94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

POLICY AND PRACTICE REVIEWS article

Front. Energy Res., 15 November 2021

Sec. Bioenergy and Biofuels

Volume 9 - 2021 | https://doi.org/10.3389/fenrg.2021.750514

This article is part of the Research TopicSustainable Aviation FuelsView all 26 articles

The United States, spurred in part by international developments, is expanding its law and policy to incentivize the use of sustainable aviation fuels. While the U.S. has agreed to participate in the International Civil Aviation Organization’s (ICAO’s) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), it has only recently adopted federal rules that define greenhouse gas emission reduction standards for certain classes of airplanes (effective January 2021). However, such standards focus on engine efficiency rather than the fuel burned. For sustainable aviation fuels, the U.S. continues to rely on voluntary programs at a federal, state, and regional level. The federal Renewable Fuel Standard program allows producers to opt in. In addition, states have started to allow sustainable aviation fuel producers to “opt in” to their programs; this includes California’s Low Carbon Fuel Standard, Oregon’s Clean Fuels Program, and Washington’s newly adopted Clean Fuels Program. Other states are also starting to consider such programs. Elsewhere, states like Hawaii are starting to support SAF production in other ways, including through tax mechanisms. In addition, regional and private efforts to adopt and/or promote sustainable aviation fuels are underway. This piecemeal approach—due in part to the lack of cohesive U.S. federal policy—stands in contrast to the European Union’s Renewable Energy Directive and Emissions Trading System, and adoption of policies by European countries. Because of aviation’s international nature, tracking what is happening in Europe matters greatly for U.S. carriers. As the U.S. works to meet its international obligations through CORSIA, finding a way forward with sustainable aviation fuel in the United States may depend on a more defined federal policy. Actions taken by both the EU and European countries offers some guidance for actions that could be taken by the U.S. Even in the absence of more defined measures, better tracking of voluntary measures is a critical step.

Consistent law and policy guidance for sustainable aviation fuel (SAF) is critical to ensure emission reductions from aviation, both for U.S. carriers flying domestically and internationally. Although airline miles flown decreased temporarily due to COVID-19, airline travel had been increasing significantly and is expected to do so again. As the largest emitter of CO2 from aviation, the U.S. has up until now depended on voluntary activities related to SAF to reduce such emissions.

As part of the International Civil Aviation Organization (ICAO), the U.S. has agreed to legal regulation of greenhouse gas (GHG) emissions from aircraft. The U.S. is starting to do so by implementing ICAO standards and recommended practices. During the last decade, this includes the development and implementation of CO2 emission standards and the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). While U.S. federal policy is starting to adapt to these international commitments, state, regional and private initiatives for reducing aviation-related GHG emissions by increasing the use of SAF may be the driver necessary to support more aggressive federal action.

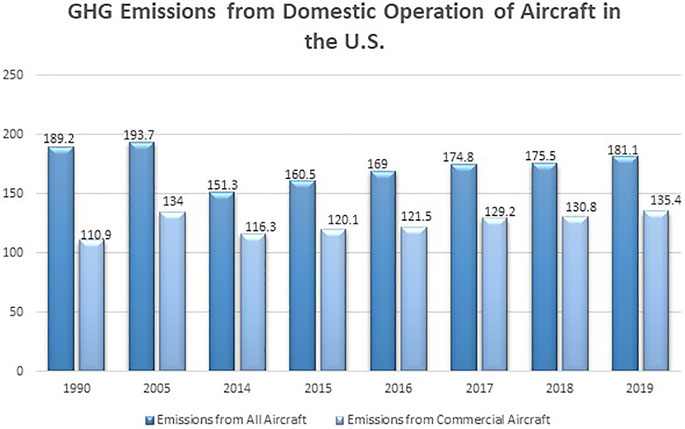

According to the Intergovernmental Panel on Climate Change (IPCC), aviation is estimated to generate 2% of anthropogenic CO2 emissions. According to a study published by the International Council on Clean Transportation, the United States was the biggest CO2 emitter from the aviation sector in 2018, followed by China (Graver et al., 2019, p. 6). China is expected to replace the U.S. as the world’s largest passenger market by 2029 (IATA, 2015). Aviation emissions also include nitrogen oxide, water vapor, particulate matter, and other pollutants. In the U.S., aircraft emissions constituted about 2.7% of total GHG emissions in 2019 (EPA, 2021, at 2–37). Although greenhouse gas emissions in the U.S. from the aviation sector overall decreased by 4% (7.9 MMT CO2) between 1990 and 2019, which includes a 66% (23.1 MMT CO2) decrease in GHG emissions from domestic military operations, GHG emissions from the domestic operation of commercial aircrafts increased by 22% (24.3 MMT CO2) from 1990 to 2019 (Figure 1; EPA, 2021, at 3–24). From 2003 to 2017, revenue passenger miles in the U.S. increased from 657.3 billion to 964.3 billion, and people taking flights increased from 647.5 million passengers to 849.3 million passengers (Bureau of Transportation Statistics, 2018). While there were 1,054.79 billion revenue passenger miles in 2019, this decreased to 377.99 billion in 2020 due to the COVID-19 pandemic (Mazareanu, 2021).

FIGURE 1. GHG Emissions from domestic aircraft operation in the U.S. (EPA, 2021, at 3–24; prepared based on data from EPA Inventory of U.S. Greenhouse Gas Emissions and Sinks: 1990–2019).

Despite the increase in passengers around the world on average of 5% percent each year prior to the coronavirus outbreak, aviation has decoupled its emissions growth to around 3% due to advancements in new technology and coordinated action to implement new operating procedures (Air Transport Action Group, 2017, p. 2). Consistent law and policy incentives would continue this advancement.

Although the use of sustainable aviation fuel is considered an important element for further reducing aviation’s impacts on the climate change and improving air quality (ICAO, 2016a, p. 153), not all SAF produce less emissions than the petroleum displaced. For example, biodiesel produced from the first rotation cycle of palm produces 98% more emission than the fossil fuel (Meijide et al., 2020, p. 4). A life cycle assessment of each type of SAF is beyond the scope of this review.

What counts as “sustainable aviation fuel” in turn depends on a number of definitions. In general, SAF is fuel produced from renewable and waste resources—such as biological and non-biological resources—that help provide an ecological balance by avoiding depletion of natural resources and reducing climate change impacts (Air Transport Action Group, 2017, p. 4). CORSIA specifically defines sustainable aviation fuel as “a renewable or waste-derived aviation fuel that meets the CORSIA Sustainability Criteria” under Volume IV, Annex 16 of the Convention on the International Civil Aviation (ICAO, 2018). There are two criteria for CORSIA sustainable aviation fuels: 1) “CORSIA eligible fuel should generate lower carbon emissions on a life cycle basis,” at least 10% compared to the aviation fuel on a life cycle basis; 2) “CORSIA eligible fuel should not be made from biomass obtained from land with high carbon stock” (ICAO, 2019). Sustainable aviation fuel is considered an alternative to fossil fuel sources because it includes any materials or substances that can be used as fuels, other than conventional fossil sources (CAAFI, n.d.a). Drop-in fuels can be used “as is” in engines that operate with only conventional fuel and do not require adaptation of the fuel distribution network or the engine fuel systems. The term “drop-in” refers to alternative jet fuels that are entirely compatible with a conventional jet fuel in terms of materials, safety, and composition (CAAFI, n.d.b).1

ASTM International has certified seven SAF production pathways; additional pathways are being evaluated. In 2009, ASTM International approved the FT-SPK method (Fischer-Tropsch Synthetic Paraffinic Kerosene), which allows for biomass converted to synthesis gas and then into the aviation fuel. In 2011, HEFA-SPK pathway (Hydroprocessed Esters and Fatty Acids), hydroprocessing of oil and fats, was approved under D7566-11. In 2014, HFS-SIP method (Hydroprocessed Fermented Sugars to Synthesized Iso-Paraffinic) was approved; this is the microbial conversion of sugars to a hydrocarbon. In 2016, ATJ-SPK (Alcohol to Jet Synthetic Paraffinic Kerosene) was certified; this involves upgrading of alcohols from sugars or cellulose to jet fuels. In 2018, FT-SPK/A, a variation of FT-SPK “where alkylation of light aromatics creates a hydrocarbon blend that includes aromatic compounds” was approved (European Union Aviation Safety Agency et al., 2019, p. 42). Catalytic Hydrothermolysis Jet (CHJ) was approved on December 15, 2019, and published as ASTM D766 Annex A6. The biofuel is produced using the isoconversion process which converts waste fats, oils, and greases into jet fuel (Biofuels International, 2020). The seventh pathway for SAF production, HC-HEFA, was approved in May 2020 as Annex 7 to ASTM’s SAF specification D7566, which establishes criteria for the production of a type of synthesized paraffinic kerosene from hydrocarbon-hydroprocessed esters and fatty acids (Green Car Congress, 2020).

The International Civil Aviation Organization (ICAO) indicated that if enough alternative fuels were produced in 2050 to substitute for conventional jet fuel, projected CO2 emissions could be decreased by 63% from international flights (ICAO, 2016a, p. 19). Certification of seven different types of sustainable jet fuel makes this at least possible (CAAFI, n.d.b). The certification process allows a maximum blend of 50% (SAF with conventional jet fuel) for some technologies. ICAO is leading the efforts to prepare international agreements and aspirational targets on how to achieve such reductions.

