94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Earth Sci., 26 January 2024

Sec. Interdisciplinary Climate Studies

Volume 12 - 2024 | https://doi.org/10.3389/feart.2024.1301632

This article is part of the Research TopicEnergy, Economy, and Climate Interactions: Challenges and Opportunities, volume IIView all 13 articles

Common prosperity is a social policy goal pursued by the Chinese government and an ideal social status for humanity. On the basis of three theoretical hypotheses, this study involved the analysis of county-level digital inclusive finance data and rural survey data. The Hierarchical Linear Model was employed to empirically analyze the impact and mechanism of digital inclusive finance on the common prosperity of rural households. The results indicate that the county-level digital inclusive finance index, as well as its depth and coverage, can significantly and directly promote common prosperity. Furthermore, it was found that household livelihood strategies are one of the regulatory mechanisms, and digital inclusive finance significantly promotes common prosperity through factors such as opportunities for migrant work, property income, business livelihood models, and agricultural livelihood models. In addition, financing methods are also important adjustment mechanisms, and digital inclusive finance significantly promotes the common prosperity through digital tools and loan availability variables. Our research provides favorable evidence for the cross-level interaction effect of county-level digital inclusive finance on the common prosperity of rural households.

Common prosperity is a desirable societal status aspired by humanity. Developed countries do not explicitly use the term “common prosperity,” but similar keywords like income inequality (Atkinson, 2016; Alacevich and Anna, 2017), quality of life and wellbeing assessment (OECD, 2012), and subjective wellbeing (Diener et al., 1993) are often included in the discussion of social policy objectives. The 19th National Congress of the Communist Party of China (CPC), held in October 2017, clearly put forward the strategic goal that: “Common prosperity for everyone is basically achieved” by the middle of this Century. Similarly, the Fifth Plenary Session of the 19th Central Committee of the Communist Party of China (CPC) raised the important topic of “Making solid advances toward common prosperity”. The 20th National Congress of the Communist Party of China further proposed that: “Chinese-style modernization is a modernization for the common prosperity of all people.” In the same vein, the 20th National Congress of the Communist Party of China proposed that “Chinese modernization is the modernization of common prosperity for all people”. Common prosperity is an important feature of Chinese-style modernization, emphasizing the prosperity of all people, both in terms of material and spiritual wellbeing. Common prosperity is an essential requirement of Chinese socialism, characterized by all people collectively striving for an increasingly developed and globally leading level of productivity, resulting in the shared experience of a progressively happy and improved life (Liu PL. et al., 2021). Common prosperity encompasses two dimensions: affluence and equitable sharing (Li, 2021). It also includes equal access to opportunities for all members of society (Kakwani et al., 2022). The critical aspect of common prosperity lies in effectively managing the synergistic relationship between equity and efficiency (Xia et al., 2022). On a macro scale, it signifies a state where people enjoy a prosperous life with abundant material resources, spiritual confidence, social harmony, a pleasant environment, and wellbeing (Liu and Wang, 2022). At the household level, meeting people’s reasonable needs is a prerequisite for achieving common prosperity for all. In terms of content, common prosperity encompasses income, wealth, health, recreational opportunities, and cultural activities (Liu C. et al., 2022), including addressing subjective well-being disparities (Liu and Zhang, 2023).

However, China still faces significant income disparities and inadequate social security. Yet, implementing reforms that balance efficiency and equity is key to promoting common prosperity (Hong, 2022). Digital financial inclusion refers to a new type of financial model that relies on Internet technologies such as big data and cloud computing and combines financial tools and platforms to provide low-income people with financial services, including credit, payment, deposits, and insurance (Tan et al., 2023). As an inclusive financial system that addresses the financial vulnerabilities of individuals, digital financial inclusion aligns with the ideals and objectives of promoting common prosperity among the people. The Plan for Promoting the Development of Inclusive Finance (2016–2020) issued by China’s State Council in 2015 emphasizes that inclusive finance should be based on the principles of “equal opportunity and benefiting people’s livelihoods”. In 2005, the United Nations introduced the concept of “digital financial inclusion”. By integrating technologies such as big data, artificial intelligence, and blockchain, digital financial inclusion allows farmers and low-income groups to access financial services and the resulting economic growth benefits. This provides technological support for achieving common prosperity for the people. The G20 High-Level Principles on Digital Financial Inclusion emphasize that the primary aim of digital financial inclusion is to provide formal financial services to underserved consumer groups like farmers, women, and the poor. These are the “long tail” individuals who have been excluded from the traditional finance system (Beck et al., 2018). The core objectives of digital financial inclusion are “universal” and “inclusive”, echoing “common” and “affluent”, respectively. On the one hand, “universal” implies a wider audience. Through fragmented scenarios for user credit profiling, digital financial inclusion expands the scope and coverage of financial services (Liu Y. et al., 2021). This, in turn, can provide efficient, convenient, and affordable financial support for disadvantaged groups (Wu et al., 2021). On the other hand, “inclusive” implies benefiting all the people. Digital financial inclusion utilizes digital technology to alleviate information asymmetry, promote national economic growth (Daud and Ahmad, 2023), and allow low-income people to share the dividends of growth through the “trickle-down effect” (Zhang XJ., 2021), thus realizing financial “equal opportunity and benefit people’s livelihood” (Zhang JL. et al., 2022).

The existing literature on the impact of digital financial inclusion on rural households’ common prosperity is relatively limited. At the macro level, current research predominantly focuses on how digital financial inclusion promotes balanced regional economic growth (Zhang et al., 2019), alleviates regional poverty (Xiong and Huang, 2022; Liu and Liu, 2020), reduces income inequality (Zhou and Chen, 2022), and stimulates rural industrial development (Chen and Wen, 2023), among other issues. At the micro level, existing literature primarily emphasizes digital financial inclusion at the provincial level to promote household income growth (Zhang L., 2021; Zhang and Lu, 2023), increase household employment opportunities (Manyika et al., 2016), and enhance social insurance and educational equity (Pierrakis and Collins, 2013), among other benefits. A few studies have started to examine how digital financial inclusion promotes common prosperity among residents, focusing on aspects such as stimulating entrepreneurship (Zhang JL. et al., 2022), mitigating unequal opportunities (Tian et al., 2022), and encouraging non-farm employment (Chen and Jiang, 2023).

Rural residents are a primary target of digital financial inclusion services, and they are a key group of focus in China’s endeavor to construct a society of shared prosperity. This study explores the mechanisms through which digital financial inclusion facilitates rural households’ common prosperity. It places particular emphasis on examining how household livelihood strategies and financing instruments moderate the impact of digital financial inclusion. The potential marginal contributions of this study include: (Atkinson, 2016) Distinguishing from existing research that utilizes provincial-level digital financial data, this study matches county-level digital financial inclusion data with farm household data, creating a hierarchical dataset with nested relationships (Alacevich and Anna, 2017). Due to the hierarchical nature of the data, traditional regression methods commonly used in existing studies overlook the nested relationships within the data, potentially leading to bias in parameter estimation. Consequently, this study employs a multilevel model, which is better suited for analyzing data with nested structures by allowing error components at different levels. (OECD, 2012). In the examination of the mechanism of action, this study associates intermediate variables like rural households’ livelihood strategies and financing methods with county-level digital financial inclusion. It explores the interactive moderating effect across hierarchical levels to gain a deeper understanding of how digital financial inclusion influences households’ common prosperity.

