- 1Graduate School of Business, Universiti Sains Malaysia, Penang, Malaysia

- 2Department of Banking and Financial Markets, Financial University Under the Government of the Russian Federation, Moscow, Russia

- 3School of Social Sciences, Universiti Sains Malaysia, Penang, Malaysia

Growing energy demand but stagnant production followed by volatile exchange rate leads Pakistan to energy imbalances and potential economic contraction. Yet, studies on sectoral energy imports are limited and inconclusive without accessing the asymmetric effect of currency fluctuations. We examine the impacts of Pakistani rupee volatility on monthly energy imports based on the nonlinear autoregressive distributed lag (NARDL) estimations. Augmented Dickey–Fuller and Phillips–Perron tests were used to conduct unit root testing, and the bound testing approach was used to examine the long-term cointegration. The long-run asymmetry was tested with the Wald test, and using the NARDL model, we examined both short-run and long-run asymmetric effects of exchange rate volatility on energy imports. The bound test was established and supported through

Introduction

Energy is a key driver in sustaining socioeconomic development. Energy consumption is one of the main indicators to assess the standard of living in a country. On account of fast industrial and technological development, the demand for energy is expanding very fast especially among the developing Asian economies (World Energy Outlook, WEO, 2018). The International Energy Agency (IEA, 2019) projected that the world energy demand will grow by a quarter by 2040, while the demand in Asia will grow by 40%. Of all, Asia makes up half of the energy growth in natural gas, 80% in crude oil, and 100% in coal. This increasing energy demand in Asia is startling as it represents two-third of the world total energy growth (IEA, 2019).

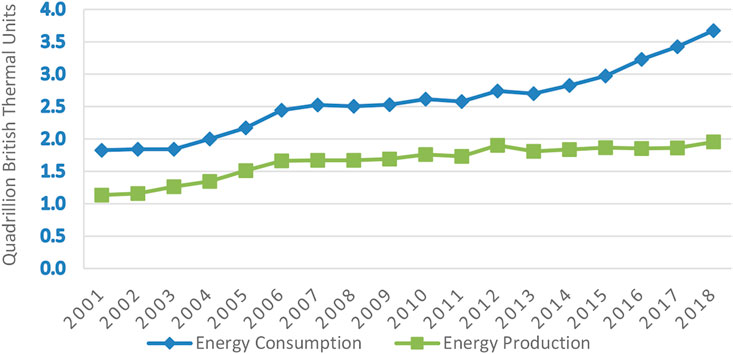

Among other developing Asian countries, Pakistan is confronted with potential energy imbalances since decades ago (Pakistan Energy Outlook, PEO, 2010). The energy problem is expected to result in much serious socioeconomic development, but less academic studies and policy adjustments have been put forward. The primary energy demand in Pakistan has grown almost 80% in the last 15 years, but the production of energy is seriously insufficient. As depicted in Figure 1, the gap between energy demand and supply is large and widening with time (Raza et al., 2015; Rafique and Rehman, 2017). The economy of Pakistan is going through major energy crises of all time (Mahmood et al., 2014; Shahbaz et al., 2018). Mahmood et al., (2016) argued that the poor energy policy, political unrest, and weak law and order situation lead Pakistan to energy crises. Similarly, Komal and Abbas (2015) commented that the dependency on oil and gas for energy production (around 80%), the financial instability of energy supply firms, heavy circular debt, decline in gas reserves, and inefficient utilization of inexpensive hydel and coal are the factors contributing to energy crises in Pakistan.

FIGURE 1. Pakistan’s energy production and consumption (2001–2018)1.

In Pakistan, the average per capita electricity consumption is 456 kilowatt hours (KWh), which is 30% less than the Asian average and quarter of the world average (Naeem et al., 2014). Mahmood et al., (2016) argued that the electricity shortages are the primary reason for low per capita energy consumption. The current electricity shortages of 8,000 MW in 2017 were expected to reach 13,000 MW at the end of 2020 (Shahbaz et al., 2018). The World Energy Outlook (WEO, 2016) observed that about 51 million people (27% of total population) in Pakistan do not have access to electricity, while 144 million people do not have a reliable electricity connection.

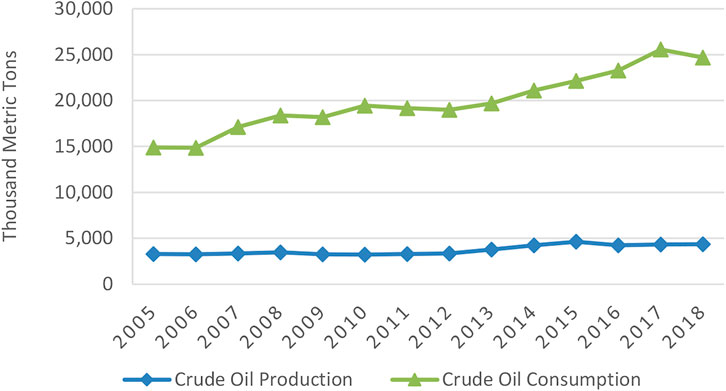

The average crude oil consumption of Pakistan is 26 million tons, of which only 15% is domestically produced (Planning Commission of Pakistan GOP, 2015–2016). The gap between production and consumption of crude oil is depicted in Figure 2 (Ministry of Finance, Government of Pakistan, 2018). The State Bank of Pakistan (2015) reported that Pakistan’s total oil production is 86,500 barrels per day and the recoverable reserves are 371 million barrels. In the financial year 2017–2018, the domestic production of natural gas was 978 billion cubic feet (BCF), whereas 192 BCF were imported to meet the total natural gas demand (Economic Survey of Pakistan, 2017–18). Imran and Amir (2015) predicted considering the current rate at which oil and gas are consumed that if new resources are not explored, the oil resources will exhaust by 2025 and natural gas by 2030.

FIGURE 2. Pakistan’s crude oil production and consumption2.

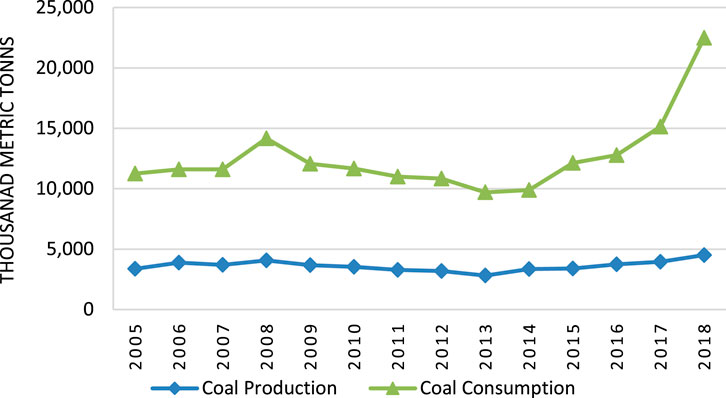

Moreover, the annual coal demand is 11.5 million tons, of which 60% is internally produced and 40% is imported (Ministry of Finance, Government of Pakistan, 2015; Planning Commission of Pakistan, Government of Pakistan, 2017). Figure 3 elaborates the accelerating coal consumption and stagnant production in Pakistan. Unsurprisingly, the production of all these energy sources, particularly the power sector, is heavily dependent on the usage of fossil fuels (Mahmood et al., 2016). The share of these fossil fuels is around 65% of total energy requirements (Ministry of Finance, GOP, 2014–2015). But the fossil fuel resources are depleting at an alarming rate.

FIGURE 3. Pakistan’s coal production and consumption3.

