- School of Management, Harbin University of Commerce, Harbin, China

After implementing the Dual-credit policy, automakers must adjust their production and operation strategies to cope with policy changes. This paper studies an automotive supply chain consisting of an automaker that produces traditional fuel vehicles and new energy vehicles and a dealer as the research object. Meanwhile, this paper constructs a trading strategy and a cooperative strategy model considering consumers’ fuel consumption sensitivity and endurance capacity sensitivity. This paper also compares decentralized and centralized decision-making of automotive supply chain under different strategies. Furthermore, this paper compares and analyzes the optimal credits strategies of automaker with different investment amounts. The research finds that automaker can obtain positive new energy vehicle credits (NEV credits) through direct trading or by cooperatively obtaining NEV credits with other automakers. Whether automaker chooses the trading strategy or the cooperative strategy, members’ profits of centralized decision-making in automobile supply chain are better than decentralized decision-making. When the investment amount of automaker is small, the cooperative strategy is more advantageous. After coordination through the revenue-sharing contract, the benefits of supply chain members reach Pareto optimality. This paper helps enterprises effectively deal with the Dual-credit policy and provides a reference for achieving carbon emission reduction targets in China.

1 Introduction

With the increase in consumers’ low-carbon awareness and environmental protection awareness, the factors affecting product demand have long gone beyond simple price considerations. With the continuous growth of the number of fuel vehicles, overall carbon emissions continue to rise. There are the directions of joint efforts of governments what reduce fuel consumption of fuel vehicles and promote new energy vehicles. In the face of severe climate change, countries worldwide have introduced relevant policies to assume the responsibility and obligation of carbon emission reduction. The “Bali Road Map” formulated in 2007 insists on tackling climate change under sustainable development and proposes specific emission reduction targets, approaches, and measures (Christoff, 2016). In December 2009, the target proposed by the 15th meeting of the Parties to the United Nations Framework Convention on Climate Change required developed countries to reduce their emissions by 40% by 2020 compared with the base year of 1990 and to achieve zero emissions by 2050 (at least 95% reduction in emissions) (East Asian Seas, 2009). In September 2020, China proposed the goal of Dual Carbon to achieve a carbon peak by 2030 and carbon neutrality by 2060 (Cui, 2020). To implement the national strategic policy, the government promotes the transformation of consumer consumption patterns to new energy or low-carbon energy through subsidies.

The government and policymakers should strengthen policies to reduce environmental pollution (Sun H. et al., 2020). With the decline of government subsidy policies, the “Measures for Parallel Management of Average Fuel Consumption of Passenger Vehicle Enterprises and New Energy Vehicle Credits” (“Dual-credit” policy) will become the primary policy affecting the decision-making of automakers and dealers. It is reported that Wuling Hongguang MINI EV sold more than 420,000 units in 2021 (Mark, 2021). From the cost analysis alone, the profit of the Wuling Hongguang MINI EV electric vehicle is slim. However, relying on the sales of new energy credits, SAIC-GM-Wuling MINI EV single electric vehicle can earn thousands of RMB in revenue. SAIC-GM-Wuling can earn billions of RMB from Wuling Hongguang MINI EV alone through the Dual-credit policy. Meanwhile, some enterprises that produce traditional fuel vehicles suffer heavy losses.

Fuel vehicles use gasoline or diesel as fuel, resulting in exhaust emissions and urban air pollution. Consumers with low-carbon preferences refuse to choose fuel vehicles because of their high fuel consumption (McCollum et al., 2018). Although new energy vehicles are clean products, “mileage anxiety” caused by low endurance has become the most important concern of consumers. Due to the long construction period of charging infrastructure and the large number of stakeholders involved, it is an important direction to increase consumers’ willingness to buy, which improves the endurance mileage of new energy vehicles in the short term. With the concept of sustainable development, the study of renewable energy is increasing (Chang et al., 2022; Irfan et al., 2022). New energy is environmentally friendly and uninterrupted (He et al., 2020; Zhao et al., 2021). Improving energy efficiency is sufficient to meet the needs of energy stakeholders (Li et al., 2021). The study of the endurance limit of new energy vehicles must be examined in order to provide better services for consumers (Xia et al., 2020). In summary, consumers with both fuel consumption sensitivity and endurance concerns are the focus of current automobile supply chain decision-making.

The Dual-credit policy represents the corporate average fuel consumption credits (CAFC credits) and the new energy vehicle credits (NEV credits) (Chai et al., 2022). Under Dual-credit policy, if the actual value of fuel consumption of automakers is greater than the standard value, negative CAFC credits will be generated, and positive NEV credits must be purchased to offset. Otherwise, positive CAFC credits will be generated. If the value of NEV credits is lower than the standard value, negative NEV credits will be generated, which should be compensated at the end of the year. Otherwise, positive NEV credits will be generated, which can be put into the market for sales. Under the Dual-credit policy, some automakers generate NEV credits due to the production and sales of new energy vehicles and rely on the sale of NEV credits to obtain substantial income. Some companies that produce traditional fuel vehicles generate negative CAFC credits due to the production and sales of traditional fuel vehicles. Therefore, they must buy NEV credits to offset. Meanwhile, we investigate the decentralized decision-making and the centralized decision-making of the automotive supply chain consisting of an automaker and a dealer under different strategies to explore the decision relationship between automakers and dealers. Under the Dual-credit policy, how automakers handle relationships with other automakers and dealers and make correct decisions has become an essential issue for enterprises.

This paper explores the automotive supply chain consisting of an automaker that produces price-competitive traditional fuel vehicles and new energy vehicles and a dealer under the Dual-credit policy. We construct a trading strategy and a cooperative strategy model and compare decentralized decision-making and centralized decision-making of the automobile supply chain under different strategies considering consumers’ fuel consumption sensitivity for traditional fuel vehicles and consumers’ endurance capacity sensitivity for new energy vehicles. Furthermore, we compare and analyze the optimal credits strategy of the automaker for responding to the Dual-credit policy in time. Finally, this paper designs a revenue-sharing contract to solve the problem of supply chain coordination to maximize the benefits of supply chain members. It provides the corresponding theoretical basis and promotes the sustainable development of the automobile retail industry.

The rest of this paper is organized as follows. Section 2 reviews the relevant literature. In Section 3, we introduce our problems and assumptions. Then, we introduce two essential models in Section 4, which are supply chain decision-making based on automaker’s credits trading strategy and supply chain decision-making based on automaker’s credits cooperative strategy. We also study decentralized decision-making, centralized decision-making, and supply chain coordination decision-making under two strategies, respectively. We analyze the automotive supply chain credits strategy based on supply chain decision-making and the credits strategy considering revenue-sharing contracts to achieve the optimal decision in Section 5. Finally, we provide our conclusions in Section 6. The evidence is given in the Supplementary Appendix.

