- 1Department of Econometrics, Sakarya University, Sakarya, Turkey

- 2College of Business Administration, Abu Dhabi University, Abu Dhabi, United Arab Emirates

- 3Department of Economics, Ankara Yıldırım Beyazıt University, Ankara, Turkey

- 4Nord University Business School, Bodø, Norway

Energy is a crucial development indicator of production, consumption, and nation-building. However, energy diversification highlighting renewables remains salient in economic development across developing economies. This study explores the economic impact of renewables (RE) and fossil fuel (NRE) utilization in 17 emerging nations. We use annual data with timeframe between 1980 and 2016 and propose a bootstrap panel causality approach with a Fourier function. This allows the examination of multiple structural breaks, cross-section dependence, and heterogeneity across countries. We validate four main hypotheses on the causal links attached to the energy consumption (EC)-growth nexus namely neutrality, conservation, growth, and feedback hypotheses. The findings reveal a causal relationship running from RE to GDP for Brazil, Egypt, Indonesia, Korea, Pakistan, and the Philippines, confirming the growth hypothesis. Besides, the results validate the conservation hypothesis with causality from GDP to RE for China, Colombia, Egypt, Greece, India, Korea, South Africa, and Turkey. We identify causality from NRE to GDP for Pakistan, Mexico, Malaysia, Korea, India, Greece, Egypt, and Brazil; and from GDP to NRE for Thailand, Peru, Malaysia, India, Greece, Egypt, and Colombia. We demonstrate that wealth creation can be achieved through energy diversification rather than relying solely on conventional energy sources.

Introduction

Energy has long been considered a substantial driver of economic growth, and traditional energy demand, following an upward trend for many decades (Sadorsky, 2009; Ellabban et al., 2014). However, from the beginning of the century, countries have been exposed to different energy-connected issues worldwide, and the reliance on conventional energy has generated grave international concerns (Owusu and Asumadu, 2016). It has become common knowledge that increasing use of conventional energy sources such as oil, petroleum, and coal, to achieve economic growth—is associated with severe environmental degradation that affects both environment and human health. Nevertheless, emerging nations consider restrictions on carbon-intensive energy as harmful to actions targeted toward development (Edenhofer et al., 2014). Thus, industrial states are forced to create and finance schemes to deal with climate change primarily driven by industrial operations. These problems propelled international communities and institutions to search for regular energy alternatives (Ozturk and Bilgili, 2015). Besides, specialists highlight that cleaner energy sources can actively mitigate carbon emissions and preserve environmental quality (Yildirim, 2014; Owusu and Asumadu, 2016; Danish et al., 2017). Therefore, a vast literature that unpacks the story of complex energy (EC)–growth nexus exists (Wolde-Rufael, 2009; Sarkodie et al., 2020).

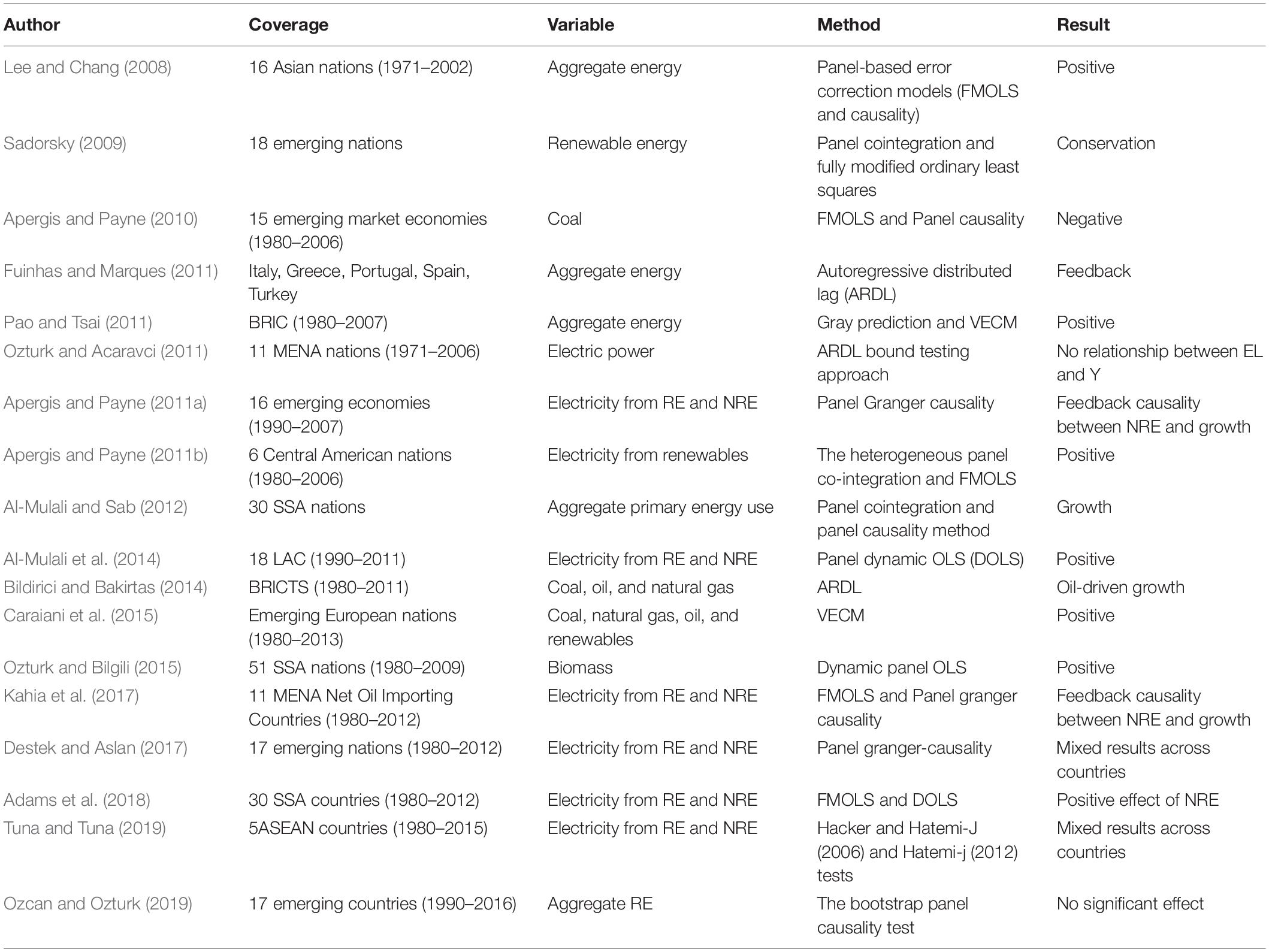

A broad array of scholars has explored the dynamic nexus between clean energy and development for various countries via regional panel data sets using various methodologies and documented mixed empirical findings. For example, some scholars demonstrate a positive relationship between energy consumption (either renewable or non-renewable) and economic growth, such as Apergis and Payne (2011b), Al-Mulali et al. (2014), Pao et al. (2014), Cetin (2016), Destek (2016), Afonso et al. (2017), Adams et al. (2018), Venkatraja (2019), Le and Sarkodie (2020), among others. By contrast, other scholars reveal a negative relationship between energy consumption and economic growth. Higher consumption of energy, viz. energy intensity imposes negative consequences on economic development, as demonstrated by Apergis and Payne (2010); Ocal and Aslan (2013), Maji (2015); Venkatraja (2019), Awodumi and Adewuyi, 2020. Between positive and negative impact, some studies demonstrate a neutral effect between energy consumption and growth —which means that higher or lower energy consumption has no impact on economic growth, as demonstrated by Ozturk and Acaravci (2011); Aïssa et al. (2014), Ozcan and Ozturk (2019); Razmi et al. (2020), among others.

The mixed empirical findings that examine the causality between energy and economy can be categorized into four main hypotheses namely the neutrality, conservation, growth, and feedback theories (Ozturk, 2010; Payne, 2010). The neutrality hypothesis highlights no causal link between energy and growth such that structural changes in economic and energy portfolio have no impact on economic and energy growth trajectory (Apergis and Payne, 2009). The conservation hypothesis confirms a causal link from growth to energy—revealing that the implementation of energy conservation and management policies has no economic effect (Jakovac, 2018). The growth hypothesis underlines a causal link from energy to growth. Thus, efforts to decrease energy consumption will hamper economic growth (Yildirim et al., 2012). The feedback hypothesis indicates a mutualistic connection between energy and growth—implying that the institutionalization of economic and energy policies targeted at reducing either energy, growth, or both may backfire in the face of economic prosperity and energy security (Ayres, 2001). The non-existence of consensus on the causal relationship between energy and growth indicates a gap in the literature that continuously requires further studies to confirm such findings. These mixed findings signal an ongoing debate that future studies are invited to participate.

This study contributes to the ongoing debate by expanding the extant literature by analyzing the role of energy diversification in wealth creation in developing economies. The specific novel contribution that this study presents can be observed from three aspects: variables used, scope of the sample, and method employed. From the variable perspective, most studies argue that environmental degradation is driven by using non-renewable energy (NRE) for economic growth, but the implications of environmental damage cannot be ignored. This study contributes to the literature by not only focusing on the role of fossil fuels but also renewable energy. Another effort of this study is the inclusion of labor and capital into the analysis to create a multivariate system that analyzes the causal connection between energy consumption and economic growth. In this sense, our study proposes a panel bootstrap causality test to explore the linkage in emerging countries. Thus, from the sampled perspective, we utilize both renewables (RE) and fossil fuel utilization (NRE) in economic growth function. We assess the performance of both and establish the coherence of investing in renewables from 1990 to 2016 across 17 emerging countries including Argentina, Brazil, Chile, Colombia, Egypt, Greece, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, South Africa, Thailand, and Turkey. These countries are adopted based on the newest 2020 Morgan Stanley Capital International classification (MSCI 2020) and data completeness. To the best of our knowledge, no study has used this set of countries. Hence, involving this set of countries as a sample can supply new information regarding the EC-growth nexus in MSCI’s group of emerging countries. There are mainly two reasons for selecting emerging countries. First, emerging countries require high energy needs namely fossil fuels to boost economic development (Waheed et al., 2019). Second, the main reason for the outgrowth in CO2 emissions during the twenty-first century was mainly attributed to a surge in CO2 emissions from developing countries (Crippa et al., 2020). Thus, emerging countries may tend to renewable energy sources to induce economic growth. From a methodological perspective, contrary to existing studies that utilize Granger causality technique, we apply a bootstrap panel causality methodology with a Fourier function. The novel effort of this study is to handle an econometric model that is superior to its counterparts in the available literature. In this way, structural breaks, cross-section dependence, and cross-country heterogeneity can be controlled.

