- Department of Mechanical Engineering, Khalifa University, Abu Dhabi, United Arab Emirates

Fossil fuels will continue to play an important role for the forthcoming decades, including in key hard-to-abate transport and industrial sectors. Unconventional oil (UO) has emerged as a sizeable contributor to meeting the global energy demand in the energy transition period. However, unfavorable circumstances compounded by the Covid-19 pandemic have intensified uncertainties and speculation regarding the future prospects of these resources. This mini-review explores prospects and challenges faced by UO development in the Covid-19 era, focusing on technical, economic, energy security, and environmental sustainability aspects. While UOs have been significantly affected by the pandemic in the short term, limited medium to long-term UO projections exist, with contrasted findings. The review reveals the multiplicity and complexity of interactions between the Covid-19 pandemic and the discussed UO aspects, the diversity of views, and conflicting short- and long-term goals of the energy industry.

Introduction

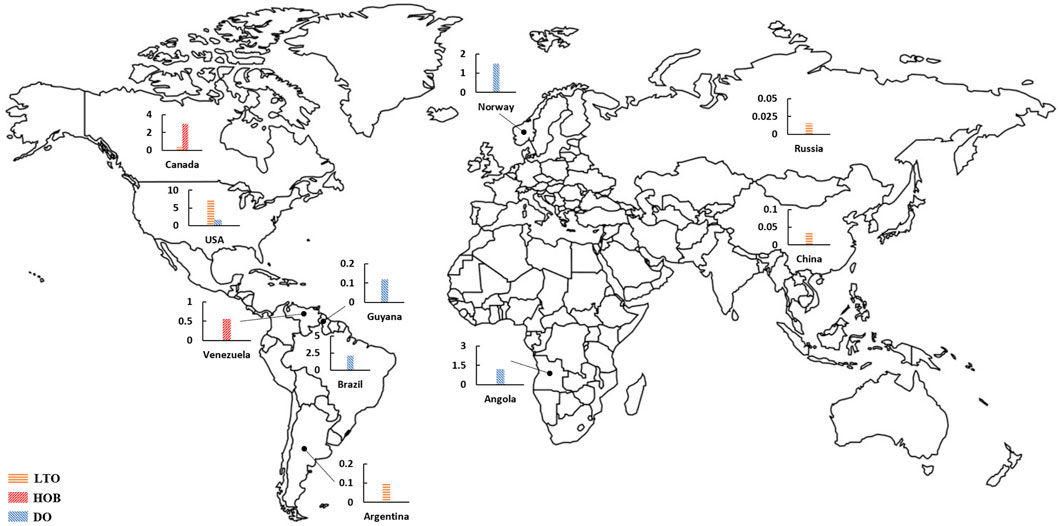

Despite substantial global efforts to transition away from fossil fuel-based energy sources to reduce environmental impact and address climate change, oil could still contribute up to 25–30% of the global energy mix in 2040 depending on scenario (DNV, 2017; BP, 2020). This is contributed by renewable deployment pace limitations particularly in developing economies (IEA, 2021a), and the need for energy-dense fuels in heavy/long-distance transport, as well as chemical feedstock (e.g., lubricants, plastics, fertilizers) and high-grade heat in industrial applications, with limited low-carbon alternatives in the short to medium term (BP, 2020; IEA, 2021b). Meeting demand in the context of both energy security and the foreseeable depletion of aging conventional fossil resources, has driven the development of more complex, difficultly exploitable reserves (IEA, 2021b; Manfroni et al., 2021), in particular, unconventional resources (Kryukov and Moe, 2018; Delannoy et al., 2021). Unconventional reserves have been estimated to account for up to 80% of total hydrocarbon resources (Caineng et al., 2015), with conservatively ∼500–1,000 billion barrels (bbl) of recoverable unconventional oil (UO) (DNV, 2017; IEA, 2021b). The most prevalent UO types include light tight oil (LTO), heavy oil and natural bitumen (HOB/Oil Sands), deepwater oil (DO), and kerogen oil (Kapustin and Grushevenko, 2018; IEA, 2021b)1. UO development in the past 2 decades has been enabled by progress in extraction technologies including hydraulic fracturing for LTO and steam-assisted gravity drainage (SAGD) for HOB, as well as favorable oil prices in the mid‒2000s, which contributed to make these resources become commercially viable (IEA, 2021b). With these advances, the share of UO reached ∼10% of total liquids production by 2020, from less than 5% in 2000 (DNV, 2017; IEA, 2021b). Recent UO production estimates for main exploited resources (i.e., LTO, HOB, DO) are represented in Figure 1. UO development, considered a revolution in the energy industry, has altered the geographies of oil and energy security (Gordon, 2012; Marlin-Tackie and Smith, 2020).

FIGURE 1. Recent LTO, HOB, and DO production estimates in mb/d derived from (EIA, 2016; Aizhu, 2021; Astakhova, 2021; James, 2021; Mogollon, 2021; OPEC, 2021; Spencer, 2021).

