- School of Economics and Management, China University of Petroleum-Beijing, Beijing, China

Technology innovation has become the main driving force of China’s economic growth. Sustainable development highlights the harmonious symbiosis of the economy and the ecological environment. Renewable energy companies characterized by technology-intensive and environmental friendliness are playing an increasingly important role in achieving economic development while alleviating environmental pressure. Therefore, this paper selects the A-share renewable energy listed companies in China between 2014 and 2019 as samples, using the fixed-effect model and the logit model to explore the effect of technology innovation on corporate sustainability. We find that technology innovation has a positive effect on both financial sustainability (FS) and social and environmental sustainability (SES). Due to the imbalance of regional social and environmental development and different degrees of emphasis placed on environmental and social responsibility, the positive impact of technology innovation on SES is heterogeneous between the east and the central and west regions. Moreover, as the strategic emerging industry, although the renewable energy industry is granted lots of subsidies from the government, the results show that when government subsidies exceed the threshold, the effect of technology innovation on FS is weakened. Government subsidies have a negative moderating effect on the relationship between innovation and SES. Furthermore, we subdivide government subsidies into government subsidies beforehand (GSB) and government subsidies afterwards (GSA). We reveal that the threshold effect of government subsidies mainly comes from GSA, while the moderating effect of government subsidies is caused by GSA and GSB. This paper is an expansion and enrichment of current studies on sustainable development and also puts forward feasible suggestions for the government to formulate precise and effective subsidy policies to stimulate technology innovation.

Introduction

After 40 years of reform and opening up, China’s economy has entered a “new era,” the mode of economic development has shifted from extensive growth based on scale and speed to intensive growth based on quality and efficiency, and the driving force of development has also been converted from factors and investment to innovation. The 19th National Congress of the Communist Party of China requires economic development to be compatible with the carrying capacity of resources and the environment. The development of renewable energy is regarded as the most effective way to alleviate environmental problems on the premise of ensuring economic development (PA Østergaard and Sperling, 2014; Wang et al., 2018), and technology is the essence of renewable energy development (Wang et al., 2020). Therefore, the technology innovation of renewable energy companies should not only stimulate corporate economic growth but also have a positive effect on the environment and society, which can be concluded as realizing the sustainable development of economy, society, and environment.

Although there is a consensus that technology innovation is important to sustainable development (Cancino et al., 2018; UNCTAD, 2018), different scholars have given different opinions on the real effect of technology innovation. Some scholars consider that the corporate sustainable competitive advantage comes from their resources, which are difficult to imitate (Wernerfelt, 1984; Barney, 1991; Xu et al., 2019), and the scarce resources that companies cannot imitate come from the creation of R&D activities (Bakar and Ahmad, 2010; Jawad and Mustafa, 2019). They believe that innovation is an important tool to achieve economic growth, environmental protection, and social development at the same time, and is the best way to use resources (Klewitz and Hansen, 2014; Akwesi, 2019). However, some scholars hold different views. They think that innovation investment can easily bring serious financial burdens (Beason and Weinstein, 1996; Nitsch, 2009), which inhibits rather than promotes corporate financial performance (Diaz Arias and van Beers, 2013). Moreover, some scholars consider that the relationship between technology and financial sustainability (FS) is different from its impact on social and environmental sustainability (SES) (Saunila et al., 2019). The first objective this paper intends to accomplish is to investigate the relationship between technology innovation and corporate sustainability. Furthermore, due to the imbalance of regional social and environmental development in China, whether the relationship between them has regional heterogeneity is also worthy to be explored.

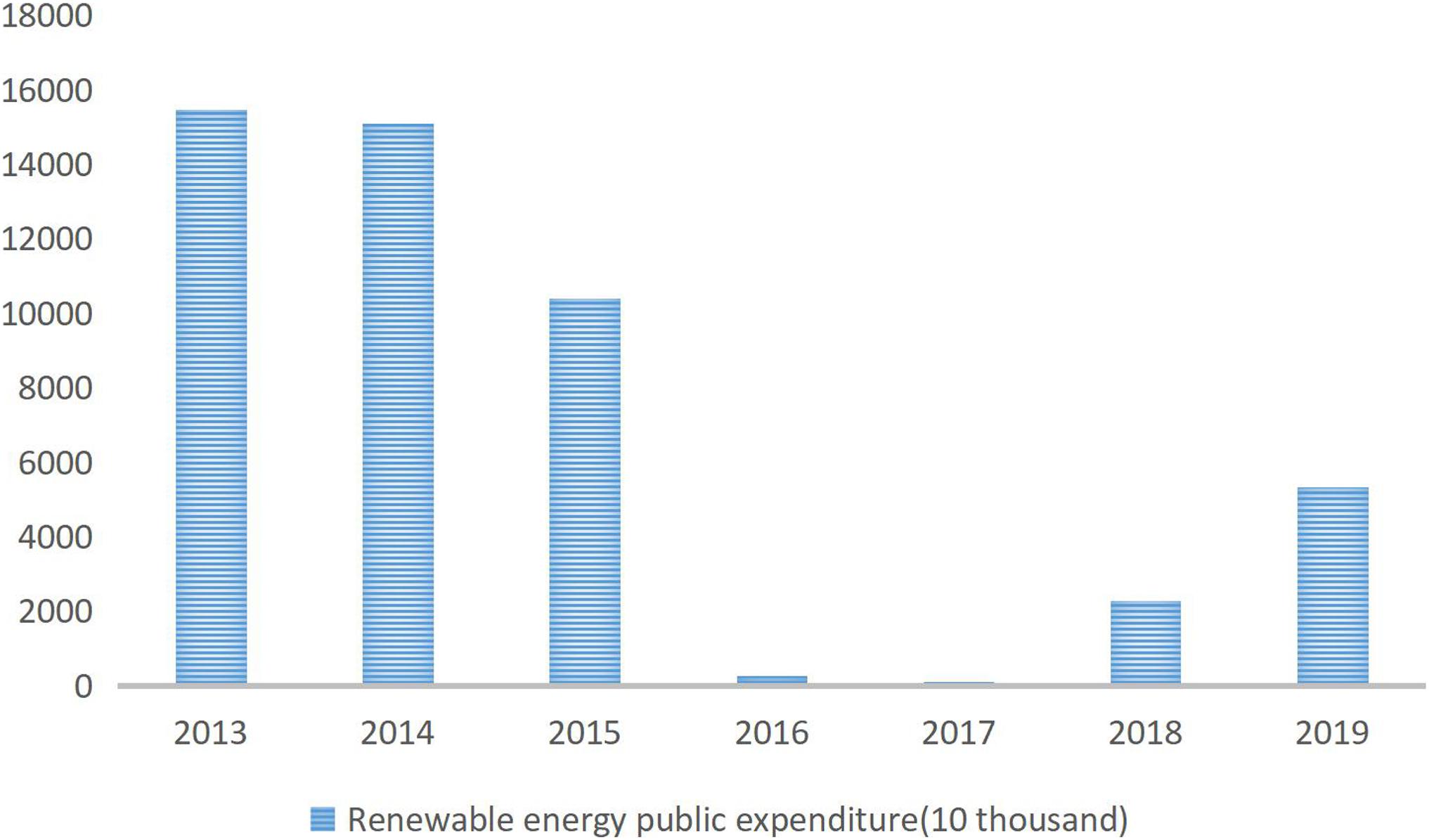

Companies’ technology innovation activities have positive externalities of improving resource efficiency and promoting economic development (Long and Summers, 1991; Yudi et al., 2019). However, technology innovation also has risks such as long investment return cycle and competitors’ imitation (Staw and Dutton, 1981; McKinley et al., 2014), and government subsidies have always been an important means to compensate for such loss of technology spillover (Arrow, 1971; Kang and Park, 2012; Lim et al., 2017; Qiao and Su, 2020). As a pillar of China’s strategic emerging industries, the renewable energy industry has been strongly supported by the government. However, according to the public budget expenditure for renewable energy published by the China Energy Administration (see Figure 1), public funding subsidies for renewable energy have shown a gradual reduction process from 2013 to 2017. There is an upward trend after 2018, but it has not reached the original height, and the subsidies for the renewable energy industry are gradually receding. Although the purpose of subsidies is to guide innovation and achieve development, scholars have not reached a consensus on the effect of government subsidies. Some scholars consider that government subsidies are common tools to reduce the loss of private profits brought by technology spillovers and encourage companies to increase R&D investment (Batlle, 2011; Zhang et al., 2014; Su and Zhou, 2019). Nevertheless, government subsidies can also inhibit the development of companies, because government subsidies may focus more on political gains rather than economic benefits, resulting in excessive production and efficiency losses and affecting the development of companies (Beason and Weinstein, 1996; Bergström, 2000; Tzelepis and Skuras, 2004; Howell, 2017; Hu et al., 2019). The second objective this paper aims to accomplish is to explore what role the government subsidies play between technology innovation and corporate sustainability.

Government supports the development of the renewable energy industry through multiple methods, including policy guidance, direct fiscal subsidies, tax incentives, and the establishment of special funds (see Supplementary Appendix). In terms of policy guidance, since 2012, the government has attached great importance to the innovation of renewable energy companies and has issued several incentive policies to promote the development of renewable energy companies. In addition to policy guidance, direct financial subsidies have played a major role in alleviating funding difficulties for renewable energy companies and helping to promote products. The government also provides tax incentives in multiple taxes such as value-added tax, income tax, vehicle and vessel tax, and vehicle purchase tax. Besides, the government has established a special fund to support the development of the renewable energy industry. Therefore, investigating whether different types of government subsidies have different impacts on the relationship between technology innovation and corporate sustainability is the third objective this paper intends to accomplish.

The contributions of this paper: First, based on the micro company level, include government subsidies, technology innovation, and corporate sustainability into the same framework, discussing the role of government subsidies between technology innovation and corporate sustainability. Corporate sustainability is measured from two dimensions of financial and SES, which is different from most documents that only measure corporate sustainability from the growth of financial performance. This paper is an expansion for current studies about sustainable development. Second, due to the imbalance of regional social and environmental development, it is found that technology innovation has regional heterogeneity in the promotion of corporate sustainability. Renewable energy companies obtain different types of subsidies, so this paper subdivides government subsidies into government subsidies beforehand (GSB) and government subsidies afterwards (GSA); we find that different subsidies have different impacts on the relationship between technology innovation and corporate sustainability. Based on the study conclusions, we put forward feasible suggestions for the government to formulate and improve precise and effective subsidy policies.

Literature Review

Sustainability

Sustainability has gradually become a new consensus for corporate development, which requires companies to promote corporate economic growth and solve corporate environmental problems by improving resource use efficiency and reducing environmental pollution (Lin and Benjamin, 2017). Regarding the definition of sustainability, the Brundtland Commission (WCED, 1987) emphasized the economic and environmental dimensions of sustainability and defined sustainability as “meeting contemporary needs without compromising the satisfaction of future generations’ Need for development.” The Triple bottom line proposed by Elkington (1998) also pointed out that broad sustainability includes three dimensions—economy, society, and environment. The Triple bottom line puts forward new requirements for considering the development capabilities of companies, transforming from the pursuit of economic benefits to the common development of economy, society, and environment (Yudi et al., 2019). Environmental sustainability focuses on protecting the natural environment, reducing the consumption of natural resources, and producing environmentally friendly products (Lucas, 2010). Social sustainability emphasizes the improvement of the organizational relationship between human and society and the improvement of human well-being (Guerrero-Villegas et al., 2018). The economic aspect of sustainable development refers to maximizing profits by increasing revenue and reducing costs (Jawad and Mustafa, 2019). It is necessary to take into account the harmony and unity of the environment and society when expanding economic value. Therefore, this paper measures corporate sustainability from FS and SES.