Incorporating structural breaks into the analysis reveals mixed results across the sample of emerging countries. First, most sample countries have no significant causal relationship between energy utilization and economic growth, even after structural breaks are controlled. This finding suggests the dominance of the neutrality hypothesis, which indicates that energy utilization and economic growth are mutually independent. Second, in terms of causal relationship between GDP and RE, the study found that six emerging economies, namely, Brazil, Colombia, Indonesia, Mexico, Pakistan, and Thailand demonstrate a significant causal relationship from GDP to RE consumption—which supports the conservation hypothesis. Contrary, Greece, Korea, and Turkey are in support of the growth hypothesis where a significant causal relationship is found from RE to GDP. In terms of the relationship between NRE and GDP by controlling for structural breaks, only Brazil exhibits unidirectional causality from NRE to GDP. A causal relationship running from GDP to NRE is confirmed in Korea, Pakistan, and the Philippines. Besides, South Africa is the only country where the two causality-links are present.

Overall, the findings from this study are in support of past literature such as Ozturk and Acaravci (2011); Destek and Aslan (2017), which found unidirectional causal links in MENA countries. This study also differs from Kahia et al. (2017), which illustrates a bi-directional causal relationship between both energy sources and economic growth—demonstrating the substitutability of energy sources to boost economic growth in MENA countries. In the context of fossil energy consumption, our results demonstrate significant inconsistency with Pao and Tsai (2011). Their findings offer significant unidirectional and bi-directional causality between energy utilization and economic growth in Brazil and India. We deduce that the current study contributes to the literature and provides a significant heterogeneity across emerging countries and demonstrates the role of considering a structural break in the causal relationship between energy and economic growth.

This study is organized as follows: literature review, description of data underlying the analysis and methodology, detail empirical results, and highlights from the study with policy implications.

Literature Review

Efforts to achieve stable growth and preserve environmental quality are fast transforming into a hot topic across the globe among governments, academics, international institutions, and various stakeholders involved. Despite the extensive literature on the EC-economic growth link since the influential study of Kraft and Kraft (1978), there has been no consensus among scholars about the direction of causality (Ozcan and Ozturk, 2019). Scholars have also extensively examined the link between aggregate NRE/RE and economic growth. For example, based on the autoregressive distributed lag (ARDL) technique and its variations, Afonso et al. (2017) indicated that NRE actively promotes growth in Turkey. Using the same methodology, Dogan (2016) obtained similar outcomes for a panel of 28 countries. By applying fully modified ordinary least square (FMOLS), dynamic ordinary least squares, and Granger causality in the context of Latin America and Sub-Saharan Africa (SSA), Al-Mulali et al. (2014), Adams et al. (2018), offered argument in favor of the growth effects of NRE consumption. Ozturk and Bilgili (2015) confirmed such findings for biomass energy in SSA via dynamic panel OLS analysis.

Given the relationship between aggregate energy consumption and growth, scholarly evidence points out the positive impact of the latter on the former, regardless of the methodology used [e.g., Lee and Chang (2008) in the case of Asia and Pao and Tsai (2011) for BRIC countries]. Considering total RE, based on OLS analysis applied for China, Fang (2011) noted similar results. This is in line with Apergis and Payne (2011b), who applied FMOLS for six states in Central America and documented that RE consumption enhances growth. In contrast, ARDL-supported findings of Razmi et al. (2020) show no substantial long-run effect of RE on development in Iran, despite some positive short-run impact. Using the bootstrap panel causality, Ozcan and Ozturk (2019) highlighted similar outcomes for RE in emerging countries.

Using various causality analyses, many authors highlight that NRE Granger causes growth (Aydin (2019) / OECD members; Kahia et al. (2016)/MENA net oil-exporters; Kahia et al. (2017)/MENA net oil-importers). Similar outcomes are also underlined for emerging nations by Apergis and Payne (2011a); Destek and Aslan (2017). In contrast to common evidence, using the ARDL bound testing approach, Ozturk and Acaravci (2011) showed an insignificant impact of electric power on growth in the MENA region.

A few authors focus on specific non-renewable energy sources such as oil, natural gas, and coal and provide support for their persuasive power to enable economic growth. For example, Bloch et al. (2015) applied ARDL and Granger methodologies to show the positive implications of oil and coal for growth in China. This dovetails research by Caraiani et al. (2015) in the context of emerging European countries for oil, gas, coal, and RE. Although the ARDL model of Bildirici and Bakirtas (2014) revealed a Granger causality between oil and growth in the context of Brazil, Russian, India, China, Turkey, and South Africa, mixed outcomes are presented for natural gas and coal. However, Apergis and Payne (2010) used FMOLS and panel causality specifications to emphasize that coal use adversely affects development in emerging economies.

The impact of NRE on growth among leading oil producers in Africa between 1980 and 2015 revealed an asymmetric effect of the former on economic growth and CO2 emission in all nations under analysis, except Algeria (Awodumi and Adewuyi, 2020). Findings from the study emphasized that in Nigeria, positive changes in NRE consumption hinders growth and dilutes CO2 emissions. In Gabon, an increase in NRE consumption sustains growth and environmental health. In the case of Egypt, the consumption of NRE types has no substantial inferences on environmental quality as it enables higher rates of growth. For Angola, positive changes in NRE use lead to better economic growth, although the impact on emissions is mixed across time and fuel type. Thus, it seems imperative for policy-making in African oil-producing states to examine ways to promote RE technologies in the quest for growth—if they maintain the use of their rich resources-petroleum and natural gas. Mechanisms for the reward and sanctions should be put in place to enhance compliance with environmental rules.

Based on heterogeneous panel data analysis, other studies explored the nexus of RE consumption and growth for E-7 (China, India, Brazil, Mexico, Russia, Indonesia, and Turkey) countries between 1992 and 2012 and pointed out a long-run connection among GDP, RE use, and other variables. In other words, RE consumption facilitates real economic growth in E-7 countries.

The implications of both RE and NRE on growth in 17 emerging nations using bootstrap panel causality revealed that the growth hypothesis holds only for Peru in the RE scenario (Destek and Aslan, 2017). The conservation hypothesis is confirmed for Thailand and Colombia (unidirectional causality spanning from growth to EC); the feedback hypothesis is confirmed for South Korea and Greece, and the neutrality hypothesis is valid for the remaining 12 selected states (no link between energy consumption and growth). In the case of NRE consumption, there is unidirectional causality from energy consumption to growth in the case of China, Colombia, Mexico, and the Philippines (the growth hypothesis). Besides, unidirectional causality is observed from growth to NRE in the context of Egypt, Peru, and Portugal; bi-directional causality between NRE use and economic growth for Turkey (the feedback hypothesis); and no relationship between energy consumption and growth (the neutrality hypothesis) for the remaining emerging markets.

Economic growth, the main target of all states, has led to considerable academic research exploring the impact of RE on the former. The study of Maji (2015), based on the ARDL method found a negative link between RE and growth in the long-term and a non-substantial relationship in the short-term. This confirms previous findings by Ocal and Aslan (2013), who underlined adverse effects of RE on economic development in Turkey, South Africa, and Mexico. By contrast, Destek (2016) found a positive nexus between the two variables for India. By using panel cointegration approaches, Aïssa et al. (2014) found no causality between RE and growth in the short-term (neutrality hypothesis). Based on a similar methodology, Pao et al. (2014) examined RE and NRE-growth nexus for a panel of four emerging countries (Mexico, Indonesia, South Korea, and Turkey). They confirmed the growth hypothesis for RE and growth in the long-term, accompanied by the feedback hypothesis in the short-term.

Using a panel regression model applied to Brazil, Russia, India, and China (BRIC) for the 1990–2015 timeframe, Venkatraja (2019) provides arguments supporting the growth hypothesis. Hence, the decrease of RE to the total energy use may have allowed faster growth in BRIC states. Shakouri and Yazdi (2017) investigated the link between various variables, inter alia, growth, RE, and energy consumption in South Africa during 1971–2015 and documented a long-run link among them and bi-directional causality between RE and growth (the feedback hypothesis). Thus, the empirical findings revealed that RE facilitates economic growth, and in parallel, growth promotes the use of clean energy sources.

Zafar et al. (2019) disaggregated energy, e.g., RE and NRE consumption, and used a second-generation panel unit root test applied to Asia-Pacific Economic Cooperation states during 1990–2015 to inspect the long-term nexus between EC and growth. The findings showed the positive effect of EC, both RE, and NRE, on economic growth. Besides, the time-series individual country analysis also indicated a stimulating role of RE on growth. Moreover, the heterogeneous causality analysis identified a feedback effect among growth, RE, and NRE use. This empirical evidence highlights more investments in RE sectors and encourages the development of renewable energy to achieve energy growth. These empirical studies are summed in Table 1.

Materials and Methods

Data

Many empirical studies that use Granger causality test have examined the causal relationship in a two-variable context, but Granger has stated that ignoring other related variables may cause spurious causality. Besides, neglected variables in a bivariate system can result in non-causality, as indicated by Lütkepohl (1982). To remedy the omitted variable bias, this study follows Payne (2009); Apergis and Payne (2010), and Ozcan and Ozturk (2019), and test the causality between RE, NRE, and economic growth (GDP- real gross domestic product) by including measures of capital and labor. Both data on the RE and NRE are defined in billion kWh while GDP, and real gross fixed capital formation (K) in constant 2010 US$, and labor force (L) in millions. We take logarithms of all variables and use population data to convert them into per capita. We used annual data from 1990 to 2017 that was retrieved from WDI database of the World Bank and Energy Information Administration for 17 emerging countries1 determined by Morgan Stanley Capital International classification and data completeness.

