94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

OPINION article

Front. Energy Res., 01 June 2022

Sec. Sustainable Energy Systems

Volume 10 - 2022 | https://doi.org/10.3389/fenrg.2022.923739

This article is part of the Research TopicSustainable and Environmental Development of Energy Economics based on Smart Grids and EnergyTechView all 16 articles

EnergyTech is a promising investment project for three reasons. The first reason is the overall high investment attractiveness of energy projects due to high global energy demand and broad prospects for return on investment (Ayub et al., 2022; Verba et al., 2022). The second reason is that EnergyTech is not just “smart” technologies in the energy sector but a transition to clean energy (Ratner et al., 2022; Štreimikienė et al., 2022). The implementation of projects on the creation of “smart” infrastructure in the field of clean (renewable) energy allows the operation of infrastructure facilities for a longer period compared to projects for the extraction and use of non-renewable energy (for example, fossil fuels) (Gallo et al., 2020; Sisodia et al., 2020; Ratner et al., 2021).

The third reason is the strategic importance of the projects under consideration for the state, combined with their high social significance, providing support for the state and society (Knayer and Kryvinska, 2022; Kamruzzaman and Alruwaili, 2022). The focus of this article is the problem related to the fact that, despite the prospects, investment projects in the field of EnergyTech in 2020–2021 faced the problem of a shortage of financial resources due to the COVID-19 crisis.

In the existing literature, much attention is paid to the issues of energy financing. Chien et al. (2021), Gong et al. (2021), Li et al. (2022), Popkova et al. (2019) in their works point to the key role of financing in the development of the energy economy, and also note that this role is to ensure the lack of energy resources for economic systems. The cited works emphasize the infrastructure formative function of the energy sector in the system of entrepreneurship, as well as the need for energy availability to maintain a high quality of life of the population, ensure uninterrupted industrial production and continuous economic growth.

Taking into account the general economic downturn, the worsening investment climate, acute government budget deficits and the increase in public debt in many countries, Iqbal and Bilal (2021), Taghizadeh-Hesary et al. (2022), Tran (2021) note that in the context of the COVID-19 crisis, the amount of financing for EnergyTech decreased and progress in its development has slowed down. The works of Lean and Lee (2022), Popkova et al. (2021), Zhao et al. (2022), Zhou and Liu (2022) also indicate that the pandemic and the COVID-19 crisis had a contradictory impact on EnergyTech, on the one hand, causing a shortage of its financing and increased risks of practical implementation of SDG 7, but, on the other hand, by creating common financing conditions for the countries of the world, thereby ensuring equal opportunities for the development of EnergyTech in developed and developing countries.

A review of the literature showed that the issues of financing EnergyTech in the context of the COVID-19 crisis are widely studied in available publications. However, the causal relationships of changes in the amount of financing of EnergyTech in the context of the COVID-19 crisis remain poorly understood and uncertain, which is a research gap. In addition, existing publications are characterized by a generalized consideration of the fuel and energy complex with insufficient attention to its complicated internal structure. Uncertainty regarding the specifics of changes in financing and the pace of development of individual EnergyTech markets in the context of the COVID-19 crisis is another research gap.

Both identified gaps are filled in this article through an in-depth study and clarification of the cause-and-effect relationships of changes in financing and progress in the development of EnergyTech in the context of the COVID-19 crisis with a combination of quantitative and qualitative research methods. The purpose of this article is to identify the problems of financing EnergyTech during the COVID-19 crisis and in the post-pandemic period, as well as to determine the prospects for their solution.

Using the structural analysis method, a quantitative and qualitative assessment of the dynamics of statistical data was carried out for the most accurate and reliable identification of changes in the financing of EnergyTech in the conditions of the COVID-19 crisis. As a result, based on the materials of the International Energy Agency (2022), it was found that energy investments have changed unevenly among energy markets and have two features.

The first feature: the decline in investment in the development of the main energy markets. The downturn in upstream investments (compared to 2019) was 35% in 2020, in mid/downstream investments - 31% in 2020, in coal supply - 5% in 2020, and in fossil fuel power - 15% in 2020. In all these markets, in 2021, there was a significant lag from the pre-pandemic level (2019). The second feature is the independence of alternative and electric energy financing from the impact of the COVID-19 crisis. Thus, in the nuclear market, the volume of financing practically did not change in 2020, and in 2021 it even increased by 3%. In the electricity networks and battery storage market, the amount of financing also remained virtually unchanged in 2020, and increased by 10% in 2021.

