- 1School of Economics and Management, Nanjing University of Science and Technology, Nanjing, China

- 2School of Economics, Nanjing University of Posts and Telecommunications, Nanjing, China

This study aims to investigate whether the subsidies promote pollution reduction or not by taking the power companies in China as a case study. So, we built a fixed-effects panel data model first, which is then used to verify the influence of government subsidies on pollution reduction in power companies. Additionally, how the subsidy influencing mechanism would work is also investigated. Results find that subsidies can significantly reduce power companies’ pollution, especially sulfur dioxide emissions and soot. At the same time, the result also showed that the government subsidies could encourage power companies to cut emissions by taking measures like end-of-pipe control and green innovation. Also, from the perspective of heterogeneity, government subsidies have a better effect on the regions with stronger environmental regulations, less economically developed regions, big-scale companies, and companies with low slack.

1 Introduction

1.1 Background

As the largest developing country in the world, China is facing multiple challenges such as economic growth, employment security, and environmental governance (Ai et al., 2020). Among these, environmental governance is more stressful; as a result, emission reduction targets were set for each public and private sector company (Usman et al., 2021). Many administrative and voluntary approaches and subsidies were popped out at the federal and local levels in line with this. Compared with administrative orders and voluntary approaches, government subsidies have no negative impact on companies’ output, and they can influence companies’ behavior through the market force (Davis, 2017). Therefore, government subsidies can be an essential policy instrument and play an indispensable role in leading companies to allocate resources and shoulder social responsibilities (Frye and Shleifer, 1997; Wang et al., 2020). To deal with the increasingly severe environmental pollution, China’s central government issued a notice about regulating the funding channels for environmental protection in early 1984. The document held that at least 80% of the fee the government levies on companies for the discharge of pollutants had to be used to subsidize companies’ environmental protection. In 1994, the Ministry of Environmental Protection and the Ministry of Finance jointly issued a couple of provisions about enhancing the management of environmental subsidies, which specially regulated the use of the means of government subsidies to stimulate companies’ environmental protection. In 2003, regulations regarding the utilization and management of pollutant discharge fees regulated that the fee should be used for companies’ pollution management. The interim measures for the management of special funds allocated by the Central Finance for Emission Reduction of Major Pollutants issued by the Ministry of Finance in 2007 regulated establishing national funds for emission reduction of major pollutants and encouraging provincial-level governments to enact environmental subsidy policies for local environmental protection. The 12th 5-year (from 2011 to 2015) plan requested local governments to increase the budgets for environmental gradually subsides in their annual financial plans (Ren et al.,2021). When we look at the sectors, economic growth, and environmental governance, the energy sector has a prominent role in the nation’s economy. However, the stressing point is its environmental impact. Considering the case of power companies in China, they are dominated by coal as a resource for producing power, and this determines the severe effect of the electric power industry on environmental quality (Yan and Yang, 2008). In 2012, China became the most significant contributor to global sulfur dioxide (SO2) emissions (Shi et al., 2016). The current rates rose to 33%, and coal power plants seem to be the primary sources (Zhao et al., 2013; Nakaishi et al., 2021). Noticing this, the Chinese government started emphasizing emission reduction in power companies by providing investment subsidies for technology innovation and reform through direct fiscal appropriation, finance discounts, and tax subsidies (Gao et al., 2009; Liang et al., 2015; Shi et al., 2016; Zhang et al., 2017; Hou et al., 2020; Schreifels et al., 2021). For instance, the government passed a regulation requiring the newly built coal power plants to install desulfurization units. A price subsidy for desulfurization is offered to promote this, that is, raising the price limit for electricity to 0.015 yuan per kilowatt hour. Also, to improve the development of new-energy power firms in line with environmental regulations, the government provided subsidies to the renewable power plants (including wind power plants, photovoltaic power plants, and biomass power plants) (Li, 2021). However, these measures mainly include sewage discharge permission which the power companies must apply in advance. On the other side, the local governments take compulsive measures to limit the companies’ production and ensure the emission complies with standards for discharge of pollutants. But these sewage discharge permission significantly affected the power companies’ pollution management costs; in many instances, their costs are increased. It became worse and burdened the companies when the business scale of sewage discharge was immense. Such burdens lead to limiting production levels to reduce the pollution management cost. But such development approaches made the national economy unsustainable.

To counter such issues, researchers like Zhang and Zhang (2011) and Wang and Zhang (2018) showed that increasing the facilities for pollution reduction and green technology innovations can save energy and reduce emissions. We reviewed end-of-pipe treatment and green innovative strategies in the following sections to understand this more thoroughly.

