- 1College of International Economics and Trade, Ningbo University of Finance and Economics, Ningbo, China

- 2Ningbo Philosophy and Social Science Key Research Base “Regional Open Cooperation and Free Trade Zone Research Base”, Ningbo, China

- 3Climate Change and Energy Economics Study Center, Economics and Management School of Wuhan University, Wuhan, China

- 4PBC School of Finance, Tsinghua University, Beijing, China

Based on data on 280 prefecture-level cities from 2008 to 2019, this study uses a difference-in-difference (DID) model to first analyze the impact of China’s green finance pilot policy (GFPP) on total factor energy efficiency (TFEE) and then further investigate the mediating and heterogeneous effects of GFPP. Results indicate that first, GFPP effectively improves TFEE, and the robustness tests show that the estimation results are reliable. Second, GFPP mainly improves TFEE by promoting industrial structure optimization and green technology innovation. Last, the role of GFPP in improving TFEE is mainly reflected in cities with high environmental protection enforcement and intellectual property protection. Therefore, China must expand the GFPP scope, further improve the local green finance practice capability, actively guide green fund to support energy technology innovation, accelerate green industrial transformation, and pool social forces to jointly promote green economic development.

1 Introduction

China has experienced rapid development in industrialization and urbanization in the past 44 years since the reform and opening up policy, while vast amount of fossil energy fuel this rapid development (Khan et al., 2022). China consumed five billion tons of standard coal in 2020, an increase of 21% compared with that in 2012; among them, coal energy consumption accounted for 57%, but decreased by 11 percentage points compared with that in 2012 (Chen et al., 2021). Although the consumption of traditional fossil energy, especially coal, continues to decline and the energy consumption structure continues to optimize, China’s economic development still depends on massive energy consumption. The long-standing coal-based energy use brings heavy environmental pollution and carbon emission, thus posing a long-term constraint on sustainable economic development (BP, 2018; Zhou et al., 2022). China’s goal of carbon neutrality calls for improving total factor energy efficiency (TFEE) and decarbonizing the energy structure (Liu et al., 2018a; Zhou et al., 2021). However, problems such as energy scarcity and negative environmental pollution externality make it difficult to achieve emission reduction and energy efficiency improvement only by relying on market forces. Therefore, reasonable and effective environmental policies must be adopted to remedy the market failure defect (Li et al., 2022).

Green finance has the dual function of optimizing capital allocation and protecting the environment, and thus become a beneficial supplement to traditional environmental regulation policies (Su et al., 2022). Green finance pilot policy (GFPP) is an important tool for China to support the development of low-carbon economy through financial instruments. In 2016, the Guiding Opinions on Building a Green Financial System was issued by China for the first time. And green finance was defined as economic activities for supporting environmental improvement, coping with climate change, and conserving and efficiently utilizing resources. Meanwhile, the implementation of GFPP has become a strong policy signal to support firms’ green investment. In order to explore a valid path to develop green finance and establish a sound green financial system, China has implemented the GFPP, hoping to explore the experience and practices that can be replicated and promoted from the pilot policy, so as to better play the positive role of green finance in boosting China’s economic green transformation. On 14 June 2017, China formally launched green finance reform and innovation pilot zone in five provinces (Zhejiang, Xinjiang Uygur Autonomous Region, Guangdong, Guizhou, and Jiangxi). Following the macro guidance and combining with the local realities, the local governments of the pilot areas have successively issued various policies to explore effective measures to promote green development. The characteristics of the GFPP mainly include the following five aspects. First, support financial institutions to set up green financial business units or green branches, and encourage petty loans, financial leasing companies to participate in green finance. Second, encourage the development of green credit and green insurance, and encourage green enterprises to raise funds through bond issuance, listing, etc. Third, explore the establishment of environmental rights and interests trading markets such as emission rights, water rights and energy use rights, and establish information sharing platforms such as enterprise pollution emissions and environmental violations records. Fourth, increase the support of local government bonds for public welfare green projects. Fifth, establish a green financial risk prevention mechanism. GFPP mainly affects green technology innovation (GTI) and industrial structure optimization (ISO) through financing function, cost internalization function, and information transmission function. The improvement of ISO and GTI may improve productivity, reduce energy consumption, and thus improve TFEE. The implementation of GFPP provides us with a quasi-natural experiment to analyze the impact of green finance on TFEE through a difference-in-difference (DID) model. So far, GFPP has been in operation for 5 years. Can it improve TFEE by promoting GTI and ISO in pilot provinces? Under the background of green economy development and low-carbon energy transformation, studying the impact of GFPP on TFEE can provide theoretical support for China to optimize the green financial system, improve TFEE, and achieve green development. Our study also can provide reference for other countries in the world to use financial tools to improve TFEE, so as to promote the sustainable development of global energy.

We empirically studied the effect of GFPP on TFEE, and found that GFPP mainly improves TFEE through ISO and GTI. The marginal contributions of our study can be summarized as follows: First, based on the data of prefecture-level Chinese cities, the effect of GFPP is examined from the perspective of TFEE, which enriches relevant empirical studies on GFPP. Second, we exploit the exogenous event of the establishment of GFPP as quasi-natural experiment. And the extensive robustness tests helps to alleviate the interference of endogeneity problems and provide reliable empirical evidence for the impact of GFPP on TFEE. Last, the influence mechanism and heterogeneity effect of GFPP are further investigated while assessing the impact of GFPP on TFEE.

