- School of Economics and Management, China University of Mining and Technology, Xuzhou, China

The government is actively pursuing a financial subsidy policy to assist new energy companies in strengthening their ability to innovate independently, but the impact of government subsidies has been contentious. Using 142 new energy listed companies in Shanghai and Shenzhen A-stocks from 2012 to 2018, a fixed-effect model was used to examine the impact of government subsidies on new energy companies’ R&D investment, as well as the changes in the relationship between the two under conditions of economic policy uncertainty and enterprise heterogeneity. The results indicate that government subsidies have an inverted U-shaped effect on enterprise R&D investment; that is, while appropriate subsidies promote enterprise R&D investment, excessive subsidies suffocate other funds invested by the company in R&D and exacerbate the company’s proclivity to invest in fixed assets. Furthermore, economic policy uncertainty has a more substantial negative adjustment effect on the relationship between government subsidies and corporate R&D investment than fixed-asset investment. Additionally, research indicates that in China’s eastern coastal regions, the impact of government subsidies on R&D investment is more remarkable for high-risk preference enterprises and non-state-owned enterprises than in the central and western regions, where the negative adjustment effect of economic policy uncertainty is more remarkable for low-risk-preference and non-state-owned enterprises. It is recommended that government departments ensure economic policy stability and continuity and that subsidy selection be more targeted and precise in determining subsidy funds.

Introduction

New energy industries' economic and social benefits have become increasingly prominent considering the dual challenges of economic development and environmental governance (Bekun, 2022). In 2019, China’s new energy industries added value at 14.9%, and Chinese companies accounted for 209 of the world’s top 500 new energy companies (Su and Lin, 2021). In comparison to conventional energy sources such as coal and petroleum, new energy represented by unconventional energy sources such as solar energy, wind energy, nuclear energy, and biomass energy offers more significant economic benefits and development potential, which has gradually attracted the attention of governments in almost every country (Bekun et al., 2018; Sun et al., 2021). The Central Committee of the Communist Party of China’s proposal for the 14th Five-Year Plan for national economic and social development and the long-term goal for 2035 emphasizes the importance of accelerating the growth of the new energy industry, profoundly integrating it with various industries, increasing new energy consumption and storage capacity, and promoting clean, low-carbon, safe, and efficient energy utilization (Xinhua News Agency, 2020). The notice on further improving the financial subsidy policy for the promotion and application of new energy vehicles emphasizes the importance of optimizing technical indicators, adhering to the “excellent and strong” and improving the subsidy standard (The Ministry of Finance, 2020). Policymakers must strike a favorable balance between energy subsidies and the government’s financial burden (Husaini et al., 2019). China’s energy market is in high demand, and R&D and innovation in new energy technologies are critical for alleviating the energy crisis and achieving the “Two Mountains” goal (Jiang and Tan, 2013). However, new energy companies currently face a high demand for R&D funds, a lack of technological innovation capabilities, and a high reliance on critical technologies. As a result, the growth of new energy industries has revealed significant bottlenecks (Zhou et al., 2020).

To promote the development of new energy enterprises, the central government and local governments have issued a series of supportive policy measures, including designating the new energy industry as one of the seven strategic emerging industries and establishing industrial policies to assist enterprises with R&D (Nan and Han, 2019). Under the market mechanism, enterprises’ R&D and innovation activities are external, and the public attributes of innovation results force enterprises to bear all R&D costs without receiving all benefits, resulting in the enterprise’s innovation activities having an uneconomic externality, affecting the enterprise’s R&D enthusiasm, and thus causing market failures (Zhan et al., 2019; Shang and Huang, 2018). The government must intervene and provide the necessary support to encourage businesses to invest in R&D. However, numerous scholars have discovered that research and innovation are contingent upon a firm’s technical capabilities and resource strength (Zhang and Chen, 2016). Indeed, it is difficult to ensure the stability and continuity of government subsidies (Wallsten, 2000). Temporary government subsidies are insufficient to alter the company’s R&D strategy and will suffocate the enterprise funds initially invested in R&D (David et al., 2000). The academic community is divided on the relationship between government subsidies and R&D investment. According to Xiao et al. (2012), government subsidies encourage and crowd out corporate R&D investment. Subsidies initially encourage companies to increase R&D investment, but as the amount of subsidies increases, the incentive effect gradually erodes and eventually eliminates the company’s R&D investment. Li and Zheng (2016) discovered that enterprises can increase their government subsidies by pursuing strategic innovation, that is, pursuing innovation “quantity” rather than innovation “quality” Catering innovation through policy tools may not result in significant R&D investment. It is challenging to improve an enterprise’s capacity for innovation significantly. Enterprise R&D investment is both high-risk and long-term in nature. Government subsidies, when used effectively, can increase corporate cash flow and encourage businesses to invest in R&D (Hewitt-Dundas and Roper, 2010). However, unstable government subsidies and opaque distributions make businesses more hesitant to invest in R&D. For fixed R&D projects, temporarily wealthy government subsidy funds will dwindle the company’s original R&D funds and increase the company’s proclivity to invest in fixed assets (Nan and Han, 2019; Fu et al., 2021). Zhang and Chen (2016) found that while government subsidies will promote enterprise R&D investment within a reasonable range, excessive subsidies will crowd out other funds intended for enterprise R&D, resulting in more stable capital flow investment in fixed assets. Fixed assets such as real estate can effectively withstand an enterprise’s internal financial fluctuations and alleviate the strain of financing constraints. Additionally, new energy companies benefit from favorable land policy treatment. When there are too many subsidies, businesses tend to invest in fixed assets. While there is a wealth of research on the relationship between government subsidies and R&D investment, their conclusions vary significantly, and few works of literature also consider the impact of government subsidies on corporate R&D and fixed-asset investment. Thus, government subsidies and the relationship between corporate R&D and fixed-asset investment are critical for the investment decisions and policy formulation of new energy companies.

Numerous events in recent years, including the financial crisis, government elections, and Sino-US trade frictions, have resulted in significant fluctuations in economic policies, and enterprises’ internal and external environments have demonstrated an unstable state (Sun, 2019). It creates uncertainty, which has several consequences for enterprise capital allocation and investment behavior (Liu and Zhang, 2020). Tan and Zhang (2017) discovered that when economic policies are uncertain, changes in external policy and increased financing constraints lead enterprises to express uncertainty about their future form of judgment. As a result, enterprises will typically increase their cash holdings rather than diversify their investment portfolios. Uncertainty in economic policy discourages corporate investment through real options and financial friction. According to Nan and Han (2019), uncertainty will stifle corporate R&D investment and exacerbate corporate financing constraints and fixed-asset investment tendencies. Liu and Zhang, (2020) have a significant inhibitory effect on corporate fixed-asset investment, more pronounced in firms with low asset reversibility. Liu and Zhang, (2020) believe that moderate environmental uncertainty will increase an organization’s capacity for organizational learning and willingness to self-innovate, thereby increasing R&D investment. However, if uncertainty persists beyond a critical point, it will result in scarce resources, fierce competition, and reduced corporate R&D investment. Corporate capital allocation is determined by the trade-off between the added benefits of early investment and the waiting value of new information (Gulen and Ion, 2016). The R&D investment of new energy companies is highly irreversible and highly policy-sensitive. External economic policy changes will have a disproportionate impact on their investment activities. While the new energy industry has proliferated in recent years due to policy support, it has also encountered significant financing constraints, overcapacity, a lack of technological innovation motivation, and low innovation efficiency (Wang and Zou, 2018; Sun et al., 2020). Scholars have debated the fund allocation and investment behavior of businesses in the face of economic policy uncertainty. Will businesses continue investing, or will they actively reduce investment until the uncertainty subsides? It is worth investigating further.

Thus, this paper uses the Shanghai and Shenzhen A-share new energy listed companies from 2012 to 2018 as a research sample to examine the impact of government subsidies on new energy company R&D investment, analyzes the relationship between the two over time in the context of economic policy uncertainty and enterprise heterogeneity, and further explores the differences in the effects of government subsidies on corporate R&D investment and the regulatory effects of economic policy uncertainty in companies with different property rights, regional characteristics, and risk preferences. Additionally, it expects to make recommendations and countermeasures to encourage investment in new energy enterprises based on empirical research findings. The following are the possible contributions. (1) In contrast to previous research that found a single linear relationship between government subsidies and corporate R&D investment, this paper discovers that government subsidies have a nonlinear effect on the R&D investment of new energy companies. While government subsidies will encourage appropriate levels of enterprise R&D investment, excessive subsidies will crowd out other forms of capital investment for R&D and increase a firm’s proclivity to invest in fixed assets. (2) Against the backdrop of current economic policy uncertainty, this paper includes a review of the research literature on enterprise investment behavior under economic policy uncertainty scenarios. (3) Further subsampling reveals a cross-sectional difference between the effect of government subsidies on corporate R&D investment and the regulatory effects of economic policy uncertainty. Government subsidies have a more significant impact on R&D investment in eastern coastal areas, high-risk preference enterprises, and non-state-owned enterprises; economic policy uncertainty has a more significant negative adjustment effect in central and western regions, low-risk preference enterprises, and non-state-owned enterprises. Hence, it is recommended that government departments ensure the stability and consistency of economic policies, be more targeted in their subsidy object selection, and be more precise in their subsidy fund determination.