Technology Innovation and Sustainability

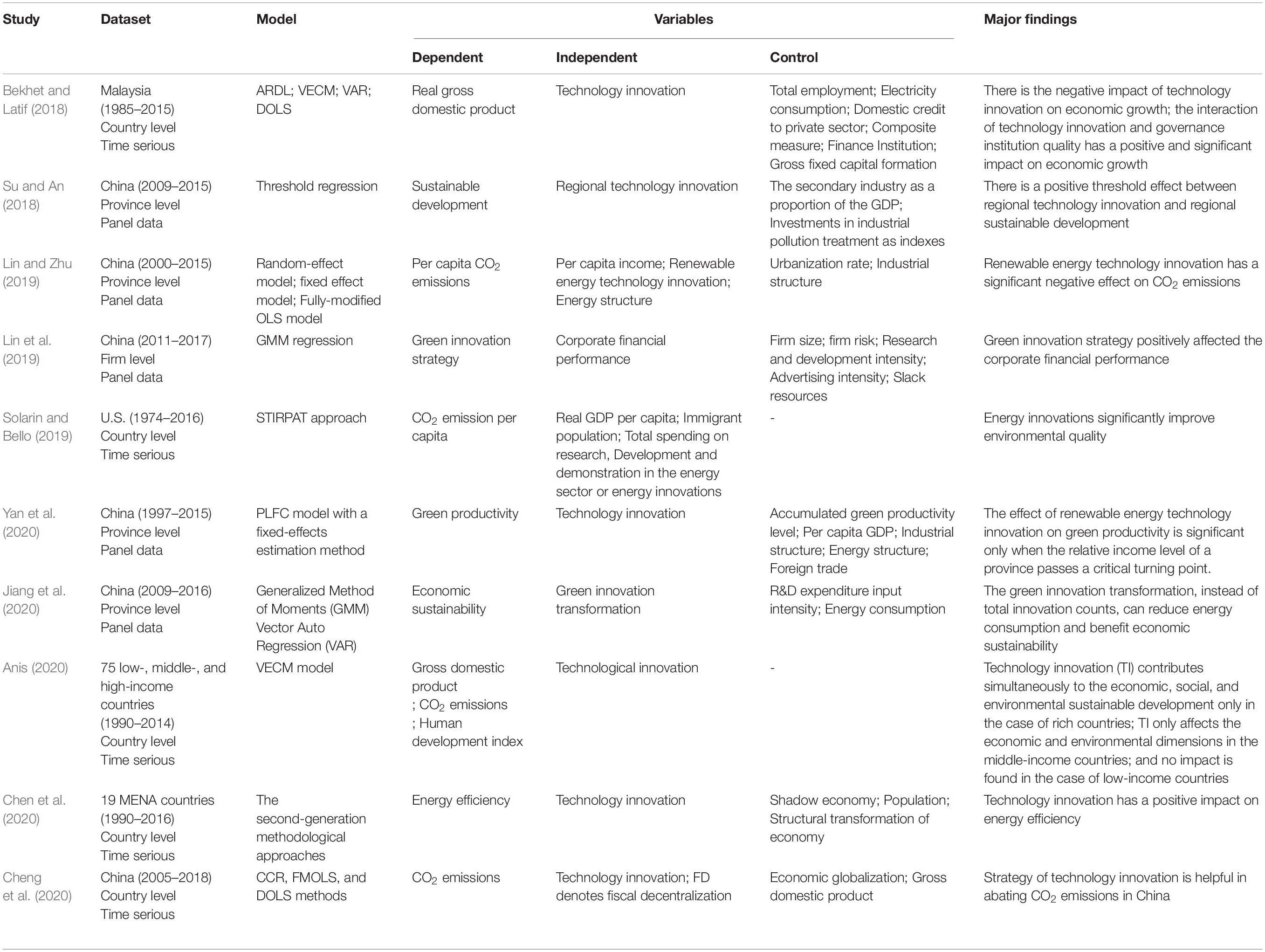

Some studies have addressed the question of how technology innovation affects sustainability (see Table 1). Most studies suggest that technology innovation has a positive effect on sustainability. Especially for the renewable energy industry, technology innovation not only promotes economic sustainability (Jiang et al., 2020; Yan et al., 2020) but also reduces carbon dioxide emissions and promotes environmental sustainability (Solarin and Bello, 2019; Cheng et al., 2020). On the contrary, some scholars also put forward different opinions on the relationship between technology innovation and corporate sustainability. Bekhet and Latif (2018) believe that although technology innovation does not play a positive role in sustainable economic growth, the interaction between good governance quality and technology innovation will have a significant positive impact on economic sustainability in the long run. Also, some scholars believe that the impact of technology innovation on sustainability depends on the economic level of the region (Anis, 2020).

The Role of Government Subsidies

Government subsidies are regarded as a tool to correct the market failure (Arrow, 1971). However, because of the inefficient subsidies caused by rent-seeking, in many conditions, government subsidies have not achieved the expected results. At present, the relationship between government subsidies and corporate sustainability can be divided into three categories: promotion, inhibition, and no impact. Scholars with the view of promotion believe that government subsidies can have a positive impact on corporate financial performance, market share, and environmental awareness. Soltani-Sobh et al. (2017) consider that the government incentives are positively correlated with the Electric vehicle market share growth in the US. Deng et al. (2020) divide government subsidies into selective subsidies and non-selective subsidies, suggesting that selective subsidies can help companies maintain high performance, while the effectiveness of non-selective subsidies depends on the intensity of regional legal protection and market competition. Besides, some scholars point out that the government will also promote companies’ emphasis on the environment (Wang and Zhang, 2020). Scholars with the opposite view believe that companies receiving government subsidies may focus more on political gains rather than economic benefits, resulting in excessive production and efficiency losses, and affecting the development of companies (Beason and Weinstein, 1996; Bergström, 2000; Tzelepis and Skuras, 2004; Howell, 2017; Hu et al., 2019). Some scholars believe that government subsidies do not directly affect the sales of companies, but government subsidies make an indirect contribution to company sales by improving technology (Li et al., 2020). Technology comes from innovation, and government subsidies only play a guiding and supporting role, but the endogenous driving force for companies still comes from innovation. However, there is not a consensus on the relationship between government subsidies and technology innovation. Scholars with opposite views believe that government subsidies have a crowding-out effect on technology innovation (Busom, 2000; Liu et al., 2019). Supporters believe that government subsidies can promote the level of innovation (Lin and Luan, 2020; Yu et al., 2020). Other scholars pointed out that different technologies require different types of policy tools, and demand-driven policies may be more effective for renewable companies’ technology innovation (Pitelis et al., 2019). In addition, some scholars believe that the effect of government subsidies on technology innovation is non-linear; only at certain intervals can government innovation and non-innovation subsidies play a role in promoting innovation (Liu et al., 2020; Li et al., 2020).

Above all, current studies have focused on the importance of technology innovation for sustainability, but most of the existing studies have focused on sustainability at the macro level and have not reached an agreement about the relationship between technology innovation and sustainability. Besides, although current studies have noticed that government subsidies, as external tools, will affect technology innovation and corporate growth, there is still considerable controversy over the effects of government subsidies. Therefore, based on the micro company perspective, this paper examines the impact of technology innovation on corporate sustainability and explores whether there is regional heterogeneity in the relationship between them. Besides, this paper explores the role of government subsidies in the impact of technology innovation on corporate sustainability and discusses whether different types of subsidies have different effects.

Hypothesis Development

The Relationship Between Technology Innovation and Corporate Sustainability

The Relationship Between Technology Innovation and FS

The resource-based view (RBV) and the knowledge-based view (KBV) explain why innovation affects corporate FS from the perspective of competitive advantage. RBV points out that companies with scarce resources that are difficult to imitate will gain a stronger competitive advantage and show better and sustainable financial performance (Wernerfelt, 1984; Barney, 1991; Barney, 2001; Kuncoro and Suriani, 2017; Hameed et al., 2020). Inimitable resources come from technology innovation (Bakar and Ahmad, 2010), because technology innovation helps companies develop new products and services, construct the barrier from their competitors, and make companies expand their business scale, then enhance their competitiveness (Ireland et al., 2001; Su and Zhou, 2019). Among all the resources pointed out by RBV, knowledge is the most relevant to the competitiveness of companies (Villasalero, 2017). KBV shows that transforming tacit knowledge into explicit knowledge is the source of sustainable competitive advantage (Yang, 2008, 2012; Jawad and Mustafa, 2019). Technology Innovation contributes to knowledge management (Kamara et al., 2002), which leads to the explicit expression of accumulated knowledge. Therefore, innovation is a key factor for companies to seize the competition and promote corporate financial potential (Patterson, 1998; Veland and Shqipe, 2011; VanderPal, 2015; Zhang et al., 2018). Based on the analysis above, this paper proposes hypothesis 1:

H1: There is a positive relationship between technology innovation and corporate FS.

The Relationship Between Technology Innovation and SES

Due to the reduction of natural resources and the intensification of global warming issues, social and corporate stakeholders are paying more and more attention to corporate environmental and social sustainability (Albort-Morant et al., 2018; Davenport et al., 2019), which is different from only focusing on financial growth. In the face of this revolution, green technology innovation characterized by minimizing impacts on the environment by conserving energy and resources (Lee and Kim, 2011), providing companies with the opportunity to use win-win logic to increase innovation to improve competitiveness (Porter and Van der Linde, 1995; Kong et al., 2016; Ishak et al., 2017; Li et al., 2019). Because producing green products, low resource consumption, high cleanliness, etc. are the characteristics of the renewable energy company, the technology innovation of the renewable company is consistent with the meaning of green technology innovation, which makes positive contributions to the realization of environmental and social sustainable development goals (Xie et al., 2019). So, to sum up, this paper proposes hypothesis 2:

H2: There is a positive relationship between technology innovation and corporate SES.

The Role of Government Subsidies Between Technology Innovation and Corporate Sustainability

Because of the long investment return cycle, competitors’ imitation, and uncertainty (Staw and Dutton, 1981; McKinley et al., 2014), under-investment in innovation is obvious in the market (Arrow, 1972). Government subsidies are considered an important tool to solve market failure problems. Subsidies aim to show a signal effect, helping companies relieve financial pressure when doing innovation activities (Yu et al., 2020). However, government subsidies also bring many unexpected negative effects, especially when government subsidies are tremendous. Companies choose rent-seeking rather than innovation to enhance their short-term competitive advantage, excessive subsidies make rent-seeking activity and crowding-out effect more serious, hindering their promotion effect on innovation, which inhibit companies’ long-term development (Howell, 2017; Peng and Liu, 2018; Ahn et al., 2020; Guo et al., 2020). Therefore, this paper proposes hypothesis 3:

H3: There is a threshold effect of government subsidies, when government subsidies are greater than the threshold value, the contribution of technology innovation to FS would be weakened.

Based on stakeholder theory, companies must respond to the needs of stakeholders when making decisions to gain a competitive advantage (Roy and Goll, 2014). Therefore, the focus of stakeholders’ concerns will affect the operating direction of companies, especially those that have received government subsidies (Deng et al., 2020). With the increasing attention paid to the environment and society, to obtain government subsidies, companies will carry out more innovative activities to take more environmental and social responsibility, and companies that have received subsidies will also actively indicate to stakeholders that they attach importance to SES (Wang and Zhang, 2020). However, government subsidies may also have a crowding-out effect on technology innovation (Busom, 2000: Liu et al., 2019) and excessive government subsidies act as a substitution in the relationship between innovation and SES, thereby inhibiting innovation’s promotion to SES. Based on the analysis above, this paper proposes hypothesis 4:

H4a: Government subsidies have a positive moderating effect on the relationship between technology innovation and SES.

H4b: Government subsidies have a negative moderating effect on the relationship between technology innovation and SES.

Research Method

Data

This paper selects the data of China A-share listed companies from 2014 to 2019 in the field of renewable energy. The data of ESG rating and technology innovation comes from the Wind database, the data of government subsidies is collected from the companies’ annual reports, and the rest comes from the CSMAR. After excluding samples with ST, ST∗, and missing main variables, a panel data of 166 Chinese renewable energy companies is obtained (there are 830 observations) finally.

