94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Energy Res. , 24 June 2022

Sec. Sustainable Energy Systems

Volume 10 - 2022 | https://doi.org/10.3389/fenrg.2022.913032

This article is part of the Research Topic Interactions Between China’s National Emissions Trading Scheme and Electricity Market: Practices and Policies View all 27 articles

The internal and external monitoring mechanism is a beneficial monitoring mode which is in line with the current national condition, the situation of the power grid, and the construction progress of the power spot market. However, the independence of third-party monitoring agencies cannot be completely guaranteed because of the incomplete management system of China’s electricity market at present. Therefore, the market is prone to power rent-seeking in which third-party monitoring agencies conspire with the market internal monitoring organization. Based on the evolutionary game theory, this study constructed a coordination game model between third-party monitoring agencies and the market internal monitoring organization, as well as an asymmetric coordination game model between the interest group composed of internal and external monitoring agencies and government regulatory authorities. By analyzing the evolutionarily stable strategy of each game participant, the study identified the underlying factors that affect the strategic choices made by internal and external monitoring agencies and government regulatory authorities and then put forward some reasonable suggestions for reducing the probability of third-party monitoring agencies colluding with internal monitoring organizations so that the efficiency of internal and external monitoring mechanisms can be improved.

With the continuous development of China’s electric power system reform and the establishment of the electricity spot market, power market supervision has drawn more and more attention (Streimikienė et al., 2016; Strielkowski et al., 2017; Kumar and France, 2022). The electricity market is often extremely complicated in design because of the economic and social demand on its supply–demand balance and a reliable electric power system. In addition, the electricity load has a small demand elasticity, which means it cannot respond to the market’s real-time price immediately, so this enables power generators to have an opportunity to adjust load and manipulate prices (Song and Cui, 2016; Maekawa and Shimada, 2019). Due to these characteristics, in the process of China’s electric power market reform, there are not only behaviors that disrupt the fair and effective market competition but also speculative behaviors that take the advantage of electricity market rules’ loopholes, which greatly affect the operation efficiency of the electricity market. So establishing a powerful market monitoring mechanism is an efficient way to solve these problems. Through monitoring, simulation, and analysis, the monitoring agencies propose the constructive advice for the power dispatching and trading center, the behavior of all market participants, market rules, and scheduling procedures’ defects so as to ensure the smooth and orderly operation of the electricity market (Dzikevičius and Šaranda, 2016; Jin et al., 2021). The most fundamental vitality of the electricity market comes from the market itself, which is embodied in efficiency. Therefore, building a comprehensive electric power monitoring mechanism can minimize the impact of market external factors on efficiency so that the long-term vitality of the power market can be guaranteed.

The objective of market monitoring includes not only the violations in the ordinary sense but also the behaviors that conform to market rules but violate the original intention of market design. Moreover, monitoring agencies have obligations to discover rules and loopholes and propose corresponding solutions timely before the market participants find and abuse them for personal gain. For example, the monitoring agency should be able to effectively identify the abuse of market power and market manipulation that hinder market efficiency, playing a role in correcting market failures. In the meantime, they can provide evaluation and beneficial suggestions for market performance and judge whether the market rules have created incentives for market participants, thereby enabling the electric power market to operate efficiently. The market monitoring agencies supervise all market participants; therefore, a high-quality monitoring result is the source and guarantee of market participants’ confidence in the market. This requires that the monitoring agencies must release genuine and transparent monitoring results. For example, the monitoring agency should have no interest relationship with the monitoring results and should regularly release their market evaluation reports to the public. Consequently, the monitoring agencies play an indispensable role in the electricity power market reform and construction.

So who should be responsible for monitoring the market? At present, the international power monitoring mode can be roughly divided into three categories: government monitoring, internal monitoring, and independent third-party monitoring. However, neither the government nor the power trading and dispatching agencies are eligible to supervise due to their role and function. Government authorities, on the one hand, cannot attract professional monitoring talents with an economics background because of the wages and staffing issues. On the other hand, the government’s work on employment, environmental protection, and taxation may not coincide with or even contradict the goals required by the electricity market. So the government’s impartiality in market monitoring will be doubted. As the rule makers and operators of power dispatching, trading and dispatching agencies may intentionally or unintentionally uphold existing regulations and are sensitive to criticisms and accusations, which may lead to the failure of internal market monitoring. An independent third party has three characteristics: the budget of the monitoring department is independent, the monitoring personnel is independent, and the monitoring agency has independent decision-making power. Market monitoring is carried out by independent “third parties” in mature markets such as Europe and the United States, such as PJM and FERC. Therefore, as the electric power reform deepens, market participants’ calls for third-party monitoring are strengthening.

