- 1Zhejiang Electricity Trading Center Co., Ltd., Hangzhou, China

- 2Zhejiang Huayun Mdt Info Tech Ltd., Hangzhou, China

- 3China Center for Energy Economics Research, School of Economics, Xiamen University, Xiamen, China

Electricity generation relies heavily on fossil fuels in China, and this has posed great challenges for sustainable development. In 2015, China launched a new series of power reforms, aimed primarily at sustainable development and building a competitive power market system, where an information disclosure system plays an important role. This paper analyzes the effects of sensitive information disclosure, constructs different information disclosure scenarios, and compares the market clearing results under different scenarios. The results show that information transparency is conducive to the promotion of market efficiency. However, some problems, especially collusion, arise and inevitably bring negative impacts to the power market. Therefore, more attention should be paid to the content and quality of data transparency to avoid manipulations in the market. The data of power systems are complex and various, and thus big data applications may be conducive to effective information disclosure and better market regulation. Moreover, disclosure delay will help the electricity market become more transparent by reducing the risk of collusion. Besides, the information’s scope and contents, timing should also be taken into consideration. These findings may provide some references for the sustainable development of the electricity industry and have certain policy implications for policymakers.

Introduction

With the increasing development of the economy, the demand for energy sources increases continually (Song et al., 2020). Sustainable and green development has become a major concern for all industries worldwide (Rane and Thakker, 2019). Environmental pollution brought about by massive fossil energy burning has posed great challenges for sustainable development (Song et al., 2019). In China, coal is the most important element of electricity production and consumption in response to energy endowment characterized by “rich in coal, poor in oil, and little in gas.” The energy structure of electric power causes many environmental issues; however, the cost of clean power is much higher than that of thermal power, leading to difficulties in power supply structure adjustment (Xie and Zhao, 2018; Khan, 2020). Increasingly strict environmental supervision and energy policy adjustment have put forward requirements for sustainable electricity supply, while traditional power networks have been unable to meet these requirements. In the era of big data, with the attention of the national power sector, the power industry is also developing toward informatization. With the continuous improvement of the power grid, the degree of integration of cloud technology and other emerging technologies with the power industry is continuously strengthened, and data in the power industry has also witnessed a substantial growth. Big data applications bring opportunities and challenges for the sustainable development of the power industry.

In 2015, China launched a new round of power reforms, aimed primarily at sustainable development of the electricity industry and building an “open, orderly, competitive, and complete” power market system (Song and Cui, 2016; Liu et al., 2019). To facilitate the implementation of this reform, a series of supplementary actions have been taken, for example the construction of an electric power trading center and eight pilots for electric power spot transaction. The spot market is an important part of the electricity market system, which plays a fundamental supporting role in coordinating market transactions and ensuring system security. With the advent of electricity spot trading, the transaction mode has been changed and transaction frequency has increased substantially. Consequently, the electricity information system has become a necessity for the electricity market.

In 2020, the National Energy Administration released a draft regulation entitled “Measures for Information Disclosure in the Electricity Spot Market,” which stipulates the principles, methods, and contents of information disclosure. The electricity market is complex, where the information disclosure mechanism plays an important role in promoting market efficiency (Jin et al., 2020). Power generators, retailers, grid enterprises, and consumers are important participants in the electricity market. Thus, these players are also the main subjects for information disclosure. The foundation of ensuring effectiveness and enhancing competition in the electricity market depends on the fulfilling of obligations and responsibilities of market participants. The information disclosure mechanism is also of immense significance for market fairness and transparency as it reduces information asymmetry.

Information will be updated when it flows into the market. The participants will act on this new information and make decisions with more accurate analysis and prediction. Thus, high quality electricity information is the basis that forms effective pricing mechanisms. It is believed that the advanced information disclosure regime will be conducive to increasing transparency, improving market competition, reducing transaction costs, and ensuring electricity security (Healy and Palepu, 2001; Hooper et al., 2009; Delmas et al., 2010; Niefer, 2014).

