- 1Business School, Monash University, Melbourne, VIC, Australia

- 2School of Business, Nanjing Normal University, Nanjing, China

- 3College of Economics and Management, Nanjing University of Aeronautics and Astronautics, Nanjing, China

- 4School of Finance, Shandong Technology and Business University, Yantai, China; Siam University, Bangkok, Thailand

Solar energy technology innovation plays a crucial role in achieving green and sustainable development and a low-carbon economy. The literature focuses on the economic and environmental effects of solar energy but ignores the role of solar energy investment in multilateral development banks (MDBs) on technological innovation. Using the panel data of 37 countries, including OECD countries and China, from 2006 to 2019, we adopt a multi-period DID model to empirically analyze the impact of solar energy investment in MDBs on technological innovation. The results show that solar energy investment in MDBs can significantly promote technological innovation, with the conclusion still being valid after conducting a series of robustness tests. The heterogeneity results indicate that the promoting effect of solar energy investment in MDBs on technological innovation is more significant in regions with higher human capital and higher innovation ability. The findings of this paper can be a useful addition to the literature on solar energy and technological innovation and serve as a useful reference for countries around the world as they accelerate solar energy investment and promote technological innovation.

1 Introduction

As an important support for a country’s economic and social development, energy is related to national security, economy and people’s livelihood and is an important material basis for people’s survival. With the development of modern industry, energy usage has gradually become the primary influencing factor in terms of national economic development. At the same time, the consumption of traditional fossil energy sources such as coal and oil has continued to grow with the increasing population. Additionally, energy consumption emits a large amount of carbon dioxide (CO2), nitrogen oxides and other greenhouse gases, which have a negative impact on the global climate. The key to solving this problem is the development of environmentally friendly renewable energy sources, such as water, wind, tidal and solar energy sources.

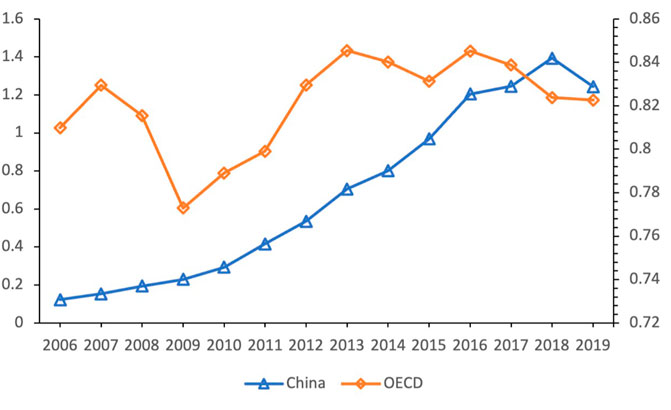

Technological innovation in the field of renewable energy can maximize the efficiency of energy use and reduce the negative impact on the global environment. Particularly, as a renewable energy source with great potential, solar energy has aroused worldwide attention due to its power generation efficiency and potential, as well as its extremely low carbon intensity (Yu et al., 2022). Owing to these high-tech properties and power generation efficiency, the use of solar energy can effectively alleviate the pressure of global traditional fossil energy depletion and international climate deterioration. Moreover, solar energy is conducive to promoting national economic and social development within the tolerance of the climate and environment. Therefore, a new round of energy structure adjustment and the potential for an energy technology revolution is bound to occur. In such a case, it is of great strategic importance to carry out technological innovation. Countries around the world have reached a consensus on the importance of developing renewable energy from four perspectives—energy security, economic growth, environmental protection and employment increase (4Es). Figure 1 fully shows the patent application situation in Organization for Economic Co-operation and Development (OECD) countries and China, which reflects the importance of each country for the issue of technological innovation. While promoting renewable energy technologies, countries rely on different types of energy sources according to their resource endowments or energy characteristics. Among them, solar energy, as a widely available energy source, has received further attention with the development of storage facilities such as photovoltaic cells. Solar energy technologies can be acquired through learning or the technology diffusion brought about by foreign investment, which shows that these technologies have high technological potential. However, this situation also implies that these technologies lose their use value with the continuous development and progress of the economy and society (Evenson, 2010; Güney, 2022), which also means that renewable energy technologies are characterized by the depreciation of their technical value. In the context of the rapid innovation and development of modern industry, the rate of depreciation of technical knowledge in the energy sector is as high as 10%–40% per year. Additionally, it is important to continuously replenish solar technologies with new technical knowledge and reduce the rate of depreciation of technical knowledge (Benkard, 2000; Watanable, 2000; Hall, 2007; Nemet, 2009). Increased innovation ability can drive the rate of replenishment of technological knowledge beyond the rate of depreciation, thus ensuring the economic efficiency of these solar technologies.

Solar energy investment is characterized by high capital requirements, long investment return cycles and high risks, which are the factors that cause high solar energy investment costs (Abdelrazik et al., 2022), thus further exacerbating the extent of underinvestment in solar-energy-related projects. In that case, it is difficult to meet the demand for solar energy financing through domestic government and private sector investments alone. As international financial organizations, MDBs provide low-interest financing and professional advice to economies with the aim of restoring global economic development and facilitating the reform of economic systems in developing countries. The system structure of MDBs presents the dynamic characteristics of overall diversity and change. Their project investments in the global economy are intersecting and complex and are closely related to certain economic issues such as international politics and climate change. These project investments have an important impact on the promotion of economic development and social progress. Since the interest rates of financial support provided by MDBs are much lower than the market interest rates in the same period and the project funds obtained from MDBs are often characterized by long repayment terms and favorable repayment policies, they enable economies to obtain large amounts of development assistance funds with minimal financing costs to invest in technological innovation (Gurara et al., 2020). The distinctive feature of MDBs, compared to other financial institutions, is that they do not aim at profit maximization and are able to mobilize multiple resources as well as provide good credit guarantees as supranational organizations. Access to solar energy investment in MDBs can effectively alleviate domestic financing needs and facilitate the flow of more funds to the technology research and development (R&D) sector, resulting in an increase in technological innovation (Matthäus and Mehling, 2020). Therefore, solar energy investment in MDBs can have a very important impact on technological innovation.

In this study, the European Investment Bank (EIB), New Development Bank (NDB), and Asian Infrastructure Investment Bank (AIIB) as MDBs, are selected as a sample to investigate their impact on technological innovation. We investigate whether there is an impact of solar energy investment in MDBs on technological innovation using the sample. Accordingly, whether this impact differs across countries with different levels of economic development is also investigated. First, most of the literature analyzes the relationship between renewable energy investment in MDBs and economic growth and carbon emissions. This study focuses on solar energy as a renewable energy source and selects solar energy investment in MDBs as a policy shock through which to assess policy utility by a multi-period difference-in-differences (DID) method. Second, while most of the literature takes a single country as a sample to study a single economy, this study expands the sample to 37 countries around the world to analyze the impact of solar energy investment in MDBs on technological innovation. Moreover, this study explores the global effect of this impact more precisely from a multi-economy perspective. Finally, this study analyzes the heterogeneity of the sample from the perspectives of human capital and innovation ability.