In the U.S., SAF use by airlines has been largely voluntary to date. This policy review paper explores the legal framework for the reduction of greenhouse gas emissions from domestic operation of aircraft in the U.S. and how international changes are affecting the United States. Part 2 briefly lays out overall regulation of the aviation industry, starting with ICAO’s role. Part 3 outlines regulation of sustainable jet fuel at the U.S. federal level. It first examines the federal endangerment finding, the U.S. Renewable Fuel Standard, and implementation for aviation. Part 4 examines state, regional, and private efforts to promote sustainable jet fuels. Finally, Part 5 returns to the international arena by examining the European Union efforts to decrease aviation-related greenhouse gas emissions and how those might inform U.S. efforts.

The need for predictable and enforceable U.S. law and policy directly relates to international aviation agreements. The framework for sustainable jet fuel in international flights has been led by the International Civil Aviation Organization under the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).

The International Civil Aviation Organization (ICAO) was established by the Convention on International Civil Aviation, known as the Chicago Convention, signed on December 7, 1944.2 According to Article 44, ICAO’s aims and objectives are to develop the principles and techniques of international air navigation and to foster the planning and development of international air transport. ICAO does not have regulatory authority. Once it adopts a guidance or standard, it is up to member states (countries) to adopt and enforce them.

ICAO has multiple layers of governance. The General Assembly, which meets every 3 years, considers major policy issues in the economic, legal, technical cooperation, and environmental fields brought to its attention by the Council or states. ICAO’s executive body, the Council, convenes the Assembly, submits annual reports to the Assembly, and appoints and defines committee duties. The Committee on Aviation Environmental Protection (CAEP) assists the Council in formulating new policies and adopting Standards and Recommended Practices (SARPs) related to aviation environmental activities. It has 25 members, including the U.S., and 17 observers (ICAO, 2016b).

In 2013, the 38th General Assembly unanimously agreed to develop a global market-based measure (MBM) scheme to reduce greenhouse gas emissions from international aviation. How to effectuate this scheme took some time to develop. In its October 2016 meeting, ICAO’s 39th General Assembly adopted Resolution A39-3, an agreement to implement a global MBM scheme known as the “Carbon Offsetting and Reduction Scheme for International Aviation” (CORSIA) as part of a set of measures, which also include aircraft technologies, operational improvements, and sustainable aviation fuels (ICAO, 2016c). In 2018, the ICAO Council formally adopted CORSIA to offset international civil aviation’s CO2 emissions above 2020 levels.3 The 2019 General Assembly then adopted Resolution A40-19 (Consolidated Statement of continuing ICAO policies and practices related to environmental protection—CORSIA), which replaced the previous Assembly’s Resolution A39-3. It requested the ICAO Council to develop and update the CORSIA documents but mostly reiterated Resolution A39-3’s objectives (ICAO, n.d.a). The 2019 Assembly also urged states to assess ICAO’s taxation policies in their related national objectives and “to conduct appropriate cost-benefit analyses before the introduction of taxes on air transport” (ICAO, n.d.b).

By adopting CORSIA, the ICAO General Assembly sought to use offsets or to promote use of CORSIA-eligible fuels to enable reductions in greenhouse gas emissions (European Union Aviation Safety Agency et al., 2019, p. 78). CORSIA‐eligible fuels can be a CORSIA-defined sustainable aviation fuel or a CORSIA lower carbon aviation fuel (ICAO, 2018). In the pilot phase (2021–2023) and first phase (2024–2026), CORSIA applies only to international flights between voluntarily participating states.4 Eighty-eight states, including the U.S., pledged to participate in the initial phases (ICAO, 2020). Regardless of their participation, all member states whose aircraft operators undertake international flights must monitor, report and verify emissions from international flights during 2019 and 2020.5 The average yearly emissions reported during this period will be used as baseline for the carbon neutral growth from 2020.

An eligible emission unit arises from emissions reduction achieved by the implementation of a project elsewhere from various sectors, including domestic aviation (ICAO Secretariat, 2017). On March 13, 2020, the ICAO Council approved a set of eligible emissions units during the pilot phase from eight emissions programs: the American Carbon Registry, Architecture for REDD + Transactions (ART), China GHG Voluntary Emission Reduction Program, Clean Development Mechanism, Climate Action Reserve, Global Carbon Council (GCC), the Gold Standard, and Verified Carbon Standard (ICAO, 2021). The emission units are issued for activities between 2016 and 2020 and will be published on the ICAO CORSIA website (ICAO, 2021).

The second phase (2027–2035) is mandatory. It will apply to “all States that have an individual share of international aviation activities in RTKs (Revenue Ton Kilometers) in year 2018 above 0.5 percent of total RTKs or whose cumulative share in the list of states from the highest to the lowest amount of RTKs reaches 90 per cent of total RTKs, except Least Developed Countries (LDCs), Small Island Developing States (SIDS) and Landlocked Developing Countries (LLDCs).”6 Revenue Ton Kilometers or RTKs is the measure of capacity used for passengers and cargo expressed in metric tons, multiplied by the distance flown. In other words, it corresponds to the volume of air transport activity.7 The scheme does not cover aircraft operators emitting less than 10,000 tons of CO2 emissions from international aviation per year; aircraft with less than 5,700 kg of Maximum Take Off Mass (MTOM); or humanitarian, medical and firefighting operations.8 The amount of CO2 emissions required to be offset by an aircraft operator in given year would be defined by combining the operator’s emissions growth with a sector-wide growth factor.9 Each airline operator must meet its offsetting requirements for international flights on a 3-years compliance basis period.

In February 2019, ICAO’s Committee on Aviation Environmental Protection (CAEP) agreed to the “means to calculate and claim the benefits accrued from the use of sustainable aviation fuels within the context of CORSIA.” (ICAO, 2019a). The CAEP approved “default values and the methodologies for calculating actual values needed to calculate the life-cycle CO2 emissions reduction benefits of different feedstocks” (ICAO, 2019a). An airline operator will be able to satisfy their CORSIA offset requirements by claiming emissions reductions from the use of CORSIA eligible fuels; if they use CORSIA eligible fuels, they can reduce or eliminate their offset requirements. The ICAO Council released sustainability criteria for CORSIA eligible fuels in June 2019 (ICAO, 2019b) and requirements for Sustainability Certification Schemes in November 2019 (ICAO, 2019c).

The U.S. has started down the path of direct CORSIA compliance. On March 14, 2019, the Federal Aviation Administration (FAA) published a notice in the Federal Register announcing the availability of the CORSIA Monitoring, Reporting and Verification (MRV) Program.10 The MRV Program has enabled the U.S. to implement the CORSIA standards and recommended practices and monitor, report and verify CO2 emissions from international flights. The program required U.S. air carriers, commercial, and general aviation operators to submit to the FAA certain airplane CO2 emissions data for 2019 and 2020.11 Under the MRV Program, each country’s reported data was used for the calculation of CORSIA’s baselines. While the U.S. is making other federal law and policy changes that help support the use of SAF, the 2027 deadline for the Phase II mandates will likely require more coordinated action by the U.S. to address its international aviation footprint.

While U.S. reduction of emissions through the use of sustainable aviation fuels has been voluntary to date, recent legal changes at a federal level have started to recognize the importance of reducing aviation-related greenhouse gas emissions. In 2016, the U.S. Environmental Protection Agency issued an “endangerment finding” that greenhouse gas emissions from aviation contributed to air pollution under the Clean Air Act. On December 28, 2020, EPA published its first greenhouse gas emissions regulations for airplanes. Further, the U.S. Renewable Fuel Standard (RFS) program, originally enacted in 2005 and amended in 2007, allows renewable jet fuel to generate credits and creates an incentive for SAF; however, these are not requirements. In addition to voluntary opportunities under the RFS, agreements at ICAO are resulting in changes in U.S. policy as mentioned above. More details on each of these dynamics is addressed in further detail below, followed by a review of state and regional/industry initiatives in Part 4.

In 2016, the U.S. Environmental Protection Agency issued an endangerment finding, determining that emissions from certain aircraft, defined below, were endangering the public health and welfare.12 The 2016 rule was based on the 2009 endangerment finding for light duty vehicles under Section 202(a) of the Clean Air Act (CAA).13

EPA issued the endangerment finding for the U.S. aviation sector under CAA Section 231(a) (2) (A). This requires the EPA Administrator to issue “proposed emission standards applicable to the emission of any air pollutant from… aircraft engines which in his judgment causes, or contributes to, air pollution which may reasonably be anticipated to endanger public health or welfare.” In its final finding on July 25, 2016, EPA determined that CO2 and nitrous oxide emissions from certain classes of engines in certain aircraft were contributing to the mix of GHGs in the atmosphere that were endangering the public health and welfare.14 Covered aircraft include subsonic jet aircraft with a maximum takeoff mass (MTOM) greater than 5,700 kg and subsonic propeller-driven aircraft with a MTOM greater than 8,618 kg.15 Examples of covered aircraft include the Cessna Citation CJ3+, the Embraer E170, Airbus 380, Boeing 747, ATR 72 and the Bombardier Q400.