1.2 End-of-Pipe Treatment Strategy

The end-of-pipe treatment strategy is a passive environmental governance approach (Hart, 1995; Sharma et al., 1998); it is the first approach raised and adopted in environmental management. It is mainly introduced through the purchases and installations of pollution control equipment (for instance, the desulfurization equipment or using the raw materials which will generate fewer pollutants) when companies face pressure from external environmental regulations during electric power production. More specifically, coal ore with less sulfur content can reduce SO2 emissions. On the other side, the waste heat recovery of soot for reheating can further reduce the cost of the resources used for heating the coal and help enhance the plant’s energy efficiency. In such cases, innovative changes are needed for the plant equipment, affecting the investments where the company should be able to manage it. This is where the government subsidy comes into the picture and helps to increasing the cash flow of the subsidized companies and meet the capital demand for companies to upgrade their equipment with new technology in line with environmental regulations (Zhang and Zhang, 2011; Wang et al., 2015; Wang and Zhang, 2018; Yan et al., 2019).

1.3 Green Innovative Strategies

In the early days, the pollution management technologies adopted during the life cycle of environmental management practice were relatively few. But to meet the demand for environmental management, companies have started adopting green innovative strategies (Wang and Zhang, 2020; Wang and Li, 2021). The positive externalities of green innovations will lead to innovative social benefits being higher than private benefits; technology spillovers will result in the consequence that innovative companies cannot internalize all the innovative benefits. As a result, the companies started facing capital shortages and the burden of operating costs when engaging in green innovative activities. In such cases, the government subsidies can make up the cost of companies’ green innovations and encourage companies’ participation in environmental technology innovations. In addition, relevant social investors tend to invest in companies compliant with national regulations. The government’s subsidies to environmental innovations have some signaling function. For instance, the companies that receive government subsidies can send specific signals to the society, telling the potential investors that they comply with the government’s environmental regulations and meet the government’s requirements for environmental protection so that they can get investment from the outside world (Wang and Wang, 2019; Xing et al., 2019).

From the earlier discussed end-of-pipe treatment and green innovative strategies, two hypotheses were formulated, hypothesis 1: government subsidies can help implement companies’ pollution control strategies and increase the equipment investment for environmental management to reduce the emission of pollutants; hypothesis 2: government subsidies can promote the green innovative level of power companies and reduce the emission of pollutants.

So, based on the formulated hypotheses, this article aims to study how government subsidies impact the pollution reduction of power companies from the perspectives of pollution prevention and control strategies and green innovation strategies. For this, the microdata of power companies is considered. The key contributions of the study include complementing the existing research from the microperspective of power plants combined with the emission data, followed by the analysis of the heterogeneous impact of government subsidies on the emission of pollutants from the perspective of slack that enriches the existing research. Additionally, we also bring out some operational insights that help in policy amendments.

The article structure is as follows; Section 2 introduces the empirical approaches and variables used in the investigation. Section 3 discusses the fundamental regression results, followed by a brief analysis of the relevant mechanisms. Section 4 provides the conclusion and suggestions.

2 Methods

A fixed-effects panel data model shown in Eq. 1 was adopted to test if government subsidies can help promote pollution reduction of power companies or not.

where the subscripts

2.1 Data Sources and the Sample Selection

The data at the prefecture and city levels are from China City Statistical Yearbooks; the data at the provincial level is from the China environment yearbook released by the Ministry of Ecology and Environment of the People’s Republic of China. The power company’s microdata from China industry business performance data reports are considered. This mainly covers the foremost financial variables of all state-owned and big nonstate-owned industrial enterprises in China. Then, we matched the power company’s financial index data with pollution data and patent data with the China city statistical yearbook to get the indexes needed for research and analysis. However, due to data availability limitations, we only included the data from 1998 to 2014 at the company level. In addition, we eliminated the samples with a debt to assets ratio below 0, and the study also does a 10% winsorization to continuous variables to prevent the influence of extreme values on results.

2.2 Variables

While under investigation, this study accounts for numerous variables types. For instance, the explained variables, explanatory variables, control variables, and the mechanism analysis variables.

The views of Wu et al. (2018) and Xing et al. (2019) were adopted to measure the government subsidies by the amount of subsidies (denominated in millions and yuan) a company receives in the year. Moreover learning from existing literature (Nie et al., 2008; Usman and Jahanger, 2021; Wang et al., 2021), we also analyzed some other factors that may influence enterprises’ pollution reduction like the characteristics of power companies, the characteristics of prefecture-level cities and the level of regional environmental regulations. The control variables of companies’ characteristics include lnsize (firm size represented by the natural logarithm of the year-end total assets), age (years a company has been in business calculated through the formula: the year it is observed deducts the year when it is founded plus one), lev (financial leverage of a company represented by the debt-to-assets ratio: long-term debt divided by total assets), ROA (earnings of a company indicated by the Return on Total Assets), and lncapital (profitability of a company’s main businesses indicated by operating profit margin: the amount of operating profit divided by primary business income). Moreover, the factors that can be used to control the development of urbanization and industrialization like lnpgdp (the per-capita GDP level of the city in which a company is located), lnpop (density of population: year-end total population divided by the territorial area of the city), and struc2 (the ratio of the second and third industries’ output value to GDP) are added. These variables are expressed in logarithmic forms, respectively. Considering the possible impact of environmental regulation, the levels of different regions on companies’ emission of pollutants are considered. Also, learning from Hong et al. (2011), the pollution discharge fee is viewed as a proxy variable. The data relating to pollution discharge fees are available only at the provincial level, so we used the provincial-level pollution discharge fees (lnfees) to indicate the environmental regulation levels of different cities. Some researchers in the literature have already tested how intermediate variables (number of the equipment for pollution management and number of green innovations) reduce a company’s emissions. Hence, we adopted the validation method of the mechanism of an intermediary function raised by Wen and Ye (2013), see Eq. 2.

