- 1Center for Industrial and Business Organization, Dongbei University of Finance and Economics, Dalian, China

- 2National School of Agricultural Institution and Development, South China Agricultural University, Guangzhou, China

Subsidies and penalties are two main regulation methods adopted by authorities to promote the development of renewable energy. Due to the possibility of subsidy fraud, it is necessary to explore effective ways to combine these two policies. In this article, subsidy and penalty policies are incorporated into a sequential game theory model to explore the impact of different regulatory mechanisms on the promotion of renewable energy from recycled resources. We take biodiesel production from used cooking oil (UCO) as an example. UCO can be converted into environmentally friendly biodiesel or mixed with fresh cooking oil, resulting in inferior cooking oil containing harmful carcinogens but with huge profits. There are two mechanisms in the sequential combination model, spot checks after subsidy and subsidy after spot checks. Under both cases, fines are imposed if fraud is found during spot checks. The amounts of subsidies and fines also need to be determined. We show that the effects of subsidies depend on the implementation of the timing. The ex-ante subsidies have no effect. When spot checks are performed first, the larger subsidies will increase the probability of producing inferior cooking oil due to lower probability of spot checks. While combined with penalties, the ex-post subsidies have a positive effect on biodiesel production, that is, there exists synergy effect of penalty and subsidy on renewable energy production. In an infinitely repeated game, the shutdown threat of a grim trigger strategy (GTS) is much easier to induce biodiesel production than the penalty threat of a tit-for-tat strategy (TFT). When penalties are large enough, TFT can achieve the same goal of legal production effectively as GTS. The sooner illegal production is observed, the lower penalties are required to induce the processor to produce legally. Compared to subsidies, penalties are more effective in encouraging processors to produce renewable energy rather than illegal products. Moreover, our simulation results suggest that higher fines or profits from legal production are more likely to stimulate renewable energy production than subsidies. Our findings enrich our knowledge of the link between government regulations and the promotion of renewable energy.

Introduction

Faced with the challenges of energy shortages and rising greenhouse gas emissions, countries around the world have gradually adopted various policies to stimulate the use of environmentally friendly renewable energy, among which subsidies and penalties are the main intervention means (al Irsyad et al., 2017; Saghir et al., 2019; Chen et al., 2021). For example, the Japanese government provides investment subsidies for solar energy projects to encourage clean energy supply (Kimura and Suzuki, 2006) and allocates direct subsidies for biofuel companies (Zhang et al., 2015). In Europe, Germany and Spain provide subsidies of around €60/MWH and €300/MWH, respectively, to wind and solar renewable energy producers (Abrell et al., 2019). At the same time, subsidy fraud has become a serious problem. Kumar (2019) stated that 70% of the subsidy was provided to ineligible solar rooftop projects in India. In 2017, the world’s leading electric car maker, Tesla, lost the electric vehicle subsidies from the German government after it was accused of gaming the subsidy system (Lambert, 2017). Penalties are introduced to reduce misbehavior by renewable energy producers. The Chinese government fines three times money for solar photovoltaic subsidy fraud (Yuan et al., 2015; Liu et al., 2021).

Although both subsidies and penalties are widely followed, implementing them effectively remains a challenge. Chang et al. (2011) pointed out that direct subsidy is the main driving factor on solar water heater market expansion in Taiwan, but the high-level subsidy might cause a negative impact on users or a sustainable industry. Zhang et al. (2014) studied the subsidy effect of the biofuel processing industry in different stages from investment, raw material input to final product, and found that investment subsidy is less effective compared with the other two. A benefit–cost analysis of subsidizing residential solar panels in the United States was conducted by Tibebu et al. (2021) and the results showed that in comparison with the federal tax credit, the optimal subsidy schedule can raise net benefits by 250%. In terms of penalty, Lu et al. (2018) developed a penalty-cost-based design mechanism, which can reduce the cost of net zero energy building (NZEB) owners by half. Although a few studies attempt to design and apply the reward–penalty mechanism to lessen the over-generation from renewable energy systems (Md et al., 2017) and to reduce the risk in auctions of renewable energy support (Kreiss et al., 2017), the literature regarding the effective combination of subsidies and penalties is still limited.

From the perspective of sustainable energy use, biodiesel is increasingly being adopted as an important alternative to clean energy in the field of transportation, which is a key factor in global climate change (Fischer and Schrattenholzer, 2001). There are two main sources of biodiesel: oily plants, such as the nonedible Jatropha oil, and fatty acid-rich waste including UCO. On the basis of a life cycle assessment, biodiesel processed from UCO has nearly 74% reduced impact on the environment and 80% reduced global warming effect compared with nonedible Jatropha oil (Sajid et al., 2016). In addition, the usage of UCO as a feedstock in biodiesel production (Rincón et al., 2019) can lead to a cost reduction of 60–90% compared to other fatty acid–rich waste (Marchetti et al., 2008). According to Kharina et al. (2018), subsidizing UCO-to-biodiesel production can save the government 345 billion rupiahs (approximately US $24M) per year, in comparison with the subsidy of the same amount of palm biodiesel.