Bootstrap Panel Causality Test With Fourier Function

If the inclusion of lagged values of a variable (say Y) improves the accuracy of the prediction of another variable (say X), then it can be said that there exists causality from Y to X. Since the seminal paper of Granger (1969), there are an enormous number of empirical studies that analyze the causal relationship between the considered variables in several disciplines. However, theoretical developments in causality tests have been slower compared to other econometric techniques, such as unit root tests or cointegration tests. Although Fourier functions that capture structural changes, regardless of the number, form, and locations of them have emerged since 2006 for assessing unit root properties (see Becker et al., 2006), proposing the use of Enders-Jones driven causality analysis. Thus, this study considers structural breaks following Enders and Jones (2016) and extend the bootstrap panel causality test of Kónya (2006) with a Fourier function. The causality test of Kónya (2006) is based on an estimation of the set of equations using a Seemingly Unrelated Regression (SUR) system and Wald tests with country-specific bootstrap critical values that allow country-specific causality. The proposed test in this study considers both cross-sectional dependence and heterogeneity in the panel data set. Since bootstrap simulations produce unit-specific critical values, it is not necessary to test the stationarity of the series or existence of cointegrating relationship between the series, before performing the test. In addition to these properties by allowing structural breaks via a Fourier function, we can reveal the nature of the relationships between the variables.

This study analyzes the causal relationship between energy consumption and economic growth in a multivariate framework by including capital and labor into the specification to control omitted-variable bias. Besides, the production activity requires handling both capital and labor beyond the use of non-renewable and renewable energy (Nazlioglu et al., 2011). Therefore, the model specification is based on the extended version of Cobb-Douglas production function. In this context, variables on capital, labor, and energy consumption are essential to examine the causal connection in a multivariate system (Omri and Kahouli, 2014).

The empirical specification of our study with the inclusion of labor, capital, and energy consumption can be expressed as:

and

Where EC denotes either renewables or fossil fuels and GDP signifies real GDP. We treat K (real gross fixed capital formation) and L (labor force) as auxiliary variables while testing for causality between Y and EC—without directly involving them in the Granger causality test. N shows the number of countries (i = 1,.2,…,17), T shows time-period and l indicates the optimal lag length selected using Akaike information criteria. w, T, and π represent the trend term, number of observations, and constant (3.1428), respectively. On the other hand, k shows a particular single frequency used in this study (Becker et al., 2006).

Although studies that employ Fourier functions generally select an integer value instead of k, by following the suggestions of Christopoulos and Leon-Ledesma (2011) and Omay (2015), we allow fractional values for k and select the value which gives the minimum sum of squares residuals by searching for all frequencies for k = [0.1,0.2,…,5]. Integer frequencies indicate temporary break, while fractional frequencies would imply that the effect of structural breaks is permanent (Christopoulos and Leon-Ledesma, 2011). After finding the optimum value of k, we estimate the system 1, and 2 via the SUR estimator suggested by Zellner (1962), and test the existence of causal relationships. There are four possible outcomes of causality between GDP and RE or NRE:

(a) There is a unidirectional causality relationship from EC to GDP if not all γ1,is are zero in Eq. 1, but all β2,is are zero in Eq. 2.

(b) Existence of unidirectional causality from GDP to EC if not all β2,is are zero in Eq. 2, but all γ1,is are zero in Eq. 1.

(c) Existence of bi-directional causality between GDP and EC if neither γ1,i nor β2,i are zero.

(d) Existence of no causality relationship between GDP and EC if both γ1,i andβ2,iare zero.

We test the existence of these four relationships using Wald test statistics and obtain the necessary cross-section-specific critical values via bootstrap-driven simulations to account for small sample bias2.

Results and Discussion

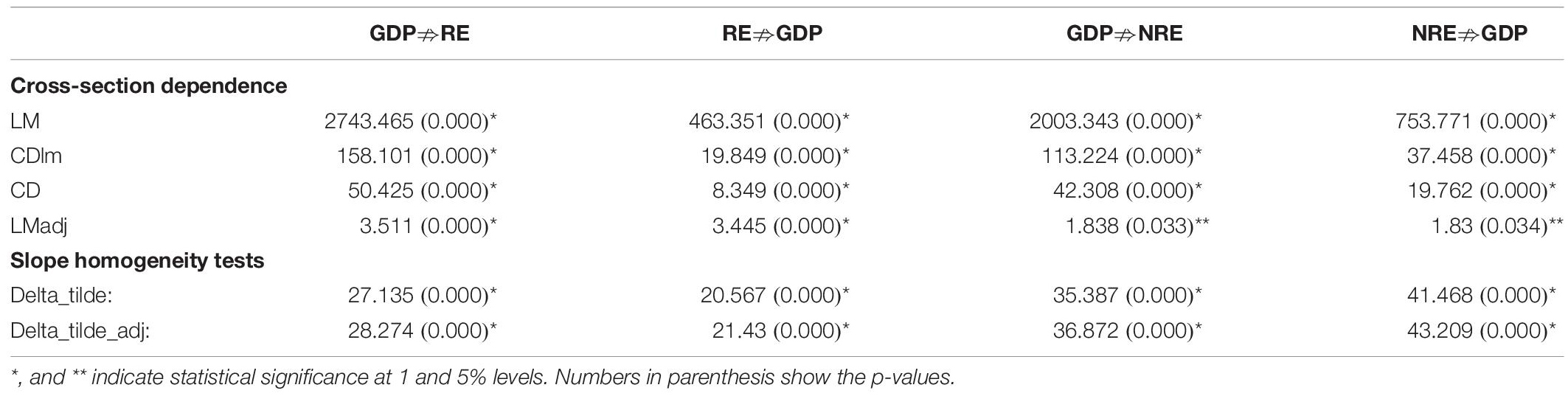

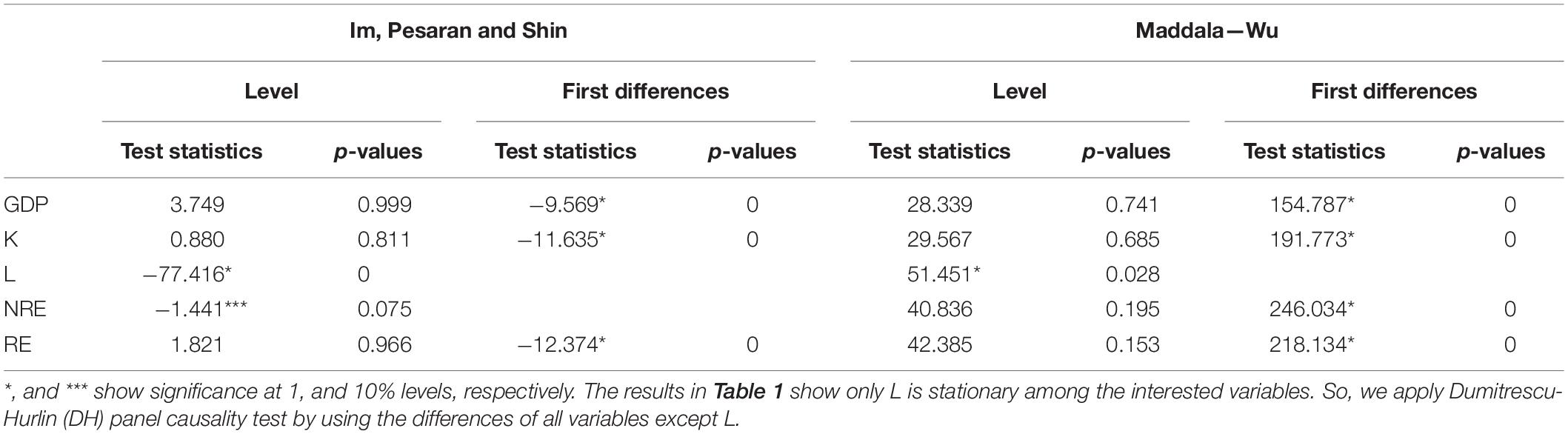

Testing for cross-section dependence across sampled countries in panel settings allows the minimization and elimination of spillover effects and global shocks that lead to misspecification and spuriousness in estimated models. Cross-section dependence may be caused by spatial effects, ignored common factors, or unobserved factors (Baltagi and Hashem Pesaran, 2007; Breitung and Pesaran, 2008). Neglecting cross-sectional dependence and utilizing first-generational panel techniques that do not consider the dependence can lead to inconsistent estimators (Hsiao, 2007). Before proceeding to apply the bootstrap panel causality analysis, we test the existence of cross-section dependence across members of the panel using Breusch and Pagan (1980) LM test, Pesaran (2004) scaled LM test, Pesaran (2004) CD test, and Pesaran et al. (2008) bias-corrected scaled LM test. Besides, the slope heterogeneity across sample countries matters to obtain the country-specific causal relationship in the current analysis, so we further test slope homogeneity using delta tests on the assumption that homogeneity in causality test equations can be misleading due to country-specific characteristics (Pesaran and Yamagata, 2008)3. Table 2 illustrates the results of the specified equations in testing the causality between pairs of RE-GDP and NRE-GDP.

The null hypothesis of no cross-section dependence across countries in Table 2 can be rejected for all equations—implying the existence of cross-section dependence in all specified equations. Besides, the results of the Delta test provide evidence of slope heterogeneity in all equations. The literature argues that differences in designed energy and growth policies in emerging economies create such heterogeneity across countries (Ozcan and Ozturk, 2019). Due to the presence of cross-section dependence and slope heterogeneity across countries, we carry out the panel bootstrap causality analysis.

