- Umm Al-Qura University, Makkah, Saudi Arabia

The economy of Saudi Arabia is primarily oil-based, and the energy system is heavily dependent on fossil fuel sources. Electrical demand in Saudi Arabia has been overgrowing due to the high rates of both population and economy. The real problem is that most of this demand has been met by polluting sources, which in turn causes severe economic and environmental challenges. Despite the abundant amount of clean and freely available renewable sources, the practice of benefiting from these sources is minimal and modest. Therefore, the country has launched a promising vision, one pillar of which is diversifying energy sources and reducing dependence on oil. Since Saudi Arabia is located within the equatorial Sun Belt area, the country is a candidate for leading the World’s renewable energy industry, particularly solar energy. This paper discusses the current energy policy in Saudi Arabia, the associated main energy-related challenges and promising opportunities, and the efforts and actions taken by the country’s policymakers to address these challenges and to take advantage of available opportunities–especially those related to electrical energy–to assure continued future prosperity for subsequent generations.

1 Introduction

The Kingdom of Saudi Arabia, which straddles the Arabian Peninsula with an approximate total area of 2,150,000 square kilometers, is one of the G20 countries that together represent approximately 80 percent of the World’s economic output, two-thirds of the global population, and three-quarters of international trade (G20, 2020). Saudi Arabia has high growth rates in both people and the economy. The General Authority for Statistics estimates that the total population in Saudi Arabia in 2020 is more than 35 million inhabitants, with an approximately 2.3 percent annual population growth rate (General Authority for statistics, 2022a), while the growth rate of GDP at constant prices reached 9.9 percent in the first quarter of 2022 on a yearly basis (General Authority for statistics, 2022b). Saudi Arabia is a founder member of the Organization of the Petroleum Exporting Countries (OPEC) and is at the top of the oil-market leading countries in the World. In 2019, the average crude oil production was 9.81 million barrels per day, thus ranking the country as the World’s leading oil exporter and the second-largest oil producer. The country possesses more than 267.02 billion barrels of crude oil reserves representing approximately 18 percent of the World’s proven crude oil reserves (OPEC, 2019), (KAPSARC, 2019).

Furthermore, Saudi Arabia is considered the eighth-largest producer of natural gas and has the eighth-largest proven gas reserves in the World (BP, 2021). The country’s economy is mainly oil-based, where oil has been considered the primary source of government revenue. Nevertheless, some actions have been taken by the government to reduce the share of oil revenue to the total revenue and compensate for that cut by other non-oil-based revenue sources to help create a more diverse and sustainable economy. In 2018, oil accounted for nearly 68 percent of government revenue compared to 2012, for instance, where the share of oil was almost 92 percent (Ministry of Finance, 2019). In terms of energy sources, Saudi Arabia has primarily relied on fossil fuel sources for domestic consumption as primary energy sources for a long time. The total 2019 energy production of Saudi Arabia was 2,495.55 million MWh which came from three sources oil, natural gas, and renewables. The contribution of oil and gas was approximately 62 percent and 37 percent, respectively, where the remaining 1 percent came from other sources, including wind, solar, biofuels, and waste (IEA, 2022a). In April 2016, the country launched a national strategic transformation called Vision 2030 encompassing several sectors, one of which is reducing the reliance on oil and diversifying energy sources. This paper discusses the current features of Saudi Arabia’s energy policy and the available opportunities for transforming into sustainable, less oil-dependent energy for the country in the context of Vision 2030.

2 Saudi Arabia’s energy strategy and associated challenges

Due to the abundance of hydrocarbons in Saudi Arabia, the Kingdom’s energy system has relied on and been limited to two fossil fuel sources: oil and natural gas. This trend in energy policy was promoted by the increasingly high prices of oil exports offset by low domestic production costs (Alnatheer, 2005). The absence of diversity in energy sources and increased reliance on only two sources: oil and gas, has been the primary long-term challenge for Saudi Arabia’s energy system. This challenge could be seriously aggravated considering that Saudi Arabia is one of the fastest-growing countries in the World in all aspects, notably energy, due to the high level of growth in both population and economy as well as government subsidies for the energy sector that kept water/electricity prices low and encouraged wasteful consumption. According to International Monetary Fund (IMF), energy subsidies accounted for approximately 18 percent of the country’s GDP (Coady et al., 2019). As a result, in 2020, Saudi Arabia was the largest consumer of oil in the Middle East and the fourth-largest oil consumer in the World, with an average consumption rate of 3.5 million barrels per day. Meanwhile, natural gas consumption exceeded 112.1 billion cubic meters, ranking the country as the World’s sixth-largest consumer of natural gas (BP, 2021). Buildings’ electricity, land transportation, and industry are the key sectors in the Kingdom that consume over 90 percent of domestic energy (Saudi Energy Efficiency Center, 2021).

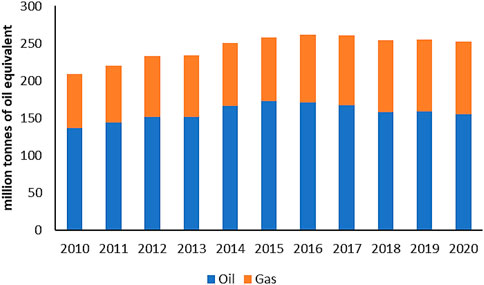

Historically, the high domestic consumption of oil and gas has increased each year and is projected to keep growing, threatening the future of generations to come if no serious action is taken. Figure 1 shows the historical increase of oil and gas domestic consumption for the period from 2010 until 2020 (BP, 2021).

Between 2007 and 2017, fossil fuel consumption in Saudi Arabia rose by more than 58 percent compared to less than 5 percent in North America. For the same period, fossil fuel consumption declined by more than 7 percent in Europe (BP, 2018). In 2017, the domestic oil consumption per capita overshot the consumption per capita of some leading industrial countries such as China and Japan (BP, 2018).

At its current pace, by 2030, domestic oil consumption will be almost as large as oil exports and is expected to reach around nine million barrels of oil equivalent per day (Contestabile, 2018), (Gately et al., 2012). Indeed, this will cause significant challenges in the country’s energy future by threatening the share of oil specialized for export, as a vast amount of oil production will be domestically consumed. Moreover, the prices of most energy products in the Kingdom were lower than world prices; the high growth of domestic oil consumption would increase the associated subsidizing costs wounding social welfare (Gately et al., 2012; Rehman, 2012; Krane, 2017). As a result of the decreasing quantity of exported oil and rising energy subsidizing costs, the national economy might be negatively affected as the Kingdom’s economy is primarily oil-based.