2 Literature review

Our study relates to two strands of research. The first strand mainly investigates the impacts of economic and social variables on energy efficiency, whereas the second one mainly evaluates the effects of the green finance policy. In the first category, scholars have found that technological progress, factor market distortion, foreign trade, industrial structure, trade openness degree, digital economy and energy consumption structure have impacts on TFEE. With the strengthening of resource and environmental constraints and the continuous improvement of energy and environmental policies, some studies have begun to explore the causal relationship between environmental policies and TFEE. For example, based on a survey of companies, Kasper (2015) investigated the causal link between Danish’s environmental regulation and TFEE. They found that due to the ambiguity of the government environmental regulatory framework, it was unable to provide appropriate guidance for local officials in pollution regulation and energy efficiency improvement. Fossati et al. (2016) took Brazil’s environmental laws and regulations as research objects and found that strict environmental laws and regulations have significantly promoted TFEE improvement. Zhou and Qi (2022) calculated the TFEE of China’s 280 cities from 2006 to 2016 and revealed that carbon trading pilot market can significantly promote the improvement of TFEE. Zhang and Song (2021) measured the TFEE of China’s interprovincial metal subindustry and claimed that the relationship between a market-based environmental regulation and TFEE is an inverted U-shaped. Wu et al. (2021) calculated the environmental regulation intensity index of 30 provinces in China from 2006 to 2016 and argued that an environmental regulation can improve TFEE. Based on the data of green TFEE of China’s 281 cities, Zhao et al. (2022)find that digital economy can significantly reduce green TFEE.

By sorting out research on GFPP, the number of relevant studies about the effect of GFPP is limited. In terms of qualitative research on the green finance policy, Chiara and Carlo (2015) discussed how to reduce the risk of the green finance policy through the national policy. Carolyn (2017) discussed issues related to government green subsidy policies. Megan and Stephen (2019) only discussed the situation where the green climate fund faces a significant reduction in funding sources. In terms of empirical research on China’s green finance policy, Shi et al. (2022) and Muhammad et al. (2022) took China’s GFPP, launched in 2017, as a quasi-natural experiment and studied the impact of GFPP on corporate debt financing cost and innovation. Due to the short time since the launch of China’s GFPP, relevant research is still lacking. Our study also can refer to the line of literature that evaluated China’s green credit policy (GCP), since it has similar goals with GFPP. Liu et al. (2018b) took the GCP launched in 2012 as a quasi-natural experiment and found that GCP prompts financial institutions to adjust their credit strategies for high-polluting enterprises, thus affecting the investment structure and efficiency of these enterprises. Wang et al. (2022a) also revealed that GCP improves the green innovation quality of enterprises. Yang (2022) explored the impact of GCP on enterprise export quality by exporting data of listed enterprises. As a part of the green financial system, green bonds prices and carbon prices and their influencing factors have also been extensively studied. Scholars found that the uncertainty of economic policies, energy prices, carbon market concerns, etc. have a significant impact on carbon prices and green bonds prices (Duan et al., 2021; Ren et al., 2022a; Ren et al., 2022b; Wang et al., 2022b; Wen et al., 2022; Zhao and Wen, 2022; Zheng et al., 2022). By sorting out the main research context of green finance, we find that with the optimization of China’s green finance system, a mismatch remains between policy research and evaluation in green finance policy research; a timely evaluation and summary of policy implementation effectiveness, which is not conducive to the later policy improvement and formulation, is also lacking. In addition, only a few studies have scientifically analyzed the effect mechanism of GFPP on TFEE, and related empirical research is relatively scarce.

3 Theoretical analysis

3.1 Impact of green finance pilot policy on total factor energy efficiency

First, like traditional finance, the most basic function of green finance is to allocate financial resources. The main difference is that green finance directs capitals to environment-friendly and energy efficient enterprises so as to fuel sustainable growth, whereas traditional finance favors large enterprises with good qualifications. By directing capital flows to the environmental protective industry through green credit, green bond, and green fund, GFPP aims at promoting environmental protection in the process of industrial development (Yang and Zhang, 2022). GFPP helps to ease the credit constraint of environmentally friendly firms. Besides, it also sends a strong signal to capital providers to incorporate environmental performance into consideration when making investment decisions. Therefore, heavily polluted and inefficient enterprises are under higher pressure of capital constraint after the implementation of CGPP, which further push them to actively seek change. When facing bankruptcy risk due to limited capital, enterprises must adjust their product structures, reduce or give up highly polluting products, and shift their production capacity to environmentally friendly products, and finally realize internal transformation to regain green funds (Yang, 2022). Enterprises make the whole industry close to the environment-friendly and efficient industry by optimizing product structure and thus forming an elimination mechanism in the whole economy and society, giving rise to environment-friendly enterprises and promoting TFEE. In addition, the appearance of environmentally friendly and efficient enterprises intensify competition as the public pays increasing attention to environmental production. In a fiercely competitive environment, companies extract excess surplus value to obtain profit and scramble to raise the technology level to further improve production efficiency and TFEE.

Second, under GFPP management, the government and the market work together to internalize enterprise pollution cost. In the past, the costs of high-polluting enterprises were mainly production and operation costs. Now, in response to GFPP requirements, high-polluting enterprises have to bear another two new costs, namely, pollution control and financing costs. Pollution control cost refers to the cost that enterprises pay to reduce the environmental pollution and prevent negative external effect spillover to create a good development environment for other enterprises around. Since high-polluting enterprises are rejected from the opportunity to obtain funds that are dedicated to green firms and enjoy preferential green policies, they have to pay higher interests than the green firms. And this premium is financing cost (Liu and Xiong, 2022). Both of these two additional costs caused by GFPP pose constraint on firms’ production expansion. High-polluting enterprises can only reduce polluting product production, but in this way, profits are reduced. Therefore, enterprises are forced to improve the technical level to speed up production and increase product quantity (Qi et al., 2021), which directly leads to TFEE improvement.

