- 1School of Economics and Business Administration, Chongqing University, Chongqing, China

- 2Department of Materials and Production, Aalborg University, Aalborg, Denmark

- 3School of Management Science and Real Estate, Chongqing University, Chongqing, China

- 4School of Intelligent Technology and Engineering, Chongqing University of Science and Technology, Chongqing, China

With the rapid development of short-term and spot trade of liquefied natural gas (LNG), the natural gas market is gradually evolving from regionalization to globalization. At the same time, the existence and rationality of long-term LNG contracts have become increasingly controversial. To explore the value of long-term LNG contracts in the process of natural gas market globalization, this article constructs a two-stage game model and applies China’s LNG trade data in 2018 to the model. The study shows that, compared with complete import of short-term LNG, even if the long-term LNG contracts do not have price advantages, importing an appropriate amount of long-term LNG may help to increase the total LNG imports, reduce the price of LNG, and thus improve import benefits. Besides, a moderate amount of long-term LNG contracts is conducive to the establishment of a stable and flexible natural gas supply system and the security of natural gas imports. Therefore, natural gas importers should not underestimate or even ignore the value of long-term LNG contracts while actively participating in short-term and spot trade of natural gas.

1 Introduction

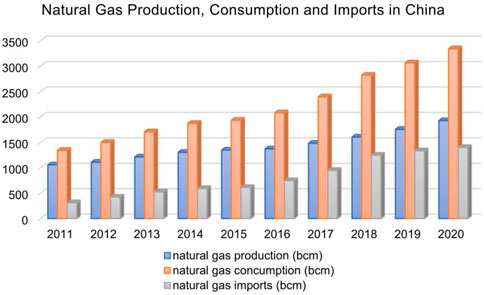

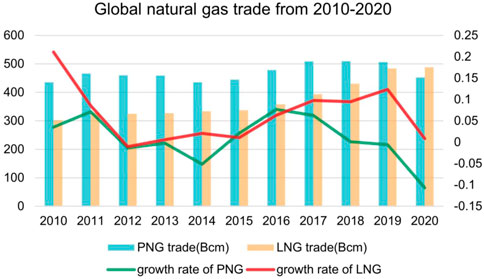

To achieve the goals of the Paris Agreement aiming at controlling the rise of global temperatures, regions and countries are actively optimizing their energy consumption structures (Liu G. et al., 2021). As a bridge for smooth transition from traditional fossil energy system to clean and renewable energy system, natural gas plays an important role in reducing carbon emissions and promoting sustainable development of human society, and has become a strategic choice for energy mix optimization and decarbonization in countries around the world. Therefore, the proportion of natural gas in the energy consumption structure has shown a clear upward trend in recent years, and the global natural gas trade has become increasingly prosperous (Zhang et al., 2017; Kan et al., 2019; Su et al., 2019; Gong et al., 2020; Holland et al., 2020; Liu C. et al., 2021; Jang et al., 2021; Ye et al., 2021; Zhang et al., 2021). Currently, international natural gas trade is mainly in the form of liquefied natural gas (LNG) and pipeline natural gas (PNG) (Aseel et al., 2021). Although the trade share of PNG has historically been higher than LNG, the former is vulnerable to pipeline, geographic and geopolitical influences. In contrast, LNG trade, which is convenient, flexible and suitable for long-distance transportation, has grown steadily, and its growth rate has gradually exceeded that of PNG (see Figure 1) (Lin et al., 2010; Jansen et al., 2012; Yang et al., 2016; Nikhalat-Jahromi et al., 2017a; Basak et al., 2019; Ritz, 2019; Najm and Matsumoto, 2020). It is foreseen that LNG is expected to overtake PNG to become the main force of world gas trade, reducing transportation costs and increasing price arbitrage opportunities, thus de-regionalizing the overall gas market (Siliverstovs et al., 2005; Neumann, 2008; Geng et al., 2014; Barnes and Bosworth, 2015; Liu et al., 2020). Therefore, paying attention to the LNG market and trade trends is of great significance for countries to comply with global gas trade, transform energy consumption structure and achieve net-zero emission goals.

FIGURE 1. Global natural gas trade from 2010 to 2020 (BP, 2021).

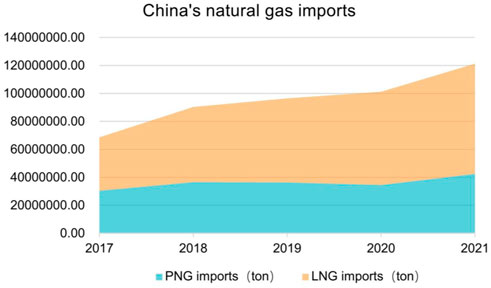

The trade of LNG is traditionally dominated by long-term contracts (LTCs, the contract period is more than 20 years), with price linked to oil price. Recently, spot trade of LNG is becoming more and more popular due to the emergence of new suppliers and consumers (Allevi et al., 2019; Shahrukh et al., 2021) (see Figure 2). In 2019, the global LNG trade is 359 million tons, of which short-term LNG contracts (STCs, the contract period is less than 5 years, including spot) reach 116 million tons, accounting for 32% of the total LNG trade. With the rapid growth in the share of short-term and spot LNG trading (Aune et al., 2009), a more liquid and arbitrageable spot market is emerging. This is not only driving the formation of a global gas market, but also eroding the value of LTCs (Nikhalat-Jahromi et al., 2017b). In the future, whether long-term LNG contracts will be completely replaced by STCs remains to be further analyzed. In this context, this study will focus on the value of long-term LNG contracts in the process of gas market integration, so as to provide some references for optimizing gas trading strategies and ensuring gas supply security.

FIGURE 2. LNG trade in 2021 (Shell, 2021). MTPA, million tons per annum; MT, million tons.