To overcome this issue of growing energy demand and depleting energy resources, Pakistan has no other option but to opt for energy imports. If this energy demand is not met, the country’s economy will face severe consequences since energy consumption is directly associated with economic growth (Lee and Chang, 2008; Bartleet and Gounder, 2010; Shahbaz et al., 2013), urbanization, industrialization, financial development (Shahbaz and Lean, 2012), technological development, and social growth (Mahmood et al., 2016). The economic growth of a country largely depends on the level of energy consumption and supply position (Yaseen et al., 2020). Ahmed et al., (2016) described that per capita energy consumption in Pakistan is directly associated with the economic growth of the country. The countries such as France, United States, and China have the highest per capita energy consumption and, consequently, are the fastest growing economies (Ozturk and Acaravci, 2010). But Pakistan does not have enough indigenous energy resources, and energy import requirements are expected to grow from 30 to 70% by 2025/26, costing $50 billion annually in foreign exchange (Pakistan Economic Outlook, 2010). The government of Pakistan spent 14.5 billion US dollars only on oil imports in 2014 (State Bank of Pakistan, 2015). Such imbalances in energy trade, if not corrected, may cause contraction of GDP growth from 2.4% in 2019/2020 (Global Economic Prospects, 2020) to potential recession (World Bank bulletin, April 7, 2020).

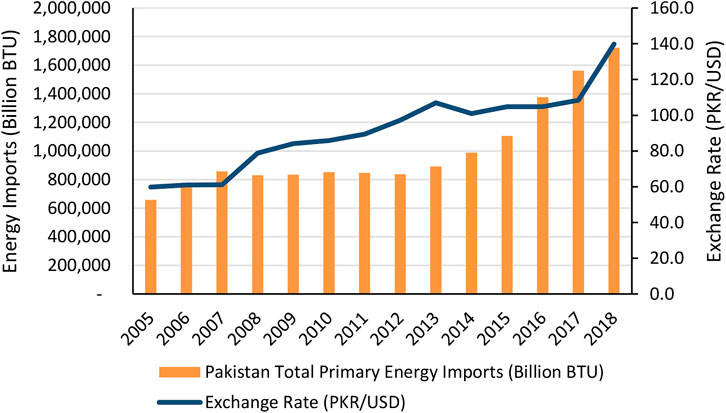

On the contrary, the foreign exchange of Pakistani rupee (PKR) against the US dollar (PKR/USD) is quite volatile in recent years. The PKR/USD fluctuated at rates from 58 to 166 throughout 2000 until March 2020 with a high tendency toward depreciation. During the recent period of January 2018 to December 2019, the PKR devalued about 33% (see Figure 4). In consort with the highly volatile PKR/USD and fluctuations in international energy prices, Pakistan’s energy imports increased by 34% to $1.27 billion, within a single month of July 2019 (Pakistan Bureau of Statistics, 2019). This amount equals to one-fourth of the total import bill. Put differently, the bill of energy import is 59% of the total export bill. The trends of primary energy import and exchange rates are captured in Figure 4. The lack of alternative energy resources and weakening economy performance suggested that much efforts are needed to enhance the competency of local energy supply to correct the energy trade gap. The energy crisis will accelerate if Pakistan becomes more dependent in energy imports due to foreign exchange fluctuations. To gain a better picture of such issue, there is an urgent need for a comprehensive investigation via the sub-sector level of energy imports.

FIGURE 4. Co-movements of exchange rate and energy imports (2005–2018)4.

However, despite the urgent call for energy corrections in Pakistan, recent studies on the subject matter are still limited and far from conclusive. These studies of foreign exchange volatility–trade flows can be classified into two major groups. The first strand examined trade flows of Pakistan with the rest of the world (Javed and Farooq, 2009; Alam and Ahmed, 2010; Saqib and Sana, 2012), while the other investigated the aggregate and bilateral trade flows of Pakistan with selected major trading partners (Alam and Ahmed, 2011; Hassan, 2013; Alam et al., 2018). Most of these studies used aggregate trade flows and reported mixed findings because the aggregation in data cut off the opposite effect of various commodities like one commodity positive effect with the other commodity negative effect. Thus, the aggregated data findings are overgeneralized and inappropriate to devise the exchange rate and trade policies for the respective industry or commodity. In a way, aggregation bias may lead to inappropriate discussions and misleading policy recommendations. Later studies realized the shortcomings and tried to venture into disaggregate data. Still, most of them concluded mixed findings.

Most important, of all, is the potential analytical flaw due to the assumption of the symmetric effect of exchange rate volatility on trade flows by past studies. The symmetric effect implies that if a unit increase in foreign exchange volatility expands trade by x percent, then a unit decrease in foreign exchange volatility should reduce trade by the same x proportion. But in practice, traders may respond in an asymmetric manner due to expectations or business attitudes. For example, a trader who decided to trade less in response to increased volatility may still trade less with decreased volatility. This may happen due to loss of market confidence, lack of availability, or risk tolerance among the financial managers.

Studies at the global level already reported that not only domestic prices (Delatte and Lopez-Villavicencio, 2012) but also the prices of exports and imports (Bussiere, 2013; Bahmani-Oskooee and Fariditavana, 2016) respond asymmetrically to exchange rate changes. The asymmetric effects of exchange rate volatility on international trade flows (both imports and exports) were confirmed partially in a short run as well as in a long run (see, e.g., Bahmani-Oskooee and Aftab, 2017; Bahmani-Oskooee et al., 2020). In a recent study on bilateral industrial trades of Pakistan against Japan, (Bahmani-Oskooee et al., 2016) distinguished industries that were affected positively by rupee fluctuations from those that were negatively affected. It was the pioneer study that examined the asymmetric effect of exchange rate volatility on different industries in Pakistan. Still, the focus was tilted toward the effect of exchange rate changes on trade flows, while the specific effect on energy imports is broadly ignored.

Putting all in a nutshell, there is obvious lack of literature to study the energy imports–exchange rate volatility nexus to tackle the issue of energy imbalances in Pakistan. This study is set to assess the short-run and long-run asymmetric effects of recent exchange rate volatility on Pakistan’s monthly energy imports, during March 2005 to December 2019. A nonlinear autoregressive distributed lag (NARDL) is applied in the analyses by the spirit of (Shin et al., 2014). This econometric procedure allows to have a mixture of I(1) and I(0) in regressors, which, at the same time, is able to capture both short-run and long-run asymmetric effects of exchange rate volatilities over time. To our best knowledge, this study is the first to introduce the NARDL to examine the exchange rate volatility–energy imports nexus for Pakistan. The sectoral level energy imports include crude oil (CRO), petroleum products (PPD), coal (COA), and electricity (ELC). Natural gas, however, is excluded from the present study due to data insufficiency. Pakistan only started natural gas imports in 2014, and the short series do not meet the requirement of NARDL estimations. In addition, we also include some other macroeconomic variables in the analyses.

Theoretically, the foreign inflows have three possible effects, namely, scale, composition, and technique effects. The scale effect is that a rise in foreign inflows triggers domestic economic activity, which, in turn, accelerates the energy demand. On the contrary, the technique effect is supposed to be negative since foreign inflows brought energy efficiency on the international investor’s facilities and the diffusion of such efficiency techniques across domestic sectors and the community as a whole; hence, these energy efficiency techniques reduce a country’s energy import demand. However, the composition effect is indeterminate since it is subjected to the sectoral distribution of Foreign direct investment inflows5 and the level of economic activity in the host country.

The empirical findings of the FDI effect on energy demand are mixed, where one group of studies supports the positive effect (see Sadorsky, 2010; Lee, 2013; Omri and Kahouli, 2014; Rahman et al., 2019) and the other group supports the negative effect (see Mielnik and Goldemberg, 2002; Doytch and Narayan, 2016). However, a stream of studies concluded this effect to be either heterogeneous across countries or insignificant (see Hübler and Keller, 2008; Keho, 2016; Paramati et al., 2016). Interestingly, the study of Salim et al., (2017) found the short-run positive and long-run negative effects of FDI on energy demand. In line with the studies of positive effect, scale effect, we are expecting the positive effect of foreign direct investment on energy imports of Pakistan.

