms in China. Res. Pol. 47 (1), 108–120. doi:10.1016/j.respol.2017.10.004

Chu, J., and Fang, J. (2020). Economic policy uncertainty and firms' labor investment decision. China finan. Rev. Int. 11 (1), 73–91. doi:10.1108/CFRI-02-2020-0013

Cin, B. C., Kim, Y. J., and Vonortas, N. S. (2017). The impact of public R&D subsidy on small firm productivity: Evidence from Korean SMEs. Small Bus. Econ. 48 (2), 345–360. doi:10.1007/s11187-016-9786-x

Crespo Cuaresma, J., Lutz, W., and Sanderson, W. (2014). Is the demographic dividend an education dividend? Demography 51 (1), 299–315. doi:10.1007/s13524-013-0245-x

Dai, Y., Kong, D., and Liu, S. (2018). Returnee talent and corporate investment: Evidence from China. Eur. Acc. Rev. 27 (2), 313–337. doi:10.1080/09638180.2016.1264306

De Spiegelaere, S., Van Gyes, G., and Van Hootegem, G. (2018). Innovative work behaviour and performance-related pay: Rewarding the individual or the collective? Int. J. Hum. Resour. Man. 29 (12), 1900–1919. doi:10.1080/09585192.2016.1216873

De Winne, S., and Sels, L. (2010). Interrelationships between human capital, HRM and innovation in Belgian start-ups aiming at an innovation strategy. Int. J. Hum. Resour. Manage. 21 (11), 1863–1883. doi:10.1080/09585192.2010.505088

Edziah, B. K., Sun, H., Adom, P. K., Wang, F., and Agyemang, A. O. (2022). The role of exogenous technological factors and renewable energy in carbon dioxide emission reduction in Sub-Saharan Africa. Renew. Energy 196, 1418–1428. doi:10.1016/j.renene.2022.06.130

Fitzgerald, T., Balsmeier, B., Fleming, L., and Manso, G. (2021). Innovation search strategy and predictable returns. Manage. Sci. 67 (2), 1109–1137. doi:10.1287/mnsc.2019.3480

Fryges, H. (2009). Internationalisation of technology-oriented firms in Germany and the UK. Small Bus. Econ. 33 (2), 165–187. doi:10.1007/s11187-008-9100-7

Gao, X., and Rai, V. (2019). Local demand-pull policy and energy innovation: Evidence from the solar photovoltaic market in China. Energy Policy 128, 364–376. doi:10.1016/j.enpol.2018.12.056

Gao, Y., Hu, Y., Liu, X., and Zhang, H. (2021). Can public R&D subsidy facilitate firms’ exploratory innovation? The heterogeneous effects between central and local subsidy programs. Res. Policy. 50 (4), 104221. doi:10.1016/j.respol.2021.104221

Ge, S., and Liu, X. (2022). Catch-up in solar PV industry of China: A perspective of industrial innovation ecosystem. Int. J. Innov. Technol. Manage. 19 (06), 2250016. doi:10.1142/S021987702250016X

Guo, R., Ning, L., and Chen, K. (2022). How do human capital and R&D structure facilitate fdi knowledge spillovers to local firm innovation? A panel threshold approach. J. Technol. Transf. 47, 1921–1947. doi:10.1007/s10961-021-09885-y

Haini, H. (2019). Internet penetration, human capital and economic growth in the ASEAN economies: Evidence from a translog production function. Appl. Econ. Lett. 26 (21), 1774–1778. doi:10.1080/13504851.2019.1597250

Ilinitch, A. Y., D'Aveni, R. A., and Lewin, A. Y. (1996). New organizational forms and strategies for managing in hypercompetitive environments. Organ. Sci. 7 (3), 211–220. doi:10.1287/orsc.7.3.211

Jabbour, C. J. C., Mauricia, A. L., and Jabbour, A. B. L. D. (2017). Critical success factors and green supply chain management proactivity: Shedding light on the human aspects of this relationship based on cases from the Brazilian industry. Prod. Plan. Control. 28 (6-8), 671–683. doi:10.1080/09537287.2017.1309705

Jacob, J., and Subba, B. B. (2022). Towards exceptionalism: The communist party of China and its uses of history. China Rep. 58, 7–27. doi:10.1177/00094455221074169

Jiang, C., Liu, D., Zhu, Q., and Wang, L. (2021). Government subsidies and enterprise innovation: Evidence from China's photovoltaic industry. Discrete Dyn. Nat. Soc. 2021, 1–9. doi:10.1155/2021/5548809

Jiang, H. (2021). Spatial character and backflow pattern of high-level returned talents in China. Complexity 2021, 1–11. doi:10.1155/2021/8839552