Due to the above reasons, many countries and regions have adopted incentive measures to promote the production of biodiesel from UCO and to reduce the possibility of illegal processing of UCO into other products. Mixing UCO with fresh edible oil can lead to higher profits for processors but serious health problems for consumers (Cai et al., 2015; Ortner et al., 2016; Liu, 2018; Tsai, 2019). For example, biodiesel produced from UCO can enjoy the double counting of carbon dioxide emission reduction in Europe. In Japan, the government subsidizes biodiesel companies to reduce incentives for illegal UCO processing. In China and Japan, restaurants can be fined or shut down if they buy processed UCO or sell it to illegal institutions. Zhang et al. (2017) stated that the penalty mechanism is one of the key determinants that affect the performance of biofuel companies.

The game modeling method is suitable for the theoretical study of the situation where stakeholders have different objectives. The dynamic game model developed by Zhang et al. (2014) compares the incentive effects of different subsidy modes on UCO supply for biofuel refining and sales of UCO-refined products. With a non-cooperate game-theoretical model, Wang et al. (2017) assess the promotion impact of the consumer’s response capability on the penetration of distributed photovoltaic systems. A three-stage Stackelberg game model is used to explore the optimal subsidy policy for green energy trading among user residents, service providers, and the grid (Wu et al., 2021). However, it is still unclear that how governments should effectively combine subsidy and penalty measures and what effect it would be if subsidy and penalty measures are taken simultaneously. We integrate subsidy and penalty policies into one game-theoretical model to examine the influence of different regulatory mechanisms on the processing decisions of UCO processors.

The rest of this article is structured as follows. The Model Specification section discusses the specifications in the model. The Simulation Results section shows the simulation results. We offer concluding remarks and practical implications in the Conclusions and Practical Implications section.

Model Specification

We assume that a processor can produce two kinds of products, one is a good product such as renewable energy with low profit under the government subsidy policy, and the other is a bad product such as unqualified products or carcinogens with high profit. For example, there is a financial support policy for the promotion of new energy cars from 2012 in China, and pure electric vehicles will be subsidized according to cruising range. In order to get a subsidy of up to US$14k, some car enterprises choose to make a false report of cruising range and produce low-standard battery instead of high-standard battery. Take UCO as an example, we consider a waste UCO processor that can produce either biodiesel legally or inferior cooking oil illegally. A local government can perform a spot check to see whether the processor produces biodiesel rather than inferior cooking oil. The spot check can be implemented before or after providing subsidies1. To encourage the processor to convert the waste oil into biodiesel fuel through a chemical process, the government provides a subsidy to the processor if the processor produces biodiesel and otherwise punishes the processor with a fine.

One-Stage Game Model With Subsidy Given Before Spot Checks

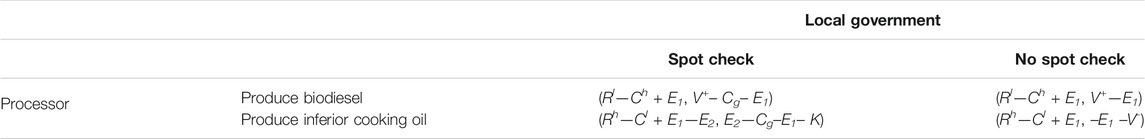

Consider the static game with complete information. We assume that the cost of recycling waste oil is negligible and focus on the cost difference between the production of biodiesel and inferior cooking oil. The strategic-form representation of the game where the subsidy is given first and then a spot check is performed is in Table 1.

In this table,

Given these payoffs, we find the following pure and mixed Nash equilibria.

Scenario 1. When

Scenario 2. Suppose

Scenario 3. There is a mixed Nash equilibrium as follows:

The processor is indifferent between producing biodiesel and producing inferior cooking oil when

The government is indifferent between performing a spot check and not performing a spot check when

Equations 3, 4 pin down the equilibrium probabilities of performing a spot check and producing inferior cooking oil as given by Eqs 1, 2.

Lemma 1.

a) When

b) When

c) When

Lemma 1 says that there is a unique pure Nash equilibrium with the processor producing inferior cooking oil and the local government not checking the firm when the sum of the cost of the spot check and the recycling or disposal cost of inferior cooking oil is greater than the sum of the penalty the local government imposes on the processor and the social cost of the reuse of waste oils by consumers. This outcome makes sense because the cost of checking is so high for the government that no check is performed, so the processor’s best response to the government’s strategy is to produce inferior cooking oils because of the high profit. However, when the sum of the cost of the spot check and the recycling or disposal cost of inferior cooking oil is lower than the sum of the penalty and the social cost of the reuse of waste oils by consumers and the penalty is lower than the difference in the profits of these two products, the government always performs the spot check, but the processor’s best response is still to produce inferior cooking oil to earn the higher profit. When both the costs and the difference in the profits of these two products are greater than the penalty, there is no unique pure Nash equilibrium. If the government performs the spot check, the processor produces biodiesel; if the government does not perform the spot check, the processor produces inferior cooking oil. If the processor produces biodiesel, the best response for the government is to not check; if the processor produces inferior cooking oil, the best response for the government is to perform the spot check and punish the processor. There is a mixed Nash equilibrium with the probabilities of the processor producing inferior cooking oil and of the government performing a spot check.