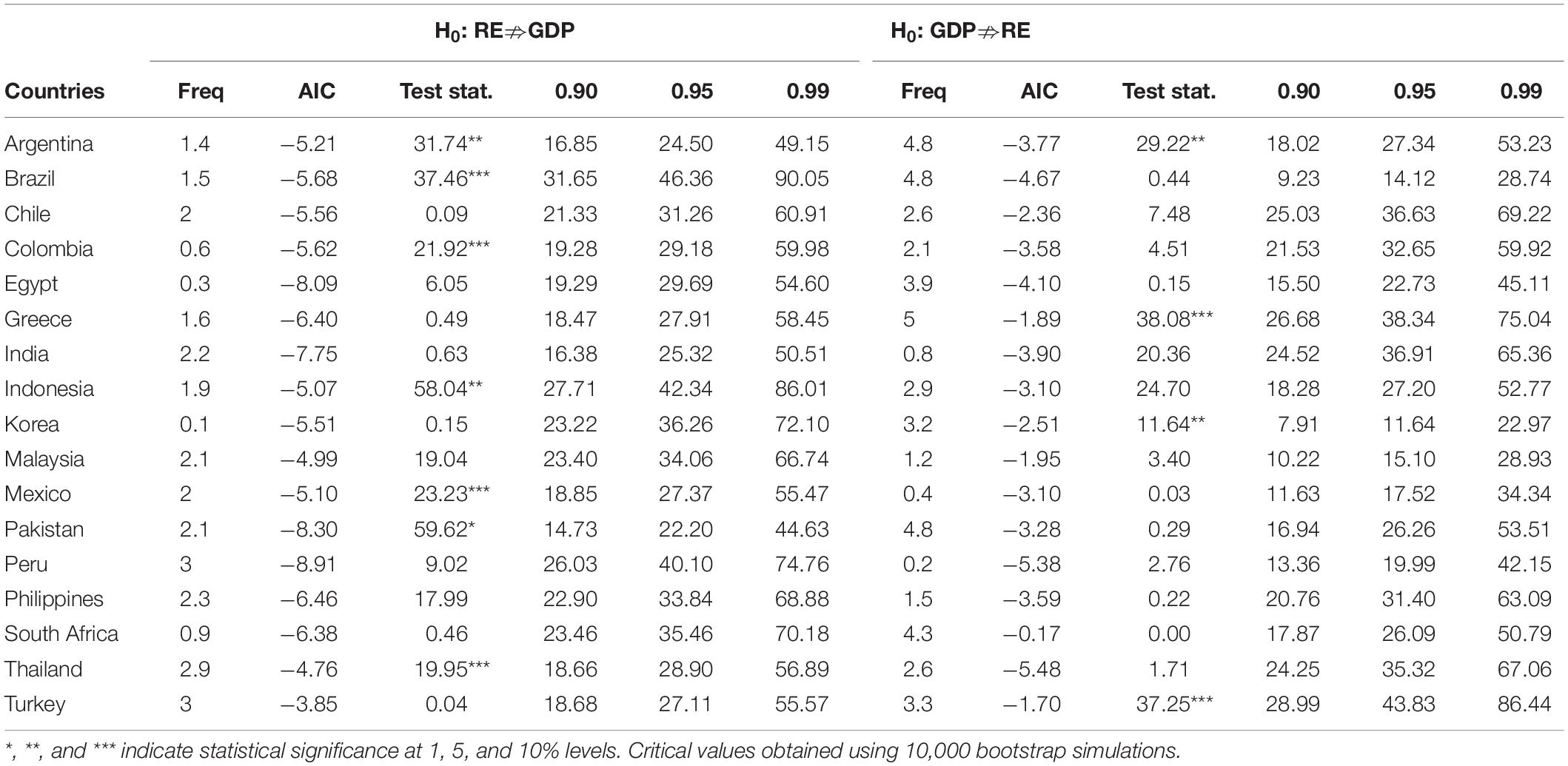

The next step in the empirical analysis consists of investigating the causality between two sets of pairs (RE and GDP; NRE and GDP) in both bootstrap panel and Fourier bootstrap panel causality tests4. The study first obtains the results of causality test without a Fourier function presented in Tables 3, 4.

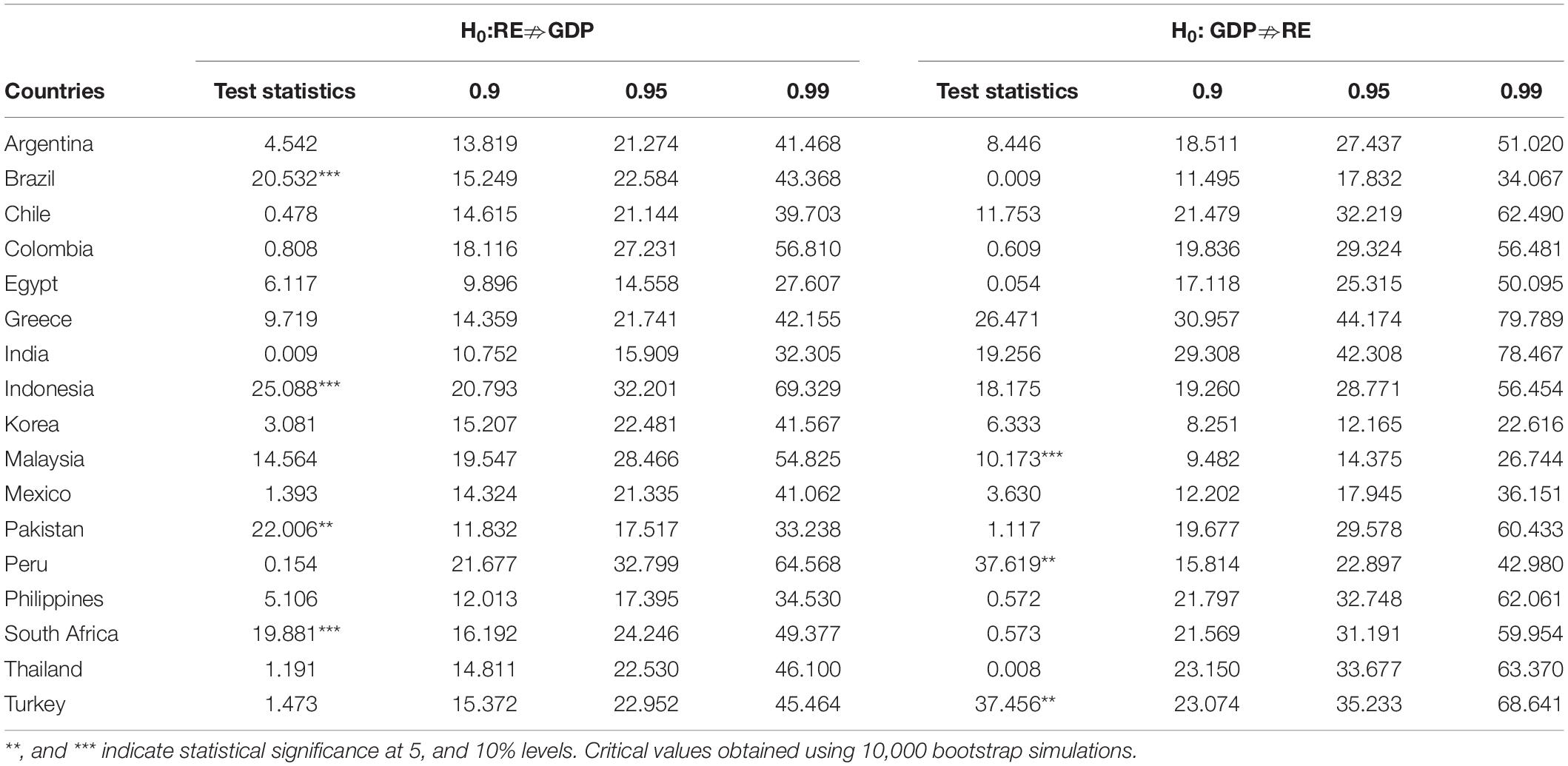

Evidence from the causality test between RE and GDP5 is presented in Table 3. The bootstrap panel causality test detects no causal relationship between RE and GDP in 10 out of 17 sampled countries. More than half of the sampling countries provide data supporting the neutrality hypothesis. This infers that policies that trigger renewable energy consumption cannot affect economic activity, and policies that are enhanced by growth cannot influence renewable energy consumption. The insignificant causal relationship between the consumption of renewables and economic activity in most emerging countries may indicate the early stages of developing renewable energy equipment (Bhattacharya et al., 2016).

Besides, our results exhibit a unidirectional causal relationship between RE and GDP in 7 out of 17 emerging countries. These findings are not consistent with Ozcan and Ozturk (2019) where they found evidence for neutrality hypothesis for Brazil, Indonesia, and South Africa. A probable explanation of such divergence might be that the inclusion of a wider period is in operation. In a time series analysis with bootstrap causality test, Tuna and Tuna (2019) found no causal relationship between renewable energy consumption and economic growth in Indonesia and Malaysia. The results demonstrate unidirectional causality running from RE to GDP for Brazil, Indonesia, Pakistan, and South Africa. The results of the outlined countries are consistent with the growth hypothesis based on renewable energy and GDP nexus. This perhaps accentuates renewable energy as a driver of economic growth, hence, efforts to diversify the energy mix with renewables will accelerate economic productivity. Our findings also suggest these countries will increase their production processes by expanding renewable energy inclusion to achieve future economic growth.

The bootstrap panel causality analysis detects unidirectional causality running from GDP to RE in Malaysia, Peru, and Turkey (Table 3). These countries illustrate evidence of conservation hypothesis, where contextually, conservative energy policies will not hurt economic productivity whereas energy conservation policies do not exacerbate economic growth concerns. Our findings for bootstrap panel causality differ from Destek and Aslan (2017). They found bidirectional causality between renewable energy consumption and economic growth in Greece and Korea, and unidirectional causality running from renewable consumption to economic growth in Peru. The inconsistency of our findings with Destek and Aslan (2017) might be due to our inclusion of capital and labor in the analysis.