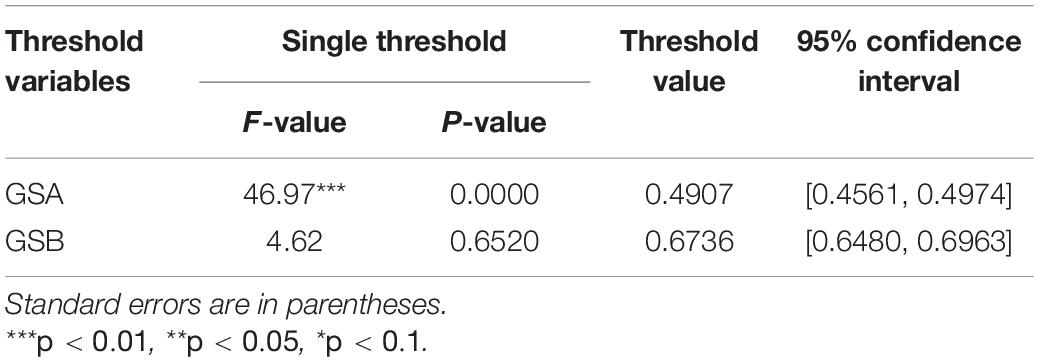

Variables

In this study, the dependent variables are the FS and SES, and the independent variable is technology innovation. Government subsidies are the threshold variable and the moderating variable. In addition, our study considers some control variables. The selected variables will be discussed separately later, and the definition of each variable is presented in Table 2.

Table 2. Independent variable, dependent variable, moderating (threshold) variable, and control variable definition.

Corporate Sustainability

This paper analyzes corporate sustainability from two dimensions: FS and SES. Firstly, for the FS, McKelvie and Wiklund (2010) indicates that companies with different types and companies in different periods show different growth characteristics. Higgins (1981) points out that FS reflects a company’s ability to use resources to obtain income. Tibor et al. (2015) and Peng and Liu (2018) define income as entrepreneurial companies’ growth capacities. However, revenue only reflects companies’ financial performance, not show the dynamic growth of the companies. Pandey (1994) and Zhao and Wijewardanab (2012) explained that in the long run, the company’s growth is an increase in company size and activities. Growth means that the company’s expansion activities involve sales, profits, and assets. Xu et al. (2020) point out that the FS is the maximum growth rate of operating revenue that can be achieved, and the average sales growth is a recurring indicator of performance because it discloses market acceptance and technical quality (Marino and De Noble, 1997; Utsch and Rauch, 2000), which is also regarded as an important parameter of corporate competitiveness (Bobillo et al., 2006; Ciro et al., 2020). Therefore, this paper selects the growth rate of operating revenue as an indicator of FS.

Sustainability needs to meet multiple aspects simultaneously (Elkington, 1998); FS alone cannot represent corporate sustainability (Gladwin et al., 1995). According to the “Triple bottom line” concept, society and environment are also two important parts of sustainability. So, this paper chooses ESG rating to measure SES. ESG is an important standard for measuring environmental protection and social responsibility of companies. The environmental rating takes into account waste of resources, green products, environmental violations, etc.; social rating is the concern for social contribution and external certification of the new energy company (Nirino et al., 2020). Nollet et al. (2016) believes that ESG rating is one of the best parameters for measuring the environmental, social, and business impact of the companies.

This paper selects Hua Zheng ESG Rating Index in the Wind database to measure the SES. Referring to the study of Zhang and Zhao (2019), we quantify the companies’ ESG performance as 0, if its ESG rating is BBB and below, and quantify the remaining companies’ ESG performance as 1.

Technology Innovation

Previous studies have used the intensity of R&D investment (Cumming et al., 2016), all intangible assets and capability (Sung, 2019), the proportion of technical staff, design or research, the proportion of sales or profits of new products (Chouaibi, 2020), and the number of patent applications (He et al., 2018; Plank and Doblinger, 2018) to measure technology innovation. It is a kind of strategic behavior that companies increase innovation inputs to raise profit opportunities (Clausen, 2009), and R&D investment can reflect companies’ efforts in promoting technology innovation and companies’ innovation ability (Hagedoorn and Cloodt, 2003). So, referring to the study of Xu et al. (2020), this paper uses the proportion of R&D expenditure to operating income to measure technology innovation.

Government Subsidies

Government subsidies are often measured by the natural logarithm of the total amount of government subsidies (Wu and Hu, 2020) or public expenditure for encouraging R&D and protection activities for industrial intellectual property (Sung, 2019). Hu et al. (2019) use the government subsidy amount reported under the non-operating income on the Statement of Financial Performance and divide it by the total assets as the indicator. Zhang and Guan (2021) choose the government subsidy amount in the annual report data of listed companies as the indicator. Combining the latest China Accounting Standards for government subsidies in 2017 and the study of Song et al. (2020), this paper uses government subsidies amount in deferred income and current income to measure government subsidies.

Control Variables

This paper selects five control variables based on previous studies: company size, equity concentration, return on total assets (ROA), company age, and capital structure.

The natural logarithm of revenue is used to measure the size of the company. The scale of a company is directly related to finances, and it is usually reflected in total assets, fixed assets, income, and the number of employees (Ahmedova, 2015). Considering that most of the renewable energy companies are in the start-up stage, revenue can more fully reflect the size of the company, so this paper chooses natural logarithm of revenue.

The capital structure is reflected by the debt-to-asset ratio. An increase of debt will aggravate financial risk and worsen capital constraints (Yu et al., 2020), and innovation is a risky activity with a long-lasting cycle (Li et al., 2020), so this paper chooses debt-to-asset ratio to measure the company’s risk situation.

ROA refers to the profitability of a company on its total assets. Return on total assets is usually defined as an accounting measure of performance (Waddock and Graves, 1997), which can be used to measure the company’s profitability. The most basic requirement of corporate sustainability is continuous profitability, so this paper chooses ROA as one of the control variables.

The H index is used to measure the concentration of equity. The share ratio of major shareholders may affect the way managers use government subsidies. Equity diversification can strengthen management supervision and restrain rent-seeking behavior (Yu et al., 2020). Equity concentration may lead to insufficient technology innovation activities because of “moral hazard” (Lin and Luan, 2020).

The company age. Young companies have additional resource constraints than old companies (Sung, 2019), and older companies have more time to accumulate knowledge and experience to support innovation (Li et al., 2020), so the company age is also an important control variable.

Econometric Model

Effect of Technology Innovation on FS and SES

According to the study of Hu et al. (2019) and Yang et al. (2019), this paper constructs the regression model (1) as below to test the impact of technology innovation on FS. Referring to Ben-Akiva and Lerman (1985), this paper constructs the regression model (2) to test the effect of technology innovation on SES:

where i is the firm and t is the year; μi is the unobservable firm-specific effect and ηt refers to the unobservable time-specific effect; and β is the coefficients of the effect of technology innovation on FS and SES. Size, Top1, ROA, Lev, and Age are included in control variables, which represent the heterogeneity of companies. εi,t refers to the random error term.

Threshold and Moderating Effect of Government Subsidies

Referring to Qing et al. (2021), existing studies typically add a quadratic term to the model or consider Hansen’s static threshold model. Hansen first proposed the threshold model (Hansen, 1999), which was used to describe the characteristics of skip or structural break as for the correlation between different variables. Seo and Shin (2016) proposed the first-difference GMM estimation of the dynamic panel threshold model. On this basis, this paper constructs the regression model (3) to test the threshold effect of government subsidies.

Hansen believes that the explanatory variable or the independent threshold variable can be set as the threshold variable. Therefore, when one of the threshold variables is selected, the other threshold variables could still be used as control variables. So, this paper selects government subsidies as the threshold.

Referring to Hong et al. (2019), Liu and Tsaur (2020), and Yu et al. (2020), this paper adds the interaction between government subsidies and technology innovation to construct the regression model (4) to test the moderating effect of government subsidies:

c1 denotes threshold values of the government subsidies. β1, β2 are the coefficients of the effect of technology innovation on FS under the single threshold effect of government subsidies. β3 indicates the impact of government subsidies on the effects of technology innovation on SES.

Empirical Results

Descriptive Statistics and Correlation Analysis

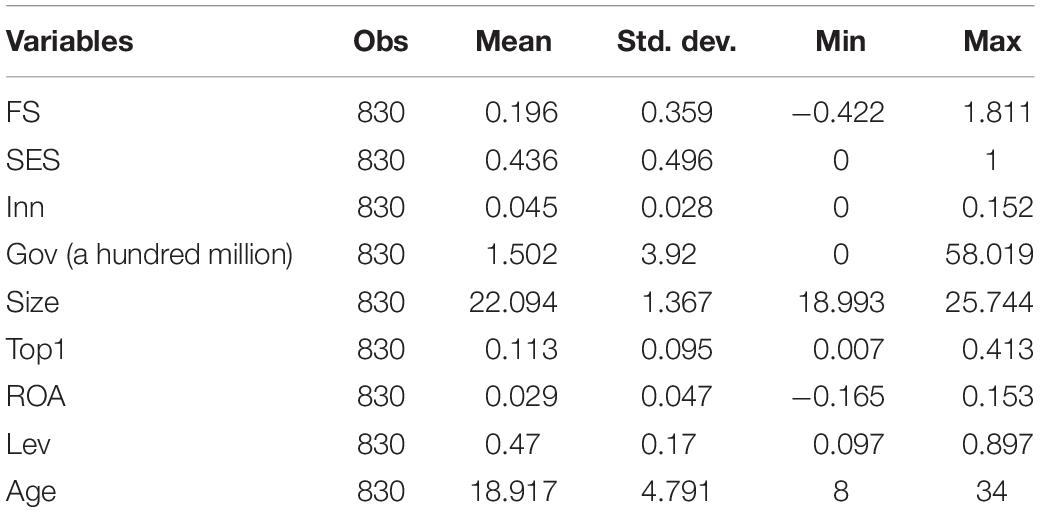

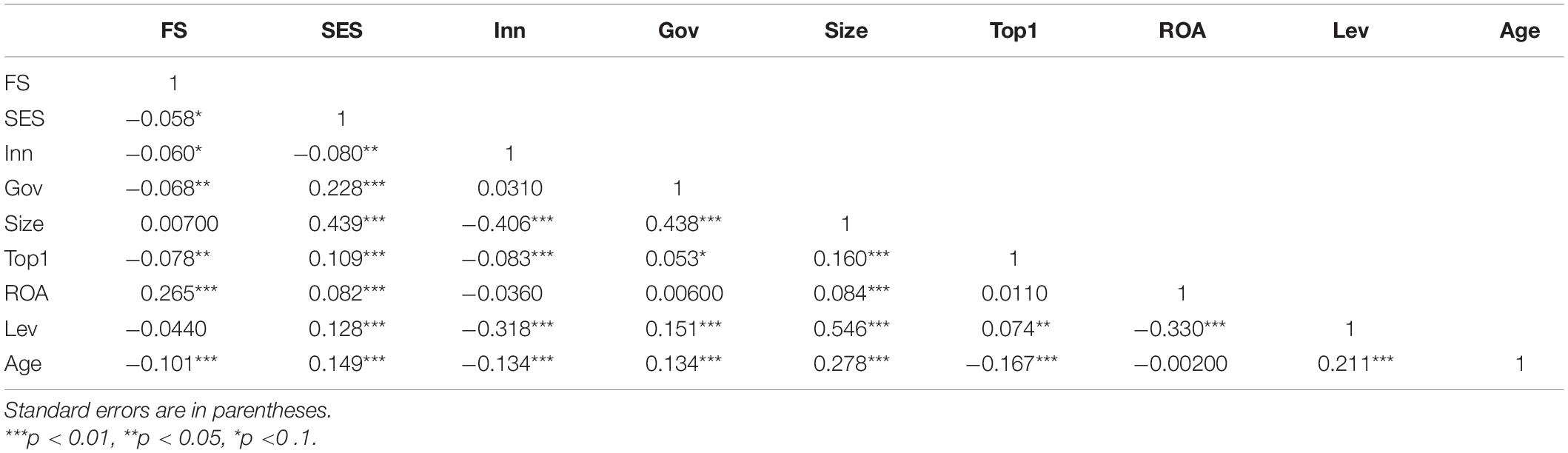

The descriptive statistics and correlations of dependent variables, independent variables, moderating (threshold) variable, and control variables are shown in Tables 3, 4, respectively.