Finally, GFPP not only affects enterprise capital and cost but also enterprise investment decision by policy signals (Shi et al., 2022). GFPP implementation is a signal to major enterprises that the environmental protection industry receives policy support. Enterprises and governments in socialist countries have maintained delicate relationships; enterprises always adjust their production structures to comply with government policies. After the implementation of policies conducive to the environmental protection industry, policy signals can attract a large number of entrepreneurs to enter the environmental protection industry and expand the market share of environmental protection enterprises, so that high-efficiency enterprises occupy a larger proportion in the market than before. In addition, the signal of government support for the environmental protection industry attracts the attention of investors, causing an influx of capital into this sector (Zhang et al., 2022). This signal also makes the financing of polluting industries more difficult than before, forces them to transform their industrial structures, and ultimately improves TFEE.

To sum up, this study proposes the following hypothesis: China’s GFPP can improve TFEE.

3.2 Impact mechanism of green finance pilot policy on total factor energy efficiency

Authorities’ intention to develop green finance raise financial institution awareness in incorporating firms’ environmental risks into their investment decision. Heavily polluted enterprises are more likely to be regulated and thus in higher risks. Financial institution will be more cautious about allocating funds to these firms, and thus curb the blindly expansion of these enterprises. Therefore, the GFPP generates huge external pressure on highly polluting enterprises and stimulates enterprises to actively engage in transition, while strengthening GTI is a critical way to achieve this purpose. GTI improvement leads to TFEE improvement (Chen et al., 2022). Due to the large amount of capital required for a green technology project, ensuring the long-term stable supply of capital flow only by relying on an enterprise’s own fund is difficult, so external funds are needed (Qi et al., 2021; Zhou and Wang, 2022). Benefiting from GFPP, enterprises can obtain external support through green credits, green bonds, and other channels to make up for the short board of the capital chain and help technological breakthrough with stable R&D investment. In some pilot areas, the government has implemented a partial guarantee mechanism. Eligible projects and quality enterprises, but lacking collateral security, are guaranteed by the government. This practice has achieved credit enhancement, broken through financing difficulties from the root, improved enterprise willingness to independent R&D, and ultimately promoted TFEE improvement.

For energy efficient industries, GFPP can support green industry development by expanding financing channels (Chen et al., 2019). For high energy-intensive industries, GFPP increase their financing costs, intensify financing constraints, and curb energy-consuming enterprise investments (Zhang, 2021). The GFPP accelerates green transformation through financing punishment and investment inhibition effects, improves unit resource output levels, and then improves TFEE. In addition, GFPP affects social expectations by releasing policy signals, guides social funds to green and innovative industries, upgrades industrial structures (Yan et al., 2022), and ultimately promotes TFEE improvement.

Therefore, this paper further proposes the second hypothesis: GFPP mainly affects TFEE through ISO and GTI.

4 Research design

4.1 Model

4.1.1 Difference-in-difference model

Following Muhammad et al. (2022), we employ the DID method to explore the relationship between GFPP and TFEE. We take five pilot provinces, which have established GFPP, as the treatment group. We use the following model to guide our empirical analysis:

where subscripts i, t represent city and year, respectively. treat×post represents GFPP, and treat is the dummy variable of the pilot area. The pilot area takes 1 and the nonpilot area takes 0. post refers to the dummy variable of the establishment time of GFPP. It equals to 1 when

4.1.2 Mediation effect model

We use the mediation effect model to test whether GFPP can improve TFEE through GTI and ISO.

Explanatory variable Med refers to GTI and ISO in Eqs 2, 3, respectively. Through the significance of β1, λ1, and λ2, we can test the mediating effects of GTI and ISO.

4.1.3 Parallel trend test model

A presumption of DID specification is parallel trend, which means no systematic difference exists in the TFEE trend between pilot and nonpilot areas before the implementation of GFPP or if a difference exists, then the difference is fixed. We employ the following model to test the parallel trend.

where postt is the dummy variable of the year. If the year is 2012, then post 2012 = 1, and the rest are 0. If

4.2 Sample selection and variable definition

4.2.1 Sample selection

We take the panel data of 280 prefecture-level cities in China from 2008 to 2019 as sample and set 2017–2019 as the implementation year of GFPP. In terms of the division of treated and control groups, we consider the cities under the jurisdiction of the five pilot provinces as the treats group, whereas the others as control group. The sample data are mainly from the China City Statistical Yearbook. All price data are deflated on the basis of 2008.

4.2.2 Variable definition

TFEE: According to the methods of Wu et al. (2020) and Zhou and Qi (2022), our study uses the super-efficiency slack-based measure-undesirable model to calculate TFEE. We select labor, capital, and energy as input; gross regional product as desirable output; and industrial sulfur dioxide, industrial smoke, and industrial wastewater as undesirable output. Due to the lack of energy consumption data in cities, according to Cheng et al. (2019), Zhou and Qi (2022), we take the total electricity consumption as the proxy indicator of energy consumption.

GTI: Drawing on the practice of Wang et al. (2022a), when measuring the GTI level, we manually collate the number of green patents granted in each city on the basis of the green patent IPC classification number published by WIPO. The number of green patents granted is taken as the index to measure GTI.