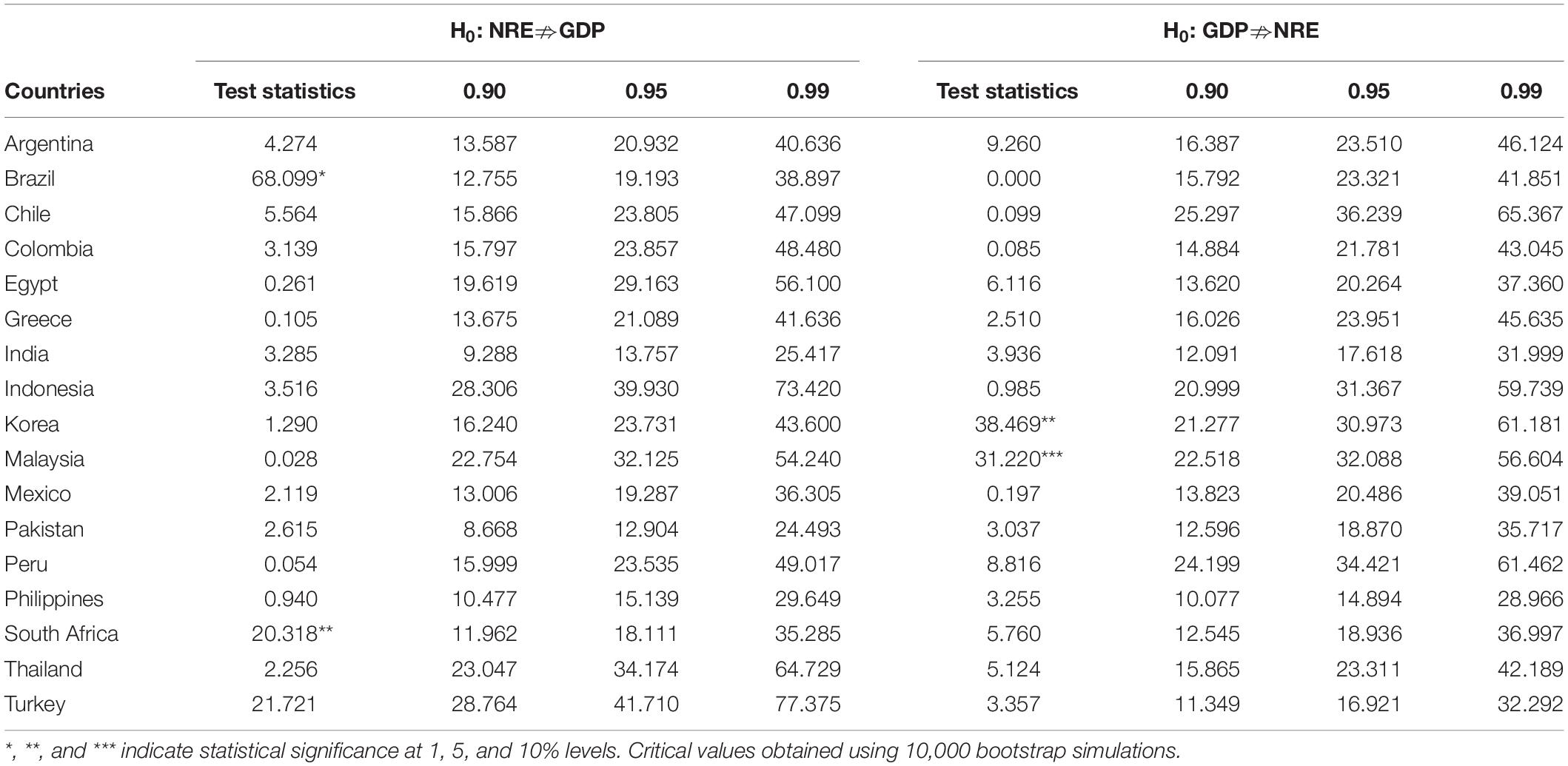

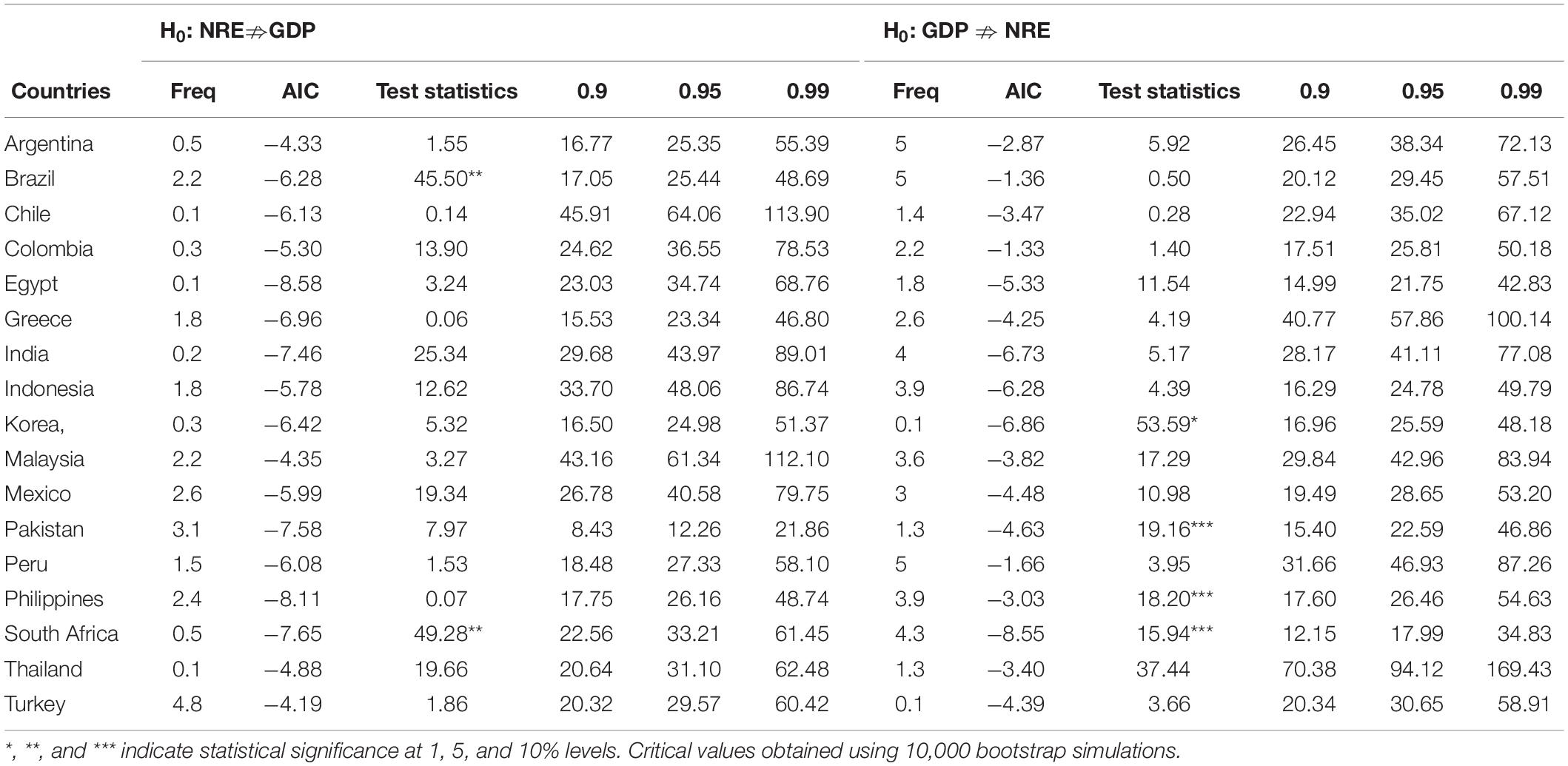

The results of causality between NRE and GDP are reported in Table 4. The results of bootstrap panel causality analysis provide more evidence for the neutrality hypothesis in emerging economies. There is a causal relationship between fossil energy consumption and economic growth in any direction in 4 out of 17 sampled countries. Therefore, the neutrality hypothesis is verified in many of the emerging economies for non-renewable energy consumption-GDP nexus. Non-renewable energy consumption and economic productivity have an insignificant impact on each other, which indicates that fossil fuel consumption and economic growth are mutually independent.

As presented in Table 4, unidirectional causality runs from NRE to GDP in Brazil and South Africa. The bootstrap panel causality analysis verifies the growth hypothesis in these countries in the case of non-renewable energy consumption-economic growth nexus. Combining with the findings for RE-GDP nexus, Brazil, and South Africa are in line with the growth hypothesis both in the cases of renewable and non-renewable energy cases. This infers that energy-specific policies will influence economic productivity in these countries. Hence, we can deduce that renewable and non-renewable energy sources can be used as a substitute for each other (Apergis and Payne, 2012).

The significant unidirectional causality from GDP to NRE supports the existence of a conservation hypothesis for Korea and Malaysia. Therefore, we can deduce that these countries do implement energy-saving policies without bearing extra costs of sluggish economic activity. In other words, the introduction of energy-efficient policies and demand-oriented measures has no negative consequences on economic activity (Apergis and Payne, 2011b). Also, since the depletion of non-renewable energy sources creates environmental distress, these countries benefit from energy-saving policies to reduce the environmental threat. The use of capital and labor in our analysis might create different findings compared to Destek and Aslan (2017) in the case of non-renewable energy. However, they found causal linkages between non-renewable energy consumption and economic growth in Egypt, Mexico, Colombia, Peru, Philippines, and Turkey.

Although the bootstrap panel causality test (Kónya, 2006) is robust to cross-section dependence and slope heterogeneity, it does not consider structural breaks. Thus, ignoring structural breaks in testing causality leads to incorrect results. This study also considers structural changes in energy utilization-economic productivity nexus and performs the Fourier bootstrap panel causality test. Empirical results of the Fourier bootstrap panel causality test are displayed in Table 5 for the RE-GDP relationship.

