- School of Finance, Tonglong University, Tongling, Anhui, China

With the implementation of the carbon-neutral goal, an evolutionary game of carbon decision behavior was derived from the difference between government carbon mitigation and enterprises’ performance growth. This paper constructed a double-performance (DP) objective function of environmental performance and corporate performance. Four carbon decision factors, namely, carbon emission rights, carbon tax, green innovation, and green subsidy, were added separately into the DP model to search for the equilibrium point using the Stackelberg game. The research shows the following: (ⅰ) the price effect of carbon emission rights can restrain excess carbon emission of enterprises to a certain extent; (ⅱ) the reverse effect of a carbon tax can force enterprises to achieve the carbon mitigation goal through green innovation; (ⅲ) the reinforcement effect of green innovation can strengthen the promotion of environmental performance but accelerate the decline of corporate performance; and (ⅳ) the incentive effect of green subsidy can make corporate performance reach the inflection point ahead of time and realize DP synergistic growth. The evolutionary game between the government and enterprises results in the fluctuation change that causes DP to rise first, then decrease, and finally increase. Also, DP can be developed in a synergistic way under collaborative governance for its consistency of carbon decision behavior.

Introduction

As the carbon-neutral goal has been put forward by the government in China, many enterprises have implemented green innovation strategies to solve the negative impact of carbon emissions on the environment by the pressure from the low-carbon regulation. Meanwhile, scholars explored some effective ways of low-carbon regulatory instruments, such as carbon emission rights, carbon tax, green innovation, and green subsidies, to help enterprises to solve the negative externalities of carbon emissions. However, there is no consensus on the coordination of carbon mitigation and performance enhancement. It is probably because the mechanism of contract coordination with incentive constraints between the government and enterprises has not been established.

Since the Paris Agreement on global warming in 2015, a carbon mitigation system has become a global consensus based on carbon emission rights. Following the world trend of a community with a shared future for mankind, the China’s carbon emission trading market gradually formed from a regional pilot system into a domestic carbon emissions trading system (ETS). By 27 September 2022, the carbon emission allowances (CEAs) have traded more than 195 million tons, with a cumulative turnover of 8.559 billion yuan in the Shanghai Environment and Energy Exchange. Even though the carbon emission trading market can effectively restrain the carbon decision behavior of enterprises in the pilot area to mitigate their carbon emissions, there is also a spillover effect, leading to incoordination of carbon mitigation in the adjacent areas. As the current structural contradiction in energy consumption leads to increased carbon emissions, some scholars call for collaborative development patterns between emissions trading schemes and green innovation policies (Cheng et al., 2016; Adkin, 2019). It is important to set up a hybrid policy between the carbon emissions trading market and the carbon tax mechanism.

The research by Zhang et al. (2022) proved that a hybrid carbon policy can help change the incoordination to reach a carbon emissions peak, which will lower the economic cost of enterprises than the effect of pure carbon ETS. That is, carbon emission rights should be combined with the carbon tax policy to consider whether it can achieve a more desired effect. Meanwhile, Nie et al. (2022) found that carbon taxes seem more efficient than emission taxes to reduce energy inputs, outputs, profits, and emissions if enterprise information conditions are incomplete. Then, the “carbon peak before 2030 action plan” proposed a tax policy system for green and low-carbon development of enterprises. However, the research by Luo et al. (2022) also showed that a carbon tax can effectively promote manufacturers to invest in carbon reduction technology or remanufacture to reduce carbon emissions, but it may demotivate manufacturers to remanufacture if a reasonable carbon tax is not designed because the unreasonable carbon tax will make the enterprises pay more cost and also increase the system cost of the tax. It is necessary to further explore the effect of the carbon tax and carbon emission right on economic growth and environmental protection.

Under the external pressure of low-carbon regulation, enterprises should do their utmost to reduce carbon emissions. Even if the government takes the form of carbon emissions rights, carbon tax, carbon subsidy, and constantly promoting green innovation in enterprises, there is still a question of how can their goals be agreed upon to achieve a new equilibrium in the process of gaming the outcome of carbon decisions between the government and enterprises. This is key current research for enterprises to adapt to the low-carbon policy. Therefore, this paper discussed the effects of four factors on DP based on the evolutionary game of carbon decision behavior between the government and enterprises, attempting to improve the following aspects: on the one hand, the DP model was constructed to analyze the impact mechanism of carbon decision factors; on the other hand, an equilibrium point and a mutual influence mechanism of the carbon decision behavior were revealed through the influence analysis of carbon decision factors on DP.

The contributions of this paper are mainly embodied in the following three aspects: 1) in the previous literature, the effects of carbon emission rights, carbon tax, and carbon subsidy have been described separately, but how they work in practice has not been explained, especially lacking the link explanation for the carbon decision-making game between the government and enterprises. We put them into the DP model one by one to study their synergy effects on environmental performance and corporate performance. 2) The environmental performance should not be expanded indefinitely at the expense of corporate performance under the carbon-neutral goal. We tried to find an equilibrium point between the government and enterprises to realize double-performance synergy in the process of the carbon decision-making game. 3) We also used MATLAB to conduct numerical analysis on the parameter values to demonstrate the effects of low-carbon regulatory instruments on green innovation in enterprises. From the two aspects of green innovation pioneer and green innovation follower, we analyzed the effects of low-carbon regulatory instruments on green innovation in enterprises after the government’s carbon decision-making. The effect of carbon decision behavior selection on enterprises is discussed, and the corresponding countermeasures are put forward.

Literature review and assumptions

Literature review of carbon decision between the government and enterprises

Pigou proposed an environmental tax to solve the problem of negative externalities. Based on this, the carbon tax was used to achieve the binding target of carbon mitigation by increasing the environmental cost of polluting enterprises. Current scholars hold two views of the carbon tax’s effect on reducing emissions. One is that the carbon tax can reduce corporate emissions. Jia and Lin. (2020) found that the carbon emissions of energy enterprises will be cut down if the government proposes a carbon tax policy. In addition, the research by Pretis (2022) also showed that the carbon tax has reduced transportation emissions in North America but has not “” led to reductions in aggregate CO2 emissions yet. Then, there is another view: the carbon tax will bring in some negative externalities itself, although it can restrain corporate emissions to a certain extent. Yu et al. (2020) and Tian et al. (2020) suggested that the higher carbon tax rate will cause negative effects on economic development. The research by Xu and Wei. (2022) compared the introduction of a carbon tax that can curb traditional energy consumption and emissions significantly, which helps to mitigate the negative environmental impact of China’s value-added tax (VAT) reform but negative to promote economic growth. In other words, with the adoption of a carbon tax policy, even if companies are forced to reduce carbon emissions, there may also be an adverse effect on the economic development of enterprises in practice. To solve the uncoordinated problem between carbon mitigation and the economic performance of enterprises, the ESG (environmental, social, and governance) strategy has been put forward, which suggests that a coordinated mechanism of carbon emission rights and carbon tax should be established to encourage clean energy development by subsidizing R&D in the fossil fuel industry with tax incentives or tax rebates (Fragkos et al., 2017; Su et al., 2021; Zhao et al., 2021). Yang et al. (2021) found that carbon emissions are cut more rapidly when the carbon tax grows faster. That is, the carbon tax could stimulate green investment in the electricity system and affect carbon mitigation, but there is overall a greater tendency for agents to go bankrupt when the tax grows faster. So, the dual role of the carbon tax policy makes it necessary to consider more effective ways to improve the negative externalities of corporate carbon emissions.