Kim, D., and Lee, C. Y. (2022). R&D employee training, the stock of technological knowledge, and R&D productivity. R&D Manag. 52 (5), 801–819. doi:10.1111/radm.12521

Klingebiel, R., and Rammer, C. (2014). Resource allocation strategy for innovation portfolio management. Strat. Manag. J. 35 (2), 246–268. doi:10.1002/smj.2107

Ko, Y. J., O'Neill, H., and Xie, X. (2021). Strategic intent as a contingency of the relationship between external knowledge and firm innovation. Technovation 104, 102260. doi:10.1016/j.technovation.2021.102260

Krammer, S. M. (2022). Human resource policies and firm innovation: The moderating effects of economic and institutional context. Technovation 110, 102366. doi:10.1016/j.technovation.2021.102366

Lin, B., and Luan, R. (2020). Do government subsidies promote efficiency in technological innovation of China’s photovoltaic enterprises? J. Clean. Prod. 254, 120108. doi:10.1016/j.jclepro.2020.120108

Liu, C., Liu, L., Zhang, D., and Fu, J. (2021). How does the capital market respond to policy shocks? Evidence from listed solar photovoltaic companies in China. Energy Policy 151, 112054. doi:10.1016/j.enpol.2020.112054

Liu, F., Sim, J. Y., Sun, H., Edziah, B. K., Adom, P. K., and Song, S. (2023). Assessing the role of economic globalization on energy efficiency: Evidence from a global perspective. Rev 77, 101897. doi:10.1016/j.chieco.2022.101897

Liu, G., Pang, L., and Kong, D. (2017). Effects of human capital on the relationship between export and firm innovation. Chin. Manag. Stu. 11 (2), 322–345. doi:10.1108/CMS-01-2017-0020

Liu, S., and Yang, X. (2021). Human capital externalities or consumption spillovers? The effect of high-skill human capital across low-skill labor markets. Reg. Sci. Urban Econ. 87, 103620. doi:10.1016/j.regsciurbeco.2020.103620

Liu, Y., Jin, D., Liu, Y., and Wan, Q. (2022). Digital finance, corporate financialization and enterprise operating performance: An empirical research based on Chinese A-share non-financial enterprises. Electron. Commer. Res. (Avaliable online: 04 September 2022). doi:10.1007/s10660-022-09606-z

Long, R., Cui, W., and Li, Q. (2017). The evolution and effect evaluation of photovoltaic industry policy in China. Sustainability 9 (12), 2147. doi:10.3390/su9122147

Luan, R., and Lin, B. (2022). Positive or negative? Study on the impact of government subsidy on the business performance of China's solar photovoltaic industry. Renew. Energy. 189, 1145–1153. doi:10.1016/j.renene.2022.03.082

MacLachlan, I., and Gong, Y. (2022). China's new age floating population: Talent workers and drifting elders. Cities 131, 103960. doi:10.1016/j.cities.2022.103960

McGuirk, H., Lenihan, H., and Hart, M. (2015). Measuring the impact of innovative human capital on small firms’ propensity to innovate. Res. Policy. 44 (4), 965–976. doi:10.1016/j.respol.2014.11.008

Menéndez Blanco, J. M., and Montes-Botella, J.-L. (2017). Exploring nurtured company resilience through human capital and human resource development: Findings from Spanish manufacturing companies. Int. J. Manpow. 38 (5), 661–674. doi:10.1108/IJM-11-2015-0196

Mohammadi, A., Broström, A., and Franzoni, C. (2017). Workforce composition and innovation: How diversity in employees’ ethnic and educational backgrounds facilitates firm-level innovativeness. J. Prod. Innov. Manag. 34, 406–426. doi:10.1111/jpim.12388

Park, S., and Park, I. (2021). The value-added creation effect of industry position in global value chains: Implications for asia-pacific economies. Asian-Pacific Econ. Lit. 35 (2), 95–122. doi:10.1111/apel.12329

Peng, C. H., Wu, L. L., Wei, C. P., and Chang, C. M. (2022). Intrafirm network structure and firm innovation performance: The moderating role of environmental uncertainty. IEEE Trans. Eng. Manage. 69 (4), 1173–1184. doi:10.1109/TEM.2020.2973456

Piening, E. P., Baluch, A. M., and Salge, T. O. (2013). The relationship between employees’ perceptions of human resource systems and organizational performance: Examining mediating mechanisms and temporal dynamics. J. Appl. Psychol. 98 (6), 926–947. doi:10.1037/a0033925

Rauch, A., Frese, M., and Utsch, A. (2005). Effects of human capital and long–term human resources development and utilization on employment growth of small–scale businesses: A causal analysis. Entrep. Theory Pract. 29 (6), 681–698. doi:10.1111/j.1540-6520.2005.00103.x