Background and Hypotheses

Theoretical Review on the Impact of Government Subsidies on R&D Investment of New Energy Enterprises

The new energy industry, as a strategic emerging industry reliant on technological innovation and R&D as the primary drivers of development, has received policy support and guidance from the government since the industry’s inception (Zhu et al., 2019). Government intervention can compensate for the external loss of market competition in the new energy industry, and new energy enterprises can be encouraged to innovate and develop. Government intervention can compensate for the external loss of market competition in the new energy industry and encourage new energy enterprises to innovate and develop. There is no doubt that policy support in the form of financial subsidies (Shang and Huang, 2018), tax breaks (Pan, 2019), and land and energy preferential production factors (Nan and Han, 2019) has a sizable impact on new energy enterprises’ R&D investment. The government extends a “visible hand” to assist emerging industries in growing and improving their competitiveness through resource reallocation. While it can alleviate some of the burdens of “policy tasks” for new energy companies, the impact of traditional energy sources, industry competition, and fluctuations in the industrial environment make it difficult for the government to gauge the level of support. On the other hand, excessive protection will stifle the internal motivation for innovation, potentially reducing the company’s R&D input and output (Dou et al., 2019). There is a wealth of research on government subsidies and enterprise R&D investment, but the conclusions reached by different scholars are contentious, with the debate centered on whether government subsidies have “crowding in” or “crowding out” effects on enterprise R&D investment.

According to proponents of the “crowd-in” effect, technological innovation activities are spillover. Due to the quasi-public nature of R&D accomplishments, enterprises bear all innovation costs but not all innovation benefits. Therefore, government intervention and necessary support are required to motivate R&D activities and correct market failures during the innovation process (Guan and Yam, 2015). Government subsidies can effectively correct market failures by increasing corporate cash flow and surplus, rapidly expanding corporate capital pools (Shang and Huang, 2018), and mitigating the cost risk associated with the “spillover effect” of R&D activities, thereby increasing corporate enthusiasm for R&D and innovation and stimulating enterprises to carry out previously uneconomic R&D activities (Wang and Hou, 2015). Therefore, government subsidies have a “crowding-in” effect on corporate R&D spending. Bianchini et al. (2019) examined the impact of R&D subsidies on corporate R&D investment across a range of institutional frameworks, compared the impact of government policies on R&D investment in Spain and 13 European economies, and concluded that regardless of the economic system, enterprises receiving government subsidies invest more in R&D than enterprises that do not receive government subsidies. Liu et al. (2016) used propensity score matching to examine the effect of government subsidies on the R&D investment of high-tech manufacturing enterprises in Jiangsu Province. Government subsidies significantly increased the R&D intensity of high-tech manufacturing enterprises, which was more effective than small-scale and non-state-owned enterprises in overcoming financing constraints.

On the other hand, according to proponents of the “crowding out” effect, there is information asymmetry in selecting subsidy objects and determining the subsidy amount. When information asymmetry exists, resource-scarce enterprises frequently choose political donations to establish contact with the government and secure political resources (Yuan et al., 2015). Political donations are a common form of rent-seeking in an imperfect system. To maintain political ties, businesses must continue to contribute to politics and invest additional production resources in unproductive rent-seeking activities, thereby “squeezing out” the company’s existing R&D resources (Li and Qiu, 2015). While rent-seeking behavior can result in excess profits for the enterprise, as competition for the monopoly market position intensifies, the enterprise’s rent-seeking price increases, resulting in rent-seeking income not being sufficient to offset the cost and the enterprise having to absorb some of its internal expenses (Krammer and Jiménez, 2020). To offset rising rent-seeking costs, high-risk, high-investment R&D funds are frequently the first to bear the brunt (Luo et al., 2013). Cai et al. (2018) discovered that the political connections created by rent-seeking activities distort enterprise resource allocation efficiency. Maintaining relationships between government and business frequently consumes significant financial and material resources from businesses, reducing their investment in R&D activities. Wang and Zou (2018) examined 1,293 large private enterprises that were publicly listed in China between 2010 and 2014 and discovered a negative correlation between the strength of political ties and the strength of enterprise R&D. Tong and Chen (2016) further noted in their research that if private enterprises receive government subsidies based on political ties rather than on future R&D innovation, the rent-seeking activities of political donations will not benefit enterprises’ R&D investment.

Numerous studies conducted in recent years have demonstrated that government subsidies do not have a single linear relationship with R&D investment. There is a limit to the promotion effect of government subsidies on R&D investment. When government subsidies reach a certain level, the government increases them but squeezes out other enterprises’ original R&D investments (Guellec and Van Pottelsberghe, 2003; Dai and Cheng, 2014). The R&D activities of new energy companies are both capital- and technology-intensive, with high technical barriers and significant capital requirements. Government subsidies are a significant source of external funding for businesses, as they can effectively alleviate the plight of corporate R&D funding constraints while also sending positive signals to the rest of the world. Disclosure of information to banks, venture capitalists, and other external investors enable enterprises to manage external financing better and accelerate R&D activities. Subsidies provided by the government during the establishment of R&D projects serve as an excellent incentive for R&D activities. Following receipt of government subsidies, enterprises make a substantial initial investment in R&D. Even if the government ceases to provide subsidies, businesses will continue to invest. Since the government continues to supplement subsidies only to replace the enterprise’s R&D expenditure, this has a crowding-out effect on R&D investment. Xiao et al. (2012) found that while government subsidies initially incentivize enterprises to invest in R&D, the incentive effect diminishes as the intensity of subsidies increases. When the optimal subsidy threshold is exceeded, the company’s R&D investment is squeezed out. An et al. (2016) examined data from innovative businesses and discovered that the incentive effect of government subsidies on R&D investment has a critical value. Excessive subsidies suffocate the enterprise’s original R&D funds and act as a deterrent to enterprise innovation. Overall, government subsidies alleviate corporate financing constraints and encourage corporate R&D investment in the early stages of R&D, but as subsidies increase, the company’s initial R&D funds will gradually dwindle. As such, the following hypothesis is proposed:

Hypothesis 1. (H1). Government subsidies have an inverted U-shaped relationship with enterprise R&D investment; they will encourage enterprise R&D investment within a reasonable range.Excessive government subsidies will suffocate the company’s initial R&D investment and exacerbate the company’s proclivity for fixed-asset investment. There are primary reasons for this. First, as a strategic emerging industry, the new energy industry integrates new materials, organizations, equipment, and personnel. Its R&D activities are characterized by long return cycles, rapid technology updates, and a high level of innovation risk. Additionally, the positive externalities associated with R&D and innovation activities result in a significant “free-riding” phenomenon for other businesses. The inadequacy of intellectual property protection and the absence of implementation mechanisms have significantly harmed enthusiasm for R&D and innovation (Peng et al., 2015). Numerous risk factors contribute to enterprises’ external uncertainties, and R&D investment is irreversible. Therefore, it is certain to be more circumspect about R&D investment. Compared to R&D investment, which carries a high risk of innovation and a long payback period, the fixed-asset investment carries a low risk, immediate effect, and high visibility. It takes a long time for financing, investment, and accomplishments in R&D to be converted into market value. Enterprises prefer fixed-asset investment, which is a direct investment method that is immediate and rapid (Nan and Han, 2019). The growth of the domestic real estate industry and skyrocketing housing prices have attracted people from all walks of life to come and share a slice of the soup in recent years. As a result, internal demand for corporate R&D has been stifled, and companies are increasingly inclined to invest in low-risk, stable-income fixed assets. Increased fixed-asset investment harms enterprises’ cash flow, thereby limiting R&D investment.Second, the government has a clear preference for subsidy selection. Enterprises with close ties to the government frequently receive many government subsidies, and the irrationality of the subsidy target determination harms corporate investment decisions (Li, 2019). On the one hand, there is a lack of close collaboration between government and business, making it difficult for businesses to obtain resources. As rational economic actors seeking to maximize economic benefits, enterprises typically invest capital in reversible fixed-asset investments. Additionally, fixed assets such as real estate are considered mortgage assets by lenders and can effectively address the issue of external financing constraints. However, because the period for technological innovation and production efficiency improvement is lengthy, uncertain factors pervade it, and it cannot resolve corporate financing issues effectively. High financing constraints make it impossible to resolve effectively, and internal demand for R&D investment is stifled. Fixed-asset investment is the optimal investment strategy for businesses seeking to maximize returns. On the other hand, the close relationship between government and business enables businesses to access additional political resources. The greater the government’s likelihood of using businesses to accomplish social objectives, the greater the incentive for businesses to expand their production scale and social influence. Enterprises will use specialized resources to invest in fixed assets such as asset purchases or engineering construction, establish effective financing channels through the integration of industry and finance, and acquire banks to broaden their business scope and achieve expansion (Cheng et al., 2020). Additionally, maintaining positive government-business relations requires businesses to invest significant energy and resources, which will inevitably eat into the company’s R&D budget. The closer the relationship between the government and the enterprise, the more subsidies the enterprise receives, and the more it tends to focus on low-risk, stable-income, and short-term projects such as government regulation and franchising, thereby inhibiting high-risk R&D investment. As a result, the following hypothesis is proposed:

Hypothesis 2. (H2). Government subsidies positively correlate with enterprise fixed-asset investment in a U-shaped fashion; when an enterprise receives government subsidies above the optimal level, it tends to invest in fixed assets, crowding out R&D investment.