However, Coase believed that the Pigou tax cannot completely solve the negative externality problem. He proposed the property rights theory to solve the externality by clearly defining property rights, which provides theoretical guidance for the construction of a carbon emission trading market. The present research found that the carbon emission trading mechanism is helpful to stimulate enterprises’ green investment, especially in promoting the rapid development of low-carbon industries and easing the financial constraints of emerging enterprises in the high-carbon emission industries (Zhao et al., 2021; Wang and Zhang, 2022). In addition, financial policy synergies between emission trading instruments and carbon mitigation support instruments can also contribute to the green innovation of enterprises (Locatelli et al., 2016; Krkkinen et al., 2020). Similar studies have shown that carbon emissions trading instruments have significantly contributed to the incentive aspect of green innovation, which is largely consistent with the “Porter hypothesis” (Goldblatt, 2010; Hong et al., 2022). Furthermore, Shi et al. (2018) pointed out that scholars should focus on the “Porter hypothesis” effects to study the impact of carbon emissions rights trading. However, the research by Dai et al. (2018) showed that the carbon emissions trading rights have not produced a “Porter effect” on the productivity of manufacturing enterprises in China. Yang et al. (2022) proved that the generation plan of the units can coordinate with the carbon quota level and provide a trading strategy for the power generation enterprises. Scholars also argued that the unified carbon emissions trading market cannot be achieved without the tough measures of government regulation (Stepp et al., 2009; Chen and Lin, 2021; Burke and Gambhir, 2022).

Under the interactive influence of carbon emission rights and carbon tax, enterprises have to implement a green innovation strategy to improve their carbon footprint. Owen et al. (2018) concluded that a finance ecosystem approach is required to ensure complementary forms of finance for low-carbon investment. So, scholars have reached a unanimous conclusion that government regulation can stimulate green innovation of enterprises to gain better environmental performance (Wang, 2011); in turn, it can also increase energy efficiency and carbon mitigation through expanding technological innovation (Ren et al., 2022). However, Chen et al. (2021) found that the “weak” Porter hypothesis has not been realized in the current carbon emission trading market of China, whose pilot policy has an evident lagging effect on restraining the green innovation of enterprises. Meanwhile, as an institutional incentive, the green subsidy is important to stimulate the green development of enterprises through fiscal policy, which is used to increase the green innovation level (Hanlon, 2019). Previous research shows that green subsidies have a stronger positive impact on overall investment efficiency and purely technical efficiency than carbon tax (Zhao et al., 2021). Specifically, if the green subsidy is higher, firms will adopt a smaller scale of investment and accelerate the investment rate; if the green subsidy is lower, the green innovation investment will bring a higher welfare effect (Nagy et al., 2021). The research on the impact of the carbon tax and carbon emission trading market on wind power in China by Sun et al. (2022) showed that investors will vote for wind farms under the scenario of carbon trading and subsidy policy coordination, and they will also pay the funds in coal-fired power generation under the scenario of the carbon tax and subsidy coordination. The result is clear that carbon tax, government subsidy, and green innovation have different effects on green innovation investment (Chen and Ma, 2021).

Therefore, this study established an evolutionary game model of carbon decision-making between enterprises and governments using the impact factors of carbon emission rights, carbon tax, green innovation, and green subsidies to analyze whether there are two inflection points of the Porter hypothesis and to explore the equilibrium point position in the process of carbon decision-making.

Assumptions of carbon decision between the government and enterprises

The pursuit of interest maximization is a premise for the government and enterprises to separately make their carbon decision behavior. To simulate the evolutionary game like the real situation as far as possible, this paper proposed the following assumptions:

(i) In the carbon quota allocation and emissions trading market, the price of carbon quota is less than the profit of carbon emissions. This will ensure that enterprises can still make profits based on paying for the carbon emission rights and limit the arbitrage by selling carbon quotas (Jiang et al., 2016; Yu X et al., 2022). If the transaction cost is higher than the carbon price, no region will have the incentive to reduce carbon emissions through green innovation (Chen et al., 2019).

(ii) The government gives subsidies for enterprises’ green innovation rather than carbon emissions trading (Li et al., 2021). Such subsidies help to raise green innovation to reduce carbon emissions and enable them to trade in more spare carbon allowances. As a result, the subsidy for green innovation was set for carbon mitigation (Yu Y et al., 2022).

(iii) The government expects enterprises to pay a higher environmental cost for carbon quotas to maximize the carbon-neutral goal (Chen et al., 2019). The carbon tax compels enterprises to minimize their carbon emissions; similarly, green subsidies stimulate enterprises to maximize their carbon mitigation (Li et al., 2021). So, the environmental performance objective function can be constructed according to the carbon decision objective.

(iv) Under the influences of low-carbon regulations, enterprises are generally divided into green innovation pioneers or green innovation followers (Ding and Hu, 2021). Then, the Stackelberg game was used to analyze the difference in carbon decision behavior and its effect on DP.

Theoretical models

Game order of carbon decision behavior

Tong et al. (2022) found that carbon trading market prices and customers’ low-carbon preferences are key factors influencing the retail price, total carbon emissions, and social welfare. So, the carbon quotas allocation mechanism was set up for the carbon mitigation goal based on the carbon emission rights to form a double market: a primary allocation market of carbon quotas dominated by the government and a secondary trading market of carbon quotas dominated by enterprises. On this basis, we analyzed the evolutionary game process between them through the carbon quota price and benefit distribution mechanism to explain the effects of carbon decision factors on DP.

There are four factors: carbon emission rights, carbon tax, green innovation, and green subsidy, which were added one by one into the DP model to verify the different goal choices, evolution path, and influences of carbon decision behavior between the government and enterprises.