Currently, most of the studies on long-term contracts and short-term agreements for gas trade are based on the European gas market. Shahrukh et al. (2019) constructed a mixed-integer linear programming (MILP) model and compared the cost of transportation through long-term contracts with spot market purchases. The result showed that spot market purchase was better than long-term contracts. Based on the empirical model, Wachsmuth et al. (2017) analyzed the development of natural gas prices and discussed the changes of import contracts in Central and Eastern Europe (CEE). It was found that a decreased share of oil-indexed long-term contracts had significantly cut down the gas prices in Central Europe. Accordingly, importing companies in CEE countries tend to replace the expiring long-term gas import contracts with short-term agreements. By exploring the determinants of changes in the duration of long-term gas export contracts signed in the period from 1963 to 2015, Niyazmuradov and Heo (2018) found that contracts became shorter due to gas market liberalization process in Continental Europe, technological development along the gas value chain and increase in LNG fleet size. Contrary to the above view, using a unique data set of 262 long-term contracts between natural gas producers and importers, Hirschhausen and Neumann (2008) estimated the impact of different institutional, structural and technical variables on the duration of contracts, and found that contracts linked to an asset-specific investment were on average 4 years longer than those that are not. This is because LTCs can reduce trade risk for producers and importers, increase leverage and reduce financing costs when the upstream cost structure is primarily driven by the cost of capital (Abada et al., 2017). Therefore, the decrease of the duration of take-or-pay contracts for gas supply to Europe does not mean the disappearance of long-term contracts (Neumann and Hirschhausen, 2004). Especially for countries heavily relied on LNG imports, considering that short-term trading of natural gas has transaction volume risks, price risks, and infrastructure risks, short-term efficiency is not sufficient to guarantee a well-functioning long-term market, these countries are willing to forgo some flexibility in favor of supply security (Mazighi, 2004; Ruester, 2009; Abada et al., 2019). Therefore, spot volumes of LNG may continue to grow in the future, but there will eventually be an upper limit to the ratio of spot to long-term contract transactions (Hartley, 2015; Nikhalat-Jahromi et al., 2017a; Alim et al., 2018). Yet long-term contracts will have to evolve further to fit the new gas market environment. Last but not least, Neuhoff and Hirschhausen (2006) showed that if the long-run price elasticity of demand is significantly higher than the short-run demand elasticity, both producers and consumers might benefit from signing long-term contracts.

In summary, it can be seen that the existing literature has mostly analyzed the status of long-term gas contracts in Europe from the perspective of asset-specific investments, transaction costs and security of supply, with research methods focusing on MILP models, Cournot models or empirical analysis, but the findings have not yet been agreed upon. This may be due to the fact that MILP models assume deterministic values for all parameters and fail to take into account the effects of demand variability. The accuracy of the empirical model results is somewhat constrained by the availability of data. The Cournot model is suitable for participants with comparable market power. Recently, as the increase of supply and the acceleration of the globalization of natural gas, a buyer’s market is briskly emerging (Meza and Koç, 2021), more and more gas-importing countries are seeking to balance the security and economics of gas imports. For example, the oil-indexed LTCs, which failed to promptly adjust their positions, caused huge losses for European, and European importers requested to renegotiate for LTCs, gas suppliers such as Statoil, GasTerra, Sonatrach, and Gazprom were forced to modify their LTC prices and volumes in Europe (Allevi et al., 2019). Rajaraman (2009), Oladi and Gilbert (2012), and Raff (2009) were the first to explore the issue of buyer power in an international trade context, but they did not apply it to the natural gas market. Zwart (2014) applied strategic trade theory to the natural gas market in a cooperative game framework, but their focus is on an environment where both buyers and sellers have market power. Schulte and Weiser (2019) applied strategic trade theory to the natural gas market in a non-cooperative game framework, but their main analysis is the problem of sellers’ market power and the potential for buyers to mitigate monopoly suppliers’ market power by means of minimum import quotas.

Combining the existing models and the current status of the natural gas market, trade trends and changes in market power of importers and exporters, this manuscript will construct a two-stage game model that can reflect the buyer’s market power, and theoretically analyze the value of long-term LNG contracts from the perspective of economic efficiency of natural gas importing countries. Not only that, we also apply realistic natural gas trade data to the theoretical model to achieve an effective combination of theory and practice. This not only provides a reference for optimizing natural gas import strategy and securing natural gas supply, but also supplements the existing research on natural gas trade contracts.

The remainder of this article is organized as follows: Section 2 focuses on a two-stage game model to theoretically discuss the value of long-term LNG contracts. In Section 3, China’s natural gas trade data in 2018 was applied to the theoretical model. Finally, conclusions and recommendations are proposed in Section 4.

2 Modeling and analysis

2.1 Background

As the world’s largest natural gas importer (Wang et al., 2020), China is leading the growth of global LNG. At the same time, the share of short-term LNG trade in China’s natural gas imports is growing rapidly. Therefore, this study will take China’s natural gas imports as an example, establish a two-stage game model, and apply China’s natural gas trade data to the theoretical model to illustrate the value of long-term LNG contracts. Before constructing the model, several assumptions related to this study are supposed to be briefly explained:

First, to achieve green and low-carbon development, China is actively promoting the transformation of its energy consumption structure. In this process, as a bridge for the transition from fossil energy to renewable energy, the consumption of natural gas has increased year by year. However, as the relatively stable supply of domestic natural gas cannot meet the growing demand for consumption, China’s natural gas supply-demand gap largely depends on imported natural gas (Wang et al., 2020) (see Figure 3). In 2019, the dependence for foreign natural gas reached 43% (Wang et al., 2021). Therefore, this article mainly focuses on the changes and potential impacts of imported gas.