Compared to the results of bootstrap panel causality analysis, launching Fourier terms to control for structural breaks provide a relatively strong causal relationship between RE and GDP in a sample of emerging countries. The results in Table 5 show significant unidirectional causality from RE to GDP that in Brazil, Colombia, Indonesia, Mexico, Pakistan, and Thailand. Therefore, the introduction of the Fourier terms to account for structural changes provides seemingly different outcomes. In the Fourier bootstrap panel causality analysis, the results for Colombia, Mexico, and Thailand confirm the growth hypothesis in addition to countries supporting the growth hypothesis.

The significant unidirectional causality from GDP to RE in Greece, Korea, and Turkey are consistent with the conservation hypothesis. Greece and Korea illustrate the unidirectional causality from GDP to RE in Fourier analysis instead of Malaysia and Peru. Besides, when we consider structural breaks, the significant bi-directional causality is detected for Argentina, which in turn provides evidence favoring the feedback hypothesis. As noted, the feedback hypothesis proposes that energy consumption and real GDP have a significant mutual impact. Therefore, it appears economic activity is a vital element to provide essential resources for ongoing development of renewable energy (Apergis and Payne, 2010). Additionally, policies that limit demand for renewable energy can impede economic activity, and any shock to economic growth can relieve the demand for renewable energy. The neutrality hypothesis is verified in other countries, which could suggest that the renewable energy industry needs time to boost economic activity (Ozcan and Ozturk, 2019). Since structural breaks allow rejection of the null of no causal relationship for more countries in comparison with the bootstrap panel causality test, the results confirm the importance of model specification with structural breaks.

The study further examines the NRE-GDP nexus with Fourier terms, with results of the Fourier bootstrap panel causality test presented in Table 6. It can be observed that 11 out of 17 emerging economies find no significant causal linkage between NRE and GDP—demonstrating the predominance of the neutrality hypothesis in emerging economies. Besides, it seems that the inclusion of structural breaks in the Fourier analysis results in slight differences in the NRE-GDP nexus. Brazil is the only country with significant unidirectional causality from NRE to GDP, which is direct evidence supporting the growth hypothesis. The neutrality hypothesis manifests itself in Korea, Pakistan, and the Philippines. South Africa has a significant bidirectional causal relationship between NRE and GDP. The causality results are thus consistent with the feedback hypothesis and show the interdependence of NRE and GDP in South Africa.

Overall, findings of the bootstrap panel causality test seem to provide support for the neutrality hypothesis and demonstrate the insignificant causal relationship between both renewable and fossil energy consumption and economic growth in emerging countries. In particular, fossil energy consumption-economic productivity has a unidirectional causal relationship, with a relatively small proportion of the sample countries involved. The introduction of structural breaks through Fourier terms provides additional evidence favoring growth and conservation hypotheses in the nexus of RE-GDP. On the other hand, the Fourier bootstrap panel causality analysis produce mainly in support of the neutrality hypothesis in a relationship between NRE and GDP. It should be noted that emerging economies appear to have mixed outcomes, and the link between renewable as well as fossil energy use and economic growth is somewhat heterogeneous across countries.

Although we sampled emerging economies, our study provides heterogeneous findings in the causal relationship between energy consumption and economic growth. Therefore, the findings affirm the role of country-specific characteristics in energy consumption-growth nexus. In this case, we might argue that the income level of selected countries create significant differences among emerging countries since investments into renewable projects are income-dependent. For example, according to Renewable Energy Agency (IRENA) statistics, Brazil, India, Pakistan, Argentina, and Turkey are the countries with higher public investment in renewables than their counterparts between 2010 and 2018. However, the lack of causality running from renewable energy consumption to economic growth in India and Turkey breaks up this link. This infers that renewable energy investments are in their early stages and that policies encouraging renewable energy generation have been ineffective in accelerating economic productivity. Cross-country heterogeneity in our results shows energy consumption-growth nexus has several complex and interdependent linkages.

Our results provide some differences and similarities compared to existing studies for emerging economies. In the case of renewables and economic productivity relationship, our findings are slightly different from Ozcan and Ozturk (2019) and Cetin (2016) since the neutrality hypothesis highly dominates its counterparts in emerging countries. The findings of the current study are somewhat consistent with Ozturk and Acaravci (2011) and Destek and Aslan (2017), whose results suggest some unidirectional causal linkages in MENA countries. Our findings provide somewhat inconsistent results with Kahia et al. (2017), which illustrate the bi-directional causal relationship between both energy sources and economic growth demonstrates the substitutability of energy sources to boost economic growth in MENA countries. Also, by providing support for the feedback hypothesis in Central American countries, Apergis and Payne (2011b) exhibit inconsistent findings with this study. In the context of fossil energy consumption, our results demonstrate significant inconsistency with Pao and Tsai (2011). Their findings offer significant unidirectional and bi-directional causality between energy utilization and economic growth in Brazil and India. We can deduce that the current study contributes to the literature and provides a significant heterogeneity across emerging countries and demonstrates the role of considering a structural break in the causal relationship between energy and economic growth.

Conclusion

This study examined the causal relationship between energy consumption and economic growth in 17 emerging countries throughout 1990–2017. This study contributed to the extant literature in three aspects namely variable selection, sampled countries, and methodological procedure. From variables and sample perspectives, this study incorporated both renewables (RE) and fossil fuel utilization (NRE) in economic growth function across 17 emerging countries. From methodological perspective, this study adopted the bootstrap panel causality analysis by inserting Fourier terms and controlling for structural breaks in the causal framework. This included capital and labor in the analysis to control omitted-variable bias and accounted for both cross-section dependence and cross-country heterogeneity in the empirical model.

The empirical findings provide mixed results across emerging countries. First, without structural breaks taken into account, the study showed unidirectional causality in less than half of the sampled countries. The study found unidirectional running from RE to GDP in Brazil, Indonesia, and South Africa, supporting the growth hypothesis. In contrast, unidirectional causality running from GDP to RE is found in Malaysia, Peru, and Turkey, supporting the conservation hypothesis. The study showed unidirectional link from NRE to GDP in Brazil and South Africa, whereas causality from GDP to NRE is found in Korea and Malaysia. However, since more than half of the sampled countries demonstrated no causality, it is fair to conclude that, with no structural breaks, most emerging countries found no causal link between energy utilization and economic growth in terms of both renewable and non-renewable energy.

Second, when structural breaks were accounted for in the analysis, we found significant causal relationships for more sampled countries. The study found a causal relationship from GDP to RE in Brazil, Colombia, Indonesia, Mexico, Pakistan, and Thailand—supporting the conservation hypothesis. The causal relationship from RE to GDP was validated in Greece, Korea, and Turkey, supporting the growth hypothesis. By controlling the structural breaks, the unidirectional causality from NRE to GDP was confirmed in Brazil. The causal relationship running from GDP to NRE was found in Korea, Pakistan, and the Philippines. However, bidirectional causality was confirmed only in South Africa. Overall, many countries have no significant causality relationship between energy utilization and economic growth amidst controlling for structural breaks. This finding suggests the dominance of the neutrality hypothesis, which indicates that energy utilization and economic growth are mutually independent.

In a bootstrap panel causality setting, the dominant finding found no causal linkage between energy utilization and economic productivity, although few countries exhibit significant unidirectional causality and provide evidence supporting the growth or conservation hypotheses. However, the Fourier bootstrap panel causality provides further evidence supporting the unidirectional causal relationship between renewables and economic productivity. Once structural changes are taken into consideration, the growth and conservation hypotheses in renewables are confirmed in many emerging economies. However, the neutrality hypothesis still dominates the relationship between energy utilization and economic growth in most sampled emerging economies. Regardless of these findings, our study is positioned to extend the existing literature by demonstrating that a mutually exclusive relationship (i.e., the neutrality hypothesis) between energy utilization, either renewable or non-renewable energy, and economic growth is not evident in most emerging countries.

Policy implications from the findings can be elaborated as follows. First, heterogeneity in the causal connection between energy utilization in emerging economies and economic productivity suggests that energy policies must be country-specific. Second, the significant unidirectional causality between renewable/fossil energy consumption and economic productivity in Brazil and South Africa illustrates a growth hypothesis for both energy sources. It could, therefore, be concluded that these countries should substitute renewable energy sources for non-renewable energy sources. So, both countries could pursue policies that use more renewable sources in production without bearing costs on economic activity. Third, countries that verify the growth hypothesis in renewable energy contexts could develop policies promoting renewable energy investments, subsidizing renewable energy activities, tax exemptions in renewable energy production facilities (Apergis and Payne, 2012). Fourth, the conservation hypothesis in Korea, Malaysia, Pakistan, and the Philippines in terms of fossil energy consumption is significant. The fossil energy-saving policies can go in hand with environmental policies, and not hinder economic activity. Fifth, countries with no causality from renewable energy consumption to economic production might develop energy-efficient technologies to boost economic activity via renewable sources to provide sustainable economic development. Besides, the establishment of new renewable energy equipment and technologies boosts employment directly by creating job opportunities (Bhattacharya et al., 2016). Finally, policy implications related to COVID cases are also important to be addressed. The COVID pandemic poses a great challenge to global growth despite the introduction of vaccines, hence, improving factors affecting GDP growth could be promoted to prevent further economic recession. The missing link between energy consumption and economic growth will cause difficult economic rebound effects, especially during the pandemic where consumption is no longer dependable as a source of growth. Thus, this study suggests the implementation of various strategies to foster the causal link between renewable energy and economic growth, particularly given that the pandemic has declined demand for fossil fuel. This can be done through instrumentation, such as fiscal (tax incentive on energy or energy subsidies) or monetary instrument (e.g., lower credit interest rate). Further research on the linkage between energy and economic production might be to examine the effects that potential mechanisms of specific renewables and fossil energy sources exert on economic productivity.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author/s.

Author Contributions

VY: conceptualization, investigation, methodology, data curation, writing-original draft preparation, and software. IH, OO, and SS: writing-original draft preparation. All authors contributed to the article and approved the submitted version.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenrg.2021.632712/full#supplementary-material

Footnotes

- ^ (Argentina, Brazil, Chile, Colombia, Egypt, Greece, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, South Africa, Thailand, and Turkey).

- ^ See Kónya (2006, p. 985–986) for bootstrap procedure.