By issuing an endangerment finding, EPA must define emission standards applicable to GHG emissions from the aircraft engine classes listed under CAA Section 231. FAA then must issue regulations to ensure compliance with EPA’s standards. On December 28, 2020, EPA published the first GHG emissions regulations for new airplanes to be used in commercial aviation and large business jets. Although the rule will not reduce emissions more because U.S. airplanes producers have already begun working to meet the ICAO standards, it will give EPA oversight authority. Because noncompliant aircraft will likely be out of production or seek an exemption by 2028, EPA indicated that it is not expecting the regulations to reduce GHG emissions as they only apply to new type design airplanes after the effective date of the rule and to in-production airplanes on or after January 1, 2028 (Sobczyk, 2020). The standards address subsonic jet aircraft with a MTOM greater than 5,700 kg and subsonic propeller driven airplanes with a MTOM greater than 8,618 kg (EPA, 2020).

EPA promulgated the regulation without the 30-day waiting period for publication, which is normally required by the Administrative Procedure Act (APA) Section 53. EPA invoked the good cause exception to the 30-day waiting period which allows a rule to become effective upon promulgation. The immediate effective date of the rule prevented the new administration from quickly replacing or repealing the rule (Sobczyk, 2020). However, the Biden Administration issued an Executive Order on January 20, 2021 ordering, among other things, EPA to review the regulations about aviation emissions (Ahn, 2021). This remains pending.

Although the 2016 Endangerment Finding sets out a not-yet realized regulatory approach for greenhouse gas emissions, there is also a voluntary way for aviation fuel producers to earn credits under the U.S. Renewable Fuel Standard (RFS) program. The U.S. Energy Policy Act of 200516 established the RFS program and added requirements for renewable fuel production as a new section to the Clean Air Act: CAA Section 211(o).17 The program’s goal is to designate “a certain volume of renewable fuel to replace or reduce the quantity of petroleum-based transportation fuel, heating oil or jet fuel” (EPA, n.d.a). The Energy Independence and Security Act of 2007 (EISA) increased the mandatory use of renewable fuel to 36 billion gallons of U.S. biofuels in use by 2022.18 It further specified that 21 billion gallons of the 2022 goal must be derived from second generation feedstocks: non-food-based sources such as cellulosic biofuels.19 However, volume requirements for both total renewable fuel and total advanced biofuel have not been met since 2013; this has been authorized through the use of annual waivers (Bracmort, 2020, p. 1).

The RFS requires “obligated” parties to produce or purchase renewable fuels for blending. An obligated party is any “any refiner that produces gasoline or diesel fuel within the 48 contiguous states or Hawaii, or any importers that import gasoline or diesel fuel into the 48 contiguous states or Hawaii during a compliance period.”20 The definition of “obligated parties” does not include aviation fuel producers. Although federal law does not mandate production or use of renewable jet fuel, producers or importers of renewable jet fuels can generate credits under the RFS program if their fuels meet the definition of renewable fuel in 40 CFR Section 80.1401.

This definition includes four categories of renewable fuels: biomass-based diesel, cellulosic biofuel, advanced biofuel and total renewable fuel. Renewable fuels must achieve a reduction in GHG emissions compared to a 2005 petroleum baseline to qualify as a renewable fuel under the RFS program. EISA defines advanced biofuel (code “D-5”) as a renewable fuel, other than corn ethanol, that reduces greenhouse gas emissions by at least 50% when compared to petroleum diesel.21 Cellulosic biofuel (D-3, D-7) is a renewable fuel derived from cellulose, hemicellulose, or lignin derived from renewable biomass and provide a 60% reduction in emissions from baseline gasoline and diesel.22 Biomass-based diesel (D-4) must have a 50% lifecycle GHG reduction.23 Finally, renewable fuels (D-6) is produced from renewable biomass and must achieve at least a 20% reduction in lifecycle GHG emissions.24 Renewable jet fuels can qualify for RINs mostly under the D-4 code. Depending on the production process, they may also qualify for D3, D-5, and D-7.

EPA has approved renewable fuel pathways under the RFS program for all four categories of renewable fuels (EPA, n.d.b). For example, the advanced biofuel pathways already include ethanol derived from sugarcane, cellulosic ethanol made from corn stover, and sustainable jet fuel made from camelina (EPA, n.d.c).

Based on a petition by a renewable fuel producer, EPA periodically approves new pathways for alternative fuels based on feedstock and processes, codified at 40 C.F.R. Section 80.1,426. For example, on September 23, 2019, EPA approved a pathway request from Texmark Chemicals for the production of biomass-based diesel (D-4) for renewable jet fuel (EPA, 2019).25

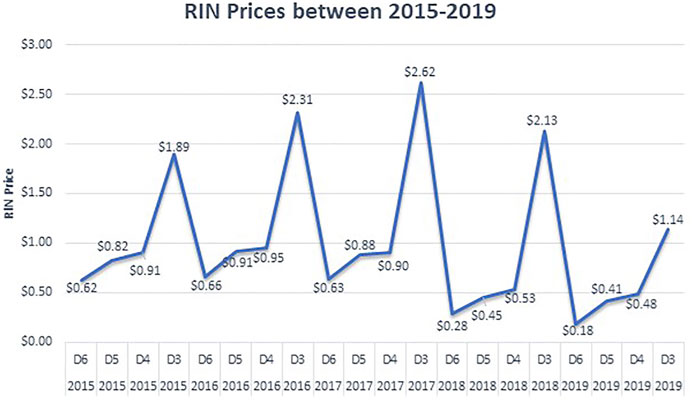

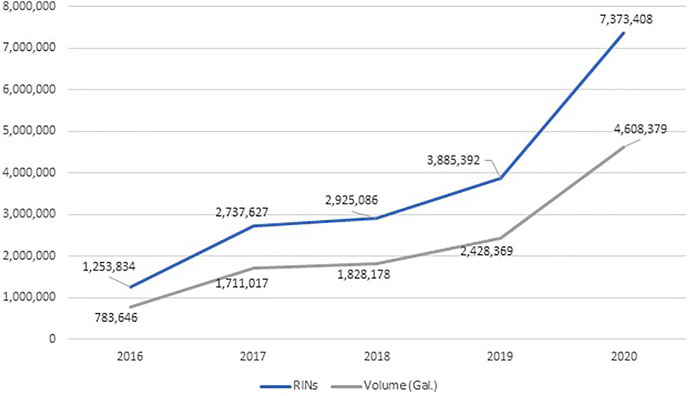

Credits under the RFS program are tracked using “Renewable Identification Numbers” or RINs. At their simplest, RINs are the “currency” of the RFS program. They serve as the accounting mechanism and trading currency used by obligated parties to satisfy the RFS. All obligated parties must acquire enough RINs to satisfy the RFS. They can do so either by buying renewable fuels and their associated RINs or buying RINs on the open market. Each gallon of renewable fuel is directly associated with an individual RIN. The number of RINs generated per gallon of biofuel depends on which type of biofuel is produced. When that RIN travels with that fuel from one party to another, it is called an “assigned RIN.” Sometimes RINs originally assigned to a batch of fuel become unassigned. Such “separated RINs” may be purchased separately. Market participants trade these RINs; Figure 2 includes annual sales reports of total RINs from 2015–2019, while Figure 3 includes the amount of renewable jet fuel produced over time and number of RINs gained with it. ASTM International-approved SAF pathways (see above) have been recognized to generate RINs.

FIGURE 2. Annual RIN sales reports (includes all RINs, not just renewable jet fuel) (EPA, n.d.b).

FIGURE 3. Renewable jet fuel production under the RFS program (EPA, n.d.c).

EPA has defined different renewable fuels to have different RIN equivalence values based on the energy density of each fuel. For instance, corn ethanol has an equivalence value of 1, so that 1 gallon of corn ethanol is associated with one RIN. Biodiesel generates 1.5 RINs, because it is more energy dense. Renewable jet fuel has an equivalence value of 1.6, so 1 gallon of renewable jet fuel is associated with 1.6 RINs. These RINs are created by renewable fuel producers or importers, and generally sold along with the renewable fuel to gasoline refiners or importers. RIN production for renewable jet fuel has been modest compared to other renewable fuel types. In 2019, fuel producers introduced 2,428,369 gallons of renewable jet fuel (EV 1.6), which generated 3,885,392 RINs. Despite the COVID-19 pandemic, this number almost doubled at the end of 2020, where producers introduced 4,608,379 gallons of renewable jet fuel (EV 1.6), which generated 7,373,408 RINs (EPA, n.d.c).

Although renewable jet fuels have one of the highest equivalence values (1.6), it still has an equivalence value smaller than renewable diesel (1.7). Because the production of renewable jet fuel generally costs more than renewable diesel, fuel producers prefer to produce renewable diesel rather than renewable jet fuel. One potential medication to incentivize SAF production would be to increase SAF’s equivalence value to 1.7 (Ghatala, 2020).

In addition, a report published by the Atlantic Council proposes extension of application of various tax credit programs to SAF production and development to reduce the price gap between SAF and conventional jet fuel (Ghatala, 2020, p. 39). Possible programs include an investment tax credit program for SAF production facilities, a performance tax credit similar to the IRS section 45Q, which provides a tax credit on a per ton basis for CO2 that is sequestered or CO2 used in enhanced oil or natural gas recovery, and a SAF-focused production tax credit (Ghatala, 2020, p. 16). In addition, existing programs can be modified. For example, the Biodiesel and Renewable Diesel Blender Tax Credit (BTC) is paid to the fuel blenders that place renewable fuels into the market (Ghatala, 2020, p. 21).26 SAF qualifies as a renewable diesel under the BTC, thereby decreasing production cost relative to fossil jet fuel but not against renewable diesel (Ghatala, 2020, p. 21).27 The program provides $1.00 per gallon of biodiesel or renewable diesel used in the blending process. Because this program expires in December 2022, the report proposes extending the program for SAF for a longer term.28

The opportunity to implement or extend such tax credits exists. Congress introduced the Sustainable Skies Act in May 2021, which would create a blender’s tax credit for SAF. The bill would provide a long-term blender’s tax credit between $1.50/gallon up and $2.00/gallon for fuels that achieve a 100% GHG emissions reductions (Hubbard, 2021). However, this has not yet passed.