UO perceived risks and benefits diverge among scientists and the public (Marlin-Tackie and Smith, 2020). While contributing to local employment, economic growth and energy security for producers in the near-term, unconventional hydrocarbons face uncertainties in a context of increased environmental and social sustainability concerns including the rapidly diminishing world carbon budget, and competition with both conventional and rising low-carbon energy sources (Deloitte, 2021). The Covid-19 pandemic has already had profound impacts on a number of sectors including energy (Jiang et al., 2021), from economic, environmental, societal and geopolitical perspectives. The question arises whether the pandemic, compounding other recent circumstances (Delannoy et al., 2021), may have amplified global and local uncertainties impacting UO, and altered UO prospects and challenges. Recent reviews related to the Covid-19 pandemic have provided valuable insights into its impact on energy (Jiang et al., 2021) including oil (Norouzi, 2021; Quitzow et al., 2021), economy (Al-Thaqeb et al., 2020; Chenli et al., 2021), and environment and sustainability (Atoufi et al., 2021; Abubakar et al., 2021). However, none of these reviews have focused on the impacts of the pandemic on UO. This article aims to contribute a brief review of UO prospects and challenges, focusing on the observed and anticipated effects of the Covid-19 pandemic on UO economic/market aspects (Economic and Market Aspects), geographies and energy security (Geographies and Energy Security) and environmental aspects (Environmental Aspects).

Economic and Market Aspects

Both prior to and during the Covid-19 pandemic outbreak, one of the most significant challenges faced for UOs’ expansion has been their sensitivity to oil price instabilities contributed by economic and other unforeseen events. This sensitivity is associated with the relatively high and varied UO breakeven prices compared to conventional oils (Gordon, 2012; Kapustin and Grushevenko, 2018)2. OPEC’s ability to adjust their budgets to lower their breakeven prices enables flexibility in responding to reductions in oil prices by controlling the supply of conventional crude and leveraging their production cost advantage when compared with unconventional resources (Kapustin and Grushevenko, 2018; IEA, 2021b).

When the economic impact of the Covid-19 pandemic manifested around April 2020, an oversupply of approximately 20 million barrels of oil per day (MMbl/d) developed, pushing oil prices to below $20/bl (Mckinsey, 2021). This resulted from a rapid decline in demand for liquid fuels, which in early 2020 dropped 9 MMbl/d below 2019 levels (IEA, 2021a), due to reduced transport and industrial activities, and supply chain disruptions (BP, 2020; Le et al., 2021). This led a number of UO producers to shut down operations, thereby significantly reducing output in Spring 2020 (Crowley et al., 2020). Although oil demand has since slowly recovered, it remained 9% below 2019 levels at the end of 2020 (McKinsey, 2021), and is not expected to fully recover to 2019 levels until 2023–2025 (IEA, 2021a; McKinsey, 2021). Crude oil prices, which dropped to negative values for the first time historically in April 2020 (Le et al., 2021), partly recovered to ∼$80/bl by mid November 2021. However, oil prices fell again by ∼10% to ∼$70/bl in a single day in late November 2021, upon discovery of the Omicron variant of Covid-19 (Ambrose, 2021). Oil prices rose again above $90/bl in February 2022, thereby placing unconventional producers in a better position to compete with conventional ones. In the near-term, oil market demand may continue to be adversely affected by insufficient vaccine deployment and the possibility of future vaccine-resistant virus variants (IEA, 2021a). Major international oil companies (e.g., BP, Chevron, Shell, Total) have recently wrote down substantial portions of their assets including more expensive and carbon-intensive unconventional fields to focus on lower-cost oil resources and shift to lower-carbon energy vectors (IEA, 2021a).

The reduction in oil prices following the Covid-19 pandemic outbreak led UO producers to pursue operations below breakeven point and to seek further improvements in efficiency in an attempt to reduce breakeven prices (Albishausen, 2020). Liabilities have further accumulated in the UO industry, with a number of bankruptcies, and increased mergers and acquisitions. Macro-economic uncertainties associated with the pandemic are thought to have been amplified by the considerable media coverage of the pandemic (Le et al., 2021). This climate has resulted in suspended/cancelled investments, and may slow global development of oil production and refining capacity over the next few years (IEA, 2021a). Investments could however be imperative to maintain market share against low-carbon technologies (Norouzi, 2021). In addition, regaining investor confidence may require efforts to focus on profitability rather than growth and market share (Albishausen, 2020), which could be facilitated by the on-going digital transformation of the oil industry (Deloitte, 2021; Elijah et al., 2021).

