- 1School of Management, Guangdong University of Technology, Guangzhou, China

- 2Innovation Theory and Innovation Management Research Center, Guangzhou, China

- 3School of Management, Guangzhou City University of Technology, Guangzhou, China

Promoting green innovation is an effective way to solve the increasingly serious environmental pollution problems in emerging economies. Information technology is constantly changing the operation mode of enterprises; however, whether information technology investment helps promote enterprises’ green innovation is still an important issue to be studied. According to resource-based and knowledge integration theory, this study constructs data from Chinese A-share listed heavy polluting enterprises during 2010–2018, adopting the panel data Tobit model to investigate the nexus between information technology investment and green innovation. Our empirical results demonstrate that the amount of information technology investment is positively correlated with the emerging levels of green patents in Chinese heavy polluting enterprises, and this positive correlation only significantly exists in state-owned enterprises (SOEs) and enterprises with a strong sense of environmental responsibility and strict environmental regulation. The findings of this study help understand in depth how information technology investment affects enterprises’ green innovation and its boundaries, which also have important policy implications for government departments and enterprises to make better use of information technology to deal with the challenge of environmental pollution.

Introduction

Environmental pollution problems have been increasingly serious in emerging economics, which has received considerable attention from the academic community and policy makers. As an important participant in emerging markets, China has been facing this issue for a long time due to its rapid industrialization and urbanization (Wang et al., 2015; Du and Huang, 2017) and has been among the world’s top polluters in recent years according to Numbeo’s national pollution index ranking1. In recent years, green transformation has become China’s national strategy. As one of the five development concepts (innovation, coordination, green development, opening up, and sharing), green development was formally written into China's "14th Five-Year Plan". Informatization, green innovation, and green energy are important ways to achieve green development. However, due to cognitive bias (Pronin, 2007), most enterprises have not yet realized that information technology investment (hereafter IT investment) and green innovation can promote the development of green energy. Given the ambiguity effect, enterprises often avoid less informed options when making decisions. Few studies focus on combining IT investment, green innovation, and green energy; therefore, an enterprise ignores the role of information technology and green innovation. In addition, enterprises have status quo bias and omission bias. So, they tend to believe that the harm caused by active action is worse than that caused by passive omission and neglect to explore the way of developing green energy. As a result, it is necessary to explore more effective measures to advance the development of green energy. Informatization and green innovation are both crucial methods.

Scientific and technological innovation is the key to achieve green energy. Both efficient utilization of traditional energy and large-scale adoption of green energy rely on scientific and technological progress (Wurlod and Noailly, 2018). Green innovation refers to green technological innovation, which is a kind of technological innovation that can reduce pollution, avoid energy consumption, and improve the ecological environment (Braun and Wield, 1994). Therefore, the Chinese government regards green innovation as an important starting point for promoting green development. In 2019, the Ministry of Science and Technology of Chinese National Development and Reform Commission has issued A Guideline on Building a Market-Oriented Green Technology Innovation System to call for enterprises to solve deep-rooted environmental pollution problems through green innovation. Green innovation promotes green energy by adopting energy-saving technology to improve energy utilization efficiency and reduce energy consumption. Green innovation is able to promote the transformation of energy and also improve social productivity and production level. Heavy pollution industry is the main source of environmental pollution with the high energy consumption and high pollution in the production process. Therefore, promoting green innovation in heavily polluting industries is the key to improving China’s environmental conditions and achieving sustainable development.

Real-time information sharing has become the basis of competition under the background of industry 4.0. Information technology is widely integrated in social production, economy, and life, making informatization, digitalization, and intelligentization become the driving force of enterprise innovation and transformation development. Informatization helps improve enterprises’ search and discover ability, decision-making efficiency, process management (Ardito et al., 2019; Lin and Kunnathur, 2019), and learning and absorption capacity (Nambisan et al., 2019), which are crucial for technical knowledge accumulation and technological research development. Improving digital capabilities through IT investment is an important way to promote enterprise transformation and upgrading. Now Chinese heavy polluting industries need to carry out green innovation. There are a wide range of factors influencing enterprise green innovation. The premise of enterprise green innovation means having the awareness to carry out relevant activities and obtain innovating ability. For heavy polluting enterprises, information technology capabilities brought by IT investment benefit enterprises’ production efficiency, pollution sources control, and pollutants utilization rate, which contribute to more competitive green products in the market. The development of information technology can promote the intelligent operation of green energy system and improve their safety, reliability, and sustainability (Dincer and Acar, 2017). With the rapid development of science and technology in China, IT investment has benefited green innovation in the context of information and digital economy and has affected the development of green energy systems. Now, research on the relationship between IT investment and product innovation stays in the initial stage. Traditional product innovation aims to improve enterprise’s profits, while green innovation aims to improve enterprise’s environmental performance such as energy saving, emissions, and pollution reduction. The influence of IT investment may differ between green innovation and traditional product innovation. However, the nexus of IT investment and green innovation still remains unclear.

Many factors may moderate the relationship between IT investment and green innovation. The factors include enterprise attribute, enterprise internal, and external factors. State ownership, environmental responsibility, and environmental regulation can stand by the three dimensions. Enterprises with different state ownership follow different business logics (Zhou et al., 2017) and react differently in face of environmental pollution. Enterprises’ sense of environmental responsibility can influence the input of base resource and knowledge learning (Shahzad et al., 2020). Environmental regulation led to different green innovation condition (Zhang et al., 2018) and had a different influence on the relationship between IT investment and green innovation. According to resource-based and knowledge integration theory, we construct data from Chinese A-share listed heavy polluting enterprises during 2010–2018 and adopt the panel data Tobit model to empirically analyze the impact of IT investment on green innovation and its moderating factors.

Our contribution is mainly reflected in the following aspects. On the one hand, we provide empirical evidence that IT investment can help promote green innovation in Chinese A-share listed heavy polluting enterprises. Green innovation is different from innovation in goals and effectiveness (Peng et al., 2021). Most existing literature only focuses on IT investment and innovation (Wu et al., 2020), but neglects the combination of information technology and green development background. We find that promoting green innovation needs plenty of resources and abilities, and the capacity that comes with IT investment can match them. We take IT investment and green innovation of heavy polluting enterprises as research subjects, which are pioneering innovations in related fields. We finally find that IT investment can promote green innovation. Our research has filled the gap between IT investment and green innovation.

On the other hand, our findings help understand in depth how IT investment affects green innovation and its boundaries. Existing literature lacks in-depth research on the heterogeneous influence of IT investment and green innovation. Exiting research shows that green innovation is influenced by the internal factors like corporate governance (Chen et al., 2016), external factors like institution factors (Sun et al., 2019), and so on. It is worthy to examine the role of these factors in the relationship between IT investment and green innovation. We clarify this influence varies for enterprises with different attributes in the nature of property rights, social responsibility, and environmental regulation. We find that IT investment only promotes green innovation in state-owned enterprises (hereinafter referred to as SOEs), enterprises with a strong sense of environmental responsibility, and enterprises in areas with strict environmental regulations.

The rest of this study is organized as follows: “Literature Review and Research Hypotheses” section reviews the related literature and proposes the research hypotheses. “Data” section describes the data and presents the model and variables. “Empirical Results and Analysis” section presents the empirical results. “Robust Test and Endogeneity Treatment” section presents further analysis, and “Concluding Remarks” section provides the conclusions and policy implications.

Literature Review and Research Hypotheses

Literature Review

A stream of literatures has discussed whether IT investment can trigger innovation. Digital transformation is crucial for all economies to cope with the fierce competition under the background of industry 4.0 (Zhou et al., 2020). Some studies have provided evidence that digitalization along with IT investment can enhance the learning ability and improve the information transparency to promote enterprise innovation (Nambisan et al., 2020). Information technology supports innovative processes by making companies respond flexibly (Wu et al., 2020). Some literatures indicate that innovation is a comprehensive utilization of internal and external knowledge (Lv et al., 2017; Xiong and Sun, 2017). Internal IT capabilities provide high quality products and services to make enterprises minimize costs and improve management efficiency. External IT capabilities enable enterprises to perceive and understand changes in external markets like consumers and other stakeholders timely (Ding and Wu, 2020). The early researches on IT investment and enterprise innovation mainly adopt the method of questionnaire interview. Nowadays, existing literatures rarely involve the role of information technology and the formation of innovation ability in decision making (Dy et al., 2017; Wu et al., 2020).