We take the partial derivatives of

(a)

(b)

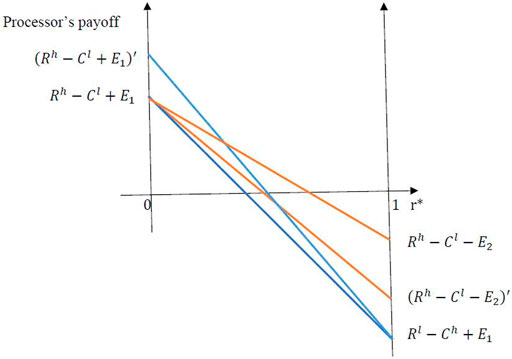

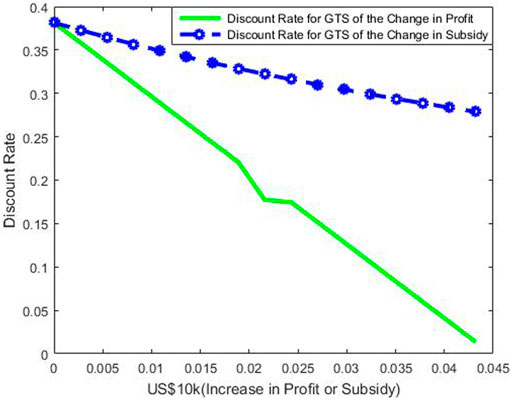

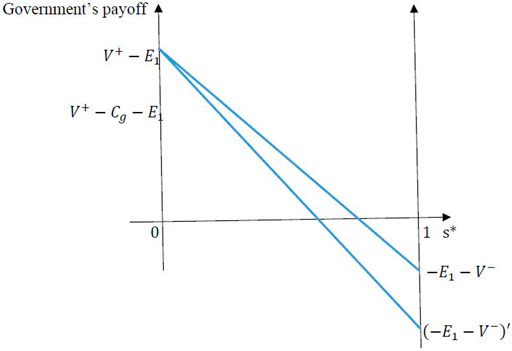

Figure 1 shows that as the social cost,

FIGURE 1. Relationship between the government’s payoff and the probability of producing inferior cooking oil.

The two blue lines in Figure 2 show that as the difference in the profits of the two products increases, so does the probability that the government performs a check. The two brown lines show that as the penalty for producing inferior cooking oil increases, the frequency of spot checks decreases. In the short run, the processor is less likely to produce inferior cooking oil when the penalty is higher; however, a higher penalty increases rather than reduces the probability of the processor producing inferior cooking oil as r* decreases in the long run because the higher penalty decreases the probability of the government performing a spot check.

Proposition 2 (incentive paradox). Ex-ante subsidy has no effect on the probabilities of the processor producing inferior cooking oil or the government performing a spot check. Increasing the penalty for the processor does not deter it from producing inferior cooking oil in one-stage game but does reduce the frequency of spot checks by the local government. Increasing the social cost of the reuse of waste oils by consumers decreases the probability of the processor producing inferior cooking oil.

One-Stage Game Model With Subsidy Given After Spot Checks

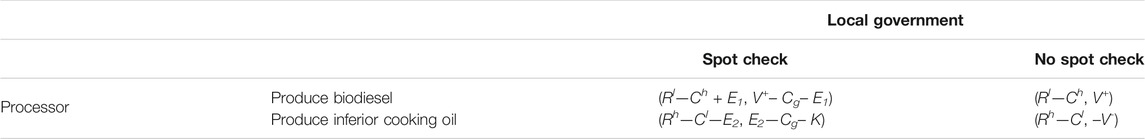

The strategic-form representation of the game when the spot check is performed first, and then, the subsidy is given as follows in Table 2. Given these payoffs, we find the following pure and mixed Nash equilibria.

Scenario 1. When

Scenario 2. When

Scenario 3. In all other cases, there is a mixed Nash equilibrium with

The processor is indifferent between producing biodiesel and producing inferior cooking oil when

The government is indifferent between performing a spot check and not performing a spot random check when

Equations 7, 8 can be solved to obtain the equilibrium probabilities of the government performing a spot check and the processor producing inferior cooking oil as given by Eqs.5, 6. We take the partial derivatives of

a)

b)

c)

Proposition 3. Therelative timing of the subsidy and spot check is important. When the subsidy is given before the spot check is performed, ex-ante subsidies have no impact on the probabilities of the processor producing inferior cooking oil or the government performing a spot check. When a spot check is performed before the subsidy is given, ex-post subsidies have a negative effect on the probability of biodiesel producing, combined with penalties have a positive effect on the probability of producing biodiesel from UCO

The difference between these two timings is the effect of subsidies. When the subsidy is given before the spot check is performed, there is no effect of subsidies on the probabilities of the processor producing inferior cooking oil or the government performing a spot check. When the spot check is performed before the subsidy is given, a larger subsidy combined with large penalties decreases the probability of the processor producing inferior cooking oil. The government may increase the subsidy and penalty to lower the probability of the processor producing inferior cooking oil and increase the probability of the processor producing biodiesel.