In the longer term, concerns of the Covid-19 pandemic having induced potentially persistent changes in consumer behavior, affecting transport fuel and industrial demand, and prompting more environmentally and socially responsible behavior, have led to question whether the oil market may return to a pre-pandemic behavior (Helm, 2020; Mulvaney et al., 2020; IEA, 2021a; Le et al., 2021). While rebounding fossil energy prices could accelerate low-carbon energy policy deployment, the pandemic may have considerably altered the economic and political context under which such policies were developed, including the European Green Deal and U.S. Green New Deal (Steffen et al., 2020). Policy constraints may have become harder to surmount, in a climate of restructuring industries, unemployment and reduced demand for goods/services including commodities; electric transportation share targets may be compromised by reduced car sales (Steffen et al., 2020). High rebound and volatility in fossil energy prices could also result in politically and socially disruptive effects slowing down low-carbon energy transitions (IEA, 2021a).

Oil markets are not assumed to return to a new normal until the pandemic has become endemic (Le et al., 2021). To accelerate recovery, measures/regulations to mitigate reduced oil demand and timely assistance to individual consumers and enterprises has been recommended (Le et al., 2021). In general, making energy policies adaptive to shocks including future pandemics has become a necessity (Steffen et al., 2020).

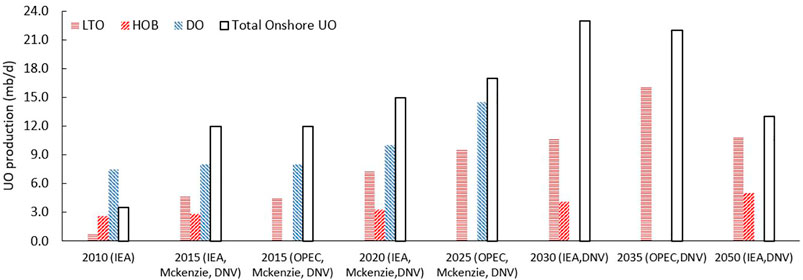

Historical and projected annual LTO, HOB, and DO production estimates are represented in Figure 2. Limited UO projections have been published since the onset of the Covid-19 pandemic. In the short-term (2025), UO shares of up to 28% have been anticipated (Hosseini et al., 2021). In the longer term, depending on scenario, UO production could grow until the early to mid 2030s, and either subsequently decline (BP, 2020; IEA, 2021b) or be maintained through 2050 (IEA, 2021b). 2030–2050 UO shares of global oil production range from 3 to 12% in (IEA, 2021a; IEA, 2021b; McKinsey, 2021), up to 50% in (Delannoy et al., 2021). Disparities in historical and projected UO production estimates between published sources are attributable to differences in UO type definitions, projection scenario assumptions (Wachtmeister and Höök, 2020), and limited information/data available related to the impacts of the pandemic.

FIGURE 2. Historical and projected annual LTO, HOB, and DO productions derived from (OPEC, 2015; IEA, 2016; DNV, 2017; Thom, 2019; IEA, 2021b; OPEC, 2021). Note: IEA data for 2020 onwards correspond to Stated Policies scenario. Mckenzie DO data derived from (Thom, 2019) include natural gas. 2035 LTO production estimates include unconventional natural gas liquids.

Geographies and Energy Security

In Covid-19 pre-pandemic analyzes, UO production over the next decades has been expected to be dominated by Venezuela (sandstone), Canada (bitumen), Russia (shale oil‒a sub-category of LTO) and the U.S. (tight oil) (Morozov et al., 2018). The ability of different UO producing geographies to resist the effects of the pandemic depends on local reserve characteristics, status of existing UO development, and economic and political circumstances (Jefferson, 2020). U.S. shale oil benefits from already developed infrastructure, abundant geological data, and ease of storage, which could facilitate delayed market release after oil price recovery (Kryukov and Moe, 2018; Jefferson, 2020). In response to the pandemic, investments in drilling were made in both the US and Canada (Quitzow et al., 2021). However, further U.S. UO development is challenged by environmental concerns, evidenced by previous hydraulic fracturing bans (Albishausen, 2020), and concerns of possible economic and energy security implications associated with potential new bans through 2021–2025 (United States Department of Energy (DOE), 2021). Canada’s heavy oils and their unfavorable breakeven prices are compounded by the expressed drive towards a low-carbon economy (Jefferson, 2020). After being significantly affected by the pandemic, Canadian UO production may rise above 2019 levels by 2026 (IEA, 2021a). Venezuela’s challenges include the heavy oil characteristics of ∼80% of its reserves, and political, economic and social circumstances (Jefferson, 2020), and insufficient reservoir management and investment (IEA, 2021a). Despite a huge shale oil resource potential, Russia faces challenges related to the high uncertainty of most of these resources, UO sector flexibility/responsiveness, infrastructure, technological deployment, and financial and regulatory framework (Kryukov and Moe, 2018). Importers’ concerns related to Russia’s crude oil quality and supply chain may have augmented during the pandemic (Jefferson, 2020). However, Russian producers are reported to have drilled but not completed wells so as to augment production rapidly when oil demand recovers from the pandemic (IEA, 2021a). The abundance of relatively light crude oil in Saudi Arabia is an advantage for recovery, but production and distribution may be exposed to future geopolitical forces (Jefferson, 2020). Despite their focus on conventional reserves, Gulf Cooperating Council (GCC) countries have recently began exploring UO (mostly shale/tight oil), local reserves of which are anticipated to be significant (Patten and Gawrych, 2019). If developed, such reserves could offer strategic market advantages to GCC producers (Patten and Gawrych, 2019). However, the 2020 fall in oil prices may have accelerated the need for economic diversification among GCC countries (Eveloy and Gebreegziabher, 2019; Arezki et al., 2020; Kabbani and Ben Mimoune, 2021).