The remainder of the article is organized as follows: Section 2 covers the theoretical analysis and research hypotheses and Section 3 presents the data and methods used. The findings from the study are presented in Section 4, and last but not least, Section 5 presents the conclusions.

The development of digital inclusive finance is conducive for narrowing regional and urban-rural disparities, promoting inclusive growth in China, and promoting common prosperity (Jing and Deng, 2022; Chen and Jiang, 2023). Provincial digital inclusive finance has significantly increased the per capita disposable income of urban and rural residents, and played a mediating role in economic growth and entrepreneurial behavior (Yang WM. et al., 2020). It has also stimulated entrepreneurial vitality and promoted technological innovation to promote regional common prosperity (Yang and Zhang, 2023). In addition, digital inclusive finance at the prefecture level mainly promotes economic growth in various regions by improving the efficiency of regional capital allocation and the level of regional entrepreneurship (Yu et al., 2022). From a multidimensional perspective, the coverage and depth of use of provincial-level digital inclusive finance has effectively promoted regional common prosperity (Liu XY. et al., 2022), while the coverage and depth of use at the prefecture level have a positive effect on common prosperity (Xu and Wu, 2022). Urban level digital inclusive finance can alleviate the uneven opportunities and income disparities faced by residents, thereby promoting overall and shared prosperity of households to a certain extent (Tian et al., 2022). In addition, improving digital infrastructure, popularizing digital tools, and improving individual financial literacy can alleviate the “Matthew effect”, thereby improving the quality and efficiency of digital inclusive financial services and promoting common prosperity for families (Zhang JL. et al., 2022). The development of digital inclusive finance can significantly promote the common prosperity of low endowment residents, reflecting the “inclusive” aspect of digital inclusive finance (Chen and Jiang, 2023).

As mentioned in the review, existing research has extensively focused on the relationship between digital inclusive finance and common prosperity, in particular, on the impact of provincial-level digital inclusive finance development on regional common prosperity. However, existing studies lack in-depth examination of how the development of county-level digital inclusive finance affects the common prosperity of rural households. In addition, existing research often matches provincial or municipal financial data with household data, and then uses panel regression methods for empirical analysis. However, such processing methods often overlook the nested relationship between provincial-level data and farmer data, leading to biased regression results. As a result, this article reports findings from a study that sought to understand the construction of a multilevel linear model suitable for processing nested data. Therefore, we propose the following Hypothesis 1.

Hypothesis 1. The county-level digital inclusive finance has a positive impact on the common prosperity of rural households.

Existing literature indicates that digital inclusive finance has a positive impact on livelihood activities such as promoting rural households’ employment, entrepreneurship, and alleviating financing constraints. In terms of increasing employment opportunities and entrepreneurial capabilities for rural households, Manyika et al. (2016) consider that the widespread application of digital finance in 2025 will create 95 million job opportunities for emerging economies. Fang and Xu (2020) used Chinese household tracking survey data to establish that the development of provincial-level digital inclusive finance has significantly promoted the employment of traditional vulnerable groups, and the impact is inclusive. Du et al. (2020) pointed out that provincial-level digital inclusive finance has significantly promoted the optimization of China’s industrial structure, thereby promoting the development of non-agricultural industries in rural areas and promoting farmers to choose non-agricultural employment. Zhang et al. (2021) found that the development of provincial-level digital inclusive finance can increase farmers’ ability to access opportunities in the financial ecosystem and improve opportunities for non-agricultural employment. Zhang and Li (2022) found that both the provincial digital inclusive finance total index and sub index increase the probability of part-time rural labor force and pure migrant workers. In addition, Wang et al. (2023) believed that cultivating human capital and enhancing residents’ ability to increase income can promote common prosperity.

On the one hand, digital inclusive finance can provide inclusive financial services, which is conducive to increasing social employment opportunities, especially providing more non-agricultural employment opportunities for farmers (Xie et al., 2018). The breadth and depth of digital inclusive finance as an accelerator for financial inclusiveness are beneficial for farmers to obtain employment opportunities (Zhang et al., 2021). With the increase of employment opportunities, the promoting effect of county-level digital inclusive finance on the common prosperity of farmers has been strengthened. This means that the opportunity for families to work outside has a positive moderating effect on the relationship between county-level digital inclusive finance and the common prosperity of farmers.

On the other hand, digital inclusive finance can promote household participation in financial markets, thereby increasing household property income (Zhang and Lu, 2023). With the increase of household property income, the promotion effect of county-level digital inclusive finance on the common prosperity of farmers has been strengthened. In addition, farmers with different livelihood models have varying demands and applications for digital inclusive finance. For households with business and agricultural livelihoods, digital inclusive finance can help them access financing opportunities for business or agricultural production. For working-class households, digital inclusive finance can help increase their access to loan opportunities for living expenses. In other words, family property income and livelihood models have a positive moderating effect on the relationship between county-level digital inclusive finance and common prosperity of farmers. Therefore, we propose the following Hypothesis 2.

Hypothesis 2. Livelihood strategies such as opportunities for rural households to work outside, property income, and business livelihood models play a positive regulatory role in promoting common prosperity through digital inclusive finance.

Existing research has shown that digital inclusive finance can play a positive role in alleviating the constraints of formal and informal credit for farmers, and improving their financial literacy. Wang and Wang (2022) broke through the limitations of spatial regions in provincial-level digital inclusive finance, enhanced the financial willingness of long tail customers, and met the financial needs of different groups. Based on the China Household Finance Survey (CHFS) data, Yang B. et al. (2020) found that the development of provincial-level digital inclusive finance significantly improves the availability of formal credit for rural households and alleviates financial exclusion in rural areas. Fan (2021) pointed out that provincial-level digital inclusive finance has improved farmers’ access to formal credit by reducing transaction costs, alleviating information asymmetry, and reducing collateral requirements, especially for low-income households. On the other hand, Zhang YH. et al. (2022) argue that digital inclusive finance alleviates information asymmetry by reducing the cost of human relationships and increasing online shopping behavior, thereby reducing the informal lending needs of farmers. Si (2022) found that county-level digital inclusive finance can help bridge the information and knowledge divide caused by factors such as geography and education level, and improve the financial literacy of farmers.

Digital inclusive finance helps improve the farmers’ access to loans (Fan, 2021). With the increase in loan availability, the promoting effect of county-level digital inclusive finance on the common prosperity of farmers is strengthened. As an important digital tool, smartphones can effectively increase the accessibility of online financial services and alleviate “digital exclusion” (Hu et al., 2021). For farmers who own smartphones, the promotion effect of county-level digital inclusive finance on the common prosperity of farmers will be strengthened. In other words, the availability of debt, the digital tools owned by households have a positive moderating effect on the relationship between county-level digital inclusive finance and common prosperity of farmers. Therefore, we propose the following Hypothesis 3.

Hypothesis 3. The availability of digital tools and debt financing methods plays a positive regulatory role in promoting common prosperity through digital inclusive finance.

The above analysis framework is shown in Figure 1.

