- 1Institute of Mineral Resources, Chinese Academy of Geological Sciences, Beijing, China

- 2Research Center for Strategy of Global Mineral Resources, Chinese Academy of Geological Science, Beijing, China

Nickel is an important key resource and plays an increasingly important role in new energy technologies. The stability of its worldwide supply chain is crucial for addressing country risks and unforeseen events. To explore the impact of country risks on the stability of the global nickel supply chain, this study conducts a complex network analysis and panel regression analysis on nickel ore, ferro-nickel, and the stainless-steel trade data from 2000 to 2022. The study reveals the mechanisms by which economic and political risks affect the trade structure of nickel commodities and identifies the drivers of global nickel supply chain patterns. The study finds that an increase in economic risk promotes diversification of supply sources, while political risk hurts export scale and resource control ability. Industrial structure adjustments and R&D investments have a significant impact on trade structure, especially on the stainless-steel trade. China is a major consumer and importer, and occupies a central position in the global nickel trade network, while Indonesia and the Philippines’ policy changes have a significant impact on the market. This study provides an empirical basis for the risk management of the global nickel supply chain and a scientific basis for policy formulation and strategic planning.

1 Introduction

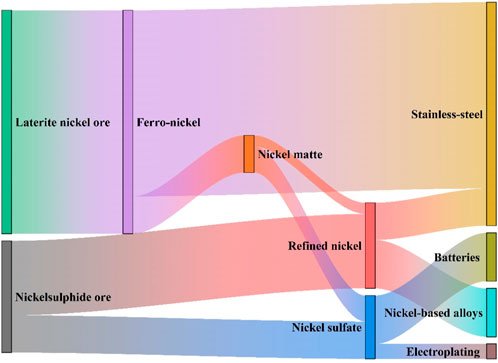

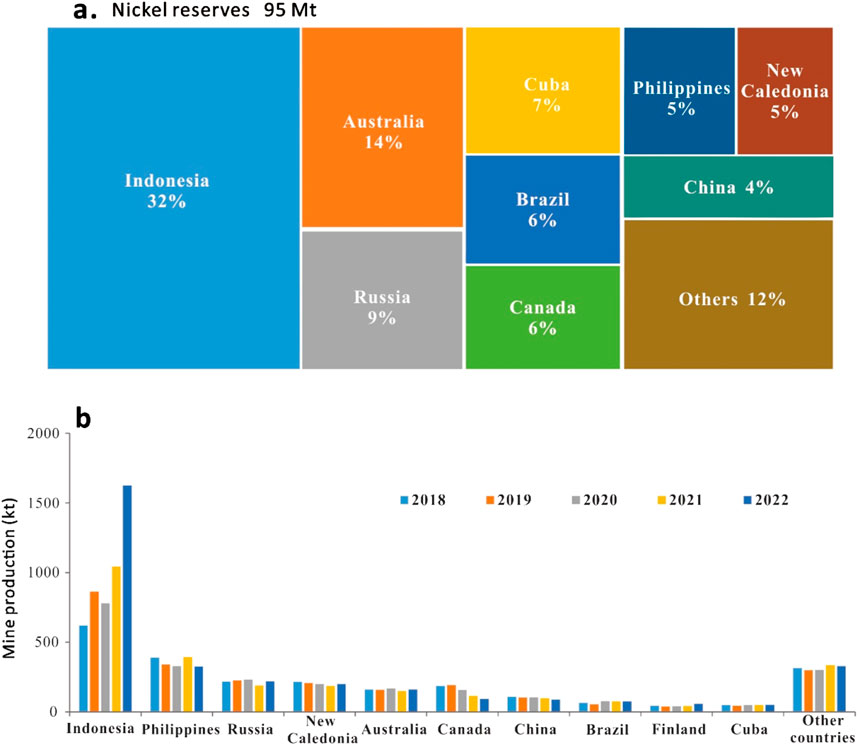

As a critical mineral, nickel has become a new focal point of competition in the global energy industry due to its scarcity, irreplaceability, and uneven distribution (Hao et al., 2024; Yang et al., 2015). With the rapid development of the global economy, nickel is widely used with a continuously increasing of international trade (Stankovic et al., 2022; Chen et al., 2024). Nickel supply chain (from ore to consumer products) involves many aspects of complex international trades (Figure 1). In recent years, some countries rich in nickel adopt policies to ban or restrict the export of nickel ores and concentrates (nickel ores), aiming to elevate the added value of their products and stimulate their economic development (Lederer et al., 2016; Wang et al., 2023; Zhu et al., 2023). This leads to increase of the complexity of nickel supply chain. Compared to nickel ores, nickel consumer commodities with higher added values can directly meet the needs of manufacturing industry (Cui and Li, 2023). The uneven distribution of global nickel leads to the instability in international trade (Figure 2). As a major producer of nickel commodities in the world, China is scarce in nickel, with prominent supply and demand contradictions and a high degree of external dependence (Wang and Xia, 2024). China’s position in the global nickel value chain is gradually rising, mainly exporting downstream commodities with higher added value, and importing upstream nickel with lower added value (Wang and Xia, 2024; Su et al., 2023). Geopolitics has a significant impact on the nickel industry chain. The key interactions are constructed based on the “power triangle” among countries with established technology (e.g., the United States), emerging technology (e.g., China), and rich resource (e.g., Indonesia). This is promoting profound changes and complex adjustments in the division of labor, operational logic, rule system, and competitive paradigm of the global nickel industry chain (Cui and Li, 2023). The strong release of Indonesia’s production capacity and the impact of anti-dumping sanctions by related trading countries produce pressure on China to maintain and expand nickel trade advantages. The game of geopolitics not only affects the international nickel trade but also poses challenges to the stability and sustainability of global nickel supply chain (Habib and Wenzel, 2016). Consequently, the study on how these factors impact nickel trade, along with the assessment of influence degree on nickel trade, will provide a scientific basis for the stability of nickel supply.

Figure 2. Global nickel reserves in 2022 (A) and mine production in major countries during 2018–2022 (B).

Previous studies mainly focused on the risk and stability of critical mineral supply chain, using the complex network theory to construct model for the global critical mineral resource trade. The core indicators of complex network theory, such as degree centrality, clustering coefficient and average path length, provide implications for the analysis of spatio-temporal evolution characteristics of network structure and the identification of the countries with a core role in the network (Zhang et al., 2015; Li and Kim, 2017; Dong et al., 2020). On this basis, the sudden risk transmission mechanism is further constructed, and the sudden risk simulation research of the critical mineral resources trade network is carried out (Jiang et al., 2020). These studies simulate the rebalancing process of the critical mineral resource supply chain network after the original network stability is disrupted by sudden risks. This method can not only describe the loss process and scale of various critical mineral resources trade network nodes in the risk transmission, but also put forward a new node risk resilience measurement method based on the simulation results of multi-risk scenarios (Shen et al., 2022). In the evaluation of node stability, double-logarithmic linear regression model is used to calculate the sensitivity of node loss scale to risk source, risk scale and price fluctuation, which is used as an essential index to evaluate node stability (Zhao et al., 2020).

Most of the studies on the risk and stability of the critical mineral supply chain focus on each node country, and the assessment of stability often stays at the level of qualitative analysis. However, with the combination of complex network theory and econometrics methods, quantitative research on the influencing factors of mineral resource trade has become the mainstream research paradigm. The application of econometrics in the mineral resource trade has been transformed from the traditional quantitative analysis (focusing on the relationship between trade volume, reserves, production, consumption and market economy conditions) to innovative research combined with complex network models (Shuai et al., 2015; Zhu et al., 2017). By including the network structure index in the explanatory variables, they can more deeply analyze the links and network patterns of mineral resource trade between countries. This interdisciplinary approach provides a novel analytical framework for assessing the changing roles of different economies in trade networks and their impact on GDP and mineral resource prices. An in-depth understanding of countries’ positions in the trade network helps to formulate more precise trade policies and strategies, optimize trade patterns, enhance the secure supply of mineral resources, and enhance economic resilience (Xi et al., 2020; Zhao et al., 2022).

In addition, previous studies mainly focus on the impact of geopolitics, economic factors, and the interplay of storage, production, and consumption on nickel trade volumes, as well as the influence of trade structure evolution on trade prices. However, there exists a gap in study concerning the underlying drivers that propel the evolution of trade structures. This study combines complex network theory with panel data modeling. Unlike previous studies that used trade volumes, prices, and economic data as dependent variables, complex network trade data for nickel ores, ferro-nickel (ferro-alloys; ferro-nickel), and stainless-steel are introduced as dependent variables to introduce an innovation that characterizes the trade structure discussed in this paper. Introduce the country risk (i.e., political risk and economic risk), industrial structure, and research and development (R&D) investment as the core independent variables to examine their impact on trade structure, in order to provide references for nickel trade to reduce the risk related to national factors and industrial structure changes.

2 Methods and data

2.1 Country risk accounting

A steady stream of global political events, such as the rise of emerging economies, political turmoil in Ukraine, the Brexit process in the United Kingdom, and trade frictions between China and the United States, are reshaping the global economic structure, increasing political risks, and profoundly impacting the global economy and commodity markets. In order to assess these geopolitical risks, we typically refer to a range of indicators, including the Geopolitical Risk (GPR) Index (Caldara and Lacoviello, 2021), the Economic Policy Uncertainty (EPU) Index (Hoang et al., 2023), the Country Risk Index (CRI) (Li et al., 2024), the Worldwide Governance Indicators (WGI) (Thomas et al., 2022), and the International Country Risk Guide (ICRG), respectively. Although indicators such as GPR, EPU, CRI, and WGI are composed of multiple sub-indicators, they mostly cover only one aspect of politics or economics and fail to fully capture the comprehensive picture of political and economic risks.

ICRG published by the PRS Group provides a comprehensive set of country risk assessment indicators that can quantify a country‘s political, economic and investment risk levels. The sub-indicators of ICRG can be used alone, or can be used as a comprehensive indicator according to the weight sum. As one of the commercial resources for country risk analysis and rating, ICRG monitors the risk profile of 141 countries and territories. ICRG provides information and important tools for key decision-making assessment in the field of global trade (Lee and Ning, 2017; Duan et al., 2018; Iqbal et al., 2020; Zhang et al., 2021). In the field of energy and mineral resources trade, ICRG is widely used in the study of investment risk and mineral resources price. It mainly discusses how global conflicts affect country risks and the spillover effects of international financial and mining markets, which is of great significance to the formulation of investment strategies and risk mitigation policies (Dong et al., 2024; Duan et al., 2018; Tang et al., 2021; Chen et al., 2016).

ICRG includes three types of national risks, which are political risk, economic risk, and financial risk, respectively. Financial risk is an assessment of the uncertainty surrounding a country’s ability to repay debts, including exchange rate, interest rate, and financing risks, and is commonly used in corporate investment risk assessment. Therefore, this article only selects the political and economic risks from the ICRG. The political risk index is composed of 12 indicators, and the economic risk index is made up of five indicators (detailed in Supplementary Tables S1, S2). Each index is scaled from 0 to its maximum possible value, with a higher score indicating a lower level of country risk. This indicator can be expressed as Zhang et al. (2021):

where Polriskij represents the political risk classification index j for country i, and max Polriskj is the maximum value of the political risk classification index j. Ecoriskij represents the economic risk classification index j for country i, and max Ecoriskj is the maximum value of the economic risk classification index j.

2.2 Complex network analysis

Countries are nodes in the network, their trade relationships serve as the connecting edges, and the volume of trade acts as the weight of these edges, thereby constructing a comprehensive nickel trade network. By utilizing data from complex network models, detailed information on the scale, globalization level, efficiency, and stability of nickel trade can be obtained. These indicators can infer the trends in international trade of mineral commodities and the status of mineral trading countries within the network. The network is represented as follows (Wang et al., 2020; Sun et al., 2024):

where G represents a complex network. V denotes the set of nodes in the network, n denotes the number of countries. E denotes the set of edges in the network. W represents the set of weights in the network.

