- 1School of Economics, Tianjin University of Commerce, Tianjin, China

- 2Teesside University Business School, Teesside University, Middlesbrough, United Kingdom

- 3Huddersfield Business School, University of Huddersfield, Huddersfield, United Kingdom

This paper examines the causal relationship between renewable energy consumption and economic growth in four countries: Brazil, Germany, Japan, and the United States. Unlike previous papers, we control economic policy uncertainty’s effects to capture the role of capabilities on the renewable energy-growth nexus. The recent Vector Autoregression (VAR)-based Granger-causality test of Rossi-Wang shows a bidirectional causal relationship between renewable energy and the economic growth in Brazil and Germany. There is also a significant causality from renewables to economic growth in the United States.

Introduction

Both developing and developed economies have increased their renewable energy use and production since the 1980’s. There are four aspects to the emergence of renewable energy. The first is technological advancement, which has reduced the cost of investing in renewable energy installations (Apergis and Payne, 2010a; Apergis and Payne, 2010b; LuqmanAhmad and Bakhsh, 2019). The second aspect relates to governments regulations which provided supportive policy implications for renewable energy investments such as the establishment of credit easing and tax deductions for green energy by most governments, which in turn, has increased certificate and portfolio standards in renewable energy investments (Apergis and Payne, 2012; Asiedu et al., 2021). The third point has to do with climate change issues. It is argued that increased use of renewable energy reduces CO2 emissions, allowing renewable energy to mitigate the harmful effects of climate change (Bowden and Payne, 2009; Payne, 2009, Ali, 2021). Finally, the increase in the price of fossil fuels has encouraged the use of renewable energy (Gozgor, 2018). With these four factors in mind, renewable energy has the potential to bring long-term economic growth.

The role of renewable energy in bringing long-tern economic growth seems to be challenged, recently, by policy uncertainties and instabilities currently facing the global economy. One of such emerging uncertainties/instabilities is the economic policy uncertainty (EPU). The EPU is policy uncertainty associated with changes in government policy direction (e.g., monetary, or fiscal policy changes, tax regulations, etc.), which tends to cause delays in spending and investment by individuals and businesses until such uncertainty is resolved. Policy changes and uncertainty relating to energy consumptions have been argued to affect the concerned country’s overall economic growth (Aizenman and Marion, 1993; Tiwari, 2011; Gulen and Ion, 2016). For example, uncertainty about energy prices can force profit-optimizing firms to either suspend or quit investment decisions, which ultimately causes a decline in the aggregate output (Bernanke, 1983; Elder and Serletis, 2010). The empirical evidence further suggests that policy uncertainty about energy use, such as reducing CO2 emissions and fossil fuels, is harmful to investment in renewable energy, which can slow down the pace of economic growth (Adedoyin and Zakari, 2020).

Although the effect of the EPU on the number of variables has been widely explored in the literature (see, e.g., Pao and Fu, 2013; Solarin and Ozturk, 2015; Bhattacharya et al., 2016); however, there are very few papers for analyzing the effect of the EPU on energy indications, the only exceptions being Adedoyin and Zakari (2020) and Ulucak and Khan (2020). For instance, Adedoyin and Zakari (2020) attempt to provide evidence on the role of the EPU in the United Kingdom’s energy consumption. By applying the Autoregressive Distributed Lag (ARDL) bound and Granger Causality tests, they show that the EPU matters to the United Kingdom most in the short run for two reasons. First, it reduces the growth of CO2 emissions. Second, with the prolonged use of the EPU, there will be a continuous rise in CO2 emissions. Using the same methodology (i.e., the ARDL bound test) for the case of the United States, Ulucak, and Khan, 2020) show that higher energy intensity contributes to pollution and that the EPU does not only adversely affects environmental quality but also strengthens the detrimental effect of energy intensity on CO2 emissions.