In this study, we investigated the mechanisms through which digital financial inclusion affects common prosperity using data from two different sources. First, we utilized household-level data obtained from a rural survey conducted by our research team in July—August 2020. The survey covered six provinces in China namely: Zhejiang, Jiangxi, Hubei, Hebei, Yunnan, and Guizhou, and employed a stratified sampling technique (Huo and Zhang, 2023). We conducted surveys in the following regions:

(1) Zhejiang Province: Suichang County, Jingning County, Xianju County, Pan’an County, Haishu District, Kecheng District, Jiangshan City, and Yuyao City.

(2) Guizhou Province: Fuquan City, Kaili City, Xiowen County, Taijiang County, and Honghuagang District.

(3) Yunnan Province: Jinghong City, Anning City, Dayaocheng County, and Yiliang County.

(4) Hubei Province: Tianmen City, Yicheng City, Guangshui City, Gongan County, and Badong County.

(5) Jiangxi Province: Wannian County, Xinfeng County, Poyang County, Ruijin City, and Wuning County.

(6) Hebei Province: Sanhe City, Taocheng City, Susong County, Xuanhua District, and Xindu District.

In each county and district, we surveyed approximately 25 households. Finally, we obtained a total dataset of 892 rural households. Specifically, Hubei Province, Jiangxi Province, and Hebei Province, located in the central region of China with average economic development level, include 107, 117, and 130 samples. Yunnan and Guizhou, located in the southwestern region of China with relatively backward economic development involve 133 and 152 samples, respectively. Zhejiang Province, located in the coastal areas of China and with relatively developed economy, involves 253 samples.

In addition, we utilized data from the Peking University Digital Financial Inclusion Index, based on user transaction data from Alipay and known for its high reliability and precision (Guo et al., 2020). This index encompasses data at three levels: provincial, municipal, and county. While previous research mainly relied on provincial and municipal data (Zhang JL. et al., 2022; Tian et al., 2022), this study incorporates county-level data more closely related to rural households ' productive lives. To address endogeneity, we used lagged data from 2019 for the level of digital financial inclusion development and measures of depth of use, coverage breadth, and digitization.

Explanatory variable: common prosperity. Most studies construct common prosperity indicators from a macro perspective, thus failing to fully capture individual-level variations. A few studies have focused on household or individual common prosperity. For example, Wang and Liu (2022) used the income gap as a measure of rural households ' common prosperity, while Liu XY. et al. (2022) assessed it based on multiple dimensions, including income, wealth, education, health, recreation, and culture. Liu et al. assigned binary values (1 or 0) to these dimensions and used the equal-weight method to calculate rural households ' common prosperity. Zhang JL. et al. (2022) constructed a common prosperity index using the equal-weight method, considering material prosperity, spiritual wellbeing, and social sharing as key dimensions.

The concept of common prosperity essentially reflects the conditions for all individuals to lead a better life under socialist principles (Zhang and Wang, 2023). Chen (2022) argues that common prosperity is relative to people’s needs, and meeting those needs is a scientifically and human-oriented measure of common prosperity. This study focuses on core aspects of a good life as perceived by rural households, elaborating a common prosperity index comprising eight dimensions: economic wellbeing, healthcare, pension level, education, material life, spiritual fulfillment, community environment, and social engagement. This index is informed by prior research, including works by Tan and Wu (2022) and Zhang and Wang (2023). In particular (refer to Table 1), the economic level indicator reflects the household’s economic situation, including whether per capita household income exceeds 50% of the per capita income and whether the household income satisfaction score exceeds 3. Healthcare indicators reflect family members’ health status and eligibility for critical illness insurance. Endowment-level indicators include whether the household has purchased endowment insurance and whether they can provide pensions for elderly family members, reflecting their ability to support the elderly.

Indicators of the level of education reflect children’s access to appropriate primary and secondary education and their educational attainment satisfaction level. The material life indicator focuses on the household’s possession of key durable goods, such as cars, air conditioning or heating, computers, and the Internet, among other goods, and their subjective evaluation of life satisfaction. Indicators of spiritual life reflect whether the household has opportunities for outbound travel and can enjoy cultural and recreational facilities in the village, as well as “culture to countryside” activities. Community environment indicators reflect socio-ecological conditions, including factors like exposure to water pollution, air pollution, noise pollution, and subjective evaluation of social security status. The social participation indicator reflects the family’s engagement in social events such as weddings and funerals of relatives and friends, as well as their relationships with neighbors in terms of mutual assistance.

Given that the equal-weight method overlooks the variations among the indicators, this study draws inspiration from Zhang and Wang (2023) in measuring the rural households’ common prosperity index, employing the item response theory method. Since all indicators are binary variables, the two-parameter Logistic model is applied to estimate the potential capacity value Theta, which reflects the rural households’ common prosperity status. In the specific application, the Theta value is normalized and transformed into a continuous variable ranging from 0 to 1 (Li, 2020). The function of the two-parameter Logistic model (Luo, 2012) is as follows:

In Eq. 1, the discrimination parameter

Core explanatory variables: County-level digital financial inclusion index, digital financial inclusion coverage breadth, usage depth, and digitization index. To account for the scale differences between the variable data and to address heteroskedasticity, a logarithmic transformation is applied to the county-level financial inclusion index and its sub-indicators (Zhang and Lu, 2023). To address the issue of endogeneity, this study utilizes the 2019 county-level digital financial inclusion development data with a one-period lag.

Moderating variables: rural households’ livelihood strategies and financing instruments. The livelihood strategies proposed in this study include property income patterns, migrant work opportunities, and livelihood patterns. First, digital financial inclusion can promote household participation in financial markets, thereby increasing household property income (Zhang and Lu, 2023). In this study, the logarithmic value of property income is chosen as the moderating variable. Secondly, due to the provision of inclusive financial services, digital financial inclusion contributes to the establishment of new enterprises, the expansion of business operation scale, and the creation of more non-agricultural employment opportunities for rural households (Zhang and Li, 2022; Xie et al., 2018). In addition, the breadth and depth of digital financial inclusion, serving as powerful drivers of financial inclusion, can enhance rural youth’s access to their financial ecosystems (Zhang et al., 2021). In this study, the proportion of migrant workers is selected as the moderating variable. Thirdly, different livelihood models have different needs and applications for digital financial inclusion, and livelihood models have become an important moderating variable. The livelihood models of rural households referred to in this study are divided into agricultural livelihood model, migrant livelihood model, and business livelihood model (Zhang and Huo, 2022).

On the other hand, the availability of loaning and financing instruments such as smartphone tools are also the moderating variables examined in this study. Studies have shown that household debt, especially non-housing debt, is an important mechanism for digital financial inclusion to improve the livelihood outcomes of rural households (Zhou et al., 2021). As an important digital tool, smartphones can effectively increase the accessibility of online financial services, alleviate “digital exclusion” (Hu et al., 2021), and even promote the investment of rural households in online wealth management products.

Control Variables: The common prosperity of households is influenced by various factors, including family characteristics and the characteristics of the household head. In this study, five control variables were selected: the age of the household head, the health status of the household head, the education level of the household head, the household size, and the household’s social capital. Definitions and descriptive statistics for each variable can be found in Table 2.

