- 1Institute of County Economic Development and Rural Revitalization Strategy, Lanzhou University, Lanzhou, China

- 2School of Economics, Lanzhou University, Lanzhou, China

Transportation infrastructure and market integration play an important role in building China’s new development pattern of dual circulation. Taking 220 cities in 19 urban agglomerations in China as the study sample, this study analyzes the impact of rapid transit development on urban economic growth from 2008 to 2019 and examines the heterogeneity of the difference in market integration capability in promoting urban economic growth based on the two-way fixed effects model. The main conclusions are as follows: 1) the improvement of travel convenience brought about by the development of expressways and high-speed railways significantly promoted urban economic growth; 2) market integration has significantly restricted the promotion of the construction of expressways and high-speed railways to urban economic growth. In other words, cities with less market integration have greater economic benefits from expressway and high-speed railway construction; 3) there is a certain substitution of the role of expressways and high-speed railways in promoting urban economic growth, and for cities that already have a relatively complete expressway network, further construction of high-speed railways will inhibit the promotion effect of expressway development on urban economic growth; 4) expressway and market integration have a stronger role in promoting urban economic growth in the eastern region than in the central and western regions, while high-speed railway and market integration promote the economic growth in the eastern region, and the impact on economic growth in the central and western regions is not significant. The findings of this study have implications for optimizing the planning of expressway and high-speed railway construction and promoting high-quality regional development in China and other developing countries.

1 Introduction

If you want to be rich, first build roads. This sentence has always been regarded as a golden rule of China’s economic development; the government and ordinary people seem to believe that the construction of roads and railways can spread the economic resources of regional central cities to the surrounding small cities and drive the economic growth of the surrounding small cities (Zhang, 2017). Since the reform and opening up, China has carried out large-scale transportation infrastructure construction, and various transportation modes represented by expressways and high-speed railways have achieved leapfrog development. In 2020, the total length of China’s road and railway was 5.198 million kilometers and 146,000 km, which was 5.8 times and 2.8 times that in 1978, when the length of expressways and high-speed railways was 161,000 km and 37,900 km, creating a great feat of the length from scratch to the world’s first (Ministry of Transport of the People’s Republic of China, 2021).

Transportation infrastructure is often considered to be the key to promoting economic growth and development, as the organization of economic activity in geographic space depends crucially on the transportation of goods and people (Redding and Turner, 2015). Theoretically, the impact of transportation infrastructure on economic growth is accomplished through both direct and indirect effects. The direct effect means that the investment of transportation infrastructure, as a factor input, can not only directly drive the increase in total output but also affect capital accumulation through “multiplier effect,” thereby driving the increase in social total demand and national income to be several times the investment (Li et al., 2011). Compared with the direct effect, the indirect effect of transportation infrastructure is more prominent (Wang and Ni, 2016). The essence of transportation infrastructure is to provide services for the public, and it has the basic attributes of public goods, that is, externalities, and it is easy to produce spatial spillover effect (Sun et al., 2020). On the one hand, the improvement of transportation infrastructure reduces transportation costs and time costs and improves the level of inter-regional accessibility, which accelerates the transfer of economic factors, such as capital and labor, from non-central cities to regional central cities, thus promoting economic agglomeration and growth in central cities and large cities (Qin et al.,. 2017; Banerjee et al., 2020). On the other hand, the improvement of transportation infrastructure connects the economic activities of different regions into a whole, which makes the boundaries of cities and urban agglomerations continue to overflow, breaking the limitation of knowledge spillover in geographical space and promoting economic growth in surrounding small cities through the diffusion of knowledge and technology in regional central cities and large cities (Baum-Snow et al., 2017; Miwa et al., 2022). It should be noted that although the improvement of transportation infrastructure can cause inter-regional spillover effect of regional economic growth, the economic decline of less developed areas is caused by the large concentration of production factors from surrounding small cities to central cities (Boarnet, 1998). The construction of transportation infrastructure may also increase environmental pollution, which is not conducive to economic growth (Li et al., 2021).

The impact of transportation infrastructure construction on economic growth has been empirically tested in a large number of literatures, but the conclusions are inconsistent. A large number of studies have shown that the construction of transportation infrastructure can reduce transaction costs and improve economic efficiency, promoting economic growth (Donaldson, 2018; Sun and Zhang, 2021). Some studies have found that the construction of transportation infrastructure has caused economic activities to agglomerate and transfer from non-central cities to central cities along the route, inhibiting the economic growth of non-central cities and leading to a polarized economic pattern between large cities and small cities (Yu F. et al., 2019). A few studies suggest that the impact of transportation infrastructure construction on economic growth may not be significant (Farhadi, 2015). Existing studies focus on the economic effects of the construction of roads (Coşar and Demir, 2016), railways (Forero et al., 2020), airports (Startz, 2016), and ports (Karimah and Yudhistira, 2020). With the rapid development of high-speed railways as a new mode of transportation, more and more research studies have begun to pay attention to the regional economic effects of high-speed railways in recent years (Li et al., 2018; Lu et al., 2022). High-speed railway refers to the passenger-dedicated railway with the design speed of the new line being 250 km/h (including reservation) and above, and the initial operating speed being not less than 200 km/h (Nation Railway Administration of the People’s Republic of China, 2013). High-speed railway lines only undertake part of the passenger transport function. Due to the high fares of high-speed railways, the target audience is more business travelers (Tan et al., 2019); the importance of high-speed railways in the flow of medium- and long-distance people is becoming more and more prominent. However, from the perspective of short-distance transportation of people and goods, road transportation still occupies an absolutely dominant position. In 2020, the passenger volume and freight volume of China’s road transport accounted for 71.3% and 73.8%, respectively. The most important in China’s road transportation is expressway transportation. High-speed railway has the advantages of large passenger capacity, less time consumption, punctuality, low energy consumption, and little influence from weather, which makes it popular among people, while expressway has door-to-door flexibility to cover areas not accessible by high-speed railway (Jiang et al., 2015). Therefore, when analyzing the impact of rapid transportation on urban economic growth, expressways must be considered.