Fairness, justice, and openness are the basic principles of the electricity market, whereas severe information asymmetry lies in the power sector which hinders the establishment of an effective electricity market. The effective operation and market development need to maintain a certain degree of transparency for the discovery of market inequities and inefficiencies. At present, the information system has not been fully explored, though research on this topic has gradually increased since the new electricity reform. It is worth noting that ways in which the information disclosure system could be perfected is still being explored in China.

Information in the electric power market can be divided into public information, open information, and private information. However, the electricity markets in China are still in their infancy, with an information disclosure system where basic trading information and practical operating conditions are the main focus. With the development and perfection of the market, more information could do with transparency, such as the bidding strategies used by power generators. However, sometimes problems will arise when sensitive information becomes open, for example, tacit collusion. That is, frequent interaction of bidders will increase their chances of transmitting information, and this interaction also gives them more opportunities to learn how to cooperate, which is particularly likely to lead to tacit collusion between power generators.

As mentioned above, it is widely recognized that the information disclosure mechanism plays an important role in the electricity market. However, the study on information disclosure is not enough, especially for the extent and quality of optimal market data transparency in the context of new electricity reform in China. Based on the game theory, this paper mainly focuses on the effects of disclosing sensitive information, taking power generators’ bidding data as an example, at the early stage of market liberalization. How to use big data to further perfect the information disclosure mechanism has also been discussed in the era of big data. These findings may help to provide some references for further development of information disclosure systems and electricity reform.

This paper is organized as follows. Section “Literature Review” reviews the related literature. Section “Model Description” presents model constructs. In section “Model Analysis,” we analyze and compare the optimal bidding strategies of power generators under different scenarios. Section “Further Discussion” discusses how to further perfect the information disclosure mechanism with the help of big data application. Section “Conclusions and Policy Implications” concludes.

Literature Review

The electricity industry has the characteristic of a natural monopoly, which reaps a good deal of benefits and also results in operational inefficiency (Peng and Tao, 2018). The electricity market reform in China can be traced to the 1980s, while progress was very slow until 2002 (Wang and Chen, 2012). In the 2002 reform, the state grid company was split into five generation enterprises and two grid enterprises to break the monopoly, aimed at improving the generation efficiency and sustainable development of the electricity industry (Meng et al., 2016; Zeng et al., 2016; Deng et al., 2018). However, there still exists some problems in the electricity sector, for example, the regulated price and weak competition between two grid companies (Yu, 2012). For the further development of the electricity sector, China launched a new round of electricity reforms in 2015, mainly focusing on the retail market (Lin and Purra, 2019; Lin et al., 2019). More participants are encouraged to take part in the electricity market to introduce the competition mechanism into the sell side (Peng and Tao, 2018). The essence of this new reform is to form a competitive mechanism and thus to reduce electricity costs for other industries and improve operational efficiency (Yao et al., 2019).

With further introduction of a competition mechanism, the electricity trading system in China has been gradually perfected and market efficiency has improved considerably (Meng et al., 2016; Li et al., 2017). Regional electric power transaction markets have been established in some provinces, such as Zhejiang and Guangdong. In today’s marketization trend for power industries, information flow becomes particularly important. To be more specific, the information disclosure mechanism is essential to the efficiency and fairness of the whole power market (Yang et al., 2018). Markard and Holt (2003) find that critical information disclosure will help to improve competition in the electricity market by increasing consumer’s ability to choose electricity offerings. Darudi et al. (2015) quantitatively measure the impacts of the transparency of bidding data of generating enterprises on unilateral exercises of market power and short-term market price. Their results on an actual market (Alberta) indicate that inappropriate bidding disclosure may allow power generators to increase price significantly, which in turn increases end user consumers’ expenses. Brown et al. (2018) examine the role of information transparency in Alberta’s wholesale electricity market and find that certain firms would respond to rival offer changes with a lag by using data on the bidding behavior of firms. Yang et al. (2018) review the information disclosure mechanism of several typical electricity markets and stress that timely and precise information should be disclosed to the market participants through a centralized and authorized information disclosure mechanism. Jin et al. (2020) investigate and compare the power retailers’ information disclosure strategies under new electricity reforms in China and find that information non-transparency will inevitably result in market inefficiency.

