- State Key Laboratory of Alternate Electrical Power System with Renewable Energy Sources (North China Electric Power University), Beijing, China

China’s electricity market is undergoing a rapid development stage from plan to market and will exist in plan and market models for a long time. Based on the status quo of China’s power plan and market in-depth, this paper has studied and put forward a kind of market transaction mechanism adapted to the plan and market models of China. The mechanism arranges a priority generation plan first to match the priority electricity plan. Especially for renewable energy generation output greater than planned value, it carries out priority arrangement of renewable energy generation to guarantee its reliable consumption. Then medium- and long-term market transactions and incremental spot market transactions are carried out. This paper detailed design operational processes such as priority plan, medium- and long-term, spot (i.e., day-ahead, intraday, and real time), auxiliary services, and balance stages. Finally, based on actual data of the provincial electricity market, the calculation and analysis are carried out to verify that the method proposed in this paper can effectively reduce market imbalance and promote renewable energy consumption, which has a certain practical value for China’s electricity market development.

1 Introduction

At present, China’s electricity market is promoting the transition from plan to market. Although various regions continue to promote the deregulation of power generation and consumption plans, planned power consumption will still exist in the future for a long time. According to orderly deregulation of power generation and consumption plans and relevant policies of priority generation and consumption plans, the proportion of priority electricity in China is close to 39% at present, and the proportion of priority generation on the generation side is about 68%. It can be seen that the mismatch between priority generation and consumption is very prominent, and due to the different economic development structures and power supply structure, the degree of mismatch between priority generation and consumption varies greatly among provinces (Li et al., 2019a). From the perspective of the power consumption side, according to China’s relevant policies, residents, agriculture, important public utilities, and public welfare users are given priority to purchase electricity and to not participate in a market-oriented transaction, and their power supply is guaranteed by power grid enterprises according to government pricing (Badal et al., 2019; Chen et al., 2020).

According to statistics, in 2019, the power consumption (including power loss) of priority power purchase users in the State Grid business zone was 1.83 trillion kWh, accounting for 39% of power supply, and market space of power purchase side was about 61%. At present, 34% of the power purchase side is liberalized, and about 27% of the mismatch space needs to be further liberalized (Ding et al., 2020; Xu et al., 2021). From the perspective of the power generation side, priority generation mainly guarantees the demand of clean energy consumption, unit heating, and regulatory power generation required by safe operation, inter-provincial resource allocation, etc. Their pricing methods include government pricing (guaranteed price) and market pricing (guaranteed bidding). In 2019, the priority generation scale of the State Grid business zone was 3.24 trillion kWh, accounting for 68% of power supply, of which the guaranteed quantity of government pricing was 66% and the guaranteed quantity of market pricing was 2%. At present, 34% of the power generation side is market-oriented. According to the principle of optimal generation matching and optimal purchase, 61% of the power purchase side can be market-oriented, and about 27% of the power generation side needs to be further market-oriented (that is, the guaranteed bidding part will be raised from 2% to 29%) (Erdiwansyah et al., 2021; Wang et al., 2020).

Considering the current situation and characteristics of China’s power system, the design of its market model should be based on the requirements of priority generation and consumption policies, while the priority consumption requirements of renewable energy should be taken into account. At present, the market model design ideas proposed by many scholars can be divided into centralized and decentralized modes, which are adopted by European countries and the Americas (Li et al., 2019b). However, the existing research generally does not consider the basic conditions of China’s electricity market design, and to some extent, it is difficult to adapt to the actual operation of China’s power system, so new design ideas need to be adopted. At the end of the last century, Shandong, Zhejiang, and other some provinces in China adopted the full-electricity bidding model in the spot market, but none of them achieved effective results. In 2019, eight provincial spot market trials launched in China also adopted the above typical model, and their progress was also slow (Song et al., 2020). Literature (Zhang and Shi, 2020; Guo et al., 2017) put forward some feasible suggestions for the development status of China’s electricity market but did not give specific design ideas and did not consider the details such as priority generation, priority consumption, and renewable energy consumption, so there is still a certain distance in practical application. Literature (Zhang et al., 2021) presented a hydrogen production method based on renewable energy, which combined renewable energy utilization with a hydrogen demand model by using a hierarchical coordinated control strategy. Literature (Zhang et al., 2021) provided a new solution for renewable energy utilization and created conditions for renewable energy to participate in electricity market competition.

With the gradual deregulation of China’s power generation and consumption plans and in-depth promotion of spot market pilot construction, eight pilot provinces have carried out a lot of exploratory work and made positive progress (Zhao et al., 2014). Among them, six provinces such as Guangdong, Shanxi, and Gansu have adopted the market mode of centralized bidding for all electricity, which is a complex mode and has high requirements for system parameters. Fujian and Inner Mongolia adopted the market model of partial electricity bidding, which is a simple model. However, they also exposed some deep-seated problems, and there are three common problems in the pilot operation of China’s spot market. First, the connection between priority generation and market transactions is mainly caused by the mismatch of priority generation and priority consumption scales. Second is the connection between medium- and long-term markets and spot markets. Third, the participation of renewable energy in the market has not been effectively solved, such as high volatility and large prediction deviation. It is difficult to promote and expand the scope of the spot market pilot. In essence, these problems are closely related to the fact that the spot market model commonly used at present does not link up with China’s objective reality (Fu et al., 2021a; Lam et al., 2018).