At present, green innovation has been debated hotly, and the studies mainly focus on innovation, technology, green, sustainability, performance, and so on. There is a large volume of published studies describing the influencing factors of green innovation. For example, existing research results mainly spot on the inside of the organization (Xavier et al., 2017; Zhou et al., 2018) and corporate governance, such as company size, establishment time, shareholding ratio, R&D investment, internal benefits, comprehensive management system, and senior management cognition. (Chen et al., 2016). From the external perspective of enterprises, institutional factors (Sun et al., 2019), green social capital (Awan et al., 2019), pollution spillover (Luo et al., 2021), and upstream and downstream factors such as customers, suppliers, and markets (Bai et al., 2019) also have an impact on enterprises' green innovation. As for the research on the driving force of green innovation, existing results suggest that reputation mechanism (Zhang and Walton, 2017), government subsidies (Xie et al., 2015), and the pressure of environmental regulation (Cheng, 2020) are the driving force to promote enterprises’ green innovation. In reality, fewer enterprises take the initiative to promote green innovation. The theoretical basis of green technology innovation mainly includes Porter hypothesis, regulation push and pull theory, science and technology push and market pull theory, and double externality theory.

Based on the studies above, researches on the relationship between IT investment and green innovation are still in the blank stage. As green innovation plays a crucial role in innovation, how IT investment affects green innovation of heavy polluting enterprises is worthy of attention. We should take the following aspects into account: first, most of the researches adopt questionnaire interview and use small data sample. So far, however, there has been a lack of large-sample microdata application, which fails to provide more accurate quantitative analysis for evaluating IT investment effect and fails to be widely representative. Second, there is a shortage of in-depth research on heterogeneity factors influence between IT investment and green innovation. Most literatures only study whether IT investment promotes innovation activities but fail to explore the performance, motivation, and possible path in heterogeneous subjects.

Research Hypotheses

IT Investment and Green Innovation

Resource-based theory implies that enterprises improve operating and decision-making efficiency based on their own resources (Wernerfelt, 1984; Barney, 1991). To give priority to ecology and green development, enterprises should improve producing speed, optimize operating mode, and reduce costs. Nowadays, heavy polluting enterprises have been confronted with serious environmental problems, making green innovation become an urgent situation. In order to solve environmental pollution problems and realize green innovation, heavy polluting enterprises have to adopt a better control process and get corresponding support from hardware and software facilities. The introduction of advanced information technology, equipment, and talents has enhanced the foundation of green technology research and development. Computer-aided designing, manufacturing, diagnosing, testing, and other technologies can make green technology run through the whole process of production. Heavy polluting enterprises’ informatization has broaden the financing channels, and the venture capital also has provided external capital to improve green innovation’s source and stability. In addition, enterprises need to increase the information storage capability and enlarge the information search space. IT investment has brought much resource advantages (Ardito et al., 2021), enabling standardized information storage process and improvement of decision-making efficiency (Nambisan et al., 2020).

Knowledge integration theory refers to forming new knowledge by combining enterprises’ inside and outside knowledge (Ruiz-Jiménez et al., 2016). IT investment mainly supports two capabilities: internal and external IT capabilities (Mao et al., 2016). Internal IT ability refers to internal knowledge that makes every enterprise process transparent and visualized. When faced with pollution problems, management decision making and green products innovation are advantageous to the flow of knowledge within the organization (Scuotto et al., 2017; Eller et al., 2020). Due to the increased external knowledge, enterprises can perceive the changes of external market and policy timely and make scientific response effectively (West and Bogers, 2014). Heavy polluting enterprises absorb internal and external knowledge acquired from IT investment by using their knowledge integration ability (Liu et al., 2013) and then affect the whole enterprise operation process (Qi et al., 2021). Green technology patents and related knowledge can help enterprises improve innovation level by overcoming technology transfer and spillover obstacles and obtaining vital information and knowledge from the external environment. Heavy polluting enterprise uses information search and discover ability to acquire external knowledge and improve green innovation ability to ease the pollution source. From the perspective of knowledge integration, heavy polluting enterprises systematize, socialize, and coordinate work by combining consciousness motivation with green innovation foundation (Kogut and Zander, 1992; de Boer et al., 1999; Van den Bosch et al., 1999).

Hypothesis H1. IT investment can promote green innovation of heavy polluting enterprises.

IT Investment, State Ownership, and Green Innovation

There are usually two kinds of institutional logics in Chinese market: political logic and market logic, which have different influence orientations on enterprises’ decision making (Zhou et al., 2017), thus having different effect on the relationship between IT investment and green innovation. Due to the influence of political consciousness and resource advantages, SOEs usually follow political logic. As SOEs’ controlling subjects are closely connected with government organizations, they tend to consider the willingness of the state when making decisions. With the government advocates alleviating environmental problems through green innovation and promoting transformation and upgrading by informatization, state-owned heavy polluting enterprises put more energy and resources to information construction and green innovation activities (Klemetsen et al., 2018). CEO’s promotion in SOEs usually depends on their political achievements; thus, they would pay more attention in developing green strategies and trigger green innovation (Rong et al., 2017). Meanwhile, SOEs’ cost of green innovation technology exploration is lower owing to the policy advantages and financial subsidies, so the innovation and environmental protection atmosphere inside can be stronger than non-SOEs (Sun et al., 2017). The advantages of capital and costs are usually helpful for SOEs to face the risk of green innovation (Bai et al., 2019). Non-SOEs follow the market logic in their decision making and pursue more profit in business activities. Enterprises cannot get great benefits in the short term since the cost of green innovation is high. Green innovation relies more on resource input; however, non-SOEs share few resources and are under heavy financial burden, thus crowding out the green innovation resource. Green innovation’s positive impact on enterprises’ performance improvement takes a long time to emerge. Managers are forced to give up green innovation with high input, high risk, and high uncertainty under the pressure of short-term performance and cash flow. Therefore, non-SOEs usually have less motivation in green innovation than SOEs (Květoň and Horák, 2018).

Hypothesis H2. IT investment plays a stronger role in promoting green innovation of state-owned heavy polluting enterprises.

IT Investment, Environmental Responsibility, and Green Innovation

With the improvement of enterprises’ environmental responsibility, IT investment of heavy polluting enterprises has a stronger effect on green innovation. A large number of literatures show that all aspects of enterprise social responsibility are closely related to environmental development, especially environmental responsibility (Shahzad et al., 2020). Heavy polluting enterprises fulfill their social responsibility by adopting industrial transformation and technological innovation to reduce environmental pollution (Li and Wang, 2018; Kraus et al., 2020). Enterprises are able to gain first-mover advantage by adopting an ecofriendly market-driven strategy, which motivate them to undertake green innovation (Fudenberg and Levine, 2009). Enterprises with strong sense of environmental responsibility are more inclined to take environmental protection measures when making investment decisions under the same condition of IT investment amount, internal decision-making thresholds, and knowledge learning and integration costs. A strong sense of environmental responsibility can increase resource productivity and efficiency, drive industries rule making, and finally promote industrial process change and product innovation.

Hypothesis H3. IT investment has a stronger positive effect on the green innovation of heavily polluting enterprises with a strong sense of environmental responsibility.

IT Investment, Environment Regulation, and Green Innovation

As environmental pollution and environmental regulation exist in the production processes, heavy polluting enterprises are faced with system pressure (Zhang et al., 2018). Implying nongreen technologies has preliminary production advantages because of the scale effect. Many heavy polluting enterprises lack environmental protection awareness and willingness to carry out green innovation. In this case, the government needs to take guidance and supervision measures, such as increasing investment to solve environmental problems. Heavy polluting enterprises need to maximize stakeholder’s benefit and meet the environmental protection requirements of suppliers, consumers, and other stakeholders. So, they should attach importance to environmental problems and take practical activities to achieve sustainable development. As the supervision focus of environmental authorities, heavy polluting enterprises tend to solve environmental problems by IT investment. Enterprises with stricter environmental regulation usually invest more resources related to environmental pollution government under a similar informationization condition and then increase their internal and external knowledge to deal with pollution. Meanwhile, government departments’ supervision has enhanced enterprises’ environmental awareness and impetus for green innovation when collecting local environmental information (Dowell and Muthulingam, 2017).