Some literature has also focused on information disclosure and environmental performance and finds that mandatory information disclosure may be a vital component for improving the utilization of clean energy. For example, as stressed by Boardman and Palmer (2007), electricity labels which provide information about the source and the electricity environmental effects are unique opportunities for consumers to transfer suppliers to more sustainable sources of electricity. Delmas et al. (2010) find that mandatory information disclosure programs in the electricity market will achieve the targeted goals, which lead to a reduction in the average proportion of fossil fuels and increasing utilization of clean fuels. Bae and Yu (2018) examine the relationship between mandatory disclosure and states’ adoption of renewable energy policy, and they stress that mandatory disclosure on fuel fix and greenhouse gas emissions have significantly positive effects.

In the previous research, it is widely recognized that information disclosure mechanisms play an important role in operational efficiency in the electricity market. However, information disclosure in some literature is sometimes referred to as environmental disclosure and few studies have discussed the extent and quality of optimal market data transparency of China’s information disclosure mechanism under their new electricity reforms. The information disclosure system is still in its infancy, and thus this paper mainly focuses on the effects of disclosing sensitive information, taking power generators’ bidding strategies for example, which are considered as private information within the existing disclosure rules. Moreover, we also discuss the feedback of “private information becoming open,” and the way to perfect the information disclosure system with the help of big data applications, in order to promote the sustainable development of information disclosure and the whole industry.

Model Description

The electricity market is as complex as the product is intangible. With the development of power markets and electricity reformation, the information disclosure system will be perfected. We adopt the game model that is often applied to the analysis of market participants’ behavior. We assume that there are two power generators in this market: firm 1 and firm 2. The production cost of firm i (i ∈ {1,2}) is assumed as (a similar assumption could be seen in Liu et al., 2019), where qi is the product quantity of firm i, ai is the fixed costs, b and ci are parameters related to the variable cost.

According to the trading rules, the power generator quotes the quantity and related prices to the trading center. However, the consumers only declare their needs. We assume the market demand is p = D−λ(q1 + q2), where D is the basic electricity demand and λ is the sensitivity to the price. The pricing strategy of firm i is assumed as qi = βi(pi−b), where βi is the parameter for optimal pricing strategy. The market will be cleared in terms of power generators’ bidding strategies and electricity demand. After that, the market clearing price is decided and requirements for firm i will be settled finally, which is qi = βi(P−b). When the electricity market clears, there is Q = q1 + q2.

The revenue of firm i is πi(qi) = Pqi−Ci(qi), where P is clearing pricing and Ci is production cost. What should be noted is that power producers will decide their bidding strategies in response to their rivals’ behavior. Under different information disclosure mechanisms, the information obtained by power producers is different, so the optimal bidding strategies also differ, leading to various market clearing results. The notations of variables are as shown in Table 1.

Model Analysis

To compare bidding strategies of power generators under different cases, we first formulate basic models with and without full private information disclosure.

Information Disclosed (ID)

According to the trading rules, the trading center announces the demand and requests each power generator to make a quotation. It is assumed that private information is fully disclosed in this scenario. The power generator formulates a quotation strategy in response to electricity demand and market information. After the quotation, the market clearing price will be decided with the balance of electricity supply and demand. Finally, the power generators charge the market clearing prices and are settled with respect to its quotation strategy.

When formulating bidding strategies, power generators will determine optimal policy based on different market conditions, comprehensively considering market information and the behavior of competitors. That is, as the market is becoming transparent, the power generators will choose to act on this new information. Under this case, the pricing strategies of firm 1 and firm 2 can be shown as q1 = β1(p−b) and q2 = β2(p−b). And thus, we can obtain the market clearing price, which is a function of power generators’ pricing parameters.