It is necessary to deeply analyze the influence of expressway and high-speed railway development on urban economic growth and further examine the mutual influence between expressway and high-speed railway. The mechanism of the impact of transportation infrastructure improvement on urban economic growth is complex, and the difference of the market integration level between regions will also affect urban economic growth. It is difficult for a fragmented and isolated market to play a positive role in the market mechanism. An integrated and unified market is not only conducive to expanding the market size and deepening the specialization of labor but also promoting full market competition, playing the role of scale economy and standardize market rules (Sheng and Mao, 2011). It allows labor, capital, and other factors of production to flow freely and eventually to the most efficient sectors and regions. Therefore, it is necessary to speed up the construction of a unified national market, break local protection and market segmentation, break through the key blocking points that restrict the economic cycle, and promote the smooth flow of commodity factor resources on a larger scale (Liu and Zhu, 2014). The factors that lead to the fragmentation of the domestic market are diverse and can be roughly divided into three categories: natural factors, technical factors, and institutional factors (Fan et al., 2017). Natural market segmentation refers to two markets that are naturally formed and separated due to physical factors such as spatial distance; technical market segmentation refers to the formation of two technological markets characterized by horizontal differences; institutional market segmentation refers to the formation of two markets characterized by local protection under the influence of economic, political, and other human factors. As a result, we have obtained two effective ways to break the domestic market segmentation. One is to increase the investment in transportation infrastructure construction to improve the efficiency of market transactions, thereby reducing natural market segmentation and technical market segmentation. The second is to reduce institutional market segmentation by eliminating local protection and optimizing institutional design. However, by eliminating local protection and optimizing system design, it involves changes in laws and regulations and the economic system, which is more difficult (Pan and Ye, 2021). Therefore, only strengthening the construction of transportation infrastructure is the most effective way to break the segmentation of the domestic market. First, the “space-time compression effect” brought about by the improvement of transportation infrastructure can significantly improve the accessibility level of the city in which it is located, thus greatly alleviating the natural market segmentation caused by geographical distance barriers (Ye and Pan, 2020). Second, the improvement of transportation infrastructure can reduce the transaction cost of enterprises, promote the cross-regional flow of resources, and improve the efficiency of market transactions, thereby breaking the technical market segmentation (Ma et al., 2020). Third, transportation infrastructure improvement can expand the market scale and promote specialized division of labor, while the higher the degree of regional specialized division of labor, the more conducive it is to the comparative advantages of trade in different regions and promoting regional trade cooperation. In this context, local governments may face higher opportunity costs of market segmentation, which will motivate them to reduce local protection and market segmentation policies (Sun and Yin, 2021). It should also be noted that investment in transport infrastructure may increase the financial pressure on local governments and the competitive pressure on local enterprises, thereby incentivizing local governments to adopt market segmentation policies (Mao and Wang, 2018).

Market integration and market segmentation are two aspects of the same problem, and the existing research mostly analyzes it from the perspective of market segmentation. Some studies have found that market segmentation caused by local protection can distort the efficient allocation of resources, leading to the convergence of regional industrial structures and loss of efficiency of enterprises and industries, which can hinder economic growth (Jing and Zhang, 2019). There are also some views that the impact of market segmentation on economic growth is an inverted U-shaped curve (Sun and Lei, 2018). When the degree of market segmentation is low, local protection and market segmentation are beneficial to local economic growth, but when the degree of market segmentation exceeds a certain critical value, its effect on local economic growth will turn to inhibition. Market segmentation can be mediated by the highly isomorphic regional industrial structure, which can promote economic growth by promoting regional specialization and division of labor (Fu and Qiao, 2011). Some studies have also found that the impact of market segmentation on economic growth is uncertain; it may be inverted U-shaped or positive U-shaped, or it may not be significant (Song et al., 2014). In fact, the market segmentation that exists between regions in China is a “prisoner’s dilemma” situation. When other local governments adopt local protection and market segmentation policies, the local government must also adopt a “beggar-thy-neighbor policy” in order to protect the local economy. This could lead to a market-segmentation race among local governments, which could improve the relative performance of the local economy by taking down rivals. If all local governments give up local protection and market segmentation, then all localities will benefit. However, this situation does not seem to occur in China. The fact is that some local governments are currently benefiting from market segmentation but at the cost of huge dis-economies of scale, which adversely affects China’s overall economic growth (Lu and Chen, 2009).

The existence of market segmentation between regions will be detrimental to economic growth, while market integration can implement the free flow of commodities and factors between regions, give full play to the positive role of the market in allocating resources, and improve economic growth. The reduction of transaction costs and the improvement of transaction efficiency brought about by the improvement of transportation infrastructure can promote the cross-regional flow of commodities and production factors, reducing the degree of market segmentation between regions and improving the level of market integration. However, existing research seldom pays attention to the relationship between transportation infrastructure improvement, market integration, and economic growth and pays more attention to discussing and analyzing the relationship between the two. In 2020, the fifth plenary session of the 19th Communist Party of China (CPC) Central Committee proposed to accelerate “the new development paradigm featuring dual circulation, in which domestic and overseas markets reinforce each other, with the domestic market as the mainstay.” From the perspective of regional coordinated development, the realization of the domestic circulation must break the market segmentation and realize the free flow of various elements between regions (Zhang and Yang, 2020; Liu et al., 2021). Based on the understanding of smoothing the domestic circulation and promoting coordinated regional development under the new situation, this study will take 220 cities in 19 urban agglomerations in China as research samples to empirically test the impact of the development of expressways and high-speed railways on urban economic growth and the heterogeneity of urban economic growth caused by different levels of market integration. This is of great significance for enriching existing research, optimizing investment strategies for expressways and high-speed railways in China, and promoting regional high-quality development.