Hypothesis H4. IT investment has a stronger positive effect on the green innovation of heavily polluting enterprises in areas with strict environmental regulations.

Data

Data and Samples

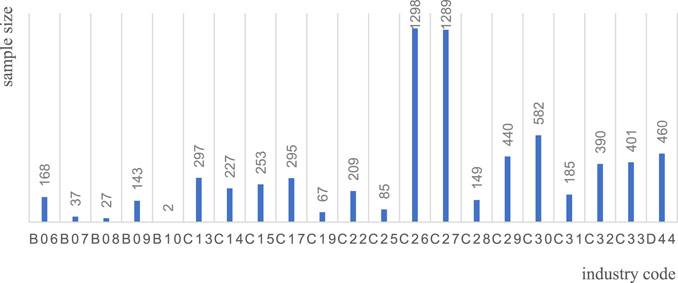

According to the List of Classified Management of Environmental Protection Verification of Listed Companies (EIA Letter [2008] 373) and Cai et al. (2020), the samples are composed of listed Chinese heavy polluting enterprises. The heavy polluting enterprises are contained from 2010 to 2018. The samples are finally refined into 21 categories as follows and the distribution is shown in Figure 1: B06 coal mining and washing; B07 oil and gas mining; B08 ferrous metal mining and dressing; B09 nonferrous metal mining and dressing; B10 nonmetallic mining and dressing; C13 agricultural food processing; C14 food manufacturing; C15 wine, beverage, and refined tea manufacturing; C17 textiles; C19 leather, fur, feather and its products, and shoes; C22 paper and paper products; C25 petroleum, coal, and other fuel processing; C26 chemical raw materials and chemicals manufacturing; C27 pharmaceutical manufacturing; C28 chemical fiber manufacturing; C29 rubber and plastic products; C30 nonmetallic mineral products; C31 ferrous metal smelting and calendering; C32 nonferrous metal processing; C33 metal products; and D44 electric power, thermal production, and supply. We can draw from the figure that C26 chemical raw materials and chemicals manufacturing and C27 pharmaceutical manufacturing industries are the main source of pollution, which would cause relevant authorities’ attention.

We first download the listed enterprises’ original IT investment data from Wind database. Then, we collect the Chinese listed companies' green patent data from CNRDS database. Next, we gather enterprise environmental responsibility index from Hexun database and get environmental regulation data from China Statistical Yearbook. Later, we derive all kinds of financial data and other industry index data from CSMAR database.

In addition, we perform basic processing on some outliers in the sample, such as deleting sample values that cannot be obtained. For the sake of alleviating the bias caused by particularly extreme values, we winsorized 1 and 99% to continuous variables. After excluding financial enterprises, ST and *ST enterprises, we finally collect 7004 observations in enterprise-year level.

Variables

Green Innovation

We measure green innovation based on the number of green invention patent applications of listed companies. Our main dependent variable is natural logarithm of one plus the patent application amount. Green patents are conducive to resource conservation, energy efficiency improvement, pollution prevention, and sustainable development. They are widely used as the main measure of green innovation (Fabrizi et al., 2018; Fang and Na, 2020). The number of patent applications reflects the instantaneous innovation ability of enterprises. Therefore, we choose the number of green patent applications as the measurement index of green innovation.

IT Investment

On the basis of previous relevant studies (Wang et al., 2020), we use the total amount of enterprise hardware and software investment to analyze IT investment, including IT hardware investment and IT software investment. We replace IT hardware investment with the year-end balance of electronic equipment, microcomputer, and other items in the company's fixed assets list. We use the year-end balance of the company's intangible assets related to computer software, systems, and information-related technologies. Our main independent variable is natural logarithm of one plus the IT software and hardware amount. Heavy polluting enterprises must better manage information to achieve transformation and upgrading. Exploring the impact of IT investment on green innovation of heavy polluting enterprises is significant, so we take IT investment of heavy polluting enterprises as an independent variable.

Moderating Variables

We focus on three types of moderating variables from the perspective of enterprise attributes, internal factors and external factors, including state ownership, environmental responsibility degree, and environmental regulation.

The state ownership represents the actual controller nature of the company, which is set as dummy variable (Hu et al., 2021; Zhao and Li, 2021). We define 1 to represent SOEs and 0 to represent non-SOEs. We use environmental responsibility scores from Hexun database to measure the sense of enterprise environmental responsibility (Kraus et al., 2020) according to previous relevant studies (Lin and Bao, 2021). In terms of the environmental regulation, we take the ratio of the government’s environmental investment to GDP amount of each province as a measure index (Shen, 2012; Chen and Qian, 2019).

Control Variables

In this study, control variables include R&D investment (Rd), government subsidy (Sub), net profit margin on total assets (Roa), asset-liability ratio (Lev), company Size (Size), Cash ratio (Cash), and shareholding ratio of the largest shareholder (Top).

The R&D investment is measured by natural logarithm of one plus the research and development amount in the current year. The larger the amount of R&D investment is, the more special support for innovation and output of innovation will be (Huang et al., 2021).

Government subsidy is measured by natural logarithm of one plus the government subsidy amount in the current year. The more government subsidies enterprises received, the more they are likely to innovate accordingly (Khan et al., 2020).

Cash ratio is measured by the ratio of monetary funds plus investment in securities to current liability. As innovation needs sufficient financial support, this index is chosen to measure the cash level of enterprises (Core and Guay, 2001; Huang et al., 2021; Lv et al., 2021).

The net interest rate on total assets is measured by the ratio of enterprise’s net profits to total average assets. Enterprises with better business performance are more inclined to carry out innovative research and development activities (Huang et al., 2021; Lv et al., 2021).

The asset-liability ratio is measured by the ratio of total liability to total assets. Moderate operating liabilities enable enterprises to obtain more cash flow and thus have sufficient funds to carry out green innovation activities (Huang et al., 2021; Lv et al., 2021).

The size of enterprise is measured by the natural logarithm of one plus the total assets amount of the enterprise. When the enterprise is large, the asset size is large and the constraint is small. Moreover, large-scale enterprises choose to participate more in innovation activities (Bu et al., 2020; Huang et al., 2021; Lv et al., 2021).

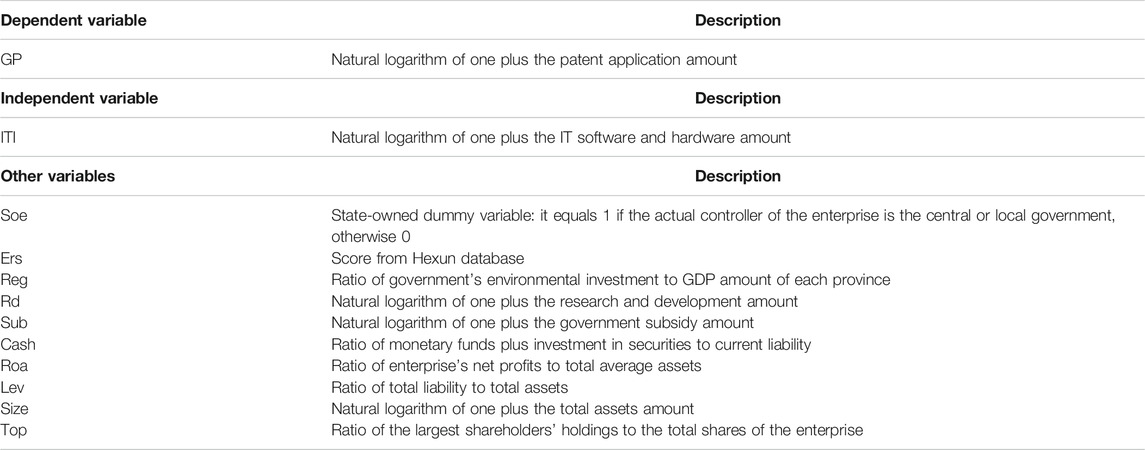

The shareholding ratio of the largest shareholder is measured by the ratio of the largest shareholders' holdings to the total shares of the enterprise. The large shareholding ratio is conducive to the rapid decision making of the company (Mudambi and Swift, 2014; Lv et al., 2021). Here, Table 1 shows all of the variable definitions.