According to Eq. (1), the demand for firm 1 can be shown as follows.

And then, we can have the profit of firm 1.

The first order derivatives of πm with respective to β1 is expressed as follows.

With some algebra, we can obtain the optimal pricing parameter for firm 1.

Similarly, the optimal pricing parameter for firm 2 is shown as Eq. 5.

Based on the analysis above, we find that the optimal pricing strategies of power generation enterprises will meet the condition of Eqs. 4, 5. By solving these two equations, the market clearing prices and quantity can be settled. We will carry out simulation analysis to prove this in the following part. Also, we have , ; this indicates that the higher optimal pricing parameter, the higher the market clearing price and the lower the production quantity, leading to low market efficiency.

No Information Disclosed (NID)

According to the pricing strategies of the power generators, the relationship between the market clearing electricity price and the quotation strategy can be obtained. However, the assumption of full information disclosure cannot be satisfied in reality. When the information is missing or the decision-making cost is too high, the power generation company will ignore the influence of the competitors. Therefore, we assume private information is not disclosed in this part and discuss the consequences. In this case, the optimal pricing parameter only concerns cost parameters and price sensitivity. Hence, the pricing strategies for firm 1 and 2 are shown as follows.

Accordingly, we can obtain the market clearing price and production quantity.

Where β1 and β2 satisfy Eqs. 6, 7. Through comparison, we can find that the market efficiency and social welfare have been improved by information disclosure, with lower market clearing price and higher production quantity.

The electricity market is similar to the ordinary trading market to some extent, but it has certain particularities at the same time. The entire market constitutes a system network of electrical information trading. The importance of information is also apparent. The key information mainly includes electricity supply and demand, grid congestion, electricity price, load, etc. The player in the market will act on the information disclosed by other participants. Effective disclosure of the private information plays a key role in improving market efficiency, reducing transaction costs, and increasing electricity quantity.

Information Disclosed With Collusion (IDC)

Collusion means that there is an explicit or implicit non-competitive agreement between rivals to increase bid prices for higher market prices (Esmaeili Aliabadi et al., 2016). In the repeated quotation market, power generators have the motivation to form a tacit collusion in order to avoid “price wars.” The supplier can gain more with a high enough market clearing price, though they end up selling less (Palacio, 2020). Disclosure of quotation information will exacerbate the risk of collusion. Under the case of tacit collusion, the total profits of firm 1 and firm 2 can be shown as follows.

We can obtain the first order derivatives of π with respective to β1 and β2 which are shown as follows.

Using algebra, the optimal bidding strategy parameters of power generators can be calculated. The optimal bidding strategies would satisfy the following formula at equilibrium.

Information Disclosed With Time Delay

When it comes to the case that private information is disclosed with time delay, the power market efficiency will be improved inevitably. Disclosure delay combines the advantages of information disclosed and no information disclosed while improving the market transparency and avoiding the possibility of tacit collusion at the same time. It can be inferred from the ID and NID cases that when private information in the power market is disclosed with time delay, power generators cannot fully predict their rivals’ behavior but can make their decisions based on the historical information which partially reflects the market conditions. Therefore, we can draw the conclusion that market efficiency will be greatly improved with disclosure delay. We will explore how to prove this using model analysis in our future research.