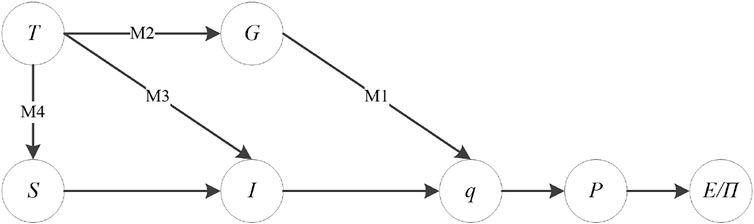

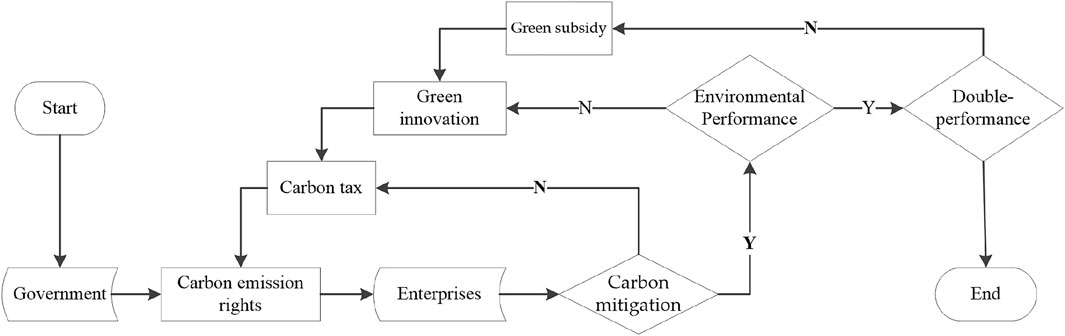

Because the goal of carbon mitigation for the government and the target of performance growth for enterprises are different, their carbon decision behavior becomes evolutionary games and forms different decision orders, as shown in Figure 1, which are given as follows:

(i) According to the carbon mitigation rhythm of the carbon-neutral goal and a maximizing principle of environmental performance, the government first formulates a primary allocation of carbon quota and promulgates an incentive-restraint scheme of carbon mitigation.

(ii) An enterprise perceives the requirement of low-carbon regulation and decides on carbon emission, carbon mitigation, and green innovation according to its profit maximization target.

(iii) If enterprises are short of carbon quotas, they should actively seek carbon quotas from the carbon emissions trading market, while surplus companies would sell their remaining carbon quotas to the market to search for more profits.

(iv) Then, the implementation of carbon mitigation policies and the results of enterprises’ carbon decision behavior should be assessed by the government. The government should impose an appropriate carbon tax on the excess part of carbon emissions and also give a green subsidy to the excess part of carbon mitigation to optimize the incentive-restraint mechanism of carbon decision behavior.

(v) After several evolutionary games between the government and enterprises, they nearly reach the carbon-neutral goal, which makes carbon mitigation equal to carbon emission. Then, it will help them promote a win–win path of the carbon decision choice.

FIGURE 1. Carbon decision behavior for the evolutionary game between the government and enterprises.

Critical factors of carbon decision behavior

Based on the aforementioned theoretical analysis, considering the research conclusions of Fan et al. (2016), Song et al. (2019), and Li et al. (2022), the government and enterprises should follow their own maximizing goals of carbon decision behavior. The government expects to reduce carbon emissions through the increasing costs of enterprises for environmental performance, while enterprises want maximum profits for corporate performance to cut down their total costs through many more production with carbon emissions. In this case, we need to assume the following conditions: all carbon quotas in the primary market are allocated for enterprises to meet the government’s carbon emission targets; all carbon quota selling and buying in the secondary market should be zero; carbon emissions, carbon mitigation, and carbon quotas are matched with each other, including the certification of carbon mitigation which has also been calculated in the carbon emissions trading market. Then, the DP model was constructed. Four variables were added to the DP model to describe the evolutionary game process of carbon decision behavior between the government and enterprises to reveal the effects of low-carbon regulations.

The present research shows that the government expects enterprises to improve their profitability based on paying for carbon emission rights. So, we first built a carbon emission rights model M1; then, carbon tax (T) was added to the model M2 = M1+T, and enterprises’ green innovation (I) was promoted to M3 = M2+I; finally, the model M4 = M3+S was obtained, when the enterprise was given green subsidy (S).

In addition, the enterprises were divided into green innovation pioneers (i1) and green innovation followers (i2) to discuss the difference in sustainable competitive advantage caused by firm heterogeneity. Also, the effects of the low-carbon competing strategy on the differentiation of carbon decision behavior were analyzed using the Stackelberg game.

To simulate the carbon decision behavior of the government and enterprises, the definition of decision variables and parameters of their carbon decision-making factors was set as shown in Table 1.

Carbon emission rights model

In the carbon emission trading market, both the government and enterprises regard carbon quotas as a general commodity. They should follow the law of price and the demand of exchange. The allocation criteria of carbon quota and decision variables of carbon emission are affected by market resource allocation. Thus, the price demand function of the government-dominated carbon quota in the primary allocation market can be set to

where E(G) is the environmental performance, which is the product quantity of carbon quota G and can be sold with its unit price PG by the government. Based on the derivatives trading market of carbon emission rights, the government expects maximized environmental performance through carbon quota allocation to control the carbon emissions of enterprises.

Π(q) is the corporate performance, which is composed of three parts:

(i) The profit

(ii) Under the fixed carbon quota, enterprises take measures to achieve a certain amount of carbon mitigation. It will form a part of carbon quota savings. They will put this part of the savings into the secondary trading market to obtain additional revenue, which is expressed with

(iii) When the carbon quota consumed in production is not enough, it is necessary to buy some quotas from the secondary trading market for enterprises. In addition, the environmental cost

When enterprises perceive the operation of the carbon emission rights from the emissions trading market, they will make strategic choices of green innovation pioneers or green innovation followers. The government will assign different carbon quotas to the two types of enterprises according to their carbon emissions and value scale. Therefore, the total amount of the carbon quotas shall be equal to the sum of the carbon quotas obtained by two types of enterprises, that is,

Carbon tax model

As the ETS is not a complete market, it is difficult to trigger the intrinsic motivation of enterprises to reduce carbon emissions by the price mechanism alone. Most enterprises often wait for the green innovation pioneers to achieve carbon mitigation because of the high cost of green innovation and then follow the green innovation strategy to minimize the opportunity costs. At this time, the government implements a carbon tax compulsory measure to increase the environmental cost to make enterprise profitability drop. It will force them to efficiently reduce their carbon emissions. Thus, it has a significant influence on enterprises’ decisions on carbon quotas and carbon mitigation. In this process, there are generally two different models of carbon quota pricing: on the one hand, the price of carbon quota initially allocated by the government is equal to

In formula (2), the environmental performance E(G) was added to the carbon tax

At the same time, the corporate performance Π(q) also includes the carbon tax

Green innovation model

As a carbon tax is levied on the excess part of carbon emissions of enterprises, their environmental cost increases, and corporate performance drops. It forced them to reconsider carbon mitigation. In the long run, enterprises must choose a green innovation strategy. Generally speaking, raising green innovation (I) while keeping the supply of carbon quota and carbon tax unchanged can also stimulate the willingness of buying the carbon quota. So, the price demand function of the carbon quota is set to

In formula (3), the environmental performance has not changed substantially compared with the model M2. However, after enterprises perceived the carbon tax, they realized that the carbon-neutral goal is a long-term rather than campaign-style environmental protection, and a deep understanding of green development is the long-term strategy. At this point, green innovation (I) is added to the corporate performance objective function

From the input–output view, green innovation will inevitably lead to more costs. However, the short-term effect is not necessarily significant, and its impact is limited. Therefore, the profit per unit of carbon emissions is set as an exogenous variable (R), and the green innovation cost is set as a quadratic function to show the characteristics of the law of marginal decline.