2.2.1 Global trade network model for nickel commodities

(1) Average degree (Trade scale)

In the international mineral trade network, “degree” refers to the number of countries engaged in mineral trade with that country. Within the framework of the constructed complex network, a higher average degree signifies a more extensive trade scope, indicating a wider engagement in trade activities. Conversely, a lower average degree denotes a more limited trade scope, suggesting fewer trade connections (Zhong, 2016).

where <k> represents average degree. N is the total number of nodes (countries or regions), and ki is the degree of node i, representing the number of trade relationships each importing country has. This metric offers a quantitative measure of the breadth of trade engagement for the countries involved in the bulk mineral trade network.

(2) Modularity (The degree of trade globalization)

In the mineral trade network, the degree of globalization of mineral is represented by modularity Q. The smaller the modularity, the weaker the trade structure, the less differentiation between countries, the fewer trade cliques, and the higher the degree of globalization. The equation is as follows (Blondel et al., 2008):

where m represents the number of edges in the network structure,

(3) Average path length (Trade efficiency)

The average path length L is the average edge length between trading partners, which can represent trade efficiency. In the trade network, the smaller the average path length, the higher the transmission efficiency, and the trading countries have relatively closer partnerships (Zhong, 2016).

where d(i,j) represents the shortest path distance from node i to node j in an undirected network.

(4) Standardized Interaction Index (NMI)

Normalized Mutual Information Coefficient (NMI) is a commonly used metric in cluster analysis to measure the similarity between two clustering results (Cavalett and Ortega, 2009; Zhong, 2016). The higher the NMI value, the greater the degree of similarity, indicating a higher level of consistency in classification or grouping. In the context of this study, NMI is used to calculate the similarity of trade network structures between adjacent years. This calculation can serve as an indicator to assess the stability of the evolution of trade networks.

where

2.2.2 Nickel product trade structure

The global nickel supply chain has complex and diverse trade factors, involving multiple levels of supply side, demand side and consumer side (Gereffi and Lee, 2012). On the supply side, factors such as resource endowment, production technology, political and economic situation, policy adjustment, environment and sustainability have a significant impact on global nickel supply (Bai et al., 2022). For example, nickel ores export bans in Indonesia and Tanzania have directly affected supply in international markets (Yu et al., 2023). On the demand side, factors such as global economic conditions, industrial policies, and international trade environments play a significant role. With the development of the new energy and electric vehicle industries, the demand for nickel has increased significantly. As the main consumption field of nickel, stainless-steel industry prosperity directly affects the consumption of nickel. At the same time, with the development of electric vehicles and renewable energy industries, the demand for nickel-ion batteries is also growing. These factors together shape the trade pattern of the global nickel supply chain.

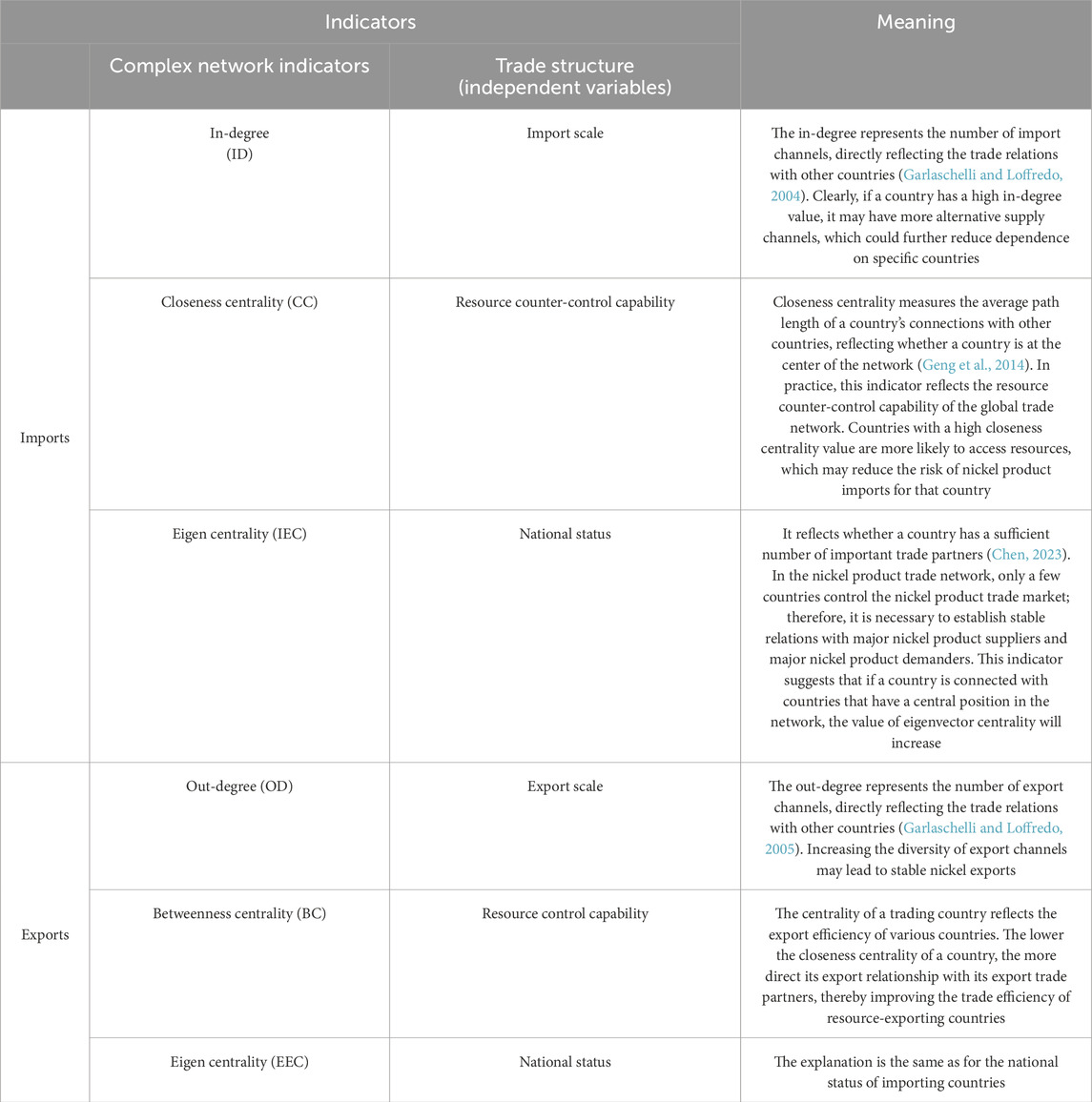

This study attempts to explore the driving factors affecting the trade pattern of the nickel supply chain from four dimensions (e.g., economic risk and political risk, technology, and industrial structure). In the nickel supply chain, imports and exports have different trade strategies and roles. In order to identify the main trade patterns of specific countries, this study selects the centrality value of the country in the global trade network, which represents the trade structure of the importing and exporting countries, namely, trade scale, resource control ability and national status. Six indicators of major trading countries are selected during the period from 2000 to 2022 as the dependent variables in the panel regression model (Table 1).

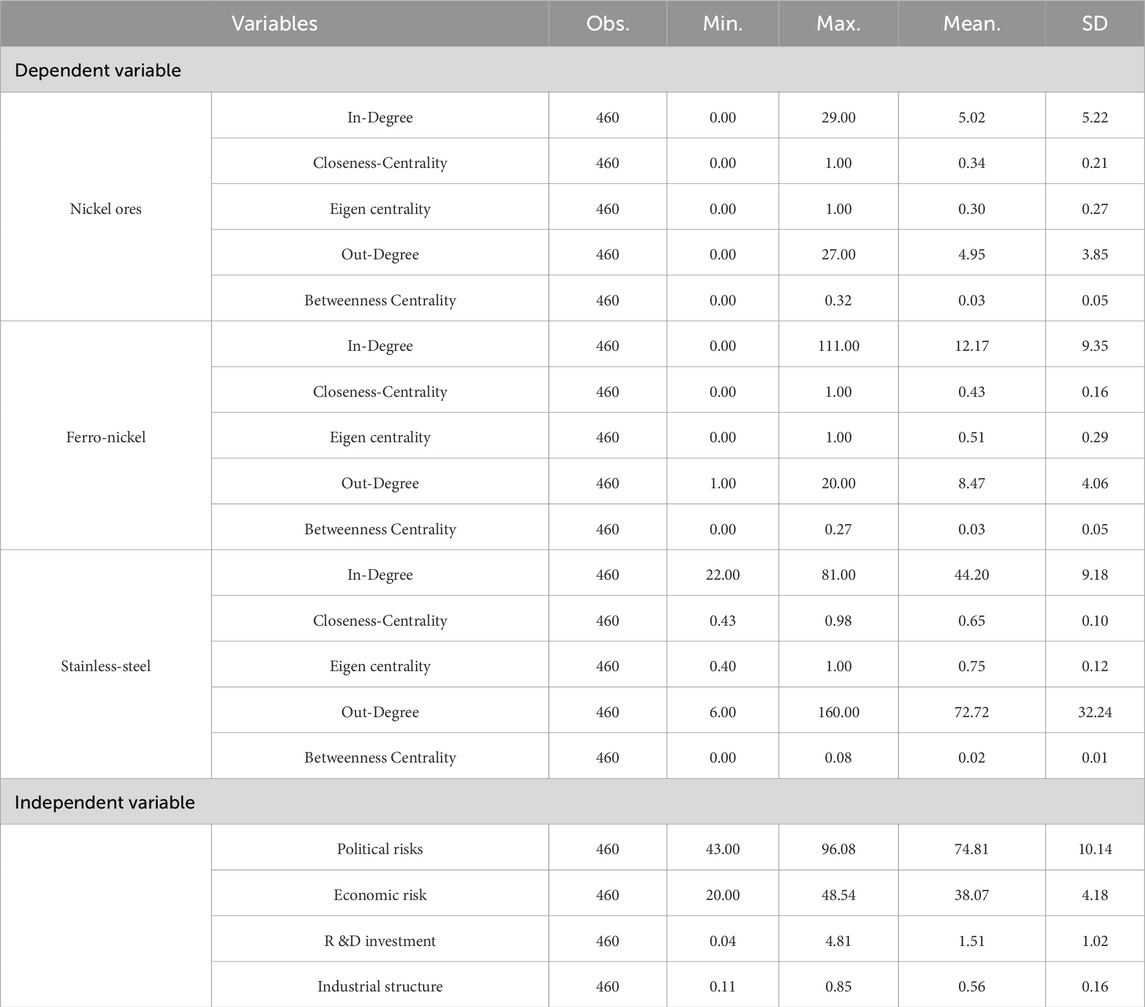

2.2.3 Panel regression model

This study uses data of nickel product trade structure (e.g., trade scale, resource control ability and national status) as dependent variables, political risk, economic risk, R&D input and industrial structure adjustment as the core independent variables of the model, the import and export panel data model are established. Considering the differences in trade strategies between importers and exporters respectively. The influence of political risk, economic risk, R&D investment and industrial structure on the trade structure of nickel ores, ferro-nickel and stainless-steel is emphatically studied. Table 2 is descriptive statistics of all variables (Zheng et al., 2022).

where subscript i represents the country; t represents the time; Y refers to the dependent variable composed of trade structure indicators; im represents import trade; ex represents export trade. ISit is industrial structure. β is the regression coefficient; α is the constant term related to the country; ε is a random variable.

Three methods are used to test the stationarity of all variables, and all three methods pass, indicating that all variable series are stationary (Supplementary Table S4), and these variables can be used directly for regression.