The independent third-party monitoring is new to China’s electricity market design. At present, China continuously introduces third-party monitoring agencies. The basic rules for intermediate and long-term electricity transactions jointly issued by the National Development and Reform Commission and the National Energy Administration in 2020 encourage regions which met standards to introduce third-party monitoring. Guangdong province has taken the lead in introducing third-party market business audit institutions, and the electric power spot market rules in Zhejiang province have also determined to introduce third-party monitoring agencies. After the introduction of third-party detection, what is the behavioral decision of each subject under the dual detection mechanism? How to improve the efficiency of electricity market monitoring? How to prevent conspiracy between third-party monitoring agencies and internal stakeholders? These questions need to be settled properly, and enough attention should be paid to the design and construction of the power spot market so that the legitimate rights and interests of market participants can be protected, and a good market order can be maintained.

Based on the earlier discussion, this study takes the internal and external monitoring mechanism of the electricity market in the spot market as the research object and takes advantage of the evolutionary game model to investigate the behavior selection of government regulatory authorities, third-party monitoring agencies, and electric power market internal monitoring organizations under the circumstance of information asymmetry and limited rationality, in order to identify the problems and obstacles that exist in the actual operation of the internal and external monitoring mechanism in the power spot market so as to provide conducive suggestions for the government to effectively introduce and establish a truly independent third-party monitoring. The remainder of this study is structured as follows. Section 2 presents a review of the related literature works, followed by the model hypothesis, model building, and analysis in Section 3. Conclusion and policy suggestions are presented in Section 4.

Electricity market monitoring plays a key role under the conditions of free electricity market. (Chen et al., 2018; Xu et al., 2021). The core purpose of electric power monitoring is to ensure the efficient, fair, open, and impartial operation of the electric power market, meanwhile maximizing market efficiency and social benefits without damaging the power reliability and stability (Pinczynski and Kasperowicz, 2016; Du et al., 2021; Halkos and Nomikos, 2021). Power market operation monitoring can master the situation of the power market in real time by closely tracking the adjustment or addition of trading varieties, trading rules, trading parameters, and changes in related policies, thus identifying potential problems and risks in advance and then providing the reference for establishing the market simulation mechanism.

Therefore, the issues in the monitoring of the electricity market and prevention of incorrect electric usage behavior have attracted worldwide attention in the research field of the competitive electricity market (Lisin et al., 2016; Cheng and Yao, 2021), which has been fully embedded in sustainable energy development strategies. Many scholars have carried out research studies on the construction of the market monitoring index system and the measurement and monitoring of market power in the electric power market. In the research field of the measurement index of the electric market, (Lin et al., (2002) based on the market structure design, the concentration ratio (CR) has been proposed. Gan and Bourcier (2002a) and Gan and Bourcier (2002b) put forward the must-run ratio (MRR) index based on market supply and demand. Ding et al. (2003) put forward market price controllable (MPC). The Lerner index (LI) is presented by Zhao et al. (2003) based on the market efficiency design. In addition, Patton (2003) brings forward the Residual Supply Index (RSI), and Bataille et al. (2019) proposed the “Return on Withholding Capacity Index” (RWC) as a complementary index to the RSI. Amanibeni (2021) proposes a comprehensive approach for market power detection based on a centrality concept in social network analysis (SNA), and the obtained results show that SNA can be used as an effective tool for monitoring the market power in future smart grids with a plenty of players and complexity. These indexes, respectively, provided ideas and methods for the measurement and evaluation of the sellers’ market power in the electricity market from different perspectives, reflecting the size and changing rules of the market power and providing a lot of valuable information for the electricity market monitoring. After an overview of various indicators, Yu et al. (2022) analyzed and summed up the United States, Nordic, and Singapore electricity market monitoring indicator system design. Finally, the theoretical characteristics of each index and its advantages and disadvantages in the application are summarized, which has an enlightening effect on the countermeasures of multiple transaction entities in China’s electricity market.

In discussing the research on the establishment of monitoring institutions in the electricity market, Patton (2003) provided a brief overview of the positioning of electricity market monitoring agencies and recommended specific solutions to monitor the market power and market operation. Rahimi and Sheffrin (2003) summarized an effective market design and the key elements required to implement the market monitoring system, and then pointed out that the effectiveness of the electricity market is ensured by monitoring market inefficiencies, the possibility of market power abuse, and market power issues. By studying the monitoring experience of the electric power market in Britain, California, New Zealand, Spain, and other countries, Wolak (2005) expounded on the procedures of market monitoring and the independence of market monitoring procedures. Garcia and Reitzes (2007) elaborated on the reasons for the emergence of market power in the electricity market and the necessity of setting up an independent market monitoring agency for the electricity market. They also described some commonly used methods for monitoring the electricity market and weakening market power and finally drew conclusions about the approaches in practice and the reasons behind policy differences. Zhao et al. (2008) built a monitoring system for helping the regulator make decisions on the market policy and predicting the future market scenarios, which consists of a price forecast mechanism and market simulator. With the system theory of electricity market monitoring as its basis and by using principal component analysis, the study conducts empirical analysis on the operation of the electric power market in California from 2000 to 2007, which proved the practicality and importance of the electricity market monitoring and early warning function. Gao et al. (2008), Michaels (2008) took RTO and market monitoring institutions (MMI) as examples to study the important role which market monitoring agencies play in power market monitoring, such as supervising the electricity market competition to ensure that the electricity transaction will not be manipulated by the market power of the generator. Yang et al. (2021) investigated the development status of the power spot market in Gansu from the perspectives of power structure and transaction mode and also expounded the necessity and path for establishing the market monitoring mechanism.