Summary Statistics

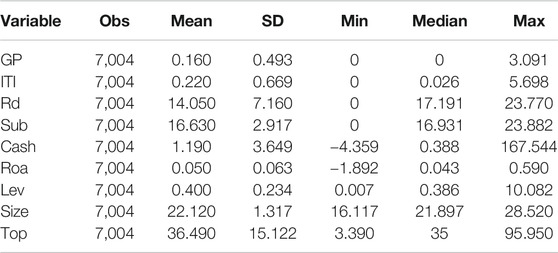

The statistical characteristics of our main variables are listed in Table 2. We collected 7004 observations. The average number of green patent applications of enterprises is 0.16, greater than the median, indicating that there are not many green invention patents applied by heavy polluting enterprises in China.

Empirical Results and Analysis

Baseline Results

The value of green innovation is between 0 and 1, and a total of 6,093 observations of green innovation are 0 in 7,704 observations and green innovation number is centered above 0. It is not suitable to continue to use the least square method in traditional regression to estimate the parameters, and it meets the setting conditions of the Tobit regression model of the restricted dependent variable (Tobin, 1958). So first we construct a panel Tobit model to explore the direct impact of economic policy uncertainty on green innovation. Our baseline regression equation based on the Tobit model is as follows:

Control represents the control variable, η and θ represent industry effect and year effect, and μ represents the random error term. GP is explanatory variable and represents the logarithm of green invention patent applications of enterprises in the current year. ITI is explanatory variable and represents the logarithm of total IT investment in the current period.

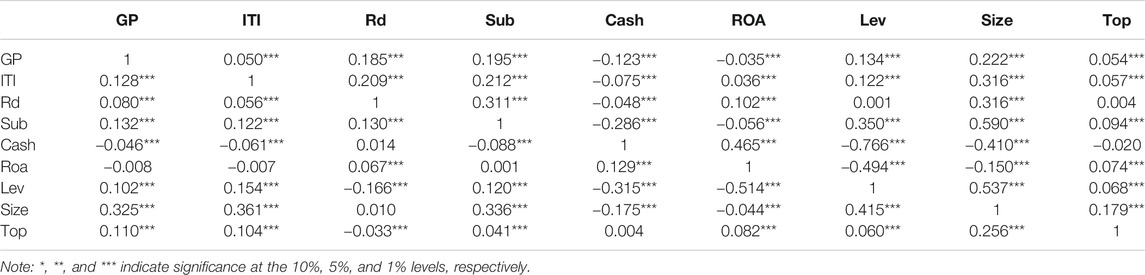

For preliminarily discussing the relationship between IT investment, green invention patent application, and other control variables, we perform a Pearson correlation analysis on the panel data, and the results are shown in Table 3. IT investment is positively correlated with enterprise green innovation.

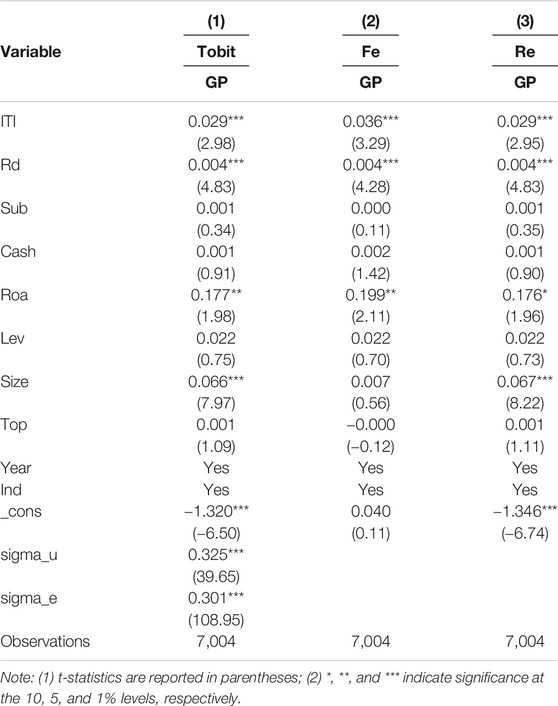

For testing the relationship between IT investment and green innovation in heavily polluting enterprises, we perform a Tobit regression on the panel data and our basic empirical results are shown in Table 4. In column 1, the coefficient of the interaction term is positive and significant at the 1% level according to the results under the control of related variables. This means that when we do not consider the influence of other factors, heavy polluting enterprise green innovation ability will increase 0.029 units when an additional unit of IT investment increases.

According to the resource-based theory and knowledge integration theory, IT investment exerts positive effect on green innovation of heavy polluting enterprises. They achieve standardization of work content, specialization of knowledge transfer procedures, integration of working information, and knowledge from IT investment. The standardization of enterprise process system and decision-making efficiency of management are improved, thus contributing to the reduction of production costs and risk. IT investment’s social advantages help employees recognize the business philosophy and organizational culture, uphold environmental protection beliefs and strengthen environmental protection skills learning, and then realize the organizational goals. Green innovation is the right way to promote transformation and upgrading. IT investment helps various departments coordinate and communicate with each other, which results in strong internal learning atmosphere. The manager is inclined to make environment-oriented decisions and combine the internal and external goals for the sake of solving the prominent environmental problems (Sinha and Akoorie, 2010). Heavy polluting enterprises need to explore green knowledge and technology to develop new business solutions and promote environmental products and innovation processes (Zhang and Walton, 2017). Therefore, the more IT investment the heavy polluting enterprises put in, the higher level will the green innovation be.

Heterogeneous Effects

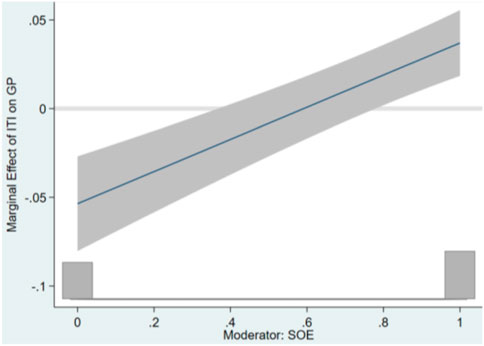

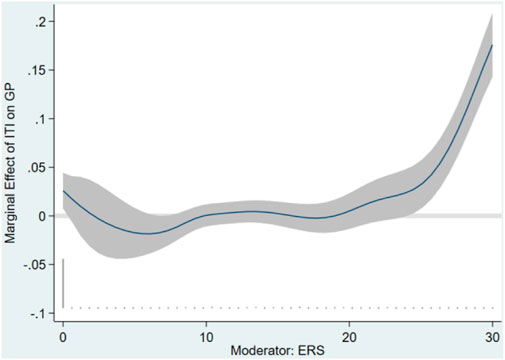

After answering the question of whether IT investment is effective on enterprise green innovation, we further analyze the affecting factors of the two to provide a basis to improve the implementation effect of relevant policies. From the perspective of enterprise attributes, internal factors and external factors, we choose state ownership, sense of environmental responsibility, and environmental regulation to represent the three aspects. The marginal effects of the three factors are shown in the figure below, which is drawn by the Kernel test in the Interflex command (Hainmueller et al., 2019). This method visualizes the multiplicative interaction model, relaxes the linear interaction effect on hypothesis, and prevents excessive explanation. Traditional rendering methods only present the marginal effect on specific values; however, they fail to present it continuously. Interflex can make up for this limitation, and the kernel estimator can reduce the deviation raised from the lack of common support.

Effects of State Ownership

Figure 2 shows the marginal effect of IT investment on green innovation of heavily polluting SOEs and non-SOEs. The blue line represents the size of the moderating effect, and the gray area represents the 95% confidence interval. When the Soe value is greater than 0.592, the marginal effect of IT investment on green innovation is positive. However, when the Soe value is less than 0.592, the marginal effect of IT investment on green innovation is negative. The marginal effect is negative in non-SOEs (non-SOEs = 0) and positive in SOEs (SOEs = 1). In addition, the marginal effect of SOEs (SOEs = 1) is stronger than that of non-SOEs (non-SOEs = 0). This is because the system logic, resource capacity, and other aspects between the two types of enterprises are different (Liu et al., 2016). The results indicate that IT investment plays a stronger role in promoting green innovation of state-owned heavy polluting enterprises.