The digital financial inclusion explored in this study uses county-level data, while rural households’ common prosperity, livelihood patterns, and household characteristic factors belong to household-level data, and there is a data nesting relationship between the two. For this type of hierarchical data, the hierarchical linear model (HLM) decomposes the changes in the explanatory variables into individual and intergroup changes, which can address the problem of solving the hierarchical effect (James, 1982). Based on the modeling framework proposed by Bryk and Raudenbush (Bryk and Raudenbush, 1992), this study is divided into three steps: First, a null model is constructed to carry out a diagnostic analysis of the cross-tier effects of digital financial inclusion on common prosperity. Second, a random intercept model is constructed to analyze the direct impact of county-level digital financial inclusion on common prosperity. Third, a random intercept model and a random slope model are constructed to analyze the moderating effects of digital financial inclusion at the county level on the variables related to the livelihood strategy category and the means of financing at the household’s level affecting’ common prosperity. The specific models are described below.

Null model (Eq. 2 and Eq. 3). No explanatory variables are added to the null model, and only a random intercept at the county level is included to test for the presence of a hierarchical structure in the data.

where

Random Intercept Models (Eqs 4–6). The random model is based on the zero model by gradually adding explanatory variables, that is digital financial inclusion variables. The intercept terms of explanatory variables of household level vary with different counties, and the random slope of each county is fixed.

Where

Random intercept model and random slope models (Eqs 7–9). The random intercept model is designed to take into account the situation that the impact of level 2 digital financial inclusion on common prosperity is changing with the level 1 households’ tier variable. This study utilizes random intercept and random slope models to address this issue.

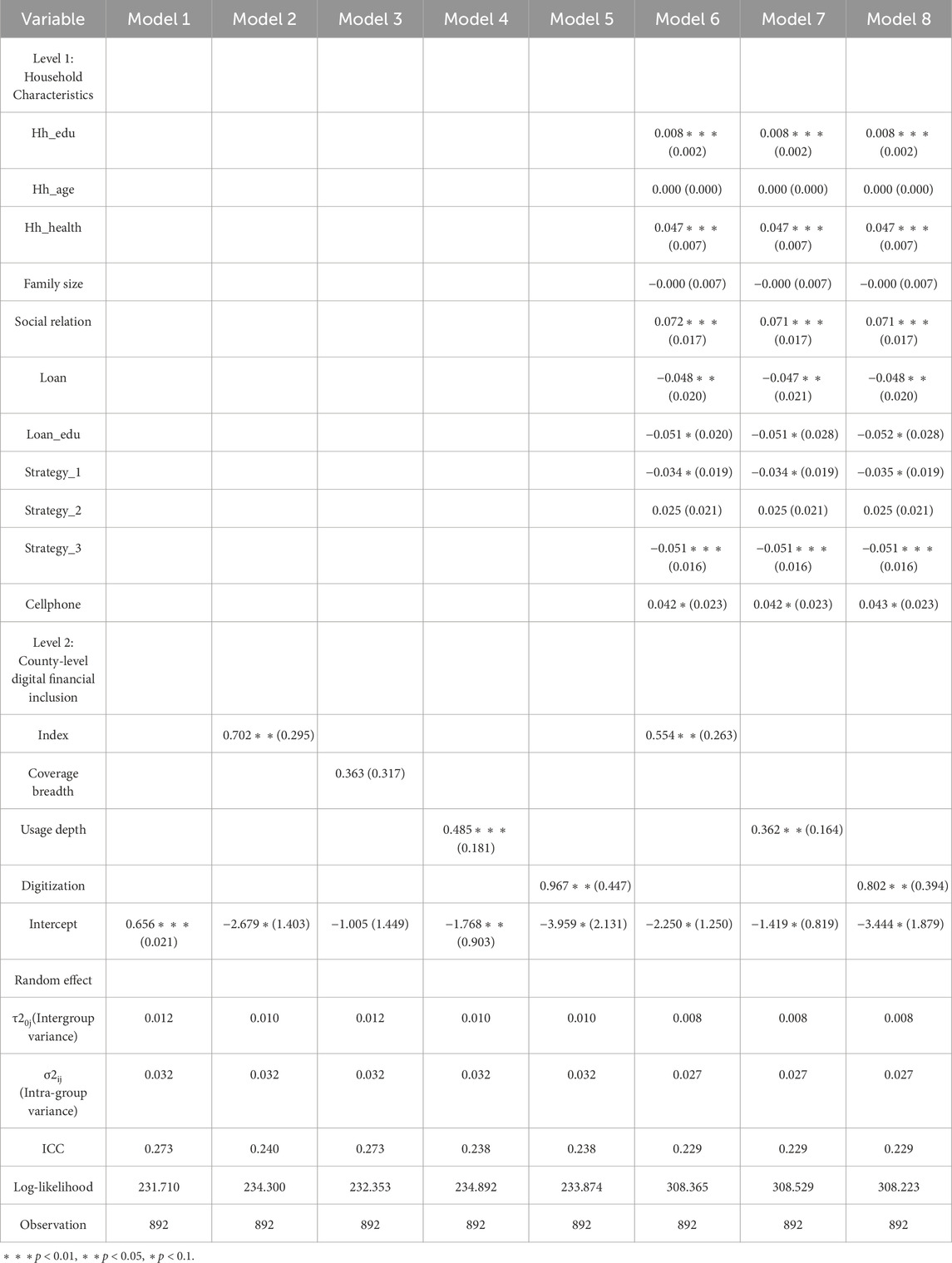

The HLM diagnostic model (null model) can verify whether digital financial inclusion has a cross-level impact on rural households’ common prosperity. Model 1 in Table 3 provides the results from the null model, with variance estimates of 0.012 and 0.032 for counties (level 2) and households (level 1), respectively, indicating significant differences in common prosperity among counties. The Intraclass Correlation Coefficient (ICC) was further calculated to be 0.273 (ICC = τ20j/(τ20j + δ2ij)), signifying that 27.3% of the overall variation in common prosperity results from county-level factors. The ICC exceeds the diagnostic critical value of 0.059 established by Cohen (1988), and the disparity among the dependent variable groups should not be overlooked. Therefore, a hierarchical linear model should be employed to analyze the mechanism through which digital financial inclusion impacts common prosperity at the county level.

TABLE 3. Regression results of HLM of digital financial inclusion directly affecting to common prosperity.

Firstly, a random intercept model is established to incorporate county-level digital financial inclusion and farm household-level characteristic variables separately, to focus on the direct impact effects of digital financial inclusion levels. The random intercept model assumes that the differences in common prosperity all originate from the county level. In Table 3, Models 2-5 are random intercept models that incorporate only county-level digital financial inclusion variables. The results demonstrate that digital financial inclusion, the depth of digital financial inclusion usage, and the level of digitization in digital financial inclusion have a significant positive impact on common prosperity at the 0.05 significance level. This indicates that county-level digital financial inclusion and its two dimensions (depth of usage and digitization level) contribute significantly to the promotion of common prosperity. The development of digital financial inclusion is a significant factor in promoting common prosperity. Hypothesis 1 was partially confirmed with statistical significance. Since the estimated coefficient of cover-age breadth in digital financial inclusion is not significant, it will not be considered in the subsequent models. Additionally, in the random effect part, the variation at the county level decreased from 0.012 to 0.01, resulting in a decrease of 16.7%, indicating that the inclusion of county-level independent variables can enhance the explanatory power of common prosperity.

