- 1Business Management Research Center, School of Business Administration, Huaqiao University, Quanzhou, China

- 2Department of Tourism Management, South China University of Technology, Guangzhou, China

This study explores consumers’ motivations to switch to new products in the context of disruptive innovation and investigates the role of comparative economic value and green trust. Switching from an existing product to a disruptive green product not only involves benefits but also requires major sacrifices, which are not encountered in the context of continuous innovation. In this study, the relationships between comparative economic value, green trust, self-accountability, and disruptive green product switching intent are examined. Data were collected from China with self-administered questionnaires regarding the disruptive green product. Results of a structural model reveal positive relationships between comparative economic value, green trust, and disruptive green product switching intent. In addition, green trust mediates the effects of the comparative economic value on the disruptive green product switching intent, and self-accountability moderates the relationship between green trust and disruptive green product switching intent. From a practitioner perspective, the research is important because it illuminates the consumer’s motivations regarding product switching in the hitherto unexplored field of automobiles, for which we have shown that our extended model yields meaningful results.

Introduction

Since consumers pay more attention to the rise of environmental protection activities and the impact of pollution, consumer environmentalism has become more popular in the world (McIntosh, 1991). In the environmental era, consumers may switch from their current products to green products (Chen and Chang, 2012). The topic of consumers’ switching intentions and behaviors has received extensive attention from scholars and practitioners due to their important impact on the survival, performance, and growth of enterprises (Asimakopoulos and Asimakopoulos, 1980; Kamolsook et al., 2019). Existing literature has extensively explored the motivation of consumers to maintain brand loyalty (Frank et al., 2012), while the literature on the consumer’s motivation to switch to alternative products is scarce. In addition, some research has explained the consumer’s switching intent from current products to upgraded products and disruptive technologic products (Ye and Potter, 2011; Bhattacherjee et al., 2012; Kamolsook et al., 2019). Few studies have paid attention to the consumer’s switching intention in green products under the context of disruptive innovation.

The rapid development and changes of disruptive innovation (Hopp et al., 2018) have an influence on the existing markets and consumers. Disruptive green products can not only provide new functionality (Sandstrom et al., 2014) but also long-term social and environmental value. Prior studies related to disruptive products have paid attention to the organizational issues, such as the effect of disruptive innovation on the business performance of both the incumbents and new entrants (Christensen, 1997; Christensen et al., 2018; Zach et al., 2020). Few studies have focused on the personal topics (Danneels, 2004). Therefore, under the context of disruptive innovation, it is not clear whether the existing research conclusions on the switching intent of consumers can explain the consumer’s willingness to switch from current products to disruptive green products.

In this study, we explored consumer switching to disruptive green products, which are based on the green products introduced by the enterprise in the process of disruptive innovation (hereafter abbreviated as DGP). A disruptive product has many opportunities to enter existing and new markets (Christensen et al., 2018). Also, consumers switching from the current product to a disruptive product will involve higher risks (Walsh et al., 2002) because they can not only gain benefits but also need to make sacrifices (Kamolsook et al., 2019). Moreover, under most circumstances, consumers generally own the current product and the DGP simultaneously. In this situation, switching means that consumers need to invest more time and energy, and the sunk cost of the current product leads to greater sacrifices (Moore, 1991); thus, DGP switching has become a trade-off. This research assumes that the consumers have experience in using the existing product and can use the disruptive green product without changing their behavior too much. Moreover, the DGP is inclined to be at least as good as the existing product in terms of functionality or usability, so the new product will not cause significant losses to consumers.

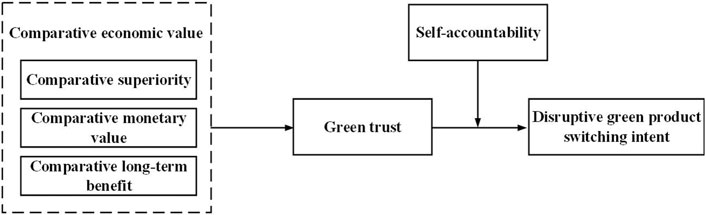

The first purpose of this research is to examine the formation mechanism of the consumer’s switching intent from current products to DGPs. Previous studies have confirmed that there is a positive correlation between perceived value and intention (Zeithaml, 1988; Kuo et al., 2009). A product can deliver value to consumers by distinguishing it from competitors’ products and providing them with benefit (Zeithaml, 1988). Taking into account the consumer’s trade-off of switching costs, we depend on the theory of comparative economic value to construct our model. We argue that compared to continuous innovation, the choice of switching to a DGP contains greater attention to the comparative economic value of the DGP are more often associated with the current product and that the higher the comparative economic value of the DGP, the higher the probability of DGP switching intent.

Second, we contend that green trust plays an essential mediating role in the process of the consumer intent to switch to a DGP. Positive expectations of the intention or behavior of the other party would lead to trust related to the intention to take vulnerability (Rousseau et al., 1998). Green trust is a willingness to rely on a product or service based on the beliefs or expectations arising from its reputation, credibility, benevolence, and ability for environmental performance (Chen, 2010). Indeed, green trust is an important premise of green consumption willingness (Wasaya et al., 2021); when consumers trust green products, their intent to switch from current products to green products will also increase. Existing research argued that green trust has a positive effect on consumers’ purchasing intention, but its effect on consumers’ switching intention has not been fully explored. In addition, the misgiving of the ecosystem and environmental protection have become one of the most concerning issues for citizens; consumers believe that taking social and environmental responsibility is a self-standard held by individuals (Tran and Paparoidamis, 2021). This supports the foundation of the current study, which is that if an individual believes that they will be achieving this kind of self-accountability, they may be motivated to act in an environmentally or socially sustainable way. A previous study has argued that consumers are likely to have varying degrees of self-accountability (Peloza et al., 2013; Dhiman et al., 2018). Although prior study has shown that self-accountability may influence purchase intention (Rowe et al., 2017), the relationship between self-accountability and consumer switching intent has not been fully explored. To explore this formation process and extend the existing literature, our study examines the moderating effect of the self-accountability.

Our study aims at making at least three contributions. First, previous studies paid less attention to the topic of green consumption in the context of disruptive innovation. To break through the limitation, this study expands the focus to a series of more fundamental issues, in view of the fact that new energy vehicles are both disruptive products and green products, focusing on the automotive industry, exploring the impact of the comparative economic value of new energy vehicles on consumers’ DGP switching behavior. Second, we introduced green trust to reveal its intermediary mechanism between the comparative economic value and the DGP switching intent. This helps to reveal the specific mechanism of the comparative economic value on the DGP switching intent and helps to deepen the research on consumers purchasing disruptive products in the context of green consumption. Third, when considering the relationship between green trust and DGP switching intent, we further investigate the moderating effect of self-accountability, which can make the research results more consistent with the actual situation.