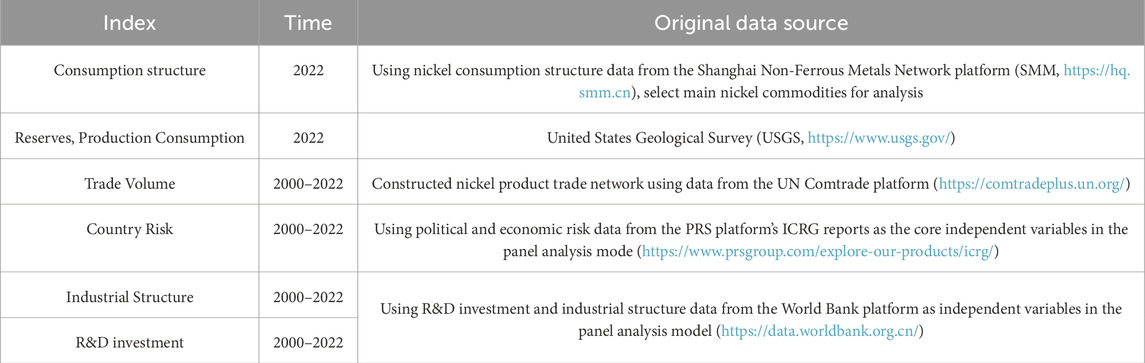

2.3 Data source

This study analyzes all stages of the nickel supply chain (Figure 1). At the upstream stage of the nickel supply chain, there are two types of ores, which are laterite nickel ores (60%) and nickel sulfide ore (40%). Ferro-nickel is the primary product in the midstream stage. The downstream stage is dominated by stainless-steel overwhelmingly, taking percentage of 67%. Noteworthily, we did not select nickel battery as the research object, because the consumption of nickel in nickel battery is very small compared with stainless-steel. Therefore, this article chooses nickel ores, ferro-nickel, and stainless-steel as the research object.

The trade data of three nickel commodities are obtained from UN Comtrade through HS codes, including nickel ores (nickel ores and concentrates) (260,400), ferro-nickel (ferro-alloys; ferro-nickel) (720,260), and stainless-steel (7,218, 7,219, 7,220, 7,221, 7,222, and 7,223) (Nickel metal conversion factors are shown in Supplementary Table S3). These codes facilitate the conversion of trade data into a uniform metric using different conversion coefficients, the details of which are presented in the supplementary file.

The R&D investment and industrial structure data of each country come from the World Bank. R&D investment is expressed as a proportion of R&D expenditure in GDP, offering an insight into the innovation capacity of the countries involved. The industrial structure is gauged by the export share of medium-high-tech industries within the manufacturing sector, highlighting the technological orientation and complexity of the exporting economies. The data and the sources involved in this study are listed in Table 3.

This article includes all countries involved in the global trade of three nickel commodities when building a global trade network. When constructing the panel data model, we focus on the top 20 countries in the global nickel import and export, accounting for more than 90% of the total trade volume.

3 Results

3.1 The trade pattern and structure of nickel commodities

3.1.1 Global trade pattern

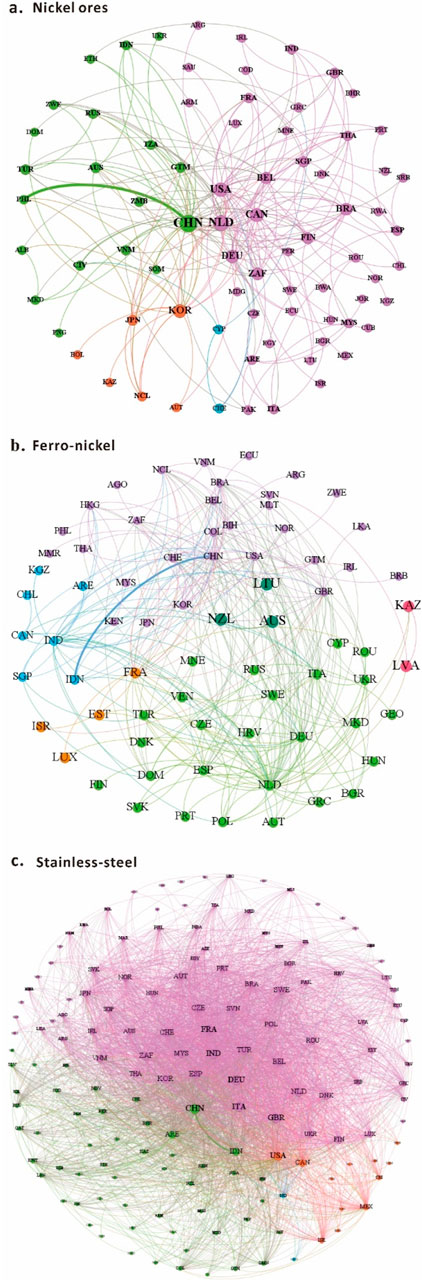

The major global nickel-producing and exporting countries are Indonesia, the Philippines, New Caledonia, and Russia (Yang et al., 2021). China is the leading consumer country, accounting for more than 43% of global consumption (Zeng et al., 2018; Warner et al., 2007). However, as primary producers, Indonesia and the Philippines are not the core of the nickel trade network. Developed countries such as the United States, Britain, and Canada occupy the core position in the nickel trade network (Yu et al., 2023; Ma et al., 2022; Chen et al., 2024) (Figure 3).

Figure 3. Trade pattern of nickel ores, ferro-nickel and stainless-steel in 2022. (A) Nickel ores, (B) Ferro-nickel, (C) Stainless-steel.

Based on the complex network model, a comparative analysis of the evolution in nickel trade is conducted by examining scale, efficiency, community, and stability. This study identifies the transformations in the trade structure of key countries within the nickel supply chain. The assessment is primarily focused on the scale of trade, the capacity for resource control, and the national status in trade (Equation 4).

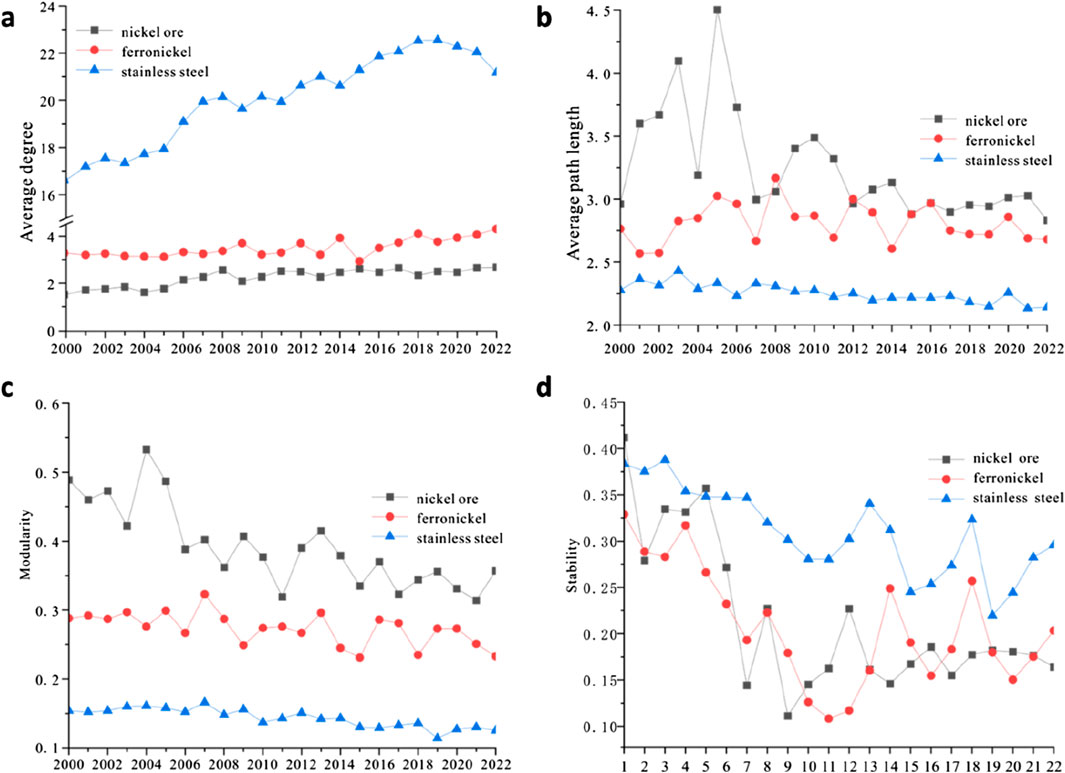

Figure 4A illustrates the changes in the global trade average degree of the nickel supply chain from 2000 to 2022. The average degrees of the import and export trade networks for nickel ores, ferro-nickel, and stainless-steel generally showed an upward trend. There was a stable upward trend from 2000 to 2007 and fluctuations occurred during 2008–2014. After 2014, the average degrees of nickel ores and ferro-nickel continued to rise steadily, while the trade scale of stainless-steel began to decline in 2020. The rise of newly industrialized countries and the rapid development of high technology were the main reasons for the expanding scale of global trade in emerging minerals. Influenced by the global economic crisis in 2008 and the COVID-19 during 2020–2022, there was a slight decrease in the trade scale of nickel ores, ferro-nickel, and stainless-steel in both 2009 and 2020.

Figure 4. The evolution of the global nickel trade pattern, including average degree (A), average path length (B), modularity (C) and stability (D).

The average path length of the global import and export network exhibited fluctuations, with no significant overall downward trend, indicating that the global trade efficiency of the nickel supply chain was unstable (Figure 4B) (Equation 6). There was an intense fluctuation with an overall trend that first increased and then decreased in the average path length from 2000 to 2007. From 2008 to 2014, the average path length was relatively low and remained stable. After 2014, the average path length of nickel ores, ferro-nickel, and stainless-steel tended toward stability. In 2005, the average path length of the nickel supply chain peaked, indicating a decline in global trade efficiency, which was attributed to two primary factors. Nickel prices were at a relatively high level, which suppressed consumer demand, especially in the stainless-steel industry. Secondly, the Indian Ocean tsunami 2004 caused severe damage to regions such as Sumatra Island. Although the exploitation of natural resources like oil, copper, and nickel was minimally affected, the increased financial and economic strain on Indonesia due to reconstruction efforts in 2005 impacted its mineral resource trade (Ke, 2006). In early 2014, Indonesia declared a ban on nickel ores exports, aiming to enhance the added value of domestic ore smelting. This ban disrupted the nickel supply-demand pattern, causing short-term price increases. Yet, the overall trend remained downward, which in turn led to changes in the trade efficiency of ferro-nickel.

Modularity is an indicator used to measure the degree of network division. The higher the modularity, the more pronounced the network division. The modularity of the nickel supply chain showed an overall downward trend, indicating an increase in the concentration degree of global trade (Figure 4C) (Equation 5). There was a stable state from 2000 to 2007 and frequent fluctuations from 2008 to 2014. From 2014 to 2022, there were still minor fluctuations. However, overall, the situation remained stable at a low level, with a slight decrease in modularity and a gradual increase in concentration. From 2014 to 2022, there were still minor fluctuations. It remained in a stable low state, with a slight decrease in modularity and a gradual increase in concentration degree.

NMI of the nickel supply chain was relatively low and essentially ranging from 0.1 to 0.4. The curves of the NMI fluctuated greatly, generally showing a state of first decreasing and then increasing, indicating that the stability of the global trade structure of the nickel supply chain was relatively poor (Figure 4D) (Equation 7).

3.1.2 Evolution of the trade structure of the major trading countries of nickel commodities

Countries which have high level of reserves and productions occupy the primary status in the global nickel trade.