Effects of Environmental Responsibility

Figure 3 shows the marginal effect of IT investment on green innovation of heavy polluting enterprises with different sense of environmental responsibility. When the value of environmental responsibility fulfillment degree is greater than 19.592, the marginal effect is positive. However, when the value of environmental responsibility fulfillment degree is less than 19.592, the marginal effect is negative. The marginal effect is negative with the weaker sense of environmental responsibility and positive with the stronger sense of environmental responsibility. In addition, the marginal effect of heavy polluting enterprises with strong sense of environmental responsibility is stronger than others. We can draw the conclusion that IT investment has a stronger positive effect on the green innovation of heavily polluting enterprises with a strong sense of environmental responsibility.

Effects of Environmental Regulation

Figure 4 shows the marginal effect of IT investment on green innovation of heavy polluting enterprises under different environmental regulation. The diagram shows that when the environmental regulation degree is greater than 3.627, the marginal effect is positive. However, when the environmental regulation degree is less than 3.627, the marginal effect is negative. The marginal effect is negative under the loose environmental regulation and positive under the strict environmental regulation. In addition, the marginal effect of heavy polluting enterprises with strict environmental regulation is stronger than others. We can draw the conclusion that IT investment has a stronger positive effect on the green innovation of heavily polluting enterprises in areas with strict environmental regulations.

Robust Test and Endogeneity Treatment

Alternative Estimation Methods

In order to further test the reliability of the research results, the random effect model and the fixed effect model were used in this study to conduct surrogate tests respectively. The result is shown in the second and third columns in Table 4. In the random effect model, the regression coefficient of IT investment on the green innovation ability of heavy polluting enterprises is 0.036, which passes the t-statistical test of 1% significance level. In the fixed effect model, the regression coefficient of IT investment on green innovation ability of heavy polluting enterprises is 0.029, which passes the t-statistical test of 1% significance level. This indicates that IT investment still plays a promoting role in green innovation of heavy polluting enterprises after changing the model, which is consistent with the original conclusion.

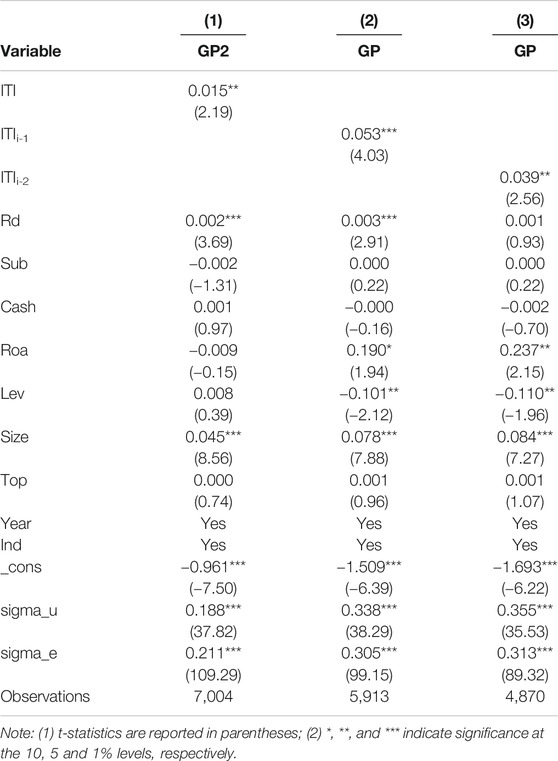

Alternative Proxies for Green Innovation

In order to further test the reliability of the research results, we select alternative variables and put them into the model for regression analysis again. We test the robustness of the conclusion by changing the green innovation measurement index of enterprises. The number of successful applications of green invention patents (GP2) is a common indicator of green innovation, so it is introduced as the substitution variable. We can find in the first column of Table 5 that the coefficient of IT investment is positive and statistically significant at the 5% level, indicating that IT investment positively impacts the green innovation of heavy polluting enterprises. This finding provides evidence of the hypothesis.

Alternative Proxies for IT Investment

The increasing number of green invention patent applications has a negative effect on the increase of IT investment. The higher the level of the green innovation is, the stronger the internal and external capabilities of enterprises will be, which tend to improve the enterprises’ informatization. Therefore, the endogenous problem of mutual causality between IT investment and green invention patent applications occurs in the analysis. We lagged the total IT investment of enterprises by one and two periods to solve the problem, which are represented by ITIi-1 and ITIi-2 (Bi and Zhai, 2017). We control the endogeneity and explore the relationship between IT investment and green innovation of heavy polluting enterprises. As is shown in the second and third columns of Table 5, the coefficients of the lagging IT investment of the first and second phases are positive and statistically significant at the 1% level and 5% level, respectively. This indicates that there is still a significant positive correlation between IT investment and enterprise green innovation after one and two lagged periods. This finding provides evidence that increased IT investment can help promote green innovation in heavy polluting enterprises.

Endogenous Treatment

Regression After PSM

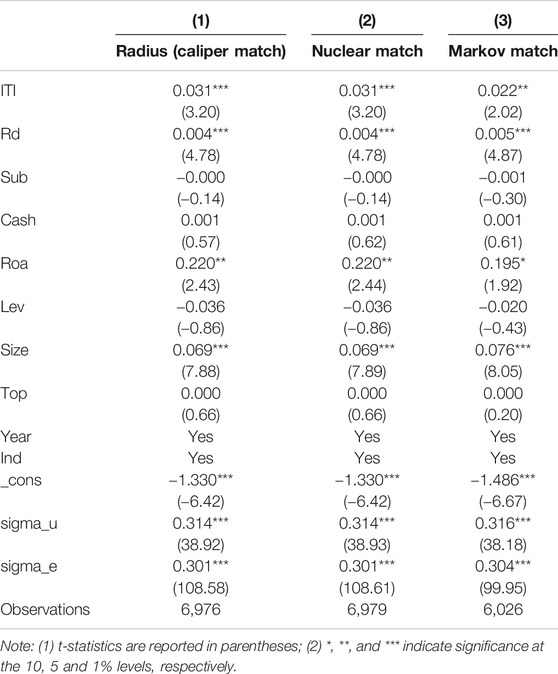

We use propensity score matching to solve the inverse causality caused by sample selection bias. The enterprise's choice of IT investment decision is often not a random behavior, but a choice made by the enterprise according to its own operating conditions. Enterprises with a higher level of green innovation tend to have abilities including stronger learning ability, higher decision-making efficiency, and stronger process management ability. In this situation, they may be more inclined to invest in IT and thus result in sample self-selection bias. Therefore, in order to control selection bias, we use PSM method before regression analysis. This method is a nonparametric estimation tool that does not require a specific function form and requires the setting of treatment group and control group (Tian and Meng, 2018; Huang et al., 2021). We divided the total samples into two groups and calculated the average value of IT investment by industry and year. The sample enterprises higher than the average value are regarded as the treatment group, and the lower are treated as the control group. We use radius matching, nuclear matching, and Markov matching to remove the unmatched results and regress the observed values after matching. The results shown in Table 6 suggest that IT investment is positively correlated with green innovation of enterprises, indicating that the results are still robust.

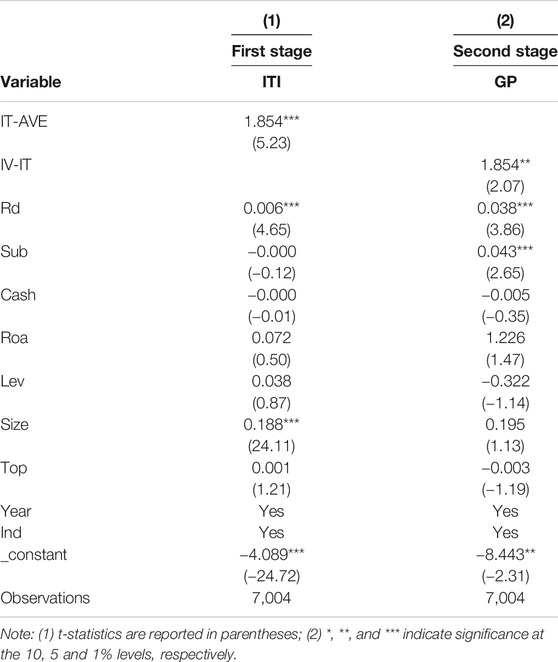

Test Results Based on IV Tobit Model of Basic Results

We test the instrumental variable (IV) to exclude the effect of endogeneity. IV is a popular technique of estimation that is widely used when the correlation between the explanatory variables and the regression error term is suspected. The IT investment of other enterprises in the whole industry affects the IT investment of a single enterprise. Therefore, we select IT-AVE, the average of IT investment in other sample companies in the same industry and year as the instrument (Zhang et al., 2020), which satisfies the correlation requirements of instrumental variables. At the same time, individual companies are unlikely to influence overall IT investment by industry and year. Therefore, the instrumental variables selected in this study have met the exogenous requirements of instrumental variables.