Theoretical Background and Hypotheses

From Comparative Economic Value to Disruptive Green Product Switching Intent

Comparative economic value is the consumer’s perception of the overall economic benefits of the DGP as compared to those of the consumer’s current product. It is composed of 1) comparative monetary cost, 2) comparative long-term benefit, and 3) comparative superiority (Holbrook, 1999; Kamolsook et al., 2019). These three economic dimensions belong to perceived value and have been affirmed to be important elements of consumer value (Sánchez-Fernández and Iniesta-Bonillo, 2009). The switching intent of consumers is the intention of individuals to migrate or not to migrate to a new product (Ajzen, 1991). Switching intention usually represents a favorable result because it often refers to consumers to transfer from an old product to an upgraded product with more advanced technical functions and benefits (Kamolsook et al., 2019). Previous research further explained that switching intent and behavior occurs when consumers are dissatisfied with their previous choices and take notice of other specific alternative products (Bhattacherjee et al., 2012; Frank et al., 2012; Hsieh et al., 2012). Our work extends the existing literature by exploring the switching intent of the disruptive green product.

It is generally believed that the overall structure of the perceived value will influence the repurchasing intent (Frank et al., 2012; Frank et al., 2014), the switching behavior (Gale and Wood, 1994), and the acceptance and usage of green products (Chen and Chang, 2012; 2013; Gonçalves et al., 2016). Previous studies have largely supported the influence of the perceived value on environment-related behaviors (Gonçalves et al., 2016). Based on the theory of consumption values (Sheth et al., 1991), different aspects of the perceived value have be confirmed that can affect behavior (Papadas et al., 2019) with regard to consumers’ perceptions of the proper functions and benefits of disruptive green products. Comparative economic value is an extended concept of the perceived value that compares the expected benefits of disruptive green products with both the expected economic sacrifice and the comparative benefits of the consumer’s current product (Kamolsook et al., 2019). Compared with non-green products and traditional green products, disruptive green products should possess the novel function to enhance purchase intentions (such as DGP switching intent). Existing study has identified comparative economic value as a significant predictor of disruptive technology product switching intent (Mathwick et al., 2001). The intention of switching involves exiting a current relationship (Keaveney, 1995), which means—in our study—replacement of a current product that consumers already own with a disruptive green product. High comparative economic value can lead to an increase in switching intent (Kamolsook et al., 2019). With the rise and popularity of environmentalism, comparative economic value is also essential to disruptive green product switching intent. We thus hypothesize the following:

H1: Comparative economic value is positively related to disruptive green product switching intent.

From Comparative Economic Value to Green Trust

Perceived value is related to a trade-off between the perceived benefits and affordability of a product (Monroe and Krishnan, 1985). The essence of trust is the individual’s psychological response to a certain object in a specific social environment; specifically, it is a willingness to accept a certain object (Rousseau et al., 1998; Lin et al., 2003). Concerning the context of the environmental era, (Chen, 2010) reported that green trust is a willingness to depend on an object based on the belief or expectation attributable to its credibility, benevolence, and ability with regard to environmental performance. Past research hypothesized that there is a positive correlation between perceived value and consumer trust, since a high level of perceived value can increase post-purchase confidence of the product (Sweeney et al., 1999; Sánchez-Fernández and Iniesta-Bonillo, 2009; Rasheed and Abadi, 2014). Comparative economic value, as a part of perceived value, is also important in influencing green trust. In the process of consumers choosing disruptive green products, the higher the value of environmental protection performance and quality delivered by the product itself, the higher the comparative economic value perceived by consumers, which will ultimately enhance the green trust of the disruptive green product (Laufer, 2003). On the contrary, some companies exaggerate the environmental value of their products to the extent that their customers distrust their products more (Kalafatis et al., 1999). Hence, we hypothesize that the comparative economic value of consumers positively affects their green trust and propose the following hypothesis:

H2: Comparative economic value is positively related to green trust.

From Green Trust to Disruptive Green Products Switching Intent

Green trust refers to consumers who believe that a green product is reliable and trustworthy, and it is committed to complying with environmental commitments (Li et al., 2021; Wasaya et al., 2021). Indeed, previous research on green marketing has determined how green trust affects green behavior. Chen and Chang (2012) demonstrated the positive relationship between green trust and green intentions. Green trust means that another party will abide by their pro-environmental commitment, thereby helping to increase the intention of green behavior (Li et al., 2021). Due to the green nature of the DGP, consumers will also be affected by green trust when switching from the current product to disruptive green products. Hence, we hypothesize a direct positive link between green trust and disruptive green product switching intent. More specifically, we hypothesize the following:

H3: Green trust is positively related to disruptive green product switching intent.

Comparative Economic Value Associated With Disruptive Green Product Switching Intent Vis-à-Vis Green Trust

Prior research asserts that perceived value would impact not only an expectation of products (such as green trust) but also influence the purchase intent (such as the DGP switching intent) (Lalicic and Weismayer, 2021). Perceived value refers to the consumer’s overall assessment of the utility of a product based on the consumers’ perceptions of what they are obtaining and what they are sacrificing (Zeithaml, 1988). By comparing the value of disruptive green products with that of existing products, this comparative value will have an impact on consumers’ green trust (Sirdeshmukh et al., 2002; Anderson and Srinivasan, 2003). Moreover, Flavián et al. (2006) suggested that perceived value contributes to enhancing the consumer’s level of trust, which eventually reduces decision risk and facilitates purchase decision (Flavián et al., 2006).

We suggest that comparative economic value exerts its influence on DGP switching intent via green trust. According to the reasoned action (TRA) theory (Fishbein and Ajzen, 1975; Ajzen and Fishbein, 1980), an individual’s behavioral intentions are determined by cognitive factors such as attitudes and subjective norms, and behavioral intentions will further determine personal performance. If consumers perceive a product as a high risk, they would be unwilling to trust the product (Mitchell, 1999). In the context of green consumption, green trust can help consumers’ perceived risks and encourage consumers to show positive green purchase behavior (Rahbar and Abdul Wahid, 2011; Chen and Chang, 2013). Taken together, these arguments suggest that the relationship between comparative economic value and DGP switching intent will be mediated by green trust. We thus hypothesize the following:

H4: Green trust mediates the relationship between comparative economic value and disruptive green product switching intent.