The remainder of this paper is organized as follows. Chapter 2 presents the literature review and theoretical hypotheses. Chapter 3 presents the methodology and data. Chapter 4 presents the empirical results, including multi-period DID benchmark regression, robustness tests and heterogeneity analysis. Chapter 5 presents the conclusions.

2 Literature review and theoretical hypotheses

As one type of renewable energy source, solar energy, compared to traditional fossil fuel energy sources, has the advantages of abundant potential, high power generation efficiency and low carbon emissions and is friendly toward the climate while meeting energy demand, thus playing an important role in the economic and social development of a country (Karayel et al., 2022). Due to the high upfront construction costs of solar energy for utilization and maintenance and the spillover effects of expertise in the renewable energy sector requiring substantial financial support, significant financial support is needed on an ongoing basis to make solar technologies competitive in the international market (Amo-Aidoo et al., 2022; Yasmeen et al., 2022). In addition, factors such as international climate change and surging energy demand are negatively impacting the economic effect of solar technologies, and thus, the level of innovation in solar technologies needs to be urgently increased. Technological innovation is a guarantee for the effective use of solar energy to meet energy consumption demand and achieve sustainable development, which not only is of great strategic importance for the construction of a clean, efficient, low-carbon and safe modern energy system but can also improve people’s livelihood and quality of life. The literature has explored the factors affecting renewable energy technology innovation from four main perspectives: innovation, climate, energy and policy. In the field of innovation, the factors influencing renewable energy technology innovation are mainly R&D expenditure, personnel investment involved in R&D and education, which play a positive role in promoting renewable energy technology innovation by continuously accumulating knowledge and experience in the R&D process (Kim & Kim, 2015; Bayer et al.,2013; Jaffe et al., 1998). In the field of climate change, CO2 emissions and related emission intensity are usually considered the main factors affecting renewable energy technology innovation, and these variables significantly reduce the ability of renewable energy technology innovation, showing a negative influencing relationship (Lanjouw and Mody, 1996; Costantini and Crespi, 2008). In the energy sector, renewable energy consumption and financial investment are considered the main factors affecting renewable energy technology innovation, both of which stimulate the potential of renewable energy technology innovation (Foxon et al.,2007). In the policy area, the institutional arrangement of technology innovation policies and their enactment are considered the most critical drivers of the enhancement of renewable energy technology innovation capacity (Yi and Liu, 2015). To further utilize solar energy and give full play to its energy potential, attention needs to be paid to the issue of technological innovation in solar energy. To this end, relevant studies have suggested that solar energy, as a seasonal energy source, suffers from a time mismatch in resource utilization and, thus, requires the consideration of capital investment through state subsidies, financing or the use of financial channels, like foreign investment, to upgrade solar energy reserve technologies or related facilities to save energy in the heating season for better use in the non-heating season (Gao et al., 2022; Yu et al., 2022). In addition to the seasonal nature of the energy source itself, which requires post-development storage technologies, the full utilization of solar energy requires certain long-distance transportation technologies. Due to the geographical location and distribution of natural resources, the utilization of solar energy resources requires local long-distance transportation facilities, and thus, the improvement of power transportation conditions and technologies at one location can facilitate the use of solar energy on a larger scale (Neupan et al., 2022; Sun et al., 2022). In addition to the need for technological innovation in the development and utilization stages, the post-maintenance of solar resource-related facilities also requires technological investment and technical staffing, which achieve sustainability in the use of solar resources and the restructuring of the country’s energy consumption (Abdelrazik et al., 2022).

The different backgrounds and motivations for the creation of MDBs have led to significant differences in their development missions, operational scopes, etc. (Strand, 2013; Park and Strand, 2015), and these differences have implications for the targeting of MDBs investment (Babb, 2009). Some scholars have analyzed the impact of the differences in the governance structures of MDBs on their investment decisions by systematically comparing them (Gutner, 2002; Kilby, 2011; Kilby and Bland, 2012). Moreover, other studies have comparatively analyzed how the investment decisions of MDBs are affected by geopolitics from the perspective of shareholders’ rights. Through comparative analysis, it is found that under the existing voting system, the United States, as a major economic power, plays a greater influencing role in the investment decisions of MDBs compared to other countries. It is an urgent issue to regulate the investment decision system of MDBs and truly bring into play the economic benefits of their investment (Copelovitch, 2010; Lyne et al., 2009). In addition, although the existing studies on MDBs have focused mainly on the analysis of the World Bank (WB), the Asian Development Bank and the Inter-American Development Bank have also been the subjects of many scholars’ studies because of their short establishment time, unique operating philosophy and institutional nature (Neumayer, 2003; Kilby, 2006).

The development of technological innovation is constrained by various economic and political factors, such as resource endowment, industrial structure, and international economic status, and shows significant regional heterogeneity (Lutz et al., 2017). In the process of technological innovation, each country gradually forms its own national characteristics in combination with its resource endowment, domestic and international market environment, and relevant policies of its government in the field of the technology innovation development preferences for solar energy (Yoo & Ready, 2014; Yang et al., 2016). Therefore, the effect of solar energy investment on technological innovation can be affected by a variety of factors, including the economic and social costs of applying and promoting the use of solar technology. The effective point of project investment and effective utilization rate of project investment have an impact on technological innovation (Horbach and Rammer, 2017). The differences in national natural resource endowments, energy conservation and emission reduction targets, as well as economic development levels, can impact the effectiveness of MDBs solar project investments (Carley, 2009; Trappey et al., 2015; Li et al., 2016; Nyiwul, 2017; Szulecki, 2017). Based on the above factors, the following hypotheses are proposed:

Hypothesis 1 Solar energy investment in MDBs can significantly improve technological innovation.

Hypothesis 2 Solar energy investment in MDBs can have a stronger promoting effect on technological innovation in regions with higher human capital.

Hypothesis 3 Solar energy investment in MDBs can have a stronger promoting effect on technological innovation in regions with a higher innovation ability.