In terms of oil demand, the Asia-Pacific region including China and India is expected to dominate growth through 2040 due to population and economic growth, including increased vehicle ownership. The pandemic has been a source of tension between the US and China, and could lead China to either emphasize energy security and rely on its coal resources, or to take a lead in low-carbon energy technologies (Oxford Energy Forum, 2020). Oil consumption is expected to decrease in Europe over the next decades due to rising sustainable energy policies (Morozov et al., 2018) including in response to the pandemic (Quitzow et al., 2021).

The pursuit of improved resilience (Fattouh, 2021) may involve deglobalization, as countries aim at reduced dependence on imported goods/services, and restoring certain domestic activities and supply chains (BP, 2020). Energy security concerns may augment, and increase unconventional development to avoid energy imports in countries possessing such reserves, while at the same time fossil energy trading may reduce (BP, 2020). The pandemic has highlighted the volatility of fossil fuel prices, potentially resulting in renewables appearing less risky (Oxford Energy Forum, 2020), although the potential future price volatility of key minerals used in clean energies could also lead to geopolitical instabilities (IEA, 2021b). Decentralized renewables may be more reliable than centralized energy sources during pandemics (Norouzi et al., 2020). However, access to renewables is geographically uneven and the pandemic may have enlarged the gap between the “leaders and laggards” of a global energy transition (Quitzow et al., 2021).

Environmental Aspects

On the supply side, unconventional resource extraction, refining, and transport involve energy and natural resource (i.e., land, water) intensive processes that result in atmospheric pollution, land damage and pollution3, surface/ground water use/pollution and waste water disposal issues, and habitat and local community disruptions (Albishausen, 2020; Marlin-Tackie and Smith, 2020). The predicted weighted-average energy return on energy investment (EROI), of oil liquids production could decline from 44 in 1950 to 6.7 in 2050, reflecting an increase in direct and indirect energy requirements to produce oil liquids from 15.5% of produced oil liquids currently, to 50% by 2050 (Delannoy et al., 2021).

The environmental impact assessment of UOs requires careful analysis considering the wide variability between fields and processes, under limited public data availability (Brandt et al., 2018). Life cycle analyses collectively highlight the higher GHG impact of UOs compared to conventional oils (Nduagu and Gates, 2015; Brandt et al., 2018). Exploitation of aging conventional and UO fields combined could translate into 6–26% additional emissions per average barrel produced (Manfroni et al., 2021). Meeting climate targets is generally considered to imply a prompt reduction in global oil consumption (IEA, 2021a), and there is a significant concern that unconventional development may delay clean energy transitions; the overall environmental and social impacts of unconventional resources remain a main argument against their development (Overland, 2015; Marlin-Tackie and Smith, 2020).

The pandemic is thought to have increased public and government receptiveness of pollution and environmental risks (Oxford Energy Forum, 2020), and need for resilience planning in sustainability (Lior, 2020). Higher rates of Covid-19 mortality have been observed in communities exposed to elevated air pollution (Mulvaney et al., 2020). UO indirect socio-economic impacts (Gordon, 2012; Albishausen, 2020) may gain increased importance in a carbon-constrained future and pandemic era, and oil companies may increasingly turn their attention to climate mitigation (Deloitte, 2021; IEA, 2021a). Reducing gas utilization for drilling and refining has been suggested, as well as using renewables for fossil fuel extraction (Manfroni et al., 2021). Limiting flaring and enforcing petcoke disposal (instead of burning) in HOB refining, among others measures, has been estimated to potentially avoid 10–50 cumulative Gt CO2-eq emissions by 2050 (Brandt et al., 2018). However, production costs could increase in regions with net-zero pledges and reduce producers’ competiveness (IEA, 2021b). High carbon tax credits and lowered oil prices following the pandemic have been found to render carbon storage projects in U.S. saline formations more attractive than enhanced oil recovery (Meckel et al., 2021). However, this could consume critical storage capacity from other emitting sectors (Dooley et al., 2009). On the other hand, it has been argued that rapid defossilization could disrupt the fossil energy industry’s profitability and constrain climate change mitigation options (Oxford Energy Forum, 2020; Manfroni et al., 2021). Considering fossil revenue losses associated with the pandemic, it is uncertain what emphasis oil companies will place on low-carbon measures and technologies (Kuzemko et al., 2020; Oxford Energy Forum, 2020).

