- 1School of Business, Nanjing University of Information Science and Technology, Nanjing, China

- 2Development Institute of Jiangbei New Area, Nanjing University of Information Science and Technology, Nanjing, China

- 3Research Center for Prospering Jiangsu Province with Talents, Nanjing University of Information Science and Technology, Nanjing, China

The banking and borrowing (BB) system has been developed gradually in the tradable permits market to perform a role as an environmental management tool. One question naturally arises as to how it will impact the behaviors of firms and the efficiency in presence of market power in the permits market. This paper considers market power in two cases: with and without the BB system. The equilibrium behaviors of the firms are identified in two cases. The findings show that the producing and discharging behaviors of firms depend on the permits price elasticity of output price without BB system, while they only depend on the growth rate of the output price in the BB system. Although both cases fail to obtain efficient solutions, the market with a BB system is capable of alleviating the inefficiency arising from market power compared with that without a BB system. The path of permits price satisfies the Hotelling rule in the case of the BB system, while it is closely related to the path of output price and output price elasticity of permits price in the case without the BB system.

Introduction

The permits market is a cost-effective way to reduce pollution: the cost efficiency is attainable in a competitive tradable permits system. Generally, the efficiency availability needs two conditions in the case of an intertemporal tradable permits market: costs efficiency across firms and across time (Hagem and Westskog, 1998; Zhu et al., 2017; Jiang, et al., 2018). The banking and borrowing (BB) system enables the agents to move permits across time freely. Permits banking means saving some permits in one period to use or trade in later periods, and borrowing means using more in one period than the current standard amount and paying them back in the future (Kling and Rubin, 1997). The acid rain program in the United States firstly introduced banking. The EU ETS also allowed banking, but ruled out borrowing in phase I (2005–2007) and II (2008–2012). After that, it allowed both banking and borrowing in phase III (2013–2020). More studies consider the relationships between the BB system and costs efficiency. One question we are concerned with here is how the BB system impacts the firms’ behaviors and total costs efficiency when considering market power in an intertemporal tradable permits system.

Cronshaw and Kruse (1996) and Rubin (1996) initially propose a formal analysis associated with the system-wide efficiency in a dynamic tradable permits market. More and more interesting issues were explored by a succession of exploitation work in several cases. Cronshaw and Kruse (1996) demonstrate that a full competitive tradable permits market with banking can lead to the lowest costs without profit regulation using a discrete-time model. Rubin (1996) proposes a model of tradable permits market with the BB system and shows that the decentralized solutions make the costs efficiency attainable under joint-cost minimization. However, the following studies show that a tradable permits market with the BB system does not necessarily mean welfare maximization when considering the negative externality of pollutions (Kling and Rubin, 1997; Leiby and Rubin, 2001) since agents in the market always sub-optimally discharge more in the early period than in future. Leiby and Rubin (2001) show that social welfare optimization can be obtainable if the emissions cap and trading ratio for banking and borrowing are correctly set. The analyses above are confined in the framework of the perfect information. In addition, some theoretical studies examine the influences of uncertainties in several cases (such as demand, abatement cost technologies, and forward trading) on permit prices and banking behavior (Schennach, 2000; Maeda, 2004; Newell et al., 2005). Yates and Cronshaw (2001) consider how to decide the optimal trading ratio in banking and borrowing under asymmetric information. Feng and Zhao (2006) examine the efficiency of permits markets with banking systems involved in both uncertainty and asymmetric information, and they show that welfare improvement by banking depends on the relative magnitude of the information effect and externality effect. A few papers propose empirical analysis of the BB system. Stevens and Rose (2002) show that the most gains are from permits trading across nations, but the gains from the trading market with the BB system are low. Cason and Gangadharan (2004) find that banking can reduce the price volatility arising from the imperfect emissions control but result in more emissions. On the contrary, Bosetti et al. (2009) show that the BB system can not only improve welfare but also reduce more emissions in short term. However, none of these studies have analyzed the market power in the tradable permits market.