The Role of Self-Accountability With Environmental Protection

We further argue that the extent to which green trust will influence the switching intent of DGP may be further contingent on the extent of self-accountability. Self-accountability refers to an activation of a person’s desire to live up to internal self-standards (Peloza et al., 2013). Most consumers report that they should make consumption choices according to ethical and sustainability criteria (Trudel and Cotte, 2009). In other words, consumers maintain their self-standard that they should behave in an ethical and sustainable manner (Peloza et al., 2013; Dhiman et al., 2018). Consumers’ green consumption behavior is consistent with ethical or responsible consumption, which refers to consumption in a sustainable and responsible way (Peattie, 2010). Moreover, when an individual decides to avoid feelings of guilt from choosing unethical choices, such expected results have been shown to be associated with ethical purchase decisions (Onwezen et al., 2013; Antonetti and Maklan, 2014; Antonetti et al., 2015). Accordingly, consumers are likely to be characterized by varying degrees of self-accountability (Tran and Paparoidamis, 2021). Individuals with higher self-accountability are more likely to engage in sustainable and environmentally friendly purchase behaviors. Therefore, when self-accountability to this salient self-standard is heightened, if consumers have had a green trust, they would possess a higher level of DGP switching intent. Conversely, when individuals have low levels of self-accountability, it can result in loss of DGP switching intent. We thus hypothesize the following:

H5: Self-accountability moderates the relationship between green trust and disruptive green product switching intent.

In summary, the conceptual model of this study is proposed in Figure 1.

Methodology and Measurement

Data Collection and Sample

In order to verify our hypothesis and promote our conclusions, we selected the automobile contexts that consumers consider switching from the current product to the DGP. After literature research and interviews with experts who had substantial research experience in the field of disruptive innovation (Wells and Erskine, 2016), we selected the new energy vehicle as the disruptive green product because the new energy vehicle has two important attributes of disruptive and green. From a technology perspective, the new energy vehicle is based on an entirely different power mechanism than fuel automobiles. From a consumer perspective, with the development of science and technology, new energy vehicles have numerous advantages and benefits, but they still have many disadvantages in comparison with fuel automobiles. Before reaching a switching decision, consumers have to weigh the benefits against the drawbacks of new energy vehicles compared to fuel automobiles. We targeted consumers from China where the transition from fuel automobiles to new energy vehicles is currently underway.

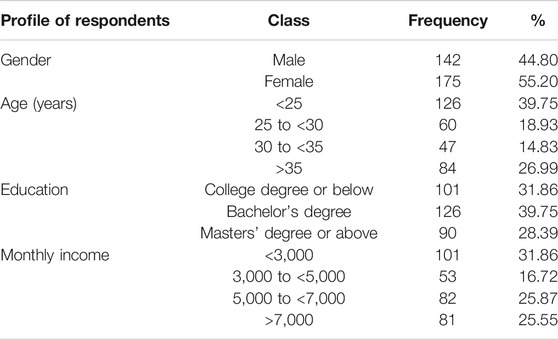

To verify the hypotheses and the research framework, we applied the questionnaire survey from April 1, 2021 to July 25, 2021. The research object of this study focuses on Chinese consumers who have the purchase or use experience of the DGP (new energy vehicles) in China. The questionnaires were randomly sent to consumers who had experience in purchasing or using fuel automobiles. The research assistants use electronic questionnaires with each randomly selected consumer to confirm that he or she has the purchase or use experience of automobiles. If he or she had the purchase or use experience of automobiles, the research assistants would undertake the subsequent procedures. A total of 400 consumers were surveyed. After deleting invalid responses with missing or incomplete information, our final sample consists of 317 consumers, with a valid rate of 79.25%. The detailed demographic characteristics of respondents are shown in Table 1.

Variable Measurement

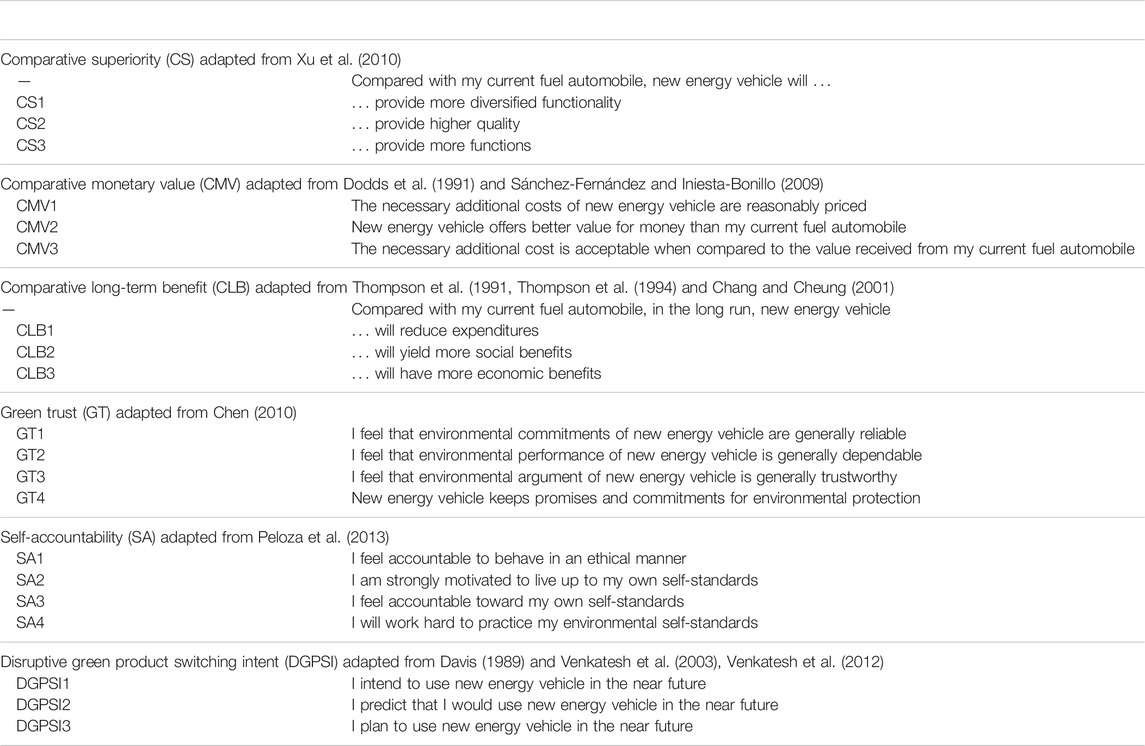

Most measurement items of key research variables were adopted from prior research to ensure the rationality and validity of the questionnaire to a certain extent, and all the items were measured by using a 7-point Likert scale. The appendix lists the scales and their literature sources, with respect to the product context of new energy vehicles. We asked experts to translate the questionnaire into Chinese and back into English, held a pre-test with thirty independent Chinese consumers followed by interviews, refined the survey structure and item of the questionnaire, and secured the questionnaire quality.