Based on the above basic conditions, this paper will analyze in detail the problems existing in China’s existing market transaction mechanism, focusing on how to improve renewable energy consumption capacity through the design of market transaction mechanism. According to the order of arranging priority plan, then organizing the medium- and long-term market transactions, and then organizing the future incremental spot transaction, this paper will study the mechanism with relative decoupling between plan and market, which can effectively reduce the imbalance of generation and consumption sides’ funds. The operation process of this mechanism, such as priority plan, medium- and long-term, spot market, auxiliary service, and balance stage, is designed in detail. At the same time, the effectiveness of the proposed ideas is verified by combining them with engineering examples. The result shows that the market transaction mechanism proposed in this paper can effectively promote the improvement of renewable energy consumption capacity and that it can reduce unbalanced funds.

2 Basic Ideas of Market Transaction Mechanism Design

Considering the current situation of China’s electricity market, in order to ensure the smooth and orderly promotion of spot market pilot, the core of market model design should grasp the following five key issues.

First, the market is relatively decoupled from the plan. In the market design, the plan and market parts can be decoupled. Different processing methods can be adopted for the plan and market parts to realize the balance and matching of both sides of generation and consumption, respectively. It not only ensures the implementation of the planning part but also ensures that the market competition part forms a reasonable price, which is convenient for coordination of market settlement and market main interests. With the further liberalization of power generation and consumption plans, the market part will be increased accordingly. The spot market competition will be carried out for some power space outside priority generation and consumption plans and medium- and long-term market trading contracts. The plan arrangement of priority generation will be formed based on load forecast, market transaction result, and priority generation forecast. But it is necessary to explain that partial power competition does not change the current situation of the whole power regulation and operation, and it is still necessary to insist on safety control of the total power system.

Second, we should strive to achieve the balance between the generation and consumption sides. In terms of the total amount, for the situation that the priority generation scale is more than the priority consumption scale, it shall be gradually released in accordance with the order of high price units, heating units, renewable energy, and inter-provincial power transmission and to encourage power generation enterprises and users to meet the demand for quantity assurance through bilateral negotiation transactions. For the case that the priority generation scale is less than the priority consumption scale, the priority generation plan of quantity guaranteed and price guaranteed can be arranged according to the equal proportion principle in conventional power supply. About the market trading curve, the middle and long-term trading belt curves are signed, short-term transactions are carried out, transaction frequency is improved gradually, and continuous market operation will be realized. Then, more flexible means of adjusting the trading curve for market entities are provided. According to market transaction results, priority generation arrangement, and safety constraints, the generation plan of each type of power generation subject is formed, and the corresponding market entities bear balance responsibility in real-time operation.

Third, the market balance mechanism should be improved. In order to ensure a real-time balance of power generation and consumption and reasonably reflect real-time supply and demand of power system and balance cost, system safety constraints such as network topology constraints and unit operation constraints can be comprehensively considered based on market transaction results in the medium- and long-term and day-ahead, priority generation and consumption plans, and centralized and unified dispatching. Based on the principle of minimum adjustment cost, the system is balanced. After that, the responsible party causing the imbalance shall be settled in an unbalanced quantity, and each party shall bear its own responsibility. The corresponding balance mechanism of electricity from other provinces shall be implemented according to spot market rules or the corresponding deviation handling mechanism. It should be noted that the balance mechanism is different from auxiliary service, which is an after-event apportion mechanism, while the former is a market-based pre-event mechanism.

Fourth, renewable energy consumption demand should be fully considered. The renewable energy guarantee uses electricity quantity within hours to guarantee the price and ensures that electricity outside the hours participates in a market transaction. In the day-ahead market stage, renewable energy shall determine the output plan curve of the next day according to the forecast and submit it to the dispatching organization. If space outside the medium- and long-term market transactions cannot meet the predicted renewable energy output or demand of priority consumption, dispatching organization can substitute the medium- and long-term trading curves and the arrangement of the initial priority generation plan in advance according to certain principles, and the whole society shall jointly assume the responsibility of renewable energy consumption. In the real-time balance stage, renewable energy takes the generation curve determined in the future as the benchmark and bears the system adjustment cost the same as conventional power supply.

Fifth, the problem of unbalanced funds should be resolved fairly and reasonably. On the basis of realizing matching of the total amount of priority generation and consumption as far as possible, for the corresponding electricity consumption of the consumers who purchase electricity priority such as residential agriculture, if the actual purchase price exceeds the approved average price, the unbalanced funds generated shall be guaranteed by the proportion of all market power generation enterprises. For the difference between government price of renewable energy and market price, market-oriented power users shall bear the difference funds and increase the price in the market of industrial and commercial users.