In the first column of Table 7, we select IT investment as the explained variable and calculate IT-AVE as the explanatory variable to carry out multiple regression. The empirical test results show that the regression coefficient of IT-AVE is significantly positive, which is consistent with the expectation of this study. In the second column of Table 7, we regress the IV-IT obtained in the first stage with the number of green patent applications, i.e., green innovation of enterprises, as the explained variable. The regression results show that the regression coefficient of IV-IT is significantly positive at the level of 5%. These results indicate that the results obtained from the previous tests are less affected by endogeneity problems.

Based on the above studies, robustness test and endogeneity discussion were conducted. We can draw the conclusion that IT investment can promote green innovation of heavy polluting enterprises, which is consistent with the original conclusion.

Concluding Remarks

Exploring how IT investment affects green innovation of heavy polluting enterprises is of great research value under the social background of rapid development in information technology, sustainable development in environment, and innovation atmosphere. The industrial digitization, green transformation, and traditional industry upgrading goals mentioned in the 14th Five-Year Plan of the Chinese government have provided an opportunity and paved the way for our study. We established a Tobit model with relevant data of heavy polluting industries in listed companies from 2010 to 2018 to explore the impact of IT investment on green innovation. The empirical results are shown as follows. First, IT investment promotes green innovation of heavy polluting enterprises. Second, IT investment plays a stronger role in promoting green innovation of state-owned heavy polluting enterprises. Third, IT investment has a stronger positive effect on the green innovation of heavily polluting enterprises with a strong sense of environmental responsibility. Fourth, IT investment has a stronger positive effect on the green innovation of heavily polluting enterprises in areas with strict environmental regulations. Our conclusion is a supplement to the related research on IT investment and enterprise innovation.

This study provides a reference for designing green innovation policies of heavily polluting industries in China and other developing countries, which is conducive to solve the pollution problems and promote industrial transformation and upgrading. First, we can predict that heavy polluting enterprises should increase their IT investment to positively accelerate green innovation. Second, state-owned heavy polluting enterprises should take the initiative to undertake greater responsibility for information upgrading and environmental protection construction and actively promote green innovation through IT investment. Third, enterprises must have an active environmental awareness and should take the responsibility to solve pollution problems. Fourth, the government should formulate appropriate policies to give correct and positive guidance and urge heavy polluting enterprises to carry out environmental protection activities.

The conclusions of the relationship between IT investment and green innovation can be transferred to other relevant areas, such as the energy field, whose environmental protection problem is also prominent. Informatization is helpful to build intelligent energy system and promote green development level in this field. Comprehensive informatization of energy systems plays an important role in processing large amounts of data, discovering causal relationships between different data sources, extracting knowledge, and predicting valuable information based on related data sources. Combining information technology with energy system planning, operation, management, policy, and trade can promote the planning and operation of energy system. Adopting information technology to collect information from the electric power, the customer, the energy investment, and other bodies is able to deepen people’s understanding of the energy system and ultimately be beneficial to the blooming of green innovative products and services. China's sustainable development can be accelerated by the green energy industry.

This research has several limitations that suggest future research opportunities. First, we test a single-industry hypothesis and the generality of our findings may be limited in other industry settings. Future research is encouraged to examine our claims in other industries, particularly those with a high potential risk of environmental pollution. Second, our research samples are from a single country and may be affected by some backgrounds and policies when placed in different countries. In the future, these studies can be put into different enterprises in different countries to improve the external validity of the theory.

Data Availability Statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author Contributions

XC, WM, and YP carried out conceptualization, writing the original manuscript, and revising. YT and ML did methodology development, model design, and data collection. GZ participated in conceptualization and manuscript revision. SY did results discussion and language polish.

Funding

This study was supported by the National Natural Science Foundation of China (71602038) “The Impact of Sticky Salary on Executive R&D Investment Decisions and Performance: Based on the Perspective of Failure Tolerance Theory”, the National Natural Science Foundation of China (71874036) “China's Innovation Policy Tool Portfolio Influencing Mechanism of Enterprise R&D Investment and Performance”, the National Natural Science Foundation of China (72074056) “Research on Technological Evolution Characteristics and Market Diffusion Path of Disruptive Innovation: A Perspective of Value Creation”, Humanities and Social Science Research General Project of the Ministry of Education (18YJA630079) "Research on the Impact of my country's Innovation Policy Combination on Enterprise R&D: Based on the Perspective of Policy Tools", Guangdong Provincial Natural Science Foundation Project (2021A1515011923) "The Effect and Mechanism of the Development of Digital Finance on Enterprise Innovation: Based on the Perspective of Spatial Economics", Guangdong Provincial Philosophy and Social Science “13th Five-Year Plan” Project (GD20CGL21) “Financial Technology and SME Innovation Empowerment: Theoretical Mechanism and Empirical Test Based on the Data of Prefecture-City—Enterprise in Guangdong", and Guangdong Provincial Philosophy and Social Science “13th Five-Year Plan” Project (GD20CYJ10) “Can Digital Financial Inclusion Help Mass Entrepreneurship: Theoretical Analysis and Guangdong Evidence.”

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1https://www.numbeo.com/cost-of-living/

References

Ardito, L., Petruzzelli, A. M., Panniello, U., and Garavelli, A. C. (2019). Towards Industry 4.0: Mapping Digital Technologies for Supply Chain Management-Marketing Integration. Business Process Manag. J. 25, 11. doi:10.1108/BPMJ-04-2017-0088

Ardito, L., Raby, S., Albino, V., and Bertoldi, B. (2021). The Duality of Digital and Environmental Orientations in the Context of SMEs: Implications for Innovation Performance. J. Business Res. 123, 44–56. doi:10.1016/j.jbusres.2020.09.022

Awan, U., Sroufe, R., and Kraslawski, A. (2019). Creativity Enables Sustainable Development: Supplier Engagement as a Boundary Condition for the Positive Effect on green Innovation. J. Clean. Prod. 226, 172–185. doi:10.1016/j.jclepro.2019.03.308

Bai, Y., Song, S., Jiao, J., and Yang, R. (2019). The Impacts of Government R&D Subsidies on green Innovation: Evidence from Chinese Energy-Intensive Firms. J. Clean. Prod. 233, 819–829. doi:10.1016/j.jclepro.2019.06.107

Barney, J. (1991). Firm Resources and Sustained Competitive Advantage. J. Manag. 17 (1), 99–120. doi:10.1177/014920639101700108

Bi, X., and Zhai, S. (2017). From National Natural Resources Accounting System to Disclosure of enterprise Natural Resources Assets-The Discussion Based on the Balance Sheet of Oil Asset. Account. Res. 1 (01), 46–52+95. doi:10.3969/j.issn.1003-2886.2017.01.007

Braun, E., and Wield, D. (1994). Regulation as a Means for the Social Control of Technology. Tech. Anal. Strateg. Manag. 6 (3), 259–272. doi:10.1080/09537329408524171

Bu, M., Qiao, Z., and Liu, B. (2020). Voluntary Environmental Regulation and Firm Innovation in China. ECONOMIC MODELLING 89, 10–18. doi:10.1016/j.econmod.2019.12.020

Cai, X., Zhu, B., Zhang, H., Li, L., and Xie, M. (2020). Can Direct Environmental Regulation Promote green Technology Innovation in Heavily Polluting Industries? Evidence from Chinese Listed Companies. Sci. Total Environ. 746, 140810. doi:10.1016/j.scitotenv.2020.140810