Then, the study by Rahman et al. (2019) found a long-term cointegrating relationship between remittances and energy demand in South Asian economies, including Pakistan. They stated that workers’ remittances accelerate the household’s income and, hence, push energy consumption. Lim and Basnet (2017) argued that the effect of remittances on energy demand is based on the factor whether remittances enhance a household’s income in the case of transitory income hypothesis or permanent income hypothesis. In the latter case, a rise in a household’s income increases their energy consumption, while in the former case, a rise in the household income is either saved or smoothed over a lifetime. Thus, the effect of remittance on energy demand depends upon the channel it takes. Akçay and Demirtaş (2015) stated remittances accelerate the energy demand in both the short run and long run directly, and indirectly, the spike in energy demand is channeled through industrialization and economic growth. Since the effect of remittances on energy demand depends upon the channel, demand, or supply it takes, the effect of remittances could be either positive or negative on energy imports of Pakistan.

On the contrary, few studies report a positive effect of industrial production on energy demand (Zhao and Wu, 2007; Adom et al., 2012; Shahbaz and Lean, 2012; Keho, 2016). However, some studies found a negative effect (see Mallick and Mahalik, 2014), and others do not find any effect of industrial production index on energy demand (Erdogdu, 2007). We used the industrial production index (IPI) in place of GDP due to two main reasons. First, we are using monthly sectoral energy imports because the GDP data are not available in monthly frequency (Bahmani-Oskooee and Aftab, 2017; Sharma and Pal, 2019). Second, the IPI represents purely the production sector that is one of the major consumers of energy (Zhao and Wu, 2007). Therefore, the industrial production index is used as one of the predictor variables in the regression equation.

The importance of exchange rate in the energy literature increased due to the dependency of economies on external sources to meet the domestic energy demand. Such dependency of a country on external sources for energy imports leads to the effect of exchange rate on the capacity of a country to demand either more or less energy (Uche and Nwamiri, 2020). Exchange rate can affect energy trade through the opportunity cost of energy products and the attractiveness of domestic energy products relative to the foreign energy products. Empirical studies found the effect of exchange rate to be significant and negative on the primary energy consumption in Pakistan (i.e., Shahbaz et al., 2018) and gasoline consumption in Iran (Ghoddusi et al., 2019). In the panel framework, De Schryder and Peersman (2015) found that exchange rate appreciation diminishes the crude oil demand of oil-importing countries. They elaborated that the shift in crude oil demand due to the exchange rate is larger than the shift caused by the global oil prices expressed in US dollars. For our other explanatory variable, interest rate, one study reported a significant association between the interest rate and the energy demand (i.e., Karanfil, 2009). Lastly, the inflation, consumer price index, is found to be negatively associated with the energy demand (see Mukhtarov et al., 2020).

Theoretical Underpinnings

One the one hand, due to the rising energy demand and limited supply, Pakistan is increasing energy imports to meet the domestic demand. On the other hand, the Pakistani rupee (PKR) is significantly volatile, particularly due to substantial depreciation in the recent past. This higher energy import is requiring more foreign exchange, and the demand for foreign exchange is triggering further volatility and depreciation in the PKR. The energy situation will further deteriorate if Pakistan becomes more energy import dependent due to foreign exchange fluctuations. In the energy literature, the exchange rate will gain much attention when countries around the world begin to import more and more energy from external sources to meet the domestic energy demand (see, i.e., Uche and Nwamiri, 2020). The current study is examining the effect of exchange rate and, most importantly, exchange rate volatility on Pakistan’s commodity level energy imports. Most of the previous studies used aggregated trade flows and reported inconclusive results because the aggregation in data cut off the opposite effect, for example, the negative effect on one commodity with the positive effect on another commodity. The findings of these studies are overgeneralized and inappropriate to devise policies for respective industries/commodities. The most important drawback of past studies is the analytical flaw due to the assumption of the symmetric effect of exchange rate volatility on trade. However, there could be an asymmetric effect due to the attitude of international traders. For example, if a trader increases trade by 10% when exchange rate volatility declines one unit, he/she may not increase trade by the same 10% when exchange rate volatility increases one unit. Therefore, the current study examined and found long-run cointegration among the variables followed by short-run and long-run asymmetric effects of exchange rate volatility on Pakistan’s energy imports of four commodities, namely, crude oil, electricity, coal, and petroleum products.

In addition to the exchange rate and exchange rate volatility, the current study has also taken other macroeconomic variables into consideration, which have the potential to influence Pakistan’s energy imports. Theoretically, a rise in foreign inflows can increase domestic economic activity, resulting in the energy demand increase; if the domestic energy supply is not sufficient, the country has to import more energy to meet the domestic energy demand. On the contrary, FDI brings energy efficiency on investors’ facilities and the diffusion of this efficiency in domestic sectors, and this efficiency increases domestic production and, therefore, diminishes energy imports. The effect of the second macroeconomic variable, remittances, is positive on the imports of electricity and negative on petroleum products, coal, and crude oil. The effect of remittances depends on the question whether workers’ remittances increase the household income in the case of transitory income or permanent income hypothesis. In the latter case, a rise in a household’s income increases their energy consumption, while in the former case, a rise in the household income is either saved or smoothed over a lifetime. Conversely, foreign remittances can be injected to the investment market to enhance domestic energy production, hence reducing the demand for energy imports. Furthermore, the effect of industrial production index (IPI) is negative on the imports of petroleum products and positive on the imports of crude oil, coal, and electricity. The negative effect of IPI might be due to the fact that industrial production increases energy demand. While if the industrial production is increasing in the energy sector, it will increase the domestic energy supply and, consequently, diminish the demand for energy imports. Furthermore, the effect of interest rate on crude oil, electricity, and coal is found to be significant, where a swelling interest rate expands “crude oil” and “electricity” imports while reduces imports of “coal.” The higher interest rate in the domestic market relative to foreign markets increases the attractiveness of foreign energy commodities, thereby increasing the energy import demand. On the contrary, the higher interest rate hurt consumers’ purchasing power and, therefore, energy demand. Lastly, except electricity, the consumer price index (inflation) accelerates imports of crude oil, electricity, and coal.

The rest of this paper is organized as follows: Methodology presents the models and estimation. The empirical results are reported in Empirical Results. Lastly, Conclusion and Policy Implications presents conclusions and policy implications.

Methodology

Econometric Framework

Most of the previous studies using aggregate trade flows included standard explanatory variables in the import demand equation such as the relative income, relative prices, exchange rate, and uncertainty measure constructed as exchange rate volatility. We included some other macroeconomic variables affecting the energy demand, namely, foreign remittances, foreign direct investments, interest rate, inflation, and industrial production index. In line with recent studies (e.g., Bahmani-Oskooee and Aftab, 2017), we begin with the following basic equation:

Here,

Theoretically, the sign associated with

Equation (1) is expected to provide the long-run coefficients of the cointegrating relationship among the variables. These long-run estimates can be produced via the error correction model (ECM), where changes in the energy demand are associated with either the disequilibrium in previous periods or the variation caused by changes in other explanatory variables. The short-run estimates are differentiated from the long-run ones through the dynamic adjustment mechanism in Equation (1). The new specification is provided as

The error correction framework was provided by Pesaran et al. (2001), where both short-term and long-term effects can be measured simultaneously in a single equation. In Equation (2), short-run effects are captured with first-difference operators, while the long-term effect is captured through estimates from

This methodology has certain advantages over other previously used methodologies. First, the approach is well suited to small samples than conventional methods that only deal with large samples. Second, the previously used standard ECM is similar to the Engle–Granger two-step method, prone to be less efficient as compared to our method. Lastly, the ARDL framework does not require all variables to be integrated at the same order, but the response variable should be I(1). For example, if some of the variables in Equation (2) are integrated at level I(0) and others at first difference I(1), using previous methods like Engle–Granger and Johansen and Juselius would produce misleading results.

For measuring the asymmetric effect, we have to introduce nonlinear adjustments to the volatility measure. This is done using the partial sum concept of Shin et al. (2014), where the volatility measure is disaggregated into positive changes in exchange rate volatility (rupee depreciation) and negative changes in exchange rate volatility (rupee appreciation). The partial sums are like

In Equation (5),

Shin et al. (2014) stated that, irrespective of one additional variable in the nonlinear specification, the same bound values of Pesaran et al. (2001) are applicable. They further suggested that two of the additional variables in Equation (5) should be treated as one variable; thus, the same upper and lower bound critical values could be used to test for the long-term cointegration. Once we estimate the nonlinear model as in Equation (5), a few asymmetric assumptions could be tested. First, if n1 ≠ n2, for example, positive changes in exchange rate (PCH) follow a different lag order in comparison with negative changes in exchange rate volatility (NCH), the adjustment asymmetry will be established.

