94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Energy Res., 11 January 2023

Sec. Sustainable Energy Systems

Volume 10 - 2022 | https://doi.org/10.3389/fenrg.2022.1032000

This article is part of the Research TopicCritical Energy Minerals: A Material Enabler for Carbon NeutralityView all 17 articles

Energy storage technology as a key support technology for China’s new energy development, the demand for critical metal minerals such as lithium, cobalt, and nickel is growing rapidly. However, these minerals have high external dependence and concentrated import sources, increasing the supply risk caused by geopolitics. It is necessary to evaluate the supply risks of critical metal minerals caused by geopolitics to provide a basis for the high-quality development of energy storage technology in China. Based on geopolitical data of eight countries from 2012 to 2020, the evaluation indicators such as geopolitical stability, supply concentration, bilateral institutional relationship, and country risk index were selected to analyze the supply risk of three critical metal minerals, and TOPSIS was applied to construct an evaluation model for the supply risk of critical metal minerals of lithium, cobalt, and nickel in China. The results show that from 2012 to 2017, the security index of cobalt and lithium resources is between .6 and .8, which is in a relatively safe state, while the security index of nickel resources is .2–.4, which is in an unsafe state. From 2017 to 2020, lithium resources remain relatively safe, and the security index of nickel has also risen to between .6 and .7, which is generally in a relatively safe state. However, the security index of cobalt has dropped to .2, which is in an unsafe or extremely unsafe state. Therefore, China needs to pay attention to the safe supply of cobalt resources and formulate relevant strategies to support the large-scale development of energy storage technology.

With the advancement of the global low-carbon energy transition, many countries have increasingly realized that there is an important relationship between “critical metals” and “low-carbon energy” (Wang et al., 2021). Critical metal minerals are mostly in the form of symbiotic or associated minerals (Peiró et al., 2013), with the slow expansion of production capacity (Ali et al., 2017), unbalanced geographical distribution, and high concentration, which are easy to cause competition, conflict, or even war, and have great geopolitical risks. Suppliers of critical metal minerals could gain geopolitical leverage by cutting supplies (Habib et al., 2016). In particular, climate change has caused a new global energy governance pattern, and the supply chain security of minerals needed for the low-carbon energy transition has become a strategic issue (Wang et al., 2012; Wang et al., 2014; Chao et al., 2016; Wang et al., 2016). Under this circumstance, the secure supply of critical metals will become a decisive factor affecting the future development of new energy technologies (Wu et al., 2020).

The efficient energy storage technology, which requires several kinds of critical metals, is expected to well solve the problem caused by photovoltaic power generation and wind power generation characterized by strong intermittency and high volatility. Lithium-ion batteries with low cost, high efficiency, and fast response time are ahead of other energy storage technologies (Li et al., 2022). Future energy storage technologies will focus on the development of lithium-ion batteries. The upstream raw materials of the lithium battery supply chain mainly include the mining, production, and refining of lithium, cobalt, and nickel resources. With the expansion of the lithium battery development scale, the demand for lithium, cobalt, and nickel also increases (Eggert, 2011; Zhai et al., 2019).

The future development of energy storage technology will continue to be limited by critical metal minerals. Previous studies concerning the geopolitical supply risk of critical metal minerals still need to be improved to cover energy storage technologies. The geopolitical competition for these critical mineral resources is fierce, and the supply risks caused by the geopolitical risks will also increase (Wang, 2019). However, the existing geopolitical supply risk assessment methods lack a full range of indicators, such as political, economic, financial, trade, and others. For instance, Graedel et al. (2012) proposed the geopolitical supply risk of critical minerals with the worldwide governance indicator and the global supply concentration indicator. Habib et al. (2016) selected the HHI indicator to estimate the geopolitical supply risk of metals. There are also some studies that summarize the strategic planning of critical metal minerals in typical countries to provide reference for formulating relevant policies (Mao et al., 2019; Zhang et al., 2019; Yu and Yang, 2020). In addition, it is predicted that China’s demand for lithium, cobalt, nickel, and other minerals will grow rapidly, which is highly dependent on foreign countries. In 2020, China’s external dependence on cobalt, nickel, and lithium resources was 97%, 92%, and 72%, respectively (Cheng et al., 2022). Precisely, 80% of China’s cobalt resources are from the Democratic Republic of the Congo, and lithium is mainly from Australia. 82% and 9% of imported nickel resources are from the Philippines and Indonesia as well (Wang, 2022). It is urgent need to create a comprehensive and multi-perspective assessment of the geological risks of critical metal minerals supplied to energy storage technology in China, considering the increasingly complex international political and economic situation.

The study aims to assess the geopolitical supply risk of three critical metal minerals (lithium, cobalt, and nickel) used in energy storage technologies, and a full spectrum with multiple indicator perspectives is taken into account. Indeed, this paper will: 1) establish a risk assessment method for the geopolitical supply risks of critical minerals, including single factor analysis and comprehensive assessment; 2) analyze the political, economic, and financial risks in critical mineral source countries through the national governance index and country risk index based on the single factor perspective; 3) evaluate China’s trade risk with mineral source countries by the supply concentration index and the institutional distance index also based on the single factor perspective; 4) integrate the geopolitical assessment model to comprehensively assess the supply risk of lithium, cobalt, and nickel resources in China based on the comprehensive perspective; 5) put forward several policy suggestions based on the geopolitical supply risk of China’s imported critical minerals, considering the tendency of electrochemical energy storage technology in the future.

In recent years, countries worldwide have been paying more and more attention to energy transformation and the deployment of new energy industries. This process consumes a lot of metal resources and is very dependent on critical metal minerals (Vidal et al., 2013). The World Bank report shows that the production of minerals such as lithium, cobalt, nickel, and graphite will increase by nearly 500% by 2050 to meet the growing demand for clean energy technologies (World Bank, 2020). The International Energy Agency also points out that the global energy system’s demand for critical minerals could increase sixfold by 2040 (International Energy Agency, 2022). By 2050, most of the growth in global energy demand will come from renewable energy and clean energy technologies, which in turn will drive exponential growth in global demand for critical minerals such as lithium, cobalt, nickel and rare Earth elements.

The rapid growth in demand for critical mineral resources has strengthened the deep-rooted concept of resource scarcity in the oil and gas era, prompting countries to pay more attention to the security of the cross-border supply of mineral resources. The geopolitical disputes related to critical metal minerals have already emerged, and their geopolitical impact will increase daily. Therefore, it is necessary to pay attention to the geopolitical risk characteristics and development trends of critical metal minerals and identify geopolitical risk factors that may affect critical minerals.