3 Market Transaction Mechanism to Promote Renewable Energy Consumption

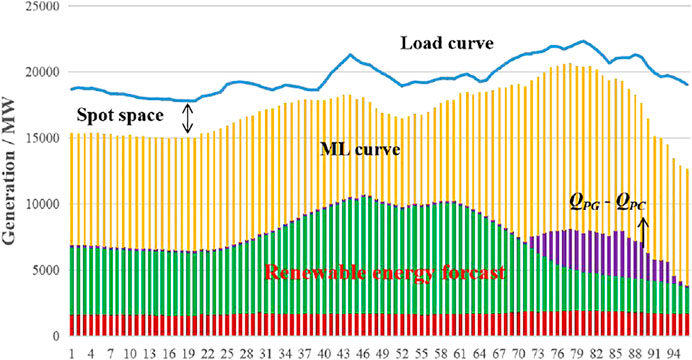

The multi-temporal scale market trading mechanism to promote renewable energy consumption is to arrange a priority generation plan, then organize medium- and long-term market-oriented transactions, and then carry out daily incremental spot trading. The superposition of the three curves matches the load forecasting curve, as shown in Figure 1. Figure 1 shows that the various components of the power generation side correspond to the user side. From the bottom to the top, the priority generation planning curve corresponds to the priority consumption planning curve, and the two are correlated. Then medium- and long-term contract curves will be arranged, which is formed by medium- and long-term transactions between the power generation side and user side. The gap between the above two types of curves and the day-ahead load prediction curve is used as the spot incremental bidding space. The green square represents renewable energy forecasting biases that need to be prioritized in the incremental spot bidding space, perhaps even adjusting the medium- and long-term contract curves. The specific operation flow is as follows:

Step 1. Power dispatching organization forecasts priority generation and consumption curves (renewable energy enterprise submits the output prediction curve of the next day), and according to predetermined rules, power dispatching organization shall allocate the different types of priority generation units and form the planned electricity space.

where QPG refers to priority generation; QPG.H, QPG.RE, QPG.N, and QPG.E respectively refer to hydro-power, renewable energy, nuclear power, and other types of generation priority. This section mainly considers the forecast changes of QPG.RE and assumes that other types of generation priority will be implemented according to plan, while QPC refers to priority consumption. QPC.RA, QPC.IP, QPC.PW, and QPC.E refer to residential agricultural, important public utilities, public welfare, and other preferential electricity, respectively.

The priority plan QP is

Step 2. On the basis of the priority generation curve, medium- and long-term contract curve contracts are superimposed to form the basis for the spatial arrangement of incremental bidding.

where QIP is the incremental bidding space; Qtotal is the total demand, namely, load forecast; QML is the medium- and long-term market transaction size, which includes the electricity scale formed by all medium- and long-term contracts and the part where priority generation exceeds priority consumption (i.e., the purple part in Figure 2).

It can be seen from Eq. 1 and Eq. 4 that the predicted change of QPG.RE may affect the priority generation scale, thus changing the incremental bidding space.

Step 3. In the incremental bidding space, the market operation organization organizes the power generation and load players to report demand of day-ahead incremental transactions (including purchase and sell) and conducts centralized bidding to clear, which adopts the principle of maximizing social welfare. Its model is as follows:

subject to

where Eqs. 6–8 are system constraints including power balance constraint, standby constraint, and safety constraint, respectively. Eqs. 9–12 are unit characteristic constraints including unit output power constraint, unit climbing rate constraint, minimum shutdown time constraint, and minimum operation time constraint. N is the number of units;

Step 4. According to the daily load forecast and safety requirements, the results of priority generation and market transactions are adjusted to form the final day-ahead generation plan. Component accumulation diagram at power generation side is shown in Figure 2. The top blue curve is the load curve, which is predicted by the power dispatching department before spot trading. The red part at the bottom is the unit output of the power system to ensure its safety, which is generally determined by the dispatching organization in advance according to system operation mode, and it is the priority generation plan. The green part is the predicted power generation output of renewable energy and also the priority generation plan. The power generation contract formed in the yellow part of the medium- and long-term markets is the clearing result of medium- and long-term market transactions participated by all market subjects. The purple part is the part where priority generation exceeds priority consumption, which is included in the medium- and long-term markets.

3.1 Medium- and Long-Term Stage

For the priority generation plan, it can agree on electricity quantity in the medium- and long-term transaction stages and roll over the adjustment within a month (Le et al., 2019; Sun et al., 2020). In the monthly stage, it is suggested that the priority generation contract does not sign monthly curve, only the curve formation mode is defined, that is, determine the power quantity and decomposition curves in the market in accordance with market rules, and monthly electricity quantity is not used as the basis for plan and settlement. In the day-ahead stage, the day-ahead curve of priority generation is formed according to the security needs of the power grid and relevant rules. The balance responsibility is distinguished in real-time balance, and the corresponding subject shall bear or share according to the corresponding rules.