Simulation and Comparison

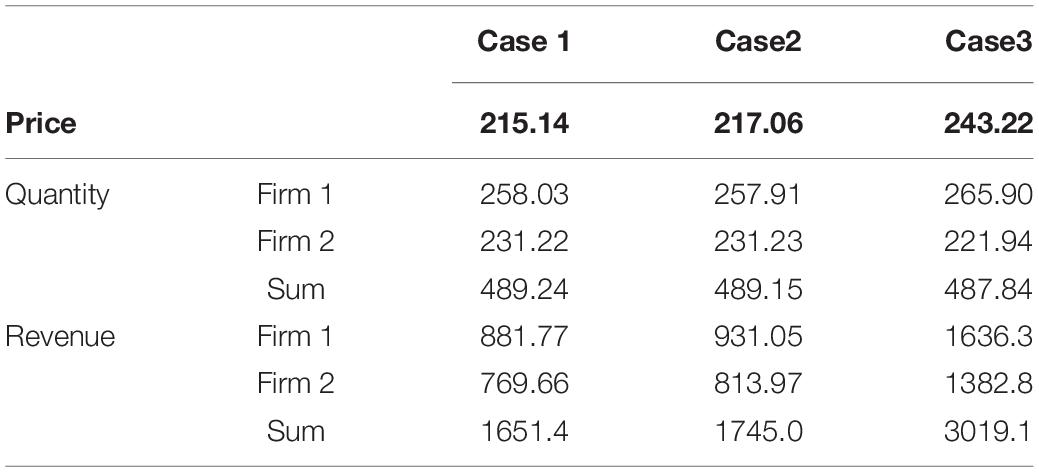

We assume that the production cost for power generators is as shown in Table 2. The demand function is p = 500−0.05Q. Based on market demand and production costs, Table 3 presents market clearing results under different scenarios. Case 1 shows the scenario with complete information disclosure, while case 2 is the scenario when the information is missing and the power generation company neglects the strategy of rival enterprises. In addition, case 3 presents the scenario when there are collusions among bidders in the electricity market.

By comparing, it is found that the clearing price is highest under case 3, while the quantity is the lowest. Information disclosure will make things better, resulting in a lower price and higher quantity compared with case 2. In the case of collusion, the profit of the manufacturer is greatly improved compared to the case without collusion, thus there is a good reason to believe that the power generation enterprises have strong collusion motivations. However, the collusion between power generators will result in the loss of social welfare and market inefficiency, i.e., a higher price and lower quantity.

As mentioned above, the essence of electricity industry reform is to reduce the energy costs for manufacturing and other industries by introducing competition into this sector. Moreover, the government has taken many measures to lower electricity prices in recent years and will continue to explore ways to achieve this goal (Yang and Faruqui, 2019). We find that the disclosure of some sensitive information will improve the market operational efficiency. However, some problems arise at the same time. Collusion among players will inevitably have negative impacts on fairness and efficiency.

Currently, the construction of the spot market is still at an early stage, thus the required information which needs to be disclosed is just basic information. With the progress of marketization, there must be a better way to solve this dilemma. Disclosure delay may help turn the electricity market into a more transparent one by reducing the collusion risk. In addition to the principles, methods, and contents of information disclosed, timing also should be taken into consideration.

Further Discussion

As China’s economy steps into a new normal phase, its growth has slowed down in recent years. The electricity industry, a national fundamental industry, is of vital importance to the sustainable development of the national economy. The essence of China’s electricity reform is to improve operational efficiency by introducing a competition mechanism, thus reducing energy costs for other industries and finally boosting the economic activities. To facilitate the implementation of the new reform in 2015, a series of supplementary actions have been taken, where the construction of an information disclosure system is of vital importance.

Market information is necessary for players in the electricity trading market to make decisions. A large amount of data will be generated during power generation and consumption. An adequate disclosure principle is essential to the perfection of market mechanisms. Market operation is efficient only when the decisions of participants are made with complete information. Missing information or information asymmetry will lead to resource misallocation and market inefficiency, which do great harm to both the developing market and future market. Under the current system, the power grid enterprises are the main links between power producers and end-consumers, which makes the transaction price unable to reflect the market demand and transmit effective signals to power generation enterprises and investors correctly. The formation mechanism of the electricity price and the corresponding process are hidden from consumers, which leads to information asymmetry and is closely related to resource allocation. Failure of information transmission would increase the risk in market transactions, posing a big obstacle to the construction of an “open, competitive, and orderly” electricity market.