Second, if either size or sign, at any given lag order, of PCH is different from that of NCH, the effect is considered to be asymmetric. Third, if the estimated Wald test rejects null hypothesis stating that sum of the coefficients associated with PCH is equal to the sum of the coefficients associated with NCH (

Data Description

The current study uses monthly data ranging from March 2005 to December 2019, making a total of 178 observations. The exchange rate (PKR/USD) series are sourced from the website of Pacific Exchange Rate System. A decrease in exchange rate indicates PKR appreciation, and vice versa. As for exchange rate volatility (

Then, other macroeconomic variables including the foreign direct investment (

In addition, the crude oil, electricity, coal, and petroleum products data are gathered and cross-checked from a variety of sources, which include the Pakistan Bureau of Statistics (PBS), State Bank of Pakistan (SBP), Pakistan economic surveys (PES), Pakistan Energy Outlook (PEO), and International Energy Agency (IEA). These four types of energy series are gathered from different sources carrying different units of measurements. We thereby convert them into a single unit by using some scientific modus operandi of energy quantification. Primarily, thousand barrels of crude oil, thousand tons of petroleum products, thousand tons of coal, and gigawatt hours of electricity were converted into thousand US dollars. For the analysis purpose, all variables (except

Scheme of the Study

First of all, we perform descriptive analysis to check if our data are free from outliers and calculate the correlation matrix to check for the possible multicollinearity. The data property of integration is checked using unit root tests, e.g., augmented Dickey–Fuller (ADF) and Phillips–Perron (PP) tests. In the ARDL–NARDL settings, all dependent variables are required to be integrated at order one, I(1), and the independent variables can be either level stationary or first-difference stationary (Pesaran et al., 2001).

After checking the data properties, a prior estimation of the ARDL model in Equation (1) is conducted6. The ARDL model is then extended to the NARDL model. For that, we apply the partial sum concept of Shin et al. (2014) to decompose the exchange rate volatility measure in Equations (3) and (4), into the positive and negative elements. The NARDL short-run and long-run estimates were then generated from the nonlinear equation (5) of Shin et al. (2014). In what follows, the potential long- and short-run asymmetry effects are examined based on Equation (6) using Wald tests (Wald-L, Wald-S).

At the same time, the cointegration relationship is verified through the bound test (F-stat.) and alternatively via the adjusted t-test of Pesaran et al. (2001) due to the small sample size (n < 30). And the error correction terms (ECTs) are estimated to gauge the short-run adjustments toward long-run equilibrium (speed of adjustments). Finally, the corresponding diagnostic tests are also conducted to justify the validity of our results. These include the Lagrange multiplier for serial correlation, Ramsey RESET test for model specification, JB test for normality, and cumulative sum and cumulative sum of squares for model stability.

Empirical Results

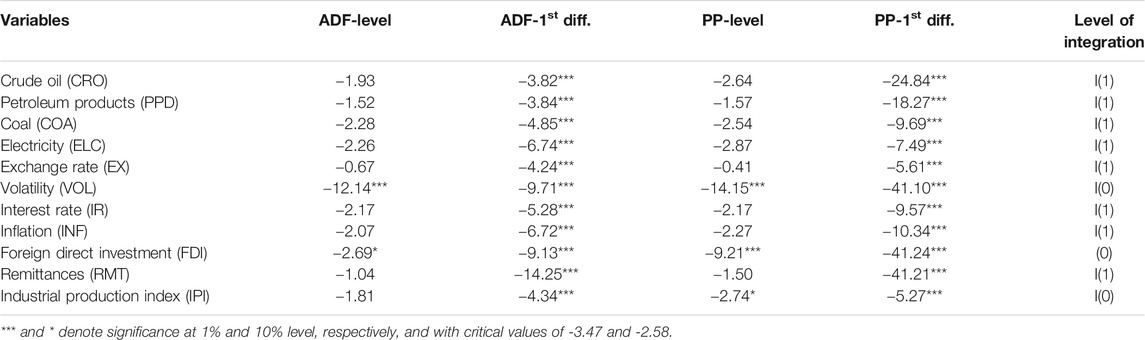

Before the estimation of empirical models, the data property is examined to verify the order of integration of each variable, as reported in Table 1. Two renowned unit root tests, namely, the augmented Dickey–Fuller (ADF) and Phillips–Perron (PP) tests, are applied at both level and first difference, with the assumption of constant, and trend. All the energy imports that are taken as dependent variables (crude oil, CRO; petroleum products, PPD; coal, COA; electricity, ELC) are I(1). The rest of the variables such as remittances (RMT), foreign direct investment (FDI), interest rate (IR), inflation (INF), industrial production index (IPI), exchange rate (EX), and exchange rate volatilities (VOL) are either first-difference or level stationary. Thus, it is safe to apply the ARDL–NARDL methodology that allows to have a mixture of I(0) and I(1) but not I(2) among the regressors.

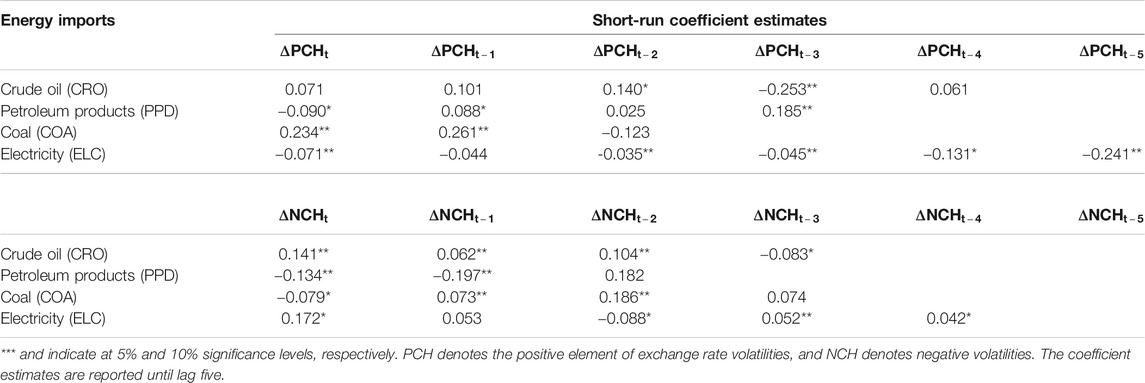

In the NARDL energy import demand model, the short-run estimates for positive (ΔPCH) and negative (ΔNCH) volatilities are reported in Table 2. First, the results show significant (but with different signs) coefficients in all energy sources (except CRO positive), thus supporting the short-run effect of exchange rate volatility on energy imports. Second, we observed adjustment asymmetry in all energy sources because the lag order followed by ΔNCH is different from that followed by ΔPCH. Third, the short-run effect is found to be asymmetric since either the size or sign of the coefficient associated with ΔPCH and ΔNCH at each lag is different.