The market power in the tradable permits market has been discussed in the seminal work of Hahn (1984). Egteren and Weber (1996), Westskog (1996), and Maeda (2003) also analyze the costs efficiency in various cases following Hahn’s insight. After that, the costs efficiency and firms’ behaviors are well examined by various thermotical models, which both consider the output market and tradable permits market (Sartzetakis, 1997a, Sartzetakis, 1997b; Eshel, 2005; Hatcher, 2012; Hintermann, 2017; Jiang et al., 2016). However, all these papers display an absence of dynamic modeling, namely, they do not consider banking and borrowing in the models. Hagem and Westskog (1998) initially examine market power in the dynamic case and show that both the BB system and durable system incur cost inefficiency since the former distorts the allocation of pollution abatements across firms and the latter distorts that across time. But it is not clear which system is better as it depends upon the conditions. The following study (Hagem and Westskog, 2008) further shows that market power brings about misallocation of permits across time market when allowing banking but rules out borrowing. Liski and Montero (2005) consider the stock and flow allocation between a large firm and a small firm. If the large one receives no stock allocation, it will bank by following the competitive permits price. But they do not supply the general equilibrium path of the firms. Liski and Montero (2006) analyze the impacts of spot trading, stock trading, and forward trading on the market power, and they show the large firm can manipulate the spot market, and the forward trading can alleviate the market power. However, they rule out borrowing in the model as well.

This paper mainly looks into how the firms behave in the tradable permits market with and without the BB system in the presence of market power. Specifically, we suppose that there are two types of firms regulated in a finite planning horizon. They are both price takers in output markets. The large firm is a monopoly seller or buyer in the permits market, and another is a fringe firm, which is considered as a price taker in the permits market. For simplicity, we only consider spot trading and one-to-one intertemporal trading in this paper. This study mainly contributes to characterizing the behaviors of firms’ producing and discharging and price path in uncompetitive carbon market with banking and borrowing and without ones. Our results show that the carbon market with a BB system alleviates distortion arising from the market power compared to that without BB system. Furthermore, we identify the equilibrium behaviors of firms in two cases of without a BB system and with a BB system. The producing and discharging behaviors of firms depend on the permits price elasticity of output price in no BB (carbon permits banking and borrowing) system, while they only depend on the growth rate of output price in the BB system. The path of permits price still satisfies the Hotelling rule in the BB system, but it does not work anymore without the BB system in which the path of permits price is closely related to the path of output price and output price elasticity of permits price.

The rest of the paper is organized as follows. The following section proposes a basic model. In Regulator’s Problem, we present a simple analysis of the behaviors of firms and efficient solutions, which makes the system-wide welfare maximization attainable. In No Banking and Borrowing System, we consider market power in the permits market and characterize the behaviors of firms without a BB system. In Banking and Borrowing System, we will characterize the behaviors of firms in the permits market with a BB system and show how a BB system alleviates the market power. The final section concludes.

Basic Model

We suppose that there are two firms,

It is inevitable to produce some unexpected productions by the firms, such as pollutions or CO2. The regulator has to curb the emissions by setting an emission cap,

Suppose firm one might exercise its market power to manipulate permits prices to its own advantage. It may be a monopoly seller (or monopoly buyer) at each time, which means that it can credibly manipulate permits price by controlling the number of permits for sale at any time. Firm 2 may be a buyer (or seller) and price taker. In the following, we will only analyze the situation in which firm one is a monopoly seller and firm two is a buyer, while the other situation is easily understood as the analysis is processed in the same way.

Any firm can transfer the permits across time by banking and borrowing as long as its cumulative emissions on the horizon are less than the total permits it holds.

The total change rate should be

Regulator’s Problem

This section explores the paths of firms that achieve the regulator’s goal, which needs to maximize the total welfare subjects to the emissions cap

Obviously, the integral term

Lagrange multiplier

As

This specifies the behaviors of emissions and outputs along time of each firm. As

It can be found that the behaviors of each firm only depend on the growth rate

Eq. 5 shows precisely the necessary conditions for efficient solutions. Next, we will use these conditions to compare the inefficiency arising from market power between having no BB system and having a BB system and identify the behaviors of firms in two cases.