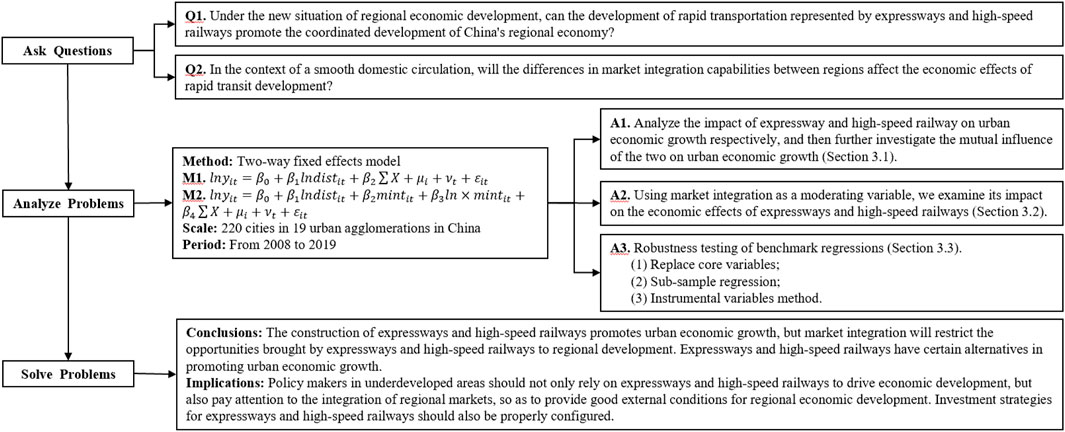

The possible marginal contributions of this study are mainly reflected in three aspects: 1) taking economic growth as the starting point, this study specifically examines the impact of the development of expressways and high-speed railways on economic activities and further explores the relationship between expressways and high-speed railways, supplementing the existing literature. Existing studies have discussed the respective economic growth effects of expressways (Liu et al., 2019) and high-speed railways (Yao and Wang, 2020), but there is little literature on the relationship between expressways and high-speed railways. 2) This study examines the heterogeneity of expressway and high-speed railway development affecting urban economic growth from the perspective of market integration, providing a new entry point and perspective for studying the impact of transportation infrastructure on economic activities. From the available studies, this study is closest to the study by Yao and Wang (2020), who discuss the heterogeneity of differences in market integration capacity with regard to the role of high-speed railroads in promoting high-quality development in Chinese counties from 2008 to 2013. Their study found that market integration reinforces the opportunities that high-speed railway brings to regional development, contrary to the findings of this study. Their explanation is that with the improvement of the travel convenience of high-speed railways, enterprises in the city will gain more development opportunities, and the improvement of market integration can reduce the transaction costs of enterprises, which ultimately leads to economic growth. Our interpretation is that more convenient rapid transportation infrastructure improves inter-regional accessibility, reduces transaction costs, and expands market size, thereby promoting urban economic growth; in cities with a low degree of market integration, the reduction of transaction costs and the expansion of market scale brought about by the development of expressways and high-speed railways will be more obvious, so that their role in promoting urban economic growth will be stronger. 3) This study provides a better identification strategy to address the endogeneity between transportation infrastructure and economic development by constructing instrumental variables of transportation infrastructure based on the geographical location of each city. The previous literature mostly used historical road (Baum-Snow et al., 2017; Zhang et al., 2018; Guo and Hu, 2021) or geographic slope (Bian et al., 2019) as instrumental variables of transportation infrastructure, which are not suitable for panel data because they do not change with time. Figure 1 is the technical roadmap of this study.

2 Method and Data

2.1 Study Area

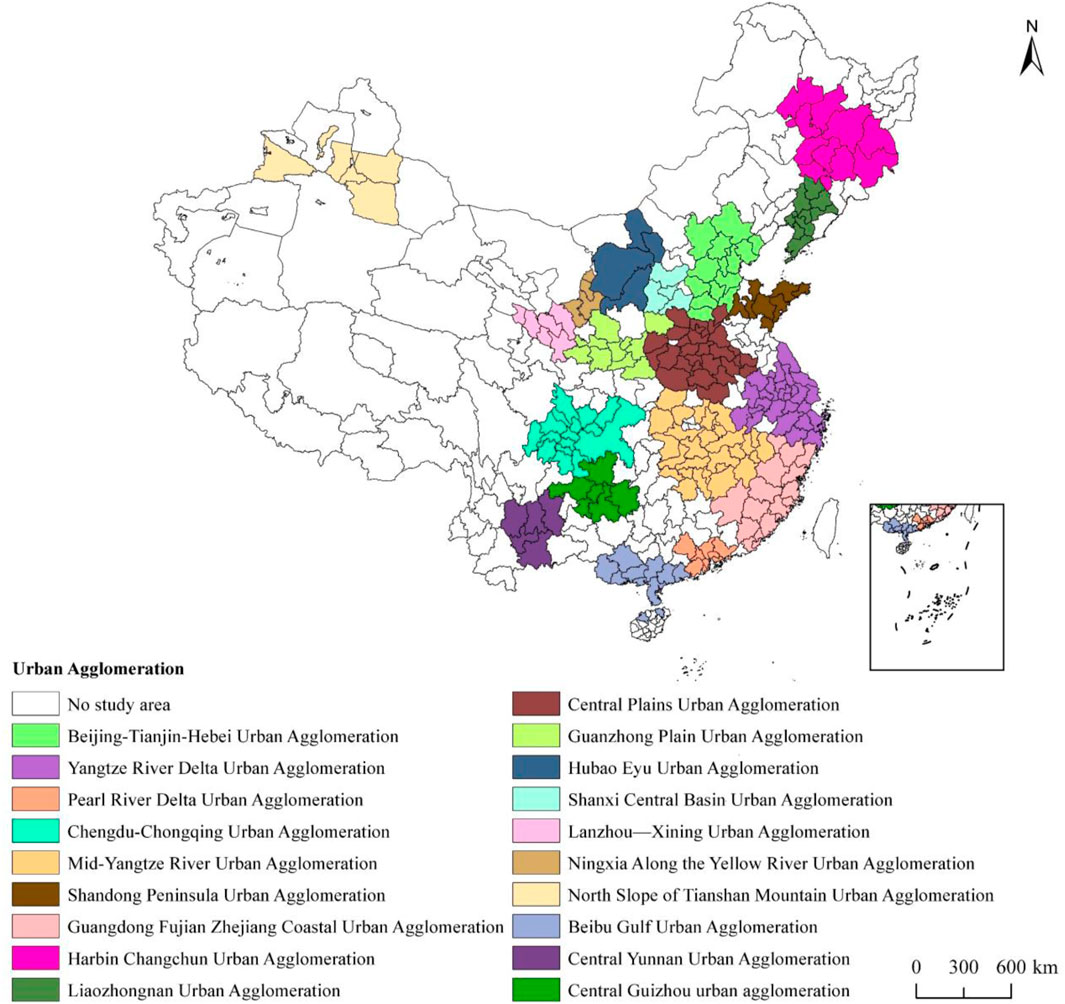

Urban agglomeration is a high-level organizational form of regional economic activities in the process of industrialization and urbanization, which can produce huge economic agglomeration effects, realize the rational allocation of resources in the region and the free flow of elements, and promote the process of regional integration (Sun and Zhou, 2022). Cities included in the urban agglomeration can fully obtain the radiation and driving role of the central city, driving the overall high-quality development of the region. Therefore, the study area of this study is determined according to the 19 urban agglomerations planned in the Outline of the 14th Five-Year Plan (2021–2025) for National Economic and Social Development and Vision 2035 of the Peoples Republic of China. In the process of collection, the content defined in the published planning text shall prevail, and the unpublished planning text shall be determined according to relevant planning and research literature. Considering the availability and comparability of data, the study area focuses on municipality- and prefecture-level cities (including autonomous prefectures), and 220 cities were finally determined Figure 2. In 2019, 220 cities in 19 urban agglomerations contributed 85,164.40 billion yuan to China’s GDP, with a proportion of 86.33% of gross GDP, indicating that even if accounting errors are excluded, the 220 cities in 19 urban agglomerations have an absolute dominant position in China’s economy. Therefore, the study area selected in this study can well reflect China’s economic development.

2.2 Index Selection

The variables involved in this study include explained variables, core explanatory variables, moderator variables, and other control variables. This study uses real per capita GDP (

Regarding the core explanatory variables, referring to the practice of Faber (2014), the straight-line distance from the city center to the nearest expressway and high-speed railway station is used to measure the development level of expressways and high-speed railways in the city. Specifically, the mean of the straight-line distance between the city center and the nearest expressway and high-speed railway station of all counties under the jurisdiction of each city is used. Considering that the built-up areas of many cities are not located in the center of the region, this study uses each regional government seat as the city center. First, manually sort out the construction and opening time of all expressways and high-speed railway stations, as well as the main control points and other information, using publicly available information on the Internet. Second, on the basis of the national expressways and high-speed railway stations opened before 2008, the information of newly built and opened expressways and high-speed railway stations was updated year by year, and finally, the rapid traffic database containing the distribution of expressways and high-speed railway stations from 2008 to 2019 was obtained. Then, the locations of the geographic centers of all cities were calculated by combining the 2007 county-level administrative boundaries of China. Finally, the straight-line distance from the city center to the nearest expressways and high-speed railway station was calculated based on the ArcGIS 10.8 for each year and each county-level administrative district.