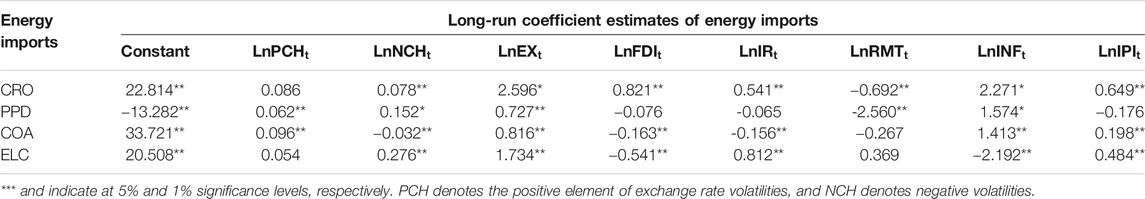

To explore whether this short-run asymmetric effect lasts in the long-run, we also report long-run coefficient estimates in Table 3. All negative forex volatilities (NCH) carry significant and positive coefficients (except coal), supporting the negative long-run effect of volatility on energy imports. As for positive forex volatilities (PCH), coefficients are all positive but only significant for petroleum and coal demands. Contrary to our expectations, the coefficients of exchange rate (LnEX-PKR/USD) are all reported as positive and significant, implying that an increase in exchange rate (rupee depreciation) accelerates energy imports. Ideally, an increase in exchange rate (rupee depreciation) diminishes the domestic energy demand (Shahbaz et al., 2018; Ghoddusi et al., 2019), thereby reducing the energy imports. Since the energy resources in Pakistan diminish and the energy demand grows rapidly, the country has no option but to import energy irrespective of the consequences.

The results also tend to suggest the long-run asymmetric effect of exchange rate volatility on Pakistan’s energy imports due to the different size and sign of the respective coefficient attached to PCH and NCH. To confirm our results of asymmetry, we rely on the Wald tests widely used in the literature (Badeeb and Lean, 2018). Following Bahmani-Oskooee et al. (2020), a maximum of six lags is applied based on Akaike’s information criterion (AIC) for optimum model selection. First, the Wald-S test examines the short-run cumulative or impact asymmetric effect of exchange rate volatilities on energy demands. Table 4 reveals asymmetric impact in all energy sectors (CRO, COA, and ELC) except petroleum products (PPD). Such asymmetric effects suggest that decreasing volatility has a significant and positive effect on imports of crude oil and electricity.

Then, the long-term–normalized PCH and NCH estimates are utilized to examine the differences of impacts. As expected, the reported Wald-L test statistics are significant to reveal long-run cumulative or impact asymmetric effects in all energy import demand models. In brief, short-run and long-run cumulative or impact asymmetry is observed in all energy sources, implying that the importers of these energy sources behave differently when volatility in exchange rate increases as compared to when volatility decreases. At the sectoral level, the results show that, in the long run, both increasing and decreasing exchange rate volatilities accelerate crude oil, petroleum products, and electricity imports of Pakistan. On the contrary, increasing exchange rate volatility increases coal imports, and decreasing exchange rate volatility diminishes coal imports. However, the magnitude (size of coefficient) of the effect of increasing volatility is significantly different from that of decreasing volatility, suggesting that the effect of exchange rate volatility is asymmetric in all sectoral energy imports of Pakistan.

On the contrary, the coefficients of foreign direct investment are found to be significant and negative (except crude oil), suggesting that a higher foreign direct investment in Pakistan reduces energy imports. The effect of interest rate on crude oil, electricity, and coal is found to be significant, where a swelling interest rate expands “crude oil” and “electricity” imports while reduces imports of “coal.” A higher flow of remittance into the country discourages energy imports of crude oil and petroleum products. Conversely, the rising consumer prices (inflation) increase the import of crude oil, petroleum products, and coal, while reduce the import of electricity. Finally, the industrial production index (IPI) is also found to be a key contributor to the imports of crude oil, electricity, and coal. Pakistan’s future industrialization will further push this energy demand, thereby paving the way for an increase in energy imports.

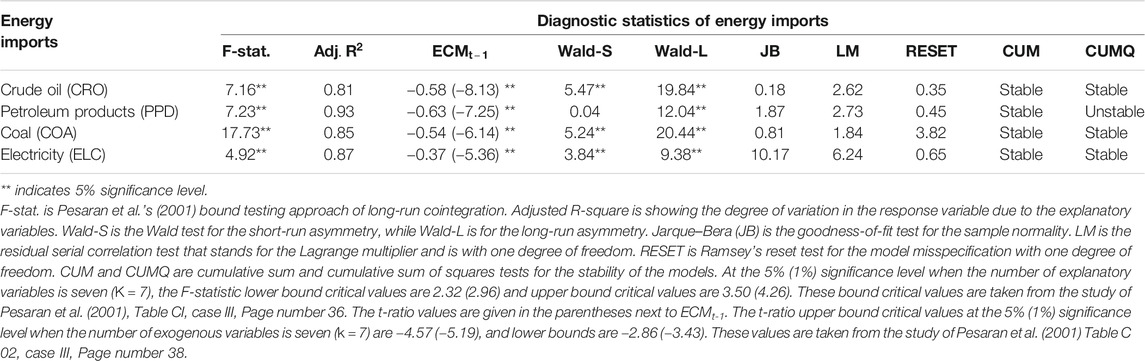

To validate the coefficient estimates, we introduced long-term cointegration. This can be done via the F-statistic whose estimates are reported in Table 4. It can be seen clearly that the F-statistic estimates are highly significant and exceeding the upper bound critical value of Pesaran et al. (2001), suggesting the existence of long-term cointegration. Alternatively, this long-run cointegration is supported by

The significant association has been found by the past studies between exchange rate volatility and crude oil and commodity prices (see Rafiq et al., 2009; Ghosh, 2011; Jain and Biswal, 2016). Furthermore, our asymmetric effect of exchange rate volatility supports the findings of Bahmani-Oskooee and Aftab (2017), Bahmani-Oskooee and Saha (2020), and Dada (2020). They also reported that the effect of increasing volatility in exchange rate is different from that of decreasing volatility on sectoral imports. Rafiq et al. (2009) also found the effect of oil prices (energy) to be asymmetric, implying that the effect of increasing oil prices is different from that of decreasing oil prices. Additionally, Badeeb and Lean (2018) reported significant and positive asymmetric effects of oil prices on the sectoral “oil and gas Islamic index.” Likewise, the Granger-causal association of exchange rate and energy prices is also reported to be asymmetric (Tiwari and Albulescu, 2016). Recently, the study of Uche and Nwamiri (2020) also found the short-run and long-run asymmetric effects of exchange rate changes on energy demand in Nigeria. In a nutshell, the nonlinear analysis revealed that, in all energy imports, the short-run and long-run effects of exchange rate volatility are asymmetric and sectoral specific. While the imports of one specific energy source may benefit from increased volatility, another energy import could be hurt by decreased volatility or the rate at which increased volatility benefits the import trade flow of an energy source could be less than the rate at which decreased volatility could hurt.

These results are validated by a number of diagnostic statistics reported in Table 4. As stated by Pesaran et al. (2001), before the application of ARDL models, one should assure that the models are free from serial correlation and statistically stable. To ensure the autocorrelation-free models, we applied the Lagrange multiplier (LM) test that has chi-square distribution with four degrees of freedom at the 95% confidence interval. The resulting estimates are less than the critical values and insignificant, implying autocorrelation-free models. Furthermore, all the models as indicated by CUMS (cumulative sum) and CUSUMSQ (cumulative sum of squares) are statistically stable, except the import demand model of petroleum products where a dummy variable is in place to bring stability. The study of Ozturk and Acaravci (2010) also suggests to use CUMS and CUMSQ for the model’s stability prior to the application of ARDL models. Moreover, to ensure that no such model is misspecified, Ramsey’s RESET test is applied. The results reject the null hypothesis of model misspecifications. Finally, normality of the data is indicated by the Jarque–Bera test (JB) and model fitness through

Conclusion and Policy Implications

When the exchange rate system shifted from the fixed to the flexible exchange rate system in 1973, it led to the emergence of a new area of research where studies examined the effect of exchange rate volatility or uncertainty on international trade. In the recent past with the availability of trade data in a longer time period, the time series models replaced cross-sectional studies. In addition, the availability of sectoral or even commodity level data in monthly and quarterly frequencies led to the examination of the effect of exchange rate volatility on disaggregated trade flows, to draw industry-specific and commodity-specific policy implications. More importantly, with the recent advancements in econometric techniques, studies tend to examine the asymmetric effects of exchange rate volatility on trade flows. These studies have shown that, in some sectors where the linear models have insignificant effect, the nonlinear models produce significant outcomes. The argument behind the asymmetric effect of exchange rate volatility is that the effect of increasing volatility in exchange rate is different from that of decreasing volatility. In this study, using a nonlinear autoregressive distributed lag model, we examined the asymmetric effect of exchange rate volatility on the monthly imports of Pakistan’s four energy commodities, namely, crude oil, petroleum products, coal, and electricity. The results from the nonlinear autoregressive distributed lag model show short-run and long-run asymmetric effects of exchange rate volatility on energy imports. The conclusions of this study are as follows.