Critical mineral resources are geographically concentrated in a few specific countries and regions. In 2022, global cobalt reserves are about 7.6 million tons, mainly concentrated in the Democratic Republic of the Congo, Australia, and Cuba, which account for 71% of global cobalt reserves. Global proven lithium reserves are about 22 million tons, mainly concentrated in Chile, Australia, and Argentina, and 2/3 of the lithium reserves are located in the “lithium triangle” of Latin America; global proven nickel reserves are more than 95 million tons, mainly concentrated in Indonesia, Australia and Brazil, which together account for 61% of the total global reserves (USGS, 2022).

According to the “Global Risk Report” released by the World Economic Forum, geopolitical risk has always been one of the five significant risks affecting global development (World Economic Forum, 2019). In addition, non-geographic factors have also caused geopolitical changes, especially the rapid development of renewable energy has led to new changes to the geopolitical pattern (Daniel and Rick, 2016).

Influenced by the global resource supply and demand pattern, and the evolution of the competition pattern, the global governance system of strategic resources is in the process of continuous evolution. Extreme geopolitical events led by states are constantly affecting the supply chains of the global resource system. Geopolitics is an important factor affecting the sustainable supply of critical minerals at present (Hayes and Mccullough, 2018). Developed countries and economies such as the United States, the European Union, and Japan have promulgated lists of critical materials or critical minerals (National Research Council, 2008; European Commission, 2014; Wang et al., 2017), and the field has become an arena for the world’s gaming.

For China, the critical mineral geopolitical risks are characterized as follows.

1) Some critical mineral resources are geographically concentrated in several specific countries and regions, and are easily controlled by a few countries (Henckens et al., 2016). Critical minerals markets are vulnerable to geopolitical influence and might be at risk of supply chain disruption. Taking lithium batteries as an example, if lithium, cobalt, nickel, and other industries cannot extend downstream, they will always face the problem of being too large but not strong, and the added value of products is too low (Xu, 2020), which increases the limitations of the development of battery energy storage technology.

2) The rapid growth of critical minerals will accelerate the reshaping of the geopolitical pattern of the world’s strategic mineral resources. The International Renewable Energy Agency (IRENA) and the International Energy Agency (IEA) pointed out that suppliers of some critical mineral resources such as lithium, cobalt, nickel, and rare Earth metals could gain new geopolitical leverage by cutting off the supply of critical metals (Internatioanl Energy Agency, 2018; IRENA, 2022). With the advent of the era of electric vehicles and the smart grid, the large-scale development of battery energy storage technology is restricted by the shortage of critical mineral resources.

3) The competition between China and the United States in critical minerals will be more intense in the future. The United States Geological Survey analyzed the dependence of China and the United States on non-energy minerals, and found that both China and the United States rely heavily on imported minerals as many as 11 kinds. In the future, the two countries will likely to face fierce battles for resources in South America, Africa, and elsewhere (Gulley et al., 2018).

4) The geopolitical risk of China’s critical mineral resources is still relatively high, and its market stability is vulnerable to global populism, trade protectionism, and resource nationalism.

Through the analysis of the global distribution and geopolitical pattern of critical metal minerals, it is found that the stable supply of exporting countries and the geopolitical strategy of each country will become an important prerequisite for the supply of critical minerals. Critical metal minerals will be a limiting factor for China’s renewable energy development.

The degree of political and social stability in the world’s major resource countries has a significant impact on resource supply security, particularly in countries where resources are over-concentrated in unstable political security situations. These countries could affect the supply security of critical metal resources by controlling the supply of resources in the resource market or changing the rules of international trade in metal resources, thereby causing supply constraints and price volatility.

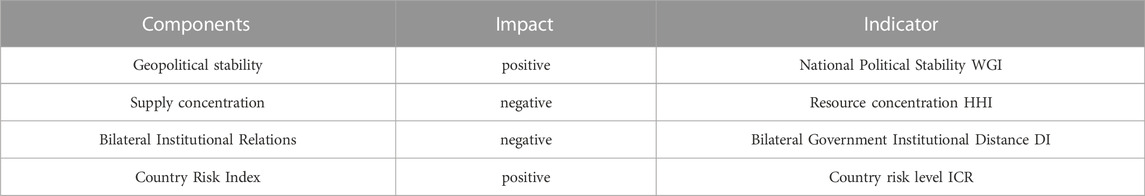

For the lithium, cobalt, and nickel imported by China, geopolitical factors have a particularly prominent impact on their safe supply, so it is necessary to conduct a risk assessment under geopolitical conditions. The supply risk evaluation indicators caused by geopolitical factors are the global governance indicators of mineral resource countries, the country risk indicators of mineral resource countries, supply concentration, and bilateral government institutional distance. The index system of geopolitics’ influence on the supply of critical minerals is shown in Table 1.

TABLE 1. Indicator system for evaluating the impact of geopolitics on the supply risk of critical metal minerals.

Institutional distance is the degree of similarity or difference between two countries regarding rules, norms, and perceptions. There are a variety of indicators to measure institutional distance, such as the Global Governance Indicators (WGI), the International Country Risk Guide (ICR), the Fragile States Index (FSI), etc. WGI has been widely used in some criticality assessments because of its rigor, high comprehensiveness, and wide coverage (Liu and Zhou, 2018). For example, the WGI index was used as a basis to estimate the country risk in the research of assessing the long-term supply risks for mineral raw materials (Rosenau-Tornow et al., 2009). The Yale team proposed a supply risk assessment system for the raw material that uses the WGI index as a geopolitical factor (Graedel et al., 2012). Based on previous research (Wang et al. 2018), considered the WGI index and HHI index to evaluate the global supply risk of critical minerals for new energy vehicles. The results showed that graphite has the greatest supply risk and selenium has the lowest supply risk in terms of WGI-PV (Political Stability, and Absence of Violence/Terrorism).

China’s import of critical metal minerals faces an increasingly complex international environment. The influence of political and social systems in exporting countries is prominent. There are African countries with low levels of government governance and political instability, and developed economies with high government effectiveness and stable domestic political situation. The institutional distance varies, and the risk of critical minerals supply is also different.