Second, China’s natural gas imports currently include PNG and LNG (see Figure 4). While PNG imports are constrained by LTCs and design capacity, LNG trade allows for greater flexibility in diversifying import routes and sources (Paltsev and Zhang, 2015; Bai and Lam, 2019; Yin and Lam, 2022). Thus, suppliers of imported natural gas can be subdivided into three categories: long-term contract PNG suppliers, long-term contract LNG suppliers, and short-term agreement LNG suppliers. It is noteworthy that long-term LNG contracts are more vulnerable to short-term trade shocks than PNG trade with pipeline constraints. Therefore, referring to the studies by Eser et al. (2019) and Schulte and Weiser (2019), this article further assumes that long-term LNG suppliers will sell their LNG at marginal cost to maintain their market share.

Third, as an import player in the global natural gas market, changes in China’s natural gas imports will have a substantial impact on natural gas prices in the international market (Li et al., 2018). Given the political and geographical challenges associated with PNG import (Jovanović et al., 2019), and the high variability of short-term LNG import, we assume that China first determines the amount of long-term LNG contracts to ensure the security and economics of natural gas imports. Therefore, China is the leader in the natural gas trade game, while short-term LNG suppliers and PNG suppliers are followers1 (Brander and Spencer, 1985).

To show the model in a more detailed and intuitive way, the game model with generalized supply and demand functions is considered; then, the generalized supply and demand function model is simplified to a linear one; finally, the optimal import strategy for natural gas is analyzed according to the simplified model.

2.2 General model

In a dynamic model of exhaustible resource consumption, Yang (2013) simulated the “observable delay” between leader and follower decisions by setting discrete times, and then lists the profit objectives of the leader and the follower separately to capture the structure of the master-slave game. Chen (2021) analyzed the optimal strategies for the manufacturer’s process mean and the buyer’s order quantity under the conditions of 1) complete symmetric information between the two parties, 2) the manufacturer’s stackelberg model with symmetric information and the buyer’s stackelberg model with symmetric information, and 3) the cooperative game with symmetric information. Therefore, with reference to the ideas of the above literature and the market structure of this article, following generalized model are constructed.

Denote the long-term LNG suppliers, the short-term LNG suppliers, and the PNG suppliers as 1, 2, and 3, respectively. Their supply, total cost, and marginal cost are

The objective functions for short-term LNG suppliers and PNG suppliers are expressed as:

The first-order conditions for profit maximization are:

From Eq. 3 and Eq. (4), the optimal supplies of short-term LNG and PNG are

The objective function of natural gas import is:

The first item on the right-hand side of Eq. 5 represents the maximum total amount willing to pay for imported natural gas, while the second and third items indicate the actual total amount paid for imported natural gas, respectively. Specifically, the second item represents the actual expenditures for importing short-term LNG and PNG, and the third item represents the actual expenditure for importing long-term LNG.

This can be reformulated as follows:

We can give Eq. 7 a general economic interpretation. When the long-term LNG imports are optimal, the import revenue brought by the increase of one (marginal) unit of the long-term LNG is equal to the import loss. The left-hand side of Eq. 7 shows the gains from importing long-term LNG, with the first term representing the payment that would be paid for importing short-term LNG and PNG at the current price, and the second term indicating the additional benefits from a lower price due to receiving one (marginal) unit more from the long-term LNG suppliers (The expenditures for importing short-term LNG and PNG decreased). The right-hand side of Eq. 7 shows the loss caused by importing long-term LNG. The first term represents the cost of importing long-term LNG at the current price, and the second term indicates the additional cost from a higher marginal cost due to importing one (marginal) unit of long-term LNG (The expenditures for importing long-term LNG increased).

Plugging

Due to the law of demand, we know that

The requirement that the marginal costs of the long-term LNG contracts should not be too high intuitively makes sense. According to the law of increasing marginal cost, the more the long-term LNG is imported, the higher its marginal cost will be. Large

Proposition 1. Compared with completely importing short-term LNG and PNG, a certain amount of long-term LNG, i.e.,

The above analysis shows that the acceleration of the globalization of the natural gas market and the development of short-term trade of LNG does not mean the disappearance of long-term LNG contracts. In other words, the value of long-term LNG contracts should not be underestimated or even ignored by importing countries actively participating in LNG short-term trade.

2.3 Simplified model

With a general two-stage game model, Subsection 3.2 indicates that long-term LNG contracts may enhance the benefits of natural gas imports. To intuitively display the above findings, this section simplifies the general supply and demand function model. Due to the spread of the new coronavirus, the public health crisis has a huge impact on the world economy and international trade. To explore the import and export strategies under the coronavirus epidemic, Tang et al. (2022) constructed a two-stage game model and used the inverse solution method to derive the optimal output of firms in importing and exporting countries before and after the epidemic outbreak. Assuming two firms selling homogeneous goods in different countries, one of which is the dominant firm and the other is the following firm, Ferreira (2012) explored the effect of market structure on international trade by constructing a master-slave game model. In analyzing the economic consequences of complete import liberalization in the Turkish gas market, Hasanov (2017) constructed a simple game theoretic models and derived equilibrium quantities and market prices with and without exporter capacity constraints. The above literature has different themes or concerns, but they all construct game models for different market structures with linear demand functions as the basic assumption. Referring to the above literature, we simplify the general supply and demand function into a linear one and determines the optimal imports of long-term LNG.

Assume that the inverse demand function of gas import is

The objective functions of short-term LNG suppliers and PNG suppliers are:

The first-order conditions for profit maximization are:

Combine Eq. 11 and Eq. (12), we get

Thus,

The objective function of natural gas import is:

The first-order condition is:

Plugging

Equation. 17 shows that, compared with completely importing PNG and short-term LNG, a strictly positive long-term LNG will improve the economics of natural gas import if

According to the above analysis, the optimal imports of long-term LNG, short-term LNG, and PNG are determined further.