3 Methodology and data

3.1 Sample description

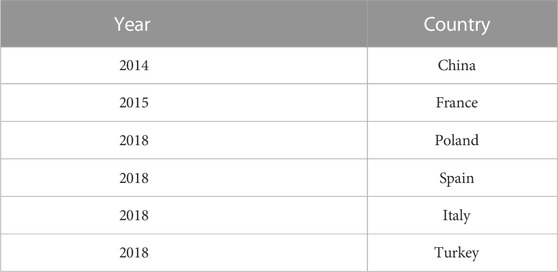

To evaluate the effect of solar energy investment in MDBs and accurately capture the degree of improvement in technological innovation, this study adopts a quasi-natural experiment using countries that received solar energy investment in MDBs in 2014, 2015, and 2018 as research subjects. Moreover, controlling for year and country fixed effects, the DID method is used to mitigate the effects of variables and measurement errors. Data for this study are obtained from the World Bank (WB), the European Investment Bank (EIB), the New Development Bank (NDB) and the Asian Infrastructure Investment Bank (AIIB). Furthermore, 14-year balanced panel data for a total of 37 OECD countries and China from 2006–2019 are obtained. Table 1 shows the statistical table of solar energy investment in MDBs.

3.2 Model setting

During the sample period, six countries received solar energy investment MDBs, as the policy shock year was inconsistent. Therefore, the multi-period DID method is chosen to estimate whether solar energy investment in MDBs is beneficial for technological innovation. In terms of model construction, according to Wang et al. (2023), the specific model is as follows:

where i refers to the country and t refers to the year;

Explained variables: The explanatory variable in this study is the number of resident patent applications (Pat). The key explanatory variable is

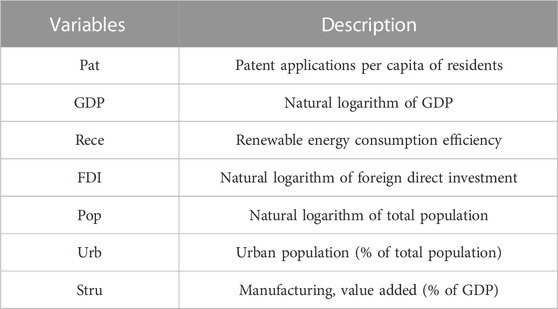

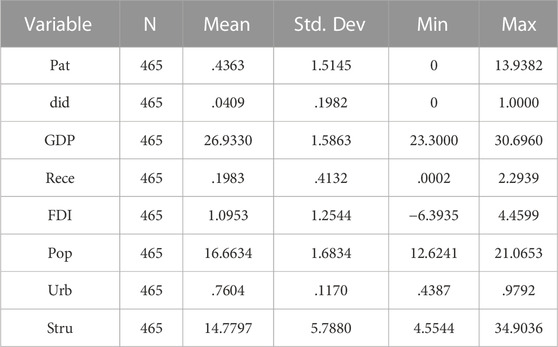

3.3 Variable description

The results of the descriptive statistics are shown in Table 3. During the sample period, the mean and maximum values of the number of resident patent applications for each country are 0.4363 million and 13.9382 million, respectively. Technological innovation varies widely among countries, and there is an urgent need to obtain solar energy investment in MDBs to further improve technological innovation.

4 Empirical results

4.1 Benchmark regression analysis

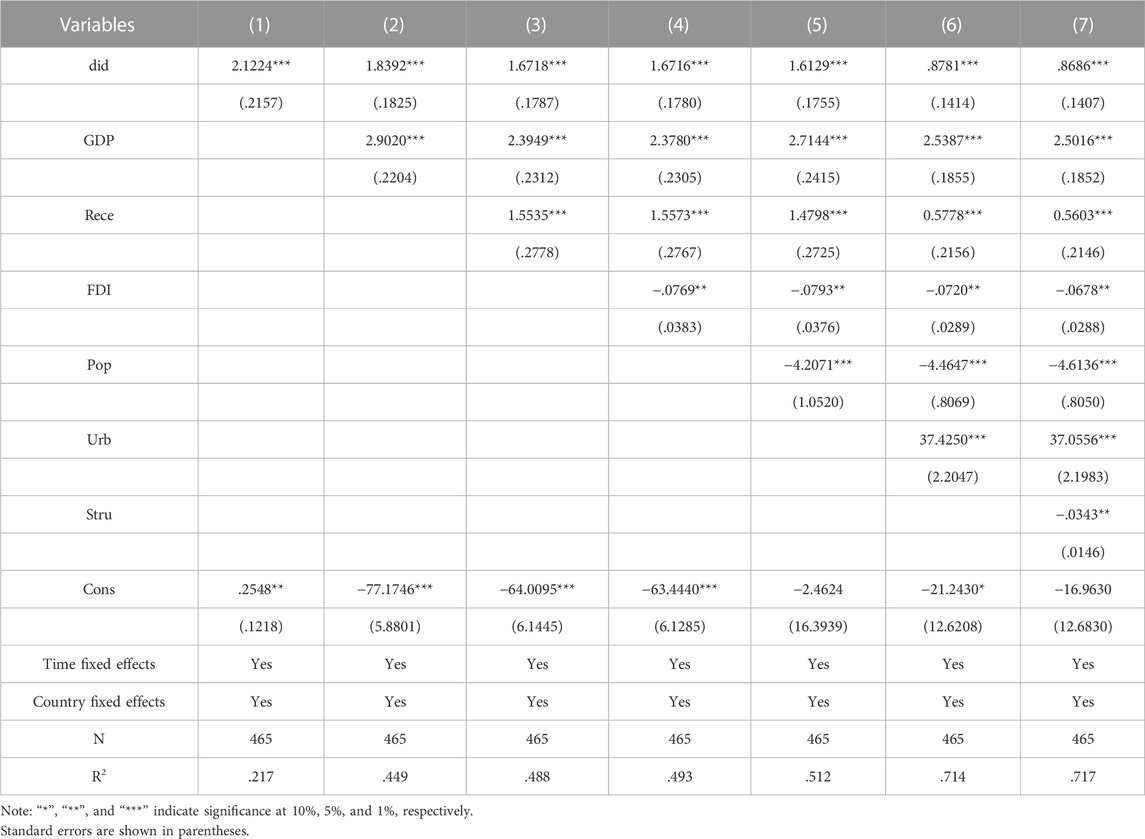

This study uses the multi-period DID method to measure the impact of solar energy investment in MDBs on technological innovation. The empirical results are shown in Table 4. Column (1) shows the results without adding control variables. Columns (2) to (7) show the regression results with the inclusion of control variables on an item-by-item basis. The empirical results show that the regression coefficients of DID are all significantly positive at the 1% level, indicating that solar energy investment in MDBs can significantly increase technological innovation in countries, thus verifying Hypothesis 1. Countries that receive solar energy investment in MDBs have more adequate financial resources. To encourage enterprises to use more environmentally friendly solar energy for production activities, the government provides financial support to those enterprises using solar energy to alleviate their green financing constraints. Additionally, the government provides tax relief benefits to these enterprises so that their production costs are greatly reduced. The environmental costs of the economy and society are also significantly reduced. With the stimulation of solar energy investment in MDBs funds, innovative technology development in the solar field is becoming the focus of economic and social attention. More productive and efficient production technologies and patent innovations are emerging and being promoted and used, thus continuously improving technological innovation in the solar field.