From the previous literature, it can be discovered that most of the existing literature works focus on the monitoring of the power market from the perspective of monitoring methods and the evaluation of monitoring results, and little attention is paid to who should take the monitoring role, which means that the monitoring mechanism is not known. Currently, there are three main monitoring modes, namely, the government supervision, internal monitoring, and independent third-party monitoring. In Australia, New Zealand, and Europe, the government takes the role of monitoring, while PJM in the United States belongs to third-party monitoring. Due to their functions and complex interest relationships, the government and internal monitoring organizations cannot be well qualified for power market monitoring. However, it is very difficult to ensure the complete independence of China’s electric power market monitoring if the European and American monitoring models are replicated. Therefore, introducing third-party monitoring agencies to form an internal and external monitoring mechanism which suits China’s national conditions has become an important step for China’s electric power market reform and design. This was also the aim of this study. Under the theoretical framework of evolutionary game, this study constructed two models: one is the coordinated and balanced game model between third-party monitoring agencies and internal monitoring organization, and the other is the asymmetry evolutionary game model between interest groups, which consist of third-party monitoring agencies and internal monitoring organization, and government regulatory agencies, aiming to investigate how to guarantee the independence of third-party monitoring and the reliability and effectiveness of monitoring results to the maximum content under the internal and external monitoring mechanism.

As a crucial economic analysis tool, game theory has been widely used in various fields to explain some social phenomena (Su et al., 2018a; Su et al., 2018b; Ma and Sun, 2018; Xie et al., 2018). Based on the bounded rationality and incomplete information of the participants, evolutionary game theory breaks through the condition of complete rationality of traditional games, which has greatly developed game theory, making it more applicable (Smith, 1976).The operation efficiency of the dual-monitoring mechanism in the electricity market is the result of the continuous study of the respective interests of the system composed of government regulatory authorities, internal monitoring organizations, and third-party monitoring agencies and then adjusting its strategy accordingly, which is consistent with the evolutionary game theory. Therefore, by adopting the evolutionary game theory as the analysis tool and researching the evolution of participants’ strategies, this article finds out the underlying factors that propel government regulatory authorities, third-party monitoring agencies, and internal monitoring organizations to falsify supervision results and affect their strategic choices under evolutionary stability and equilibrium and then put forward some suggestions so that the monitoring efficiency of the power spot market can be improved.

The dual-monitoring mechanism of the electricity market refers to internal market monitoring organizations and third-party monitoring agencies complementing each other. Monitoring agencies are in a favorable position compared with the electricity market participants as a result of information asymmetry. Market internal monitoring organizations have potential interest relationships with power generators, while nowadays the independence of third-party monitoring agencies cannot be guaranteed, so the public must resort to government authorities to supervise in order to defend their own interests. Internal market monitoring organizations and third-party monitoring agencies are all for the purpose of making profits, while government supervision is mandatory and aims to ensure the effective operation of the market. Therefore, according to the purpose and status of each monitoring subject, we defined the market internal monitoring organization and third-party monitoring agencies as interest group 1 and government regulatory authorities as interest group 2, to investigate the game equilibrium results between the two interest groups. At the same time, there is also a game within the interest group 1, and the result of the game will directly exert influence on the government’s regulatory strategy. In particular, this section will construct two evolutionary game models for market internal monitoring organizations, third-party monitoring agencies, and government regulatory agencies: (1) the equilibrium game model between the third-party monitoring agencies and the internal market monitoring agencies within the interest group 1; (2) the asymmetric evolutionary game model between interest group 1 and interest group 2. The game relationships between the three stakeholders are shown in Figure 1.

Under the internal and external monitoring mechanism, market monitoring is mainly conducted by the internal monitoring organizations of the electricity market trading and dispatching agencies and independent third-party monitoring agencies. On the one hand, because the monitoring reports and recommendations are made by third-party monitoring agencies and internal monitoring organizations, other power market participants have no access to know their authenticity due to information asymmetry. Therefore, third-party agencies and internal monitoring organizations are susceptible to power rent-seeking. On the other hand, it is not easy for third-party monitoring agencies to become truly independent. Even in the North American power market where the third-party monitoring model has been more mature, there are many contradictions and obstacles for independent third-party monitoring agencies, such as the tangible or intangible intervention from the monitored market participants’ management level, or third-party monitoring agencies’ budgets being actually controlled by some monitored participants. Moreover, China’s current electricity management system cannot provide a sound independent environment for third-party monitoring agencies, so it is hard for third-party monitoring agencies to publish unconstrained reports. In order to prevent power rent-seeking, supervision from government authorities plays an indispensable role in the internal and external monitoring mode. However, the supervision from government authorities has limitations, so third-party monitoring agencies and market internal monitoring organizations may conspire with each other to jointly conceal the true monitoring information or selectively publish reports that are beneficial to power generators. In addition, one of them may resort to power rent-seeking, too. Based on the aforementioned analysis, the hypotheses are proposed as follows:

Hypothesis 1:. the strategy set of the third-party monitoring agencies and the internal market monitoring organizations is {conspiracy, non-conspiracy}.