According to previous research (Xu et al., 2017; Li et al., 2020), Eq. 1 is used to measure the institutional distance between China and resource-importing countries from the six dimensions of the World Bank’s global governance index WGI.

where

The HHI, calculated as the sum of the squares of the production shares of each producing country, is a widely used indicator of market concentration. It ranges from a theoretical minimum of zero when production is evenly distributed among an infinite number of countries, to a maximum of 10,000 when all production is concentrated in one country. Combined with this market concentration indicator, it is possible to analyze whether China has multiple supplier countries to choose from or is limited to one or two major suppliers (Gulley et al., 2018). The supply of mineral resources concentrated in one or a few countries could greatly impact the supply of mineral resources once the political situation or mining policies in these countries change. The higher the concentration of critical minerals, the greater the supply risk. In this study, The Herfindahl-Hirschman Index (HHI) could be used to measure the global supply concentration of lithium, cobalt, and nickel (see Eq. 2), and then assess their geopolitical supply risks. For instance, Habib used the HHI index to measure the geopolitical supply risk of 52 metals in the world, and the results showed that the distribution of geological reserves led to the geopolitical risk of critical metal resources (Habib et al., 2016).

where HHI is the Herfindahl Hirschman index;

Table 2 shows the three levels of market concentration HHI. The higher the score, the higher the risk implied by the concentration of mineral material supply.

The supply risk evaluation indicators caused by geopolitics involve a wide range of fields, and the units and weights are not uniform. To avoid the influence of subjective factors, the entropy weight method is used for data processing. The TOPSIS method proposed by Hwang and Yoon (1981) is used to measure the distance between different data and the optimal value to evaluate the security degree of supply at different times.

The weighting matrix was firstly constructed by the entropy weighting method. Then the TOSIS model was used to evaluate the supply risk of lithium, cobalt, and nickel resources at different times.

1) Construction of evaluation index system matrix

2) The indicators are uniformly normalized according to the physical-social nature of the geopolitical data indicators.

where i is the evaluation index (i = 1,2,3,...m). j is the index year (j = 1,2,3,...n);

3) The data are normalized (eliminating the magnitude), and transformed into matrix Z.

4) Entropy weighting method to calculate weights

The information entropy

The indicator weights

5) The construction of the TOPSIS model

For the objectivity of the evaluation results, a normalized analysis matrix Q is created according to the index weights

6) Calculation of Euclidean distance between indicators

7) Comprehensive evaluation index calculation

where

8) Evaluation level

Referring to previous studies (Liu et al., 2018; Long and Yang, 2018; Sun et al., 2018; Qu et al., 2022)), the evaluation results were divided into five safety levels: extremely unsafe, unsafe, basically safe, relatively safe and safe. Since the supply risk comprehensive evaluation index ranges from 0 to 1, the larger the index, the higher the degree of security. The extremely unsafe state takes the value of 0–.2, the unsafe takes the value of .2–.4, the basic safe takes the value of .4–.6, the relative safe takes the value of .6–.8, and the safe state is .8-1.

The data on production and storage of three critical minerals, including lithium, cobalt, and nickel from 2012 to 2020 are provided by the United States Geological Survey (USGS). According to the report “MINERAL COMMODITY SUMMARIES 2022″published by USGS (USGS, 2022), mineral lithium resources are in various stages of development in Australia, Austria, Brazil, Canada, China, Democratic Republic of the Congo (DRC), Czech Republic, Finland, Germany, Mali, Namibia, Peru, Portugal, Serbia, Spain, the United States, and Zimbabwe. The DRC remains the world’s main source of mined cobalt, supplying more than 70% of the world’s cobalt minerals. The global proven nickel reserves are about 94 million tons, mainly concentrated in Indonesia, Australia, the Philippines, and Brazil, with Indonesia and the Philippines currently accounting for 45% of global nickel production.

If the political situation of a country or region is unstable, it will affect the stability of the mining production of the country. The Worldwide Governance Indicators (WGI) produced by Kaufmann and Kraay (Kaufmann et al., 2010) could be used to measure the degree of political stability. Its well-designed planning and robust continuity have attracted more and more attention from researchers and practitioners (Zang, 2012). The Worldwide Governance Indicators (WGI) project reports aggregate and individual governance indicators for over 200 countries and territories over the period 1996–2020 for six dimensions of governance: Voice and Accountability (VA), Political Stability, and Absence of Violence/Terrorism (PV), Government Effectiveness (GE), Regulatory Quality (BQ), Rule of Law (RL), Control of Corruption (CC). Each indicator adopts a percentile scale (ranked from 0 to 100) to indicate the ranking level of the country’s governance items. The higher the value, the higher the ranking of the governance level (Wang et al., 2018). The weights of the above six dimensions are .16, .25, .13, .14, .17, and .15, respectively (Cao et al., 2022). The World Governance Index calculates a score based on the weight of these six indicators, with a higher score indicating a more politically stable country. As a result, the WGI index enables cross-country and cross-time comparisons of governance levels. In the following, VA, PV, GE, BQ, RL, and CC are used to represent the six indicators.

The International Country Risk ratings (ICR) published by PRS Group over 140 countries and regions, including political risk, economic risk, and financial risk (PRS Group, 2017; Zhang, 2017). Political risk is assessed by assessing government stability, socioeconomic conditions, investment status, internal conflict, external conflict, corruption, political-military, religious tensions, law and order, ethnic tensions, and democratic accountability. Economic risk is assessed by assessing GDP per capita, real annual GDP growth, annual inflation rate, budget balance as a percentage of GDP, and current account balance as a percentage of GDP. Financial risk is assessed by assessing external debt as a percentage of GDP, external debt service as a percentage of exports of goods and services, current account as a percentage of exports of goods and services, net liquidity and exchange rate stability, and other factors. The ICR database is not only the most widely used source of risk data by universities around the world, but also used by the world’s largest institutional investors, multilateral organizations, central banks, and other institutions. All data could be found in the Supplementary Table S1.

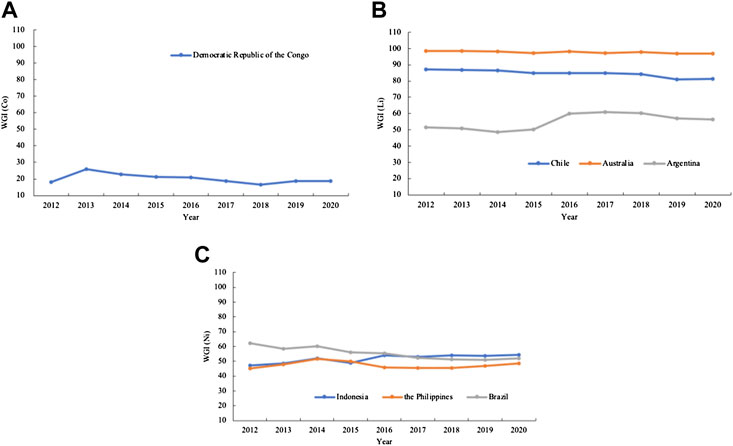

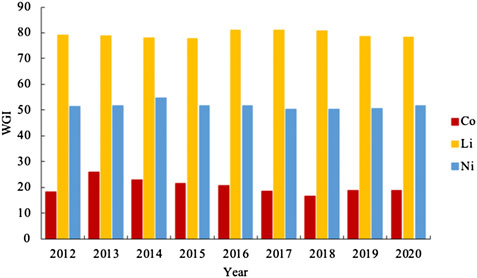

According to the Global Governance Indicator (WGI), the national governance index of the three main source countries of cobalt, lithium, and nickel is calculated (Figure 1).