Despite the 2016 Endangerment Finding and subsequent federal laws related to regulating aviation emissions, U.S. federal law and policy remains based on voluntary measures driven by the Renewable Fuel Standard. Individual states have also been working to incentivize reductions in aviation-related emissions, again through voluntary measures so far. Finally, regional airports and individual airlines have also been adopting SAF in their operations.

Absent a comprehensive federal program mandating the use of sustainable aviation fuel, states have been working to promote use of sustainable aviation fuels through incentives at the state level. California’s Low Carbon Fuel Standard has provided a model now adopted in Oregon and Washington and being considered in other states. Hawaii has taken a different approach mainly through tax incentives.

At the same time, regional airports, airlines, and private industry are moving forward with developing, supplying and using SAF to reduce aviation-related GHG emissions.

California’s Low Carbon Fuel Standard (LCFS) may pave the way for a functional opt-in credit system to incentivize production and use of sustainable aviation fuel, important because California accounts for one-fifth of U.S. jet fuel use (U.S. Energy Information Administration, 2021a). The LCFS, created by California Executive Order S-1-07 in 2007 and approved by the California Air Resources Board (CARB) in 2009, calls for a reduction of at least 10% in the carbon intensity of California’s transportation fuels by 2020 compared to conventional petroleum fuels (CARB, n.d.a). A 2018 amendment to the LCFS requires a 20% reduction in carbon intensity by 2030 (CARB, n.d.a). In addition to reducing greenhouse gas emissions, the secondary goals of the LCFS program are to diversify the fuel portfolio of California, reduce petroleum dependence, and reduce emissions of other air pollutants.

The program, administered by CARB, requires regulated producers of petroleum-based fuels to reduce the carbon intensity of their fuels by either developing low carbon fuel products, or by buying LCFS credits from other producers who develop and sell low carbon alternative fuels. Regulated parties under the LCFS include providers of most petroleum and biofuel products in California. Alternative fuel providers already achieving the 2020 reduction goals are exempt, but they may “opt in” to the program to generate credits they can sell on the LCFS marketplace (CARB, 2021a).

Under the LCFS, each fuel is given a carbon intensity rating which accounts for GHG emissions associated with the production, transportation, and use of a given fuel (CARB, n.d.c).

Fuels that have lower carbon intensity than the target established by CARB generate credits. Fuels with higher carbon intensities than the target generate deficits (CARB, n.d.c). Fuel producers with deficits must have enough credits, through generation or acquisition, to be in annual compliance with the standard (CARB, n.d.c). Carbon credit generating fuels include bio-based natural gas, fossil-based natural gas, electricity, hydrogen, ethanol, biomass-based diesel and renewable diesel fuels. Carbon deficit generating fuels include conventional gasoline and diesel fuels. The LCFS program uses CARB-accredited verifiers to provide additional verification of reported reductions in carbon intensity. This process is substantially similar to the existing verification standards for emissions reductions in California’s cap and trade program.

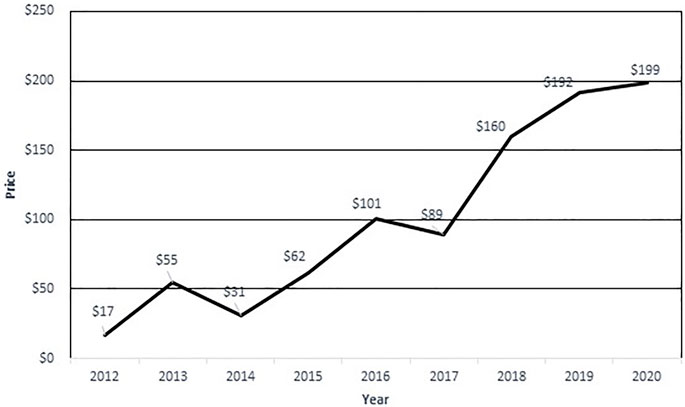

The LCFS is a performance-based standard allowing the market to determine how the carbon intensity of California’s transportation fuels will be reduced. It does not favor one fuel over another (California Delivers, n.d.). In other words, “because the standard is technology-neutral, companies can earn LCFS “credits” any number of ways, including improving their processes or through switching to renewable feedstocks and inputs” (PROMOTUM, 2015, p. 3). The program incentivizes adoption of low-carbon transportation fuels, based on the fuel’s carbon intensity. While the average price for a credit under the program was $31, $101, and $160 for 2014, 2016, and 2018, respectively, the average price per credit was $192 for 2019 and $199 for 2020 (Figure 4; CARB, 2021b). The average price of credits increased over the years, peaking in 2020.

FIGURE 4. Average price for a credit under California LCFS (CARB, 2021b).

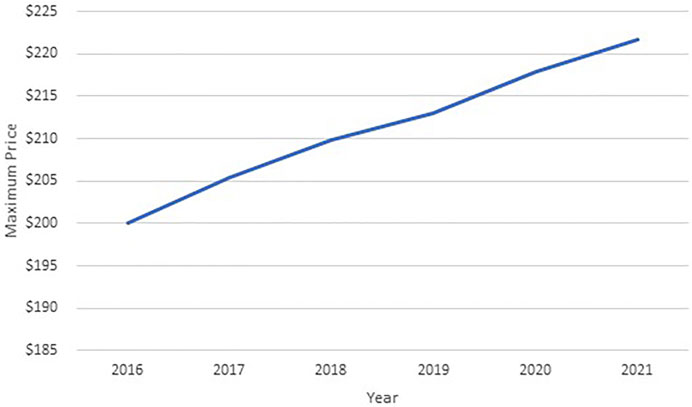

CARB sets a maximum price for selling a credit each year (CARB, 2020),29 which was $200.00 for 2016, $205.40 for 2017, $209.92 for 2018, $213.07 for 2019, $217.97 for 2020, and $221.67 for 2021 (Figure 5; CARB, n.d.b).

FIGURE 5. Maximum price for selling a credit each year under LCFS program (CARB, n.d.b).

One concern with the LCFS is the potential impact on indirect land use change. While direct effects of the production and use of the fuel is calculated via the California Greenhouse Gases, Regulated Emissions, and Energy Use in Transportation (CA-GREET) and Oil Production Greenhouse Gas Emissions Estimator (OPGEE) models, indirect land use change (ILUC) is calculated via Global Trade Analysis Project (GTAP) and Agro-Ecological Zone Emissions Factor (AEZ-EF) models, which are the strongest approach against ILUC risk, although not a perfect protection (CARB, n.d.a, p. 16).

In September 2018, CARB voted to add SAF producers to the list of entities that may voluntarily opt-in to the LCFS program. As of January 1, 2019, alternative jet fuels can generate credits under California’s LCFS. Currently, aircraft, military vehicles, ocean vessels, and locomotives are exempt from LCFS regulation. Some SAF related credits are being generated under this opt-in.

On November 5, 2020, the average incentive per gallon for SAF in a given year was $1.0516/gal, a decrease from $1.4250/gal (Pedrick, 2020); additional information on SAF consumed versus credits is included in Table 1. However, SAF production in California is sputtering compared to production of renewable diesel. Why? The main reason is that renewable diesel allows an obligated party to avoid generating deficits that would have resulted from the use of conventional diesel. However, conventional jet fuel or aviation gasoline is exempt under the LCFS and does not generate deficits. Second, a fuel with a low carbon intensity (e.g. produced from used cooking oil or tallow) will generate more revenue than a fuel with a high carbon intensity (e.g. produced from soybean oil) (Mazzone et al., 2021, p. 13). Renewal diesel and SAF are produced by using similar feedstocks and process. However, SAF requires an additional fractionation step which adds cost to the production of SAF. Because the LCFS program assigns renewable diesel a higher energy density, obligated parties prefer to produce renewable diesel compared to SAF (Mladenik, 2020).

TABLE 1. SAF consumed in California (Pedrick, 2020).

Although the LCFS has been subject to several legal challenges both at the federal and state level, it has been upheld in a complicated set of legal decisions. On September 19, 2013, the Ninth Circuit Court of Appeals upheld the California LCFS in a federal case known as Rocky Mountain I, reversing the district court decision holding that the California’s LCFS violated the dormant Commerce Clause of the U.S. Constitution.30 The Ninth Circuit held that the California LCFS did not facially discriminate against out-of-state commerce because the carbon intensity measurement is based on scientific data (e.g., transportation emissions, electricity supplies) rather than the fuel’s state of origin.31 Further, the Court held that California was not imposing its regulations on other jurisdictions.32

After the Rocky Mountain I decision, a California state court issued a decision in 2013 requiring CARB to reconsider the LCFS based on procedural administrative law requirements.33 The court said that CARB failed to comply with the procedural requirements required under the California’s Administrative Procedure Act (APA) and California Environmental Quality Act (CEQA) i.e., to complete an environmental analysis before approving the LCFS.34 That led CARB to adopt the 2015 LCFS which repealed the 2011 LCFS and the 2012 amendments. The 2015 LCFS was identical to the 2011 LCFS and kept the same carbon intensity and lifecycle analysis. After the re-adoption of the LCFS in 2015, plaintiffs appealed again alleging that the environmental analysis “still did not adequately analyze the potential for increase NOx emissions” (Hecht, 2019). The Court of Appeal ruled in favor of plaintiffs, ordering CARB to complete another environmental analysis (Hecht, 2019). As a result of the order, CARB amended the LCFS in 2018 (CARB, 2018).