Models 6–8 in Table 3 indicate that the random intercept model adds characteristic variables of household level. The estimated results of the model show that factors such as the education level and health status of the household head, as well as variables such as family social capital and ownership of smartphones, have significant positive effects on common prosperity. However, the presence of household loans and education loans has a significantly negative impact on common prosperity. The reason is that, due to difficulties in livelihood and daily life, families address their livelihood issues by resorting to loaning, including education loans, and the level of common prosperity among these families is relatively lower. In addition, relatively disadvantaged agricultural livelihood patterns and wage labor livelihood patterns also have a significantly negative impact on common prosperity. This indicates that households primarily engaged in agriculture or wage labor experience relatively lower levels of common prosperity. One possible reason is that, whether engaged in farming or migrating for labor, households’ income growth and social security are relatively limited, thereby constraining improvements in family economic wellbeing, material living conditions, and overall quality of life. Furthermore, the between-group variance decreased from 0.032 in Model 1 to 0.027 in Model 8, indicating that the independent variables at the household level explain 15.6% of the variance in household-level common prosperity.

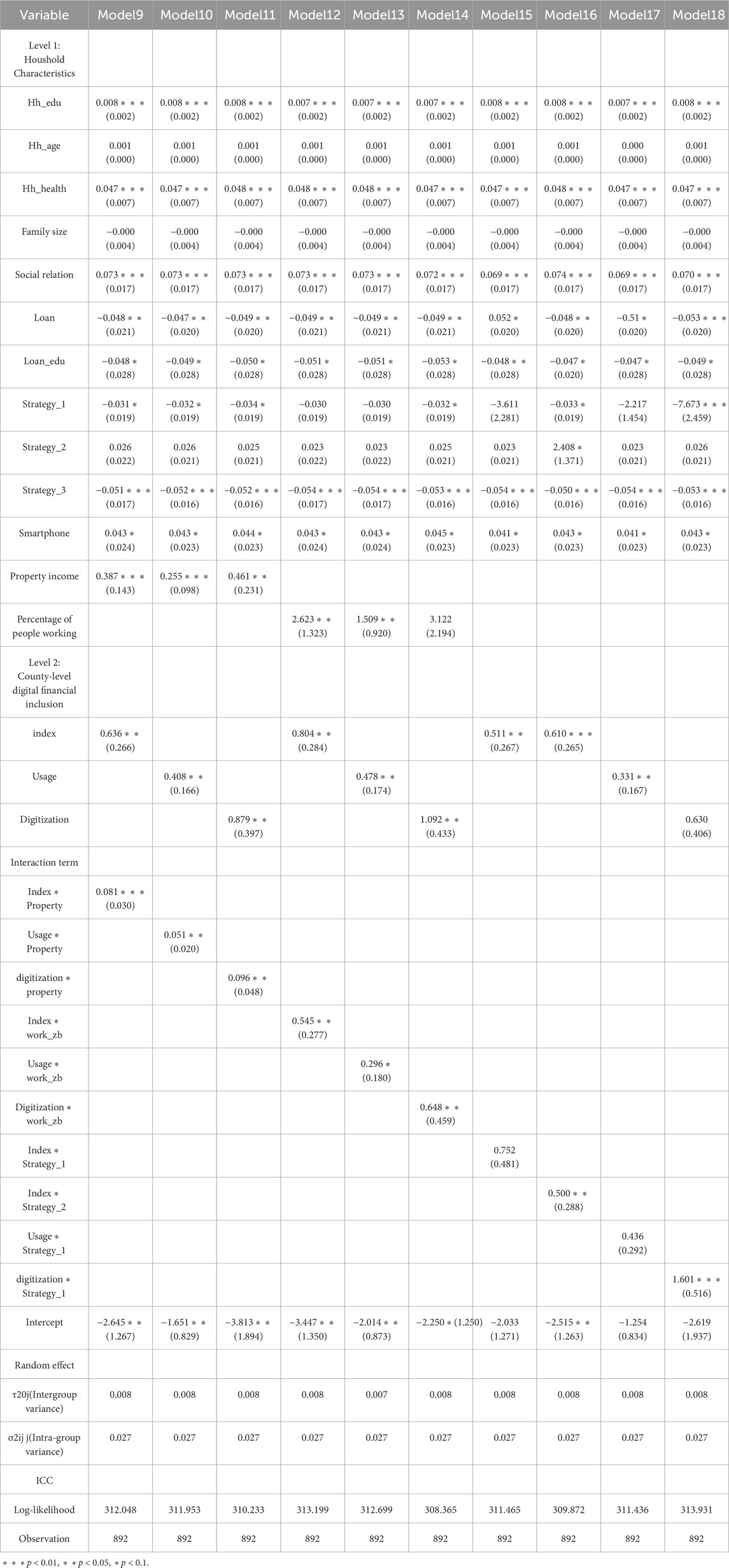

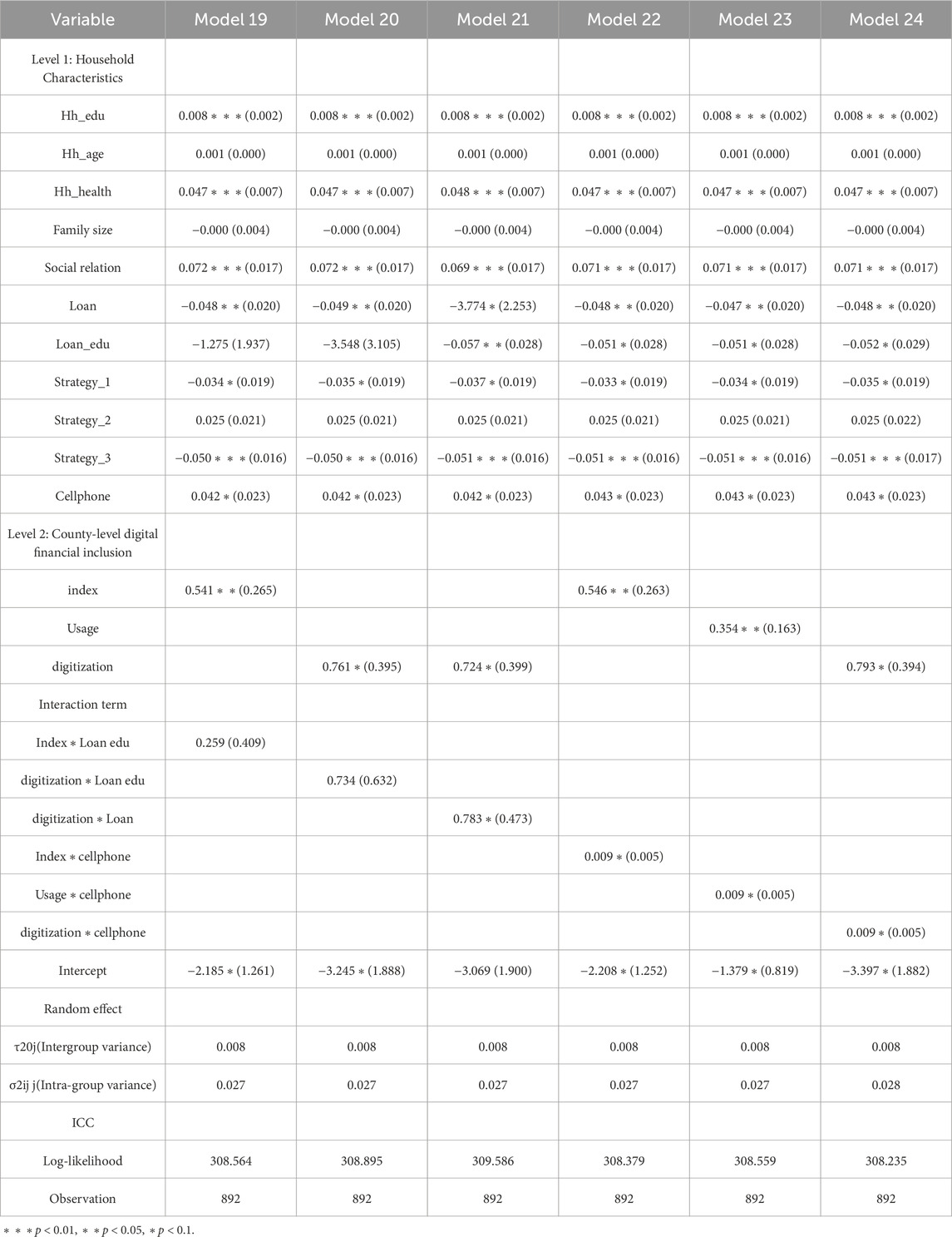

The random intercept and random slope models were further developed to study the interaction between digital financial inclusion development and rural households’ livelihood strategies in the county. The focus was on the impact of digital financial inclusion on regulating property income, enhancing opportunities to work outside the home, and livelihood patterns. In Table 4, Models 9–11 represent the regression results of the interaction term with households’ property income as the intermediate variable, indicating that the influence of households’ property income on promoting households’ common prosperity increases with the level of development, depth of usage, and digitization of digital financial inclusion. Hypothesis 2 was partially confirmed with statistical significance. Digital financial inclusion innovates financial products through Internet platforms and explores factors related to financial attributes, which contributes to enhancing residents’ property-based income increase (Liu XY. et al., 2022). Models 12–14 represent the regression results of the interaction term with the proportion of households’ laborers as an intermediate variable, and the impact of the proportion of laborers on households’ common prosperity escalates with the development level of digital financial inclusion. Hypothesis 2 was partially confirmed with statistical significance. Digital financial inclusion increases rural youth’s ability to access opportunities in the financial ecosystem and improves the probability of non-farm employment for rural youth (Zhang et al., 2021). Models 15–18 represent the regression results of the interaction term with livelihood mode as the intermediate variable. The results of model 16 indicate that compared to other households, the common prosperity level of households following the livelihood mode increases with the level of digital financial inclusion. The possible explanation is that digital financial inclusion expands the beneficiary scope of financial services, making it easier for households to access and use financial products, and even providing convenient financing channels for entrepreneurial farmers (Cohen, 1988), which contributes to the realization of common prosperity for these entrepreneurial farmers. Meanwhile, Model 18 shows that the level of common prosperity of households in the agricultural livelihood model increases with the enhancement of digital financial inclusion, which suggests that the improvement in digital financial inclusion also facilitates the utilization of financial products by agricultural production farmers, helping them address financing difficulties and thus enhance their livelihoods. However, the coefficients of the interaction terms of Models 15 and 17 are not significant, indicating that the livelihood mode of labor is not an effective intermediate variable for digital financial inclusion to affect households’ common prosperity. Hypothesis 2 was partially confirmed with statistical significance.

TABLE 4. The impact of digital financial inclusion moderating livelihood strategies on common prosperity.