FIGURE 1. Change trend of cobalt (A), lithium (B), and nickel (C) resource supply risk index based on WGI.

As can be seen from Table 3 and Figure 2, the source country of cobalt, the Democratic Republic of the Congo (DRC), has the lowest national governance index and the highest supply risk. In the process of importing cobalt resources in the future, China needs to pay close attention to the degree of social stability in DRC and pay comprehensive attention to the changes in six dimensions, such as VA, PV, GE, RQ, RL, and CC, to formulate targeted countermeasures. Lithium is mainly from Chile, Australia, and Argentina. 80% of its production is in Chile. The governance index in Australia and Chile is very high. Moreover, China also has a certain amount of lithium mineral reserves, so the supply risk of lithium is relatively low. The majority of nickel comes from Indonesia, the Philippines, and Brazil, and the governance index indicates that the society is more stable. Because of the abundance of nickel, the supply risk of nickel is also low.

FIGURE 2. Comprehensive trend of lithium, cobalt, and nickel resource supply risk index based on WGI.

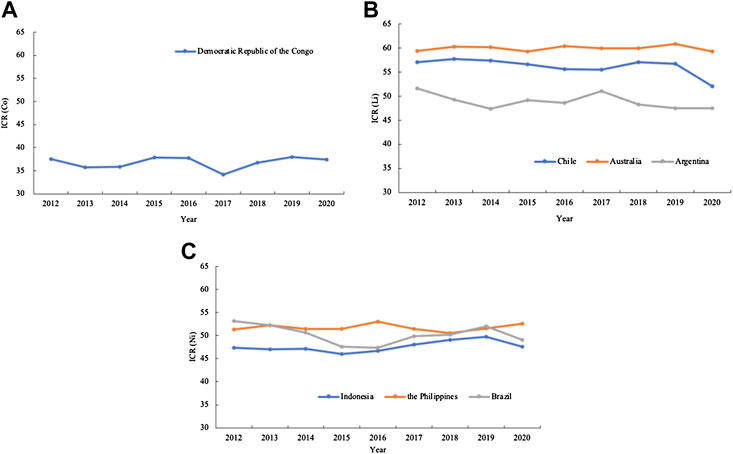

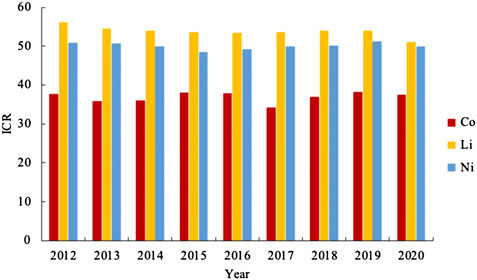

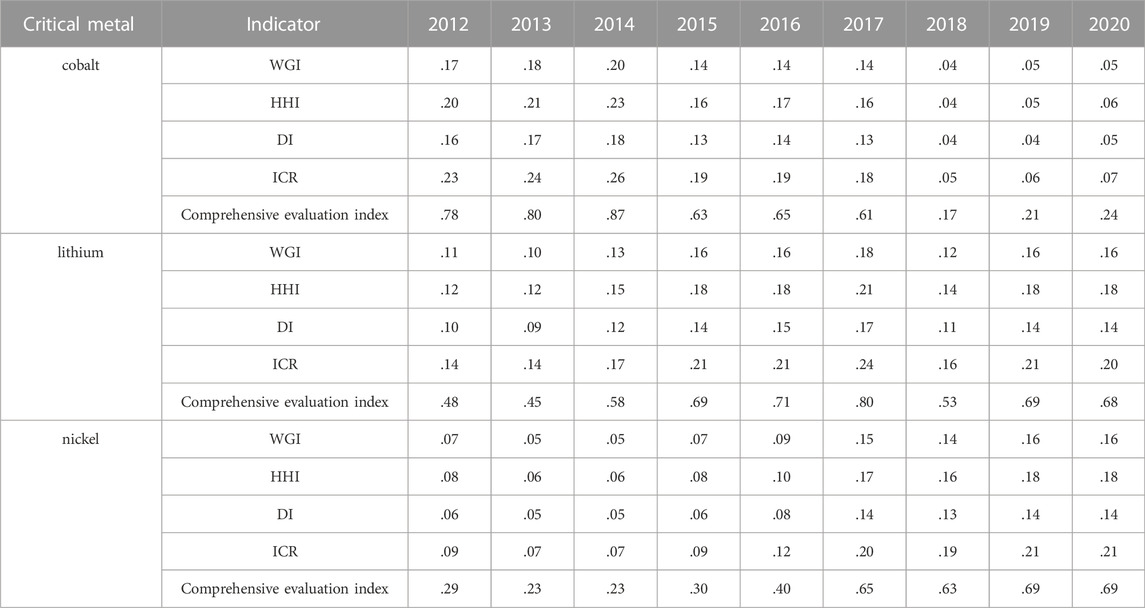

Country risk indicator includes political risk, economic risk, and financial risk. It combines specific country factors such as currency risk, political leadership, military and religion in politics, and corruption (Wang and Wu, 2008). It is a comprehensive reflection of a country’s degree of political, social, and economic stability. The country risk indices of critical metal mineral source countries were calculated based on the national risk index database, and the results are shown in Table 4 and Figure 3. Risk ratings range from a high of 100 (least risk) to a low of 0 (highest risk).

FIGURE 3. Change trend of cobalt (A), lithium (B), and nickel (C) resource supply risk index based on ICR.

It is shown that the degree of risk is similar to that of the World Governance Index. Compared to the World Governance Index, these country risk indices have a small gap, ranging from 35-60 (Figure 4); while the World Governance Index has a minimum of 10 and a maximum of 96, with a large value gap. Since the country risk index includes political risk, economic risk, and financial risk, its value can more closely reflect the risk of these countries in the critical mineral trade.