On the demand side, by inducing persistent low-contact (e.g., teleworking) energy expenditure, the pandemic may accelerate electrification and other changes in energy consumption (Oxford Energy Forum, 2020). Remote working is however currently essentially confined to services and dependent on technology often only available in developed economies (IEA, 2021a). Unlike for transport, oil demand for petrochemicals has not been significantly affected by the pandemic, partly owing to the need for medical protective equipment and packaging (IEA, 2021a).

Conclusions

UO future development, as for the energy sector, is challenging to predict considering the multiplicity and complexity of influencing factors, diversity of views, divergence between short- and long-term goals, and spatial and temporal heterogeneity of the pandemic impacts. While UO has been significantly affected by the Covid-19 pandemic in the short term, limited medium and long-term projections exist, with contrasted findings. A comprehensive analysis of the pandemic impact on UO and broader energy sources considering economic, energy security and environmental aspects is unlikely to be feasible until the pandemic may be considered endemic. Instead, this article highlighted key questions, and potential outcomes and directions to address UO challenges in the pandemic era.

Author Contributions

HE initiated the article draft. VE proposed the topic, edited and expanded the article draft.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

The authors thank Mr. Timileyin Aworinde, Khalifa University, for assisting in sourcing references.

Footnotes

1LTO is comprised of low-density oils trapped in ultra-low permeability reservoirs, and is most prevalent in the U.S.A. (Gordon, 2012). HOB consists of dense, viscous hydrocarbon mixtures that arise as a product of conventional oil degradation, and is mostly found in Canada, South America and Eurasia (Kapustin and Grushevenko, 2018). DO refers to offshore oil reservoirs deeper than ∼125 m, and is prominently found in the Gulf of Mexico and Brazil off-shore (EIA, 2016). Kerogen oil is composed of source rock laced with solid organic matter that can be turned into hydrocarbon, and found in a number of countries worldwide. However few kerogen pilot production projects are in operation due to economic, technical and ecological challenges (IEA, 2017; Kapustin and Grushevenko, 2018).

2LTO had a breakeven price of $40−$67 per barrel (bl) in the U.S.A. in 2020 (Wigwe et al., 2020), while HOB produced using SAGD technologies had a breakeven price between $40−$80/bl in Canada in 2016, and the world-average DO breakeven price was estimated at ∼$55/bl in 2017 (DNV, 2017; IEA, 2021b). By contrast, Middle East OPEC conventional oil producers set their breakeven prices between $40−$70/bl in 2017, significantly lower than $60−$130/bl in 2014 (IEA, 2021b). Based on pre-pandemic projections, UO production costs of $50−$55/bl or lower could permit to effectively respond to OPEC interventions (DNV, 2017).

3e.g., LTO hydraulic fracturing, HOB in-situ extraction, toxic/radioactive substance accumulation, landscape changes, seismicity (Albishausen, 2020; Marlin-Tackie and Smith, 2020).

References

Abubakar, L., Salemcity, A. J., Abass, O. K., and Olajuyin, A. M. (2021). The Impacts of COVID-19 on Environmental Sustainability: A Brief Study in World Context. Bioresour. Techn. Rep. 15, 100713. doi:10.1016/j.biteb.2021.100713

Aizhu, C. (2021). PetroChina's Gulong Shale Project May Bolster China's Oil Output. Available at: https://www.reuters.com/business/energy/petrochinas-gulong-shale-project-may-bolster-chinas-oil-output-2021-09-30/ (Accessed January 15, 2022).

Al-Thaqeb, S. A., Algharabali, B. G., and Alabdulghafour, K. T. (2020). “The Pandemic and Economic Policy Uncertainty,” in International Journal of Finance and Economics. Chichester, United Kingdom: John Wiley & Sons, 1–11. doi:10.1002/ijfe.2298

Albishausen, N. (2020). The Impact of the Covid-19 Pandemic on the US Shale Industry: An (Expert) Review (MD, USA: Johns Hopkins University). MSc Thesis.

Ambrose, J. (2021). Oil price Drops 10% in Biggest One-Day Fall since Early Days of Pandemic. The Guardian, November 16, 2021, Available at: https://www.theguardian.com/business/2021/nov/26/oil-prices-plunge-as-new-covid-variant-spooks-markets (Accessed December 3, 2021).

Arezki, R., Moreno-Dodson, B., Yuting, F. R., Romeo, G., Ha, N., Nguyen, C., et al. (2020). "Trading Together: Reviving Middle East and North Africa Regional Integration in the Post-COVID Era," in Middle East and North Africa Economic. Washington, DC: World Bank. Available at: https://openknowledge.worldbank.org/handle/10986/34516 (Accessed January 7, 2022).