where

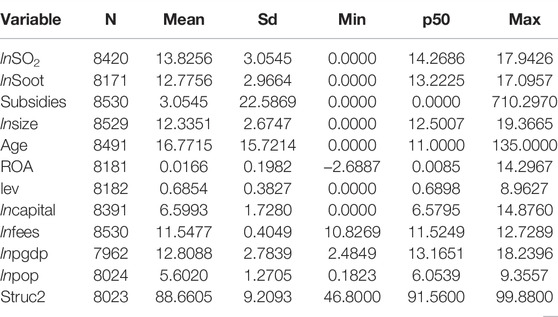

The proxy variable of pollution management facilities is the investment in equipment for pollution reduction, that is, the number of facilities for flue gas purification and the number of facilities for wastewater management. Regarding the measurement indexes of green technology innovations, this study learns from previous research and uses the logarithms of the number of applications for green patents (Dong and Wang, 2019; Pei Xiao et al., 2019), that is, because the patent is a strong index of green innovations (Berrone et al., 2013). The research is carried out based on the information about companies’ patent applications released by the State of Intellectual Property Office of China by combining the international patent classification code of green patents listed on the green patent list, which is provided by WIPO (World Intellectual Property Organization) and the keywords (environmental protection, energy saving, pollution reduction, low carbon, cleanness, recycle, and sustainability) of the new definition of companies’ green innovations raised by Lim and Prakash (2014). Research investment is also a standard index for green innovations; this study does not adopt the index because the research investment index in China industry performance data is only available till 2007. Compared with other analysis methods, the descriptive statistical analysis can more visually measure the overall level and scale of one region’s green technology innovations. Hence, the study adopts the descriptive statistical analysis method; details are given in Table 1.

3 Results and Discussion

3.1 Benchmark Regression Result

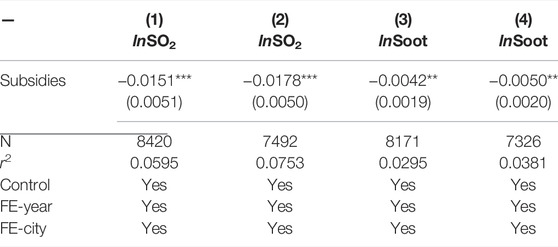

The benchmark regression results shown in Table 2 are estimated based on Eq. 1, where the regression formula controls the company fixed effects and year fixed effects, and standard errors cluster at the city level. It only considered core explanatory variables in column 1 and government subsidies remarkably improved the reduction of SO2 emissions of power plants at 1%. It added control variables in column 2; the results show that the explanatory variables are still significantly negative. We can see from the coefficients that government subsidies help reduce power companies’ SO2 emissions by 0.0178 tons. Similarly, government subsidies can substantially reduce soot emissions by 0.005 tons. Therefore, benchmark regression analysis initially proves that government subsidies statistically and economically influence the emission reduction of SO2 and soot.

3.2 Robustness Test Results

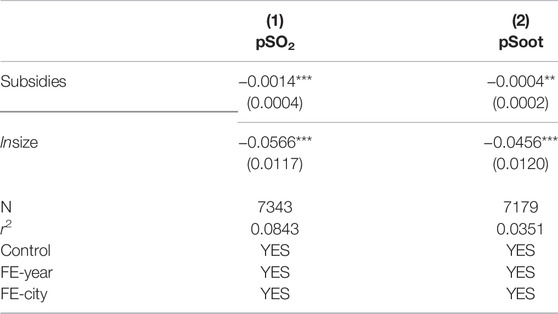

The robustness test results include the observed effects of substitution variables and the downsizing of company samples. The emission intensity of pollutants is taken as a substitution variable to reprove government subsidies’ impact on pollution reduction. The emission intensity indexes required are represented by SO2 and soot divided by the total industrial output value. There are many new types of power generation options; these include hydropower plants, solar power companies, wind power enterprises, and biomass power plants. Such a sample would cause deviations and errors. To avoid this, we only considered thermal power plants when testing the government subsidies’ effects on reducing the emission of pollutants.