One major takeaway from these studies is their limited application to either the United Kingdom (Adedoyin and Zakari, 2020) or the United States (Ulucak and Khan, 2020). Besides, neither of these studies captures the effect of the EPU in the growth model. A broader understanding of how the EPU affects energy use across countries will provide a clearer insight into the global policy focus regarding uncertainty and energy use. Therefore, differing from existing studies, our paper examines the causal relationship between renewable energy consumption and economic growth in four countries: Brazil, Germany, Japan, and the United States by controlling for the effects of the EPU to capture the role of capabilities on renewable energy-growth nexus.

At this stage, we implement the recent Vector Autoregression (VAR)-based Granger-causality test of Rossi and Wang (2019). The authors argue that the traditional Granger causality test that assumes stationarity of variables is not reliable in modelling relationship between variables with high uncertainty/instabilities as it can lead to misleading inferences. They extend (Rossi’s, 2005) methodology and include robust versions of the Mean and Exponential Wald, Nyblom, and Andrew’s Quasi-Likelihood Ratio tests. Rossi and Wang (2019) illustrate how to test the Granger causality to produce robust results in the presence of instabilities.

Our paper focuses on the cases of Brazil, Germany, Japan, and the United States because they have one of the world’s major renewable energy matrices, with high renewable energy generation and use. A study by the International Renewable Energy Agency (IRENA) (2016) estimated that, by 2030, renewable energy would contribute to the overall global economic growth by values between 0.6 and 1.1%, amounting to $706 billion to $1.3 trillion. A further study estimate that renewable energy will be worth $ T2 trillion in 2050, with the United States, Germany, Japan, and Brazil, among other nations, experiencing the most of these increases (IRENA, 2018).

On the other hand, the United States is the biggest economy globally and one of the largest renewable energy consumers. Of the world’s total primary energy consumption, the United States is the largest energy consumer country with a share of 16.2% annual growth rate and CO2 emission of 14.5% as of 2019.1 Japan, Germany, and Brazil had a share of 3.2, 2.3, and 2.1%, and the CO2 emission rate of 3.3, 2 and 1.3%, respectively (British Petroleum (BP), 2020). While the electric power sector accounted for 56% of total renewable energy consumption in the United States in 2019, about 17% of the country’s electricity generation was from renewable energy sources (U.S. Energy Information Administration, 2021). EIA 2021 estimates that renewable energy consumption will continue to rise in the country up to 2050.

Being a technology giant country, Japan has recently put forward new legislation in 2017 with plans to increase its reliance on and use renewable energy to 24% of its energy mix, representing more than double of its current production. In 2019, it was reported that Japan needs to import 90% of its energy. Due to the Fukushima disaster in 2011, the country’s share from nuclear sources plummeted significantly from 30% to a production target of just 20% by 2030 (Casey, 2017). Consequently, Japan is now turning to other energy sources, including wind, solar, and tidal power, to reduce its reliance on foreign sources and further enhance innovation in its domestic energy sector.

In Germany, renewable energy is mainly based on solar, wind, and biomass. The country has one of the world’s largest photovoltaic installed capacities, making it the world’s major renewable energy economy with a powerful wind power capacity. German’s share of renewable electricity reached 10% in 2005 from just 3.4% in 1990, and by 2019, it recorded 42.1% of gross electricity consumption (EIA, 2020). Recently, the German government is focusing particularly on the offshore wind farm, following the European Union (EU)’s mandatory energy plan requirement of reducing CO2 emission by 20% before the end of 2020 and consumption of renewable energies of 20% of the total EU consumption.

Brazil is also another country with a solid renewable energy matrix. A large chunk of Brazil’s renewable energy is from hydroelectric power plants. With the recently introducing public policies (e.g., the 10-years Energy Expansion Plan 2026) that aim to promote other non-traditional renewables (e.g., ethanol, made from sugarcane), the share of Brazil’s renewable energy is now rising reasonably. Renewable sources supplied about 44% of the Brazilian energy consumption as of 2016 and 79.3% in 2018 (IEA Bioenergy, 2018).