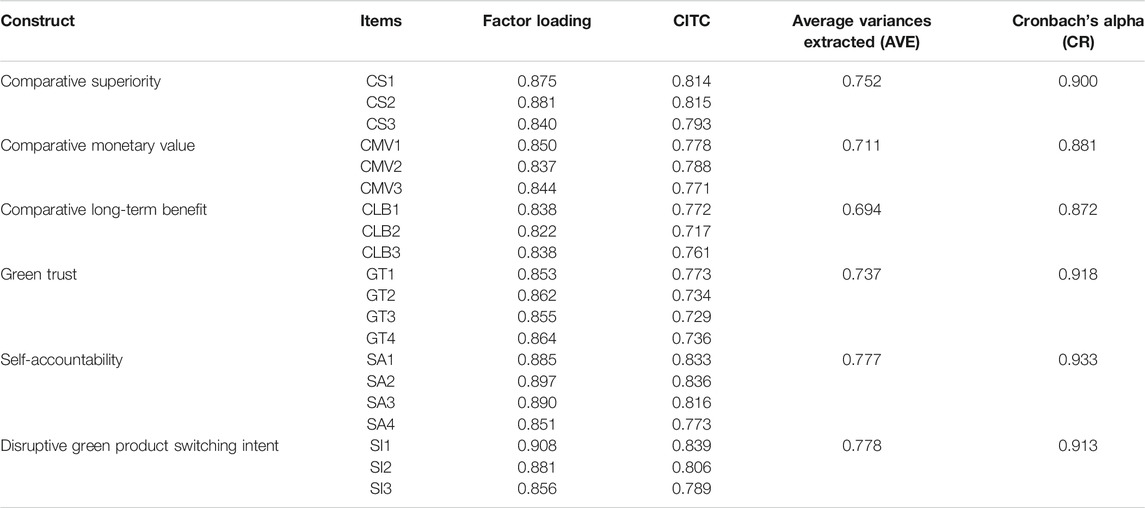

Synthesizing the ideas of Sánchez-Fernández and Iniesta-Bonillo, (2009), we assessed comparative superiority, comparative monetary value, and comparative long-term benefit as three main aspects of comparative economic value. Comparative superiority is measured by three items along a single dimension (α = 0.900). Respondents were asked to compare new energy vehicles with traditional fuel automobiles in terms of diversified functions and quality (Xu et al., 2010). Meanwhile, the scale of comparative monetary value was based on a scale used by Dodds et al. (1991) and Sánchez-Fernández and Iniesta-Bonillo, (2009), which includes three items measured along a single dimension (α = 0.881). Respondents were asked to rate the extent of trade-off between the monetary sacrifice of using new energy vehicles and the additional value of the new energy vehicle over the fuel automobile. Finally, consistent with the work of Thompson et al. (1991), Thompson et al. (1994) and Chang and Cheung (2001), we measured comparative long-term benefit using a three-item scale (α = 0.830). Respondents were asked to rate the degree of insight that switching to the new energy vehicle would lead to long-term economic and social benefits.

Green trust was measured using four items (α = 0.918) based on the study by Chen (2010) to evaluate the degree of a willingness to depend on new energy vehicles based on the belief or expectation resulting from its credibility, benevolence, and ability with regard to its environmental performance.

Self-accountability was measured using four items (α = 0.933) based on the study by Peloza et al., 2013. Respondents were asked to rate the activation of a person’s desire to live up to internal self-standards.

Disruptive green product switching intent was measured using three items (α = 0.913) that were adapted from the study by Kamolsook et al., 2019. Respondents were asked to rate the intent to replace the current product (fuel automobiles) with the disruptive green product (new energy vehicles).

All the items used in these instruments were measured using a 7-point Likert scale (1 = strongly disagree, 7 = strongly agree). Appendix A contains all the scales used in the study.

Analysis and Results

Descriptive Statistics of the Latent Constructs

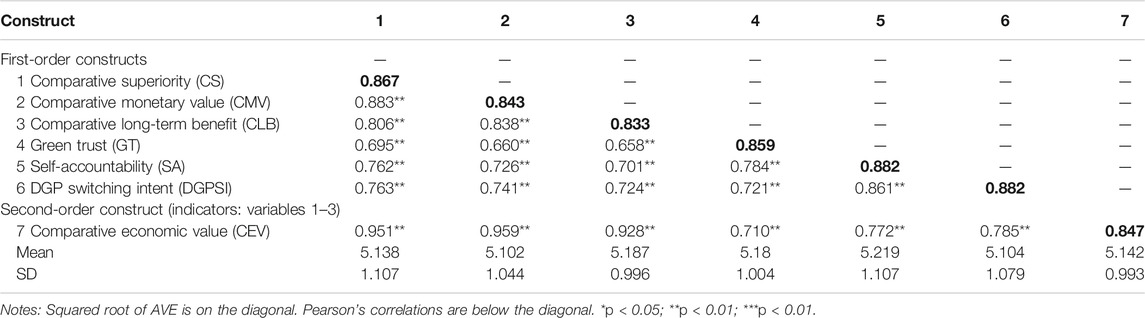

The statistical analyses were conducted using SPSS 25.0 and AMOS 24.0. We report the correlation between the main constructs in this research in Table 2. There are positive correlations among comparative superiority, comparative monetary value, comparative long-term benefit, green trust, self-accountability, and disruptive green product switching intent. The results show that it is suitable for further regression analysis.

Reliability and Validity

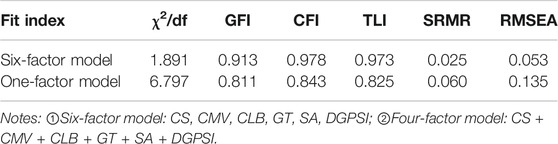

We first performed confirmatory factor analysis (CFA) to evaluate the goodness of our proposed six-factor model fit. As is shown in Table 3, the CFA results showed that our six-factor baseline model produced good fit with the data: χ2/df = 1.891, GFI = 0.913, CFI = 0.978, TLI = 0.973, SRMR = 0.025, RMSEA = 0.053. Then, we performed CFA to assess the fit of one-factor models. The one-factor model 1 in which we loaded all items onto one single latent variable: χ2/df = 6.797, GFI = 0.811, CFI = 0.843, TLI = 0.825, SRMR = 0.060, RMSEA = 0.135. The results showed that the six-factor model was significantly better than the one-factor model. We can thus deduce that the possibility of common method bias in this study is low (Iverson and Maguire, 2000).