Among the control variables, the level of economic development (GDP), renewable energy consumption efficiency (Rece), and urbanization level (Urb) are all significantly positive at the 1% level, indicating that the increase in economic development, the improvement in renewable energy consumption efficiency and the increase in urbanization level all contribute to the increase in the level of technological innovation. The increase in the economic development level, national income and government budget is thus improved to a certain extent. The economy and society pay more attention to the R&D and utilization of clean energy, which attracts more talent with high technology. Therefore, clean energy has a positive promotion effect on technological innovation. The increase in the efficiency of renewable energy use reflects the importance attached to the development of clean energy by the economy and society. As this emphasis deepens, technical talent gradually moves to the energy innovation technology sector and improves technological innovation. The regression coefficients of foreign direct investment (FDI), population size (Pop) and industrial structure (Stru) are significantly negative, indicating that the increase in foreign investment, the expansion of population size and the change in industrial structure all have a suppressive effect on innovation. The production activities of foreign-invested enterprises are mainly simple processing and assembling. Therefore, there is very little technological R&D. Therefore, an increase in foreign investment suppresses technological innovation in the country. The expansion of population size aggravates the income gap. More government spending is used to alleviate income inequality rather than technological innovation, thus promoting technological innovation. The increase in secondary industry output value represents the development of industrial manufacturing. The increase in the output of the secondary industry represents a better development of the industrial manufacturing industry, which is characterized by a large number of mechanical production activities with low technological content, thus inhibiting the increase in technological innovation.

4.2 Parallel trend test

The key prerequisite assumption for the validity of the multi-period DID method is the parallel trend assumption. The trend of technological innovation over time is consistent between the treatment and control groups countries before and after policy implementation. Therefore, this study uses the event study method for parallel trend testing (Jacobson et al., 1993), and we adopt the following econometric model:

where

Based on the distribution characteristics of the sample data, the data before solar energy investment in MDBs are aggregated to period -8, and those after solar energy investment in MDBs are aggregated to period 5. When t < 0,

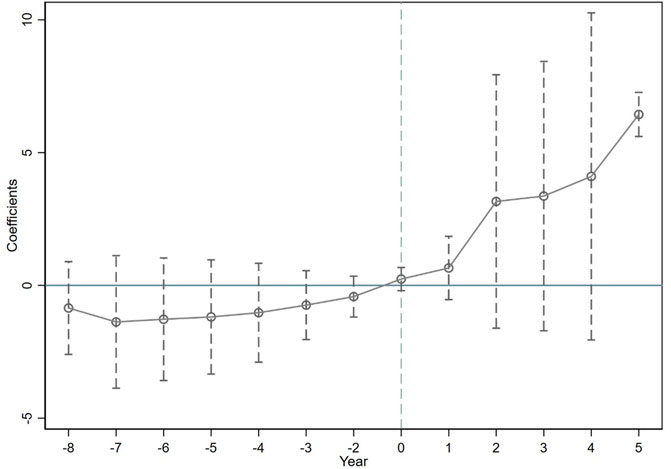

FIGURE 2. Parallel trend of total carbon emissions. Notes: Circles indicate the coefficients, and solid lines indicate 95% confidence intervals.

The parallel trend test plot shown in Figure 2 indicates that the coefficient is not significant when t < 0. These results indicate that there is no significant difference in technological innovation between the experimental and control groups of countries before obtaining solar energy investment in MDBs. The sample passes the parallel trend test, indicating that the coefficient of

4.3 Robustness tests

The benchmark regression results show that solar energy investment in MDBs can significantly promote technological innovation. In addition, to ensure the reliability of the regression results, a multidimensional robustness test, analyzing multiple perspectives, such as the placebo test, replacement of the explained variables, and eliminating samples, is conducted.

4.3.1 Placebo test

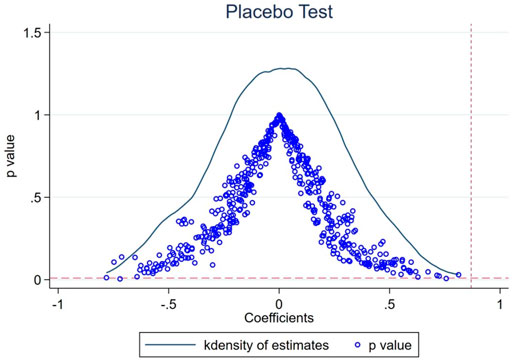

To avoid the regression results being affected by unobservable omitted variables and losing their persuasive power, this study uses a placebo test by replacing the countries in the treatment group (Cai et al.,2016). Six countries are randomly selected from the sample data as a dummy experimental group. The remaining countries are used as a dummy control group for the regression analysis. The above process is repeated 500 times to obtain 500 multi-period DID benchmark regression coefficients and corresponding p values. The kernel density function distribution of the 500 coefficient estimates and p values are plotted in Figure 3.

FIGURE 3. Placebo test results. Notes: The estimated coefficients are the upper and lower limits of the 95% confidence interval.

As shown in Figure 3, the regression coefficients fall around 0 and obey a normal distribution, which is significantly different from the coefficient estimate (.8686) of Regression (7) in Table 4. Most of the p values are more significant than .1. The regression results are not significant, among which the benchmark regression estimates are outliers. Therefore, the interference of other random factors in the results can be excluded.