From the perspective of global trade trends and the development and utilization of nickel, the nickel trade is divided into three stages. (1) From 2000 to 2007, sulfide nickel ores were the primary commodities in the upstream stage, which were predominantly used for the production of electrolytic nickel and stainless-steel (Henckens and Worrel, 2020; Chen et al., 2024). The global demand for nickel was driven by the growth in the stainless-steel industry, and the supply of nickel from sulfide ores struggled to keep pace with the increasing demand. This led to a situation where the inventory levels of nickel, particularly on the London Metal Exchange (LME), remained low, which in turn drove the prices of nickel upwards (Hong et al., 2023). The reliance on sulfide nickel ores was significant, setting the stage for the nickel market dynamics that followed in the subsequent years (Gereffi and Lee, 2012). (2) From 2007 to 2016, with the advancement of smelting technology, laterite nickel ores gradually replaced sulfide nickel ores, establishing their dominant position in the nickel industry (König, 2021; Keskinkilic, 2019; Zevgolis and Daskalakis, 2022). Countries with large laterite nickel reserves, such as Indonesia and the Philippines, became more prominent suppliers. (3) Since 2017, the demand for nickel sulfate, a key ingredient in ternary batteries, has skyrocketed, particularly due to the rapid growth of the electric vehicle (EV) industry (Chen et al., 2021). This upsurge in demand propels nickel prices higher, indicating the metal’s importance in the clean energy transition. Concurrently, the stockpiles of nickel at the London Metal Exchange (LME), a benchmark for global metal trading, have seen a consistent decline, reaching historically low levels (Hong et al., 2023). This tightening supply situation was exacerbated by Indonesia’s two mining export bans in 2014 and 2020, which not only disrupted the global nickel market but also amplified the price volatility. The bans were part of Indonesia’s strategy to boost domestic processing and add value to its nickel commodities, thereby impacting the international market and highlighting the country’s influence on the global nickel trade (Pubudi et al., 2024). From the perspective of global trade trends and the development and utilization of nickel, the nickel trade is divided into three stages. (1) From 2000 to 2007, sulfide nickel ores were the primary commodities in the upstream stage, which was predominantly used for the production of electrolytic nickel and stainless-steel (Henckens and Worrel, 2020; Chen et al., 2024). The global demand for nickel was driven by the growth in the stainless-steel industry, and the supply of nickel from sulfide ores struggled to keep pace with the increasing demand. This led to a situation where the inventory levels of nickel, particularly on the London Metal Exchange (LME), remained low, which in turn drove the prices of nickel upwards (Hong et al., 2023). The reliance on sulfide nickel ores was significant, setting the stage for the nickel market dynamics that follow in the subsequent years (Gereffi and Lee, 2012). (2) From 2007 to 2016, with the advancement of smelting technology, laterite nickel ores gradually replaced sulfide nickel ores, establishing their dominant position in the nickel industry (König, 2021; Keskinkilic, 2019; Zevgolis and Daskalakis, 2022). Countries with large laterite nickel reserves, such as Indonesia and the Philippines, became more prominent suppliers. (3) Since 2017, the demand for nickel sulfate, a key ingredient in ternary batteries, has skyrocketed, particularly due to the rapid growth of the electric vehicle (EV) industry (Chen et al., 2021). This upsurge in demand propels nickel prices higher, indicating the metal’s importance in the clean energy transition. Concurrently, the stockpiles of nickel at the London Metal Exchange (LME), a benchmark for global metal trading, have seen a consistent decline, reaching historically low levels (Hong et al., 2023). This tightening supply situation was exacerbated by Indonesia’s two mining export bans in 2014 and 2020, which not only disrupted the global nickel market but also amplified the price volatility. The bans were part of Indonesia’s strategy to boost domestic processing and add value to its nickel commodities, thereby impacting the international market and highlighting the country’s influence on the global nickel trade (Pubudi et al., 2024).