Chen, C.-J., Lin, B.-W., Lin, Y.-H., and Hsiao, Y.-C. (2016). Ownership Structure, Independent Board Members and Innovation Performance: A Contingency Perspective. J. Business Res. 69 (9), 3371–3379. doi:10.1016/j.jbusres.2016.02.007

Chen, X., and Qian, W. (2019). Influence of Environmental Regulation and Industry Heterogeneity on Technological Innovation of Manufacturing Enterprises: Based on the Comparison between Coastal and Inland Areas of China. doi:10.1142/10411

Cheng, C. C. J. (2020). Sustainability Orientation, green Supplier Involvement, and green Innovation Performance: Evidence from Diversifying green Entrants. J. Bus Ethics 161 (2), 393–414. doi:10.1007/s10551-018-3946-7

Core, J., and Guay, W. R. (2001). Stock Option Plans for Non-executive Employees. J. financial Econ. 61 (2), 253–287. doi:10.1016/s0304-405x(01)00062-9

de Boer, M., Van Den Bosch, F. A. J., and Volberda, H. W. (1999). Managing Organizational Knowledge Integration in the Emerging Multimedia Complex. J. Manag. Studs 36 (3), 379–398. doi:10.1111/1467-6486.00141

Dincer, I., and Acar, C. (2017). Smart Energy Systems for a Sustainable Future. Appl. Energ. 194, 225–235. doi:10.1016/j.apenergy.2016.12.058

Ding, X., and Wu, S. (2020). The Impact of IT Capability on Open Innovation Performance: The Mediating Effect of Knowledge Integration Capability. Manag. Rev. 32 (10), 147–157. doi:10.14120/j.cnki.cn11-5057/f.2020.10.012

Dowell, G. W. S., and Muthulingam, S. (2017). Will Firms Go green if it Pays? T He Impact of Disruption, Cost, and External Factors on the Adoption of Environmental Initiatives. Strat. Mgmt. J. 38 (6), 1287–1304. doi:10.1002/smj.2603

Du, X., and Huang, Z. (2017). Ecological and Environmental Effects of Land Use Change in Rapid Urbanization: The Case of Hangzhou, China. Ecol. Indicators 81, 243–251. doi:10.1016/j.ecolind.2017.05.040

Dy, A. M., Marlow, S., and Martin, L. (2017). A Web of Opportunity or the Same Old story? Women Digital Entrepreneurs and Intersectionality Theory. Hum. Relations 70 (3), 286–311. doi:10.1177/0018726716650730

Eller, R., Alford, P., Kallmünzer, A., and Peters, M. (2020). Antecedents, Consequences, and Challenges of Small and Medium-Sized enterprise Digitalization. J. Business Res. 112, 119–127. doi:10.1016/j.jbusres.2020.03.004

Fabrizi, A., Guarini, G., and Meliciani, V. (2018). Green Patents, Regulatory Policies and Research Network Policies. Res. Pol. 47 (6), 1018–1031. doi:10.1016/j.respol.2018.03.005

Fang, X., and Na, J. (2020). Stock Market Reaction to green Innovation: Evidence from GEM Firms. Econ. Res. J. 55 (10), 106–123. (in Chinese).

Fudenberg, D., and Levine, D. K. (2009). “Maintaining a Reputation when Strategies Are Imperfectly Observed,” in A Long-Run Collaboration on Long-Run Games (World Scientific), 143–161.

Hainmueller, J., Mummolo, J., and Xu, Y. (2019). How Much Should We Trust Estimates from Multiplicative Interaction Models? Simple Tools to Improve Empirical Practice. Polit. Anal. 27 (2), 163–192. doi:10.1017/pan.2018.46

Hu, G., Wang, X., and Wang, Y. (2021). Can the green Credit Policy Stimulate green Innovation in Heavily Polluting Enterprises? Evidence from a Quasi-Natural experiment in China. Energ. Econ. 98, 105134. doi:10.1016/j.eneco.2021.105134

Huang, M., Li, M., and Liao, Z. (2021). Do politically Connected CEOs Promote Chinese Listed Industrial Firms' green Innovation? the Mediating Role of External Governance Environments. J. Clean. Prod. 278, 123634. doi:10.1016/j.jclepro.2020.123634

Khan, M. A., and Qin, X. (2020). Uncertainty and R&D Investment: Does Product Market Competition Matter?. Res. Int. Business Finance 52, 101167. doi:10.1016/j.ribaf.2019.101167

Klemetsen, M. E., Bye, B., and Raknerud, A. (2018). Can Direct Regulations Spur Innovations in Environmental Technologies? A Study on Firm‐Level Patenting. Scand. J. Econ. 120 (2), 338–371. doi:10.1111/sjoe.12201

Kogut, B., and Zander, U. (1992). Knowledge of the Firm, Combinative Capabilities, and the Replication of Technology. Organ. Sci. 3 (3), 383–397. doi:10.1287/orsc.3.3.383

Kraus, S., Rehman, S. U., and García, F. J. S. (2020). Corporate Social Responsibility and Environmental Performance: The Mediating Role of Environmental Strategy and green Innovation. Technol. Forecast. Soc. Change 160, 120262. doi:10.1016/j.techfore.2020.120262

Květoň, V., and Horák, P. (2018). The Effect of Public R&D Subsidies on Firms' Competitiveness: Regional and Sectoral Specifics in Emerging Innovation Systems. Appl. Geogr. 94, 119–129. doi:10.1016/j.apgeog.2018.03.015

Li, B., and Wang, B. (2018). Corporate Social Responsibility(CSR),media Supervision,and Financial Performance-Empirical Data Based on A Share Heavy Pollution Industry. Account. Res. 1 (07), 64–71. doi:10.3969/j.issn.1003-2886.2018.07.009

Lin, C., and Kunnathur, A. (2019). Strategic Orientations, Developmental Culture, and Big Data Capability. J. Business Res. 105, 49–60. doi:10.1016/j.jbusres.2019.07.016

Lin, Z., and Bao, L. (2021). Research about the Effects of CSR on Supply Chain Emission Reduction Decision-Making and Government Subsidy Efficiency. Chin. J. Manag. 21, 1–12. doi:10.16381/j.cnki.issn1003-207x.2019.2132

Liu, H., Ke, W., Wei, K. K., and Hua, Z. (2013). The Impact of IT Capabilities on Firm Performance: The Mediating Roles of Absorptive Capacity and Supply Chain Agility. Decis. support Syst. 54 (3), 1452–1462. doi:10.1016/j.dss.2012.12.016

Liu, X., Li, X., and Li, H. (2016). R&D Subsidies and Business R&D: Evidence from High-Tech Manufacturing Firms in Jiangsu. China Econ. Rev. 41, 1–22. doi:10.1016/j.chieco.2016.08.003

Luo, Y., Salman, M., and Lu, Z. (2021). Heterogeneous Impacts of Environmental Regulations and Foreign Direct Investment on green Innovation across Different Regions in China. Sci. Total Environ. 759, 143744. doi:10.1016/j.scitotenv.2020.143744

Lv, C., Shao, C., and Lee, C.-C. (2021). Green Technology Innovation and Financial Development: Do Environmental Regulation and Innovation Output Matter? Energ. Econ. 98, 105237. doi:10.1016/j.eneco.2021.105237

Lv, Y., Han, S., Su, J., and Wang, S. (2017). Research on the Construction of university-driven Open Innovation Ecosystem. Manag. Rev. 29 (04), 68–82. doi:10.14120/j.cnki.cn11-5057/f.2017.04.007

Mao, H., Liu, S., Zhang, J., and Deng, Z. (2016). Information Technology Resource, Knowledge Management Capability, and Competitive Advantage: The Moderating Role of Resource Commitment. Int. J. Inf. Manag. 36 (6), 1062–1074. doi:10.1016/j.ijinfomgt.2016.07.001

Mudambi, R., and Swift, T. (2014). Knowing when to Leap: Transitioning between Exploitative and Explorative R&D. Strat. Mgmt. J. 35 (1), 126–145. doi:10.1002/smj.2097

Nambisan, S., Lyytinen, K., Yoo, Y., and William, C. (2020). Handbook of Digital Innovation. Northampton, Massachusetts: Edward Elgar Publishing. doi:10.4337/9781788119986

Nambisan, S., Wright, M., and Feldman, M. (2019). The Digital Transformation of Innovation and Entrepreneurship: Progress, Challenges and Key Themes. Res. Pol. 48 (8), 103773. doi:10.1016/j.respol.2019.03.018