Hypothesis 2:. the probability of the conspiracy being exposed by the government regulatory department is

Hypothesis 3:. when the conspiracy is discovered and punished by government regulators, both parties will be fined

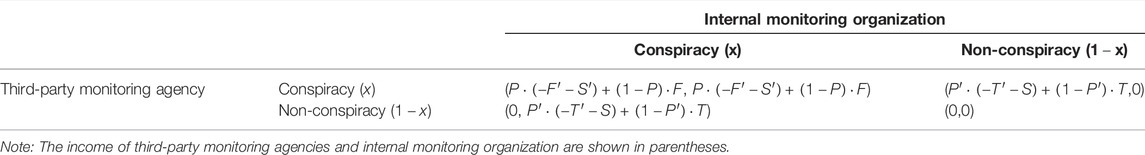

TABLE 1. Payoff matrix between the third-party monitoring agency and the internal monitoring organization.

Under government supervision, there is information asymmetry between government departments, third-party monitoring agencies, and market internal monitoring organizations that will make the game participant judge the strategies of other game participants based on historical experience, and they will continuously learn and adjust their own strategy in trials. Consequently, the dynamic adjustment of third-party monitoring agencies and internal market monitoring organizations’ strategies can be reflected by the replication dynamic process in the evolutionary game. Based on the payoff matrix in Table 1, this study computed the replicator dynamics equations of third-party monitoring agencies and internal market monitoring organizations and conducted analysis of the stability of their strategies, respectively.

Likewise,

Since the game is a symmetrical game, the replicator dynamics equations of third-party monitoring agencies and market internal monitoring organizations selecting conspiracy strategy are the same, which are shown in Eq. 7.

Three equilibrium solutions are derived from

It should be denoted that

As shown in Figure 2, (conspiracy, conspiracy) and (non-conspiracy, non-conspiracy) may be the stable equilibrium strategy solution of the evolutionary game system. The final convergence point of the long-term evolution of the system will finally converge depending on the value of parameters

We defined violations as rent-seeking unilaterally or colludingly by third-party monitoring agencies and internal agencies, so we assumed that the behavioral strategy set of the interest group 1 comprising third-party monitoring agencies and internal market monitoring organizations is {violation, non-violation}.The behavioral strategy set of interest group 2, namely, the government regulatory authorities that represent the appeal of the public interest, is {supervision, non-supervision}.In this model,

From Table 2,

Therefore, the replicator dynamics equation of interest group 1 choosing violation is as follows:

Similarly,

Therefore, the replicator dynamics equation of interest group 2 choosing violation is as follows:

Simultaneous Equations 11 and 15 and Eq. 16 can be obtained.

By solving Eq. 16, all the strategic equilibrium solutions of the evolutionary game model can be obtained, which are

The Jacobian matrix is shown as Eq. 17.

According to Lyapunov stability theory, when the trace of the Jacobian matrix is less than 0 and the determinant is bigger than 0, the equilibrium point is the stability point. Based on the theory, an analysis of the stability of each local equilibrium point is conducted, and the results are shown in Table 3.

It is easy to obtain from the aforementioned analysis that

This study assumes that

Case 1:. if the government authorities do not fully fulfill their regulatory responsibilities and

Case 2:. if the government authorities do not fully fulfill their regulatory responsibilities and

Case 3:. if the government authorities do not fully fulfill their regulatory responsibilities and