Proposition 4. Comparing the two methods, the probability of biodiesel production caused by the first method (subsidy given before spot checks) is higher than that caused by the second method (spot checks are performed before subsidy given).

Given the probability of the government performing a spot check in the nth stage and the probability of producing biodiesel we derived above, then the conditional probability of biodiesel production caused by the first method (subsidy given before spot checks) can be written as,

where

Substitute Eqs 1, 2, 5, 6 into the following conditional probabilities, we have,

and

Dynamic Infinitely Repeated Game Model

We assume as above that there is one waste oil processor that can produce either biodiesel legally or inferior cooking oil illegally. The local government encourages the waste oil processor to produce biodiesel legally and gives the processor a subsidy according to its reported biodiesel production. If the waste oil processor deviates from producing biodiesel and the inferior cooking oil illegally instead and this is discovered during a spot check, the local government punishes the waste oil processor with a fine.

Because government supervision is a repeated process, both the local government and the processor know the results of the most recent spot check. Both sides readjust their strategies given the outcome of the most recent stage of the game. The processor decides whether to produce biodiesel legally or inferior cooking oil illegally, and the local government adjusts its probability of performing a spot check to adjust its cost. The game between the local government and the waste oil processor is an infinitely repeated game of complete information.

The following two strategies, grim trigger strategy (GTS) and tit-for-tat strategy (TFT), can be used to punish the processor producing inferior cooking oil in the infinite repeated game.

First, GTS is as follows, start by cooperating, that is, the waste oil processor producing biodiesel and the government does not perform a spot check at stage 1, and continue to cooperate until the waste oil processor deviates to produce the inferior cooking oil, once a deviation observed, the government will immediately punish the waste oil processor to shut down and cannot produce either legal biodiesel or illegal inferior cooking oil any more.

Suppose both the government and the processor choose to cooperate at the beginning of the infinite repeated game, the government performs a spot check in the nth stage and the processor continues to produce biodiesel.

To induce the processor to produce biodiesel to be a Nash equilibrium, the expected payoff to the processor of producing biodiesel must be no lower than the processor’s expected payoff to producing inferior cooking oil. So it is only when the government punishes the processor for producing poor-quality cooking oil, the processor’s profit is lower when producing inferior quality cooking oil than when producing biodiesel. The expected payoff to the processor of producing biodiesel is greater than and equal to the expected payoff to the processor of producing inferior quality cooking oil in the first n stages until the illegal production is discovered with shutting down in the nth stage as shown in Eq. 13.

Which results in

or

where the numerator is the profit difference between legal biodiesel production and illegal inferior cooking oil production. Moreover, the denominator represents the benefit to cooperate to produce legal biodiesel, and the numerator represents the inventive to cheat to produce illegal inferior cooking oil.

Given the discount rate,

The second strategy is known as TFT, which starts by cooperating, that is, the waste oil processor producing biodiesel, and the government does not perform a spot check at stage 1, and continue to do (either cooperate or cheat) what the rival did in the most recent period. Once the waste oil processor deviates to produce the inferior cooking oil, the government will immediately revert to a period of punishment of the remaining period to perform a spot check definitely in order to push the waste oil processor back to cooperate and produce legal biodiesel again.

which is equivalent to

where

Where the numerator is the profit difference between legal biodiesel production and illegal inferior cooking oil production and represents the inventive to cheat to produce illegal inferior cooking oil, in other words, it is also the cost of cheating in the future. It can be considered as a threat of cheating. Moreover, the denominator is the penalty,

Given the discount rate,

Proposition 5. When the discount factor, δ, is sufficiently large, producing biodiesel is a perfect Nash equilibrium grim trigger strategy or tit-for-tat strategy for the processor in the infinitely repeated game. The discount rate, δ, is such that:

a)

b)

c) If

Since GTS or TFT can be a Nash equilibrium, when

Proposition 6. The discount factor,

If we substitute

Lemma 7. There exists a sufficient condition that ensures producing biodiesel when

Simulation Results

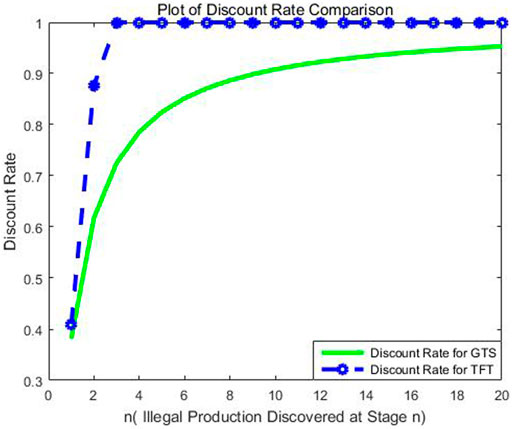

Policy makers want an efficient regulation method to achieve the objective of biodiesel production instead of inferior cooking oil production in the infinitely repeated game. Although this policy objective is clear and unique, the exact amount of subsidy or penalty for each outcome has not been calculated in the literature, to our best knowledge. We believe that the reason was that an analytic calculation is not possible, and one has to use simulations for this. Our simulation code is written in MATLAB. It begins with drawing net profits for the processor producing biodiesel and inferior cooking oil based on the current situation in Shanghai, China. Then, we adjust different levels of stages (from stage 1–20) at which the illegal production by the processor will be discovered to show the changes in discount rate for the GTS and TFT strategies in the long run and the changes in penalties. Finally, we adjust different levels of profit difference between biodiesel and inferior cooking oil production and subsidy to show that the effect of change in profit of illegal and legal production on penalties. One set of values and numbers corresponds to one strategy. Knowing these values, by using our theoretical model, we calculate different levels of discount rate, the amount of penalty and subsidy.