For medium- and long-term market-oriented transactions, on the basis of standardizing annual and monthly regular market operation, the power transaction with the curve is carried out based on available transfer capability (ATC) and other constraints, gradually shortening transaction cycles, rolling out short-term power transactions in a month, realizing continuous market operation within a month, allowing market entities to adjust the transaction contract curve continuously through multiple transactions, and promoting market transactions to be as close to actual operation as possible, connecting with spot transactions well (Ming et al., 2020; Cong et al., 2020). For special power generation types such as renewable energy, the curve can be determined by itself or agreed in advance before market closing according to transaction contracts and submitted to dispatching organizations. For those unable to submit curves, the dispatching organization shall decompose them to form a reasonable power generation curve in a clear way.

3.2 Spot Market Stage

Spot market stage under the condition of co-existence of plan and market mainly includes day-ahead stage and real-time balance stage (the intraday stage is carried out as required), as is shown in Figure 3.

3.2.1 Day-Ahead Stage

Arrangement of Priority Plan. In the market, power dispatching organization forecasts optimal priority consumption plan curves in advance and decomposes them into various types of power generation according to the model of determining priority generation based on priority consumption (Fu et al., 2021b). The remaining market space after priority plan deduction and auxiliary service arrangement is market transaction space. The specific arrangement of the priority plan model is as follows:

a) External power generation. Adhere to physical implementation and serve as the boundary of the provincial market. Corresponding to the priority consumption part of external power generation, a certain peak adjustment can be arranged in combination with the power load curve of the purchase province, and it is used to match priority generation first.

b) Heating units in the thermoelectric period and nuclear power. Basically, they have no regulation capacity. The medium- and long-term transaction power is deducted from the power generation plan in advance to match the priority consumption curve. If this part of electricity is too large, it is necessary to strengthen market guidance and encourage market players to participate in medium- and long-term transactions. The price difference contract can be used to correspond to the priority consumption curve.

c) Renewable energy. When it is offered by fully guaranteed acquisition, the priority consumption curve shall be matched according to the forecast curve of renewable energy enterprises in advance as a difference contract. In this case, when the renewable energy generation curve exceeds the priority consumption curve, it indicates that renewable energy in the province has no full guarantee acquisition conditions, and it is necessary to set up guaranteed acquisition hours in a year (or reduce market-oriented users) and determine difference contract according to the acquisition hours.

d) General base part (mainly thermal power units). Its curve is determined corresponding to the remaining part of the priority consumption curve.

Market Transactions. The power generation enterprises, electricity retailers, and power users are free to participate in the transaction in combination with their own actual demand and medium- and long-term transactions and to purchase or sell electricity through the centralized market. The incremental power curve of day-ahead transactions overlaps the medium- and long-term market-oriented curves to form the final market-oriented transaction curve.

Form a Day-Ahead Plan. The dispatching organization checks the overall power generation arrangement and can adjust power generation arrangement according to operation safety needs of the power grid (or combined with balance adjustment quotation) to form a day-ahead generation plan (Li et al., 2018).

Adjust Medium- and Long-Term Transaction Results and Initial Priority Plan Arrangement. If space outside the market-oriented transactions cannot meet the predicted demand for priority generation output of renewable energy or the demand of priority consumption, results of medium- and long-term market-oriented transactions and the initial priority plan arrangement shall be replaced accordingly, and the whole society shall fairly assume the responsibility of renewable energy consumption and priority consumption. The specific methods are as follows:

Power dispatching organization shall check medium- and long-term transactions’ decomposition curves of priority generation and market-oriented generation by each period (15 min) to ensure that the sum of medium- and long-term transactions’ decomposition curves at all periods does not exceed medium- and long-term acceptance space of the whole network. For the part of priority generation output such as renewable energy exceeding the acceptance space in a period, the replacement of medium- and long-term market transaction results shall be replaced by the order from the later to previous transaction time. The units replaced shall be adjusted according to the proportion of electricity decomposition in the medium- and long-term transaction period until medium- and long-term acceptance space is met. If the acceptance space is still not satisfied after the replacement of all medium- and long-term market transactions, the priority plan curve shall be adjusted according to reverse order of priority generation arrangement, and the adjusted units shall be adjusted according to the proportion of decomposition power in the period of the priority generation plan. The cost deviation between the excess generation of renewable energy and the replaced electricity shall be included in unbalanced funds for allocation. For the shortage of priority generation output such as renewable energy, which cannot meet the demand for priority consumption, it shall be supplemented by the principle of equal proportion guarantee of regular power supply in this province.

3.2.2 Balance Stage

In order to solve system balance problems caused by load forecasting deviation, change of priority generation output such as renewable energy, requirements of grid safety constraints, and system abnormality and equipment failure, system balance resources at the following moment are used as transaction targets of real-time balance mechanism at a certain time on operation day, and the transaction is carried out rolling.

The units shall declare balance adjustment price to participate in real-time balance market transactions (the qualified load side can also participate in the declaration). The dispatching organization calls real-time balance resources according to the principle of minimum total adjustment cost of the transaction object.

The real-time balance market adopts marginal price settlement, and the quotation of the last winning unit in the transaction cycle is the marginal price of the period. Renewable energy power generation enterprises take the balance responsibility based on the day-ahead power curve.