The average of FS is 19.6%, the minimum is −42.2%, and the maximum is 181.1%, indicating that most of the sample companies are in the growth stage, but the development gap between companies is large; the average of SES is 0.436, indicating that the overall performance of the sample companies is relatively good in environment and society, and the standard deviation is 0.496, which means that there are differences in SES among different companies; R&D investment accounts for 4.5% of operating income, indicating that the sample companies focus on R&D investment and technology innovation as a whole; the average value of Gov is 1.502, indicating the government’s positive attitude toward the development of renewable energy companies, and the standard deviation is 3.92, indicating that government subsidies vary greatly among different companies.

This paper uses the Pearson method to analyze the correlation between variables. The results in Table 3 show that there is a high correlation between FS, SES, Gov, and Inn, indicating that the variables are statistically correlated. The correlation coefficient between the variables is low (<0.5), and VIF is >1 and <10, indicating that there is no interference of multicollinearity.

Regression Analysis

According to previous study results, technology innovation has a lag effect on companies’ development (Yun et al., 2008; Campbell, 2012; Yarden and Caldes, 2013; Xu et al., 2020), so this paper lags the technology innovation variables by 1 year. Referring to the studies of Roberts and Whited (2011); Sudarshan and Todd (2012), and Zhang et al. (2018), this paper avoids the endogenous problem between technology innovation and corporate sustainability through the practice of lagging technology innovation, and it is obvious that the current corporate sustainability has no impact on previous technology innovation. Besides, to eliminate the interference of outliers on the estimation results, this paper winsorizes our variables at the 1st and 99th percentiles.

The Relationship Between Technology Innovation and FS

The result of the Hausman test (P < 0.0000) shows that the fixed effects regression model is suitable. The regression analysis results are as follows:

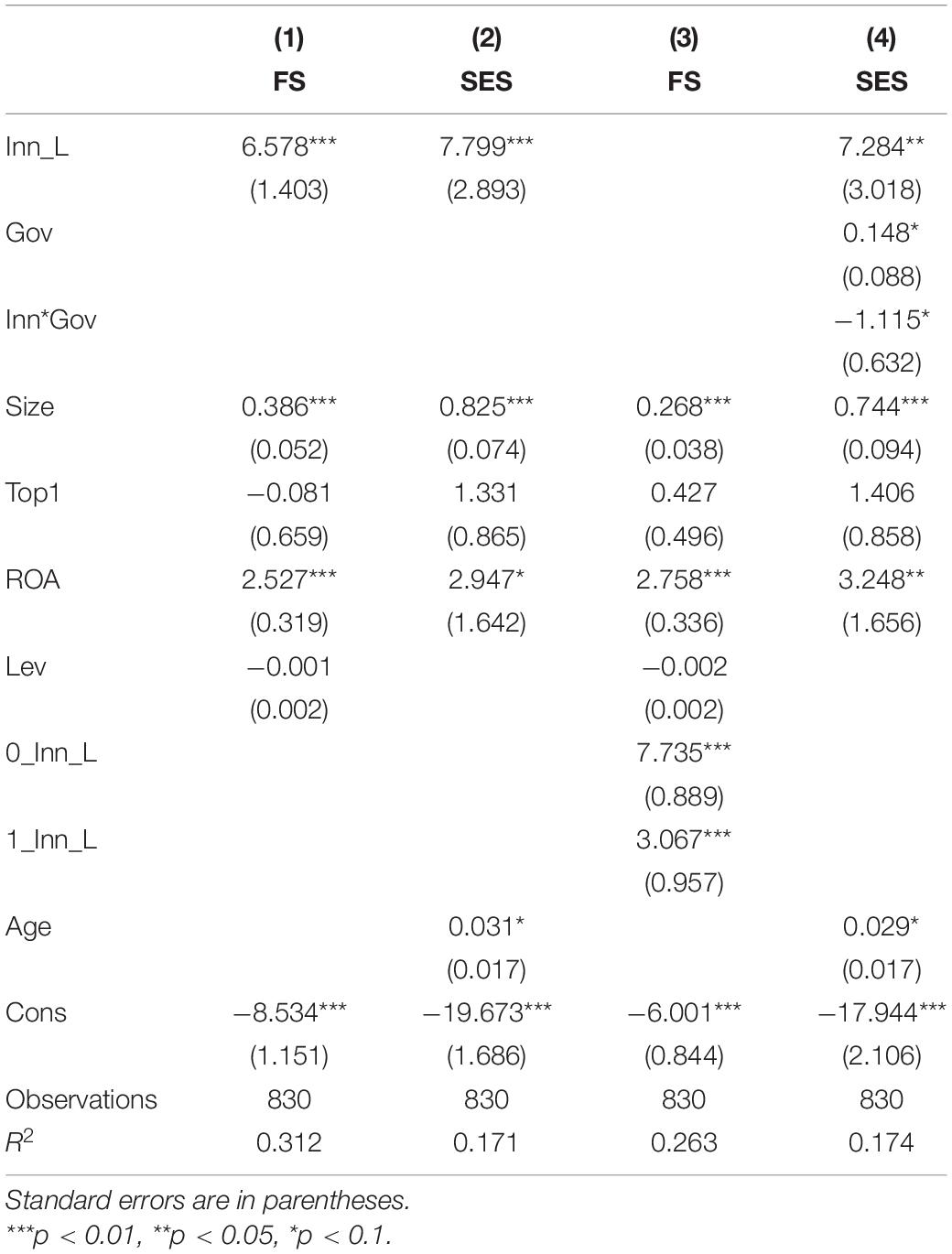

From the regression results of model (1) in Table 5, it can be seen that there is a significant positive relationship between Inn_L and FS (β = 6.578, p < 0.01), which means that technology innovation will promote the company’s FS. Therefore, hypothesis 1 is accepted. The reason may be that, on the one hand, the pioneer advantage gained by companies through technology innovation can help the company respond to rapid changes and the heterogeneity of markets (Chouaibi, 2020; Ma et al., 2021); on the other hand, technology innovation can provide organizations with continuous learning ability (Cheng et al., 2014).

The Relationship Between Technology Innovation and SES

Since ESG indicators are dummy variables, this paper uses the logit model to perform regression analysis. According to the regression results of model (2) in Table 5, Inn_L can promote corporate SES, so hypothesis 2 is accepted. It proves that renewable energy companies’ innovation has the characteristics of green technology innovation, which minimizes impacts on the environment by conserving energy and resources (Lee and Kim, 2011), is beneficial to reduce environmental impacts during a product’s life cycle (Christensen, 2011), and improves processes to reduce adverse environmental impacts. Renewable energy companies’ innovation brings them differentiation advantages (Cheng et al., 2014) and is beneficial to their SES.

The Role of Government Subsidies Between Technology Innovation and Corporate Sustainability

Threshold effect of government subsidies between technology innovation and FS

This paper uses government subsidies as the threshold variable. The result in Table 6 shows that only a single threshold model is significant at the 1% level. Additionally, a small confidence interval indicates that the threshold value is accurate; that is, the effect of Inn_L on FS has a single threshold effect of Gov. The estimated thresholds for Gov is 0.5181, and the 95% confidence interval for threshold values is [0.5066, 0.5193].

According to the regression results of model (3) in Table 5, we can find that if Gov exceeds the threshold, the promotion effect of Inn_L weakens. When the Gov is less than the threshold, a 1% increase of Inn_L results in a 7.735% increase in FS at the 1% significance level. When Gov exceeds the threshold, for every 1% increase in Inn_L, FS increases to 3.067% at the 1% significance level. The results show that technology innovation has a significant threshold effect on FS, so hypothesis 3 is accepted.

It means when government subsidies are greater than the threshold value, with the increase of government subsidies, the crowding-out effect emerges (Jiang and Yan, 2018). Excessive government subsidies would be wasted through various rent-seeking approaches (Wu and Hu, 2020), which weakens companies’ capability to innovate independently in the long term (Yu et al., 2020), that is, suppresses companies’ financial growth.

Moderating effect of government subsidies between technology innovation and SES

According to the regression results of model (4) in Table 5, the regression coefficient of the cross term between Gov and Inn_L is negative (p < 10%), indicating that Gov has a negative moderating effect on the promotion relationship between Inn_L and SES. Thus, hypothesis 4b is accepted.

The result suggests that government subsidies have a crowding-out effect on technology innovation (Liu et al., 2019; Busom, 2000) and excessive government subsidies act as a substitution in the relationship between innovation and SES, inhibiting the positive effect of technology innovation. Companies would choose rent-seeking to achieve short-term benefits (Lee et al., 2014; Du and Mickiewicz, 2016), instead of developing long-term environmental and social projects. Thus hindering the promotion of technology innovation on SES.

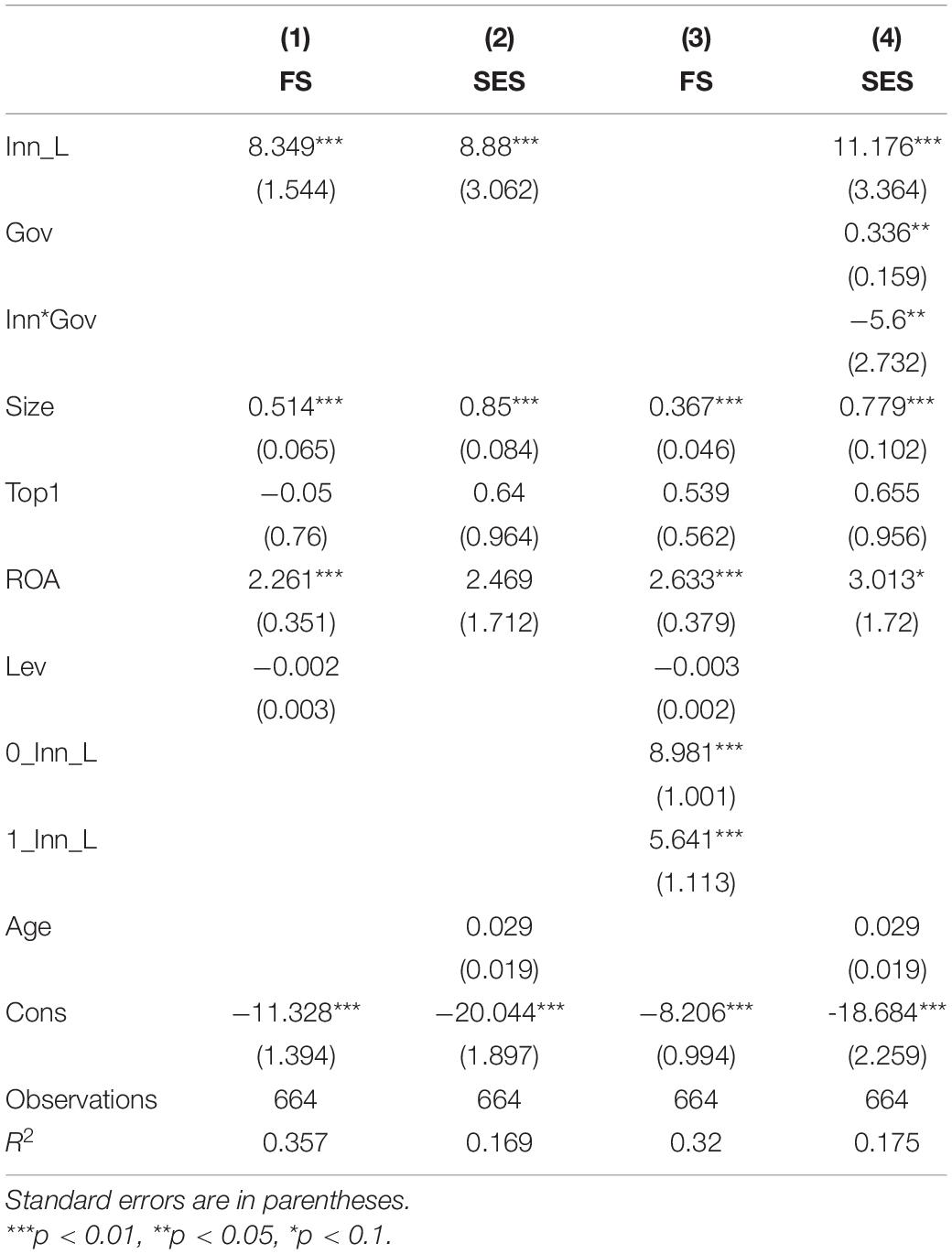

Robustness Test

In order to further verify the reliability of the study results and investigate the stability of the model, this paper adjusts the period of the sample, changing the study time to 2014–2018, to conduct a robustness test. The results are as above.