2 Literature review

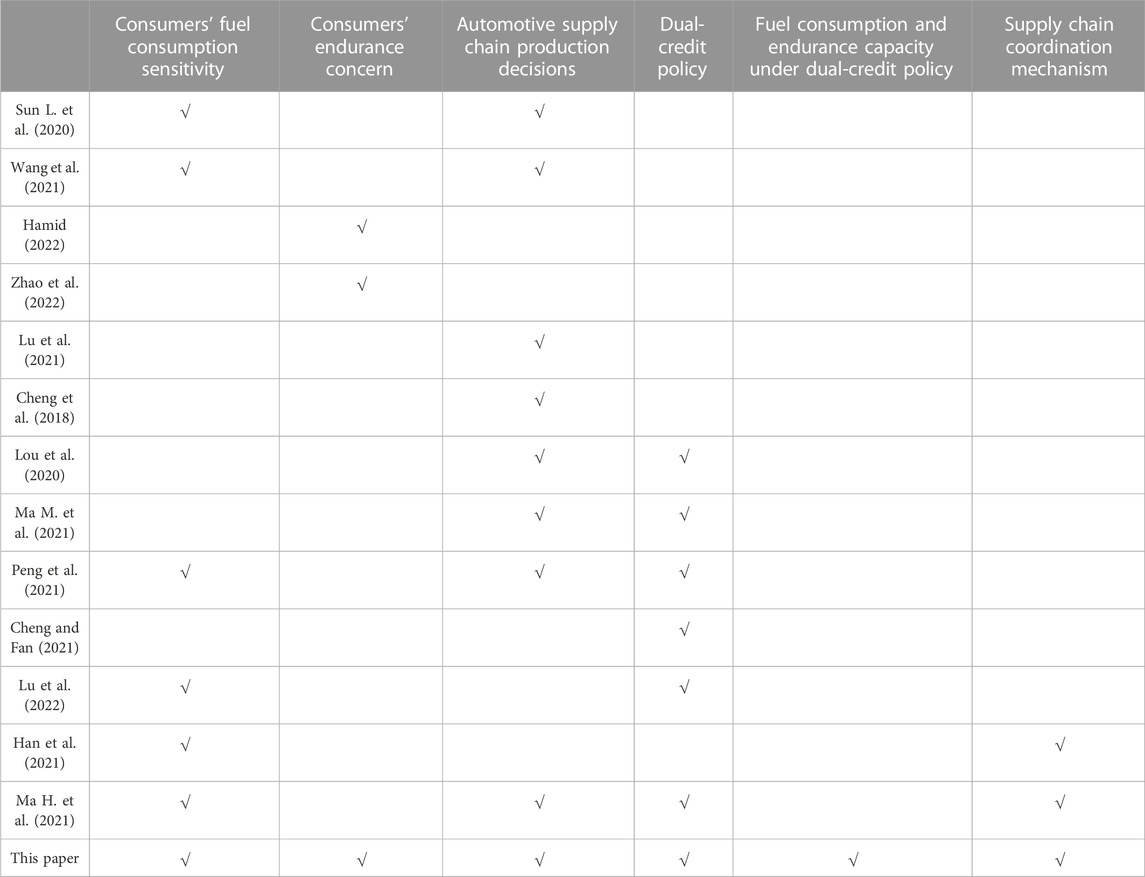

In this section, we review the research highly related to our work. These studies can be divided into six streams which are consumers’ fuel consumption sensitivity and endurance concern, new energy policy, Dual-credit policy, automotive supply chain production decisions under the Dual-credit Policy, automaker’s credits strategy under the Dual-credit Policy, and supply chain coordination mechanism. We summarize the relevant literature in Table 1 to compare previous studies and locate this study.

2.1 Consumers’ fuel consumption sensitivity and endurance concern

When consumers make decisions, the fuel consumption of traditional fuel vehicles has become an important factor. Consumers with low-carbon preferences generally do not buy fuel vehicles (Lu et al., 2022). It is necessary to study the impact of consumers’ low-carbon preferences on consumer decision-making. Sun et al. (2020) construct a Stackelberg differential game model dominated by manufacturers under centralized and decentralized decision-making considering the lag of emission reduction technology and the low-carbon preference of consumers. The result shows that the lag of emission reduction technology and consumers’ low-carbon preferences positively affect manufacturers’ carbon emission transfer levels (Sun L. et al., 2020). Wang et al. (2021) build a low-carbon supply chain consisting of leading retailers and small and medium-sized manufacturers considering consumers’ price and carbon-reduction sensitivity. The result shows that the retailer has a lower selling price, a lower carbon emission reduction level, a lower product demand, and a lower profit (Wang et al., 2021).

In addition to the fuel consumption coefficient of traditional fuel vehicles, the endurance of new energy vehicles is also an important factor for consumers. It is necessary to study the endurance limit based on charging infrastructure. Hamid (2022) designs an innovative approach that can systematically determine the location of electric vehicle charging stations considering fairness and efficiency to maximize accessibility and utilization (Hamid, 2022). Zhao et al. (2022) discuss two possible solutions to the challenge of electric vehicle mileage anxiety, which are converting various forms of waste energy into electrical energy and reducing battery power to provide ancillary services (Zhao et al., 2022). Overall, the above literature examines the impact of consumers’ low-carbon preferences or endurance concerns on the automotive industry from the demand-side perspective. The development of the automotive industry is influenced not only by consumers but also by policies.

2.2 New energy policy

Most of the existing research on new energy policy is about its impact on the production decision-making of enterprises. Zhao (2021) analyzes the game behavior between the government and automakers, starting with different government subsidy strategies. The study shows that government subsidies can improve battery life compared to no government subsidies (Zhao, 2021). Luo et al. (2014) study an automotive supply chain in which the manufacturer and retailer offer electric vehicles (EVS) to different types of consumers under the government’s price discount incentive scheme, which involves price discount rates and subsidy caps. The results show that subsidy caps effectively influence manufacturers’ optimal wholesale pricing decisions with higher unit production costs (Luo et al., 2014). Lu et al. (2021) study the impact of government subsidies on the green innovation investment of new energy companies. The results show that the impact of direct subsidies on green innovation investment of new energy companies is more significant than that of indirect subsidies (Lu et al., 2021). Chen et al. (2020) construct and study a two-tier supply chain consisting of a battery supplier (BS) and an electric vehicle manufacturer (EVM). The study finds that a low subsidy threshold enables BS to increase the driving mileage level above the subsidy threshold (Chen et al., 2020). Cheng et al. (2018) combine the subsidy relief policy and stochastic demand in the EV market to study the optimal decision-making of EV manufacturers and EV sellers. The research shows that the reduction of EV subsidies does not have a significant negative impact on EV subsidies (Cheng et al., 2018).

2.3 Dual-credit policy

With the decline of government subsidy policies, the Dual-credit policy becomes the primary policy affecting the decision-making of automakers and dealers. The substitution effect of the Dual-credit policy on government subsidy policy must be explored. As the sustainability policy in emerging markets, the Dual-credit policy achieves the energy-saving and emission-reduction goals of the auto industry (Li and Xiong, 2021). Li et al. (2020) discuss the impact of the subsidy policy and the Dual-credit policy on new energy vehicles and find that under the Dual-credit policy, gradually reducing subsidies can partially offset the negative impact of the Dual-credit policy on new energy vehicles (Li et al., 2020a). Li et al. (2020) explore the impact of subsidy policy and Dual-credit policy on NEV and FV production decisions considering battery recycling and found that adopting the Dual-credit policy can simultaneously improve the technical level of NEV and FV manufacturers (Li et al., 2020b). Yu et al. (2021) use a Stackelberg game model to model a two-stage automotive supply chain to explore the impact of alternative policies on production and pricing strategies. The research shows that when subsidies are phased out, demand for traditional fuel vehicles may also decline as well as electric vehicles (Yu et al., 2021).

Meanwhile, it is necessary to study the impact of the Dual-credit policy on industry development. Li et al. (2018) use an analytical model based on game theory to quantitatively simulate the development of new energy vehicles under different scenarios. The research shows that the Dual-credit policy can effectively promote the development of new energy vehicles. The proportion of the entire automobile market will be as high as 3.9% (Li et al., 2018). Ou et al. (2018) summarize the Dual-credit policy and develop a new energy and oil consumption credits model to quantify the policy’s impact on consumer choice and industry profit. The study shows that under the Dual-credit policy, NEV credits are often used to make up for negative CAFC credits (Ou et al., 2018). Li et al. (2020) construct a multi-period credit market dynamic equilibrium model. The research shows that reducing the credits index of new energy vehicles can slow down the growth rate of internal combustion engine vehicle production and promote the substantial growth of new energy vehicles (Li Y. et al., 2020). Most of previous studies are the substitution effect of the Dual-credit policy on the government subsidy policy and the impact of the “Dual-credit” policy on the development of the industry. The impact of the Dual-credit policy on the production decision of the supply chain has not been studied.