Next, we found that the corrected item-total correlation (CITC) of all items was above 0.7. As shown in Table 4, all Cronbach’s alpha values and CR values are higher than the accepted value of 0.7. Therefore, we concluded that the scales used in this study were reliable. Furthermore, it can be seen that the AVE values are greater than the minimum accepted value of 0.5 (see Table 2), thus supporting the discriminant validity between the constructs. Based on the above results, we believed that the reliability and validity of the measurements in this study were within an acceptable range.

Hypothesis Testing

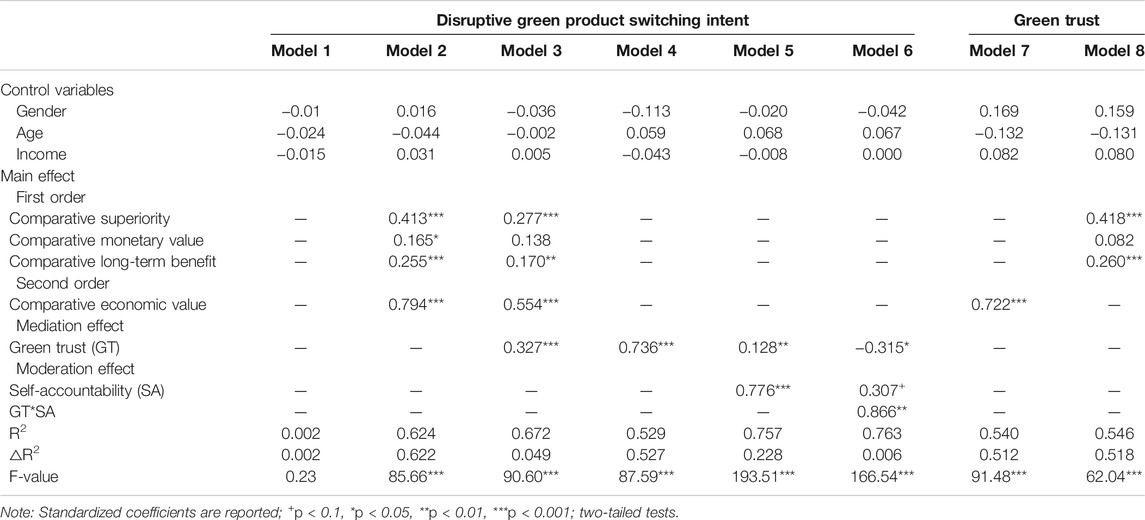

We use hierarchical regression to test the theoretical hypotheses about comparative economic value, green trust, self-accountability, and DGP switching intent, and the empirical results are shown in Table 5. We found a positive relationship between the comparative economic value and DGP switching intent (β = 0.794, p < 0.001, Model 2). Moreover, the relationships between comparative superiority and DGP switching intent (β = 0.413, p < 0.001, Model 2), comparative monetary value and DGP switching intent (β = 0.165, p < 0.05, Model 2), and comparative long-term benefit and DGP switching intent (β = 0.255, p < 0.001, Model 2) have been analyzed, which is significant, thus supporting H1. As illustrated in Model 7 and Model 3, the comparative economic value is positively related to green trust (β = 0.722, p < 0.001) and green trust is positively related to DGP switching intent (β = 0.255, p < 0.001), thus supporting H2 and H3.

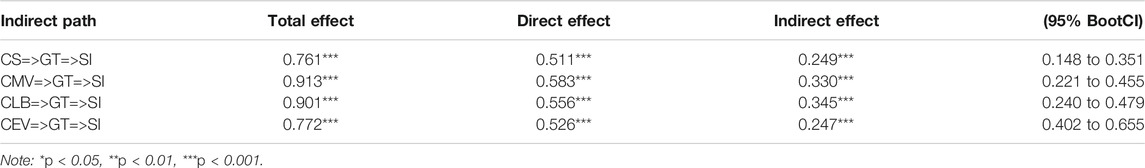

H4 proposed the mediation role of green trust in the relationship between comparative economic value and DGP switching intent. As shown in Model 3, when green trust was entered, the effect of comparative superiority on DGP switching intent decreased while remaining significant (β = 0.277, p < 0.001), and this indicated that green trust partially mediated the effect of comparative superiority on DGP switching intent; the effect of comparative superiority on DGP switching was not significant (β = 0.138, n. s), and this suggested that green trust fully mediated the effect of the comparative monetary value on DGP switching intent; the effect of comparative long-term benefit on DGP switching intent decreased while remaining significant (β = 0.170, p < 0.01), and this indicated that green trust partially mediated the effect of comparative long-term benefit on DGP switching intent. We further tested the mediation effects using path analysis and the bootstrapping method (Edwards and Lambert, 2007). As illustrated in Table 6, the indirect paths of “Comparative superiority → Green trust → DGP switching intent” (0.148–0.351), “Comparative monetary value → Green trust → DGP switching intent” (0.221–0.455), and “Comparative long-term benefit → Green trust → DGP switching intent” (0.240–0.479) were significant, in support of H4.

In order to test H5, we test our moderating effect according to the procedure recommended by Cohen et al. (2003). Before generating the interaction terms, we mean-centered all the variables involved. Model 6 showed that the interaction term between green trust and self-accountability was positively and significantly related to DGP switching intent (β = 0.866, p < 0.01). In addition, as shown in Figure 2, we drew a graph of the moderating effect of self-accountability, and thus H5 was supported.

Discussion

Theoretical Contributions

This study contributes to the literature on comparative economic value and disruptive green product switching intent in several ways. Our first contribution is to reveal the direct and indirect pathway whereby comparative economic value links with DGP switching intent through the mediation of green trust. First of all, we find that comparative superiority, comparative monetary value, and comparative long-term benefit are positively associated with DGP switching intent. Previous studies have shown that comparative economic value has an important impact on the consumer’s switching intent (Gale and Wood, 1994; Kamolsook et al., 2019). Our research results have further verified and expanded this view. In addition, Kamolsook et al. (2019) have pointed out that disruptive innovation is the key to improving the environmental performance of products and have suggested that future research on the switching intent can focus on the environmental performance of products and the personal attributes of consumers. Our research responds to this question. Second, researchers have highlighted that the green trust is an essential factor in raising the consumer’s green purchase intentions (Chen and Chang, 2012). Confente et al. (2020) found that switching intention is differently affected by the independent variables. However, little research has considered green trust as a vital psychological factor situated between comparative economic value regarding the DGP and the consumer’s switching intent. We find that green trust has a mediating effect on the relationship between the comparative economic value and DGP switching intent. The results show that consumers would be willing to accept the DGP if the products’ comparative value and environmental features were made clear and if these products’ environmental commitments are generally trustworthy. Taken together, these findings contribute significantly to understandings of the correlation between the comparative economic value and DGP switching intent and form a more systematic foundation for theoretical and empirical research on perceived value and switching intent.