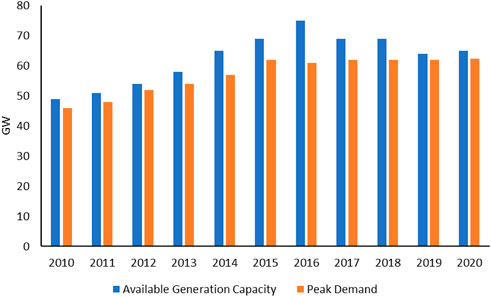

In terms of electricity consumption, the consumption of the building sector constitutes 29 percent of the primary energy consumption, equivalent to 1,315 million barrels of oil equivalent per day (Saudi Energy Efficiency Center, 2021). In 2014, the average consumption of residential consumers, who represent 50 percent of the total consumers in the country, was about 24 MWh of electricity, ranked the third highest consumption per household in the World after Kuwait and Qatar, respectively (Matar and Anwer, 2017a), (Matar and Anwer, 2017b). According to the Water and Electricity Regulatory Authority (WERA), formerly the Electricity and Cogeneration Regulatory Authority (ECRA), the total available generation capacity in 2020 was 65 GW, while the peak demand was 62.3 GW. Historically, the peak demand has been increasing over time, which places high pressure on the Saudi Electricity Company (SEC) to meet this rapid growth by expanding the generation capacity as well as transmission and distribution systems. The historical evolution of peak demand and generation capacity between 2010 and 2020 is shown in Figure 2 (Water & Electricity Regulatory Authority (WERA), 2010; 2011; 2012; 2013; 2014; 2015; 2016; 2017; 2018; 2019; 2020).

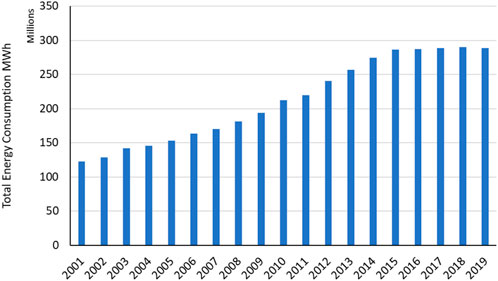

Electricity consumption in the Kingdom has been increasing over the years in terms of total consumption and consumption per capita. Figure 3 shows the total electricity consumption from 2001 to 2019 (KAPSARC, 2022).

For the period from 2010 to 2017, for example, the consumption of electricity per capita in the Kingdom rose by 20 percent, compared to the United States, in which the consumption of electricity per capita declined by more than 5.9 percent (IEA, 2022a), (IEA, 2022b). Based on the current energy policy and rapid growth in population and economy, the peak demand in Saudi Arabia is expected to keep increasing and reach approximately 84 GW by 2030 and 103 GW by 2040 (Al Harbi and Csala, 2019). Accordingly, at the current pace of using current sources for power generation, an additional 12 percent of oil barrels should be burned to meet the rapid growth of peak demand in 2030, which will be doubled every ten years. Furthermore, the pattern of electric load in the Kingdom has high variability over the day, causing a considerable difference between peak and off-peak values (Almasoud and Gandayh, 2015). This variation of the load pattern has several operational and planning implications, one important of which is related to the lack of optimal utilization of system assets.

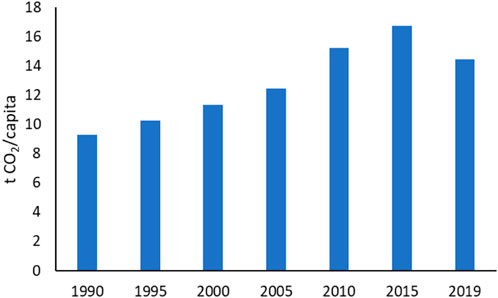

In addition, while outlining the current energy policy and its associated economic challenges, environmental issues should not be overlooked in the discussion. The relationship between greenhouse gas (GHG) emissions and fossil fuels is closely linked. Thus, unsurprisingly, Saudi Arabia has recorded a high emission level over the past decades due to the increased reliance on polluting sources of oil and gas. Figure 4 illustrates the CO2 emissions level per capita between 1990 and 2019 (IEA, 2022a). In 2019, Saudi Arabia was the World’s 10th largest CO2-emitting country (Crippa, 2020).

The growth of the GHG emissions level gives a dangerous indication of Saudi Arabia’s contribution to global warming. Saudi Arabia, as a rapidly developing country with high growth in population and economy, must urgently address these challenges in order to assure long-term sustainable prosperity for the future of Saudis and stable oil market prices. Thus, the rapid increase in domestic oil and gas consumption combined with the high growth of both economy and population, in addition to the associated increase in the level of GHG emissions, will pose significant challenges for the policymakers in the Kingdom in the future from all aspects, mainly economic and environmental. The subsequent sections discuss the opportunities for the Kingdom to diversify its energy mix and how the Saudi Arabian government has tackled these challenges using available energy sources. The discussion focuses primarily on the electricity sector as it is one of the most significant contributors to these challenges, as pointed out earlier.

3 Potential opportunities of alternative electrical energy sources

The Kingdom has inexhaustible available renewable sources similar in significance to oil and can be used to help meet the electrical energy demand. Of these, notable sources are solar and wind. In addition to renewables, the country can adopt nuclear energy to diversify the energy supply mix. This section discusses the potential opportunities to deploy alternative energy sources that can power the Kingdom.

3.1 Solar

Solar energy converts freely available sunlight into electricity via different technologies, including Photovoltaic (PV) panels and Concentrated Solar Power (CSP) systems. The conversion process, which varies based on the technology used, could be achieved directly through PV panels or indirectly through CSP. PV panels convert sunlight into electricity in the form of direct current (DC). In contrast, CSP systems use mirrors or lenses to concentrate the sunlight onto a small area and then convert this concentrated light into heat. This heat is further used to drive steam turbines which activate generators to produce electrical power (KICP, 2009; Intergovernmental Panel on Climate Change, 2011; The Worldwatch Institute, 2013). However, the availability of incoming solar radiation (insolation) at a given location is the most crucial element in determining the capacity factor of solar technology (Intergovernmental Panel on Climate Change, 2011). The capacity factor of PVs ranges from 12–27 percent, whereas the capacity factor of CSPs varies between 35–42 percent.