No Banking and Borrowing System

We reexamine Hahn’s case (1984) in the dynamic view without a BB system. Either banking or borrowing is illegal in this situation. Therefore, no firms will store any permit, and they will use up all permits they hold each time. Therefore

The maximization problem requires that the profit each time,

The second-order conditions are shown in Supplementary Appendix A1. Eq. 7 means that the fringe firm has to choose a level of output and the permits needed to buy in each time so as to make MPC equal the output price and make MAC equal the permits price. The following can be derived from Eq. 7:

Because the trading market prohibits the firms from banking and borrowing, firm two does not get any extra permits each time except for buying from the market, and firm one does not gain any revenue from the excessive permits each time except for selling them to firm 2. The permits price thus strictly depends on

The second-order conditions are also shown in Supplementary Appendix A1. Eq. 9 shows firm one needs to select a level of outputs and permits for sale to make MPC equal the output price each time and make MAC equal the marginal revenue of the permits market. However, Eq. 9 further shows the permits price equals MAC only when the trading volume is zero. Firm one will push up the permits price, which exceeds its MAC if

where

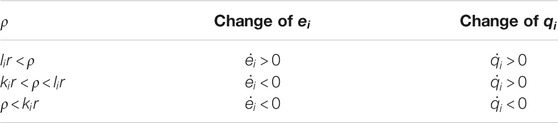

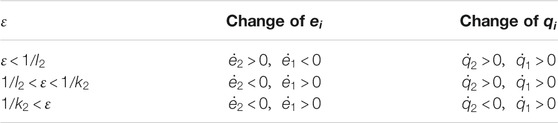

If

The path of the emission of firm one is completely opposite to that of firm 2,

The definitions of

Banking and Borrowing System

The firms can transfer the permits freely across time in such banking and borrowing systems. The equilibrium permits price in the intertemporal market with full competition satisfies the Hotelling rule:

The present value Lagrange equation of firm

where

As firm two is a price taker in both markets, its MPC still equals output price, and the discounted MAC still equals the discounted permits price. Supplementary Appendix A3 has shown that the discounted permits price is the function of

The first-order conditions of firm 1 are

The left of Eq. 16 is fixed, which means that the discounted MAC of firm one remains the same over time. However, the discounted price will be below the discounted MAC of firm 1 as long as the total sales of permits are not zero. Although a BB system results in inefficiency across firms, it can make the efficient allocation of permits across time. Because a BB system disables and segments the permits markets in two periods, the firm with market power fails to make an independent discrimination price during each time in the BB system. Consequentially, the monopoly firm can only make a uniform discrimination price, which leads to inefficiency across firms but efficiency across time. Therefore, the distortion from the market power cannot be eliminated completely but can be effectively alleviated by a BB system compared with having no BB system. In sum, differentiating Eq. 13 with respect to

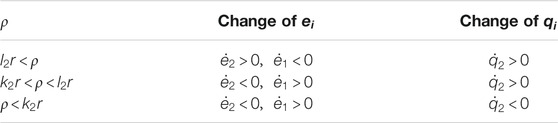

The behaviors of firm two can be obtained from Eq. 17, which has the same form as Eq. 6. As

As a result, the behaviors of a decentralized equilibrium with a BB system are shown in Table 3. The behaviors of emissions and outputs are just closely related to the growth rate of output price. The behaviors of firm two are the same as the ones of systemwide optimization, but the behaviors of firm one change. If the growth rate of output price is large enough, the emissions and outputs of firm two will both increase over time, and they will both decay if the growth rate is small enough. The optimal path of emissions of firm one is opposite to that of firm 2. However, we do not show the optimal path output of firm 1 as a sign of

Conclusion

We explored the behaviors of the firms in a finite horizon in two cases in which the firms are allowed to bank and borrow and not to do these in the tradable permits market with a monopoly seller. The behaviors of firms in the market without a BB system depend on the growth rate of output price and the permits price elasticity of the output price. If the permits price elasticity of the output price is large enough and the output price keeps rising, the emissions and outputs of the fringe firm both decrease with time, while the firm with market power discharges more in the later periods and the level of the output increases with the time. The behaviors of firms in the market without a BB system only depend on the growth rate of the output price. The emissions and outputs of firm two will both increase with time if the growth rate of output price is large enough, and they will both decay if the growth rate is small enough. The optimal path of emissions of firm one is opposite to that of firm 2. The growth rate of permits price with a BB system satisfies the Hotelling rule, but it is related to the growth rate of output price and permits price elasticity of output price in the situation without a BB system.