2.4 Automotive supply chain production decisions under the dual-credit policy

Under the Dual-credit policy, the production decisions of decentralized and centralized supply chains must be studied. Zhou et al. (2019) explore the impact of the Dual-credit policy on pricing decisions and green innovation investment in Dual-channel supply chains and find that a generalized Dual-credit policy could raise both thresholds to facilitate the transition to achieve associated TECP emissions reductions (Zhou et al., 2019). Lou et al. (2020) establish a model for optimizing fuel economy improvement levels and internal combustion engine vehicle (ICEV) production under a two-credit strategy. The study shows that when the year-end new energy vehicle credits of automakers do not meet the standard, the Dual-credit policy is not conducive to the production of energy-efficient vehicles (Lou et al., 2020). Ma et al. (2021) establish a decentralized and centralized decision-making model under the Dual-credit policy. The research shows that the Dual-credit policy can effectively encourage the supply chain of new energy vehicles to increase investment in research and development, improve the technical level of new energy vehicles, and increase the profit of the supply chain (Ma M. et al., 2021). Peng et al. (2021) study the production decisions of automakers under decentralized and centralized supply chains considering consumer preference and two-credit strategy, and the study shows that when consumers have higher environmental preferences, manufacturers and retailers should increase the prices of new energy vehicles (Peng et al., 2021). Ma et al. (2021) discuss the level of fuel economy improvement and production of conventional internal combustion engine locomotives (ICEV) and new energy vehicles, research and development (R&D) cost-sharing contracts, and ICEV revenue-sharing contracts aimed at harmonizing the traditional automotive supply chain, and the results show that in some cases, cost-sharing contracts of the supply chain may be better than revenue-sharing contracts (Ma H. et al., 2021). Many scholars have studied the production decision of automobile supply chain under the Dual-credit policy, but they have not considered the credits strategy of automakers.

2.5 Automaker’s credits strategy under the dual-credit policy

Under the dual credit policy, the choice of credits strategy of automakers affects the operation decision and development of enterprises. The credits trategy of automakers must be examined. Cheng and Fan (2021) study the production strategy options for competition and cooperation between fuel vehicle competitors and new energy vehicle competitors under the Dual-credit policy. The research shows that maintaining a relatively high credit price for the Dual-credit policy is often more conducive to promoting the expansion of new energy vehicles than setting a high output ratio of new energy vehicles (Cheng and Fan, 2021). Lu et al. (2022) study the pricing and emission reduction decision-making of two manufacturers when consi dering consumers’ low-carbon preferences and price competition under the background of Dual-credit. The research shows that the Dual-credit policy can reduce the price of new energy vehicles, improve the profits of new energy vehicle manufacturers, and promote the active emission reduction of fuel vehicles (Lu et al., 2022). No scholar studies comprehensively the optimal credits strategy of automakers considering consumers’ fuel consumption sensitivity and new energy vehicles’ endurance capacity constraints sensitivity under the Dual-credit policy, which is done in this paper. To achieve optimal credits strategy and production decision-making, enterprises need a reasonable mechanism to coordinate.

2.6 Supply chain coordination mechanism

Designing reasonable contract mechanism can make supply chain members reach Pareto optimum. Mondal and Giri (2021) establish four models of centralized, decentralized, retailer-led revenue-sharing, and bargaining revenue-sharing under the purchase restriction policy. The research shows that retailer-led revenue-sharing can achieve a win-win situation for manufacturers and retailers (Mondal and Giri, 2021). Han et al. (2021) design a revenue-sharing contract by building a Stackelberg model. The research shows that supply chains will benefit from the increase in consumer environmental awareness but will be constrained by carbon emission reduction (CER) investment costs (Han et al., 2021). Han et al. (2021) establish a supply chain (SC) model, including a centralized and decentralized decision-making model. The finding suggests that supply chains’ quality control (QC) under consumer bundling behavior (CBB) cannot be coordinated only through wholesale price contracts, and it can be perfectly coordinated through this contract in terms of cost (Lan et al., 2021). Shen (2021) establishes a retailer-dominated bargaining expectation game model with a revenue-sharing contract. The research shows that the revenue-sharing contract could improve greening levels and reduce retail prices compared with the decentralized decision-making model (Shen, 2021). Li and Liu (2020) design a contract with a supplier and a retailer to coordinate newsboy settings. The contract is limited to a particular two-part charging system with a wholesale price equal to unit production costs (Li and Liu, 2020). Cui et al. (2020) establish a revenue-sharing contract considering the green farming cost for farmers and the green marketing cost for retailers. The study finds that revenue-sharing contracts are beneficial to improve the greening level and to increase the profits of farmers and retailers (Cui et al., 2020). Shao and Liu (2022) study the revenue-sharing and cost-sharing contract that incentivize manufacturers to improve the greenness of subsidized products compared with wholesale price contracts based on the complementary product supply chain taking into account consumers’ environmental awareness and green subsidies provided by the government (Shao and Liu 2022).

There are few researches on the coordination and optimization of automobile supply chain under the credit policy. Ma et al. (2021) design and develop a cost sharing contract and a revenue sharing contract to coordinate the traditional automobile supply chain. The research result shows that in some cases, the supply chain cost sharing contract may be better than the revenue sharing contract (Ma H. et al., 2021). Under the Dual-credit policy, no scholar has yet considered the fuel sensitivity coefficient of consumers and the endurance concern of new energy vehicles, explored the credits strategy of automakers and the optimal production decisions of automobile supply chain members, and designed reasonable contracts to coordinate the supply chain members.

To sum up, previous studies on the Dual-credit policy mainly focused on its impact on the production decisions of decentralized and centralized supply chains or the credits strategy of automaker. By reviewing the previous studies, it is found that no scholar studied the automotive supply chain decision problems based on automaker’s credits strategy under the Dual-credit policy. Based on previous studies, this paper explores the credit cooperation and trading strategies among automakers under the Dual-credit policy. We analyze the optimal credits strategy of automaker considering consumers’ fuel consumption sensitivity and endurance capacity sensitivity for new energy vehicles. Meanwhile, this paper explores the optimal decision-making of automaker and dealer. It provides the corresponding theoretical reference for automobile manufacturers to deal with the relationship with other automakers and retailers. By studying the credits strategy, we provide corresponding theoretical support for automaker to respond to the Dual-credit policy. The literature review is shown in Table 1.

This paper considers the impact of fuel consumption of traditional fuel vehicles and the endurance limit of new energy vehicles on consumer decision-making. Compared with Sun et al. (2020) (Sun L. et al., 2020) and Wang et al. (2021), who focus on the impact of consumers’ low-carbon preferences, the research in this paper has more theoretical reference value. Compared with Cheng and Fan (2021) and Lu et al. (2022), who focus on the impact of dual credit policy on decentralized and centralized supply chain production decisions, this paper discusses the decision-making of automobile supply chain based on automobile manufacturers’ credits strategy under dual credit policy and provides corresponding theoretical support for automobile manufacturers to respond to Dual-credit policy. Compared with Ma H. et al., 2021 (Ma et al., 2021b), who focus on the study of the improvement level of fuel economy and the impact of output of traditional internal combustion engine vehicles and new energy vehicles, this paper comprehensively considers the impact of fuel consumption of traditional fuel vehicles and the endurance limit of new energy vehicles.

3 Problem description and assumptions

In the Dual-credit policy, there is competition between traditional fuel vehicles and new energy vehicles produced by automaker. Therefore, we introduce the cross-price elasticity coefficient. Considering consumers’ environmental protection and endurance capacity sensitivity for new energy vehicles, this paper studies the credits cooperation and trading strategy of automaker and analyzes the optimal credits strategy of automaker.