After CARB’s 2015 updates, plaintiffs in the federal case amended their complaint—which had challenged the 2012 amendments to the LCFS’s crude oil provisions—to challenge the 2015 version of the LCFS. After losing at the U.S. District Court, plaintiffs appealed to the Ninth Circuit again, alleging that all three versions of the LCFS violate the Commerce Clause for two reasons. The first was by facially and purposefully discriminating against interstate commerce in their treatment of crude oil and ethanol; the second was by regulating extra territorially.35 On January 28, 2019, the Ninth Circuit held that challenges to the 2011 LCFS and the 2012 amendment were moot because CARB repealed these amendments.36 It also dismissed plaintiffs’ claim of extraterritoriality because it was precluded in Rocky Mountain I,37 and said that “plaintiffs do not and cannot explain how their extraterritoriality claims under the Commerce Clause function differently against the new version of the regulation.”38 After the plaintiffs’ request for review by the U.S. Supreme Court in Rocky Mountain I was denied, plaintiffs did not file a petition with the Supreme Court.

Having withstood these legal challenges, California’s LCFS is becoming more operational day by day and serves as a model for other states, particularly given that as of January 1, 2019, alternative jet fuel producers can generate credits under the LCFS. California’s LCFS is critical as a template for other states, and for the U.S. as a whole.

Oregon’s Clean Fuels Program is modeled on California’s LCFS; like in California, the aviation sector is not required to but may generate credits. In 2009, the Oregon Legislature passed HB 2186, authorizing the Oregon Environmental Quality Commission to reduce the average carbon intensity of Oregon’s transportation fuels by 10% over a 10-year period. In 2015, the Legislature passed SB 324, directing the Oregon Department of Environmental Quality (DEQ) to implement the Clean Fuels Program.39 Effective in 2016, the Clean Fuels Program is part of Oregon’s overall plan to reduce greenhouse gas emissions including methane emissions from the transportation sector by reducing reduce carbon intensity for gasoline and diesel fuels used in-state by 10% from 2015 levels by 2025.

Each year, the Oregon DEQ establishes Clean Fuel Standards, which is the annual average carbon intensity with which a regulated party must comply. This allows the State to update its annual targets until the 10% reduction by 2025 is met.40 The State set baseline carbon intensity levels—94.63 (gCO2/MJ) for gasoline, 95.29 for diesel and 90.8 for alternative jet fuel-for compliance in 2021 (Oregon DEQ, n.d.a). Clean fuels are those that have a lower carbon intensity level than the fuel replaced. Most types of ethanol, biodiesel, renewable diesel, renewable natural gas, biogas, electricity, and hydrogen qualify (Oregon DEQ, n.d.b).

Like California’s LCFS, deficits are generated when the carbon intensity of a certain fuel exceeds the Clean Fuel Standard in a given year and credits are generated if the carbon intensity is below the Clean Fuel Standard. Credit generators can voluntarily register with the program if they would like to generate and sell credits. Regulated parties are importers of gasoline, diesel, ethanol, and biodiesel. Producers of ethanol and biodiesel within the State of Oregon are also regulated parties. These regulated parties must comply with the Clean Fuels Program regulations, including purchasing credits from generators through the state’s marketplace when necessary.

Fuels used for aviation, construction equipment, farm vehicles, locomotives, logging vehicles, military vehicles, racing vehicles and watercrafts are exempt from the carbon intensity reduction requirements. However, as of January 1, 2019, renewable aviation fuels are now an “opt in” fuel for generating credits, which may spur further development (Lipson, 2019).41

As in California, Oregon was sued for these standards. In March 2015, the American Fuel and Petrochemical Manufacturers, American Trucking Associations, and Consumer Energy Alliance challenged the Oregon Program before the U.S. District Court in Oregon. Plaintiffs alleged that the Program violated the Commerce Clause and was preempted by the Clean Air Act (CAA) Section 211(c).42 The District Court dismissed the case.43 The Ninth Circuit said that the Oregon Program did not infringe on the Commerce Clause as it had also held for the California LCFS in Rocky Mountain I,44 also dismissing plaintiffs’ preemption claim under Article IV, paragraph 2 of the U.S. Constitution, commonly known as the Supremacy Clause. CAA Section 211(c)(4)(A) prohibits states from adopting rules to control and prohibit emissions from motor vehicles related to a fuel or additive if the EPA has decided to regulate a particular fuel, or if the EPA has found that no such regulation is necessary and publishes this decision in the Federal Register. Although the EPA excluded methane under the 1994 Reformulated Gasoline Rule (RFGR) indicating that it did not present a sufficient threat to the public health or welfare, it did not find that regulating methane’s contributions to greenhouse gas emissions was unnecessary nor published it as required under CAA Section 211(c) (4)(i).45 Therefore, the Ninth Circuit denied the plaintiff’s preemption argument. Plaintiffs then petitioned to the U.S. Supreme Court for review; this was denied on May 13, 2019. This cleared any challenges against the constitutionality of the Oregon Clean Fuels Program.

At this point, Oregon’s Clean Fuels Program is starting to generate credits. Overall, the Clean Fuels Program reduced 5,300,000 metric tons of GHG between 2016–2020 (Oregon DEQ, n.d.a). However, the state’s quarterly data summaries do not provide the SAF consumption amount or credits based on SAF (Oregon DEQ, n.d.c). Being able see this kind of data would be critical.

The Oregon Clean Fuels Program has been strengthened by an Oregon Executive Order on climate change. On March 10, 2020, Oregon Governor Kate Brown issued an executive order that aims to limit GHG emissions to 45% below 1990 levels by 2035, and an 80% reduction by 2050 with the help of 18 state agencies (VanderHart, 2020). The move came after the Oregon Senate killed a bill about a cap and trade program 1 week earlier. The order requires agencies to amend building codes to prioritize energy efficiency and decrease the carbon intensity of gasoline (VanderHart, 2020). It directed the Environmental Quality Commission and the Department of Environmental Quality to amend the Clean Fuels Program to reduce emissions by 20% below 2015 levels, and 25% by 2035 (VanderHart, 2020). How this plays out remains to be seen, particularly for SAF.

The State of Washington followed the path taken by California and Oregon by adopting a Clean Fuels Program which allows SAF producers to generate credits. This is critical as Washington has several large U.S. Air Force and Navy installations and is among the top-10 jet fuel consuming states (U.S. Energy Information Administration, 2021b). It is also home to Boeing, one of the world’s largest aircraft manufacturers.

Setting the stage was Washington’s Renewable Fuel Standard (WRFS), effective in 2013, which requires that at least 2% of all of the diesel fuel sold within the state be biodiesel or renewable diesel.46 This statute was a legislative response to the “public interest (in) establish (ing) a market for alternative fuels in Washington.” Goals for the WRFS include reducing “dependence on foreign oil,” improving “the health and quality of life for Washingtonians” and stimulating “the creation of a new industry in Washington that benefits farmers and rural communities.”47 The required percentage of biodiesel or renewable diesel sold within the state is supposed to increase from 2 to 5% 180 days after the Washington State Department of Agriculture determines that in-state feedstock and oil seed crushing capacity can meet a 3% sales requirement.48

Washington increased its focus on renewable transportation fuels through very recent legislation. On April 25, 2021, Washington adopted, and on May 17, 2021, Governor Inslee signed the legislation for its Clean Fuels Program that will reduce GHG emissions from transportation fuels sold in the state by 20% below 2017 levels by 2038 (Christensen et al., 2021).49 The bill ordered the Washington Department of Ecology to develop rules to implement the program which must become effective no later than January 1, 2023.50 The bill exempts fuels used for aircraft, vessels, railroad locomotives, military tactical vehicles, and until January 1, 2028, logging, off-road, agriculture and mining vehicles (Hopkins et al., 2021).51 However, like in California and Oregon, these industries can voluntarily opt in to the program in order to generate credits. The Clean Fuels Program will be linked to low carbon fuel standard programs in Oregon and California, creating a robust market for carbon reduction credits (Christensen et al., 2021). How this regional approach affects aviation-related credits also remains to be seen.

Other states are starting to consider LCFS-type laws. For example, Colorado released a roadmap on pollution reduction and a clean energy transition (Colorado Energy Office, 2021). In 2021, New Mexico proposed a LCFS, which, if adopted, would have allowed aviation industry to generate credits (New Mexico Environment Department, 2021). In addition, New York tried to introduce bills relating to LCFS both in 2020 and 2021, however, neither proposal advanced to a vote (Argus Media, 2021). Finally, Minnesota proposed a LCFS program but did not pass it during the 2021 legislative session (Orenstein, 2021). The effort of these states highlights the potential for more of a national standard or approach and merit watching.