3.2.1 Substitution Variables

The regression results (in Table 3) indicate that government subsidies have a remarkable effect on reducing emission intensities of SO2 and soot. It shows that government subsidies can help improve companies’ productivity and reduce pollution under unit production value. In other words, government subsidies reduce the cost companies’ cause to the outside world through power plants’ technological improvements and green technology innovations.

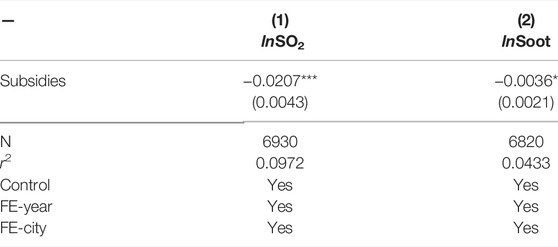

3.2.2 Downsizing the Sample Size

From the results shown in Table 4, we can see that government subsidies have a remarkable effect on reducing SO2 and soot emissions. Also, the parameters and coefficients of regression results are more prominent than benchmark regression results, indicating that government subsidies have a remarkable impact on thermal power companies’ emissions reduction.

3.3 Analysis of Heterogeneity

This section presents the results related to the heterogeneity of enforcement of environmental regulations, levels of economic development, firm size, and the slack.

3.3.1 Heterogeneity of Enforcement of Environmental Regulations

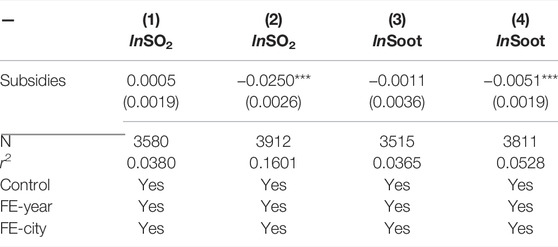

Environmental management requires companies to increase their budgets (on pollution reduction) or reduce their benefits, so companies will have no motivation to overachieve the goal of emission reduction as requested by local environmental rules when there are some differences in the enforcement of regional environmental regulations. Generally, the companies in the regions with weak enforcement of regulations usually have a relatively low motivation to reduce the emission of pollutants, so government subsidies’ effects will be ineffective. Keeping this in view, Table 5 presents the heterogeneity of enforcement of environmental regulations results.

From Table 5, we can see that columns 2 and 4 are the regions with strong enforcement of environmental regulations where the government subsidies' effect on power companies' emission reduction was stronger. This observation is in line with the results reported by Chen and Chen (2018) and Cheng and Chen. (2019). They said that the regulations and measures could effectively reduce environmental pollution. Therefore, if we want government subsidies to function and perform effectively, we need to combine them with environmental regulations and policies.

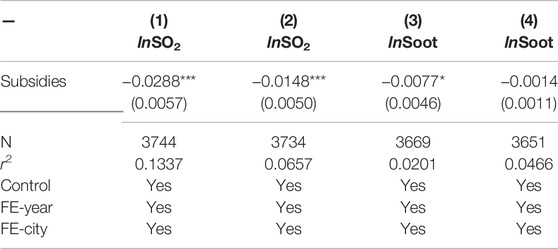

3.3.2 Heterogeneity of Levels of Economic Development

In Table 6, the results of the heterogeneity levels of economic development are shown. The difference in levels of regional economic development is another factor that may influence the government’s subsidy effect on power companies' pollution reduction targets. This is because government subsidies’ outcome depends on the relative value where the companies in more economically developed regions would exhibit low value. It might be due to the more active financial markets, and the chances for power companies to get funds are high from the market. In addition, such active markets give the power companies more access to funds. Government Subsidies have a relatively weak effect on relieving business liquidity pressure and financing pressure, so the subsidies’ impact on the emission reduction of pollutants is relatively weak.

On the contrary, the effect on the power companies in less economically developed regions is strong. The sample companies in columns 1 and 3 of Table 6 belong to the power enterprises in less economically developed regions, government subsidies’ effect on the emission reduction is stronger than the power companies (in columns 2 and 4) in more economically developed regions. This concludes that government subsidies can better affect the emission reduction of power companies in less economically developed regions.

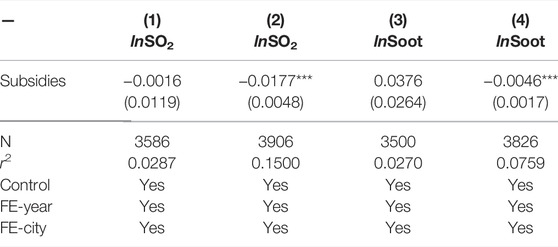

3.3.3 Heterogeneity of Firm Size

The firm size could potentially affect the emission reduction targets. For instance, when compared with small-scale companies, the investment made by big-scale companies for reducing the emission of pollutants and green innovations could potentially result in a scale effect. So, in such situations, the government subsidies’ influence on the pollution reduction of companies may be heterogeneous.