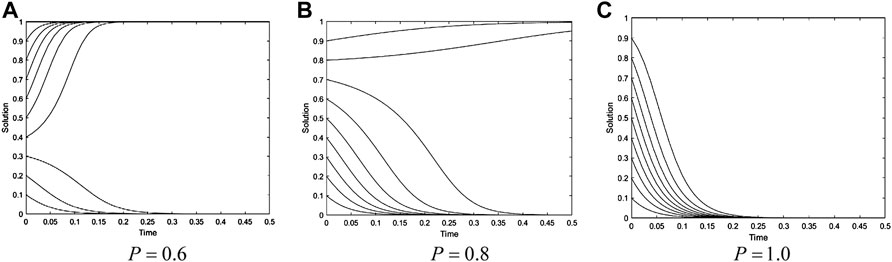

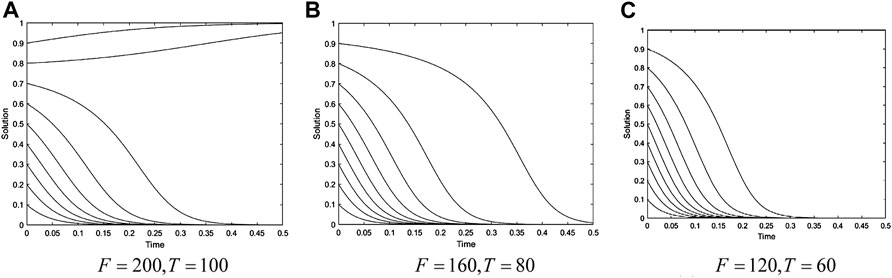

To analyze the impacts of different parameters on the evolutionary process specifically, we further used the MATLAB simulation tool to conduct the sensitivity analysis of the evolutionary game model proposed in Section 3.2. First, in order to explore the impact of government department supervision intensity on the strategic choice of internal market monitoring organizations and third-party monitoring agencies, this study carried out the numerical simulations of evolutionary game paths under different p-values. The initial values of parameters are set as

FIGURE 3. Dynamic phase diagram of the evolutionary game under different

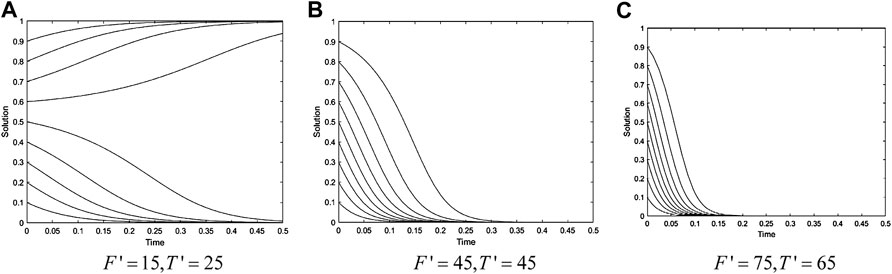

The asymptotic stability analysis of the evolutionary game in Section 3.2 shows that the game equilibrium between the third-party monitoring agencies and the internal market monitoring organizations is closely related to the cost and benefit under different strategic choices. In order to describe more intuitively the evolution trajectory of the game between third-party monitoring institutions and market monitoring institutions under different collusive benefits and different levels of punishment from government and public, respectively, we, then, further made the sensitivity analysis for each model parameter. In particular, we simulated the evolution path of game system equilibrium under different value combinations of

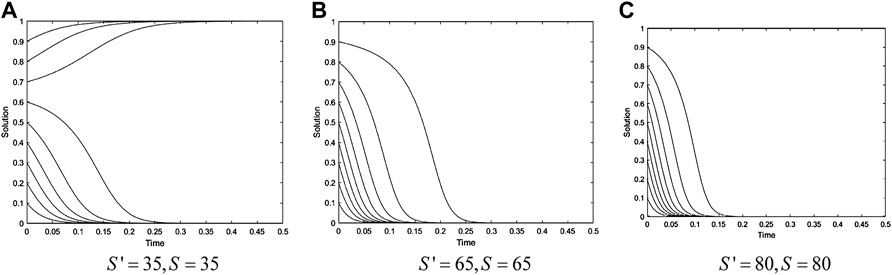

FIGURE 4. Dynamic phase diagram of the evolutionary game under different values of

When third-party monitoring agencies and internal market monitoring organizations choose not to implement effective inspection and tend to collude, they will suffer certain losses due to their bad reputation and reduced credibility among the public once their rent-seeking behavior is disclosed. It can be seen from Figure 5 that when the value of the losses due to the adverse social influence increases, the evolution speed of both third-party monitoring agencies and internal market monitoring organizations in choosing “not conspire” will increase, which leads to the persistent choice of “not conspire” of both parties. In addition, as the monitoring agencies know that their behavior will be subjected to strict public supervision and the rent-seeking behavior will have a serious negative impact on their reputation, the probability that they choose the “not conspire” strategy will be higher. Therefore, the government can strengthen the information disclosure of non-compliant power monitoring agencies so as to give full play to the effective supervision role of the society. In addition, it is necessary to reduce the public’s tolerance for the illegal rent-seeking behavior of monitoring agencies so that the monitoring agencies will generate greater social pressure when they choose a “collusion” strategy. This will more effectively prevent the collusion between third-party monitoring agencies and internal market monitoring organizations.

FIGURE 5. Dynamic phase diagram of the evolutionary game under different values of

The impact of the benefit gained by the monitoring agencies for rent-seeking behaviors on the two stakeholders’ strategy selection process is shown in Figure 6. We can find that when the profit that both third-party monitoring agencies and internal market monitoring organizations may get from their collusion behavior is lower, the probability of the two stakeholders choosing the strategy “not conspire” will approach 1 more quickly in the long run. This illustrates that the lower potential benefits of collusion by the monitoring agencies are conducive to better realizing the functions of both third-party monitoring agencies and internal market monitoring agencies, thus conducting effective and fair monitoring of the operation of the electricity market.