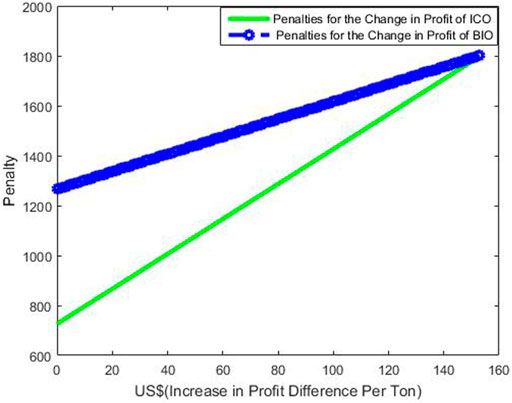

Figure 3 shows that the discount rates comparison between GTS and TFT which two strategies need to be Nash equilibria as the stage at which the illegal inferior cooking oil production is checked out, where stage

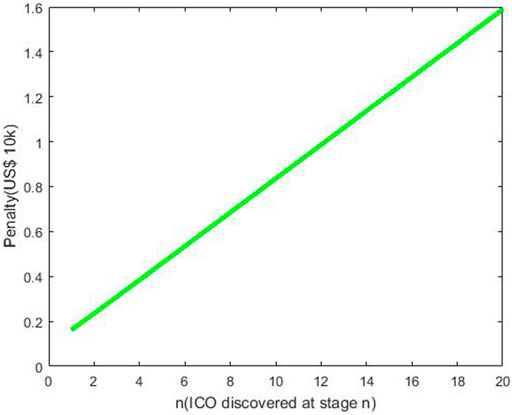

FIGURE 4. Increase in penalties for TFT of the changes in stage at which illegal production is discovered.

Figure 5 shows that the discount rate comparison for GTS of the changes in profit of biodiesel and subsidy. As the profit of biodiesel and subsidy increase by the same amount per year, the corresponding discount rates show that it is higher for increase in subsidy than for increase in the profit of biodiesel production. Moreover, the effect of the increase of subsidies on the discount rate is far less than that of the increase in profit of biodiesel production. It is better to increase the profit growth of biodiesel or shrink the profit difference between biodiesel and inferior cooking oil to guide biodiesel production instead of increase in subsidies.

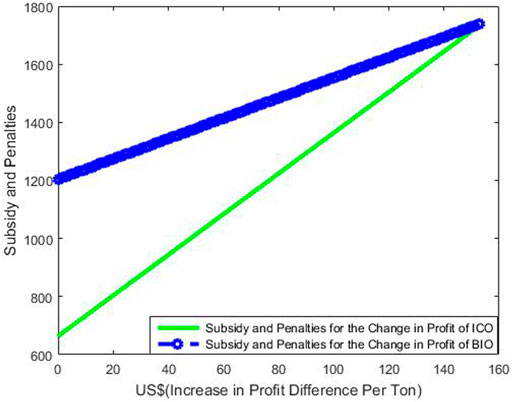

Figures 6, 7 show that the effect of change in profit of illegal and legal production on penalties when subsidy is given and on the sum of subsidies and penalties with

Lemma 8. The later production of illegal inferior cooking oil was observed, the higher patience required to cooperate for TFT strategy than GTS strategy to induce the processor to produce biodiesel in infinitely repeated game. Moreover, the effects of same increase in profit of biodiesel and subsidy are different, and it is much easier and better to increase the profit of biodiesel instead of subsidies to guide biodiesel production. Increasing profits from legal production is more effective in reducing penalties and subsidies than increasing profits from illegal production.

Conclusions and Practical Implications

Conclusions and Discussion

In this article, a sequential game theory model is developed to study the combined effects of subsidies and penalties on the promotion of renewable energy production with an example of biodiesel production from UCO. This model considers three aspects, including the intensity of the government punishment, the relative timing of government subsidies, and the cost of government regulations. Regardless of the timing of the subsidy, it is more effective to raise penalties punishment and reduce the cost of spot checks. When the combined cost of spot checks and the recycling or disposal exceeds fines and social losses to consumers, governments do not spot check and processors tend to produce illegal outputs. Otherwise, the government conducts random checks, and the processor produces illegal products with a positive probability.