To the best of our knowledge, this study is the first research in the empirical literature to examine the causal relationship between renewable energy and economic growth by controlling the role of economic policy uncertainty. For this purpose, we utilize the recent VAR-based Granger-causality test of Rossi and Wang (2019) in instabilities, which is another novelty of the study. We observe a bidirectional causal relationship between renewable energy and economic growth in Germany. There is also a significant causality from renewables to economic growth in Brazil and the United States. However, there is no significant causality between renewable energy and economic growth in Japan.

The remainder of the study is organized as follows. Literature Review provides a literature review of the renewable energy-growth nexus. Data, Model, and Methodology defines the data, sets the empirical model, and explains the Granger-causality test. Empirical Results discusses the empirical findings. Conclusion concludes.

Literature Review

There are four views to explain the causality between economic growth and renewable energy. First, the “growth hypothesis” indicates that renewable consumption causes economic growth. Second, the “conservation hypothesis” states that economic growth causes renewable energy. Third, the “feedback hypothesis” suggests a bidirectional causal relationship between renewable energy and economic growth. Finally, the “neutrality hypothesis” proposes no causality between renewable energy and economic growth (Tiba and Omri, 2017).

There are previous papers to examine these hypotheses. For instance, Sadorsky (2009a) argues that energy use in all forms (such as industrial and residential, among others) is a primary determinant of economic growth and prosperity. As countries prosper, energy demand also increases. Sadorsky (2009b) also models the relationship between energy consumption and income for a panel of 18 emerging market economies from 1994 to 2003. The panel estimates confirm, yet again, that income per capita exert a statistically significant positive impact on per capita renewable energy consumption, thus providing evidence in support of the conservation hypothesis.

Using the panel dataset of 20 OECD countries, Apergis and Payne (2010a) investigate the causal link between renewable energy consumption and economic growth within a multivariate framework over 1985–2005. The Granger-causality test results show a two-way causal relationship between renewable energy consumption and economic growth in both the short-run and the long run. However, considering Eurasia’s dependency on fossil fuels, Apergis and Payne (2010b) further extend their analyses to examine the validity of the feedback hypothesis for the panel of 13 countries within Eurasia, this time using a short data set covering the period of 1992–2007 within a multivariate framework. The heterogeneous panel cointegration test suggests a long-run equilibrium relationship between real GDP and renewable energy consumption, among other variables. Similarly, for a panel of six Central American countries over the period 1980–2006, Apergis and Payne (2011) find evidence of a bidirectional causal relationship between renewable energy consumption and economic growth in both the short-run and long run. A unidirectional causality from economic growth to renewable energy use is also found by Rahman and Velayutham (2020). Similar results also hold for the panel of 80 countries throughout 1999–2004 are obtained by Apergis and Payne (2012); thus, reiterating the validity of the feedback hypothesis that renewable energy consumption and economic growth are interdependently related.

Motivated by the role of renewable and non-renewable energy in Brazil’s economic growth and how, in turn, economic growth experienced in Brazil played a crucial role the growth and development as well as the recent massive investment in the country’s renewable energy sector, Pao and Fu (2013) attempted to obtain if there was evidence for the “feedback hypothesis” in Brazil throughout 1980–2010 by exploring the causal relationship between economic growth (real GDP) and four types of energy consumption: non-hydroelectric renewable energy consumption, total renewable energy consumption (TREC), non-renewable energy consumption, and the total primary energy consumption. Their study’s long-run relationship indicates that a 1% increase in the TREC increases real GDP by 0.20%. An error correction model application further indicates a bidirectional causal relationship between the TREC and economic growth, among other findings. However, this outcome is fascinating because recently, development suggests that Brazil could change dramatically from a large oil importer to a self-sufficient energy economy. The pioneer works of Bhattacharya et al. (2016), Carmona et al. (2017), and Inglesi-Lotz (2016) also find support for the “feedback hypothesis”. Similar results are obtained by Solarin and Ozturk (2015) for a panel of Latin American countries.