Random intercept and random slope models were further developed to study the interaction between digital financial inclusion development and households’ means of financing in the county, focusing on the impact of digital financial inclusion in regulating households’ loaning, educational loaning and ownership of digital tools (smartphones). In Table 5, none of the interaction term coefficients are significant for the results of Models 19-20 with educational loaning by households as the intermediate variable, indicating that educational loaning is not a valid mediating variable. The results of Model 21, which uses household loaning as an intermediate variable, indicate that the impact of household loaning on common prosperity increases with the degree of digital financial inclusion in the county. Hypothesis 3 was partially confirmed with statistical significance. While digital financial inclusion reduces transaction costs, mitigates information asymmetry, and lowers collateral requirements, among other factors, it increases the likelihood of households’ access to formal credit (Fan, 2021). It can particularly reduce the poverty rate among low-income households, thereby contributing to the achievement of common prosperity (Zhou et al., 2021). The results of the interaction terms in Models 22–24, using household ownership of smartphones as an intermediate variable, indicate that the influence of smartphones on common prosperity increases with the level of digital financial inclusion in the county, as well as its depth of usage and digitization. Hypothesis 3 was partially confirmed with statistical significance. The development of digital financial inclusion has led to the popularization of digital financial services, and rural households can conveniently use their smartphones for mobile payments, loan applications, and other financial operations (Yin et al., 2019). This, in turn, helps farmers to alleviate their financing constraints, improves their financial difficulties related to production and livelihood, and enhances the living standards and quality of life for rural households.

TABLE 5. The impact of digital financial inclusion moderating financing means on households’ common prosperity.

This article uses the county-level digital inclusive finance index developed by the Digital Finance Research Center of Peking University, and household survey data. It employs the HLM model to empirically examine the direct impact of the digital inclusive finance index and its sub-dimensions on the common prosperity of rural households. It further discusses the regulatory mechanism of household livelihood strategies and financing methods on promoting common prosperity through county-level digital inclusive finance. The main research conclusions are as follows: firstly, the null model indicates that there are significant differences in the common prosperity among different counties. 27.3% of the variation in the common prosperity is caused by county-level digital inclusive finance factors, and the HLM is appropriate. Secondly, the depth and coverage of the county-level digital inclusive finance index and its sub indicators can significantly promote common prosperity. Thirdly, family livelihood strategies are important regulatory mechanisms. With the improvement of the development level of county-level digital inclusive finance, the role of households’ property income in promoting common prosperity will become increasingly significant, and the role of migrant work opportunities in promoting common prosperity for rural households will continue to strengthen. In addition, rural households who engage in business and agricultural livelihoods can enjoy more of the common prosperity effect generated by digital inclusive finance. Fourthly, financing methods also play an important regulatory role. With the improvement of county-level digital inclusive finance, the availability of loans and the role of digital tools in promoting common prosperity is becoming increasingly evident.

Based on the above research conclusions, this article proposes the following suggestions. Firstly, it is necessary to strengthen the construction of digital inclusive financial infrastructure in rural areas, and to provide technical support for rural households to deeply utilize digital inclusive finance. On one hand, we should accelerate the construction and upgrading of broadband communication network hardware, and accelerate the promotion and application of big data, cloud computing, and 5G technology (Yang B. et al., 2020). On the other hand, we should promote the popularization of affordable smartphones for rural residents and narrow the gap in external digital resource endowments among residents. Secondly, the development and services of digital inclusive financial products should focus on the key livelihood strategies of rural households. We suggest increasing financial support for rural households’ business, entrepreneurship, agricultural production and other business activities. It is also important to strengthen public welfare training on financial knowledge for rural households, and to continuously enrich financial products such as agricultural deposits, wealth management, and insurance, and provide service support for increasing rural households’ property income.