The timing of a subsidy or penalty also plays an important role in regulation. Ex-ante subsidies have no effect on the probabilities that processors produce illegal products or that the government conducts spot checks, so more subsidies are not always better. The results are consistent with Chang et al. (2011), who empirically find that high levels of subsidies may cause a negative impact on users or sustainability resource production. Larger penalties do not prevent more processing of illegal products, but they do reduce the need for spot checks. Ex-post subsidies reduce the probability of spot checks which will increase the illegal production.

Extending our model to an infinitely repeated game, we find a negative relationship between penalty and discount factor. A small discount factor makes processors less patient, so they are more willing to produce illegal products for short-term gain. In such cases, it is necessary to increase punishment like shutting down or heavy penalties. In such cases, severe penalties like closure or heavy fines may be necessary. In the infinitely repeated game, the earlier illegal production can be detected, the lower the penalty required to induce the processor to produce renewable energy products such as biodiesel.

Lu et al. (2018) show that a penalty-cost-based mechanism can reduce the cost of renewable energy users. Our study shows that the combination of subsidies and penalties can not only increase the production of renewable energy but also decrease the probability of negative output. In addition, the efficiency and effectiveness of misconduct monitoring can reduce the penalty needed to mitigate illegal products. Between the two combined regulation methods, ex-post subsidy is more effective than ex-ante subsidy. This can explain why China’s solar photovoltaic incentive policy has changed from ex-ante subsidy such as “Golden Sun Plan” to ex-post subsidy such as feed-in tariff policy (Yuan et al., 2015).

Our results provide a theoretical basis for the government’s regulatory (GTS or TFT) strategies. When the penalties are not large enough, it is easier for GTS than TFT strategy to induce renewable energy production in an infinitely repeated game. While the penalties are large enough, TFT achieves the same objective as GTS does in biodiesel production. The simulation results show that the high-profit margin of renewable energy is a better incentive for producers to process legal products than subsidies.

Previous researches mostly focus on the positive benefits of reward and punishment policies (e.g., Kreiss et al., 2017; Md et al., 2017), while our model can provide more detailed dynamic characteristics of the subsidy and penalty mechanisms. Our study further emphasizes the importance of policy environment. The subsidy and penalty mechanism should be adjusted dynamically in accordance with the change of policy environment such as renewable energy producers’ cost structure, production and management efficiency, and technology levels.

Practical Implications

First, ex-post subsidies outperform ex-ante subsidies. In practice, a successful ex-post subsidy mechanism requires detailed subsidy rules and monitoring of sustainable energy projects throughout their life cycle. Participation of third-party organizations and timely evaluation of every subsidy can contribute to the success of regulation.

Second, the grim trigger strategy (GTS) outperforms the tit-for-tat strategy (TFT). Generally, GTS is superior to TFT when the penalty is not too severe. To achieve the same effect as GTS, the penalties in TFT must be severe enough and even requiring shutting down the business. It echoes a Chinese old saying, “desperate diseases need desperate remedies”. A testimony is the case of Taiwan. In 2014, the maximum fine on illegal production of UCO increased from $0.28M to $3.13M after a severe scandal of mixing refined UCO with fresh cooking oil. Since then, the tougher penalty has greatly reduced the opportunism behavior of UCO processors. On the other hand, companies should not only comply with the environmental regulation but also take a more proactive approach by seeking competitive advantage from sustainability practices.

Third, synergized effect of subsidy and penalty measures on renewable energy production. Subsidies and penalties must be combined, since higher subsidies may lead to more illegal output in the absence of penalties. Regardless of the timing of providing subsidies, the imposition of penalties can always have a positive impact on sustainability production. Two other elements, namely the detection of misbehavior and profit margins, are important factors influencing the implementation of subsidies and penalties. The less punishment is needed if misbehavior can be detected in time. Hence, governments should pay more attention to the use of big data, information transmission, and other technologies to improve the efficiency and effectiveness of regulation. The less subsidy is needed if the more profit companies can gain from technological and managerial innovation. Thus, governments can provide corresponding research and development funds to incentivize technological and managerial innovation. The intensity of subsidies and penalties should also be adjusted according to governments’ ability to detect misbehavior and companies’ level of technological or managerial innovation.

There are some limitations on our model, such as the assumption of only one processor. However, there may be more than one processor in practice. If we extend this assumption, competition between processors might lower the profits. Our theoretical results may be revised. Furthermore, in future, our work will extend our model with complete information to the game with incomplete information.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, and further inquiries can be directed to the corresponding author. The codes generated for this study are available on request to the corresponding author.

Author Contributions

All authors have significantly contributed to the article. XM and YD are the leaders of this research team who organized and designed the study. XM completed the main model design and simulation analysis. ZT and YD were responsible for supervision and funding acquisition and the writing of part I and part II. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China (No.71872031 and 71302180), Science Research Project of Department of Education of Liaoning Province (LN 2019X02, LN 2020X06 and PT202107), Guangdong Basic and Applied Basic Research Foundation (No. 2020A1515010456), and Guangdong Provincial University Innovation Team Project (No.2017WCXTD001).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

The authors thank the National Natural Science Foundation of China, Department of Education of Liaoning and Guangdong for supporting this research.