For the market integration indicator, this study uses the inverse of the degree of market segmentation from 2008 to 2019 in China as measured using the “price method”, considering the latest mainstream research directions. For the specific calculation methods, please refer to the study by Gui et al. (2006). The core idea of the “price method” comes from the “Model of Iceberg Cost” (Samuelson, 1964), which is a modification to the “Law of One Price.” Due to transaction costs, some of the value of the commodity will melt like a glacier in the process of trade. Even if there is full arbitrage, the price of the same commodity in the two places will not be exactly equal but will fluctuate within a certain range. Take two places

The factors affecting economic growth are quite complex, and the realization of regional economic growth may be the result of the spatial synergy of multidimensional factors (Zhang, 2012). In order to minimize the impact of other factors on urban economic growth, the following control variables were selected with reference to the research of Guo & Hu (2021) and Yu Y. Z. et al. (2019). 1) Human Capital Accumulation (

2.3 Methodology: Two-way Fixed Effects Model

Based on the travel convenience brought by the construction of expressways and high-speed railways from 2008 to 2019, this study aims to explore the impact of expressways and high-speed railways on urban economic growth and analyze the heterogeneity of the difference in market integration capability in promoting urban economic growth. First, analyze the impact of expressway and high-speed railway construction on urban economic growth without considering the impact of market consolidation. The regression equation is denoted as follows:

where

Then, on the basis of Eq. 1, the interaction terms of market integration with expressways and high-speed railways are added to investigate how different levels of market integration affect the economic growth effects of construction of expressways and high-speed railways. The regression equation is denoted as follows:

where

2.4 Data Source

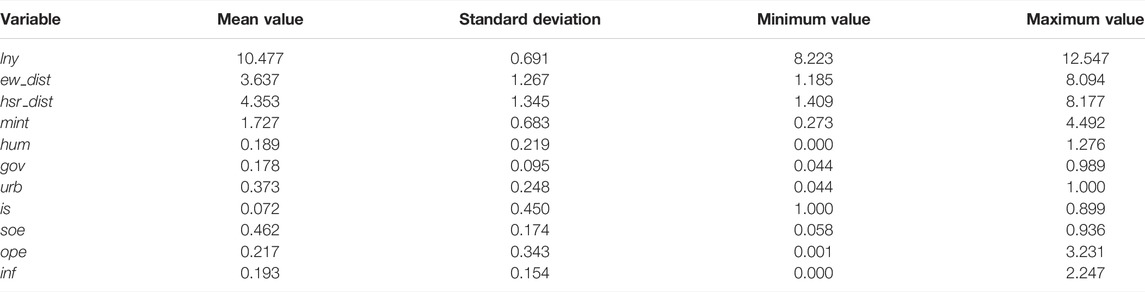

This study focused on 220 cities in 19 urban agglomerations in China from 2008 to 2019. The relevant data involved were mainly sourced from the China city statistical yearbook, China statistical yearbook for regional economy, and other statistical yearbooks and bulletins of various cities. Import and export data were obtained from the Wind database. The data such as the opening time and main control points of expressway lines and high-speed railway stations were derived from public information on the Internet. All latitude and longitude data for expressways, high-speed railways, and county-level administrative regions came from Baidu Electronic Maps. For some missing data, the linear interpolation method was used to complete the data. The results of descriptive statistics for all the above variables are shown in Table 1.

3 Empirical Results

3.1 Rapid Transit Development and Urban Economic Growth

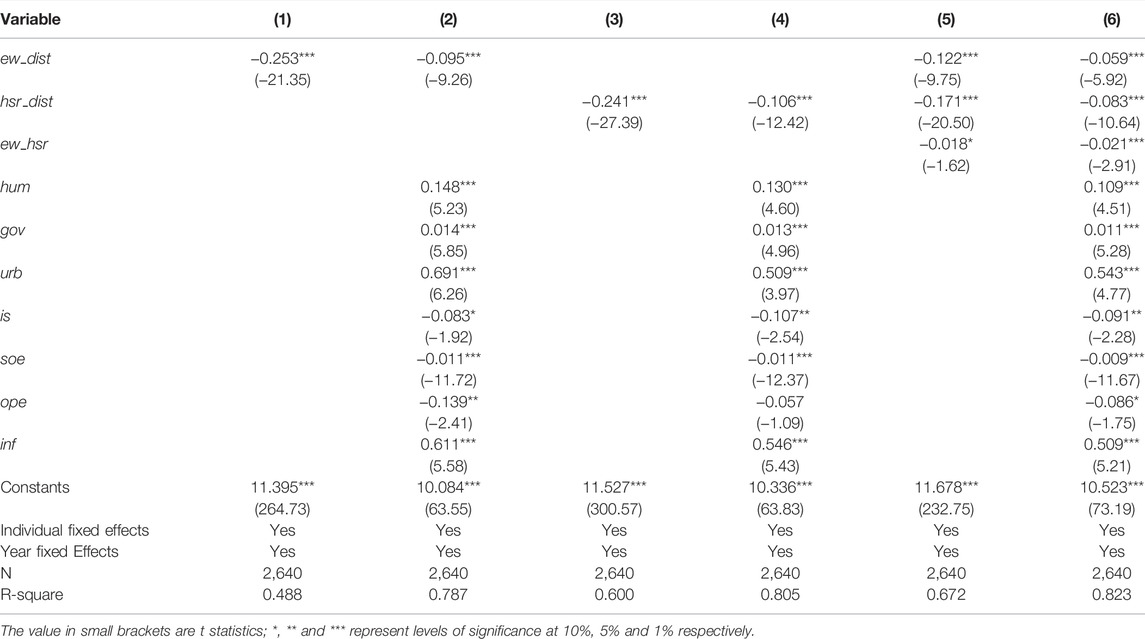

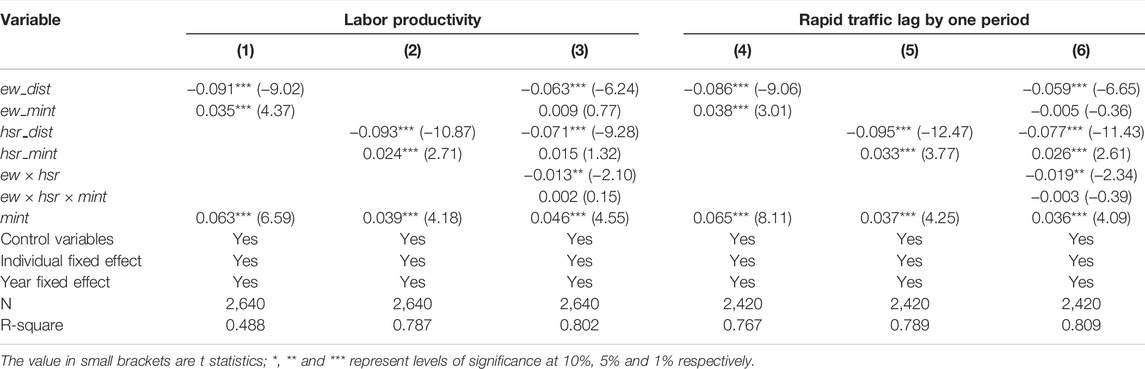

First, perform a multicollinearity test on the model before the regression analysis. The variance inflation factor (VIF) of all variables was less than 10, and the average variance inflation factor was 1.68, indicating that there was no serious multicollinearity among the variables. Second, according to the F test and Hausman test, the fixed effect (FE) result is the best, so the following regressions all use the fixed effect model. Table 2 reports the regression results of the impact of expressway and high-speed railway development on urban economic growth. The results show that the coefficients of expressways (