3.3 Auxiliary Service Market

The auxiliary service market is determined by power dispatching organization to meet the needs of system safe and stable operation by compulsive supply, medium- and long-term procurement or purchasing in advance, and compensation for the auxiliary service providers is made according to market rules. Recently, the provincial auxiliary service market is the main way in China, and the auxiliary service varieties such as frequency modulation and standby are carried out. Gradually, power dispatching organization could expand the scope of the auxiliary service market, build an inter-provincial auxiliary service market, and solve the problems of reserve and mutual assistance when adjustment capacity is insufficient.

3.4 Transaction Organization Process

The government departments shall determine and issue inter-provincial priority generation plans, and provincial priority generation and consumption plans for the next year. Each province conducts electric power transactions in the order of annual (or multi-year), monthly, and multi-day based on factors such as power grid security, supply and demand situation, and power supply structure.

Yearly Stage. For planned electricity, priority generation electricity in a province determined in each region shall be signed before the yearly bilateral transaction starts, the yearly power purchase and sale contracts between a power generation company and a supply service provider shall be signed, and the yearly electricity scale and monthly electricity plan shall be agreed. According to the yearly electricity consumption forecast of non-market users, each region, after deducting priority generation of each link, will distribute yearly priority generation in coal-fired power generation enterprises and determine a monthly electricity plan. For market-oriented electricity, after the priority generation is implemented in a province, the provincial organization of yearly transactions will be carried out, and the curve is broken down into months.

Monthly Stage. For planned electricity, according to monthly demand forecast, power generation and consumption balance, and monthly maintenance plan arrangement, the planned monthly electricity can be adjusted and confirmed by market players before monthly implementation. Before D-1, the power dispatching organization is allowed to make a rolling adjustment to the power generation plan based on the factors such as unit restriction and large deviation caused by section constraints. For market-oriented electricity, after priority generation is implemented in a province, a monthly transaction with a power curve is carried out. In order to effectively reflect the balance between power supply and demand and to reduce the impact of intermittent and fluctuant renewable energy on the balance of power and electricity, it is necessary to gradually shorten medium- and long-term transaction cycles, increase their frequency, and give market players the right to participate in a transaction independently. Short-term transactions in a month can be carried out continuously according to market demand.

Day-Ahead Stage. For planned electricity, power dispatching organization forecasts priority consumption curves and decomposes them into various types of power generation according to the model of determining priority generation based on priority consumption. For large deviation of priority generation curve caused by large fluctuation of renewable energy output or large fluctuation of priority consumption of specific users, power dispatching organization can adjust other market-oriented contracts and priority plan arrangement. For market-oriented electricity, based on the priority generation and consumption plans and medium- and long-term transaction results, two sides of power generation and consumption shall declare incremental transaction demand in different periods, and the centralized bidding will form the curve of day-ahead incremental results. The plan and arrangement of priority generation and consumption, medium- and long-term trading curves, and day-ahead incremental transactions shall be checked by dispatching security.

Balance Stage. In order to solve the system balance problems caused by load forecasting deviation, renewable energy and other priority generation output changes, grid safety constraints, and system abnormality and equipment failure, the system balance resources at the following moments are used, as the transaction will be carried out rolling to adjust the deviation power. The system up and down adjustment costs are apportioned according to some causes and certain rules on the power generation side.

3.5 Market Settlement

The priority generation plan shall be settled according to the online tariff approved by government departments. The transaction electricity in the medium- and long-term markets is settled according to the transaction price approved by all parties. The electricity quantity in the spot market is settled according to the following.

For a transaction in the day-ahead market, the market-clearing electricity shall be settled according to the price formed by the day-ahead market. Based on the real-time balance mechanism, the unbalanced electricity between actual power generation and consumption curve of market transaction players and transaction plan curve (including intraday transaction electricity and balance service electricity) shall be settled according to the price formed by the real-time balance mechanism. The cost of system balance adjustment is apportioned by generator unit or user who causes deviation electricity according to the proportion of total deviation electricity.

For unbalanced fund channeling, an unbalanced fund diversion mechanism can be established, and grid enterprises collect permitted income and bear no profit or loss caused by the market operation.

For the external electricity from other provinces, settlement and assessment mechanisms of the deviation electricity shall be established, and rolling will not be allowed. According to the different causes of deviation caused by selling and buying provinces, the implementation rules shall be referred to. After the establishment of a multi-provincial spot market, settlement shall be conducted according to the corresponding spot price.

4 Project Case Analysis

4.1 Calculation and Analysis

In order to effectively verify the feasibility and practicability of the market transaction mechanism proposed in this paper, the whole-day operation data of the electricity market of Province X in 2020 is selected, for example, calculation and analysis, and the decomposition curve is shown in Figure 4. By the end of 2020, the total installed capacity of renewable energy in X province was 32 million kW, accounting for 31% of the installed capacity of the province. Renewable energy in X province has participated in market transactions and effectively increased consumption proportion through market transactions.