4.3.2 Replacement of the explained variable

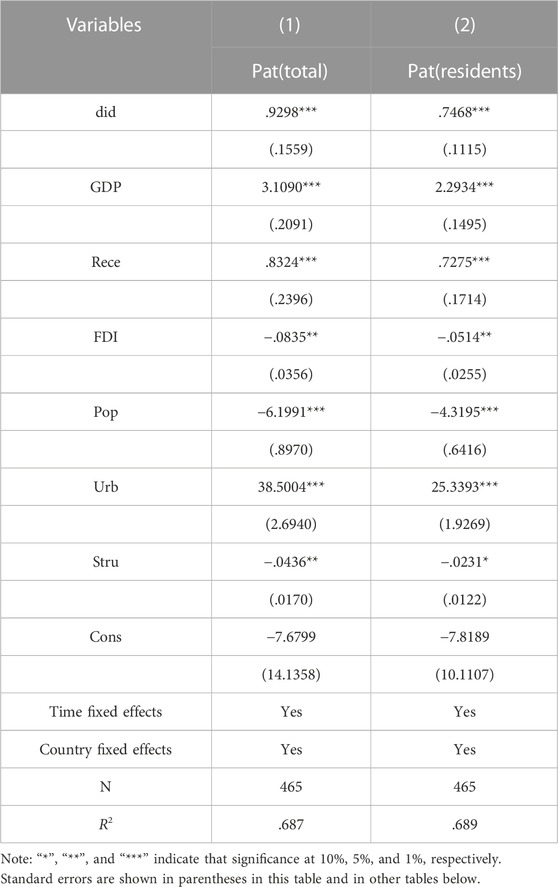

In the benchmark regression, the number of resident patent applications is used as the explained variable. To test the rationality of the model design, regression analysis is conducted using the sum of the number of resident and non-resident patent applications as a new explained variable. The empirical results are shown in column (1) of Table 5. The DID coefficient is still positive at the 1% significance level. This regression result justifies the regression model constructed in this study, indicating that there is indeed a significant positive contribution of solar energy investment in MDBs to technological innovation.

4.3.3 Eliminating observations

To further verify the reliability of the regression results, this study performs a before-and-after 1% tailing of the sample data. The regression results are shown in column (2) of Table 5. The signs of the DID coefficients remain consistent with those in the benchmark regression, and all of them are positive at the 1% significance level. Therefore, the reliability of the benchmark regression results is further confirmed.

4.4 Heterogeneity analysis

The 37 countries in the sample include 25 countries distributed in the European continent, three countries distributed in the North American continent, five countries distributed in the Asian continent, two countries distributed in the Oceanian continent, and two countries distributed in the South American continent. The level of economic development varies significantly among countries, and countries with different levels of economic development have significant differences in terms of human capital and innovation ability. Therefore, this study analyzes the heterogeneity of the sample from the perspective of human capital and innovation ability.

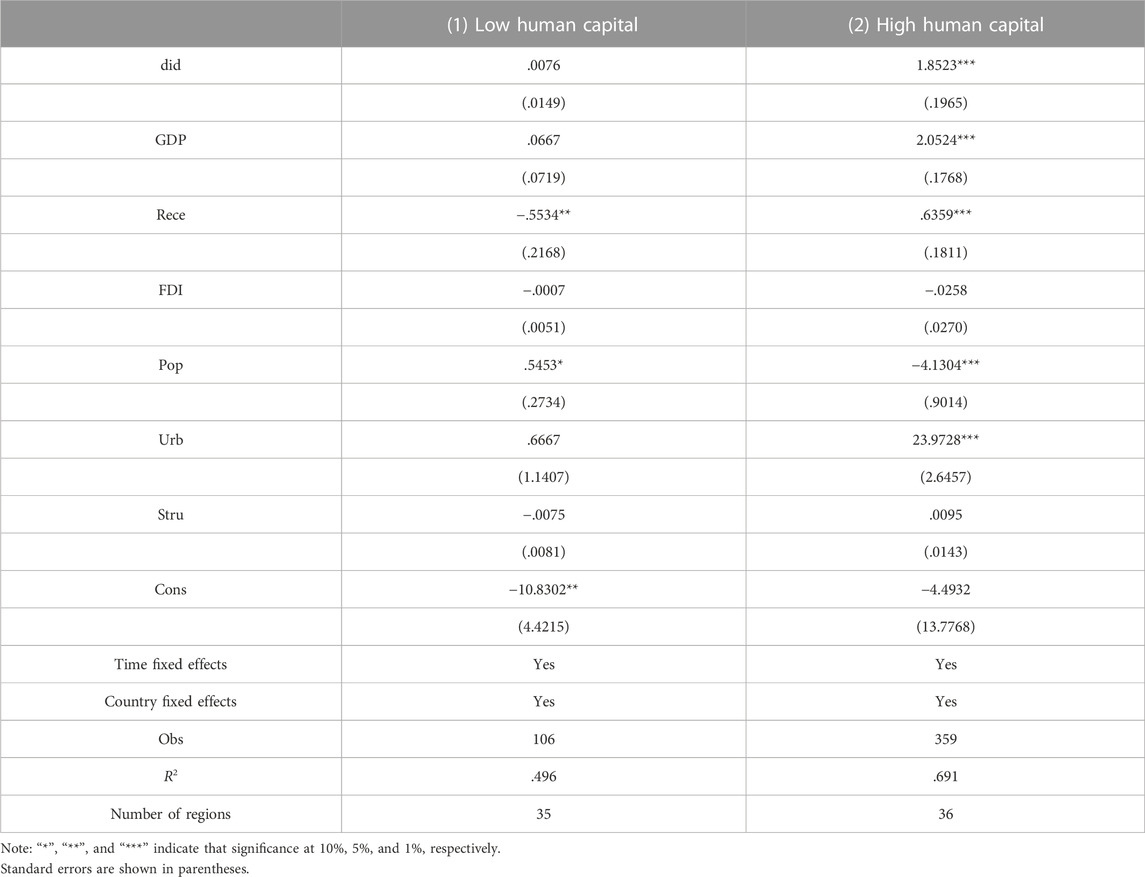

4.4.1 Human capital

In this study, heterogeneity is analyzed from the perspective of the labor force participation rate (working population/total population). The empirical results are shown in Table 6. Column (1) illustrates the non-significant effect of solar energy investment in MDBs on technological innovation in countries with lower human capital. In contrast, column (2) illustrates that the effect of solar energy investment in MDBs on technological innovation is significantly positive at the 1% level in countries with higher human capital. Thus, Hypothesis 2 is supported. Countries with higher human capital have more highly educated and skilled professionals than do those countries with lower human capital, which attracts more skilled people to the technology sector and thus significantly contributes to technological innovation in a country.