Among the main control variables, human capital accumulation, government intervention, level of urbanization, and level of informatization are significantly positively correlated with urban economic growth, indicating that accelerating the accumulation of human capital, expanding the scale of government expenditure, and improving the level of urbanization and informatization significantly promote urban economic growth. The industrial structure is significantly negatively correlated with economic growth, indicating that China’s current industrial structure upgrade is still in a period of deep adjustment. The coefficient of the proportion of the state-owned economy is significantly negative, indicating that increasing the proportion of state-owned economy in the national economy is not conducive to urban economic growth, and the ultimate goal of state-owned enterprise reform should be to improve the competitiveness of state-owned enterprises. The coefficient of the level of opening up is significantly negative, indicating that China’s current foreign trade dependence is too high, and the domestic economy is subject to the world economy.

3.2 Rapid Transit Development, Market Integration, and Urban Economic Growth

Table 3 reports the impact of rapid transit development and market integration on urban economic growth. The regression results show that no matter whether the control variable is added or not, the estimated coefficient of market integration (

3.3 Robustness Test

3.3.1 Replace the Measurement Indicators of the Main Variables

In order to exclude the possible interference caused by the selection of variable measurement, this study replaces the measurement indicators of the main variables. First, after using real labor productivity calculated at constant prices in 2007 to replace real per capita GDP as a measure of urban economic growth, the results are reported in columns (1–3) of Table 4. The results show no significant changes in the sign and significance of the coefficients of the core explanatory variables, indicating that the above findings are robust.

Second, both expressways and high-speed railways are lagged by one period to replace the core explanatory variables, and the results are reported in columns (4–6) of Table 4. It can be seen from the results that the development of expressways and high-speed railways and the improvement of market integration level have significantly promoted urban economic growth, while market integration has significantly inhibited the promotion of expressway and high-speed railway development on urban economic growth, and there is a certain substitution of the role of expressways and high-speed railways in promoting urban economic growth. These results are consistent with the baseline regression, indicating that the baseline regression results are robust.

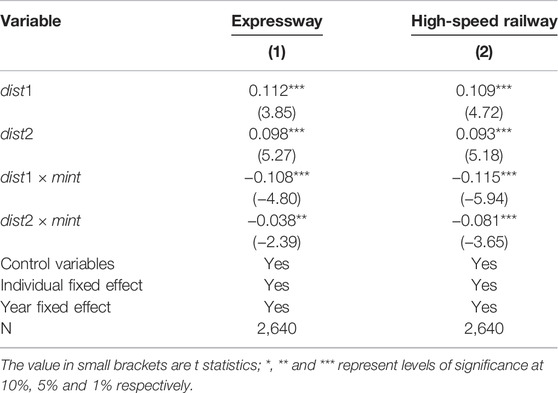

Third, drawing on the research of Ghani et al. (2016), the dummy variable of whether a city center is located within a certain distance of the nearest expressway and high-speed rail station is used to measure expressways and high-speed railways. Specifically,

3.3.2 Sub-Sample Regression

In general, provincial capitals and large cities tend to have better transportation infrastructure, excluding municipalities, provincial capitals, and sub-provincial cities can alleviate the endogeneity problem caused by reverse causality to a certain extent (Chandra and Thompson, 2000), and the regression results are shown in columns (1–3) of Table 6. The results show that after excluding municipalities, provincial capitals, and sub-provincial cities, the absolute value of the coefficient of the interaction between expressway and market integration and the coefficient of the interaction between high-speed railway and market integration have both decreased, but they are still significantly positive.

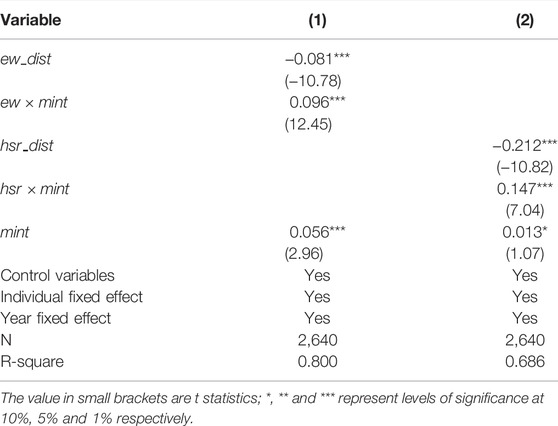

Considering China’s vast territory, differences in geographical location and natural resource endowments lead to significant regional differences, and the level of transportation infrastructure and market integration as well as the level of economic and social development are also very different from place to place; this study further discusses the impact of expressway, high-speed railway, and market integration on urban economic growth in different regions. According to the classification standard published by the National Bureau of Statistics of the People’s Republic of China, the research samples are divided into two regions, eastern region and central and western regions, and the regression results are shown in columns (4–9) of Table 7. From the results, the coefficients of expressway are significantly negative at the 1% level and the coefficients of its interaction term with market integration are significantly positive at the 5% level of significance, both in the eastern region and central and western regions. In terms of the absolute value of the coefficients, the eastern regions are significantly larger than the central and western regions, which indicates that the promotion effect of expressway development and market integration on urban economic growth is stronger in the central and western regions. In the eastern region, the coefficient of the high-speed railway and the coefficient of the interaction between the high-speed railway and market integration are both significant at the 1% level, while in the central and western regions, the coefficient of the high-speed railway and the coefficient of the interaction between the high-speed railway and market integration are both not significant.

The possible explanation is that the construction of high-speed railways in the central and western regions started late, leading to few lines and low density, and even many cities in the central and western regions have not yet opened high-speed railways; thus, the economic growth effect of high-speed railway development in the central and western regions has not been played in a short time. Also, it is noted that the coefficient of the interaction term of expressway and high-speed railway is not significant in the eastern region, but it is significant in the central and western regions. This may be in the eastern region has formed a more complete network of expressways and high-speed railways, the new high-speed railway to the expressway replacement role is not obvious.

3.3.3 Instrumental Variables Method

Although the baseline regression controls as much as possible for factors that may affect both rapid transit development and urban economic growth, the empirical results may still be influenced by some unobservable factors, and this omitted variable problem may lead to biased estimated coefficients for rapid transit development. At the same time, the higher the level of urban economic growth, the better the rapid transit development, and there may be a reverse causality between the two. In order to alleviate the endogeneity problem caused by omitted variables or reverse causality, this study further adopts the instrumental variable method to solve it. With regard to the selection of instrumental variables, we use the “least cost path spanning tree networks” method to connect the central cities with straight lines and use “whether the city is located on a straight line connecting the central cities” as an instrumental variable for “whether the city is connected to expressway or high-speed railway,” following the ideas of Faber (2014) and Hornung (2015). The planning goal of China’s expressways and high-speed railways is to connect to the central cities in each region of the country. Whether a non-central city is connected to an expressway or high-speed railroad depends to a large extent on whether the city is located in a straight line between the central cities in the expressway or high-speed railroad network. If the straight-line distance between a city and the central city is very far, to include the city in the expressway or high-speed railway network will make a substantial detour, which will greatly increase the construction cost of the expressway or high-speed railway, so the city will have a high probability of not being connected to the expressway or high-speed railway. Moreover, the distance between the city and the central city in a straight line is not related to its recent economic development level but is determined by its historical geographical location, so it has a strong exogenous nature.