The Influence of Government Subsidies on the Investment Behaviors of Enterprises Under Economic Policy Uncertainty

Economic policy uncertainty has a profound effect on both the macroeconomic environment and the behavior of micro-enterprises. Economic policy uncertainty primarily manifests itself in two stages. The first stage is that the enterprise is unaware of whether and when the government will issue relevant policy documents and whether the new documents will alter current economic policy; the second stage is that the implementation strength and effect of the government policy after it is promulgated, as well as the extent to which enterprises interpret the government policy, remain unknown. The preceding stage was primarily responsible for the uncertainty created by the macroeconomic environment’s chain reaction, while the latter stage may result in more violent fluctuations in the company’s own investment decisions (Meng and Shi, 2017). Corporate investment decisions are highly dependent on anticipated future returns. When economic policy is uncertain, corporate investment requirements fluctuate due to uncertainty (Liu and Zhang, 2020). According to traditional net present value theory, enterprise investment is beneficial only when the expected investment income exceeds the investment cost. If an investment is not irreversible and can be delayed, the net present value theory is no longer applicable. According to real option theory, because investment projects are irreversible and have sunk costs, enterprises tend to wait for a clear investment opportunity to avoid losses caused by uncertainty to the greatest extent possible (Gulen and Ion, 2016). Specifically, the enterprise investment can earn more additional income only when the expected investment income exceeds the sum of the cost and waiting value. The greater the degree of economic policy uncertainty, the higher the return on investment businesses will pay to wait for the uncertainty to subside and seize investment opportunities (Kim and Kung, 2017). For R&D projects involving a greater degree of irreversible investment, investment failure means that companies will have a more challenging time realizing their capital, and their R&D investment decisions will be more conservative. When it comes to fixed-asset investment with a low degree of irreversible investment, and when it is impacted by uncertainty, firms are more likely to resist risk through asset realization, implying a weaker degree of fixed-asset investment suppression. Tran’s (2019) found in his observational samples from 18 countries that economic policy uncertainty significantly harmed enterprises’ ability to take risks and that countries with substantial uncertainty avoidance cultures have a more vital ability to take risks. Ashraf and Shen (2019) examined loan data from 17 national banks and discovered a significant positive correlation between economic policy uncertainty and bank loan interest rates. Economic policy uncertainty increases a company’s default risk, and as a result, banks raise loan interest rates, increasing corporate financing constraints and impeding enterprise investment behavior. Xu (2019) believes that economic policy uncertainty inhibits corporate innovation activities by increasing the cost of R&D funds, and not just because the investment is irreversible. Economic policy uncertainty significantly impacts firms with financing constraints or excessive reliance on external funds in market competition. Tan and Zhang (2017) examined the path of economic policy uncertainty as it affects the investment behavior of Chinese enterprises and discovered that when economic policies are uncertain, external policy changes and increased financing constraints cause enterprises to make uncertain future judgments. Enterprises will frequently prefer to increase their cash holdings over expanding their investment scale. Uncertainty in economic policy has stifled corporate investment via two channels: real options and financial friction. Rao and Xu (2017) examined the effect of China’s economic policy uncertainty index on corporate investment, finding that as economic policy uncertainty increased, overall corporate investment exhibited a significant downward trend. The research of Li and Yang (2015) further established that an increase in the uncertainty index surrounding China’s economic policy would have a depressing effect on corporate investment.

According to some scholars, businesses can anticipate uncertainty by identifying potential sources of uncertainty, investing in R&D in advance, and accumulating technological and brand advantages. Uncertainty can stimulate a company’s dynamic adjustment and organizational learning capabilities, while a potential sense of crisis can activate corporate adventure motivation, prompting businesses to increase R&D investment to maintain a competitive edge. However, the new energy sector is markedly different from traditional enterprises as a new industry. The new energy industry’s development is inextricably linked to government policies. Subsidies from the government are a significant source of external capital for R&D investment activities. Under the dual guarantee of industrial policies and government subsidies, the risk of R&D investment is the lowest. Economic policy uncertainty will significantly impact the company’s policy guidance and market environment. The company’s investment risk will increase, external financing channels will narrow, the market environment will deteriorate, and investment and corporate cash flow will be inextricably linked. Uncertainty reduces an enterprise’s investment desire, and the enterprise will prioritize its healthy survival and development capabilities and strengthen its solvency in the event of economic policy uncertainty to overcome the risk period (Li, 2019). Government subsidies are a significant source of funding for businesses. A significant capital injection improves the cash ratio of the business and serves as a guarantee of the business’s solvency capital. When irreversible R&D investment and high risks are combined, they increase the company’s waiting value, causing the company to wait for the uncertainty to subside before making investment decisions, resulting in a suppression of corporate R&D investment demand when economic policy uncertainty increases (Li, 2019). Fixed asset investment is relatively reversible, and when it is negatively impacted, the asset realization rate is high, allowing it to resist risks and overcome financial difficulties effectively. When economic policy uncertainty occurs, corporate fixed-asset investment demand is only marginally suppressed, and economic policy uncertainty has a negligible effect. Accordingly, the following hypothesis is advanced:

Hypothesis 3. (H3). Economic policy uncertainty has a negative adjustment effect on the relationship between government subsidies and corporate investment. Corporate R&D investment is more constrained than fixed-asset investment.

Research Method

Sample and Data

The research sample for this article was the A-share new energy listed companies in Shanghai and Shenzhen from 2012 to 2018, excluding ST and *ST companies with abnormal financial status and listed companies with missing data on the variables studied in this article. Finally, 142 newly listed energy companies were chosen as research subjects. The research relies on data on government subsidies, R&D investment, and enterprise characteristics from the CSMAR database (Guotai'an Information Technology Co., Ltd., 2020) and on data on economic policy uncertainty from the China Economic Policy Uncertainty Index compiled by Baker et al. (2020). To minimize the effect of extreme values on empirical analysis, continuous variables required for empirical analysis are subjected to winsorize tailing at a level of 1% above and below the total sample.

Variable Definitions

1) R&D investment (RD): Related literature uses the ratio of R&D investment to operating income to quantify the intensity of corporate R&D investment, but operating income, mainly accrued income, is subject to corporate earnings management. To mitigate the effect of multicollinearity between variables, and following Sun’s (2019), the natural logarithm of the total amount of R&D investment in new energy companies plus 1 is chosen as the indicator of R&D investment level. Additionally, robust testing uses the R&D investment intensity (the ratio of total R&D investment to total assets) of new energy companies as a proxy for R&D investment. Removing the difference in R&D investment caused by different enterprise sizes makes it possible to calculate the difference more accurately. The investment level in R&D that a business makes concerning its size is a good indicator of how much money it spends on R&D.

2) Fixed-asset investment (FAI): Using the research methods of Nan and Han (2019) and tracking changes in the enterprise’s fixed-asset investment quota, this paper can determine the ratio of the current period’s increase in fixed assets to the enterprise’s total assets at the end of the period, objectively reflecting fixed-asset investment.

3) Government subsidies (GS): The amount of “government subsidies included in the current profit and loss” disclosed by listed companies in the new energy industry in their annual report is used to calculate government subsidies. To mitigate the effect of heteroscedasticity, the methods of Shang and Huang (2018) are used for reference, with the natural logarithm of the number of government subsidies as the proxy variable.

4) Economic policy uncertainty (EPU): Baker et al. (2020) index of China’s economic policy uncertainty is used to quantify economic policy uncertainty. It extracts keywords from the South China Morning Post, Hong Kong’s largest English newspaper, and calculates the number of reported events relating to China’s economic uncertainty. It then uses the quantitative treatment of the reported events and the total number of articles published in the current month to calculate the final monthly economic policy uncertainty index. Baker et al. (2020) have rigorously demonstrated the effectiveness of his economic policy uncertainty index. Moreover, their index is relatively mature, which means that it is not dependent on the occurrence of specific political or economic events to produce a continuous quantitative economic policy uncertainty index. Given that Baker et al. (2020) calculated the monthly China Economic Policy Uncertainty Index based on prior research (Sun, 2019), the annual economic policy uncertainty index is calculated as the arithmetic average of the monthly economic policy uncertainty index over one year.

5) Risk appetite (Lev): The debt level of a business, expressed as the asset-liability ratio, is used as a proxy for the degree of risk appetite. Above the sample, the median asset-liability ratio is 1 and vice versa (Meng and Shi, 2017). While debt financing is less expensive than equity financing, it entails more significant financial risks. Thus, to a certain extent, the level of corporate debt reflects the degree of radicalization of corporate financial policies. Radical financial policies are both high-yielding and risky. Therefore, risk appetite has a consistent connotation.

6) Property rights (state): It is divided into two categories based on the characteristics of the enterprise: state-owned enterprises (state-owned enterprises, state-owned joint ventures, and state-owned and collective joint ventures) and non-state-owned enterprises. For state-owned enterprises, the dummy variable is set to 1; for other non-state-owned enterprises, it is set to 0.

7) Area: This term refers to the various listed companies’ regions. The regions are classified as eastern coastal areas (Beijing, Shanghai, Tianjin, Liaoning, Shandong, Jiangsu, Zhejiang, Fujian, and Guangdong) and non-eastern coastal areas. The eastern coastal area is assigned a value of 1, while the western coastal area is assigned a value of 0.

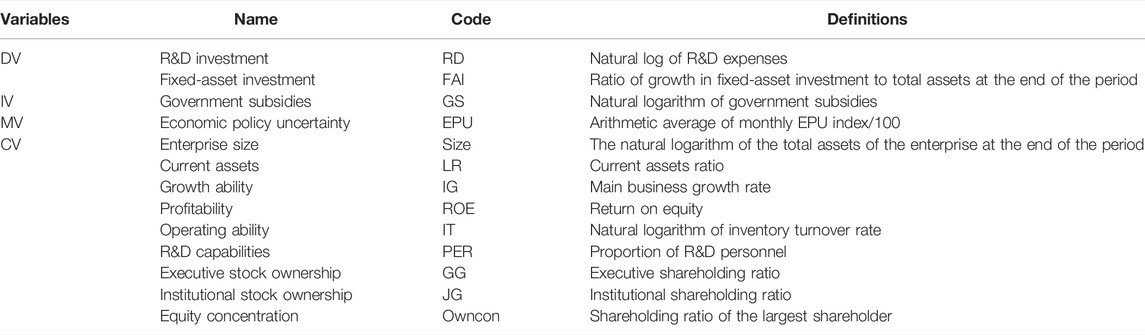

8) Control variables: This paper selects enterprise size, current assets, profitability, growth capability, operating capability, R&D capabilities, executive stock ownership, institutional stock ownership, and equity concentration as the control variables based on the research of relevant scholars (Nan and Han, 2019; Sun, 2019; Liu and Zhang, 2020). Each variable’s name, definition, and code are listed in Table 1.