The third feature: increasing investments in “green” (“clean”) energy. Thus, the volume of financing for low carbon fuels remained unchanged in 2020, and increased by 3% in 2021. The volume of financing of renewable power in the context of the COVID-19 pandemic and crisis increased by 9% in 2020, and then by another 4% in 2021. It was also found that the total volume of global energy investments in the context of the COVID-19 pandemic and crisis decreased by 8%, while the share of investments in “green” energy in their overall structure increased from 20% in 2019 to 25% in 2021.

In order to determine the consequences of the above-described changes in the volume and structure of its financing, the international experience of EnergyTech development was analyzed. The study was conducted on the example of the top three developed countries (Finland ranks first; Denmark—second; Sweden - third) and top three developing countries (China ranks 25th; Brazil - 27th; Mexico - 29th) in the 2021 Global Energy Innovation Index Rankings (ITIF, 2022a). As a result, using the trend analysis method, three global trends in the development of EnergyTech in the conditions of the COVID-19 crisis (compared to the pre-pandemic period) were identified, based on ITIF (2022a), ITIF (2022b) statistics.

The first trend: progress in knowledge development and diffusion (option generation). In Denmark, this indicator increased by 54.42% from 9.5 points in 2019 to 14.67 points in 2021; in Sweden - by 33.59% from 9.2 points in 2019 to 12.29 points in 2021. In developing countries, the trend under consideration is more moderate. So, in China, this indicator increased by 29.88% from 8.7 points in 2019 to 11.30 points in 2021; in Brazil - by 3.42% from 7.3 points in 2019 to 7.55 points in 2021.

The second trend is an increase in the level of entrepreneurial experimentation and market formation (scale-up). In Finland, this indicator increased by 59.56% from 9.2 points in 2019 to 14.68 points in 2021; in Sweden - by 22.89% from 11.4 points in 2019 to 14.01 points in 2021. In developing countries, this trend is less pronounced. So, in Brazil, this indicator increased by 2.44% from 8.6 points in 2019 to 8.81 points in 2021; in Mexico - by 11.64% from 7.3 points in 2019 to 8.15 points in 2021.

The third trend is a decrease in social legalization and international collaboration. In developed countries, this trend is poorly expressed. In Finland, the indicator in question increased by 9.07% from 12.9 points in 2019 to 11.73 points in 2021. In Sweden, it increased by 25.69% from 14.4 points in 2019 to 10.70 points in 2021. This trend is much stronger in developing countries. In China, the indicator in question increased by 62.43% from 7.8 points in 2019 to 2.93 points in 2021. In Brazil, by 53.17% from 8.2 points in 2019 to 3.84 points in 2021.

From the above results of trend analysis, it is noticeable that all three trends are most clearly manifested in developed countries. Consequently, in the context of the COVID-19 crisis, the decline in the availability of financing for EnergyTech has exacerbated the imbalances in its development and increased the inequality of countries in the practical implementation of SDG 7.