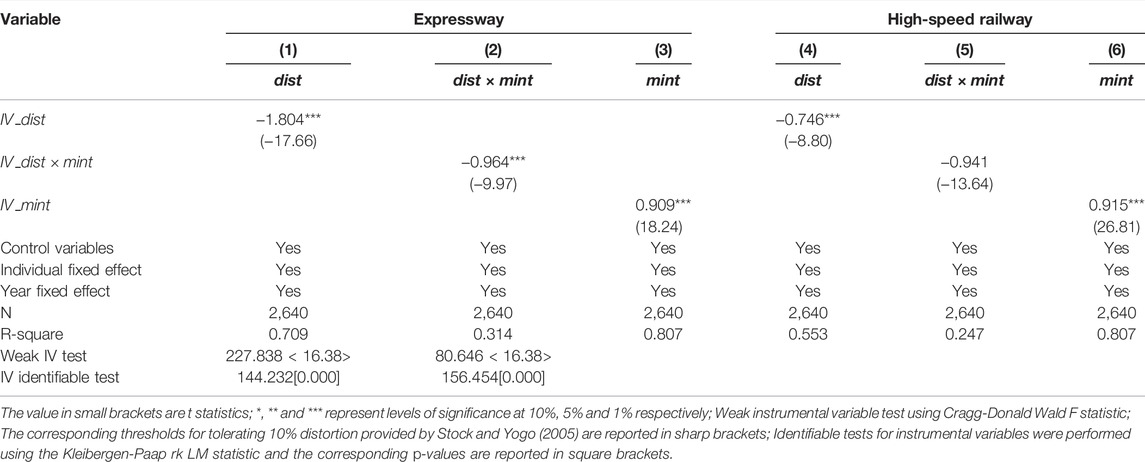

The instrumental variables (

Using the instrumental variables constructed above, the baseline regression was estimated using two-stage least squares (2SLS), and the regression results are presented in Tables 7, 8. The Cragg–Donald Wald F-statistics of 227.838 and 80.646 in the first stage estimation, respectively, both passed the weak instrumental variables test, and the Kleibergen–Paaprk LM statistics of 144.232 and 156.454, respectively, also passed the instrumental variables identifiability test. The results of the second stage show that the coefficients of both expressways and high-speed railways are significantly negative, and the coefficients of the interaction term of expressway and high-speed railway with market integration, respectively, are all significantly positive, which are consistent with the baseline regression, indicating that the results of the baseline regression are still robust after addressing the endogeneity issue.

4 Discussion and Conclusion

4.1 Discussion

When studying the impact of transportation infrastructure on economic activities, the most important thing is to deal with the endogeneity problem caused by causality (Liu and Zhou, 2014), which is addressed by two approaches in this study. The first method is to remove all municipalities, provincial capitals, and sub-provincial cities from the sample by referring to the study by Chandra and Thompson (2000). This is mainly because these cities tend to have better economic development than other cities, and the government tends to give priority to these cities when planning transportation infrastructure, so excluding these cities can suppress reverse causality to a certain extent. The second method is to draw on the work of Faber (2014) and Hornung (2015) to solve it by constructing instrumental variables for highways and high-speed railroads based on the geographical location of each city. The research conclusions of this study are still robust after dealing with endogeneity issues and a series of robustness tests.

The findings of this study help policy makers understand the contribution of transportation infrastructure to economic growth from the perspective of transportation infrastructure upgrading and market integration, especially for those in less developed regions. As a basic, leading and strategic industries and important service industries, transportation infrastructure is an important underpinning for sustainable development of urban economy (He et al., 2020). Thus, accelerating the construction of transportation infrastructure and striving to improve the coverage of transportation infrastructure in the country is the basis of economic and social development. However, the construction of transportation infrastructure, especially high-grade transportation infrastructure, is characterized by large investment scale, long construction cycle, and low return on capital, which means that the government may induce a debt crisis if it recklessly makes large-scale transportation infrastructure construction investments (Fan et al., 2017). It is also important to be aware of the complexity of transportation infrastructure affecting economic activity. There is heterogeneity in the impact of different transportation infrastructures on urban economic growth, and differences in the level of market integration (Yao and Wang, 2020) and financial constraints (Liu et al., 2019) can also affect the economic effects of transportation infrastructure. Therefore, the government should reasonably guide the investment in transportation infrastructure and strive to maximize the economic effect of transportation infrastructure to narrow the regional economic development gap and achieve high-quality regional economic development.

However, there are some shortcomings in this study. First, this study only examines the impact of rapid transit development and market integration on urban economic growth at the macro-city level, but the micro-action mechanism of rapid transit development and market integration for urban economic growth is not discussed, which is the future research direction and focus of this study. Second, regarding the measurement index of expressways and high-speed railways, no unified standard has been formed in the academic community. This study uses the straight-line distance of the city center from the nearest expressways and high-speed railway stations, and since this distance varies little during the study period and there are several cities with no changes in consecutive years, there may be some bias in using this index to measure their economic effects, which requires further exploration of better measurement indexes in the future. Third, this study focuses only on the moderating effect of commodity market integration on rapid transit development, but differences in the degree of integration of factor markets, such as labor and capital, also affect the economic effects of rapid transit development, which also needs to be explored more in the future.

4.2 Conclusion

Taking 220 cities of 19 urban agglomerations in China as research samples, this study empirically tests the impact of rapid transportation development on urban economic growth from 2008 to 2019 and further analyzes the heterogeneity of urban economic growth due to different levels of market integration. The results show that 1) the shorter the straight-line distance from the city center to the nearest expressway and high-speed railway station, the higher the level of urban economic growth, indicating that the increased travel convenience brought by expressway and high-speed railway development significantly promotes urban economic growth. Simultaneously, there is a certain substitution between expressways and high-speed railways in promoting urban economic growth. For those cities that have already established a relatively well-developed expressway network, further development of high-speed railways will restrict the promotion of expressway development on urban economic growth. 2) Market integration significantly promotes urban economic growth, while different levels of market integration significantly restrict the promotion of expressway and high-speed railway on urban economic growth; the poorer the market integration, the greater the economic growth effect from the development of expressways and high-speed railways, while the stronger the market integration, the smaller the economic growth effect from the development of the development of expressways and high-speed railways. However, the impact of market integration on the substitution role between expressways and high-speed rail is not significant. 3) The development of expressways and market integration have a stronger role in promoting the economic growth in the eastern region than in the central and western regions, while the development of high-speed railways and market integration have only promoted the economic growth in the eastern region and do not have significant effects on economic growth in the central and western regions.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

This work was supported by the National Social Science Foundation Western Region Project (Grant No. 20XJL008) and the Fundamental Research Funds for the Central Universities (Grant No. 21lzujbkydx044).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Banerjee, A., Duflo, E., and Qian, N. (2020). On the Road: Access to Transportation Infrastructure and Economic Growth in China. J. Dev. Econ. 11 (1), 1–53. doi:10.1016/j.jdeveco.2020.102442

Baum-Snow, N., Brandt, L., Henderson, J. V., Turner, M. A., and Zhang, Q. (2017). Roads, Railroads, and Decentralization of Chinese Cities. Rev. Econ. Statistics 99 (3), 435–448. doi:10.1162/rest_a_00660

Bian, Y. C., Wu, L. H., and Bai, J. H. (2019). Does High-Speed Rail Improve Regional Innovation in China? J. Financial Res. (06), 132–149.