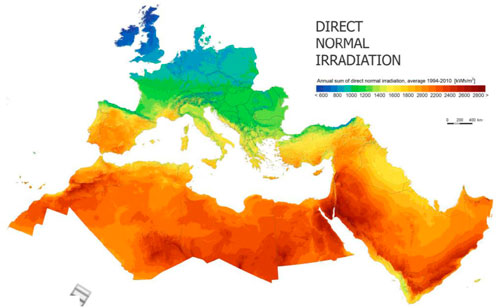

Nevertheless, thermal energy storage could significantly influence the increased capacity factor of CSP systems (Intergovernmental Panel on Climate Change, 2011). Saudi Arabia has considerable potential in terms of solar technology, as the country is located within the equatorial Sun Belt–where high radiation levels exist (Almasoud and Gandayh, 2015). The Solar Radiation Atlas, developed by King Abdulaziz City for Science and Technology and the U.S. National Renewable Energy Laboratory in 2000, observed that Saudi Arabia has high direct normal irradiance (DNI). The DNI can reach up to 30 MJ/m2/day and does not fall below 24 MJ/m2/day throughout the year (Alnatheer, 2005). Globally speaking, Saudi Arabia is qualified to be one of the World’s leading solar energy-based technology countries due to its high level of DNI, as shown in Figure 5 (Betak et al., 2012).

FIGURE 5. Solar map of EU-MENA region (Betak et al., 2012).

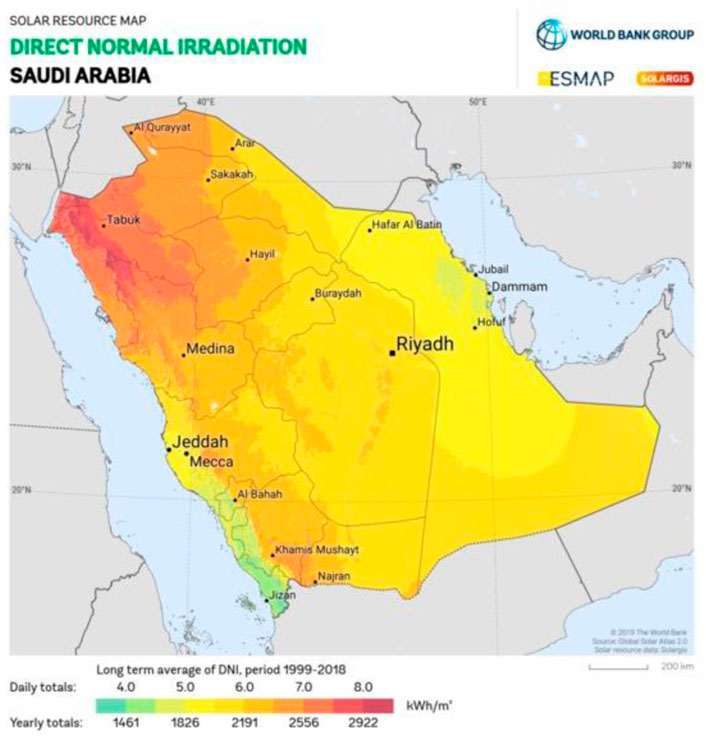

A solar map of Saudi Arabia, depicted in Figure 6, clearly shows that broad expanses of the country have a high level of solar insolation, particularly in the northwest region (Solargis, 2020). Non-etheless, in 2021, the installed capacity of solar energy in the Kingdom was approximately 440 MW (IRENA, 2022a).

FIGURE 6. Solar map of Saudi Arabia (Solargis, 2020).

3.2 Wind

Wind technology is one of the most environmentally friendly renewables. The primary mechanism of wind technology, which emerged in the 1970s, is to convert the mechanical movement of wind turbine blades into electrical power (Intergovernmental Panel on Climate Change, 2011). Wind turbines can be placed on land (onshore turbines) or at sea (offshore turbines). The capacity factor of wind turbines varies between 20–45 percent depending on turbine type, design, location, and size (Intergovernmental Panel on Climate Change, 2011). In 2016, approximately 16 percent of the World’s electricity generated by renewables was met by wind technology (IRENA, 2022b). The Kingdom has a promising opportunity to benefit from wind energy technology. The Red Sea and the Arabian Gulf coastlines in Saudi Arabia have the highest wind speed in the country, particularly in Dhahran and Yanbu cities (Rehman, 2004). In 2021, the installed capacity of wind energy in the Kingdom was only 3.25 MW (IRENA, 2022c).

3.3 Nuclear

Nuclear technology is substantially mature and used worldwide as it is highly reliable, clean, and safe. In over 50 countries, there are 441 nuclear power reactors online with a total electrical capacity of more than 390 GW representing approximately 10 percent of the World’s electricity, while another 53 reactors are presently under construction (International Atomic Energy Agency, 2020), (World Nuclear Association, 2022). Unlike renewables, nuclear is stable and has a considerable power-generating capacity. Nuclear technology has not yet been deployed in the Kingdom for power generation; however, Saudi policymakers may seriously consider adopting atomic technology for peaceful uses. Some studies found that nuclear would be a cost-effective option for the Kingdom to diversify the energy supply mix and reduce CO2 emission levels (Alshammari and Sarathy, 2016).

4 The future of Saudi Arabia’s electrical energy

As observed from the previous section, despite the incredible opportunities available to the Kingdom from renewables, the true benefit achieved is modest. Nevertheless, the government has realized the inevitability of developing alternative sustainable energy sources and adopting the global trend of transitioning into inexhaustible energy sources. The decision-makers in the Kingdom must take serious actions toward introducing alternative sustainable and clean energy sources such as renewable and nuclear energy. Thus, deploying clean energy sources is inevitable to overcome the country’s energy-related challenges. Nevertheless, this practice alone would be insufficient unless accompanied by a sustainable long-term energy efficiency program to manage the challenges associated with electrical energy demand. This section discusses the actions that the government has taken in this manner.

4.1 Establishment of King Abdullah City for Atomic and Renewable Energy (KA-CARE)

Because Saudi Arabia was utterly dependent on fossil fuel sources, there was no regulatory authority for renewable and nuclear energy. In light of this, royal decree A/35 was issued on 17 April 2010 to establish a scientific city–King Abdullah City for Atomic and Renewable Energy (KA-CARE). The main objective of KA-CARE is to build a prosperous energy future for the country by developing substantial alternative energy sources (KA-CARE, 2010).