Green subsidy model

For enterprises, green innovation is unlikely to be effective in the short term. The continued high input and low output are likely to generate a sense of disgust. This necessitates the government to give enterprises some green innovation compensation. Moreover, punishing without awards also does not conform to the incentive-restriction mechanism. Therefore, the impact of green innovation, carbon tax, carbon quota, and carbon mitigation decision is discussed by adding green subsidy (S) based on model M3. Other factors being equal, the government’s green subsidies will make enterprises less willing to buy a carbon quota, which can stimulate them to buy a carbon quota by lowering the price in the secondary trading market. The price demand function of the carbon quota is set to

In formula (4), the green subsidy variable is added to the environmental performance

Equilibrium analysis of carbon decision behavior

The equilibrium solution of the DP models

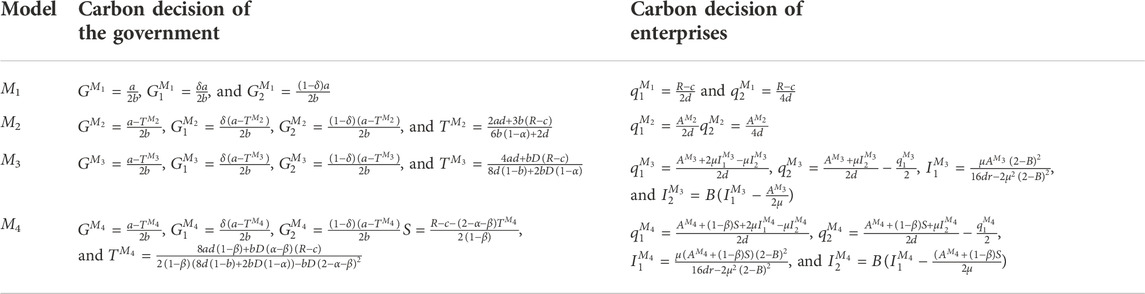

Based on the order of carbon decision behavior in the four models, first, the government determines the intensity and rhythm of carbon quotas, carbon taxes, and green subsidies. Then, enterprises choose the strategies of carbon emission, carbon mitigation, and green innovation when they perceive low-carbon regulation. A different strategy of enterprises leads to different carbon decision behaviors. Then, the government determines the incentive-constraint measures for carbon mitigation. According to the carbon decision behavior of the government and enterprises, we used the Stackelberg game to solve the DP model. By making the first derivative of the carbon decision factor zero, the optimal value of DP can be determined, and the equilibrium solution can be obtained, as shown in Table 2.

where

(i) In M1 and M2,

(ii) In M2, M3, and M4, carbon tax T and carbon quota g are inversely related to green subsidy S. It has been shown that the green subsidy can stimulate the willingness of enterprises to green innovation. Also, it will reduce the amount of carbon tax and carbon quota, thereby promoting carbon mitigation.

(iii) In other words, as the regulatory intensity of carbon tax T, green innovation I, and green subsidy S increase, the carbon mitigation of enterprises shows an increasing trend, which indicates the high effectiveness of low-carbon regulation.

(iv) In M4, there is a co-directional relationship between the green innovation of enterprises and the green subsidy of the government. This indicates that the green subsidy for green innovation results can reverse the green innovation cost of enterprises.

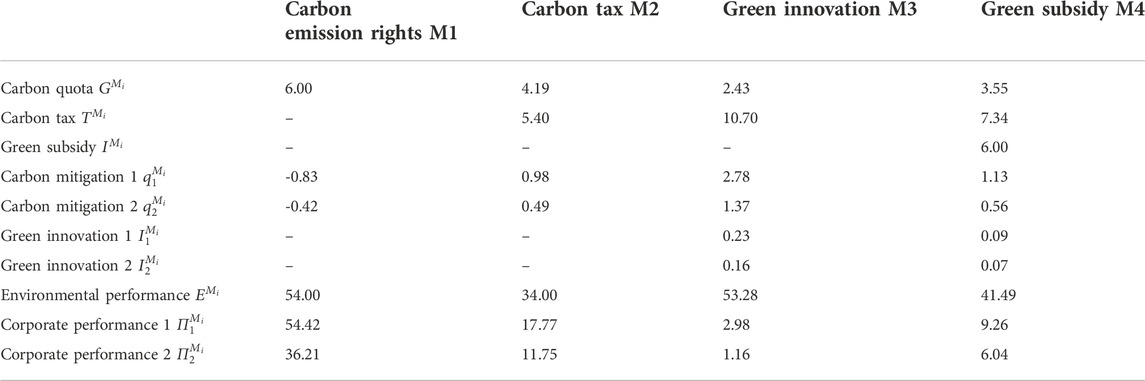

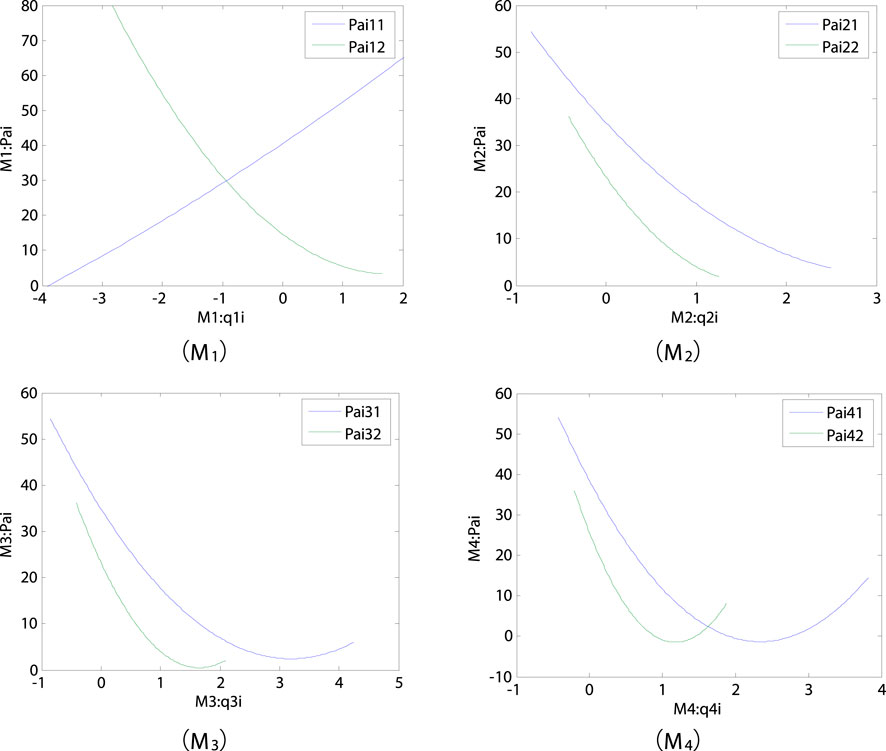

The equilibrium analysis of the DP models

Based on the aforementioned theoretical analysis, we designed four models to obtain the unique equilibrium solution using the Stackelberg game for the carbon decision behavior between the government and enterprises. As there is no real carbon tax in China at present, we used the research methods of Eyland and Zaccour (2014), Hou et al. (2016), and Lin et al. (2021) for the carbon policy reference and used MATLAB to conduct numerical analysis on the parameter values of the four models. Then, we used the method of assigning value codes to analyze the relations of four decision-making factors and their constraints with the DP function to visually show the impact of a carbon tax, green innovation, and green subsidy on the carbon decision behavior between the government and enterprises. So, we assigned value codes to each parameter as follows:

In M1, the two markets of carbon quota mainly involve four parameters: A = 18, B = 1.5, C = 22, and D = 1.2; the primary distribution coefficient of the carbon quota is δ = 0.6; and the profit per unit of carbon emissions is calculated as R = 24. In M2, a carbon tax (T) is introduced, and its effect on the secondary trading market of the carbon quota is calculated as A = 0.2. In M3, green innovation (I) is introduced, and its effect on the secondary trading market of the carbon quota is given as M = 0.4, and the reciprocal value of the green innovation output rate is given as R = 2.5. In M4, green subsidy (S) is introduced, and its effect on the secondary trading market of the carbon quota is calculated as β = 1.2. The aforementioned parameter values are brought into Table 2 to obtain the equilibrium point of DP. Furthermore, the optimal value of DP can be obtained using the Stackelberg game, as shown in Table 3.

From Table 3, we can see that the equilibrium point of DP for each decision factor is fluctuant:

(i) Comparing M2 with M1, we can see that the government has effectively reduced the carbon quota and carbon emission of enterprises by adopting carbon tax regulations. This shows that under the punishment of carbon tax, enterprises consume carbon quotas and produce carbon emissions more carefully, resulting in a large decline in corporate performance. Therefore, the government cannot simply impose a carbon tax on the carbon emissions of enterprises to improve environmental performance, which will only lead to a decline in corporate performance without environmental performance improvement. The carbon tax policy can stimulate enterprises to carbon mitigation based on environmental costs to guide them to carry out green innovation activities to force carbon mitigation. Therefore, a carbon tax is a prerequisite for enterprises to reduce carbon emissions.

(ii) Comparing M3 with M2, we know that green innovation can not only reduce carbon emissions but also promote environmental performance. At the same time, green innovation raises the environmental cost and weakens the enterprise’s profitability to a certain extent, which causes loss of economic resilience. The government tries to weaken corporate performance by increasing the environmental cost and then stimulates the willingness of enterprise’s green innovation, which cannot satisfy corporate performance and environmental performance coordinated growth. It has not had a sustainable development request yet. There is also a need for governments to give subsidies to enterprises to encourage sustainable green innovation activities to cover the short-term costs.

(iii) Comparing M4 with M3, we know that the government can improve the efficiency of using carbon quotas to reduce the negative effect of the carbon tax and to increase the quantity of carbon mitigation. This shows that enterprises gradually restore the endogenous power of carbon quota consumption and promote corporate performance based on the incentive-restraint mechanism of carbon mitigation, that is, to achieve coordinated growth of corporate performance and environmental performance.

(iv) In the evolutionary game process from M1 to M4, each additional carbon decision factor will affect the size of the equilibrium point of DP. This indicates that the effects of the carbon tax, green innovation, and green subsidy will shift the equilibrium point and even change the orientation and concavity of DP.

The impact path of the DP models

(i) The conduction path of carbon decision factors in the DP model is selected as variables, the effects of different carbon decision variables on DP are analyzed, and the conduction path of carbon decision factors is investigated.

As we can see from Table 2, the equilibrium solution of M1 is finally determined solely by carbon quota and carbon mitigation. So these two variables are taken as the starting point of the conduction path of carbon decision factors, and the equilibrium solutions of M2, M3, and M4 are uniquely determined by the carbon tax. The carbon tax is taken as the starting point of the carbon decision factors. At the same time, considering the consistency of the four decision factors and the carbon reduction amount being determined by the carbon tax only, carbon mitigation is used as the independent variable to reveal the different effects of the enterprise’s carbon reduction behavior on DP. The transmission paths of the effects of carbon decision factors are shown in Figure 2.

(ii) The impact path of carbon mitigation. In Table 3, carbon quota

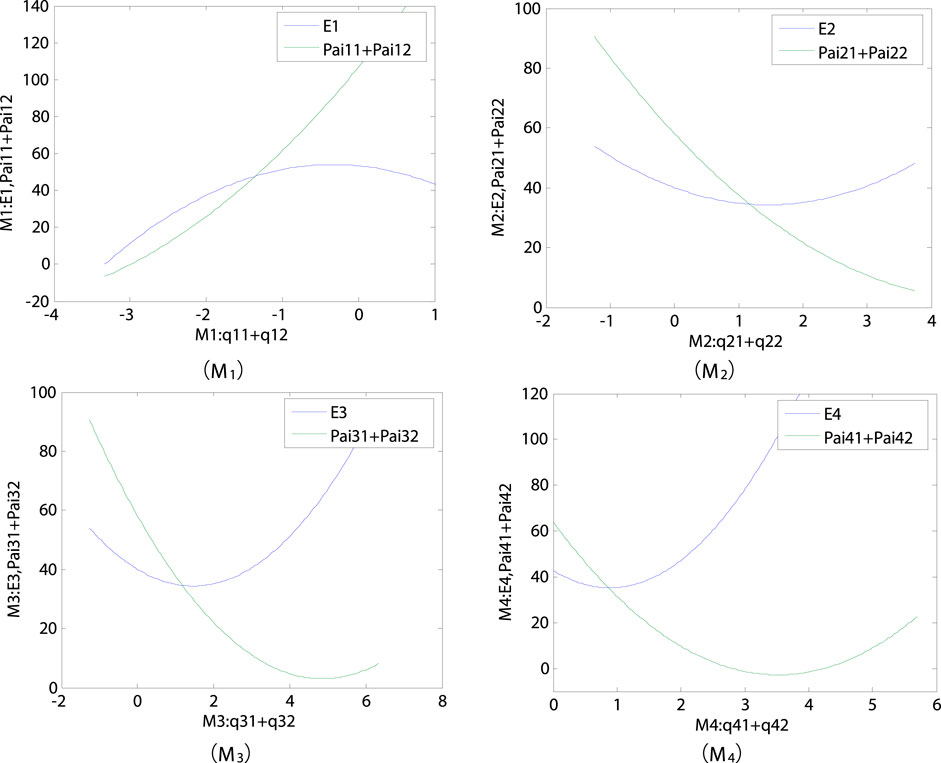

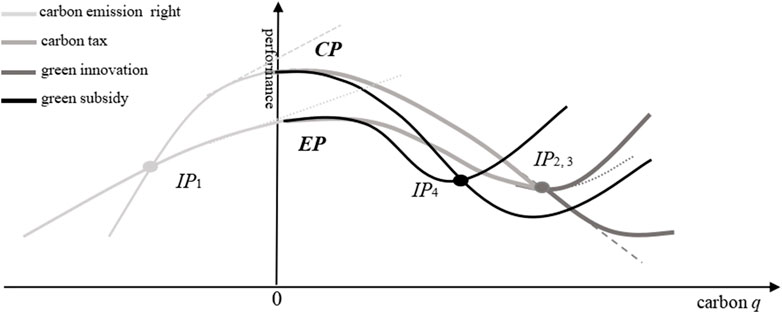

Figure 3 reports the DP cure trends as carbon mitigation increases (

(iii) We take carbon mitigation as an independent variable and corporate performance as a dependent variable to realize the different influences of firm heterogeneity on DP, which is described in Figure 4. We also find some meaningful conclusions as follows: ① in the carbon emission right model (M1), the increase in carbon tax leads to a decrease in corporate performance. This shows that the carbon tax has a great effect on the performance of firm 2 at the same level of carbon mitigation. ② Green innovation makes the inflection point of corporate performance appear to help enterprises adapt to the pressure of external carbon mitigation. They will generate internal motivation for the synergies of environmental performance and corporate performance. That would present the performance resilience rebound tendency. ③ The incentive effect of green subsidy makes the inflection point move to the left at the same level of carbon mitigation as the corporate performance of both firm 1 and firm 2 improved.