Boarnet, M. G. (1998). Spillovers and the Locational Effects of Public Infrastructure. J. regional Sci. 38 (3), 381–400. doi:10.1111/0022-4146.00099

Chandra, A., and Thompson, E. (2000). Does Public Infrastructure Affect Economic Activity? Regional Sci. urban Econ. 30 (4), 457–490. doi:10.1016/s0166-0462(00)00040-5

Coşar, A. K., and Demir, B. (2016). Domestic Road Infrastructure and International Trade: Evidence from Turkey. J. Dev. Econ. 118, 232–244. doi:10.1016/j.jdeveco.2015.10.001

Donaldson, D. (2018). Railroads of the Raj: Estimating the Impact of Transportation Infrastructure. Am. Econ. Rev. 108 (4-5), 899–934. doi:10.1257/aer.20101199

Faber, B. (2014). Trade Integration, Market Size, and Industrialization: Evidence from China's National Trunk Highway System. Rev. Econ. Stud. 81 (3), 1046–1070. doi:10.1093/restud/rdu010

Fan, X., Song, D. L., and Zhang, X. Y. (2017). Does Infrastructure Construction Break up Domestic Market Segmentation? Econ. Res. J. 52 (02), 20–34.

Farhadi, M. (2015). Transport Infrastructure and Long-Run Economic Growth in OECD Countries. Transp. Res. Part A Policy Pract. 74, 73–90. doi:10.1016/j.tra.2015.02.006

Forero, A., Gallego, F. A., González, F., and Tapia, M. (2020). Railroads, Specialization, and Population Growth: Evidence from the First Globalization. J. Popul. Econ. 34 (3), 1027–1072. doi:10.1007/s00148-020-00804-3

Fu, Q., and Qiao, Y. (2011). How Government Competition Has Contributed to China's Rapid Economic Growth: A Re-examination of the Relationship between Market Segmentation and Economic Growth. J. World Econ. 34 (07), 43–63.

Ghani, E., Goswami, A. G., and Kerr, W. R. (2016). Highway to Success: The Impact of the Golden Quadrilateral Project for the Location and Performance of Indian Manufacturing. Econ. J. 126 (591), 317–357. doi:10.1111/ecoj.12207

Gui, Q. H., Chen, M., Lu, M., and Chen, Z. (2006). Segmentation or Consolidation in China's Domestic Commodity Markets: an Analysis Based on the Relative Price Approach. J. World Econ. (02), 20–30.

Guo, P. F., and Hu, X. Y. (2021). Infrastructure Investment, Market Integration and Regional Economic Growth. Wuhan Univ. J. (Philosophy Soc. Sci. 74 (06), 141–157. doi:10.14086/j.cnki.wujss.2021.06.013

He, G., Xie, Y., and Zhang, B. (2020). Expressways, GDP, and the Environment: the Case of China. J. Dev. Econ. 145, 102485. doi:10.1016/j.jdeveco.2020.102485

Hornung, E. (2015). Railroads and Growth in Prussia. J. Eur. Econ. Assoc. 13 (04), 699–736. doi:10.1111/jeea.12123

Jiang, H. B., Zhang, W. Z., Qi, Y., and Jiang, J. L. (2015). The Land Accessibility Influenced by China’s High-Speed Rail Network and Travel Cost. Geogr. Res. 34 (06), 1015–1028. doi:10.11821/dlyj201506002

Jing, W. M., and Zhang, J. N. (2019). The Impact of Market Segmentation on Economic Growth: from the Perspective of Unbalanced Regional. Reform (09), 103–114.

Karimah, I. D., and Yudhistira, M. H. (2020). Does Small-Scale Port Investment Affect Local Economic Activity? Evidence from Small-Port Development in indonesia. Econ. Transp. 23, 100180. doi:10.1016/j.ecotra.2020.100180

Li, C., Lin, T., Zhang, Z., Xu, D., Huang, L., and Bai, W. (2021). Can Transportation Infrastructure Reduce Haze Pollution in China? Environ. Sci. Pollut. Res. 29 (11), 1–18. doi:10.1007/s11356-021-16902-y

Li, H., Strauss, J., Shunxiang, H., and Lui, L. (2018). Do high-speed Railways Lead to Urban Economic Growth in China? A Panel Data Study of China's Cities. Q. Rev. Econ. finance 69, 70–89. doi:10.1016/j.qref.2018.04.002

Li, P., Wang, C. H., and Yu, G. C. (2011). A Literature Review of Infrastructure and Economic Development. J. World Econ. 34 (05), 93–116.

Liu, C., Liu, C. R., and Sun, T. (2019). Transportation Infrastructure, Financial Constraint and County Industry Development: Evidence from China’s National Trunk Highway System. Manag. World 35 (07), 78–88+203. doi:10.19744/j.cnki.11-1235/f.2019.0093

Liu, C., and Zhou, L. A. (2014). Expressway Construction and Regional Economic Development: Evidence from China's County Level. Econ. Sci. (02), 55–67. doi:10.19523/j.jjkx.2014.02.005

Liu, H., and Zhu, Z. Y. (2021). From Provincial Market to Regional Market—Based on the Calculation of Five Urban Agglomerations Market Segmentation. Inq. into Econ. Issues (01), 124–135.

Liu, R., Dai, W., and Li, Z. (2021). Reduce Trade Cost and Smoothen Domestic Economic Circulation. Shanghai J. Econ., (02), 25–35. doi:10.19626/j.cnki.cn31-1163/f.2021.02.003

Lu, M., and Chen, Z. (2009). Fragmented Growth: Why Economic Opening May Worsen Domestic Market Segmentation? Econ. Res. J. 44 (03), 42–52.

Lu, Y., Yang, S., and Li, J. (2022). The Influence of High-Speed Rails on Urban Innovation and the Underlying Mechanism. PloS One 17 (3), e0264779. doi:10.1371/journal.pone.0264779

Lv, B. Y., and He, Y. (2020). On the Trend of Regional Market Integration: Measurement and Analysis on Chinese Commodity Market Segmentation Based on City Data. Econ. Theory Bus. Manag. (04), 13–25.