Our second contribution is that we clarify how the comparative economic value becomes variables that correlate with the consumer’s green trust. Building on recent work on the trust, we hold that the green trust is a willingness to depend on a product based on belief or expectation about environmental performance (Ganesan, 1994; Chen, 2010), with this willingness being affected by perceived value (Kim et al., 2008). We find that the green trust is not only a positive emotion that influences DGP switching intent; what is more, it is influenced by comparative economic value. It is positively correlated with the comparative economic value. Previous studies have revealed that certain values associated with environmental quality are positively correlated with environmentally friendly behaviors and other intermediate elements such as psychological factors (Neuman, 1986; Li et al., 2021). For its part, the green trust is a key element allowing consumers to improve their behavior to search for and analyze green products’ information (Laufer, 2003). However, only a few studies have explored the role of green trust in the relationship between values and purchase intention. Our study analyzes the role of the green trust as an intermediary, while enriching the research on the variables that we treat as antecedents of that intermediary.

The third contribution is that self-accountability positively moderates the relationship between green trust and DGP switching intent. Specifically, switching from the old (fuel automobiles) to the new products (new energy vehicles) is more driven by self-accountability. This highlights self-accountability as a potential trigger of the consumer’s disruptive green products switching intent. Peloza et al. (2013) advanced that self-accountability is related to ordinary green products, while little is known about consumer perceptions of disruptive green products because of their novelty and relevance to disruptive innovation. Our research refines the conclusions in this area and addresses the fact that the consumers are treated as unique individuals with unique psychological judgments. Their acceptance of disruptive green products is guided by self-accountability.

Managerial Implications

Our findings have important managerial implications for understanding consumers’ DGP switching intent. First, our findings indicate the significance of comparative economic value as a driver to switch from existing products to disruptive green products. Most consumers would not sacrifice their needs just for environmental protection when choosing products, because this requires consumers to make a trade-off between the general attributes and environmental friendliness of the product (Ginsberg and Bloom, 2004). Thus, consumers need to understand the DGP in an all-round way. By comparing with existing products, the higher the comparative economic value perceived by consumers, the more willing they are to switch to the DGP. In order to successfully make consumers accept the DGP, it is necessary that companies provide overall information about the benefits and advantages of DGPs and their usage. Companies can use green marketing activities to help change consumers’ attitudes toward disruptive green products and usage intention. Second, our results demonstrate that the more consumers who trust the DGP’s environmental commitments, the easier it is for consumers to switch to the DGP. This requires companies to eliminate consumers’ concerns about DGPs and enhance their confidence in DGPs when conducting green marketing, thereby enhancing consumers’ switching intent and behavior.

Limitations and Future Research

This study has some limitations and avenues for future research. First of all, the generalizability of this study’s conclusions is constrained by the fact that one special kind of consumer (e.g., automobile users) within a single text (e.g., disruptive innovation) is examined. Future research could replicate this model on products or services in different industries, to see whether our research results are still valid. Second, our study uses cross-sectional data, which limits our design about causality. Although cross-sectional data can illuminate the temporary relationship between comparative economic value and DGP switching intent, whether the relationship between comparative economic value and green trust and the consumer’s switching intent will change over time is best to pass verification of longitudinal data. Third, this study estimates the fitting of comparative economic value without considering the relationship between different dimensions of comparative economic value and switching behavior. This may become an interesting research topic in the future.

Data Availability Statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author Contributions

CL, XL, and CY contributed to conception and design of the study. CL and XL organized the database. XL performed the statistical analysis and wrote the first draft of the manuscript. All authors contributed to manuscript revision and read and approved the submitted version.

Funding

This research is supported by National Natural Science Foundation of China under Grant 71974059 (Research on the impact mechanism of entrepreneurs’ contradictory cognitive framework on disruptive innovation in the context of external change) and National Social Science Foundation of China under Grant 18ZDA062 (Research on the impact of digital enabling on the innovation of manufacturing firms in the context of digial economy).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ajzen, I., and Fishbein, M. (1980). Understanding Attitudes and Predicting Social Behavior. NJ: Prentice-Hall Englewood Cliffs.

Ajzen, I. (1991). The Theory of Planned Behavior. Organizational Behav. Hum. Decis. Process. 50, 179–211. doi:10.1016/0749-5978(91)90020-T

Anderson, R. E., and Srinivasan, S. S. (2003). E-satisfaction and E-Loyalty: A Contingency Framework. Psychol. Mark. 20 (2), 123–138. doi:10.1002/mar.10063

Antonetti, P., Baines, P., and Walker, L. (2015). From Elicitation to Consumption: Assessing the Longitudinal Effectiveness of Negative Emotional Appeals in Social Marketing. J. Marketing Manage. 31, 940–969. doi:10.1080/0267257X.2015.1031266

Antonetti, P., and Maklan, S. (2014). Feelings that Make a Difference: How Guilt and Pride Convince Consumers of the Effectiveness of Sustainable Consumption Choices. J. Bus Ethics 124 (1), 117–134. doi:10.1007/s10551-013-1841-9

Asimakopoulos, G., and Asimakopoulos, S. (1980). Understanding Switching Intention of Information Systems Users. Ind. Manage. Data Syst. 114. doi:10.1108/IMDS-10-2013-0412

Bhattacherjee, A., Limayem, M. M., and Cheung, C. (2012). User Switching of Information Technology: a Theoretical Synthesis and Empirical Test. Inf. Manage. 49 (7), 327–333. doi:10.1016/j.im.2012.06.002

Chen, Y.-S. (2010). The Drivers of Green Brand Equity: Green Brand Image, Green Satisfaction, and Green Trust. J. Bus Ethics 93 (2), 307–319. doi:10.1007/s10551-009-0223-9

Chen, Y. S., and Chang, C. H. (2012). Enhance green purchase Intentions. Manage. Decis. 50 (3), 502–520. doi:10.1108/00251741211216250

Chen, Y. S., and Chang, C. H. (2013). Towards green Trust. Manage. Decis. 51 (1), 63–82. doi:10.1108/00251741311291319

Christensen, C. M., Mcdonald, R., Altman, E. J., and Palmer, J. E. (2018). Disruptive Innovation: An Intellectual History and Directions for Future Research. Jour. Manage. Stud. 55 (7), 1043–1078. doi:10.1111/joms.12349

Christensen, C. M. (1997). The Innovator's Dilemma: When New Technologies Cause Great Firms to Fail. Boston, Massachusetts: Harvard Business School Press.