Our study provides favorable evidence for the cross-layer interaction effect of county-level digital inclusive finance on the common prosperity. However, the study has some limitations that can be addressed in future studies. Due to the cross-sectional data used, there are significant limitations in inferring causal relationships in this study. Therefore, in future, longitudinal data should be constructed. In addition, this study cannot rule out the possibility of other explanations for the impact of digital inclusive finance on common prosperity, such as differences in financial literacy among rural households. Differences in financial literacy may lead to households’ acceptance and application effectiveness of digital inclusive finance, which directly affects households’ livelihood decisions and their outcomes. Future research should focus on the internal relationship between regional digital inclusive finance, financial literacy, and the common prosperity of rural households.

Publicly available datasets were analyzed in this study. This data can be found here: https://opendata.pku.edu.cn/.

MZ: Conceptualization, Funding acquisition, Investigation, Methodology, Resources, Software, Supervision, Validation, Writing–original draft, Writing–review and editing. TZ: Writing–original draft. ZH: Conceptualization, Data curation, Methodology, Writing–review and editing. PW: Formal Analysis, Validation, Writing–review and editing.

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research was funded by the Key Research Project of Soft Science in Zhejiang Province (Project No. 2023C25046), the Humanities and Social Sciences Foundation of the Ministry of Education of China (Project No. 22YJAZH153), Zhejiang Federation of Humanities and Social Sciences Circles Research Project (Project No. 2022N95), Hangzhou Philosophy and Social Science Planning Project (Project No. Z22JC092), and Research Center for Digital Economy and Sustainable Development of Water Resources, Zhejiang University of Water Resources and Electric Power (Project No. xrj2022014).

The authors would like to thank the editors and reviewers for their valuable comments and suggestions.

Author PW was employed by Zhejiang Infrastructure Construction Group Co., Ltd.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Alacevich, M., and Anna, S. (2017). Inequality: a short history. Washington: Brookings Institution Press.

Atkinson, A. B. (2016). Inequality: what can be done. Practice 40, 289–292. doi:10.3326/fintp.40.2.6

Beck, T., Pamuk, H., Ramrattan, R., and Uras, B. R. (2018). Payment instruments, finance and development. J. Dev. Econ. 133, 162–186. doi:10.1016/j.jdeveco.2018.01.005

Bryk, A. S., and Raudenbush, S. W. (1992). Hierarchical linear models: applications and data analysis methods. London: Sage Publications, Inc.

Chen, H. B., and Jiang, Y. J. (2023). Digital financial inclusion, non-farm employment, and common prosperity. Wuhan. Finance, 51–59.

Chen, H. X. (2022). The natural scale and spatial dimension of common prosperity. Chinese social science today, 3.

Chen, Y. M., and Wen, T. (2023). Can digital inclusive finance promote the development of rural industries: analysis based on spatial measurement model. J. Agrotechnical Econ., 32–44. doi:10.13246/j.cnki.jae.2023.01.001

Daud, S. N. M., and Ahmad, A. H. (2023). Financial inclusion, economic growth and the role of digital technology. Finance Res. Lett. 53, 103602. doi:10.1016/j.frl.2022.103602

Diener, E., Sandvik, E., Seidlitz, L., and Diener, M. (1993). The relationship between income and subjective well-being: relative or absolute. Soc. Indic. Res. 28, 195–223. doi:10.1007/BF01079018

Du, J. M., Wei, S. W., and Wu, W. Y. (2020). Does digital financial inclusion promote the optimization of industrial structure? Comp. Econ. Soc. Syst., 38–49.

Fan, W. X. (2021). Does digital financial inclusion improve farmers' access to credit? J. Huazhong Agric. Univ. Soc. Sci. Ed., 109–119+179. doi:10.13300/j.cnki.hnwkxb.2021.01.013

Fang, G. F., and Xu, J. Y. (2020). Does digital inclusive finance promote employment? evidence from a follow-up investigation on Chinese families. Financial Econ. Res. 35, 75–86.

Guo, F., Wang, J. Y., Wang, F., Kong, T., Zhang, X., and Chen, Z. Y. (2020). Measuring China's digital financial inclusion: index compilation and spatial characteristics. China Econ. Q. 19, 1401–1408. doi:10.13821/j.cnki.ceq.2020.03.12

Hong, Y. X. (2022). Promoting common prosperity through reforms that balance efficiency and fairness. Economist, 5–15. doi:10.16158/j.cnki.51-1312/f.2022.02.002

Hu, L., Yao, S. Q., Yang, C. Y., and Ji, L. H. (2021). Is digital inclusive finance conducive to alleviating relative poverty? J. Finance Econ. 47, 93–107. doi:10.16538/j.cnki.jfe.20210924.301

Huo, Z. H., and Zhang, M. (2023). Multidimensional deprivation and subgroup heterogeneity of rural households in China: empirical evidence from latent variable estimation methods. Soc. Indic. Res. 165, 975–997. doi:10.1007/s11205-022-03018-0

James, L. R. (1982). Aggregation bias in estimates of perceptual agreement. J. Appl. Psychol. 67, 219–229. doi:10.1037//0021-9010.67.2.219

Jing, D. C., and Deng, G. Q. (2022). Digital economy and common prosperity: a perspective based on urban-rural income gap. Guizhou Soc. Sci., 121–128. doi:10.13713/j.cnki.cssci.2022.09.006

Kakwani, N., Wang, X., Xue, N., and Zhan, P. (2022). Growth and common prosperity in China. China & World Econ. 30, 28–57. doi:10.1111/cwe.12401

Li, F. (2020). An analysis of the political psychological mechanism of online political participation: measurement and analysis based on item response theory. J. Party Sch. Tianjin Comm. CPC 22, 39–46.

Liu, C., Liu, X. M., and Yu, W. C. (2022a). Can insurance allocation promote common prosperity-empirical analysis based on 1609 survey data of farmers. J. Financial Dev. Res., 3–9. doi:10.19647/j.cnki.37-1462/f.2022.10.001

Liu, J. K., and Zhang, Y. L. (2023). The impact of social quality on the subjective welfare of rural residents in China in the perspective of common prosperity. J. Beijing Univ. Technol. Soc. Sci. Ed. 23, 36–49.

Liu, J. Y., and Liu, C. Y. (2020). Rural poverty alleviation effect of digital inclusive finance: effects and mechanisms. Collect. Essays Finance Econ., 43–53. doi:10.13762/j.cnki.cjlc.2020.01.004

Liu, M. Y., and Wang, S. G. (2022). Promoting common prosperity through rural revitalization: solving difficulties and realizing paths. Guizhou Soc. Sci., 152–159. doi:10.13713/j.cnki.cssci.2022.01.014

Liu, P. L., Qian, T., Huang, H. X., and Dong, X. B. (2021a). The connotation, realization path and measurement method of common prosperity for all. J. Manag. World 37, 117–129. doi:10.19744/j.cnki.11-1235/f.2021.0111

Liu, X. Y., Huang, Y., Huang, S. R., and Zhang, T. L. (2022b). Digital inclusive finance and common prosperity: theoretical mechanism and empirical evidence. Financial Econ. Res. 37, 135–149.

Liu, Y., Luan, L., Wu, W., Zhang, Z., and Hsu, Y. (2021b). Can digital financial inclusion promote China's economic growth? Int. Rev. Financial Analysis 78, 101889. doi:10.1016/j.irfa.2021.101889

Manyika, J., Lund, S., Singer, M., White, O., and Berry, C. (2016). Digital finance for all: powering inclusive growth in emerging economies. San Francisco: McKinsey Global Institute.

OECD (2012). Your better life index. Available at: http://oecdbetterlifeindex.org.