Model Building

To examine the relationship between government subsidies and enterprise R&D investment, as well as the regulatory effect of economic policy uncertainty, the following models are constructed for empirical analysis based on the research methods of Liu and Zhang (2020):

Model 1 tests the inverted U-shaped relationship between government subsidies and enterprise R&D investment, with YEAR as the annual dummy variable to control the fixed time effect of R&D investment in new energy companies. According to theoretical analysis, the value of

Models 2 and 3 test the positive U-shaped impact of government subsidies on corporate fixed-asset investment. They also evaluate the crowding-out effect of government subsidies on the optimal threshold for corporate R&D investment. As per theoretical analysis, if the crowding-out effect of R&D investment exists, the values of the government subsidy coefficients in Eqs 2 and 3 are opposite. Hence, the value of

Models 4 and 5 further explore the crowding out effect of government subsidies deviating from the optimal threshold on R&D investment and the substitution effect of fixed-asset investment on R&D investment. From theoretical analysis, the value of

Models 6 and 7 test the moderating effect of economic policy uncertainty on the relationship between government subsidies and corporate R&D investment. From theoretical analysis, economic policy uncertainty negatively regulates the relationship between government subsidies and R&D investment. Thus,

Models 8 and 9 assess the moderating effect of economic policy uncertainty on the relationship between government subsidies and enterprise fixed-asset investment. Based on theoretical analysis, economic policy uncertainty weakens the impact of government subsidies on fixed-asset investment. Therefore,

Empirical Findings

Descriptive Statistical Analysis

Table 2 contains a descriptive statistical analysis of this paper’s major variables. As the table indicates, the average value of a fixed-asset investment in new energy companies is 0.054, while the standard deviation is 0.061, signifying that fixed-asset investment in new energy companies somewhat varies. The average value of government subsidies received by new energy companies is 12.69, with a standard deviation of 5.945, implying that while government subsidies provide new energy companies with more subsidies, the amount received by individual companies varies significantly. The average value of R&D investment is 14.257, and the standard deviation is 7.643, inferring that while new energy companies’ overall R&D status is favorable, there are significant differences in the level of R&D investment among companies. Finally, economic policy uncertainty has an average value of 2.806, indicating that businesses’ level of economic policy uncertainty has changed significantly over the sample period.

Empirical Analysis

Examination of the Relationship Between Government Subsidies and R&D Investment

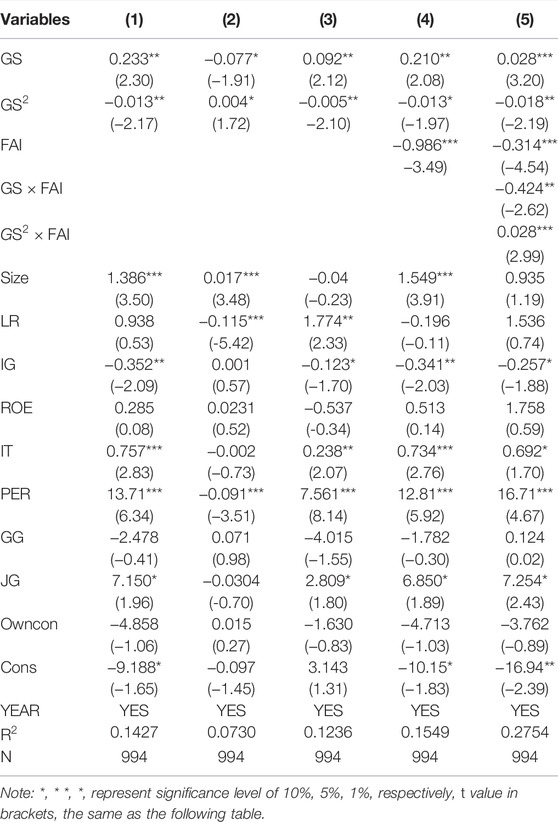

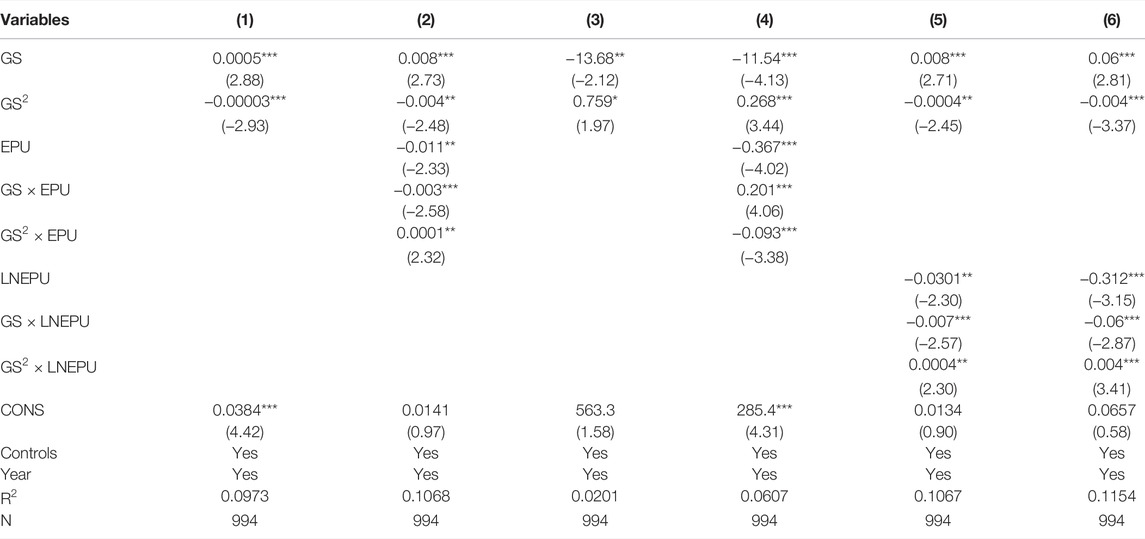

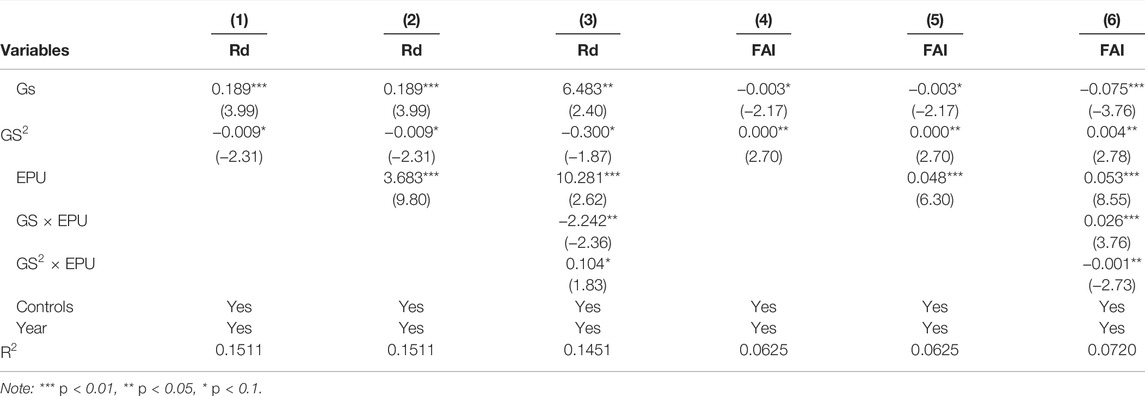

To verify the theoretical hypothesis via the F and Hausman tests, it is determined that regression analysis should be performed using a fixed effect model. Table 3 shows the regression results for government subsidies on corporate R&D investment. The relationship between government subsidies and corporate R&D investment is summarized in Column 1. The coefficient of government subsidy is significantly positive, while the coefficient of its square term is significantly negative. If the subsidy intensity exceeds the threshold for enterprise-level R&D investment, it will have a deterrent effect. Hence, H1 is confirmed. Column 2 contains the regression coefficients for the relationship between government subsidies and fixed-asset investment by businesses. The government subsidy coefficient is significantly negative, while the square term coefficient is significantly positive, indicating that an excessive level of government subsidy will suffocate other funds used by enterprises for R&D and exacerbate enterprises’ investment in fixed assets. In Column 3, the government subsidy coefficient is significantly positive. In contrast, its square term coefficient is significantly negative, signifying that before government subsidy gradually increases to the optimal level, the ratio of government subsidy to fixed-asset investment is positively related, further implying that government subsidy will encourage enterprise R&D investment. When government subsidies continue to grow, the square term and the ratio of fixed-asset investment exhibit a negative correlation; government subsidies will crowd out other capital investments that could have been used for R&D and then increase enterprises’ fixed-asset, thereby crowding out R&D investment. Column 4 shows a significant negative coefficient for fixed-asset investment, while the regression coefficient for government subsidies decreases. It demonstrates that increasing fixed-asset investment by government-subsidized enterprises will inevitably squeeze out other capital investments originally used for R&D. Column 5 includes the interaction item between government subsidy and fixed-asset investment. Government subsidy primary and fixed-asset investment interaction item has a significantly negative regression coefficient. The interaction item of government subsidy secondary and fixed-asset investment has a statistically significant positive regression coefficient. It contrasts with the sign of the government subsidy’s regression coefficient on R&D investment, inferring that the government subsidy’s effect on R&D investment is weakened by fixed-asset investment. Government subsidy’s regression coefficient decreases by 0.205 and 0.005, respectively, validating that when government subsidy exceeds the optimal threshold, it will replace the original capital used by enterprises for R&D, increase the investment tendency of enterprises’ fixed assets, and thus crowd out enterprises’ R&D investment. Therefore, H2 is confirmed.