Columns 1 and 3 in Table 7 represents small-scale power companies, whereas columns 2 and 4 represent big-scale power enterprises. The observed regression results indicate that government subsidies’ impact on reducing big-scale companies’ emissions is more remarkable. But in the case of small-scale companies, although the influence on SO2 emission reduction is significant, the impact on soot emission is not as impressive. So, the overall observation is that the big companies are more able to take social responsibilities. In contrast, the small companies use the subsidies they receive for production, which further encourages the companies to purchase the equipment for pollution reduction.

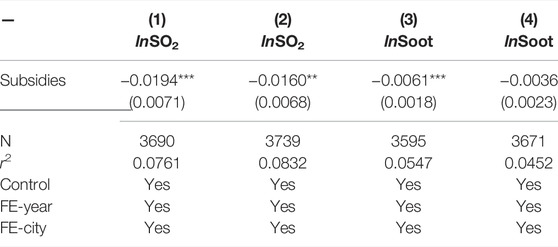

3.3.4 Heterogeneity of Slack

Slack belongs to companies’ internal resources like surplus cash and idle production equipment. Suppose, if a company has enough slack to support green fields, its dependence on external resources will decrease, and the relative value of government subsidies to the company will be low. Generally, slack can be divided into low discretion slack (SR1) and high discretion slack (SR2). SR1 has low liquidity, and it needs more time to convert or to be utilized when facing some specific utilization (Li and Liu, 2010). For instance, idle production equipment.

Regarding the method for measuring low discretion slack (Herold et al., 2006; Iyer and Miller, 2008; Latham and Braun, 2008; Yang et al., 2015), we used Eq. 3.

In Table 8, the heterogeneity of the low discretion slack (SR1) result is given. From Table 8, we can see that columns 1 and 3 belong to the SR1 low group, and government subsidies have a remarkable effect on companies’ emissions reduction. In contrast, columns 2 and 3 belong to the SR1 high group, and government subsidies’ impact on companies’ emission reduction is insignificant. This indicates that if a company has a high SR1, it will not be easy for government subsidies to mobilize the company’s internal organizations to use the resources for emission reduction.

High discretion slack (SR2) is not for specific utilization or needs. It has relatively high liquidity, so administrators can more easily control it. We used the quick ratio index to measure it, as shown in Eq. 4.

In Table 9, the heterogeneity of the high discretion slack (SR2) result is given. From the measuring results of Table 9, it can be observed that the government subsidies’ impact on the reduction of SO2 emissions has a better effect on power companies with low SR2 (in column 1) when compared with power companies with high SR2 (in column 2). Coming to the influence of government subsidies on soot emission reduction, it is remarkable for the companies with low SR2 (in column 3) and not significant for the ones with high SR2 (in column 4). This indicates that companies with high SR2 have abundant liquid assets, and their government subsidies' relative value is low, revealing that subsidies cannot remarkably encourage them to allocate the slack to the field of pollution reduction.

Overall, the heterogeneity of slack results suggests that government subsidies significantly affect the emission reduction of power companies. The effect could be more significant for companies with scarce slack than for those with rich slack.

3.4 Mechanism Analysis

This section presents the mechanism analysis test results for the hypothesis 1: government subsidies can help implement companies’ pollution control strategies and increase the equipment investment for environmental management to reduce the emission of pollutants, and hypothesis 2: government subsidies can promote the green innovative level of power companies and reduce the emission of pollutants.

3.4.1 Pollution Prevention and Control Approaches

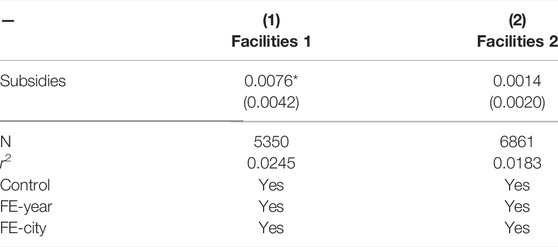

From the aforementioned results, it can be understood that subsidies positively impact pollution prevention equipment purchases. To understand this, two facility approaches, where facility one represents the number of exhaust gas pollution management facilities and facility two represents the number of wastewater pollution management facilities, are considered. The regression model shown in Eq. 2 verifies government subsidies’ influence on the number of facilities for pollution management, and the results are given in Table 10. From Table 10, it can be observed that government subsidies have a significant positive effect on the investment in facilities for fuel gas purification. However, they do not substantially impact the investment in facilities for wastewater treatment, and the influence is still positive.