The results of the robustness test in Table 7 are consistent with previous regression in general, indicating that even if we change the time frame of the data and reduce the sample size, technology innovation still has a positive effect on financial, social, and environmental sustainability. Besides, excessive government subsidies weaken the role of technology innovation in promoting both FS and SES. These indicate that the model in this paper is robust and the study results also have certain reliability.

Discussion

Regional Heterogeneity

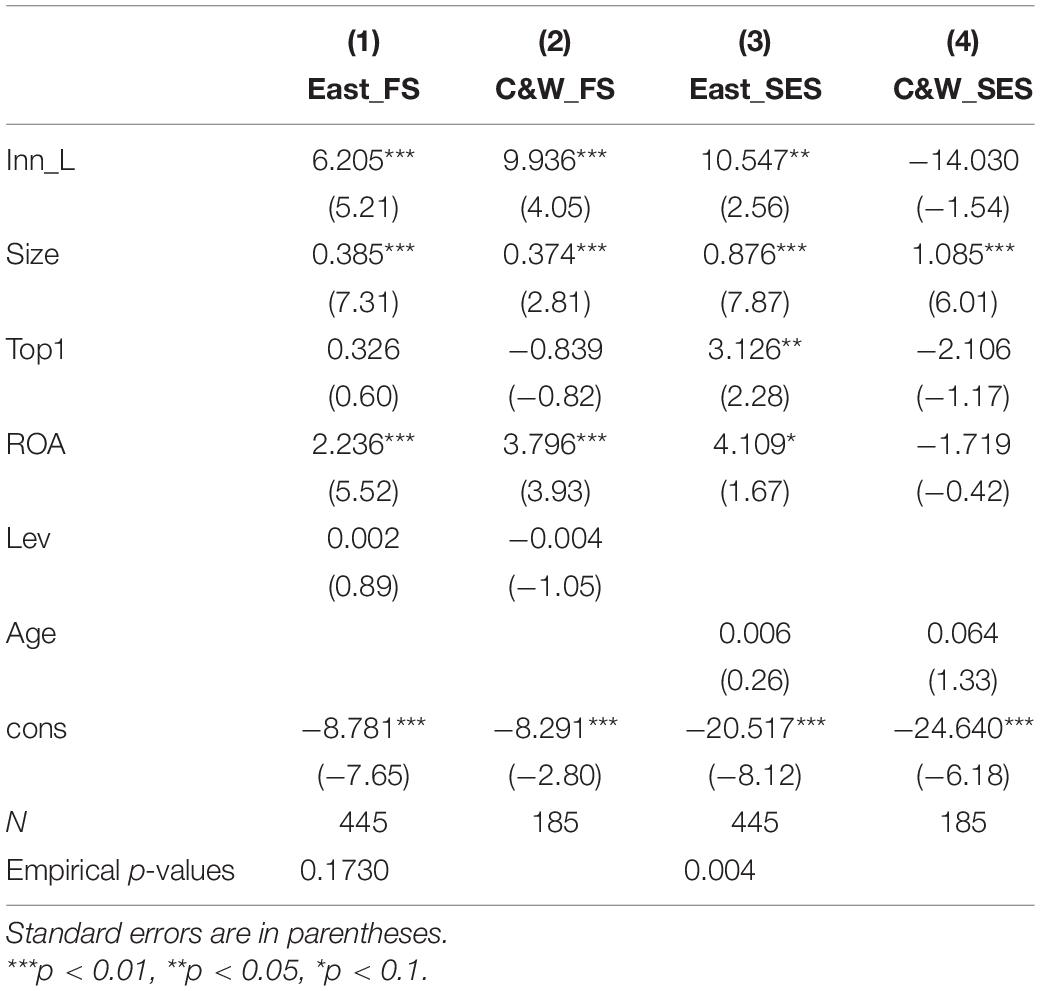

In order to further study whether the impact of technology innovation on corporate sustainability has regional heterogeneity, and according to the division of regions by the National Bureau of Statistic, we find that the east covers 445 samples, central covers 105 samples, and west covers 80 samples, which means that listed renewable energy companies are mainly located in the east, with a small number of samples in the central and west, and the development level of the central and west is relatively backward compared to the eastern regions, so this paper divides the region into the east and the central & west (C&W).

Grouping regression was carried out according to the region. The results of grouping regression are shown in Table 8. The empirical p-values are estimated based on the null hypothesis that the coefficients are equal for the two groups under consideration.

Effect of Technology Innovation on FS Between the East and C&W

According to the regression results of models (1) and (2) in Table 8, the coefficients of Inn_L in the two groups are 6.205 and 9.936, which are both significant at the 1% level; that is, Inn_L has a positive effect on FS. However, empirical p-value is 0.1730, suggesting that there is no significant difference in the coefficient of Inn_L between the two groups, which means that there is no difference in the promotion of technology innovation on FS between the east and the C&W.

The conclusion that the technology innovation of companies in the east and the C&W promotes the FS is consistent with the conclusion of Pandit et al. (2011), and their result shows that activities related to innovation have a positive impact on profits, while controlling the company’s leverage and its scale. A possible reason is that the technology innovation of companies can bring about a decrease in production and management costs, thereby increasing corporate profits and improving corporate financial performance. More importantly, Zhu et al. (2014) found that the accumulated technological progress will enhance the core competitiveness of the company, and external investors will be full of confidence in the future development of the company, so that the value of the company will continue to increase.

Effect of Technology Innovation on SES Between the East and C&W

From the regression results of models (3) and (4) in Table 8, it can be seen that there is a significant positive relationship between Inn_L and SES (β = 10.547, p < 0.05) in the east. However, Inn_L has no significant effect in the C&W. The empirical p-value is 0.004, suggesting that there is a significant difference in the coefficient of Inn_L between the two groups, which means that there is difference in the relationship of technology innovation and SES between the east and C&W.

A possible reason is that there are differences in the regional environmental and social development between the east and the C&W. Yang and Wen (2017) found that the green development efficiency of the east and the C&W presents a serious polarization pattern. Chen and Wang (2018) believed that due to population migration, the C&W are aging faster than the east. The study of Hu et al. (2018) found that the average urban land use efficiency of China is higher in the east than in the C&W under the concept of green development. The quality of industrial development between the east and the west has the biggest difference (Deng and Liu, 2021). The east is no longer in the stage of relying on pollutant emissions to promote economic growth, while the increase in population and resource consumption in the central region leads to more pollutant emissions, and the west region is weak in environmental protection (He and Ran, 2009). With the same technology innovation resources, the contribution value of the economic indicators such as “GDP,” “GDP per capita,” and “industrial added value” in the northwest is lower than that in the east (Zhu and Zhang, 2005).

Due to the imbalance of regional social and environmental development, there are corresponding differences between eastern and C&W companies in the performance of social responsibility and innovation capabilities. Firstly, there are different degrees of emphasis placed on environmental and social responsibility. The eastern companies have a deeper understanding of the concept of social responsibility and related standards (Deng and He, 2013). Second, there are differences in the practice of company social responsibility, which means that eastern companies are at the highest level in terms of social responsibility for shareholders, employees, and environmental resources and the construction of a social responsibility management system, while company social responsibility in the northwest is the lowest level in China (Dong and Liu, 2017). Third, there are differences in the company’s innovation capabilities. There are obvious regional differences in the distribution of corporate innovation capabilities, and it shows the same spatial pattern as China’s regional economic development (Wang and Gao, 2017). Thus, there is obvious regional heterogeneity in the impact of company technology innovation on SES. Compared with the C&W, the technology innovation of eastern companies has played a significant role in promoting SES.