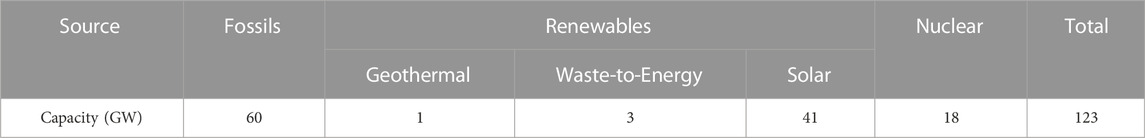

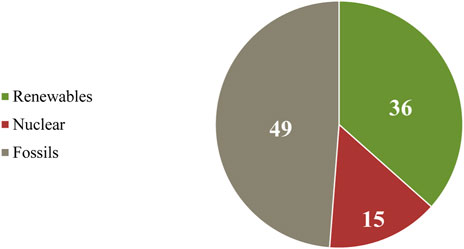

Upon issuing the royal decree, KA-CARE has set out a good and ambitious long-term energy plan for the country until 2032. The plan has mainly focused on resolving the difficult challenge regarding the high reliance on fossil fuels to meet the rapidly increased demand for electricity. Essentially, the plan has been established to develop a new energy supply mix that maximizes the return in terms of saving larger quantities of domestically consumed oil, creating a new economic sector, and deploying environmentally-friendly sustainable energy sources (Yamani, 2011a; Yamani, 2011b; KA-CARE, 2011). After examining all possible scenarios, KA-CARE introduced the 2032-proposed supply mix, which depends on fossil fuel and clean sources. KA-CARE has recommended keeping fossil fuels as a primary source for the 2032 power generation capacity target. Yet, its contribution will decline by half and be compensated by other clean sources. Nuclear and three renewable sources (geothermal, waste-to-energy, and solar) will account for the remaining second half of electricity’s generation capacity (Yamani, 2011a; Yamani, 2011b; KA-CARE, 2011; KA-CARE, 2012). The total 2032-target of power generation capacity is 123 GW, as detailed in Table 1.

Figure 7 illustrates the contribution percentage for all primary sources to the power generation capacity proposed by KA-CARE.

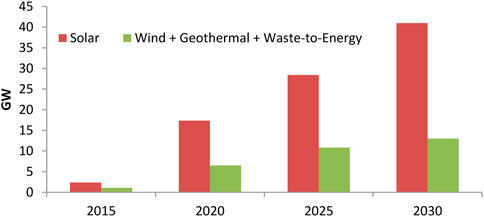

Apart from electricity, since approximately 70 percent of potable water in Saudi Arabia comes from desalinating seawater (The Embassy of Saudi Arabia in the United States, 2022), an additional 9 GW generated from wind energy will be designated for desalination purposes (KA-CARE, 2012). Therefore, considering the extra 9 GW of wind energy, the total renewable capacity target will rise to 54 GW; hence, the total capacity for all sources will become 132 GW. The roadmap of renewable energy deployment toward the 2032 target is illustrated in Figure 8 (KA-CARE, 2011).

4.2 Launch of the national renewable energy program

The NREP was launched in 2017 as one of the strategic initiatives under Vision 2030 and the Custodian of the Two Holy Mosques initiative for renewable energy (Vision, 2018). The program aims to help diversify the energy sources of the Kingdom by increasing the share of renewable energy production in total energy production. NREP program has revised the 2032-target previously proposed by KA-CARE to achieve a more realistic target of 27.3 GW by 2023 and 58.7 GW by 2030, approximately 70 percent of which will come from solar sources (KA-CARE, 2020). To achieve this goal, the Ministry of Energy established the Renewable Energy Project Development Office (REPDO) to deliver on this goal in collaboration with other energy sector stakeholders, including KA-CARE, WERA, and SEC (KA-CARE, 2020), (REPDO, 2020a). As a result of this program, REPDO has planned many renewable projects across the Kingdom to achieve renewable targets. In 2017, REPDO targeted two renewable energy projects currently under construction. Sakaka (300 MW of solar) and Dumat Al-Jandal (400 MW of wind) are located in the Kingdom’s northwest region. In addition, REPDO plans to launch other solar projects in different locations, including Al-Qurrayat (200 MW), Madinah (50 MW), Rafha (45 MW), Al-Faisaliyah (600 MW), Rabigh (300 MW), Jeddah (300 MW), Mahd Al-Dhahab (20 MW), Wadi Al-Dawaser (120 MW), Layla (80 MW), Ar-Rass (700 MW), and Saad (300 MW) (REPDO, 2017; REPDO, 2018; REPDO, 2019; REPDO, 2020b).

4.3 An agreement with SoftBank’s Vision Fund

In March 2018, the Kingdom, represented by Saudi Arabia’s Public Investment Fund (PIF), signed an agreement with SoftBank’s Vision Fund to invest 45 billion dollars in large-scale solar-related projects throughout the Kingdom (Shu, 2018a; Marwa et al., 2018; Kabeer, 2022). The project is considered the biggest of its kind in the World, as it aims to generate 200 GW of solar energy by 2030 (Shu, 2018b). In addition, the project includes integrating battery technology, constructing a solar equipment manufacturing facility, and building centers for research and development and education and training (DiChristopher, 2018). According to Masayoshi Son, SoftBank Group CEO, the project is expected to create 100,000 jobs, triple Saudi electricity generation capacity, increase Saudi gross domestic product by 12 billion dollars, and save the Kingdom 40 billion dollars in power costs (Shu, 2018b), (DiChristopher, 2018).

4.4 Energy efficiency programs

The increase in yearly peak demand and electricity consumption, as well as the high variation of the daily load curve, are considered the main challenges associated with the electricity industry in the Kingdom. Thus, promoting an energy efficiency program alongside deploying clean energy sources would help develop a sustainable energy policy for the country. The primary efforts introduced by the government toward promoting energy efficiency programs are outlined as follows:

4.4.1 Saudi energy efficiency center

Prior to 2010, some electricity-related conservation and awareness campaigns to rationalize the use of electricity, especially the demand during peak time, were launched in the country; non-etheless, most of these campaigns were ineffective and the benefit was less than the expected due to the absence of legislation and regulations that mandate the implementation of such conservation policies (Al-Ajlan et al., 2006). Consequently, royal decree 6927/MB was issued in September 2010 to mandate the implementation of thermal insulation in all new buildings (Saudi Electricity Company, 2020). Two months later, the government established the Saudi Energy Efficiency Center (SEEC), the main objective of which is to rationalize and increase energy efficiency in production and consumption to preserve the Kingdom’s natural resources and enhance the economic and social welfare of the Kingdom’s population (Saudi Arabia’s National Unified Portal for Government Services, 2022). As one of the primary endeavors toward achieving this objective, SEEC has developed a nationwide program called the “Saudi Energy Efficiency Program” through which over 100 initiatives have been introduced to improve the energy efficiency of the most energy-consuming sectors: buildings, land transportation, and industry (Saudi Energy Efficiency Center, 2021). With regards to improving the electricity efficiency in buildings, SEEC attributes the high electricity consumption in the building sector to the use of low energy-efficient appliances and the lack of thermal insulation. Therefore, a series of initiatives have been launched to improve electricity efficiency in buildings through issuing and updating the standards of thermal insulation materials, home appliances, and lighting products. The primary outcomes of these initiatives include improving the electricity consumption per subscriber in the buildings sector in 2020 by 3.81 percent compared to 2019 (Saudi Energy Efficiency Center, 2021).