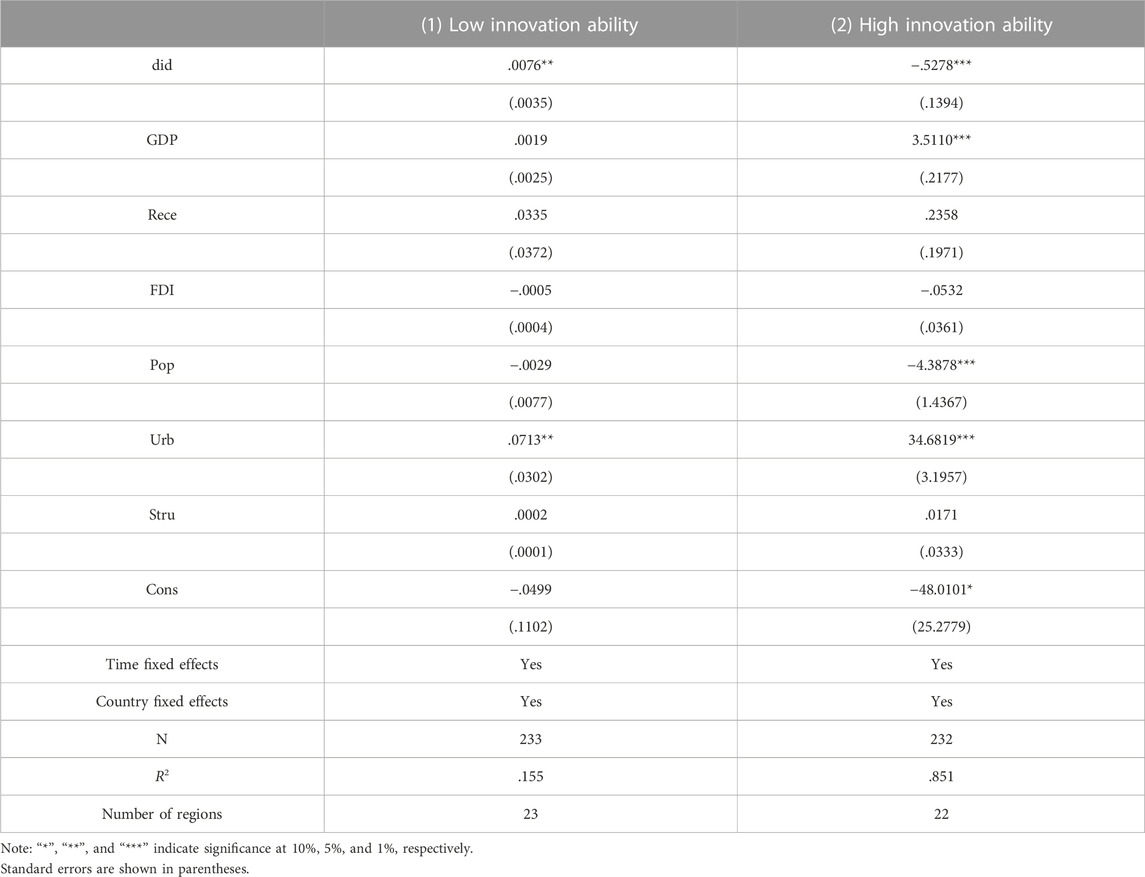

4.4.2 Innovation ability

This study conducts heterogeneity analysis from the perspective of innovation ability (R&D expenditure of GDP). The empirical results are shown in Table 7. As shown in column (1) of Table 7, the effect of solar energy investment in MDBs on technological innovation is significantly positive at the 5% level in countries with lower innovation ability. However, in countries with higher innovation ability, as shown in column (2) in Table 7, this effect is significantly positive at the 1% level. A comparative analysis of columns (1) and (2) reveals that the contribution of solar energy investment in MDBs to technological innovation is more significant in countries with higher innovation ability. Therefore, Hypothesis 3 is supported. Countries with higher innovation ability are able to invest more financial support in technology innovation, while simultaneously attracting more technical professionals to engage in technology development and innovation research in the field of technology innovation, which in turn has a more significant effect on the improvement of technology innovation.

5 Conclusion

This study, using data of 37 OECD countries and China for 14 years from 2006–2019 and adopting a multi-period DID benchmark regression model, considers solar energy investment in MDBs as a policy shock. We explore the impact of solar energy investment in MDBs on technological innovation and conduct heterogeneity analysis based on human capital and innovation ability, drawing the following conclusions. (1) Solar energy investment in MDBs can significantly improve the technological innovation of an economy. The level of economic development, efficiency of renewable energy use, foreign direct investment, population size, urbanization level, and industrial structure can also influence technological innovation. (2) There is regional heterogeneity in the effect of solar energy investment in MDBs on technological innovation, which is reflected in human capital and innovation ability; i.e., there are differences in the effect between countries with different human capital and innovation ability levels. The effect of solar energy investment in MDBs on technological innovation is stronger in countries with higher human capital and innovation ability and weaker in countries with lower economic development.

In summary, this study makes the following recommendations (Liang et al., 2022; Fang et al., 2022). First, increasing government efforts to encourage technological innovation, developing and implementing national programs to develop relevant science and technology, and attracting skilled personnel to participate in technological innovation research are recommended. Since technological innovation has the characteristics of high risk and high investment, it faces difficulty in meeting the demand for capital investment by the private sector alone. The government can raise large sums of money by virtue of national credit and policy preferences and invest them in the field of technological innovation. For example, the government can open a reward mechanism for innovation achievements and improve the protection of patent achievements to attract more technical talent to participate in technological innovation research. Since there are large differences in the level of economic development among global economies, government support policies with national development characteristics should be formulated according to the natural resource endowment and basic national conditions of the country in the process of playing government functions to promote technological innovation. On this basis, local governments can be appropriately delegated to make appropriate adjustments to technological innovation subsidy policies according to the individual characteristics of local administrative regions to more efficiently achieve the development of local technological innovation. The development of technological innovation inevitably has an impact on the international image of a country and increases the confidence of MDBs in the development of solar energy in the country, which in turn increases the amount and frequency of investment by MDBs in solar energy in the country, forming a virtuous circle.

Second, comprehensive solar energy project funds using a supervision system and solar energy policy system to improve the efficiency of the use of project funds should be fully constructed. To maximize the use of solar energy investment in MDBs, the government needs to improve the tracking and monitoring system for the use of such funds to achieve transparency and clarity in the use of financing and to prevent corruption. Moreover, the government should track the records from the acquisition of funds, the flow of funds, the transit of funds and the final output. Special verification posts should be set up to divide the flow of funds among different departments, and a monitoring system with separation of responsibilities should be designed. Additionally, the government should establish an all-round systematic information base to grasp the utilization of project funds. In addition, the government should match the final output of the used funds with the initial input to better estimate the difference between the utilization efficiencies of the funds in different sectors. Accordingly, the government can adjust the strength of technology innovation support policies in different sectors and consciously and appropriately tilt policy support toward sectors with higher utilization of funds to maximize technology innovation while also ensuring balanced development in each sector.

The shortcomings of this study are as follows. First, only solar energy investment in MDBs is taken as a policy shock, and the role of the amount of financing funds on technological innovation is not reflected. Second, this study selects only some of the solar energy investments in MDBs and does not consider the overall situation of all the MDBs. Therefore, these deficiencies should be complemented by subsequent studies.