To conclude the literature review, various studies have analyzed the relationship between renewable energy consumption and economic growth in developing and developed countries. Even the most recent studies exist (e.g., Aydin, 2019; Ajmi and Inglesi-Lotz, 2020; Gao and Zhang, 2021) merely examine the causal relationship between renewable energy consumption and economic growth of some number of countries. None of these studies capture the effect of economic policy uncertainty in a growth model. Therefore, our paper contributes to this literature by introducing a new growth model that includes economic policy uncertainty on economic growth.

Data, Model, and Methodology

Our sample covers the annual data in Brazil (1970–2019), Germany (1971–2019), Japan (1970–2019), and the United States (1965–2019). The begging date of the sample is based on the data availability. We use renewable energy consumption (mtoe), and the data is obtained from British Petroleum Statistical Review. We also consider economic growth, based on logarithmic changes of per capita gross domestic product with the constant 2010 $ prices. We also use the World Uncertainty Index (WUI) to capture the role of economic policy uncertainty, and the data are obtained from https://worlduncertaintyindex.com/. A greater value of the WUI means that there is a greater level of economic policy uncertainty. At this stage, we test the following causal relationships:

In Eqs. 1, 2,

Empirical Results

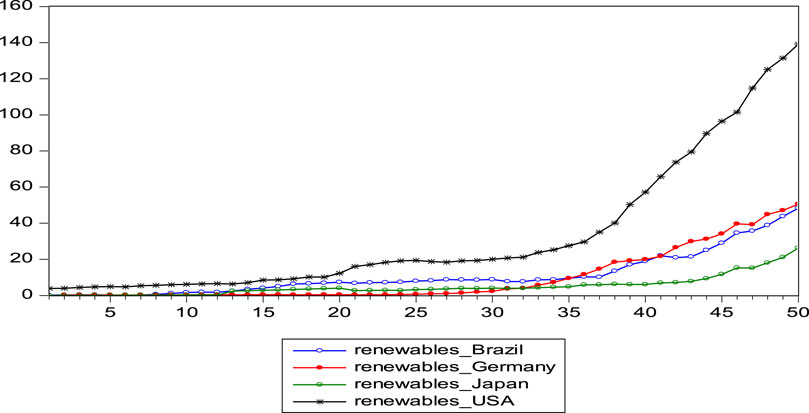

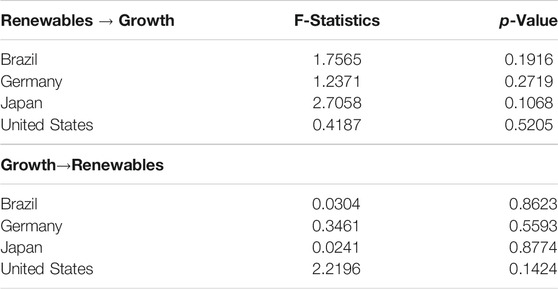

Following Gozgor (2016), we implement various unit root tests and confirm the renewable energy, growth, and the EPU series are stationary. Figure 1 shows the renewable energy consumption for four countries. United States consumes the most of renewable energy among four countries. Table 1 shows the results for traditional Granger Causality test of Granger (1969), and it indicates that no Causality relationships found between renewable energy consumption and economic growth for all countries at the 5% significant level.