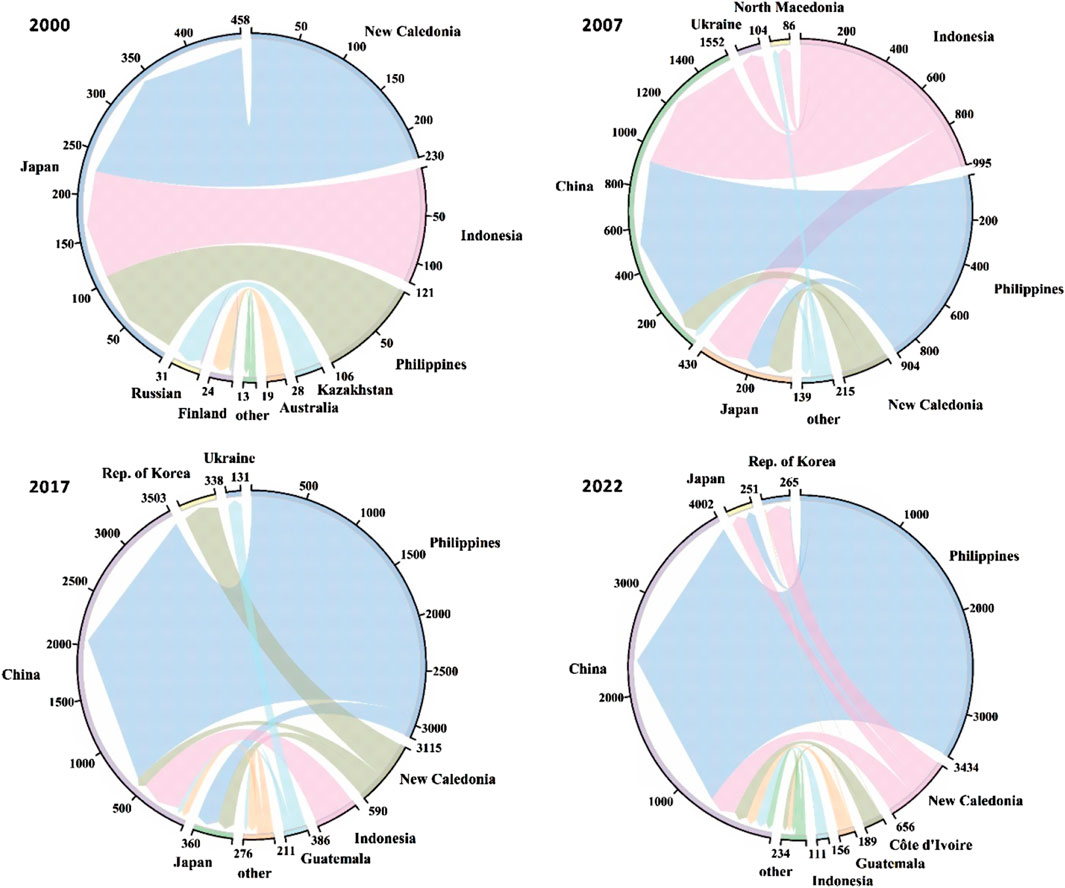

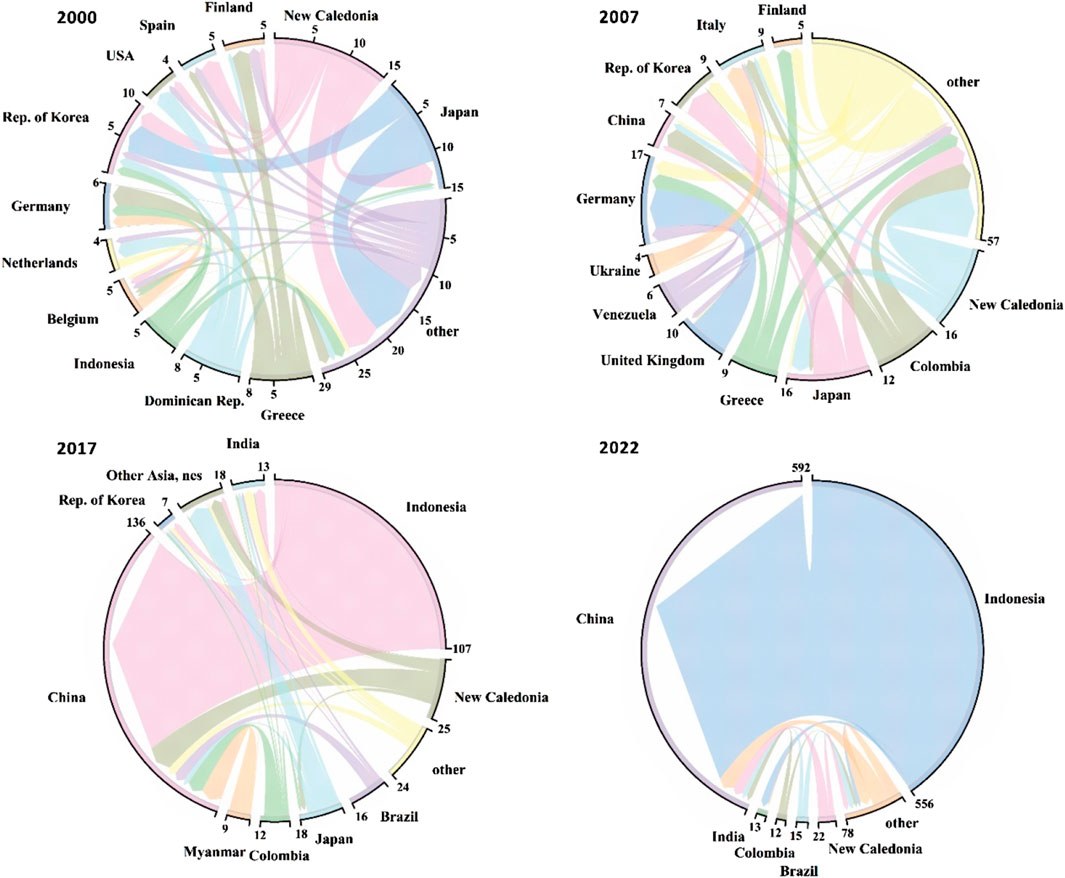

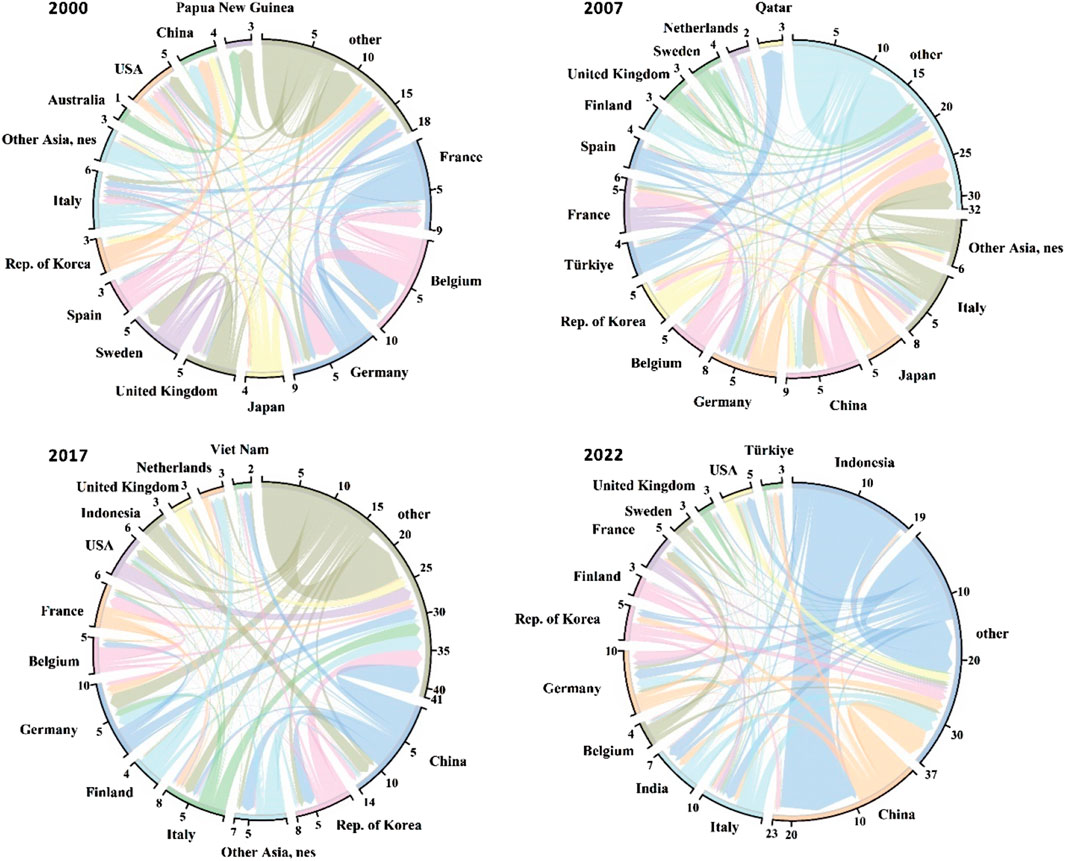

Compared with ferro-nickel and stainless-steel, the trade of nickel ores was relatively concentrated (Figures 5–7). The Philippines was the main exporting country, with increasing export volumes year by year, while Indonesia’s export of nickel ores showed a downward trend. China, Japan, and South Korea were the central importing countries, with China showing an upward trend. In 2017, Indonesia became the main exporting country of ferro-nickel, and the trade of ferro-nickel showed a trend of gathering. By 2022, more than 85% of Indonesia’s ferro-nickel exported to China accounted for the global total. Stainless-steel trade was the most widely covered in terms of countries and trade scale in the nickel supply chain trade, with China being the main importing country, but the proportion was not more than 20%. Indonesia’s ban on the export of nickel ores and industrial development policies had provided support for the trade of ferro-nickel and stainless-steel in Indonesia. Compared with nickel ores, the trade of ferro-nickel and stainless-steel in Indonesia showed an upward trend.

Figure 5. Major trading countries and trade volumes in the nickel ores for the years 2000, 2007, 2017, and 2022.

Figure 6. Major trading countries and trade volumes in the ferro-nickel for the years 2000, 2007, 2017, and 2022.

Figure 7. Major trading countries and trade volumes in the stainless-steel for the years 2000, 2007, 2017, and 2022.

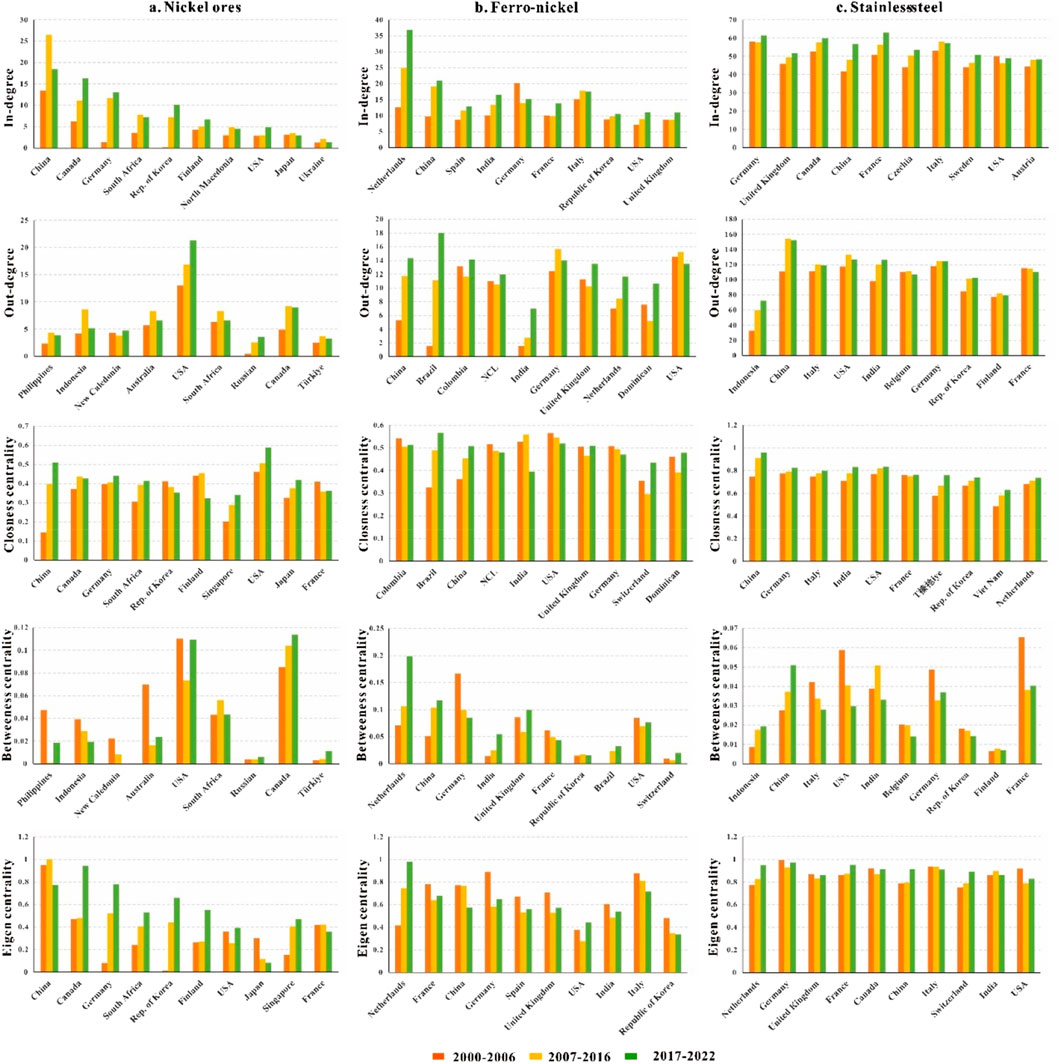

In the statistical analysis of panel data, the study identified countries that occupy a core position in nickel trade, including major exporters of nickel such as Indonesia, the Philippines, New Caledonia, and Russia, as well as major consumers such as China, South Korea, Japan, and India, as well as developed countries such as the United States, Canada, the United Kingdom, the Netherlands, and Italy. Therefore, in the analysis of trade structure, this study did not analyze each of the top 20 countries in trade volume separately but selected the top ten countries in trade structure for in-depth analysis according to the three key stages of the development trend of the nickel supply chain. This approach aims to gain a more accurate grasp of the key dynamics and trends in the global nickel trade. For the five structural parameters (in-degree, out-degree, closeness centrality, betweenness centrality, and eigen centrality) of importers and exporters from 2000 to 2022, this study calculated the average values for the three stages and ranked countries based on these indicators (Figure 8). The trade structure of the main trading countries in the three stages of the nickel supply chain had changed, but the main trading countries did not. Compared with nickel ores and ferro-nickel, the scale of stainless-steel trade, the ease of resource availability, and the association with exporting countries were the highest. The main countries for import nickel ores and ferro-nickel are mainly concentrated in East Asian, such as China, Japan and, South Korea. Meanwhile the main importing countries for stainless-steel were relatively dispersed. Besides China, the United States and various European countries constituted significant import hubs, indicating a diverse and widespread demand for stainless-steel across these regions. Since 2000, the proportion of China’s imports of nickel ores and ferro-nickel began to increase rapidly, and by 2022, China’s imports of nickel ores and ferro-nickel accounted for 86% and 92% of the global total imports, respectively (Figures 5–7). In the trade of nickel commodities, although the United States was not the largest in trade scale and the association with major exporting countries in the trade of nickel commodities was not high, its resource counter-control ability was the highest, which was related to its overseas resource control layout. Although China had a huge trade scale, it mainly relied on the Philippines for nickel ores and Indonesia for ferro-nickel, and had a very high association with major resource-exporting countries, but the resource counter-control ability was insufficient, and it was easily affected by policy and economic changes in major resource-exporting countries. In addition, among the main importing countries, economically developed countries occupied an advantageous position, which could better promote the evolution of the nickel industry chain trade pattern (Figure 8).

Figure 8. The main trade structure of the nickel supply chain. (A) Nickel ores, (B) Ferro-nickel, (C) Stainless-steel.

In terms of trade commodities, similar to the import trade structure, compared with nickel ores and ferro-nickel, the scale of stainless-steel trade was more extensive. In terms of trading countries, the United States, China, South Africa, Germany, and Canada played a key role in the export trade market of nickel commodities; among them, the United States and European countries had a high resource control ability and occupied an important trade position, playing an important role in the export trade of nickel commodities. The global nickel reserves and production were relatively concentrated, mainly distributed in Australia, South Africa, Canada, Russia, Indonesia, and the Philippines. South Africa and Canada were strong global exporters of nickel and had advantages in weighted degree, betweenness centrality, and eigen centrality, to a certain extent, they could control the trade of nickel ores. However, the main exporting countries, such as Indonesia, and the Philippines had relatively single export channels. After Indonesia restricted the export of nickel ores in 2014, the Philippines became the country for China’s import of nickel ores, accounting for more than 80% of the country’s total export of nickel ores to China. In addition, the resource control ability and trade status of the main exporting countries of nickel ores were relatively low. Indonesia had very rich nickel ores, but the development mode of simply exporting metal resources could not give full play to Indonesia’s resource advantages. In order to improve the added value of metal mining commodities, Indonesia first banned the export of nickel ores in 2014, but it was not until 2020 that Indonesia’s nickel pig iron output exceeded that of China, becoming the world’s largest supplier of nickel. The proportion of Indonesia’s import volume of nickel pig iron in China reached as high as 84%. To cope with policy changes in Indonesia, foreign investment-built nickel smelting plants in Indonesia, which improved the added value of Indonesia’s nickel commodities but also exposed the shortcomings of its resource control. The Indonesian government began to impose export tariffs on ferro-nickel and nickel pig iron in 2022, and policy uncertainty had a greater impact on the supply of ferro-nickel and stainless-steel in China.

In summary, China was a major importer of nickel commodities, with a significant trade center status. In recent years, the import volume always ranked first in the world, and the proportion of imported nickel ores and ferro-nickel was even as high as more than 80%, respectively, depending on the Philippines and Indonesia, with a single import channel and insufficient resource counter-control ability. Once there was a political and economic crisis in the exporting countries, it would put great pressure on China’s trade in nickel commodities. On the other hand, the main exporting countries, such as the Philippines and Indonesia, were not significant in terms of export channel diversity, resource control ability, and trade status. Trade was subject to market demand and changes in industrial structure, domestic policy changes, increased investment risks by foreign capital, and thus affected the stability of the trade market. However, developed countries such as the United States and the European Union, although the import and export trade volumes were small, had a higher degree of resource balance due to their priority in the development process, resulting in a relatively high diversity of trade channels, resource control and counter-control ability, and trade center status during the research period. The policies and economic crises of major importing and exporting countries had a relatively small impact on such countries, but changes in the industrial structure of high-tech affect the trade of such countries, such as the high-nickel matte from Russia.