4.4.2 Electricity price reform

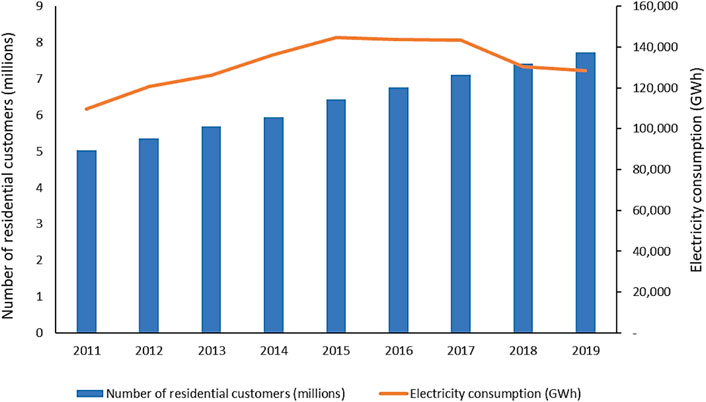

The high economic and population growth would most likely result in a proportional increase in energy consumption. In terms of electricity, the growth rate of electricity consumption in the Kingdom exceeded the growth rates of other influencing factors. Policymakers attribute the high electricity consumption to the absence of incentives for consumers to change their consumption behavior due to the cheap price of electricity, particularly the subsidized residential tariff (Matar and Anwer, 2017a). Figure 9. Shows the historical electricity consumption of the residential sector, which rapidly increases until 2015 (Water & Electricity Regulatory Authority (WERA), 2011; 2012; 2013; 2014; 2015; 2016; 2017; 2018; 2019; 2020).

Indeed, this growing consumption rate, mainly met by exhaustible resources, along with continued subsidies by the government, whose economy is oil-based, would cause a monetary burden to the government and threatens the sustainability of the Kingdom’s energy sources. Thus, in December 2015, the government of Saudi Arabia announced an ambitious plan to reform the price of energy products over the next 5 years, including the price of electricity for the residential sector, to curb the growth of demand, improve energy efficiency and compensate for the drop in oil price (Arab Petroleum Investments Corporation (APICOPR), 2016). The plan to reform electricity prices involves raising the price of electricity and cutting subsidies through two phases, mainly targeting the residential sector, whose customers represented more than 49 percent of the total customers in 2015 (Water & Electricity Regulatory Authority (WERA), 2015). The first phase involved raising the tariff for households whose consumption level lies between 4,000 and 6,000 kWh a month from SAR 0.12/kWh to SAR 0.20/kWh. The tariff of households with a monthly consumption level of more than 6,000 kWh was set at SAR 0.30/kWh. The tariffs of low-consumption households remained at SAR 0.05/kWh and SAR 0.10/kWh for consumption levels of 1–2,000 kWh and 2,001–4,000 kWh, respectively. In 2018, the government introduced the reform plan’s second phase, where electricity consumption brackets were modified. All households whose consumption level is 1–6,000 kWh a month were grouped into one bracket with a revised tariff of SAR 0.18/kWh, whereas the tariff of households who consume more than 6,000 kWh a month remained at SAR 0.30/kWh (Arab Petroleum Investments Corporation (APICORP), 2018), (Aldubyan and Gasim, 2020).

The reform plan for electricity prices did not involve changing the tariff of other sectors. Due to the significant increase in the price of electricity and other energy products in the second phase, the government accompanied the second phase with a cash-transfer program (Citizen’s Account). The program aims to help protect low-income households from any additional burden the increase in energy prices may cause (Citizen’s Account, 2020). Although the reform plan might have direct and indirect effects on the welfare of some segments of society, it has many positive impacts on the economic and environmental levels of the country in the long term, as investigated in (Gonand et al., 2019), (Mikayilov et al., 2020). In fact, a higher price of electricity would be an incentive for households to change their consumption behavior and reduce electricity usage, which in turn, reduces electricity demand growth rate, decreases air pollution level, reduces government spending on expansion projects for the electricity grid, save more barrels of oil, improves the reliability of the power system, optimizes utilization of natural resources, and increases government non-oil revenue.

4.4.3 Smart metering project

In December 2019, SEC kicked off a project to replace existing mechanical and analog power meters with smart and digital meters for more than 10 million residential and business customers across the country for a total cost of SAR 9.55 billion (ARAB NEWS, 2019), (SEC, 2020). The project started in February 2020 and should complete by March 2023 (Argaam20, 2019). The installment of smart power meters is one of the company’s national plans for digital transformation, and it is expected to improve the quality of electricity service in the country (SEC, 2020). Many benefits can be achieved by installing smart meters for both utilities and consumers, the most important of which, from the author’s perspective, is the capability of measuring the instantaneous energy consumption for each type of customer for each hour. This benefit would help SEC increase the operation efficiency of the electricity system in different aspects, particularly by developing an incentive Time-of-Use (TOU)-based pricing plan for different customer sectors. Many studies discussed the advantages of developing a TOU plan for the electricity system of Saudi Arabia, including, for example, managing the growth of peak demand through load-shifting during peak times, reducing the urgent necessity to expand generation capacity, saving more barrels of oil, and increasing the opportunity to export power (Mahmoud et al., 2010; ECRA, 2012; Hafez, 2017; Matar, 2017).

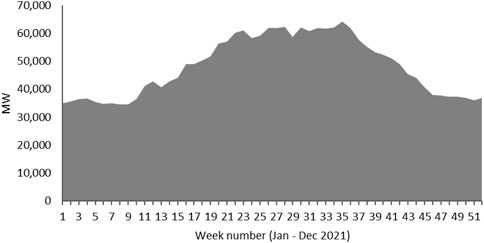

4.5 Exporting electricity overseas

Due to Saudi Arabia’s advantageous geographical location, it could profit from exporting electricity to Europe in the winter seasons. Figure 10 depicts the electricity demand pattern of Saudi Arabia over a typical year from January to December 2021 (Water & Electricity Regulatory Authority (WERA), 2021). This pattern clearly shows that the demand for electricity rises during summer and drops during winter. This high demand in summer is mainly due to cooling systems which consume 50 percent of electrical energy, the highest in the World (Alshehri et al., 2020). In contrast to Saudi Arabia, the weather in Europe during the winter seasons is cold; hence, the electricity demand is high for heating systems. Therefore, the surplus generation capacity in Saudi Arabia during winter can be exported to Europe. Nevertheless, Saudi Arabia needs to develop a regulatory environment for power network interconnection with neighboring regions.