- ^ For a detailed explanation of these tests please refer to Yilanci and Ozgur (2019).

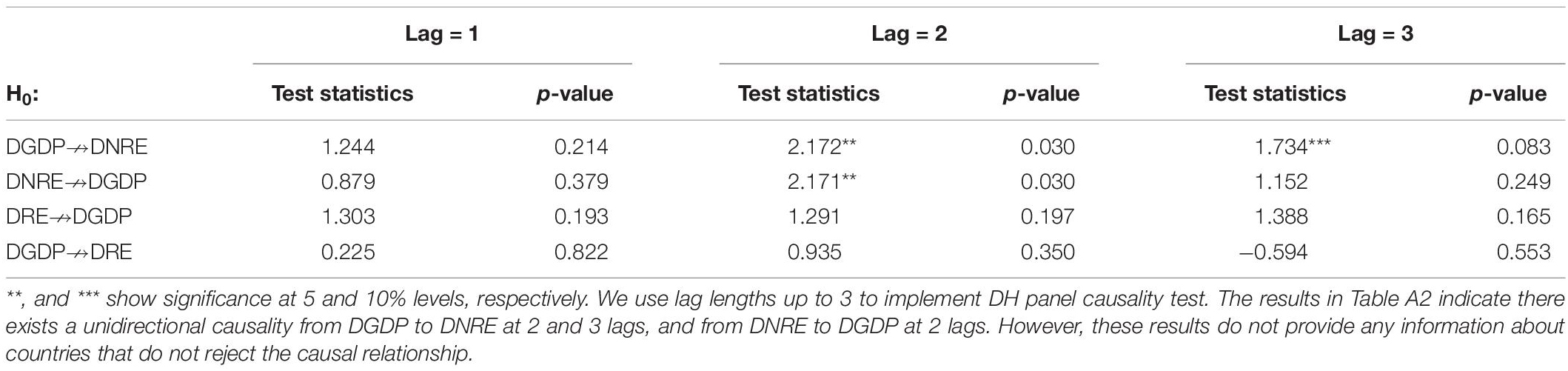

- ^ We also conducted Dumitrescu-Hurlin (Dumitrescu and Hurlin, 2012) causality test and presented the results in Appendix TABLE A2. The results show unidirectional causality exists from GDP to NRE.

- ^ We also applied Dumitrescu-Hurlin panel causality test and presented the results in the Appendix TABLE A2. Test results show no causality between GDP and NRE.

References

Adams, S., Klobodu, E., and Apio, A. (2018). Renewable and nonrenewable energy, regime type and economic growth. Renew. Energy 125, 755–767. doi: 0.1016/j.renene.2018.02.135

Afonso, T., Marques, A., and Fuinhas, J. (2017). Strategies to make renewable energy sources compatible with economic growth. Energy Strategy Rev. 18, 121–126. doi: 0.1016/j.esr.2017.09.014

Aïssa, M., Jebli, M., and Youssef, S. (2014). Output, renewable energy consumption and trade in Africa. Energy Policy 66, 11–18. doi: 0.1016/j.enpol.2013.11.023

Al-Mulali, U., Fereidouni, G., and Lee, J. (2014). Electricity consumption from renewable and nonrenewable sources and economic growth: evidence from Latin American countries. Renew. Sustain. Energy Rev. 30, 290–298. doi: 0.1016/j.rser.2013.10.006

Al-Mulali, U., and Sab, C. (2012). The impact of energy consumption and CO2 emission on the economic growth and financial development in the Sub Saharan African countries. Energy 39, 180–186. doi: 0.1016/j.energy.2012.01.032

Apergis, J., and Payne, E. (2011a). Renewable and nonrenewable electricity consumption–growth nexus: evidence from emerging market economies. Appl. Energy 88, 5226–5230. doi: 0.1016/j.apenergy.2011.06.041

Apergis, N., and Payne, J. (2009). Energy consumption and economic growth in Central America: evidence from a panel cointegration and error correction model. Energy Econ. 31, 211–216. doi: 0.1016/j.eneco.2008.09.002

Apergis, N., and Payne, J. (2010). The causal dynamics between coal consumption and growth: evidence from emerging market economies. Appl. Energy 87, 1972–1977. doi: 0.1016/j.apenergy.2009.11.035

Apergis, N., and Payne, J. (2011b). The renewable energy consumption–growth nexus in Central America. Appl. Energy 88, 343–347. doi: 0.1016/j.apenergy.2010.07.013

Apergis, N., and Payne, J. E. (2012). Renewable and nonrenewable energy consumption-growth nexus: evidence from a panel error correction model. Energy Econ. 34, 733–738. doi: 0.1016/j.eneco.2011.04.007

Awodumi, O., and Adewuyi, A. (2020). The role of nonrenewable energy consumption in economic growth and carbon emission: evidence from oil producing economies in Africa. Energy Strategy Rev. 207:100434. doi: 0.1016/j.esr.2019.100434

Aydin, M. (2019). Renewable and nonrenewable electricity consumption–economic growth nexus: evidence from OECD countries. Renew. Energy 136, 599–606. doi: 0.1016/j.renene.2019.01.008

Ayres, R. (2001). The minimum complexity of endogenous growth models: the role of physical resource flows. Energy 26, 817–838. doi: 0.1016/s0360-5442(01)00031-7

Baltagi, B. H., and Hashem Pesaran, M. (2007). Heterogeneity and cross section dependence in panel data models: theory and applications introduction. J. Appl. Econ. 22, 229–232. doi: 0.1002/jae.955

Becker, R., Enders, W., and Lee, J. (2006). A stationarity test in the presence of an unknown number of smooth breaks. J. Time Ser. Anal. 27, 381–409. doi: 0.1111/j.1467-9892.2006.00478.x

Bhattacharya, M., Paramati, S. R., Ozturk, I., and Bhattacharya, S. (2016). The effect of renewable energy consumption on economic growth: evidence from top 38 countries. Appl. Energy 162, 733–741. doi: 0.1016/j.apenergy.2015.10.104

Bildirici, M., and Bakirtas, T. (2014). The relationship among oil, natural gas and coal consumption and economic growth in BRICTS (Brazil, Russian, India, China, Turkey and South Africa) countries. Energy 65, 134–144. doi: 0.1016/j.energy.2013.12.006

Bloch, H., Rafiq, S., and Salim, R. (2015). Economic growth with coal, oil and renewable energy consumption in China: prospects for fuel substitution. Econ. Modell. 44, 104–115. doi: 0.1016/j.econmod.2014.09.017

Breitung, J., and Pesaran, M. H. (2008). “Unit roots and cointegration in panels,” in The Econometrics of Panel Data. Advanced Studies in Theoretical and Applied Econometrics, eds L. Mátyás and P. Sevestre (Berlin: Springer), 279–322. doi: 0.1007/978-3-540-75892-1_9

Breusch, T. S., and Pagan, A. R. (1980). The lagrange multiplier test and its applications to model specification in econometrics. Rev. Econ. Stud. 47, 239–253. doi: 0.2307/2297111

Caraiani, C., Lungu, C., and Dascãlu, C. (2015). Energy consumption and GDP causality: a three-step analysis for emerging European countries. Renew. Sustain. Energy Rev. 44, 198–210. doi: 0.1016/j.rser.2014.12.017

Cetin, M. (2016). Renewable energy consumption-economic growth nexus in E-7 countries. Energy Sources B Econ. Plan. Policy 11, 1180–1185. doi: 0.1080/15567249.2016.1156195

Christopoulos, D. K., and Leon-Ledesma, M. A. (2011). International output convergence, breaks, and asymmetric adjustment. Stud. Nonlinear Dyn. Econ. 15, 1–33.

Crippa, M., Guizzardi, D., Muntean, M., Schaaf, E., Solazzo, E., Monforti-Ferrario, F., et al. (2020). Fossil CO2 Emissions of All World Countries -2020 Report, EUR 30358 EN. Luxembourg: Publications Office of the European Union. doi: 0.2760/143674

Danish, Z. B., Wang, B., and Wang, Z. (2017). Role of renewable energy and nonrenewable energy consumption on EKC: evidence from Pakistan. J. Clean. Prod. 156, 855–864. doi: 0.1016/j.jclepro.2017.03.203

Destek, M. (2016). Renewable energy consumption and economic growth in newly industrialized countries: evidence from asymmetric causality test. Renew. Energy 95, 478–484. doi: 0.1016/j.renene.2016.04.049

Destek, M. A., and Aslan, A. (2017). Renewable and non-renewable energy consumption and economic growth in emerging economies: evidence from bootstrap panel causality. Renew. Energy 111, 757–763. doi: 0.1016/j.renene.2017.05.008

Dogan, E. (2016). Analyzing the linkage between renewable and nonrenewable energy consumption and economic growth by considering structural break in time-series data. Renew. Energy 99, 1126–1136. doi: 0.1016/j.renene.2016.07.078

Dumitrescu, E. I., and Hurlin, C. (2012). Testing for granger non-causality in heterogeneous panels. Econ. Modell. 29, 1450–1460.

Edenhofer, O., Pichs-Madruga, R., Sokona, Y., Seyboth, K., Matschoss, P., Kadner, S., et al., eds. (2014). “Summary for policymakers,” in Climate Change 2014: Mitigation of Climate Change. IPCC Special Report on Renewable Energy Sources and Climate Change Mitigation. (Cambridge, United Kingdom and New York, NY: Cambridge University Press).

Ellabban, O., Abu-Rub, H., and Blaabjerg, F. (2014). Renewable energy resources: Current status, future prospects and their enabling technology. Renew. Sustain. Energy Rev. 39, 748–764. doi: 0.1016/j.rser.2014.07.113

Enders, W., and Jones, P. (2016). Grain prices, oil prices, and multiple smooth breaks in a VAR. Stud. Nonlinear Dyn. Econom. 20, 399–419.