Discussion

With the carbon mitigation increase, DP shows different changes in the sectors through the optimization of carbon decision behavior between the government and enterprises. The inflection point of the DP curve is the equilibrium point of carbon decision behavior. The economic logic of this point means that the trend of the growth curve will change after the inflection point, as shown in Figure 5.

In Figure 5, EP refers to the environmental performance curve, and CP refers to the corporate performance curve. DP intersects three inflection points, namely, IP1, IP2, and IP4. In other words, the relationship between DP and carbon mitigation is neither a single positive nor negative correlation but a combination of “U” and “inverted U” characteristics, showing an “inverted S” trend. It has a distinct stage feature (Ding and Hu, 2021).

Therefore, this paper verified the differential effects of carbon emission rights, carbon tax, green innovation, and green subsidy on the inverted “S” curves of DP. Four effects can be obtained:

(i) The price effect of carbon emission rights. Based on the carbon emission trading market, the equilibrium point of carbon mitigation of the enterprise is negative in resource allocation with the core price of the carbon quota. This shows that enterprises are in the stage of excess carbon emissions and have not completely reversed the traditional high carbon emission production mode. As the price adjustment of carbon emission rights appears in the secondary trading market, the excess part of carbon emission decreases gradually, which promotes the DP curve to be improved and shows a decreasing trend of marginal effect.

(ii) The reverse effect of the carbon tax. After the government imposed carbon tax regulation, the equilibrium point IP2 of enterprise carbon mitigation changed from a negative value to positive value, which means that real carbon mitigation has approached. However, we have noticed that environmental performance has not improved significantly. The main reason is that the government has implemented mandatory carbon mitigation policies to force enterprises to improve the original production model, but more use of regulation approach and short-term or effective reduction of carbon emissions also affect corporate performance, resulting in economic resilience loss. That is to say, the carbon tax stimulates enterprises to reduce environmental costs and promote their carbon mitigation, which will contribute to the improvement of environmental performance. However, at this point, enterprises will face a dilemma between development and green innovation. They have to pay more transaction costs for the development and pay more environmental costs for green innovation. This would not achieve Porter’s efficiency.

(iii) The reinforcement effect of green innovation. The green innovation behavior of enterprises can change the growth trend of the DP curve and make it develop in the direction of expected carbon reduction. When the enterprise carbon mitigation crosses the equilibrium point of IP3, green innovation not only helps to enhance the speed of environmental performance improvement but also helps to slow down the decline of corporate performance. It will make the inflection point of carbon mitigation. However, the unexpected increase in green innovation costs also opens up the gap between corporate performance and environmental performance, resulting in more serious performance bias. In other words, while green innovation can help to improve environmental performance, it cannot guarantee coordinated growth with corporate performance in the evolutionary game of carbon decision behavior between the government and enterprises. If we cannot see the growth momentum of corporate performance for a long time, or if we cannot find the inflection point, will green innovation continue in such a long and huge opportunity cost? Even if it has reached the inflection point, it is easy to lose confidence in enterprises. This necessitates the government to focus on the effectiveness of the green innovation strategy.

(iv) The incentive effect of green subsidies. According to the Porter hypothesis, the impact of environmental regulation on corporate performance has two stages, namely, “compliance cost” and “innovation compensation.” However, at the same time, we should see that these two stages have different effects on enterprises to obtain competitive advantage: on the one hand, green innovation will bring sustainable competitive advantage for enterprises in the long term. The expected benefits will be bigger on the tortuous road but not clear when that will happen; on the other hand, the increased costs of green innovation investments will reduce corporate performance in the short term and affect the immediate sustainable competitive advantage on the contrary. The green subsidy can make the equilibrium point IP3 of carbon mitigation move to the left, which significantly shortens the time of “compliance cost” and enables the enterprise to obtain the result of “innovation compensation” in advance. That is to say, when the enterprise carbon mitigation crosses the equilibrium point IP4, the environmental performance and corporate performance can be increased synergistically.

To sum up, comparing four different carbon decision factors, the carbon mitigation of enterprises starts from the guiding of low-carbon regulation. It is a coercive effect of reverse pressure and is further strengthened in the green innovation stage. Finally, the enterprise obtains a sustainable competitive advantage under the incentive effect of green subsidy. Therefore, green innovation breaks the evolutionary game between the government and enterprises and makes both sides achieve performance breakthroughs.

Conclusion

Under the carbon-neutral goal of the Chinese government, strategic research needs to resolve the contradiction between carbon mitigation and corporate performance for green recovery. In contrary to the previous studies focusing on the effectiveness analysis of low-carbon regulation policy in order to answer the question of the decline of enterprise profitability, this paper discussed the development path of DP. We added four decision factors, namely, carbon emission rights, carbon tax, green innovation, and green subsidy, into the DP model with the incentive-constraint factors. Then, we used the Nash equilibrium and the Stackelberg game to analyze the dynamic equilibrium of carbon decision behavior, revealing the price effect of carbon emission rights, the reverse effect of the carbon tax, the reinforcement effect of green innovation, and the incentive effect of green subsidy. Finally, we verified the relationship between carbon mitigation and DP.

This study found that enterprises are not willing to take the initiative in carbon mitigation for the environmental performance in the emissions trading market mechanism but changing their strategy from the reduced costs of the carbon tax and the increasing benefits of the carbon subsidy. They will decide for choosing the first-action strategy or the after-action strategy according to the profits of carbon mitigation. As green innovation is a necessary way for them to reduce carbon emissions when the government and enterprises have different carbon decision-making goals, enhancing the willingness of enterprises to green innovation and stimulating the internal emission reduction driving mechanism are the fundamental ways of carbon mitigation. However, more attention should be paid to the additional costs for the green innovation pioneers caused by continuous investment. Therefore, the government must give green subsidies to compensate for the resilience of corporate performance and to meet the requirements of coordinated growth of environmental performance.

Comparing the impact of these four decision factors on DP, it was found that carbon emission rights can be used as the underlying structure of the carbon-neutral goal. It can stimulate the willingness of enterprises to green innovation as the starting point and give full play to the role of the carbon tax and green subsidies. It is more important to form a carbon decision-making goal that both sides can agree on to guide the followers to carry out green innovation and implement carbon mitigation to avoid the first-mover disadvantage of green innovation pioneers. So this can build an effective incentive-restraint mechanism for carbon mitigation.