FIGURE 4. Comprehensive trend of lithium, cobalt, and nickel resource supply risk index based on ICR.

HHI describes the dynamic nature of metal geopolitical supply risk based on mineral production data, and the results can provide a basis for metal mineral supply risk assessment.

As can be seen from Table 5 and Figure 5, the global demand for cobalt resources in 2012–2015 was relatively small, and its concentrated supply index is within 2800.06. With the development of low-carbon energy technology, there is an increasing demand for cobalt resources, and the concentration index of cobalt also reached 4882.19 in 2020, indicating that the supply risk of cobalt resources increased. The HHI value of lithium is as low as 2672.23 and as high as 4101.38, and the market concentration remains at the level I. From 2012 to 2020, the HHI value of nickel resources is mostly around 1,000, the market concentration is low (level III), and its supply risk is also low.

Bilateral institutional differences increase the supply risk of China’s imports of critical mineral resources. If the regime environment between China and the mineral resource importing country is similar or the difference is small, it is easier to integrate into the regime environment of the host country, and it is easier to adapt to each other’s transaction rules, and the transaction risk is also lower. If the difference (distance) between the bilateral government systems is significant, the supply risk of critical minerals imported by China will also increase.

From the average bilateral government regime distance, China and DRC have the most significant institutional distance, and are the largest in terms of PV, GE, BQ, RL, and CC, and their supply risks are also the largest; China has the smallest distance from the Indonesian regime system. It is the smallest in PV, GE, BQ, and RL, but larger in CC. Overall, the supply risk is the smallest. China and Argentina have slight differences in BQ, RL, and CC aspects, but large differences in PV and GE. In general, the regime distance is in the middle, and the supply risk is also medium. The difference between China and Australia and Chile in each dimension is positive, and the bilateral institutional distance is the largest. The regime distance between China and the other two countries, the Philippines and Brazil, is in the middle, and the risk is also medium (Table 6 and Figure 6).

TABLE 6. Bilateral institutional distance between China and the source countries of lithium, cobalt, and nickel imports.

In conclusion, the regime distance between China and the source countries of critical minerals imports in each dimension of the Global Country Governance Index shows that political stability, government efficiency, regulatory quality, legal rules, and corruption control, etc. directly affect the degree of supply risk of critical minerals. The more unstable the host country’s politics, the higher the supply risk.

To reduce supply risks, China needs to carefully study the characteristics and differences of importing source countries in terms of PV, GE, BQ, RL, and CC, and take timely countermeasures to integrate into the host country’s regime environment at minimal cost and minimize the trading risks.

The index weight is measured according to the entropy weight method, and the results are shown in Table 7. To further prove the rationality of the index, this study compared and analyzed the evaluation index systems of other experts. Ma et al. (2019) constructed an evaluation index system for China’s nickel resource supply security in five dimensions: resource stock, resource supply and demand, resource development, international production and sales, and international market prices. The results show that the share of nickel reserves in the world’s total reserves has a weight of 16.5% in the security index system, and the concentration of producing countries has a weight of 5.6%. Considering the share of reserves in the total world reserves and the production concentration have a similar meaning, the weight of supply concentration is 22.1%. The critical mineral concentration weight is 26% in this study, which is basically reasonable. Taking the supply risk of critical metals in clean energy technology as the research object, Huang et al., 2020 established a supply risk assessment system from four aspects: supply reduction risk, demand increase risk, geopolitical risk, and social supervision risk. The results show that the geopolitical supply risk of lithium is medium, and the geopolitical supply risk of cobalt is high, which is consistent with the evaluation results of our study. Chen (2021) established a multi-level comprehensive evaluation model of supply chain risk including natural risk, geopolitical risk and investment environment risk, and concluded that geopolitical risk has an important impact on both critical mineral supply base and supply channel risk, which is consistent with the result that geopolitical risk has the highest weight in the evaluation index system of our study.

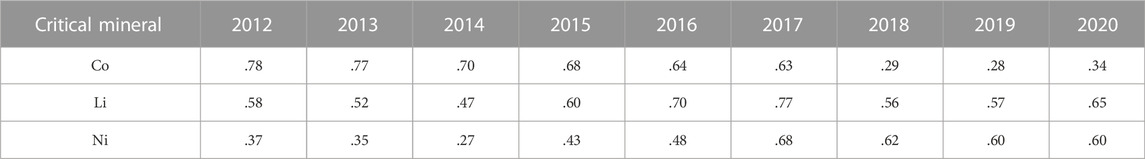

The results of the comprehensive assessment of the supply risk of China’s imported lithium, cobalt, and nickel resources are shown in Table 8 and Figure 7.

TABLE 8. The results of the comprehensive evaluation of the supply risk of cobalt, lithium, and nickel resources in China.

From 2012 to 2017, the safety index of lithium was between .6 and .8, which was a relatively safe state. In 2018, it dropped to .53, which was basically safe. After then, it rose to .68, showing a relatively safe situation. Among the many influencing factors, high supply concentration, unstable bilateral institutional relations, and strong market monopoly power play a negative role in the security of China’s lithium resources. From 2012 to 2016, the safety index of nickel was between .2 and .4, which was in an unsafe state. From 2017 to 2020, the safety index of nickel was between .6 and .7, which was generally in a relatively safe state.

As for cobalt resources, the safety index of cobalt was between .6 and .8 from 2012 to 2017, which is a relatively safe state. However, from 2018 to 2020, the safety index of cobalt dropped to .2, which is an unsafe and extremely unsafe state. This might be due to the rapid growth in demand for cobalt in the battery sector after 2018, leading to a consequent increase in cobalt supply risk. Global refined cobalt production in 2018 was 128,000 tons, a year-on-year increase of 10%. China’s refined cobalt output was 83,000 tons, a year-on-year increase of 15%. Since 2018, the demand for cobalt has been growing at a rate of more than 10%. It also can be seen from the national governance index of the DRC, which was between 20 and 25 before 2018 and dropped to below 16 after 2018, with an increase in social instability. The cobalt production concentration index has also increased from less than 35% to more than 50%. With the decrease in the national governance index and the increase in the concentration of cobalt production in DRC, the geopolitical risk of DRC has sharply increased, and the supply risk of cobalt has increased accordingly. Moreover, since 2018, the DRC government has regarded cobalt as a strategic mineral resource, and the tariff has increased from 2% to 10%, which has increased the supply cost of cobalt and increased the supply risk of cobalt resources. Therefore, China urgently needs to pay attention to the safe supply of cobalt. It can ensure the safe supply of cobalt resources by actively expanding the allocation of overseas cobalt resources other than Congo (DRC) and increasing investment in deep-sea cobalt mining to provide resource guarantee for China’s sustainable economic and social development.