The tradable permits market in both cases leads to heterogeneously inefficient solutions. The fringe firm’s strategy on settling the permits without a BB system is not as flexible as that with a BB system. It cannot get any more permits except for purchasing some from the market. Thereby, the monopoly seller is able to credibly manipulate the permits price each time, and this results in both inefficient allocations across the firms and time. The BB system provides more choices on distributing the permits, and the firms can transfer the permits across time freely. The monopoly firm can only make a uniform discrimination price at the horizon due to failing to segment the market across time. As a result, the market with BB system can alleviate the inefficiency compared with that without BB system.

The basic results proposed provide some policy implications. Firstly, banking and borrowing is a useful instrument to alleviate the distortion of permits price arising from the strategy firms with market power since the free transferability of permits in such a system will make the efficiency attainable across time. Secondly, the regulator can easily control the price of the output market to effectively adjust the behaviors of discharging instead of adjusting the emission cap, which is more complicated to implement in practice. For example, the strategy firm usually discharges more in the current period and less in the latter periods compared to the socially desirable path of discharging in a high growth rate of output price. In this case, the regulator can lower the growth rate to adjust the discharging path of the firm with market power close to the socially desirable path.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author Contributions

MJ: Methodology, Original draft Writing; XF: Calculation, Draft writing; LL: Software, Writing-Reviewing and Editing.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

Our heartfelt thanks should be given to the National Natural Science Foundation of China (71903099), the General Foundation of Philosophy and Social Science Research in Colleges and Universities in Jiangsu Province (2019SJA0165), and the Natural Science Foundation of the Jiangsu Higher Education Institutions of China (19KJB610019) for funding supports.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenrg.2021.704556/full#supplementary-material

Footnotes

1For example, the electric power sector is the largest CO2 emitter in the region, and the price of electricity is almost regulated by the government such that all firms are price takers.

2

3For simplicity, we omit the time variable

4Obviously,

5The flow allocation for the firms is constant in each time:

References

Bosetti, V., Carraro, C., and Massetti, E. (2009). Banking permits: economic efficiency and distributional effects. J. Pol. Model. 31, 382–403. doi:10.1016/j.jpolmod.2008.12.005

Cason, T. N., and Gangadharan, L. (2004). Emissions variability in tradable permit markets with imperfect enforcement and banking. J. Econ. Behav. Organ. 61, 199–216. doi:10.1016/j.jebo.2005.02.007

Cronshaw, M., and Kruse, J. (1996). Regulated firms in pollution permit markets with banking. J. Regul. Econ. 9, 179–189. doi:10.1007/BF00240369

Egteren, H., and Weber, M. (1996). Marketable permits, market power, and cheating. J. Environ. Econ. Manag. 30, 161–173. doi:10.1006/jeem.1996.0011

Eshel, D. M. D. (2005). Optimal allocation of tradable pollution rights and market structures. J. Regul. Econ. 28, 205–223. doi:10.1007/s11149-005-3109-5

Feng, H., and Zhao, J. (2006). Alternative intertemporal permit trading regimes with stochastic abatement costs. Resource Energ. Econ. 28, 24–40. doi:10.1016/j.reseneeco.2005.04.002

Hagem, C., and Westskog, H. (2008). Intertemporal emission trading with a dominant agent: How does a restriction on borrowing affect efficiency?. Environ. Resource Econ. 40, 217–232. doi:10.1007/s10640-007-9149-9

Hagem, C., and Westskog, H. (1998). The design of a dynamic tradeable quota system under market imperfections. J. Environ. Econ. Manag. 36, 89–107. doi:10.1006/jeem.1998.1039

Hahn, R. W. (1984). Market power and transferable property rights. Q. J. Econ. 99, 753–765. doi:10.2307/1883124

Hatcher, A. (2012). Market power and compliance with output quotas. Resource Energ. Econ. 34, 255–269. doi:10.1016/j.reseneeco.2011.12.002

Hintermann, B. (2017). Market Power in Emission Permit Markets: Theory and Evidence from the EU ETS. Environ. Resource Econ. 66, 89–112. doi:10.1007/s10640-015-9939-4