Footnotes

1The Shanghai government, for example, released a specific emergency subsidy method for promoting UCO-biodiesel conversion in 2016. According to the method, municipal governments provide companies subsidy based on the documents submitted by the companies. The governments can choose to implement spot checks before or after providing subsidies.

2Since

3When

References

Abrell, J., Kosch, M., and Rausch, S. (2019). Carbon Abatement with Renewables: Evaluating Wind and Solar Subsidies in Germany and Spain. J. Public Econ. 169, 172–202. doi:10.1016/j.jpubeco.2018.11.007

al Irsyad, M. I., Halog, A. B., Nepal, R., and Koesrindartoto, D. P. (2017). Selecting Tools for Renewable Energy Analysis in Developing Countries: An Expanded Review. Front. Energ. Res. 5, 34. doi:10.3389/fenrg.2017.00034

Cai, Z.-Z., Wang, Y., Teng, Y.-L., Chong, K.-M., Wang, J.-W., Zhang, J.-W., et al. (2015). A Two-step Biodiesel Production Process from Waste Cooking Oil via Recycling Crude Glycerol Esterification Catalyzed by Alkali Catalyst. Fuel Process. Tech. 137, 186–193. doi:10.1016/j.fuproc.2015.04.017

Chang, K.-C., Lin, W.-M., Lee, T.-S., and Chung, K.-M. (2011). Subsidy Programs on Diffusion of Solar Water Heaters: Taiwan's Experience. Energy Policy 39 (2), 563–567. doi:10.1016/j.enpol.2010.10.021

Chen, X., Xiao, J., Yuan, J., Xiao, Z., and Gang, W. (2021). Application and Performance Analysis of 100% Renewable Energy Systems Serving Low-Density Communities. Renew. Energ. 176, 433–446. doi:10.1016/j.renene.2021.05.117

Fischer, G., and Schrattenholzer, L. (2001). Global Bioenergy Potentials through 2050. Biomass and bioenergy 20 (3), 151–159. doi:10.1016/S0961-9534(00)00074-X

Islam, M., Sun, Z., and Dagli, C. (2017). Reward/penalty Design in Demand Response for Mitigating Overgeneration Considering the Benefits from Both Manufacturers and Utility Company. Proced. Comp. Sci. 114, 425–432. doi:10.1016/j.procs.2017.09.007

Kharina, A., Searle, S., Rachmadini, D., Kurniawan, A. A., and Prionggo, A. (2018). The Potential Economic, Health and Greenhouse Gas Benefits of Incorporating Used Cooking Oil into Indonesia’s Biodiesel. White Paper 26. Available at: https://theicct.org/sites/default/files/publications/UCO_Biodiesel_Indonesia_20180919.pdf. (Accessed July 26, 2021).

Kimura, O., and Suzuki, T. (2006). “30 Years of Solar Energy Development in Japan: Co-evolution Process of Technology, Policies, and the Market,” in Berlin Conference on the Human Dimensions of Global Environmental Change:“Resource Policies: Effectiveness, Efficiency, and Equity, Berlin, 17-18 November 2006, 17–18. Available at: https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.454.8221&rep=rep1&type=pdf. (Accessed July 26, 2021).

Kreiss, J., Ehrhart, K.-M., and Haufe, M.-C. (2017). Appropriate Design of Auctions for Renewable Energy Support - Prequalifications and Penalties. Energy Policy 101, 512–520. doi:10.1016/j.enpol.2016.11.007

Kumar, Y. (2019). RTI Activist Files Plaint Seeking FIR in Solar Subsidy Scam. The Times of India. Available at: https://timesofindia.indiatimes.com/city/dehradun/rti-activist-files-plaint-seeking-fir-in-solar-subsidy-scam/articleshow/67477645.cms. (Accessed July 26, 2021).

Lambert, F. (2017). Tesla Loses EV Subsidies in Germany after Being Accused of Gaming the System. Electrek. Available at: https://electrek.co/2017/12/01/tesla-loses-ev-subsidy-germany-accused-gaming-system/1. (Accessed July 26, 2021).

Liu, C., Liu, L., Zhang, D., and Fu, J. (2021). How Does the Capital Market Respond to Policy Shocks? Evidence from Listed Solar Photovoltaic Companies in China. Energy Policy 151, 112054. doi:10.1016/j.enpol.2020.112054

Liu, T., Liu, Y., Wu, S., Xue, J., Wu, Y., Li, Y., et al. (2018). Restaurants' Behaviour, Awareness, and Willingness to Submit Waste Cooking Oil for Biofuel Production in Beijing. J. Clean. Prod. 204, 636–642. doi:10.1016/j.jclepro.2018.09.056

Lu, Y., Zhang, X., Huang, Z., Wang, D., and Zhang, Y. (2018). Penalty-cost-based Design Optimization of Renewable Energy System for Net Zero Energy Buildings. Energ. Proced. 147, 7–14. doi:10.1016/j.egypro.2018.07.027

Marchetti, J. M., Miguel, V. U., and Errazu, A. F. (2008). Techno-economic Study of Different Alternatives for Biodiesel Production. Fuel Process. Tech. 89 (8), 740–748. doi:10.1016/j.fuproc.2008.01.007