ISO: According to the methods of Cheng et al. (2019), ISO is the percentage of the added value of the secondary industry in the added value of the tertiary industry.

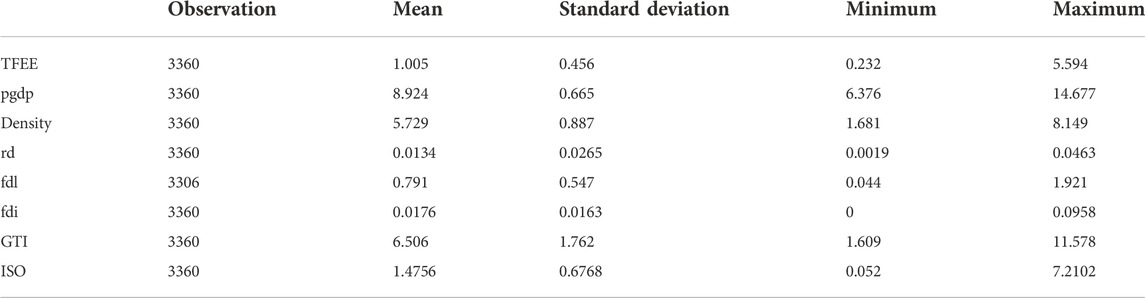

Control variables: Population density (density) is obtained by dividing the populations of cities by the areas of administrative regions and taking the logarithm; Per capita gross regional product (pgdp) is obtained by dividing the gross regional product of each city by the total population and taking the logarithm; research and development (R&D) intensity (rd): the ratio of urban scientific and technological expenditure to fiscal expenditure; foreign direct investment (fdi): the ratio of foreign direct investment to GDP; financial development level (fdl): the ratio of the loan balance of a financial institution to GDP. The descriptive statistics of variables are presented in Table 1.

5 Empirical results

5.1 Difference-in-difference results

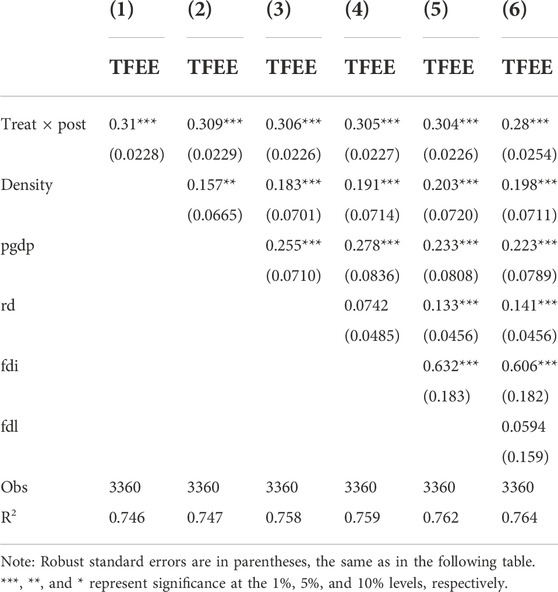

We estimate the impact of GFPP on TFEE through Model 1. The DID coefficients from the first to sixth columns of Table 2 have little differences and are significantly positive at 1%. Thus, GFPP can significantly improve TFEE. Following the macro guidance and combining with the local reality, the local governments in each pilot area have successively issued various effective measures to explore policies and promote green development. Financial resource allocation has first driven the optimization of other resource element allocation and then improved TFEE.

5.2 Robustness test

5.2.1 Parallel trend and counterfactual test

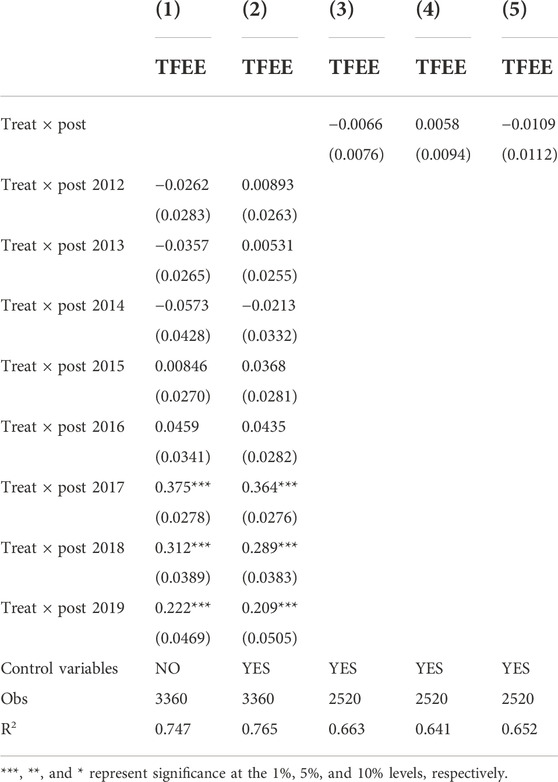

We conduct a parallel trend test according to Model (4). Before the GFPP implementation in 2017, the DID coefficients in the first and second columns of Table 3 were insignificant. After GFPP implementation, the DID coefficients in the first and second columns of Table 3 have become significantly positive. That is, the parallel trend test is passed. Subsequently, we perform a counterfactual test. We assume that the establishment periods of GFPP were in 2014, 2015, and 2016. Then, we remove the samples in 2017 and later conduct regression according to Model (1). The DID coefficients from the third to fifth columns of Table 3 are insignificant, which means that the counterfactual test is passed.