The ARDL bound test was established and supported through

The economic policies that stabilize the exchange rate are expected to hold the adversaries of exchange rate volatility on energy imports. As the results show that higher exchange rate volatility expands Pakistan’s energy imports, this increasing energy import will lead Pakistan to be import dependent. The higher energy imports will require more foreign exchange, and the demand for foreign exchange will trigger further volatility and depreciation in the PKR. This cyclical effect of exchange rate–import has the potential to reduce the socioeconomic development in the country. The policymakers can put in place the countercyclical monetary and fiscal measures to stabilize the exchange rate. Similarly, policymakers can use some other economic policies to stabilize the exchange rate such as opening the capital markets, controlling the foreign currency–dominated debt in both private and public domains, and reducing current and fiscal account deficit.

During stagnant economic activity in the country, the monetary authorities can increase the money supply to expand the output and employment; hence, the downward push in interest rate will enhance growth in the sectors with high sensitivity to the interest rate. Conversely, the higher money supply could accelerate inflation and then the monetary authorities should hold the money supply to push the interest rate upward and reduce the uncertainty. As a countercyclical strategy, the government can relax taxation and enhance expenditures to boost growth and demand in order to foster economic activity.

As the fast-growing energy demand in Pakistan cannot be fulfilled via short-term strategies, the long-term domestic and foreign investments are needed to expand the energy production. The government should introduce reforms particularly in the regulatory and taxation systems to provide a conducive environment to foreign and domestic investments in the energy sector. Furthermore, the financial system in the country should be strengthened to provide investors with easily accessible trade credit and the facility of effective hedging against the volatile exchange rate.

Lastly, our results show that the asymmetric effect of exchange rate volatility is sectoral specific; thus, one trade policy for all energy sources will not be sufficient. Therefore, the nature of each source should be taken into consideration while deciding on the trade policy. We found the effect of exchange rate volatility is sectoral-specific; therefore, future studies are advised to examine the effect of exchange rate uncertainty on other sources.

The current study is conducted with a few limitations. In the case of Pakistan, monthly energy data for a larger time span are not available. In addition, we only account for the four non-renewable energy sectors, so future studies can examine the effect of exchange rate volatility on other non-renewable energy imports. Furthermore, the future is of renewable energy; therefore, future studies can examine the association of exchange rate with renewable energy. Moreover, the used sectoral imports in the current study are standalone; future studies can examine the effect of exchange rate changes on the energy production, consumption, and imports for more comprehensive findings.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

AS: Conceptualization, Methodology, Formal analysis, Writing-original draft, review and editing. TC: Conceptualization, Methodology, Supervision, writing-review and editing. AM: Data and literature collection, preliminary analysis and writing. HL: Visualization, Writing-review and editing, Project administration.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Footnotes

1Pakistan total primary energy consumption and production series are extracted from the Energy Information Administration (EIA)—https://www.eia.gov/international/data/world/total-energy/more-total-energy-data

2The data of crude oil production, consumption, and imports are sourced from the Asian Development Bank (ADB). Source link: https://data.adb.org/dataset/pakistan-key-indicators

3In the same way, the data of coal production, consumption, and imports are also sourced from the ADB. Source link: https://data.adb.org/dataset/pakistan-key-indicators

4The primary energy imports data are extracted from the EIA, and exchange rate data are gleaned from the website of Pacific Exchange Rate System. Source URL: https://fx.sauder.ubc.ca/data.html

5For example, if the foreign inflows are distributed in the energy sector, it will boost energy production and, hence, reduce the energy demand. On the contrary, if the FDI is concentrated in the transportation or manufacturing sectors, it will accelerate the energy demand.

6For brevity, both the descriptive statistics and prior estimation of ARDL results are not shown here but available upon request from the authors. The full NARDL results are reported in Tables 2–4.

References

Adom, P. K., Bekoe, W., Amuakwa-Mensah, F., Mensah, J. T., and Botchway, E. (2012). Carbondioxide Emissions, Economic Growth, Industrial Structure, and Technical Efficiency: Empirical Evidence from Ghana, Senegal, and Morocco on the Causal Dynamics. Energy 47 (1), 314–325. doi:10.1016/j.energy.2012.09.025

Aftab, M., Syed, K. B. S., and Katper, N. A. (2017). Exchange-rate Volatility and Malaysian-Thai Bilateral Industry Trade Flows. Journal of Economic Studies 44 (1), 99–114. doi:10.1108/jes-05-2015-0091

Ahmed, S., Mahmood, A., Hasan, A., Sidhu, G. A. S., and Butt, M. F. U. (2016). A Comparative Review of China, India and Pakistan Renewable Energy Sectors and Sharing Opportunities. Renew. Sustainable Energ. Rev. 57 (1), 216–225. doi:10.1016/j.rser.2015.12.191

Akçay, S., and Demirtaş, G. (2015). Remittances and Energy Consumption: Evidence from Morocco. Int. Migr. 53 (6), 125–144. doi:10.1111/imig.12202

Alam, S., and Ahmed, Q. M. (2010). Exchange Rate Volatility and Pakistan’s Import Demand: an Application of Autoregressive Distributed Lag Model. Int. Res. J. Finance Econ. 48 (1), 7–23. Available at: http://www.eurojournals.com/finance.htm

Alam, S., and Ahmad, Q. M. (2011). Exchange Rate Volatility and Pakistan's Bilateral Imports from Major Sources: An Application of ARDL Approach. International Journal of Economics and Finance 3 (2), 245–254. doi:10.5539/ijef.v3n2p245

Alam, S., Ahmed, Q. M., and Shahbaz, M. (2018). The Effect of Exchange Rate Volatility on Pakistan's Bilateral Exports to Major Recipients. Glob. Business Rev. 19 (2), 328–341. doi:10.1177/0972150917713539

Badeeb, R. A., and Lean, H. H. (2018). Asymmetric Impact of Oil Price on Islamic Sectoral Stocks. Energ. Econ. 71 (1), 128–139. doi:10.1016/j.eneco.2017.11.012

Bahmani‐Oskooee, M., and Kovyryalova, M. (2008). Impact of Exchange Rate Uncertainty on Trade Flows: Evidence from Commodity Trade between the United States and the United Kingdom. World Economy 31 (8), 1097–1128. doi:10.1111/j.1467-9701.2008.01116.x

Bahmani-Oskooee, M., and Aftab, M. (2017). On the Asymmetric Effects of Exchange Rate Volatility on Trade Flows: New Evidence from US-Malaysia Trade at the Industry Level. Econ. Model. 63 (1), 86–103. doi:10.1016/j.econmod.2017.02.004

Bahmani-Oskooee, M., and Fariditavana, H. (2016). Nonlinear ARDL Approach and the J-Curve Phenomenon. Open Econ. Rev. 27 (1), 51–70. doi:10.1007/s11079-015-9369-5

Bahmani-Oskooee, M., Iqbal, J., and Salam, M. (2016). Short Run and Long Run Effects of Exchange Rate Volatility on Commodity Trade between Pakistan and Japan. Econ. Anal. Pol. 52 (1), 131–142. doi:10.1016/j.eap.2016.09.002

Bahmani-Oskooee, M., Miteza, I., and Tanku, A. (2020). Exchange Rate Changes and Money Demand in Albania: a Nonlinear ARDL Analysis. Econ. Change Restruct. 53 (1), 619–633. doi:10.1007/s10644-019-09261-9

Bahmani-Oskooee, M., and Saha, S. (2020). Exchange Rate Risk and Commodity Trade between U.S. And India: an Asymmetry Analysis. J. Asia Pac. Economy 25 (4), 675–695. doi:10.1080/13547860.2019.1701307