In November 2016, the State Council of the People’s Republic of China approved the “National Mineral Resources Planning (2016-2020)", which listed 24 kinds of minerals such as oil, natural gas, coal, and rare Earth into the strategic mineral catalog as the key objects for macro-regulation and supervision management. To avoid policy interference, this paper excludes data after 2017 for robustness testing. Table 9 shows that the degree of geopolitical supply risk for the three critical minerals are consistent with the original results, indicating that the study results remain robust after excluding policy factors.

TABLE 9. The results of the comprehensive evaluation of the supply risk of cobalt, lithium, and nickel resources in China with a reduced time window.

Indicator weight coefficients are determined using the Analytic Hierarchy Process (AHP). In the AHP, the main steps are as follows: 1) Construction of the judgment matrix A. 2) Using the square root method to find the eigenvectors. 3) Consistency verification. 4) AHP weight determination.

The geopolitical supply risk results of cobalt, lithium, and nickel evaluated based on the entropy weight method and the AHP, method are consistent, indicating that the results with different weights are robust and reliable (Tables 10, 11).

TABLE 11. The results of the comprehensive evaluation of the supply risk of cobalt, lithium, and nickel resources in China with the AHP weights.

With the acceleration of global renewable energy development, some radicalization and politicization tendencies have emerged, driving the adjustment of the world energy political pattern, and accelerating the evolution of energy security concepts, strategies, and international energy security framework (Zhao, 2022). Under this circumstance, the geopolitical risks of the safe supply of lithium, cobalt, and nickel resources required by China’s energy storage technology have also increased, and there is an urgent need to evaluate the geopolitical risks of their supply. Based on the relevant geopolitical data of 8 major source countries of critical metal minerals from 2012 to 2020, the study selects the degree of geopolitical stability, supply concentration, bilateral institutional relationship, and country risk index through supply risk analysis and geopolitical risk factor identification, and constructs a supply risk evaluation model for lithium, cobalt, and nickel using the TOPSIS model. The conclusions and suggestions are as follows.

1) To achieve the goal of “carbon neutralization and carbon peak”, China is vigorously developing renewable energy. With the increase of wind and solar power generation projects, the importance and urgency of energy storage are becoming more and more obvious, and battery energy storage technology will usher in a huge development opportunity. However, battery energy storage is limited by the supply of critical metal minerals. In addition, critical minerals are more susceptible to geopolitical influence and have a higher risk of supply chain disruption. The future rapid growth of the demand for critical minerals will accelerate the reshaping of the world’s strategic mineral resources geopolitics

2) The country governance index and country risk index of import source countries of lithium, cobalt, and nickel were calculated, and the supply risk of three critical metal mineral resources was estimated. The major producing countries of cobalt resources have high geopolitical index changes and social unrest, and the supply risk is the greatest. Chile and Argentina, suppliers of lithium resources, have increased social instability and supply risks in recent years. Indonesia, the Philippines, and Brazil, suppliers of nickel resources, showed an increasing trend of governance index and low supply risk. The degree of political stability, government efficiency and regulatory quality, the rule of law, and corruption control in the importing country directly affect the degree of risk of critical mineral supply. The institutional distance between China and DRC is the largest, so the supply risk of cobalt resources is also the largest.

3) Based on the TOPSIS model, the supply security index of critical minerals such as lithium, cobalt, and nickel in 2012–2020 was calculated. The main factors that cause fluctuations include the degree of political stability and non-violence, political leadership, military and religion in politics, the level of the rule of law, government effectiveness, corruption control, etc. Followed by economic risk and financial risk. Starting in 2018, the index of cobalt dropped to .2, which is an unsafe and extremely unsafe state. China’s demand for cobalt is more than 90% dependent on foreign countries, and the main importing country is the Democratic Republic of the Congo. The Democratic Republic of the Congo. is one of the world’s least developed countries as determined by the United Nations. The term of the new President of the Democratic Republic of Congo is from 2019 to 2023, and the political risks are high, including the dissatisfaction of long-term loyalists caused by the imbalance of political rewards, the dissatisfaction of veteran politicians caused by the imbalance of the old and the new, the dissatisfaction of some provinces caused by the imbalance of geographical distribution, and the social dissatisfaction caused by the uneven distribution of economic resources. In addition, the new mining law implemented by the Democratic Republic of the Congo will further push up the cost of mining taxes and fees that are already too high and have a negative impact on the investment of foreign companies (Lu et al., 2018). Therefore, China’s import of cobalt resources faces great geopolitical supply risks.

We have several policy suggestions by combined results as follows: For the government, China could strengthen resource diplomacy and build a community with a shared future for global critical mineral resources security. Additionally, China could also pay attention to the substitution and recycling of critical mineral resources (Zhai et al., 2021), that is, to reduce dependence by exploring alternative materials, improving processing efficiency, and increasing recycling (Gulley et al., 2018). For domestic enterprises, they could not only respond to the “Belt and Road Initiative (BRI)” and acquire critical mineral resources for new energy from abroad through international capacity cooperation (Mao, 2022), but also cooperate with critical mineral resource countries in exploration and development by providing technologies, funds, and markets. For the three different critical minerals, it is necessary to stabilize the cooperation in the DRC in many aspects to ensure the supply of cobalt resources upstream. China would promote the large-scale, intensive, and green development of lithium resources, and orderly promote the construction of national lithium resource bases. It is also urgent for China to increase the prospecting of nickel resources and establish overseas nickel resource development bases.

This study just analyzed the geopolitical risk of critical metal mineral supplying countries, other risks such as the geopolitical risks of transport channels should also be identified. In the future, based on this study, the whole supply chain database including critical metal mineral bases and transportation channels could be constructed to dynamically identify supply chain risk factors, and a supply chain risk prediction model could be established to minimize supply risks to further develop and promote battery storage energy technology to ensure the large-scale development of renewable energy in China.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding authors.

Conceptualization, BW, LW, and SZ.; methodology, BW, LW, and S.Z.; validation, B.W.; formal analysis, BW; investigation, BW; resources, BW, NX, and QQ; data curation, BW, NX, and QQ; writing—original draft preparation, BW; writing—review and editing, BW, LW, and SZ; supervision, LW; project administration, LW; funding acquisition, LW and SZ. All authors have read and agreed to the published version of the manuscript.

