- 1Faculty of Management and Service, Vyatka State University, Kirov, Russia

- 2Department of Management and Logistics in the Agro-Industrial Complex, Volgograd State Agricultural University, Volgograd, Russia

- 3Head of the Center for Marketing Initiatives, Stavropol, Russia

- 4Department of Economics and Management, North Caucasus Federal University, Stavropol, Russia

Introduction

The adoption of Sustainable Development Goal 7 (SDG 7) “affordable and clean energy” has made the sustainable and ecological development of energy economics a pressing issue. Strong corporate social responsibility of EnergyTech energy companies is necessary to achieve this goal. However, the problem is that the formulation of this SDG focuses on social and environmental advantages without taking into account the capabilities and benefits of energy companies.

This causes a gap between theory and practice of sustainable and environmental development of energy economics. To overcome this gap, it is necessary to rethink the corporate social responsibility of EnergyTech energy companies from the standpoint of effectiveness and choose the most effective direction for the manifestation of this responsibility.

Corporate social responsibility of energy companies has two manifestations: internal and external. The external manifestation is based on the important global mission of energy companies in large energy economies to ensure an uninterrupted supply of their products to those countries that are experiencing energy shortages. That is, in this case, it is a matter of responsibility to their consumers.

The trends of recent years in the global energy resource market have determined the specificity of the external manifestation of the corporate social responsibility of energy companies. The environmental agenda of the European Union countries, which are among the key consumers of energy resources in the world, plays an important role in this context. These countries have announced that an environmental tax on the carbon footprint from mining and export of energy resources will soon be introduced. This has transformed the modern idea of the external manifestation of the corporate social responsibility of energy exporting companies for supporting the sustainability of energy from preventing its shortage (“affordable energy”) to ensuring its environmental friendliness (“clean energy”).

This has brought the traditionally isolated external manifestation as close as possible to the internal manifestation of the corporate social responsibility of energy companies associated with their responsibility to the population and the environment of the territory in which they conduct their business activities. Therefore, in this article, attention is focused on the internal manifestation of responsibility, which has become the main factor at the present time. The purpose of this study is to identify promising areas of the corporate social responsibility of energy companies EnergyTech in support of sustainable and environmental development of energy economics.

Existing Directions of Corporate Social Responsibility of Energy Companies

The study is based on the fundamental provisions of the theory of sustainable energy. According to it, EnergyTech is interpreted as the economic activity of energy companies for efficient, safe, and environmental-friendly economical extraction, transformation, transportation, storage, and use of energy (Yang et al., 2021; Alabugin et al., 2022; Wang and Nam-gyu, 2022).

That is, the criteria for assigning energy companies to EnergyTech are high effectiveness, safety of their activities for humans, and low environmental costs. Therefore, corporate social responsibility has laid the basis of EnergyTech, and it is reasonable that this responsibility should be the determining factor of its current boundaries and prospects for further development.

This study discusses four promising areas of corporate social responsibility of energy companies EnergyTech for sustainable and environmental development of energy economics identified and studied in detail in the existing literature.

The first direction is connected with the development of clean energy. Clean (i.e., renewable) energy enables reducing the depletion of natural resources and preserving the legacy of future generations (Wu et al., 2022a; Jia et al., 2022). A statistical indicator of the practical implementation of this direction is renewable electricity output (according to the World Bank calculations, 2022).

The second direction is to increase the availability of energy. Priority satisfaction of domestic demand is one of the main expectations of society from energy companies. The difficulty lies in the fact that governments often establish price limits for the sale of power resources on the domestic market, making it less profitable for energy companies (Popkova and Sergi, 2021; Popkova et al., 2019; Melin et al., 2022). Therefore, the practice under consideration belongs to the field of corporate social responsibility. The statistical indicator of the practical implementation of this direction is access to electricity (according to the World Bank calculations, 2022).

The third direction is to reduce the natural resource rent in the GDP. The reduction in the extraction of energy resources makes it possible to impede the rate of the depletion of natural resources of energy economies; therefore, it is important for society and environmental protection (Agboola et al., 2021; Awosusi et al., 2022; Wu et al., 2022b). The statistical indicator of the practical implementation of this direction is the total natural resource rents (according to the World Bank calculations, 2022).

The fourth direction is to reduce the export of energy resources. This direction is designed to prevent the so-called Dutch disease that threatens energy economies. Within the framework of this direction of corporate social responsibility, the extracted energy resources are designed to cater to the internal needs of the economy, supporting the development of diversified domestic production (Day and Day, 2017; Chamberlain and Kalaitzi, 2020). The statistical indicator of the practical implementation of this direction is fuel exports (according to the World Bank calculations, 2022).