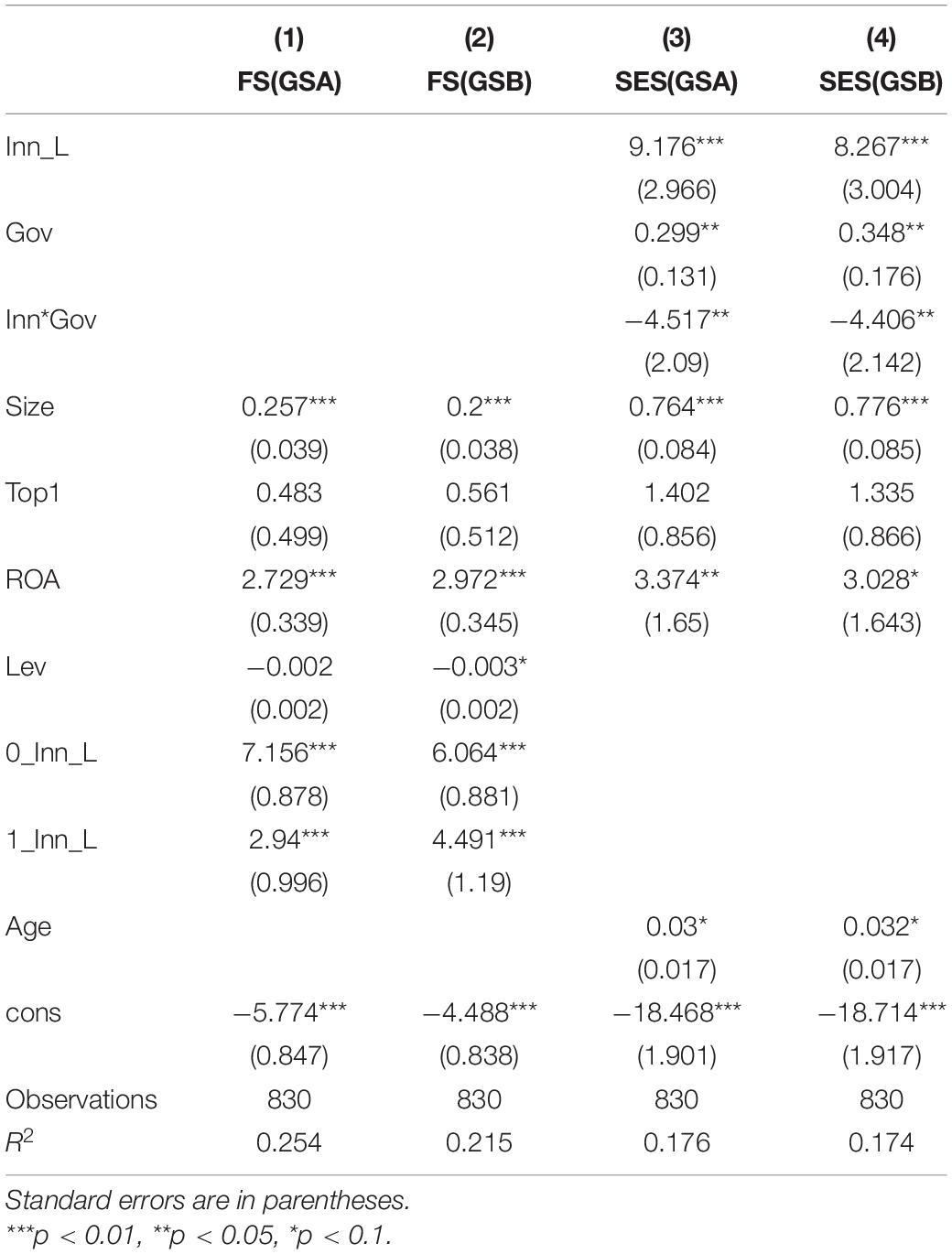

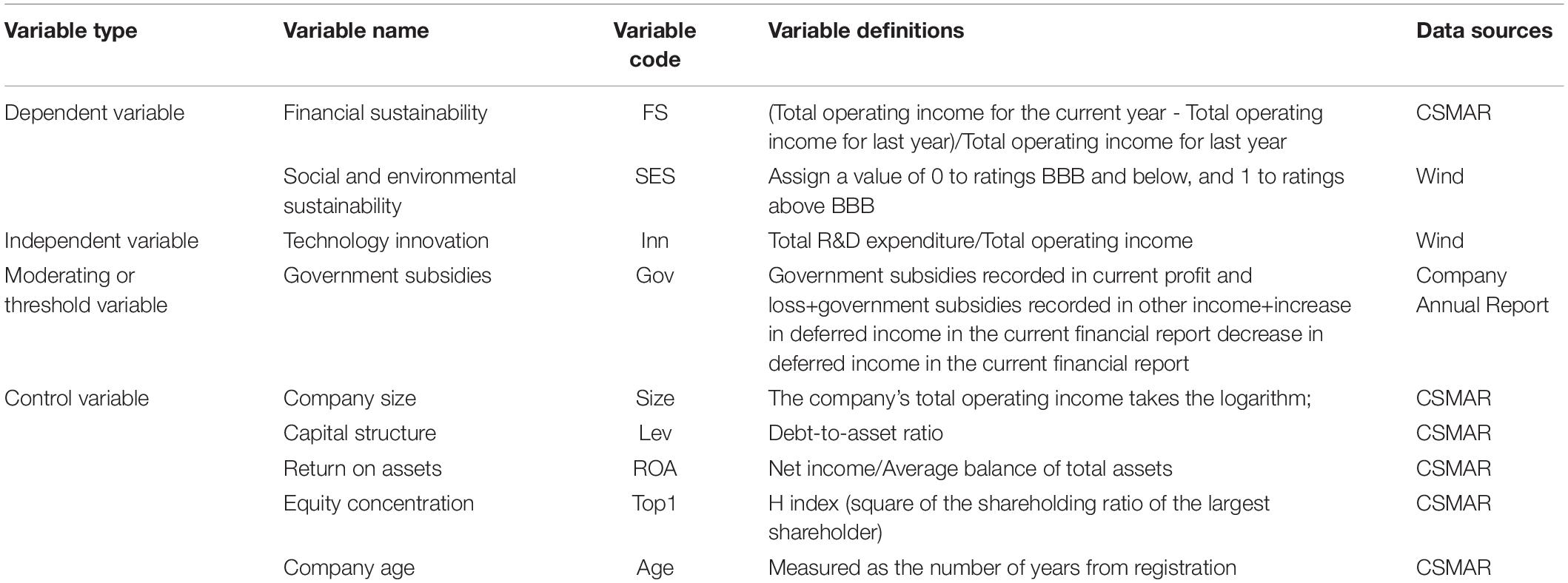

The Role of GSB and GSA

According to the “Accounting Standard for Business Enterprises No. 16–Government grants,” government subsidies received by companies can be subdivided into government subsidies related to assets and government subsidies related to income. Government subsidies related to assets refer to government subsidies obtained by companies for purchasing and constructing long-term assets. Government subsidies related to income refer to government subsidies other than government subsidies related to assets. Government subsidies related to income can be subdivided into those used to compensate the related costs or losses in the future period and those used to compensate the related costs or losses that have incurred. According to the time when companies receive the government subsidies, this paper defines those compensations for the related costs or losses that the company has incurred as GSA, and other subsidies as GSB. Taking the new energy vehicle industry as an example, subsidies for companies’ R&D investment, intellectual property awards, and establishment of R&D bases belong to the GSB. While price subsidies, exemption from purchase tax, and electricity subsidies can be classified as GSA. Referring to the study of Yu et al. (2020), we use the increase in deferred government subsidies in the current financial report to measure GSB and measure GSA as the amount of subsidies recorded in current profit and loss, and in other income after deducting the amortization of deferred income.

The Role of GSB

According to the regression results of model (2) and model (4) in Table 9, GSB inhabit the positive relationship between technology innovation and corporate sustainability.

The reason may be that the renewable energy industry is a technology-intensive industry; if companies want to gain a competitive advantage, they need to continue to carry out technology innovation. However, technology innovation requires a large amount of capital investment and has a high degree of uncertainty and spillover effects, which reduces the motivation for corporate innovation to a certain extent. The government needs to give certain subsidies and support before the start of the innovation project, that is, GSB. Because GSB are received before the investment in the project, they created a larger space for rent-seeking (Lee et al., 2014; Du and Mickiewicz, 2016; Wu and Hu, 2020). Therefore, when the threshold for subsidies is low, there are many companies attracted to squeeze into the renewable energy industry, especially large traditional energy companies (Peng and Liu, 2018). These large companies are more likely to receive subsidies due to their political connections, making start-ups that need subsidies for technology innovation unable to receive financial support. On the one hand, the intervention of several traditional energy companies has increased the intensity of competition in the renewable energy industry, and on the other hand, they have distorted the allocation efficiency of subsidies. Under the dual pressures of finance and excessive competition, the innovative motivation of renewable energy companies has weakened, which inhibits corporate sustainability.

The Role of GSA

According to the regression results of the threshold effect test in Table 10, only a single threshold model is significant at the 1% level for GSA, while GSB has no threshold effect. The estimated threshold for GSA is 0.4907, and the 95% confidence interval for threshold values is [0.4561, 0.4974]. In Table 8, When GSA exceed the threshold, for every 1% increase in technology innovation, the coefficient of financial growth decreases from 7.156 to 2.94%. The regression coefficient of the cross term between GSA and technology innovation is negative in model (3). These indicate that GSA are the main reason for the threshold effect of government subsidies and have a restraining effect on the relationship between technology innovation and corporate sustainability.

GSA aim to make up for the cost of completed projects, but they alleviate the promotion of technology innovation on corporate sustainability. Our results are different from the opinions of some scholars. Some scholars believe that GSA will be more effective than GSB (Peng and Liu, 2018), because GSA have a smaller rent-seeking space. This paper considers that although GSA are intended to help companies to expand market influence, if the actual production and sales capacity of renewable energy companies is not taken into account when formulating subsidy policies, only making the number of driving permits, registration certificates, and license plates reported as a basis for subsidies gives companies room to cheat for subsidies. Taking new energy vehicles as an example, 2013–2015 is a golden period for China to vigorously develop the new energy vehicle industry. The scope and amount of subsidies continue to expand, which provides opportunities for companies to cheat. For example, on September 8, 2016, the Ministry of Finance revealed that five new energy vehicle manufacturers, including Suzhou Jimxi Bus Manufacturing Co., Ltd., intended to defraud the government’s subsidies for more than one billion yuan. These companies used licenses without cars, cars without electricity, inconsistent signs, related parties and dealers idle, end-users idle, and other means to defraud government subsidies by inflating production quantity. On the one hand, cheating for subsidies reduces the efficiency of subsidies. Innovative companies that need subsidies fail to obtain funds, which undermines the companies’ enthusiasm for innovation. On the other hand, the actual sales situation is not taken into account in making the subsidy standards, falsely reporting their market influence through idle production after production or through expanding production blandly. GSA only play a role in mobilizing the companies’ enthusiasm in production, not promoting the enthusiasm for innovation, but have a negative impact on corporate sustainability.

Conclusion and Policy Implications

Conclusion

This study investigates the impact of technology innovation on corporate financial, social, and environmental sustainability and further investigates the mechanism of government subsidies in the relationship between technology innovation and corporate sustainability. A sample of 830 observations is obtained from the 166 A-share listed companies in the renewable energy industry of China from 2014 to 2019. The hypotheses are tested by the application of the fixed-effect model and the logit model. The following conclusions are drawn:

(1) Technology innovation will promote financial, social, and environmental sustainability.

(2) Technology innovation has a significant role in promoting FS in both the eastern and central and western regions; technology innovation has regional heterogeneity in SES and has a significant role in promoting the eastern and central and western regions.

(3) When the government subsidies are greater than the threshold value, the role of technology innovation in promoting FS is weakened.

(4) Government subsidies play a negative role in the relationship between technology innovation and SES).

(5) The threshold effect of subsidies mainly comes from the GSA, while the moderating effect of government subsidies is caused by both GSA and GSB.

Policy Implications

The objective of this paper is to empirically analyze the impact of technology innovation on corporate sustainability and investigate what role government subsidies play. This paper enriches the theoretical studies about the sustainable development of renewable energy companies. Furthermore, this paper puts forward the following policy implications:

First, refine the subsidy policy to achieve precise subsidies. At present, except for the new energy vehicles industry, most subsidy policies for the renewable energy industry are too broad, only suggesting policy directions without specifying specific implementation measures, so the operability is poor. Future policy formulation can be more precise and strengthen supervision and management during policy implementation.

Second, adjust the directions of subsidies. At present, the GSA and GSB in the renewable energy industry are not effective. Because GSB give space for rent-seeking, the future policies should focus on R&D subsidies and establishing a reasonable technical threshold. Improve market research work, and make technology standards adapt to market development. For GSA, the focus can be shifted to subsidies for supporting facilities and subsidies for consumers, as price subsidies and purchase subsidies may have negative effects such as blind production. Taking the new energy vehicle industry as an example, at present, China’s subsidies are mostly concentrated on the promotional subsidies; insufficient charging facilities are another important factor that limits the development of the new energy vehicle market. The government should adjust the directions of subsidies, to improve the market consumers’ acceptance of new energy vehicles. Besides, most of the current subsidies focused on companies and pay insufficient attention to consumers. The government can refer to the experience of other countries, such as the U.S. federal government to purchase new energy vehicles to take a slope-back tax credit and the U.S. state governments through electricity tariff relief and driving facilities and other supporting subsidies to reduce the cost of using new energy vehicles. Through subsidies to enable consumers to get real benefits, improve the efficiency of subsidies and expand the market influence of renewable energy companies.

Third, increase the stimulation for R&D. Because innovation is an important driving force to promote corporate sustainability, the government can put forward higher requirements for companies’ innovation, from subsidy driven gradually to policy promotion. The Chinese government has issued a number of subsidies to motivate companies to carry out R&D to increase innovation for many years, but the efficiency of subsidies has been undermined by the rent-seeking behavior. How to make companies’ innovation from encouraging to compulsory is the core of government policy-making. The Measures for the Parallel Management of Average Fuel Consumption and Points of New Energy Vehicles for Passenger Vehicle Companies, issued in September 2017, form a market-oriented mechanism to promote the coordinated development of energy-saving and new energy vehicles through the establishment of a point trading mechanism, which, to a certain extent, imposes mandatory requirements on the innovation. In the future, technology innovation not only needs to be driven by subsidy policy but also needs to be promoted by reward and punishment measures.

The subsidy policies can only play a role in guiding development; for companies in the context of high-quality development, how to enhance their innovation ability is the first way to achieve sustainable development. In the early stage of the COVID era, China’s renewable energy industry faces the dual pressure of subsidy declines and production shutdowns. The production and sales of new energy vehicles fell by about 50%, and a large number of wind power projects planned and under construction were difficult to complete. In the face of emergencies, the government has taken a lot of helping measures for the renewable energy industry, such as extending the subsidies for new energy vehicles for 2 years to 2022. In order to cut off the transmission path of the COVID-19 as far as possible, off-line production activities during the COVID era were strictly managed, and the advantages of automated production and cloud office gradually show out. Digitalization and intelligence are future transformation directions of companies. In the post-COVID era, guiding the renewable energy industry to accelerate the digitalization process and making technology innovation fully include digital transformation can be the focus of policy guidance. Companies should fully grasp the opportunity of intelligent transformation to better achieve corporate sustainability, that is, not only to apply intelligence and digitalization to product innovation, but also to promote it to management and governance innovation. This paper will further explore the relationship among different types of technology innovation, government subsidies, and corporate sustainability in the post-COVID era in the future study.

Our study has insightful results, but it also has some limitations. Due to limitations on data availability, we only collect panel data over a relatively short time period. As a result, we cannot investigate the long-term effects. We will try to integrate the long-term effect of technology innovation in the future.

Data Availability Statement

Publicly available datasets were analyzed in this study. This data can be found here: https://www.gtarsc.com/#/index, and Wind dataset.

Author Contributions

All authors listed have made a substantial, direct and intellectual contribution to the work, and approved it for publication.