If the information disclosed is incomplete, for example, information on the bidding strategies of rivals, then the decision of power generators will not conform to the actual situation, leading to higher market clearing prices and lower production quantity, i.e., low social welfare. Information cost is a major component of transaction cost which includes the negotiation cost paid by the market participants due to the lack of relevant information. Meanwhile, effective information is also conducive for regulatory agencies to reduce corresponding supervision costs.

Information unfairness is an obstacle to ensure the efficiency of the electricity market. For example, a power generator can obtain more information on supply, demand, price, and so on to make its own decisions better. To sum up, the development and perfection of the information disclosure mechanism has a long-term impact on market efficiency and fairness. Therefore, it is of great significance for the power market to perfect the current information disclosure mechanism and improve the quality of circulating information.

The power trading center platform and data service website are the main platforms for power information disclosure. However, the data of the power system is various and complex. Different sources would make it more difficult for market participants to obtain useful information. Thus, a unified platform of information disclosure is needed. Moreover, big data mining may be conducive to effective information disclosure and better regulation.

Information can be divided into public information, open information, and private information with the current information disclosure rules. Private information is required to be disclosed to specific players and regulators. Based on the analysis above, we find that the disclosure of some private information or sensitive information will improve the market operational efficiency. On the other hand, the disclosure of private information will also create some problems, for example, collusion of generators’ quotations. Therefore, how to deal with this private information is a problem that needs to be solved. Information disclosure delay may be a better way to solve this dilemma, which can refine information in the market and reduce collusion risk at the same time. It should be stressed here that electricity spot system and information disclosure system are still in their infancy. Consequently, the improvement of the electricity market and information disclosure timing are worthy of our focus.

Conclusion and Policy Implications

In recent years, China’s power industry has been moving toward informatization and stepping into the “big data era.” Power industry data is experiencing blowout growth. The importance of data in the power industry has become increasingly prominent. Based on the game theory, this paper analyzes the effects of sensitive information disclosure and compares the market clear results under different scenarios. The results show that information transparency is conducive to the promotion of market efficiency, i.e., lower market clearing prices and higher production quantity. However, some problems, for example, collusion, arise and will inevitably have negative impacts. More attention should be paid to the content and quality of data transparency to avoid manipulations in the market. What’s more, disclosure delay may help make the electricity market more transparent by reducing the collusion risk. In addition to the scope and contents of information disclosed, timing also should be taken into consideration. These findings may provide some references for the future development of information disclosure systems and electricity reforms.

In summary, information transparency has a long-term positive impact on market efficiency and fairness by reducing information asymmetry. Therefore, improving the current information disclosure mechanism is of great significance to the power market. The power trading center platform and data service website are the main platforms for power information disclosure. Various sources may lead to difficulty in accessing information. Thus, a unified platform of information disclosure is urgently needed. And the main information disclosed by electric power generation companies mainly includes basic information, such as company name, equity status, unit number, capacity, power generation business license, energy consumption level, etc. The data of power systems are complex and various; big data technology can effectively collect and process massive amounts of power data and display them in a centralized manner, so as to explore the value of the data and provide guidance for related work. Therefore, big data applications will be useful for effective information disclosure and better regulation.

The theory of information disclosure is based on mature markets, but China’s power market is still in its infancy. In the initial stage, this market faces various unexpected risks, thus, the smooth operation is currently the primary goal. The basic electricity information may be enough as some participants would unreasonably use the sensitive or private information to form a conspiracy, damaging market efficiency. To reduce operational risks caused by system weakness, the information disclosed should meet the present stage’s need. With the development and perfection of the market, information disclosure by all market players must be complete. For some sensitive information, disclosure delay may be a better way to solve this dilemma, which can refine market information and reduce collusion risk at the same time.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

LJ and WL: conceptualization, methodology, and writing—original draft. XW: software, data curation, writing–review, and editing. JY and PZ: conceptualization, methodology, writing–original draft, writing—review, and editing, supervision. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the National Natural Science Foundation of China [Grant Nos. 71874149 and 71934001] and National Social Science Fund of China [Grant No. 20ZDA084].