The first-order condition

Thus, the optimal imports of long-term LNG, short-term LNG, and PNG are

It is clear that, the demand price of natural gas import is the weighted value of marginal costs

3 Empirical study

The theoretical model in Section 2 shows that long-term LNG contracts with high prices have the potential to enhance the benefits of natural gas importers. To further quantify LTCs’ value of LNG in the context of globalization of the gas market and illustrate the applications of the above theoretical model, we apply the simplified model to the Chinese natural gas market. The outbreak of the epidemic in 2019 has led to a deterioration of the global economy and a dampening of energy demand, and the bankruptcy of the OPEC+ production cut agreement has further exacerbated the downward trend of crude oil prices. At the same time, LNG prices showed a continuous downward trend. Therefore, we choose 2018 natural gas market data to apply the model, thus reflecting the LNG market before the outbreak of the epidemic. Specifically, we first estimated the parameters in the model; and then analyzed the impact of long-term LNG contracts on gas imports in three scenarios: 1) Not setting the number of long-term LNG contracts; 2) At least signing a certain number of long-term LNG contracts; 3) Optimal imports of long-term LNG contracts; finally, the relevant policy recommendations are proposed by comparing the application results with the actual status quo.

3.1 Parameters estimation

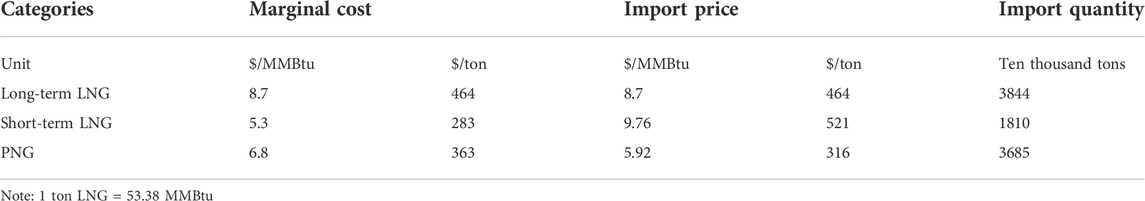

In 2018, Chinese imports of long-term LNG, short-term LNG, and PNG were 38.44 million tons, 18.1 million tons, and 36.85 million tons, respectively. The marginal cost of Russian gas at 6.8 $/MMBtu is used as an approximation of the marginal cost of PNG suppliers. Short-term and long-term marginal cost of U.S. LNG are used to represent the marginal cost of short-term and long-term LNG suppliers, about 5.3 $/MMBtu and 8.7 $/MMBtu, respectively (Mitrova and Boersma, 2018). The average price of imported PNG is calculated by the total imports and expenditures of PNG announced by the General Administration of Customs, about 5.92 $/MMBtu. The JKM published by Platts is the most widely quoted measure of spot LNG prices in Asia (Alim et al., 2018). Thus, we chose JKM to reflect the price of short-term LNG, and JKM was about 9.76 $/MMBtu in 2018 (BP, 2019). The above data are displayed in Table 1.

We further introduce a reference price

3.2 Impact of long-term LNG contracts on China’s gas import in three scenarios

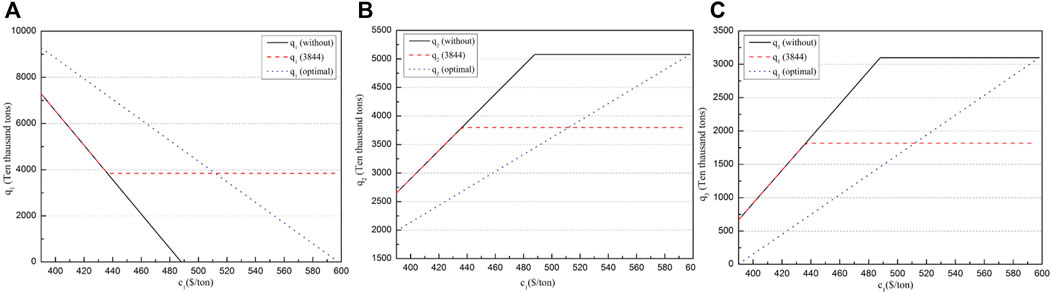

As mentioned earlier, the long-term LNG suppliers are pricing based on its marginal cost, because the marginal supply costs of long-term LNG were uncertain when the LTCs were signed, implications of long-term LNG imports are discussed in dependence on the prices for long-term LNG

Scenario 1: Not setting the number of long-term LNG contracts

In this situation, the long-term LNG contracts will not be signed if its price is higher than the demand price of gas import, which means the import demand of natural gas is satisfied by PNG and short-term LNG; otherwise, long-term LNG, short-term LNG, and PNG will be imported altogether.

Scenario 2: At least signing 38.44 million tons/year of long-term LNG contracts

In this situation, a certain amount of long-term LNG contracts is signed even if its price is higher than the demand price of imported gas. Remarkably, importing too much long-term LNG means a higher cost and less flexibility, so appropriate imports of long-term LNG are necessary. In 2018, China’s LNG imports are 56.54 million tons, of which long-term LNG is 38.44 million tons. Based on realistic data, this study assumes that at least 38.44 million tons/year of long-term LNG contracts is signed, regardless of the price of the long-term LNG and the degree of globalization of the natural gas market.

Scenario 3: Optimal imports of long-term LNG contracts

In this situation, China first decides whether to import long-term LNG and how to maximize the benefits, and then short-term LNG suppliers and PNG suppliers determine their exports, respectively.