Pierrakis, Y., and Collins, L. (2013). Crowdfunding: a new innovative model of providing funding to projects and businesses. Available at: https://ssrn.com/abstract=2395226.

Si, L. J. (2022). The impact of digital financial inclusion on farmer's income inequality: an empirical analysis based on CFPS data. Econ. Rev., 100–116. doi:10.19361/j.er.2022.05.07

Tan, C., and Wu, H. T. (2022). Research on the impact of rural labor mobility on the common prosperity of farmers. Chin. J. Agric. Resour. Reg. Plan., 1–9.

Tan, L. Z., Zhang, Y. Z., and Zhou, Z. S. (2023). Impact of digital inclusive finance on rural multidimensional relative poverty: evidence from provincial data in China. J. Agro-Forestry Econ. Manag. 22, 224–232. doi:10.16195/j.cnki.cn36-1328/f.2023.02.24

Tian, Y., Zhang, Q., and Guo, L. H. (2022). Digital financial inclusion and the realization of common prosperity-based on the perspectives of total prosperity and shared prosperity. J. Shanxi Univ. Finance Econ. 44, 1–17. doi:10.13781/j.cnki.1007-9556.2022.09.001

Wang, P., and Wang, K. (2022). The impact of digital financial inclusion on common prosperity: a research study. Finance and economy, 3–10+39. doi:10.19622/j.cnki.cn36-1005/f.2022.07.001

Wang, Y., and Liu, L. (2022). How can migrant workers returning home for entrepreneurship promote common prosperity of farmers in rural areas? Chin. Rural. Econ., 44–62.

Wang, Y., Yang, H., and Zhang, X. W. (2023). Digital financial inclusion, household consumption, and common prosperity. Statistics Decis. 39, 148–153. doi:10.13546/j.cnki.tjyjc.2023.03.027

Wu, Y., Wu, X., Li, J., and Zhou, L. (2021). Digital finance and household portfolio efficiency. J. Manag. World 37, 92–104. doi:10.19744/j.cnki.11-1235/f.2021.0094

Xia, J. C., Wang, P. F., and Shen, S. Z. (2022). The inner logic and realization path of common prosperity: based on equity and efficiency perspective. Consum. Econ. 38, 3–10.

Xie, X. L., Shen, Y., Zhang, H. X., and Guo, F. (2018). Can digital finance promote entrepreneurship? —evidence from China. China Econ. Q. 17, 1557–1580. doi:10.13821/j.cnki.ceq.2018.03.12

Xiong, D. P., and Huang, Q. (2022). Digital inclusive finance, farm entrepreneurship and multidimensional relative poverty. Dongyue Trib. 43, 38–48+191. doi:10.15981/j.cnki.dongyueluncong.2022.09.003

Xu, Y. B., and Wu, W. Z. (2022). The effect of digital inclusive finance development on common prosperity: an empirical analysis based on 287 prefecture-level cities. New Finance, 33–40.

Yang, B., Wang, X. N., and Deng, W. H. (2020b). How does digital inclusive finance affect households access to formal credit? Evidence from CHFS. Mod. Econ. Sci. 42, 74–87.

Yang, W. M., Li, L., and Wang, M. W. (2020a). Digital financial inclusion and income of urban and rural residents: based on the intermediary effect of economic growth and entrepreneurial behavior. J. Shanghai Univ. Finance Econ. 22, 83–94. doi:10.16538/j.cnki.jsufe.2020.04.006

Yang, Y. W., and Zhang, Y. X. (2023). Mechanism of shared prosperity and paths to its realization empowered by digital inclusive finance. J. Yunnan Minzu Univ. (Philosophy Soc. Sci. Ed. 40, 123–133. doi:10.13727/j.cnki.53-1191/c.20221228.004

Yin, Z. C., Gong, X., and Guo, X. Y. (2019). The impact of mobile payment on entrepreneurship—micro evidence from China household finance survey. China World Econ., 119–137. doi:10.19581/j.cnki.ciejournal.2019.03.017

Yu, J. L., Zhou, J., and Cui, M. (2022). Digital financial inclusion and inter-regional common prosperity—theoretical logic and empirical evidence. J. Shanxi Univ. Finance Econ. 44, 1–15. doi:10.13781/j.cnki.1007-9556.2022.10.001

Zhang, B., and Li, N. (2022). Research on the influence of digital inclusive finance on non-agricultural transfer of rural labor force—empirical research based on CFPS data. Lanzhou Academic Journal., 113–128.

Zhang, J. L., Dong, X. F., and Li, J. (2022a). Can digital inclusive finance promote common prosperity? An empirical study based on micro household data. J. Finance Econ. 48, 4–17+123. doi:10.16538/j.cnki.jfe.20220316.101

Zhang, L. (2021a). Digital inclusive finance, county industrial upgrading with farmers' income growth. Res. Financial Econ. Issues, 51–59. doi:10.19654/j.cnki.cjwtyj.2021.06.005

Zhang, M., and Huo, Z. H. (2022). Study on measurement and determinants of rural households' sense of gain: taking 16 villages in Zhejiang province as example. Areal Res. Dev. 41, 136–141.

Zhang, M., and Wang, X. (2023). Measurement of common prosperity of Chinese rural households using graded response models: evidence from Zhejiang province. Int. J. Environ. Res. Public Health 20, 4602. doi:10.3390/ijerph20054602

Zhang, Q., Kuang, Z. H., and Wang, Y. H. (2021). Research on the impact of digital financial inclusion on rural youth non-agricultural employment. Finance and economy, 34–45. doi:10.19622/j.cnki.cn36-1005/f.2021.11.004

Zhang, W., and Lu, Y. (2023). A study of the impact of digital inclusive finance on household property income. J. Financial Dev. Res., 79–86. doi:10.19647/j.cnki.37-1462/f.2023.03.011

Zhang, X., Wan, G. H., Zhang, J. J., and He, Z. Y. (2019). Digital economy, financial inclusion, and inclusive growth. Econ. Res. J. 54, 71–86.

Zhang, X. J. (2021b). Financial development and common prosperity: a research framework. Economic Perspectives, 25–39.

Zhang, Y. H., Liu, Z. Q., and Tian, C. Y. (2022b). The impact of digital financial inclusion on informal borrowing in rural areas. Wuhan. Finance, 79–88.

Zhou, L., and Chen, Y. Y. (2022). Digital inclusive finance and urban-rura disparity: theoretical mechanism, empirical evidence and policy choice. World Econ. Stud., 117–134+137. doi:10.13516/j.cnki.wes.2022.05.004

Keywords: Chinese rural households, common prosperity, digital inclusive finance, moderation effect, hierarchical linear model

Citation: Zhang M, Zhu T, Huo Z and Wan P (2024) A study of the promotion mechanism of digital inclusive finance for the common prosperity of Chinese rural households. Front. Earth Sci. 12:1301632. doi: 10.3389/feart.2024.1301632

Received: 25 September 2023; Accepted: 11 January 2024;

Published: 26 January 2024.

Edited by:

Xander Wang, University of Prince Edward Island, CanadaReviewed by:

Iqbal Yulizar Mukti, Telkom University, IndonesiaCopyright © 2024 Zhang, Zhu, Huo and Wan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mei Zhang, emhhbmdtQHpqd2V1LmVkdS5jbg==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.