The market demand for traditional fuel vehicles and new energy vehicles can be expressed as follows: Q1ij=θμ−bp1ij+fp2ij−σt1, Q2ij=(1−θ)μ−bp2ij+fp1ij−φt2. According to the research literature (Lu et al., 2022), we assume the calculation method of credits is CAFC credits =

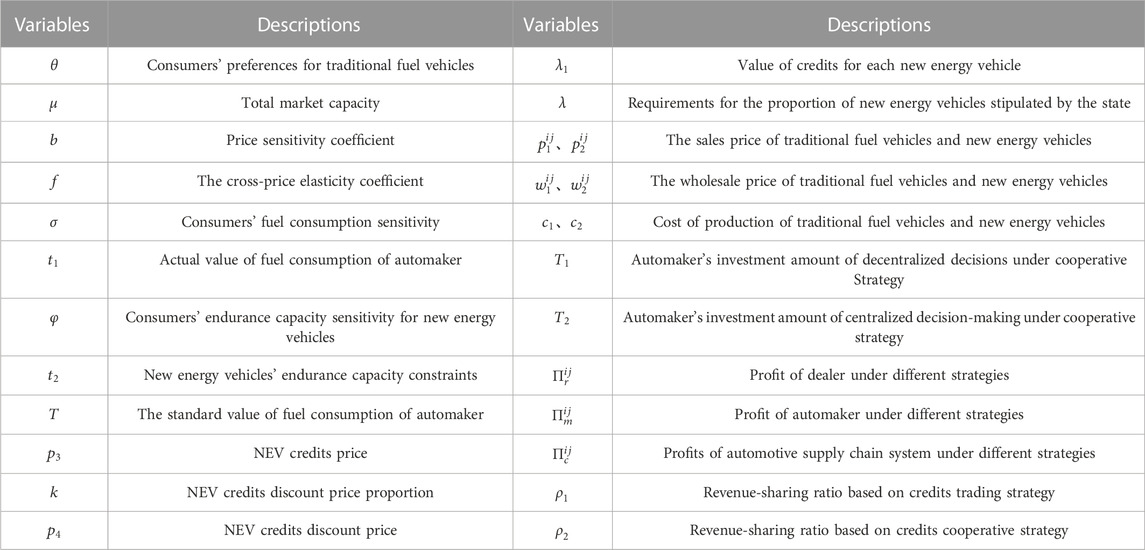

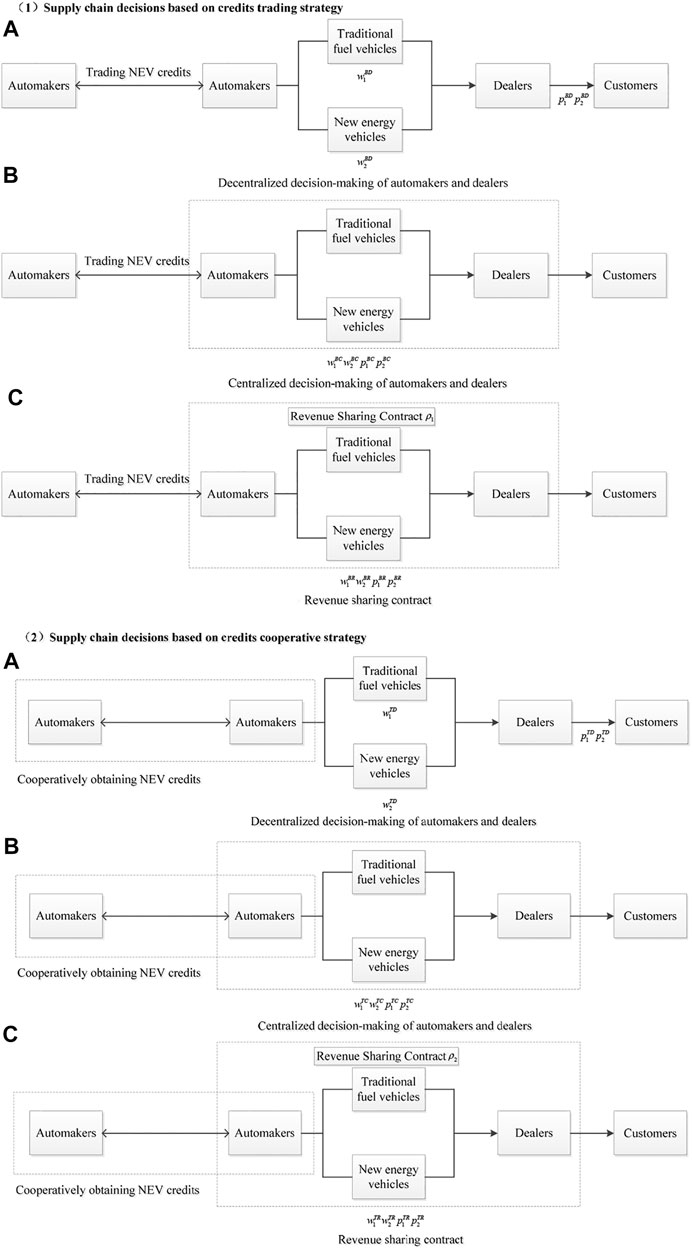

Under the Dual-credit policy, automaker’s strategy for compensating for negative credits or dealing with positive credits for new energy can be divided into trading and cooperative strategies. This paper compares and analyzes the trading strategy and cooperative strategy of automaker. We also consider decentralized decision-making and centralized decision-making of automaker and dealer under two strategies considering consumers’ fuel consumption sensitivity and new energy vehicles’ endurance capacity constraints sensitivity. Furthermore, we coordinate the supply chain through the revenue-sharing contract so that the benefits of supply chain members achieve Pareto optimality. The strategic choice of automaker for different investment amounts are compared and analyzed. The variables and descriptions used in this article are shown in Table 2.

We assume that i = B, T denotes the conditions under which automaker chooses the trading strategy and cooperative strategy; j = D, C, R denotes supply chain decentralized decision-making, centralized decision-making, and contract coordination. We make that {BD, BC, BR, TD, TC, TR} denote the decentralized decision-making, centralized decision-making, and revenue-sharing contract based on credits trading strategy and decentralized decision-making, centralized decision-making, and revenue-sharing contract based on credits cooperative strategy.

The frame structure of the article is shown in Figure 1.

4 Analysis of credits strategy of automotive supply chain

When the actual value of fuel consumption of automaker is t1∈(T,∞), the actual value of fuel consumption of automaker is greater than the standard value. It is necessary to obtain NEV credits. The credits strategies that automaker can choose are direct purchase strategies and cooperative strategies.

4.1 Supply chain decision based on credits trading strategy

It is the quickest way to eliminate negative CAFC credits that automaker trades directly with other NEV manufacturers. At this time, automaker directly purchases the positive NEV credits of other automakers to repay the excess CAFC credits and repay the negative NEV credits.

4.1.1 Model BD: Decentralized decision-making of automaker and dealer

Under decentralized decision-making, automaker and dealer play a Stackelberg game. The decision sequence is that automaker determines the wholesale prices of traditional fuel vehicles and new energy vehicles. According to wholesale prices determined by automaker, dealer decides on sales prices of traditional fuel vehicles and new energy vehicles. The profit functions of automaker and dealer are as follows:

Among them,

Proposition 1: By using the reverse solution method, under decentralized decision-making based on the credits trading strategy, we have the optimal decisions for sales prices, wholesale prices, and sales volumes of traditional fuel vehicles and new energy vehicles:

4.1.2 Model BC: Centralized decision-making of automaker and dealer

Under centralized decision-making, automaker and dealer regard the entire supply chain system as an enterprise and make joint decisions to determine sales prices of traditional fuel vehicles and new energy vehicles. The profit function of the entire supply chain system is as follow:

Proposition 2: Under centralized decision-making based on the credits trading strategy, we have the optimal decisions on sales prices and sales volumes of traditional fuel vehicles and new energy vehicles:

Proposition 3: When automaker chooses the trading strategy, the benefit of the supply chain system under centralized decision-making is more excellent than those of decentralized decision-making. Under centralized decision-making, the sales volumes of traditional fuel vehicles and new energy vehicles are more significant than in decentralized decision-making.When automaker chooses the trading strategy, automaker and dealer jointly set the sales prices and wholesale prices of traditional fuel vehicles and new energy vehicles under centralized decision-making to maximize the profit of the entire system and pursue a win-win situation. However, dealer chooses to increase the sales prices to obtain higher profit, which will lead to their sales volumes decreasing. The automaker pursues maximizing their profits and increasing wholesale prices under decentralized decision-making and ultimately reducing automaker’s profit. The profit of entire supply chain system decreases. So, the sales volumes of traditional fuel vehicles and new energy vehicles under centralized decision-making are greater than those under decentralized decision-making, and the revenue of supply chain system is greater than that of decentralized decision-making.