Danneels, E. (2004). Disruptive Technology Reconsidered: A Critique and Research Agenda. J. Product. Innovation Manage. 21 (4), 246–258. doi:10.1111/j.0737-6782.2004.00076.x

Dhiman, A., Sen, A., and Bhardwaj, P. (2018). Effect of Self-Accountability on Self-Regulatory Behaviour: A Quasi-Experiment. J. Bus Ethics 148 (1), 79–97. doi:10.1007/s10551-015-2995-4

Fishbein, M., and Ajzen, I. (1975). Belief, Attitude, Intention and Behaviour: An Introduction to Theory and Research. Reading, MA: Addison-Wesley.

Flavián, C., Guinalíu, M., and Gurrea, R. (2006). The Role Played by Perceived Usability, Satisfaction and Consumer Trust on Website Loyalty. Inf. Manage. 43 (1), 1–14. doi:10.1016/j.im.2005.01.002

Frank, B., Abulaiti, G., and Enkawa, T. (2012). What Characterizes Chinese Consumer Behavior? A Cross-Industry Analysis of the Chinese Diaspora in Japan. Mark Lett. 23 (3), 683–700. doi:10.1007/s11002-012-9171-8

Frank, B., Enkawa, T., and Schvaneveldt, S. J. (2014). How Do the success Factors Driving Repurchase Intent Differ between Male and Female Customers? J. Acad. Mark. Sci. 42 (2), 171–185. doi:10.1007/s11747-013-0344-7

Gale, B. T., and Wood, R. C. (1994). Managing Customer Value: Creating Quality and Service that Customers Can See. New York: Simon & Schuster.

Ganesan, S. (1994). Determinants of Long-Term Orientation in Buyer-Seller Relationships. J. Marketing 58 (2), 1–19. doi:10.1177/002224299405800201

Ginsberg, J. M., and Bloom, P. N. (2004). Choosing the Right Green Marketing Strategy. MIT Sloan Manag. Rev. 46 (1), 79–84.

Gonçalves, H. M., Lourenço, T. F., and Silva, G. M. (2016). Green Buying Behavior and the Theory of Consumption Values: A Fuzzy-Set Approach. J. Business Res. 69 (4), 1484–1491. doi:10.1016/j.jbusres.2015.10.129

Holbrook, M. B. (1999). “Introduction to Consumer Value,” in Consumer Value: A Framework for Analysis and Research. Editor M. B. Holbrook (New York, NY: Routledge), 1–28. doi:10.4324/9780203010679.ch0

Hopp, C., Antons, D., Kaminski, J., and Salge, T. O. (2018). Disruptive Innovation: Conceptual Foundations, Empirical Evidence, and Research Opportunities in the Digital Age. J. Product. Innovation Manage. 35 (3), 446. doi:10.1111/jpim.12448

Hsieh, J.-K., Hsieh, Y.-C., Chiu, H.-C., and Feng, Y.-C. (2012). Post-adoption Switching Behavior for Online Service Substitutes: A Perspective of the Push-Pull-Mooring Framework. Comput. Hum. Behav. 28 (5), 1912–1920. doi:10.1016/j.chb.2012.05.010

Iverson, R. D., and Maguire, C. (2000). The Relationship between Job and Life Satisfaction: Evidence from a Remote Mining Community. Hum. Relations 53 (6), 807–839. doi:10.1177/0018726700536003

Kalafatis, S. P., Pollard, M., East, R., and Tsogas, M. H. (1999). Green Marketing and Ajzen's Theory of Planned Behaviour: a Cross‐market Examination. J. Consumer Marketing 16 (5), 441–460. doi:10.1108/07363769910289550

Kamolsook, A., Badir, Y. F., and Frank, B. (2019). Consumers' Switching to Disruptive Technology Products: The Roles of Comparative Economic Value and Technology Type. Technol. Forecast. Soc. Change 140 (MAR), 328–340. doi:10.1016/j.techfore.2018.12.023

Keaveney, S. M. (1995). Customer Switching Behavior in Service Industries: An Exploratory Study. J. Marketing 59 (2), 71–82. doi:10.1177/002224299505900206

Kim, C., Zhao, W., and Yang, K. H. (2008). An Empirical Study on the Integrated Framework of E-CRM in Online Shopping: Evaluating the Relationships Among Perceived Value, Satisfaction, and Trust Based on Customers' Perspectives. J. Electron. Commerce Organizations 6, 1.

Kuo, Y.-F., Wu, C.-M., and Deng, W.-J. (2009). The Relationships Among Service Quality, Perceived Value, Customer Satisfaction, and post-purchase Intention in mobile Value-Added Services. Comput. Hum. Behav. 25 (4), 887–896. doi:10.1016/j.chb.2009.03.003

Lalicic, L., and Weismayer, C. (2021). Consumers' Reasons and Perceived Value Co-creation of Using Artificial Intelligence-Enabled Travel Service Agents. J. Business Res. 129, 891–901. doi:10.1016/j.jbusres.2020.11.005

Laufer, W. S. (2003). Social Accountability and Corporate Greenwashing. J. Business Ethics 43 (3), 253–261. doi:10.1023/A:1022962719299

Li, G., Yang, L., Zhang, B., Li, X., and Chen, F. (2021). How Do Environmental Values Impact green Product purchase Intention? the Moderating Role of green Trust. Environ. Sci. Pollut. Res. 28 (33), 46020–46034. doi:10.1007/s11356-021-13946-y

Lin, N.-P., Weng, J. C. M., and Hsieh, Y.-C. (2003). Relational Bonds and Customer's Trust and Commitment - A Study on the Moderating Effects of Web Site Usage. Serv. Industries J. 23 (3), 103–124. doi:10.1080/714005111

Mathwick, C., Malhotra, N., and Rigdon, E. (2001). Experiential Value: Conceptualization, Measurement and Application in the Catalog and Internet Shopping environment☆11☆This Article Is Based upon the First Author's Doctoral Dissertation Completed while at Georgia Institute of Technology. J. Retailing 77 (1), 39–56. doi:10.1016/S0022-4359(00)00045-2

McIntosh, A. (1991). The Impact of Environmental Issues on Marketing and Politics in the 1990S. J. Market Res. Soc. 33 (3), 205–217.