Data availability statement

The original contributions presented in the study are included in the article/supplementary materials, further inquiries can be directed to the corresponding author.

Author contributions

WS: Writing original draft, data proceeding, and project administration. RL: Resources, writing—original draft. RC: Conceptualization, methodology, software, validation, formal analysis, writing—original draft. ZJ: Empirical analysis. MC: Data analysis and writing.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abdelrazik, M. K., Abdelaziz, S. E., Hassan, M. F., and Hatem, T. M. (2022). Climate action: Prospects of solar energy in Africa. Energy Rep. 8, 11363–11377. doi:10.1016/j.egyr.2022.08.252

Amo-Aidoo, A., Kumi, E. N., Hensel, O., Korese, J. K., and Sturm, B. (2022). Solar energy policy implementation in Ghana: A leap model analysis. Sci. Afr. 16, e01162. doi:10.1016/j.sciaf.2022.e01162

Babb, S. (2009). Behind the development banks: Washington politics, world poverty, and the wealth of nations. Chicago, IL: University of Chicago Press.

Bayer, P., Urpelainen, J., and Wallace, J. (2013). Who uses the clean development mechanism? An empirical analysis of projects in Chinese provinces. Glob. Environ. change 23 (2), 512–521. doi:10.1016/j.gloenvcha.2012.12.002

Benkard, C. L. (2000). Learning and forgetting: The dynamics of aircraft production. Am. Econ. Rev. 90 (4), 1034–1054. doi:10.1257/aer.90.4.1034

Bland, E., and Kilby, C. (2012). Informal influence in the Inter-American development bank. Working Paper 22. Villanova, PA: Villanova School of Business Economics.

Cai, X., Lu, Y., Wu, M., and Yu, L. (2016). Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J. Dev. Econ. 123, 73–85. doi:10.1016/j.jdeveco.2016.08.003

Cao, D., Peng, C., Yang, G., and Zhang, W. (2022). How does the pressure of political promotion affect renewable energy technological innovation? Evidence from 30 Chinese provinces. Energy 254, 124226. doi:10.1016/j.energy.2022.124226

Carley, S. (2009). State renewable energy electricity policies: An empirical evaluation of effectiveness. Energy policy 37 (8), 3071–3081. doi:10.1016/j.enpol.2009.03.062

Copelovitch, M. S. (2010). Master or servant? Common agency and the political economy of IMF lending. International Studies Quarterly 54 (1), 49–77.

Costantini, V., and Crespi, F. (2008). Environmental regulation and the export dynamics of energy technologies. Ecol. Econ. 66 (2-3), 447–460. doi:10.1016/j.ecolecon.2007.10.008

Evenson, R. E. (2010). “Induced adaptive invention/innovation and productivity convergence in developing countries,” in Technological change and the environment (New York, NY: Routledge), 67–102.

Fang, J., Gozgor, G., Mahalik, M. K., Mallick, H., and Padhan, H. (2022). Does urbanisation induce renewable energy consumption in emerging economies? The role of education in energy switching policies. Energy Econ. 111, 106081. doi:10.1016/j.eneco.2022.106081

Foxon, T., Gross, R., Heptonstall, P., Pearson, P., and Anderson, D. (2007). Energy technology innovation: A systems perspective. Report for the Garnaut Climate Change Review. Seattle, WA: Semantic Scholar.

Gao, D., Kwan, T. H., Hu, M., and Pei, G. (2022). The energy, exergy, and techno-economic analysis of a solar seasonal residual energy utilization system. Energy 248, 123626. doi:10.1016/j.energy.2022.123626

Gozgor, G., and Paramati, S. R. (2022). Does energy diversification cause an economic slowdown? Evidence from a newly constructed energy diversification index. Energy Econ. 109, 105970. doi:10.1016/j.eneco.2022.105970

Güney, T. (2022). Solar energy, governance and CO2 emissions. Renew. Energy 184, 791–798. doi:10.1016/j.renene.2021.11.124

Gurara, D., Presbitero, A., and Sarmiento, M. (2020). Borrowing costs and the role of multilateral development banks: Evidence from cross-border syndicated bank lending. J. Int. Money Finance 100, 1. doi:10.5089/9781484386200.001

Gutner, T. L. (2002). Banking on the environment: Multilateral development banks and their environmental performance in Central and Eastern Europe. Cambridge, MA: MIT Press.

Hall, B. H. (2007). Measuring the returns to R&D: The depreciation problem. Working Paper13473. New York NY: JSTOR.

Horbach, J., and Rammer, C. (2017). Energy transition in Germany and regional spillovers: What triggers the diffusion of renewable energy in firms? ZEW Discussion Papers No. 17-044. Germany: EconStor. (17-044).

Jacobson, L. S., LaLonde, R. J., and Sullivan, D. G. (1993). Earnings losses of displaced workers. Am. Econ. Rev. 83 (4), 685–709. doi:10.2307/2117574

Jaffe, A. B., Fogarty, M. S., and Banks, B. A. (1998). Evidence from patents and patent citations on the impact of NASA and other federal labs on commercial innovation. J. Industrial Econ. 46 (2), 183–205. doi:10.1111/1467-6451.00068

Jiang, Z., Lyu, P., Ye, L., and wenqian Zhou, Y. (2020). Green innovation transformation, economic sustainability and energy consumption during China’s new normal stage. J. Clean. Prod. 273, 123044. doi:10.1016/j.jclepro.2020.123044

Karayel, G. K., Javani, N., and Dincer, I. (2022). Green hydrogen production potential for Turkey with solar energy. Int. J. Hydrogen Energy 47 (45), 19354–19364. doi:10.1016/j.ijhydene.2021.10.240

Kilby, C. (2006). Donor influence in multilateral development banks: The case of the Asian Development Bank. Rev. Int. Organ. 1 (2), 173–195. doi:10.1007/s11558-006-8343-9

Kilby, C. (2011). Informal influence in the Asian development bank. Rev. Int. Organ. 6 (3), 223–257. doi:10.1007/s11558-011-9110-0

Kim, K., and Kim, Y. (2015). Role of policy in innovation and international trade of renewable energy technology: Empirical study of solar PV and wind power technology. Renew. Sustain. Energy Rev. 44, 717–727. doi:10.1016/j.rser.2015.01.033

Lanjouw, J. O., and Mody, A. (1996). Innovation and the international diffusion of environmentally responsive technology. Res. policy 25 (4), 549–571. doi:10.1016/0048-7333(95)00853-5

Li, Z., Jia, X., Foo, D. C., and Tan, R. R. (2016). Minimizing carbon footprint using pinch analysis: The case of regional renewable electricity planning in China. Appl. Energy 184, 1051–1062. doi:10.1016/j.apenergy.2016.05.031