Funding

This work was supported by Science Foundation of China University of Petroleum-Beijing (No. ZX20200109).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Acknowledgments

The data refers to the National Bureau of Statistics, and it is publicly available.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenrg.2021.638459/full#supplementary-material

References

Ahmedova, S. (2015). Factors for increasing the competitiveness of small and medium sized enterprises (SMEs) in Bulgaria. Procedia Soc. Behav. Sci. 195, 1104–1112. doi: 10.1016/j.sbspro.2015.06.155

Ahn, J. M., Lee, W., and Mortara, L. (2020). Do government R&D subsidies stimulate collaboration initiatives in private firms? Technol. Forecast. Soc. Change 151:119840. doi: 10.1016/j.techfore.2019.119840

Akwesi, A.-K. (2019). The resource-based view: a tool of key competency for competitive advantage. Probl. Perspect. Manag. 17, 143–152.

Albort-Morant, G., Leal-Rodríguez, A. L., and De Marchi, V. (2018). Absorptive capacity and relationship learning mechanisms as complementary drivers of green innovation performance. J. Knowl. Manag. 22, 432–452. doi: 10.1108/JKM-07-2017-0310

Anis, O. (2020). Technological innovation and sustainable development : does the stage of development matter? Environ. Impact Assessm. Rev. 83:106398. doi: 10.1016/j.eiar.2020.106398

Arrow, K. J. (1971). “The economic implications of learning by doing,” in Readings in the Theory of Growth, ed. F. H. Hahn (London: Palgrave Macmillan). doi: 10.1007/978-1-349-15430-2_11

Arrow, K. J. (1972). “Economic welfare and the allocation of resources for invention,” in Readings in Industrial Economics, ed. C. K. Rowley (London: Palgrave). doi: 10.1007/978-1-349-15486-9_13

Bakar, L. J. A., and Ahmad, H. (2010). Assessing the relationship between firm resources and product innovation performance: a resource−based view. Bus. Process Manag. J. 16, 420–435. doi: 10.1108/14637151011049430

Barney, J. B. (1991). Firm resources and sustained competitive advantage. J. Manag. 17, 99–120. doi: 10.1177/014920639101700108

Barney, J. B. (2001). Resource-based theories of competitive advantage: a ten-year retrospective on the resource-based view. J. Manag. 27, 643–650. doi: 10.1016/S0149-2063(01)00115-5

Batlle, C. (2011). A method for allocating renewable energy source subsidies among final energy consumer. Ener. Policy 39, 2586–2595. doi: 10.1016/j.enpol.2011.02.027

Beason, R., and Weinstein, D. (1996). Growth, economies of scale, and targeting in Japan (1955-1990). Rev. Econ. Statist. 78, 286–295. doi: 10.2307/2109930

Ben-Akiva, M. E. and Lerman, S. R. (1985). Discrete Choice Analysis: Theory and Application to Travel Demand. Cambridge, MA: MIT Press.

Bekhet, H. A., and Latif, N. W. A. (2018). The impact of technological innovation and governance institution quality on Malaysia’s sustainable growth: evidence from a dynamic relationship. Technol. Soc. 54, 27–40. doi: 10.1016/j.techsoc.2018.01.014

Bergström, F. (2000). Capital subsidies and the performance of firms. Small Bus. Econ. 14, 183–193. doi: 10.1023/A:1008133217594

Bobillo, A. M., Rodriguez Sanz, J. A., and Gaite, F. T. (2006). Innovation investment, competitiveness, and performance in industrial firms. Thunderb. Int. Bus. Rev. 48, 867–890. doi: 10.1002/tie.20126

Busom, I. (2000). An empirical evaluation of the effects of R&D subsidies. Econom. Innovat. N. Technol. 9, 111–148. doi: 10.1080/10438590000000006

Campbell, M. (2012). What a difference a year makes: time lag effect of information technology investment on firm performance. J. Organ. Comput. Electron. Commer. 22, 237–255. doi: 10.1080/10919392.2012.696944

Cancino, C. A., Ariel, I. L. P., Ramaprasad, A., and Syn, T. (2018). Technological innovation for sustainable growth: an ontological perspective. J. Clean. Product. 179, 31–41. doi: 10.1016/j.jclepro.2018.01.059

Chen, M., Sinha, A., Hu, K., and Shah, M. I. (2020). Impact of technological innovation on energy efficiency in industry 4.0 era: moderation of shadow economy in sustainable development. Technol. Forecast. Soc. Change 164:120521. doi: 10.1016/j.techfore.2020.120521

Chen, R., and Wang, M. (2018). Unbalanced economic development, population migration and regional differences of population aging——based on the research of 287 prefecture-level cities in China. J. Demogr. 40, 71–81.

Cheng, C. C. J., Yang, C. -l., and Sheu, C. (2014). The link between eco-innovation and business performance: a taiwanese industry context. J. Clean. Product. 64, 81–90. doi: 10.1016/j.jclepro.2013.09.050

Cheng, Y., Awan, U., Ahmad, S., and Tan, Z. (2020). How do technological innovation and fiscal decentralization affect the environment? A story of the fourth industrial revolution and sustainable growth. Technol. Forecast. Soc. Change 162:120398. doi: 10.1016/j.techfore.2020.120398

Chouaibi, J. (2020). Innovation and financial performance in manufacturing companies: an empirical study tunisian. J. Knowl. Econ. doi: 10.1007/s13132-020-00692-8

Christensen, T. B. (2011). Modularised eco-innovation in the auto industry. J. Cleaner Product. 19, 212–220. doi: 10.1016/j.jclepro.2010.09.015

Ciro, T., Matricano, D., Candelo, E., and Sorrentino, M. (2020). Crowdfunded and then? The role of intellectual capital in the growth of equity-crowdfunded companies. Measur. Bus. Excell. 24:31. doi: 10.1108/MBE-02-2020-0031

Clausen, T. H. (2009). Do subsidies have positive impacts on R&D and innovation activities at the firm level? Struct. Change Econ. Dynam. 20, 239–253. doi: 10.1016/j.strueco.2009.09.004

Cumming, D., Rui, O., and Wu, Y. P. (2016). Political instability, access to private debt, and innovation investment in China. Emerg. Mark. Rev. 29, 68–81. doi: 10.1016/j.ememar.2016.08.013

Davenport, M., Delport, M., Blignaut, J. N., Hichert, T., and van der Burgh, G. (2019). Combining theory and wisdom in pragmatic, scenario-based decision support for sustainable development. J. Environ. Plann. Manag. 62, 692–716. doi: 10.1080/09640568.2018.1428185

Deng, J., and Liu, R. (2021). Regional differences in the quality of China’s industrial development and its distribution dynamic evolution. Statist. Decis. 37, 92–96.

Deng, X., Xianyi, L., Schuler, D. A., Huan, L., and Xiaofei, Z. (2020). External corporate social responsibility and labor productivity: a S-curve relationship and the moderating role of internal CSR and government subsidy. Corpor. Soc. Responsibil. Environ. Manag. 27, 393–408. doi: 10.1002/csr.1877

Deng, Z., and He, Y. (2013). The difference and improvement of corporate social responsibility: the perspective of regional classification comparison. Tianjin Soc. Sci. 5, 97–100.

Diaz Arias, A., and van Beers, C. (2013). Energy subsidies, structure of electricity prices and technological change of energy use. Ener. Econom. 40, 495–502. doi: 10.1016/j.eneco.2013.08.002

Dong, S., and Liu, H. (2017). Analysis of the regional differences in the performance of social responsibilities of the enterprises under the state-owned assets supervision and administration commission. Commer. Account. 22–24.

Du, J., and Mickiewicz, T. (2016). Subsidies, rent seeking and performance: being young, small or private in China. J. Bus. Ventur. 31, 22–38. doi: 10.1016/j.jbusvent.2015.09.001

Elkington, J. (1998). Partnerships from cannibals with forks: the triple bottom line of 21st-century business. Environ. Qual. Manag. 8, 37–51. doi: 10.1002/tqem.3310080106

Gladwin, T., Kennelly, J., and Krause, T. (1995). Shifting paradigms for sustainable development: implications for management theory and research. Acad. Manage. Rev. 20, 874–907. doi: 10.5465/amr.1995.9512280024

Guerrero-Villegas, J., Sierra-García, L., and Palacios-Florencio, B. (2018). The role of sustainable development and innovation on firm performance. Corpor. Soc. Responsibil. Environ. Manag. 25, 1350–1362. doi: 10.1002/csr.1644

Guo, F., Zou, B., Zhang, X., Bo, Q., and Li, K. (2020). Financial slack and firm performance of SMMEs in China: Moderating effects of government subsidies and market-supporting institutions. Int. J. Product. Econom. 223:107530. doi: 10.1016/j.ijpe.2019.107530

Hagedoorn, J., and Cloodt, M. (2003). Measuring innovative performance: is there an advantage in using multiple indicators? Res. Pol. 32, 1365–1379. doi: 10.1016/S0048-7333(02)00137-3

Hameed, W. U., Nisar, Q. A., and Wu, H.-C. (2020). Relationships between external knowledge, internal innovation, firms’ open innovation performance, service innovation and business performance in the Pakistani hotel industry. Int. J. Hospital. Manag. 92:102745. doi: 10.1016/j.ijhm.2020.102745

Hansen, B. E. (1999). Threshold effects in non-dynamic panels: estimation, testing, and inference. J. Econ. 93, 345–368. doi: 10.1016/S0304-4076(99)00025-1

He, C., and Ran, M. (2009). Environmental pollution and economic growth——a study on regional differences based on inter-provincial panel data. China Popul. Resourc. Environ. 19, 56–62.

He, Z.-X., Xu, S.-C., Li, Q.-B., and Zhao, B. (2018). Factors that influence renewable energy technological innovation in China: a dynamic panel approach. Sustain. Times 10:124. doi: 10.3390/su10010124

Hong, J., She, Y., Wang, S., and Dora, M. (2019). Impact of psychological factors on energy-saving behavior: moderating role of government subsidy policy. J. Clean. Product. 232, 154–162. doi: 10.1016/j.jclepro.2019.05.321

Howell, A. (2017). Picking ‘winners’ in China: do subsidies matter for indigenous innovation and firm productivity? China Econom. Rev. 44, 154–165. doi: 10.1016/j.chieco.2017.04.005

Hu, B., Li, J., and Kuang, B. (2018). Evolutionary characteristics and influencing factors of urban land use efficiency differences under the concept of green development. Econom. Geogr. 38, 183–189.

Hu, J., Jiang, H., and Holmes, M. (2019). Government subsidies and corporate investment efficiency: Evidence from China. Emerg. Mark. Rev. 41:658. doi: 10.1016/j.ememar.2019.100658

Ireland, R. D., Hitt, M. A., Camp, S. M., and Sexton, D. L. (2001). Integrating entrepreneurship and strategic management actions to create firm wealth. AMP 15, 49–63. doi: 10.5465/ame.2001.4251393

Ishak, I., Jamaludin, R., and Abu, N. H. (2017). Green technology concept and Implementation: a brief review of current development. Adv. Sci. Lett. 23, 8558–8561. doi: 10.1166/asl.2017.9928

Jawad, A., and Mustafa, S. (2019). Impact of knowledge management practices on green innovation and corporate sustainable development: a structural analysis. J. Clean. Product. 229, 611–620. doi: 10.1016/j.jclepro.2019.05.024

Jiang, W., and Yan, Z. (2018). The certification effect of R&D subsidies from the central and local governments: evidence from China. R D Manag. 8, 615–626. doi: 10.1111/radm.12333

Jiang, Z., Lyu, P., Ye, L., and Zhou, Y. W. (2020). Green innovation transformation, economic sustainability and energy consumption during China’s new normal stage. J. Clean. Product. 273:123044. doi: 10.1016/j.jclepro.2020.123044

Kamara, J. M., Anumba, C. J., and Carrillo, P. M. (2002). A clever approach to selecting a knowledge management strategy. Int. J. Proj. Manag. 20, 205–211. doi: 10.1016/S0263-7863(01)00070-9

Kang, K. N., and Park, H. (2012). Influence of Government R & D support and inter-firm collaborations on innovation in korean biotechnology SMEs. Technovation 32, 68–78. doi: 10.1016/j.technovation.2011.08.004

Klewitz, J., and Hansen, E. G. (2014). Sustainability-oriented innovation of SMEs: a systematic review. J. Clean. Product. 65, 57–75. doi: 10.1016/j.jclepro.2013.07.017

Kong, T., Feng, T., and Ye, C. (2016). Advanced manufacturing technologies and green innovation: the role of internal environmental collaboration. Sustainability 8:1056. doi: 10.3390/su8101056

Kuncoro, W., and Suriani, W. O. (2017). Achieving sustainable competitive advantage through product innovation and market driving. Asia Pac. Manag. Rev. 23, 186–192. doi: 10.1016/j.apmrv.2017.07.006

Lee, E., Walker, M., and Zeng, C. (2014). Do Chinese government subsidies affect firm value? Account. Org. Soc. 39, 149–169. doi: 10.1016/j.aos.2014.02.002

Lee, K. H., and Kim, J. W. (2011). Integrating suppliers into green product innovation development: an empirical case study in the semiconductor industry. Bus. Strat. Environ. 20, 527–538. doi: 10.1002/bse.714

Li, G., Wang, X., Su, S., and Su, Y. (2019). How green technological innovation ability influences enterprise competitiveness. Technol. Soc. 59:101136. doi: 10.1016/j.techsoc.2019.04.012

Li, Q., Wang, M., and Xiangli, L. (2020). Do government subsidies promote new-energy firms’ innovation? Evidence from dynamic and threshold models. J. Clean. Product. 286.