The Test of Adjustment Effect of Economic Policy Uncertainty

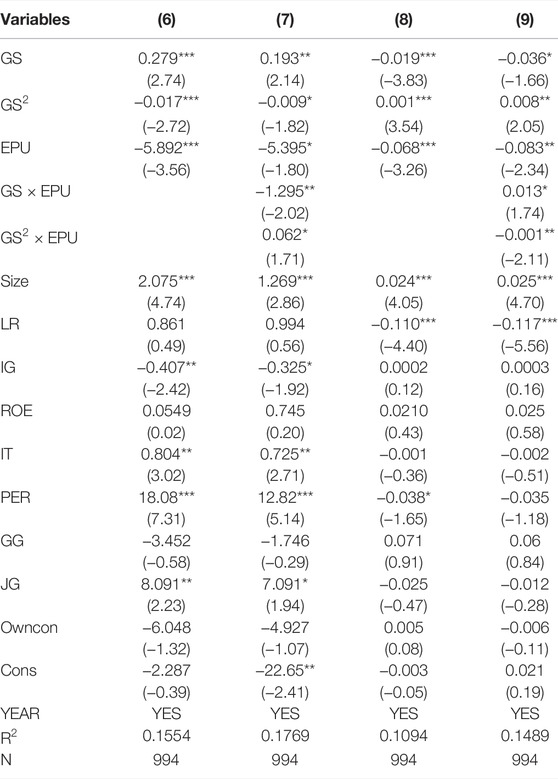

China’s EPU index has risen rapidly since 2016, reaching 935.31 in December 2018, a 247.24% increase over the same period in 2017, signifying that China’s economic policy environment is unstable. Table 4 shows the impact of government subsidies on corporate R&D and fixed-asset investment under various scenarios of economic policy uncertainty. As shown in Columns 6 and 7, the coefficient of economic policy uncertainty is significantly negative, implying that economic policy uncertainty has limited enterprise R&D investment. Furthermore, government subsidy and economic policy uncertainty have a significant negative interaction coefficient, which is in the opposite direction of the government subsidy coefficient, and a significant positive square interaction term coefficient, which is in the opposite direction of the government subsidy square term coefficient, inferring that economic policy uncertainty has a significant negative adjustment effect on the relationship between government subsidies and enterprise R&D investment. Referring to the judgment method of nonlinear relationship adjustment by Liu et al. (2019), the adjustment effect is in the opposite direction of the main effect coefficient, causing the main effect curve to decline in general and tend to be flat.

As shown in Columns 8 and 9 of Table 4, the economic policy uncertainty coefficient is significantly negative, implying that the EPU has a detrimental effect on corporate fixed-asset investment. Furthermore, the direction of the interaction coefficient between government subsidies and economic policy uncertainty is the opposite of the main effect, indicating that EPU harms the relationship between government subsidies and enterprise fixed-asset investment. As economic policy uncertainty increases, enterprises reduce their fixed-asset investment quotas. Under the scenario of economic policy uncertainty, the coefficient of government subsidy to R&D investment decreased by 0.086 and 0.008, respectively. In contrast, the coefficient of government subsidy to fixed-asset investment decreased by 0.027 and 0.007, respectively, inferring that the effect of government subsidies on R&D investment is significantly weakened under the scenario of economic policy uncertainty. Hence, H3 is confirmed.

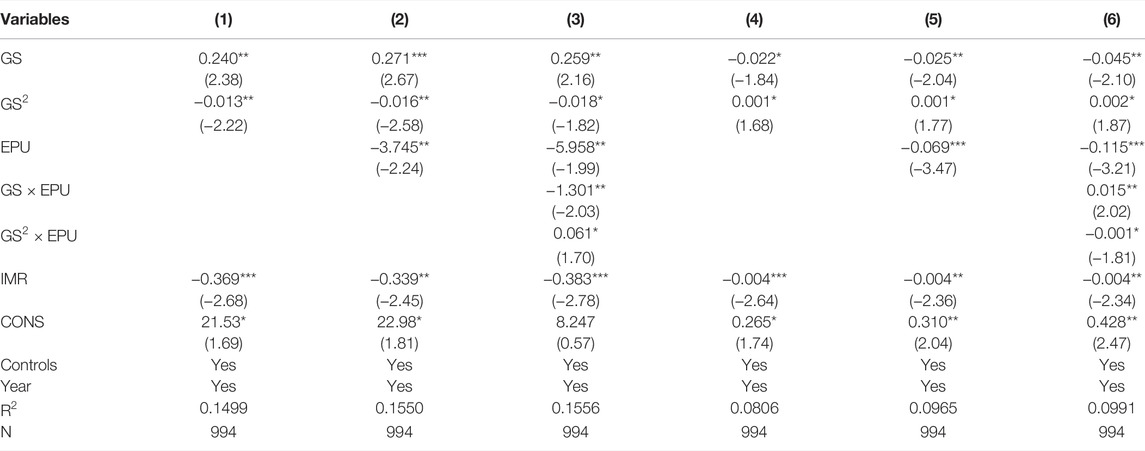

Robust Test

1) Sample selection bias: China’s enterprise R&D investment is voluntary, and companies have the option of disclosing information. The Heckman two-stage model is used in this paper to account for sample selection bias, and the regression results show no significant difference, as shown in Table 5.

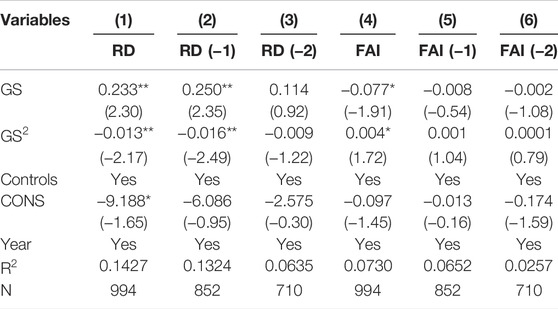

2) Variable measurement bias: To avoid the deviation of empirical results caused by different variable measurement methods, this paper first regresses on the natural logarithm of the increase in fixed assets. Second, in robust testing, the R&D investment intensity (i.e., the ratio of total R&D investment to total assets) of new energy companies is used as a proxy for R&D investment. Third, the original equation is regressed using the natural logarithm of the annual arithmetic mean of the economic policy uncertainty index. The empirical findings are summarized in Table 6. There is no statistically significant difference between the regression and original results.

3) Time lag effect test: Government subsidies may have a lag effect on enterprise R&D investment. Numerous scholars have previously examined the role of government subsidies in enterprise R&D investment, emphasizing the importance of the time lag effect. Therefore, it is critical to analyze the lag period in the model to develop accurate government subsidy policies and improve their effectiveness. Given the small sample size of new energy companies, this paper examines whether the dependent variables’ impact on government subsidies is lagging. Government subsidies have a continuous and significant effect on R&D investment in the current and lag periods at a level of 5% but have no lag effect on fixed-asset investment, as shown in Table 7.

4) Missing key control variables: Given the critical influence of managerial power on corporate R&D investment decisions, this paper includes managerial power as a control variable (if the chairman serves concurrently as general manager, it is 1, otherwise it is 0) in the regression model. Table 8 summarizes the regression results.

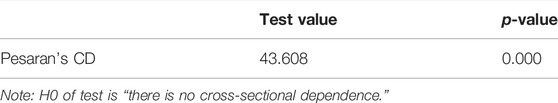

5) This paper examines cross-sectional dependence (CD) in the data to determine whether the effects of government subsidies on one firm may spill over to other firms which can result in misleading results if correlated with independent variables (Anser et al., 2021). Specifically, it applies Pesaran CD tests because the data are short panels. Table 9 summarizes the results of the CD tests.

As shown in Table 9, the null hypothesis is rejected because the probability value is statistically significant at the 1% significance level. Hence, this paper reports the existence of cross-sectional dependence. Given the possibility of cross-sectional and sequence autocorrelation in panel data, the Driscoll and Kraay (1998) method is used to adjust the coefficient standard error while simultaneously taking autocorrelation and heteroscedasticity into account. The regression result is consistent with the original result (Table 10).

Further Analysis

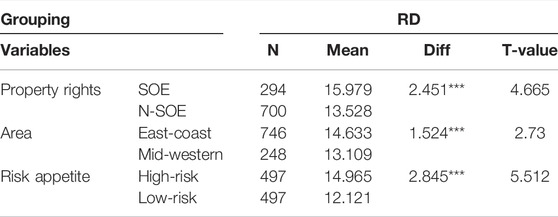

Due to differences in property rights and the difficulty for new energy companies to apply for government subsidies, new energy companies’ decision-making process for R&D investment also varies significantly due to different risk appetites and the combination of industry and finance. Hence, this paper also categorizes the samples by the nature of the enterprise’s intellectual property rights, regional characteristics, and risk tolerance. The two-sample T-test results in Table 11 indicate that the selected subsamples of the grouping variables have statistically significant differences. Thus, group regression analysis is possible.

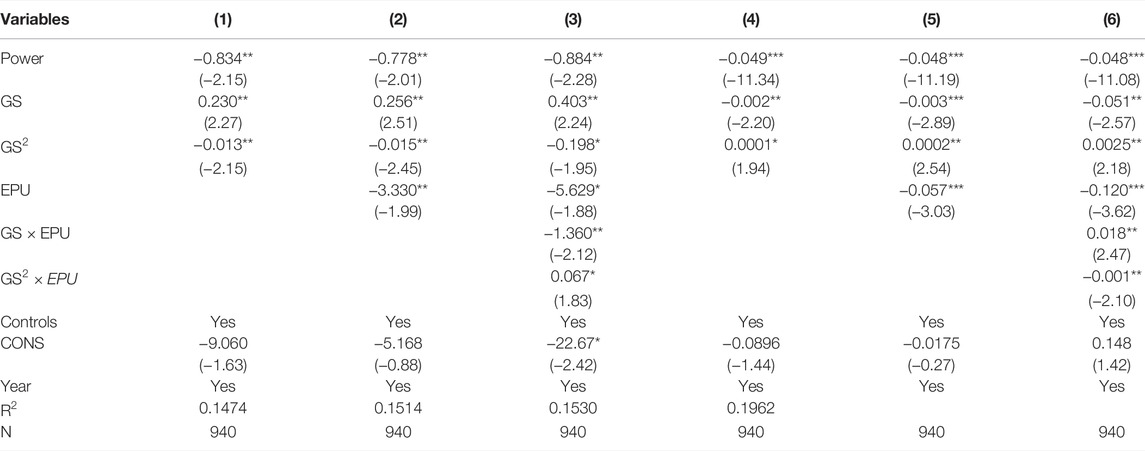

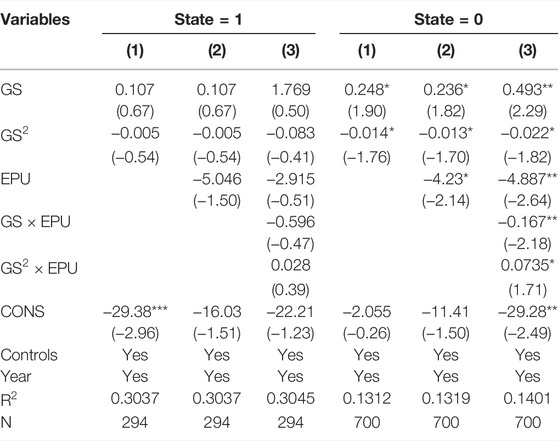

The Impact of Property Rights Heterogeneity on the Relationship Between Government Subsidies and R&D Investment