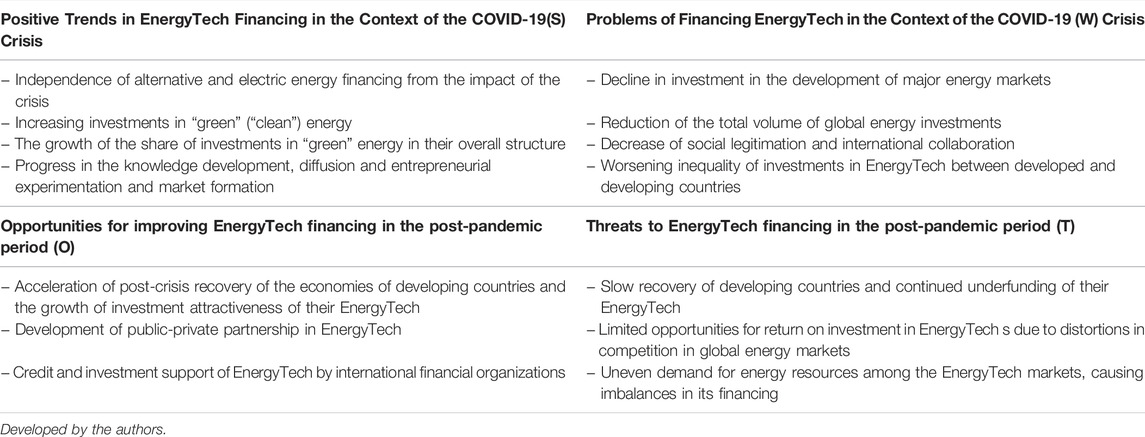

The obtained results of quantitative and qualitative research are summarized in Table 1. Based on them, a SWOT analysis of current problems and prospects for their solution was carried out to clarify the cause-and-effect relationships of EnergyTech financing in the conditions of the COVID-19 crisis and in the post-pandemic period.

TABLE 1. SWOT analysis of EnergyTech financing problems during the COVID-19 crisis and in the post-pandemic period.

As shown in Table 1, there are a number of threats to EnergyTech financing in the post-pandemic period. One of the threats is the slow recovery of developing countries and the continued underfunding of their EnergyTech. In this case, the gap in energy investments between developed and developing countries will remain. Another threat is the limited opportunities for the return on investment in EnergyTech due to distortions in competition in global energy markets.

Disruptions in global value chains and energy shocks, including the increase in world prices for fuel and energy resources observed in the first half of 2022, may provide a disincentive for energy companies to develop, as well as reduce the investment attractiveness of “green” energy development projects. Another threat is the uneven demand for energy resources among the EnergyTech markets, which causes imbalances in its financing.

The possibilities of improving EnergyTech financing in the post-pandemic period are connected, firstly, with the accelerated post-crisis recovery of the economies of developing countries and the growth of the investment attractiveness of their EnergyTech. Secondly, they are also related to the development of public-private partnerships, which should be given increased attention in EnergyTech. Thirdly, they are linked to the credit and investment support of EnergyTech from international financial organizations, especially in relation to developing countries.

The contribution of the article to the literature is to clarify the cause-effect relationships of changes in financing and progress in the development of EnergyTech in the context of the COVID-19 crisis, as well as prospects in the post-pandemic period. In opposition to the viewpoints by Chien et al. (2021), Gong et al. (2021), Li et al. (2022), Popkova et al. (2019), Sheng et al. (2021) it has been proven that financing of “green” energy is a priority in EnergyTech, which in the conditions of the COVID-19 pandemic and crisis turned out to be the most investment-attractive (compared to the main/traditional energy markets (compared to the main/traditional energy markets (upstream, mid/downstream, coal supply, fossil fuel power).

In contrast to Iqbal and Bilal (2021), Taghizadeh-Hesary et al. (2022), Tran (2021), it is proved that in the conditions of the COVID-19 crisis, the amount of financing for EnergyTech has changed unevenly and, despite its general reduction, the amount of financing for “green” (“clean”) energy (low carbon fuels, renewable power) has increased, as well as the amount of financing for alternative and electric energy (nuclear and electricity networks) has been preserved. Thanks to this, progress in the development of EnergyTech has not slowed down, but even accelerated. For example, in Denmark, knowledge development and diffusion increased by 54.42%, and in Finland, entrepreneurial experimentation and market formation increased by 59.56%.

Unlike Popkova et al. (2021), Zhao et al. (2022), Zhou and Liu (2022), it has been proven that the pandemic and the COVID-19 crisis have not reduced, but increased the inequality between developed and developing countries in the field of financing EnergyTech, which is a serious problem that needs to be addressed as a priority in the post-pandemic period. The theoretical value of the results obtained is that they make it possible to see SDG seven in a new perspective, i.e. they show that “clean” energy comes to the fore. This means that the financing of EnergyTech is not aimed at supporting industrial economic growth, but at decarbonization. The resource role of energy gives way to resource efficiency: the conservation of energy resources and their environmental friendliness.

Thus, the actual problems of financing EnergyTech in the context of the COVID-19 crisis have been identified, including a reduction of investments in the development of major energy markets, a decrease in the total volume of global investments in energy, a decline in social legitimation and international collaboration, as well as an increase in the inequality of investment in energy technologies between developed and developing countries.

The prospects for solutions in the post-pandemic period related to the growth of investment attractiveness of EnergyTech in developing countries, with the development of public-private partnerships and with credit and investment support of EnergyTech from international financial organizations, especially in relation to developing countries, are also identified.