Bartleet, M., and Gounder, R. (2010). Energy Consumption and Economic Growth in New Zealand: Results of Trivariate and Multivariate Models. Energy Policy 38 (7), 3508–3517. doi:10.1016/j.enpol.2010.02.025

Bollerslev, T. (1986). Generalized Autoregressive Conditional Heteroskedasticity. J. Econom. 31 (3), 307–327. doi:10.1016/0304-4076(86)90063-1

Bussiere, M. (2013). Exchange Rate Pass-Through to Trade Prices: The Role of Nonlinearities and Asymmetries*. Oxford Bull. Econ. Stat. 75 (5), 731–758. doi:10.1111/j.1468-0084.2012.00711.x

Chen, S.-S., and Chen, H.-C. (2007). Oil Prices and Real Exchange Rates. Energ. Econ. 29 (3), 390–404. doi:10.1016/j.eneco.2006.08.003

Dada, J. T. (2020). Asymmetric Effect of Exchange Rate Volatility on Trade in Sub-saharan African Countries. J. Econ. Administrative Sci. EarlyCite. 37, 149–162. doi:10.1108/JEAS-09-2019-0101

De Schryder, S., and Peersman, G. (2015). The U.S. Dollar Exchange Rate and the Demand for Oil. Energy Journal. 36 (3), 1–16. doi:10.5547/01956574.36.3.ssch

Delatte, A.-L., and López-Villavicencio, A. (2012). Asymmetric Exchange Rate Pass-Through: Evidence from Major Countries. J. Macroeconomics 34 (3), 833–844. doi:10.1016/j.jmacro.2012.03.003

Doytch, N., and Narayan, S. (2016). Does FDI Influence Renewable Energy Consumption? an Analysis of Sectoral FDI Impact on Renewable and Non-renewable Industrial Energy Consumption. Energ. Econ. 54 (1), 291–301. doi:10.1016/j.eneco.2015.12.010

Ejaz, M., and Iqbal, J. (2019). “Estimation and Forecasting of Industrial Production Index,” in SBP Working Paper Series (Karachi, Pakistan: State Bank of Pakistan). No. 103.

Erdogdu, O. (2007). The Effects of Energy Imports: The Case of Turkey. Germany: University Library of Munich, 5413. Available at: https://EconPapers.repec.org/RePEc:pra:mprapa

Gadanecz, B., and Mehrotra, A. N. (2013). The Exchange Rate, Real Economy and Financial Markets. BIS paper (73b), 1–8. Available at: https://ssrn.com/abstract=2497130

Ghoddusi, H., Morovati, M., and Rafizadeh, N. (2019). Foreign Exchange Shocks and Gasoline Consumption. Energ. Econ. 84 (1), 1–13. doi:10.1016/j.eneco.2019.08.005

Ghosh, S. (2011). Examining Crude Oil Price - Exchange Rate Nexus for India during the Period of Extreme Oil Price Volatility. Appl. Energ. 88 (5), 1886–1889. doi:10.1016/j.apenergy.2010.10.043

Hassan, M. (2013). Volatility of Exchange Rate Effecting Trade Growth: A Case of Pakistan with US, UK and UAE. Eur. Scientific J. 9 (1), 277–288. Available at SSRN: https://ssrn.com/abstract=2254504.

Hübler, M., and Keller, A. (2008). “Energy Savings via FDI? Empirical Evidence from Developing Countries,” in Kiel Working Paper, No. 1393 (Kiel, Germany: Kiel Institute for the World Economy (IfW), Kiel)Available at: http://hdl.handle.net/10419/4125

Imran, M., and Amir, N.(2015). A short-run solution to the power crisis of Pakistan. Energy Policy 87 (1), 382–391. doi:10.1016/j.enpol.2015.09.028

Jain, A., and Biswal, P. C. (2016). Dynamic Linkages Among Oil Price, Gold Price, Exchange Rate, and Stock Market in India. Resour. Pol. 49 (1), 179–185. doi:10.1016/j.resourpol.2016.06.001

Javed, Z., and Farooq, M. (2009). Economic Growth and Exchange Rate Volatility in the Case of Pakistan. Pakistan J. Life Soc. Sci. 7 (2), 112–118. Available at: http://pjlss.edu.pk/pdf_files/2009_2/3.pdf

Karanfil, F. (2009). How Many Times Again Will We Examine the Energy-Income Nexus Using a Limited Range of Traditional Econometric Tools?. Energy Policy 37 (4), 1191–1194. doi:10.1016/j.enpol.2008.11.029

Keho, Y. (2016). What Drives Energy Consumption in Developing Countries? the Experience of Selected African Countries. Energy Policy 91 (1), 233–246. doi:10.1016/j.enpol.2016.01.010

Komal, R., and Abbas, F. (2015). Linking Financial Development, Economic Growth and Energy Consumption in Pakistan. Renew. Sustainable Energ. Rev. 44 (1), 211–220. doi:10.1016/j.rser.2014.12.015

Lee, C.-C., and Chang, C.-P. (2008). Energy Consumption and Economic Growth in Asian Economies: a More Comprehensive Analysis Using Panel Data. Resource Energ. Econ. 30 (1), 50–65. doi:10.1016/j.reseneeco.2007.03.003

Lee, J. W. (2013). The Contribution of Foreign Direct Investment to Clean Energy Use, Carbon Emissions and Economic Growth. Energy Policy 55 (1), 483–489. doi:10.1016/j.enpol.2012.12.039

Lim, S., and Basnet, H. C. (2017). International Migration, Workers' Remittances and Permanent Income Hypothesis. World Development 96 (1), 438–450. doi:10.1016/j.worlddev.2017.03.028

Mahmood, A., Javaid, N., Zafar, A., Ali Riaz, R., Ahmed, S., and Razzaq, S. (2014). Pakistan's Overall Energy Potential Assessment, Comparison of LNG, TAPI and IPI Gas Projects. Renew. Sustainable Energ. Rev. 31 (1), 182–193. doi:10.1016/j.rser.2013.11.047

Mahmood, A., Razzaq, S., Khan, A. R., Deen, S. Z. U., and Hussain, A. (2016). Pakistan’s Energy Import Options. in Proceedings Of 2nd International Multi-Disciplinary Conference. Pakistan:Gujrat. doi:10.1109/inmic.2016.7840158

Mallick, H., and Mahalik, M. K. (2014). Energy Consumption, Economic Growth and Financial Development: A Comparative Perspective on India and China. Bull. Energ. Econ. Econ. Soc. Development Organ. 2 (3), 72–84. Available at: https://ideas.repec.org/a/ijr/beejor/v2y2014i3p72-84.html

McKenzie, M. D. (1999). The Impact of Exchange Rate Volatility on International Trade Flows. J. Econ. Surv. 13 (1), 71–106. doi:10.1111/1467-6419.00075

Mielnik, O., and Goldemberg, J. (2002). Foreign Direct Investment and Decoupling between Energy and Gross Domestic Product in Developing Countries. Energy Policy 30 (2), 87–89. doi:10.1016/S0301-4215(01)00080-5

Ministry of Finance, Government of Pakistan (2015). Pakistan Economic Survey 2014-15, [Online]. Available from: http://www.finance.gov.pk/survey/chapters_15/14_Energy.pdf (Accessed April 25, 2020).

Ministry of Finance, Government of Pakistan (2018). Pakistan economic survey 2017–18 [Online]. Available from: http://www.finance.gov.pk/survey/chapters_18/EconomicSurvey_2017_18.pdf (Accessed April 15, 2020).