In contrast, Hawaii has focused more on tax incentives. While not yet allowing for the same LCFS type program, Hawaii presents an interesting opportunity given the major role that aviation plays in Hawaii’s economy, energy balance, and CO2 inventory. Hawaii consumes over 700 million gallons of jet fuel per year, excluding the jet fuel consumption of the U.S. military (Hawaii Natural Energy Institute, 2020). All jet fuel used is petroleum-based. The transportation sector uses almost two-thirds of all petroleum consumed in Hawaii; of this, jet fuels constitutes half of all transportation fuel consumed in the state because of significant demand from military installations and commercial airlines (U.S. Energy Information Administration, 2021c).

Hawaii is beginning to develop an incentive system for SAF, mainly through tax credits. This is bolstered by Hawaii’s determination to “achieve its goal of 100 percent of renewable energy generation by 2045” (Hawaii State Energy Office, N.D.). Although this is currently focused on generation of electricity, Hawaii’s focus on renewable energy sources may provide the policy support needed to grow the biofuels industry for transportation, including for aviation.

There are a number of laws in place that support renewable fuels. For example, Hawaii enacted the Hawaii Environmental Response, Energy, and Food Security Tax (aka the “Barrel Tax”) in 1993. The Barrel Tax, originally set at $0.05 per barrel, increased to $1.05 per barrel on July 1, 2010 with the passage of Act 73, Session Laws of Hawaii 2010.52 In theory, the tax discourages the importation and use of petroleum-based fuels, incentivizing the use of alternative or biofuels. Its major impact, however, has been to create a funding source for energy and food security initiatives. Of the proceeds generated, a portion of the tax collected provides support for four funds: the Environmental Response Revolving Fund, the Energy Security Special Fund, the Energy Systems Development Special Fund, and the Agricultural Development and Food Security Fund. The tax also provides support for the Hawaii Clean Energy Initiative and the Hawaii Natural Energy Institute. The Barrel Tax on petroleum products specifically excludes aviation fuels and any fuel sold to a refiner. Despite these exemptions, the Barrel Tax applies to roughly 2/3 of the barrels of fossil fuels imported into Hawaii each year and provides more than $25 million in revenue to the state annually (Department of Taxation, State of Hawaii, 2016, p. 21). Set to sunset in 2015, the tax was extended for 15 more years in 2014, so now sunsets in 2030.53

A direct avenue to support aviation and implementation of SAF may come through a production tax credit. A renewable fuels production tax credit provides an income tax credit equal to $0.20 per 76,000 BTUs (or about $0.29 per gallon) of renewable fuels including renewable jet fuel sold for distribution in Hawaii beginning after December 31, 2016.54 The facility must produce at least 2.5 billion BTUs annually to receive the tax credit and may claim the tax credit for up to 5 years, not to exceed $3 million per calendar year.55 After 1 year of production, the taxpayer must complete and submit an independent, third-party certified statement to the Department of Business, Economic Development, and Tourism.56 The statement must include, among other things, the type, quantity, and British thermal unit value of each qualified renewable fuel, the feedstock used for each type of qualified renewable fuel, and the proposed total amount of credit to which the taxpayer is entitled for each calendar year.57 However, this tax credit program expires on December 31, 2021; 58 if it is renewed, it may be a vehicle to support production of SAF.

Financial incentives and a voluntary market may also help. In 2021, Hawaii passed House Bill 683, which has established a SAF program to provide matching grants to Hawaii small businesses developing and producing SAF (Burnett, 2021).59 The bill set baseline carbon intensity for jet fuel at 89 g of CO2 per megajoule.60 Therefore, a SAF production which has carbon intensity below 89 g of CO2 per megajoule would be eligible to receive matching grants.

Other proposed incentives might help bolster local SAF production. For example, in March 2020, the Hawaii legislation proposed to replace the existing barrel tax with a carbon emission tax on each fossil fuel, including jet fuel. If enacted, the tax on jet fuel would be $0.0598 per gallon.61 Hawaiian Senator Karl Rhoads said that “aviation fuel and electricity are taxed relatively lightly if you look at the per-carbon content” (Dalzell, 2019). While the bill did not advance to the House floor, it does signify that aviation fuel is a topic of concern.

An alternative pathway may also come through a statewide alternative fuel standard. In 2006, the Hawaiian legislature passed Act 240, creating the Hawaii Alternative Fuel Standard (AFS). This Act required 20 percent of highway fuel to come from alternative fuel by 2020, increasing to 30 percent by 2030.62 It includes biomass crops and municipal solid waste as eligible renewable energy sources. Ethanol produced from cellulosic materials is considered the equivalent of 2.5 gallons of non-cellulosic ethanol under the AFS.63 While aviation is currently not a regulated under Hawaii’s AFS, which currently focuses only on highway fuel standards, it could be modified or updated like Washington State did to allow for SAF.

Aviation offers Hawaii an opportunity to meet its GHG reduction goals, with a number of legal and policy pieces already in place to support SAF development and others proposed. Whether these come to fruition or not remains to be seen. Even as the federal government and states figure out how to support SAF, regional and airline initiatives are moving forward anyway.

Because of the different developments at the federal and state level—in part in response to CORSIA—some airports and airlines are adopting infrastructure for SAF with private industry is scaling up to meet these demands. For example, the Port Authority of New York and New Jersey and the company NESTE signed a MOU on June 6, 2019 to work together to facilitate the use of SAF at Port Authority facilities (Aviation Benefits Beyond Borders, 2019). On June 18, 2018, NESTE announced a partnership with Dallas Fort Worth International Airport to reduce air pollution from activities at the airport. The solutions include use of NESTE MY Renewable Jet Fuel at Dallas Fort Worth International Airport, along with renewable de-icing fluid, paints and plastics (Tisheva, 2018).

Airlines are also taking steps toward sustainable aviation fuel. United Airlines conducted the first commercial flight based on biofuel using algae derived aviation fuel on November 7, 2011 (Ayres, 2011). This was followed by the world’s first commercial flight based on forest residuals-based fuels from Seattle to Washington, D.C. conducted by Alaskan Airlines on November 14, 2016 (Alaska Airlines Newsroom, 2016). Alaska Airlines also signed a Memorandum of Understanding (MOU) with NESTE to work closely to “design, create and implement solutions that lay the groundwork for the wider adoption of renewable fuels within the airline industry” (Alaska Airlines Newsroom, 2018). On September 17, 2019, Delta Air Lines announced a $2 million investment to partner with Northwest Advanced Bio-fuels for study of a potential facility to produce biofuel from wood residues and wood slash. The facility is expected to be established in Washington State to provide fuel for Delta operations in Seattle, Portland, San Francisco, and Los Angeles (Delta News Hub, 2019a). That same year, Delta concluded a long-term offtake agreement to purchase 10 million gallons per year of advanced renewable biofuels from Gevo (Delta News Hub, 2019b). Similarly, on May 22, 2019, United Airlines agreed to purchase up to 10 million gallons of cost-competitive sustainable aviation fuel from World Energy over the next 2 years. United Airlines is the first airline in the world to use sustainable aviation biofuel on continuous basis (United Airlines, 2019).

Other private companies are also working to meet demand for SAF. For example, Fulcrum Bioenergy constructed a biorefinery in Storey County, Nevada, to convert municipal solid waste (MSW) into renewable jet fuel (Fulcrum BioEnergy, 2021). The facility is expected to process about 175,000 tons of MSW annually creating 11 million gallons per year of renewable synthetic crude oil which will then be upgraded to transportation fuels including SAF (Fulcrum BioEnergy, 2021). On April 15, 2018, the Oregon DEQ approved construction of a bio-jet and biodiesel production plant to be built in Oregon. The plant will convert 166,000 tons of woody biomass into 16.1 million gallons/year of renewable fuel (Red Rock Biofuels, n.d.). World Energy aims to increase SAF production from 25 million gallons per year to 150 million gallon per year while NESTE aims to increase its production from 34 million gallons per year to 500 gallons per year after 2023.

While voluntary now, these airport, airline, and industry initiatives tie back into the global emphasis on reducing greenhouse gas emissions from aviation. Such actions are ramping up in the European Union, which is critical for U.S.-based aviation. The push of EU-based regulation is also an important factor that will continue to shape U.S. law and policy for SAF.

While the U.S. federal and state governments are working on potential incentives for renewable jet fuel, the aviation industry is global and responding to international pressures as well. In 2009, the European Union adopted a Renewable Energy Directive which required fuel suppliers to produce at least 14% of their transportation fuel from renewable fuels. Although the RED targets do not apply to aviation fuel, SAF counts as a renewable source to meet the RED targets (European Union Aviation Safety Agency et al., 2019, p. 48). Along with EU wide policies, country-specific laws are driving change.

In 2009, the EU adopted the Renewable Energy Directive (RED), which sets out an overall policy for the production of energy from renewable sources in the EU.64 First, the RED required EU countries to fulfill at least 20% of their energy needs and at least 10% of their transportation fuels from renewable sources by 2020 (European Commission, n.d.a). A revision to the RED entered into force in December 2018 and stipulates a new binding target of at least 32% for energy by 2030 (European Commission, n.d.a). Fuel suppliers are required to ensure that at least 14% of their transportation fuel comes from renewable energy by 2030.