Table 12 examines the effect of government subsidies on corporate R&D investment and the moderating effect of economic policy uncertainty in firms with varying levels of property rights. As the table indicates, there is no evidence of an inverted U-shaped relationship between government subsidies and corporate R&D investment in state-owned enterprises, and economic policy uncertainty has little effect on SOE R&D investment. It may be because SOE R&D investment is more motivated by political objectives, its external financing constraints are modest, enterprise resources are plentiful, and government subsidies and external economic policy changes have little effect on its investment decisions. Additionally, policies protect state-owned enterprises due to their unique relationship with the government. Therefore, external economic policy uncertainty has little effect on them. As a result, economic policy uncertainty will have little effect on state-owned enterprises’ R&D investment. Non-state-owned enterprises, on the other hand, do not face the same constraints as state-owned enterprises. The market environment is cutthroat, and the best outcome of a variety of portfolio games is the use of government subsidies. R&D investment can help businesses gain market share, generate excess returns, and aid in corner-cutting. Government subsidies can help enterprises invest in R&D in the appropriate range. When the intensity of government subsidies exceeds the optimal level, non-state-owned enterprises will raise their R&D funds and invest in investments that generate stable earnings, thereby crowding out corporate R&D investment. non-state-owned enterprises face increased competition in the open market. When economic policy uncertainty increases, financing constraints for non-state-owned enterprises become more severe. Enterprises should exercise greater caution considering policy changes and the volatility of the futures market. Due to the inherent risks and high investment required for R&D activities, high-level enterprises become more conservative, which inevitably reduces their R&D investment.

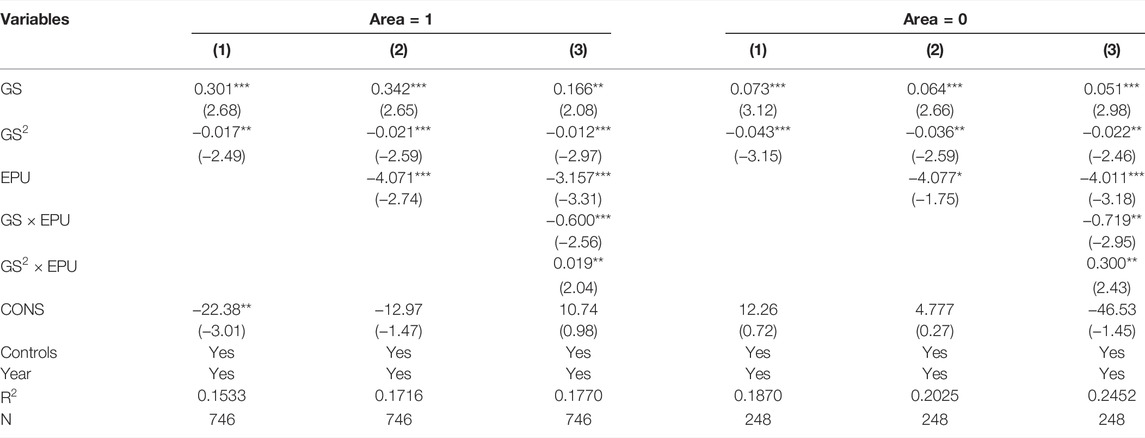

The Influence of Regional Heterogeneity on the Relationship Between Government Subsidies and R&D Investment

Eastern coastal new energy enterprises benefit from a more transparent market environment, fiercer enterprise competition, and a greater sense of innovation. An open and transparent market environment, combined with a pool of technical talent, creates an ideal environment for R&D and innovation. On the other hand, market transparency is low in the central and western regions, product market competition is low, and enterprises’ R&D investment intensity is lower than in the eastern coastal regions due to a scarcity of talents and market consolidation. The regression results in Table 13 illustrate the effect of regional differences on corporate R&D investment. The findings indicate that government subsidies have a much smaller effect on R&D investment in new energy companies in the central and western regions than in the eastern coastal regions. Economic policy uncertainty should also have a more substantial inhibitory effect on R&D investment in the central and western regions.

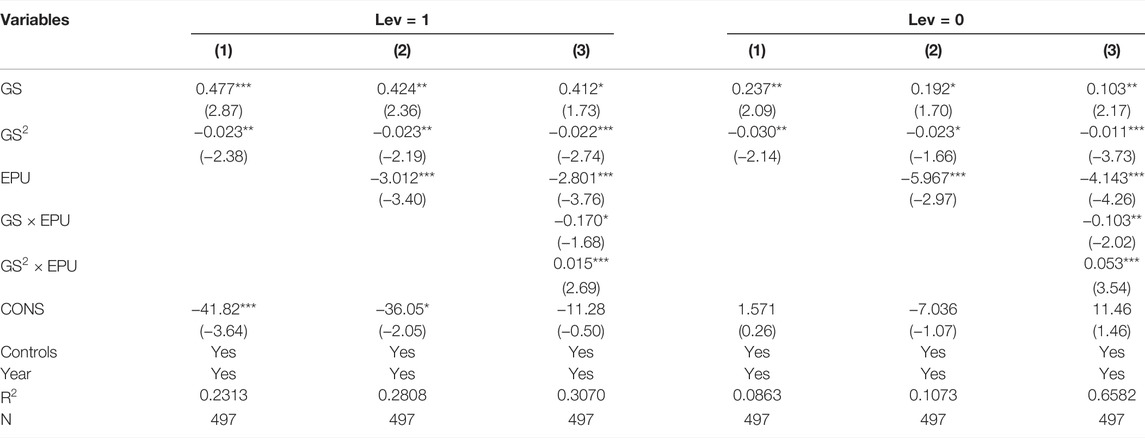

The Impact of Risk Appetite on the Relationship Between Government Subsidies and R&D Investment

Companies with varying degrees of risk tolerance frequently exhibit disparate R&D investment styles. Enterprises with a high risk appetite are optimistic about investment prospects and prefer to maximize returns through venture capital; enterprises with a low risk appetite prefer to wait and see and invest only when the risk is acceptable. Two distinct investment styles represent risky, high-yielding investments and low-risk, stable returns. As shown in Table 14, the negative impact of economic policy uncertainty on the high-risk preference group is less than that on the low-risk preference group, and the high-risk preference group’s R&D investment intensity is roughly double that of the control group. When economic policy uncertainty and government subsidies are factored in, the ratio increases fourfold, indicating that new energy companies with a high risk tolerance can conduct R&D investment activities more effectively and even maintain a high R&D investment intensity in the face of economic policy fluctuations.

Discussion

Energy subsidies can be rationalized to achieve environmental management objectives in energy use (Husaini et al., 2021). However, continuous R&D innovation is conducted based on the enterprise’s technical capability and resource strength. Temporary government subsidies will not change an enterprise’s R&D strategy but divert funds previously used for R&D investment (Wallsten, 2000; Shen and Luo, 2015). Government subsidies incentivize and crowd out enterprise R&D investment (Xiao et al., 2012). While subsidies initially stimulate enterprises to increase R&D investment, as the subsidy amount increases, the incentive effect gradually diminishes, and when the optimal subsidy threshold is exceeded, enterprises’ R&D investment is crowded out. This paper concludes that government subsidies have an inverted U-shaped effect on enterprise R&D investment; that is, while appropriate subsidies encourage enterprise R&D investment, excessive subsidies suffocate other funds invested in R&D and exacerbate the company’s proclivity to invest in fixed assets. The R&D investment of new energy enterprises is irreversible and policy-sensitive, and external economic policy changes significantly impact its investment activities. Therefore, economic policy uncertainty will stifle corporate R&D investment, exacerbate corporate financing constraints, and reverse recent trends in fixed-asset investment (Nan and Han, 2019; Liu and Zhang, 2020). Compared to fixed-asset investment, economic policy uncertainty has a more substantial negative adjustment effect on the relationship between government subsidies and corporate R&D investment. Additionally, this paper has discovered that government subsidies have a more significant impact on R&D investment in China’s eastern coastal regions for high-risk preference enterprises and non-state-owned enterprises. In contrast, economic policy uncertainty has a more significant negative adjustment effect on low-risk preference and non-state-owned enterprises in the central and western regions.

Conclusions and Policy Recommendations

Conclusions

In recent years, academics have discussed the difficulties and hotspots associated with government subsidies and corporate R&D investment behavior. From the perspective of economic policy uncertainty, this paper examines the impact of government subsidies on enterprise R&D and fixed-asset investment. It then analyzes the impact on enterprise R&D investment in three dimensions: the nature of enterprise property rights, regional differences, and risk preference. The following are the research conclusions. (1) Within a reasonable range, government subsidies have a promoting inverted U-shaped effect on R&D investment. Subsidies that are more than what a business invests in R&D will crowd out other funds and increase the proclivity of businesses to invest in fixed assets. (2) Compared to fixed-asset investment, economic policy uncertainty has a more significant adverse effect on the relationship between government subsidies and enterprise R&D investment. (3) Further research revealed that while government subsidies have a more significant impact on R&D investment in eastern coastal areas, high-risk preference enterprises, and non-state-owned enterprises, the negative regulatory effect of economic policy uncertainty is more substantial in central and western regions, low-risk preference enterprises, and non-state-owned enterprises.