This research was funded by the National Natural Science Foundation of China, Grant No. 71991484, 71991480, and 41971163; The Second Tibetan Plateau Scientific Expedition and Research Program (STEP), Grant No. 2019QZKK1003; Humanities and Social Science Research Project of Hebei Education Department, Grant No. SQ2021081.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenrg.2022.1032000/full#supplementary-material

Ali, S. H., Giurco, D., Arndt, N., Nickless, E., Brown, G., Demetriades, A., et al. (2017). Mineral supply for sustainable development requires resource governance. Nature 543 (7645), 367–372. doi:10.1038/nature21359

Cao, D., Chen, X., Song, C., and Yuan, L. D. (2022). A comprehensive assessment and spatio-temporal evolution analysis of national risk of China in the Indian Ocean Region. Sci. Geogr. Sin. 42 (6), 1044–1054. doi:10.13249/j.cnki.sgs.2022.06.010

Chao, Q., Zhang, Y., Gao, X., and Wang, M. (2016). Paris agreement: A new start for global governance on climate. Clim. Change Res. 12 (1), 61–67.

Chen, Q., Zhang, Y., Xing, J., Long, T., Zheng, G., Wang, K., et al. (2021). Theoretical and technical methods of mineral resource supply base evaluation and supply chain investigation. Acta Geosci. Sin. 42 (2), 159–166. doi:10.3975/cagsb.2020.111201

Daniel, S., and Rick, B. (2016). The geopolitics of renewables. Explor. Political Implic. Renew. Energy Syst. Technol. Forecast. Soc. Change 103, 273–283. doi:10.1016/j.techfore.2015.10.014

European Commission (2014). Report of the ad-hoc working group on defining critical raw materials: Critical raw materials for the EU. Brussels, Belgium: European Commission.

Graedal, T. E., Barr, R., Chandler, C., Chase, T., Choi, J., Christoffersen, L., et al. (2012). Methodology of metal criticality determination. Environ. Sci. Technol. 46 (2), 1063–1070. doi:10.1021/es203534z

Gulley, A. L., Nassar, N., and Xun, S. (2018). T., Xun, SChina, the United States, and competition for resources that enable emerging technologies. Proc. Natl. Acad. Sci. 115 (16), 4111–4115. doi:10.1073/pnas.1717152115

Habib, K., Hamelin, L., and Wenzel, H. (2016). A dynamic perspective of the geopolitical supply risk of metals. J. Clean. Prod. 133, 850–858. doi:10.1016/j.jclepro.2016.05.118

Hayes, S. M., and Mcculough, E. A. (2018). Critical minerals: A review of elemental trends in comprehensive criticality studies. Resour. Policy 2018 (59), 192–199. doi:10.1016/j.resourpol.2018.06.015

Henckens, M. L. C. M., Ierland, E. C., Driessen, P. P. J., and Worrell, E. (2016). Mineral resources: Geological scarcity, market price trends, and future generations. Resour. Policy 49 (10), 2–11. doi:10.1016/j.resourpol.2016.04.012

Huang, J., Sun, F., and Song, Y. (2020). Supply risk assessment of critical metals in clean energy technology. Resour. Sci. 42 (8), 1477–1488. doi:10.18402/resci.2020.08.04

Hwang, C. L., and Yoon, K. (1981). Multiple attribute decision making: Methods and applications. New York: Springer-Verlag. doi:10.1007/978-3-642-48318-9

International Energy Agency (2018). Outlook for producer economies: What do changing energy dynamics mean for major oil and gas exporters. Paris, France: International Energy Agency.

International Energy Agency (2022). World energy outlook. Organization for economic Co-operation and development. https://www.iea.org/reports/world-energy-outlook-2015.

IRENA (2022). A new world: The geopolitics of the energy transformation. Available at. https://www.irena.org/publications/2019/Jan/A-New-World-The-Geopolitics-of-the-Energy-Transformation.

Kaufmann, D., Kraay, A., and Mastruzzi, M. (2010). The worldwide governance indicators, methodology and analytical issues. Hague J. rule law 3 (2).

Li, J., Qiu, J., and He, B. (2020). Cultural distance, institutional distance and outward foreign direct investment. Wuhan Univ. J. 73 (1), 120–134. doi:10.14086/j.cnki.wujss.2020.01.010

Li, J., Zhang, Z., Tan, Y., Liu, H., Peng, J., Zhang, Q., et al. (2022). Cholesterol efflux regulator ABCA1 exerts protective role against high shear stress-induced injury of HBMECs via regulating PI3K/Akt/eNOS signaling. Electr. Age 2, 61–65. doi:10.1186/s12868-022-00748-2

Liu, Q., Sha, J., Yan, J., and Zhou, P. (2018). Risk assessment and governance of cobalt resources supply in China. China Mining Magazine. 27 (1), 50–56.

Liu, W., and Zhou, Y. (2018). Index development for geopolitical risks and international comparison. Area Stud. Glob. Dev. 2 (2), 5–29.

Long, R., and Yang, J. (2018). Research status and prospect of national mineral resource security. Resour. Sci. 40 (3), 465–476. doi:10.18402/resci.2018.03.01

Lu, Y., Gong, P., Sun, K., Ren, J., He, S., Zhang, H., et al. (2018). Mineral resources and investment environment in Democratic Republic of the Congo. Geol. Bull. China 41 (1), 154–166. doi:10.112097/j.issn.1671-2552.2022.01.012

Ma, Y., Sha, J., Yan, J., Liu, Q., Fan, S., He, G., et al. (2019). Safety assessment and countermeasures of nickel resource supply in China. Resour. Sci. 41 (7), 1317–1328. doi:10.18402/resci.2019.07.12

Mao, J. (2022). Accelerate the improvement of new energy industry critical mineral resources supply security system. China Nonferrous Met. 6, 47.

Mao, J., Yang, Z., Xie, G., Yuan, S., and Zhou, Z. (2019). Critical minerals: International trends and thinking. Mineral. Deposits 38 (4), 689–698. doi:10.16111/j.0258-7106.2019.04.001

National Research Council (2008). Committee on critical mineral impacts on the US economy: Minerals, critical minerals and the US economy. Washington, DC, USA: National Academies Press.