The contribution of the article to the literature is to substantiate that the COVID-19 pandemic and crisis not only created challenges and threats, but also provided prerequisites and revealed positive trends in EnergyTech financing, among which the priority of investment support for green energy plays a key role. This can be explained by the popularity of the environmental version of EnergyTech, and as a result, the growing attention to the environmental agenda. In the context of the pandemic, serious progress has been made in decarbonizing the economy, achieved by increasing the financing of “clean” energy and requiring support in the post-pandemic period.

The practical significance of the research results is that the identified prospects and the proposed authors’ recommendations will be useful for improving the financing of EnergyTech in the post-pandemic period. The conducted research is limited to considering only the experience of leaders in the development of EnergyTech, while the problem of financing of the energy economy in other countries remains outside the scope of this article–it is proposed to devote further scientific research to its study. Another interesting issue is the consideration of regional differences in the financing of EnergyTech, which is also proposed to focus on in future research.

Conceptualization, VO, ND, AA, and AS; Formal analysis, AA; Methodology, VO; Project administration, AS and AA; Resources, AA and ND; Writing—review and editing, ND and VO.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Ayub, S., Ayob, S. M., Tan, C. W., Taimoor, M., Ayub, L., Bukar, A. L., et al. (2022). Analysis of Energy Management Schemes for Renewable-Energy-Based Smart Homes against the Backdrop of COVID-19. Sustain. Energy Technol. Assessments 52, 102136. doi:10.1016/j.seta.2022.102136

Chien, F., Zhang, Y., and Hsu, C.-C. (2021). Assessing the Nexus between Financial Development and Energy Finance through Demand- and Supply-Oriented Physical Disruption in Crude Oil. Environ. Sci. Pollut. Res. 28 (46), 66086–66100. doi:10.1007/s11356-021-15535-5

Gallo, E., Wu, Z., and Sergi, B. S. (2020). China's Power in its Strategic Energy Partnership with the Eurasian Economic Union. Communist Post-Communist Stud. 53 (4), 200–219. doi:10.1525/j.postcomstud.2020.53.4.200

Gong, X., Ji, Q., and Lin, B. (2021). Literature Review and Frontier Direction Exploration of Energy Finance. Xit. Gongcheng Lilun yu Shijian/System Eng. Theory Pract. 41 (12), 3349–3365. doi:10.12011/SETP2020-0163

Information Technology and Innovation Foundation (ITIF) (2022a). Global Energy Innovation Index. National Contributions to the Global Clean Energy Innovation System. Availble at: https://www2.itif.org/2019-global-energy-innovation-index.pdf (data accessed: 06.04.2022).

Information Technology and Innovation Foundation (ITIF) (2022b). The 2021 Global Energy Innovation Index: National Contributions to the Global Clean Energy Innovation System. Availble at: https://itif.org/publications/2021/10/18/2021-global-energy-innovation-index-national-contributions-global-clean (data accessed: 06.04.2022).

International Energy Agency (2022). World Energy Investment 2021. Availble at: https://iea.blob.core.windows.net/assets/5e6b3821-bb8f-4df4-a88b-e891cd8251e3/WorldEnergyInvestment2021.pdf (data accessed: 06.04.2022).

Iqbal, S., and Bilal, A. R. (2021). Energy Financing in COVID-19: How Public Supports Can Benefit? Cfri 12, 219–240. doi:10.1108/CFRI-02-2021-0046

Kamruzzaman, M. M., and Alruwaili, O. (2022). Energy Efficient Sustainable Wireless Body Area Network Design Using Network Optimization with Smart Grid and Renewable Energy Systems. Energy Rep. 8, 3780–3788. doi:10.1016/j.egyr.2022.03.006

Knayer, T., and Kryvinska, N. (2022). An Analysis of Smart Meter Technologies for Efficient Energy Management in Households and Organizations. Energy Rep. 8, 4022–4040. doi:10.1016/j.egyr.2022.03.041

Lean, H. H., and Lee, C.-C. (2022). Editorial: Energy Economics and Energy Finance in Developing and Emerging Countries. Front. Energy Res. 10, 814273. doi:10.3389/fenrg.2022.814273

Li, Z., Gallagher, K., Chen, X., Yuan, J., and Mauzerall, D. L. (2022). Pushing Out or Pulling in? the Determinants of Chinese Energy Finance in Developing Countries. Energy Res. Soc. Sci. 86, 102441. doi:10.1016/j.erss.2021.102441