Astakhova, O. (2021). Russia Makes Progress on Shale Oil Output but Hurdles Remain. Available at: https://www.reuters.com/article/russia-oil-shale-idUSL8N2KL2MV (Accessed January 15, 2022).

BP (2020). Energy Outlook 2020 Edition. Available at: https://www.bp.com/en/global/corporate/energy-economics/energy-outlook.html (Accessed December 3, 2021).

Brandt, A. R., Masnadi, M. S., Englander, J. G., Koomey, J., and Gordon, D. (2018). Climate-wise Choices in a World of Oil Abundance. Environ. Res. Lett. 13 (4), 044027. doi:10.1088/1748-9326/aaae76

Caineng, Z. O. U., Guangming, Z. H. A. I., Zhang, G., Hongjun, W., Zhang, G., Jianzhong, L., et al. (2015). Formation, Distribution, Potential and Prediction of Global Conventional and Unconventional Hydrocarbon Resources. Pet. Exploration Develop. 42 (1), 14–28.

Chenli, M., Bannerman, S., and Abrokwah, E. (2021). “Reviewing the Global Economic Impacts and Mitigating Measures of COVID-19,” in Total Quality Management & Business Excellence. Abingdon, United Kingdom: Taylor & Francis Group, 1–15. doi:10.1080/14783363.2021.1981130

Crowley, K., Wethe, D., and Tobben, S. (2020). The Pandemic Has Broken Shale and Left Oil Markets in OPEC Hands. Bloomberg News, Available at: https://www.bloomberg.com/news/articles/2020-11-28/the-pandemic-has-broken-shale-and-left-oil-markets-in-opec-hands (Accessed December 3, 2021).

D. Atoufi, H., Lampert, D. J., and Sillanpää, M. (2021). COVID-19, a Double-Edged Sword for the Environment: a Review on the Impacts of COVID-19 on the Environment. Environ. Sci. Pollut. Res. 28, 61969–61978. doi:10.1007/s11356-021-16551-1

Delannoy, L., Longaretti, P.-Y., Murphy, D. J., and Prados, E. (2021). Peak Oil and the Low-Carbon Energy Transition: A Net-Energy Perspective. Appl. Energ. 304, 117843. doi:10.1016/j.apenergy.2021.117843

Deloitte (2021). 2022 Oil and Gas Industry Outlook. Available at: https://www2.deloitte.com/content/dam/Deloitte/us/Documents/energy-resources/us-2022-outlook-oil-and-gas.pdf (Accessed December 3, 2021).

DNV (2017). Oil and Gas Forecast to 2050, Energy Transition Outlook 2017, DNV. Available at: https://eto.dnv.com/2017/oilgas (Accessed December 3, 2021).

Dooley, J. J., Dahowski, R. T., and Davidson, C. L. (2009). The Potential for Increased Atmospheric CO2 Emissions and Accelerated Consumption of Deep Geologic CO2 Storage Resources Resulting from the Large-Scale Deployment of a CCS-Enabled Unconventional Fossil Fuels Industry in the U.S. Int. J. Greenhouse Gas Control. 3, 720–730. doi:10.1016/j.ijggc.2009.08.004

EIA (2016). Offshore Oil Production in deepwater and Ultra-deepwater Is Increasing. Washington DC, United States: U.S. Energy Information Administration. Available at: https://www.eia.gov/todayinenergy/detail.php?id=28552# (Accessed January 15, 2022).

Elijah, O., Ai Ling, P., Rahim, S. K. A., Geok, T. K., Arsad, A., Abdul Kadir, E., et al. (2021). A Survey on Industry 4.0 for the Oil and Gas Industry: Upstream Sector. IEEE Access 9, 144438–144468. doi:10.1109/ACCESS.2021.3121302

Eveloy, V., and Gebreegziabher, T. (2019). Excess Electricity and Power-To-Gas Storage Potential in the Future Renewable-Based Power Generation Sector in the United Arab Emirates. Energy 166, 426–450. doi:10.1016/j.energy.2018.10.088

Fattouh, B. (2021). Saudi Oil Policy: Continuity and Change in the Era of the Energy Transition. Oxford, United Kingdom: UK Energy Research Center. The Oxford Institute for Energy Studies. OIES paper: WPM 81. ISBN 978-1-78467-169-3.

Gordon, D. (2012). Understanding Unconventional Oil. Carnegieendowment. Available at: https://carnegieendowment.org/files/unconventional_oil.pdf (Accessed December 3, 2021).

Helm, D. (2020). The Environmental Impacts of the Coronavirus. Environ. Resource Econ. 76, 21–38. doi:10.1007/s10640-020-00426-z

Hosseini, S. H., Shakouri G., H., and Kazemi, A. (2021). Oil price Future Regarding Unconventional Oil Production and its Near-Term Deployment: A System Dynamics Approach. Energy 222, 119878. doi:10.1016/j.energy.2021.119878

IEA (2021a). Oil 2021 Analysis and Forecast to 2026. Paris, France: International Energy Agency. Available at: https://www.iea.org/reports/oil-2021 (Accessed December 3, 2021).