Jiang, M. X., Yang, D. X., Chen, Z. Y., and Nie, P. Y. (2016). Market power in auction and efficiency in emission permits allocation. J. Environ. Manage. 183, 576–584. doi:10.1016/j.jenvman.2016.08.083

Jiang, M., Zhu, B., Wei, Y.-M., Chevallier, J., and He, K. (2018). An intertemporal carbon emissions trading system with cap adjustment and path control. Energy policy 122, 152–161. doi:10.1016/j.enpol.2018.07.025

Kling, C., and Rubin, J. (1997). Bankable permits for the control of environmental pollution. J. Public Econ. 64, 101–115. doi:10.1016/S0047-2727(96)01600-3

Leiby, P., and Rubin, J. (2001). Intertemporal permit trading for the control of greenhouse gas emissions. Environ. Resource Econ. 19, 229–256. doi:10.1023/a:1011124215404

Liski, M., and Montero, J.-P. (2005). A note on market power in an emission permits market with banking. Environ. Resource Econ. 31, 159–173. doi:10.1007/s10640-005-1769-3

Liski, M., and Montero, J.-P. (2006). On pollution permit banking and market power. J. Regul. Econ. 29, 283–302. doi:10.1007/s11149-006-7400-x

Maeda, A. (2004). Impact of banking and forward contracts on tradable permit markets. Environ. Econ. Pol. Stud 6, 81–102. doi:10.1007/BF03353932

Maeda, A. (2003). The emergence of market power in emission rights markets: the role of initial permit distribution. J. Regul. Econ. 24, 293–314. doi:10.1023/a:1025602922918

Newell, R., Pizer, W., and Zhang, J. (2005). Managing Permit Markets to Stabilize Prices. Environ. Resource Econ. 31, 133–157. doi:10.1007/s10640-005-1761-y

Rubin, J. D. (1996). A model of intertemporal emission trading, banking, and borrowing. J. Environ. Econ. Manag. 31, 269–286. doi:10.1006/jeem.1996.0044

Sartzetakis, E. S. (1997a). Raising rivals’ costs strategies via emission permits markets. Rev. Ind. Organ. 12, 751–765. doi:10.1023/a:1007763019487

Sartzetakis, E. S. (1997b). Tradeable emission permits regulations in the presence of imperfectly competitive product markets: welfare implications. Environ. Resource Econ. 9, 65–81. doi:10.1007/bf02441370

Schennach, S. M. (2000). The economics of pollution permit banking in the context of Title IV of the 1990 Clean Air Act Amendments. J. Environ. Econ. Manag. 40, 189–210. doi:10.1006/jeem.1999.1122

Stevens, B., and Rose, A. (2002). A dynamic analysis of the marketable permits approach to global warming policy: a comparison of spatial and temporal flexibility. J. Environ. Econ. Manag. 44, 45–69. doi:10.1006/jeem.2001.1198

Westskog, H. (1996). Market Power in a System of Tradeable CO2 Quotas. Ej 17, 85–103. doi:10.5547/ISSN0195-6574-EJ-Vol17-No3-6

Yates, A. J., and Cronshaw, M. B. (2001). Pollution Permit Markets with Intertemporal Trading and Asymmetric Information. J. Environ. Econ. Manag. 42, 104–118. doi:10.1006/jeem.2000.1153

Keywords: banking and borrowing, market power, tradable permits, intertemporal trading, efficiency

Citation: Jiang M, Feng X and Li L (2021) Market Power, Intertemporal Permits Trading, and Economic Efficiency. Front. Energy Res. 9:704556. doi: 10.3389/fenrg.2021.704556

Received: 03 May 2021; Accepted: 08 June 2021;

Published: 29 July 2021.

Edited by:

Yong-cong Yang, Guangdong University of Foreign Studies, ChinaReviewed by:

Kangkang Zhang, China University of Geosciences Wuhan, ChinaRuipeng Tan, Nanjing Normal University, China

Copyright © 2021 Jiang, Feng and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Minxing Jiang, MTg1ODg4NDc1MTVAMTYzLmNvbQ==

Minxing Jiang

Minxing Jiang Xingliang Feng

Xingliang Feng Liang Li

Liang Li