4.1.3 Model BR: Revenue-sharing contract

From the above propositions, it can be seen that under decentralized decision-making, the sales volumes of supply chain members are less, and the profits are slim. In this section, the supply chain is coordinated through the revenue-sharing contract, and dealer is encouraged to sell products so that the sales volumes of supply chain members can reach the level of centralized decision-making. The revenue-sharing ratio is obtained by solving. Under the revenue-sharing contract, dealer receives a portion of automaker’s revenue to achieve the optimal decision, and the revenue-sharing ratio is ρ1. The profit functions for automaker and dealer are as follows:

Proposition 4: Under the revenue-sharing contract based on the credits trading strategy, we have the optimal decisions on sales prices, wholesale prices, and sales volumes of traditional fuel vehicles and new energy vehicles:

In the state of the revenue-sharing contract, the entire supply chain reaches a state of centralized decision-making, which is

The revenue-sharing ratio is:

After the coordination of the revenue-sharing contract, the sales volumes of traditional fuel vehicles and new energy vehicles are more significant than the sales volume before coordination, which is Q1BR*>Q1BD*,Q2BR*>Q2BD*. The profits of automaker and dealer are more significant than their respective profits before coordination, which are ΠmBR≥ΠmBD and ΠrBR≥ΠrBD.

4.2 Supply chain decision based on credits cooperative strategy

Under the credits cooperative strategy, automaker cooperates with other automakers. The automaker acquires part of profit and assume corresponding responsibility through investment, and does not participate in the decision-making. The cooperative manufacturer offsets the negative CAFC credits. We assume that they jointly determine the credits discount price p4=kp3(0<k<1) of the positive NEV credits through negotiation.

4.2.1 Model TD: Decentralized decision-making of automaker and dealer

Under decentralized decision-making, automaker’s investment amount is T1, and the profit functions of automaker and dealer are as follows:

Proposition 5: Under decentralized decision-making based on credits cooperative strategy, we have the optimal decisions for sales prices, wholesale prices, and sales volumes of traditional fuel vehicles and new energy vehicles:

4.2.2 Model TC: Centralized decision-making of automaker and dealer

Under centralized decision-making, automaker’s investment amount is T2. The profit function of the entire supply chain system is as follow:

Proposition 6: Under centralized decision-making based on credits cooperative strategy, we have the optimal decisions on sales prices and sales volumes of traditional fuel vehicles and new energy vehicles:

Proposition 7: When automaker chooses the cooperative strategy, the benefit of supply chain system under centralized decision-making is greater than that of decentralized decision-making. Under centralized decision-making, the sales volumes of traditional fuel and new energy vehicles are more remarkable than in decentralized decision-making.Automaker and dealer jointly set sale prices and wholesale prices of traditional fuel vehicles under centralized decision-making, aiming to maximize the whole system’s profit and pursue a win-win situation when automaker chooses the cooperative strategy. Therefore, the sales volumes of traditional fuel vehicles and new energy vehicles are greater than those of decentralized decision-making, and the revenue of the supply chain system is more significant than decentralized decision-making under centralized decision-making.

4.2.3 Model TR: Revenue-sharing contract

Under the revenue-sharing contract, dealer obtains a portion of automaker’s revenue and improves the sales volumes of products. The revenue-sharing ratio is ρ2. The profit functions of automaker and dealer are as follows:

Proposition 8: Under the revenue-sharing contract based on credits cooperative strategy, we have the optimal decisions on sales prices, wholesale prices, and sales volumes of traditional fuel vehicles and new energy vehicles:

In the state of the revenue-sharing contract, the entire supply chain reaches a state of centralized decision-making, which is

The revenue-sharing ratio is:

After coordination, the sales volumes of traditional fuel vehicles and new energy vehicles are greater than the sales volumes before coordination, which are Q1TR*>Q1TD* and Q2TR*>Q2TD*. The profits of automaker and dealer are more significant than their respective profits before coordination, which are ΠmTR≥ΠmTD and ΠrTR≥ΠrTD.

Proposition 9: When automaker investment amount in centralized decision-making

Proposition 10: When the discounted price of NEV credit is low, it is more advantageous for automaker to adopt the cooperative strategy. When the discounted price of NEV credit is high, the advantage of the cooperative strategy decreases. When the price of NEV credit is low, it is more advantageous for automaker to adopt the trading strategy. When the price of NEV credit is high, it is more advantageous for automaker to adopt the cooperative strategy.When automaker invests a certain amount of investment, and the discounted price of NEV credit is low, automaker can directly trade NEV credits at a lower discount price of NEV credit, reducing the cost and obtaining high returns. On the contrary, when the discounted price of NEV credit is high, automaker chooses direct trading NEV credits without investing, which is more beneficial. When price of NEV credit is low, automaker adopts a more beneficial trading strategy to increase profit. When the price of NEV credit is high, automaker should adopt the cooperative strategy to obtain NEV credits at a specific discounted price, reduce cost and increase profit.

Proposition 11: The sales of traditional fuel vehicles are inversely proportional to customers’ fuel consumption sensitivity. The sales of new energy vehicles are inversely proportional to consumers’ endurance limits requirement for new energy vehicles. Customers’ fuel consumption sensitivity and consumers’ endurance limits requirement for new energy vehicles will not affect credits strategy choice of automobile manufacturers.When customers’ fuel consumption sensitivity increases, they raise awareness of environmental protection, start to focus on environmental travel, and avoid choosing traditional fuel vehicles to meet their responsibilities and obligations when purchasing cars. It leads to a decrease in sales of traditional fuel vehicles. Meanwhile, when consumers increasingly focus on new energy vehicles’ endurance capability, endurance limits requirement on new energy vehicles will affect their purchase decisions. The sales of new energy vehicles decline.

Proposition 12: When automaker chooses the cooperative strategy, the sales prices of traditional fuel vehicles improve with the increase of credits discount prices and credits prices. The sales volumes of traditional fuel vehicles decrease with the increase of credits discount prices and credits prices. New energy vehicles are the opposite.When automaker chooses the cooperative strategy, with the increase of credit discount price and credit price, the cost that automaker purchases NEV credits increases. Due to high costs, the automaker must improve the sales prices of traditional fuel vehicles. It will lead to the sales volumes of traditional fuel vehicles decreasing and profits decreasing. Meanwhile, with the increase in credit discount price and credit price, the sales price of new energy vehicle decreases to improve their sales volumes. It will obtain more NEV credits and profits.

Hypothesis 1: When the actual value of fuel consumption of automaker is t1∈(0,T], the actual value of fuel consumption of automaker is less than the standard value. The credits strategies that automaker can choose are marketing strategy and cooperative strategy. At this time, there is

5 Numerical analysis

This section takes an automaker producing traditional fuel vehicles and new energy vehicles as an example for analysis. Referencing cars’ sales data over the years and combined with the literature (Ou et al., 2018), we assume total market capacity μ = 1 million vehicles, consumers’ preferences for traditional fuel vehicles θ = 0.4, price sensitivity coefficient b = 7, the cross-price elasticity coefficient f = 2, consumers’ fuel consumption sensitivity σ = 0.6, the actual value of fuel consumption of automaker t1 = 8.86L/100km, consumers’ endurance capacity sensitivity for new energy vehicle φ = 0.6, new energy vehicles’ endurance capacity constraints t2 = 225km, the standard value of fuel consumption of automaker T = 6.9L/100km, NEV credits price p3 = 3,000RMB/credit, NEV credits discount price p4 = 1,200RMB/credit, the value of the credit for each new energy vehicle λ1 = 3.51, requirements for the proportion of new energy vehicles stipulated by the state λ = 0.1, cost of production of traditional fuel vehicles c1 = 50,000 RMB/vehicle, cost of production of new energy vehicles c2 = 30,000 RMB/vehicle.