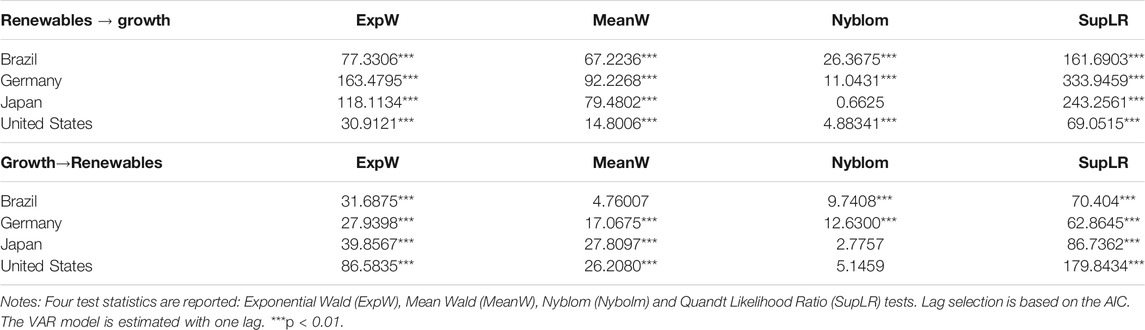

Then we implement the Rossi-Wang causality test and report the results in Table 2. Regarding the causality from renewables to growth, we find that all test statistics (ExpW, MeanW, Nyblom, and SupLR) are statistically significant at the 1% level in Brazil, Germany, and the United States.

Regarding the causality from growth to renewables, we observe that all test statistics (ExpW, MeanW, Nyblom, and SupLR) are statistically significant at the 1% level in Brazil and Germany.

Therefore, we conclude a bidirectional causal relationship between renewable energy and the economic growth in Brazil and Germany. There is also a significant causality from renewables to economic growth in the United States. However, there is no significant causal relationship in Japan.

We check the robustness of the results. Specifically, we exclude outlier observations and rerun the causality analyses. The results align with the benchmark results, but we do not report them to save space.

Conclusion

This paper examines the causal relationship between renewable energy consumption and economic growth in four countries: Brazil, Germany, Japan, and the United States. We control the impact of economic policy uncertainty on renewable energy-growth nexus. The findings from the VAR-based Granger-causality test of Rossi and Wang (2019) show a bidirectional causal relationship between renewable energy and economic growth in Brazil and Germany. There is also a significant causality from renewables to economic growth in the United States. However, there is no robust causality between renewable energy and economic growth in Japan.

Future studies can test for the relationship between different macroeconomic indicators and energy variables in other developed and developing economies. Finally, future studies can use disaggregated level renewable energy data (e.g., biomass, solar, and wind).

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding authors.

Author Contributions

ZL: Methodology, Writing-Original Draft Preparation, Supervision. LZ: Writing-Revision Draft Preparation. CL: Investigation, Software, Visualization, Writing-Original Draft Preparation. AI: Data Curation, Writing-Original Draft Preparation. XZ: Supervision, Editing, Writing-Original Draft Preparation.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

The authors acknowledge the funding from the Philosophy and Social Science Fund of Tianjin City, China. Project #: TJYJ20-012 (“Prompting the Market Power of Tianjin City’s E-commerce Firms in Belt and Road Countries: A Home Market Effect Approach”).

Footnotes

1Primary energy here is composed of commercially traded fuels and modern renewables that are used to generate electricity (BP, 2020: 8).

References

Adedoyin, F. F., and Zakari, A. (2020). Energy Consumption, Economic Expansion, and CO2 Emission in the UK: The Role of Economic Policy Uncertainty. Sci. Total Environ. 738, 140014. doi:10.1016/j.scitotenv.2020.140014

Aizenman, J., and Marion, N. P. (1993). Policy Uncertainty, Persistence and Growth. Rev. Int. Econ. 1 (2), 145–163. doi:10.1111/j.1467-9396.1993.tb00012.x

Ajmi, A. N., and Inglesi-Lotz, R. (2020). Biomass Energy Consumption and Economic Growth Nexus in OECD Countries: A Panel Analysis. Renew. Energ. 162, 1649–1654. doi:10.1016/j.renene.2020.10.002

Apergis, N., and Payne, J. E. (2012). Renewable and Non-renewable Energy Consumption-Growth Nexus: Evidence from a Panel Error Correction Model. Energ. Econ. 34 (3), 733–738. doi:10.1016/j.eneco.2011.04.007