Ren, S., and Song, Z. (2021). Intellectual capital and firm innovation: Incentive effect and selection effect. Appl. Econ. Lett. 28 (7), 617–623. doi:10.1080/13504851.2020.1767281

Saether, E. A. (2019). Motivational antecedents to high-tech R&D employees' innovative work behavior: Self-determined motivation, person-organization fit, organization support of creativity, and pay justice. Int. J. Hum. Resour. Manag. 30 (2), 100350. doi:10.1016/j.hitech.2019.100350

Salimi, M., and Della Torre, E. (2022). Pay incentives, human capital and firm innovation in smaller firms. Int.Small Bus. J. 40 (4), 507–530. doi:10.1177/02662426211043237

Sanders, K., Jorgensen, F., Shipton, H., Van Rossenberg, Y., Cunha, R., Li, X., et al. (2018). Performance-based rewards and innovative behaviors. Hum. Resour. Manage. 57 (6), 1455–1468. doi:10.1002/hrm.21918

Shao, Y., and Chen, Z. (2022). Can government subsidies promote the green technology innovation transformation? Evidence from Chinese listed companies. Econ. An. Policy. 74, 716–727. doi:10.1016/j.eap.2022.03.020

Shi, X., Chen, Y., Xia, M., and Zhang, Y. (2022). Effects of the talent war on urban innovation in China: A difference-in-differences analysis. Land 11, 1485. doi:10.3390/land11091485

Shubbak, M. H. (2019). The technological system of production and innovation: The case of photovoltaic technology in China. Res. Pol. 48 (4), 993–1015. doi:10.1016/j.respol.2018.10.003

Sierra-Morán, J., Cabeza-García, L., and González-Álvarez, N. (2022). Independent directors and firm innovation: The moderating role of gender and nationality diversity. Eur. J. Innov. Manage. (Avaliable online: 12 July 2022). doi:10.1108/EJIM-12-2021-0621

Söderblom, A., Samuelsson, M., Wiklund, J., and Sandberg, R. (2015). Inside the black box of outcome additionality: Effects of early-stage government subsidies on resource accumulation and new venture performance. Res. Policy. 44 (8), 1501–1512. doi:10.1016/j.respol.2015.05.009

Song, M., Pan, X., Pan, X., and Jiao, Z. (2019). Influence of basic research investment on corporate performance: Exploring the moderating effect of human capital structure. Manage. Decis. 57 (8), 1839–1856. doi:10.1108/MD-06-2018-0708

Stiglitz, J. E. (2015). Leaders and followers: Perspectives on the nordic model and the economics of innovation. J. Public. Econ. 127, 3–16. doi:10.1016/j.jpubeco.2014.09.005

Sun, H., Awan, R. U., Nawaz, M. A., Mohsin, M., Rasheed, A. K., and Iqbal, N. (2021). Assessing the socio-economic viability of solar commercialization and electrification in south Asian countries. Environ. Dev. Sustain. 23, 9875–9897. doi:10.1007/s10668-020-01038-9

Sun, X., Li, H., and Ghosal, V. (2020). Firm-level human capital and innovation: Evidence from China. China Econ. Rev. 59, 101388. doi:10.1016/j.chieco.2019.101388

Tang, T., Zhang, S., and Peng, J. (2021). The value of marketing innovation: Market-driven versus market-driving. J. Bus. Res. 126, 88–98. doi:10.1016/j.jbusres.2020.12.067

Teixeira, A. A., and Queirós, A. S. (2016). Economic growth, human capital and structural change: A dynamic panel data analysis. Res. Policy. 45 (8), 1636–1648. doi:10.1016/j.respol.2016.04.006

Wang, F., Li, Y., and Sun, J. (2020). The transformation effect of R&D subsidies on firm performance: An empirical study based on signal financing and innovation incentives. Chin. Manag. St. 14 (2), 373–390. doi:10.1108/CMS-02-2019-0045

Wang, H., Zheng, S., Zhang, Y., and Zhang, K. (2016). Analysis of the policy effects of downstream Feed-In Tariff on China’s solar photovoltaic industry. Energy Pol. 95, 479–488. doi:10.1016/j.enpol.2016.03.026

Wang, L., Kong, D., and Zhang, J. (2021). Does the political promotion of local officials impede corporate innovation? Emerg. Mark. Financ. Tr. 57 (4), 1159–1181. doi:10.1080/1540496X.2019.1613223

Wang, L., Xue, Y., Chang, M., and Xie, C. (2020). Macroeconomic determinants of high-tech migration in China: The case of yangtze river delta urban agglomeration. Cities 107, 102888. doi:10.1016/j.cities.2020.102888