Fang, Y. (2011). Economic welfare impacts from renewable energy consumption: the China experience. Renew. Sustain. Energy Rev. 15, 5120–5128. doi: 0.1016/j.rser.2011.07.044

Fuinhas, J., and Marques, A. (2011). Energy consumption and economic growth nexus in Portugal, Italy, Greece, Spain and Turkey: an ARDL bounds test approach. Energy Econ. 34, 511–517. doi: 0.1016/j.eneco.2011.10.003

Hsiao, C. (2007). Panel data analysis—advantages and challenges. Test 16, 1–22. doi: 0.1007/s11749-007-0046-x

Jakovac, P. (2018). “Causality between energy consumption and economic growth: literature review,” in Proceedings of the 5th International Conference on Education and Social Sciences, Istanbul.

Kahia, M., Aïssa, M., and Lanouar, C. (2016). Impact of renewable and nonrenewable energy consumption on economic growth: new evidence from the MENA Net Oil Exporting Countries (NOECs). Energy 116, 102–115. doi: 0.1016/j.energy.2016.07.126

Kahia, M., Aïssa, M., and Lanouar, C. (2017). Renewable and nonrenewable energy use- economic growth nexus: the case of MENA Net Oil Importing Countries. Renew. Sustain. Energy Rev. 71, 127–140. doi: 0.1016/j.rser.2017.01.010

Kónya, L. (2006). Exports and growth: granger causality analysis on OECD countries with a panel data approach. Econ. Modell. 23, 978–992. doi: 0.1016/j.econmod.2006.04.008

Kraft, J., and Kraft, A. (1978). On the relationship between energy and GNP. J. Energy Dev. 3, 401–403.

Le, H. P., and Sarkodie, S. A. (2020). Dynamic linkage between renewable and conventional energy use, environmental quality and economic growth: evidence from emerging market and developing economies. Energy Rep. 6, 965–973. doi: 0.1016/j.egyr.2020.04.020

Lee, C., and Chang, C. (2008). Energy consumption and economic growth in Asian economies: a more comprehensive analysis using panel data. Resour. Energy Econ. 3, 50–65. doi: 0.1016/j.reseneeco.2007.03.003

Lütkepohl, H. (1982). Non-causality due to omitted variables. J. Econom. 19, 367–378. doi: 0.1016/0304-4076(82)90011-2

Maji, I. (2015). Does clean energy contribute to economic growth? Evid. Nigeria Energy Rep. 1, 145–150. doi: 0.1016/j.egyr.2015.06.001

Nazlioglu, S., Lebe, F., and Kayhan, S. (2011). Nuclear energy consumption and economic growth in OECD countries: cross-sectionally dependent heterogeneous panel causality analysis. Energy Policy 39, 6615–6621. doi: 10.1016/j.enpol.2011.08.007

Ocal, O., and Aslan, A. (2013). Renewable energy consumption–economic growth nexus in Turkey. Sustain. Energy Rev. 28, 494–499. doi: 0.1016/j.rser.2013.08.036

Omay, T. (2015). Fractional frequency flexible Fourier form to approximate smooth breaks in unit root testing. Econ. Lett. 134, 123–126. doi: 0.1016/j.econlet.2015.07.010

Omri, A., and Kahouli, B. (2014). Causal relationships between energy consumption, foreign direct investment and economic growth: fresh evidence from dynamic simultaneous-equations models. Energy Policy 67, 913–922. doi: 10.1016/j.enpol.2013.11.067

Owusu, P. A., and Asumadu, S. S. (2016). A review of renewable energy sources, sustainability issues and climate change mitigation. Cogent Eng. 3:1167990. doi: 0.1080/23311916.2016.1167990

Ozcan, B., and Ozturk, I. (2019). Renewable energy consumption-economic growth nexus in emerging countries: a bootstrap panel causality test. Renew. Sustain. Energy Rev. 104, 30–37. doi: 0.1016/j.rser.2019.01.020

Ozturk, A. (2010). A literature survey on energy-growth nexus. Energy Policy 38, 340–349. doi: 0.1016/j.enpol.2009.09.024

Ozturk, I., and Acaravci, A. (2011). Electricity consumption and real GDP causality nexus: evidence from ARDL bounds testing approach for 11 MENA countries. Appl. Energy 88, 2885–2892. doi: 0.1016/j.apenergy.2011.01.065

Ozturk, I., and Bilgili, F. (2015). Economic growth and biomass consumption nexus: dynamic panel analysis for Sub-Sahara African countries. Appl. Energy 137, 110–116. doi: 0.1016/j.apenergy.2014.10.017

Pao, H., Li, Y., and Fu, H. (2014). Clean energy, non-clean energy, and economic growth in the MIST countries. Energy Policy 67, 932–942. doi: 0.1016/j.enpol.2013.12.039

Pao, H., and Tsai, C. (2011). Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 36, 685–693. doi: 0.1016/j.energy.2010.09.041

Payne, J. (2010). Survey of the international evidence on the causal relationship between energy consumption and growth. J. Econ. Stud. 37, 53–95. doi: 0.1108/01443581011012261

Payne, J. E. (2009). On the dynamics of energy consumption and output in the US. Appl. energy 86, 575–577. doi: 0.1016/j.apenergy.2008.07.003

Pesaran, M. H. (2004). General Diagnostic Tests for Cross Section Dependence in Panels. Cambridge Working Papers in Economics 0435, Faculty of Economics. Cambridge: University of Cambridge, doi: 0.17863/CAM.5113

Pesaran, M. H., Ullah, A., and Yamagata, T. (2008). A bias−adjusted LM test of error cross−section independence. Econ. J. 11, 105–127. doi: 0.1111/j.1368-423x.2007.00227.x

Pesaran, M. H., and Yamagata, T. (2008). Testing slope homogeneity in large panels. J. Econ. 142, 50–93. doi: 0.1016/j.jeconom.2007.05.010

Razmi, S., Ramezanian, B., Behname, M., Salari, T., and Razmi, S. (2020). The relationship of renewable energy consumption to stock market development and economic growth in Iran. Renew. Energy 145, 2019–2024. doi: 0.1016/j.renene.2019.06.166

Sadorsky, P. (2009). Renewable energy consumption and income in emerging economies. Energy Policy 37, 4021–4028. doi: 0.1016/j.enpol.2009.05.003

Sarkodie, S. A., Ackom, E., Bekun, F. V., and Owusu, P. A. (2020). Energy–climate–economy–population nexus: an empirical analysis in Kenya, Senegal, and Eswatini. Sustainability 12:6202. doi: 0.3390/su12156202

Shakouri, B., and Yazdi, S. (2017). Causality between renewable energy, energy consumption, and economic growth. Energy Sources B Econ. Plan. Policy 12, 838–845. doi: 0.1080/15567249.2017.1312640

Tuna, G., and Tuna, V. (2019). The asymmetric causal relationship between renewable and non- renewable energy consumption and economic growth in the ASEAN-5 countries. Resour. Policy 62, 114–124. doi: 0.1016/j.resourpol.2019.03.010

Venkatraja, B. (2019). Does renewable energy affect economic growth? Evidence from panel data estimation of BRIC countries. Int. J. Sustain. Dev. World Ecol. 27, 107–113. doi: 0.1080/13504509.2019.1679274

Waheed, R., Sarwar, S., and Wei, C. (2019). The survey of economic growth, energy consumption and carbon emission. Energy Rep. 5, 1103–1115. doi: 0.1016/j.egyr.2019.07.006

Wolde-Rufael, Y. (2009). Energy consumption and economic growth: the experience of African countries revisited. Energy Econ. 31, 217–224. doi: 0.1016/j.eneco.2008.11.005

Yilanci, V., and Ozgur, O. (2019). Testing the environmental Kuznets curve for G7 countries: evidence from a bootstrap panel causality test in rolling windows. Environ. Sci. Pollut. Res. 26, 24795–24805. doi: 0.1007/s11356-019-05745-3

Yildirim, E. (2014). Energy use, CO2 emission and foreign direct investment: is there any inconsistence between causal relations? Front. Energy 8:269–278. doi: 0.1007/s11708-014-0326-6

Yildirim, E., Sarac, S., and Aslan, A. (2012). Energy consumption and economic growth in the USA: evidence from renewable energy. Renew. Sustain. Energy Rev. 16, 6770–6774. doi: 0.1016/j.rser.2012.09.004

Zafar, M., Shahbaz, M., Hou, F., and Sinha, A. (2019). From nonrenewable to renewable energy and its impact on economic growth: the role of research & development expenditures in Asia-Pacific economic cooperation countries. J. Clean. Prod. 212, 1166–1178. doi: 0.1016/j.jclepro.2018.12.081

Zellner, A. (1962). An efficient method of estimating seemingly unrelated regressions and tests for aggregation bias. J. Am. Stat. Assoc. 57, 348–368. doi: 0.1080/01621459.1962.10480664

Appendix

To apply the Dumitrescu-Hurlin (DH) panel causality test, we should first determine the integration levels of the variables. Table A1 shows the panel unit root test results:

Keywords: panel causality, Fourier functions, structural changes, renewable energy, non-renewable energy, economic growth

Citation: Yilanci V, Haouas I, Ozgur O and Sarkodie SA (2021) Energy Diversification and Economic Development in Emergent Countries: Evidence From Fourier Function-Driven Bootstrap Panel Causality Test. Front. Energy Res. 9:632712. doi: 10.3389/fenrg.2021.632712

Received: 23 November 2020; Accepted: 01 March 2021;

Published: 19 March 2021.

Edited by:

Hooi Hooi Lean, Universiti Sains Malaysia (USM), MalaysiaReviewed by:

Evan Lau, Universiti Malaysia Sarawak, MalaysiaSeema Narayan, RMIT University, Australia

Ehsan Rasoulinezhad, University of Tehran, Iran

Copyright © 2021 Yilanci, Haouas, Ozgur and Sarkodie. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Samuel Asumadu Sarkodie, YXN1bWFkdXNhcmtvZGllc2FtdWVsQHlhaG9vLmNvbQ==

Veli Yilanci

Veli Yilanci Ilham Haouas2

Ilham Haouas2 Onder Ozgur

Onder Ozgur Samuel Asumadu Sarkodie

Samuel Asumadu Sarkodie