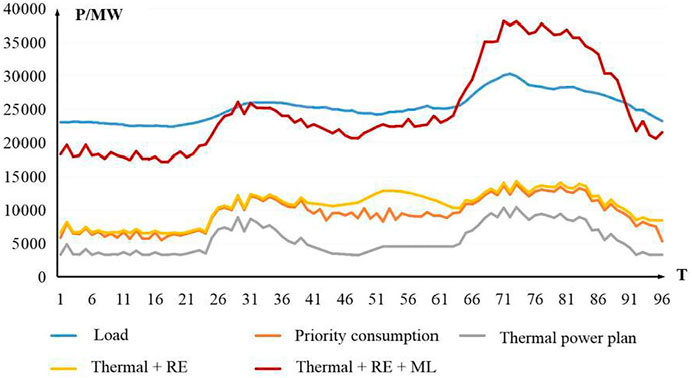

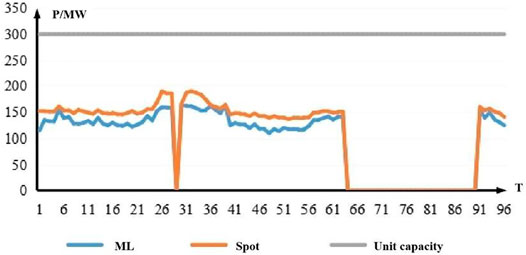

It can be seen from Figures 5 and 6 that after the base output of thermal power in Province X is superimposed with priority generation output of renewable energy, the priority generation plan curve is formed. On this basis, medium- and long-term market transactions are carried out, and medium- and long-term curves (red) are formed after superimposing medium- and long-term contracts. Compared with the date load forecasting curve, the part of the former lower than the latter is the space of the day-head incremental spot transaction, while the part of the former higher than the latter is the space of adjusting the base or medium- and long-term marketization contracts before spot transactions. Generally, contract adjustment is carried out first, and then an incremental spot transaction is carried out.

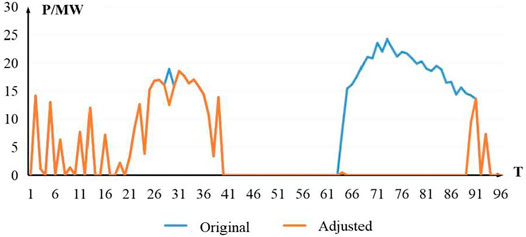

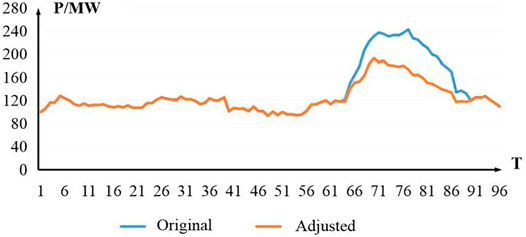

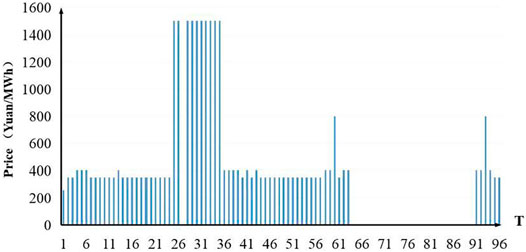

Take Unit K in Province X as an example; first, adjust the base contract and medium- and long-term market-oriented contracts, as shown in Figure 4, and then carry out a day-ahead incremental spot transaction. The clearing power and price of Unit K are shown in Figures 7 and 8.

Compared with the current spot market model in X province, operation results of the new market model in this paper are shown in Table 1.

After the market transaction mechanism proposed in this paper is adopted, the whole-day settlement deviation cost is 1.1 million yuan. In the spot market model adopted by Province X at the present stage, the whole-day deviation cost is 27.96 million yuan; compared with this model, the deviation cost can be reduced by 26.86 million yuan. In addition, about 34 million kWh of renewable energy can be increased with earnings of 11.3 million yuan, and the benefit of promoting renewable energy consumption is also very obvious.

From the organizational process and calculation results, it can be seen that the newly designed market transaction mechanism has the advantages of relative decoupling between plan and market, clear responsibilities of both sides of power generation and consumption, simple market model, good compatibility, and strong scalability. The most important thing is that the mechanism carries out a market transaction on the basis of renewable energy consumption, fully ensuring renewable energy consumption space in the future. However, in the intraday or real-time stage, priority generation such as renewable energy is required to bear the responsibility of system balance, which has a certain pressure on renewable energy units.

In general, the proposed mechanism can better solve the practical problems of current spot pilot operation, such as imbalance of funds and poor connection between market and plan, especially for the full guarantee of implementation of priority generation such as renewable energy, and has certain guiding significance for guiding some regions in China to carry out spot market pilot.

4.2 Analysis of Advantages and Disadvantages of Market Model

4.2.1 Advantage Analysis

First, the electricity plan of the new market model is relatively decoupled from the traditional centralized bidding market. Under the market model of promoting renewable energy consumption, decoupling design of plan and market can adopt different treatment methods, which is in line with the actual situation of a physical delivery attribute of priority generation and consumption in China. With gradual liberalization of priority generation, the balance and matching of both sides of generation and consumption will be realized, which is conducive to reducing the scale of unbalanced funds.