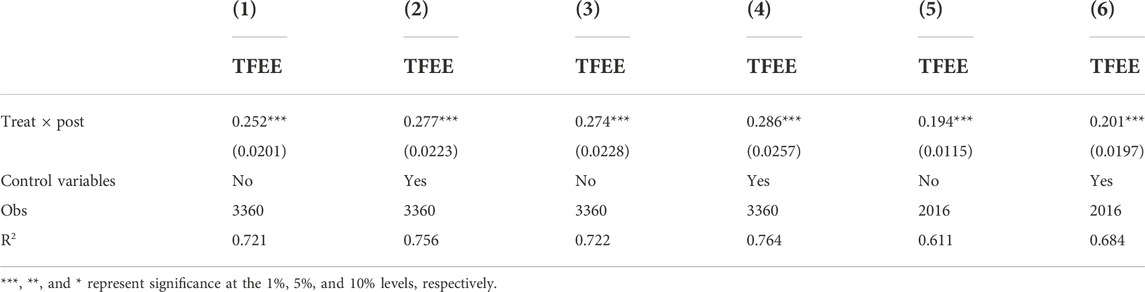

5.2.2 Climate and energy policy effect elimination

To reduce greenhouse gas emissions during the GFPP process, China has implemented some climate policies at province and city levels. For example, China’s seven provinces implemented a carbon trading pilot policy in 2013. To eliminate the interference of the province-level climate policy, we add the cross-multiplication term of province fixed effect and year fixed effect to Model (1) according to Zhou and Qi (2022). The DID coefficients in the first and second columns of Table 4 are still significant. At the city level, China implemented the low-carbon city pilot policy covering 87 cities from 2010 to 2017. To eliminate the interference of the city-level climate policy, we add the cross-multiplication term of city fixed effect and year fixed effect to Model (1). The DID coefficients in the third and fourth columns of Table 4 remain significant at 1% level.

During the GFPP process, China has implemented heterogeneous energy policies on the basis of the resource endowments of different regions. For example, new-energy provinces in the west (Ningxia, Gansu, Yunnan, Qinghai, and Xinjiang) have significant advantages in developing new energy. China has implemented supportive policies for new energy development in the west. In some large coal provinces (Jiangsu, Inner Mongolia, Shandong, Hebei, Shanxi, Henan, and Shaanxi), China has implemented energy-saving policies focusing on improving TFEE in these regions. Therefore, we exclude the sample large coal consumption provinces and western new-energy provinces to strip the interference of energy policies on TFEE. The DID coefficients in the fifth and sixth columns of Table 4 are significant at 1% level.

5.2.3 Propensity score matching–difference-in-difference estimation

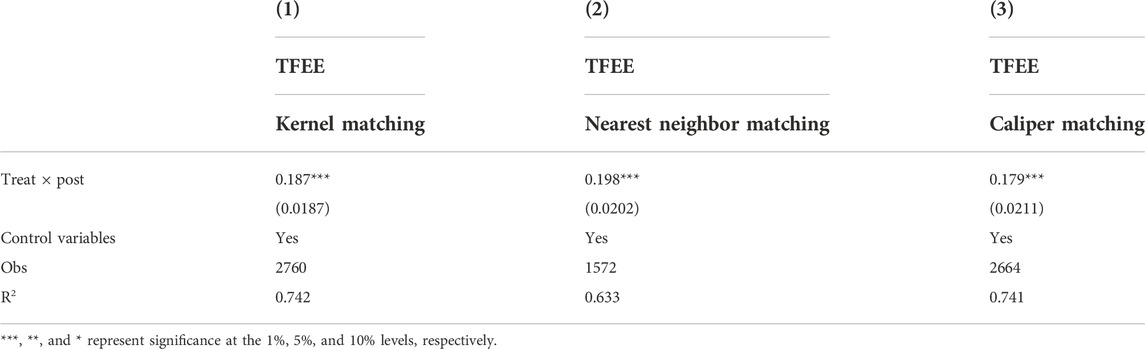

The resource endowments and economic levels of the research samples in this study are quite different, which makes the DID method have selective bias. The DID method may not ensure that the samples of treatment and control groups have the same individual characteristics before GFPP implementation. Therefore, we combine propensity score matching (PSM) with the DID model and use the recognition features of kernel, nearest neighbor, and caliper matching methods to match the samples of treatment and control groups. Subsequently, we regress the matched samples according to Model (1). The results of the balance test of PSM are shown in Supplementary Appendix SA1. The DID coefficients from the first to third columns in Table 5 are significant at 1%.

5.3 Influencing mechanism

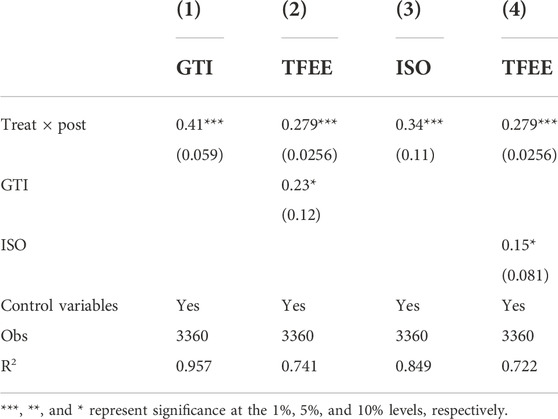

We analyze the mediating effect of GTI based on Models (2) and (3). DID and GIT coefficients in the first and second columns of Table 6 are significant at 10%, indicating that GTI is the mediating variable for GFPP to improve TFEE. We analyze the mediating effect of ISO according to Models (2) and (3). The DID and ISO coefficients in the third and fourth columns of Table 6 are significant at 10%, suggesting that ISO is the mediating variable for GFPP to improve TFEE.