Apergis, N., and Payne, J. E. (2010a). Renewable Energy Consumption and Economic Growth: Evidence from a Panel of OECD Countries. Energy Policy 38 (1), 656–660. doi:10.1016/j.enpol.2009.09.002

Apergis, N., and Payne, J. E. (2010b). Renewable Energy Consumption and Growth in Eurasia. Energ. Econ. 32 (6), 1392–1397. doi:10.1016/j.eneco.2010.06.001

Apergis, N., and Payne, J. E. (2011). The Renewable Energy Consumption-Growth Nexus in Central America. Appl. Energ. 88 (1), 343–347. doi:10.1016/j.apenergy.2010.07.013

Asiedu, B. A., Hassan, A. A., and Bein, M. A. (2021). Renewable Energy, Non-renewable Energy, and Economic Growth: Evidence from 26 European Countries. Environ. Sci. Pollut. Res. 28 (9), 11119–11128. doi:10.1007/s11356-020-11186-0

Aydin, M. (2019). The Effect of Biomass Energy Consumption on Economic Growth in BRICS Countries: A Country-specific Panel Data Analysis. Renew. Energ. 138, 620–627. doi:10.1016/j.renene.2019.02.001

Bernanke, B. S. (1983). Irreversibility, Uncertainty, and Cyclical Investment. Q. J. Econ. 98 (1), 85–106. doi:10.2307/1885568

Bhattacharya, M., Paramati, S. R., Ozturk, I., and Bhattacharya, S. (2016). The Effect of Renewable Energy Consumption on Economic Growth: Evidence from Top 38 Countries. Appl. Energ. 162, 733–741. doi:10.1016/j.apenergy.2015.10.104

Bowden, N., and Payne, J. E. (2009). The Causal Relationship between U.S. Energy Consumption and Real Output: A Disaggregated Analysis. J. Pol. Model. 31 (2), 180–188. doi:10.1016/j.jpolmod.2008.09.001

Carmona, M., Congregado, E., Feria, J., and Iglesias, J. (2017). The Energy-Growth Nexus Reconsidered: Persistence and Causality. Renew. Sust. Energ. Rev. 71, 342–347. doi:10.1016/j.rser.2016.12.060

Elder, J., and Serletis, A. (2010). Oil Price Uncertainty. J. Money, Credit Banking 42 (6), 1137–1159. doi:10.1111/j.1538-4616.2010.00323.x

Gao, J., and Zhang, L. (2021). Does Biomass Energy Consumption Mitigate CO2 Emissions? the Role of Economic Growth and Urbanization: Evidence from Developing Asia. J. Asia Pac. Economy 26 (1), 96–115. doi:10.1080/13547860.2020.1717902

Gozgor, G. (2018). A New Approach to the Renewable Energy-Growth Nexus: Evidence from the USA. Environ. Sci. Pollut. Res. 25 (17), 16590–16600. doi:10.1007/s11356-018-1858-9

Gozgor, G. (2016). Are Shocks to Renewable Energy Consumption Permanent or Transitory? an Empirical Investigation for Brazil, China, and India. Renew. Sust. Energ. Rev. 66, 913–919. doi:10.1016/j.rser.2016.08.055

Granger, C. W. J. (1969). Investigating Causal Relations by Econometric Models and Cross-Spectral Methods. Econometrica 37, 424–438. doi:10.2307/1912791

Gulen, H., and Ion, M. (2016). Policy Uncertainty and Corporate Investment. Rev. Financial Stud. 29 (3), 523–564.

Inglesi-Lotz, R. (2016). The Impact of Renewable Energy Consumption to Economic Growth: A Panel Data Application. Energ. Econ. 53, 58–63. doi:10.1016/j.eneco.2015.01.003

International Renewable Energy Agency (2018). Global Energy Transformation: A Road Map to 2050. Abu Dhabi: IRENA.

International Renewable Energy Agency (2016). Renewable Energy Benefits: Measuring the Economics. Abu Dhabi: IRENA.