Mitchell, V. W. (1999). Consumer Perceived Risk: Conceptualisations and Models. Eur. J. Marketing 33 (1/2), 163–195. doi:10.1108/03090569910249229

Neuman, K. (1986). Personal Values and Commitment to Energy Conservation. Environ. Behav. 18 (1), 53–74. doi:10.1177/0013916586181003

Onwezen, M. C., Antonides, G., and Bartels, J. (2013). The Norm Activation Model: An Exploration of the Functions of Anticipated Pride and Guilt in Pro-environmental Behaviour. J. Econ. Psychol. 39, 141–153. doi:10.1016/j.joep.2013.07.005

Papadas, K.-K., Avlonitis, G. J., Carrigan, M., and Piha, L. (2019). The Interplay of Strategic and Internal green Marketing Orientation on Competitive Advantage. J. Business Res. 104, 632–643. doi:10.1016/j.jbusres.2018.07.009

Peattie, K. (2010). Green Consumption: Behavior and Norms. Annu. Rev. Environ. Resour. 35 (1), 195–228. doi:10.1146/annurev-environ-032609-094328

Peloza, J., White, K., and Shang, J. (2013). Good and Guilt-free: The Role of Self-Accountability in Influencing Preferences for Products with Ethical Attributes. J. Marketing 77 (1), 104–119. doi:10.1509/jm.11.0454

Rahbar, E., and Abdul Wahid, N. (2011). Investigation of green Marketing Tools' Effect on Consumers' purchase Behavior. Business Strategy Ser. 12 (2), 73–83. doi:10.1108/17515631111114877

Rasheed, F. A., and Abadi, M. F. (2014). Impact of Service Quality, Trust and Perceived Value on Customer Loyalty in Malaysia Services Industries. Proced. - Soc. Behav. Sci. 164, 298–304. doi:10.1016/j.sbspro.2014.11.080

Rousseau, D. M., Sitkin, S. B., Burt, R. S., and Camerer, C. (1998). Not So Different after All: A Cross-Discipline View of Trust. Acad. Manage. Rev. 23 (3), 393–404. doi:10.5465/amr.1998.926617

Rowe, Z. O., Wilson, H. N., Dimitriu, R. M., Breiter, K., and Charnley, F. J. (2017). The Best I Can Be: How Self-Accountability Impacts Product Choice in Technology-Mediated Environments. Psychol. Mark. 34 (5), 521–537. doi:10.1002/mar.21003

Sánchez-Fernández, R., and Iniesta-Bonillo, M. Á. (2009). Efficiency and Quality as Economic Dimensions of Perceived Value: Conceptualization, Measurement, and Effect on Satisfaction. J. Retailing Consumer Serv. 16 (6), 425–433. doi:10.1016/j.jretconser.2009.06.003

Sandström, C., Berglund, H., and Magnusson, M. (2014). Symmetric Assumptions in the Theory of Disruptive Innovation: Theoretical and Managerial Implications. Creativity Innovation Manage. 23 (4), 472–483. doi:10.1111/caim.12092

Sheth, J., Newman, B., and Gross, B. (1991). Consumption Values and Market Choices: Theory and Applications. J. Marketing Res. 29, 487.

Sirdeshmukh, D., Singh, J., and Sabol, B. (2002). Consumer Trust, Value, and Loyalty in Relational Exchanges. J. Marketing 66 (1), 15–37. doi:10.1509/jmkg.66.1.15.18449

Sweeney, J. C., Soutar, G. N., and Johnson, L. W. (1999). The Role of Perceived Risk in the Quality-Value Relationship: A Study in a Retail Environment. J. Retailing 75 (1), 77–105. doi:10.1016/s0022-4359(99)80005-0

Tran, T. T. H., and Paparoidamis, N. G. (2021). Taking a Closer Look: Reasserting the Role of Self-Accountability in Ethical Consumption. J. Business Res. 126, 542–555. doi:10.1016/j.jbusres.2019.11.087

Walsh, S. T., Kirchhoff, B. A., and Newbert, S. (2002). Differentiating Market Strategies for Disruptive Technologies. IEEE Trans. Eng. Manage. 49 (4), 341–351. doi:10.1109/tem.2002.806718

Wasaya, A., Saleem, M. A., Ahmad, J., Nazam, M., Khan, M. M. A., and Ishfaq, M. (2021). Impact of green Trust and green Perceived Quality on green purchase Intentions: a Moderation Study. Environ. Dev. Sustain. 23 (9), 13418–13435. doi:10.1007/s10668-020-01219-6

Wells, , and Erskine, P. (2016). Will the Momentum of the Electric Car Last? Testing an Hypothesis on Disruptive Innovation. Technol. Forecast. Soc. Change 105, 77. doi:10.1016/s0040-1625(16)00057-3

Xu, X., Venkatesh, V., Tam, K. Y., and Hong, S.-J. (2010). Model of Migration and Use of Platforms: Role of Hierarchy, Current Generation, and Complementarities in Consumer Settings. Manage. Sci. 56 (8), 1304–1323. doi:10.1287/mnsc.1090.1033

Ye, C., and Potter, R. (2011). The Role of Habit in Post-Adoption Switching of Personal Information Technologies: An Empirical Investigation. Commun. Assoc. Inf. Syst. 28 (1). doi:10.17705/1cais.02835

Zach, F. J., Nicolau, J. L., and Sharma, A. (2020). Disruptive Innovation, Innovation Adoption and Incumbent Market Value: The Case of Airbnb. Ann. Tourism Res. 80, 102818. doi:10.1016/j.annals.2019.102818

Zeithaml, V. A. (1988). Consumer Perceptions of Price, Quality, and Value: A Means-End Model and Synthesis of Evidence. J. Marketing 52 (3), 2–22. doi:10.1177/002224298805200302

Appendix A:

TABLE 7 | Measurement scales and items (new energy vehicle context).

Keywords: comparative economic value, comparative superiority, comparative monetary value, comparative long-term benefit, disruptive green product switching intent, green trust, self-accountability

Citation: Lin C, Lai X and Yu C (2021) Switching Intent of Disruptive Green Products: The Roles of Comparative Economic Value and Green Trust. Front. Energy Res. 9:764581. doi: 10.3389/fenrg.2021.764581

Received: 25 August 2021; Accepted: 11 October 2021;

Published: 08 December 2021.

Edited by:

Quande Qin, Shenzhen University, ChinaReviewed by:

Yanfang Zheng, Henan University, ChinaZhao Xiaonan, North China University of Technology, China

Yufang Liu, Zhejiang University of Finance and Economics, China

Copyright © 2021 Lin, Lai and Yu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Chuanpeng Yu, eXVjcDIwMTVAc2N1dC5lZHUuY24=

†These authors have contributed equally to this work and share first authorship

Chunpei Lin

Chunpei Lin Xiumei Lai

Xiumei Lai Chuanpeng Yu2*

Chuanpeng Yu2*