Second, the balance responsibility of power generation and consumption is clear. Under the market model of promoting renewable energy consumption, balance responsibilities, and corresponding economic relations of market-oriented power generation and consumption, priority generation and consumption are relatively fair and clear, which is also in line with the market basis of China’s absolute proportion of bilateral direct transactions. Afterward, according to the deviation between planned output and actual output, the imbalance amount of the responsible party shall be settled, so that each party shall be responsible.

Third, the new market model is simple, has good compatibility, and has strong scalability. In terms of time, the market model of promoting renewable energy consumption can be compatible with existing priority plans and medium- and long-term market transactions and can adapt to the market process of priority generation, which is conducive to the smooth start of the spot market. From the perspective of space, the market model of promoting renewable energy consumption is convenient for standardizing interface design and unifying market rules among different provincial markets and is conducive to the integration of provincial markets and gradually forming a national unified electricity market.

Fourth, it is conducive to the proper solution of cross subsidies. Under the market model of promoting renewable energy consumption, the boundary between market and plan is clear, which can guarantee the balance of quantity and price of priority generation and consumption to the greatest extent, and is conducive to stabilizing source of cross subsidies, reducing new profits and losses of policy-based cross subsidies, and recovering cross subsidies through transmission and distribution price, so as to ensure the price stability of residents’ agricultural and other security electricity.

4.2.2 Disadvantage Analysis

First, compared with the whole electricity market model (whole electricity within the day-ahead spot centralized bidding range), it is more conservative. Under the market model of promoting renewable energy consumption, part of the electricity is involved in the spot market, competition is not sufficient, and market efficiency and resource allocation efficiency are not as good as those of the whole electricity market model, which may be difficult for the entire power industry and some experts to accept.

Second, adjusting the market model of the existing spot pilot provinces is required. Most of China’s existing spot pilot provinces adopt a market model of centralized bidding of all electricity. The market model of promoting renewable energy consumption needs to make great changes in market rules and technical support system of current spot pilot provinces, but it has little impact on most of the provinces that have not yet been started.

5 Conclusion

Based on the reality of China’s existing market transaction mechanism, this paper designs and proposes a market transaction mechanism to promote renewable energy consumption, and adapts it to the plan and market models of China. The mechanism carries out a market transaction in the order of first arranging a priority plan, then organizing medium- and long-term market trading, and then organizing day-ahead incremental spot trading. Operational processes of this mechanism, including priority plan, medium- and long-term, spot stage, auxiliary service, and balance stage, have been defined. For deviations in priority plans caused by renewable energy output or large fluctuations of priority consumption, adjustments can be made by adjusting other marketization contracts and priority plans. Example shows that this method has the advantages, such as relative decoupling between plan and market, clear balance responsibility between power generation and consumption, simple model, good compatibility, and strong scalability, and is conducive to properly solving cross subsidies. It is hoped to provide a reference for improving renewable energy consumption capacity and improving China’s current market trading mechanism.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author Contributions

GGL and GDL conceived and designed the study. GDL and MZ performed the engineering example verification. GGL and GDL wrote the paper. GGL, GDL and MZ reviewed and edited the manuscript. All authors read and approved the manuscript.

Funding

This work is supported by the project of the National Key Research and Development Program Foundation of China (No. 2016YFB0900100).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Badal, F. R., Das, P., Sarker, S. K., and Das, S. K. (2019). A Survey on Control Issues in Renewable Energy Integration and Microgrid. Prot. Control. Mod. Power Syst. 4 (1), 87–113. doi:10.1186/s41601-019-0122-8

Chen, G., Liang, Z., and Dong, Y. (2020). Analysis and Reflection on the Marketization Construction of Electric Power with Chinese Characteristics Based on Energy Transformation. Proc. CSEE 40 (2), 369–379. doi:10.13334/j.0258-8013.pcsee.191382

Cong, Y., Zhang, L., and Tao, W. (2020). Quantitative Evaluation Method of Transmission Pricing Mechanism under Circumstance of Electricity Spot Market. Proc. CSEE 40 (21), 369–379. doi:10.13334/j.0258-8013.pcsee.191549

Ding, Y., Xie, K., Pang, B., Li, Z., and Guo, L. (2020). Key Issues of National Unified Electricity Market with Chinese Characteristics (1): Enlightenment and Suggestions from Foreign Countries. Power Syst. Tech. 44 (7), 2401–2410. doi:10.13335/j.1000-3673.pst.2020.0422

Erdiwansyah, fnm., Mahidin, fnm., Husin, H., Nasaruddin, fnm., Zaki, M., and Muhibbuddin, fnm. (2021). A Critical Review of the Integration of Renewable Energy Sources with Various Technologies. Prot. Control. Mod. Power Syst. 6 (1), 37–54. doi:10.1186/s41601-021-00181-3

Fu, X., Wu, X., and Liu, N. (2021). Statistical Machine Learning Model for Uncertainty Planning of Distributed Renewable Energy Sources in Distribution Networks. Front. Energ. Res. 9, 809254. doi:10.3389/fenrg.2021.809254