Policy Recommendations

The conclusion of this paper contributes to a better understanding of the impact of government subsidies on enterprises’ R&D investment behavior, expands the existing literature on the factors affecting new energy enterprise investment, and identifies the effect boundary between government subsidies and new energy enterprise R&D investment behavior under conditions of economic policy uncertainty, thereby providing a new theoretical foundation for this issue.

First, as one of the strategic emerging industries tasked with altering the economic growth mode and reshaping the energy consumption structure, the new energy industry exhibits technology-intensive characteristics. R&D innovation has the potential to generate enormous economic and social benefits and contribute to economic growth and enterprise innovation. However, the domestic new energy industry’s technology is still in its infancy. Several factors, including high innovation costs, a lengthy development cycle, high risk, and high product costs, mean no clear competitive advantage over traditional fossil fuels in the energy market. Furthermore, due to insufficient protection of intellectual property rights and ineffective environmental regulations, the new energy industry’s technology spillover and positive environmental externalities cannot be compensated through the market, exacerbating the new energy industry’s development dilemma. In an imperfectly competitive market environment, the government must act as a “supporting hand” in fine-tuning subsidy policies and assist firms in various ways, including taxation, law, and talent development, to increase their market competitiveness maximize social and economic benefits. Regarding subsidy distribution, the government should maintain a high level of transparency regarding R&D subsidies and work to eliminate the phenomenon of incorrect and excessive subsidies caused by information asymmetry. In terms of subsidy intensity, government departments should closely monitor the company’s early R&D preparation, initial investment, and mid-to-late projects, adjust the subsidy intensity following the enterprise’s R&D projects and capacity, encourage the enterprise to strengthen its capacity for independent innovation, and gradually reduce or eliminate the subsidy after it reaches a certain level, avoiding the enterprise’s excessive reliance on the subsidy. In terms of external financing, the government should diversify external financing channels, optimize the external business environment, provide preferential treatment to high-quality enterprises with a greater capacity for independent innovation, and provide policy guidance to enterprises with a lower capacity for independent innovation.

Second, given that economic policy uncertainty has a significant negative impact on corporate investment, the government should strengthen its credibility and transparency to maintain the stability and continuity of economic policies that can effectively avoid economic policy uncertainty at its source, thereby fostering a favorable investment and financing environment. Due to the diversity of enterprise characteristics, their ability to withstand the uncertainty of external economic policies varies. When formulating policies to guide enterprise innovation and development, the government should consider the environmental differences between the central and western regions, low-risk preferences, and non-state-owned enterprises and provide timely policy guidance and innovation incentives. For state-owned enterprises, the government should develop supportive policies to increase their enthusiasm for R&D, strengthen oversight of the flow of subsidies to state-owned enterprises, establish a performance evaluation system to increase their awareness of independent innovation, strictly define the period of policy preferences and subsidies, and avoid excessive reliance on subsidies. New energy enterprises should maximize their inherent advantages, rely on policy support to increase R&D investment, strengthen dynamic adjustment and organizational learning capabilities, and significantly increase innovation output, thereby enhancing innovation capabilities and preserving core advantages.

Subsidy policies have varying short-term effects on various renewable energy sources and can have some negative consequences. Due to the sample space-time interval and scope constraints, this paper does not consider the heterogeneity within the same industry. Furthermore, due to a lack of measurement indicators, this paper cannot quantify the impact of all intermediary mechanisms, such as industry competition intensity. The R&D activities of new energy companies vary by subsector. In subsequent research, much more data and analysis can be conducted on the subsectors of new energy companies, resulting in more valuable research results.

Data Availability Statement

Publicly available datasets were analyzed in this study. These datasets can be found at: https://data.stats.gov.cn/easyquery.htm?cn=A01 and https://www.gtarsc.com/.

Author Contributions

ML: conceptualization, funding acquisition, supervision, project administration, methodology, investigation, formal analysis, and writing—original draft. JW: investigation, writing original draft, formal analysis, data curation, and software. YL: project administration, data curation, writing—original draft, and formal analysis. XL: project administration, formal analysis, and software. QL: Revise and data curation. JL: Revise and data curation. YQ: investigation and data curation. LZ: investigation and data curation.

Funding

This research was financially supported by the National Natural Science Foundation of China (no. 71874186), The Key Project of Philosophy and Social Science Research in Colleges and Universities in Jiangsu Province (no. 2018SJZDI084), Jiangsu Social Science Fund Base Project (no. 19JD010), and Xuzhou Policy Guidance Plan (Soft Science Research) (no. KC21370).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

An, H., Chen, Y., Luo, D., and Zhang, T. (2016). Political Uncertainty and Corporate Investment: Evidence from China. J. Corporate Finance 36, 174–189. doi:10.1016/j.jcorpfin.2015.11.003

Anser, M. K., Syed, Q. R., Lean, H. H., Alola, A. A., and Ahmad, M. (2021). Do economic Policy Uncertainty and Geopolitical Risk lead to Environmental Degradation? Evidence from Emerging Economies. Sustainability 13, 5866. doi:10.3390/su13115866

Ashraf, B. N., and Shen, Y. (2019). Economic Policy Uncertainty and banks' Loan Pricing. J. Financial Stab. 44, 100695. doi:10.1016/j.jfs.2019.100695

Baker, S. R., Bloom, N., and Davis, S. J. (2020). Economic Policy Uncertainty Index: Mainland Papers for China. Available at: https://fred.stlouisfed.org/series/CHNMAINLANDEPU (Accessed January, 2021).

Bekun, F. V. (2022). Mitigating Emissions in India: Accounting for the Role of Real Income, Renewable Energy Consumption and Investment in Energy. Int. J. Energ. Econ. Pol. 12. doi:10.32479/ijeep.12652

Bekun, F. V., Alola, A. A., and Sarkodie, S. A. (2019). Toward a Sustainable Environment: Nexus between Co2 Emissions, Resource Rent, Renewable and Nonrenewable Energy in 16-eu Countries. Sci. Total Environ. 657, 1023–1029. doi:10.1016/j.scitotenv.2018.12.104

Bianchini, S., Llerena, P., and Martino, R. (2019). The Impact of R&D Subsidies under Different Institutional Frameworks. Struct. Change Econ. Dyn. 50, 65–78. doi:10.1016/j.strueco.2019.04.002

Cai, D., Li, X., and Li, T. (2018). The Effects of Government Subsidies and Rent-Seeking on R&D of Enterprises. Financ. Econ. 14, 105–118.

Cheng, L., Xie, E., and Li, Y. (2020). Political Ties and SMEs’ R&D Intensity under the View of Relationship Embeddedness: The Moderating Effects of Institutional Development and Competitive Intensity. East. China Econ. Manag. 34, 46–53. doi:10.19629/j.cnki.34-1014/f.191001003

Dai, X., and Cheng, L. (2014). The Threshold Effects of Fiscal Subsidy Policy on Corporate R&D Investment. Sci. Res. Manag. 35, 68–76. doi:10.19571/j.cnki.1000-2995.2014.06.009

David, P. A., Hall, B. H., and Toole, A. A. (2000). Is Public R&D a Complement or Substitute for Private R&D? A Review of the Econometric Evidence. Res. Pol. 29, 497–529. doi:10.1016/S0048-7333(99)00087-6

Dou, M., Wei, J., and Ma, W. (2019). Does the National R&D and Tax Policies Promote Corporate R&D Activities? Stud. Sci. Sci. 37, 1394–1404. doi:10.16192/j.cnki.1003-2053.2019.08.006

Driscoll, J. C., and Kraay, A. C. (1998). Consistent Covariance Matrix Estimation with Spatially Dependent Panel Data. Rev. Econ. Stat. 80 (4), 549–560. doi:10.1162/003465398557825

Fu, Y., Hu, C.-h., and Yang, D.-x. (2021). Conservative or Aggressive? the Dynamic Adjustment of the Feed-In Tariff Policy for Photovoltaic Power Generation in China. Front. Energ. Res. 9, 672920. doi:10.3389/fenrg.2021.672920

Guan, J., and Yam, R. C. M. (2015). Effects of Government Financial Incentives on Firms' Innovation Performance in China: Evidences from Beijing in the 1990s. Res. Pol. 44, 273–282. doi:10.1016/j.respol.2014.09.001

Guellec, D., and Van Pottelsberghe, B. (2003). The Impact of Public R&D Expenditure on Business R&D*. Econ. Innovation New Technology 12, 225–243. doi:10.1080/10438590290004555

Gulen, H., and Ion, M. (2016). Policy Uncertainty and Corporate Investment. Rev. Financ. Stud. 29, hhv050–564. doi:10.1093/rfs/hhv050

Guotai'an Information Technology Co., Ltd (2020). CSMAR China Financial Database. Available at: https://www.gtarsc.com/(Accessed January, 2021).