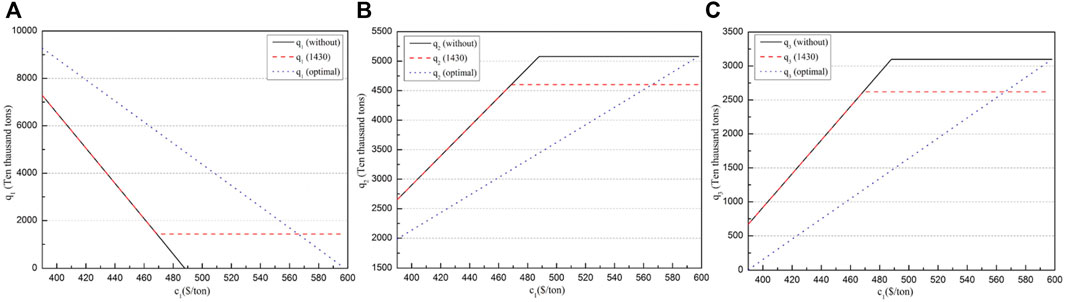

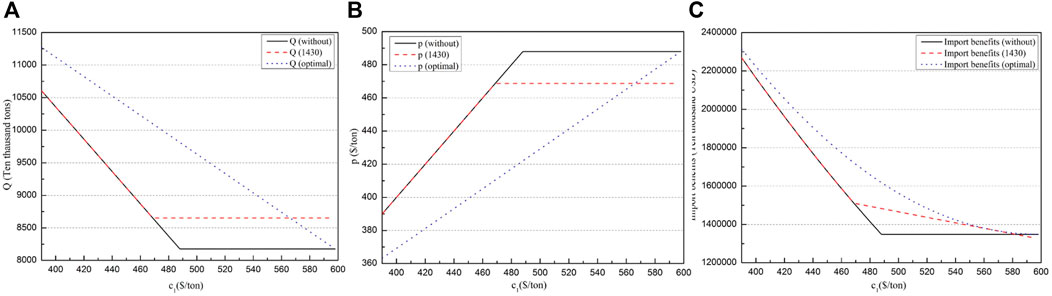

Figure 5A shows that in the former two scenarios, as the price of long-term LNG

Figure 5B and 5C illustrate that the trend of short-term LNG imports

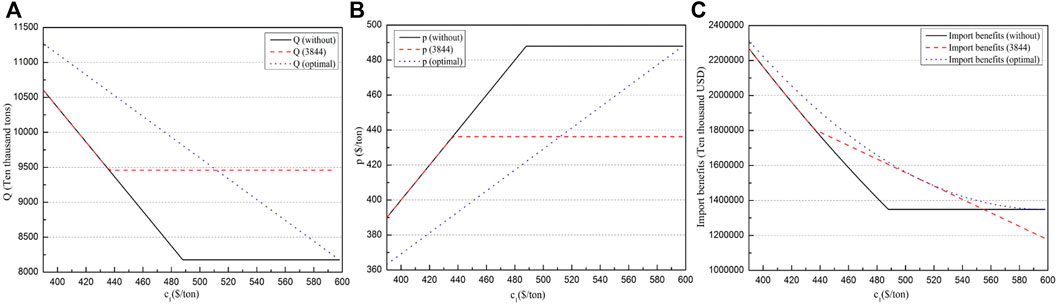

Figure 6A shows that the trend of total imports of natural gas

FIGURE 6. (A) Total imports

Figure 6B illustrates that the demand price of gas imports

Figure 6C suggests that the benefits of natural gas import

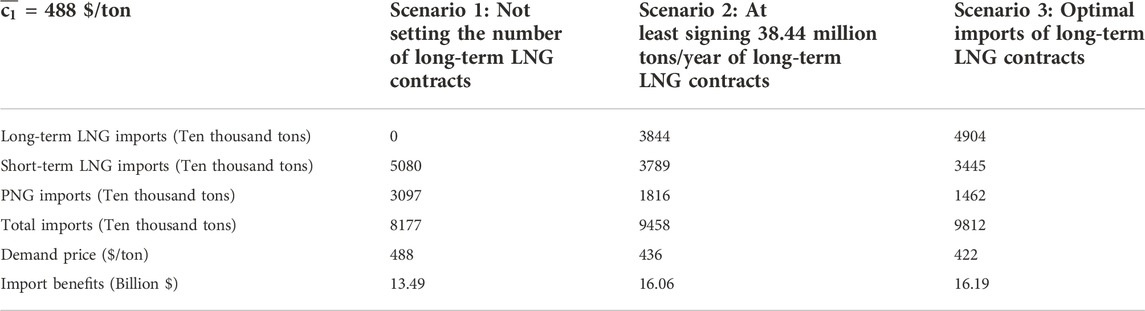

To intuitively show the above results, we further collate the impacts of long-term LNG contracts on China’s natural gas imports in three scenarios, as shown in Table 2:

To sum up, importing long-term LNG is possible to reduce the demand price, increase the total imports, and thereby improve the benefits of imports.

It is noticed that China’s long-term LNG imports and the average price of imported LNG in 2018 are approximately 38.44 million tons and 471.5 $/ton, where the average price is lower than the corresponding threshold of 555 $/ton. Therefore, it is beneficial for China to import 38.44 million tons of long-term LNG, and it is even possible to import more long-term LNG. Facing the active short-term trade of LNG and the accelerating globalization of natural gas market, maintaining a certain proportion of long-term LNG contracts will optimize the structure, guarantee security, and even increase the economic benefits of natural gas imports.

3.3 Robustness research

With the development of short-term LNG and the acceleration of the globalization of the gas market, the proportion of long-term LNG is decreasing gradually. Yet this study shows that importing 38.44 million tons of long-term LNG is helpful to improve the benefits of China’s natural gas imports. To verify the robustness of the findings, this section assumes that at least 15% of China’s natural gas import demand is met by long-term LNG, regardless of whether the long-term LNG contracts have a price advantage. In 2018, China’s natural gas imports were 95.19 million tons, while the imports of long-term LNG should be at least 14.3 million tons. Therefore, we verify the impacts of long-term LNG contracts on China’s natural gas imports in three cases: 1) Not setting the number of long-term LNG contracts; 2) At least signing 14.3 million tons/year of long-term LNG contracts; 3) optimal imports of long-term LNG contracts, as shown in Figure 7; Figure 8.