In the available literature, the essence of the aforementioned directions of corporate social responsibility of energy companies is disclosed in detail. However, their attitude toward EnergyTech in order to achieve sustainable and environmental development of energy economics remains poorly understood and unclear. In this study, in order to fill the identified gap, when determining the promising areas of the corporate social responsibility of energy companies EnergyTech to achieve sustainable and environmental development of energy economics, the criterion of economic effectiveness of these directions is taken into account, allowing the assessment of their consequences (compare costs and benefits) for energy companies.

Rethinking Existing Directions of Corporate Social Responsibility of Energy Companies From the Positions of EnergyTech

To rethink the existing directions of the corporate social responsibility of energy companies from the standpoint of EnergyTech, this study uses the methodology of Game Theory. Using the chosen methodology, a comparative analysis of the implementation of each of the four identified directions is carried out and from the standpoint of their effectiveness through the ratio of the expected economic benefits for energy companies and the economy as a whole (gross domestic product, calculated by the International Monetary Fund, 2022) to the required costs (investment in energy with private participation according to the World Bank calculations, 2022).

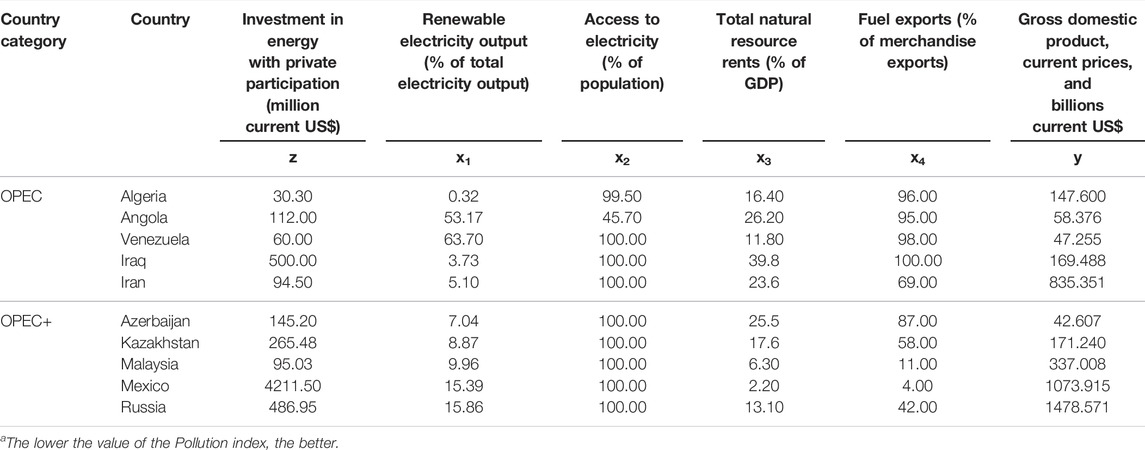

To reflect the experience of EnergyTech, the research in this study is carried out on the example of the world’s largest energy economies (energy exporters) from among OPEC and OPEC+, the sample of which is formed according to the criterion of the availability of statistical data (Table 1). Since data for 2021 are still being calculated, this study is based on data from 2020, which makes it possible to assess the potential contribution of the directions of the corporate social responsibility of energy companies to support the economic growth of energy economies in the context of the COVID-19 pandemic and crisis. According to the calculations of the World Bank, the decline in global GDP in 2020 amounted to 5.2%. Therefore, when comparing the directions of corporate social responsibility, their potential in preventing this decline is assessed.

The data were obtained from references to the International Monetary Fund (2022) and the World Bank, 2022.

According to Table 1, the investment in energy with private participation in the major energy economies of the world in 2020 averaged $0.60 billion, and the gross domestic product averaged $436.14 billion. Therefore, the economic effectiveness of energy economies was 726.79 (436.14/0.60). This means that the GDP exceeded investments in the energy sector with private participation by 726.79 times. The target rate of GDP growth for all the areas under consideration is 5.20%, that is, the GDP should amount to $458.83 billion (436.14*1,052).

Based on the statistics collected in Table 1, an econometric model (1) was obtained using the regression analysis method:

According to the obtained model (1), the first identified direction of corporate social responsibility associated with the development of clean energy is ineffective for energy companies and damages the economic growth of energy economies. Therefore, this direction contradicts the criteria of EnergyTech and will not be further considered in this work (it is not promising).