Ortner, M. E., Müller, W., Schneider, I., and Bockreis, A. (2016). Environmental Assessment of Three Different Utilization Paths of Waste Cooking Oil from Households. Resour. Conservation Recycling 106, 59–67. doi:10.1016/j.resconrec.2015.11.007

Rincón, L. A., Cadavid, J. G., and Orjuela, A. (2019). Used Cooking Oils as Potential Oleochemical Feedstock for Urban Biorefineries - Study Case in Bogota, Colombia. Waste Manag. 88, 200–210. doi:10.1016/j.wasman.2019.03.042

Rizwanul Fattah, I. M., Ong, H. C., Mahlia, T. M. I., Mofijur, M., Silitonga, A. S., Rahman, S. M. A., et al. (2020). State of the Art of Catalysts for Biodiesel Production. Front. Energ. Res. 8, 101. doi:10.3389/fenrg.2020.00101

Saghir, M., Zafar, S., Tahir, A., Ouadi, M., Siddique, B., and Hornung, A. (2019). Unlocking the Potential of Biomass Energy in Pakistan. Front. Energ. Res. 7, 24. doi:10.3389/fenrg.2019.00024

Sahar, S., Sadaf, S., Iqbal, J., Ullah, I., Bhatti, H. N., Nouren, S., et al. (2018). Biodiesel Production from Waste Cooking Oil: an Efficient Technique to Convert Waste into Biodiesel. Sust. Cities Soc. 41, 220–226. doi:10.1016/j.scs.2018.05.037

Sajid, Z., Khan, F., and Zhang, Y. (2016). Process Simulation and Life Cycle Analysis of Biodiesel Production. Renew. Energ. 85, 945–952. doi:10.1016/j.renene.2015.07.046

Tibebu, T. B., Hittinger, E., Miao, Q., and Williams, E. (2021). What Is the Optimal Subsidy for Residential Solar? Energy Policy 155, 112326. doi:10.1016/j.enpol.2021.112326

Tsai, W.-T. (2019). Mandatory Recycling of Waste Cooking Oil from Residential and Commercial Sectors in Taiwan. Resources 8 (1), 38. doi:10.3390/resources8010038

Wang, G., Zhang, Q., Li, H., McLellan, B. C., Chen, S., Li, Y., et al. (2017). Study on the Promotion Impact of Demand Response on Distributed PV Penetration by using Uon-Cooperative Game Theoretical Analysis. Appl. Energ. 185, 1869–1878. doi:10.1016/j.apenergy.2016.01.016

Wu, X., Zhuang, Y., Bai, W., Zhou, Y., and Wang, Y. (2021). Optimal Subsidy Policy for Green Energy Trading Among Three Parties: A Game Theoretical Approach. Available at: https://ieeexplore.ieee.org/abstract/document/9344683. (Accessed July 26, 2021).

Yuan, X., Shi, M. G., and Sun, Z. (2015). “Research of Electricity Stealing Identification Method for Distributed PV Based on the Least Squares Approach,” in 2015 5th International Conference on Electric Utility Deregulation and Restructuring and Power Technologies (DRPT), Changsha, 26-29 Nov. 2015 (IEEE), 2471–2474. Available at: https://ieeexplore.ieee.org/abstract/document/7432661?casa_token=AAA:v56h6sBdOuFRKTKJXnXK8W0WX50ykJlBGAnz8M774rR4hsCyFEDtySKUhtAfZJwuNNLoqes. (Accessed July 26, 2021).

Zhang, H., Li, L., Zhou, P., Hou, J., and Qiu, Y. (2014). Subsidy Modes, Waste Cooking Oil and Biofuel: Policy Effectiveness and Sustainable Supply Chains in China. Energy Policy 65, 270–274. doi:10.1016/j.enpol.2013.10.009

Zhang, H., Ozturk, U. A., Zhou, D., Qiu, Y., and Wu, Q. (2015). How to Increase the Recovery Rate for Waste Cooking Oil-To-Biofuel Conversion: A Comparison of Recycling Modes in China and Japan. Ecol. Indicators 51, 146–150. doi:10.1016/j.ecolind.2014.07.045

Keywords: renewable energy, subsidy, penalty, game-theoretical analysis, biodiesel, used cooking oil

Citation: Dou Y, Zhang T and Meng X (2021) A Theoretical Model of Sequential Combinatorial Games of Subsidies and Penalties: From Waste to Renewable Energy. Front. Energy Res. 9:719214. doi: 10.3389/fenrg.2021.719214

Received: 02 June 2021; Accepted: 09 August 2021;

Published: 13 October 2021.

Edited by:

Bai-Chen Xie, Tianjin University, ChinaReviewed by:

Xian-Liang Tian, Zhongnan University of Economics and Law, ChinaAwais Bokhari, COMSATS University Islamabad, Lahore Campus, Pakistan

Copyright © 2021 Dou, Zhang and Meng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xin Meng, bWVuZ3hpbkBkdWZlLmVkdS5jbg==

Yijie Dou

Yijie Dou Tong Zhang

Tong Zhang Xin Meng

Xin Meng