5.4 Heterogeneity analysis

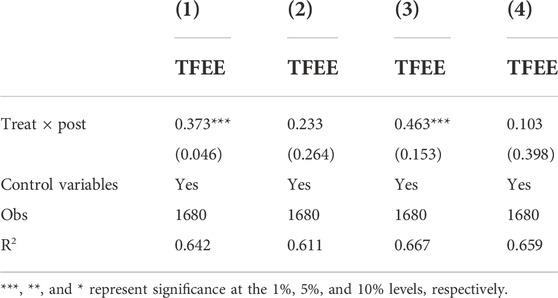

We analyze the heterogeneous effect of GFPP on TFEE in regions with different environmental protection law enforcements (EPLEs). Specifically, we calculate EPLEs in different regions on the basis of the per capita pollution charge in each province according to Bao et al. (2013), Wang and Wang (2021). Based on the median of the regional EPLE in that year, if the regional EPLE is higher than the median, then it is a EPLE area; otherwise, it is weak. The first column of Table 7 presents the results in areas with strong EPLEs, and the DID coefficient is significant at 1%. The second column shows the results in areas with weak EPLEs, and the DID coefficient is insignificant. Thus, GFPP can promote TFEE improvement in regions with strong EPLEs. GFPP effectiveness needs the support of relevant environmental laws. That is, strengthening environmental laws can promote local enterprises to reduce pollution emissions and increase GTI. When the GTI level in a pilot area is improved, TFEE is improved.

Next, we analyze the heterogeneous effect of GFPP on TFEE under different intellectual property right protection intensity (IPRPI) levels. We use the patent non-infringement ratio in each region to measure IPRPI. The ratio is 1 minus the number of patent infringement disputes in each region divided by the number of authorized patents. The greater the patent non-infringement ratio, the better the IPRPI. On the basis of the median value of local IPRPI in that year, we divide the samples of regions with strong and weak intellectual property protection levels. We successively regress them according to Eq. 1. In Table 7, the third column presents the results of regions with strong IPRPI levels, and the DID coefficient is significant; meanwhile, the fourth column shows the results of regions with weak IPRPI levels, and the DID coefficient is insignificant. Therefore, in regions with strong IPRPI levels; GFPP can promote TFEE improvement. As an important institutional arrangement to protect innovative enterprise achievements, the incentive role of intellectual property protection has been confirmed by existing literature. When the local intellectual property protection is strong, local enterprises have high innovation enthusiasm, which is reflected in high R&D investment and innovation output, thus driving TFEE improvement. On the contrary, the greater the degree of intellectual property infringement, the more negative the enterprise innovation performance and the more insignificant the impact on TEFF.

6 Conclusion, policy implications, and limitations

6.1 Conclusion

We analyze the impact of GFPP on TFEE through a DID model and various robustness and mediating effect tests to draw the following main conclusions: 1) GFPP implementation can significantly improve TFEE, and various robustness tests reveal that our results are reliable. 2) At this stage, GFPP mainly improves TFEE through industrial structure optimization and green technology innovation. 3) Compared with cities with weak EPLEs, GFPP can improve the TFEE of cities with strong EPLEs; Compared with cities with weak IPRPI levels, GFPP can improve the TFEE of cities with strong IPRPI levels.

6.2 Policy implications

We propose the following policy recommendations according to our conclusions.

First, GFPP implementation can significantly improve TFEE. The Chinese government should expand the GFPP scope, further improve green finance practical ability, and gradually promote the pilot experience to the whole country. At the same time, China needs to strengthen cooperation with other countries in the field of green finance, actively publicize and promote China’s green finance policies, expand China’s green development requirements to investment and construction of the Belt and Road Initiative, and promote the promotion and landing of green finance in the world.

Second, the Chinese government must guide green funds to support GTI and promote intelligent energy utilization. It must also accelerate new energy and Internet technology integration and innovation, strengthen micro-energy network and energy Internet construction, reduce the loss caused by long-distance energy transmission, implement energy cascade utilization, and improve comprehensive energy utilization efficiency in China.

Third, Chinese financial institutions should deeply develop universally applicable green consumer financial products to form long-term demands for green financial development. The focus of China’s energy demand is gradually shifting to the consumer side, but consumer decisions are largely affected by financial choices. Therefore, financial institutions can use the existing e-commerce platform to analyze and evaluate the big data of green consumption willingness and ability, strengthen innovation in the consumer finance field, develop universally applicable green consumer financial products, and thus enhance green finance penetration and influence.

Last, the Chinese government should promote long-term demand formation for green financial development, drive social green production engine in terms of source power, and promote TFEE improvement.

6.3 Limitations

In the theoretical analysis, this paper does not empirically study the impact mechanism of GFPP on TFEE from the scale effect, technology effect and structure effect. We will conduct research from the above three channels in the future. Due to the lack of indicator data to measure green finance at the city level, we can only study the impact of green finance on TFEE through GFPP. In the future, we will look for proxy variables of green finance and explore the impact of green finance on TFEE from provincial level sample data.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://data.cnki.net/statisticalData/index?ky=%E4%B8%AD%E5%9B%BD%E5%9F%8E%E5%B8%82%E7%BB%9F%E8%AE%A1%E5%B9%B4%E9%89%B4&IsSubcribe=0.