Lim, C. Y., Wang, J., and Cheng (Colin), Z. (2017). China’s “Mercantilist” government subsidies, the cost of debt and firm performance. J. Bank. Finan. 86, 37–52. doi: 10.1016/j.jbankfin.2017.09.004

Lin, B., and Benjamin, N. I. (2017). Green development determinants in China: a non-radial quantile outlook. J. Clean. Product. 162, 764–775. doi: 10.1016/j.jclepro.2017.06.062

Lin, B., and Luan, R. (2020). Do government subsidies promote efficiency in technological innovation of China’s photovoltaic enterprises? J. Clean. Product. 254:120108. doi: 10.1016/j.jclepro.2020.120108

Lin, B., and Zhu, J. (2019). The role of renewable energy technological innovation on climate change: Empirical evidence from China. Sci. Total Environ. 659:449. doi: 10.1016/j.scitotenv.2018.12.449

Lin, W.-L., Cheah, J.-H., Azali, M., Ho, J. A., and Yip, N. (2019). Does firm size matter? Evidence on the impact of the green innovation strategy on corporate financial performance in the automotive sector. J. Clean. Product. 229, 974–988. doi: 10.1016/j.jclepro.2019.04.214

Liu, D., Chen, T., Liu, X., and Yu, Y. (2019). Do more subsidies promote greater innovation? Evidence from the Chinese electronic manufacturing industry. Econom. Model. 80, 441–452. doi: 10.1016/j.econmod.2018.11.027

Liu, H. T., and Tsaur, R. C. (2020). The theory of reasoned action applied to green smartphones: moderating effect of government subsidies. Sustainability 12:5979. doi: 10.3390/su12155979

Liu, Z., Li, X., Peng, X., and Lee, S. (2020). Green or nongreen innovation? Different strategic preferences among subsidized enterprises with different ownership types. J. Clean. Product. 245:118786. doi: 10.1016/j.jclepro.2019.118786

Long, J. B. D., and Summers, L. H. (1991). Equipment investment and economic growth. J. Bradford Longs Work. Pap. 106, 445–502.

Lucas, M. (2010). Understanding environmental management practices: integrating views from strategic management and ecological economics. Bus. Strat. Environ. 19, 543–556. doi: 10.1002/bse.662

Ma, Y., Zhang, Q., and Yin, Q. (2021). Top management team faultlines, green technology innovation and firm financial performance. J. Environ. Manag. 285:112095. doi: 10.1016/j.jenvman.2021.112095

Marino, K. E., and De Noble, A. F. (1997). Growth and early returns in technology-based manufacturing ventures. J. High Technol. Manag. Res. 8, 225–242. doi: 10.1016/S1047-8310(97)90004-3

McKelvie, A., and Wiklund, J. (2010). Advancing firm growth research: a focus on growth mode instead of growth rate. Entrep. Theory Pract. 34, 261–288. doi: 10.1111/j.1540-6520.2010.00375.x

McKinley, W., Scott, L., and Michael, B. (2014). Organizational decline and innovation: turnarounds and downward spirals. Acad. Manag. Rev. 39, 88–110. doi: 10.5465/amr.2011.0356

Nirino, N., Santoro, G., Miglietta, N., and Quaglia, R. (2020). Corporate controversies and company’s financial performance: exploring the moderating role of ESG practices. Technol. Forecast. Soc. Change 162:120341. doi: 10.1016/j.techfore.2020.120341

Nitsch, V. (2009). Die another day: duration in german import trade. Rev. World Econ. 145, 133–154. doi: 10.1007/s10290-009-0008-3

Nollet, J., Filis, G., and Mitrokostas, E. (2016). Corporate social responsibility and financial performance: a non-linear and disaggregated approach. Econ. Model. 52, 400–407. doi: 10.1016/j.econmod.2015.09.019

Østergaard, P., and Sperling, K. (2014). Towards sustainable energy planning and management. Int. J. Sustain. Ener. Plann. Manag. 1, 1–5. doi: 10.5278/ijsepm.2014.1.1

Pandit, S., Charles, E. W., and Zach, T. (2011). The effect of R&D inputs and outputs on the relation between the uncertainty of future operating performance and R&D expenditures. J. Account. Audit. Finan. 26:15255.

Patterson, M. L. (1998). From experience: linking product innovation to business growth. J. Product. Innovat. Manag. 15, 390–402. doi: 10.1111/1540-5885.1550390

Peng, H., and Liu, Y. (2018). How government subsidies promote the growth of entrepreneurial companies in clean energy industry: an empirical study in China. J. Clean. Product. 188, 508–520. doi: 10.1016/j.jclepro.2018.03.126

Pitelis, A., Vasilakos, N., and Chalvatzis, K. (2019). Fostering innovation in renewable energy technologies: choice of policy instruments and effectiveness. Renew. Ener. 151, 1163–1172. doi: 10.1016/j.renene.2019.11.100

Plank, J., and Doblinger, C. (2018). The firm-level innovation impact of public R&D funding: evidence from the German renewable energy sector. Ener. Policy 113, 430–438. doi: 10.1016/j.enpol.2017.11.031

Porter, M. E., and Van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econom. Perspect. 9, 97–118. doi: 10.1257/jep.9.4.97

Qiao, H., and Su, Q. (2020). Impact of government subsidy on the remanufacturing industry. Waste Manag. 120, 433–447. doi: 10.1016/j.wasman.2020.10.005

Qing, L., Wang, M., and Xiangli, L. (2021). Do government subsidies promote new-energy firms’ innovation? Evidence from dynamic and threshold models. J. Clean. Product. 286:124992. doi: 10.1016/j.jclepro.2020.124992

Roberts, M. R., and Whited, T. M. (2011). Endogeneity in empirical corporate finance. Sim. Sch. Work. Pap. 11, 11–29. doi: 10.2139/ssrn.1748604

Roy, A., and Goll, I. (2014). Predictors of various facets of sustainability of nations: the role of cultural and economic factors. Int. Bus. Rev. 23, 849–861. doi: 10.1016/j.ibusrev.2014.01.003

Saunila, M., Nasiri, M., Ukko, J., and Rantala, T. (2019). Smart technologies and corporate sustainability: the mediation effect of corporate sustainability strategy. Comput. Indust. 108, 178–185. doi: 10.1016/j.compind.2019.03.003

Seo, M. H., and Shin, Y. (2016). Dynamic panels with threshold effect and endogeneity. Economics 195, 169–186. doi: 10.1016/j.jeconom.2016.03.005

Solarin, S. A., and Bello, M. O. (2019). Energy innovations and environmental sustainability in the U.S.: the role of immigration and economic expansion using a maximum likelihood method. Sci. Tot. Environ. 712:135594. doi: 10.1016/j.scitotenv.2019.135594

Soltani-Sobh, A., Heaslip, K., Stevanovic, A., Bosworth, R., and Radivojevic, D. (2017). Analysis of the electric vehicles adoption over the United States. Transportat. Res. Proc. 22, 203–212. doi: 10.1016/j.trpro.2017.03.027

Song, J., Zhang, H., and Su, Z. (2020). Does capitalization reflect innovation?–Evidence from Firms receiving R&D subsidy. Account. Res. 6, 3–23.

Staw, B. M., and Dutton, S. J. E. (1981). Threat rigidity effects in organizational behavior: a multilevel analysis. Administr. Q. 26, 501–524. doi: 10.2307/2392337

Su, X., and Zhou, S. (2019). Ambidextrous innovation and firm competitive position: empirical evidence from listed companies in China. South China J. Econom. 38, 52–77.

Su, Y., and An, X. -I. (2018). Application of threshold regression analysis to study the impact of regional technological innovation level on sustainable development. Renew. Sustain. Ener. Rev. 89, 27–32. doi: 10.1016/j.rser.2018.03.005

Sudarshan, J., and Todd, T. M. (2012). The role of stock liquidity in executive compensation. Account. Rev. 87, 537–563. doi: 10.2308/accr-10204

Sung, B. (2019). Do government subsidies promote firm-level innovation? Evidence from the Korean renewable energy technology industry. Ener. Policy 132, 1333–1344. doi: 10.1016/j.enpol.2019.03.009

Tibor, T., Edina, K., and Laurentiu, D. (2015). Risk and growth analysis of small and medium size enterprises between 2010 and 2012. Proc. Econ. Financ. 32, 1323–1331. doi: 10.1016/S2212-5671(15)01509-9

Tzelepis, D., and Skuras, D. (2004). The effects of regional capital subsidies on firm performance: an empirical study. Small Bus. Enterprise Dev. 11, 121–129. doi: 10.1108/14626000410519155

UNCTAD (2018). Technology and Innovation Report 2018: Harnessing Frontier Technologies for Sustainable Development. Geneva: United Nations Publication.

Utsch, A., and Rauch, A. (2000). Innovativeness and initiative as mediators between achievement orientation and venture performance. Eur. J. Work Organ. Psychol. 9, 45–62. doi: 10.1080/135943200398058

VanderPal, G. A. (2015). Impact of R&D expenses and corporate financial performance. J. Account. Finan. 15, 135–149.

Veland, R., and Shqipe, G. (2011). Theoretical framework of innovation: competitiveness and innovation program in macedonia. Eur. J. Soc. Sci. 23, 268–276.

Villasalero, M. (2017). A resource-based analysis of realized knowledge relatedness in diversified firms. J. Bus. Res. 71, 114–124. doi: 10.1016/j.jbusres.2016.10.011

Waddock, S. A., and Graves, S. B. (1997). The corporate social performance-financial performance link. Strateg. Manag. J. 18, 303–319.

Wang, B., Wang, Q., Wei, Y.-M., and Li, Z.-P. (2018). Role of renewable energy in China’s energy security and climate change mitigation: an index decomposition analysis. Renew. Sustain. Ener. Rev. 90, 187–194. doi: 10.1016/j.rser.2018.03.012

Wang, P., and Gao, Y. (2017). An empirical study on the differences of regional innovation ability in China–a comment on the influencing factors of regional innovation ability. J. Nanj. Univ. Technol. (Soc. Sci. Ed.) 16, 121–128.

Wang, Y., and Zhang, Y. (2020). Do state subsidies increase corporate environmental spending? Int. Rev. Finan. Anal. 72:101592. doi: 10.1016/j.irfa.2020.101592

Wang, Y., Zhang, D., Ji, Q., and Shi, X. (2020). Regional renewable energy development in China: a multidimensional assessment. Renew. Sustain. Ener. Rev. 124:565.

WCED (1987). World Commission on Environment and Development. Our Common Future. New York, NY: Oxford University Press.

Wernerfelt, B. (1984). A resource-based view of the firm. Strat. Mgmt. 5, 171–180. doi: 10.1002/smj.4250050207