The RED provides multipliers which count use of biofuel by a factor greater than 1 to encourage the use of advanced biofuels, while limiting the contribution of bio-based biofuel derived from food and feed crops (European Union Aviation Safety Agency et al., 2019, p. 48). Advanced biofuels are defined as biofuels produced from the feedstock listed in the RED, Annex IX; this includes algae, municipal waste, industry waste not fit for use in the food or feed chain, straw, animal manure and sewage sludge, tall oil pitch, forestry biomass, and other non-food cellulosic material. A multiplier inflates the contribution of certain renewables; this includes a 1.2 multiplier for sustainable aviation fuels compared to fuels used in transportation and rail sectors. In other words, “the contribution of non-food renewable fuels supplied to these sectors count 1.2 times their energy content” (European Commission, 2019). This contrasts to the 1.6 multiplier provided by the U.S. Renewable Fuel Standard (RFS).

While the RED targets do not apply to aviation fuel, a 2015 amendment introduced a way that countries can voluntarily opt in through their own legislation (European Union Aviation Safety Agency et al., 2019, p. 48). A number of countries are starting to pursue this; see below.

In the meantime, emissions for airline flights in Europe are also regulated under the EU Emissions Trading System (ETS). The EU ETS is a cap and trade system which limits the overall level of CO2 emissions allowed from certain sectors but authorizes participants to buy and sell allowances as they require (European Commission, n.d.b). Launched on January 1, 2005, the EU ETS helps EU countries achieve their commitments to cap greenhouse gas emissions in a cost-effective way (European Commission, n.d.b). In addition to CO2 emissions from commercial aviation within the European Economic Area, it covers the power and heat sector, energy-intensive industry sectors including oil refineries, steel works and production of iron, aluminum, metals, cement, lime, glass, ceramics, pulp, paper, cardboard, acids and bulk organic chemicals, nitrous oxide (N2O) emissions from production of nitric, adipic and glyoxylic acids and glyoxal, and perfluorocarbons (PFCs) from aluminum production (European Commission, n.d.b). In addition to EU countries, the program applies to Norway, Iceland and Liechtenstein, which are other members of the European Economic Area (European Commission, n.d.b).

In July 2008, the EU issued a directive including aviation activities in the EU ETS beginning on January 1, 2012.65 EU ETS for aviation applies to emissions from flights from, to, and within the EU plus Iceland, Liechtenstein and Norway. The U.S. aviation industry then challenged the ETS directive for aviation.66 Ultimately, the European Court of Justice dismissed the plaintiffs’ claims in 2011.67 However, the EU limited application of the EU-ETS to only intra-Europe flights, known as the “stop the clock” decision because of non-European airlines and partners pushback.68 At this point, flights to and from an airport beyond these countries have been excluded until 2023 to facilitate negotiation of a global agreement at ICAO (European Union Aviation Safety Agency et al., 2019, p. 75). Also excluded are military aviation, search and rescue flights, state flights transporting third countries’ heads of state, government and government ministers, and police flights.

Aircraft operators receive some free allowances for their emissions from member states. They may emit up to the limit but must offset the remaining emissions. At the end of each year, each emission source must submit allowances at least equal to its emissions in the preceding year. Every ton of CO2 emitted require one allowance. An operator with more allowances than needed may sell the extra to another entity needing credit (Leggett et al., 2012, p. 10). If the operator does not have enough allowances to satisfy its previous year’s emissions, it can buy additional allowances at auction or from other companies having a surplus (Transport and Environment, n.d.). During the period from January 1, 2012 to December 31, 2012, the total quantity of allowances allocated to aircraft operators was 97% of the average historic aviation emissions between 2004 and 2006 (Leggett et al., 2012, p. 12). Eighty-five percent of the allowances were distributed for free, and 15% of the total allowances were auctioned with a bidding process. The allowances for phase of 2013–2020 was set to 95% of historical aviation emissions (European Union Aviation Safety Agency et al., 2019, p. 76). While 82% of the allowances are allocated freely, 15% are auctioned, and 3% of them are allocated free to new entrants and fast-growing operators (European Union Aviation Safety Agency et al., 2019, p. 76). In other words, if their emissions are over 95%, they have to purchase allowances from other sectors. If there is still 15% available from the auction, they can purchase from there as well.

In addition to aviation allowances, aircraft operators may benefit from allowances from stationary sources but not vice versa. For example, while an airline operator can use allowances from a stationary source, e.g. a steel production company, the company is not allowed to use allowances from the aviation sector. Aircraft operators can also use international credits up to 15% of their emissions in 2012. Between 2013 and 2020, each aircraft operator could use certain international credits up to a maximum of 1.5% of its verified emissions during that phase (European Union Aviation Safety Agency et al., 2019, p. 76). During the fourth phase of EU ETS, from 2021 to 2030, each annual limit will be further reduced by 2.2% each year from the aviation cap. Emission reductions will have to be exclusively domestic, meaning no international credits may be used (European Union Aviation Safety Agency et al., 2019, p. 78). EU ETS provides an incentive to use SAF attributing zero emissions to SAF under the EU ETS (European Union Aviation Safety Agency et al., 2019, p. 48), although almost all SAF have an actual life-cycle carbon intensity greater than zero. Therefore, the use of SAF reduces an airlines’ emissions, and the number of allowances it has to purchase. That, in turn, provides a financial incentive for airlines to use more SAF instead of conventional jet fuels (European Union Aviation Safety Agency et al., 2019, p. 48).

On July 14, 2021, the European Commission adopted a package of proposals called “Fit for 55,” which would provide a GHG emissions reduction of 55% by 2030 compared to 1990 levels (European Commission, 2021a). The proposals include “application of emissions trading to new sectors and a tightening of the existing EU ETS; greater energy efficiency; a faster roll-out of low emission transport modes and the infrastructure to support them; measures to prevent carbon leakage; and tools to preserve and grow natural carbon sinks” (European Commission, 2021a).

As a part of the package, the European Commission proposed a revision of the RED in July 2021, which raises renewable targets by at least 40% in 2030 (European Commission, 2021b). Another proposal provides blending mandates for SAF on aviation fuel suppliers via the Refuel EU Aviation initiative. The blending mandates are proposed for 5-year periods beginning in 2025: a minimum of 2% from 2025; a minimum of 5% from 2030, of which a minimum share is of 0.7% of synthetic aviation fuels, while in 2050 reaching to 63% of SAF, with a minimum share of 28% of synthetic aviation fuels.69

Another proposal under the package aims to gradually single out free emission allowances for aviation and to transition to full auctioning of allowances by 2027 (Campi, 2021). Finally, another proposal would terminate the tax exemption for kerosene used as fuel in the aviation industry and heavy oil used in the maritime industry (Campi, 2021). Although it is not clear when the proposal would enter into force, all of them have to be approved by the Council of the EU and the European Parliament in order to take effect (Buyck, 2021). Even as further EU mandates are considered, individual countries within the EU are taking action.

In addition to EU-wide action, different countries are also enacting legislation. For example, the Netherlands has enacted national legislation which allowed SAF producers to generate biofuel certificates (called Hernieuwbare Energie Eenheid-HBEs), when supplying SAF to the Dutch Market. These HBEs can be sold to the road transport obligated parties (Meijerink, 2016, p. 6). The SAF must be produced in the Netherlands (Meijerink, 2016, p. 19).

Germany increased its aviation tax which entered into force in April 2020 (Ash, 2019). The aim of the tax is to reduce CO2 emissions from the aviation sector and incentivize people to use less air travel and more railway transportation. The tax increase will raise airfares by around 28% overall (Ash, 2019). The tax is charged per passenger at the following rates: domestic and Europe flights, €12.88; mid-haul, €32.62; and long haul (which is more than 6,000 km), €58.73 (FCC Aviation, n.d.a).

France adopted the French Eco Tax but delayed its entry until air traffic returns to 2019 levels (Mitchell, 2021; FCC Aviation, n.d.b). It will be applied with the solidarity tax. Passengers traveling to airports in the European Economic Area and Switzerland will be charged at €2.63 (lower rate) or €20.27 (higher rate) depends on traveling in lowest class or higher classes. Passengers traveling to all other destination will be charged between €7.51 or €63.07 (Mitchell, 2021; FCC Aviation, n.d.b). The French government also announced a roadmap to replace jet fuel with 2% of SAF from 2025, 5% by 2030 and 50% by 2050 (GreenAir, 2020).

Since January 2020, Norway requires aviation fuel suppliers to blend 0.5% biofuel into their jet fuel (Norwegian Ministry of Climate and Environment, 2018). The country aims to have a 30% share of biofuels in the aviation sector by 2030 (Gevo Inc., 2020).

In contrast, the United Kingdom Renewable Transport Fuel Obligation (RTFO) requires suppliers of transport and non-road mobile machinery fuel in the United Kingdom to show that at least 9.75% of the fuel they supply after 2020 (which will increase to 12.4% in 2032) comes from renewable and sustainable sources (Department of Transport, 2018). Although aviation fossil fuels are not covered under the RTFO program, the changes in 2018 to the RTFO have allowed renewable jet producers to opt into the program (Department of Transport, 2018). After the withdrawal of the United Kingdom from the EU, the United Kingdom adopted the United Kingdom Emission Trading Scheme replacing the EU ETS. The United Kingdom ETS will apply to energy intensive industries including aviation (UK Department for Business, Energy and Industrial Strategy, 2021). Specifically, covered aviation routes include United Kingdom domestic flights, flights between the United Kingdom and Gibraltar, and flights departing the United Kingdom to European Economic Area countries operated by all aircraft operators, regardless of nationality (UK Department for Business, Energy and Industrial Strategy, 2021). Free allocation of allowance in the United Kingdom ETS will be similar to Phase IV of the EU ETS (UK Department for Business, Energy and Industrial Strategy, 2021). It is possible that EU and the United Kingdom will decide to form a new partnership for the EU ETS (European Union Aviation Safety Agency, n.d.).