3.4.2 Green Innovative Approaches

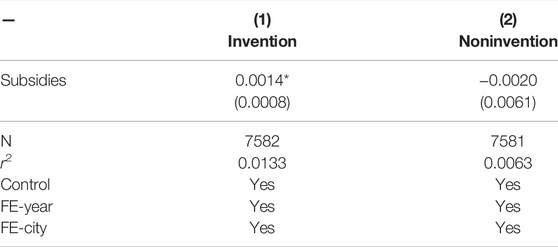

Table 11 presents the results of the green innovative strategies obtained by solving the regression model shown in Eq. 2. Here, invention patents are regarded as substantive innovations (invention), appearance design patents, and utility model patents as strategic innovations (noninvention) (Li and Zheng, 2016). Table 11 results reveal that the government subsidies are helpful for the substantive innovations of power companies where the income in the form of subsidy would be allocated for improving green technologies in the company. However, government subsidies’ influence on companies’ nonsubstantive innovations is not notable, indicating that government subsidies cannot realize the goal of reducing company emissions through strategic innovations.

4 Conclusion and the Suggestion

This study investigated whether the existing subsidies will promote pollution reduction or not by taking the power companies in China as a case study. For this, a fixed-effects panel data model was built to verify the influence of government subsidies. Based on the investigation, the following conclusions were made:

• An increase of one million yuan in government subsidies could potentially reduce the SO2 and shoot emissions in power companies by 0.0178 and 0.005 tons, respectively.

• The heterogeneity results suggest that government subsidies significantly affect the emission reduction of power companies but depend upon many factors. So, it is always advised to consider the enforcement level of environmental regulations, levels of economic development, firm size, and slack. Moreover, government subsidies have a more prominent effect on the pollution reduction of regions with stronger environmental regulations, less economically developed regions, big-scale companies, and companies with low slack.

• Mechanism analysis shows that government subsidies can encourage companies to increase facilities for emission reduction and adopt green innovative technologies.

Based on the concluding remarks, we proposed the following suggestions, given that government subsidies have a more considerable marginal effect on power companies.

• Green innovations have a emission reduction effect and a knowledge spillover effect, so government subsidies not only need to encourage power companies to reduce the emission of pollutants through the two approaches but also encourage the companies to focus on green inventions and innovations.

• It is strongly advised that the government subsidies combine with environmental regulations to deal with power companies’ pollution reduction.

• There is a high potential and scope for emission reduction in economically developed regions as they have better access to funds and technology. So, the government subsidies should give more support to companies in that region.

• Scale effects should be considered when providing government subsidies, especially for the big-scale companies. Given such a policy, the scale effect of pollution reduction could be realized practically.

• More considerable support should be given to the power companies whose slack is low. Hence, formulating a policy in line with slack would be better.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

National Natural Science Foundation of China: The measurement and influential mechanism of rebound effect of household energy consumption in China under “30/60 target” (No.72104112).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

We acknowledge the contributions of associate professor Wang Jingjing.

References

Ai, H., Hu, S., Li, K., and Shao, S. (2020). Environmental Regulation, Total Factor Productivity, and Enterprise Duration: Evidence from China. Bus. Strat. Env. 29 (6), 2284–2296. doi:10.1002/bse.2502

Ai, H., Zhou, Z., Li, K., and Kang, Z. (2021). Impacts of the Desulfurization Price Subsidy Policy on SO2 Reduction: Evidence from China’s Coal-Fired Power Plants. Energy Policy 157, 1–13. doi:10.1016/j.enpol.2021.112477

Berrone, P., Fosfuri, A., Gelabert, L., and Gomez-Mejia, L. R. (2013). Necessity as the Mother of 'green' Inventions: Institutional Pressures and Environmental Innovations. Strat. Mgmt. J. 34 (8), 891–909. doi:10.1002/smj.2041

Chen, S., and Chen, D. (2018). Air Pollution, Government Regulations & High-Quality Economic Development. Econ. Res. J. 2, 20–34.

Cheng, G., and Chen, X. (2019). New Path of Sustainable Development: Environmental Regulation and Technological Progress: An Empirical Test Based on Threshold Effect. J. Anhui Normal Univ. Humanit. Soc. Sci. 3, 69–77. doi:10.14182/j.cnki.j.anu.2019.03.009

Davis, L. W. (2017). The Environmental Cost of Global Fuel Subsidies. Energy J. 38, 7–27. doi:10.5547/01956574.38.si1.ldav

Dong, Z., and Wang, H. (2019). Local-Neighborhood Effect of Green Technology of Environmental Regulation. China Ind. Econ. 1, 100–118. doi:10.19581/j.cnki.ciejournal.2019.01.006

Frye, T., and Shleifer, A. (1997). The Invisible Hand and the Grabbing Hand. Am. Econ. Rev. 87, 354–358.