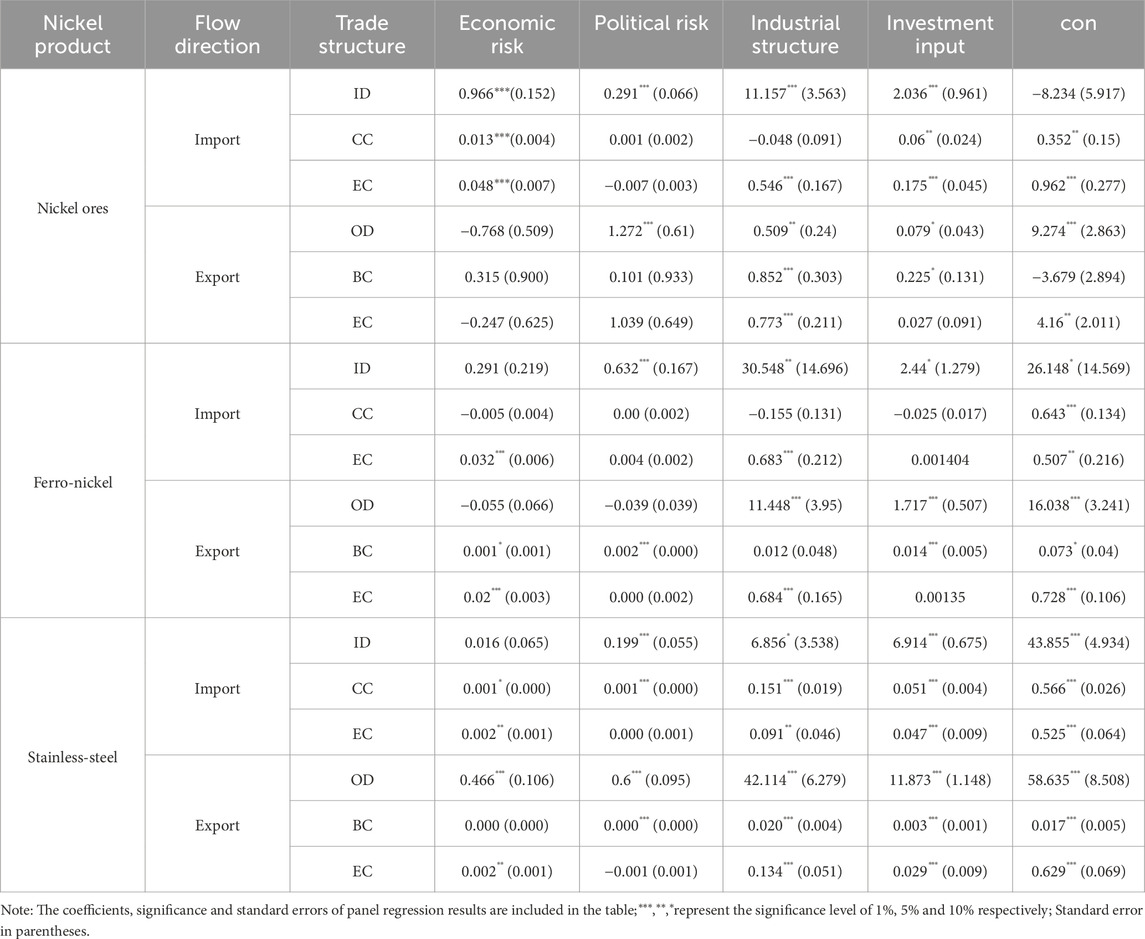

3.2 Impact of country risks on nickel supply chain trade structure

This study established two types of regression models. The first model pertains to import trade within the nickel supply chain, while the second model relates to export trade within the same chain. These models correspond to six scenarios that explore the impact of country risk (economic and political), industrial structure, and R&D investment on the import scale of importing countries (ID), their resource counter-control capability (CC), and the national status in import trade (IEC), as well as the export scale of major exporting countries (OD), their resource control capabilities (BC), and national status in export trade (EEC).

3.2.1 The impact of country risk on the trade structure of major importing countries in the nickel supply chain

Table 4 shows the regression results of the effect of country risk on the import trade structure of the nickel supply chain. From the perspective of importing countries, economic risk was significantly and positively correlated with the trade structures of three types of nickel commodities. The impact of economic risk on nickel ores was particularly substantial. When importing countries faced economic risks, their trade scale for nickel ores, counter-control capabilities over resources, and influence in trade were all subject to change. To a certain extent, countries that imported nickel could increase their import channels, diversifying the pressures and uncertainties associated with concentrated resource imports. This diversification could ensure the stability and security of resource imports, thereby reducing the impact of economic risk on the trade of critical minerals. Consequently, this led to an enhanced ability to counter-control resources, strengthened connections with countries engaged in resource trade, and a corresponding elevation in their trade status. However, when economic risk increased by one unit, the counter-control capability for nickel ores only improved by 0.013 units. The trade advantages brought about by economic risk, while significant, resulted in minimal changes. Compared to the import of nickel ores, the impact of economic risk on the trade of ferro-nickel and stainless-steel was relatively lower. There was a significant positive correlation between economic risk and the eigenvector centrality of ferro-nickel, and it significantly affected the eigenvector centrality and closeness centrality of stainless-steel, with both showing positive influences.

Table 4. Regression results for the role of countries in the nickel product (Equations 1, 2, 8).

Political risk had a significant impact on the trade scale of the three types of nickel commodities and exhibited a negative correlation. Specifically, political risk had a notably negative impact on the counter-control ability of resources for stainless-steel. When the of an importing country increased by one unit, the trade scale of nickel ores, ferro-nickel, and stainless-steel in the importing country correspondingly decreased by 0.3, 0.6, and 0.2 units, respectively, while the resource counter-control ability for stainless-steel decreased by 0.1%. Nickel is primarily distributed in areas such as the Philippines and Indonesia, with a relatively concentrated distribution. At the current stage, the global trade pricing mechanism for nickel mainly relies on futures pricing, and nickel consumers tend to use futures contract prices to purchase nickel. Under these circumstances, although it may seem that nickel-importing countries have an import advantage, in reality, exporters who sign futures trade with countries with lower political risks can obtain more stable profits. Therefore, on this basis, political risk has a significant negative correlation impact on the import trade structure of the three types of nickel commodities.

Changes in the industrial structure had a significant impact on the scale of trade and the national status in trade for nickel ores, ferro-nickel, and stainless-steel, with the degree of impact decreasing in that order. When the industrial structure changed by one unit, the trade scale of the three commodities moved in the same direction by 11, 30, and 7 units, respectively. Changes in the industrial structure altered the demand for nickel in different industries, leading to fluctuations in the volume of resource imports. As the industrial structure adjusted, the rise of emerging industries or the decline of old ones caused importing countries to seek new trade partners or adjust existing trade relations, thereby increasing the scale of import trade. Additionally, the adjustment of the industrial structure showed a significant negative correlation with the national status of ferro-nickel importing countries at the significance level of 1%. An optimized industrial structure reduced dependence on raw materials such as ferro-nickel, leading to a declining trend in its position in import trade.

The R&D investment had a more pronounced impact on the trade structure, with significant correlations at the significance level of 1% for both the import trade of nickel ores and stainless-steel, while its impact on the import trade structure of ferro-nickel was relatively smaller. Unlike the positive impact of R&D investment on the national status in stainless-steel import trade, the R&D investment had a negative impact on the trade status of nickel ores. The negative impact may have been due to technological innovation leading to increased production efficiency, which reduced import demand and thus lowered the import volume of nickel ores. In contrast, in the stainless-steel industry, the positive impact was because technological innovation promoted product quality and innovation, enhancing competitiveness in the international market.

3.2.2 The impact of country risk on the trade structure of major exporting countries in the nickel supply chain

The economic risk did not significantly affect the trade scale, resource control capabilities, or national status in trade for countries that exported nickel ores. However, it demonstrated a significant positive correlation with the trade status of countries exporting ferro-nickel and the trade scale of stainless-steel at the significance level of 1%. As high-value-added commodities, ferro-nickel and stainless-steel had high demand and competitiveness in the international market. The economic risk could have caused fluctuations in demand, which might have significantly impacted the export volumes of commodities such as ferro-nickel and stainless-steel. Therefore, an increase in economic risk was positively correlated with the trade status of countries exporting ferro-nickel and the trade scale of stainless-steel. Compared to nickel ores, the trade of ferro-nickel and stainless-steel was more dependent on a stable market environment and supply chain, and an increase in economic risk could have had a more pronounced impact on their trade status and scale.

Political risk exhibited a significant negative correlation with the trade scale of nickel ores and stainless-steel and a significant negative relationship with the resource control capabilities of ferro-nickel at the significance level of 1%, albeit with a small change coefficient. Political instability led to interruptions, delays, or political interventions in resource extraction, thereby reducing the export of nickel ores. Moreover, importing countries, aiming to ensure the stability of resource supply, preferred to trade with countries that had higher political stability.

The optimization of the industrial structure significantly affected the trade structure of all three commodities. It had a negative impact on the trade scale of nickel ores and ferro-nickel and a positive impact on the export trade scale of stainless-steel. As the industrial structure changed, substitutes or emerging industries emerged, leading to a decrease in demand for nickel ores and ferro-nickel, thus affecting the trade scale. The optimization and adjustment of the industrial structure intensified market competition, and exporting countries faced greater competitive pressure, leading to a decrease in the trade scale of nickel ores and ferro-nickel. However, the optimization of the industrial structure reduced the production cost of stainless-steel, thereby increasing its trade scope.

The R&D investment significantly affected the export trade structure of nickel commodities. Higher R&D investment typically promoted technological innovation and improvement in product quality, thereby enhancing the competitiveness and market share of exported commodities and affecting the export trade structure. Regarding the industrial structure and R&D investment, when changes occurred in both, the import and export trade structure of the three types of nickel commodities was significantly affected. Before 2007, the production of stainless-steel from sulfide nickel ores was dominant, during which Indonesia was the main exporter of nickel ores. From 2007 to 2016, smelting of laterite nickel ores for ferro-nickel and processing into stainless-steel took the dominant position, during which the Philippines’ nickel ores export was dominant. During this period, China’s product processing advantages became evident, becoming the main producer of ferro-nickel. Additionally, Indonesia’s export ban on nickel ores in 2014 led to frequent changes in the global nickel trade market during this period. After 2016, the demand for ternary batteries, mainly made of nickel sulfate, kept growing rapidly. The increase in R&D investment, to some extent, increased the utilization rate of nickel ores, and with the reduction of processed product costs, the scale of nickel ores imports relatively decreased.

4 Discussions

4.1 The evolution trend of global nickel trade networks

The trade structure of different nickel commodities varies. Between 2000 and 2022, the average degree of stainless-steel has increased significantly, and the trade scale of stainless-steel has expanded significantly. In contrast, the volume of nickel ores and ferro-nickel trade has changed little (Figure 3A). During this period, changes in industrial structure, fluctuations in the global economy, and the implementation of the Indonesian ban have adversely affected the efficiency of nickel ores trade. In contrast, the average path length of stainless-steel has remained relatively stable over the same period (Figure 3B). Compared with nickel ores and ferro-nickel, stainless-steel has the least concentration (Figure 3C) and less fluctuation in stability (Figure 3D), both reflecting the relatively high degree of stability within the stainless-steel trade network, underlining the strong resilience of its trade network to economic and political uncertainties (Chen et al., 2024; Olafsdottir and Sverdrup, 2019).

Since 2000, the growth in global nickel demand has been closely linked to the industrialization of emerging market countries and the development of high-tech industries (Elshkaki et al., 2017). This surge in demand has led to a significant increase in the trading volume and the number of trading countries for nickel ores, ferro-nickel, and stainless-steel, particularly in the stainless-steel industry (Olafsdottir and Sverdrup, 2021). However, the efficiency of the global nickel supply chain did not improve in tandem with the increase in trade volume (Figure 4B). Despite closer connections among trading partners, the overall trade transmission efficiency did not see a marked enhancement. This could be attributed to global supply and demand imbalances, economic and market uncertainties, shifts in policy, and the complexity of the nickel supply chain (Wang and Xia, 2024; Cristina et al., 2019). For instance, The global economic crisis in 2008 led to a decline in demand, while the COVID-19 pandemic in 2020 caused disruptions in supply chains and drastic changes in demand (Hassan et al., 2023), with corresponding changes in trade efficiency. It illustrates that changes in economy and policy can impact the structure of nickel trade.