5 Conclusion

The previous sections have addressed Saudi Arabia’s energy policy, associated main challenges, potential opportunities, and the actions taken by the government in response. As discussed earlier, Saudi Arabia’s energy system relies entirely on fossil fuels. The rapid growth of the population and economy combined with government subsidies for electricity tariffs have resulted in a higher increase in electricity demand, most of which is met using fossil fuel sources. This practice presented a significant challenge for policymakers. Furthermore, the environmental footprint of fossil fuels adds considerable challenge to the situation. Though burning more oil may help meet the growing domestic demand in the short term, this practice could lead to a domestic and international economic recession. Indeed, all these factors in addition to the global transition into inexhaustible energy sources, have been the driving force for the policymakers in the Kingdom to take serious steps toward finding alternative sustainable and clean energy sources and improving energy efficiency. Consequently, serious actions have been taken by the Kingdom aiming to diversify the energy supply mix and introduce energy efficiency programs. This strategy would benefit Saudi Arabia in the long-term by lowering the reliance on fossil fuels, which in turn would help achieve numerous benefits, including, for instance:

• Meeting the growing demand for electricity in a sustainable, clean, and reliable manner.

• Preserving oil and gas, which in turn extends their life, increases their reserve levels, and frees larger quantities of oil available for export.

• Reducing air pollution and GHG emissions.

• Developing a new economic sector and creating new job opportunities.

• Improving electricity efficiency consumption.

• Exporting electricity.

As a result, the actions taken by the country’s policymakers have borne fruit. The electricity consumption curve of residential customers started to flatten and decline, although the number of customers kept increasing, as depicted in Figure 9, for the post-2015 period. For example, the 2019 consumption level of electricity in the residential sector declined by 11 percent compared to 2015, which is equivalent to saving more than two million barrels of oil equivalent per year. According to (Soummane and Ghersi, 2022), for the period between 2019 and 2030 and under the current tariff, residential demand is expected to recover at an average annual growth rate of 1.1 percent. Environmentally, the level of CO2 emissions started to reduce. The CO2 emissions per capita decreased by approximately 16 percent in 2019 compared to the 2015-level, as shown in Figure 4.

Although the benefits might be achieved by implementing an energy price reform plan for the country’s economy, the policymakers in the Kingdom are required to assess the effectiveness of the cash-transfer program through the Citizen’s Account for low-income households. The effect of increasing the prices of energy products and the compensated amount of cash should be examined to mitigate any additional monetary burden for low-income families.

Author contributions

The author confirms being the sole contributor of this work and has approved it for publication.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Al Harbi, F., and Csala, D. “Saudi Arabia's electricity: Energy supply and demand future challenges,” in Proceedings of the 2019 IEEE 1st Global Power, Energy and Communication Conference, GPECOM 2019, Nevsehir, Turkey, June 2019, 467–472.

Al-Ajlan, S., Al-Ibrahim, A., Abdulkhaleq, M., and Alghamdi, F. (2006). Developing sustainable energy policies for electrical energy conservation in Saudi Arabia. Energy Policy 34 (16), 1556–1565. doi:10.1016/j.enpol.2004.11.013

Aldubyan, M., and Gasim, A. (2020). Energy price reform in Saudi Arabia: Modeling the economic and environmental impacts and understanding the demand response. Energy Policy 148, 111941. doi:10.1016/j.enpol.2020.111941

Almasoud, A. H., and Gandayh, H. M. (2015). Future of solar energy in Saudi Arabia. J. King Saud Univ. - Eng. Sci. 27 (2), 153–157. doi:10.1016/j.jksues.2014.03.007

Alnatheer, O. (2005). The potential contribution of renewable energy to electricity supply in Saudi Arabia. Energy Policy 33 (18), 2298–2312. doi:10.1016/j.enpol.2003.12.013

Alshammari, Y. M., and Sarathy, S. M. (2016). Achieving 80% greenhouse gas reduction target in Saudi Arabia under low and medium oil prices. Energy Policy 101, 502–511. doi:10.1016/j.enpol.2016.10.027

Alshehri, T., Howarth, N., Fuentes, R., and Odnoletkova, N. (2020). Future Cool. Saudi Arab Technol. Mark. Policy Options. https://www.kapsarc.org/research/publications/the-future-of-cooling-in-saudi-arabia-technology-market-and-policy-options/.

Arab News, (2019). 10 million Saudi homes to get smart meters. https://www.arabnews.com/node/1601571/saudi-arabia.

Arab Petroleum Investments Corporation (APICORP), (2016). Energy price reform in the GCC: Long road ahead. Dammam: APICORP Energy Research. https://www.apicorp.org/wp-content/uploads/2021/12/Energy-price-reform-in-the-GCC-long-road-ahead.pdf.

Arab Petroleum Investments Corporation (APICORP), (2018). Saudi energy price reform getting serious. Dammam: APICORP Energy Research. https://www.apicorp.org/wp-content/uploads/2021/12/Saudi-energy-price-reform-getting-serious.pdf

Argaam20, (2019). Saudi Electricity awards SAR 9 bln smart meter project to local, Chinese firms. https://www.argaam.com/en/article/articledetail/id/1335418.

Betak, J., Suri, M., Cebecauer, T., and Skoczek, A. “Solar resource and photovoltaic electricity potential in EU-MENA region,” in Proceedings of the 27th European Photovoltaic Solar Energy Conference and Exhibition, Frankfurt, Germany, September 2012, 4623–4626.

BP, (2018). BP statistical review of world energy. Available at: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2018-full-report.pdf (Accessed April 24, 2020).

BP, (2021). BP statistical review of world energy. https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2021-full-report.pdf.

Citizen's Account, (2020). For the citizen's account. https://www.ca.gov.sa/about.

Coady, D., Parry, I., Le, N.-P., and Shang, B. (2019). Global fossil fuel subsidies remain large: An update based on country-level estimates. Washington, DC, USA: International Monetary Fund.

Contestabile, M. (2017). Growth through diversification and energy efficiency : Energy productivity in Saudi Arabia. Riyadh Beirut.

Crippa, M. (2020). Luxembourg, Europe: Publications Office of the EU - European Union. doi:10.2760/687800Fossil CO2 & GHG emissions of all world countries - 2020 Report

DiChristopher, T. (2018). SoftBank, Saudi Arabia creating world's biggest solar power project | CNBC. https://www.cnbc.com/2018/03/27/softbank-and-saudi-arabia-announce-new-solar-power-generation-project.html.