Gao, C., Yin, H., Ai, N., and Huang, Z. (2009). Historical Analysis of SO2 Pollution Control Policies in China. Environ. Manag. 43, 447–457. doi:10.1007/s00267-008-9252-x

Hart, S. L. (1995). A Natural-Resource-Based View of the Firm. Amr 20 (4), 986–1014. doi:10.5465/amr.1995.9512280033

Herold, D. M., Jayaraman, N., and Narayanaswamy, C. R. (2006). What Is the Relationship between Organizational Slack and Innovation? J. Manag. Issues 18 (3), 372–392.

Hong, T., Yu, M., and Jiang, J. (2011). Determination of Industrial Pollution-An Empirical Study Based on Pollution Demand-Supply Schedule. Manag. Rev. 23 (10), 3–9. doi:10.16538/j.cnki.fem.2011.08.004

Hou, B., Wang, B., Du, M., and Zhang, N. (2020). Does the SO2 Emissions Trading Scheme Encourage Green Total Factor Productivity? an Empirical Assessment on China's Cities. Environ. Sci. Pollut. Res. 27, 6375–6388. doi:10.1007/s11356-019-07273-6

Iyer, D. N., and Miller, K. D. (2008). Performance Feedback, Slack, and the Timing of Acquisitions. Acad. Manag. J. 51 (4), 808–822. doi:10.5465/amj.2008.33666024

Latham, S. F., and Braun, M. R. (2008). The Performance Implications of Financial Slack during Economic Recession and Recovery: Observations from the Software Industry (2001∼2003). J. Manag. Issues 20 (1), 30–50.

Li, W., and Zheng, M. (2016). Is it Substantive Innovation or Strategic Innovation? the Impact of Macroeconomic Industry Policies on Micro-enterprise Innovation. Econ. Res. J. 4, 60–73.

Li, X., and Liu, C. (2010). High-discretion Slack Resources or Low-Discretion Slack Resources-An Empirical Study on the Structure of Organizational Slack. China Ind. Econ. 7, 94–103.

Li, X. (2021). Environmental Regulation, Government Subsidies and Regional Green Technology Innovation. Econ. Surv. 38 (03), 14–23. doi:10.15931/j.cnki.1006-1096.2021.03.002

Liang, D., Dong, H., Fujita, T., Geng, Y., and Fujii, M. (2015). Cost-effectiveness Analysis of China’s Sulfur Dioxide Control Strategy at the Regional Level: Regional Disparity, Inequity and Future Challenges. J. Clean. Prod. 90, 345–359. doi:10.1016/j.jclepro.2014.10.101

Lim, S., and Prakash, A. (2014). Voluntary Regulations and Innovation: The Case of ISO 14001. Public Admin Rev. 74 (2), 233–244. doi:10.1111/puar.12189

Nakaishi, T., Takayabu, H., and Eguchi, S. (2021). Environmental Efficiency Analysis of China’s Coal-Fired Power Plants Considering Heterogeneity in Power Generation Company Groups. Energy Econ. 102, 1–13. doi:10.1016/j.eneco.2021.105511

Nie, H., Tan, S., and Wang, Y. (2018). Innovation, Firm Size and Market Competition: From the Evidence of Firm-Level Panel Data in China. J. World Econ. 7, 57–66. doi:10.3969/j.issn.1002-9621.2008.07.005

Ren, S., Sun, H., and Zhang, T. (2021). Do Environmental Subsidies Spur Environmental Innovation? Empirical Evidence from Chinese Listed Firms. Technol. Forecast. Soc. Change 173, 1–12. doi:10.1016/j.techfore.2021.121123

Schreifels, J. J., Fu, Y., and Wilson, E. J. (2021). Sulfur Dioxide Control in China: Policy Evolution during the 10th and 11th Five-Year Plans and Lessons for the Future. Energy Policy 48, 779–789. doi:10.1016/j.enpol.2012.06.015

Sharma, S., and Vredenburg, H. (1998). Proactive Corporate Environmental Strategy and the Development of Competitively Valuable Organizational Capabilities. Strat. Mgmt. J. 19 (8), 729–753. doi:10.1002/(sici)1097-0266(199808)19:8<729::aid-smj967>3.0.co;2-4

Shi, G., Zhou, L., Zheng, S., and Zhang, Y. (2016). Environmental Subsidy and Pollution Control: an Empirical Study Based on the Power Industry. Economics 15, 1439–1462.