For the second direction of corporate social responsibility of energy companies in energy economies (increasing energy availability), a system of Eq. 2 is obtained:

According to the obtained system of Eq. 2, with the growth of access to electricity by 1% of the population, the growth of the gross domestic product by $ 7.7997 billion is achieved, but this requires an additional $10.115 million investment in energy with private participation. According to Table 1, in 2020, access to electricity among the energy economies averaged 94.52%. Based on the revealed regression dependencies Eq. 2, it was found that to increase the GDP to the target $458.83 billion, it was necessary to increase access to electricity by 3.08% (up to 97.43% of the population), which will require an increase in investment in energy with private participation by 4.90% (up to $ 629.52 million). In this case, the effectiveness of this direction of corporate social responsibility will be 728.85 (458.83/0.63).

For the third direction of corporate social responsibility of energy companies in the energy economies (reduction of natural resource rent in GDP), a system of Eq. 3 is obtained:

According to the obtained system of Eq. 3, with the reduction of total natural resource rents by 1% of the GDP, the growth of the gross domestic product by $ 19.121 billion is achieved, but this requires an additional $54.228 million investment in energy with private participation. According to Table 1, in 2020, the total natural resource rents averaged 18.25% of the GDP among the energy economies. Based on the revealed regression dependencies Eq. 3, it was found that in order to increase the GDP to the target $458.83 billion, it is necessary to reduce total natural resource rents by 6.50% (up to 17.06% of GDP), which will require an increase in investment in energy with private participation by 10.73% (up to $664.48 million). In this case, the effectiveness of this direction of corporate social responsibility will be 690.51 (458.83/0.66).

For the fourth direction of corporate social responsibility of energy companies in the energy economies (reduction of energy exports), a system of Eq. 4 is obtained:

According to the obtained system of Eq. 4, with a decrease in fuel exports by 1% of merchandise exports, an increase in the GDP by $8.8533 billion is achieved, but this requires an additional $21.359 million investment in energy with private participation. According to Table 1, in 2020, fuel exports among the energy economies averaged 66% of merchandise exports. Based on the revealed regression dependencies in Eq. 4, it was found that in order to increase the GDP to the target $458.83 billion, it is necessary to reduce fuel exports by 3.88 (to 63.44% of merchandise exports), which will require an increase in investment in energy with private participation by 9.11% (to $654.74 million). In this case, the effectiveness of this direction of corporate social responsibility will be 700.78 (458.83/0.65).

Discussion and Conclusion

Thus, the results show that the most promising direction of the corporate social responsibility of energy companies to achieve sustainable and environmental development of energy economics from the standpoint of EnergyTech is the direction involving increasing the availability of energy for the population–its effectiveness was estimated at 728.85 and even higher than in 2020.

Attention should also be paid to less effective, from the standpoint of EnergyTech, but also promising areas of corporate social responsibility of energy companies for sustainable and environmental development of energy economics: a reduction of natural rents in the GDP and reduction of energy exports. Their effectiveness was estimated at 690.51 and 700.78, respectively. The effectiveness of these directions is lower not only in comparison with the selected most promising direction but also in comparison with 2020, although both of these directions have the potential of economic crisis management of energy economies. The direction associated with the development of clean energy proved to be unpromising.

The contribution of this study to the literature consists in rethinking the existing directions of corporate social responsibility of energy companies to achieve sustainable and environmental development of energy economics from the standpoint of EnergyTech. This helped identify the most promising direction (increasing the availability of energy for the population), which allows balancing the interests of society and environmental protection with the interests of energy companies.

The practical significance of the conclusions is that they can serve as a practical guide on the corporate social responsibility of energy companies in large energy economies. The proposed most promising direction of corporate social responsibility will allow increasing its economic effectiveness and ensure a massive transition of energy companies in large energy economies to EnergyTech.

In conclusion, it should be noted that the focus of this study was on large energy economies (energy exporting countries), and the study conducted is limited by their experience. The experience of other countries, in particular, large energy consumers dependent on their exports, deserves special consideration. Most likely, the corporate social responsibility of energy companies in these countries will have its own specifics and its own promising directions of EnergyTech, which should be studied in the future.