Ecra, (2012). A strategy for smart meters and smart grids in the kingdom of Saudi Arabia. https://ecra.gov.sa/en-us/ECRAStudies/Pages/study2.aspx.

G20, (2020). G20. https://g20.org/en/Pages/home.aspx.

Gately, D., Al-Yousef, N., and Al-Sheikh, H. M. H. (2012). The rapid growth of domestic oil consumption in Saudi Arabia and the opportunity cost of oil exports foregone. Energy Policy 47, 57–68. doi:10.1016/j.enpol.2012.04.011

General Authority for statistics, (2022). Gross domestic product first quarter of 2022. https://www.stats.gov.sa/sites/default/files/GDP.Press.Release.Report Q12022E_2.pdf.

General Authority for statistics, (2022). Population estimates. https://www.stats.gov.sa/en/43.

Gonand, F., Hasanov, F. J., and Hunt, L. C. (2019). Estimating the impact of energy price reform on saudi arabian intergenerational welfare using the MEGIR-SA model. Energy J. 40 (3), 101–123. doi:10.5547/01956574.40.3.fgon

Hafez, O. “Time of use prices considering smart meters and their future implementation in Saudi Arabia smart grid,” in Proceedings of the Saudi Arab. Smart Grid Conf. SASG 2017, Jeddah, Saudi Arabia, December, 2017, 1–5. doi:10.1109/SASG.2017.8356504

Iea, Saudi Arabia - countries & regions - IEA.2022 https://www.iea.org/countries/saudi-arabia.

Iea, United States - countries & regions - IEA.2022 https://www.iea.org/countries/united-states.

Intergovernmental Panel on Climate Change, (2011). Special report on renewable energy sources and climate change mitigation. Cambridge, United Kingdom: Cambridge University Press.

International Atomic Energy Agency, (2020). Pris - home. https://pris.iaea.org/pris/.

Irena, Wind energy.2022 https://www.irena.org/wind.

Irena, Workbook: IRENA renewable energy Insights_Technologies.2022 https://public.tableau.com/shared/Q2YX2HBWS?:showVizHome=no.

Irena, Workbook: IRENA renewable energy Insights_Technologies.2022 https://public.tableau.com/shared/JWP9WMSZT?:toolbar=n&:display_count=n&:origin=viz_share_link&:embed=y.

Ka-Care, (2012). Building the renewable energy sector in Saudi Arabia. https://www.irena.org/-/media/Files/IRENA/Agency/Events/2012/Sep/5/5_Ibrahim_Babelli.pdf.

Ka-Care, (2020). National renewable energy program. https://www.energy.gov.sa/ar/FutureEnergy/RenewableEnergy/pages/renew1.aspx.

Ka-Care, (2010). Royal decree establishing KA-CARE. https://www.kacare.gov.sa/en/about/Documents/KACARE_Royal_Decree_english.pdf.

Ka-Care, (2011). Saudi Arabia's renewable energy strategy and solar energy deployment roadmap. https://rise.esmap.org/data/files/library/saudi-arabia/KSA/RE/RE.3.5_Saudi.Arabia’s.Renewable.Energy.Strategy.and.Solar.energy.deployment.roadmap.pdf.

Kabeer, N. Saudi Arabia's public investment fund to invest $45 billion in SoftBank for solar projects - mercom India.2022 https://mercomindia.com/saudi-arabia-pfc-invest-softbank-solar/.

Kapsarc, (2019). Dashboard. https://datasource.kapsarc.org/page/dashboard/.

Kapsarc, Electricity consumption, production, number of subscribers, peak load and actual generating capacity — KAPSARC data portal.2022 https://datasource.kapsarc.org/explore/dataset/electricity-consumption-production-number-of-subscribers-and-peak-load-1980-2004/table/?disjunctive.electricity_indicator&refine.electricity_indicator=Total+Energy+Consumption+MW%2Fh&refine.electricity_indica.

Kicp, (2009). The KICP annual strategic study: Saudi Arabia solar energy manufacturing and technology assessment. https://docplayer.net/11656934-The-kicp-annual-strategic-study-saudi-arabia-solar-energy-manufacturing-and-technology-assessment-kaust-industry-collaboration-program-kicp.html.

Krane, J. (2017). Beyond 12.5: The implications of an increase in Saudi crude oil production capacity. Energy Policy 110, 542–547. doi:10.1016/j.enpol.2017.08.052

Mahmoud, S., Alyousef, Y., Alusaimi, Y., Yassin, I., and Alelwan, A. (2010). Time-of-Use tariff program in Saudi Arabia: Design, implementation, and evaluation. J. King Saud Univ. - Eng. Sci. 22 (2), 165–172. doi:10.1016/s1018-3639(18)30503-8

Marwa, R., Stephen, K., Nafisa, E., and Tom, A. (2018). Saudi starts work with SoftBank on 200 gigawatt solar plan: Minister - Reuters. https://www.reuters.com/article/us-saudi-softbank-solar/saudi-starts-work-with-softbank-on-200-gigawatt-solar-plan-minister-idUSKBN1OI16T.

Matar, W. (2017). A look at the response of households to time-of-use electricity pricing in Saudi Arabia and its impact on the wider economy. Energy Strategy Rev. 16, 13–23. doi:10.1016/j.esr.2017.02.002

Matar, W., and Anwer, M. (2017). Jointly reforming the prices of industrial fuels and residential electricity in Saudi Arabia. Energy Policy 109, 747–756. doi:10.1016/j.enpol.2017.07.060

Matar, W., and Anwer, M. (2017). Reforming industrial fuel and residential electricity prices in Saudi Arabia. https://www.kapsarc.org/research/publications/reforming-industrial-fuel-and-residential-electricity-prices-in-saudi-arabia/.

Mikayilov, J. I., Darandary, A., Alyamani, R., Hasanov, F. J., and Alatawi, H. (2020). Regional heterogeneous drivers of electricity demand in Saudi Arabia: Modeling regional residential electricity demand. Energy Policy 146, 111796. doi:10.1016/j.enpol.2020.111796

Ministry of Finance, (2019). Budget statement: Fiscal year 2020. https://www.mof.gov.sa/en/budget/Pages/Statement.aspx.

Rehman, H. (2012). Saudi petrochemicals: End of the magic porridge pot? Dubai: President and Fellows of Harvard College.

Rehman, S. (2004). Prospects of wind farm development in Saudi Arabia. Renew. Energy 30 (3), 447–463. doi:10.1016/j.renene.2004.04.008

Repdo, (2020). About the renewable energy project development Office (REPDO). https://www.powersaudiarabia.com.sa/web/index.html.