FIGURE 8. (A) Total imports

Figures 7A, 8B indicate that the long-term LNG imports

4 Conclusions and recommendations

To quantitatively analyze the value of long-term LNG contracts in the context of natural gas market integration, we constructed a two-stage game mode to theoretically analyze the impact of long-term LNG contracts on China’s natural gas imports, demand prices, and import benefits. Additionally, we further applied China’s natural gas trade data in 2018 to the theoretical model, and compared the theoretical application with the actual import, then the relevant policies and recommendations are proposed. The main conclusions and recommendations are as follows:

1) Intuitively, long-term LNG contracts are conductive to guarantee the security of natural gas imports, and their relatively high prices also bring greater economic pressure to natural gas importers. However, this study shows that even if long-term LNG contracts have no price advantage, signing a certain number of long-term LNG contracts still has the potential to increase total imports, reduce demand prices, and thus improve the benefits of natural gas imports. In other words, long-term LNG contracts with relatively high prices are expected to balance the security with economic benefits of natural gas imports. Specifically, if the long-term LNG price is below a certain threshold, importing long-term LNG will increase the benefits of natural gas importing countries; the lower the marginal cost of long-term LNG, the more obvious the benefits of importing long-term LNG; the higher the marginal cost of short-term LNG and PNG, or the stronger the willingness to pay for imported natural gas, the more significant the economic benefits of importing long-term LNG.

2) Practically, China’s long-term LNG imports in 2018 were about 38.44 million tons, and the average import price was about $471.5/ton, which was lower than the threshold value ($555/ton) of model application results. This means that the importing 38.44 million tons of long-term LNG is beneficial for China, and even more long-term LNG contracts could be considered. In the future, short-term LNG may become more active, but this does not mean the disappearance of long-term LNG contracts. On the contrary, signing an appropriate amount of long-term LNG contracts is beneficial to build a stable and flexible natural gas supply system, diversify natural gas trade risks, ensure the security of natural gas imports, and even increase import revenue. Therefore, while natural gas importing countries comply with the natural gas trade trend and actively participate in short-term and spot trade, the value of long-term LNG contracts should not be underestimated or even ignored.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

XX: Conceptualization, methodology, software, writing—original draft, review, and editing. RW: review and editing. YL: software and editing. JW: review and editing. TL: review and editing.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Similar to the game in the seminal analysis of Brander and Spencer (1985), the country’s action takes place before the firm’s actions. Brander and Spencer (1985) mention that the market intervention announced by the government is assumed to be credible as the reason why the country is able to move first.

References

Abada, I., De Maere D’Aertrycke, G. D. M., Ehrenmann, A., and Smeers, Y. (2019). What models tell us about long-term contracts in times of the energy transition. Econ. Energy. Env. Pol. 8, 163–182. doi:10.5547/2160-5890.8.1.iaba

Abada, I., Ehrenmann, A., and Smeers, Y. (2017). Modeling gas markets with endogenous long-term contracts. Oper. Res. 65, 856–877. doi:10.1287/opre.2017.1599

Alim, A., Hartley, P., and Lan, Y. (2018). Asian spot prices for LNG and other energy commodities. Energy J. 39, 123–141. doi:10.5547/01956574.39.1.aali

Allevi, E., Boffino, L., De Giuli, M. E., and Oggioni, G. (2019). Analysis of long-term natural gas contracts with vine copulas in optimization portfolio problems. Ann. Oper. Res. 274, 1–37. doi:10.1007/s10479-018-2932-x

Aseel, S., Al-Yafei, H., Kucukvar, M., Onat, N. C., Turkay, M., Kazancoglu, Y., et al. (2021). A model for estimating the carbon footprint of maritime transportation of liquefied natural gas under uncertainty. Sustain. Prod. Consum. 27, 1602–1613. doi:10.1016/j.spc.2021.04.002

Aune, F., Rosendahl, K., and Sagen, E. (2009). Globalisation of natural gas markets - effects on prices and trade patterns. Energy Jo. 30, 39–45. doi:10.5547/ISSN0195-6574-EJ-Vol30-NoSI-4

Bai, X., and Lam, J. S. L. (2019). A destination choice model for very large gas carriers (VLGC) loading from the US Gulf. Energy 174, 1267–1275. doi:10.1016/j.energy.2019.02.148

Barnes, R., and Bosworth, R. (2015). LNG is linking regional natural gas markets: Evidence from the gravity model. Energy Econ. 47, 11–17. doi:10.1016/j.eneco.2014.10.004

Basak, M., Perrons, R. K., and Coffey, V. (2019). Schedule overruns as a barrier for liquefied natural gas projects: A review of the literature and research agenda. Energy Rep. 5, 210–220. doi:10.1016/j.egyr.2019.01.008

BP (2021). Statistial review of world energy. Available at: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2021-full-report.pdf (Accessed July 8, 2021).

BP (2019). Statistical review of world energy. Available at: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2019-full-report.pdf (Accessed June 17, 2019).

Brander, J. A., and Spencer, B. J. (1985). Export subsidies and international market share rivalry. J. Int. Econ. 18, 83–100. doi:10.1016/0022-1996(85)90006-6

Chen, C-H. (2021). Applying game theory in Newsvendor’s supply chain model. J. Inf. Optim. Sci. 42, 1367–1382. doi:10.1080/02522667.2021.1885748

Eser, P., Chokani, N., and Abhari, R. (2019). Impact of Nord Stream 2 and LNG on gas trade and security of supply in the European gas network of 2030. Appl. Energy 238, 816–830. doi:10.1016/j.apenergy.2019.01.068

Ferreira, F. A. (2012). International Stackelberg model with tariffs. AIP Conf. Proc. 1479, 1155–1158. doi:10.1063/1.4756354

Geng, J.-B., Ji, Q., and Fan, Y. (2014). A dynamic analysis on global natural gas trade network. Appl. Energy 132, 23–33. doi:10.1016/j.apenergy.2014.06.064

Gong, C., Gong, N., Qi, R., and Yu, S. (2020). Assessment of natural gas supply security in Asia Pacific: Composite indicators with compromise Benefit-of-the-Doubt weights. Resour. Policy. 67, 101671. doi:10.1016/j.enpol.2021.112425