Usman, M., and Jahanger, A. (2021). Heterogeneous Effects of Remittances and Institutional Quality in Reducing Environmental Deficit in the Presence of EKC Hypothesis: a Global Study with the Application of Panel Quantile Regression. Environ. Sci. Pollut. Res. 28 (28), 37292–37310. doi:10.1007/s11356-021-13216-x

Usman, M., Makhdum, M. S. A., and Kousar, R. (2021). Does Financial Inclusion, Renewable and Non-renewable Energy Utilization Accelerate Ecological Footprints and Economic Growth? Fresh Evidence from 15 Highest Emitting Countries. Sustain. Cities Soc. 65, 102590. doi:10.1016/j.scs.2020.102590

Wang, H., Tang, X., Xu, P., and Dong, Q. (2021). Effects and Influencing Mechanism of Environmental Subsidies on Regional Innovation Ability-Based on the Perspective of Spatial Spillover. J. Statistics 2 (8), 53–66.

Wang, Juanru., and Zhang, Yu. (2018). Environmental Regulation, Green Technology Innovation Intention and Green Technology Innovation Behavior. Stud. Sci. Sci. 36 (2), 321–360.

Wang, K., Yang, G., Liu, J., and Li, X. (2015). Research on Competition for IPO Resources, Government Subsidies and Companies’ Business Performance, 9. Manag. World, 147–157.

Wang, M., and Li, Y. (2021). Market Regulation, Product Consumption Choice and Enterprise Green Technological Innovation. J. Eng. Manag. 35 (2), 44–54. doi:10.13587/j.cnki.jieem.2021.02.005

Wang, X., and Wang, F. (2019). No Resource or No Motivation? Government Subsidies, Green Innovation and Incentive Strategy Selection. Sci. Res. Manag. 40 (7), 131–139. doi:10.19571/j.cnki.1000-2995.2019.07.013

Wang, Y., and Zhang, Y. (2020). Do State Subsidies Increase Corporate Environmental Spending? Int. Rev. Financial Analysis 72, 1–11. doi:10.1016/j.irfa.2020.101592

Wen, Z., and Ye, B. (2014). Analyses of Mediating Effects: The Development of Methods and Models. Adv. Psychol. Sci. 22 (5), 731–745. doi:10.3724/sp.j.1042.2014.00731

Wu, J., Tian, Z., and Long, X. (2018). The Impact of Government Subsidies on Corporate Innovation in Strategic Emerging Industries. Stud. Sci. Sci. 36 (1), 158–166.

Xiao, P., Jiang, A., and Yun, Y. (2019). Private Investment, Environmental Regulation and Green Technological Innovation-Analysis of Spatial Dubin Model Based on 11 Provinces and Cities in the Changjiang River Economic Belt. Sci. Technol. Prog. Policy 8, 44–51.

Xing, H., Wang, F., and Gao, S. (2019). Does Government Subsidy Promote Substantial Innovation in Enterprises: Influence Mechanism Based on Resource and Signal Transmission Attributes. Mod. Econ. Res. 3, 57–64.

Yan, G., and Yang, J. (2008). Implementing Mechanism of Total Emission Control SO2 in Power Sector. Environ. Sci. Technol. 5, 134–138.

Yan, X., Jin, X., and Tong, T. (2019). Research Hotspots and Development Outline of China’s Environmental Regulations: Based on Visualization Analysis of CNKI. Jiang Xi Soc. Sci. 5, 99–110.

Yang, J., Liu, Q., and Shi, J. (2015). The Value of Corporate Green Innovation Strategy. Sci. Res. Manag. 36 (1), 18–25.

Zhang, G., and Zhang, X. (2011). Review and Prospect of the Green Innovation Research Outline in Foreign Countries. Foreign Econ. Manag. 33 (8), 25–32.

Zhang, J., Zhang, Y.-x., Yang, H., Zheng, C.-h., Jin, K., Wu, X.-c., et al. (2017). Cost-effectiveness Optimization for SO 2 Emissions Control from Coal-Fired Power Plants on a National Scale: A Case Study in China. J. Clean. Prod. 165, 1005–1012. doi:10.1016/j.jclepro.2017.07.046

Keywords: government subsides, pollution reduction, green innovation, mediating effect model, environmental management

Citation: Wang Q, Zheng X and Yue Z (2022) Investigation on Heterogeneous Influence of Government Subsidies on Pollution Reduction of Power Companies and Its Influencing Mechanism. Front. Energy Res. 10:896621. doi: 10.3389/fenrg.2022.896621

Received: 15 March 2022; Accepted: 29 April 2022;

Published: 15 June 2022.

Edited by:

Nallapaneni Manoj Kumar, City University of Hong Kong, Hong Kong SAR, ChinaReviewed by:

Mohammad Haseeb, Wuhan University, ChinaFernando Caixeta, Federal Institute of Education, Science Technology of the Triângulo Mineiro, Brazil

Copyright © 2022 Wang, Zheng and Yue. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiaoqi Zheng, emhlbmd4aWFvcWlAbmp1cHQuZWR1LmNu

Qin Wang1,2

Qin Wang1,2 Xiaoqi Zheng

Xiaoqi Zheng