Author contributions

CZ: Conceptualization; Writing-Original draft preparation; Methodology; Writing—Review and Editing. QS: Funding acquisition; Supervision. LY: Data curation; Formal analysis; Methodology; Writing-Original draft preparation; Writing—Review and Editing.

Funding

This work was supported by the Major Program of National Social Science Foundation of China (No. 18ZDA107).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenrg.2022.1076050/full#supplementary-material

References

Bao, Q., Shao, M., and Yang, D. L. (2013). Environmental regulation, provincial legislation and pollution emission in China. Econ. Res. J. 12, 42–54.

BP (2018). BP statistical Review of world energy 2018[R/OL], Available at: http://www. bp. com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html.

Carolyn, F. (2017). Environmental protection for sale: Strategic green industrial policy and climate finance. Environ. Resour. Econ. 66 (3), 553–575. doi:10.1007/s10640-016-0092-5

Chen, H., Qi, S. Z., and Tan, X. J. (2022). The improvement pathway for industrial energy efficiency under sustainability perspective. Sustain. Energy Technol. Assessments 51, 101949. doi:10.1016/j.seta.2022.101949

Chen, J. W., Jiang, N. P., and Xin, Li (2019). Basic logic, optimal boundary and orientation choice of green finance. Reform 7, 119–131.

Chen, Z., Song, P., and Wang, B. (2021). Carbon emissions trading scheme, energy efficiency and rebound effect—evidence from China's provincial data. Energy Policy 157 (7), 112507. doi:10.1016/j.enpol.2021.112507

Cheng, J. H., Yi, J. H., Dai, S., and Xiong, Y. (2019). Can low-carbon city construction facilitate green growth? Evidence from China's pilot low-carbon city initiative. J. Clean. Prod. 231, 1158–1170. doi:10.1016/j.jclepro.2019.05.327

Chiara, C., and Carlo, M. (2015). Environmental policies and risk finance in the green sector: Cross-country evidence. Energy Policy 83 (08), 38–56. doi:10.1016/j.enpol.2015.03.023

Duan, K., Ren, X. H., Shi, Y. K., Mishra, T., and Yan, C. (2021). The marginal impacts of energy prices on carbon price variations: Evidence from a quantile-on-quantile approach. Energy Econ. 95, 105131. doi:10.1016/j.eneco.2021.105131

Fossati, M., Scalco, V. A., Linczuk, V. C. C., and Lamberts, R. (2016). Building energy efficiency: An overview of the Brazilian residential labeling scheme. Renew. Sustain. Energy Rev. 65, 1216–1231. doi:10.1016/j.rser.2016.06.048

Kasper, D. H. (2015). The options of local authorities for addressing climate change and energy efficiency through environmental regulation of companies. J. Clean. Prod. 98 (1), 175–184. doi:10.1016/j.jclepro.2014.12.067

Khan, H., Wei, L., and Khan, I. (2022). Institutional quality, financial development and the influence of environmental factors on carbon emissions: Evidence from a global perspective. Environ. Sci. Pollut. Res. 29, 13356–13368. doi:10.1007/s11356-021-16626-z

Li, K., Tan, X. J., Yan, Y. X., Jiang, D., and Qi, S. (2022). Directing energy transition toward decarbonization: The China story. Energy 261, 124934. doi:10.1016/j.energy.2022.124934

Liu, C., and Xiong, M. X. (2022). Green finance reform and corporate innovation: Evidence from China. Finance Res. Lett. 48, 102993. doi:10.1016/j.frl.2022.102993

Liu, X., Wang, E., and Cai, D. (2018a). Environmental regulation and corporate financing—quasi-natural experiment evidence from China. Sustainability 10, 4028. doi:10.3390/su10114028

Liu, X., Wang, E., and Cai, D. (2018b). Green credit policy, property rights and debt financing: Quasi-natural experimental evidence from China. Finance Res. Lett. 29, 129–135. doi:10.1016/j.frl.2019.03.014

Megan, B., and Stephen, M. (2019). Resilience through interlinkage: The green climate fund and climate finance governance. Clim. Policy 19 (3), 342–353. doi:10.1080/14693062.2018.1513358

Muhammad, I., Asif, R., Arshian, S., and Yang, X. (2022). Influence mechanism between green finance and green innovation: Exploring regional policy intervention effects in China. Technol. Forecast. Soc. Change 182, 121882. doi:10.1016/j.techfore.2022.121882

Qi, S. Z., Zhou, C. B., Li, K., and Tang, S. Y. (2021). Influence of a pilot carbon trading policy on enterprises' low-carbon innovation in China. Clim. Policy 1, 318–336. doi:10.1080/14693062.2020.1864268

Ren, X. H., Dou, Y., Dong, K. Y., and Li, Y. (2022a). Information spillover and market connectedness: Multi-scale quantile-on-quantile analysis of the crude oil and carbon markets. Appl. Econ. 54 (38), 4465–4485. doi:10.1080/00036846.2022.2030855

Ren, X. H., Duan, K., Tao, L. Z., Shi, Y., and Yan, C. (2022b). Carbon prices forecasting in quantiles. Energy Econ. 108, 105862. doi:10.1016/j.eneco.2022.105862

Shi, J. Y., Yu, C. H., Li, Y. X., and Wang, T. (2022). Does green financial policy affect debt-financing cost of heavy-polluting enterprises? An empirical evidence based on Chinese pilot zones for green finance reform and innovations. Technol. Forecast. Soc. Change 179, 121678. doi:10.1016/j.techfore.2022.121678