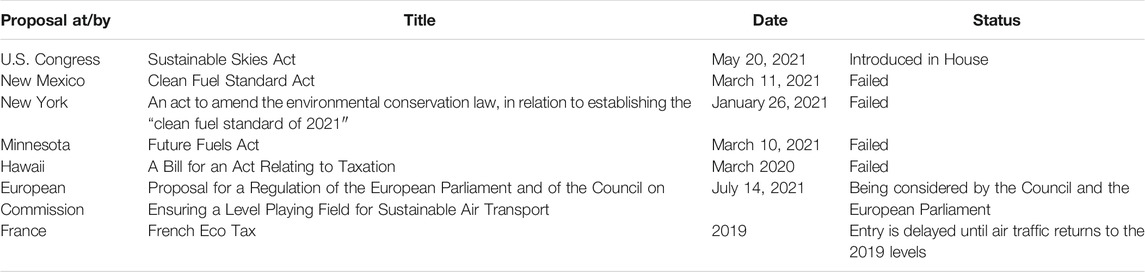

Each of these actions potentially affects U.S. companies that fly internationally while also providing examples of what could be pursued in the U.S. as it works to comply with international commitments. Table 2 also highlights proposed actions.

TABLE 2. Example laws and regulations relating SAF that are pending or failed. (Sources: European Commission, 2021a; Burnett, 2021; New Mexico Environment Department, 2021; Argus Media, 2021; Orenstein, 2021.)

As discussed above, the international nature of aviation is driving efforts to reduce greenhouse gas emissions and increase SAF through international agreements and country-by-country implementation. As the U.S. works to meet its current voluntary but soon to be mandatory reductions in aviation-related GHG emissions, it could learn from actions taken by various U.S states, the European Union (EU), and individual European countries. These actions include, but are not limited to, adopting a SAF blending mandate, a federal low carbon fuel standard program, various tax credits, and/or a cap and trade program. As discussed in this review, there are multiple ways to refine existing programs or develop new programs. For any changes, analysis of how such changes might affect the supply chain and/or economics should be considered; however, such analyses are outside the scope of this review. Providing further law and policy support for GHG reductions from aviation—provided any source of SAF indeed reduces GHG emissions—is critical for the U.S. in meeting its commitments and obligations under CORSIA and as an opportunity to step into a leadership role as countries around the worlds works to reduce GHG emissions.

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

This research was funded by the U.S. Federal Aviation Administration Office of Environment and Energy through ASCENT, the FAA Center of Excellence for Alternative Jet Fuels and the Environment, project 001 through FAA Award Number 13-C-AJFE-PSU under the supervision of Nate Brown (U.S. FAA). Any opinions, findings, conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views of the FAA.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The authors would like to thank KL (U.S. DOT Volpe Center), Nate Brown (U.S. FAA) and Michael P. Wolcott (WSU) for their critical review and comments as well as Season Ashley Hoard, Carol Sim and Christina M. Sanders from the WSU. Any errors are those of the authors.

1There are alternative fuels that are not SAF. For example, coal-based FT (Fischer-Tropsch) fuels are from an alternative/non-traditional jet fuel but they are not SAF.

2Convention on International Civil Aviation, Dec. 7, 1944, 15 UNTS 295.

3The Council adopted CORSIA on June 27, 2018 as Annex 16, Volume IV to the Chicago Convention.

4In this instance, states mean countries.

5Because the COVID-19 pandemic has caused a sharp decline in aviation activity, the ICAO Council changed the CORSIA baseline to 2019 emissions only and voted to remove 2020 emission from two other baseline calculation in the scheme. “ICAO Council Agrees CORSIA Baseline Change to Protect Covid-Stricken Airline Sector from Higher Carbon Costs,” GreenAir Archives, July 1, 2020, https://www.greenaironline.com/news.php?viewStory=2715. This was criticized by EDF which said that paragraph 11(e) (1) (i) of the 2016 General Assembly Resolution A39-3, re-affirmed by ICAO in 2019, already allows airlines to calculate their offset obligation for 2021, 2022, and 2023 based on their 2020 emissions rather than their emissions in those years and there was no need to change baselines. Pedro Piris-Cabezas and Annie Petsonk, “Coronavirus and CORSIA,” EDF, March 2020, https://www.edf.org/sites/default/files/documents/Coronavirus_and_CORSIA_analysis.pdf.

6Resolution A39-3, para. 9(e). “A State’s individual RTK share is calculated by dividing the State’s RTKs by the total RKTs of all States. Those State who have an individual RTK share below 0.5 percent of the total RTK, will be exempt from offsetting requirements, unless the cumulative RTK share is less than 90 percent. The cumulative RTK share is calculated by sorting the individual RTK shares from the highest to lowest, then successively increasing the value by summing the RTK shares from highest to lowest until the value reaches 90%. The values of all States are considered for this calculation, regardless if a State might be exempted from offsetting requirements in CORSIA afterwards.” ICAO, What is CORSIA and How Does It Work? Environment, https://www.icao.int/environmental-protection/Pages/A39_CORSIA_FAQ2.aspx (accessed June 6, 2019).

7Ibid.

8Resolution A39-3, para. 13.

9Resolution A39-3, para. 11.

10FAA’s CORSIA Monitoring, Reporting and Verification Program, 84 Fed. Reg. 9,412 (Mar. 14, 2019).

11Ibid.

1240 C.F.R. §§ 87 and 1,068.

13Ibid.

14.Finding That Greenhouse Gas Emissions from Aircraft Cause or Contribute to Air Pollution that May Reasonably Anticipated to Endanger Public Health and Welfare, 81 Fed. Reg. 54,421 (Aug. 15, 2016).

15Ibid. at 54,423.

16EPAct 2005, Pub. L. No. 109–58, § 1,501.

17Clean Air Act, 42 U.S.C. § 7,545 (o) (2010).

18Energy Independence and Security Act of 2007, Pub. L 110–140.

19CAA § 211(o) (2)(B) (i) (I).

2040 CFR § 80.1406.

21CAA § 211(o) (1) (B).

22CAA § 211 (o) (1) (E).

23CAA § 211(o) (1) (D).

24CAA § 211(o) (1) (J); 40 CFR § 80.1401.

25Renewable Fuel Standard Program: Grain Sorghum Oil Pathway, 83 Fed. Reg. 37,735 (Envtl. Prot. Agency, Aug. 2, 2018).

2626 U.S. Code § 40A.

27Ibid. § 40A(f).

28Ibid.

2917 Cal. Code of Regulations Section 95,487 (a) (2) reads as follows: A regulated entity may not (D) Sell or transfer credits at a price that exceeds the Maximum Price set by the following formulate: 1) $200 (MTCO2e) in 2016. 2) The per credit price shall be adjusted annually by the rate of inflation as measured by the most recently available 12 months of the Consumer Price Index for All Urban Consumers. “Consumer Price Index for All Urban Consumers” means a measure that examines the changes in the price of a basket of goods and services purchased by urban consumers, and is published by the U.S. Bureau of Labor Statistics. 3) The Maximum Price will be published on the first Monday of April and go into effect on June 1st.

30Rocky Mountain Farmers Union v. Corey, 730 F.3d 1,070 (9th Cir. 2013).

31Rocky Mountain, 730 F. 3d at 1,089.

32Ibid. at 1,101.

33POET, LLC v. CARB, 218 Cal. App. 4th 681, 766-67.

34Ibid.

35Rocky Mountain Farmers v. Corey (9th Cir. Jan. 18, 2019) (No. 17-16881), p. 16.

36Ibid., at 19.

37Ibid. at 20.

38Ibid. at 21.

39ORS 468A.275.

40OAR 340-253-8,010.

41OAR 340-253-320, 330 and 350.

42Am. Fuel and Petrochemical Mfrs. v. O′ Keeffe, 134 F. Supp. 3d 1,270 (D. Or. Sept. 23, 2015).

43Am. Fuel and Petrochemical Mfrs. v. O’Keeffe, 903 F.3d 903 (9th Cir. Or. Sept. 7, 2018).

44Am. Fuel and Petrochemical Mfrs., 903 F.3d 903, 911.

45Am. Fuel and Petrochemical Mfrs. v. O′ Keeffe, 134 F. Supp. 3d at 1,285.

46RCW 19.112.110.

47Washington State Legislature, RCW 19.112.110, Notes: Findings—Intent—2006 c 338, https://app.leg.wa.gov/RCW/default.aspx?cite=19.112.110.

48RCW 19.112.110.

49HB 1091, Chapter 317, Law of 2021, 67th Legislature, 2021 Regular Session, Effective Date July 25, 2021.

50Ibid., Sec. 3.

51Ibid., Sec. 4 (5), Sec. 5 (1) (b) and (2).

52HB 2421, Act 73 (2010), available online at https://www.capitol.hawaii.gov/session2010/bills/HB2421_ACT73_.pdf.

53Act 107, Session Laws of Hawaii 2014.

54HI Rev. Stat. § 235–110.31.

55Ibid.

56Ibid.

57Ibid.

58Ibid.

59Hawaii House Bill 683 (2021), Regular Session.