Popkova, E. G., Inshakov, O. V., and Bogoviz, A. V. (2019). Regulatory Mechanisms of Energy Conservation in Sustainable Economic Development. Lect. Notes Netw. Syst. 44, 107–118. doi:10.1007/978-3-319-90966-0_8

Popkova, E. G., Inshakova, A. O., Bogoviz, A. V., and Lobova, S. V. (2021). Energy Efficiency and Pollution Control through ICTs for Sustainable Development. Front. Energy Res. 9, 735551. doi:10.3389/fenrg.2021.735551

Ratner, S., Berezin, A., Gomonov, K., Serletis, A., and Sergi, B. S. (2022). What Is Stopping Energy Efficiency in Russia? Exploring the Confluence of Knowledge, Negligence, and Other Social Barriers in the Krasnodar Region. Energy Res. Soc. Sci. 85, 102412. doi:10.1016/j.erss.2021.102412

Ratner, S., Berezin, A., and Sergi, B. S. (2021). Energy Efficiency Improvements under Conditions of Low Energy Prices: The Evidence from Russian Regions. Energy Sources, Part B Econ. Plan. Policy, 1–20. doi:10.1080/15567249.2021.1966134

Sheng, Z., Yuan, G., Xiru, D., Minglong, Z., Yi, W., and Yu, H. (2021). Research on High Quality Evaluation and Influencing Factors of China Energy Finance: Evidence from A-Share New Energy Companies. Front. Environ. Sci. 9, 662424. doi:10.3389/fenvs.2021.662424

Sisodia, G. S., Awad, E., Alkhoja, H., and Sergi, B. S. (2020). Strategic Business Risk Evaluation for Sustainable Energy Investment and Stakeholder Engagement: A Proposal for Energy Policy Development in the Middle East through Khalifa Funding and Land Subsidies. Bus. Strat. Env. 29 (6), 2789–2802. doi:10.1002/bse.2543

Štreimikienė, D., Samusevych, Y., Bilan, Y., Vysochyna, A., and Sergi, B. S. (2022). Multiplexing Efficiency of Environmental Taxes in Ensuring Environmental, Energy, and Economic Security. Environ. Sci. Pollut. Res. 29 (5), 7917–7935. doi:10.1007/s11356-021-16239-6

Taghizadeh-Hesary, F., Zakari, A., Alvarado, R., and Tawiah, V. (2022). The Green Bond Market and its Use for Energy Efficiency Finance in Africa. Cfri 12, 241–260. doi:10.1108/CFRI-12-2021-0225

Tran, Q. H. (2021). The Impact of Green Finance, Economic Growth and Energy Usage on CO2 Emission in Vietnam - a Multivariate Time Series Analysis. Cfri 12, 280–296. doi:10.1108/CFRI-03-2021-0049

Verba, N., Nixon, J. D., Gaura, E., Dias, L. A., and Halford, A. (2022). A Community Energy Management System for Smart Microgrids. Electr. Power Syst. Res. 209, 107959. doi:10.1016/j.epsr.2022.107959

Zhao, W., Liu, X., Wu, Y., Zhang, T., and Zhang, L. (2022). A Learning-To-Rank-Based Investment Portfolio Optimization Framework for Smart Grid Planning. Front. Energy Res. 10, 852520. doi:10.3389/fenrg.2022.852520

Keywords: financing, investment in the energy sector, EnergyTech, energy economy, “green” energy, COVID-19 crisis, post-pandemic period

Citation: Osipov VS, Alekseev AN, Deberdeeva NA and Seregina AA (2022) Problems of EnergyTech Financing in the Context of the COVID-19 Crisis and the Post-Pandemic Period and the Prospects for Their Solution. Front. Energy Res. 10:923739. doi: 10.3389/fenrg.2022.923739

Received: 19 April 2022; Accepted: 09 May 2022;

Published: 01 June 2022.

Edited by:

Bruno Sergi, Harvard University, United StatesReviewed by:

Sadriddin Khudaykulov, Tashkent State Economic University, UzbekistanCopyright © 2022 Osipov, Alekseev, Deberdeeva and Seregina. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Vladimir S. Osipov, dnMub3NzaXBvdkBnbWFpbC5jb20mI3gwMDAyNjtoYWlyc3A=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.