IEA (2016). World Energy Outlook 2016. Paris, France: International Energy Agency. Available at: https://www.iea.org/reports/world-energy-outlook-2016 (Accessed January 15, 2022).

IEA (2017). World Energy Outlook 2017. Paris, France: International Energy Agency. Available at: https://www.iea.org/reports/world-energy-outlook-2017 (Accessed December 3, 2021).

IEA (2021b). World Energy Outlook. Paris, France: International Energy Agency. Available at: https://www.iea.org/reports/world-energy-outlook-2021 (Accessed December 3, 2021).

James, C. (2021). Guyana Cautious on 2021 Oil Output, price. Available at: https://www.argusmedia.com/en/news/2187148-guyana-cautious-on-2021-oil-output-price (Accessed January 15, 2022).

Jefferson, M. (2020). A Crude Future? COVID-19s Challenges for Oil Demand, Supply and Prices. Energ. Res. Soc. Sci. 68, 101669. doi:10.1016/j.erss.2020.101669

Jiang, P., Fan, Y. V., and Klemeš, J. J. (2021). Impacts of COVID-19 on Energy Demand and Consumption: Challenges, Lessons and Emerging Opportunities. Appl. Energ. 285, 116441. doi:10.1016/j.apenergy.2021.116441

Kabbani, N., and Ben Mimoune, N. (2021). Economic Diversification in the Gulf: Time to Redouble Efforts. Policy briefing. January 2021, Available at: https://www.brookings.edu/research/economic-diversification-in-the-gulf-time-to-redouble-efforts/#footnote-40 (Accessed January 7, 2022).

Kapustin, N. O., and Grushevenko, D. A. (2018). Global Prospects of Unconventional Oil in the Turbulent Market: a Long Term Outlook to 2040. Oil Gas Sci. Technol. - Rev. IFP Energies Nouvelles 73, 67 (Accessed December 3, 2021). doi:10.2516/ogst/2018063

Kryukov, V., and Moe, A. (2018). Does Russian Unconventional Oil Have a Future? Energy Policy 119, 41–50. doi:10.1016/j.enpol.2018.04.021

Kuzemko, C., Bradshaw, M., Bridge, G., Goldthau, A., Jewell, J., Overland, I., et al. (2020). Covid-19 and the Politics of Sustainable Energy Transitions. Energ. Res. Soc. Sci. 68, 101685. doi:10.1016/j.erss.2020.101685

Le, T.-H., Le, A. T., and Le, H.-C. (2021). The Historic Oil price Fluctuation during the Covid-19 Pandemic: What Are the Causes? Res. Int. Business Finance 58, 101489. doi:10.1016/j.ribaf.2021.101489

Lior, N. (2020). “Sustainable Energy Development Status with Key Lessons from the Pandemic. Keynote,” in Proceedings of the 33rd International Conference on Efficiency, Cost, Optimization, Simulation, and Environmental Impact of Energy Systems (ECOS 2020), Osaka, Japan, June 29–July 3.

Manfroni, M., Bukkens, S. G. F., and Giampietro, M. (2021). The Declining Performance of the Oil Sector: Implications for Global Climate Change Mitigation. Appl. Energ. 298, 117210. doi:10.1016/j.apenergy.2021.117210

Marlin-Tackie, F. A., and Smith, J. M. (2020). Key Characteristics Influencing Risk Perceptions of Unconventional Energy Development. J. Clean. Prod. 251, 119644. doi:10.1016/j.jclepro.2019.119644

Mckinsey (2021). Global Oil Outlook to 2040. Available at: https://www.mckinsey.com/industries/oil-and-gas/our-insights/global-oil-supply-and-demand-outlook-to-2040 (Accessed December 3, 2021).

Meckel, T. A., Bump, A. P., Hovorka, S. D., and Trevino, R. H. (2021). Carbon Capture, Utilization, and Storage Hub Development on the Gulf Coast. Greenhouse Gas Sci. Technol. 11, 619–632. doi:10.1002/ghg.2082

Mogollon, M. (2021). Venezuela's 2021 Crude Output Shows No Growth from Last Year. Available at: https://www.spglobal.com/platts/en/market-insights/latest-news/oil/122921-venezuelas-2021-crude-output-shows-no-growth-from-last-year (Accessed January 15, 2022).

Morozov, I. V., Potanina, Y. M., Voroninn, S. A., Kuchkovskaya, N. V., and Siliush, M. D. (2018). Prospects for the Development of the Oil and Gas Industry in the Regional and Global Economy. Int. J. Energ. Econ. Pol. 8 (4), 55–62.