Conflict of Interest

LJ, WL, and XW were employed by company Zhejiang Electricity Trading Center Co., Ltd. JY was employed by company Zhejiang Huayun Mdt Info Tech Ltd.

The remaining author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

Bae, H., and Yu, S. (2018). Information and coercive regulation: the impact of fuel mix information disclosure on states’ adoption of renewable energy policy. Energy Policy 117, 151–159. doi: 10.1016/j.enpol.2018.03.010

Boardman, B., and Palmer, J. (2007). Electricity disclosure: the troubled birth of a new policy. Energy Policy 35, 4947–4958. doi: 10.1016/j.enpol.2007.04.021

Brown, D. P., Eckert, A., and Lin, J. (2018). Information and transparency in wholesale electricity markets: evidence from Alberta. J. Regul. Econ. 54, 292–330. doi: 10.1007/s11149-018-9372-z

Darudi, A., Moghadam, A. Z., and Bayaz, H. J. (2015). “Effects of bidding data disclosure on unilateral exercise of market power,” in Proceedings of the 2nd International Congress on Technology, Communication and Knowledge (ICTCK 2015), Mashhad. doi: 10.1109/ICTCK.2015.7582641

Delmas, M., Montes-Sancho, M. J., and Shimshack, J. P. (2010). Information disclosure policies: evidence from the electricity industry. Econ. Inq. 48, 483–498. doi: 10.1111/j.1465-7295.2009.00227.x

Deng, N., Liu, L., and Deng, Y. (2018). Estimating the effects of restructuring on the technical and service-quality efficiency of electricity companies in China. Util. Policy 50, 91–100. doi: 10.1016/j.jup.2017.11.002

Aliabadi, D. E., Kaya, M., and Şahin, G. (2016). Determining collusion opportunities in deregulated electricity markets. Electr. Power Syst. Res. 141, 432–441. doi: 10.1016/j.epsr.2016.08.014

Healy, P. M., and Palepu, K. G. (2001). Information asymmetry, corporate disclosure, and the capital markets: a review of the empirical disclosure literature. J. Account. Econ. 31, 405–440. doi: 10.1016/S0165-4101(01)00018-0

Hooper, L., Twomey, P., and Newbery, D. (2009). Transparency and Confidentiality in Competitive Electricity Markets. Energy and Infrastructure Division of the Bureau of Europe and Eurasia. Working Paper. Washington, DC: United States Agency for International Development.

Jin, L., Chen, C., Wang, X., Yu, J., and Long, H. (2020). Research on information disclosure strategies of electricity retailers under new electricity reform in China. Sci. Total Environ. 710:136382. doi: 10.1016/j.scitotenv.2019.136382

Khan, I. (2020). Sustainability challenges for the south Asia growth quadrangle: a regional electricity generation sustainability assessment. J. Clean. Prod. 243:118639. doi: 10.1016/j.jclepro.2019.118639

Li, H., Kopsakangas-savolainen, M., Xiao, X., and Lau, S. (2017). Have regulatory reforms improved the efficiency levels of the Japanese electricity distribution sector? A cost metafrontier-based analysis. Energy Policy 108, 606–616. doi: 10.1016/j.enpol.2017.06.032

Lin, J., Kahrl, F., Yuan, J., Liu, X., and Zhang, W. (2019). Challenges and strategies for electricity market transition in China. Energy Policy 133:110899. doi: 10.1016/j.enpol.2019.110899

Lin, K., and Purra, M. (2019). Transforming China’s electricity sector: politics of institutional change and regulation. Energy Policy 124, 401–410. doi: 10.1016/j.enpol.2018.07.041

Liu, H., Zhang, Z., Chen, Z., and Dou, D. (2019). The impact of China’s electricity price deregulation on coal and power industries: two-stage game modeling. Energy Policy 134:110957. doi: 10.1016/j.enpol.2019.110957

Markard, J., and Holt, E. (2003). Disclosure of electricity products-lessons from consumer research as guidance for energy policy. Energy Policy 31, 1459–1474. doi: 10.1016/S0301-4215(02)00201-X

Meng, M., Mander, S., Zhao, X., and Niu, D. (2016). Have market-oriented reforms improved the electricity generation efficiency of China’s thermal power industry? An empirical analysis. Energy 114, 734–741. doi: 10.1016/j.energy.2016.08.054

Niefer, M. J. (2014). Information and competition in electric power markets: is transparency the holy grail. Energy 35:375.