The concentration of the global nickel trade network has increased significantly in recent years (Figure 4C). China, the United States, Indonesia, and 17 other core countries make up 74% of the global nickel trade, highlighting the concentration of production and trade activities (Sun et al., 2024). In addition, geopolitical factors are increasingly affecting the global nickel trade, with countries preferring to trade with politically aligned trading partners, a phenomenon known as “friend-shoring,” further driving the increase in trade concentration (Ma et al., 2022). There are differences in the added value of different commodities in the nickel supply chain, and developed countries usually dominate the high-value-added links, which is also an important factor leading to the increase in the concentration of traded commodities (Sun et al., 2024).

The fluctuation of supply and demand in the nickel trade market is one of the main factors that lead to the decline of the stability of the nickel supply chain. The global nickel supply and demand situation has shifted from a previous tight state to a surplus. In particular, between 2021 and 2022, the global supply and demand balance of metal nickel has gradually been broken, showing a trend of excess, and this excess state is expected to continue. The oversupply of the market and the weak demand have put double pressure on the price and trade stability of nickel. This change in supply and demand patterns could lead to less stability in trade as markets adjust to new supply and demand relationships. In addition, the rapid development of technology and the dramatic expansion of production capacity have had a profound impact on the stability of the global trade in nickel commodities. In 2007, for example, laterite nickel ores entered the historical stage, which greatly promoted the surge in nickel-iron production capacity in China and other countries, thus reshaping the structure of nickel trade on a global scale and bringing significant changes to its stability.

To sum up, although the trading volume of nickel commodities has increased in recent years, and the number of countries involved in trade has also increased, factors such as supply and demand imbalances, political risks, economic fluctuations, technological progress, and industrial structure adjustment have had a significant impact on the trade structure of the global nickel supply chain. The combination of these complex and changeable factors makes the global trade structure of the nickel supply chain face many challenges, and its stability and predictability are tested (Song et al., 2023). There was a need to focus on how to strengthen a country’s competitiveness and risk resistance in the global nickel industry through diversifying import sources, optimizing industrial structure, and increasing R&D investment (Ali et al., 2019; Tilton et al., 2018).

4.2 Different effects of country risk on the import and export trade structures

Economic risks exerted a more pronounced influence on the import trade structure of the nickel supply chain, while political risks had a more significant bearing on the export trade structure, aligning with the findings of other scholars regarding the impact of country risks in the energy sector (Zhang et al., 2021). The higher the economic risk, the shakier the economic foundation, which failed to offer solid guarantees for the returns and security of foreign investments in the nickel industry. A downturn in foreign direct investment in domestic nickel production and exploration due to elevated economic risks severely compromised the regular supply of domestic nickel. Consequently, countries grappling with higher economic risks were compelled to broaden their import channels to satisfy their nickel consumption demands. However, an increase in import sources did not automatically translate to an increased volume of nickel resource imports. For instance, during the economic crisis, while the overall trade volume for global nickel ores, ferro-nickel, and stainless-steel declined, the trade scale for major importing countries like China and Japan actually registered a slight uptick. With the escalation of economic risks, these countries exhibited vulnerabilities in their nickel supply, prompting them to diversify their nickel supply channels to mitigate reliance on imports, drawing a parallel with their broader mineral resource trade strategies (Chalvatzis and Ioannidis, 2017). It became evident that countries with higher economic risks also face repercussions on their domestic nickel production. As a result, their reliance on external nickel supplies intensified, leaving them with the option to import nickel from a more diverse array of countries to alleviate their dependency.

In contrast to the energy trade, an uptick in national political risk did not confer a short-term boon to the nickel trade (Kitamura and Managi, 2017). Given the concentrated distribution of nickel, escalating political risks emerged as a significant threat to the supply capabilities of exporting countries. Importers focused on the geopolitical landscape of their exporting counterparts. To safeguard the security of the nickel supplies, importing countries were more inclined to source resources from countries with a stable political climate (Yu et al., 2023). There existed a negative correlation between the export scale of exporting countries and the level of political risks. In terms of resource control capacity, increased political and economic risks may lead to a weakening of resource control capacity in exporting countries. The core trade countries that have the right to speak control the trade of nickel commodities (Gorman and Dzombak, 2018; Yu et al., 2023). This suggests that increased political and economic risks for exporting countries, especially in the face of international pressure, could weaken their ability to control nickel. Resource-rich countries can influence the global nickel trade structure through policy adjustments. Indonesia plans to impose an export ban or tax on nickel, which limits exports of nickel commodities containing less than 40 percent. As the world’s largest nickel producer, Indonesia wants to upgrade its supply chain and become a global battery manufacturing hub (NBR). Such a policy change could weaken the ability of exporting countries to control nickel, as they may be affected by international market and policy changes. The impact of country risk on the national status of trading countries is not significant. For individual exporting countries, while the increase in political risk implies an unstable political environment in nickel producing countries, which increases the risk of foreign investment and may have an impact on their resource output and the fiscal spending of trading partners, this change has not materially altered their linkages with key countries (Zhou et al., 2023; Chen et al., 2024). In the short term, trade links with key countries appear solid and resilient to fluctuations in political and economic risks.

The optimization of industrial structure and the upsurge in R&D investment notably influenced the export trade structure of the nickel supply chain. As the industrial structure was refined and R&D investment grew, shifts in the composition of nickel ores production occurred, leading to a weakened market demand for nickel ores and a bolstered domestic capacity for production and processing, which in turn led to a decrease in export volume and scale (Ma et al., 2022). The adjustment of industrial structure has stimulated the increase in the added value of nickel commodities, thus expanding the production of nickel commodities to meet the different needs of different markets. This shift has changed the trade structure of export mineral commodities, making it more biased towards high-value-added commodities. This is the driving force behind the increased demand for ferro nickel and stainless-steel and the corresponding expansion in the scale of exports. At the same time, resource control capacity has increased proportionally, and trade links with other countries have also increased.

4.3 The impact of country risks on nickel supply chain and its particularity

4.3.1 Economic risk and political risk on nickel trade

Country risks, industrial structures, and R&D investments have differential impacts on the import and export trade structures within the nickel industry chain. The extent of country risk influence on the nickel industry chain is notably distinct. The economic risk correlated significantly with the import scale of nickel ores at the significance level of 1%, demonstrating a substantial positive relationship (Table 4). Compared with nickel-iron and stainless-steel, nickel ores trade concentration is higher (Figure 4C), nickel ores as the upstream raw material of the supply chain, its price and trade scale are more sensitive to macroeconomic changes (Zhou et al., 2024). As a result, economic risks have a more significant impact on the scale of raw ore trade.

Processed mineral commodities often occupy the middle to high tiers of the value chain, possessing a certain level of added value. The influence of technological factors on these commodities may outweigh the direct impact of economic risks, which is also reflective of the varying degrees of impact that R&D investments have on the export trade structure of nickel ores, ferro-nickel, and stainless-steel as illustrated in the panel data in Table 4. The diversified markets and product structures for these resource-based processing commodities conferred a higher resilience to risks, thereby diminishing the significance of economic risks on them. Furthermore, the adjustment of the industrial structure exerted a more pronounced influence on the export trade of stainless-steel compared to that of nickel ores and ferro-nickel. This finding is consistent with the notion that a more optimized industrial structure can enhance the competitiveness and added value of exports, making them less susceptible to economic volatility (Wong and Liu, 2011; Umer et al., 2022).

Political risks exert their influence on the nickel trade primarily through shifts in policy, geopolitical tensions, and the stability of governance. Elevated political risks can often result in heightened policy uncertainty within resource-rich countries, manifesting as export bans on mineral resources or abrupt alterations in fiscal policies. Such developments can impede the continuity and reliability of resource production and exports, culminating in a reduced scale of export trade. A case in point is Indonesia’s prohibition on nickel ores exports, which sent shockwaves through the global nickel supply chain. These policy shifts compelled countries reliant on Indonesian nickel to recalibrate their import strategies to maintain an uninterrupted flow of supply (Blondel et al., 2008).

4.3.2 Particularity of nickel supply chain

The production and consumption of nickel are notably concentrated. The principal nickel-producing countries, such as Indonesia, the Philippines, Russia, and Australia, supply a significant portion of the world’s nickel, while the major consumer base is predominantly in China, the United States, and the European Union. This level of concentration renders the international trade in nickel more vulnerable to the risks emanating from specific countries than is the case with other minerals like copper and aluminum. For example, policy changes in Indonesia and the Philippines exert a considerable influence on the global nickel supply chain, a level of impact not as pronounced in the trade of other minerals (Umer et al., 2022). Although lithium and copper are also produced predominantly in certain countries, their geographical distribution of resources might be broader (Hafner, 2020). Lithium is significantly present in the South American “Lithium Triangle” of Chile, Argentina, and Bolivia, as well as in Australia and China. Even if the trade of lithium and copper exhibits some concentration, their application sectors and demand dynamics differ from those of nickel, which may, in turn, affect trade structures and their sensitivity to country risks.

Nickel’s application spectrum is both broad and critical, particularly in high-value industries such as stainless-steel and battery manufacturing. The burgeoning electric vehicle industry has led to a marked increase in demand for high-quality nickel, thereby amplifying the influence of country risks on the nickel supply chain (Zheng et al., 2022). Economic and political risks significantly impact the trade structure of high-value commodities like ferro-nickel and stainless-steel, underscoring their acute sensitivity to market demands and policy environments. While lithium is predominantly utilized in the battery sector, particularly in new energy batteries, and copper has widespread applications in electrical engineering and electronics, each mineral product, despite its different application areas, shares similarities in how their added value and trade patterns are shaped by industrial structures and R&D investments (Wang et al., 2018).

The management of country risks in the nickel trade is significantly more complex. The global commerce of nickel is swayed not merely by the underpinnings of supply and demand but also by the unpredictable currents of future markets and the ebbs and flows of financial capital. Although financial elements are recognized for their influence across the trade of diverse mineral resources, their effect on the nickel market stands out as exceptionally pronounced. This heightened sensitivity is attributed to a confluence of critical factors, including the metal’s pivotal role in key industries, the concentration of production within specific geopolitical regions, and the metal’s pronounced reaction to speculative trading and financial market maneuvers. This intricate interplay of elements underscores the need for a nuanced and vigilant approach to risk management within the nickel trade. The sharp volatility in the nickel futures market on the LME in 2022 was a case in point, highlighting the financial market’s exposure to uncertainty and risk in the nickel trade (Wang et al., 2023). Hedging activities by companies in the nickel supply chain are common and can influence market dynamics. The influx of capital from index investments in commodities, including nickel, can drive prices away from supply and demand fundamentals. Exchange rate fluctuations, which affect the global trade of nickel, can have a more immediate impact on this metal than on others. Geopolitical events, such as tensions in the South China Sea affecting nickel ores exports, can lead to increased risk premiums in the nickel trade. Shifts in economic policies, such as the implementation of export taxes or bans by major producers, can instantly alter the supply scenario and significantly affect nickel prices (Zheng et al., 2022). These underscore the unique sensitivity of the nickel market to financial influences, highlighting the necessity for a sophisticated approach to risk management in this sector.

In summary, the influence of economic and political risks on the nickel trade operates through distinct channels, and the concentration of nickel production coupled with its use in high-value applications increases its susceptibility to country risks. Compared to other mineral resources, the distinctive and intricate dynamics of nickel in the global supply chain call for a more sophisticated approach to risk management and the development of key policies. This nuanced strategy must account for the unique sensitivities and complexities inherent in the nickel trade, ensuring a balanced and effective response to the multifaceted challenges it faces.

4.4 Limitation and future work

The study on the impact of country risk on trade structure has been relatively comprehensive. However, the study is based on past data, nickel trade patterns, and country risks are dynamic, so it may not be possible to fully predict future trade trends and risks. Countries’ trade policies change from time to time, which can affect the pattern and efficiency of nickel trade, and studies may not reflect these changes in a timely manner. In the subsequent research, a comprehensive summary of nickel mining, production, consumption, trade, and each stage of the influencing factors, the establishment of nickel industry chain adaptive system, and nickel supply security research has a very important significance.