Wang, M., Xu, J., Zhao, S., and Bian, H. (2022). Redefining Chinese talent management in a new context: A talent value theory perspective. Asia Pac. J. Hum. Resou. 60 (2), 219–251. doi:10.1111/1744-7941.12323

Wang, Q., Jiang, H., Zhang, T., Li, J., Zhang, H., Wu, D., et al. (2022). Analysis of development status and problems of China’s PV industry in the first half of 2022. Environ. Sci. Pollut. Res. 10, 5–12. doi:10.19911/j.1003-0417.tyn20220829.a

Wei, T., and Clegg, J. (2017). Exploring sources of value destruction in international acquisitions: A synthesized theoretical lens. Int. Bus. Rev. 26 (5), 927–941. doi:10.1016/j.ibusrev.2017.03.002

Wen, D., Gao, W., Qian, F., Gu, Q., and Ren, J. (2021). Development of solar photovoltaic industry and market in China, Germany, Japan and the United States of America using incentive policies. Energy explor. Exploit. 39 (5), 1429–1456. doi:10.1177/0144598720979256

Wen, H., and Lee, C. C. (2020). Impact of fiscal decentralization on firm environmental performance: Evidence from a county-level fiscal reform in China. Environ. Sci. Pollut. Res. 27 (29), 36147–36159. doi:10.1007/s11356-020-09663-7

Wu, A. (2017). The signal effect of government R&D subsidies in China: Does ownership matter? Technol. Forecast. Soc. Chang. 117, 339–345. doi:10.1016/j.techfore.2016.08.033

Wu, T., Yang, S., and Tan, J. (2020). Impacts of government R&D subsidies on venture capital and renewable energy investment--an empirical study in China. Resour. Pol. 68, 101715. doi:10.1016/j.resourpol.2020.101715

Xiong, Y., and Yang, X. (2016). Government subsidies for the Chinese photovoltaic industry. Energy Pol. 99, 111–119. doi:10.1016/j.enpol.2016.09.013

Xu, X., Cui, X., Chen, X., and Zhou, Y. (2022). Impact of government subsidies on the innovation performance of the photovoltaic industry: Based on the moderating effect of carbon trading prices. Energy Policy 170, 113216. doi:10.1016/j.enpol.2022.113216

Xu, Z., Meng, L., He, D., Shi, X., and Chen, K. (2022). Government Support's signaling effect on credit financing for new-energy enterprises. Energy Pol. 164, 112921. doi:10.1016/j.enpol.2022.112921

Yang, H., Phelps, C., and Steensma, H. K. (2010). Learning from what others have learned from you: The effects of knowledge spillovers on originating firms. Acad. Manag. J. 53 (2), 371–389. doi:10.5465/amj.2010.49389018

Yang, J., Jiang, Y., Chen, H., and Gan, S. (2022). Digital finance and Chinese corporate labor investment efficiency: The perspective of financing constraints and human capital structure. Front. Psychol. 13, 962806. doi:10.3389/fpsyg.2022.962806

Yi, R., Wang, H., Lyu, B., and Xia, Q. (2021). Does venture capital help to promote open innovation practice? Evidence from China. Eur. J. Innov. Manage. (Avaliable online: 14 June 2021). doi:10.1108/EJIM-03-2021-0161

Yu, H. J. J., Popiolek, N., and Geoffron, P. (2016). Solar photovoltaic energy policy and globalization: Amultiperspective approach with case studies of Germany, Japan, and China. Prog. Photovoltaics Res. Appl. 24 (4), 458–476. doi:10.1002/pip.2560

Yue, M. L., Li, R. N., Ou, G. Y., Wu, X., and Ma, T. C. (2020). An exploration on the flow of leading research talents in China: From the perspective of distinguished young scholars. Scientometrics 125 (2), 1559–1574. doi:10.1007/s11192-020-03562-x

Zhang, C., and Guan, J. (2022). Government sponsorship and innovation: The gazelle plan in China's zhongguancun science Park. R&D Manage 53, 197–223. Avaliable online: 27 September 2022). doi:10.1111/radm.12557

Zhang, G., Wang, X., and Duan, H. (2019). How does the collaboration with dominant R&D performers impact new R&D employees' innovation performance in different cultural contexts? A comparative study of American and Chinese large firms. Technol. Forecast. Soc. Chang. 148, 119728. doi:10.1016/j.techfore.2019.119728

Zhang, H., Deng, T., Wang, M., and Chen, X. (2019). Content analysis of talent policy on promoting sustainable development of talent: Taking Sichuan Province as an example. Sustainability 11 (9), 2508. doi:10.3390/su11092508

Zhang, J. (2020). The incentive effect of government subsidies on innovation of Chinese enterprises-an explanation based on U-shaped relationship. Econ. Perspect. 6 (6), 91–108.