FIGURE 6. Dynamic phase diagram of the evolutionary game under different values of

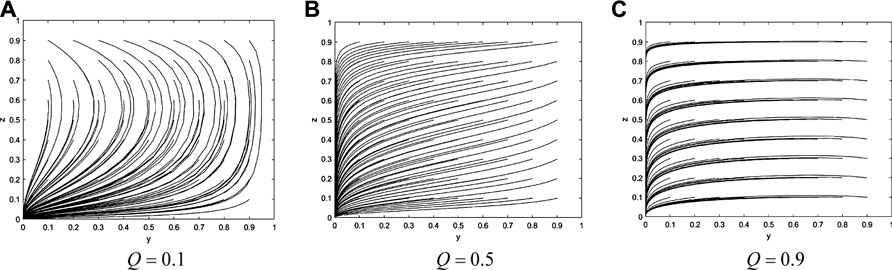

Figure 7 shows the simulation results of equilibrium point

FIGURE 8. Convergence phase diagram of the game system with different Q values. (A) Q = 0.1; (B) Q = 0.5; and (C) Q = 0.9.

At present, China’s electricity spot market is still in its initial stage, and the market rules need to be further improved. Some unavoidable deficiencies or loopholes in the market rules give market participants the opportunity to manipulate the market. Therefore, only by closely monitoring the operation of the power market can the construction of the power market be further promoted. A set of the comprehensive regional power market monitoring system can make a difference in ensuring the effective operation of the electric power market, avoiding uneconomic incentives resulting in market design and making sure that laws and regulations are well obeyed during market operation. Currently, among all mainstream monitoring modes, the internal and external monitoring mechanism is a monitoring mode that is adapted to China’s current national situation, the power grid situation, and the progress of the power spot market. However, restricted by China’s power management system, the independence of third-party monitoring agencies cannot be guaranteed. Consequently, third-party agencies may yield to the temptation of profit or to the pressure exerted by stakeholders and conspire with internal monitoring organizations, resulting in power rent-seeking. Based on this fact, this study constructed the evolutionary game models between the third-party monitoring agency and the internal monitoring organization of the power market, as well as between the interest groups constituted by internal and external monitoring agencies and the government regulatory authorities, respectively. Through the analysis of the evolution of participants’ strategies, the following conclusions have been drawn:

(1) Third-party monitoring agencies and market internal monitoring organizations are more inclined to conspire with each other to seek profit, with the main reason being a relatively high profit can be obtained through conspiracy and power rent-seeking. Therefore, in order to prevent the conspiracy, it is necessary to reduce the profits they can get through conspiracy. , In particular, the greater the probability that the government regulatory department finds the collusion of monitoring institutions and the economic penalty for the collusion, the greater is the negative social impact that monitoring institutions suffer from the disclosure of the violation, which is conducive to the evolution of the game system to the ideal state.

(2) Third-party monitoring agencies tend to choose violation strategies because it is profitable to fabricate results or take the path of power rent-seeking with pollutant discharging enterprises. But the fundamental reason is that the independence of the third-party monitoring agencies cannot be guaranteed. For example, an interest relationship may be found between the staff of the third-party monitoring agencies and the monitored entities. Therefore, the key point of lowering third-party violation is to cut off such interest links and reduce the benefits obtained by third-party monitoring agencies obtained from illegal practices.

(3) The cost of long-term supervision by government regulatory authorities is relatively high, and there are no additional rewards for them. So it is inevitable that there is no regulatory motivation, and long-term effective supervision cannot be conducted. For government regulators, although negligence will be punished, if the net income for fulfilling their duty of supervising is less than the penalty for negligence, then, non-supervision will be a better choice. Therefore, raising the cost of penalties for regulator failure can motivate the supervisors to perform their duties.

The key element for the effectiveness of the electricity market’s internal and external monitoring mechanism lies in the independence of third-party monitoring agencies, and government monitoring can be carried out cost-effectively and effectively. Combined with the conclusions of this study, the following policy suggestions are put forward:

(1) Continuously to improving relevant laws and regulations and continuously promoting the improvement of electricity market supervision laws and regulations; at the same time, efforts should be made to implement the requirements and penalties for the violations of various laws and regulations.

(2) Local government can employ several part-time but professional and authoritative people to form a monitoring team. The team members are only responsible for reporting the monitoring results to the government regulators and are authorized to publish monitoring reports in fixed terms. At the same time, the trading center must guarantee the independence of internal monitoring personnel and cannot interfere with its work or review the monitoring result. In this way, the independence of monitoring agencies is guaranteed without paying too much cost.

(3) Third-party monitoring agencies should be authorized by government regulatory authorities and publish monitoring reports regularly. Market trading and dispatching institutions have no right to neither intervene in “third party” monitoring nor review the monitoring report in advance. The trading center should charge the “market monitoring fee” to all market participants to offset the operation cost of “third-party” monitoring agencies and ensure their financial independence.

Based on the earlier research, subsequent research can explore the impact of the evolutionary stability strategies of each game subject on the market efficiency from the perspective of the electricity market. It is also advisable to explore the impact of the evolutionary stability strategy of each game player on social welfare.