Since the focus of this paper is to analyze the credits strategy of automaker, and the difference between the decentralized supply chain and the centralized supply chain is not discussed in-depth, the investment amounts of automaker under model TD and model TC are, respectively: T1=1, T2=1.

5.1 Analysis of credits strategy of automotive supply chain

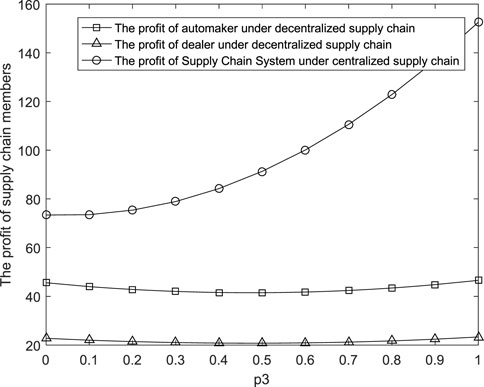

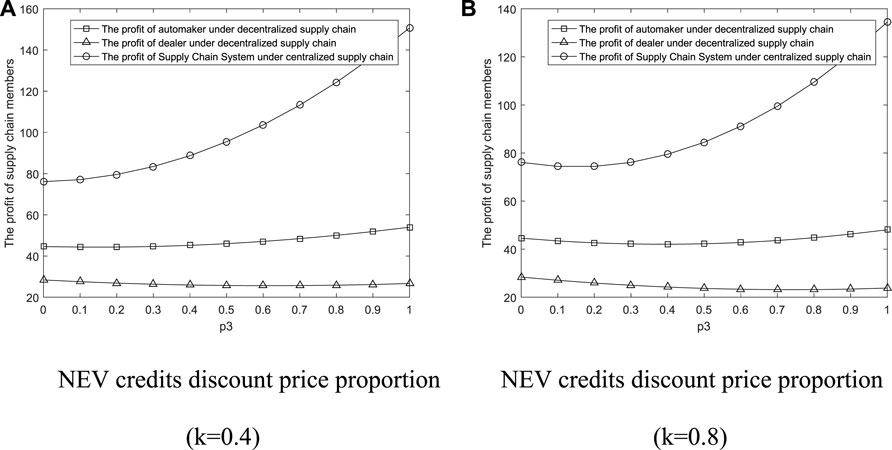

It can be seen from Figures 2, 3 that the profit of the supply chain system is more significant under centralized decision-making, whether the trading strategy or cooperative strategy. Proposition 3 and Proposition 7 are verified. When automaker’s investment amount is small, automaker should adopt the cooperative strategy. Otherwise, the trading strategy is more advantageous. When automaker invests a certain amount of investment, and the discounted prices of NEV credits are low, it is more advantageous for automaker to adopt the cooperative strategy. When the discounted prices of NEV credits are high, the advantage of the cooperative strategy reduces.

Meanwhile, when the prices of NEV credits are low, it is more advantageous for automaker to adopt the trading strategy. When the prices of NEV credits are high, it is more advantageous for automaker to adopt the cooperative strategy. The cooperative strategy can bring discount prices of NEV credits to automaker so that enterprises’ costs reduce, and the profits increase when the automaker’s investment amount is small. However, when the discounted prices of NEV credits are low, enterprises’ costs reduce. When NEV credits price is low, automaker does not need to invest capital. The cost of direct trading of positive NEV credits reduces, and the profit increases. Proposition 10 is verified.

5.2 Analysis of credits strategy considering contract coordination

It can be seen from Figure 4 that by designing the corresponding revenue-sharing contracts under the automaker’s trading strategy and cooperative strategy, the profits of automaker and dealer are higher than their profits before coordination. After coordinating, automaker’s profit increases as NEV credits prices increase. It shows that the higher the prices of NEV credits, the higher the automaker’s profit by trading credits for new energy vehicles from Figure 4. Therefore, the revenue-sharing contract can effectively coordinate the automotive supply chain, make the members of the automotive supply chain achieve Pareto optimality, and promote the rapid development of the automotive retail industry. Proposition 4 and Proposition 8 can be further verified.

FIGURE 4. Analysis of the credits Strategy of automaker before and after Coordinating. (A) Comparison of benefits of auto maker and dealer before and after coordinating under the trading strategy. (B) Comparison of profits of automaker and dealer before and after coordinating under the cooperative strategy.

5.3 Analysis of supply chain decision under different credits strategies

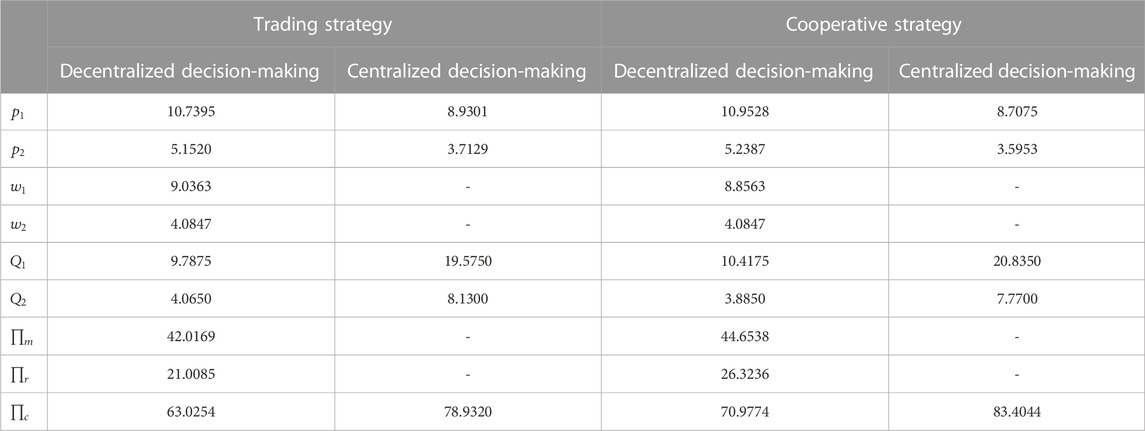

It can be seen from Table 3 that when automaker’s investment amount is smaller, regardless of whether automaker and dealer make the decentralized decision-making or the centralized decision-making, automaker chooses the cooperative strategy to make automaker and dealer get higher returns compared with the trading strategy. Under the trading and cooperative strategy of automaker, the sales prices of traditional fuel vehicles and new energy vehicles in the centralized decision-making of the automotive supply chain reduce, and their sales volumes increase. Compared with decentralized decision-making, the profit of the supply chain system is larger, and customer satisfaction is higher, which helps to improve brand loyalty in the centralized decision-making.

6 Conclusion and policy implications

6.1 Conclusion

Under the background of the Dual-credit policy, the research object of this paper is an automotive supply chain consisting of an automaker and a dealer. According to the different ways of obtaining NEV credits for automaker, the credits strategy can be divided into trading strategy and cooperative strategy. Under the two strategies, the automotive supply chain’s decentralized decision-making model and centralized decision-making model are constructed. The optimal decision-making of the automotive supply chain under the two strategies is compared and analyzed from the perspective of customers’ environmental protection awareness and consumers’ endurance capacity sensitivity for new energy vehicles. The supply chain under the two strategies is coordinated through the revenue-sharing contract so that the supply chain members can achieve Pareto optimality to achieve optimal decisions. For different investment amounts, automaker’s optimal credits strategy choice is explored.