The continuous epidemic has severely damaged corporate performance and brought greater uncertainty to low-carbon regulation. The dual pressure undoubtedly has a very negative impact on corporate performance. If the adjustment of the market rescue policy is not in place, it may further worsen the contradiction between carbon mitigation and economic efficiency. It is not conducive to the coordinated growth of environmental performance and corporate performance. Focusing on the incentive of low-carbon regulation to enterprises’ green innovation and promoting carbon mitigation activities, the following countermeasures are put forward: first, we should make full use of the mandatory and incentive nature of low-carbon regulation fiscal tools such as carbon tax and green subsidy to achieve a reasonable combination of the two sides so that they can stimulate the willingness of enterprises to green innovation and orderly guide the transformation of the carbon mitigation dynamic mechanism from government compulsion to enterprise autonomy. Second, we should continue to improve the price mechanism of carbon emission trading and appropriately intervene in the supply and demand laws of the primary allocation market and the secondary trading market of carbon quotas. Also, the minimum price limit of carbon quotas should be implemented to control the primary quota demand for enterprises while encouraging them to actively participate in the secondary trading of saving allocation. Third, considering the pilot policy of carbon tax and green subsidies to increase the sensitivity of enterprises to energy conservation and carbon mitigation, we should effectively stimulate enterprises’ green innovation and enhance the resilience of corporate performance to cope with pressure. By improving the compensation mechanism of enterprises’ green innovation, we will move toward the path of sustainable and coordinated development of carbon mitigation and economic efficiency.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author contributions

YD: conceptualization, writing—review and editing, writing—original draft preparation and investigation; YH: conceptualization, resources, writing—review and editing, and software; JL: reviewed and edited the final manuscript.

Funding

This study was financially supported by the Major Project of Higher Educational Humanity and Social Sciences Foundation of Anhui Province (SK2021ZD0084) and the Scientific Research Foundation for Talent Introduction of Tongling University (2021tlxyrc06).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adkin, L. E. (2019). Technology innovation as a response to climate change: The case of the climate change emissions management corporation of alberta. Rev. Policy Res. 36 (5), 603–634. doi:10.1111/ropr.12357

Burke, J., and Gambhir, A. (2022). Policy incentives for greenhouse gas removal techniques: The risks of premature inclusion in carbon markets and the need for a multi-pronged policy framework. Energy Clim. Change 12 (3), 100074. doi:10.1016/j.egycc.2022.100074

Chen, X., and Lin, B. (2021). Towards carbon neutrality by implementing carbon emissions trading scheme: Policy evaluation in China. Energy Policy 157, 112510. doi:10.1016/j.enpol.2021

Chen, Y., and Ma, Y. (2021). Does green investment improve energy firm performance? Energy Policy 153 (1), 112252. doi:10.1016/j.enpol.2021.112252

Chen, Z., Yuan, X. C., Zhang, X., and Cao, Y. (2019). How will the Chinese national carbon emissions trading scheme work? The assessment of regional potential gains. Energy Policy 137, 111095. doi:10.1016/j.enpol.2019.111095

Chen, Z., Zhang, X., and Chen, F. (2021). Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol. Forecast. Soc. Change 168, 120744. doi:10.1016/j.techfore.2021.120744

Cheng, B., Dai, H., Wang, P., Xie, Y., Chen, L., Zhao, D., et al. (2016). Impacts of low-carbon power policy on carbon mitigation in Guangdong Province, China. Energy Policy 88, 515–527. doi:10.1016/j.enpol.2015.11.006

Dai, Y., Li, N., Gu, R., and Zhu, X. (2018). Can China’s carbon emissions trading rights mechanism transform its manufacturing industry? Based on the perspective of enterprise behavior. Sustainability 10 (7), 2421. doi:10.3390/su10072421

Ding, Y., and Hu, Y. (2021). Inflection point of green total factor productivity by low-carbon regulation from Chinese economics recovery. Sustainability 13 (22), 12382. doi:10.3390/su132212382

Eyland, T., and Zaccour, G. (2014). Carbon tariffs and cooperative outcomes. Energy policy 65 (5), 718–728. doi:10.1016/j.enpol.2013.10.043

Fan, J., Li, J., Wu, Y., Wang, S., and Zhao, D. (2016). The effects of allowance price on energy demand under a personal carbon trading scheme. Appl. Energy 170, 242–249. doi:10.1016/j.apenergy.2016.02.111

Fragkos, P., Tasios, N., Paroussos, L., Capros, P., and Tsani, S. (2017). Energy system impacts and policy implications of the European Intended Nationally Determined Contribution and low-carbon pathway to 2050. Energy Policy 100, 216–226. doi:10.1016/j.enpol.2016.10.023

Goldblatt, M. (2020). Comparison of emissions trading and carbon taxation in South Africa. Clim. Policy 10 (5), 511–526. doi:10.4324/9781849775717-5

Hanlon, W. W. (2019). Coal smoke, city growth, and the costs of the industrial revolution. Econ. J. 130 (626), 462–488. doi:10.1093/ej/uez055

Hong, Q., Cui, L., and Hong, P. (2022). The impact of carbon emissions trading on energy efficiency: Evidence from quasi-experiment in China's carbon emissions trading pilot. Energy Econ. 110, 106025. doi:10.1016/j.eneco.2022.106025

Hou, Y., Jia, M., Chen, T., Sun, C., Zhu, L., and Wei, K. (2016). Research on the optimal emission-abatement R & D subsidy policy under carbon tariff. Ecol. Econ. 32, 3. doi:10.3969/j.issn.1671-4407.2016.03.011

Jia, Z., and Lin, B. (2020). Rethinking the choice of carbon tax and carbon trading in China. Technol. Forecast. Soc. Change 159, 120187. doi:10.1016/j.techfore.2020.120187

Jiang, W., Liu, J., and Liu, X. (2016). Impact of carbon quota allocation mechanism on emissions trading: An agent-based simulation. Sustainability 8 (8), 826. doi:10.3390/su8080826

Kärkkäinen, L., Lehtonen, H., Helin, J., Lintunen, J., Peltonen-Sainio, P., Regina, K., et al. (2020). Evaluation of policy instruments for supporting greenhouse gas mitigation efforts in agricultural and urban land use. Land Use Policy 99, 104991. doi:10.1016/j.landusepol.2020

Li, C., Wang, J., Zheng, J., and Gao, J. (2022). Effects of carbon policy on carbon emission reduction in supply chain under uncertain demand. Sustainability 14, 5548. doi:10.3390/su14095548

Li, Z., Pan, Y., Yang, W., Ma, J., and Zhou, M. (2021). Effects of government subsidies on green technology investment and green marketing coordination of supply chain under the cap-and-trade mechanism. Energy Econ. 101, 105426. doi:10.1016/j.eneco.2021.105426

Lin, H., Ma, C., Sun, Q., and Li, Dan. (2021). Research on carbon reduction optimization strategy and coordination mechanism in consideration of corporate social responsibility. Operations Res. Manag. Sci. 30, 1.