Su, C. W., Li, W. H., Muhammad, U., and Lobont, O. R. (2022). Can green credit reduce the emissions of pollutants? Econ. Analysis Policy 74, 205–219. doi:10.1016/j.eap.2022.01.016

Wang, H. T., Qi, S. Z., Zhou, C. B., Zhou, J., and Huang, X. (2022a). Green credit policy, government behavior and green innovation quality of enterprises. J. Clean. Prod. 331, 129834. doi:10.1016/j.jclepro.2021.129834

Wang, X., Li, J. Y., and Ren, X. H. (2022b). Asymmetric causality of economic policy uncertainty and oil volatility index on time-varying nexus of the clean energy, carbon and green bond. Int. Rev. Financial Analysis 83, 102306. doi:10.1016/j.irfa.2022.102306

Wang, X., and Wang, Y. (2021). Research on the green innovation promoted by green credit policies. J. Manag. World 37 (6), 173–189.

Wen, F. H., Zhao, H. C., Zhao, L. L., and Yin, H. (2022). What drive carbon price dynamics in China? International Review of financial. Int. Rev. Financ. Anal. 79, 101999. doi:10.1016/j.irfa.2021.101999

Wu, H., Hao, Y., and Ren, S. (2020). How do environmental regulation and environmental decentralization affect green total factor energy efficiency: Evidence from China. Energy Econ. 91, 104880. doi:10.1016/j.eneco.2020.104880

Wu, H., Hao, Y., Ren, S., Yang, X., and Xie, G. (2021). Does internet development improve green total factor energy efficiency? Evidence from China. Energy Policy 112247, 112247. doi:10.1016/j.enpol.2021.112247

Yan, C., Mao, Z. C., and Ho, K. C. (2022). Effect of green financial reform and innovation pilot zones on corporate investment efficiency. Energy Econ. 113, 106185. doi:10.1016/j.eneco.2022.106185

Yang, G. (2022). Can the green credit policy enhance firm export quality? Evidence from China based on the DID model. Front. Environ. Sci. 969726. doi:10.3389/fenvs.2022.969726

Yang, Y., and Zhang, Y. L. (2022). The impact of the green credit policy on the short-term and long-term debt financing of heavily polluting enterprises: Based on PSM-DID method. Int. J. Environ. Res. Public Health 19, 11287–11318. doi:10.3390/ijerph191811287

Zhang, A. X., Deng, R. R., and Wu, Y. F. (2022). Does the green credit policy reduce the carbon emission intensity of heavily polluting industries? -Evidence from China's industrial sectors. J. Environ. Manag. 331, 114815. doi:10.1016/j.jenvman.2022.114815

Zhang, D. (2021). Green credit regulation, induced R&D and green productivity: Revisiting the Porter Hypothesis. Int. Rev. Financial Analysis 75, 101723. doi:10.1016/j.irfa.2021.101723

Zhang, Y., and Song, Y. (2021). Environmental regulations, energy and environment efficiency of China’s metal industries: A provincial panel data analysis. J. Clean. Prod. 280, 124437. doi:10.1016/j.jclepro.2020.124437

Zhao, L. L., and Wen, F. H. (2022). Risk-return relationship and structural breaks: Evidence from China carbon market. Int. Rev. Econ. Finance 77, 481–492. doi:10.1016/j.iref.2021.10.019

Zhao, S. Q., Peng, D. Y., Wen, H. W., and Wu, Y. (2022). Nonlinear and spatial spillover effects of the digital economy on green total factor energy efficiency: Evidence from 281 cities in China. Environ. Sci. Pollut. Res. Int. 8, 1–21. doi:10.1007/s11356-022-22694-6

Zheng, Y., Wen, F. H., Deng, H. S., and Zeng, A. (2022). The relationship between carbon market attention and the EU CET market: Evidence from different market conditions. Finance Res. Lett. 50, 103140. doi:10.1016/j.frl.2022.103140

Zhou, C. B., Li, Y. K., and Sun, Z. X. (2022). Has the carbon trading pilot market improved enterprises' export green-sophistication in China? Sustainability 14, 10113. doi:10.3390/su141610113

Zhou, C. B., and Qi, S. Z. (2022). Has the pilot carbon trading policy improved China's green total factor energy efficiency? Energy Econ. 114, 106268. doi:10.1016/j.eneco.2022.106268

Zhou, C. B., Qi, S. Z., Zhang, J. H., and Tang, S. y. (2021). Potential Co-benefit effect analysis of orderly charging and discharging of electric vehicles in China. Energy 226, 120352. doi:10.1016/j.energy.2021.120352

Keywords: green finance pilot policy, total factor energy efficiency, industrial structure optimization, green technology innovation, environmental protection enforcement, intellectual property protection

Citation: Zhou C, Shaozhou Q and Yuankun L (2023) China’s green finance and total factor energy efficiency. Front. Energy Res. 10:1076050. doi: 10.3389/fenrg.2022.1076050

Received: 21 October 2022; Accepted: 22 November 2022;

Published: 13 January 2023.

Edited by:

Xiaohang Ren, Central South University, ChinaCopyright © 2023 Zhou, Shaozhou and Yuankun. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Chaobo Zhou, emhvdWNoYW9ib0B3aHUuZWR1LmNu

Chaobo Zhou

Chaobo Zhou Qi Shaozhou3

Qi Shaozhou3