5 Conclusion

This study employs a comprehensive approach, integrating complex network theory with panel regression models, to dissect the profound influence of country risk on the trade structure of the nickel supply chain represented by nickel ores, ferro-nickel, and stainless-steel. The findings unveil the pivotal role that country risk factors, particularly political and economic risks, play in sculpting the global nickel trade network. The main conclusions are summarized as follows:

(1) The scale of global nickel trade is growing, but the trade efficiency has not been improved simultaneously, the import and export channels are concentrated, and the stability is poor. Developed economies dominate the nickel trade, with the United States playing a key role in the global nickel trade network, with close relationships with major trading partners such as China. China occupies a central position in nickel resource import trade, but has no obvious advantage in exports. Overall, economically developed countries maintain an advantage in the global nickel trading network. The increase in import channels can effectively spread the risk. On the basis of stabilizing the existing trade links with Russia, Australia, Canada, China should strengthen nickel trade with New Caledonia, Indonesia, South Africa, and other countries to achieve multi-dimensional development of import channels.

(2) Country risks have a significant impact on trade within the nickel supply chain. The increase in economic risks promotes the diversification of import channels and strengthens the resource counter-control ability and trade position of importing countries. However, in the short term, economic risks will not significantly alter the trading relationships of major trading countries. In order to ensure the supply security of nickel, importing countries are more willing to cooperate with countries with stable political environments, which may lead to the weakening of the intermediary role of nickel-exporting countries. It is suggested to invest in the development of overseas nickel mineral resources, promote the construction of regional supply chains, and hedge the risks caused by China’s large imports of upstream commodities from these countries by strengthening the dependence of major upstream product importing countries (regions) on the downstream commodities of China’s nickel industry chain.

(3) Compared with nickel commodities, national risk has a greater impact on nickel ores trade, and industrial structure and R&D investment have a significant positive impact on nickel product trade. It is recommended that industrial structure adjustment and research and development investment be increased in order to expand the scale of trade in nickel processing commodities, enhance the resource control capacity of trading countries, and enhance their national status in the global trade hierarchy.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://comtradeplus.un.org.

Author contributions

XJ: Conceptualization, Data curation, Formal Analysis, Investigation, Methodology, Project administration, Resources, Validation, Visualization, Writing–original draft, Writing–review and editing. CL: Conceptualization, Formal Analysis, Funding acquisition, Supervision, Writing–original draft, Writing–review and editing. TL: Formal Analysis, Supervision, Visualization, Writing–review and editing. JL: Writing–review and editing. XW: Writing–review and editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This study is financially supported by the Basic Science Center Project for National Natural Science Foundation of China (No. 72088101, the Theory and Application of Resource and Environment Management in the Digital Economy Era), the Integrated Project of the Major Research Plan of the National Natural Science Foundation of China (No. 92162321), and the National Natural Science Foundation of China (Grant No. 71991485).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/feart.2024.1487521/full#supplementary-material

References

Ali, S. H., Perrons, R. K., Toledano, P., and Maennling, N. (2019). A model for “smart” mineral enterprise development for spurring investment in climate change mitigation technology. Energy Res. & Soc. Sci. 58, 101282. doi:10.1016/j.erss.2019.101282

Bai, Y. Y., Zhang, T. Z., Zhai, Y. J., Jia, Y. K., Ren, K., and Hong, J. L. (2022). Strategies for improving the environmental performance of nickel production in China: Insight into a life cycle assessment. Journal of Environmental Management, 114949–114949. doi:10.1016/J.JENVMAN.2022.114949

Blondel, V. D., Guillaume, J. L., Lambiotte, R., and Lefebvre, E. (2008). Fast unfolding of communities in large networks. Comput. Sci. 2008 (3), P10008. doi:10.1088/1742-5468/2008/10/p10008

Caldara, D., and Lacoviello, M. (2021). Measuring geopolitical risk. Working paper, Board of Governors of the Federal Reserve Board. doi:10.1257/AER.20191823

Cavalett, O., and Ortega, E. (2009). Emergy, nutrients balance, and economic assessment of soybean production and industrialization in Brazil. J. Clean. Prod. 17 (8), 762–771. doi:10.1016/j.jclepro.2008.11.022

Chalvatzis, K. J., and Ioannidis, A. (2017). Energy supply security in southern Europe and Ireland. Energy Procedia105 105, 2916–2922. doi:10.1016/j.egypro.2017.03.660

Chen, C. (2023). Research on link prediction algorithm based on complex network feature vector centrality and clustering coefficients. Tianjin University of Technology. (in Chinese).

Chen, W., Jiang, Y. F., and Liu, Z. G. (2024). Unveiling structural differentiation in the global nickel trade network: a product chain perspective. J. Geogr. Sci. 34 (4), 763–778. doi:10.1007/s11442-024-2226-y

Chen, H., Liao, H., Tang, B. J., and Wei, Y. M. (2016). Impacts of OPEC's political risk on the international crude oil prices: An empirical analysis based on the SVAR models[J]. Energy Economics, 5742–49. doi:10.1016/j.eneco.2016.04.018

Chen, X., Zhang, T. Y., Ye, W. X., Wang, Z. W., and Lu, H. H-Ching (2021). Blockchain-Based Electric Vehicle Incentive System for Renewable Energy Consumption. IEEE Transactions on Circuits and Systems, II. Express briefs 68 (1), 396–400. doi:10.1109/TCSII.2020.2996161

Cristina, C., Aaditya, M., and Michele, R. (2019). “Policy uncertainty, trade, and global value chains: some facts, many questions,” The World Bank. Policy Research Working Papers. doi:10.1596/1813-9450-9048

Cui, S. J., and Li, Z. P. (2023). The “power triangle” of critical minerals: an examination based on the global nickel industry chain. J. Lat. Am. Stud. 45 (05), 96–118+161. (in Chinese)

Dong, G. G., Qing, T., Du, R. J., Wang, C., Li, R. Q., Wang, M. G., et al. (2020). Complex network approach for the structural optimization of global crude oil trade system. J. Clean. Prod. 251 (2020), 119366. 0959-6526. doi:10.1016/j.jclepro.2019.119366

Dong, Q. Y., Du, Q. Y., and Du, A. M. (2024). Interplay between oil prices, country risks, and stock returns in the context of global conflict: A PVAR approach. Research in International Business and Finance (PB), 102545–102545. doi:10.1016/J.RIBAF.2024.102545

Duan, F., Ji, Q., Liu, B. Y., and Fan, Y. (2018). Energy investment risk assessment for nations along China's Belt & Road Initiative. J. Clean. Prod. 170, 535–547. doi:10.1016/j.jclepro.2017.09.152

Elshkaki, A., Reck, B. K., and Graedel, T. E. (2017). Anthropogenic nickel supply, demand, and associated energy and water use. Resour. Conservation Recycl. 125, 300–307. doi:10.1016/j.resconrec.2017.07.002

Garlaschelli, D., and Loffredo, M. I. (2004). Fitness-dependent topological properties of the world trade web. Phys. Rev. Lett. 93 (18), 188701. doi:10.1103/PhysRevLett.93.188701

Garlaschelli, D., and Loffredo, M. I. (2005). Structure and evolution of the world trade network. Phys. A Stat. Mech. its Appl. 355 (1), 138–144. doi:10.1016/j.physa.2005.02.075

Geng, J. B., Ji, Q., and Fan, Y. (2014). A dynamic analysis on global natural gas trade network. Appl. Energy 132, 23–33. doi:10.1016/j.apenergy.2014.06.064

Gereffi, G., and Lee, J. (2012). Why the world suddenly cares about global supply chains. J. Supply Chain Manag. 48 (3), 24–32. doi:10.1111/j.1745-493X.2012.03271.x

Gorman, R. M., and Dzombak, A. D. (2018). A review of sustainable mining and resource management: transitioning from the life cycle of the mine to the life cycle of the minera. Resour. Conservation & Recycl., 137281–137291. doi:10.1016/j.resconrec.2018.06.001

Habib, K., and Wenzel, H. (2016). Reviewing resource criticality assessment from a dynamic and technology specific perspective-using the case of Direct - drive wind turbines. J. Clean. Prod. 112, 1123852–1123863. doi:10.1016/j.jclepro.2015.07.064

Hafner, A. K. (2020). Diversity of industrial structure and economic stability: evidence from Asian gross value added. Asia-Pacific J. Regional Sci. 4 (1), 413–441. doi:10.1007/s41685-020-00152-w

Hao, H. C., Wang, A. J., Ma, Z., and Han, M. (2024). Composition and evolution of the nickel global governance framework and the participation path of China. Sci. & Technol. Rev. 42 (5), 61–69. doi:10.3981/j.issn.1000-7857.2024.05.006

Hassan, Y., Malek, A., Hammad, Y., and Sundarakani, B. (2023). The impact of COVID-19 on supply chains: systematic review and future research directions. Operational Res. 23, 48. doi:10.1007/S12351-023-00790-W

Henckens, M., and Worrell, E. (2020). Reviewing the availability of copper and nickel for future generations. The balance between production growth, sustainability and recycling rates. J. Clean. Prod. 264, 121460. doi:10.1016/j.jclepro.2020.121460

Hoang, D. P., Chu, L. K., and Thanh, T. T. (2023). How do economic policy uncertainty, geopolitical risk, and natural resources rents affect economic complexity? Evidence from advanced and emerging market economies. Resour. Policy (PA) 85, 103856. doi:10.1016/j.resourpol.2023.103856

Hong, S. F., Li, M. Y., and Luo, Y. M. (2023). Multiple time-scales analyses of nickel futures and spot markets volatility spillovers effects. Mineral. Econ. 37 (1), 25–34. doi:10.1007/S13563-023-00389-9

Iqbal, S. P., Arooj, F., Hou, Y. M., Qaiser, A., and Robina, I. (2020). Oil supply risk and affecting parameters associated with oil supplementation and disruption. J. Clean. Prod.255, 120187. doi:10.1016/j.jclepro.2020.120187

Jiang, W. J., Liu, R. R., Fan, T. L., Liu, S. S., and Lv, L. Y. (2020). An overview of prevention and recovery strategies for cascading failures in interdependent networks. Acta Phys. Sin. 69 (08), 81–91. (in Chinese).

Ke, C. Q. (2006). Earthquake induced tsunami in Indian Ocean and its warning to China. Chin. J. Geol. Hazard Control 17 (4), 91–96. (in Chinese).

Keskinkilic, E. (2019). Nickel laterite smelting processes and some examples of recent possible modifications to the conventional route. Metals 9 (9), 974. doi:10.3390/met9090974

Kitamura, T., and Managi, S. (2017). Driving force and resistance: the network feature in oil trade. Appl. Energy 208, 361 e75. doi:10.1016/j.apenergy.2017.10.028

König, U. (2021). Nickel laterites—mineralogical monitoring for grade definition and process optimization. Minerals 11 (11), 1178. doi:10.3390/MIN11111178

Lederer, J., Kleemann, F., Ossberger, M., Rechberger, H., and Fellner, J. (2016). Prospecting and exploring anthropogenic resource deposits: the case study of vienna's subway network. J. Industrial Ecol. 20 (6), 1320–1333. doi:10.1111/jiec.12395

Lee, C. C., and Ning, S. L. (2017). Dynamic relationship of oil price shocks and country risks. Energy Econ. 66, 571–581. doi:10.1016/j.eneco.2017.01.028

Li, Y. L., Huang, J. B., Zeng, A. Q., and Zhang, H. W. (2024). Trade risk transmission of global cobalt industrial chain based on multi-layer network. Resour. Policy 105338-105338, 105338. doi:10.1016/J.RESOURPOL.2024.105338