Palacio, S. M. (2020). Predicting collusive patterns in a liberalized electricity market with mandatory auctions of forward contracts. Energy Policy 139:111311. doi: 10.1016/j.enpol.2020.111311

Peng, X., and Tao, X. (2018). Cooperative game of electricity retailers in China’s spot electricity market. Energy 145, 152–170. doi: 10.1016/j.energy.2017.12.122

Rane, S. B., and Thakker, S. V. (2019). Green procurement process model based on blockchain-IoT integrated architecture for a sustainable business. Manage. Environ. Qual. 31, 741–763. doi: 10.1108/MEQ-06-2019-0136

Song, M., and Cui, L. (2016). Economic evaluation of Chinese electricity price marketization based on dynamic computational general equilibrium model. Comput. Ind. Eng. 101, 614–628. doi: 10.1016/j.cie.2016.05.035

Song, M., Fisher, R. J., and Kwoh, Y. (2019). Technological challenges of green innovation and sustainable resource management with large scale data. Technol. Forecast. Soc. Change 144, 361–368. doi: 10.1016/j.techfore.2018.07.055

Song, M., Zhu, S., Wang, J., and Zhao, J. (2020). Share green growth: regional evaluation of green output performance in China. Int. J. Prod. Econ. 219, 152–163. doi: 10.1016/j.ijpe.2019.05.012

Wang, Q., and Chen, X. (2012). China’s electricity market-oriented reform: from an absolute to a relative monopoly. Energy Policy 51, 143–148. doi: 10.1016/j.enpol.2012.08.039

Xie, B., and Zhao, W. (2018). Willingness to pay for green electricity in Tianjin. China: based on the contingent valuation method. Energy Policy 114, 98–107. doi: 10.1016/j.enpol.2017.11.067

Yang, Y., Bao, M., Ding, Y., Song, Y., Lin, Z., and Shao, C. (2018). Review of information disclosure in different electricity markets. Energies 11:3424. doi: 10.3390/en11123424

Yang, Y., and Faruqui, A. (2019). Reducing electricity prices and establishing electricity markets in China: dos and don’ts. Electr. J. 32:106633. doi: 10.1016/j.tej.2019.106633

Yao, X., Huang, R., and Du, K. (2019). The impacts of market power on power grid efficiency: evidence from China. China Econ. Rev. 55, 99–110.

Yu, Y. (2012). How to fit demand side management (DSM) into current Chinese electricity system reform. Energy Econ. 34, 549–557. doi: 10.1016/j.eneco.2011.08.005

Keywords: sustainable development, electricity market, information, disclosure rules, collusion risk

Citation: Jin L, Liu W, Wang X, Yu J and Zhao P (2021) Analyzing Information Disclosure in the Chinese Electricity Market. Front. Energy Res. 9:655006. doi: 10.3389/fenrg.2021.655006

Received: 18 January 2021; Accepted: 24 February 2021;

Published: 15 March 2021.

Edited by:

Yongping Sun, Hubei University of Economics, ChinaReviewed by:

Ailun Wang, Southwestern University of Finance and Economics, ChinaHouyin Long, Fuzhou University, China

Copyright © 2021 Jin, Liu, Wang, Yu and Zhao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Panting Zhao, cmFpbmJvd3pwdEAxNjMuY29t

Luosong Jin1

Luosong Jin1 Panting Zhao

Panting Zhao