The research results show that: (1)Customers’ fuel consumption sensitivity and endurance limits requirement for new energy vehicles will not affect the credits strategy choice of automobile manufacturers but will only affect the sales of traditional fuel vehicles and new energy vehicles. (2)The optimal decision of automaker is affected by credit discount prices and credit prices. With the increase of credits discount prices and credits prices, the sales prices of traditional fuel vehicles increase, and the sales volumes decrease. New energy vehicles are the opposite. (3) Whether automaker chooses the trading strategy or the cooperative strategy, centralized decision-making in the automotive supply chain is better than decentralized decision-making. Therefore, automaker should carry out centralized decision-making with dealer to create a win-win situation. (4) When the actual value of fuel consumption of automaker is greater than the standard value, and automaker’s investment amounts are small, the cooperative strategy is more advantageous, and automaker could choose to cooperate with other automakers to get NEV credits. When the actual value of fuel consumption of automaker is less than the standard value, and automaker’s investment amounts is more significant, the cooperative strategy is more advantageous, and automaker should choose to cooperate with other automakers to sell NEV credits. (5)Under the trading and cooperative strategies, when the revenue-sharing ratio reaches a certain threshold, the revenue-sharing contract can effectively coordinate the supply chain so that the benefits of supply chain members can reach Pareto optimality. Therefore, the automotive supply chain members can use the revenue-sharing contract to coordinate the supply chain system to maximize the members’ income.

6.2 Policy implications

The prices and values of NEV credits for each new energy vehicle affect their sales prices and sales volumes. To better achieve the goal of carbon emission reduction, the government should formulate reasonable prices and values of NEV credits for each new energy vehicle to encourage automaker to produce new energy vehicles, improve consumers’ low-carbon preferences and encourage consumers to develop a green and environmentally-friendly lifestyle. It will be difficult to further reduce carbon emissions unless consumers’ fuel consumption sensitivity is improved and their endurance capacity sensitivity is reduced. In reality, the fuel consumption sensitivity of consumers will be positively affected by increasing fuel prices. It is necessary to systematically and scientifically set the position of the electric vehicle charging pile to improve its utilization rate or increase the number of the electric vehicle charging pile to reduce the requirements for the endurance capacity sensitivity of consumers. As consumers’ fuel consumption sensitivity increase and their endurance capacity sensitivity decrease, automobile manufacturers will produce more new energy vehicles to meet consumer demand. This will convert the negative impact of the Dual-credit policy on automobile manufacturers into the positive impact. It will encourage consumers to buy more new energy vehicles so that enterprises can better cooperate with policies and obtain higher returns.

To maximize their interests, automaker should collaborate with other automakers in credit to respond to the Dual-credit policy. In addition, establishing a solid partnership between automakers and dealers will increase sales volumes and achieve a win-win situation for both parties striving for centralized decision-making. Similarly, due to the differences in prices of NEV credits, discount prices of NEV credits, and investment amounts, automaker should make optimal strategic choices to cope with market and policy changes in enterprises and promote the sustainable development of the automobile retail industry.

This study has several limitations. It would be interesting to extend our research in some directions. This paper considers the strategic choices between automaker, dealer, and other automakers. However, it only starts from a single cycle under the Dual-credit policy from the perspective of automaker that produces both traditional fuel vehicles and new energy vehicles. In the future, the strategic choices of automobile manufacturers that produce traditional fuel vehicles and new energy vehicles in multiple cycles can be studied. In addition, the credits strategy of automakers can be studied in the case of uncertain demand in the future.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Materials, further inquiries can be directed to the corresponding author.

Author contributions

HH and DL conceived, designed, and wrote the manuscript. HH and DL contributed significantly to the analysis and manuscript preparation. HH and DL performed the model analyses and wrote the manuscript. ZY performed the analysis by reviewing and editing. All authors have agreed to the published version of the manuscript.

Funding

This article is supported by the reform and develop high-level talent projects in local universities supported by the central government (2020GSP13), National Social Science Foundation of Heilongjiang Province (No.20GLB114), Social Science Foundation Think Tank Project of Heilongjiang Province (No.21ZK032).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenrg.2022.963900/full#supplementary-material

References

Chai, Q., Xiao, Z., and Zhou, G. (2022). Strategy selection for traditional car manufacturers under the dual-credit policy. J. Industrial Eng. Eng. Manag. 36 (1), 124–133. doi:10.13587/j.cnki.jieem.2022.01.011

Chang, L., Saydaliev, H. B., Meo, M. S., and Mohsin, M. (2022). How renewable energy matter for environmental sustainability: Evidence from top-10 wind energy consumer countries of European Union. Sustain. Energy, Grids Netw. 31, 100716. doi:10.1016/j.segan.2022.100716

Chen, Z., Fan, Z., and Foropon, C. (2020) Quality management in humanitarian operations and disaster relief management: A review and future research directions. Ann. Operations Res. 319, 1045–1098. doi:10.1007/s10479-020-03695-5

Cheng, J., Wang, J., and Gong, B. (2018). Game-theoretic analysis of price and quantity decisions for electric vehicle supply chain under subsidy reduction. Comput. Econ. 55, 1185–1208. doi:10.1007/s10614-018-9856-z

Cheng, Y., and Fan, T. (2021). Production coopetition strategies for an FV automaker and a competitive NEV automaker under the dual-credit policy. Omega 103, 1–20. doi:10.1016/j.omega.2020.102391

Christoff, P. (2016). The promissory note: COP 21 and the Paris Climate Agreement. Environ. Politics 25 (5), 1–23. doi:10.1080/09644016.2016.1191818

Cui, L., Guo, S., and Zhang, H. (2020). Coordinating a green Agri-Food supply chain with revenue-sharing contracts considering retailers’ green marketing efforts. Sustainability 12 (4), 1–16. doi:10.3390/su12041289

Cui, R. (2020). China's 2060 carbon neutrality target: Opportunities and challenges. China Dialogue Available at: https://chinadialogue.net/en/climate/chinas-2060-carbon-neutrality-target-opportunities-and-challenges/ (Accessed June 6, 2022).

East Asian Seas, (2009). “Summary,”. report, 23–27. [EB/OL]. East Asian Seas (EAS) Congress Available at: https://enb.iisd.org/events/east-asian-seas-eas-congress-2009/summary-report-23-27-november-2009 (Accessed June 6, 2022).

Hamid, I. (2022). A multicriteria GIS-based decision-making approach for locating electric vehicle charging stations. Transp. Eng. 9. doi:10.1016/J.TRENG.2022.100135

Han, C., Gu, H., Sui, L., and Shao, C. (2021). Carbon emission reduction decision and revenue-sharing contract with consumers’ low-carbon preference and CER cost under carbon Tax. Math. Problems Eng. 2021, 3458607–3458611. doi:10.1155/2021/3458607

He, W., Abbas, Q., Alharthi, M., Mohsin, M., Imran, H., Xuan, V. V., et al. (2020). Integration of renewable hydrogen in light-duty vehicle: Nexus between energy security and low carbon emission resources. Int. J. Hydrogen Energy 45 (51), 27958–27968. doi:10.1016/j.ijhydene.2020.06.177

Irfan, M., Elavarasan, R. M., Ahmad, M., Mohsin, M., Dagar, V., and Hao, Y. (2022). Prioritizing and overcoming biomass energy barriers: Application of AHP and G-TOPSIS approaches. Technol. Forecast. Soc. Change 177, 121524. doi:10.1016/j.techfore.2022.121524

Lan, C., Martínez, O. S., Fenza, G., and Crespo, R. G. (2021). Design of coordination contract for quality control-based supply chain under consumer balking behavior with fuzzy environment. J. Intelligent Fuzzy Syst. 40 (4), 8295–8305. doi:10.3233/JIFS-189652

Li, J., Ku, Y., Liu, C., and Zhou, Y. (2020). Dual credit policy: Promoting new energy vehicles with battery recycling in a competitive environment? J. Clean. Prod. 243, 1–26. doi:10.1016/j.jclepro.2019.118456