Hewitt-Dundas, N., and Roper, S. (2010). Output Additionality of Public Support for Innovation: Evidence for Irish Manufacturing Plants. Eur. Plann. Stud. 18, 107–122. doi:10.1080/09654310903343559

Husaini, D. H., Lean, H. H., and Ab-Rahim, R. (2021). The Relationship between Energy Subsidies, Oil Prices, and CO2 Emissions in Selected Asian Countries: a Panel Threshold Analysis. AUSTRALASIAN JOURNAL ENVIRONMENTAL MANAGEMENT 28 (04), 339–354. doi:10.1080/14486563.2021.1961620

Husaini, D. H., Puah, C.-H., and Lean, H. H. (2019). Energy Subsidy and Oil price Fluctuation, and price Behavior in Malaysia:A Time Series Analysis. Energy 171 (03), 1000–1008. doi:10.1016/j.energy.2019.01.078

Jiang, Z., and Tan, J. (2013). How the Removal of Energy Subsidy Affects General price in China: A Study Based on Input-Output Model. Energy Policy 63 (3), 599–606. doi:10.1016/j.enpol.2013.08.059

Kim, H., and Kung, H. (2017). The Asset Redeployability Channel: How Uncertainty Affects Corporate Investment. Rev. Financ. Stud. 30, 245–280. doi:10.1093/rfs/hhv076

Krammer, S. M. S., and Jiménez, A. (2020). Do political Connections Matter for Firm Innovation? Evidence from Emerging Markets in Central Asia and Eastern Europe. Technol. Forecast. Soc. Change 151, 119669. doi:10.1016/j.techfore.2019.05.027

Li, F., and Yang, M. (2015). Can Economic Policy Uncertainty Influence Corporate Investment? the Empirical Research by Using China Economic Policy Uncertainty Index. J. Financ. Res. 15, 115–129.

Li, S., and Qiu, W. (2015). Political Connections, Institutional Environment and R&D Expenditure. Sci. Res. Manage. 36, 56–64. doi:10.19571/j.cnki.1000-2995.2015.04.007

Li, W., and Zheng, M. (2016). Is it Substantive Innovation or Strategic Innovation?——Impact of Macroeconomic Policies on Micro-enterprises’ Innovation. Econ. Res. J. 51, 60–73.

Li, X. (2019). Economic policy uncertainty and corporate cash policy: International evidence. J. Account. Public Pol. 38, 106694. doi:10.1016/j.jaccpubpol.2019.106694

Liu, G., and Zhang, C. (2020). Economic policy uncertainty and firms' investment and financing decisions in China. China Econ. Rev. 63, 101279. doi:10.1016/j.chieco.2019.02.007

Liu, J., Luo, F., and Wang, J. (2019). Environmental Uncertainty and Investment in Enterprise Innovation Activities: The Moderating Effect of Government Subsidies and Integration of Industry and Finance. Bus. Manag. J. 41, 21–39. doi:10.19616/j.cnki.bmj.2019.08.002

Liu, X., Li, X., and Li, H. (2016). R&D subsidies and business R&D: Evidence from high-tech manufacturing firms in Jiangsu. China Econ. Rev. 41, 1–22. doi:10.1016/j.chieco.2016.08.003

Luo, M., Ma, Q., and Li, T. (2013). Political connection and firm technological innovation performance——a study on the mediating role of R&D investment. Stud. Sci. Sci. 31, 938–947. doi:10.16192/j.cnki.1003-2053.2013.06.017

Meng, Q., and Shi, Q. (2017). The Impact of Macroeconomic Policy Uncertainty on Enterprises’ R&D: Theoretical Analysis and Empirical Study. J. World Econ. 40, 75–98.

Nan, X., and Han, Q. (2019). The impact of strategic emerging industrial policy uncertainty on R&D investment. Studies in Science of Science. Stud. Sci. Sci. 37, 254–266. doi:10.16192/j.cnki.1003-2053.2019.02.012

Pan, X. (2019). Is there a threshold for the incentive effect of preferential tax on technological innovation: An empirical analysis from the perspective of ownership structure. Sci. Res. Manag. 40, 48–57.

Peng, Z., Wen, Y., and Huang, Y. (2015). The Effect of Government Subsidies on the Performance of New Energy Companies: the Moderating Role of Corporate Internal Governance. J. Cent. Univ. Financ. Econ. 34, 80–85.

Rao, P., and Xu, Z. 2017. Has Economic Policy Uncertainty Affected Executive Turnover? Manage. Management World 32, 145–157. doi:10.19744/j.cnki.11-1235/f.2017.01.013

Shang, H., and Huang, X. (2018). Research on the interaction effects among government subsidy, R&D investment and innovation performance. Stud. Sci. Sci. 36, 446–455. doi:10.16192/j.cnki.1003-2053.2018.03.007

Shen, J., and Luo, C. (2015). Overall review of renewable energy subsidy policies in China - Contradictions of intentions and effects. Renew. Sustainable Energ. Rev. 41 (01), 1478–1488. doi:10.1016/j.rser.2014.09.007

Su, Y., and Lin, Y. N. (2021). Research on the impact of government subsidies on R & D investment of new energy enterprises. Scientific Management Res. 39, 102–110. doi:10.19445/j.cnki.15-1103/g3.2021.01.017

Sun, H., Edziah, B. K., Sun, C., and Kporsu, A. K. (2021). Institutional quality and its spatial spillover effects on energy efficiency. Socio-Economic Plann. Sci. 80, 101023. doi:10.1016/j.seps.2021.101023

Sun, H., Kporsu, A. K., Taghizadeh-Hesary, F., and Edziah, B. K. (2020). Estimating environmental efficiency and convergence: 1980 to 2016. Energy 208, 118–224. doi:10.1016/j.energy.2020.118224

Sun, Y. (2019). The Impact of Economic Policy Uncertainty on Enterprises R&D Investment. Forum Sci. Technol. China 34, 127–135. doi:10.13580/j.cnki.fstc.2019.09.020

Tan, X., and Zhang, W. (2017). The Transmission Mechanism Analysis of the Impact of Economic Policy Uncertainty on Corporate Investment. J. World Econ. 40, 3–26. doi:10.16192/j.cnki.1003-2053.2016.07.010

The Ministry of Finance (2020). Notice on further improving the financial subsidy policy for the promotion and application of new energy vehicles. Available at: http://www.gov.cn/zhengce/zhengceku/2020-12/31/content_5575906.htm (Accessed January, 2021).

Tong, A., and Chen, W. (2016). An empirical study on the influence of government subsidies on R&D investments: From a new perspective of political connection of private small and medium-sized listed firms. Stud. Sci. Sci. 34, 1044–1053. doi:10.16192/j.cnki.1003-2053.2016.07.010

Tran, Q. T. (2019). Economic policy uncertainty and corporate risk-taking: International evidence. J. Multinational Financial Management 52-53, 100605. doi:10.1016/j.mulfin.2019.100605

Wallsten, S. J. (2000). The Effects of Government-Industry R&D Programs on Private R&D: The Case of the Small Business Innovation Research Program. RAND J. Econ. 31, 82–100. doi:10.2307/2601030

Wang, M., and Hou, X. (2015). Economic Uncertainty, Government Subsidies and Corporate Technological Innovation Investment. East China Econ. Manag 29, 95–100. doi:10.3969/j.issn.1007-5097.2015.12.017

Wang, X., and Zou, H. (2018). Effect Mechanism of Industrial Policies on Innovation Performance of Wind Power Enterprises——Considering Time Lag and Regional Innovation Environment. R&d Manag. 30, 33–45. doi:10.13581/j.cnki.rdm.2018.02.002

Xiao, M., Tang, Q., and Liu, H. (2012). Incentive and Crowding-out Effects of R&D Subsidy on Companies’ R&D Expenditures Empirical Analysis Based on the Data of Chinese Listed Companies. Econ. Manag. 34, 19–28. doi:10.19616/j.cnki.bmj.2012.04.005

Xinhua News Agency (2020). Proposal of the Central Committee of the Communist Party of China on Formulating the Fourteenth Five-Year Plan for National Economic and Social Development and the Long-term Goals for 2035. Available at: http://www.gov.cn/zhengce/2020-11/03/content_5556991.htm (Accessed January, 2021).

Xu, Z. (2019). Economic Policy Uncertainty, Cost of Capital, and Corporate Innovation. J. Bank. Finance 111, 105698. doi:10.1016/j.jbankfin.2019.105698

Yuan, J., Hou, Q., and Cheng, C. (2015). The curse effect of enterprise political resources: An investigation based on political connection and enterprise technology innovation. Manage. World 30, 139–155. doi:10.19744/j.cnki.11-1235/f.2015.01.014

Zhan, J., Shao, X., and Xu, M. (2019). Influence of government subsidies on agricultural firm’s R&D investment. Sci. Res. Manag. 40, 103–111. doi:10.19571/j.cnki.1000-2995.2019.04.011

Zhang, C., and Chen, L. (2016). More Government Subsidies, More Innovation? Sci. Sci. Manag. S.& T 37, 11–9.

Zhou, W., Lu, S., Chen, J., and Gou, X. (2020). How good or how poor have China's new energy enterprises done: An empirical study based on the lagged double-market network. J. Clean. Prod. 262, 121284. doi:10.1016/j.jclepro.2020.121284

Keywords: government subsidies, R&D investment, enterprise heterogeneity, fixed-asset investment, economic policy uncertainty

Citation: Liu M, Wen J, Liu Y, Lv X, Liu Q, Lu J, Qin Y and Zhang L (2022) An Inverted U-shaped Relationship? The Impact of Government Subsidies on the R&D Investment of New Energy Companies: Economic Policy Uncertainty and Enterprise Heterogeneity Perspectives. Front. Energy Res. 10:887108. doi: 10.3389/fenrg.2022.887108

Received: 01 March 2022; Accepted: 07 April 2022;

Published: 28 June 2022.

Edited by:

Hooi Hooi Lean, Universiti Sains Malaysia (USM), MalaysiaReviewed by:

Huaping Sun, Jiangsu University, ChinaFestus Victor Bekun, Gelişim Üniversitesi, Turkey

Copyright © 2022 Liu, Wen, Liu, Lv, Liu, Lu, Qin and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Manzhi Liu, bGl1bWFuemhpQGN1bXQuZWR1LmNu; Jixin Wen, VFMyMDA3MDA3NEEzMUBjdW10LmVkdS5jbg==; Xueqing Lv, c25vd3N1bkAxNjMuY29t

Manzhi Liu

Manzhi Liu Jixin Wen*

Jixin Wen* Yingjie Liu

Yingjie Liu