Locatelli, B., Fedele, G., Fayolle, V., and Baglee, A. (2016). Synergies between adaptation and mitigation in climate change finance. Int. J. Clim. Change Strategies Manag. 8, 112–128. doi:10.1108/ijccsm-07-2014-0088

Luo, R., Zhou, L., Song, Y., and Fan, T. (2022). Evaluating the impact of carbon tax policy on manufacturing and remanufacturing decisions in a closed-loop supply chain. Int. J. Prod. Econ. 245, 108408. doi:10.1016/j.ijpe.2022.108408

Nagy, R. L., Hagspiel, V., and Kort, P. M. (2021). Green capacity investment under subsidy withdrawal risk. Energy Econ. 98, 105259. doi:10.1016/j.eneco.2021.105259

Nie, P. Y., Wang, C., and Wen, H. X. (2022). Optimal tax selection under monopoly: Emission tax vs carbon tax. Environ. Sci. Pollut. Res. 29 (8), 12157–12163. doi:10.1007/s11356-021-16519-1

Owen, R., Brennan, G., and Lyon, F. (2018). Enabling investment for the transition to a low carbon economy: Government policy to finance early stage green innovation. Curr. Opin. Environ. Sustain. 31, 137–145. doi:10.1016/j.cosust.2018.03.004

Pretis, F. (2022). Does a carbon tax reduce CO2 emissions? Evidence from British columbia. Environ. Resour. Econ. (Dordr). 83, 115–144. doi:10.1007/s10640-022-00679-w

Ren, S., Hao, Y., and Wu, H. (2022). How does green investment affect environmental pollution? Evidence from China. Environ. Resour. Econ. (Dordr). 81 (1), 25–51. doi:10.1007/s10640-021-00615-4

Shi, D., Zhang, C., Zhou, B., and Yang, L. (2018). The true impacts of and influencing factors relating to carbon emissions rights trading: A comprehensive literature review. Chn. J. Urb. Environ. Stud. 6 (3), 1850016. doi:10.1142/S2345748118500161

Song, Y., Liu, T., Liang, D., Li, Y., and Song, X. (2019). A fuzzy stochastic model for carbon price prediction under the effect of demand-related policy in China's carbon market. Ecol. Econ. 157, 253–265. doi:10.1016/j.ecolecon.2018.10.001

Stepp, M. D., Winebrake, J. J., Hawker, J. S., and Skerlos, S. J. (2009). Greenhouse gas mitigation policies and the transportation sector: The role of feedback effects on policy effectiveness. Energy Policy 37 (7), 2774–2787. doi:10.1016/j.enpol.2009.03.013

Su, L., Meng, X., Wang, M., and Gu, B. (2021). Establishing a carbon-neutrality oriented economic system through green, low-carbon, and circular development. Bull. Chin. Acad. Sci. 35 (4), 217–236.

Sun, C., Wei, J., Zhao, X., and Yang, F. (2022). Impact of carbon tax and carbon emission trading on wind power in China: Based on the evolutionary game theory. Front. Energy Res. 3, 16. doi:10.3389/fenrg.2021.811234

Tian, Z., Tian, Y., Chen, Y., and Shao, S. (2020). The economic consequences of environmental regulation in China: From a perspective of the environmental protection admonishing talk policy. Bus. Strategy Environ. 29, 1723–1733. doi:10.1002/bse.2464

Tong, W., Liu, H., and Du, J. (2022). Does the carbon trading mechanism affect social and environmental benefits of the retailer-led supply chain: Strategic decisions of emissions reduction and promotion. Front. Environ. Sci. 9, 12. doi:10.3389/fenvs.2022.971214

Wang, J. (2011). Discussion on the relationship between green technological innovation and system innovation. Energy Procedia 5 (1), 2352–2357. doi:10.1016/j.egypro.2011.03.404

Wang, W., and Zhang, Y. J. (2022). Does China's carbon emissions trading scheme affect the market power of high-carbon enterprises? Energy Econ. 108, 105906. doi:10.1016/j.eneco.2022.105906

Xu, J., and Wei, W. (2022). Would carbon tax be an effective policy tool to reduce carbon emission in China? Policies simulation analysis based on a CGE model. Appl. Econ. 54 (1), 115–134. doi:10.1080/00036846.2021.1961119

Yang, J., Azar, C., and Lindgren, K. (2021). Financing the transition toward carbon neutrality—An agent-based approach to modeling investment decisions in the electricity system. Front. Clim. 11, 7. doi:10.3389/fclim.2021.738286

Yang, Y., Liu, J., Xu, X., Xie, K., Lai, Z., Xue, Y., et al. (2022). Cooperative trading strategy of carbon emitting power generation units participating in carbon and electricity markets. Front. Energy Res. 9, 13. doi:10.3389/fenrg.2022.977509

Yu, X, X., Xu, Y., Zhang, J., and Sun, Y. (2022). The synergy green innovation effect of green innovation subsidies and carbon taxes. Sustainability 14 (6), 3453. doi:10.3390/su14063453

Yu, Y., Jin, Z. X., Li, J. Z., and Jia, L. (2020). Research on the impact of carbon tax on CO2 emissions of China's power industry. J. Chem. 2020, 1–12. doi:10.1155/2020/3182928

Yu, Y, Y., Su, Y., and Qi, C. (2022). Comparing potential cost savings of energy quota trading and carbon emissions trading for China's industrial sectors. Resour. Conservation Recycl. 186, 106544. doi:10.1016/j.resconrec.2022.106544

Zhang, Y., Qi, L., Lin, X., Pan, H., and Sharp, B. (2022). Synergistic effect of carbon ETS and carbon tax under China's peak emission target: A dynamic cge analysis. Sci. Total Environ. 825, 154076. doi:10.1016/j.scitotenv.2022.154076

Zhao, J., Chen, L., Wang, Y., and Liu, Q. (2021). A review of system modeling, assessment and operational optimization for integrated energy systems. Sci. China Inf. Sci. 64 (9), 191201–191227. doi:10.1007/s11432-020-3176-x

Keywords: carbon emission right, carbon tax, green innovation, green subsidy, double-performance

Citation: Ding Y, Hu Y and Liu J (2022) Equilibrium analysis of carbon decision behavior for the evolutionary game between the government and enterprises. Front. Energy Res. 10:990219. doi: 10.3389/fenrg.2022.990219

Received: 09 July 2022; Accepted: 31 October 2022;

Published: 21 November 2022.

Edited by:

Zequn Yang, Central South University, ChinaReviewed by:

Xiangyan Sun, Shandong Institute of Business and Technology, ChinaKourosh Halat, Islamic Azad University South Tehran Branch, Iran

Copyright © 2022 Ding, Hu and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yufeng Hu, MDEyMTY2QHRsdS5lZHUuY24=

Youqiang Ding

Youqiang Ding Yufeng Hu

Yufeng Hu Jun Liu

Jun Liu