Ma, G. R., Cheng, X. M., and Yang, E. Y. (2020). How Does Transportation Infrastructure Affect Capital Fows: A Study from High-Speed Rail and Cross-Region Investment of Listed Companies. China Ind. Econ. (06), 5–23. doi:10.19581/j.cnki.ciejournal.2020.06.001

Mao, Q. L., and Wang, F. (2018). Transport Development, Market Segmentation and Regional Industrial Growth. Finance Trade Res. (08), 16–30. doi:10.19337/j.cnki.34-1093/f.2018.08.002

Ministry of Transport of the People's Republic of China (2021). China Sustainable Transport Development Report. Available at: https://xxgk.mot.gov.cn/2020/jigou/gjhzs/202112/t20211214_3631113.html.

Miwa, N., Bhatt, A., and Kato, H. (2022). High-speed Rail Development and Regional Inequalities: Evidence from japan. Transp. Res. Rec. J. Transp. Res. Board, 036119812210785. doi:10.1177/03611981221078566

Nation Railway Administration of the People's Republic of China. (2013). What Is High Speed Rail? Available at: http://www.nra.gov.cn/ztzl/hyjc/kjcxx/kp/201605/t20160526_24387.shtml.

Pan, S., and Ye, D. Z. (2021). Research on the Impact of Transport Infrastructure on Market Segmentation: Evidence from High-Speed Rail Opening and Cross-Districe M&A of Listed Companies. Public Finance Res. (03), 115–129. doi:10.19477/j.cnki.11-1077/f.2021.03.009

Qin, Y. (2017). ‘No County Left behind?’ the Distributional Impact of High-Speed Rail Upgrades in China. J. Econ. Geogr. 17 (3), 489–520. doi:10.1093/jeg/lbw013

Redding, S. J., and Turner, M. A. (2015). “Transportation Costs and the Spatial Organization of Economic Activity,” in Handbook of Regional and Urban Economics, 5, 1339–1398.

Samuelson, P. A. (1964). Theoretical Notes on Trade Problems. Rev. Econ. statistics 46 (2), 145–154. doi:10.2307/1928178

Sheng, B., and Mao, Q. L. (2011). Trade Openness, Domestic Market Integration, and Interprovincial Economic Growth in China from 1985 to 2008. J. World Econ. (11), 44–66.

Song, D., Fan, X., and Zhao, X. (2014). Regional Development Strategy, Market Segmentation and Economic Growth. Finance Trade Econ. 35 (8), 115–126. doi:10.19795/j.cnki.cn11-1166/f.2014.08.012

Startz, M. (2016). The Value of Face-To-Face: Search and Contracting Problems in Nigerian Trade. Available at SSRN 3096685.

Stock, J. H., and Yogo, M. (2005). Testing for Weak Instruments in Linear IV Regression. Cambridge, MA: National Bureau of Economic Research, Inc. doi:10.3386/t0284

Sun, B. W., and Lei, M. (2018). Market Segmentation, Costs Reduction and High Quality Developmengt : an Analysis of a New Economic Geography Model. Reform (07), 53–63.

Sun, B. W., and Yin, J. (2021). How Can Transportation Investment Achieve High Quality Market Integration? A Perspective Based on Geographical and Institutional Market Segmentation. J. Macro-quality Res. (01), 113–128. doi:10.13948/j.cnki.hgzlyj.2021.01.009

Sun, J., and Zhou, L. (2022). Leading the Rise of Yangtze River Economic Belt with the Construction of Central Cities and City Clusters. Journal of Jiangsu University (Social Science Edition), 24 (02), 91–102. doi:10.13317/j.cnki.jdskxb.2022.019

Sun, W. H., and Zhang, J. (2021). High-speed Rail Service and Urban Total Factor Productivity. Shanghai J. Econ. (01), 90–104. doi:10.19626/j.cnki.cn31-1163/f.2021.01.008

Sun, X. T., Li, Y., and Wang, Z. H. (2020). High-speed Rail Construction and Urban Economic Development: Industrial Heterogeneity and Spatial Spillover Effect. J. Shanxi Univ. Finance Econ. 42 (02), 58–71. doi:10.13781/j.cnki.1007-9556.2020.02.005

Tan, Y. H., Yu, F., Lin, F. Q., and Zheng, M. T. (2019). China's High-Speed Railway, Trade Cost and Firm Export. Econ. Res. J. 54 (07), 158–173.

Yao, B., and Wang, H. J. (2020). High Speed Rail, Market Integration and Regional High-Quality Development. Industrial Econ. Res. 29 (02), 1–14. doi:10.13269/j.cnki.ier.2020.06.001

Ye, D. S., and Pan, S. (2020). Distance, Accessibility and Innovation: A Study on the Optimal Working Radius of High-Speed Railway Openging for Urban Innovation. Finance Trade Econ. 41 (02), 146–161. doi:10.19795/j.cnki.cn11-1166/f.20200211.004

Yu, F., Lin, F., Tang, Y., and Zhong, C. (2019a). High‐speed Railway to Success? the Effects of High‐speed Rail Connection on Regional Economic Development in China. J. Reg. Sci. 59 (4), 723–742. doi:10.1111/jors.12420

Yu, Y. Z., Zhuang, H. T., and Fu, Y. (2019b). Does the Opening of High-Speed Rail Accelerate the Spillover of Technological Innovation? Evidence from 230 Prefecture-Level Cities in China. J. Finance Econ. 45 (11), 20–31+111. doi:10.16538/j.cnki.jfe.2019.11.002

Zhang, J. (2017). High-speed Rail Construction and County Economic Development: the Research of Satellite Light Data. China Econ. Q. 16 (04), 1533–1562. doi:10.13821/j.cnki.ceq.2017.03.12

Zhang, X. L. (2012). Has Transport Infrastructure Promoted Regional Economic Growth? with an Analysis of the Spatial Spillover Effects of Transport Infrastructure. Soc. Sci. China (03), 60–77+206. doi:10.19626/j.cnki.cn31-1163/f.2021.02.003

Zhang, X. L., and Yang, C. Y. (2020). Accelerate the Formation of Domestic and International Dual Circulation of Mutual Promotion of the New Development Pattern. Guaning Dly. 07-07.

Keywords: rapid transit, economic growth, market integration, two-way fixed effects model, China

Citation: Mao J, Tian Q and Lu C (2022) Impact of Rapid Transit Development on Urban Economic Growth: An Empirical Study of the Urban Agglomerations in China. Front. Earth Sci. 10:920796. doi: 10.3389/feart.2022.920796

Received: 15 April 2022; Accepted: 05 May 2022;

Published: 15 June 2022.

Edited by:

Jianhong Xia, Curtin University, AustraliaReviewed by:

Qingsong He, Huazhong University of Science and Technology, ChinaDongxue Zhao, The University of Queensland, Australia

Ye Wei, Northeast Normal University, China

Copyright © 2022 Mao, Tian and Lu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Chengpeng Lu, bGNwQGx6dS5lZHUuY24=

Jinhuang Mao

Jinhuang Mao Qianwen Tian

Qianwen Tian Chengpeng Lu

Chengpeng Lu