The original contributions presented in the study are included in the article/supplementary material; further inquiries can be directed to the corresponding author.

LJ: responsible for model building and analysis. WL: responsible for variable selection and literature review. CC: responsible for data processing. JJ: responsible for textual content writing. WW: ideas; formulation or evolution of overarching research goals and aims and proposed innovative points.

This work was supported by the Research on Zhejiang Electric Power Market Operation Monitoring Mechanism under Spot Market Environment (Grant no. 2020FD02).

Authors LJ and WL were employed by the company Zhejiang Electric Trading Centre Co Ltd. Authors CC, JJ, and WW were employed by the company Zhejiang Huayun Mdt Info Tech Ltd.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Amanibeni, S. (2021). Market Power Assessment in Electricity Markets Based on Social Network Analysis. Comput. Electr. Eng. 94. doi:10.1016/j.compeleceng.2021.107302

Bataille, M., Bodnar, O., Steinmetz, A., and Thorwarth, S. (2019). Screening Instruments for Monitoring Market Power - the Return on Withholding Capacity Index (RWC). Energy Econ. 81, 227–237. doi:10.1016/j.eneco.2019.03.011

Chen, Q., Yang, J., Huang, Y., Lu, E., and Wang, Y. (2018). Overview of Market Power Monitoring and Mitigation Mechanism in Foreign Power Markets [J]. China South. Power Grid Technol. 12 (12), 9–15. (in chinese). doi:10.13648/j.cnki.issn1674-0629.2018.12.002

Cheng, Y., and Yao, X. (2021). Carbon Intensity Reduction Assessment of Renewable Energy Technology Innovation in china: a Panel Data Model with Cross-Section Dependence and Slope Heterogeneity. Renew. Sustain. Energy Rev. 135, 110157. doi:10.1016/j.rser.2020.110157

Ding, J. W., Shen, Y., Kang, C. Q., Xia, Q., and Hu, Z. H. (2003). A New Index for Evaluating Generators Market Power. Automation Electr. Power Syst. 27 (13), 24–29. (in chinese). doi:10.3321/j.issn:1000-1026.2003.13.006

Dzikevičius, A., and Šaranda, S. (2016). Establishing a Set of Macroeconomic Factors Explaining Variation over Time of Performance in Business Sectors. Verslas Teor. ir. Prakt. 17, 159–166. doi:10.3846/btp.2016.629

Gan, D., and Bourcier, D. V. (2002b). A Simple Method for Locational Market Power Screening. Proc. IEEE Power Eng. Soc. Transm. Distrib. Conf. 1, 434–439. doi:10.1109/PESW.2002.985037

Gan, D., and Bourcier, D. V. (2002a). Locational Market Power Screening and Congestion Management: Experience and Suggestions. IEEE Trans. Power Syst. 17, 180–185. doi:10.1109/59.982211

Gan, D., Bourcier, D. V., and Yao, X. (2021). Environmental Regulation, Green Technology Innovation, and Industrial Structure Upgrading: the Road to the Green Transformation of Chinese Cities. Energy Econ. 98, 105247. doi:10.1016/j.eneco.2021.105247

Gao, C., Bompard, E., Napoli, R., and Zhou, J. (2008). Design of the Electricity Market Monitoring System. In 3rd Int. Conf. Deregul. Restruct. Power Technol. DRPT, 99–106. doi:10.1109/DRPT.2008.4523386

García, J. A., and Reitzes, J. D. (2007). International Perspectives on Electricity Market Monitoring and Market Power Mitigation. Rev. Netw. Econ. 6. doi:10.2202/1446-9022.1127

Halkos, G. E., and Nomikos, S. N. (2021). Reviewing the Status of Corporate Social Responsibility (CSR) Legal Framework. Meq 32 (4), 700–716. doi:10.1108/meq-04-2021-0073

Jin, L., Chen, C., Li, Y., Wang, X., and Cheng, Y. (2021). How to Promote Compliance Management in the Electricity Market? an Analysis Based on the Evolutionary Game Model. Front. Environ. Sci. 9, 655080. doi:10.3389/fenvs.2021.655080

Kumar, S., and France, N. (2022). Taking Root: Independent Regulatory Agency Model of Regulation in Indian Electricity Sector. Energy Policy 164, 112863. doi:10.1016/j.enpol.2022.112863

Lin, J. K., Ni, Y. X., and Wu, F. L. (2002). A Review of Market Forces in Electricity Markets. Power Syst. Technol. 26 (11), 70–76. (in Chinese). doi:10.3321/j.issn:1000-3673.2002.11.017

Lisin, E., Sobolev, A., Strielkowski, W., and Garanin, I. (2016). Thermal Efficiency of Cogeneration Units with Multi-Stage Reheating for Russian Municipal Heating Systems. Energies 9, 269. doi:10.3390/EN9040269