Mulvaney, D., Busby, J., and Bazilian, M. D. (2020). Pandemic Disruptions in Energy and the Environment. Elemmenta Sci. Anthropocene 8 (1), 052. doi:10.1525/elementa.052

Nduagu, E. I., and Gates, I. D. (2015). Unconventional Heavy Oil Growth and Global Greenhouse Gas Emissions. Environ. Sci. Technol. 49 (14), 8824–8832. doi:10.1021/acs.est.5b01913

Norouzi, N. (2021). Post-Covid-19 and Globalization of Oil and Natural Gas Trade: Challenges, Opportunities, Lessons, Regulations, and Strategies. Int. J. Energy Res., 1–19.

Norouzi, N., Zarazua de Rubens, G., Choupanpiesheh, S., and Enevoldsen, P. (2020). When Pandemics Impact Economies and Climate Change: Exploring the Impacts of COVID-19 on Oil and Electricity Demand in China. Energ. Res. Soc. Sci. 68, 101654. doi:10.1016/j.erss.2020.101654

OPEC (2015). 2015 OPEC World Oil Outlook. Vienna, Austria: Organization of Petroleum Exporting Countries. Available at: https://www.opec.org/opec_web/static_files_project/media/downloads/publications/WOO%202015.pdf (Accessed January 15, 2022).

OPEC (2021). World Oil Outlook 2045. Vienna, Austria: Organization of Petroleum Exporting Countries. Available at: https://www.opec.org/opec_web/en/publications/340.htm (Accessed January 15, 2022).

Overland, I. (2015). “Future Petroleum Geopolitics: Consequences of Climate Policy and Unconventional Oil and Gas,” in Handbook of Clean Energy Systems. Hoboken, New Jersey, United States: John Wiley & Sons, 1–29. doi:10.1002/9781118991978.hces203

Oxford Energy Forum (2020). Covid-19 and the Energy Transition. The Oxford Institute for Energy Studies. Issue 123. Available at: https://www.opec.org/opec_web/en/publications/340.htmhttps://www.oxfordenergy.org/wpcms/wp-content/uploads/2020/07/OEF123.pdf (Accessed December 3, 2021).

Patten, A., and Gawrych, R. (2019). United States: Unconventional Oil and Gas Potential in the Middle East. Available at: https://www.mondaq.com/unitedstates/oil-gas-electricity/824232/unconventional-oil-and-gas-potential-in-the-middle-east (Accessed January 7, 2022).

Quitzow, R., Bersalli, G., Eicke, L., Jahn, J., Lilliestam, J., Lira, F., et al. (2021). The COVID-19 Crisis Deepens the Gulf between Leaders and Laggards in the Global Energy Transition. Energ. Res. Soc. Sci. 74, 101981. doi:10.1016/j.erss.2021.101981

Spencer, S. (2021). Commodities 2022: US Gulf of Mexico deepwater Oil, Gas Activity May Increase. Available at: https://www.spglobal.com/platts/en/market-insights/latest-news/natural-gas/122721-commodities-2022-us-gulf-of-mexico-deepwater-oil-gas-activity-may-increase (Accessed January 15, 2022).

Steffen, B., Egli, F., Pahle, M., and Schmidt, T. S. (2020). Navigating the Clean Energy Transition in the COVID-19 Crisis. Joule 4, 1137–1141. doi:10.1016/j.joule.2020.04.011

Thom, I. (2019). Deepwater Rising: The State of the Global deepwater Industry. Available at: https://www.woodmac.com/news/feature/deepwater-rising-the-state-of-the-global-deepwater-industry/ (Accessed January 15, 2022).

United States Department of Energy (DOE) (2021). Economic and National Security Impacts under a Hydraulic Fracturing Ban. Report to the President. Available at: https://www.energy.gov/sites/prod/files/2021/01/f82/economic-and-national-security-impacts-under-a-hydraulic-fracturing-ban.pdf (Accessed January 7, 2022).

Wachtmeister, H., and Höök, M. (2020). Investment and Production Dynamics of Conventional Oil and Unconventional Tight Oil: Implications for Oil Markets and Climate Strategies. Energ. Clim. Change 1. doi:10.1016/j.egycc.2020.100010

Keywords: unconventional oil, crude oil, oil price, environmental impact, energy security, COVID-19, pandemic

Citation: Eveloy V and Elsheikh H (2022) Unconventional Oil Prospects and Challenges in the Covid-19 Era. Front. Energy Res. 10:829398. doi: 10.3389/fenrg.2022.829398

Received: 05 December 2021; Accepted: 08 March 2022;

Published: 01 April 2022.

Edited by:

Thomas Alan Adams, McMaster University, CanadaReviewed by:

Ehsan Rasoulinezhad, University of Tehran, IranHenrique A. Matos, Universidade de Lisboa, Portugal

Stefano Mazzoni, Nanyang Technological University, Singapore

Copyright © 2022 Eveloy and Elsheikh. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Valerie Eveloy, dmFsZXJpZS5ldmVsb3lAa3UuYWMuYWU=

Valerie Eveloy

Valerie Eveloy Hassan Elsheikh

Hassan Elsheikh