Mukhtarov, S., Humbatova, S., Seyfullayev, I., and Kalbiyev, Y. (2020). The Effect of Financial Development on Energy Consumption in the Case of Kazakhstan. J. Appl. Econ. 23 (1), 75–88. doi:10.1080/15140326.2019.1709690

Naeem, D., Hashmi, A., Iftikhar, H., Khan, M. B., and Khan, W. A. (2014). Investing in Hydro Power Sector for Pakistan's Energy Security. Int. Conf. Energ. Syst. Policies, 1–6. doi:10.1109/ICESP.2014.7347003

Omri, A., and Kahouli, B. (2014). Causal Relationships between Energy Consumption, Foreign Direct Investment and Economic Growth: Fresh Evidence from Dynamic Simultaneous-Equations Models. Energy Policy 67 (1), 913–922. doi:10.1016/j.enpol.2013.11.067

Ozturk, I., and Acaravci, A. (2010). The Causal Relationship between Energy Consumption and GDP in Albania, Bulgaria, Hungary and Romania: Evidence from ARDL Bound Testing Approach. Appl. Energ. 87 (6), 1938–1943. doi:10.1016/j.apenergy.2009.10.010

Pakistan Bureau of Statistics (2019). Ministry of planning development and special initiatives, Government of Pakistan, Islamabad. Available at: https://www.pbs.gov.pk/sites/default/files//other/Pakistan_Statistical_yearbook_2019.pdf

Pakistan Energy Outlook (2010). Petroleum Institute of Pakistan, Islamabad, Pakistan. Available from: https://www.pip.org.pk/images/Outlook_Executive_Summary.pdf

Paramati, S. R., Ummalla, M., and Apergis, N. (2016). The Effect of Foreign Direct Investment and Stock Market Growth on Clean Energy Use across a Panel of Emerging Market Economies. Energ. Econ. 56 (1), 29–41. doi:10.1016/j.eneco.2016.02.008

Pesaran, M. H., Shin, Y., and Smith, R. J. (2001). Bounds Testing Approaches to the Analysis of Level Relationships. J. Appl. Econ. 16 (3), 289–326. doi:10.1002/jae.616

Planning Commission of Pakistan, Government of Pakistan (2016). Annual report 2015-16 [Online]. Available from: https://www.pc.gov.pk/uploads/docs/Ch18-Energy.pdf (Accessed Feb 10, 2020).

Planning Commission of Pakistan, Government of Pakistan (2017). Annual report 2015-16 [Online]. Available at: https://www.pc.gov.pk/uploads/annualplan/2016-2017.pdf

Rafiq, S., Salim, R., and Bloch, H. (2009). Impact of Crude Oil Price Volatility on Economic Activities: An Empirical Investigation in the Thai Economy. Resour. Pol. 34 (3), 121–132. doi:10.1016/j.resourpol.2008.09.001

Rafique, M. M., and Rehman, S. (2017). National Energy Scenario of Pakistan-Current Status, Future Alternatives, and Institutional Infrastructure: An Overview. Renew. Sustainable Energ. Rev. 69 (1), 156–167. doi:10.1016/j.rser.2016.11.057

Rahman, Z. U., Cai, H., and Ahmad, M. (2019). A New Look at the Remittances-Fdi- Energy-Environment Nexus in the Case of Selected Asian Nations. Singapore Econ. Rev. 64 (1), 1–19. doi:10.1142/S0217590819500176

Raza, S. A., Hammad, S., Shams, U., Maryam, A., Mahmood, S., and Nadeem, R. (2015). Pakistan, Tourism. J. bioprocessing Chem. Eng. 3 (1), 1–2. doi:10.1007/978-3-319-01669-6_575-1

Sadorsky, P. (2010). The Impact of Financial Development on Energy Consumption in Emerging Economies. Energy policy 38 (5), 2528–2535. doi:10.1016/j.enpol.2009.12.048

Salim, R., Yao, Y., Chen, G., and Zhang, L. (2017). Can Foreign Direct Investment Harness Energy Consumption in China? A Time Series Investigation. Energ. Econ. 66 (1), 43–53. doi:10.1016/j.eneco.2017.05.026

Saqib, N., and Sana, I. (2012). Exchange Rate Volatility and its Effect on Pakistan Export Volume. Adv. Management Appl. Econ. 2 (4), 1–7. Available at SSRN: https://ssrn.com/abstract=3288736

Shahbaz, M., Chaudhary, A. R., and Shahzad, S. J. H. (2018). Is Energy Consumption Sensitive to Foreign Capital Inflows and Currency Devaluation in Pakistan?. Appl. Econ. 50 (52), 5641–5658. doi:10.1080/00036846.2018.1488059

Shahbaz, M., and Lean, H. H. (2012). Does Financial Development Increase Energy Consumption? the Role of Industrialization and Urbanization in Tunisia. Energy Policy 40 (1), 473–479. doi:10.1016/j.enpol.2011.10.050

Shahbaz, M., Lean, H. H., and Farooq, A. (2013). Natural Gas Consumption and Economic Growth in Pakistan. Renew. Sustainable Energ. Rev. 18 (1), 87–94. doi:10.1016/j.rser.2012.09.029

Sharma, C., and Pal, D. (2019). Does Exchange Rate Volatility Dampen Imports? Commodity-Level Evidence from India. Int. Econ. J. 33 (4), 696–718. doi:10.1080/10168737.2019.1630467

Shin, Y., Yu, B., and Greenwood-Nimmo, M. (2014). Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework. in Festschrift in Honor of Peter Schmidt. New York, NY: Springer, 281–314. doi:10.1007/978-1-4899-8008-3_9

State Bank of Pakistan (2015). Import Payments by Commodity. Karachi, Pakistan: State Bank of Pakistan Statistics and Data Warehouse Department[Online]. Available from: https://www.sbp.org.pk/ecodata/Import%20Payments%20by%20Commodities%20and%20Groups.pdf (Accessed Sep 19, 2020).

Tiwari, A. K., and Albulescu, C. T. (2016). Oil Price and Exchange Rate in India: Fresh Evidence from Continuous Wavelet Approach and Asymmetric, Multi-Horizon Granger-causality Tests. Appl. Energ. 179 (1), 272–283. doi:10.1016/j.apenergy.2016.06.139

Uche, E., and Nwamiri, I. S. (2020). Dynamic Adjustments of Energy Demand to Exchange Rate and Income Differentials: Evidence from Selected OPEC Economies–NARDL Approach. Acad. J. Curr. Res. 7 (8), 183–199. Available at: https://www.researchgate.net/profile/Uche-Emmanuel/publication/344328145

World Energy Outlook (2016). International Energy Agency. Available at: https://www.iea.org/reports/world-energy-outlook-2016

World Energy Outlook (2018). International Energy Agency. Available at: https://webstore.iea.org/download/summary/190?fileName=English-WEO-2018-ES.pdf

World Energy Outlook (2019). International Energy Agency. Available at: https://www.iea.org/reports/world-energyoutlook-201

Yaseen, M., Abbas, F., Shakoor, M. B., Farooque, A. A., and Rizwan, M. (2020). Biomass for Renewable Energy Production in Pakistan: Current State and Prospects. Arab J. Geosci. 13 (2), 1–13. doi:10.1007/s12517-019-5049-x

Keywords: exchange rate volatility, energy import, asymmetric effect, commodity trade, Pakistan

Citation: Saqib A, Chan T-H, Mikhaylov A and Lean HH (2021) Are the Responses of Sectoral Energy Imports Asymmetric to Exchange Rate Volatilities in Pakistan? Evidence From Recent Foreign Exchange Regime. Front. Energy Res. 9:614463. doi: 10.3389/fenrg.2021.614463

Received: 06 October 2020; Accepted: 27 April 2021;

Published: 31 May 2021.

Edited by:

Ian Edmund William Schindler, Université Toulouse 1 Capitole, FranceReviewed by:

Xiangyun Gao, China University of Geosciences, ChinaStanislav Martinat, Institute of Geonics (ASCR), Czechia

Copyright © 2021 Saqib, Chan, Mikhaylov and Lean. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hooi Hooi Lean, aG9vaWxlYW5AdXNtLm15, bGVhcm5teUBnbWFpbC5jb20=

Abdul Saqib

Abdul Saqib Tze-Haw Chan

Tze-Haw Chan Alexey Mikhaylov

Alexey Mikhaylov Hooi Hooi Lean

Hooi Hooi Lean