Hartley, P. R., Medlock, III, K. B., Temzelides, T., and Zhang, X. (2015). Energy sector innovation and growth: An optimal energy crisis. Energy J. 36, 209–233. doi:10.5547/01956574.37.1.phar

Hasanov, M. (2017). Analyzing the effects of import liberalization in the Turkish natural gas market. Energy Sources Part B Econ. Plan. Policy 12, 237–242. doi:10.1080/15567249.2015.1072598

Hirschhausen, C. V., and Neumann, A. (2008). Long-term contracts and asset specificity revisited: An empirical analysis of producer–importer relations in the natural gas industry. Rev. Ind. Organ. 32, 131–143. doi:10.1007/s11151-008-9165-0

Holland, S. P., Mansur, E. T., Muller, N. Z., and Yates, A. J. (2020). Decompositions and policy consequences of an extraordinary decline in air pollution from electricity generation. Am. Econ. J. Econ. Policy 12, 244–274. doi:10.1257/pol.20190390

Jang, H., Jeong, B., Zhou, P., Ha, S., and Nam, D. (2021). Demystifying the lifecycle environmental benefits and harms of LNG as marine fuel. Appl. Energy 292, 116869. doi:10.1016/j.apenergy.2021.116869

Jansen, T., Lier, A. V., Witteloostuijn, A. V., and Ochssée, T. B. V. (2012). A modified Cournot model of the natural gas market in the European Union: Mixed-motives delegation in a politicized environment. Energy Policy 41, 280–285. doi:10.1016/j.enpol.2011.10.047

Jovanović, F., Rudan, I., Žuškin, S., and Sumner, M. (2019). Comparative analysis of natural gas imports by pipelines and FSRU terminals. Pomorstvo 33, 110–116. doi:10.31217/p.33.1.12

Kan, S. Y., Chen, B., Wu, X. F., Chen, Z. M., and Chen, G. Q. (2019). Natural gas overview for world economy: From primary supply to final demand via global supply chains. Energy Policy 124, 215–225. doi:10.1016/j.enpol.2018.10.002

Li, B., Yin, H., and Wang, F. (2018). Will China’s “dash for gas” halt in the future? Resour. Conserv. Recycl. 134, 303–312. doi:10.1016/j.resconrec.2018.03.028

Lin, W., Zhang, N., and Gu, A. (2010). LNG (liquefied natural gas): A necessary part in China's future energy infrastructure. Energy 35, 4383–4391. doi:10.1016/j.energy.2009.04.036

Liu, C., Wu, W.-Z., Xie, W., Zhang, T., and Zhang, J. (2021a). Forecasting natural gas consumption of China by using a novel fractional grey model with time power term. Energy Rep. 7, 788–797. doi:10.1016/j.egyr.2021.01.082

Liu, G., Dong, X., Kong, Z., Jiang, Q., and Li, J. (2021b). The role of China in the East Asian natural gas premium. Energy Strategy Rev. 33, 100610. doi:10.1016/j.esr.2020.100610

Liu, Y., Shi, X., and Laurenceson, J. (2020). Dynamics of Australia’s LNG export performance: A modified constant market shares analysis. Energy Econ. 89, 104808. doi:10.1016/j.eneco.2020.104808

Mazighi, A. (2004). Some risks related to the short-term trading of natural gas. OPEC Rev. 28, 227–239. doi:10.1111/j.0277-0180.2004.00135.x

Meza, A., and Koç, M. (2021). The LNG trade between Qatar and East Asia: Potential impacts of unconventional energy resources on the LNG sector and Qatar’s economic development goals. Resour. Policy 70, 101886. doi:10.1016/j.resourpol.2020.101886

Mitrova, T., and Boersma, T. (2018). The impact of US LNG on Russian export policy. New York, United States: Center on Global Energy Policy, the School of International and Public Affairs, University of Columbia.

Najm, S., and Matsumoto, K. i. (2020). Does renewable energy substitute LNG international trade in the energy transition? Energy Econ. 92, 104964. doi:10.1016/j.eneco.2020.104964

Neuhoff, K., and Hirschhausen, C. V. (2006). Long-term vs. short-term contracts: A European perspective on natural gas. Available at: https://www.researchgate.net/publication/238660557_Long-term_vs_Short-term_Contracts_A_European_perspective_on_natural_gas (Accessed July 18, 2022).

Neumann, A., and Hirschhausen, C. V. (2004). Less long-term gas to Europe? A quantitative analysis of European long-term gas supply contracts. Z. für Energiewirtschaft. 28, 175–182.

Neumann, A. (2008). Linking natural gas markets - is LNG doing its job? Energy J. 30, 187–200. doi:10.5547/ISSN0195-6574-EJ-Vol30-NoSI-12

Nikhalat-Jahromi, H., Angeloudis, P., Bell, M. G. H., and Cochrane, R. A. (2017a). Global LNG trade: A comprehensive up to date analysis. Marit. Econ. Logist. 19, 160–181. doi:10.1057/mel.2015.26

Nikhalat-Jahromi, H., Fontes, D. B. M. M., and Cochrane, R. A. (2017b). Future liquefied natural gas business structure: A review and comparison of oil and liquefied natural gas sectors. WIREs Energy Environ. 6, e240. doi:10.1002/wene.240

Niyazmuradov, S., and Heo, E. (2018). Long-term natural gas contracts evolution in the changing industry environment. Geosystem Eng. 21, 12–20. doi:10.1080/12269328.2017.1341348

Oladi, R., and Gilbert, J. (2012). Buyer and seller concentration in global commodity markets. Rev. Dev. Econ. 16, 359–367. doi:10.1111/j.1467-9361.2012.00667.x

Paltsev, S., and Zhang, D. (2015). Natural gas pricing reform in China: Getting closer to a market system? Energy Policy 86, 43–56. doi:10.1016/j.enpol.2015.06.027