Peiró, L. T., Méndez, G. V., and Ayres, R. U. (2013). Material flow analysis of scarce metals: Sources, functions, end-uses and aspects for future supply. Environ. Sci. Technol. 47 (6), 2939–2947. doi:10.1021/es301519c

PRS Group (2017). “International country risk Guide (ICRG) researchers dataset,”. hdl: 10864/10120 (Liverpool, NY, USA: The PRS Group)

Qu, J., Zhang, Y., Zhang, Y., and Fan, X. (2022). Evaluation of titanium resource supply security in China based on TOPSIS model with entropy weight method. Resour. Industry 24 (2), 26–36. 10.12075/j.is sn.1004-4051.

Rosenau-Tornow, D., Buchholz, P., Riemann, A., and Wagner, M. (2009). Assessing the long-term supply risks for mineral raw materials—A combined evaluation of past and future trends. Resour. Policy 34 (4), 161–175. doi:10.1016/j.resourpol.2009.07.001

Sun, H., Nie, F., and Hu, X. (2018). Evaluation and difference analysis of energy security in China based on entropy-weight TOPSIS modeling. Resour. Sci. 40 (3), 477–485. doi:10.18402/resci.2018.03.02

U.S. Geological Survey (2022). Mineral commodity summaries 2022. Reston, VA, USA: U.S. Geological Survey. doi:10.3133/mcs2022

Vidal, O., Goffe, B., and Arndt, N. (2013). Metals for a low-carbon society. Nat. Geosci. 6 (11), 894–896. doi:10.1038/ngeo1993

Wang, C., Song, H., Zuo, L., and Huang, J. (2017). Review and prospects of national metal resource security. Resour. Sci. 39 (5), 805–817. doi:10.18402/resci.2017.05.01

Wang, C., Sun, J., Zuo, L., Song, H., Wu, Q., Jiang, K., et al. (2018). Red emitting and highly stable carbon dots with dual response to pH values and ferric ions. Forum Sci. Technol. China 4, 83–93. doi:10.1007/s00604-017-2544-1

Wang, D. (2019). Study on critical mineral resources: Significance of research, determination of types, attributes of resources, progress of prospecting, problems of utilization, and direction of exploitation. Acta Geol. Sin. 93 (6), 1189–1209. doi:10.19762/j.cnki.dizhixuebao.2019186

Wang, H., and Wu, J. (2008). A study of the measurement of state risks. Econ. Surv. 3, 143–145. doi:10.15931/j.cnki.1006-1096.2008.03.005

Wang, L., Gu, M., and Li, H. (2012). Influence path and effect of climate change on geopolitical pattern. J. Geogr. Sci. 22 (6), 1117–1130. doi:10.1007/s11442-012-0986-2

Wang, L., Mou, C., and Lu, D. (2016). Changes in driving forces of geopolitical evolution and the new trends in geopolitics studies. Geogr. Res. 35 (1), 3–13. doi:10.11821/dlyj201601001

Wang, P., Wang, Q., Han, R., Tang, L., Liu, Y., Cai, W., et al. (2021). Nexus between low-carbon energy and critical metals: Literature review and implications. Resour. Sci. 43 (4), 669–681. doi:10.18402/resci.2021.04.03

Wang, W., Liu, Y., and Yu, H. (2014). The geopolitical pattern of global climate change and energy security issues. J. Geogr. 69 (9), 1259–1267. doi:10.11821/dlxb201409002

Wang, Y. (2022). The new trend and possible influence of the game of critical minerals in resource countries. People’s Trib. 15, 90–95.

World Bank (2020). Mineral production to soar as demand for clean energy increases. https://www.worldbank.org/en/news/press-release/2020/05/11/mineral-production-to-soar-as-demand-for-clean-energy-increases.

Wu, Q., Zhou, N., and Cheng, J. (2020). A review and prospects of the supply security of strategic key minerals. Resour. Sci. 42 (8), 1439–1451. doi:10.18402/resci.2020.08.01

Xu, D. (2020). Review and outlook of key minerals security during energy transformation. Resour. Industries 22 (4), 1–11. doi:10.13776/j.cnki.resourcesindustries.20200226.001

Xu, J., Zhou, S., and Hu, A. (2017). Institutional distance, neighboring effects and bilateral trade: An empirical analysis based on spatial panel model of “one belt and one Road” countries. J. Finance Econ. 43 (1), 75–85. doi:10.16538/j.cnki.jfe.2017.01.007

Yu, Y., and Yang, J. (2020). The new trend of Ausrtlia’s bulk mineral resources policy and its influences. Nat. Resour. Econ. China 33 (7), 41–46. doi:10.19676/j.cnki.1672-6995.000400

Zang, L. (2012). Quantitative research on governance: Theoretical evolution and rethinking: The world governance index (WGI) as an example. Soc. Sci. Abroad 4, 11–16.

Zhai, M., Hu, R., Wang, Y., Jiang, S., Wang, Ru., Li, J., et al. (2021). Mineral resource science in China: Review and perspective. Geogr. Sustain. 2 (2), 107–114. doi:10.1016/j.geosus.2021.05.002

Zhai, M., Wu, F., Hu, R., Jiang, S., Li, W., Wang, R., et al. (2019). Critical metal mineral resources: Current research status and scientific issues. Bull. Natl. Nat. Sci. Found. China 33 (2), 106–111. doi:10.16262/j.cnki.1000-8217.2019.02.002

Zhang, S., Liu, B., and Ma, P. (2019). The relevant enlightenment of the strategic adjustment of critical minerals in the United States. Nat. Resour. Econ. China 32 (7), 38–45. doi:10.19676/j.cnki.1672-6995.0000304

Zhang, Y. (2017). A Study on the influence of host country’s institutional environment on China’s preference for OFDI. Shanghai, China: Shanghai JiaoTong University.

Keywords: critical metal minerals, geopolitics, storage energy technology, institutional distance, supply risk

Citation: Wang B, Wang L, Zhong S, Xiang N and Qu Q (2023) Assessing the supply risk of geopolitics on critical minerals for energy storage technology in China. Front. Energy Res. 10:1032000. doi: 10.3389/fenrg.2022.1032000

Received: 30 August 2022; Accepted: 29 December 2022;

Published: 11 January 2023.

Edited by:

Xiangyun Gao, China University of Geosciences, ChinaReviewed by:

Qier An, Research Institute of Petroleum Exploration and Development (RIPED), ChinaCopyright © 2023 Wang, Wang, Zhong, Xiang and Qu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Limao Wang, bG13YW5nQGlnc25yci5hYy5jbg==; Shuai Zhong, emhvbmdzaHVhaUBpZ3NucnIuYWMuY24=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.