Author Contributions

AS and TL contributed to the conception and design of the study. GV organized the database. VO performed the statistical analysis. AS wrote the first draft of the manuscript. TL, VO, and GV wrote sections of the manuscript. All authors contributed to manuscript revision and read and approved the submitted version.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Agboola, M. O., Bekun, F. V., and Joshua, U. (2021). Pathway to Environmental Sustainability: Nexus between Economic Growth, Energy Consumption, CO2 Emission, Oil Rent and Total Natural Resources Rent in Saudi Arabia. Resour. Policy 74, 102380. doi:10.1016/j.resourpol.2021.102380

Alabugin, A. A., Liming, H., and Shishkov, A. N. (2022). Formation of the Energy-Efficient Platform of Hi-Tech Development of Renewable Power. Smart Innovation, Syst. Technol. 272, 1–9. doi:10.1007/978-981-16-8759-4_1

Awosusi, A. A., Mata, M. N., Ahmed, Z., Coelho, M. F., Altuntaş, M., Martins, J. M., et al. (2022). How Do Renewable Energy, Economic Growth and Natural Resources Rent Affect Environmental Sustainability in a Globalized Economy? Evidence from Colombia Based on the Gradual Shift Causality Approach. Front. Energy Res. 9, 739721. doi:10.3389/fenrg.2021.739721

Chamberlain, T. W., and Kalaitzi, A. S. (2020). Fuel-Mining Exports and Economic Growth: Evidence from the UAE. Int. Adv. Econ. Res. 26 (1), 119–121. doi:10.1007/s11294-020-09766-4

Day, C., and Day, G. (2017). Climate Change, Fossil Fuel Prices and Depletion: The Rationale for a Falling Export Tax. Econ. Model. 63, 153–160. doi:10.1016/j.econmod.2017.01.006

International Monetary Fund (2022). World Economic Outlook Database: October 2021. Washington, DC: International Monetary Fund. Available at: https://www.imf.org/en/Publications/WEO/weo-database/2021/October.

Jia, W., Jia, X., Wu, L., Guo, Y., Yang, T., Wang, E., et al. (2022). Research on Regional Differences of the Impact of Clean Energy Development on Carbon Dioxide Emission and Economic Growth. Humanit Soc. Sci. Commun. 9 (1), 25. doi:10.1057/s41599-021-01030-2

Melin, K., Nieminen, H., Klüh, D., Laari, A., Koiranen, T., and Gaderer, M. (2022). Techno-Economic Evaluation of Novel Hybrid Biomass and Electricity-Based Ethanol Fuel Production. Front. Energy Res. 10, 796104. doi:10.3389/fenrg.2022.796104

Popkova, E. G., Inshakov, O. V., and Bogoviz, A. V. (2019). Regulatory Mechanisms of Energy Conservation in Sustainable Economic Development. Lect. Notes Netw. Syst. 44, 107–118. doi:10.1007/978-3-319-90966-0_8

Popkova, E. G., and Sergi, B. S. (2021). Energy Efficiency in Leading Emerging and Developed Countries. Energy 221, 119730. doi:10.1016/j.energy.2020.119730

Wang, Y., and Nam-gyu, C. (2022). Research on Performance Layout and Management Optimization of Grand Theatre Based on Green Energy Saving and Emission Reduction Technology. Energy Rep. 8, 1159–1171. doi:10.1016/j.egyr.2022.02.047

World Bank (2022). Indicators: Energy & Mining. Washington, DC: World Bank. Available at: https://data.worldbank.org/indicator.

Wu, Y., Shi, Z., Lin, Z., Zhao, X., Xue, T., and Shao, J. (2022b). Low-Carbon Economic Dispatch for Integrated Energy System through the Dynamic Reward and Penalty Carbon Emission Pricing Mechanism. Front. Energy Res. 10, 843993. doi:10.3389/fenrg.2022.843993

Wu, Y., Zhou, Y., Liu, Y., and Liu, J. (2022a). A Race between Economic Growth and Carbon Emissions: How Will the CO2 Emission Reach the Peak in Transportation Industry? Front. Energy Res. 9, 778757. doi:10.3389/fenrg.2021.778757

Keywords: corporate social responsibility, energy companies, Energytech, sustainable and environmental development, energy economy

Citation: Sozinova AA, Litvinova TN, Ostrovskaya VN and Vorontsova GV (2022) Perspective Directions of Corporate Social Responsibility of Energy Companies of EnergyTech for Sustainable and Environmental Development of Energy Economy. Front. Energy Res. 10:908489. doi: 10.3389/fenrg.2022.908489

Received: 30 March 2022; Accepted: 20 April 2022;

Published: 31 May 2022.

Edited by:

Bruno Sergi, Harvard University, United StatesReviewed by:

Aidarbek T. Giyazov, Batken State University, KyrgyzstanLadislav Zak, Independent Researcher, Prague, Switzerland

Copyright © 2022 Sozinova, Litvinova, Ostrovskaya and Vorontsova. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Anastasia A. Sozinova, MTk4Mm5hc3R5YTE5ODJAbWFpbC5ydQ==

Anastasia A. Sozinova

Anastasia A. Sozinova Tatyana N. Litvinova2

Tatyana N. Litvinova2