Repdo, (2018). Saudi Arabia awards first NREP solar project. https://www.powersaudiarabia.com.sa/web/attach/news/300MW-Sakaka-Solar-PV-Project-Awarded.pdf.

Repdo, (2017). Saudi Arabia issues request for qualifications for 400 MW wind power project in Dumat Al jandal. https://www.powersaudiarabia.com.sa/web/attach/news/EN_Dumat-Al-Jandal-RFQ_v3.pdf.

Repdo, (2020). Saudi Arabia launches round three of national renewable energy program. https://www.powersaudiarabia.com.sa/web/attach/news/PRESS_RELEASE_Round3_RFQ.pdf.

Repdo, (2019). Saudi Arabia's Ministry of energy, industry and mineral resources launches round two of renewable energy program. https://www.powersaudiarabia.com.sa/web/attach/news/Press-release_29.01.2019_REPDO_EOI_RoundTwo.pdf.

Saudi Arabia’s National Unified Portal for Government Services, (2022). Saudi energy efficiency center - kingdom of Saudi Arabia. https://www.my.gov.sa/wps/portal/snp/agencies/agencyDetails/AC416/!ut/p/z1/jZBNb4JAEIZ_iweOMrPyUextxcR0I1JDtLgXsxhYSChL1m1J–vdtCdi1c5tJs-TmXeAQw68E5-NFKZRnWhtf-Dhkb1GPqFI0oiQELfxPFpuCPMQEd7GQOoF CwskTynN9gQxAP4fH28UxUc-ewTYBDOdxIkE3gtTT5uuUpDT2CehXc 7HerpivtXJbhawPWIWXAHX-X6AOwHshbJVxe8zaVd4kT1Fl1WpS-1-aDuujenPzw46OAyDK5WSbemehIN_GbU6G8hHIPTvu_x7XWUvU158DXRyAbADKsQ!/#.

Saudi Electricity Company, (2020). Thermal insulation in buildings. https://www.se.com.sa/en-us/Pages/ThermalInsulationinBuildings.aspx.

Saudi Energy Efficiency Center, (2021). Annual report 2021. https://www.seec.gov.sa/media/44alu10p/seec-ar-2021.pdf.

Sec, (2020). Smart meters. https://www.se.com.sa/en-us/customers/Pages/SmartMeters.aspx.

Shu, C. (2018). Saudi Arabia's sovereign fund will also invest $45B in SoftBank's second Vision Fund | TechCrunch. https://techcrunch.com/2018/10/07/saudi-arabias-sovereign-fund-will-also-invest-45b-in-softbanks-second-vision-fund/.

Shu, C. (2018). SoftBank Group and Saudi Arabia plan to spend $200 billion building the world's biggest solar power plant | TechCrunch. https://techcrunch.com/2018/03/28/softbank-group-and-saudi-arabia-plan-to-spend-200-billion-building-the-worlds-biggest-solar-power-plant/.

Solargis, (2020). Solar resource maps and GIS data for 200+ countries and regions. https://solargis.com/maps-and-gis-data/download/saudi-arabia.

Soummane, S., and Ghersi, F. (2022). Projecting Saudi sectoral electricity demand in 2030 using a computable general equilibrium model. Energy Strategy Rev. 39, 100787. doi:10.1016/j.esr.2021.100787

The Embassy of Saudi Arabia in the United States, Water resources.2022 https://www.saudiembassy.net/water-resources.

The Worldwatch Institute, (2013). State of the world 2013: Is sustainability still possible? 1st ed. Washington, DC, USA: Island Press.

Vision, (2018). National industrial development & logistics program. https://www.vision2030.gov.sa/v2030/vrps/nidlp.

Water & Electricity Regulatory Authority (Wera), (2011). Annual statistical booklet for electricity & seawater desalination industries. https://erranet.org/member/wera-saudi-arabia/.

Water & Electricity Regulatory Authority (Wera), (2012). Annual statistical booklet for electricity & seawater desalination industries.

Water & Electricity Regulatory Authority (Wera), (2013). Annual statistical booklet for electricity & seawater desalination industries.

Water & Electricity Regulatory Authority (Wera), (2014). Annual statistical booklet for electricity & seawater desalination industries.

Water & Electricity Regulatory Authority (Wera), (2015). Annual statistical booklet for electricity & seawater desalination industries.

Water & Electricity Regulatory Authority (Wera), (2016). Annual statistical booklet for electricity & seawater desalination industries.

Water & Electricity Regulatory Authority (Wera), (2017). Annual statistical booklet for electricity & seawater desalination industries.

Water & Electricity Regulatory Authority (Wera), (2018). Annual statistical booklet for electricity & seawater desalination industries.

Water & Electricity Regulatory Authority (Wera), (2019). Annual statistical booklet for electricity & seawater desalination industries.

Water & Electricity Regulatory Authority (Wera), (2020). Annual statistical booklet for electricity. https://erranet.org/member/wera-saudi-arabia/.

Water & Electricity Regulatory Authority (Wera), (2010). Annual statistical booklet on electricity industry. https://erranet.org/member/wera-saudi-arabia/.

Water & Electricity Regulatory Authority (Wera), (2021). Data and information. https://wera.gov.sa/Statistics/NRList.

World Nuclear Association, Nuclear power in the world today.2022 https://world-nuclear.org/information-library/current-and-future-generation/nuclear-power-in-the-world-today.aspx.

Yamani, H. (2011). Sustainable energy. https://www.youtube.com/watch?v=t6zFUzojPcc.

Yamani, H. (2011). Sustainable energy. https://www.youtube.com/watch?v=GibAuOjUZc8.

Keywords: renewable energy, peak demand, energy consumption, Saudi Arabia’s energy, renewable enegry sources

Citation: Aldhubaib HA (2022) Electrical energy future of Saudi Arabia: Challenges and opportunities. Front. Energy Res. 10:1005081. doi: 10.3389/fenrg.2022.1005081

Received: 27 July 2022; Accepted: 28 November 2022;

Published: 12 December 2022.

Edited by:

Fateh Belaid, King Abdullah Petroleum Studies and Research Center (KAPSARC), Saudi ArabiaReviewed by:

Gudina Terefe Tucho, Jimma University, EthiopiaViswanathan Balasubramanian, Indian Institute of Technology Madras, India

Copyright © 2022 Aldhubaib. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hani A. Aldhubaib, aGFkaHViYWliQHVxdS5lZHUuc2E=

Hani A. Aldhubaib

Hani A. Aldhubaib