Ma, J., and Sun, L. (2018). Complexity Analysis about Nonlinear Mixed Oligopolies Game Based on Production Cooperation. IEEE Trans. Contr. Syst. Technol. 26, 1532–1539. doi:10.1109/TCST.2017.2702120

Maekawa, J., and Shimada, K. (2019). A Speculative Trading Model for the Electricity Market: Based on japan Electric Power Exchange. Energies 12. doi:10.3390/en12152946

Michaels, R. J. (2008). Electricity Market Monitoring and the Economics of Regulation. Rev. Ind. Organ 32, 197–216. doi:10.1007/s11151-008-9172-1

Patton, D. B. (20032003). Overview of Market Monitoring Tools and Techniques. IEEE Power Eng. Soc. Gen. Meet. Conf. Proc. 1, 513–517. doi:10.1109/PES.2003.1267232

Pinczynski, M., and Kasperowicz, R. (2016). Overview of Electricity Market Monitoring. Econ. Sociol. 9, 153–167. doi:10.14254/2071-789x.2016/9-4/9

Rahimi, A. F., and Sheffrin, A. Y. (2003). Effective Market Monitoring in Deregulated Electricity Markets. IEEE Trans. Power Syst. 18, 486–493. doi:10.1109/TPWRS.2003.810680

Smith, J. M. (1976). Evolution and the Theory of Games. Am. Sci. 64, 41–45. doi:10.1007/978-1-4684-7862-4_22

Song, M.-l., and Cui, L.-B. (2016). Economic Evaluation of Chinese Electricity Price Marketization Based on Dynamic Computational General Equilibrium Model. Comput. Industrial Eng. 101, 614–628. doi:10.1016/j.cie.2016.05.035

Streimikienė, D., Strielkowski, W., Bilan, Y., and Mikalauskas, I. (2016). Energy Dependency and Sustainable Regional Development in the Baltic States: A Review. Geogr. Pannon. 20, 79–87. doi:10.5937/GEOPAN1602079S

Strielkowski, W., Lisin, E., and Astachova, E. (2017). Economic Sustainability of Energy Systems and Prices in the EU. Jesi 4, 591–600. doi:10.9770/jesi.2017.4.4(1410.9770/jesi.2017.4.4(14)

Su, X., Duan, S., Guo, S., and Liu, H. (2018a). Evolutionary Games in the Agricultural Product Quality and Safety Information System: A Multiagent Simulation Approach. Complexity 2018, 1–13. doi:10.1155/2018/7684185

Su, X., Liu, H., and Hou, S. (2018b). The Trilateral Evolutionary Game of Agri-Food Quality in Farmer-Supermarket Direct Purchase: A Simulation Approach. Complexity 2018, 1–11. doi:10.1155/2018/5185497

Wolak, F. A. (2005). Lessons from International Experience with Electricity Market Monitoring (Vol. 3692). World Bank Publications.

Xie, L., Ma, J., and Han, H. (2018). Implications of Stochastic Demand and Manufacturers' Operational Mode on Retailer's Mixed Bundling Strategy and its Complexity Analysis. Appl. Math. Model. 55, 484–501. doi:10.1016/j.apm.2017.06.005

Xu, M., Song, W., Tuo, J., Liu, D., and Li, T. (2021). Research on Operation Monitoring System of Spot Electricity Market. IOP Conf. Ser. Earth Environ. Sci. 621 (1), 012042. doi:10.1088/1755-1315/621/1/012042

Yang, C., Shi, Y., Hao, R., Zhong, X., and Zhang, T. (2021). Research on Building a Power Market Regulation System in Gansu Province and Some Possible Monitoring Methods. IOP Conf. Ser. Earth Environ. Sci. 632, 042080. doi:10.1088/1755-1315/632/4/042080

Yu, D., Guo, Y., and Tang, R. (2022). The Enlightenment of Foreign Power Market Monitoring Index System Design to china's Power Market. IOP Conf. Ser. Earth Environ. Sci. 983 (1), 012017. doi:10.1088/1755-1315/983/1/012017

Zhao, H., Liang, C., and Qin, Z. (2008). The Study of Electricity Market Monitoring Index System. In Proc. - 2008 Int. Work. Model. Simul. Optim. WMSO, 19–24. doi:10.1109/WMSO.2008.27

Keywords: electricity market, internal and external monitoring mechanisms, third-party monitoring agency, government supervision, internal monitoring organizations

Citation: Jin L, Liu W, Chen C, Ji J and Wang W (2022) Research on the Internal and External Monitoring Mechanism of the Electricity Market in the Spot Market: From the Perspective of the Evolutionary Game Theory. Front. Energy Res. 10:913032. doi: 10.3389/fenrg.2022.913032

Received: 05 April 2022; Accepted: 04 May 2022;

Published: 24 June 2022.

Edited by:

Xin Yao, Xiamen University, ChinaCopyright © 2022 Jin, Liu, Chen, Ji and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wei Wang, MjQxNjY4OTQ2N0BxcS5jb20=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.