Li, J., Ku, Y., Yu, Y., Liu, C., and Zhou, Y. (2020). Optimizing production of new energy vehicles with across-chain cooperation under China’s dual credit policy. Energy 194, 1–15. doi:10.1016/j.energy.2019.116832

Li, L., and Liu, K. (2020). Coordination contract design for the newsvendor model. Eur. J. Operational Res. 283 (1), 380–389. doi:10.1016/j.ejor.2019.10.045

Li, W., Chien, F., Hsu, C., Zhang, Y., Nawaz, M. A., Iqbal, S., et al. (2021). Nexus between energy poverty and energy efficiency: Estimating the long-run dynamics. Resour. Policy 72, 102063. doi:10.1016/j.resourpol.2021.102063

Li, X., and Xiong, Q. (2021). Phased impacts of China’s dual-credit policy on R&D. Front. Energy Res. 9, 1–12. doi:10.3389/fenrg.2021.694338

Li, Y., Zhang, Q., Liu, B., McLellan, B., Gao, Y., and Tanga, Y. (2018). Substitution effect of new-energy vehicle credit Program and corporate average fuel consumption Regulation for green-car subsidy. Energy, 223–236. doi:10.1016/j.energy.2018.03.134152

Li, Y., Zhang, Q., Tang, Y., Mclellan, B., Ye, H., Shimoda, H., et al. (2020). Dynamic optimization management of the dual-credit policy for passenger vehicles. J. Clean. Prod. 249, 1–13. doi:10.1016/j.jclepro.2019.119384

Lou, G., Ma, H., Fan, T., and Chan, H. (2020). Impact of the dual-credit policy on improvements in fuel economy and the production of internal combustion engine vehicles. Resour. Conservation Recycl. 156, 104712–104713. doi:10.1016/j.resconrec.2020.104712

Lu, C., Wang, Q., Zhao, M., and Yan, J. (2022). A study on competitive and emission reduction strategies of automobile manufacturers under the "Double credits" policy. Chin. J. Manag. Sci. 30 (1), 64–76. doi:10.16381/j.cnki.issn1003-207x.2019.1566

Lu, Y., Liu, Q., and Li, J. (2021). The impact of government subsidies on the green innovation capability of new energy automobile companies. IOP Conf. Ser. Earth Environ. Sci. 680 (1), 012113–012116. doi:10.1088/1755-1315/680/1/012113

Luo, C., Leng, M., Huang, J., and Liang, L. (2014). Supply chain analysis under a price-discount incentive scheme for electric vehicles. Eur. J. Operational Res. 235, 329–333. doi:10.1016/j.ejor.2013.11.021

Ma, H., Lou, G., Fan, T., Chan, H., and Chung, S. (2021). Conventional automotive supply chains under China's dual-credit policy: Fuel economy, production and coordination. Energy Policy 151, 1–13. doi:10.1016/j.enpol.2021.112166

Ma, M., Meng, W., Li, Y., and Huang, B. (2021). Supply chain coordination strategy for NEVs based on supplier alliance under dual-credit policy. Public Libr. Sci. 1 (10), 1–36. doi:10.1371/journal.pone.0257505

Mark, K. (2021). China: Wuling Hong Guang MINI EV sales exceed 43,000 sales YTD. [EB/OL].InsideEVs. Available at: https://insideevs.com/news/493543/wuling-hongguang-mini-ev-sales-february-2021/ (Accessed June 6, 2022).

McCollum, D. L., Wilson, C., Bevione, M., Carrara, S., Edelenbosch, O. Y., Emmerling, J., et al. (2018). Interaction of consumer preferences and climate policies in the global transition to low-carbon vehicles[J]. Nature Energy 3 (8), 664–673. doi:10.1038/s41560-018-0195-z

Mondal, C., and Giri, B. C. (2021). Analyzing a manufacturer-retailer sustainable supply chain under cap-and-trade policy and revenue sharing contract. Operational Res. 22, 4057–4092. doi:10.1007/s12351-021-00669-8

Ou, S., Lin, Z., Qi, L., Li, J., He, X., and Przesmitzki, S. (2018). The dual-credit policy: Quantifying the policy impact on plug-in electric vehicle sales and industry profits in China. Energy Policy 121, 597–610. doi:10.1016/j.enpol.2018.06.017

Peng, L., Li, Y., and Yu, H. (2021). Effects of dual credit policy and consumer preferences on production decisions in automobile supply chain. Sustainability 13 (11), 1–19. doi:10.3390/su13115821

Shao, L., and Liu, Q. (2022). Decision-making and the contract of the complementary product supply chain considering consumers’ environmental awareness and government green subsidies. Int. J. Environ. Res. Public Health 19 (5), 3100–3127. doi:10.3390/ijerph19053100

Shen, J. (2021). Uncertain two-echelon green supply chain models based on revenue sharing contract. Int. J. Mach. Learn. Cybern. 12, 2059–2068. doi:10.1007/s13042-021-01292-x

Sun, H., Pofour, A. K., Mensah, I. A., Li, L., and Mohsin, M. (2020). The role of environmental entrepreneurship for sustainable development: Evidence from 35 countries in Sub-Saharan Africa. Sci. Total Environ. 741. doi:10.1016/j.scitotenv.2020.140132

Sun, L., Cao, X., Alharthi, M., Zhang, J., Taghizadeh-Hesary, F., and Mohsin, M. (2020). Carbon emission transfer strategies in supply chain with lag time of emission reduction technologies and low-carbon preference of consumers. J. Clean. Prod. 264, 121664. doi:10.1016/j.jclepro.2020.121664

Wang, Y., Yu, Z., Jin, M., and Mao, J. (2021). Decisions and coordination of retailer-led low-carbon supply chain under altruistic preference. Eur. J. Operational Res. 293 (3), 910–925. doi:10.1016/J.EJOR.2020.12.060

Xia, Z., Abba, s. Q., Mohsin, M., and Song, G. (2020). Trilemma among energy, economic and environmental efficiency: Can dilemma of EEE address simultaneously in era of COP 21? J. Environ. Manag. 276, 111322. doi:10.1016/j.jenvman.2020.111322

Yu, Y., Zhou, D., Zha, D., Wang, Q., and Zhu, Q. (2021). Optimal production and pricing strategies in auto supply chain when dual credit policy is substituted for subsidy policy. Energy 226, 1–11. doi:10.1016/j.energy.2021.120369

Zhao, J., Patwary, A. K., Qayyum, A., Alharthi, M., Bashir, F., Mohsin, M., et al. (2021). Fueling the future with green economy: An Integration of its Determinants from renewable Sources. Energy 238, 122029. doi:10.1016/j.energy.2021.12202910.1016/j.energy.2021.122029

Zhao, W., Zhang, T., Kildahl, H., and Ding, Y. (2022). Mobile energy recovery and storage: Multiple energy-powered EVs and refuelling stations. Energy 257. doi:10.1016/J.ENERGY.2022.124697

Zhao, X. (2021). Research on new energy vehicle supply chain strategy under government subsidies. Front. Econ. Manag. 2 (3), 250–254. doi:10.6981/FEM.202103_2(3).0032

Keywords: dual-credit policy, fuel consumption, endurance capacity constraints, decentralized decision-making and centralized decision-making, revenue-sharing contract, credits strategy

Citation: Huo H, Luo D and Yan Z (2023) Automaker’s credits strategy considering fuel consumption and endurance capacity constraints under dual-credit policy in China. Front. Energy Res. 10:963900. doi: 10.3389/fenrg.2022.963900

Received: 08 June 2022; Accepted: 26 December 2022;

Published: 12 January 2023.

Edited by:

Rajesh Kumar, Malaviya National Institute of Technology, Jaipur, IndiaReviewed by:

Hanzhengnan Yu, CATRAC, ChinaMark Richards, Grand Valley State University, United States

Copyright © 2023 Huo, Luo and Yan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zhanghua Yan, MTAyNjQxQGhyYmN1LmVkdS5jbg==

Hong Huo

Hong Huo Dan Luo

Dan Luo