LuqmanAhmad, M. N., Ahmad, N., and Bakhsh, K. (2019). Nuclear Energy, Renewable Energy and Economic Growth in Pakistan: Evidence from Non-linear Autoregressive Distributed Lag Model. Renew. Energ. 139, 1299–1309. doi:10.1016/j.renene.2019.03.008

Pao, H.-T., and Fu, H.-C. (2013). Renewable Energy, Non-renewable Energy and Economic Growth in Brazil. Renew. Sust. Energ. Rev. 25, 381–392. doi:10.1016/j.rser.2013.05.004

Payne, J. E. (2009). On the Dynamics of Energy Consumption and Output in the US. Appl. Energ. 86 (4), 575–577. doi:10.1016/j.apenergy.2008.07.003

Rahman, M. M., and Velayutham, E. (2020). Renewable and Non-renewable Energy Consumption-Economic Growth Nexus: New Evidence from South Asia. Renew. Energ. 147, 399–408. doi:10.1016/j.renene.2019.09.007

Rossi, B. (2005). Optimal Tests for Nested Model Selection with Underlying Parameter Instability. Econometric Theor. 21 (5), 962–990. doi:10.1017/s0266466605050486

Rossi, B., and Wang, Y. (2019). Vector Autoregressive-Based Granger Causality Test in the Presence of Instabilities. Stata J. 19 (4), 883–899. doi:10.1177/1536867x19893631

Sadorsky, P. (2009b). Renewable Energy Consumption and Income in Emerging Economies. Energy Policy 37 (10), 4021–4028. doi:10.1016/j.enpol.2009.05.003

Sadorsky, P. (2009a). Renewable Energy Consumption, CO2 Emissions and Oil Prices in the G7 Countries. Energ. Econ. 31 (3), 456–462. doi:10.1016/j.eneco.2008.12.010

Sayigh, A. (2021). Up-date: Renewable Energy and Climate Change. Renew. Energ. Environ. Sustain. 6, 13. doi:10.1051/rees/2021004

Solarin, S. A., and Ozturk, I. (2015). On the Causal Dynamics between Hydroelectricity Consumption and Economic Growth in Latin America Countries. Renew. Sust. Energ. Rev. 52, 1857–1868. doi:10.1016/j.rser.2015.08.003

Tiba, S., and Omri, A. (2017). Literature Survey on the Relationships between Energy, Environment and Economic Growth. Renew. Sust. Energ. Rev. 69, 1129–1146. doi:10.1016/j.rser.2016.09.113

Tiwari, A. K. (2011). A Structural VAR Analysis of Renewable Energy Consumption, Real GDP and CO2 Emissions: Evidence from India. Econ. Bull. 31 (2), 1793–1806.

Keywords: renewable energy consumption, economic growth, renewable energy, economic policy uncertainty, Granger-causality test, instabilities

Citation: Lu Z, Zhu L, Lau CKM, Isah AB and Zhu X (2021) The Role of Economic Policy Uncertainty in Renewable Energy-Growth Nexus: Evidence From the Rossi-Wang Causality Test. Front. Energy Res. 9:750652. doi: 10.3389/fenrg.2021.750652

Received: 30 July 2021; Accepted: 25 August 2021;

Published: 24 September 2021.

Edited by:

Tsun Se Cheong, Hang Seng University of Hong Kong, ChinaReviewed by:

Jianmin Sun, Nanjing University of Posts and Telecommunications, ChinaHua Zhang, Zhejiang University, China

Copyright © 2021 Lu, Zhu, Lau, Isah and Zhu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Linchuang Zhu, linchuang_zhu2021@163.com; Chi Keung Marco Lau, c.lau@tees.ac.uk

Zhou Lu

Zhou Lu Linchuang Zhu1*

Linchuang Zhu1* Chi Keung Marco Lau

Chi Keung Marco Lau Aliyu Buhari Isah

Aliyu Buhari Isah