Raff, H., and Schmitt, N. (2009). Buyer power in international markets. J. Int. Econ. 79, 222–229. doi:10.1016/j.jinteco.2009.08.006

Rajaraman, I. (2009). Buyer concentration in markets for developing country exports. Rev. Dev. Econ. 13, 190–199. doi:10.1111/j.1467-9361.2008.00481.x

Ritz, R. (2019). A strategic perspective on competition between pipeline gas and LNG. Energy J. 40, 195–220. doi:10.5547/01956574.40.5.rrit

Ruester, S. (2009). Changing contract structures in the international liquefied natural gas market : A first empirical analysis. Rev. D. Économie Ind. 127, 89–112. doi:10.4000/rei.4056

Schulte, S., and Weiser, F. (2019). LNG import quotas in Lithuania – economic effects of breaking Gazprom's natural gas monopoly. Energy Econ. 78, 174–181. doi:10.1016/j.eneco.2018.10.030

Shahrukh, M., Srinivasan, R., and Karimi, I. A. (2019). Evaluating the benefits of LNG procurement through spot market purchase. Comput. Aided. Chem. Eng. 46, 1723–1728. doi:10.1016/B978-0-12-818634-3.50288-5

Shahrukh, M., Srinivasan, R., and Karimi, I. A. (2021). Optimal procurement of liquefied natural gas cargos from long-term contracts and spot market through mathematical programming. Ind. Eng. Chem. Res. 60, 3658–3669. doi:10.1021/acs.iecr.0c05757

Shell (2021). Shell LNG outlook 2021. Available at: https://www.shell.com/promos/energy-and-innovation/download-the-shell-lng-outlook-2021/_jcr_content.stream/1614823770264/2b5b3fdaa9feba85dadc9b3408c200f26eadf85f/lng-outlook-2021-final-pack-updated.pdf (Accessed February 25, 2021).

Siliverstovs, B., L'Hégaret, G., Neumann, A., and Hirschhausen, C. V. (2005). International market integration for natural gas? A cointegration analysis of prices in Europe, north America and Japan. Energy Econ. 27, 603–615. doi:10.1016/j.eneco.2005.03.002

Su, H., Zio, E., Zhang, J., Chi, L., Li, X., and Zhang, Z. (2019). A systematic data-driven Demand Side Management method for smart natural gas supply systems. Energy Convers. Manag. 185, 368–383. doi:10.1016/j.enconman.2019.01.114

Tang, W. H. J., Reivan Ortiz, G. G., Mabrouk, F., and Li, J. (2022). Research on the impact of COVID-19 on import and export strategies. Front. Environ. Sci. 10. 891780. doi:10.3389/fenvs.2022.891780

Wachsmuth, J., Breitschopf, B., and Pakalkaite, V. (2017). “The end of long-term contracts? Gas price and market dynamics in central and eastern Europe,” in Proceedings of the 2017 14th International Conference on the European Energy Market (EEM), Dresden, Germany, 06-09 June 2017. doi:10.1109/EEM.2017.7981953

Wang, S., Tang, X., Wang, J., Zhang, B., Sun, W., and Höök, M. (2021). Environmental impacts from conventional and shale gas and oil development in China considering regional differences and well depth. Resour. Conserv. Recycl. 167, 105368. doi:10.1016/j.resconrec.2020.105368

Wang, T., Zhang, D., Ji, Q., and Shi, X. (2020). Market reforms and determinants of import natural gas prices in China. Energy 196, 117105. doi:10.1016/j.energy.2020.117105

Yang, Z. (2013). Is the leading role desirable?: A simulation analysis of the stackelberg behavior in world petroleum market. Comput. Econ. 42, 133–150. doi:10.1007/s10614-012-9335-x

Yang, Z., Zhang, R., and Zhang, Z. (2016). An exploration of a strategic competition model for the European Union natural gas market. Energy Econ. 57, 236–242. doi:10.1016/j.eneco.2016.05.008

Ye, R., Zhou, Y., Chen, J., and Tu, K. (2021). Natural gas security evaluation from a supply vs. demand perspective: A quantitative application of four as. Energy Policy 156, 112425. doi:10.1016/j.enpol.2021.112425

Yin, Y., and Lam, J. S. L. (2022). Bottlenecks of LNG supply chain in energy transition: A case study of China using system dynamics simulation. Energy 250, 123803. doi:10.1016/j.energy.2022.123803

Zhang, J., Qin, Y., and Duo, H. (2021). The development trend of China’s natural gas consumption: A forecasting viewpoint based on grey forecasting model. Energy Rep. 7, 4308–4324. doi:10.1016/j.egyr.2021.07.003

Zhang, X.-N., Zhong, Q.-Y., Qu, Y., and Li, H.-L. (2017). Liquefied natural gas importing security strategy considering multi-factor: A multi-objective programming approach. Expert Syst. Appl. 87, 56–69. doi:10.1016/j.eswa.2017.05.077

Keywords: natural gas market, LNG trade, long-term contracts, short-term contracts, two-stage game

Citation: Xia X, Wu R, Liu Y, Wu J and Lu T (2023) Value of long-term LNG contracts: A theoretical and empirical study. Front. Earth Sci. 10:1058592. doi: 10.3389/feart.2022.1058592

Received: 30 September 2022; Accepted: 18 November 2022;

Published: 06 January 2023.

Edited by:

Nallapaneni Manoj Kumar, City University of Hong Kong, Hong Kong SAR, ChinaReviewed by:

Yu Ye, China University of Geosciences Wuhan, ChinaYing Zhu, Xi’an University of Architecture and Technology, China

Copyright © 2023 Xia, Wu, Liu, Wu and Lu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Rui Wu, d3VydWlAY3F1LmVkdS5jbg==

Xiaoning Xia

Xiaoning Xia Rui Wu

Rui Wu Yan Liu3

Yan Liu3