Fu, X., Yang, K., Li, G., and Zeng, D. (2021). Research on the Trading Arrangement and Clearing Model of Medium- and Long-Term Inter-provincial Markets Considering Security Constraints. Front. Energ. Res. 9, 839108. doi:10.3389/fenrg.2021.839108

Guo, H., Chen, Q., Zhong, H., Wang, Y., Zhang, W., Xia, Q., et al. (2017). Spot Market Mechanism Design and Path Planning Based on Standard Curve for Financial Delivery. Automation Electric Power Syst. 41 (17), 1–8. doi:10.7500/AEPS20170512009

Lam, L. H., Ilea, V., and Bovo, C. (2018). European Day-Ahead Electricity Market Coupling: Discussion, Modeling, and Case Study:discussion, Modeling, and Case Study. Electric Power Syst. Res. 155 (1), 80–92. doi:10.1016/j.epsr.2017.10.003

Le, H. L., Ilea, V., and Bovo, C. (2019). Integrated European Intra-day Electricity Market: Rules, Modeling and Analysis:rules, Modeling and Analysis. Appl. Energ. 238 (1), 258–273. doi:10.1016/j.apenergy.2018.12.073

Li, J., Wang, S., Ye, L., and Fang, J. (2018). A Coordinated Dispatch Method with Pumped-Storage and Battery-Storage for Compensating the Variation of Wind Power. Prot. Control. Mod. Power Syst. 3 (3), 21–34. doi:10.1186/s41601-017-0074-9

Li, G., Li, G., and Zhou, M. (2019). Comprehensive Evaluation Model of Wind Power Accommodation Ability Based on Macroscopic and Microscopic Indicators. Prot. Control. Mod. Power Syst. 4 (3), 215–226. doi:10.1186/s41601-019-0132-6

Li, G., Li, G., and Zhou, M. (2019). Model and Application of Renewable Energy Accommodation Capacity Calculation Considering Utilization Level of Inter-provincial Tie-Line. Prot. Control. Mod. Power Syst. 4 (1), 1–12. doi:10.1186/s41601-019-0115-7

Ming, H., Xia, B., Lee, K.-Y., Adepoju, A., Shakkottai, S., and Xie, L. (2020). Prediction and Assessment of Demand Response Potential with Coupon Incentives in Highly Renewable Power Systems. Prot. Control. Mod. Power Syst. 5 (2), 14–27. doi:10.1186/s41601-020-00155-x

Song, Y., Bao, M., Ding, Y., Shao, C., and Shang, N. (2020). Review of Chinese Electricity Spot Market Key Issues and its Suggestions under the New Round of Chinese Power System Reform. Proc. CSEE 40 (10), 3172–3186. doi:10.13334/j.0258-8013.pcsee.191251

Sun, Y., Zhao, Z., Yang, M., Jia, D., Pei, W., Xu, B., et al. (2020). Research Overview of Energy Storage in Renewable Energy Power Fluctuation Mitigation. CSEE J. Power Energ. Syst. 6 (1), 160–173. doi:10.17775/CSEEJPES.2019.01950

Wang, W., Liu, L., Liu, J., and Chen, Z. (2020). Energy Management and Optimization of Vehicle-To-Grid Systems for Wind Power Integration. CSEE J. Power Energ. Syst. 7 (1), 172–180. doi:10.17775/CSEEJPES.2020.01610

Xu, J., Liao, S., Jiang, H., Zhang, D., Sun, Y., Ke, D., et al. (2021). Multi-time Scale Tie-Line Energy and reserve Allocation Model Considering Wind Power Uncertainty for Multi-Area System in Hierarchical Control Structure. CSEE J. Power Energ. Syst. 7 (4), 677–687. doi:10.17775/CSEEJPES.2020.00620

Zhang, K., Zhou, B., Or, S. W., Li, C., Chung, C. Y., and Voropai, N. I. (2021). Optimal Coordinated Control of Multi-Renewable-To-Hydrogen Production System for Hydrogen Fueling Stations. IEEE Trans. Ind. Applicat., 1. doi:10.1109/TIA.2021.3093841

Zhang, X., and Shi, L. (2020). Future Research Areas and Key Technologies of Electricity Market in China. Automation Electric Power Syst. 44 (16), 1–11. doi:10.7500/AEPS20200602001

Keywords: priority generation and consumption plans, market mechanism, medium- and long-term transaction, spot market, renewable energy consumption

Citation: Li G, Li G and Zhou M (2022) Market Transaction Model Design Applicable for Both Plan and Market Environment of China’s Renewable Energy. Front. Energy Res. 10:862653. doi: 10.3389/fenrg.2022.862653

Received: 26 January 2022; Accepted: 11 February 2022;

Published: 14 March 2022.

Edited by:

Bin Zhou, Hunan University, ChinaReviewed by:

Xiurong Zhang, Beihang University, ChinaQifang Chen, Beijing Jiaotong University, China

Cheng Liu, Northeast Electric Power University, China

Copyright © 2022 Li, Li and Zhou. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Guodong Li, bGdkMDkwMUAxMjYuY29t

Gengyin Li

Gengyin Li Guodong Li

Guodong Li