Liang, J., Irfan, M., Ikram, M., and Zimon, D. (2022). Evaluating natural resources volatility in an emerging economy: The influence of solar energy development barriers. Resour. Policy 78, 102858. doi:10.1016/j.resourpol.2022.102858

Lutz, L. M., Fischer, L. B., Newig, J., and Lang, D. J. (2017). Driving factors for the regional implementation of renewable energy-A multiple case study on the German energy transition. Energy Policy 105, 136–147. doi:10.1016/j.enpol.2017.02.019

Lyne, M. M., Nielson, D. L., and Tierney, M. J. (2009). Controlling coalitions: Social lending at the multilateral development banks. Rev. Int. Organ. 4 (4), 407–433. doi:10.1007/s11558-009-9069-2

Matthäus, D., and Mehling, M. (2020). De-risking renewable energy investments in developing countries: A multilateral guarantee mechanism. Joule 4 (12), 2627–2645. doi:10.1016/j.joule.2020.10.011

Nemet, G. F. (2009). Demand-pull, technology-push, and government-led incentives for non-incremental technical change. Res. policy 38 (5), 700–709. doi:10.1016/j.respol.2009.01.004

Neumayer, E. (2003). The determinants of aid allocation by regional multilateral development banks and United Nations agencies. Int. Stud. Q. 47 (1), 101–122. doi:10.1111/1468-2478.4701005

Neupane, D., Kafle, S., Karki, K. R., Kim, D. H., and Pradhan, P. (2022). Solar and wind energy potential assessment at provincial level in Nepal: Geospatial and economic analysis. Renew. Energy 181, 278–291. doi:10.1016/j.renene.2021.09.027

Nyiwul, L. (2017). Economic performance, environmental concerns, and renewable energy consumption: Drivers of renewable energy development in sub-sahara africa. Clean Technol. Environ. Policy 19 (2), 437–450. doi:10.1007/s10098-016-1229-5

Park, S., and Strand, J. R. (2015). Global economic governance and the development practices of the multilateral development banks. England, UK: Routledge, 27–44.

Strand, J. R. (2013). “Global economic governance and the regional development banks,” in Handbook of global economic governance (England, UK: Routledge), 290–303.

Sun, W. (2019). Land transfer strategy and industrial structure upgrading—analysis based on geographical externality. Mod. Econ. 10 (4), 1134–1152. doi:10.4236/me.2019.104077

Sun, Y., Li, Y., Wang, R., and Ma, R. (2022). Measuring dynamics of solar energy resource quality: Methodology and policy implications for reducing regional energy inequality. Renew. Energy 197, 138–150. doi:10.1016/j.renene.2022.07.122

Szulecki, K. (2017). Poland's renewable energy policy mix: European influence and domestic soap opera. CICERO Working Papers 1/2017. NY, Rochester: SSRN.

Trappey, A. J., Trappey, C. V., Ou, J. J., Hsiao, C. T., Chen, K. W., and Liu, P. H. (2015). “Carbon emission analysis for renewable energy policies,” in Concurrent engineering in the 21st century (Cham: Springer), 761–778.

Wang, H., Li, Y., Lin, W., and Wei, W. (2023). How does digital technology promote carbon emission reduction? Empirical evidence based on e-commerce pilot city policy in China. J. Environ. Manag. 325, 116524. doi:10.1016/j.jenvman.2022.116524

Watanabe, C., Wakabayashi, K., and Miyazawa, T. (2000). Industrial dynamism and the creation of a “virtuous cycle” between R&D, market growth and price reduction: The case of photovoltaic power generation (PV) development in Japan. Technovation 20 (6), 299–312. doi:10.1016/s0166-4972(99)00146-7

Xin, D., and Zhang, Y. (2020). Threshold effect of OFDI on China’s provincial environmental pollution. J. Clean. Prod. 258, 120608. doi:10.1016/j.jclepro.2020.120608

Yang, Y., Solgaard, H. S., and Haider, W. (2016). Wind, hydro or mixed renewable energy source: Preference for electricity products when the share of renewable energy increases. Energy Policy 97, 521–531. doi:10.1016/j.enpol.2016.07.030

Yasmeen, R., Yao, X., Padda, I. U. H., Shah, W. U. H., and Jie, W. (2022). Exploring the role of solar energy and foreign direct investment for clean environment: Evidence from top 10 solar energy consuming countries. Renew. Energy 185, 147–158. doi:10.1016/j.renene.2021.12.048

Yi, H., and Liu, Y. (2015). Green economy in China: Regional variations and policy drivers. Glob. Environ. Change 31, 11–19. doi:10.1016/j.gloenvcha.2014.12.001

Yoo, J., and Ready, R. C. (2014). Preference heterogeneity for renewable energy technology. Energy Econ. 42, 101–114. doi:10.1016/j.eneco.2013.12.007

Yu, J., Saydaliev, H. B., Liu, Z., Nazar, R., and Ali, S. (2022). The asymmetric nexus of solar energy and environmental quality: Evidence from Top-10 solar energy-consuming countries. Energy 247, 123381. doi:10.1016/j.energy.2022.123381

Zhang, F., Deng, X., Phillips, F., Fang, C., and Wang, C. (2020). Impacts of industrial structure and technical progress on carbon emission intensity: Evidence from 281 cities in China. Technol. Forecast. Soc. Change 154, 119949. doi:10.1016/j.techfore.2020.119949

Zhu, C., and Lee, C. C. (2022). The effects of low-carbon pilot policy on technological innovation: Evidence from prefecture-level data in China. Technol. Forecast. Soc. Change 183, 121955. doi:10.1016/j.techfore.2022.121955

Keywords: solar energy investment, MDBs, technological innovation, multi-period DID, human capital, innovation ability

Citation: Sun W, Li R, Cai R, Ji Z and Cheng M (2023) The impact of solar energy investment in multilateral development banks on technological innovation: Evidence from a multi-period DID method. Front. Energy Res. 10:1085012. doi: 10.3389/fenrg.2022.1085012

Received: 31 October 2022; Accepted: 26 December 2022;

Published: 10 January 2023.

Edited by:

Huaping Sun, Jiangsu University, ChinaReviewed by:

Yusong Tan, Northwest University, ChinaJing Zhao, Nanjing University of Finance and Economics, China

Copyright © 2023 Sun, Li, Cai, Ji and Cheng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mingshuang Cheng, aGFwcHlzaGVycnkxMjNAMTYzLmNvbQ==

Weijia Sun1

Weijia Sun1 Renjie Cai

Renjie Cai