Peng, J., Song, Y., Tu, G., and Liu, Y. (2021). A Study of the Dual-Target Corporate Environmental Behavior (DTCEB) of Heavily Polluting Enterprises under Different Environment Regulations: Green Innovation vs. Pollutant Emissions. J. Clean. Prod. 297, 126602. doi:10.1016/j.jclepro.2021.126602

Pronin, E. (2007). Perception and Misperception of Bias in Human Judgment. Trends Cognitive Sciences 11 (1), 37–43. doi:10.1016/j.tics.2006.11.001

Qi, G., Jia, Y., and Zou, H. (2021). Is Institutional Pressure the Mother of green Innovation? Examining the Moderating Effect of Absorptive Capacity. J. Clean. Prod. 278, 123957. doi:10.1016/j.jclepro.2020.123957

Rong, Z., Wu, X., and Boeing, P. (2017). The Effect of Institutional Ownership on Firm Innovation: Evidence from Chinese Listed Firms. Res. Pol. 46 (9), 1533–1551. doi:10.1016/j.respol.2017.05.013

Ruiz-Jiménez, J. M., Fuentes-Fuentes, M. d. M., and Ruiz-Arroyo, M. (2016). Knowledge Combination Capability and Innovation: The Effects of Gender Diversity on Top Management Teams in Technology-Based Firms. J. Bus Ethics 135 (3), 503–515. doi:10.1007/s10551-014-2462-7

Scuotto, V., Santoro, G., Bresciani, S., and Del Giudice, M. (2017). Shifting Intra- and Inter-organizational Innovation Processes towards Digital Business: An Empirical Analysis of SMEs. Creat. Innov. Manag. 26 (3), 247–255. doi:10.1111/caim.12221

Shahzad, M., Qu, Y., Javed, S. A., Zafar, A. U., and Rehman, S. U. (2020). Relation of Environment Sustainability to CSR and green Innovation: A Case of Pakistani Manufacturing Industry. J. Clean. Prod. 253, 119938. doi:10.1016/j.jclepro.2019.119938

Shen, N. (2012). Environmental Efficiency,industrial Heterogeneity and Intensity of Optimal Regulation——Nonlinear test based on industrial panel-data. China Ind. Econ. 1 (03), 56–68. doi:10.19581/j.cnki.ciejournal.2012.03.005

Sinha, P., and Akoorie, M. E. M. (2010). Sustainable environmental practices in the New Zealand wine industry: An analysis of perceived institutional pressures and the role of exports. J. Asia-Pacific Business 11 (1), 50–74. doi:10.1080/10599230903520186

Sun, H., Edziah, B. K., Sun, C., and Kporsu, A. K. (2019). Institutional quality, green innovation and energy efficiency. Energy policy 135, 111002. doi:10.1016/j.enpol.2019.111002

Sun, X. H., Guo, X., and Zhou, G. (2017). Government subsidy, ownership, and firms' R & D decisions. J. Manag. Sci. China 20 (6), 18–31.

Tian, X., and Meng, Q. (2018). Do stock incentive schemes spur corporate innovation. Nankai Business Rev. 21 (03), 176–190. doi:10.3969/j.issn.1008-3448.2018.03.017

Tobin, J. (1958). Estimation of relationships for limited dependent variables. Econometrica 26, 24–36. doi:10.2307/1907382

Van den Bosch, F. A. J., Volberda, H. W., and de Boer, M. (1999). Coevolution of firm absorptive capacity and knowledge environment: Organizational forms and combinative capabilities. Organ. Sci. 10 (5), 551–568. doi:10.1287/orsc.10.5.551

Wang, P., Dai, H.-c., Ren, S.-y., Zhao, D.-q., and Masui, T. (2015). Achieving Copenhagen target through carbon emission trading: Economic impacts assessment in Guangdong Province of China. Energy 79, 212–227. doi:10.1016/j.energy.2014.11.009

Wang, Y., Wang, T., and Huan, L. (2020). Research on the synergistic effect of R&D expenditures for IT investment : A contingent view of internal organizational factors. Manag. World 36 (07), 77–89. doi:10.19744/j.cnki.11-1235/f.2020.0104

Wernerfelt, B. (1984). A resource-based view of the firm. Strat. Mgmt. J. 5 (2), 171–180. doi:10.1002/smj.4250050207

West, J., and Bogers, M. (2014). Leveraging external sources of innovation: A review of research on open innovation. J. Prod. Innov. Manag. 31 (4), 814–831. doi:10.1111/jpim.12125

Wu, L., Hitt, L., and Lou, B. (2020). Data analytics, innovation, and firm productivity. Manag. Sci. 66 (5), 2017–2039. doi:10.1287/mnsc.2018.3281

Wurlod, J.-D., and Noailly, J. (2018). The impact of green innovation on energy intensity: An empirical analysis for 14 industrial sectors in OECD countries. Energ. Econ. 71, 47–61. doi:10.1016/j.eneco.2017.12.012

Xavier, A. F., Naveiro, R. M., Aoussat, A., and Reyes, T. (2017). Systematic literature review of eco-innovation models: Opportunities and recommendations for future research. J. Clean. Prod. 149, 1278–1302. doi:10.1016/j.jclepro.2017.02.145

Xie, X., and Huo, J. (2015). Green process innovation and financial performance in emerging economies: Moderating effects of absorptive capacity and green subsidies. IEEE Trans. Eng. Manag. 63 (1), 101–112. doi:10.1109/TEM.2015.2507585

Xiong, J., and Sun, D. (2017). A study of the relationship among enterprise social capital,technical knowledge acquisition and product innovation performance. Manag. Rev. 29 (05), 23–39. doi:10.14120/j.cnki.cn11-5057/f.2017.05.003

Zhang, J. A., and Walton, S. (2017). Eco-innovation and business performance: the moderating effects of environmental orientation and resource commitment in green-oriented SMEs. R&D Manag. 47 (5), E26–E39. doi:10.1111/radm.12241

Zhang, Y., Wang, J., Xue, Y., and Yang, J. (2018). Impact of environmental regulations on green technological innovative behavior: An empirical study in China. J. Clean. Prod. 188, 763–773. doi:10.1016/j.jclepro.2018.04.013

Zhang, Y., Xing, C., and Wang, Y. (2020). Does green innovation mitigate financing constraints? Evidence from China's private enterprises. J. Clean. Prod. 264, 121698. doi:10.1016/j.jclepro.2020.121698

Zhao, Z., and Li, C. (2021). How does patent quality affect firm values? Business Manag. J. 12 (2020), 1–17. doi:10.19616/j.cnki.bmj.2020.12.004

Zhou, K. Z., Gao, G. Y., and Zhao, H. (2017). State ownership and firm innovation in China: An integrated view of institutional and efficiency logics. Administrative Sci. Q. 62 (2), 375–404. doi:10.1177/0001839216674457

Zhou, X., Song, M., and Cui, L. (2020). Driving force for China's economic development under Industry 4.0 and circular economy: Technological innovation or structural change? J. Clean. Prod. 271, 122680. doi:10.1016/j.jclepro.2020.122680

Keywords: information technology investment, green innovation, resource-based, knowledge integration, heavy polluting enterprises

Citation: Xiude C, Yuting T, Miaoxin L, Guangyu Z, Wencong M, Shiwei Y and Yulian P (2021) How Information Technology Investment Affects Green Innovation in Chinese Heavy Polluting Enterprises. Front. Energy Res. 9:719052. doi: 10.3389/fenrg.2021.719052

Received: 01 June 2021; Accepted: 09 July 2021;

Published: 12 August 2021.

Edited by:

Quande Qin, Shenzhen University, ChinaReviewed by:

Junhui Fu, Zhejiang University of Finance and Economics, ChinaXinxiang Shi, Sun Yat Sen University, China

Copyright © 2021 Xiude, Yuting, Miaoxin, Guangyu, Wencong, Shiwei and Yulian. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Ma Wencong, MTM1NzAzNzgyODJAMTYzLmNvbQ==; Peng Yulian, cGVuZ3lsQGdjdS5lZHUuY24=

Chen Xiude

Chen Xiude Tan Yuting1

Tan Yuting1